哈佛分析框架 外文文献及翻译

- 格式:doc

- 大小:58.00 KB

- 文档页数:13

《基于哈佛分析框架下的财务分析》一、引言财务分析是评估企业财务状况、经营成果和现金流量等重要方面的过程。

哈佛分析框架是一种综合性的财务分析方法,它结合了比率分析、战略分析和前景分析,以全面、深入地了解企业的财务状况和未来发展潜力。

本文将以某上市公司为例,运用哈佛分析框架进行财务分析。

二、比率分析1. 盈利能力分析通过对该公司的利润率、资产收益率、净资产收益率等指标进行分析,可以发现该公司具有较好的盈利能力。

其中,资产收益率和净资产收益率呈现稳步上升的趋势,表明企业资产和股东权益的盈利能力在不断提高。

2. 营运能力分析通过分析存货周转率、应收账款周转率等指标,发现该公司的营运能力较强。

存货周转率较高,表明企业存货管理效率较高;应收账款周转率较快,说明企业回款能力较强。

3. 偿债能力分析该公司的流动比率和速动比率均处于行业较高水平,表明企业短期偿债能力较强。

同时,资产负债率适中,说明企业负债结构合理,长期偿债能力有保障。

三、战略分析1. 市场地位该公司在行业中具有较高的市场份额和品牌影响力,产品具有竞争力。

通过不断推出新产品和拓展新市场,公司逐步提高了市场地位。

2. 竞争优势公司通过技术创新、品牌建设、营销策略等手段,形成了较强的竞争优势。

同时,公司还注重人才培养和企业文化建设,提高了员工的归属感和凝聚力。

3. 未来发展方向公司将继续加大研发投入,推动技术创新和产品升级。

同时,公司还将拓展新市场,提高市场份额和品牌影响力。

未来,公司将进一步加强内部管理和人才培养,提高企业的核心竞争力。

四、前景分析1. 行业发展趋势该行业具有一定的成长性和发展潜力。

随着消费者需求的不断升级和技术的不断进步,未来该行业将迎来更多的发展机遇。

2. 企业发展前景该公司具有较强的市场竞争力、技术实力和管理团队,未来发展前景良好。

同时,公司还将继续加大投入,推动技术创新和产品升级,进一步提高企业的核心竞争力。

3. 潜在风险与挑战尽管该公司具有较好的发展前景,但也面临着一些潜在的风险与挑战。

《基于哈佛分析框架下的A公司财务分析研究》一、引言在当今竞争激烈的市场环境中,对公司的财务状况进行深入分析对于投资者、债权人、潜在投资者以及管理层来说都至关重要。

本文将基于哈佛分析框架,对A公司的财务状况进行全面、深入的分析。

哈佛分析框架结合了财务分析、战略分析和估值分析,能够更全面地反映公司的整体状况。

二、财务分析1. 资产负债表分析A公司的资产负债表显示,公司资产规模稳步增长,流动资产与非流动资产比例合理。

负债方面,公司负债结构健康,无重大财务风险。

总体来看,A公司的资产负债表状况良好。

2. 利润表分析A公司的利润表显示,公司营业收入和净利润均保持稳定增长,毛利率和净利率处于行业合理水平。

此外,公司成本控制得当,费用结构合理。

3. 现金流量表分析A公司的现金流量表显示,公司经营活动产生的现金流量稳定,投资活动产生的现金流量波动较大,但总体上未对公司的现金流产生负面影响。

此外,公司的筹资活动产生的现金流量也较为稳定。

三、战略分析1. 行业分析A公司所处行业具有较高的竞争性,但行业整体呈增长趋势。

政策环境、技术环境以及社会环境等因素对行业的影响较大。

A 公司在行业中具有一定的竞争优势和市场份额。

2. 公司竞争地位分析A公司在行业中具有一定的品牌影响力和市场地位,产品和服务质量得到了消费者的认可。

此外,公司的销售渠道和营销策略也较为成功,为公司带来了稳定的收入。

四、估值分析1. 市盈率法通过市盈率法对A公司进行估值,需要确定公司的市盈率以及预测未来的收益。

根据公司历史数据和行业数据,可以得出一个合理的市盈率,进而对公司的市值进行估算。

2. 折现现金流法折现现金流法是一种更为精确的估值方法。

通过对公司未来现金流的预测以及风险调整,可以得出公司的内在价值。

这种方法需要更为详细和准确的数据支持。

五、结论与建议通过对A公司基于哈佛分析框架的财务分析研究,我们可以得出以下结论:A公司财务状况良好,资产负债表、利润表和现金流量表均表现稳健;公司在行业中具有一定的竞争优势和市场地位;估值方面,公司市值与内在价值基本相符。

目录财务分析之著名的哈佛分析框架 (1)引言 (1)背景介绍 (1)目的和意义 (2)财务分析概述 (3)定义和目标 (3)财务分析的重要性 (4)哈佛分析框架简介 (5)哈佛分析框架的基本原理 (6)框架概述 (6)资产负债表分析 (6)利润表分析 (6)现金流量表分析 (7)应用实例 (8)公司A的财务分析 (8)公司B的财务分析 (8)公司C的财务分析 (9)优缺点分析 (9)哈佛分析框架的优点 (9)哈佛分析框架的局限性 (10)结论 (11)总结哈佛分析框架的重要性 (11)对未来财务分析的展望 (12)财务分析之著名的哈佛分析框架.引言背景介绍财务分析是一种评估和解释企业财务状况的方法,它通过对财务报表和其他相关信息的分析,帮助投资者、管理者和其他利益相关者做出决策。

在财务分析领域,哈佛分析框架是一种著名的方法,它由哈佛商学院教授罗伯特·S·柯普兰于20世纪70年代提出,被广泛应用于企业财务分析和投资决策。

哈佛分析框架的提出源于对传统财务分析方法的批评。

传统财务分析方法主要关注企业的历史财务数据,如财务报表和比率分析,但忽视了企业的战略和竞争环境对财务状况的影响。

柯普兰认为,仅仅依靠历史数据进行分析是不够的,还需要考虑企业的战略定位、竞争优势和未来发展趋势。

因此,柯普兰提出了哈佛分析框架,该框架将财务分析与战略分析相结合,以全面评估企业的财务状况和潜在风险。

哈佛分析框架包括四个主要方面:财务分析、竞争分析、战略分析和前景分析。

首先,财务分析是哈佛分析框架的基础,它通过对企业的财务报表进行分析,评估企业的盈利能力、偿债能力和运营能力。

财务分析主要关注企业的利润表、资产负债表和现金流量表,通过计算各种财务比率,如利润率、资产周转率和偿债能力比率,来评估企业的财务状况。

其次,竞争分析是哈佛分析框架的重要组成部分,它通过对企业的竞争对手进行分析,评估企业在市场上的竞争地位。

LoginSearch for:Print viewAdministratorsChicago Press, Chicago, IL.Patton, M.Q. (1990), Qualitative Evaluation and Research Methods , 2nd ed., Sage, Newbury Park, CA.A chapter from an edited bookSurname, A.N.(year of publication)"Title of chapter"in Editor surname, initials (Ed.)Title of BookEditionPublisherPlace of publicationChapter page numbers.ExampleBourdieu, P.(1977), "The forms of capital", in Richardson, J.G. (Ed.), Handbook of Theory and Researchfor the Sociology of Education, Greenwood Press, New York, NY, pp. 311-56.A translated workSurname, A.N.(year of publication)Title of BookEditionTranslated by Translator name, initialsPublisherPlace of publication.ExampleBourdieu, P. (1977), Outline of a Theory of Practice, translated by Nice, R., Cambridge University Press,Cambridge.Journal articlesSurname, A.N.(year of publication)"Article title"Journal TitleVolume number, Issue number (if it exists)Article page numbers.ExampleBaron, R.M. and Kenny, D.A. (1986), "The moderator-mediator variable distinction in socialpsychological research", Journal of Personality and Social Psychology, Vol. 51, pp. 1173-82.Guthrie, J. and Parker, L. (1997) "Editorial: Celebration, reflection and a future: a decade of AAAJ",Accounting, Auditing & Accountability Journal , Vol. 10 No.1, pp. 3-8Electronic sourcesNB this refers to a source which is only available electronically, and not to sources which you may have accessed electronically but which are also available in print form, such as an article from an Emerald journal accessed via the Web.These follow the same convention of referencing as for printed sources, but include elements unique to the Web: Name(year of publication)"Article title"available at: full url(accessed date)For the last two elements, please try to remember the following conventions:When giving the url, "http://" should only be included if the address does not include "www"(accessed date) is important because of the lack of permanence of Internet sites.ExampleBetter Business Bureau (2001), "Third-party assurance boosts online purchasing", available at:/about/press/2001/101701.asp (accessed 7 January 2002).Hummingbird (2002), Hummingbird corporate website, available at: (accessed 2January 2002).Leeds Metropolitan University (2002), "Business Start-Up@Leeds Met", available at:/city/bus_startup.htmPitkow, J. and Kehoel, C. (1997), "GVU's WWW user surveys", available at: Ballantyne, D. (2000), "Dialogue and knowledge generation: two sides of the same coin in relationshipmarketing", paper presented at the 2nd WWW Conference on Relationship Marketing, November 1999-February 2000, Monash University and MCB University Press, available at:/services/conferen/nov99/rm/paper3.htmlAn electronic journal would be referenced as follows:Surname, A.N.(year of publication)"Article title"Journal TitleVolume number, Issue numberArticle page numbersAvailable at: url(accessed date)ExampleSwaminathan, V., Lepkoswka-White, E. and Rao, B.P. (1999), "Browsers or buyers in cyberspace? Aninvestigation of electronic factors influencing electronic exchange", Journal of Computer-MediatedCommunication, Vol. 5 No. 2, available at: www. / jcmc/vol5/ issue2/Conference papersSome papers may not be published in journals but may be delivered at a conference and then published as part of the proceedings of that conference, in which case, use one of the following styles as appropriate.ExampleLodi, E., Veseley, M. and Vigen, J. (2000), "Link managers for grey literature", New Frontiers in GreyLiterature, Proceedings of the 4th International Conference on Grey Literature, Washington, DC, October4-5, 1999, GreyNet, Amsterdam, pp. 116-34.Naude, P. and Holland, C. (1998), "Marketing in the information domain", in Halinen-Kaila, A. andNummela, N. (Eds), Interaction, Relationships and Networks: Visions for the Future, Proceedings of the14th Annual IMP Conference, pp. 245-62.Stauss, B. and Weinlich, B. (1995), "Process-oriented measurement of service quality by applying thesequential incident technique", paper presented at the Fifth Workshop on Quality Management inServices, EIASM, Tilburg.Strandvik, T. and Storbacka, K. (1996), "Managing relationship quality", paper presented at the QUIS5Quality in Services Conference, University of Karlstad, Karlstad.As you see, some of the above references give the date of the conference, others do not; if in doubt, follow the convention used by the conference.Government or commercial reportsParticularly when writing a case study, you may want to refer to company or government documents. In which case, the organization may become the author and the form of entry would be as follows:Organization name(year of publication)Title of reportPublisher and place of publication (may be same as author).ExampleApollo Enterprises (1993), Annual Report , p. 8.Ernst and Ernst (1978), Social Responsibility Disclosure: 1978 Survey, Ernst and Ernst, Cleveland, OH.Bank of England (2003), Quarterly Report on Small Business Statistics, Bank of England, London.Department for Trade and Industry (DTI) (2002), White Paper on Enterprise, Skills and Innovation, DTI,London.European Commission (1998), Fostering Entrepreneurship in Europe: Priorities for the Future, EuropeanCommission, Brussels.Yorkshire Forward (1999), Regional Economic Strategy, Yorkshire Forward, Leeds...Some guidelines to remember for all source typesIf all the above seems complicated, it's worth remembering that the Harvard system is actually quite logical. Bear in mind the following guidelines:The entry always begins with the author's surname, followed by initials, followed by the date in brackets.Authors' surnames and initials are always inverted, i.e. Other, A.N. (whether you are referring to the author of anarticle/chapter, or the editor of the work within which the work is found).If more than one entry by the same author, put in order of dates.Publications, whether book or journal titles, are always in italic, with significant words only capitalized. Make sure that the journal title is exactly the same, e.g. use of &/and.Excerpts from publications, i.e. book chapters, journal articles, always come in "quotes", with only the first word, proper names, and German nouns, capitalized.The name of the publisher is shown before the place of publication (as it would be in an address). Abbreviations for US states should be in short capitalized form, e.g. CA, MA, rather than Ca., Mass., and should be added as necessary.Electronic references follow the same conventions as printed ones, followed by "available at:" and the URL. Only retain "http://" if the address does NOT include www. Also, state the date when last accessed (accessed ...).Use commas to separate elements of the entry.。

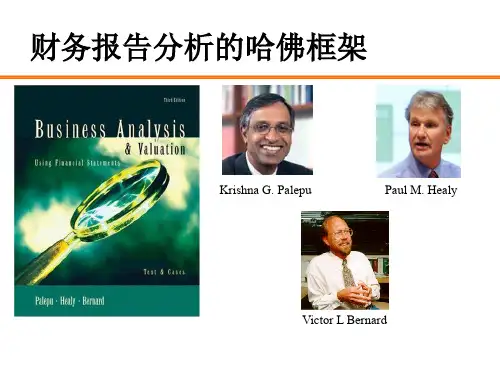

经营分析与估值克雷沙·G.帕利普保罗·M.希利摘自书籍“Business Analysis and Valuation”第五版第一章节1.简介本章的目的是勾勒出一个全面的财务报表分析框架。

因为财务报表提供给公共企业经济活动最广泛使用的数据,投资者和其他利益相关者依靠财务报告评估计划企业和管理绩效率。

各种各样的问题可以通过财务状况及经营分析解决,如下面的示例所示:一位证券分析师可能会对问:“我的公司有多好?这家公司是否符合我的期望?如果没有,为什么不呢?鉴于我对公司当前和未来业绩的评估,该公司的股票价值是多少?”一位信贷员可能需要问:“这家公司贷款给这家公司有什么贷款?公司管理其流动性如何?公司的经营风险是什么?公司的融资和股利政策所产生的附加风险是什么?“一位管理顾问可能会问:“公司经营的行业结构是什么?该策略通过在工业各个企业追求的是什么?不同企业在行业中的相对表现是什么?”公司经理可能会问:“我的公司是正确的估值的投资者吗?是我们在通信程序中有足够的投资者来促进这一过程?”财务报表分析是一项有价值的活动,当管理者在一个公司的战略和各种体制因素完成后,他们不可能完全披露这些信息。

在这一设置中,外部分析师试图通过分析财务报表数据来创建“中端信息”,从而获得有价值的关于该公司目前业绩和未来前景的展望。

了解财务报表分析所做的贡献,这是很重要的理解在资本市场的运作,财务报告的作用,形成财务报表制度的力量。

因此,我们首先简要说明这些力量,然后我们讨论的步骤,分析师必须执行,以提取信息的财务报表,并提供有价值的预测。

2.从经营活动到财务报表企业管理者负责从公司的环境中获取物理和财务资源,并利用它们为公司的投资者创造价值。

当公司在资本成本的超额投资时,就创造了价值。

管理者制定经营战略,实现这一目标,并通过业务活动实施。

企业的经营活动受其经济环境和经营战略的影响。

经济环境包括企业的产业、投入和产出的市场,以及公司经营的规章制度。

XXX分析框架与企业财务分析外文文献翻译XXX the use of the Harvard analysis XXX their internal and external environments。

XXX weaknesses。

and develop strategies for growth and success。

The article also examines the XXX of using the framework in financial analysis。

and provides examples of how it has been applied in us industries.nHarvard analysis XXX their internal and external XXX。

a renowned business strategist。

and is based on the XXX for growth and success。

The framework consists of five key components: the threat of new entrants。

the bargaining power of suppliers。

the bargaining power of buyers。

XXX substitute products or services。

and the XXX factors。

businesses XXX weaknesses。

as well as XXX.XXX of using the Harvard analysis framework in financial analysisOne of the main benefits of using the Harvard analysis framework in financial analysis is that it provides a XXX and weakness。

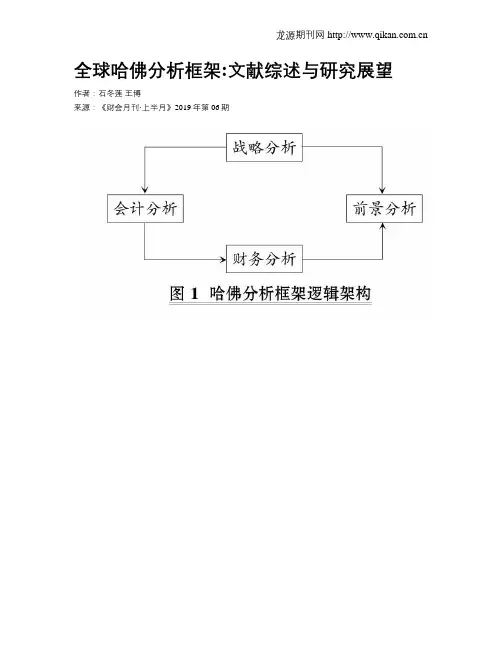

全球哈佛分析框架:文献综述与研究展望作者:石冬莲王博来源:《财会月刊·上半月》2019年第06期【摘要】通过梳理哈佛分析框架相关的研究成果,发现目前国内外关于哈佛分析框架的研究进展和侧重点存在较大差异,国外学者对哈佛分析框架的应用主要集中在战略分析维度、会计分析维度、财务分析维度和前景分析维度等方面,而国内学者对哈佛分析框架的应用主要集中在哈佛分析框架的内容、各维度之间的相互融合、企业具体层面的分析和其他用途等方面。

未来哈佛分析框架的研究主要是向框架中融入非量化要素、在战略分析维度构建财务战略矩阵、在财务分析维度使用传统财务比率分析法与项目质量分析法相结合的综合财务分析体系、在前景分析维度构建定量财务预警模型等方面做进一步探索。

【关键词】哈佛分析框架;战略分析;会计分析;财务分析;前景分析【中图分类号】F230【文献标识码】A【文章编号】1004-0994(2019)11-0053-8一、引言随着全球化进程的不断加速和资本市场发展的日新月异,企业的日常经营活动受到了宏观环境、行业格局和竞争战略等内外部因素的影响,其经营风险不断增加。

受各利益相关方的利益驱使,上市公司财务报表粉饰数据、虚构业绩等造假现象屡见不鲜。

企业为了防止详尽的信息披露泄露其商业秘密,会避免向外界披露完整的经营活动信息。

因此,各利益相关方仅运用企业披露的财务报表和采用墨守成规的传统财务分析方法,不能完全掌握企业真实的经营活动状况,更难以判断企业的未来发展趋势。

哈佛分析框架是指在财务报表分析中引进战略分析,从而实现定性分析与定量分析之间的融合。

即从战略的高度来审视企业的财务状况,并在保证会计信息质量的基础上评价企业当下业绩的可持续性,预判企业的发展方向,其完美地填补了传统财务分析体系一直以来存在的缺陷。

随着哈佛分析框架在国外不同行业的成功应用,其也越来越受到国内学者的重视,目前该领域已经成为全球财务分析研究的重要方向。

哈佛分析框架在不到20年的时间从一个不为人知的概念成为全球财务分析及其应用的主要方法之一,已成为全球财务分析研究和实践中的核心问题。

财务与会计·理财版·2013 0950Finance & Accounting分享空间哈佛大学的Krishna G. Palepu、Paul M. Healy、Victor L. Bernard 三位教授提出了一种财务分析逻辑框架,称为哈佛分析框架,包括四个关键步骤:行业分析、会计分析、财务分析及前景分析。

其思路就是在进行财务报告分析时需要考虑企业所在行业的发展环境、所处的会计政策环境、财务分析手段及行业发展前景,并结合企业自身战略管理和企业经营情况等,从全方位的角度来树立科学的分析财务报告应该遵循的基本逻辑思路及重要的财务分析理念。

这个分析套路正逐渐为国内财务分析领域所运用。

本文将阐述此框架的应用方法,希望能为使用者合理分析财务报告提供一种思路和方法。

一、行业分析行业分析的目的之一在于识别企业主要的盈利领域和商业风险,进而定性地评估企业潜在的盈利能力。

这种定性分析是财务分析重要的、首要的步骤,可以为以后的会计分析和财务分析提供依据和基础。

例如,识别企业关键的盈利因素和风险因素,可以为评价企业的关键会计政策提供线索;评价企业的竞争优势有助于评价当前的盈利水平是否可以持续;更为重要的是,行业分析可以为预测企业未来的业绩提供合理的基于哈佛分析框架的假设与前提。

行业分析的高明之处是把目标分析企业放到一个参照系中进行比较,就是将企业与其他多个同行业企业比较,判断其是否具有独特的商业资源、是否具有核心技术优势、产品和技术是否具有不可复制性等。

行业分析的另外一个重要目的是发现差异,发现异常领域或改进空间,即所谓横向比较看异常。

例如,某企业的毛利率是7%,那么这个获利水平是高还是低呢?如果同行业企业的毛利率一般都不会超过10%,普遍较低,那么7%就是一个正常的获利水平;相反,如果该企业的毛利率达到15%,此时我们就要怀疑,该企业凭什么获得远远超过行业平均的利润率水平呢?是其原材料采购成本低、工艺过程更有效率,还是产品采用了差异化路线,从而售价中包含了超额利润呢?如果找不到合理的解释,那么很可能是少计算了成本,或者营业额中含有水分。

附录1:外文原文外文翻译附录2:外文翻译钢筋混凝土建筑在地震中的抗倒塌安全性研究(二):延性和非延性框架的对比分析(Abbie B. Liel1, Curt B. Haselton2, and Gregory G. Deierlein3)摘要:本文是两篇配套论文的第二篇,旨在探讨钢筋混凝土框架结构在地震中的抗倒塌安全性,并检验加利福尼亚州在20世纪70年代中期之前所建非延性框架结构建筑的可靠性。

基于对结构响应的非线性动态模拟进行概率评估,以此来计算对应于不同的地运动特性和结构类型时结构倒塌的危险。

评估的对象是一套不同高度的非延性钢筋混凝土框架结构原型,它们是根据1967年版《统一建筑规范》中的抗震规定设计的。

结果表明,当处于一个典型的加利福尼亚高震场地时,非延性钢筋混凝土框架结构发生倒塌的年平均频率范围为(5~14)×10-3,这比按现代规范设计的结果高出约40倍。

这些数据表明新规范对延性构造和能力设计要求是行之有效的,这使得在过去的30年中新建的钢筋混凝土建筑物的安全性得到明显改善。

通过对延性和非延性结构的安全性比较,有助于出台新的规章来评估和减轻现有的钢筋混凝土框架结构建筑物地震倒塌的危险。

关键词:倒塌;地震工程;结构可靠度;钢筋混凝土结构;建筑;商业;地震影响。

引言20世纪70年代中期以前加利福尼亚州建设的钢筋混凝土框架结构缺乏好的抗震设计理念(例如:加强柱子、钢筋延性构造),这使得它们很容易在地震中发生倒塌。

这些非延性钢筋混凝土框架结构在经历了加利福尼亚州1971年圣费尔南多大地震,1979年英皮里尔谷大地震,1987年惠蒂尔纳罗斯大地震,1994年北山大地震和世界上其他地方发生的无数地震之后,已经遭受了很严重的地震损害。

这些因素促使人们关注加利福尼亚州的近40000栋钢筋混凝土建筑,其中的一部分在未来地震中可能会发生倒塌而危害生命财产安全。

然而,我们缺乏足够的数据来衡量建筑的危险程度,因而无法确定是大量的建筑均存在这种危险,还是只有特定的建筑物才存在危险。

基于哈佛分析框架的房地产公司财务研究国内外文献综述1 国外研究现状(1)关于房地产公司经营发展的研究国外关于房地产公司经营发展的研究较早,尤其是21世纪以后,相关的研究很多,Michael Ramorio(2017)研究发达国家和发展国家的不同,发达国家的房地产公司更注重建立良好的品牌形象、提升产品质量和防范资金风险,而发展中国家则更注重房地产销售这个环节,因此对影响房地产行业价格波动的政策更关注[1]。

Yontz,William L(2020)在对印度尼西亚的房地产公司发展战略的研究中,得到了发展战略需要根据外界环境的变化、企业内业务的调整和财务状况这三者共同来确定[2]。

Peter MK ,Kraft C(2020)对澳大利亚国内排名前10的房地产公司进行研究,发现实力强的房地产公司更应该积极地采用全球化战略去开拓国外市场,才是最有利于企业发展的[3]。

Ngoc N M , Tien N H(2021)根据成本模型建立了一体化战略模型同样得出了房地产公司的发展战略制定需要优先考虑其业务活动的调整[4]。

(2)关于财务分析的研究Khoja L, Chipulu M, Jayasekera R(2019)认为,在分析企业财务状况时,必须结合宏观环境和行业发展前景等非财务信息,才能全面、准确了解企业经营状况,降低经营风险[5]。

Michael H.David L和John D(2020)认为财务分析是一项非常丰富的工具,但目前缺乏适用于所有企业的分析指标。

因此提出用距离度量指标来解释股权收益、企业债券评级和企业困境的总体风险和系统性风险,并说明了大数据应用在财务分析中可以发挥的优势[6]。

Martin Fridson(2010)重点研究了股票价值分析以及并购估值的财务分析框架,指出企业的经营环境受国内外政经济环境的影响。

在财务分析框架有对外部环境信息的详细分析,可以有效地增强财务预测的准确性[7]。

价值工程基于哈佛框架杜邦分析的财务综合分析———以雅居乐地产为例Comprehensive Financial Analysis Based on the Harvard Framework DuPont Analysis:Take Agile Real Estate as an Example凌然LING Ran(昆明理工大学,昆明650500)(Kunming University of Science and Technology,Kunming650500,China)摘要:财务分析在有效评判企业发展能力方面扮演了越来越重要的角色。

通过对报表数据的整合与研究,反映了企业的盈利能力和全面经营效果。

文章利用哈佛框架为主要分析方法,并在该方法的财务与会计分析板块结合杜邦法,以雅居乐地产为例,对该公司2014-2018年度运营状况进行全面分析。

研究发现该企业在2014-2015年的财务核心指标—净资产收益率出现大幅度下降,但其余年份的盈利能力均呈相对稳定上升的趋势。

同时,该企业在债务结构方面存在一定的问题。

文章将主要针对这几个方面进一步分析,并对企业稳健发展提出相应的建议。

Abstract:Financial analysis plays an increasingly important role in effectively evaluating the development capabilities of enterprises. Through the integration and research of report data,it reflects the profitability and overall operating effect of the enterprise.The article uses the Harvard framework as the main analysis method,and combines the DuPont method in the financial and accounting analysis section of the method,taking Agile Real Estate as an example,to conduct a comprehensive analysis of the company's2014-2018operating status.The study found that the company's core financial indicator,return on equity from2014to2015,has dropped significantly,but the profitability of the rest of the year has shown a relatively stable upward trend.At the same time,the company has certain problems with its debt structure.The article focuses on further analysis of these aspects,and puts forward corresponding suggestions for the steady development of enterprises.关键词:哈佛框架;杜邦分析;净投资收益率Key words:Harvard framework;DuPont analysis;net investment yield中图分类号:F426文献标识码:A文章编号:1006-4311(2021)06-0014-03———————————————————————作者简介:凌然(2000-),女,江西萍乡人,昆明理工大学,本科。

毕业设计附件外文文献翻译:原文+译文文献出处: Andrew G. The study of Harvard analysis framework and corporate financial analysis. American Journal of sociology, 2016, 2(4): 283-301.原文The study of Harvard analysis framework and corporate financial analysisAndrew GAbstractAn effective financial analysis framework should not only learn how to use accounting data, and be good at using the accounting data. Enterprises to implement its business strategy are based on the accounting data, and ignore the enterprise environment and strategic analysis. Thus, to a more comprehensive understanding of enterprise operating performance, but also extends the traditional financial analysis object by the financial statements for the entire financial report and related institutional environment, build a new financial analysis framework is more and more necessary.New analysis framework should be more with strategic vision, focus on the development strategy of the enterprise, takes the enterprise's competitive position, USES the method of management related problem analysis, financial statement analysis and analysis of organic combination of enterprise development strategy, analysis of enterprise internal and external management environment, combined with the overall development of the enterprise strategic and long-term interests, analyze the content of the more widely and more wide, to the enterprise management decision making will be more valuable. Harvard analysis framework and harvard analysis framework arises at the historic moment, standing in a strategic point of view, is not limited to the company's financial statements, to analyze the opportunities and threats from external environment, and the enterprise internal strengths and weaknesses, the analysis of financial situation improved prediction is scientific, pointed out the direction of future development for the enterprise.Keywords: Harvard analysis framework, the electric power enterprise, strategy, financial analysis1 IntroductionThe development needs of an enterprise financial analysis for its help, financial analysis has attracted the attention of the enterprise, experts and scholars are also constantly explore the solution to the financial analysis, financial analysis framework of research in recent years, more and more. Harvard analysis is the sublimation of traditional financial analysis, the framework from the management strategy of enterprises, analyzes the financial data of the enterprise, accounting analysis, find out enterprise possible false results, and then adopt some methods to improve the quality of accounting information, and on the basis of financial analysis, realistic analysis of the results, and then forecast the prospect of the enterprise. The traditional financial analysis framework is in the long-term practice of financial analysis and theoretical summary and form, it is main analysis object with financial statements, although joined the financial comprehensive analysis model or system, but still with quantitative analysis as the basic characteristics of neglect or some important financial information cannot be effectively incorporated into the analysis framework. Traditional analysis framework is mainly analysis enterprise's financial statements, is basically a state of "report on report". And commonly used analysis methods mainly include ratio analysis, comparative analysis, trend analysis and DuPont financial analysis system, etc., mainly through the calculation and comparison of the financial statement data, draw the corresponding index data, then the results of comparative analysis and factor analysis, heavy "quantity" is not "quality", the lack of the nature of the analysis of a problem. Traditional analysis, with emphasis on the internal situation, the main process flows of the enterprise, asset utilization ability, debt paying ability, profitability analysis, and ignore the external business environment. And analysis based on financial statements and financial statements is a summary of the business in the past, and this analysis has the obvious lag. The traditional financial analysis framework to analyze the data on the enterprise accounting statements cannot havesatisfied the needs of the development of enterprises now.2 Literature reviewCommon methods of financial analysis can be summarized as three kinds: DuPont financial analysis method, economic value added and balanced scorecard method. DuPont financial analysis method the enterprise net assets yield level decomposition to the product of a number of financial ratios, by using the inner relationship between financial indicators, comprehensive management of the enterprise financial management system and the economic benefit of this evaluation. It can help enterprise management more clearly see the determinants of return on net assets, and the sales net profit margin and total asset turnover, the correlation relationship between the debt ratio, provides a clear overview to management whether the company assets management efficiency and maximize shareholder returns roadmap. Economic value added theory initially by Merton miller and Franco’s dial, two famous economists put forward. Later in the United States, tang, consulting company realized that this method is to evaluate the value of the company a good method, so the company will set up the method to promote worldwide. Economic value added is the company's operating profit after tax and the difference between the costs of capital; it takes into account the opportunity cost of capital economic profits, rather than accounting profit. It will force the company decision-makers high attention to the cost of capital. Put forward by Robert Kaplan, the balanced scorecard, which is based on enterprise strategy as the guidance, through finance, customer, operations and staff from four aspects and performance indicators of cause and effect, comprehensive management and the enterprise integrated performance evaluation system. Because of its advanced and has a certain reliability, so has been the favor of some companies. This kind of evaluation method to evaluate the quality of people to have certain request, because the choice of evaluation index need to refer to the company all aspects of characteristics, in order to fully reflect the company's financial position and operating results.In this increasingly mature, on the basis of financial analysis methods, scholars began to pay attention to these methods can be incorporated into a complete financialanalysis system, in order to form a frame structure, support for the enterprise economic operation.ErichHelford analysis framework is divided into introduction, operation analysis, investment analysis, financing analysis, value analysis several part. Summarizes the enterprise system, decision background and its relationship with financial statements and analysis tools, discussed including investment analysis, capital cost and financing options, and stock and enterprise value assessment, etc.Elisha based on the traditional financial analysis framework, which based on the analysis of enterprise debt paying ability, assets operation ability, profit ability and development ability, added into some of the industry analysis and the analysis of competition strategy. It includes business strategy analysis, accounting analysis, financial statement analysis and prospect analysis of four parts.The main points of the frame is in the business strategy analysis under the premise of accounting analysis, financial analysis and prospect analysis, shows that it is in a macro view more open order detail analysis, not only do detail analysis. Clyde P to financial analysis framework is divided into three parts, the first part of the financial accounting environment, the analysis of the data and the relationship between the enterprises the main activities, etc;The second part of accounting analysis, from the generally accepted accounting principles, analysis the connotation of the accounting item and quality; The third part of financial analysis, namely from the profitability, risk, prediction and evaluation of enterprise financial position and operating results are analyzed.3 Harvard theory analysis frameworks3.1 Strategic analysisStrategic analysis is the logical starting point of financial statement analysis, is also a Harvard analysis framework and other different parts of the financial analysis. Financial statement analysis is through the strategy analysis to the business activities of enterprises qualitative analysis of its economic significance, but also to accounting analysis and financial analysis for providing realistic background. Its main from the industry analysis and competitive strategy analysis of the two sides is analyzed. Can make use of porter five analysis, industry analysis to analyze the profitability of theindustry, by analyzing the existing and potential competitiveness, and negotiation ability, in the buying and selling market for investors to the data analysis of the industry has an overall grasp. Through the analysis of the industry development stage, the industry technological change speed, the product difference and integration, the buyer the seller number and relative size, industry market boundaries, total market and growth prospects, such as analysis, can see the nature of the industry and its status and role in the national economy. Sometimes, according to the characteristics of different industry life cycle for analysis. Must analysis the enterprise competition strategy analysis the characteristics of the industry and competitiveness problems. Choose attractive strong industry is part of business success, however, the real key to the success or failure of the enterprise is the enterprise the selected cost leadership strategy or differentiation strategy enforcement of whether to make a difference. Cost advantages including at a lower cost to provide the same product or service ability, a large number of mass production scale, production efficiency, etc.Difference advantage to supply a unique product or service cost is lower than the price, consumers preferred to buy a better product quality, more product variety, better customer service, etc.3.2 Accounting analysisAccounting analysis aims to evaluate financial statement disclosure of accounting information to the enterprise actual reflect the degree of operating conditions. Through the evaluation of enterprise accounting policies and accounting estimates whether appropriate, can assess the enterprise accounting information distortion degree. Through the analysis of the notes to financial statements, understand accounting statements behind digital detailed composition and not reflected in the information on accounting statements, by analyzing industry transverse and longitudinal analysis of the enterprise financial data that may exist in the water, and then to certain adjustment of financial data, and according to the adjusted data to the financial statements, so that they can more accurately grasp the enterprise the management condition. Accounting analysis steps in turn have to identify the key accounting policies, evaluating accounting flexibility, evaluationstrategy, accounting disclosure quality evaluation, recognize danger signals and finally eliminate the distortion of accounting information. Accounting analysis method can have the audit report to analysis, abnormal profit excluding method, cash flow analysis, related party transactions rejecting method eliminating method and the virtual assets.3.3 Financial analysisThe main content of financial analysis is to enterprise's debt paying ability, operation ability, and profit ability; create cash flow capacity using the method of financial ratio analysis and cash flow analysis to analysis and research. Is the purpose of financial analysis using the financial data to evaluate the performance of enterprise at present and the past, in order to better know and enterprise strategy is linked to performance. Ratio analysis is mainly used to evaluate the enterprise product market performance and financial policy. Cash flow analysis is mainly used to evaluate enterprise asset liquidity and financial flexibility. Analyze the corporate profitability and growth is one of the major problems of financial statement analysis and evaluation. Through the analysis of the problem can be used to develop product strategy and financial strategies. Product strategy, operation and management, including analysis of revenues and expenses management, working capital and the management of fixed assets investment management. Management of finance strategy including the analysis of debt and equity structure of financing strategy, dividend payments and profit distribution of dividend policy. Conduct financial analysis and accounting information distortion phenomenon is more common, so the Harvard analysis under the framework of financial analysis are not independent accounting data, but according to the result of step in the accounting analysis, namely the financial statements of the enterprise artificial out financial analysis, and the related parameters of the accounting statements and peer enterprises horizontal comparison, and analysis enterprise's position in the industry and its realistic situation.译文哈佛分析框架与企业财务分析研究Andrew G摘要一个有效地财务分析框架不仅要学习如何使用会计数据,而且要善于运用非会计数据。

哈佛分析框架下的企业财务分析国内外文献综述(二)国内外研究成果综述1.国内研究成果与国际比较,我们国内财务分析研究开始得晚,财务报表分析的水平也有些滞后。

但是后来由于我国学者不断得深入研究,逐渐丰富了我国财务分析方法。

张先治教授在上个世纪90年代,通过对我国的财务分析现状进行了系统的整理与研究,于1995年完成了对我国的财务分析理论的分类与定位。

在他的观点中,会计与基于会计的财务分析并不是一样的,虽然有着一定的联系,但本质上存在着很多的差异,并且张教授对这些差异一一做出了解释以及区分。

2001年教授通过对美国财务分析情况的研究与探索,对我过的财务分析体系做出了重建。

1樊行健(2005)提出,我国的会计分析一直都不怎么被大家所重视,与西方国家相比,明显存在较大的差距。

会计工作只能反映公司经济活动的原始数据信息。

因此,重点要将财务跟经济活动结合起来,并要考虑到成本分析在里面所起到的作用。

2陈如意(2006)撰写了一篇有关现行财务报表分析的文章。

文中的观点为,我国的当前基于财务报表的分析方法,有着很多弱项和空缺,其中也包括了在实际操作中的一些限制和信息披露方面的漏洞。

3黄世忠(2007)进行了案例研究。

他经过案例研究,探索出对财务分析有着重要的关键因素,分别为资产质量、现金流量情况和盈利质量这几个关键要素。

并对西方学着的理论研究成果进行了概述。

本书就财务表要素与现金流量的关系以及相关问题进行了结合实践。

4胡玉明(2007) 提出传统财务报表分析具有一定的局限,企业财务报表只是记载一些企业过去实际发生过的事情,这就使得企业财务报表会以结果导向作为起点。

就其本身而言,大家没办法明白“之所以产生这样结果”的来龙去脉,分析和使用企业财务报表的人只能够“知其然,却不知其所以然”。

他认为,企业财务报表分析的基本思维一定要从企业经营的环境和经营策略出发,在企业经营活动中反观企业财务报表,在公司财务报表中分析企业经营活动,然后对企业财务报表分析的主要框架进行构想。

随着互联网技术的迅猛发展,它逐渐的与社会生活活动紧密联系起来,电子商务也随之如雨后春笋般涌现出来。

互联网经济对传统经济模式发起了新的冲击和挑战。

网购成为了家喻户晓的新风尚。

消费者的网购需求促使形成了大量的电子商务平台。

在这种情况下,各大电商企业纷纷优化经营模式扩大经营,这一方面促进了电子商务的繁荣与发展,但同时也有一些电商企业因经营不善而倒闭退出。

根据2019最新公布的报告显示我国电商企业阿里巴巴继续位列第一,京东紧随其后,拼多多在众多电商企业中异军突起市值已位列第三。

拼多多于2015年9月成立,凭借全新的社交拼团的C2B模式在电商市场迅速站稳脚跟,三年内在美国成功上市。

由于拼多多在短短几年取得了巨大成就从而让我们看到了其研究价值所在。

在对拼多多进行分析时本文采用哈佛分析框架进行战略性高层次财务分析,然后对其后期发展提供进一步的建议。

关键词:拼多多,哈佛分析框架,财务分析,电子商务With the rapid development of Internet technology, it has gradually been closely linked with social life activities, and e-commerce has sprung up. The Internet economy has launched new shocks and challenges to the traditional economic model. Online shopping has become a household name. Consumers' online shopping demand has led to the formation of a large number of e-commerce platforms. Under such circumstances, major e-commerce companies have optimized their business models and expanded their operations. This has promoted the prosperity and development of e-commerce, but at the same time, some e-commerce companies have closed down due to poor management. According to the latest report released in 2019, China's e-commerce company Alibaba continues to rank first, followed by , Pinduoduo ranks third among many e-commerce companies with a rising market value. Pinduoduo was established in September 2015. With its new C2B model of social grouping, it quickly gained a foothold in the e-commerce market. Because Pinduoduo has made great achievements in just a few years, we have seen its research value. When analyzing Pinduoduo, this article uses the Harvard analysis framework for strategic high-level financial analysis, and then provides further suggestions for its later development.Keywords: Pinduoduo, Harvard analysis framework, Financial analysis, E-commerce目录前言 (1)1相关理论概述 (2)1.1哈佛分析框架理论 (2)1.2价值创造理论 (2)1.3研究方法 (3)2拼多多案例分析 (4)2.1拼多多基本情况 (4)2.2C2B的运营模式 (6)3基于哈佛分析框架的拼多多财务分析 (7)3.1战略分析 (7)3.1.1电商行业分析 (7)3.1.2拼多多战略分析 (8)3.2会计分析 (9)3.2.1收入确认政策 (9)3.2.2拼多多收入确认分析 (10)3.3财务分析 (10)3.3.1盈利能力分析 (10)3.3.2偿债能力分析 (12)3.3.3营运能力分析 (13)3.3.4现金流量分析 (14)3.4前景分析 (15)3.4.1风险预测 (15)3.4.2发展前景 (15)3.5哈佛分析框架总结 (16)4案列启示—对策与建议 (17)4.1C2B运营模式发展空间 (17)4.2电商企业的持续性发展 (17)结论 (18)致谢 (19)参考文献 (20)前言21世纪随着互联网与智能手机普及与应用,电子商务已渗透于人们日常生活中的各个方面,面对电商广阔的市场空间和发展前景,各大电商企业通过先进的信息技术开发出手机客户端购物软件和建立购物网站,切实的将网购这一理念渗透到人们生活之中。

摘要本文以养元智汇饮品股份有限公司为研究对象,运用文献研究法、对比分析等方法,基于哈佛框架的四个维度,在战略角度下分析该公司内部条件的优、劣势以及外部环境面临的机遇和威胁;在会计角度下分析公司的会计科目;在财务角度下对盈利、偿债、营运、发展能力进行横、纵向对比分析,为更深入的进行前景分析提供依据支持;在前景角度下对整个公司的未来发展进行科学预测,以此更加充分的了解公司状况,找出经营过程中存在的风险,使管理者做出科学的决策。

研究的结论有助于为养元饮品公司指引正确方向,同时也为同行业内的其他公司提供一定参考价值。

关键词:哈佛框架;财务分析;养元饮品ABSTRACTThis thesis takes Y angyuan Zhihui Beverage Co Ltd. as the research object, which uses literature research method, comparative analysis and other methods to analyze the advantages and disadvantages of the company's internal conditions and the opportunities and threats of the external environment based on the four dimensions of Harvard framework. Secondly, the thesis analyses the company's accounting policies under the accounting perspective. Thirdly, conducting horizontal and vertical comparative analysis of profitability, debt repayment, operation, and development capabilities under the financial perspective to provide data support for the further research. What’s more, in order to fully understand the company's situation and identify the risks in the business process to help managers make scientific decisions, the paper make the scientific forecast of the future development of the entire company. Finally, the conclusions of the study help to guide the correct direction of the nutrition drink for the company and provide some references value for other companies in the industry.Key words:Harvard framework; Financial analysis; Yanyuan Drink目录一绪论 (3)(一)研究背景 (3)(二)研究目的及意义 (4)1.研究目的 (4)2.研究意义 (4)(三)国内外研究现状 (4)1.国外研究现状 (4)2.国内研究现状 (5)(四)研究内容及方法 (5)1.研究内容 (5)2.研究方法 (5)3.研究框架图 (6)二哈佛分析框架理论 (6)(一)哈佛分析框架的提出 (6)(二)哈佛分析框架的具体内容 (6)1.战略分析 (6)2.会计分析 (6)3.财务分析 (7)4.前景分析 (7)三养元智汇饮品股份有限公司的财务分析 (5)(一)公司概述 (5)1.行业背景 (5)2.公司简介 (5)(二)战略分析 (5)1.养元饮品SWOT分析 (5)2.SWOT矩阵图 (7)(三)会计分析 (8)1.存货 (8)2.应收账款 (8)3.研发投入 (9)(四)财务分析 (9)1.盈利能力分析 (9)2.偿债能力分析 (10)3.营运能力分析 (10)4.发展能力分析 (11)(五)前景分析 (12)1.前景预测 (12)2.预测分析 (12)四问题及对策 (13)(一)养元智汇饮品股份有限公司存在的问题 (13)1.产品类型不丰富,不能满足顾客需求 (15)2.资产管理不合理,难以提高营运能力 (15)3.研发投入不到位,无法形成无形资产 (15)4.资金利用不充分,不易撬动财务杠杆 (15)5.企业规模不壮大,失去潜在市场份额 (15)(二)针对养元智汇饮品股份有限公司存在问题的对策 (14)1.加快多元发展 (14)2.加强资产管理 (14)3.加大研发投入 (14)4.加强资金利用 (14)5.加快发展步伐 (14)五结论 (23)参考文献 (23)致谢 .................................................................................................. 错误!未定义书签。

经营分析与估值克雷沙·G.帕利普保罗·M.希利摘自书籍“Business Analysis and Valuation”第五版第一章节1.简介本章的目的是勾勒出一个全面的财务报表分析框架。

因为财务报表提供给公共企业经济活动最广泛使用的数据,投资者和其他利益相关者依靠财务报告评估计划企业和管理绩效率。

各种各样的问题可以通过财务状况及经营分析解决,如下面的示例所示:一位证券分析师可能会对问:“我的公司有多好?这家公司是否符合我的期望?如果没有,为什么不呢?鉴于我对公司当前和未来业绩的评估,该公司的股票价值是多少?”一位信贷员可能需要问:“这家公司贷款给这家公司有什么贷款?公司管理其流动性如何?公司的经营风险是什么?公司的融资和股利政策所产生的附加风险是什么?“一位管理顾问可能会问:“公司经营的行业结构是什么?该策略通过在工业各个企业追求的是什么?不同企业在行业中的相对表现是什么?”公司经理可能会问:“我的公司是正确的估值的投资者吗?是我们在通信程序中有足够的投资者来促进这一过程?”财务报表分析是一项有价值的活动,当管理者在一个公司的战略和各种体制因素完成后,他们不可能完全披露这些信息。

在这一设置中,外部分析师试图通过分析财务报表数据来创建“中端信息”,从而获得有价值的关于该公司目前业绩和未来前景的展望。

了解财务报表分析所做的贡献,这是很重要的理解在资本市场的运作,财务报告的作用,形成财务报表制度的力量。

因此,我们首先简要说明这些力量,然后我们讨论的步骤,分析师必须执行,以提取信息的财务报表,并提供有价值的预测。

2.从经营活动到财务报表企业管理者负责从公司的环境中获取物理和财务资源,并利用它们为公司的投资者创造价值。

当公司在资本成本的超额投资时,就创造了价值。

管理者制定经营战略,实现这一目标,并通过业务活动实施。

企业的经营活动受其经济环境和经营战略的影响。

经济环境包括企业的产业、投入和产出的市场,以及公司经营的规章制度。

公司的业务战略决定企业如何定位自己的环境中获得竞争优势。

2.1会计制度特点1:权责发生制会计企业财务报告的基本特征之一是权责发生制,它们是以权责发生制而不是现金会计制备的。

不像现金会计,权责发生制会计与经济交流活动和实际收付现金相关的成本和效益的记录之间的区别。

净收益是应计制会计下的主要周期性业绩指标。

计算净收入,生态影响的经济交易记录的基础上的预期,并不一定是实际的现金支付。

预期的现金收入交付的产品或服务被确认为收入,和预期的现金流出与这些收入被确认为费用。

会计的必要性来自于投资者对定期财务报告的需求。

因为企业进行经济交易,在持续的基础上,在报告期导致了一个有趣的基本测量问题,结束时的会计帐簿任意闭合。

因为现金会计报告的不完整性,在生态经济带来的后果所进行的交易。

在一定时期内,权责发生制会计的目的是提供一个公司的周期性表现更完整的信息。

2.2会计制度特点2:会计准则和审计采用权责发生制会计是在许多重要的复杂性企业财务报告的中心。

由于权责发生制会计处理当前事件的预期未来现金的后果,它是主观的,依赖于各种假设条件。

谁应该负责制定这些假设条件负主要责任?一个公司的管理者被赋予作出适当的估计和假设编制财务报表的任务,因为他们有亲密的了解他们公司的业务优势。

经理授予的会计自由裁量权可能是有价值的,因为它反映了财务报表中的内部信息。

然而,由于投资者认为利润作为衡量管理者的绩效,管理者有动机利用他们的会计自由裁量权歪曲报道利润的假设、偏见。

另外,在公司内部和外部之间的合同中使用的会计数字提供了另一种管理操作的会计数字的动机。

在来管理扭曲了财务会计资料,使他们对前内部财务报表的使用者不值钱。

因此,财务报告的决定,企业管理者的代表团有成本和收益。

许多会计惯例已经形成,以确保管理者使用他们的会计灵活性来概括他们对公司经营活动的知识,而不是为了自我服务的目的而伪装现实。

例如,可测性和稳健性惯例和会计反应担心扭曲人学生可能偏向乐观。

这两个公约都试图限制管理者对悲观偏见的乐观偏见。

会计准则(公认会计原则),由财务会计标准委员会(FASB)发布和类似的标准设定在其他国家机构,也限制了潜在的扭曲,管理者可以将报告数字。

统一会计准则的尝试,以降低管理者的能力,以不同的方式记录类似的经济交易,无论是随着时间的推移或跨公司。

提高均匀性的会计准则,然而,是减少管理者反映他们公司的财务报表差异真正的业务灵活性。

严格的会计准则对经济交易的最佳效果,其会计处理不依赖于管理者的专有信息。

然而,当有重大的商业判断参与评估交易的经济后果,严格的标准,防止经理利用自己的业务知识上会不正常。

此外,如果会计准则过于僵化,他们可能会促使管理者花费经济资源来调整业务交易,以达到预期的会计结果。

审计,广义地定义为一个对上报的财务报表的人比其他人的完整性验证,确保管理人员利用会计规则和惯例一致,随着时间的推移,和他们的会计估计是合理的。

因此,审计提高会计数据的质量。

第三方审计也可能会降低财务报告的质量,因为它限制了会计规则和惯例的发展随着时间的推移。

FASB认为审计意见在标准制定过程中,核数师很可能会反对会计准则的生产数据,这是很难进行审计的,即使拟议的规则为投资者提供相关信息。

其中会计纠纷经理、审计师的法律环境,投资者也可以在裁决报告数据质量有显著的影响。

诉讼的威胁和惩罚的有益效果,证明了信息披露的准确性。

然而,一个重要的法律责任的潜力还有可能阻碍管理人员和审计人员从支持会计建议重新进行风险预测,如前瞻性信息披露。

2.3会计制度特点3:管理者的报告策略由于限制管理者对会计数据失真的能力增加的机制,并不是最优的利用会计规则来完全消除管理上的灵活性。

因此,现实世界的会计系统给管理者留下相当大的空间来影响财务报表数据。

一个公司的报告策略,即管理者使用他们的会计判断的方式,对公司的财务报表有重要影响。

企业管理者可以选择的会计和披露政策,使其更或不难的外部用户的财务报告,了解他们的业务的真实经济情况。

会计规则往往提供了一套广泛的替代品,管理者可以选择。

此外,管理者委托制定一系列的估计,在实施这些会计政策。

会计法规通常规定最低披露要求,但他们不限制经理提供额外的披露。

一个卓越的披露策略将使管理者能够将潜在的商业现实与外部投资者沟通。

企业披露战略的一个重要约束是产品市场的竞争态势。

专有信息的披露有关业务策略信息和预期的经济后果可能会伤害公司的竞争地位。

受此约束,管理者可以利用财务报表提供的评估公司的真正的生态经济业绩对投资者有用的信息。

管理者也可以利用财务报告策略操纵投资者的感知。

使用自由裁量权授予他们,管理者可以使投资者难以及时识别性能差。

例如,管理者可以选择交流计数的政策和估计,以提供一个乐观的评估公司的真实表现。

他们也可以让投资者了解真实的性能,通过控制信息自愿披露程度,性能高。

在这种程度上的财务报表信息对潜在的商业性现实随公司在某公司的时间。

这种变化在交流计数的质量提供了一个重要的机会和挑战。

3.从财务报表的业务分析由于管理者的内部知识是会计数据的价值和失真的来源,因此财务报表的外部使用者很难区分真实的信息和失真。

无法撤消会计失真,投资者可能“折扣”一个公司的会计业绩。

在这样做时,他们做了一个概率评估的程度,一个公司的报告数字反映经济现实。

因此,投资者只能对单个企业的绩效进行不精确的评估。

金融信息中介可以添加通过改善投资因素的理解公司的目前的业绩和未来前景价值。

有效的财务报表分析是有价值的,因为它试图在管理者的内部信息,从公共财务报表数据。

因为中介机构没有直接或完全访问这些信息,他们依靠他们的知识,该公司的行业及其竞争策略,以解释财务报表。

成功的中介机构至少有一个很好的理解,对行业经济的公司的经理,并合理地了解公司的竞争战略。

尽管外界分析人士与公司的相关管理者的信息劣势,他们更能客观评价其经济后果公司的投资管理和经营决策。

我们需要利用财务报表来完成四个关键步骤:(1)企业战略分析、(2)会计分析、(3)财务分析和(4)前景分析。

3.1分析步骤一:战略分析企业战略分析的目的是确定关键利润驱动程序和业务风险,并在一个定性的水平评估公司的利润潜力。

业务战略分析涉及到一个公司的行业分析和建立一个可持续的竞争优势的战略。

这种定性分析是一个重要的第一步,因为它使分析师能够更好地对以后的会计和财务分析框架进行分析。

考试简单,识别关键成功因素和关键业务风险的关键会计政策允许的识别。

评价一个企业的竞争战略有利于评价评估是否当前的盈利能力是可持续的。

最后,业务分析使分析师能够做出合理的假设,在预测公司的未来表现。

3.2分析步骤二:会计分析会计分析的目的是评估一个公司的会计捕捉到的基本业务的真实程度。

通过确定有帐户的灵活性,并通过评估公司的会计政策的恰当性和估计,分析师可以评估在一个公司的会计数字失真的程度。

在财务分析中的另一个重要的步骤是“撤销”任何会计系统通过重铸公司会计数据创建公正的会计数据。

健全的会计分析,提高了结论的可靠性从财务分析系统,为下一步的财务报表分析。

3.3分析步骤三:财务分析财务分析的目的是利用财务数据来评估一个公司的当前和过去的财务状况和评估其可持续性。

与财务分析相关的重要技能。

首先,分析应是系统和有效的。

其次,分析应允许分析师使用财务数据,探讨业务问题。

比率分析和现金流分析是最常用的金融工具。

比率分析的重点是企业的产品市场表现和财务政策的评价;现金流量分析公司的变现能力和财务弹性。

3.4分析步骤四:前景分析前景分析,专注于预测公司的未来,是业务分析的最后一步。

前瞻性分析中常用的技术是财务报表预测和估值。

这些工具允许从业务分析,研究会计分析和财务分析的合成,从而在前期分析出关于公司的未来。

虽然公司的价值是其未来现金流性能的功能,它也有可能评估公司的价值基础上的公司目前的账面价值的股票,其未来的回报率(净资产收益率)和增长。

战略分析、会计分析和财务分析,在这里讨论的框架的前三个步骤,提供一个公司的内在价值估算前良好的基础。

战略分析,除了有利的会计和财务分析,也有助于评估潜在的变化,企业的竞争优势和他们对公司未来的净资产收益率和增长的影响。

会计分析提供了一个公司的现行账面价值和净资产收益率的无偏估计。

财务分析让你获得了一个深入了解什么推动了公司目前的资产收益率。

从一个健全的业务分析的预测是有用的各种当事人,可以应用在不同的环境中。

分析的确切性质将取决于上下文。

我们将探讨包括证券分析、信用评估的情况下,兼并和收购,债务和股利政策评估,评估公司率通信策略。

上面描述的四个分析步骤是有用的,在每一个这些上下文中。

然而,适当地使用这些工具,需要熟悉的经济理论和体制因素相关的背景。

4.总结财务报表提供的公共企业生态经济活动的最广泛使用的数据;投资者和其他利益相关者依靠他们来评估计划与企业和企业管理者绩效。