Assignment for Chapter 3宋逢明金融工程习题

- 格式:doc

- 大小:42.01 KB

- 文档页数:2

Assignment for Chapter3:

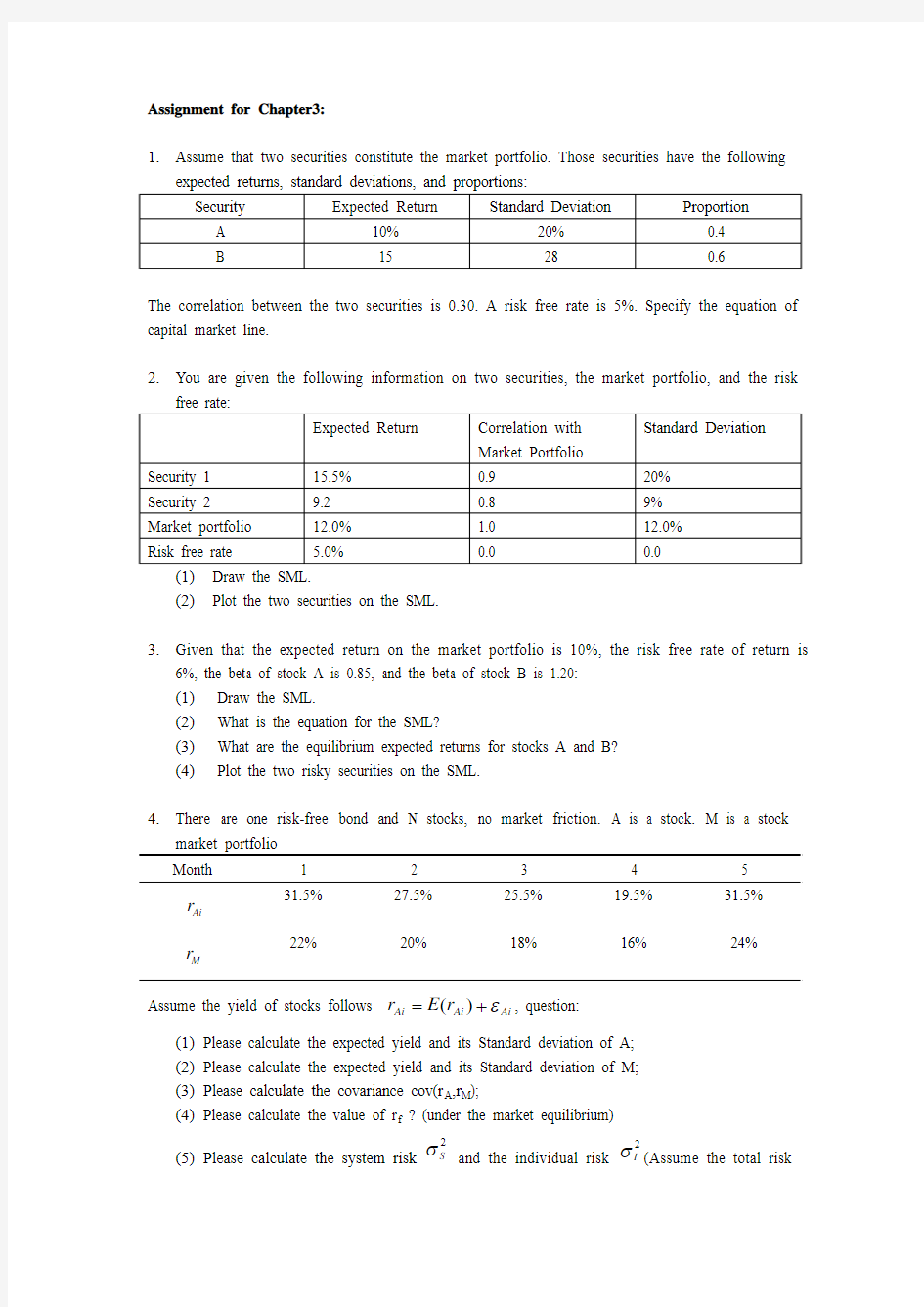

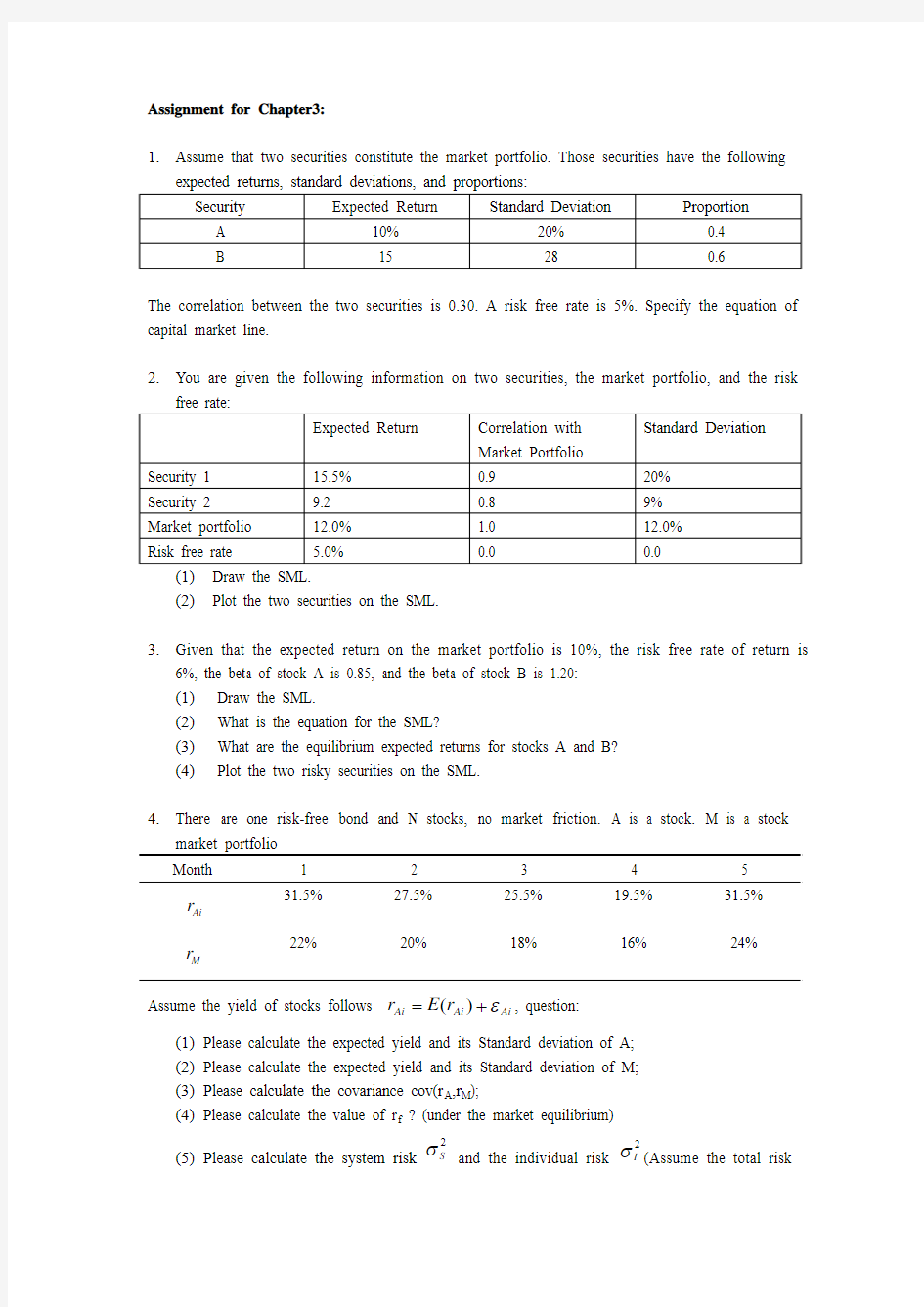

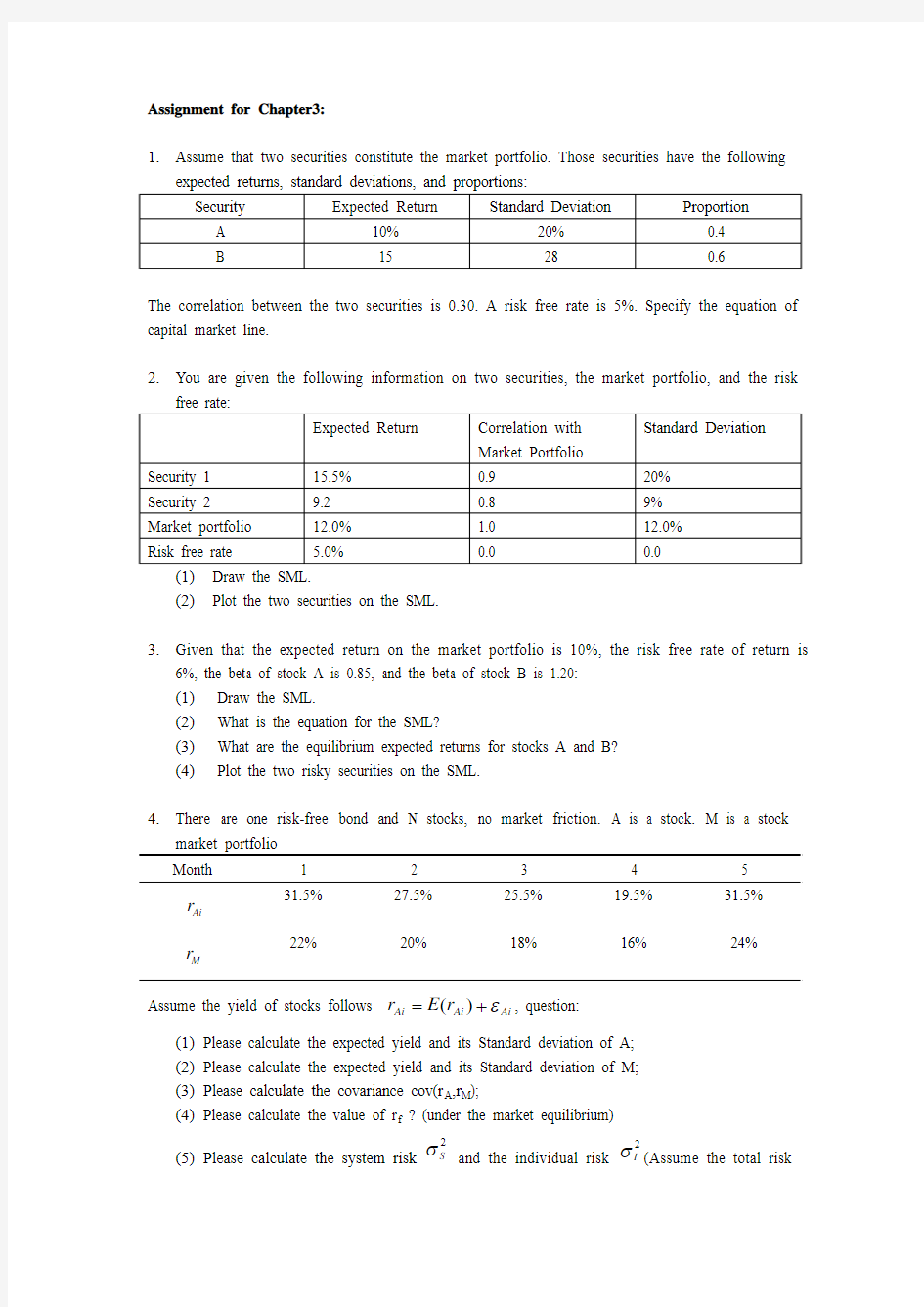

1. Assume that two securities constitute the market portfolio. Those securities have the following

The correlation between the two securities is 0.30. A risk free rate is 5%. Specify the equation of capital market line.

2. You are given the following information on two securities, the market portfolio, and the risk

(2) Plot the two securities on the SML.

3. Given that the expected return on the market portfolio is 10%, the risk free rate of return is

6%, the beta of stock A is 0.85, and the beta of stock B is 1.20: (1) Draw the SML.

(2) What is the equation for the SML?

(3) What are the equilibrium expected returns for stocks A and B? (4) Plot the two risky securities on the SML.

4. There are one risk-free bond and N stocks, no market friction. A is a stock. M is a stock

market portfolio

Month

1 2 3 4 5 Ai r 31.5% 27.5% 25.5% 19.5% 31.5% M r

22%

20%

18%

16%

24%

Assume the yield of stocks follows Ai Ai Ai r E r ε+=)(, question:

(1) Please calculate the expected yield and its Standard deviation of A; (2) Please calculate the expected yield and its Standard deviation of M; (3) Please calculate the covariance cov(r A ,r M );

(4) Please calculate the value of r f ? (under the market equilibrium)

(5) Please calculate the system risk 2S σ and the individual risk 2I σ(Assume the total risk

of stock A is σ2(rA)= σ2S+ σ2I)

5. There are two risky assets A and B.

Asset A B Expected yield 10%

6% Standard deviation 0.15

0.10

(1) I f

5.0),(=B A r r ρ, How to use the two assets to get a portfolio, which expected yield

is 8%? What is the Standard deviation of the portfolio? (2) I f

5.0),(-=B A r r ρ, How to use the two assets to get a portfolio, which expected

yield is 8%? What is the Standard deviation of the portfolio?