IIT E10Q3 5LIB material market

- 格式:pdf

- 大小:922.52 KB

- 文档页数:23

Table of Contents1. About (2)About Product (2)System Requirements: (3)2. Installation (3)Step 1: Unzip Package (3)Step 2: Install (3)Step 3: Upgrade (4)Step 4: Deloy (4)Step 5: Clean cache (4)3. How to use this extension? (5)Configuration in back-end (5)Store Locations Management (9)✓Add New Store Location (9)✓Delete Store Location (15)Schedules Management (15)✓Add New Schedule (15)✓Delete Schedule (19)Overview extension in front-end (19)4. Uninstall (21)✓Step1: (21)✓Step 2: Uninstall (22)5. Support and Contact Information (24)Support (24)Contact Information (25)Copyright© 2011-20171.A boutAbout Product:Author Netbase TeamVisit us Store Locator Extension For Magento 2Change log Click to viewVideoSupport @Support Service; @CMSMart ForumLicense OSL-3.0You are a shop owner, you have a powerful website and a chain of offline stores but your customers hardly find your local stores, then you lose a huge of customers. Store Locator Extension for Magento 2 is an effective solution that you must integrate into your site to resolve this problem. It shows all store locations, show each store's info including images,open/close time, store description... and allow your customer search for closest stores by distance, zip code, state etc.Copyright© 2011-2017System Requirements:* Operating System:- Linux as RedHat Enterprise Linux (RHEL), CentOS, Ubuntu, Debian, v..v - Composer (the last version)- Apache 2.2 or > Apache 2.2- PHP 5.6.x; 5.5.x - where x is 22 or greater; 7.0.2, 7.0.6 up to but not including 7.1, except for 7.0.5* PHP extensions requirement:- PDO/MySQL- Mbstring- Mcrypt- Mhash- Simplexml- Curl - gd2, ImageMagick 6.3.7 (or later) or both- Soap* My SQL:- MySQL 5.6.x- Mail Transfer Agent (MTA) or SMTP server2.I nstallationThere are 5 steps to install this extension:Step 1: Unzip Package∙Unzip file from your folder. It includes:∙Continue to unzip. It includes:Step 2: Install∙Coppy folder into your root magento folderCopyright© 2011-2017Step 3: Upgrade∙Go to your root magento folder -> bin by Commandline∙From command window, you write: php magentosetup:upgradeStep 4: Deloy∙Go to your root magento folder -> bin by Commandline∙From command window, you write: php magento setup:static-content:deployStep 5: Clean cache∙In admin panel, go to System -> Cache ManagementCopyright© 2011-2017Copyright © 2011-2017∙ In Mass Action, choose “Select All ” -> Click on button3. H ow to use this extension?Configuration in back-end∙ In admin panel, click onSTORE LOCATOR -> SettingsCopyright© 2011-2017Locator View Setting Copyright© 2011-2017Copyright © 2011-2017∙ Enable Locator On Frontend: Turn on/ Turn off module.∙ Latitude of Center Default: fill on the default latitude for map. ∙ Longitude of Center Default: fill on the default longitude for map.∙ Zoom Default Level: fill in value of zoom default level for map. ∙Distance Unit: Select a default distance unit (Miles/Kilometers). ∙ Remembering after each change.Service API∙Google Map API Key:fill in Google map api. To get a Google map api key, you follow link below:https:///maps/documentation/javascript/get-api-key∙Enable Comment By Facebook: Choose Yes to enable Facebook comment for your stores.∙Remembering after each change.Store Locations ManagementIn admin panel, go to STORE LOCATOR -> Manage Store Locations ✓Add New Store Location∙Step 1: In Manage Store Location, click onCopyright© 2011-2017Copyright © 2011-2017Step 2: Add New Store Location - In TabGoogle Map LocationCopyright© 2011-2017+ Address: specific a exact address that will be displayed on front-end.+ Country: select country for this store location.+ State/Province: fill in state/province of store location.+ City: fill in city of store location.+ Zip Code: fill in zip code.+ The exact location coordinates can be defined automatically after you fill location address in box “Enter a location”.- In Tab Store InformationCopyright© 2011-2017Copyright© 2011-2017+ Store Name: fill in store location name.+Identifier: fill in identifier. Please enter a valid XML-identifier (Ex: something_1, block5, id-4).+ Status: You can enable/disable the location display on the map.+ Select schedule: select schedule for this store location. To create a schedule, you can view guide “Add New Schedule” below.”+ Store Link: fill in store link for this location.+ Store Image: Upload an image for each store that will be displayed on the frontend map.+ Store Order: fill in sort order that is display in the store list in the left sidebar.+ Description: Specify additional description for this store location.-In tab Contact Information:+ Fill in Email, Phone Number and Fax Number of this store location. Copyright© 2011-2017∙Step 3: Rememberingafter adding location.✓Delete Store Location∙In manage store locations page, you tick to select the store locations you want to delete -> select “Delete” in ActionSchedules ManagementIn admin panel, go to STORE LOCATOR -> Manage Schedules ✓Add New Schedule∙Step 1: In manage schedule page, click onCopyright© 2011-2017Step 2: Add new schedule-In tab General Information : Copyright© 2011-2017+ Schedule Name: fill in schedule name for each store location.+ Status: enable/disable schedule on the front-end.- In Tab Schedule Content:Copyright© 2011-2017Copyright© 2011-2017Copyright © 2011-2017+ You select open/close time for each day. ∙Step 3: Rememberingafter adding schedule.✓ Delete Schedule∙ In manage schedules page, tick to select schedules you want to delete -> select “Delete” in Action✓Setail Store Locator page Copyright© 2011-20174.U ninstallStep1:In admin panel, go to Store →Configuration Copyright© 2011-2017Step 2: UninstallIn Configuration window, click on ADVANCED -> select AdvancedCopyright© 2011-2017Select Disable in Netbaseteam_Locator Copyright© 2011-2017Click on5.S upport and Contact InformationSupportOur Magento team is dedicated to providing customers with the best Quality, Value and Services. We would love to hear from you. For feedback about our products, please feel free to contact us at:@Support ServiceCheck out our Forum for updates and news.@CMSMart ForumCopyright© 2011-2017Contact InformationCheck out our Facebook page! Regional news and specially selected products are featured daily.@CMSMart on FacebookYou can also follow us on Twitter!@CMSMart on TwitterIf you have any question, don’t hesitate to contact us:Administration department: *****************Sales department: *****************Copyright© 2011-2017。

Silicon Labs OpenThread SDK 2.3.0.0 GA Gecko SDK Suite 4.3June 7, 2023Thread is a secure, reliable, scalable, and upgradeable wireless IPv6 mesh networking Array protocol. It provides low-cost bridging to other IP networks while optimized for low-power /battery-backed operation. The Thread stack is designed specifically for Connected Homeapplications where IP-based networking is desired and a variety of application layers maybe required.OpenThread released by Google is an open-source implementation of Thread. Googlehas released OpenThread in order to accelerate the development of products for the con-nected home and commercial buildings. With a narrow platform abstraction layer and asmall memory footprint, OpenThread is highly portable. It supports system-on-chip (SoC),network co-processor (NCP), and radio co-processor (RCP) designs.Silicon Labs has developed an OpenThread-based SDK tailored to work with Silicon Labshardware. The Silicon Labs OpenThread SDK is a fully tested enhanced version of theGitHub source. It supports a broader range of hardware than does the GitHub version,and includes documentation and example applications not available on GitHub.These release notes cover SDK version(s):2.3.0.0 GA released on June 7, 2023Compatibility and Use NoticesFor information about security updates and notices, see the Security chapter of the Gecko Platform Release notes installed with this SDK or on the TECH DOCS tab on https:///developers/thread . Silicon Labs also strongly recommends that you subscribe to Security Advisories for up-to-date information. For instructions, or if you are new to the Silicon Labs OpenThread SDK, see Using This Release.Compatible Compilers:GCC (The GNU Compiler Collection) version 10.3-2021.10, provided with Simplicity Studio.Contents1New Items (1)1.1New Components (1)1.2New Features (1)1.3New Radio Board Support (1)2Improvements (2)3Fixed Issues (3)4Known Issues in the Current Release (4)5Deprecated Items (5)6Removed Items (6)7Multiprotocol Gateway and RCP (7)7.1New Items (7)7.2Improvements (7)7.3Fixed Issues (7)7.4Known Issues in the Current Release (8)7.5Deprecated Items (8)7.6Removed Items (8)8Using This Release (9)8.1Installation and Use (9)8.2OpenThread GitHub Repository (9)8.3OpenThread Border Router GitHub Repository (9)8.4Using the Border Router (9)8.5NCP/RCP Support (10)8.6Security Information (10)8.7Support (11)New Items 1 New Items1.1 New ComponentsNone1.2 New FeaturesAdded in release 2.3.0.0•The versions of OpenThread and the OpenThread Border Router have been updated. See sections 8.2 and 8.3.•Thread 1.3.1 (experimental)o IPv4/v6 public internet connectivity: NAT64 improvements, optimization of published routes and prefixes in network data o DNS enhancements for OTBRo Thread over Infrastructure (TREL)•Network Diagnostics Improvements (experimental)o Child supervision by parento Additional link quality information in child tableo Uptime for routers•Support for the ot-cli sample application with CPC on Android Hosto The ot-cli sample application can now be used with CPC on an Android host. To build, download the Android NDK toolchain, define the environment variable "NDK" to point to the toolchain, and run the script/cmake-build-android script instead of script/cmake-build.1.3 New Radio Board SupportAdded in release 2.3.0.0Support has been added for the following radio boards:•BRD4196B - EFR32xG21B•BRD2704A - Sparkfun Thing Plus MGM240PImprovements 2 ImprovementsChanged in release 2.3.0.0•Support for “diag cw” and “diag stream”o diag cw start - Start transmitting continuous carrier waveo diag cw stop - Stop transmitting continuous carrier waveo diag stream start - Start transmitting a stream of characters.o diag stream stop - Stop transmitting a stream of characters.•Bootloader support for sample applicationso The bootloader_interface component has been added to the Thread sample apps. The component introduces support for bootloaders and also results in the creation of GBL files when building.•Reduction to code size of Certified OpenThread Librarieso The pre-built certification libraries no longer include JOINER functionality.Fixed Issues 3 Fixed IssuesFixed in release 2.3.0.01023725 Fixed an issue where detached MTDs on the Thread network hit an assert while re-attaching to the OTBR after the OTBR is rebooted.1079667 Fixed an issue where devices can no longer communicate after reporting transient out-of-buffers condition.1084368 Fixed failing HomeKit HCA test when using board 4186c and the DMP application.1095059 Added openthread 'diag stream' and 'diag cw' CLI commands. See Improvements section for additional details.1113046 Radio PAL now maintains max channel power table.1126570 Addressed a memory leak associated with PSA keys which occurs when otInstanceFinalise() is called without power cycling.1133240 Fixed a bug in setting link parameters in the meshcop forwarding layer.1139318 Request to Reduce Codesize of Certified OpenThread Library. See Improvements section for additional details. 1139449 Fixed an issue where devices stopped receiving during Tx storm.1142231 Radio SPINEL no longer asserts when no entries are available in source match table.Known Issues in the Current Release 4 Known Issues in the Current ReleaseIssues in bold were added since the previous release. If you have missed a release, recent release notes are available on https:///developers/thread in the Tech Docs tab.482915 495241 A known limitation with the UART driver can causecharacters to be lost on CLI input or output. This canhappen during particularly long critical sections thatmay disable interrupts, so it can be alleviated byrepeating the CLI or waiting long enough for statechanges.No known workaround754514 Double ping reply observed for OTBR ALOC address. No known workaround815275 Ability to modify the Radio CCA Modes at compile-time using a configuration option in Simplicity Studio is cur-rently not supported. Use the SL_OPENTHREAD_RADIO_CCA_MODE configuration option defined in openthread-core-efr32-config.h header file included with your project.1041112 OTBR / EFR32 RCP can miss forwarding packets froma CSL child if it configures an alternate channel for CSLcommunication.Due to this issue, OTBRs based on GSDK 4.2.0.0 arenot expected to pass Thread 1.2 certification unless thecustomer use cases demand a waiver to exclude alltests that require changing the primary channel. Avoid configuring alternate CSL channels until this issue is addressed.1094232 Intermittently, ot-ctl terminates after a factoryresetwhen using a CPCd connection.No known workaround1064242 OpenThread prefix commands sometimes fail to addprefix for OTBR over CPC.No known workaround1117447 Outgoing key index can be set to 0 under unknowncircumstances.No known workaround1132004 RCP can become unresponsive when receiving excessive beacon requests. This issue was seen with 3 devices sending beacons requests every 30 ms. Workaround is to reduce the number of beacon requesters and/or increase time between the requests.1143008 The OTBR can sometimes fail to transmit a CSL packet with the error "Handle transmit done failed:Abort". This could happen ifOPENTHREAD_CONFIG_MAC_CSL_REQUEST_AHEAD_US is set to low. SetOPENTHREAD_CONFIG_MAC_CSL_REQUEST_AHEAD_US to 5000.For the OTBR, you can either:1. Modify the value ofOPENTHREAD_CONFIG_MAC_CSL_REQUEST_AHEAD_US in ot-br-posix/third_party/openthread/repo/src/core/config/mac.hor2. Pass the value during setup as follows:sudo OTBR_OPTIONS="-DCMAKE_CXX_FLAGS='-DOPENTHREAD_CONFIG_MAC_CSL_REQUEST_AHEAD_ US=5000'" ./script/setup1148720 Intermittently, SED current draw is too high. No known workaroundDeprecated Items 5 Deprecated ItemsNone.Removed Items 6 Removed ItemsRemoved in release 2.3.0.0•The ot-remote-cli component has been removed. There is no replacement for this component because the functionality provided by the component is no longer required.•The Silicon Labs HomeKit extension is no longer included with this release.7 Multiprotocol Gateway and RCP7.1 New ItemsAdded in release 2.3.0.0Added a new application z3-light_ot-ftd_soc that demonstrates Zigbee and OpenThread Concurrent Multiprotocol functionality. It features a router on the Zigbee side and a Full Thread Device (FTD) on the OpenThread side. See the project description or app/framework/sce-narios/z3/z3-light_ot-ftd_soc/readme.html for details.First GA-quality release of CPC GPIO Expander module. The Co-Processor Communication (CPC) General Purpose Input/Output (GPIO) Expander is a software component designed to enable a Host device to utilize a Secondary device's GPIOs as if they were its own. With the CPC GPIO Expander, the Host device can seamlessly integrate with the Secondary device and make use of its GPIO capabilities. See https:///SiliconLabs/cpc-gpio-expander/README.md for documentation.Added antenna diversity and coex EZSP command support to Zigbeed.Added better assert reporting to Zigbeed.Added bt_host_empty application (option: -B for the run.sh script) to the multiprotocol docker container.Zigbeed now includes an implementation of emberGetRestoredEui64() which loads the CREATOR_STACK_RESTORED_EUI64 token from the host_token.nvm file.The multiprotocol container now sets the size of syslog to 100 MB by default. Users are able to change the size by modifying the "/etc/logrotate.d/rsyslog" and "/etc/rsyslog.d/50-default.conf" files and restarting the rsyslog service inside the container.7.2 ImprovementsChanged in release 2.3.0.0Reduced CPC Tx and Rx queue sizes to fit the DMP NCP on the MG13 family.Configured options on the multiprotocol RCP projects to provide ~3.3k in RAM savings, particularly for the MG1 part. This was accom-plished by•Reducing•The number of user CPC endpoints to 0•Tx CPC queue size to 15 from 20•Rx buffer count to 15•Disabling OpenThread RTT logsFor further savings, customers can look into reducing the Tx and Rx queue sizes further. Note that the downside to this change would be a reduction in message throughput due to added retries. Also, customers can look into reducing the NVM cache size based on need. As a last resort, customers may also choose to disable CPC security on both the RCP and the host. We do not recommend the last option.Changed zigbee_ble_event_handler to print scan responses from legacy advertisements in the DMPLight(Sed) app.The rcp-xxx-802154 apps now by default support 192 µsec turnaround time for non-enhanced acks while still using 256 µsec turnaround time for enhanced acks required by CSL.7.3 Fixed IssuesFixed in release 2.3.0.01078323 Resolved issue where Z3GatewayCPC asserts when there is a communication failure with the NCP during address table initialization. We will now try to reconnect to the NCP upon failure.1080517 Z3GatewayCPC now automatically handles a reset of the NCP (CPC secondary).1117789 Fixed an issue where modifying OPENTHREAD_CONFIG_PLATFORM_RADIO_SPINEL_RX_FRAME_BUFFER_SIZE caused a linker error when building Zigbeed.1118077 In the CMP RCP, Spinel messages were being dropped under heavy traffic load due to CPC not keeping up with the incoming packets. Fixed this by bundling all Spinel messages ready to be sent over CPC into one payload on the RCP and unbundling them on the host. This dramatically improves the efficiency of CPC so that it can keep up with the incoming radio traffic.1129821 Fixed null pointer dereference in Zigbeed in an out-of-buffer scenario while receiving packets.1139990 Fixed an assert in the OpenThread Spinel code that could be triggered when joining many Zigbee devices simultaneously.1144268 Fixed an issue where excessive radio traffic can cause the Zigbee-BLE NCP to get into a state where it continually executes the NCP and CPC initialization.1147517 Fixed an issue with Z3GatewayCPC on startup that could cause the reset handling of the secondary to not work correctly.7.4 Known Issues in the Current ReleaseIssues in bold were added since the previous release. If you have missed a release, recent release notes are available on https:///developers/gecko-software-development-kit.811732 Custom token support is not available when using Zigbeed. Support is planned in a future release.937562 Bluetoothctl ‘advertise on’ command fails with rcp-uart-802154-blehci app on Raspberry Pi OS 11.Use btmgmt app instead of bluetoothctl.1074205 The CMP RCP does not support two networks on the same PAN id. Use different PAN ids for each network. Support is planned in a future release.1122723 In a busy environment the CLI can become unresponsive in the z3-light_ot-ftd_soc app. This app is released as experimental quality and the issue will be fixed in a future release.1124140 z3-light_ot-ftd_soc sample app is not able to form theZigbee network if the OT network is up already.Start the Zigbee network first and the OT network after.1129032 Experimental concurrent listening feature on xG24 de-vices is disabled in this release.Support is planned in a future release.1143857 Antenna Diversity is not available on the CMP RCP forxG21 and xG24 parts, since the antenna diversityhardware is used for concurrent listening.Intended behavior.7.5 Deprecated Items None7.6 Removed Items None8 Using This ReleaseThis release contains the following•Silicon Labs OpenThread stack•Silicon Labs OpenThread sample applications•Silicon Labs OpenThread border routerFor more information about the OpenThread SDK see QSG170: Silicon Labs OpenThread QuickStart Guide. If you are new to Thread see UG103.11: Thread Fundamentals.8.1 Installation and UseThe OpenThread SDK is part of the Gecko SDK (GSDK), the suite of Silicon Labs SDKs. To quickly get started with OpenThread and the GSDK, start by installing Simplicity Studio 5, which will set up your development environment and walk you through GSDK installation. Simplicity Studio 5 includes everything needed for IoT product development with Silicon Labs devices, including a resource and project launcher, software configuration tools, full IDE with GNU toolchain, and analysis tools. Installation instructions are provided in the online Simplicity Studio 5 User’s Guide.Alternatively, Gecko SDK may be installed manually by downloading or cloning the latest from GitHub. See https:///Sili-conLabs/gecko_sdk for more information.The GSDK default installation location has changed beginning with Simplicity Studio 5.3.•Windows: C:\Users\<NAME>\SimplicityStudio\SDKs\gecko_sdk•MacOS: /Users/<NAME>/SimplicityStudio/SDKs/gecko_sdkDocumentation specific to the SDK version is installed with the SDK. API references and other information about this release are available on https:///openthread/2.1/.8.2 OpenThread GitHub RepositoryThe Silicon Labs OpenThread SDK includes all changes from the OpenThread GitHub repo (https:///openthread/openthread) up to and including commit dae3ff2c5. An enhanced version of the OpenThread repo can be found in the following Simplicity Studio 5 GSDK location:<GSDK Installation Location>\util\third_party\openthread8.3 OpenThread Border Router GitHub RepositoryThe Silicon Labs OpenThread SDK includes all changes from the OpenThread border router GitHub repo (https:///openthread/ot-br-posix) up to and including commit de7cd7b20. An enhanced version of the OpenThread border router repo can be found in the following Simplicity Studio 5 GSDK location:<GSDK Installation Location>\util\third_party\ot-br-posix8.4 Using the Border RouterFor ease of use, Silicon Labs recommends the use of a Docker container for your OpenThread border router. Refer to AN1256: Using the Silicon Labs RCP with the OpenThread Border Router for details on how to set up the correct version of OpenThread border router Docker container. It is available at https:///r/siliconlabsinc/openthread-border-router.If you are manually installing a border router, using the copies provided with the Silicon Labs OpenThread SDK, refer to AN1256: Using the Silicon Labs RCP with the OpenThread Border Router for more details.Although updating the border router environment to a later GitHub version is supported on the OpenThread website, it may make the border router incompatible with the OpenThread RCP stack in the SDK.8.5 NCP/RCP SupportThe OpenThread NCP support is included with OpenThread SDK but any use of this support should be considered experimental. The OpenThread RCP is fully implemented and supported.8.6 Security InformationSecure Vault IntegrationWhen deployed to Secure Vault High devices, sensitive keys are protected using the Secure Vault Key Management functionality. The following table shows the protected keys and their storage protection characteristics.Thread Master Key Exportable Must be exportable to form the TLVsPSKc Exportable Must be exportable to form the TLVsKey Encryption Key Exportable Must be exportable to form the TLVsMLE Key Non-ExportableTemporary MLE Key Non-ExportableMAC Previous Key Non-ExportableMAC Current Key Non-ExportableMAC Next Key Non-ExportableWrapped keys that are marked as “Non-Exportable” can be used but cannot be viewed or shared at runtime.Wrapped keys that are marked as “Exportable” can be used or shared at runtime but remain encrypted while stored in flash.For more information on Secure Vault Key Management functionality, see AN1271: Secure Key Storage.Security AdvisoriesTo subscribe to Security Advisories, log in to the Silicon Labs customer portal, then select Account Home. Click HOME to go to the portal home page and then click the Manage Notifications tile. Make sure that ‘Software/Security Advisory Notices & Product Change Notices (PCNs)’ is checked, and that you are subscribed at minimum for your platform and protocol. Click Save to save any changes.8.7 SupportDevelopment Kit customers are eligible for training and technical support. Use the Silicon Laboratories Thread web page to obtain infor-mation about all Silicon Labs OpenThread products and services, and to sign up for product support.You can contact Silicon Laboratories support at /support.Silicon Laboratories Inc.400 West Cesar Chavez Austin, TX 78701USA IoT Portfolio /IoT SW/HW /simplicity Quality /quality Support & Community /communityDisclaimerSilicon Labs intends to provide customers with the latest, accurate, and in-depth documentation of all peripherals and modules available for system and software imple-menters using or intending to use the Silicon Labs products. Characterization data, available modules and peripherals, memory sizes and memory addresses refer to each specific device, and “Typical” parameters provided can and do vary in different applications. Application examples described herein are for illustrative purposes only. Silicon Labs reserves the right to make changes without further notice to the product information, specifications, and descriptions herein, and does not give warranties as to the accuracy or completeness of the included information. Without prior notification, Silicon Labs may update product firmware during the manufacturing process for security or reliability reasons. Such changes will not alter the specifications or the performance of the product. Silicon Labs shall have no liability for the consequences of use of the infor -mation supplied in this document. This document does not imply or expressly grant any license to design or fabricate any integrated circuits. The products are not designed or authorized to be used within any FDA Class III devices, applications for which FDA premarket approval is required or Life Support Systems without the specific written consent of Silicon Labs. A “Life Support System” is any product or system intended to support or sustain life and/or health, which, if it fails, can be reasonably expected to result in significant personal injury or death. Silicon Labs products are not designed or authorized for military applications. Silicon Labs products shall under no circumstances be used in weapons of mass destruction including (but not limited to) nuclear, biological or chemical weapons, or missiles capable of delivering such weapons. Silicon Labs disclaims all express and implied warranties and shall not be responsible or liable for any injuries or damages related to use of a Silicon Labs product in such unauthorized applications. Note: This content may contain offensive terminology that is now obsolete. Silicon Labs is replacing these terms with inclusive language wherever possible. For more information, visit /about-us/inclusive-lexicon-projectTrademark InformationSilicon Laboratories Inc.®, Silicon Laboratories ®, Silicon Labs ®, SiLabs ® and the Silicon Labs logo ®, Bluegiga ®, Bluegiga Logo ®, EFM ®, EFM32®, EFR, Ember ®, Energy Micro, Energy Micro logo and combinations thereof, “the world’s most energy friendly microcontrollers”, Redpine Signals ®, WiSeConnect , n-Link, ThreadArch ®, EZLink ®, EZRadio ®, EZRadioPRO ®, Gecko ®, Gecko OS, Gecko OS Studio, Precision32®, Simplicity Studio ®, Telegesis, the Telegesis Logo ®, USBXpress ® , Zentri, the Zentri logo and Zentri DMS, Z-Wave ®, and others are trademarks or registered trademarks of Silicon Labs. ARM, CORTEX, Cortex-M3 and THUMB are trademarks or registered trademarks of ARM Holdings. Keil is a registered trademark of ARM Limited. Wi-Fi is a registered trademark of the Wi-Fi Alliance. All other products or brand names mentioned herein are trademarks of their respective holders.。

SAP移动类型详细说明SAP移动类型详细说明101 Goods receipt for purchase order or order 101有关采购订单或生产订单的收货If the purchase order or order has not been assigned to an account, a stock type (unr estricted-use stock, stock in quality inspection, blocked stock) can be entered during goods receipt.如果采购订单或订单没有指定科目,其库存类型(非限制使用库存、质量检验库存、冻结库存)可以在收货的时候输入。

If the purchase order or order has been assigned to an account, the goods receipt is not posted to the warehouse, but to consumption.如果采购订单或订单已经存在科目分配,收货没有过帐到仓库库存中,而是过帐到消耗中(PS.如成本中心、固定资产、办公用品等)。

In the case of non-valuated materials, the goods receipt is posted to the warehouse, although the purchase order has not been assigned to an account.对于无评估物料的情况,收货时也会过帐到仓库中,尽管采购订单中没有分配科目。

Possible special stock indicators:相关的特殊库存标识:• K Goods receipt for purchase order to consignment stockK有关寄售库存采购订单的收货• O Goods receipt for purchase order to stock of material provided to vendorO有关委外加工库存采购订单的收货(分包)• E GR for purchase order or order to sales order stockE有关销售订单库存的收货• Q GR for purchase order or order to project stock.Q有关项目库存采购订单的收货Goods receipt for subcontract order: at goods receipt, the consumption of the compon ents is posted at the same time (see movement type543)有关分包订单的收货:在收货时,组件的消耗过账也会同时进行(参见移动类型543)(PS.委外加工后返回的物料,原先在库存中的状态为:分包,在101收货的同时,系统会自动作543的转储动作将物料从分包库存转储到非限制自有库存中)。

sap物料事务代码Material Mangement:MM01 - 创建物料主数据XK01 - 创建供应商主数据ME11 - 创建采购信息记录ME01 - 维护货源清单ME51N- 创建采购申请ME5A - 显示采购申请清单ME55 - 批准采购申请(批准组:YH)ME57 –分配并处理采购申请MB21 - 预留MB24 - 显示预留清单ME21N- 创建采购订单ME28 - 批准采购订单(批准组:YS)ME9F - 采购订单发送确认ME2L - 查询供应商的采购凭证ME31 - 创建采购协议MD03 - 手动 MRPMD04 - 库存需求清单(MD05 - MRP 清单)MRKO - 寄售结算MELB - 采购申请列表(需求跟踪号)ME41 - 创建询价单ME47 - 维护报价ME49 - 价格比较清单MI31 - 建立库存盘点凭证MI21 - 打印盘点凭证MI22 - 显示实际盘点凭证内容MI24 - 显示实际盘点凭证清单MI03 - 显示实际盘点清单MI04 - 根据盘点凭证输入库存计数MI20 - 库存差异清单MI07 - 库存差额总览记帐MI02 - 更改盘点凭证MB03 - 显示物料凭证ME2O - 查询供应商货源库存MB03 - 显示物料凭证MMBE - 库存总览MB5L - 查询库存价值余额清单MCBR - 库存批次分析MB5B - 查询每一天的库存MB58 - 查询客户代保管库存MB25 - 查询预留和发货情况- 物料凭证查询(可以按移动MB51MB5S - 查询采购订单的收货和发票差异MB51类型查询)ME2L - 确认采购单/转储单正确MCSJ - 信息结构 S911 采购信息查询(采购数量价值、收货数量价值、发票数量价值)MCBA - 核对库存数量金额MM04 - 显示物料改变MMSC - 集中创建库存地点MIGO_GR 根据单据收货:MB1C - 其它收货MB1A - 输入发货MB1B - 转储MB31 - 生产收货MB01 - 采购收货MBST - ME31L- 创建计划协议ME38 - 维护交货计划取消物料凭证MM60 - 商品清单ME9A - 消息输出MB04 - 分包合同事后调整MB52 - 显示现有的仓库物料库存MB90 - 来自货物移动的输出CO03 - 显示生产订单IW13 - 物料反查订单(清单)IW33 - 显示维修订单VA01 -创建销售订单VL01N - 参照销售订单创建外向交货单VL02N –修改外向交货单(拣配、发货过帐)VL09 –冲销销售的货物移动VF01 –出具销售发票VF04 –处理出具发票到期清单VF11 –取消出具销售发票Warehouse Mangement:LB01 Create Transfer Requirement 创建转储需求LB02 Change transferrequirement 修改转储需求LB03 Display Transfer Requirement 显示转储需求LB10 TRs for Storage Type 按仓储类型的转储请求LB11 TRs for Material 物料转储请求LB12 TRs and Posting Change for MLEat.Doc. 转储请求及物料凭证变更传送LB13 TRs for Requirement 按需求的转储请求LD10 Clear decentralized inventory diff. 清除分散的库存差异LD11 Clear differences for decentral.sys. 清除分散系统的差异LI01 Create System Inventory Record 创建系统库存记录LI02 Change System InventoryRecord 修改系统库存记录LI03 Display System Inventory Record 显示系统库存记录LI04 Print System Inventory Record 打印系统库存记录LI05 Inventory History forStorage Bin 仓位的库存历史LI06 Block stor.types for annual invent.冻结年库存仓储类型LI11 Enter Inventory Count 输入库存盘点LI12 Change inventory count 修改库存盘点LI13 Display Inventory Count 显示库存盘点数LI14 Start Inventory Recount 库存重新盘点开始LI20 Clear Inventory Differences WM 清除库存差异仓库管理 WMLI21 Clear Inventory Differences in MM-IM 清除 MM-IM 中的库存差额LL01 Warehouse Activity Monitor 仓库活动监控LLVS WM Menu 仓库管理菜单LN01 Number Ranges for Transfer Requirem. 转储需求编号范围LN02 Number Ranges forTransfer Orders 转储单编号范围LN03 Number Ranges for Quants 数量编号范围LN04 Number Ranges for Posting Changes 修改的数字范围记帐LN05 Number Ranges for Inventory 存货的编号范围LN06 Number Ranges for Reference Number 参考号编号范围LN08 Number Range Maintenance: LVS_LENUM 编号范围维护:LVS_LENUMLP10 Direct picking for PO 直接为采购单PO分检LP11 WMstaging of crate parts WM 装箱部件待运LP12 Staging release order parts WM-PP 待运下达订单零件LP21 WM replenishment for fixed bins WM 固定仓位补充LP22 Replenishm. Planning for Fixed Bins 补充。

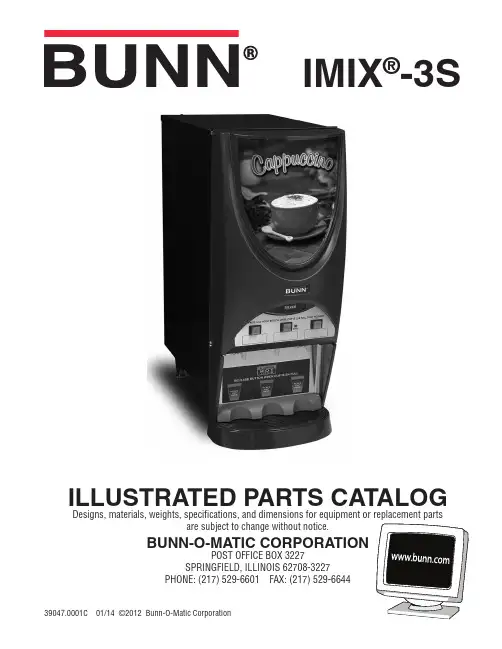

IMIX®-3SILLUSTRATED PARTS CATALOGDesigns, materials, weights, specifications, and dimensions for equipment or replacement partsare subject to change without notice.BUNN-O-MATIC CORPORATIONPOST OFFICE BOX 3227SPRINGFIELD, ILLINOIS 62708-3227PHONE: (217) 529-6601 FAX: (217) 529-664439047.0001C 01/14 ©2012 Bunn-O-Matic CorporationBUNN-O-MATIC COMMERCIAL PRODUCT WARRANTYBunn-O-Matic Corp. (“BUNN”) warrants equipment manufactured by it as follows:1) Airpots, thermal carafes, decanters, GPR servers, iced tea/coffee dispensers, MCP/MCA pod brewers thermal servers and Thermofresh servers (mechanical and digital)- 1 year parts and 1 year labor.2) All other equipment - 2 years parts and 1 year labor plus added warranties as specified below:a) Electronic circuit and/or control boards - parts and labor for 3 years.b) Compressors on refrigeration equipment - 5 years parts and 1 year labor.c) Grinding burrs on coffee grinding equipment to grind coffee to meet original factory screen sieve analysis - partsand labor for 4 years or 40,000 pounds of coffee, whichever comes first.These warranty periods run from the date of installation BUNN warrants that the equipment manufactured by it will be commercially free of defects in material and workmanship existing at the time of manufacture and appearing within the applicable warranty period. This warranty does not apply to any equipment, component or part that was not manufactured by BUNN or that, in BUNN’s judgment, has been affected by misuse, neglect, alteration, improper installation or operation, improper maintenance or repair, non periodic cleaning and descaling, equipment failures related to poor water quality, damage or casualty. In addition, the warranty does not apply to replacement of items subject to normal use including but not limited to user replaceable parts such as seals and gaskets. This warranty is conditioned on the Buyer 1) giving BUNN prompt notice of any claim to be made under this warranty by telephone at (217) 529-6601 or by writing to Post Office Box 3227, Springfield, Illinois 62708-3227; 2) if requested by BUNN, shipping the defective equipment prepaid to an authorized BUNN service location; and 3) receiving prior authorization from BUNN that the defective equipment is under warranty.THE FOREGOING WARRANTY IS EXCLUSIVE AND IS IN LIEU OF ANY OTHER WARRANTY, WRITTEN OR ORAL, EX-PRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY IMPLIED WARRANTY OF EITHER MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. The agents, dealers or employees of BUNN are not authorized to make modifications to this warranty or to make additional warranties that are binding on BUNN. Accordingly, statements by such individuals, whether oral or written, do not constitute warranties and should not be relied upon.If BUNN determines in its sole discretion that the equipment does not conform to the warranty, BUNN, at its exclusive op-tion while the equipment is under warranty, shall either 1) provide at no charge replacement parts and/or labor (during the applicable parts and labor warranty periods specified above) to repair the defective components, provided that this repair is done by a BUNN Authorized Service Representative; or 2) shall replace the equipment or refund the purchase price for the equipment.THE BUYER’S REMEDY AGAINST BUNN FOR THE BREACH OF ANY OBLIGATION ARISING OUT OF THE SALE OF THIS EQUIPMENT, WHETHER DERIVED FROM WARRANTY OR OTHERWISE, SHALL BE LIMITED, AT BUNN’S SOLE OPTION AS SPECIFIED HEREIN, TO REPAIR, REPLACEMENT OR REFUND.In no event shall BUNN be liable for any other damage or loss, including, but not limited to, lost profits, lost sales, loss of use of equipment, claims of Buyer’s customers, cost of capital, cost of down time, cost of substitute equipment, facilities or services, or any other special, incidental or consequential damages.392, A Partner You Can Count On, Air Infusion, AutoPOD, AXIOM, BrewLOGIC, BrewMETER, Brew Better Not Bitter, Brew-WISE, BrewWIZARD, BUNN Espress, BUNN Family Gourmet, BUNN Gourmet, BUNN Pour-O-Matic, BUNN, BUNN with the stylized red line, BUNNlink, Bunn-OMatic, Bunn-O-Matic, BUNNserve, BUNNSERVE with the stylized wrench design, Cool Froth, DBC, Dr. Brew stylized Dr. design, Dual, Easy Pour, EasyClear, EasyGard, FlavorGard, Gourmet Ice, Gourmet Juice, High Intensity, iMIX, Infusion Series, Intellisteam, My Café, Phase Brew, PowerLogic, Quality Beverage Equipment Worldwide, Respect Earth, Respect Earth with the stylized leaf and coffee cherry design, Safety-Fresh, , Scale-Pro, Silver Series, Single, Smart Funnel, Smart Hopper, SmartWAVE, Soft Heat, SplashGard, The Mark of Quality in Beverage Equipment Worldwide, ThermoFresh, Titan, trifecta, Velocity Brew, Air Brew, Beverage Bar Creator, Beverage Profit Calculator, Brew better, not bitter., BUNNSource, Coffee At Its Best, Cyclonic Heating System, Daypart, Digital Brew-er Control, Element, Milk Texturing Fusion, Nothing Brews Like a BUNN, Pouring Profits, Signature Series, Sure Tamp, Tea At Its Best, The Horizontal Red Line, Ultra are either trademarks or registered trademarks of Bunn-O-Matic Corporation. The commercial trifecta® brewer housing configuration is a trademark of Bunn-O-Matic Corporation.239047.1 070913TABLE OF CONTENTS3TITLEPAGE NO.Auger Drive and Hopper Assembly .............................................................................................................16Covers, Panels and Drip Tray ........................................................................................................................4Dispense Valves and Lines ..........................................................................................................................24Door, Lamp, Dispense Switches and Panels (Left and Right Hinged Doors) .................................................8Door, Lamp, Dispense Switches and Panels (Top Hinged Doors) ...............................................................12Electrical Controls .......................................................................................................................................26Mixing/Whipper Chambers and Drive Motor ...............................................................................................18Numerical Index ..........................................................................................................................................28Tank, Heater and Overflow Protection (20)39047.1 071112439047.1 071112ITEMPART NO.QTY.DESCRIPTION5* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.1 36958.0001 1 Cover, Top Rear - BLK 36958.0002* 1 Cover, Top Rear - SST 01311.00032 Screw, Truss Head BLK #8-32 x .25" 01311.0000 2 Screw, Truss Head SST #8-32 x .25" 2 36959.0001 1 Cover, Top Front - BLK (Right and Left Hinged Doors) 36959.0002* 1 Cover, Top Front - SST (Right and Left Hinged Doors) 41577.0001 1 Cover, Top Front - BLK (Top Hinged Doors) 01311.0003 2 Screw, Truss Head BLK #8-32 x .25" 01311.0000 2 Screw, Truss Head SST #8-32 x .25" 01382.0002 2 Screw, Truss Head BLK #6-32 x .375"01308.0000 2 Screw, Truss Head SST #6-32 x .375" 3 28368.0000 1 Decal, Thermostat Adjustment435926.0000 4 Bracket, Side Support 01311.0001 8 Screw, Truss Head - Locking #8-32 x .25" 5 36967.0003 1 Panel, Inner Rear (Right and Left Hinged Doors) 36967.0005 1 Panel, Inner Rear (Top Hinged Doors) 01311.0001 6 Screw, Truss Head - Locking #8-32 x .25" 6 36968.0001 1 Panel, Inner Access 01311.0000 2 Screw, Truss Head #8-32 x .25"7 36986.0000 1 Strap, Top Support (Right and Left Hinged Doors) 41660.0000 1 Bracket, Top Support (Top Hinged Doors) 01311.0001 6 Screw, Truss Head - Locking #8-32 x .25" 8 36230.0001 1 Panel, Inner Right (Right Hinged Door) 36230.0002 1 Panel, Inner Right (Left Hinged Door) 36230.0003 1 Panel, Inner Right (Top Hinged Door) 01311.0001 2 Screw, Truss Head - Locking #8-32 x .25" 9 35912.0001 2 Panel, Side - BLK (Right and Left Hinged Doors) 35912.0002* 2 Panel, Side - SST (Right and Left Hinged Doors) 35912.0012 1 Panel, Right Side (Top Hinged Doors) 35912.0014 1 Panel, Left Side (Top Hinged Doors) 01311.0003 6 Screw, Truss Head BLK #8-32 x .25"01311.0000 6 Screw, Truss Head SST #8-32 x .25" 10 34666.0000 1 Catch, Door Latch 02336.0000 2 Screw, Truss Head #4-40 x .375" 01509.0001 2 Lockwasher, Int.-tooth #4 11 26524.0000 1 Decal, Tank Heater Switch 12 26523.0000 1 Decal, Rinse/Run Switch 13 28872.0000 1 Decal, Increase/Decrease Switch 14 00669.0005 1 Plug15 36965.0001 1 Panel, Whipper Motor (Early Models) 36965.0004 1 Panel, Whipper Motor (Late Models) 01311.0001 8 Screw, Truss Head - Locking #8-32 x .25" 16 36978.0000 1 Tray, Powder Box (Early Models) 36978.0001 1 Tray, Powder Box (Late Models)17 37988.0000 2 Screw, Captive #10-32 x .50" (Early Models) 34998.0000 2 E-Ring, Retaining .127" OD 18 36644.0000 1 Bracket, Door Locking01311.00012Screw, Truss Head - Locking #8-32 x .25"COVERS, PANELS AND DRIP TRAY(Continued)39047.1 071112639047.1 071112ITEMPART NO.QTY.DESCRIPTION7* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.COVERS, PANELS AND DRIP TRAY19 36743.0001 1 Cap, Splash Panel Right 44224.0000 2 Screw, Pan Head Plastite #6 x .375"20 37498.1000 1 Panel W/Decal, Splash (Includes items 19, 21, 22, 23, & 29) 21 28328.0011 1 Decal, Caution-Hot Liquid & Cup 22 02536.0000 2 Grommet, Silicone .375" ID 23 36983.0000 1 Guide, Cup24 37462.0000 1 Bracket, Drip Tray 01311.0001 2 Screw, Truss Head - Locking #8-32 x .25" 25 36985.0000 1 Cover, Drip Tray 26 36984.0000 1 Drip Tray27 36972.0000* 1 Panel, Lower Access 01311.0000 2 Screw, Truss Head #8-32 x .25" 28 39027.0000 1 Schematic29 36743.0000 1 Cap, Splash Panel Left 44224.0000 2 Screw, Pan Head Plastite #6 x .375" 30 36974.0001 1 Shelf, Powder Box 01311.0001 2 Screw, Truss Head - Locking #8-32 x .25" 02336.0000 2 Screw, Truss Head #4-40 x .375" 31 36398.0000 1 Plug, Hole DB-9 (Early Models) 32 02434.0008* 4 Gasket, U-Channel 4.60" (Order item 46) 33 01526.0001 4 Washer, Flat .438" ID x 1.88" OD 34 03996.0000 4 Pad, Rubber 1.25" Dia. (Also see item 45) 35 26528.0000 4 Leg, 4.0" Adjustable (Also see item 45) 36 36963.0000 1 Panel, Bottom37 36229.0001 1 Panel, Inner Left (Right Hinged Door) 36229.0002 1 Panel, Inner Left (Left Hinged Door) 36229.0003 1 Panel, Inner Left (Top Hinged Door) 01311.0001 2 Screw, Truss Head - Locking #8-32 x .25" 38 36961.1001 1 Panel Assembly, Rear - BLK (Includes items 39 and 40) 36961.0002* 1 Panel Assembly, Rear - SST 01311.0003 11 Screw, Truss Head BLK #8-32 x .25"01311.0000 11 Screw, Truss Head SST #8-32 x .25" 39 00831.0000 1 Decal, Warning-Electrical 40 00656.0001 1 Decal, Comply to Plumbing Code 41 36896.0000 4 Pad, Styro 1.0" x 2.0" x 0.5" 42 37881.0000 4 Decal, No Serviceable Parts 43 00824.0002 1 Decal, Grounding44 21436.0000 2 Catch, Magnetic Snap-in (Late Models)45 13255.0003 - Kit, Leg 4.0" Adjustable (Includes 4 each of items 34 & 35) 46 02434.1000 - Gasket, U-Channel - 18" LG02434.1001-Gasket, U-Channel - 36" LG39047.1 010813839047.1 071112ITEM PART NO.QTY.DESCRIPTION9* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.1 37466.0003 1 Panel, Lamp 01360.0002 4 Screw, Pan Head Plascrew #6 - 32 x .375" 2 32806.0000 2 Lamp, Fluorescent - 7 Watts 332807.00012Lamp Holder, Fluorescent4 37456.0000 1 Lens, Fixed 02336.0000 2 Screw, Truss Head #4-40 x .375"5 37457.0000 1 Display, Graphics 37457.0006 1 Display, Iced Coffee Graphics 6 37456.0001 1 Lens, Removable7 37254.0001 1 Decal, Cleaning8 36149.0000 8 Fastener, Snap-in .197" Hole9 36667.1001 1 Panel, Door - Upper (Right Hinged Door)(Includes item 7) 36667.1003 1 Panel, Door - Upper (Left Hinged Door)(Includes item 7) 01360.0002 8 Screw, Pan Head Plascrew #6 - 32 x .375"01311.0001 19 Screw, Truss Head Locking #8-32 x .25" 10 36658.0000 1 Flange, Door11 36734.0001 1 Bracket, Inner Panel 01360.0002 2 Screw, Pan Head Plascrew #6 - 32 x .375" 12 36244.0000 1 Plug, Door Hinge 01360.0002 1 Screw, Pan Head Plascrew #6 - 32 x .375" 13 37096.0001 1 Door14 32863.1000 1 Keylock W/Keys, Door 28095.0000 1 Key Set 15 38451.0000 1 Decal, Silver Series 16 00669.0004 1 Plug, .75" x .625" hole 17 38499.0000 1 Decal, BUNN 18 39058.0000* 1 Plate Assy, Switch 19 28296.0002 3 Switch, Dispense 20 12517.0001 1 Lamp, LED21 37013.0000 1 Cover, LCD Door Lens (Early Models) 42687.0000 1 Cover, LCD Door Lens (Late Models) 44224.0000 4 Screw 22 24457.0002 1 Screw, .25" Shoulder #8-3223 36647.0000 2 Bracket, Hinge (Left Side Hinge) 36647.0001 2 Bracket, Hinge (Right Side Hinge)01311.00016Screw, Truss Head #8-32 x .25" Locking39047.1 072413DOOR, LAMP , DISPENSE SWITCHES AND PANELS(LEFT & RIGHT HINGED DOORS)(Continued)1039047.1 071112ITEMPART NO.QTY.DESCRIPTION11* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.24 34362.0000 2 Bushing, Hinge25 36661.0000 1 Flange, Door Hinge (Left Side Hinge) 36661.0001 1 Flange, Door Hinge (Right Side Hinge)26 36659.0001 1 Panel, Door - Lower (Right Hinged Door) 36659.0003 1 Panel, Door - Lower (Left Hinged Door) 01311.0000 2 Screw, Truss Head #8-32 x .25"01311.0001 1 Screw, Truss Head #8-32 x .25" Locking" 27 01403.0000 1 E-Ring, External .188" Shaft28 34667.0000 1 Keeper, Door Latch 01382.0000 2 Screw, Truss Head #6-32 x .38" 29 36669.0000 1 Bracket, Keeper Mounting 01311.0001 2 Screw, Truss Head #8-32 x .25" Locking" 30 40031.1000 1 Baffle Kit, Left Hand Hinge 40031.1001 1 Baffle Kit, Right Hand Hinge 31 40032.0000 1 Bracket 3228335.00001Clip, GroundNOTE: The following items are not illustrated 33 39038.0000 1 Plate, Latch Mounting (Left Hinged Door) 01382.0000 2 Screw, Truss Head #6-32 x .38" 34 26444.0000 2 Bushing, Strain Relief35 39013.0000 1 Wiring Harness, Door Interconnect 36 36887.0003 1 Wiring Harness, Backlight37 26537.0000 1 Decal, Flavors (Almond Amaretto, Cappuccino, French Vanilla, Hazelnut,Hot Chocolate and Raspberry Mocha)26537.0001 1 Decal, Flavors (Swiss Mocha, Mocha, Raspberry Vanilla, Irish Creme,Coffee and Original)26537.0003 1 Decal, Flavors (White Chocolate, Cinnamon Vanilla Nut, Decaf, Regular,French Vanilla and Hot Chocolate)26537.0039 1 Decal, Iced Coffee Flavors (Espresso Latte, Mocha Latte, Colombian, Dark Roast, Raspberry Coffee, Hazelnut Coffee, French Vanilla Latte, Caramel Latte,Chai Tea Latte, Horchatta)39047.1 010813DOOR, LAMP , DISPENSE SWITCHES AND PANELS(LEFT & RIGHT HINGED DOORS)1239047.1 071112ITEM PART NO.QTY.DESCRIPTION13* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.39047.1 010813DOOR, LAMP , DISPENSE SWITCHES AND PANELS(TOP HINGED DOORS)1 37466.0003 1 Panel, Lamp 01360.0002 4 Screw, Pan Head Plascrew #6 - 32 x .375" 2 32806.0000 2 Lamp, Fluorescent - 7 Watts 332807.00012Lamp Holder, Fluorescent4 37456.0000 1 Lens, Fixed 02336.0000 2 Screw, Truss Head #4-40 x .375"5 37457.0000 1 Display, Graphics 37457.0006 1 Display, Iced Coffee Graphics 6 37456.0001 1 Lens, Removable7 28335.0000 1 Clip, Ground8 40032.0000 1 Bracket9 37096.0003 1 Door 10 36244.0000 1 Plug, Door Hinge 01360.0002 1 Screw, Pan Head Plascrew #6 - 32 x .375" 11 43514.0001 2 inge 41923.0000 8 Screw, Pan Head BLK .25-20 x 41921.0000 4Washer12 32863.1000 1 Keylock W/Keys, Door 28095.0000 1 Key Set 13 38451.0000 1 Decal, Silver Series 14 38499.0000 1 Decal, BUNN 15 12517.0001 1 Lamp, LED16 00669.0004 1 Plug .75" x .625" hole 17 39058.0000* 1 Plate Assy, Switch 18 28296.0002 3 Switch, Dispense19 37013.0000 1 Cover, LCD Door Lens (Early Models) 42687.0000 1 Cover, LCD Door Lens (Late Models) 44224.0000 4 Screw20 36734.0001 1 Bracket, Inner Panel 01360.0002 2 Screw, Pan Head Plascrew #6 - 32 x .375" 21 41564.0000 1 Panel, Door - Upper (Includes item 7) 44224.0000 8 Screw, Pan Head Plastite #6 x .375" 01311.0001 19 Screw, Truss Head Locking #8-32 x .25" 22 37254.0001 1 Decal, Cleaning23 36659.0003 1 Panel, Door - Lower01311.00003Screw, Truss Head #8-32 x .25"(Continued)1439047.1 071112ITEMPART NO.QTY.DESCRIPTION15* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.39047.1 071112DOOR, LAMP , DISPENSE SWITCHES AND PANELS(TOP HINGED DOORS)24 33111.1001 2 Gas Spring 25 44095.0000 4 Shim26 02434.0005* 2 Gasket, U-channel 3.5" (order item 32) 2735260.00002Cable MountNOTE: The following items are not illustrated 28 00707.0001 2 Bushing, Strain Relief29 39013.0001 1 Wiring Harness, Door Interconnect 30 36887.0003 1 Wiring Harness, Backlight31 26537.0000 1 Decal, Flavors (Almond Amaretto, Cappuccino, French Vanilla, Hazelnut,Hot Chocolate and Raspberry Mocha)26537.0001 1 Decal, Flavors (Swiss Mocha, Mocha, Raspberry Vanilla, Irish Creme,Coffee and Original)26537.0003 1 Decal, Flavors (White Chocolate, Cinnamon Vanilla Nut, Decaf, Regular,French Vanilla and Hot Chocolate)26537.0039 1 Decal, Iced Coffee Flavors (Espresso Latte, Mocha Latte, Colombian, Dark Roast, Raspberry Coffee, Hazelnut Coffee, French Vanilla Latte, Caramel Latte,Chai Tea Latte, Horchatta) 32 02434.1000 - Gasket, U-Channel - 18" LG02434.1001-Gasket, U-Channel - 36" LG1639047.1 071112ITEMPART NO.QTY.DESCRIPTION17* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.-37010.10011Hopper Assy (Includes one each of items 1-12)1 36653.0001 3 Lid, H opper2 32337.0000 6 Mixing Blade3 32386.0001 3 Disk, Agitator (30 Tooth)4 28067.0000 3 Bushing, Auger Drive Shaft 526940.00023Shaft, Auger Drive6 37011.0001 3 H opper7 39442.0000 3 Auger, Wire8 25903.0000 3 Elbow, Ejector9 25743.0000 3 Locknut 10 36774.0000 3 Spring, Hopper Coupling11 36770.0000 3 Coupling, Auger Drive 01326.0002 3 Screw, Truss Head #10-32 x .25" 12 37539.1000 3 Shaft, Auger Drive13 36970.0000 1 Panel, Hopper Support 01311.0000 2 Screw, Truss Head #8-32 x .25" Locking 14 20960.0000 3 Screw, Shoulder #6-32 x .375" 00991.0002 3 Nut, Elastic Lock #6-32 15 - - - - - - - - - See COVERS, PANELS & DRIP TRAYS16 37037.0001 3 Gearmotor Assy, Auger (Each includes items 17 & 18) 01311.0000 9 Screw, Truss Head #8-32 x .25" 17 26401.0000 1 Dust Seal, Hopper Motor 18 36773.0000 1 Plate, Auger Drive1935260.00003Cable Mount, Adhesive (Not Illustrated)AUGER DRIVE AND HOPPER ASSEMBLY39047.1 0711121839047.1 011714ITEMPART NO. QTY.DESCRIPTION19* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.1 28295.0000 1 Fan & Bracket Assembly 120V 28295.0001 1 Fan & Bracket Assembly 230V 01311.00012 Screw, Truss Head - Locking #8-32 x .25"2 28297.0001 1 H ose, Vacuum3 25732.0000 3 Steam Collector4 25733.0003 3 Mixing Chamber 525734.1000 3 Whipper Chamber (One Piece) 25734.0002 3 Whipper Chamber (Canada Models) 625736.0000*3Dispense Tip (Early Models)(Order item 5)7 24733.0010 3 O-Ring 8 25902.0000 3 Frother9 26356.0000 3 Seal, Shaft 26356.1000 - Kit, Shaft Seal (Includes 6 Seals) 10 28866.0000 3 Receptacle, Whipper Chamber11 28865.0000 6 Nut, Whipper Motor/Receptacle Mounting 12 28867.0000 3 Slinger13 28428.1000 3 Motor, Whipper 120V 28428.1002 3 Motor, Whipper 230V1432906.0001-Kit, Preventive Maintenance (Includes items 3 thru 10 and 25903.0000 Elbow)MIXING/WHIPPER CHAMBERS AND DRIVE MOTOR39047.1 0117142039047.1 010813ITEMPART NO.QTY.DESCRIPTION21* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.1 - - - - - - - - 1 Tank, Rounded (For first replacement, order Squared Tank, Lid & Gasket) 37098.0002 1 Tank, Squared (With Copper Overflow Cup) 37098.1004 1 Tank, Squared (With Aluminum Overflow Cup)00970.0000 2 Nut, Keps #8-32 236226.0000 2 Bracket, Tank Mounting Upper 00970.0000 4 Nut, Keps #8-32 3 02536.0000 2 Grommet, .375" I.D.4 20936.1000 1 Probe Kit (Includes items indented below) 20203.0100 1 Lockwasher, Internal Tooth #8 01501.0000 1 Washer, Flat .164" ID x .375" OD 00908.0000 1 Nut, #8-325 36741.1000 1 Tank Heater, 1700W 120V (Includes item 6) 36741.1001 1 Tank Heater, 1320W 120V (Includes item 6) 36740.1000 1 Tank Heater, 3500W 230V (Includes item 6)00908.0000 4 Nut, #8-32 612398.00001Gasket, Tank Heater7 36220.0000 1 Tube, Overflow 00908.0000 3 Nut, #8-32 8 05515.0000 1 Gasket, Overflow Tube9 - - - - - - - - 1 Lid, Rounded Tank (For first replacement, order Squared Tank, Lid & Gasket) 35940.0002 1 Lid, Squared Tank 00908.0000 4 Nut, Hex #8-32 10 29329.1000 1 Thermostat, Limit 11 35937.0001 1 Gasket, Rounded Tank Lid 35937.0003 1 Gasket, Squared Tank Lid12 03803.0002 1 Switch Assy, Liquid Level (Includes items 13 & 14) 00946.0000 1 Nut, Hex .125" FPT 13 03807.0000 1 Clip, Spring 14 03633.0000 1 Gasket, Float Switch 15 22728.0000 1 Overflow Cup (Copper) 00970.0000 2 Nut, Keps #8-32 41259.1003 1 Overflow Cup (Aluminum) 41266.0000 1 Film 41280.0001 1 Elbow 04797.0000 1 Washer 16 12422.0001 2 Clamp, Hose .59"/.66" ID17 28526.0028* 1 Tube, Silicone .312" ID x 9.5" (Order item 31) 18 21801.0015 1 Tube .375" O.D. x 1.50" LG 1934392.00001Plug, Hose .375" IDTANK, HEATER AND OVERFLOW PROTECTION(Continued)39047.1 0724132239047.1 010813ITEMPART NO.QTY.DESCRIPTION23* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.20 11630.0001 1 Clamp, Shut Off 21 12422.0005 4 Clamp, Hose .62"/.71" ID22 20976.0056* 1 Tube, Silicone .375" ID x 28.0" (Order item 32) 23 37297.0006 1 Elbow, .25" Flare x .75" FTHRD 24 38948.0000 1 Tee, .50" Barb25 20976.0017* 1 Tube, Silicone .375" ID x 2.0" (Order item 32) 26 20976.0055* 1 Tube, Silicone .375" ID x 9.0" (Order item 32) 27 36233.1000 1Valve, Water Inlet 120V 36233.0001 1 Valve, Water Inlet 230V 32283.0000 2 Screw, Pan Head M4 x 6MM 28 01592.0001 1 Bushing, Snap 1.18" Dia. Hole 29 35942.0001* 1 Bracket, Tank Mounting Lower 00970.0000 4 Nut, Keps #8-32 30 36378.0001 1 Valve, Check 2.5 psi 31 36222.0001 1 Insulation, Tank32 28526.1000 - Tube, Silicone .312" ID x .562" OD x 12" 28526.1001 - Tube, Silicone .312" ID x .562" OD x 36" 28526.1002 - Tube, Silicone .312" ID x .562" OD x 60"28526.1003 - Tube, Silicone .312" ID x .562" OD x 120" 3320976.1000 - Tube, Silicone, .375" ID x .50" OD x 12.0" 20976.1001 - Tube, Silicone, .375" ID x .50" OD x 36.0" 20976.1002 - Tube, Silicone, .375" ID x .50" OD x 120.0" 34 35946.0002 1 Baffle35 34572.0000 2 Panel, Baffle Insert 34765.0000 4 Nut, Flanged #10-32 3643644.0000-Kit, Valve RebuildTANK, HEATER AND OVERFLOW PROTECTIONNot Illustrated39047.1 071112See item 352439047.1 071112ITEMPART NO.QTY.DESCRIPTION25* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.DISPENSE VALVES AND LINES39047.1 072413126369.10001Plug (Includes item 2)2 24733.0011 4 O-Ring3 39285.1001 3 Valve, Liquid Dispense 120V (Includes item 2) 39285.1002 3 Valve, Liquid Dispense 230V (Includes item 2) 01326.0000 3 Screw, Truss Head #10-32 x .25"4 28526.0027* 3 Tube, Silicone .312" ID x 16.5" (Order item 9)5 21801.0015 3 Tube, .375" OD x 1.50"6 12422.0001 3 Clamp, Hose .59"/.66" ID 725803.00003Water Inlet, Mixing Chamber8 37970.0000 4 Grommet 928526.1001 - Tube, Silicone .312" I.D. x .438" O.D. x 36" 28526.1002 - Tube, Silicone .312" I.D. x .438" O.D. x 60" 28526.1003 - Tube, Silicone .312" I.D. x .438" O.D. x 120"1045964.1000-Repair Kit, Dispense Valve (Includes Spring, Plunger, and Diaphragm)NotIllustrated2639047.1 071112ITEMPART NO.QTY.DESCRIPTION27* Indicates the part number listed is for reference only. See DESCRIPTION for possible service replacement.ELECTRICAL CONTROLS1 - - - - - - - - 1 Thermostat Assembly (Not available. Order item 23) 01311.00002 Screw, Truss Head #8-32 x .25" (Mounting)20762.00002Screw, Binding Head #8-32 x .25" (Terminal)2 28224.0000 1 Bracket02301.0001 2 Screw, Pan Head #6-32 x .312" 3 00720.0000 1 Knob 4 07073.1000 1 Grommet 5 00450.0000 4 Spacer 6 28855.1000 1 Control Board Assy, Main 01510.0000 4 Lockwasher, External-tooth #6 00973.0000 4 Nut, Keps #6-32 7 28869.0002 1 Bracket, Component Mounting 01311.0001 2 Screw, Truss Head Locking #8-32 x .25" 8 00715.0000 1 Adapter Washer, Strain Relief 120V 9 00713.0000 1 Bushing, Strain Relief 120V10 28327.0002 2 Ballast, 120V-60HZ W/Terminals 39642.0000 2 Ballast, 230V-60HZ W/Terminals 02308.0000 2 Screw, Pan Head #8-32 x .38"00970.0000 2 Nut, Keps #8-32 1128860.0000 1 Transformer Assy, 120V to 24V 28860.0001 1 Transformer Assy, 230V to 24V 00973.0000 2 Nut, Keps #6-32 12 00970.0000 2 Nut, Ground Keps #8-32 13 23522.1000 1 Switch, Tank Heater 14 23697.0000 1 Facenut15 28857.1000 1 Switch, Rinse/Run 16 28856.1000 1 Switch, Increase/Decrease 17 26444.0000 1 Bushing, Strain Relief 18 00669.0005 1 Plug 19 46640.0000 1 Drip ShieldThe following items are not illustrated20 20630.0008 1 Cord Assembly, Power 120V21 39014.0000 1 Wiring Harness, Main 01511.0000 1 Lockwasher, External-tooth #8 00908.0000 1 Nut, Hex #8-32 (Grounding) 22 28862.0000 1 Lead, Jumper2340791.1006-Thermostat Kit (Includes items 1 - 4)39047.1 071112NUMERICAL INDEXPART NO.PAGE NO.PART NO.PAGE NO.PART NO.PAGE NO.PART NO.PAGE NO.2800450.0000.........................2700656.0001...........................700669.0004......................9,1300669.0005......................5,2700707.0001.........................1500713.0000.........................2700715.0000.........................2700720.0000.........................2700824.0002...........................700831.0000...........................700908.0000....................21,2700946.0000.........................2100970.0000...............21,23,2700973.0000.........................2700991.0002.........................1701308.0000...........................501311.0000....5,7,11,13,17,2701311.0001.5,7,9,11,13,19,2701311.0003........................5,701326.0000.........................2501326.0002.........................1701360.0002......................9,1301382.0000.........................1101382.0002...........................501403.0000.........................1101501.0000.........................2101509.0001...........................501510.0000.........................2701511.0000.........................2701526.0001...........................701592.0001.........................2302301.0001.........................2702308.0000.........................2702336.0000................5,7,9,1302434.0005.........................1502434.0008...........................702434.1000......................7,1502434.1001......................7,1502536.0000......................7,2103633.0000.........................2103803.0002.........................2103807.0000.........................2103996.0000...........................704797.0000.........................2105515.0000.........................2107073.1000.........................2711630.0001.........................2312398.0000.........................2112422.0001....................21,2512422.0005.........................2312517.0001......................9,1313255.0003...........................720203.0100.........................2120630.0008.........................2720762.0000.........................2720936.1000.........................2120960.0000.........................1720976.0017.........................2320976.0055.........................2320976.0056.........................2320976.1000.........................2320976.1001.........................2320976.1002.........................2321436.0000...........................721801.0015....................21,2522728.0000.........................2123522.1000.........................2723697.0000.........................2724457.0002...........................924733.0010.........................1924733.0011.........................2525732.0000.........................1925733.0003.........................1925734.0005.........................1925734.1000.........................1925736.0000.........................1925743.0000.........................1725803.0000.........................2525902.0000.........................1925903.0000.........................1726356.0000.........................1926356.1000.........................1926369.1000.........................2526401.0000.........................1726444.0000....................11,2726523.0000...........................526524.0000...........................526528.0000...........................726537.0000....................11,1526537.0001....................11,1526537.0003....................11,1526537.0039....................11,1526940.0002.........................1728067.0000.........................1728095.0000...........................928095.0000.........................1328224.0000.........................2728295.0000.........................1928295.0001.........................1928296.0002......................9,1328297.0001.........................1928327.0002.........................2728328.0011...........................728335.0000....................11,1328368.0000...........................528428.1000.........................1928428.1002.........................1928526.0027.........................2528526.0028.........................2128526.1000.........................2328526.1001....................23,2528526.1002....................23,2528526.1003....................23,2528855.1000.........................2728856.1000.........................2728857.1000.........................2728860.0000.........................2728860.0001.........................2728862.0000.........................2728865.0000.........................1928866.0000.........................1928867.0000.........................1928869.0002.........................2728872.0000...........................529329.1000.........................2132283.0000.........................2332337.0000.........................1732386.0001.........................1732806.0000......................9,1332807.0001......................9,1332863.1000......................9,1332906.0001.........................1933111.1001.........................1534362.0000.........................1134392.0000.........................2134572.0000.........................2334666.0000...........................534667.0000.........................1134765.0000.........................2334998.0000...........................535260.0000.........................1735912.0001...........................535912.0002...........................535912.0012...........................535912.0014...........................535926.0000...........................535937.0001.........................2135937.0003.........................2135940.0002.........................2135942.0001.........................2335946.0002.........................2336149.0000...........................936220.0000.........................2136222.0001.........................2336226.0000.........................2136229.0001...........................736229.0002...........................736229.0003...........................736230.0001...........................536230.0002...........................536230.0003...........................536233.1000.........................2336233.0001.........................2336244.0000......................9,1336378.0001.........................2336398.0000...........................736644.0000...........................536647.0000...........................936647.0001...........................936653.0001.........................1736658.0000...........................936659.0001.........................1136659.0003....................11,1336661.0000.........................1136661.0001.........................1136667.1001...........................936667.1003...........................936669.0000.........................1136734.0001......................9,1336740.1000.........................2136741.1000.........................2136741.1001.........................2136743.0000...........................736743.0001...........................736770.0000.........................1736773.0000.........................1736774.0000.........................1736887.0003....................11,1536888.0002.........................1536896.0000...........................736958.0001...........................536958.0002...........................536959.0001...........................536959.0002...........................536961.0002...........................736961.1001...........................736963.0000...........................736965.0001...........................536965.0004...........................536967.0003...........................536967.0005...........................536968.0001...........................536970.0000.........................1736972.0000...........................736974.0001...........................736978.0000...........................536978.0001...........................536983.0000...........................736984.0000...........................736985.0000...........................736986.0000...........................537010.1001.........................1737011.0001.........................1737013.0000......................9,1337037.0001.........................1737096.0001...........................937096.0003.........................1337098.0002.........................2137098.1004.........................2137254.0001......................9,1337297.0006.........................2337456.0000......................9,1337456.0001......................9,1337457.0000......................9,1339047.1 011714。

Frequently Asked Questions StorageTek SL150Modular Tape Library December 5, 2017OverviewOracle’s StorageTek SL150 modular tape library is the first scalable tape library designed for small and midsize businesses. Built from a combination of Oracle software and StorageTek library technology, it delivers an industry-leading combination of ease of use and scalability. Ideal for backup and archival applications, the StorageTek SL150 modular tape library saves both time and money, setting the new standard for entry tape automation.The StorageTek SL150 modular tape library emphasizes simplicity and reduces costs through common storage management tools, do-it-yourself installation and upgrades, and encryption capability. The market-leading scalability of the StorageTek SL150 offers an important cost-saving advantage. Competitive systems require you to transition among three separate and distinct products in order to grow from an entry to a midrange library. Oracle’s innovation has yielded a library that can address th e full breadth of scale from 30 t o 450 slots with a single product. Basic Specifications•Capacity:The StorageTek SL150 scales from 30 to 450 LTO slots with a maximum capacity of more than5.4P B of uncompre ssed data (using StorageTekLTO8tape drives)•Data t ransfer r ate:Using StorageTek LTO8tape drives, you can use as many as 30 tape drives for anative throughput rate of more than 30.1TB perhour.•Interface:The StorageTek SL150 offers 8 Gb Fibre Channel and 6 Gb SAS connectivity.Customer BenefitsSimple and Scalable Rackmounted Tape Automation •Improve r eliability:To help you maintain uninterrupted access to your data, the StorageTek SL150 modular tape library leverages technology and design from the award-winning StorageTek SL500 modular library system.Minimize r isk with 24/7 a vailability.•Scale without decrea sing reliability or performance:The StorageTek SL150 modular tape library scales from 30 to 450 LTO slots—which is 15x its base module.•Simplify management and accelerate consolidation:The StorageTek SL150’s n ew operator panel and browser-based GUI offer a simple way to manage your library, whether in the data center or a remote location. Also, partitioning helps you save time, space, and energy by consolidating multiple libraries and applications into a single library.•Take advantage of a world-class services organization: Oracle’s storage industry veterans can help you pinpointopportunities to reduce costs, mitigate business risk, and better leverage information assets.Oracle Corporation, World Headquarters Worldwide Inquiries500 Oracle Parkway Phone: +1.650.506.7000Redwood Shores, CA 94065, USA Fax: +1.650.506.7200Copyright © 2017, Oracle and/or its affiliates. All rights reserved. This document is provided for information purposes only, and thecontents hereof are subject to change without notice. This document is not warranted to be error-free, nor subject to any otherwarranties or conditions, whether expressed orally or implied in law, including implied warranties and conditions of merchantability orfitness for a particular purpose. We specifically disclaim any liability with respect to this document, and no contractual obligations areformed either directly or indirectly by this document. This document may not be reproduced or transmitted in any form or by anymeans, electronic or mechanical, for any purpose, without our prior written permission.Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners.Intel and Intel Xeon are trademarks or registered trademarks of Intel Corporation. All SPARC trademarks are used under license andare trademarks or registered trademarks of SPARC International, Inc. AMD, Opteron, the AMD logo, and the AMD Opteron logo aretrademarks or registered trademarks of Advanced Micro Devices. UNIX is a registered trademark of The Open Group. 0115C O N N E C T W I T H U S/blogs/oracle/oracle。

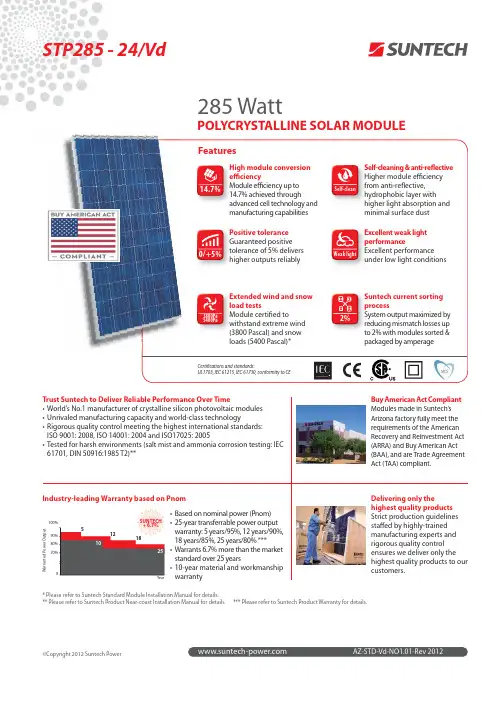

285 WattPOLYCRYSTALLINE SOLAR MODULEFeaturesAZ-STD-Vd-NO1.01-Rev 2012©Copyright 2012 Suntech PowerTrust Suntech to Deliver Reliable Performance Over Time• World’s No.1 manufacturer of crystalline silicon photovoltaic modules • Unrivaled manufacturing capacity and world-class technology• Rigorous quality control meeting the highest international standards: ISO 9001: 2008, ISO 14001: 2004 and ISO17025: 2005•Tested for harsh environments (salt mist and ammonia corrosion testing: IEC 61701, DIN 50916:1985 T2)**Industry-leading Warranty based on Pnom•Based on nominal power (Pnom)•25-year transferrable power output warranty: 5 years/95%, 12 years/90%,18 years/85%, 25 years/80% ***• Warrants 6.7% more than the market standard over 25 years• 10-year material and workmanship warranty100%Year51218102590%80%70%W a r r a n t e d P o w e r O u t p u tSUNTECH + 6.7%Buy American Act CompliantModules made in Suntech’s Arizona factory fully meet the requirements of the American Recovery and Reinvestment Act (ARRA) and Buy American Act (BAA), and are Trade Agreement Act (TAA) compliant.Delivering only thehighest quality products Strict production guidelines staff ed by highly-trained manufacturing experts and rigorous quality control ensures we deliver only the highest quality products to our customers.* Please refer to Suntech Standard Module Installation Manual for details.** Please refer to Suntech Product Near-coast Installation Manual for details. *** Please refer to Suntech Product Warranty for details.Weak lightSelf-clean14.7%0/+5%Self-cleaning & anti-refl ective Higher module effi ciency from anti-refl ective, hydrophobic layer with higher light absorption and minimal surface dust Excellent weak light performanceExcellent performance under low light conditionsPositive tolerance Guaranteed positive tolerance of 5% delivers higher outputs reliably2%3800Pa 5400PaSuntech current sorting processSystem output maximized by reducing mismatch losses up to 2% with modules sorted & packaged by amperageExtended wind and snow load tests Module certifi ed towithstand extreme wind (3800 Pascal) and snow loads (5400 Pascal)*High module conversion effi ciency Module effi ciency up to 14.7% achieved throughadvanced cell technology and manufacturing capabilities Certifi cations and standards:UL1703, IEC 61215, IEC 61730, conformity to CESTP285 - 24/VdE-mail:***********************Dealer informationSpecifi cations are subject to change without further notifi cationMechanical CharacteristicsSolar Cell Polycrystalline silicon 156 × 156 mm (6 inches)No. of Cells 72 (6 × 12)Dimensions 1956 × 992 × 50mm (77.0 × 39.1 × 2.0 inches)Weight 27.0 kgs (59.5 lbs.)Front Glass 4.0 mm (0.16 inches) tempered glass Frame Anodized aluminium alloy Junction BoxIP67 rated (3 bypass diodes)Output CablesTUV (2Pfg1169:2007), UL 4703, UL444.0 mm 2 (0.006 inches 2), symmetrical lengths (-) 1100mm (43.3inches) and (+) 1100 mm (43.3 inches)ConnectorsH4 connectors (MC4 connectable)Temperature CharacteristicsNominal Operating Cell Temperature (NOCT )45±2°C Temperature Coeffi cient of Pmax-0.44 %/°C Temperature Coeffi cient of Voc -0.33 %/°C Temperature Coeffi cient of Isc0.055 %/°CAZ-STD-Vd-NO1.01-Rev 2012Packing ConfigurationElectrical CharacteristicsSTC: lrradiance 1000 W/m , module temperature 25 °C, AM=1.5;Best in Class AAA solar simulator (IEC 60904-9) used, power measurement uncertainty is within +/- 3%NOCT: Irradiance 800 W/m , ambient temperature 20 °C, AM=1.5, wind speed 1 m/s;Best in Class AAA solar simulator (IEC 60904-9) used, power measurement uncertainty is within +/- 3%Current-Voltage & Power-Voltage Curve (285-24)Excellent performance under weak light conditions: at an irradiation intensity of 200 W/m (AM 1.5, 25 °C), 95.5% or higher of the STC effi ciency (1000 W/m ) is achievedC u r r e n t (A )P o w e r (W )Voltage (V)050100150200250300102030405001234567891000 W/m 800 W/m 600 W/m 400 W/m 200 W/m STP285 - 24/Vd。

ContentsThe Future of Level 3In July 2021, the Government completed a review and consultation that impacts Level 3 BTECs and other vocational qualifications in England.The main proposal is to introduce a choice between T levels and A levels at Level 3, where most young people pursue one of these routes at the age of 16. Alongside this the DfE recognise that in certain areas there is a clear role for alternative qualifications to T Levels and A levels such as BTECs, and these qualifications will run alongside ALetter to your local MPDear Mr/Mrs/Miss/Ms [ENTER MP NAME] MP,I am writing to you as a parent of a young person who currently studies/is hopingto study BTEC in the future/a person who is studying or hoping to study BTEC in thefuture/a person who has previously studied a BTEC and values the opportunitiesit’s given me. I would like to bring to your attention to the government’s currentreview of post-16 qualifications at level 3 and its potential impact on learners,schools, and colleges within your constituency.As you may be aware, the government is currently consulting on its review of post-16 qualifications at level 3 (A level equivalent). This is putting BTEC and career/vocational qualifications at risk. The large numbers of learners taking BTECs meanthat this risk is particularly acute with these qualifications. As a part of the currentconsultation process, organisations (including Ofqual, AoC and SFCA) have alsocautioned against pressing ahead too quickly.BTECs are taken by almost 1m learners a year in schools and colleges around thecountry. These courses not only support the career progression of young peoplewithin your constituency, but they also provide a talent pipeline to local employers,and it is important to ensure opportunities remain that reflect the breadth ofknowledge, skills and behaviours needed across industry.I am writing to you and requesting that you address the proposed changes toqualifications at level 3 on behalf of your constituents and highlight how BTECs andother career-focused qualifications provide vital progression pathways for so manyyoung people within your constituency.Best wishes,[ENTER YOUR NAME]Protect StudentChoice at 16+Campaign checklist☐Sign the ↘ petition☐Promote the ↘ Protect Student Choice petition on social media☐Send the petition to peers and parents with a request to sign and share with theirown contacts☐Write to your local MPs, asking them to support the campaign and visit yourinstitution to meet BTEC students☐Contact local employers and universities to ask them to support the campaignIf you have any questions or queries,B0857 | Version 1.3 | B&A | Nov 2021 | DCL1: Public。

JAPANESE MULTI-NATIONALsaves millions with Thomson Reuters ONESOURCE™Free Trade Agreement (FTA)ManagementHow it all beganBefore an open trade zone was forged between Japan and Europe in 2019, billions were paid in tariffs by businesses on both sides. One such Japanese manufacturing multinational was paying millions in duties, as EU was one of their highest revenue-generating markets.The biggest struggle for the company was FTA management, an area that was being managed manually. However, just as the JP-EU agreement was being discussed, the client decided to proactively evaluate options to simplify compliance. It sought a comprehensive FTA solution that could integrate with their complex ERP estate. EU FTA was a different ball game since the scale of trade was much higher, as was the associated self-certification risk.All of this motivated the client to seek a robust FTA platform. One solution that particularly stood out to them was the ONESOURCE FTA Management platform by Thomson Reuters.Approach TakenNew FTA (JP-EU) on the horizonComplex ERP landscapeRisk of non-compliance andhigh penaltiesDeep-div e workshops: Thomson Reuters’ global trade experts conducted several deep-dive workshops to understand the customer’s business and current challenges.POC implemente d: Based on these insights, Thomson Reuters helped the client draft a future roadmap with a decisive Proof of Concept (POC) delivery time. The team also highlighted the millions that would be left on the table if the client continued to take a manual approach to FTAs.Why ONESOURCE FTA solution?Superior data handling & proce ssing: Automated Origin Determination ComplianceRobust FTA solutionUser-friendly | global coverage | system readinessStrong implementation roadmap123Impact/globaltradeCONTACT USThe client engaged in extensive research to find the right solution to manage FTAs and realized that Thomson Reuters,ONESOURCE FTA management solution, fit the bill perfectly. Thomson Reuters’ solution was functionally superior and covered all bases.During the POC stage, the platform was appreciated by the customer team for its user-friendly interface, global coverage, and system readiness.ONESOURCE was uniquely positioned to help them add a technology layer, as well as empower their staff with FTA manage-ment and massive cost savings, in terms of duty reductions.Furthermore, in terms of functionality, it offered several key benefits:Ability to integrate highly complex bill of material structures and simultaneously analyze them against the Rules of Origin of multiple agreements, on a cloud-en-abled system.Ability to automatically self-certify, allow-ing for error-free declarations, mitigating potential penalties, while building the audit trail for future preferential claims.。