信用证审证练习题(3)

- 格式:doc

- 大小:32.00 KB

- 文档页数:6

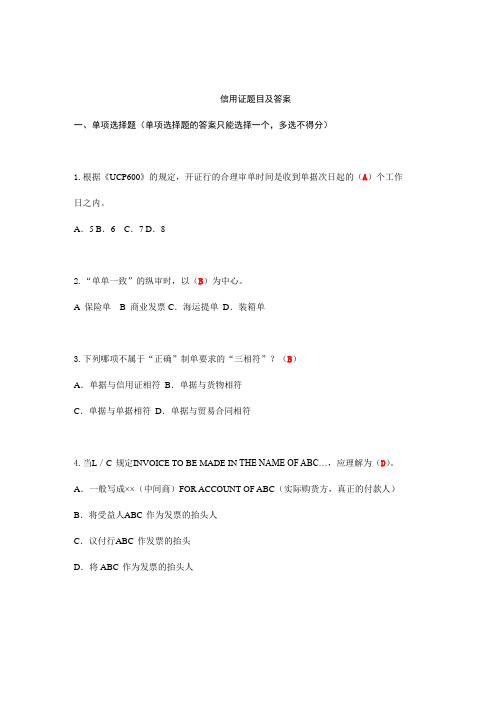

信用证题目及答案一、单项选择题(单项选择题的答案只能选择一个,多选不得分)1.根据《UCP600》的规定,开证行的合理审单时间是收到单据次日起的(A)个工作日之内。

A.5 B.6 C.7 D.82.“单单一致”的纵审时,以(B)为中心。

A 保险单B 商业发票C.海运提单D.装箱单3.下列哪项不属于“正确”制单要求的“三相符”?(B)A.单据与信用证相符B.单据与货物相符C.单据与单据相符D.单据与贸易合同相符4.当L/C 规定INVOICE TO BE MADE IN THE NAME OF ABC…,应理解为(D)。

A.一般写成××(中间商)FOR ACCOUNT OF ABC(实际购货方,真正的付款人)B.将受益人ABC 作为发票的抬头人C.议付行ABC 作发票的抬头D.将ABC 作为发票的抬头人5.根据联合国设计推荐使用的用英文字母表示的货币代码,如下表示不正确的是(C) A.CNY89.00 B.GBP89.00C.RMB89.00 D.USD89.006.在托收项下,单据的缮制通常以(C)为依据。

A.信用证B.发票C.合同D.提单7.一份信用证规定有效期为2008 年11 月15 日,装运期为2008 年10 月,未规定装运日后交单的特定期限,实际装运货物的日期是2008 年10 月10 日。

根据《UCP600》规定,受益人应在(B)前向银行交单。

A.2008 年11 月15 日B.2008 年10 月31 日C.2008 年10 月15 日D.2008 年10 月25 日8.信用证支付方式下,银行处理单据时不负责审核(C)。

A.单据与有关国际惯例是否相符 B.单据与信用证是否相符C.单据与国际贸易合同是否相符 D.单据与单据是否相符9. 在信用证业务中,有关当事方处理的是(C)。

A.服务 B.货物C.单据 D.其他行为10.在信用证支付方式下,象征性交货意指卖方的交货义务是(C)。

国内信用证试题及答案国内信用证试题一、单选题:1、国内信用证编核押方式采用总行统一规定。

国内信用证的( A ) 由CCBS 系统自动加编密押。

A.开立、修改、内部调整B. 开立、修改、议付、付款C. 开立、修改、垫款、议付D. 开立、修改、议付、注销2、经办行办理信用证业务时,应按照(A)的原则审核信用证单据。

A. 单证相符、单单相符、表面相符B. 单证相符、单单相符、帐实相符C. 单证相符、单单相符D, 单单相符、帐实相符3、国内信用证的一般修改及通知收费标准每次为(B)A.100元、100元B.100元、50元 C .50元、50元D.按金额的0.15%每次收取4、信用证条款中的四个期限控制公式为(A)A.有效期≥付款期≥交单期≥最迟装运期.B. 付款期≥交单期≥最迟装运期≥有效期.C. 交单期≥最迟装运期≥有效期≥付款期.D. 最迟装运期≥有效期≥付款期≥交单期.5. 通知行应在收到信用证或信用证修改书的次日起( )知受益人(B)A.一个营业日内 B.三个营业日内 C. 五个营业日内.D.七个营业日内6. 议付行应在收到受益人提供单证的次日起()内,通知受益人( C)A.一个营业日内 B.三个营业日内 C. 五个营业日内.D.七个营业日内7. 开证行收到委托收款行寄交信用证相关资料,审查不符时,应于次日起(C)内向委托收款行发出不符点通知。

()A.一个营业日内 B.三个营业日内 C. 五个营业日内.D.七个营业日内8、国内信用证的注销业务办理在:(A)A.开证行B.通知行C.委托收款行D.议付行9、国内信用证如果已经议付或办理委托收款,则不能进行信用证修改操作,除了哪些人同意的除外。

(B)A、开证人;B、受益人;C、买方10、委托收款行对超过合理天数未能收到的信用证款项,以及短付的款项,应及时向开证行(A)。

A、办理催收B、发出查询C、联系开证申请人付款赎单11、国内信用证编号长度为几位(C)A、8位;B、10位;C、16位;D、20位12、延期付款信用证和议付信用证的付款期限为货物装运日后或货物收据、货物发运单据签发日后(不含装运日和签发日)定期付款,最长不得超过( D)个月。

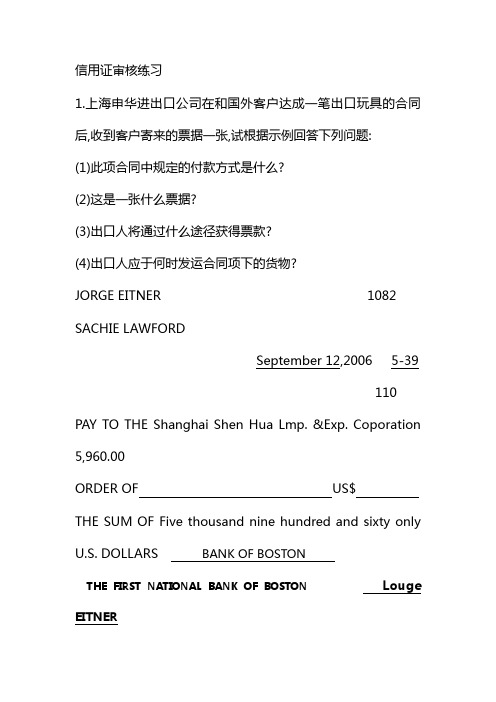

信用证审核练习1.上海申华进出口公司在和国外客户达成一笔出口玩具的合同后,收到客户寄来的票据一张,试根据示例回答下列问题:(1)此项合同中规定的付款方式是什么?(2)这是一张什么票据?(3)出口人将通过什么途径获得票款?(4)出口人应于何时发运合同项下的货物?JORGE EITNER 1082 SACHIE LAWFORDSeptember 12,2006 5-39110 PAY TO THE Shanghai Shen Hua Lmp. &Exp. Coporation 5,960.00ORDER OF US$THE SUM OF Five thousand nine hundred and sixty only U.S. DOLLARS BANK OF BOSTONTHE FIRST NATIONAL BANK OF BOSTON Louge EITNER:0 000390:837 38593 68968952.试将下列短文译成中文:ADVANTAGE AND DISADVANTAGE OF COLLECTIONThe most unsatisfactory feature of the D/P from of transaction is the possibility of the buyer or this banker refusing to honor the draft and take up the shipping documents,especially at a time when the market is falling.In such a case,the seller may not receive his payment,although he is still the owner of the goods.Under D/Pmethod,before making payment,the buyer can not get documents of title to the goods and take delivery of the goods.The ownership of the goods still remains in the hands of the seller.If the buyer dishonors the draft,the seller can sellthe goods to others.In the case of payment by D/A,the further difficulty arises that,on the buyer accepting the draft,thedocuments of title will be surrendered to him.Hence,if the buyer goes bankrupt or becomes insolvent before the payment by D/P or D/A,unless the buyer is of unquestionable integrity or of there is a special relation between the seller and the buyer.It is far better for the exporter to use L/C rather than D/P or D/A.However,under certain circumstances or for certain purposes,payment by D/P or D/A is still deemed necessary,for instance:(1)For implementation of foreign trade policy,especially for the promotion of trade with developing countries.(2)For promotion of exports,especially to push the sale of our new products and difficultsell commodities.(3)For promotion of trade with the small enterprises by the granting credits to them.(4)For simplifying procedures of payment while doing business with affiliated corporations.3.案例分析某公司出售一批货物给香港商人,成交条件为CIF香港,付款条件是付款交单见票后30天(D/P at 30 days after sight)付款,出口商在合同规定的装运期限内将货物装船后,开立远期汇票,连同商业发票和已装船海运提单委托中国银行通过港商指定的某代收银行收取货款.5天后,出口商所交货物安全运抵香港,由于当时该商品行市看好,港商凭信托收据(Trust Receipt)向代收行借出提单,提取货物并将部分货物出售.不料,由于同类商品大量抵港,致使货价迅速下跌,港商随即以出口商所交货物有质量问题为由,在汇票到期时拒绝付款,你认为出口商应该如何处理并请说明理由。

信用证练习一、单选题1、所谓“信用证严格相符”的原则,是指受益人必须做到()。

A.信用证和合同相符B.信用证和货物相符C.信用证和单据相符答案:C解析:在信用证业务中,实行的是凭单付款的原则,开证银行只根据提交的单据与信用证相符,即要求“单证一致”、“单单一致”。

2、信用证的基础是买卖合同,当使用证与买卖合同规定不一致时,受益人应要求()。

A.开证行修改B.开证申请人修改C.通知行修改答案:C3、在信用证业务中,银行的责任是:()A、只看单据,不看货物B、既看单据,又看货物C、只管货物,不看单据答案:A4、信用证上如未明确付款人,则制作汇票时,受票人应为()。

A.开始申请人B.开证银行C.议付行D.任何人答案:B5、根据国际商会《跟单信用统一惯例》的规定,如果信用上未注明“不可撤消”的字样,该信用证应视为:A.可撤消信用证B.不可撤消信用证C.远期信用证D.由受益人决定可撤消或不可撤消答案:B6、在合同规定的有效期,()负有开立信用证的义务。

A. 卖方B. 买方C.开证行D.议付行答案:B解析: 考点为开立信用证的要求。

买方负有开立信用证的义务,要求开证行开立的有条件的承诺付款的书面文件。

7、在交易金额较大,对开证行的资信有不了解时,为保证货款的及时收回,买方最好选择()。

A.可撤销信用证B.远期信用证C.承兑交单D.保兑信用证答案:D解析:信用证的选择问题,ABC收回货款的风险大。

采用保兑信用证,是指一家银行开立的信用证,由另一家银行加以保证兑付,保兑行在信用证下也承担了第一付款责任。

8、关于信用证的有效期,除特殊规定外,银行将拒绝接受迟于运输单据出单日期()天后提交的单据。

A.20B.30C.25D.21答案:D解析:本题是关于信用证的有效期与银行交单的关系。

银行拒绝接受迟于运输单据出单日期21天后提交的单据(出单日期指提单签发日期,即货物装船完毕日期)9、按照《跟单信用证统一惯例》的解释,在信用证中如未注明是可以撤销,则该证为:A.可撤销信用证B.不可撤销信用证C.由双方协商决定答案:B解析:根据《跟单信用证统一惯例》规定,信用证上未注明是可撤销信用证或不可撤销信用证时,视为不可撤销信用证。

1.根据提供的外销合同对信用证进行审核并提出修改信用证的意见。

TO: BANK OF CHINA TANGSHAN BRANCH,CHINAIRREVOCABLE DOCUMENTARY CREDIT NO.13-385FOR THE ACCOUNT OF HONGYAN TRADING CO, LTD., HONGKONG. 311 SOUTH BRIDGE STREET, HONGKONG.DEAR SIRS:WE OPEN AN IRREVOCABLE DOCUMENTARY CREDIT IN FAVOUR OF TANGSHAN FOREIGN TRADE IMP.AND EXP. CO. 188 WEIGUO ROAD TANGSHAN, CHINA.FOR A SUM OF USD1000000.00 AVAILABLE BY THE BENEFICIARY’S DRAFT(S) AT SIGHT DRAWN ON APPLICANT BEARING THE CLAUSE:“DRAWN UNDER NANYANG COMMERCIAL BANK LTD., HONGKONG. DOCUMENTARY CREDIT NO.13-385 DTAED IST MARCH,2013.”ACCOMPANIED BY THE FOLLOWING DOCUMETNS:(1) 3/3 ORIGNAL + 3NN COPIES CLEAN ON BOARD BILL OF LADINGMADE OUT TO ORDER OF APPLICANT AND MARKEDFREIGHT PREPAID .(2) INSURANCE POLICY/ CERTIFICATE IN DUPLICATE IN FAVOUR OF NANYANG COMMERCIAL BANK LTD., HONGKONG FOR 100% OF THE INVOICE VALUE BLANK ENDORSED.COVERING P.I.C.C OCEAN MARINE CARGO CLAUSES(W.A) AND WAR RISKS DATED 1st JANUARY,1981.INCLUDING WAREHOUSE TO WAREHOUSE CLAUSE UP TO FINAL DESTINATON AT DUBA(3) CERTIFICATE FO ORIGIN ISSUED BY TANGSHAN IMPORT AND EXPORT COMMODITY INSPECTION BUREAU OF THE PEOPLE’S REPUBLIC OF CHINA IN TRIPLICATE. EVIDENCING SHIPMENT OF THE FOLLOWING MERCHANDISE:AIR CONDITIONER(HUALING BRAND),10000PCS KW-23GW AND 10000 PCS KW-25GW, PACKING:IN CARTON BOX,50 KILOS NET EACH CARTON,3PC/CARTON,@HKD50.00,CIF DUBAI VIA HONGKONG,PARTIAL SHIPMENT AND TRANSSHIPMENT PROHIBITED. LATEST DATE FOR SHIPMENT: 30TH APRIL,2014. EXPIRY DATE:15TH MAY,2014.IN PLACE OF OPENER FOR NEGOTIATION. WITH 5 % MORE OR LESS BOTH IN AMOUNT AN QUANTILY ALLOWED AT THE SELLER’S OPTION.OTHER TERMS AND CONDITIONS:SHIPPER MUST SEND ONE COPIES OF SHIPPING DOCUMENTS DIRECT TO BUYER AND CERTIFICATE TO THIS EFFECT IS REQUIRED.审核结果:(1)HONGYAN 错误,应为HONGYANG。

1.根据提供的外销合同对信用证进行审核并提出修改信用证的意见。

TO: BANK OF CHINA TANGSHAN BRANCH,CHINAIRREVOCABLE DOCUMENTARY CREDIT NO.13-385FOR THE ACCOUNT OF HONGYAN TRADING CO, LTD., HONGKONG. 311 SOUTH BRIDGE STREET, HONGKONG.DEAR SIRS:WE OPEN AN IRREVOCABLE DOCUMENTARY CREDIT IN FAVOUR OF TANGSHAN FOREIGN TRADE IMP.AND EXP. CO. 188 WEIGUO ROAD TANGSHAN, CHINA.FOR A SUM OF USD1000000.00 AVAILABLE BY THE BENEFICIARY’S DRAFT(S) AT SIGHT DRAWN ON APPLICANT BEARING THE CLAUSE:“DRAWN UNDER NANYANG COMMERCIAL BANK LTD., HONGKONG. DOCUMENTARY CREDIT NO.13-385 DTAED IST MARCH,2013.”ACCOMPANIED BY THE FOLLOWING DOCUMETNS:(1) 3/3 ORIGNAL + 3NN COPIES CLEAN ON BOARD BILL OF LADINGMADE OUT TO ORDER OF APPLICANT AND MARKEDFREIGHT PREPAID .(2) INSURANCE POLICY/ CERTIFICATE IN DUPLICATE IN FAVOUR OF NANYANG COMMERCIAL BANK LTD., HONGKONG FOR 100% OF THE INVOICE VALUE BLANK ENDORSED.COVERING P.I.C.C OCEAN MARINE CARGO CLAUSES(W.A) AND WAR RISKS DATED 1st JANUARY,1981.INCLUDING WAREHOUSE TO WAREHOUSE CLAUSE UP TO FINAL DESTINATON AT DUBA(3) CERTIFICATE FO ORIGIN ISSUED BY TANGSHAN IMPORT AND EXPORT COMMODITY INSPECTION BUREAU OF THE PEOPLE’S REPUBLIC OF CHINA IN TRIPLICATE. EVIDENCING SHIPMENT OF THE FOLLOWING MERCHANDISE:AIR CONDITIONER(HUALING BRAND),10000PCS KW-23GW AND 10000 PCS KW-25GW, PACKING:IN CARTON BOX,50 KILOS NET EACH CARTON,3PC/CARTON,@HKD50.00,CIF DUBAI VIA HONGKONG,PARTIAL SHIPMENT AND TRANSSHIPMENT PROHIBITED. LATEST DATE FOR SHIPMENT: 30TH APRIL,2014. EXPIRY DATE:15TH MAY,2014.IN PLACE OF OPENER FOR NEGOTIATION. WITH 5 % MORE OR LESS BOTH IN AMOUNT AN QUANTILY ALLOWED AT THE SELLER’S OPTION.OTHER TERMS AND CONDITIONS:SHIPPER MUST SEND ONE COPIES OF SHIPPING DOCUMENTS DIRECT TO BUYER AND CERTIFICATE TO THIS EFFECT IS REQUIRED.审核结果:(1)HONGYAN 错误,应为HONGYANG。

SALES CONFIRMATIONDATE:MAY 10,2004OUR REFERENCE:IT123JSSELLER: CHINA INTERNATIONAL TEXTILES I/E CORP. JIANGSU BRANCH ADDRESS: 20 RANJIANG ROAD ,NANJING,JIANGSU,CHINABUYER: TAI HING LOONG SDN, BHD, KUALA LUMPURADDRESS: 7/F, SAILING BUILDING, NO.50 AIDY STREET, KUALA LUMPUR, MALAYSIATEL:060-3-74236211 FAX:060-3-74236212THE UNDERSIGNED SELLERS AND BUYERS HAVE AGREED TO CLOSE THE FOLLOWING TRANSACTION ACCORDING TO THE TERMS AND CONDITIONS STIPULATED BELOW:DESCRIPTION OF GOODS:QUANTITY : 300,000 YARDS 100% COTTON GREE LAWNUNIT PRICE: HKD3.00PER YARD CIF SHANGHAIAMOUNT HKD900,000.00CIF SINGAPORESHIPMENT: DURING JUNE/JULY,2004 IN TRANSIT TO MALAYSIAPAYMENT:IRREVOCABLE SIGHT L/CINSURANCE:TO BE EFFECTED BY SELLERS COVERING WPA AND WAR RISKS FOR 10% OVER THE INVOICE VALUETHE BUYER THE SELLERTAI HING LOONG SDN, CHINA INTERNATIONAL TEXTILES I/E CORP. BHD, KUALA LUMPUR. JIANGSU BRANCH买方开来的信用证如下所示:FROM: BANGKOK BANK LTD., KUALALUMPURDOCUMENTARY CREDIT NO.:98/12345DATE:JUNE 12,2004ADVISING BANK: BANK OF CHINA, JIANGSU BRANCHAPPLICANT: TAI HING LOONG SDN, BHD., P.O.B.666 KUALA LUMPUR BENEFICIARY: CHINA INTERNATIONAL TEXTILES I/E CORP., BEIJING BRANCH AMOUNT: HKD 900,000.00 (HONGKONG DOLLARS NINE HUNDRED THOUSAND ONLY)EXPIRY DATE: JUN 15, 2004 IN CHINA FOR NEGOTIATIONDEAR SIRS:WE HEREBY ISSUE THIS DOCUMENTARY CREDIT IN YOUR FAVOR, WHICH IS AVAILABLE BY NEGOTIATION OF YOUR DRAFT(S) IN DUPLICATE AT SIGHT DRAWN ON BENEFICIARY BEARING THE CLAUSE: “DRAWN UNDER L/C NO.98/12345 OF BANGKOK BANK LTD., KUALA LUMPUR DATED JUNE 12, 2004” ACCOMPAINED BY THE FOLLOWING DOCUMENTS:— SIGNED INVOICE IN QUADRUPLICATE COUNTER-SIGNED BY APPLICANT. COVERING ABOUT 300,000 YARDS (5% MORE OR LESS ACCEPTABLE) OF 65% POLYESTER, 35% COTTON GREY LAWN.— FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER, ENDORSED IN BLANK, MARKED :” NOTIFY BENEFICIARY”.— MARINE INSURANCE POLICY OR CERTIFICATE FOR FULL INVOICE VALUE PLUS 50% COVERING ALL RISKS AND WAR RISKS FROM WAREHOUSE TO WAREHOUSE UP TO KUALALUMPUR INCLUDING SRCC CLAUSE— PACKING LIST IN QUADRUPLICATE— CERTIFICATE OF ORIGIN ISSUED BY BANK OF CHINA, NANJING.— SHIPMENT FROM SHANGHAI TO PORT KELANG TO BE MADE AS SOON AS POSSIBLE. PARTIAL SHIPMENTS ARE ALLOWED TO BE DELIVERED ON TWO EQUAL SHIPMENTS.TRANSSHIPMENT PROHIBITED.SHIPMENT CAN ONLY BE EFFECT UPON RECEIPT OF APPLICANT’S SHIPPING INSTRUCTIONS THROUGH L/C OPENING BANK NOMINATING THE NAME OF CARRYING VESSEL BY MEANS OF SUSEQUENT CREDIT AMENDMENT. THE SIGNATURE SIGHED BY THE APPLICANT ON CARGO ECEIPT MUST BE IN CONFORMITY WITH THE RECORD KEPT IN ISSUING BANK.(只有收到信用证修改方式通过开证行发过来的申请人装运指示,指定装运船名后方可发货;收货单据上申请人的签名必须与留在开证行的记录相符。

任何情况下,银行审核单据总是以《UCP600》为依据。

正确答案:B试题解析:(1分)A、正确B 、错误信用证项下单证不符,开证行可以拒付货款;托收项下单据不符,买方可以拒付货款。

正确答案:A(1分)A、正确B、错误错误:信用证业务中,单证相符以单单相符为前提。

正确答案:B(1分)A、正确B、错误在信用证支付方式的情况下,卖方凭以向客户收取货款的,不是实际货物,而是与来证要求完全相符的全套单据。

正确答案:A (1分)A、正确B、错误错误:与跟单托收或协定贸易支付方式不同,信用证支付方式下,单据的作用非常重要。

正确答案:B(1分)A、正确B、错误错误:信用证项下单据应在信用证效期内和交单期内向银行提交。

如果信用证对交单期未作规定,则交单期不得迟于运输单据日期后的15天,并且不得迟于信用证的有效期。

正确答案:B试题解析:(1分)A、正确B、错误联合国设计推荐使用的运输标志(唛头)代码由收货人简称、合同号、目的地和件号四个部分组成。

正确答案:A(1分)A、正确B、错误制单指按信用证、合同和其它有关要求,并根据货物与运输等实际情况缮制有关单据,是单证工作的基础。

正确答案:A(1分)A、正确B、错误错误:审单要做到内容准确、格式完整、单据齐全、份数不缺、单证一致和单单相符,还要保证各种单据的签发日期无逻辑、惯例和条款规定上的矛盾。

正确答案:A(1分)A、正确B、错误单证的不符点只要议付行同意并进行了议付,受益人就可不接受开证行追索货款。

正确答案:B(1分)A、正确B、错误在信用证业务中,各有关方面当事人处理的是:( )正确答案:A(3分)A、单据B、货物C、服务D、其它行为2.采用信用证支付方式,受益人向客户收取货款的凭据是:( ) 正确答案:C(3分)A、已装运的实际货物B、寄单银行要求开证银行付款的书面通知C、与信用证条款完全相符的全套单据D、与买卖合同内容一致的全套单据错误:单证缮制必须做到正确、完整、及时、简明和整洁,其中,( ) 是单证工作的前提。

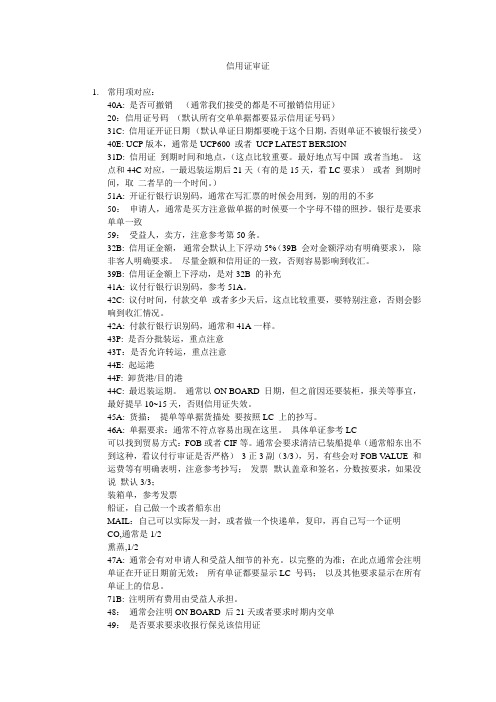

信用证审证1.常用项对应:40A: 是否可撤销(通常我们接受的都是不可撤销信用证)20:信用证号码(默认所有交单单据都要显示信用证号码)31C: 信用证开证日期(默认单证日期都要晚于这个日期,否则单证不被银行接受)40E: UCP版本,通常是UCP600 或者UCP LATEST BERSION31D: 信用证到期时间和地点,(这点比较重要。

最好地点写中国或者当地。

这点和44C对应,一最迟装运期后21天(有的是15天,看LC要求)或者到期时间,取二者早的一个时间。

)51A: 开证行银行识别码,通常在写汇票的时候会用到,别的用的不多50:申请人,通常是买方注意做单据的时候要一个字母不错的照抄。

银行是要求单单一致59:受益人,卖方,注意参考第50条。

32B: 信用证金额,通常会默认上下浮动5%(39B 会对金额浮动有明确要求),除非客人明确要求。

尽量金额和信用证的一致,否则容易影响到收汇。

39B: 信用证金额上下浮动,是对32B 的补充41A: 议付行银行识别码,参考51A。

42C: 议付时间,付款交单或者多少天后,这点比较重要,要特别注意,否则会影响到收汇情况。

42A: 付款行银行识别码,通常和41A一样。

43P: 是否分批装运,重点注意43T:是否允许转运,重点注意44E: 起运港44F: 卸货港/目的港44C: 最迟装运期。

通常以ON BOARD 日期,但之前因还要装柜,报关等事宜,最好提早10~15天,否则信用证失效。

45A: 货描:提单等单据货描处要按照LC 上的抄写。

46A: 单据要求:通常不符点容易出现在这里。

具体单证参考LC可以找到贸易方式:FOB或者CIF等。

通常会要求清洁已装船提单(通常船东出不到这种,看议付行审证是否严格)3正3副(3/3),另,有些会对FOB V ALUE 和运费等有明确表明,注意参考抄写;发票--默认盖章和签名,分数按要求,如果没说默认3/3;装箱单,参考发票船证,自己做一个或者船东出MAIL:自己可以实际发一封,或者做一个快递单,复印,再自己写一个证明CO,通常是1/2熏蒸,1/247A: 通常会有对申请人和受益人细节的补充。

1、请根据所给合同审核信用证SHANGHAI LIGHT INDUSTRIAL PRODUCTS IMPORTANG EXPORT CORPORATION128 Huqiu road Shanghai ChinaSALES CONFIRMATIONTele:86-21- NO:PLW253Fax:86-21- DATE:Sept.15,2TO:CONSOLIDATORSLIMITEDRM.13001-13007E,13/F,ASUA TERMINALS CENTER B. 003BERTH 3,KWAI CHUNG,N.T.,HONGKONGP.O.Box 531HONGKONGWe hereby confirm having sold to you the following goods on terms and conditions as stated belowNAME OF COMMODITY: Butterfly Brand Sewing MachineSPECIFICATION: JA-115 3 Drawers Folding CoverPACKING: Packed in wooden cases of one set each. QUANTITY: Total 5500setsUNIT PRICE: US$ 64.00 per set CIFC3% H.K.TOTAL AMOUNT: US$ 352000.00(Say U.S. dollars three hundred and fifty two thousand only.)SHIPMENT: During Oct./Nov. 2003 from Shanghai to H.K. with partial Shipments and transshipment permitted.INSURANCE: To be covered by the seller for 110% of total invoice value against All risks and war risks as per the relevant ocean marine cargoclauses of the People’s Insurance Company of China datedJanuary 1st,1981.PAYMENT: The buyer should open through a bank acceptable to the seller an Irrevocable Letter of Credit at 30 days after sight to reach the Seller 30 days before the month of Shipment valid fornegotiationin China until the 15th day after the date of shipment.REMARDS: Please sign and return one copy for our file.The Buyer:The Seller:CONSOLIDATORS LIMITED CORPORATION SHANGHAI LIGHT INDUSTRIALPRODUCTS IMPORT & EXPORT信用证HONGKONG & SHANGHAI BANKING CORPORATIONQUEEN’S ROAD CENTERAL, 64,H.K.TEL:822-1111 FAX:810-1112Advised through: Bank of China, NO. CN3099/714Shanghai Branch, DATE Oct.2,2003 H.K.To:Shanghai Light Industrial Products Import & Export Corp.128 HUQIU ROAD SHANGHAI, CHINADear Sirs:We are pleased to advise that for account of Consolidators Limited,H.K.,we hereby open our L/C No. CN3099/714 in your favor for a sum not exceeding about US$ 330000.00(Say US Dollars Three Hundred Thirty Thousand only) available by your drafts on HSBC at 30 days after date accompanied by the following documents:1.Signed commercial invoice in 6 copies.2.Packing List in quadruplicate.3.Full set of (3/3) clean on board B/L issued to our order notify the above mentioned buyer and marked “Freight Collect” dated not later than October 31,2003.From Shanghai to Hong Kong, Partial shipment are not permitted and trans- shipment is not permitted.4.Insurance policy in 2 copies covering C.I.F for 150% invoice value against All risks and war risks as per the relevant ocean marine cargo clauses of the People’s Insurance Company of China dated January 1st,1981.5.Certificate of Origin issued by China Council for the Promotion of International Trade.DESCRIPTION GOODS:5500 sets Sewing Machine Art. No. JA-115 packed in wooden cases or cartons each at US$ 64.00 CIF H.KDrafts drawn under this credit must be marked “drawn underH SBC,H.K.,”bearing the number and date of this credit.We under take to honor all the drafts drawn in compliance with the terms of this credit if such drafts to be presented at our counter on or before Oct. 31,2003.SPECIAL INSTRUCTIONS:(1)Shipment advice to be sent by telefax to the applicant immediately after the shipment stating our L/C No., shipping marks, name of the vessel, goods description and amount as well as the bill of lading No. and date.A copy of such advice must accompany the original documents presented for negation.(2)The negotiating bank is kindly requested to forward all documents to us(HONGKONG & SHANGHAI BANKING CORPORATION QUEEN’S ROAD CENTERAL, 64,H.K.)in one lot by airmail.It is subject to the Uniform Customs and Practice for Documentary Credits (1993) Revision, International Chamber of Commerce Publication No.500.Yours faithfullyFor HONGKONG & SHANGHAI BANKING CORPORATION标准答案:1、信用证的金额与合同不符。

信用证题目及答案一、单项选择题(单项选择题的答案只能选择一个,多选不得分)1.根据《UCP600》的规定,开证行的合理审单时间是收到单据次日起的(A)个工作日之内。

A.5 B.6C.7 D.82.“单单一致”的纵审时,以(B)为中心。

A 保险单B商业发票C.海运提单D.装箱单3.下列哪项不属于“正确”制单要求的“三相符”?(B)A.单据与信用证相符B.单据与货物相符C.单据与单据相符D.单据与贸易合同相符4.当L/C规定INVOICE TO BE MADE IN THENAMEOFABC…,应理解为(D)。

A.一般写成××(中间商)FORACCOUNTOF ABC(实际购货方,真正的付款人) B.将受益人ABC 作为发票的抬头人C.议付行ABC 作发票的抬头D.将ABC 作为发票的抬头人5.根据联合国设计推荐使用的用英文字母表示的货币代码,如下表示不正确的是(C)A.CNY89.00 B.GBP89.00C.RMB89.00D89.006.在托收项下,单据的缮制通常以(C)为依据。

A.信用证B.发票C.合同D.提单7.一份信用证规定有效期为2008年11 月15日,装运期为2008 年10 月,未规定装运日后交单的特定期限,实际装运货物的日期是2008 年10月10 日。

根据《UCP600》规定,受益人应在(B)前向银行交单。

A.2008 年11 月15 日B.2008 年10月31日C.2008 年10 月15 日D.2008年10 月25 日8.信用证支付方式下,银行处理单据时不负责审核(C)。

A.单据与有关国际惯例是否相符B.单据与信用证是否相符C.单据与国际贸易合同是否相符D.单据与单据是否相符9. 在信用证业务中,有关当事方处理的是(C)。

A.服务B.货物C.单据D.其他行为。

一、根据下列合同条款及审核要求审核英国伦敦米兰银行来证SALES CONTRACTContract No.: 055756Date: 21st. July 2005Seller: Shanghai Cereals and Oil Imp. & Exp. CorporationBuyer: ABC Company Limited 36-36 Kannon Street London U.K. Commodities and Specification: Chinese White Rice Long-shapedBroken Grains (Max): 5%Admixture (Max): 0.25%Moisture (Max): 15%Quantity: 30 000 metric tons with 10% more or less at the seller’s option Packing: Packed in gunny bags of 50kg eachUnit Price: USD400 per M/T FOB stowed Shanghai gross for netAmount: USD12 000 000 (SAY TWELVE MILLION ONLY)Shipment: during Oct. / Nov. 2005 from Shanghai to London with partial shipment and transshipment is allowedInsurance: To be covered by the buyerPayment: By Irrevocable L/C payable at sight for negotiation in China within 15 days after the shipmentMidland Bank Ltd., LondonAug. 18th, 2005Advising Bank: Applicant: ABC Company Ltd. Bank of China Shanghai BranchBeneficiary: Amount: Not exceeding USD12 000 000Shanghai cereals and oilImp. & Exp. Corp.Shanghai, ChinaDear Sirs,At the request of ABC Co. Ltd., London, we hereby issue in your favor this revocable documentary credit No. 219307 which is available by negotiation of your draft at 30 days after sight for full invoice value drawn on us bearing the clause: “Drawn under documentary credit No. 219307 of Midland Bank Ltd.,” accompanied by the following documents:1. Signed commercial invoice in 3 copies.2. Full set of 2/3 clean on board bills of lading made out to order and blank endors ed marked “Freight Prepaid” and notify applicant.3. Certificate of origin issued by AQSIQ.4. Insurance policy for full invoice value plus 10% covering all risks and war risks as per ICC dated Jan. 1st, 1981.5. Inspection certificate issued by applicant.6. Beneficiary’s certificate fax to applicant within 24 hours after shipment stating contract number, credit number, vessel name and shipping date.Covering 30 000 metric tons Chinese White Rice Long-shapedBroken Grains: 5%Admixture: 0.25%Moisture: 15%At USD400.00 per M/T FOB Shanghai, packed in plastic bags.Shipment from Chinese port to London during Oct. / Nov. 2005Transshipment is prohibited, partial shipment prohibited.This credit is valid for negotiation before Dec. 15th, 2005 in London.Special Conditions: Documents must be presented for negotiation within 5 days after the date of issuance of the bills of lading,but in any event within this credit validity.We hereby undertake to honor all drafts drawn in accordance with the terms of this credit. The advising bank is kindly requested to notify the beneficiary without adding their confirmation for Midland Bank Ltd., London.It is subject to the Uniform Customs and Practice for Documentary Credit (1993 Revision), International Chamber of Commerce Publication NO. 500.信用证主要有以下不符点:1信用证金额未考虑溢短装条款,如果溢装,则会出现单证不一致,故金额应该为”。

根据下面的销售合同审核信用证。

合同条款:

卖方:中国机械进出口公司

买方:史密斯公司

商品名称:挖掘机

数量;15台

单价:CFR欧洲主要港口每台60 000.00瑞士法郎

总值:900 000.00瑞士法郎

装运期:2002年8月自中国港口至欧洲主要口岸,允许分批装运和转船

付款条件:凭不可撤销即期信用证付款

签订日期和地点:2002年6月15日于北京

合同号码:B1125

信用证内容:

Irrevocable Documentary Credit No. 2234 dated June 25, 2002

Advising Bank: Bank of China, Beijing

Applicant: China National Machinery Imp. /Exp. Corp

Beneficiary: Smith & Co.

Amount: French Francs 900, 000.00 (Say French Francs Nine Hundred Thousand Only)

Expiry Date: September 15, 2002 for negotiation in China

We hereby issue in your favor this documentary credit which is available by presentation of your draft drawn at sight on us bearing the clause: Drawn under documentary credit No. 2234 of ABC Bank accompanied by the following documents:

(1)Signed Commercial Invoice in triplicate, indicating S/C No. B1125 dated 15 June, 2002.

(2)Full set of clean on board Bills of Lading issued to order and blank endorsed showing “Freight Paid” covering:

15 Tunnel Drillers, Model TB201, at 60 000 French Francs each CFR European Main Ports.

(3) One original Insurance Policy/Certificate covering All Risks and War Risk for 110% of invoice value.

Shipment is to be effected during August 2002 from China Port to European Main Ports.

Partial shipments prohibited. Transshipment allowed.

We hereby engage with drawers and/or bona fide holders that drafts drawn and negotiated in conformity with the terms of this credit will be duly honored on presentation and that drafts accepted within the terms of this credit will be duly

honored at maturity.

附参考答案:

Dear sirs,

We have received your L/C No. 2234 but regret to say that we have found some discrepancies in the above mentioned L/C.

Please make the following amendments in the L/C.

(1)The beneficiary should be China Machinery Imp/Exp Corp. and the applicant should be Smith Co.

(2)Swiss Francs instead of French Francs.

(3)Delete insurance clause.

(4)“Partial shipments prohibited” should read “Partial shipments allowed.”

As the stipulated time of shipment is drawing near, please make the requested amendments to the L/C as soon as possible so that we can effect shipment in time.

Yours faithfully

根据下面的销售合同审核信用证。

销售合同主要条款:

合同号码:02/51

卖方:中国化工公司

买方:纽约染料公司

商品名称:染料

数量:200桶

单价:FOB上海每桶50美元

总额:10 000美元

交货期:不迟于2002年9月12日,不允许分批装运

付款条件:不可撤销的见单后60天付款的信用证

信用证内容:

Trust Bank

New York

Date: June 15, 2002

Irrevocable Credit

No. 10002 China Chemical Co. (Beneficiary)

Gentlemen:

For the account of New York Dye Co. (account party) we hereby authorize you to draw on us at 90 days after sight to the extent of US$ 10,000.00 (Say US Dollars Ten Thousand Only).

Your drafts must be accompanied by the following documents (complete sets unless otherwise stated) evidencing shipment(s) of: 200 drums of dye at $50.00 per drum CFR Shanghai, from

Shanghai to New York, details as per your S/C No. 02/54.

Invoice in triplicate.

Insurance policy in duplicate.

Full set of on board bill of lading, dated not later than September 12, 2002, made out to order of Trust bank, New York(Reference 1002), marked “Notify New York Dye Co.” and “Freight Prepaid”.

......

附:参考答案

Dear sirs,

We are pleased to inform you that we have received your L/C No. 10002 issued by Trust Bank. However, on examining the L/C carefully, we regretfully find that certain points are not in conformity with the terms stipulated in our Contract No. 02/51.

Please make the following amendments:

(1)“At 90 days after sight” should read “At 60days after sight”.

(2)“CFR Shanghai” should read “FOB Shanghai”.

(3)Contract number should be “02/51” instead of “02/54”.

(4)Delete insurance clause.

(5)“Freight Prepaid” should be “Freight to collect”.

On receipt of your amendments to the L/C, we will arrange for the shipment without any delay.

Yours faithfully,。