hnd-economicsthe-world-economy世界经济学报告

- 格式:doc

- 大小:465.00 KB

- 文档页数:19

全球经济背景知识英语作文标题,The Global Economic Landscape: Challenges and Opportunities。

In today's interconnected world, the global economy plays a pivotal role in shaping the destiny of nations and individuals alike. With the advent of globalization, the economies of different countries have become increasingly intertwined, leading to both challenges and opportunities. In this essay, we will explore the current global economic landscape, analyze its key features, and discuss the potential paths forward.One of the defining characteristics of the contemporary global economy is its complexity and interconnectedness. Trade between nations has reached unprecedented levels, with goods and services flowing across borders at an unprecedented rate. This interconnectedness has led to increased interdependence among nations, making them vulnerable to economic shocks originating from distantcorners of the globe. For example, the 2008 financialcrisis, which originated in the United States, quickly spread to other parts of the world, triggering a global recession.Moreover, technological advancements have transformed the way business is conducted, creating both challenges and opportunities. On one hand, automation and artificial intelligence have led to increased productivity and efficiency, driving economic growth in many sectors. On the other hand, these same technologies have also led to job displacement and income inequality, exacerbating social tensions within and between countries. It is imperative for policymakers to address these challenges through targeted policies that promote inclusive growth and provide support for those affected by technological disruption.Another key feature of the global economic landscape is the rise of emerging markets, particularly in Asia. Countries such as China, India, and Indonesia have experienced rapid economic growth over the past few decades, lifting millions of people out of poverty in the process.This shift in economic power has profound implications for the global balance of power, as traditional economic powerhouses in the West grapple with the rise of new competitors. It also presents opportunities for collaboration and cooperation, as emerging economies seek to integrate themselves into the global economic system.However, alongside these opportunities come a host of challenges. Chief among them is the threat of protectionism and economic nationalism, which has reared its head in recent years. The rise of populist leaders advocating for protectionist policies has led to an increase in trade tensions and threatens to unravel the gains made through decades of economic integration. It is imperative for countries to resist the temptation of protectionism and instead work towards a more open and inclusive global economy.Furthermore, the global economy faces existential threats in the form of climate change and environmental degradation. The unchecked exploitation of natural resources and the relentless pursuit of economic growthhave taken a toll on the planet, leading to rising temperatures, extreme weather events, and loss of biodiversity. Addressing these challenges requires coordinated action on a global scale, with countries coming together to implement sustainable development strategiesand transition to a low-carbon economy.In conclusion, the global economic landscape is characterized by complexity, interconnectedness, and rapid change. While it presents numerous challenges, it alsooffers opportunities for growth, innovation, and collaboration. By working together and adopting forward-thinking policies, we can navigate the complexities of the global economy and build a more prosperous and sustainable future for all.(Note: This essay is a high-quality imitation of the style and structure commonly found in essays discussing the global economic landscape. The content is original, but the format and language borrow heavily from existing sources.)。

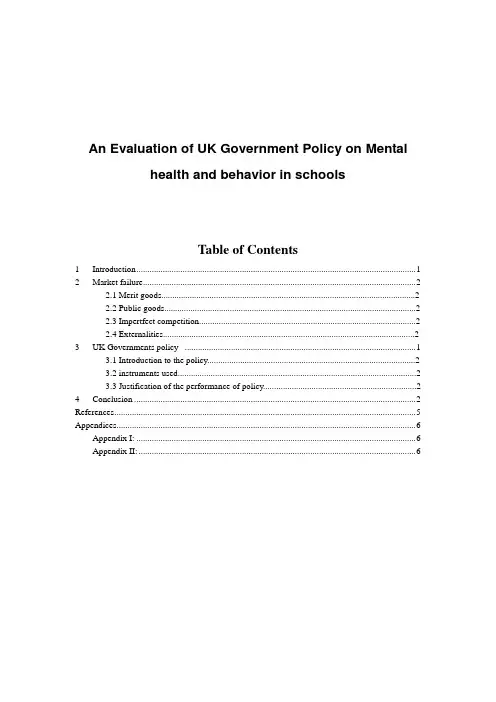

An Evaluation of UK Government Policy on Mentalhealth and behavior in schoolsTable of Contents1 Introduction (1)2 Market failure (2)2.1 Merit goods (2)2.2 Public goods (2)2.3 Impertfect competition (2)2.4 Externalities (2)3 UK Governments policy (1)3.1 Introduction to the policy (2)3.2 instruments used (2)3.3 Justification of the performance of policy (2)4 Conclusion (2)References (5)Appendices (6)Appendix I: (6)Appendix II: (6)1IntroductionThis report aims to explain the‘market failure’and the role of government in relative to merit goods, public goods, imperfect composition and externalities.The policy about mental health and behavior in school will also be introduced.Then it will describe the instruments used to achieve the policy and evaluate the policy.2Market failureMarket fail, that is, they do not provide all of the goods and services needed by the government,nor by society(SQA,2013a p184).2.1Merit goodsThe government provides services that might not be provided by the private sector in sufficient quantities or of a sufficient quantity (SQA,2013a p188).For instance,medical services,education and so on.In China,the government provides the public universities and nine year education,which support children to go to school and get a better education.2.2Public goodsThese are commodities, which would not be provided by the private sector because they would find that many people, even if they benefited from them, would refuse to pay(SQA,2013b p190), for example, grills in the park and Automatic Pet Water Fountain and so on.In many countries, the government provides the Automatic Pet Water Fountain, which is convenient for passerby to drink water whenever they want.2.3Imperfect competitionA company which control their own market , and they have no rival. A monoplist can adjust prices output in the market.for example, on February 5, 1991, pierpont Morgan bought Andrew Carnegie, Rockefeller,several iron ore and all the steel business,became the largest steel company , 65% of steel production by their control.The government could establish perfect competition through the establishment of enterprise competition policy (Peter,2013)2.4ExternalitiesAn externality is an effect of a purchase or use decision by one set of parties on others who did not have a choice and whose interests were not taken into account (SQA,2013d p188).For example, the negative externalities include car exhaust, smoking, kara OK noisy,which will do harm to the environment and people’health.As far as I am concerned, the government should have odd-and-even license plate rule and provide new energy electric vehicle.The positive externalities include new technology like purify the water and restoration of historical buildings.I think the government should support the enterprise to create more new technology.3UK Governments policy3.1 Introduction to the policy--Mental health and behavior in schoolsThe purpose of this policy is to let all pupils benefit from learning and developing in a well ordered school environment that fosters and rewards good behaviour and sanctions poor and disruptive behaviour. Their behaviour and discipline in schools advice sets out the powers and duties for school staff and approaches they can adopt to manage behaviour in their schools. It also says that schools should consider whether continuing disruptive behaviour might be a result of unmet educational or other needs. Published on16 June 2014,last updated on18 March 2016(Gov,UK,16 June 2014)3.2 Instruments usedInstruments- economic variables that governments can control directly for example, tax, public spending(SQA,2013e p194).The government take actions via government spending and relevant regulation.They found the Child and Adolescent Mental Health Services to deal with it.The specific services offered by CAMHS vary depending on the needs of the local area. The best way to influence those services overall is to get involved with the local health and wellbeing board.The government take actions to help them in referring pupils effectively to specialist CAMHS and otherwise working well with the service for the benefit of their vulnerable pupils. These include:1.The government hire some people documenting evidence of the symptoms or behaviour that are causing concern,encouraging the pupil and their parents/carers to speak to their GP2.The government spent some money working with local specialist CAMHS to make the referral process as quick and efficient as possible(Spence, S.H. 2003)3.1Justification of the performance of the policyI think the policy is successful, the mental health care benefits can make children to have a happier life.Thanks to the policy, children now have the ability to develop psychologically, emotionally, intellectually and spiritually.However,I think the policy also has some disadvantages.It has greatly increased government pressure.For example,Set up the CAMHS organization to support the school and some public organization。

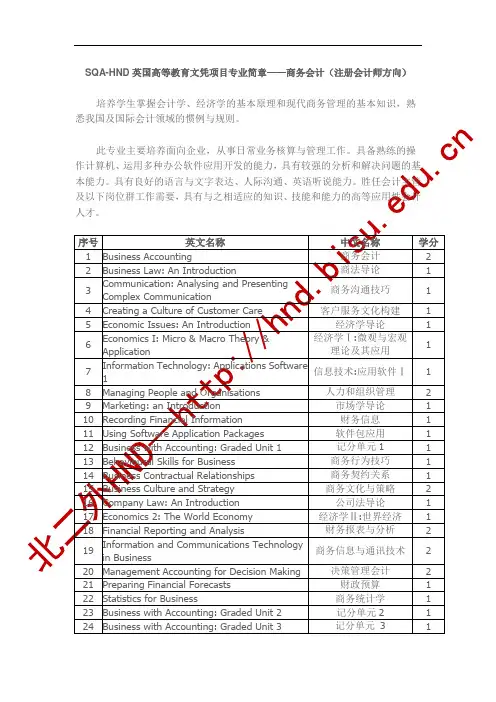

SQA-HND英国高等教育文凭项目专业简章——商务会计(注册会计师方向)

培养学生掌握会计学、经济学的基本原理和现代商务管理的基本知识,熟悉我国及国际会计领域的惯例与规则。

此专业主要培养面向企业,从事日常业务核算与管理工作。

具备熟练的操作计算机、运用多种办公软件应用开发的能力,具有较强的分析和解决问题的基本能力。

具有良好的语言与文字表达、人际沟通、英语听说能力。

胜任会计主管及以下岗位群工作需要,具有与之相适应的知识、技能和能力的高等应用性会计。

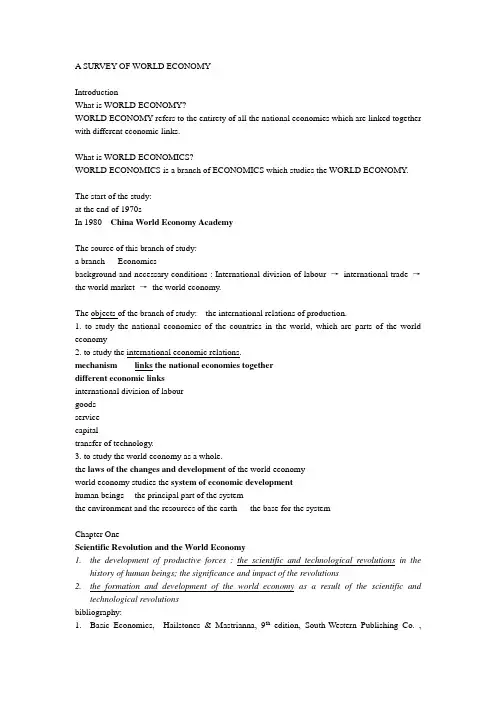

A SURVEY OF WORLD ECONOMYIntroductionWhat is WORLD ECONOMY?WORLD ECONOMY refers to the entirety of all the national economies which are linked together with different economic links.What is WORLD ECONOMICS?WORLD ECONOMICS is a branch of ECONOMICS which studies the WORLD ECONOMY.The start of the study:at the end of 1970sIn 1980---China World Economy AcademyThe source of this branch of study:a branch --- Economicsbackground and necessary conditions : International division of labour →international trade →the world market →the world economy.The objects of the branch of study: the international relations of production.1. to study the national economies of the countries in the world, which are parts of the world economy2. to study the international economic relations.mechanism links the national economies togetherdifferent economic linksinternational division of labourgoodsservicecapitaltransfer of technology.3. to study the world economy as a whole.the laws of the changes and development of the world economyworld economy studies the system of economic developmenthuman beings--- the principal part of the systemthe environment and the resources of the earth --- the base for the systemChapter OneScientific Revolution and the World Economy1.the development of productive forces : the scientific and technological revolutions in thehistory of human beings; the significance and impact of the revolutions2.the formation and development of the world economy as a result of the scientific andtechnological revolutionsbibliography:1.Basic Economics, Hailstones & Mastrianna, 9th edition, South-Western Publishing Co. ,Cincinnati, Ohio, 19922.Economics Today, roger Leroy Miller, 9th edition, Adisson-Wesley Education EducationalPublishes Inc., 19973.《世界经济学》张伯里主编中共中央党校出版社2004年7月第1版4.《当代世界经济》王广信赵丽娜主编人民出版社2002年3月第1版5.《世界经济新论》庄起善主编复旦大学出版社2004年8月第1版6.《世界经济概论》池元吉主编高等教育出版社2003年8月第1版I. the development of the Productive Forces and the Formation of the World Economy1. the influence of the Renaissance and of the Discovery of the new continentthe primitive economic system--- low productive forces--- no world economyRenaissance liberated peoplethe beginning of the Renaissance---Dante’s Commedia (14th century)Renaissance: the intermediate between the Middle Ages and the modern times;the beginning of capitalist cultural ideasthe product of the new, rising capitalist relations of productionideological feature: humanism,the enlightenment: in 18th centuryIn 1492, Columbus discovered the new continent.the new sea routeEuropean ports ---international trade centers: London, Antwerp, Lisbona solid base for the big jump of the economy.2. the impact of the first scientific and technological revolution on the world economyIn 18th century, the first scientific and technological revolutionsteam engine --- work continuouslymachine makes machinesmore products for the marketsteam boat and steam engine train --- revolution in the transport industrythe capitalist mode of productionIndustry was totally separated from farming.object of the capitalist mode of production: profit-pursuingmarkets--- raw materialsthe world market--- the world economy3. the impact of the second scientific and technological revolution on the world ecnomy Time: in the 19th centuryGermany and the United States : the heroesElectricity : a new kind of powerOther things: radio, cable, telephone, internal combustion engine, new skills for steel-making, new technology in chemical industry →heavy industryautomobile industry --- the oil industryThe second scientific and technological revolution started in heavy industryIndustry →the most import section in the national economies.More industrialized countriesimport raw materials and export finished productsfarming countries export agricultural products and other raw materials, import industry goodsthe international division of labour developed furtherScience and technology acted and reacted on each other.the study on the basic theories and the scientific research worknew inventions: new communication methods, big steel-made boat, cars and trucks, and even airplanetransport (more quick, safe, convenient and cheep) →international exchange of goods →the world market →the system of the international division of labour →more efficient production →the world market (for raw materials and finished goods )→closer relation of the countries tied together by the world market4. the formation and development of the world economya)The development and formation of the world economy was a result of the scientific andtechnological revolutionsb)The system of international division of labourThe economic ties between the suzerain states and its colonies or between the advanced industry countries and the countries producing raw materials became more strengthened. a world market formed.c)the industry capital --- the banking capital →financial capital →financial oligarch →the export of capitald)the international monetary system establisheda world currency or currenciesgold and silver acted as the world currenciesthe gold standard was establishedThe gold standard had 3 featuresFirst: It established a system of fixed exchange rate between participating countries. Stable exchange rates were considered a necessary ingredient to increase trade among nations. Second: the gold standard limited the rate of growth in a country‘s mone y supply. This was due to the fact that all ―money‖ had to be backed by gold, and the supply of gold in the world increased slowly during this period of time in history.Third: Gold served as an automatic adjustment tool for countries experiencing balance of payments problems. If a country was running a balance of payments deficit, gold would, by market forces, flow out of the country, decreasing economic activity and pushing the balance of payments back toward balance.II. the third scientific and technological revolution caused great improvement in productive forces1.The factors which caused the third scientific and technological revolutiona.the development of science and technologyb.the motivation of capital for profitsc.the government‘s support for the scientific researchd.cold war made the west and the east compete for the military equipments2. the impact of third scientific and technological revolutiontime: started at the end of 1940splace: from the US --- the former Soviet Union, Japan, and the west Europe and then the other countries.Peak: at the end of 1960s.symbols : nuclear power, computer and space technologyNew power,new materials and electronic technology made the third revolution much more remarkable than the first two ones.nuclear power --- the shortage of energy and resources --- supports quicker development of the science, technology and the production.Man-made new materialscomplex materials --- in the aviation or space technology, now even in car industry.Plastic--- used in many placesComputer totally changes our life.computer to operate machinethe improvement of the international division of labour --- the vertical one and the horizontal onethe specialization of the multinational corporations (MNCs)the global operative strategies : the international arrangement for the R&D projects, production and marketing, the flow of capital and so on.the reproduction cycle →international : production→distribution →exchange and consume --- internationalthe factors of production →international: capital, technology, raw materials and labour →international.The internationalization of production may push the productive forces to rise to a new level.Conclusion:division of labour →rise of productive forces →efficiency of the production →frequency of exchange of goods →the early system of the capitalist international division of labour ---the first scientific and technological revolution→the world market, the world currency, the system of the capitalist international division of labour →the beginning of world economy the second scientific and technological revolution→the improvement of the system of the capitalist international division of labour (early stage of internationalization of production) →the world market →(barriers to trade and surplus of capital →the export of capital) →international monetary system→world economyThen the world economy finally established.the third scientific and technological revolution→the (mature) system of the capitalist international division of labour (internationalization of production) →the world market →world economyThree steps for world economy: goods (international) (or the internationalization of goods)→capital(international) (or the internationalization of capitals) →production(international, after the 3rd scientific and technological revolution) (or the internationalization of production)Now the world economy becomes so important that almost every country is involved in it and has its own roles in it. Of course, some countries have more important roles in it. Others may have less important roles in it.III. the intenerating of the capitalist industry structurethe reproduction cycle --- the comparative decreasing input ---the comparative increasing inputlabour-intensive and resources-intensive industries →knowledge-intensive and technology-intensive industries.There are two kinds of intenerating of the industry:1.Intensive intenerating : within one industry, the input of manual labour decreases, but theinput for R&D, information service and so on increase.2.Extensive intenerating : sections which may provide other sections with services ofinformation and knowledge appear to be more important.IV. the trends and laws of the scientific and technological revolution.1.the trends:the changes become quicker and quickerthe result of the changes provides a base for a new revolution.2.the laws:1)the progress of science and technology becomes quickere.g. steam engine: from research to putting into production--- 100 yearstelephone---56 yearsradio---35 yearsairplane---14 yearstelevision---12 yearstransistor--- 5 yearssolar cell--- 2 years2)the leading industries:The time for the exchange of the leading industries becomes shorter.3)the change of scientific structure:Scientific structure:a)people (their number, their age, and their level)b)their specialization (the basic theory, applying theory, natural science, social science,hardware, and software etc. )c)the lab and the equipments and so ond)the information resources and education levelThe scientific structure is always in a dynamic state.Questions:1.How do you understand ―the world economy‖?2.How the world economy was formed?3.Please illustrate the impact of the first and the second scientific and technologicalrevolution on the formation of the world economy.4.Please illustrate the impact of the third scientific and technological revolution on theworld economy.5.How the third scientific and technological revolution promoted the globalization of theeconomy?Chapter TwoThe Productive Forces and the cycle of the world economy1.business cycle2.the economic cycles of the world economy after the World War II the features of the cycles3.the new economy and the cyclebibliography:1.Basic Economics, Hailstones & Mastrianna, 9th edition, South-Western Publishing Co. ,Cincinnati, Ohio, 19922.Economics Today, roger Leroy Miller, 9th edition, Adisson-Wesley Education EducationalPublishes Inc., 19973.Economics, N.Gregory Mankiw, 3rd edition, Tsinghua University Press 20064.《世界经济学》张伯里主编中共中央党校出版社2004年7月第1版5.《当代世界经济》王广信赵丽娜主编人民出版社2002年3月第1版6.《世界经济新论》庄起善主编复旦大学出版社2004年8月第1版7.《世界经济概论》池元吉主编高等教育出版社2003年8月第1版1.business cyclebasic problem for the capitalism--- the development of industry is always interrupted by periodic economic crisis. This makes the economic growth in the capitalist countries unstable.striking feature --- instability, fluctuationsBusiness cycle: the rise and fall of economic activity relative to the economy‘s long-term growth trend. As the cycle progresses, all parts of the economy display marked changes in activity as they move through distinctive periods usually called trough, expansion, peak, and contraction. Production, prices, income, and employment activities all show characteristic changes during the cycle; in fact, no part of the economy is free from this cycle. Extensive studies have shown that these cyclical fluctuations are found in economies throughout the world.1. Real or physical causes :Innovation Theory: the theory that business cycles are caused by breakthroughs in the form of new products, new methods, new machines, or new techniques.Agricultural Theories: theories of the business cycle that relate the general level of business activity to the weather.2. psychological causes:Psychological Theory: the theory that when investors and consumers react according tosome belief about future conditions, their actions tend to transform their outlook into reality.Rational Expectations Theory: an economic theory suggesting that individuals and business act or react according to what they think is going to happen in the future after considering all available information.3. monetary causes:Monetary Theories: theories that the business cycles is caused by the free and easy expansion of the money supply.4. spending and saving causes:Under-consumption Theories: theories that the business cycle is caused by the failure to spend all national income, resulting in unsold goods, reduced total production, and consequent reductions in employment and income.The economy does not distribute enough income among the factors ofproduction to permit purchase of all the goods and services produced bythe economy.The economy does distribute enough purchasing power to buy the totalgoods and services produced but that not all the income or purchasingpower is used.Circular flow of incomeCircular flow of income is the cyclical operation of demand, production, income, and new demand.Income =demand →production →distribution (enough) (income)= new demandIncome ≠spending ( less demand) →leakagesLeakages are flows out of the circular flow that occur when factor income is received and not spent directly on purchases.Injections are added spending in the circular flow that are not paid for out of factor income.Underinvestment Theory: the theory that recessions occur because of inadequate investment in the economy.spending on consumption is less than total incomethe difference must take the form of investmentPhases of the Cyclestwo phases: contraction 扩张and expansion 收缩The top: peakThe lowest point: troughfour phases:prosperity 繁荣;recession 衰退, 不景气;depression 萧条;recovery 复苏recession: GDP ↓continuously for two quarter (demand, investment, employment, production output, profit, even stock price and interest rate ↓)depression: long and continuous recession spreadA peak exists whenever an overall high level of economic activity prevail.A contraction occurs whenever the level of business activity drops noticeably.The trough is the period when the level of business activity has dropped as far as it is going to drop in a particular cycle.Expansion occurs when the level of business activity begins to rise.T rough: low income →low demand →price down →profit low (in spite of low cost ) →employment low →levels of investment low →interest rate downIndustries: less need to replace worn-out capitalConsumers : less need for durable goodsExpansion:Production increase →employment and income increase →demand increase →price rise (but cost rise slower) →profit rise →levels of investment increase →interest rate rise slowly →expansion is on its way to peakPeak:A peak generally has favorable social and political consequences as well as a good economic effect on society e.g. high-level prosperity.Contraction: As production increase, the economy eventually reaches the bottleneck stage. Downswings are certain to occur.Pattern of cycles:contraction →trough →expansion →peak →contractionOnce a contraction has started, a cumulative action among several elements in the economy tends to augment the downswing. During the trough, however, other forces eventually arrest the contraction and start an upward movement. Once this upward motion begins, reactions of individuals and businesses tend to augment the expansion. During the peak, however, forces build up that eventually cause a new contraction.four forces or types of economic change affect the level of business activity:(1)the trend,(2)seasonal variations,(3)random fluctuations,(4)cyclical fluctuations.The trend is the directional movement of the economy over an extended period of time, such as 20 to 30 years.Seasonal variations are recurring fluctuations in business activity over a given period, usually 1 year. The cause of the fluctuations may be natural and artificial.Random fluctuations in business activity resulted from unexpected or unusual events. A serious flood or drought can affect certain portions of the economy or even the economy as a whole. Cyclical fluctuations are changes in the level of business activity that come about regardless of the trend, seasonal variations, or random forces.internal forces of business cycles: are elements within the very sphere of business activity itself and include such things as production, income, demand, credit, interest rates, and inventories.external forces of business cycles: are elements outside the normal scope of business activity and include population growth, wars, basic changes in the nation‘s currency, and national economic policies, as well as floods, droughts, and other catastrophes (disasters) that have a pronounced effect on business activity.T ypes of business cyclethe Kitchin inventory cycle (3–5 years) —after Joseph Kitchin(约瑟夫.基钦)In 1923---article :"Review of Economic Statistics"---outlining his discovery of a 40-month cycle resulting from a study of U.S. and UK statistics from 1890 to 1922--- based on a stocking /destocking cycleInventory--- production---economythe early phases of a contraction---- inventories: rather high levelretailers supply goods out of inventory and cut orders from producersproduction--- low leveltrough--- inventories depletedcompanies --- replace inventoriesmost current sales --- ordering goods from the producerproduction increases to stimulate the economy to expandsales increase---the size of inventories increasesproduction increase --- greater demand by consumers + build up inventoriesprice increases are anticipated--- firms build up inventories and increase the ratio of inventory to sales--- increase in production (beyond the actual consumer demand)the reverse situation--- contractionthe Juglar fixed investment cycle (7–11 years) — after Clement Juglar (朱格拉)business cycle --- recovery and prosperity are associated with increases in productivity, consumer confidence, aggregate demand, and prices.The French economist identified four phases to each wave: prosperity, crisis, liquidation and recessionthe Kuznets infrastructural investment cycle (15–25 years)—after Simon Kuznets (库兹涅茨), Nobel LaureateRussian-born American economist who carried out research on the U.S. real-estate cycle. analyzed and quantified the cyclical nature of production and prices in spans of fifteen to twenty yearsThe Kondratiev wave or cycle (45–60 years) (grand supercycles)—after Nikolai Kondratiev (尼古拉·康德拉季耶夫)cycles of boom followed by depressionvisible in international production data than in individual national economiesconcerns output rather than pricesKondratiev wave --- two 'seasons': the Kondratiev Fall--- and the Kondratiev Wintera bull market is associated with 'fall' and a bear market with ‗winter‘the Forrester cycles (200 years) - after Jay Wright Forrester.the T offler civilization cycles (1000-2000 years) - after Alvin Toffler.Joseph Alois Schumpeter (约瑟夫·阿洛伊斯·熊彼特) suggested a model in which the four main cycles, Kondratiev(54 years), Kuznets (18 years), Juglar (9 years) and Kitchin (about 4 years) can be added together to form a composite waveform.A Kondratiev wave could consist of three lower degree Kuznets waves. Each Kuznets wave could, itself, be made up of two Juglar waves. Two (or three) Kitchin waves could form a higher degree Juglar wave.the four waves can be added together to form a composite waveformActually there was considerable professional rivalry between Schumpeter and Kuznets. The wave form suggested above might not include the Kuznets Cycle simply because Schumpeter did not recognize it as a valid cycle.Schumpeter suggested such a model.Contemporary opinion is that there is insufficient evidence decisively to determine whether or not the cycles do synchronize (同步) in this way.Schumpeter argued that long waves stemmed from innovation.2. the economic cycles of the world economy after the World War IIfive economic crisis since the end of World War II,(1) the first economic crisis: 1957---1958 started from the US in April 1957 and soon spread to Canada, countries in west Europe and Japan. It lasted for about one year.remarkable features: at the same time; the prices did not fall but rise.(2) the second economic crisis: 1973-1975The first “oil shock” occurred in the last quarter of 1973.a good example for an aggregate supply shock →a world economic crisis(any unanticipated shift in aggregate demand or supply are called aggregate demand shocks or aggregate supply shocks) .features for this crisis:a)it lasted a long time and the production fell down dramatically: 22 months for UK, 15months for Japan, 14 months for west Germany and 9 months for France and America.The industrial production decreased by 15.4% in the US, 11.2% in UK, 16.3% inFrance.b)bankruptcy and unemployment: about 120 thousand large firms with property more than1 million US dollars went bankrupt. The number for jobless people even reached 18.5million.c)the stock market fell drastically. (stock price index ↓76%~32%) Investment ↓20%,180 banks went bankrupt in America,d)serious inflation →stagflationtrade protection →decrease of the international trade(3) The third economic crisis: 1979~1982features:a)stagflation;b) a long time and had an intricate progress:c)bankruptcy and unemployment reached the highest record. e.g. in 1981, firms wentbankrupt: in Britain: 14,000; in France: 20,900; in west Germany: 8,500; in 1982,in the US 25,000 firms went bankrupt. At the end of 1982, the US and EC had 120million people out of work.d)the developing countries were hurt terribly.(4) The fourth economic crisis: 1990~1993features: a short crisis in America . a long time for the crisis in the world.(5) The fifth economic crisis: 2001~2002 imports of the US decreased continuously from the first quarter of 2001, which impacted on the exports of EU and Japan(6) The six economic crisis: 2008~In 2007,subprime crisis occurred in USSept. 15 2008, Lehman Brothers applied for bankruptcy protection.Sept. 16, US stock market ↓Crisis startedApril 28 2008Bufflet: recession---more serious than most people expect700 billion USDbailoutUS $700 billion for financial bailoutOctober 3, 2008--- the US Senate passed the $700 billion bank bailout bill.$85.3 billion in loans to automakers and their financing arms through the Automotive Industry Financing Program$79.3 billion to Financial firms$69.8 billion to purchase preferred shares of American International Group (AIG)$55 billion to back any losses that the Term Asset-Backed Securities Loan Facility might incur;$50 billion to Citigroup$50 billion to back any losses that the homeowners faced$45 billion in stock purchases of Bank of America$15 billion to small business$100 billion to Public-PrivateThe government has provided money to hundreds of banks and a handful of insurers and automakers as part of the $700 billion Troubled Asset Relief Program. Some small firms have repaid the government, and many big banks have announced they intend to return the money.China's 4 trillion yuan stimulus packageOn 9 November 2008, the Chinese government announced a two-year 4 trillion-yuan (us$ 586 billion ) stimulus plan to bolster economic expansion.1.5 trillion yuan to invest in railways, highways, airports, water conservancyand other major infrastructure facilities construction and urban power grids;1 trillion yuan for the Sichuan Earthquake Restoration and Reconstruction;400 billion yuan to invest in protective housing construction; rural water circuit370 billion yuan to invest in housing and other livelihood projects and gas infrastructure;150 billion yuan to invest in health care, education, health and other social undertakings;210 billion yuan in energy-saving emission reduction and eco-engineering370 billion yuan in self-innovation and structural adjustment.Most remarkable features about the economic crises after the Second World Wara)mild crises:b)Stagflationc)No very serious monetary credit crisismild crises: in 1929, industrial production↓46.2% in the US, ↓32.3% in UK, ↓32.9% in France.In 1973~1975, the industrial production↓15.4% in the US, ↓11.2% in UK, ↓16.3% in France.reasons for such a result: modern monetary, fiscal, and other measuresautomatic stabilizersmodern scientific technologyAutomatic, or built-in, stabilizers (in US): Special provisions of the tax law that cause changes in the economy without the action of Congress and the president. In other words, automatic stabilizers counter ups and downs in fiscal activity without the necessity for legislative action.e.g: the progressive income tax system , Social Security system : unemployment compensation and pension for old people.the progressive income tax system: in US, maximum rate: 40%.For an individual, as taxable income rises, the marginal tax rate rises, and as taxable income falls, so does the marginal tax rate. The average tax rate falls when less is earned. Unemployment Compensation:unemployment compensation stabilizes aggregate demand. Stabilizing Impact: The key stabilizing impact of the progressive income tax and unemployment compensation is their ability to mitigate changes in disposable income, consumption, and the equilibrium level of national income.the ―visible hand‖---the intervention of the government.Fiscal policy: is defined as the discretionary change in government expenditures and /or taxes in order to achieve such national economic goals as high employment or reduced inflation. (National goals may be: high employment, price stability, economic growth, and improvement in the nation‘s international payments balance)Changes in the government‘s fiscal stance (that is, the difference between government spending and taxation) will change the level of aggregate demand.If economy is at equilibrium output, increases in spending (or tax cuts) will lead to an inflationary boom, which eventually will lead only to higher prices.。

Economics 2: The WorldEconomyReworkContentIntroduction----------------------------------------------------------------3 Section 1: International TradeThree gains from trading internationally---------------------------------------3 FreeTrade--------------------------------------------------------------------------3Absolute and Comparative Advantage-----------------------------------------3 Protectionism----------------------------------------------------------------------4Barriers to trade-------------------------------------------------------------------4WTO and EU----------------------------------------------------------------------5Section 2: International FinanceBalance of Payments and General trends in UK Trade----------------------6 Relationship between the exchange rate and the balance of payments—14SingleCurrency------------------------------------------------------------------15 Effects on individuals and business of the Euro-----------------------------15 Section 3: Less Developed Countries (LDCs)Characteristics of a LDC--------------------------------------------------------16Current issues that face LDCs--------------------------------------------------16The impacts of multinationals on LDCs and NICs--------------------------16 Conclusion-----------------------------------------------------------------16 References------------------------------------------------------------------17 Introduction:As a member of the government of nation on the periphery of Europe, it is my obligation to illustrate the benefits of joining the EU to the Premier. In this report, I will analyze 15elements in next three parts to make a clear explanationof benefits of joining the EU.Section 1: International TradeThree gains from trading internationally:To begin with, the international trade could increase world out-put. The tendency of globalization brings the firms more opportunities to gain the labor, resources, contracts and new technology. The supply and demand will be improved with the improvement of company’s productivity.Once the supply has been improved, the goods and services were produced at lower cost and there are more and more competitions, the price of the product might fall which means consumers could get more choices and cheaper goods.In addition, the most important gaining of international trade is it can generate economic growth. Free trade could increase sales, profit margins, and market shares and the both demand and supply level has updated. Meanwhile, the producer needs more resources, labor and capital to produce more to satisfy the global market. It direct result in improving the material market, finance market, and may decline the unemployment rate.Free tradeFree trade is a concept that there is no barrier to goods and services exchanged between countries. Since different countries have different terrain, weather, resources and technology, the international trade would bring the goods which aremore valuable than the local people produce it by themselves.A good example for free trade is in Nov.18, 2004, Chinese President and Chilean President declared the start of the FTA negotiations. According to the agreement, the two countries would start tariff reduction of goods trade from July 1, 2006. Tariff of products accounting for 97% of the total of the two countries would be zero in ten years. China and Chile would carry out free trade in education, science & technology, environment protection, labor, social security, IPR, investment and promotion, mineral and industry. This agreement has promoted the free trade between China and Chile successfully.Absolute and comparative advantageAbsolute advantage refers to the ability of a particular person or a country to produce a particular good with fewer resources than another person or country. Absolute advantage is said to occur when one country can produce a good or service to pre-determined quality more cheaply than anther country. It stands contrasted with the concept of comparative advantage which refers to the ability to produce a particular good at a lower opportunity cost. Opportunity cost is defined as the cost of choosing a good or service measured in terms of the next best alternative given up. A country has a comparative advantage in producing a good if the opportunity cost of producing that good in term of other goods is lower in that country than it is in other countries.Example: Korea and Japan have following production possibilities for twocommodities, mobile phones and computers; assume that all the resources owned by each country are same.It is clear that Japan has an Absolute advantage over Korea in both commodities. But the advantage it has is much greater for mobiles. Using the same resources as Korea it can make twice as many mobile phones.For Japan the ‘cost’ of 1 Mobile phone is 10 bales of Computers, i.e. 20000/2000 For Korea it is 15, i.e. 15000/1000But if we look at the case of computers we will find that here for Japan the cost of a bale of computers is one-tenth of a Mobile phone while for Korea it is one fifteenth. In terms of the output of Mobile phone foregone (opportunity cost), computer is cheaper in Korea than Japan. Korea has a Comparative advantage in computer while Japan has comparative advantage in mobile phone.ProtectionismProtectionism is the economic policy of restraining trade between nations, throughmethods such as high tariffs on imported goods, restrictive quotas, a variety of restrictive government regulations designed to discourage imports and anti-dumping laws in an attempt to protect domestic industries in a particular nation from foreign take-over or competition.Here are two examples of protectionism:1: Britain imports bananas from its ex-colonies in South America while USA owns huge banana plantations in South America. In 1999 Britain refused to import bananas from South America, so the US government slapped tariffs on some British-made goods. The most serious one was a punitive tariff of 100% on Scottish wool products in order to limit the import from Britain.2: Another example of protectionism is in January, 2009, American government settled a policy that only the American steel can be used in America. The American government tended to use this policy to reduce the loss in financial crisis and it helps the steel workers to keep their jobs. In this example, protectionism protects the domestic lower-skilled labor and domestic industries.Barriers to tradeTo protect a country’s own industries, the country which in adverse side need to find some ways to be barriers to limit the import products, usually, the two methods are—tariff and non tariffs.Tariff is taxes or customs duties placed on foreign products to artificially raise their prices and this hopefully, suppresses domestic demand for them. This tax maybe ad value, that is, a percentage of the price of the goods or specific, that is, a tax per unit of weight or physical quantity.For example, in January 12, 2009 the Russian government raised the expropriation tariff (up to 30 percent) for the cars import in the next nine months. The import car’s price will be increased to be WP (price for the whole world) adds the tariff, since the price is increasing, the sales of the import cars must fall down. The customers might choose the Russian car instead of import cars since it is cheaper. Non-tariff barriers traditionally have been actions such Quotas, embargoes, exchange control and import deposits. Probably the best known of these is the quota. This is a physical limitation on the quantity of import. Quota is a physical limitation on the quantity of imports which had been acknowledged by local laws. Usually the importers need to apply to pay for a license to sell goods.For instance, Russia uses another method to limit foreign car import since 2008—to limit the quantity of import; only a few companies which have the import license could import cars and have a selling upper limit. Russia uses these methods to restrict the import quantity, and during the government limited foreign goods import, it can promote the domestic industries.WTO and EUIn 1948, the General Agreement on Tariffs and Trade (GATT) was established by the developed countries. In 1 Jan 1995, the GATT was supplanted by a new institution, the World Trade Organization (WTO) and aims to improve trade and investment flowsaround the world. It is an international body seeking to promote free trade by opening markets through the elimination of import tariffs. The organization administers trade agreements, monitors international trade policy and acts as a forum for trade negotiations. The four main goals of WTO are: freeing global trade through universally lowered tariffs, imposing the same rules on all members in order to homogenize the trade process, spurring competition through lowered subsidies, and ensuring the same trade concessions for all member nations. The WTO also provides technical assistance and training for developing countries. WTO aims for equal representation among members by granting each member country "most-favored nation" status; when a member country bestows a trade privilege on another nation, the privilege must be extended to all other member countries. Another tenet is "national treatment," which behooves countries to treat foreign imports equally with those produced domestically.The best example for joining the WTO is the join of China in 2007, after that, China achieves lots of benefits from the decrease of tariff, limitations and the simplification of trading procedures.EU stands for European Union and is an economic union, which aims to abolish tariffs and quotas among members, common tariff and quota system, restrictions on factor movements and harmonization and unification of economic policies and institutions. It draws out regulations, monitors member states, solves disputes and problems among member states and negotiates with other countries or international organizations on the behalf of EU members. The European Union aims to promote andsmooth free trade among internal European Union and initiatives for simplifying national and community rules include simpler legislation for the internal market (SLIM) and European Business Test Panel. For example, in Oct 16, 2009, EU and Korean government signed a free trade agreement of 100 billion US dollars after two years’negotiation and EU will cancel the tariffs on imports of textile and cars from Korea in the next three years. This will promote the free trade of EU and have positive impact on the economy.Section 2: International FinanceBalance of Payments and General trends in UK TradeBalance of payment is the name given to the record of transactions between the residents of the country and the rest of the world over a period of time. It is a key economic statistics and UK’s Balance of Payments is comprises by the current account, the capital account, the financial account which deals with flow of direct portfolio and investments and reserve assets and the International Investment Position which shows the Stock of External Financial Assets and Liabilities. The chart below shows the composition if Balance of Payments in 2008:a) The current account can be divided into four categories: trade in goods, trade in service, income and current transfers. Positive net income from abroad corresponds to a current account surplus; negative net income from abroad corresponds to a current account deficit.Here are the trade figures of recent years:Here are the Current Account Balance Chart and the Chart of trade in Goods and services of UK in last 20 years.The current balance has usually been in deficit over the last 30 years. The UK has recorded a current account deficit in every year since 1984. Prior to 1984, the current account recorded a surplus in 1980 to 1983. From 1984 to 1989, the current account deficit increased steadily to reach a high of 25.5 billion pounds in 1989, equivalent to -4.9 per cent of Gross Domestic Product (GDP). From 1990 until 1997, the current account deficit declined to a low of 1.0 billion pounds in 1997. Between 1998 and 2006, the current account deficit widened sharply, peaking at 43.8 billion pounds in 2006. This was the highest recorded in cash terms but only equated to -3.3 per cent of GDP. In the past two years, there has been a reduction in the current account deficit –in 2008 it currently stands at 25.1 billion, equivalent to -1.7 per cent of GDP.It is obvious that UK had a large deficit in trade of goods in the last 30 years and the deficit becomes lager and increases greatly from 1998 to 2008 while the surplus of trade in service grows smoothly but not as markedly as the goods deficit. The trade in goods account recorded net surpluses in the years 1980 to 1982, largely as a result of growth in exports of North Sea oil. Since then however, the trade in goods account has remained in deficit. The deficit grew significantly in the late 1980s to reach a peak of 24.7 billion in 1989, before narrowing in the 1990s to levels of around 10 billion to 14 billion. In 1998 the deficit jumped by over 9 billion, and it has continued to rise since, reaching a cash record of 92.9 billionin 2008.There are two different of Income—Direct Investment Income and Portfolio Investment Income. The Direct Investment Income means the profits earned by UK companies from overseas branches and associated company. And the Portfolio Investment Income is the interest on bonds and dividends, held abroad by UK companies and residents.Here are charts of income over the 10 years:The income section has shown positive growth from 2006 to 2008 and is very much in surplus recently.As for the current transfer, it also has two different parts:The taxes, payments and receipts to the EU, Social Security Payments abroad, and military expenditure abroad is the Central Government Transfer. And for Other Sector Transfers, it includes receipts from the EU Social Fund, taxes on income and wealth paid by UK workers and businesses to foreign governments, insurance premiums and claims.There is the Chart of Current transfer in last 10 yearsThe transfers account has shown a deficit in every year since 1960. The deficit increased steadily to reach 4.8 billion in 1990. In 1991, the deficit reduced to 1.0 billion, reflecting 2.1 billion receipts from other countries towards the UK’s cost of the first Gulf conflict. The deficit has since increased, to reach a record13.6 billion in 2008.b) Compared with Current Accounts, the composition of the Capital and Financial Account is more complicate.Capital Account has two categories:Capital transfer: It is investment grants by the government and debts which the government has agreed with the creditor do not need to be met.Acquisition and disposal of non produced/nonfinancial assets: Purchase or sales of property by foreign embassy or patents, copyrights, trademarks, franchises and leases.The capital account has shown strong steady surplus growth especially from the year of 2006 to 2008.The financial account has four categories and here are the charts of the four categories over the last ten years:According to these graphs, investment increased dramatically from the mid-1990s, reflecting the increased globalization of the world economy. Between 2000 and 2007, other investment dominated cross-border investment, primarily banking activity. In 2008 however, other investment, has recorded net disinvestment as the global financial crisis deepened leading to a reduction in loans internationally and a repatriation of deposits. In recent years, including the latest, the UK has needed to borrow from abroad to finance a continuing current account deficit, which hasresulted in inward investment (UK liabilities) exceeding outward investment (UK assets).c) The international investment position is the balance sheet of the stock of external assets and liabilities. Between 1966 and 1994 the UK’s assets tended to exceed its liabilities, by up to a record 86.4 billion pounds in 1986. But from 1995 to 2007, the UK recorded a net liability position in every year, reaching a record 352.6 billion pounds in 2006. In 2008, the UK returned to a net asset position of 92.9 billion pounds mainly due to exchange rate effects.The chart below indicates UK’s international investment position:Relationship between the exchange rate and the balance of paymentsThe exchange rate is the price of a currency in terms of other currencies. Its effect on balance of payments will depend upon its relationship with other currencies and how its value will change. As the currency weakens (devalues) the exports will become cheaper abroad but the country has to pay more for imports but the goods and services would become internationally cheaper and lead to more goods a services being purchased. If demand remains the same then the value of goods and services to the country will reduce and the current account balance may deteriorate. If the exchange rate rises then the country’s goods and services might suffer and demand from abroad could fall. If the demand remains the same however then the value of exports will rise and the current account balance should improve.For instance, when the UK market needs to import American goods (such as corns)the exchange market in UK would be the demand of U.S dollars is larger than the supply of UK pounds. If the American markets needs import more British goods, they need to exchange more pounds in the currency market, so the both of demand of US Dollar and supply of UK Pounds is increasing, meanwhile, the exchange rate of £/$ is increasing. UK pound is more valuable means the goods of UK are usually more expensive and American people need to spend more US dollars compared to the same amount of pounds. That is why the currency exchange rate is so important for the balance of payments. For example, if the exchange rate of £/$ is increasing, the American business man might not choose UK goods, because of the high price. Single CurrencyEuropean single currency Euro came to exist since 1999. There are 12 member states of EU who use Euro while UK is still not one of the members since there are both advantages and disadvantages to join it.Advantages:At firstly, the single currency reduces the exchange rate uncertainty because people don't have to convert money from one currency to another when purchase goods. Meanwhile, using the single currency will increase foreign investment such as direct inward investment since the reduction of uncertainty. Then it may produce a great transparency. Whether people buy or sell goods, consumers can compare price in a single currency. It will help to decrease the scope for price discriminations and create pressure to lower the price. Moreover, it could maintain interest ratelower and the commitment to low inflation should allow economies to operate with lower cost.Disadvantages:A country may lose the independent monetary policy if it joins the single currency. The single currency forces a country to forgo an independent monetary policy. After the single currency has been used, the country's monetary policy will determined by the supranational central bank and not by the domestic central bank. This is why the theory of optimal currency areas emphasizes the importance of flexible prices, labor mobility and fiscal transfers. Flexible prices and labor mobility become more important when a currency union exists; governments have an incentive to make markets work more efficiently.Besides, there are also political costs to the country. If the government loses control over monetary policy to the supranational central bank, politicians are limited to using fiscal policy to influence economy.Effects on individuals and business of the EuroAs for the individuals,they can get lower prices and higher quality goods and services when they have more choices due to increased competition among companies through the Euro zones; they can measure the good price through Europe and choose the best one. In addition, single currency reduces the transaction costs of traveling in Europe. Individuals could travel more frequently than past since it is more convenient and cheaper. People do not need to concern the exchange rateand commission fee when visiting the other countries in Europe.As for the business, people could avoid the exchange rate risk and traders do not need to waste time and cost on purchasing foreign currencies. Moreover, the business market could be expanded there are more opportunities.Section 3: Less Developed Countries (LDCs)Characteristics of a LDCLess Developed Countries (LDCs) mainly exist in Asia and Africa. Most LDCs’subsistence is agriculture. The land of LDCs is very ineffectively used and is very low in productivity, there are normally no modern techniques or equipment available, and the land is always threatened by floods or droughts. The birth rates in LDCs are very high but there is very heavy infant mortality since the health care system is poor.A good example for LDC is Angola. A 2007 survey concluded that low and deficient niacin status was common in Angola. Many regions in this country have high incidence rates of tuberculosis and high HIV prevalence rates. Angola has one of the highest infant mortality rates in the world and one of the world's lowest life expectancies. Current issues that face LDCsThe World Bank offers aid programs to Angola to support the health care system of Angola to reduce the infections of HIV but the aid programs they get from the World Bank of IMF carry conditions which they feel are difficult to comply with, and areexpensive.Besides, the indebtedness of Angola keeps increasing year on year. This makes Angola almost impossible to borrow more.They borrow a huge amount of money to develop their economy, purchase foreign goods and service. However, the high interest or other factors make debts become a great stress on LDCs. They are in the trip of debts, which prevent the development of their economy.The impacts of multinationals on LDCs and NICsNow days, there are more and more multi-national firms which have branches in various countries since it can reduce the labor, material, transport cost. Companies from newly industrialized countries tend to be MNCs. A good example for multinationals on NICs and LDCs is Great Wall Computer Corporation from China. This company invests 120 million dollars to build a new factory in Algeria to expand its market and increase 34 percent of its foreign sale income. The company offers more jobs to the people in Algeria thus increase the employment and income of Algerian. The company also brings new technology to this less developed country. However, the company transfers most of profits back to China and uses their financial strength to impose their will in host counties either.ConclusionAfter analyzing these 15 elements, you may have a clear acknowledge of the international trade, finance and LDCs and as for the economic environment of the whole area, it can be benefit to join the EU. It will enhance our country’s economicgrowth by attracting more free capital, using single currency and enlarge the market.References:Web research:/downloads/theme_economy/PB09.pdfRelated Web sites /wiki/Protectionism/eurocash.asp/Book resource:The Economics 2: The World Economy: Higher National Diploma. Scottish Qualifications AuthorityUnited Kingdom Balance of Payments the Pink Book 2009: Office for National Statistics。

全球大学经济学论文

近年来,全球大学的经济学研究取得了长足的进展。

经济学作为一门重要的社会科学学科,对于解析和预测经济现象、指导政策实践具有重要意义。

各个国家和地区的大学在经济学领域的研究中相互交流、切磋,推动了学科的进步和发展。

全球大学的经济学研究不仅关注经济发展的宏观问题,也深入研究了微观经济学、产业经济学、劳动经济学等领域。

通过对数理模型的建立和实证分析,经济学家们探讨了资源配置、市场机制、政府干预等诸多经济现象,为经济规律的探究提供了理论和实证支持。

此外,全球大学在集聚优秀教授和学生的同时,也积极开展国际交流与合作。

每年举办各种学术会议、论坛,促进了学者之间的互动与合作,在经验交流和研究成果的分享中不断推动着经济学领域的发展。

在未来,随着全球经济的不断发展和变化,全球大学的经济学研究将面临更多的挑战与机遇。

只有不断加强学术交流、加强合作、加深研究,才能更好地应对挑战,推动经济学领域持续健康发展。

BCS ReportAward Structure: 10HRName: 陆飞SusanHND CentreXianDa College of Economics and Humanities Shanghai International Studies UniversityDate: June 3, 2012Table of ContentIntroduction ............................... 错误!未定义书签。

Section1 (2)Section 2 (4)Section 3 (6)Section 4 (9)Conclusion (13)Reference .................................. 错误!未定义书签。