2018年泰国最全税收政策详解

- 格式:docx

- 大小:48.50 KB

- 文档页数:10

泰国外商投资优惠政策研究泰国是东南亚最具活力的经济体之一,是全球最大的稻米出口国之一,同时也是世界著名的旅游胜地。

由于其优越的地理位置、丰富的资源和具备竞争力的劳动力,泰国成为越来越多的外商投资的热门目的地。

泰国政府也一直致力于吸引外商投资,推出了一系列的优惠政策,以吸引更多的外资进入该国。

一、优越的地理位置泰国地处东南亚,是连接南亚、东北亚和澳大利亚之间的重要地理枢纽。

除了得天独厚的地理位置,泰国还拥有丰富的自然资源,如稻米、水果、橡胶等,并且其的经济结构日益多元化,市场潜力十分巨大。

这些因素使得泰国的外商投资环境变得越来越有吸引力。

二、优惠的税收政策泰国政府推行了一系列的优惠税收政策,以吸引更多的外商投资。

根据《对外国投资法》的规定,外国投资者和泰国本地企业享有相同的待遇和福利。

此外,泰国政府还为新设或扩建的企业提供一定期限的税收优惠。

根据《投资促进法》规定,新开展的企业在前三年内可以享受免税待遇。

第一年免企业所得税、第二年减半缴纳、第三年按照实际所得缴纳税款。

三、便捷的商业登记程序在泰国,外商投资者可以选择在国内设立全资子公司或者涉及少量行政审批的股权合作企业。

根据《外国投资法》,外商投资企业必须在泰国商业登记局注册成为一家泰国企业。

在注册过程中,外商投资者需要提交一些必备材料,如公司章程、股东合同、经营地的租赁合同等。

注册完成后,企业应向相关部门申请获得其需要的经营许可证。

四、完善的法律框架泰国政府一直致力于加强知识产权保护,提高法律体系的透明度,这为外商投资者提供了保障。

泰国已经通过了《专利法》、《商标法》和《版权法》,以保护知识产权。

在仲裁、诉讼和执行环节,泰国政府还设立了专门的机构和部门,以帮助外商投资者解决争议。

总之,泰国的外商投资环境越来越受到广大投资者的关注。

泰国政府提供的优惠政策、便捷的商业登记程序、完善的法律框架为外商投资者在泰国开展经济活动和投资提供了强有力的保障,这也加速了泰国经济的发展。

2018年泰国最全税收政策详解在泰国注册公司之后,公司每个月都需要将财务情况制作成财务报表,提交给泰国当地税务局,在此之前,我们首先要前往税务局办理公司所得税和企业增值税的登记。

根据泰国的相关政策,企业一年的收入额达到1,800,000泰铢(360,000RMB)以上的公司,必须在公司成立或开业后的60天內,前往税务局办理企业所得的税登记事项。

企业销售额超过600,000泰铢(RMB120,000)的公司,必须在销售额达到 600,000泰铢后的30天内,前往税务局办理企业增值税登记事项。

以上税务事项,都可以由公司内部员工办理或者交由第三方会计事务所来办理。

接下面,我们将重点介绍泰国各类税种的详细情况。

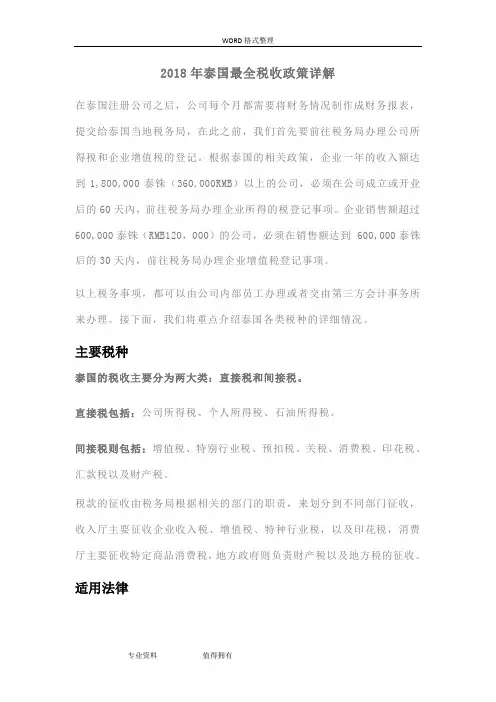

主要税种泰国的税收主要分为两大类:直接税和间接税。

直接税包括:公司所得税、个人所得税、石油所得税。

间接税则包括:增值税、特别行业税、预扣税、关税、消费税、印花税、汇款税以及财产税。

税款的征收由税务局根据相关的部门的职责,来划分到不同部门征收,收入厅主要征收企业收入税、增值税、特种行业税,以及印花税,消费厅主要征收特定商品消费税,地方政府则负责财产税以及地方税的征收。

适用法律《收入法》是泰国税收的主要适用法律。

该法对个人所得税、公司所得税、增值税、特别行业税以及印花税做了法律上的规定。

《石油收入法》则对石油和天然气特许经营所取得的收入做了规定,《海关法》则适用进出口关税的征收。

各税种介绍一.公司所得税:按照泰国法律规定,公司所得税每半年缴纳一次是中期报税表,到年底总结缴纳一次是年度报税表。

在泰国具有法人资格的公司都需依法纳税,纳税比例最高为净利润的20%。

基金和联合会、协会等社会团体的税收为净收入的2 -10%。

国际运输公司和航空业的税收则为净收入的3%。

以下为企业按净利润,需缴纳的税收比例:未注册的外国公司或未在泰国注册的公司,只需要按在泰国的收入纳税。

正常的业务开销和贬值补贴,按5-100%不等的比例从净利润中扣除。

泰国外商投资优惠政策研究泰国自1980年代开始,就在国家发展政策中大力吸引外商投资,制定了一系列外商投资优惠政策,以鼓励外国企业在泰国投资设厂,提升当地经济水平。

这些政策包括税收优惠、土地优惠、劳动力资源优惠等方面,使泰国成为了东南亚地区外商投资最活跃的国家之一。

本文将从税收优惠、土地优惠和其他政策方面对泰国外商投资政策进行研究,探讨其优势和不足之处。

一、税收优惠政策泰国税收优惠政策是吸引外国企业的一个重要手段。

根据《外国投资促进法》规定,在泰国设立生产或服务业务的外国企业,享有多项税收优惠政策。

首先是所得税减免,对于在泰国投资的外国企业,其利润在最初一段时间内可以免征所得税。

其次是加速折旧,对于投资设备,可以实行加速折旧政策,降低企业成本。

泰国还对技术转让、研发等活动给予税收优惠,鼓励企业进行技术创新和科技研发。

这些税收优惠政策有效地降低了外商投资在泰国的成本,吸引了大量的外国企业前来投资兴业。

泰国税收优惠政策也存在一些问题和挑战。

首先是执行和监管不到位,一些企业为了躲避税收,采用不正当手段规避税收,造成国家税收损失。

其次是税收政策不够稳定,一些政策频繁变动导致企业难以稳定经营。

最后是税收优惠政策导致财政收入减少,对国家经济造成一定的负担。

泰国税收优惠政策仍需要不断完善和调整,以适应国家经济发展的需要。

泰国土地优惠政策是吸引外商投资的重要政策之一。

根据《泰国外国投资法》规定,外国企业在泰国投资的,可以获得土地使用权,甚至可以获得长期的土地租赁权。

对于在固定资产投资额较大的外国企业,还可以获得土地减免的政策,降低企业成本。

这些政策有效地降低了外国企业在泰国投资的成本,提高了投资的吸引力。

土地优惠政策也存在一些问题和挑战。

首先是土地资源过度利用导致环境问题,一些外国企业在泰国投资建厂后,对土地资源的过度开发导致了环境污染和资源浪费。

其次是土地所有权不清晰,一些外国企业在泰国投资后,对土地所有权不清晰,无法有效保护自身合法权益。

泰国外商投资优惠政策研究在泰国,外商投资是其经济发展的重要推动力。

泰国政府一直致力于吸引外国资本和技术,为此制定了一系列优惠政策来鼓励外商投资。

本文将对泰国外商投资优惠政策进行研究。

泰国政府为外商提供了一系列税收优惠政策。

外国投资者的所得税率较低,依据投资金额和持续时间,税率可降至最低15%。

外国投资者还可以享受一系列免税待遇,包括免征进口税、免征增值税等。

这些税收优惠政策在一定程度上减轻了外商投资的负担,提高了投资者的回报率。

泰国政府还为外商提供了一系列行政便利措施。

外国投资者在注册公司和申请营业执照时可以享受一揽子服务。

泰国还设立了泰国投资委员会(BOI)来处理外商投资事务。

BOI 可以为投资者提供一站式服务,简化了审批程序,提高了投资效率。

泰国政府还鼓励外商投资的主要方式是提供优惠的土地使用权。

外国投资者可以购买或租赁土地用于商业和工业目的。

并且,泰国政府还设立了一些经济特区,为外商提供更多的优惠政策。

在东部经济特区,外国投资者可以享受最高50年的土地使用权,免征离岸所得税等。

泰国政府还提供了一系列的促进措施,以吸引外商投资到特定行业。

泰国政府鼓励投资者在高科技、生物科技、环境保护、清洁能源等领域进行投资,并提供了相应的奖励和优惠政策。

泰国政府还设立了创新发展基金,资助创新研发项目,为投资者提供了更多的支持。

泰国外商投资优惠政策的推出,大大提高了外商投资的吸引力。

这些政策旨在减轻外商的负担,提供行政便利,并鼓励投资者在特定领域进行投资。

通过这些政策的实施,泰国吸引了大量的外商投资,并促进了经济的快速发展。

泰国落地签新规2018泰国是一个非常适合旅游、留学、生活的国家,性价比相对来说很高,也正是因此,人们都爱去泰国。

今天店铺和大家来说说,2018年泰国落地签的新规政策。

(1)泰国入境所需证件为:有效期至少为6个月的护照、出入境卡(正联入境时收、副联出境时收)、出入境卡须用英文填写,其中姓名需用大写字母。

(2)入境手续:将出入境卡夹在护照中经移民官员办理入境手续后,到航站取出托运行李,然后拿海关申报单(如需要)到海关检查处接受检查后出海关。

旅游者可以带入的免税物品包括香烟200支,酒1公斤。

(3)出境手续:每人交付机场税500铢。

泰国移民局收去出境卡,并办理离境手续,在护照上加盖出境章。

接受安全检查。

泰国出境携带泰币不得超过5万铢。

(4)据介绍,泰国出入境规定较严,游客赴泰国短期观光旅游,须持有泰国大使馆签发的签证。

在泰国观光旅游期间,随时要接受移民官员的检查,如超过签证期限,每超过一天被罚款泰币200铢,但最高罚金不得超过2万铢。

(5)所有宗教性和国家文物一律禁止进行贸易。

旅客携带古董和佛像出境必须事先向泰国国家艺术厅申请批准证。

任何商人在泰国逗留期间所赚取的收入必须缴付所得税。

所有色情物品、毒品和武器一律禁止进出口,违法者会受到严厉处罚。

(6)在泰国博物馆组、野生动物保护组、海关署、泰国政府旅游局以及泰国大使馆、领事馆或海外代表办事处,都可索取关于外汇管制及管制项目规定的手册,并了解购买哪些物品,在离境前需向泰国海关的政府机构申请核准。

(7)根据泰国有关规定,允许携带入境免税品数量为:1公斤的甜酒或烈酒、50支雪茄、250克烟丝或200支香烟以及5卷胶卷或3卷电影胶片;动植物不准携带入境。

旅客可从免税商店购买1公斤酒、200支烟以及一架照相机、一架摄影机和个人佩带的珠宝装饰品等出境。

(8)据介绍,凡持有落地签证或旅游签证赴泰国旅游的旅客,泰国机场移民局将随机进行抽查,凡随身携带不足25000泰铢(即折合人民币5000元或等价的其他国货币)将视其为无正常消费能力,并有非法移民倾向,泰国海关将拒绝其进入泰国国境。

泰国投资政策

可享受的优惠税收政策

1、更有效的利用税务的免税优惠,对真正有利于经济发展的项目,以管理原则及管理

组织的原则给予税务方面的优惠。

2、而获得优惠投资的企业必须向投资促进委员会报告获优惠投资项目的业绩,以便投

资促进委员会审核给予该年度的免税优惠。

3、根据泰国的目前经济情况,全国分为个区,根据不同区域有不同的税务优惠,无论

设在何区,对于泰国特别重视的行业,均可获免缴机器进口税;对于泰国特别重视

的行业,无论设在何区,均可获免缴法人所得税年;给予边远地区获收入低的地区

和设施未完备的地区提供特别优惠待遇,税务优惠权益最高。

对公司组成形式及外资股份和劳工比例的规定

泰国允许外国注册种类型公司类型:、独资公司、合作公司(未注册普通伙伴;注册普通伙伴;有限合作)、有限公司(公共有限公司;私人有限公司;有限合作公司)。

根据农业、畜牧业、渔业、勘探与开采矿业和年颁布的外商投资法中的服务行业中规定:泰籍投资者的持股量必须不低于;工业企业的投资,无论生产场所设在何处,允许外商持大股或全部股;除非有特殊理由,投促会将规定某些行业外商投资的限额。

鼓励或限制投资的领域以及外资机构的国土使用权

泰国特别重视的行业(企业)有农业及农产品生产加工业、科学技术发展和开发人才资源项目、基础设施建设及公共事业、环境保护及污染处理项目以及生产铸造、金属、电子、软件等其他工业共五大类。

列入鼓励投资的行业种类有:农业及农产品加工业(种);矿业、陶瓷及基础金属工业(种);轻工业(种);金属产品、机械和运输设备制造业(种);电子和电子工业(种);化工产品、纸张及塑胶业(种);服务业及公用事业(种)等七大类行业。

1 / 1。

泰国外商投资优惠政策研究

一、优惠的税收政策

泰国政府为吸引外来投资者,提供了许多税收优惠政策。

一般来说,企业在泰国的营

业额达到1百万泰铢时,就需要支付20%的利润税。

但是对于一些新建的制造业或出口业务,政府提供了两年至八年的税收减免;可以享有三年内的免税或减税优惠等。

二、自由资本转移和罕见的投资批准

泰国政府允许外商将利润转移到国外,对于外商投资者还允许转移资金、资产和外汇。

政府还放宽了外资对于敏感的产业的控制,尤其是现代服务行业。

对于整个泰国经济的发

展和吸引外商投资都是非常有利的。

此外长期资产的租售也得到政府的支持,使来自外国

的企业可以用更低的资金成本购买或者租赁泰国资产。

三、劳动力

泰国是劳动密集型的制造业国家,拥有实惠的劳动力资源和负担得起的电力与其他能

源资产。

对于招聘外籍人员的企业和员工,政府也允许所需签证和工作许可等种种便利。

四、高度的基础设施

泰国拥有高度发达的基础设施,包括富有竞争力的端口和空运带,以及广泛的火车和

公路网络。

为外商投资者在物流、仓储、运输、车间制造等方面提供了强有力的支持。

在文化和地理区位方面,泰国也得天独厚。

对于投资者来说,泰国的魅力就不仅仅是

地理位置的优越,还体现在丰富的文化和多种营销策略上。

泰国还致力于推动本地区和亚

欧会议,为外商在泰国的发展创造更多的机会。

泰国外商投资优惠政策研究泰国是一个外商投资的热门目的地,其优惠政策一直都备受关注。

泰国外商投资优惠政策促使各国企业加大对泰国市场的投资力度,同时也在一定程度上推动了泰国经济的发展。

本文旨在探讨泰国外商投资优惠政策的相关内容,分析其对泰国经济的影响以及存在的问题,并提出相关建议。

一、泰国外商投资优惠政策的主要内容泰国的外商投资优惠政策主要包括税收优惠、贸易便利化、产权保护等方面。

1.税收优惠:泰国对外商投资实行税收优惠政策,其中最具代表性的是泰国对外资企业的所得税优惠。

根据《泰国外国投资法》规定,外资企业可在前8年内享受所得税减免或者税收优惠,具体减免比例按照不同地区的不同政策而异。

泰国还实行了增值税减免政策、出口退税政策等,以吸引更多的外商投资。

2.贸易便利化:泰国为外商提供了便利的贸易环境和条件。

泰国加入了亚太自由贸易区(APEC),并与多个国家签订了双边和多边贸易协定,为外商提供了更广阔的市场和更便利的贸易条件。

3.产权保护:泰国政府一直重视知识产权保护,并在法律和行政管理上做了很多工作。

泰国制定了相关的法律法规,加强了知识产权的司法保护,提升了外商对泰国市场的信心。

泰国外商投资优惠政策的实施,对泰国经济产生了积极影响。

1.促进了经济发展:外商投资的增加,为泰国带来了更多的资金、技术和管理经验,促进了泰国经济的发展。

外资企业带动了相关产业链的发展,推动了泰国经济结构的升级和优化。

2.提升了就业水平:外商投资带来了更多的投资项目和企业建设,为泰国创造了更多的就业机会,提高了居民的综合收入水平。

3.促进了对外贸易:贸易便利化政策吸引了更多外国企业来泰国投资,同时也帮助泰国企业走出国门,拓展国际市场,推动了泰国对外贸易的发展。

4.带动了地方经济发展:为了吸引外商投资,泰国各地纷纷推出了各种优惠政策,这些政策带动了地方经济的发展,推动了区域经济的均衡发展。

三、存在的问题及建议泰国外商投资优惠政策也存在不足之处。

泰国收入法泰国收入法:赚钱不忘纳税,泰国怎么规定的?一、收入税的基本概念说到收入税,大家都会想到“交税”,对吧?那为什么有些人交得多,有些人交得少,甚至有些人根本没交,怎么回事?泰国的收入税法就像一把“双刃剑”,要么让你多交税,要么就给你减轻负担,前提是你得按规定来。

泰国的税法分得很清楚,税收分为“个人所得税”和“公司所得税”。

不过今天,我们先来聊聊个人所得税。

这部分真的是很接地气,不管你是老板、打工人还是自由职业者,都得搞清楚。

特别是打工人,工资一到手,就会发现“怎么少了那么多?”对啊,税一扣就少了!泰国到底怎么征收个人所得税呢?简单来说,就是你在一年内赚了多少钱,超出某个标准的部分,就得按税率交税。

每年4月,泰国的税务局会要求大家申报收入,这个时候如果你没交够税,罚款可不少呢!二、税率与税收计算那税率到底是多少呢?这个问题嘛,真的得细说。

泰国的个人所得税是实行累进税率的,也就是说,你赚得多,交的税也多。

比如说,年收入在30万泰铢以下的,税率是5%。

你觉得5%很少是吧?可是,赚得更多的就不一样了,年收入超过50万的部分,就得交10%。

再往上,收入超过100万的,就得交15%。

赚得最多的那一档是超过500万的,那税率是35%!想想看,如果你赚得特别多,一年挣上千万,税局也会笑眯眯地“恭喜”你,收你不少钱,哈哈。

不过别怕,泰国的税法其实挺人性化的,不会一次性把你全部拿走。

它是分级征税的,你多赚的部分才交更多的税。

就是类似“多得多给”的概念,普通人不用担心会被压得喘不过气。

三、怎么申报与纳税说到这,可能有人会问了,怎么才能交税呢?泰国的个人所得税申报流程也不复杂。

每年4月的时候,税务局会让所有纳税人申报上一年度的收入。

你得填报你的总收入,不管是工资、奖金、还是各种各样的附加收入。

像是奖金、股票投资的收益,甚至是外籍人士在泰国的收入,都要包括在内。

别小看这点收入,税务局可是会算得清清楚楚。

那很多人肯定要想了,税务局要看我们怎么赚的,怎么把这些钱弄来?这可得小心了!只要你如实申报,不少赚的钱你还能得到一些税收减免。

泰国企业所得税

企业所得税是对依照本国或外国法律成立的法人公司或合伙企业在泰国从事经营活动征收的一种直接税。

按照权责发生制的原则以净利润为基础计算,即用所有本会计年度中的经营收入减除税收法典中规定的允许扣除的费用后的余额。

对股息收入,一个泰国公司从另一家泰国公司收到的一半股息可以从应税收入中扣除,如果是证交所挂牌的公司,其所收到的所有股息都可以从应税收入中扣除。

在泰国具有法人资格的公司都需依法纳税,纳税比例为净利润的30%,每半年

缴纳一次。

基金和联合会、协会等则缴纳净收入的2-10%.国际运输公司和航空

业的税收则为净收入的3%.

未注册的外国公司或未在泰国注册的公司只需按在泰国的收入纳税。

正常的业务开销和贬值补贴,按5-100%不等的比例从净利润中扣除。

对外国贷款的利

息支付不用征收公司所得税。

对于拥有其他公司的股权和在泰国证券所上市的公司,所得红利全部免税,但要求持股人在接受红利之前或之后至少持股3个月以上。

在允许扣除费用中,研发成本可以作双倍扣除,职业培训成本可以做1.5倍扣除。

在泰国,有各种各样的商业组织经营形式。

选择不同的形式注册会影响税率和。

一带一路税收专栏-泰国时间:2018-07-051.泰国关于企业税收的规定是什么?税收体系和制度泰国关于税收的根本法律是1938年颁布的《税法典》,财政部有权修改《税法典》条款,税务厅负责依法实施征税和管理职能。

外国公司和外国人与泰国公司和泰国人一样同等纳税。

泰国对于所得税申报采取自评估的方法,对于纳税人故意漏税或者伪造虚假信息逃税的行为将处以严厉的惩罚。

目前泰国的直接税有3种,分别为个人所得税、企业所得税和石油天然气企业所得税,间接税和其他税种有特别营业税、增值税、预扣所得税、印花税、关税、社会保险税、消费税、房地产税等,泰国并未征收资本利得税、遗产税和赠与税。

主要税赋和税率【企业所得税】在泰国具有法人资格的公司都须依法纳税,纳税比例为净利润的30%, 每半年缴纳一次。

基金、联合会和协会等则缴纳净收入的2%-10%,国际运输公司和航空业的税收则为净收入的3%。

未注册的外国公司或未在泰国注册的公司只需按在泰国的收入纳税。

正常的业务开销和贬值补贴,按5%-100%不等的比例从净利润中扣除。

对外国贷款的利息支付不用征收公司的所得税。

企业间所得的红利免征50%的税。

对于拥有其他公司的股权和在泰国证券交易所上市的公司,所得红利全部免税,但要求持股人在接受红利之前或之后至少持股3个月以上。

企业研发成本可以作双倍扣除,职业培训成本可以作1.5倍扣除。

注册资本低于500万铢的小公司,净利润低于100万铢的,按20%计算缴纳所得税;净利润在100万-300万铢的,按25%计算缴纳。

在泰国证交所登记的公司净利润低于3 亿铢的,按25%计算缴纳。

设在曼谷的国际金融机构和区域经营总部按合法收入利润的10%计算缴纳。

国外来泰投资的公司如果注册为泰国公司,可以享受多种税收优惠。

【个人所得税】个人所得税纳税年度为公历年度。

泰国居民或非居民在泰国取得的合法收入或在泰国的资产,均须缴纳个人所得税。

税基为所有应税收入减去相关费用后的余额,按从5%到37%的五级超额累进税率征收。

泰国外商投资优惠政策研究泰国一直以来都是外商投资的重要目的地之一,其政府为吸引外商投资制定了多项优惠政策,目的是鼓励和促进外商投资,推动经济发展。

本文将分析泰国外商投资优惠政策。

泰国出台了多项针对外商投资的优惠政策,主要包括税收优惠、土地优惠、营商环境优惠等方面。

税收优惠:泰国政府设置了一系列的税收优惠政策,以吸引外国投资者前来投资。

其中主要包括优惠的公司税、源泉税、增值税以及关税等。

土地优惠:泰国政府为吸引外商投资,特别制定了土地优惠政策,允许外国投资者在泰国购买或租赁土地,土地租赁期限可长达99年。

营商环境优惠:为了提高泰国的营商环境,政府出台了一系列的政策以吸引外商投资,提高国内生产总值(GDP),例如简化企业注册手续、加强知识产权保护等措施。

二、泰国外商投资的限制虽然泰国政府制定了多项优惠政策以吸引外商投资,但是在外商投资方面仍存在一定的限制。

这些限制主要包括下列几个方面:产业限制:泰国政府制定了一系列的产业限制政策,限制了外国投资者投资的领域,如银行业、石油开采等。

股权限制:外商投资者在泰国的股权比例也存在一定的限制。

法律规定外国企业在泰国设立公司,最多只能拥有49%的股权,49%以上的股权必须由泰国本土企业持有。

就地生产限制:在一些行业中,泰国要求外国企业就地生产,即要求生产必须在泰国本土,不能通过进口中间产品进行加工,以此来促进泰国经济的发展。

泰国一直以来都是吸引外商投资的热门目的地之一,随着政府相继推出针对外商投资的优惠政策,泰国的地位将会更加重要。

同时,随着一带一路倡议的推进,泰国也将成为连接中国与东南亚、南亚的重要节点。

预计未来,泰国对外开放程度将进一步提高,更多的外商将会涌入泰国,推动经济的发展。

Taxation in ThailandThe Revenue Code outlines regulations for the imposition of taxes on income, with income tax divided into three categories : Corporate income tax, value added taxes (or specific business taxes), and personal income tax.Corporation Income Tax (CIT)Corporate Income Tax (CIT) is a direct tax levied on a juristic company or partnership which is established under Thai or foreign law and carries on business in Thailand or derive certain types of income from Thailand.The term “juristic company or partnership” (hereinafter called “company”) means a limited company, a limited partnership or a registered ordinary partnership incorporated under Thai of foreign law as well as an association and a foundation engaged in business producing revenue. The term also includes any joint venture and any trading or profit-seeking activity carried on by a foreign government or its agency or by any other juristic body incorporated under a foreign law.1.1 Taxable PersonsCorporate income tax is levied on both Thai and foreign companies. A Thai company means a company incorporated under the law of Thailand. This company is subject to tax in Thailand on its worldwide net profit at the end of each accounting period (12 months)A foreign company means a company incorporated under foreign law. Generally, a foreign company is treated as carrying on business in Thailand if it has an office, a branch or any other place of business in Thailand or has an employee, agent, representative or go-between for carrying on business in Thailand.A foreign company carrying on business in Thailand is subject to CIT only for net profit arising from or in consequence of business carried on in Thailand, at the end of each accounting period. However, the foreign company engaged in international transport is subject to tax on its gross receipts. When a foreign company disposes its profit out of Thailand, such profit will be subject to tax on the sum disposes. Profit also means any sum set aside out of profits as well as any sum which may be regarded as profit.A foreign company, not carrying on business in Thailand but deriving certain types of income from Thailand, such as service fee, interests, dividends, rents, professional fee, is subject to corporate income tax on the gross amount received. It is collected in the form of withholding tax by which the payer of income shall deduct the tax from the income at the rate shown below (Tax Rates)1.2Tax CalculationIn the calculation of CIT of a company carrying business in Thailand, it is calculated from the company’s net profit on the accrual basis. A company shall take into account all revenue arising from or in consequence of the business carried on in an accounting period and deducting from that figure all expenses as prescribed by the Revenue Code. For dividend income, one-half of the dividends received by Thai companies from any other Thai companies may be excluded from the taxableExchange of Thailand or the recipient owns at least 25% of the distributing company’s capital interest, provided that the distributing company does not own a direct or indirect capital interest in the recipient company. The exclusion of dividends is applied only if the shares are acquired not less than three months before receiving the dividends and are not disposes of within three months after receiving the dividends.In calculating CIT, deductible expenses are as follow:1.Ordinary and necessary expenses. However, the deductible amount of the following expenses is allowedat a special rate.-200% deduction of research and Development expense-150% deduction of job training expense-200% deduction of expenditure on the provision of equipment for the disabled;2.Interest, except interest on capital reserves or funds of the company;3.Taxes, except for Corporate Income Tax and Value Added Tax paid to the Thai government; losses carried forward from the last five accounting periods;5.Bad debts;6.Wear and tear;7.Donations for up to 2% of net profits;8.Provident fund contributions;9.Entertainment expenses up to 0.3% of gross receipt but not exceeding 10 million Baht;10.Depreciation provided that in no case shall the deduction exceed the following percentage of cost asshown below. However, if a company adopts an accounting method, in which the depreciation rates varyfrom year to year, the company is allowed to do so, provided that the number of years over which anasset depreciated shall not be less than 100 divided by the percentage prescribed below.Type of Asset Rate of Depreciation Durable buildings 5% Temporary buildings 100%Cost of acquisition of depletable natural resources 5%Cost of acquiring lease rights :∙If there is no written lease agreement of if there is a written lease agreement whereby continuous renewals are permitted∙If there is a written lease agreement containing no renewal clause or containing a renewal clause butrestricting renewable periods to a definitely limitedduration10%100% divided by the original and renewable leases periodsCost of acquisition of the right in a process, formula, goodwill, trademark, business license, patent, copyright or any other right:∙If the period of use in unlimited ∙If the period of use is limited10%100% divided by number of years usedOther depreciable assets not mentioned above excludingland and inventory20%Machinery used in SMEs Initial allowance of 40% on the date of acquisition and theresidual can be depreciated at 20% Machinery or equipment used in technical R&D Initial allowance of 40% on the date of acquisition and theresidual can be depreciated at 20%Cash registering machine 100% or initial allowance of 40% on the date of acquisitionand the residual can be depreciated at 20% Computers and accessories∙SMEs∙Other businesses Initial allowance of 40% on the date of acquisition and the residual can be depreciated over 3 yearsDepreciated over 3 years1.3Tax RatesTaxpayer Tax Base Rate (%)Small company First 150,000 Baht of profitNet profit exceeding 150,000 Baht butnot exceeding 1 million BahtNet profit not exceeding 1 million BahtNet profit over 1 million Baht but notover exceeding 3 million BahtNet profit exceeding 3 million Baht 0 15 25 30Companied listed on Stock Exchange of Thailand (SET) Net profit for first 300 million BahtNet profit for the amount exceeding 300million Baht2530Companies newly listed on StockExchange of Thailand (SET)Net profit 25Companies newly listed on Market for Alternative Investment (MAI) Net Profit for first 5 accounting periodsafter listingNet Profit after first 5 accountingperiods2030Bank deriving profits from InternationalBanking Facilities (IBF)Net Profit 10Foreign company engaging ininternational transportationGross Receipt 3Foreign company not carrying onbusiness in Thailand receivingdividends from ThailandGross Receipt 10Foreign company not carrying onbusiness in Thailand receiving othertypes of income apart from dividendfrom ThailandGross Receipt 15Foreign company disposing profit out ofThailandAmount disposed 10Regional Operating Headquarters(ROH)Net Profit 101.4Withholding TaxCertain types of income paid to companies are subject to withholding tax at source. The withholding tax rates depend on the types of income and the tax status of the recipient. The payer of income is required to file the return (Form CIT 53) and submit the amount of tax withheld to the District Revenue Offices within seven days of the following month in which the payment is made. The tax withheld will be credited against final tax liability of the taxpayer. The following are the withholding tax rates on some important types or income.Type of Income Withholding Tax Rate (%) Dividends 10Interest∙If paid to associations or foundations ∙In other cases 10 1Royalties∙If paid to associations of foundations ∙In other cases 10 3Advertising Fees 2 Service and professional fees∙If paid to Thai company or foreign company having permanent branch in Thailand∙Of paid to foreign company not having permanent branch in Thailand 3 5Prizes 51.5Tax Return and PaymentThai and foreign companies carrying on business in Thailand are required to file their tax returns (Form CIT %) within 150 days from the closing date of their accounting periods. Tax payment must be submitted together with the tax returns. Any company disposing funds representing profits out of Thailand is also required to pay tax on the sum so disposed within seven days from the disposal date (Form CIT 54)In addition to the annual tax payment, any company subject to CIT on net profit it also required to make tax prepayment (Form CIT 51). A company is obliged to estimate its annual net profit as well as its tax liability and pay half of the estimated tax amount within two months after the end of the first six months of its accounting period. The period tax is credited against its annual tax liability. Failure to pay the estimated tax or underpayment by more than 25 percent may subject the taxpayer to a fine amounting to 20 percent of the amount in deficit.For income paid to foreign companies not carrying on business in Thailand, the foreign company is subject to tax atmake the payment to the Area Revenue Branch Office within seven days of the following month in which the payment is made.Failure to file a tax return, late filing or filing a return containing false or adequate information may subject the taxpayer to various penalties. Failure to file a return, and subsequent non0compliance with an order to pay the tax assessed, may result in a penalty equal to twice the amount of tax due. Penalties are due within 30 days of assessment.1.6LossesNet losses may be carried forward for five accounting periods for offset against future profits from all sources. There is no provision for loss carry-back.Each company’s losses are dealt with separately. There is no form of group relief or relief by consolidation. A charge in shareholding does not affect its tax losses.1.7Tax CreditsThai companies can use foreign tax paid on business income or dividend received as a credit against the corporate income tax liability. The credit cannot exceed the amount of Thai tax on the income had the income been derived in Thailand.Credit is also given for Thai corporate income tax that has been deducted at source (as mentioned above) and for the half-year tax paid.1.8Remittance TaxesThere are two types of final withholding taxes imposed on the remittance of income or profits to foreign companies : ∙Remittance of income in the form of :- Brokerage, fees for services 15%- Royalties 15%- Interest 15%- Dividends 15%- Capital gains 15%- Rental of property 15%- Liberal professionals 15%∙Remittance of profits after corporate income tax, a sum representing profits, or a sum set aside out of profits or regarded as profits is subject to 10% withholding tax.2Value Added TaxValue added tax (VAT) is a non-cumulative broad-based consumption tax levied on the supply of goods or provision in Thailand by VAT operates. VAT is calculated on the total price of the goods delivered or services provided. A provision of services is deemed to have been made in Thailand if the service is performed in Thailand, regardless of where the service is used, or if the service is performed abroad but is used in Thailand.In principle, the input VAT on purchases of goods or services related to the business of a registered VAT operator may be credited against output VAT.Under this tax regime, value added at every stage of the production process is subject to a seven percent tax rate. This tax affects producers, providers of services, wholesalers, retailers, exporters and importers.2.1RegistrationPersons who have annual turnover in excess of 1,800,000 Baht are required to register as VAT operators. Only registered VAT operators are entitled to the credit or refund of input VAT.2.2Exemption from VATCertain persons and businesses are exempt from VAT, for example, leasing an immovable property, or sale of newspapers, magazines, or textbooks.2.3 Tax RatesThe current VAT rate is 7%A zero percent rate is applied to the following items :∙Exported goods∙Services provided in Thailand but totally used in a foreign country.∙Sales of goods or services to government agencies or state enterprises under foreign aid programs.∙Sales of goods or services to the United Nations or its specialized agencies as embassies, and consulate general.∙Sales of goods and services between bonded warehouses or between enterprises located in a Duty Free Zone2.4Vat CalculationVAT must be paid on a monthly basis, calculated as :OUTPUT TAX – INPUT TAX = TAX PAIDWhere output tax is the VAT which the operator collects from the purchaser when a sale is made, and input tax is the VAT which an operator pays to the seller of a goods or service which is then used in the operator’s business.If the result of this calculation is a positive figure, the operator must submit the remaining tax to the Revenue Department not later than 15 days after the end of this month. However, for the negative balance, the operator is entitled to a refund in a form of cash or a tax credit, which must be paid in the following month.2.5Tax InvoicesVAT operators are required to issue tax invoices indicating the amount of goods or services provided together with VAT charges. All significant particular in tax invoices must be completed as prescribed by law. Substantially incomplete or incorrect information in tax invoices may result in a VAT operator being unable to claim input tax.2.6 Tax Return and PaymentVAT taxable period is a calendar month. VAT return therefore must be filed on a monthly basis. VAT return (Form VAT 30) together with tax payment, if any, must be submitted to the Area Revenue Branch Office within 15 days of the following month. If taxpayer has more than one place of business , each place of business must file the return and make a payment separately unless there is an approval from the Director-General of the Revenue department. Services utilized in Thailand supplied by service providers in other countries are also subject to VAT in Thailand. In such a case, service recipient in Thailand is obliged to file VAT return (Form VAT 36) and pay tax, if any, on behalf of the service providers.In the case where supply of goods or services is also subject to Excise tax return and tax payment within 15 days of the following month. In case of imported goods, VAT return and tax payment must be submitted to the Customs Department at the point of import.3. Personal Income TaxPersonal Income Tax (PIT) is a direct tax levied on income of a person. A person means an individual, an ordinary partnership, a non-juristic body of person, a deceased person and an undivided estate. In general, a person liable to PIT has to compute his tax liability, file tax return and pay tax, if any, accordingly on a calendar year basis.3.1 Taxable PersonTaxpayers are classified into “resident” and “non-resident”. “Resident” means any person residing in Thailand for a period or periods aggregating more than 180 days in any tax (calendar) year. A resident of Thailand are liable to pay tax on income from sources in Thailand on a cash basis, regardless where the money is paid, as well as on the portion of income from foreign sources that is brought into Thailand. A non-resident is , however, subject to tax only on income from sources in Thailand.3.2Assessable IncomeIncome changeable to the PIT is called “assessable income”. The term covers income both in cash and in kind. Therefore, any benefits provided by an employer or other persons, such as a rent-free house or the amount if tax paid by the employer on behalf of the employee, are also treated as assessable income of the employee for the purpose of PIT.Assessable income is divided into eight categories :∙Salaries and wages∙Hire of work, office of employment or services rendered∙Goodwill, copyright, franchise, other rights, annuity, etc.∙Interest (including interest derived on bank deposit in Thailand), dividends, bonuses for investors, gains from amalgamation, acquisition or dissolution of juristic companies or partnerships, and gains fromtransferring of shares or partnership holding, etc.∙Leasing Income or property, breach of installment sales or hire-purchase contracts;∙Income from liberal professions (e.g. law, medicine, engineering, architecture, accountancy and fine arts )∙Income from construction and other contracts of work;∙Income from business, commerce, agriculture, industry, transport or any other activity not specified earlier.3.3Capital GainsMost types of capital gains are taxable as ordinary income with the following exemptions:∙Capital gains from the sale of shares in a company listed on the Stock Exchange of Thailand, provided that the sale is made on the Stock Exchange of Thailand, and from the sale of investment units in a mutual fund.∙Gains from the sale of non-interest bearing government bonds, debentures, bills, or debt instrument issuedsold for the first time at the price lower than their redemption price to an individual and the tax has beenwithheld from the difference between the redemption price earned and the selling price and the instrumenthas been stamped to the effect that tax has been so withheld.∙Gains from the sale of government bonds.3.4ExemptionsCertain types of income are exempt from personal income tax. In relation to income from employment, money derived in the form of per diem, traveling expenses, and certain fringe benefits (such as medical treatment) are tax exempt. The exemptions also cover the share of profits obtained from a non-juristic body of persons, maintenance income, derived under moral obligation , corpus of a legacy or inheritance, income of a mutual fund or from the sale of investment units in a mutual fund, interest from government bonds earned by a non-resident, etc.In addition, to support low-income earners and the aged, an income exemption is granted to taxpayers. Net income of the first 100,000 Baht is tax exempt. A Thai resident who is 65 years of age or older is also granted personal income tax exemption on income received up to an amount not exceeding 190,000 Baht.3.5ComputationThailand use a self-assessment system in collecting taxes. Taxpayers are required to declare their tax liabilities in the specific tax returns (PND 90, PND 91) and pay the tax due at the time of filing.Certain deductions and allowances are allowed in the calculation of the taxable income. Taxpayers shall make deductions from assessable income before the allowances are granted. Therefore, taxable income is calculated by : TAXABLE INCOME = assessable income – deductions – allowances3.6Deductions and AllowancesDeductions allowed for the calculation of PITType of Income DeductionIncome from employment 40% but not exceeding 60,000 BahtIncome received from copyright 40% but not exceeding 60,000 BahtIncome from letting out of property on hire∙Building and wharves∙Agricultural land∙All other types of land∙Vehicles∙Any other type of property 30% 20% 15% 30% 10%Income from liberal professions 30% except for the medical profession where 60% is allowed Income derived from contract of work whereby the contractor Actual expense or 70%Income derived from business, commerce, agriculture,industry, transport or any other activities not specified earlierActual expense or 65-85% depending on the types of income Personal allowance∙Single taxpayer∙Undivided estate∙Non-juristic partnership or body of persons 30,000 Baht for the taxpayer30,000 Baht for the taxpayer’s spouse30,000 Baht for each partner but not exceeding 60,000 Baht in totalSpouse allowance 30,000 BahtChild allowance (child under 25 years of age and studying ateducational institution or a minor or an adjusted incompetentor quasi-incompetent person)15,000 Baht each (limited to three children)Parents allowance (parents over 60 years of age with incomeless than 60,000 Baht)30,000 Baht eachOld age allowance (over 65 years of age) 190,000 Baht income exemption eachEducation )additional allowance for child studying ineducational institution in Thailand)2,000 Baht each childLife insurance premium paid by taxpayer or spouse Amount actually paid but not exceeding 50,000 Baht eachApproved provident fund contributions and/or retirement mutual fund contributions Maximum allowance (exemption) of 300,000 Baht but not exceeding 15% of incomeLong term equity fund Maximum allowance (exemption) of 300,000 Baht but notexceeding 15% of incomeHome mortgage interest Amount actually paid but not exceeding 100,000 Baht Social insurance contributions paid by taxpayer or spouse Amount actually paid eachCharitable contributions Amount actually donated but not exceeding 10% of incomeafter standard deductions and allowances3.7Tax CreditsAny taxpayer who domiciles in Thailand and receives dividends from juristic company or partnership incorporated in Thailand is entitled to a tax credit. In computing assessable income, a taxpayer shall gross up his dividends by the amount of the tax credit received. The amount of tax credit is then creditable against his tax liability.Tax credit = dividend x corporate tax rate / (100 – corporate tax rate)3.8Tax RatesPersonal income tax rates applicable to taxable income are as follow.Individual tax rates are shown below :Taxable income Tax Rate (%) Tax Amount Accumulates Tax0 – 150,000 150,000 – 500,000 500,001 – 1,000,000 1,000,001 – 4,000,000 4,000,001 and over Exempt10203037-35,000100,000900,000-35,000135,0001,035,0003.9Withholding Tax for Personal Income TaxAll persons paying assessable income are required to deduct income tax at source on each payment.4. Other Taxes4.1 Specific Business Tax (SBT)Due to the difficulty in determining the value added of certain business for the purpose of VAT imposition, an alternative tax levy on services, especially in the financial services sectors, was introduced in tandem with the VAT regime. Specific business tax (SBT) is collected on gross revenue at fixed rates.The SBT is computed on the monthly gross receipt at the following rates :Business Subject to SBT Applicable RateBanking, Finance and Credit Foncier Businesses 3.0 %Life Insurance 2.5 %Pawnshop Brokerage 2.5 %Sale of Securities in the Stock exchange 0.1 %Sale of Immovable Property, Real Estate 0.1 %Businesses with regular Transactions Similar to Commercial3.0 %BankingRemark : Local tax at the rate of 10% is imposed on top of SBT.Note : rate is applicable for registration of rights and juristic acts relating to the sale of immovable properties executed within one year from 29 March 20084.2Stamp DutyCertain documents mentioned in the Stamp Duty Schedule of the Revenue Code (e.g. power of attorney, letter of credit, check, bill of lading, service contracts, etc) must contain documentary stamps of various specified denominations. While the stamp duty is generally at nominal rates, failure to affix such stamps may be subject to a surcharge of up to 600 percent. 4.3Petroleum Income TaxThe Petroleum Income Tax Act replaces the Revenue Code in imposing a tax income from firms which own an interest in petroleum concession granted by the Thai government or which purchase iol from a concession holder for export. Net income from petroleum operations includes revenue from production, transport or sale of oil and gas, the value of gas delivered to the government as a royalty and the proceeds of a transfer of interest in a concession. The tax rate for most opertors is not less than 50 percent and not more than 60 percent of net profits.4.4Excise TaxExcise tax is currently levied on the following commodities :∙Fuel oil and petroleum products∙Beverages∙Electrical appliances∙Crystal glassware∙Motor vehicles∙Boats∙Perfume products and cosmetics∙Entertainment services∙Liquor and beer∙Cigarettes containing tobacco∙Woolen carpets∙Motor bicycles∙Batteries∙Playing cardsThe manufacturer of these products must file a return and remit the tax due prior to taking the goods from the factory or bonded warehouse. If a VAT liability arises before the goods are taken out of such locations, the manufacturer must file a return and remit the tax to the Excise Department within 15 days from the end of the month.4.5Property TaxThere are two kinds of property tax in Thailand, namely, house and land tax, and local development tax. House and land tax is imposed on the owners of a house, building structure or land, which is rented or otherwise put to commercial use. The tax rate is 12.5 percent of actual or assessed annual rental value of the property.A local development tax is imposed on any person who either owns land or is in possession of land. The tax rates vary according to the appraised value of the property, as assessed by the local authorities, usually ranging from 0.25%-0.95% annually. There is an allowance granted for land utilized for personal dwellings, the raising of livestock and the cultivation of crops by the owner. Cultivated land in excess of the exempt are is subject to one-half the statutory rate, while idle land is subject to twice the statutory rate.。

一、引言马来西亚不仅曾是世界产锡大国,而且石油储量丰富,其橡胶、棕油和胡椒的产量和出口量居世界前列。

马来西亚是亚洲地区引人注目的多元化新兴工业国家和世界新兴市场经济体。

马来西亚不仅是“东盟”创始国之一,而且是环印度洋区域合作联盟、亚洲太平洋经济合作组织、英联邦、不结盟运动和伊斯兰会议组织的成员国。

泰国南边狭长的半岛与马来西亚相连,泰国的锡储量居世界之首。

泰国不仅大量出口农产品,而且制造业发展迅速,产业结构变化明显。

泰国已成为东南亚汽车制造中心和东盟最大的汽车市场。

虽然泰国是世界最闻名的旅游胜地,但汽车业是泰国的支柱产业。

泰国也是世界新兴工业国家和世界新兴市场经济体。

泰国不仅是“东盟”创始国之一,同时也是亚太经济合作组织、亚欧会议和世界贸易组织成员。

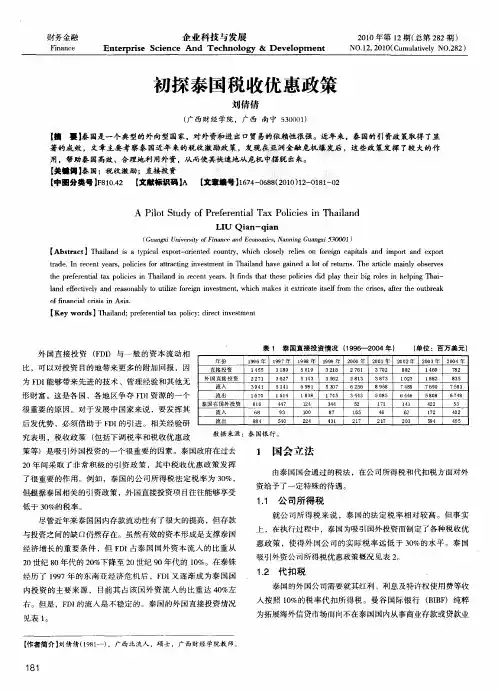

马来西亚和泰国都是中国的重要贸易伙伴和投资合作伙伴。

截至2017年底,中国在马来西亚和泰国的投资存量分别为491 470万美元和535 847万美元,分别占对东盟投资存量的5.52%和6.12%。

2013~2017年,中国企业对马来西亚和泰国的投资流量,如图1所示。

马来西亚(Malaysia)的税种主要包括公司所得税、个人所得税、销售税、消费税、关税、不动产资本利得税等。

泰国(Thailand)主要税种包括公司所得税、个人所得税、增值税、特别商业税、土地房产税、地方发展税、广告税等。

二、马来西亚与泰国的国内税收制度比较为了深入了解马来西亚和泰国的国内税收制度,现马来西亚和泰国的税收政策比较研究王素荣(对外经济贸易大学国际商学院教授)就马来西亚和泰国的流转税制度进行比较,如表1所示。

由表1可知,马来西亚和泰国的流转税税率均在6%~10%之间,均低于我国增值税的基本税率13%,与我国增值税的低税率(6%或9%)相当。

马来西亚的消费税只对5种商品征收,泰国消费税对8种商品征收。

我国征收消费税的产品有14类,包括烟、酒、化妆品、小汽车、摩托车、金银首饰、高档手表、游艇、高尔夫球及球具、成品油、实木地板、一次性筷子、鞭炮焰火、电池和涂料。

2018年泰国最全税收政策详解在泰国注册公司之后,公司每个月都需要将财务情况制作成财务报表,提交给泰国当地税务局,在此之前,我们首先要前往税务局办理公司所得税和企业增值税的登记。

根据泰国的相关政策,企业一年的收入额达到1,800,000泰铢(360,000RMB)以上的公司,必须在公司成立或开业后的60天內,前往税务局办理企业所得的税登记事项。

企业销售额超过600,000泰铢(RMB120,000)的公司,必须在销售额达到 600,000泰铢后的30天内,前往税务局办理企业增值税登记事项。

以上税务事项,都可以由公司内部员工办理或者交由第三方会计事务所来办理。

接下面,我们将重点介绍泰国各类税种的详细情况。

主要税种泰国的税收主要分为两大类:直接税和间接税。

直接税包括:公司所得税、个人所得税、石油所得税。

间接税则包括:增值税、特别行业税、预扣税、关税、消费税、印花税、汇款税以及财产税。

税款的征收由税务局根据相关的部门的职责,来划分到不同部门征收,收入厅主要征收企业收入税、增值税、特种行业税,以及印花税,消费厅主要征收特定商品消费税,地方政府则负责财产税以及地方税的征收。

适用法律《收入法》是泰国税收的主要适用法律。

该法对个人所得税、公司所得税、增值税、特别行业税以及印花税做了法律上的规定。

《石油收入法》则对石油和天然气特许经营所取得的收入做了规定,《海关法》则适用进出口关税的征收。

各税种介绍一.公司所得税:按照泰国法律规定,公司所得税每半年缴纳一次是中期报税表,到年底总结缴纳一次是年度报税表。

在泰国具有法人资格的公司都需依法纳税,纳税比例最高为净利润的20%。

基金和联合会、协会等社会团体的税收为净收入的2 -10%。

国际运输公司和航空业的税收则为净收入的3%。

以下为企业按净利润,需缴纳的税收比例:未注册的外国公司或未在泰国注册的公司,只需要按在泰国的收入纳税。

正常的业务开销和贬值补贴,按5-100%不等的比例从净利润中扣除。

对外国贷款的利息支付不用征收公司所得税。

公司內部合作所得的紅利免征50%的税。

对于拥有其他公司的股权和在泰国证券所上市的公司,所得红利全部免税,但要求持股人在接受红利之前或之后至少持股3个月以上。

税款征收期限:税款征收期以半年为基准是中期报税,在会计从初期到期末的半年后的2个月内到期,会计年度定为6个月,报税单须和公司财务报表一并提交予有关部门。

税款征收期以一年为基准是年度报税,在会计期末后的150 天内到期。

雇主须从其雇员薪金中扣除个人所得税。

除新成立公司外,会计年度定为12个月(税务部门定第二年的5月31号须报税)。

报税单须和公司财务报表一并提交予有关部门。

公司纳税人须每半年缴税,在会计年度的第八个月底前缴付50% 的预估年税。

纳税人没有按期缴付或者少缴超过25% 者,将被受罚款,计为少缴税款的20%。

二.个人所得税每个在泰国受雇用或经商的居民或非居民,在泰国取得的合法收入或在泰国的资产,均须缴纳个人所得税。

根据国际惯例及双边协定,部分人士,包括联合国官员、外交人员、某些访问专家免缴个人所得税。

任何个人,一年里在泰国住满180天或以上, 如果其国外的收入于同税收年度带入泰国, 也须缴纳所得税。

税款征收期限:税款征收期以半年为基准,在会计期末后的150 天内到期,即每半年提交一次报税单(税务部门定为当年的7-9月提交),个人所得税由雇主从其雇员薪金中扣除。

税款征收以一年为基准(除新成立的公司外),即按年度12个月总结提交一次报税单(税务部门定为第二年的1-3月份提交),报税单须和公司财务报表一并提交予有关部门。

个人所得税缴纳及退返,须在获取收入的第二年的3月底之前申报。

根据收入法第40条的有关规定,一些个人收入可以得到减免,可以减免的个人收入类别及其减免额/率如下:1)租赁收入,根据财产出租的类别,从10-30%根据房地产种类而定;2)专业收费中,医疗收入60%,其它行业30%;3)版权收入、雇佣或服务收入,40%,但是减少的总额不超过6万铢;4)承包人收入,劳务承包费:70%;5)第40条所规定的其它商业活动取得的收入,根据商业活动的性质减65%至85%;6)每个月公司购买的社保费,一年最多能减免额9,000泰铢;7)息、股利、出售证券的利得:可减免40%,但不超过六万铢;8)个人年度生活费提扣额:(1)纳税人30,000铢;(2)配偶30,000铢;(3)每个子女的教育费15,000铢;(4)纳税人和配偶获准的养老基金费10,000铢;(5)纳税人和配偶因购房或建房所付的利息10,000铢;(6)纳税人和配偶给社会保障基金的赞助实际所付数额或不高于调节后收入的10%。

为避免双重征税,泰国与下列各国签订了双边协议:奥地利,澳大利亚,孟加拉国,比利时,加拿大,中国,捷克,爱尔兰,丹麦,芬兰,法国,德国,匈牙利,印度,印度尼西亚,以色列,意大利,日本,韩国,马来西亚,卢森堡,荷兰,挪威,巴基斯坦,菲律宾,波兰,罗马尼亚,新加坡,南非,西班牙,斯里兰卡,瑞典,瑞士,英国,尼泊尔,新西兰,老挝,越南,美国。

一般来说,双边协议比泰国税务条列对纳税人更有利,因为只有当纳税人在泰国有永久性机构时其利润才须缴税。

三.增值税VAT、特别行业税泰国的增值税制度从1992年元月1日起开始实施,它取代了旧的商业税制度。

根据新的体系,产品生产加工的每一阶段的增值税税率为7%。

需缴纳此项税款的有:生产厂家、服务行业、批发商、零售商以及进出口公司。

增值税必须按月缴付,征收额如下:应纳税额=产出税额-投入税额产出税:是指销售时经营者向购买人收取的增值税;投入税:是指经营者因业务需要向供应商支付的货物或服务税额。

如果计算的结果为正,则经营者必须在每月结束后15天(每月15日之前)内主动向税务部门纳税。

如果计算结果为负,则以现金或税金核销等形式向经营者返还税款,退款在下一个月还清。

A. 零税率:货物出口,服务出口,泰籍法人的国际航运,国际海运,这些业务可以享受零税率。

如果泰国法人在国外经营享受零税率,则该国法人在泰国也可享受同等的待遇;使用国外贷款及援助向国家行政机关及国有企业销售商品及服务;向联合国及其下属机构、外国使馆及领事馆销售的商品及服务;保税仓库之间、出口加工特区的经营者之间、或前者与后者之间的商品买卖及服务。

国内商品及服务的年销售额超过600,000铢,但低于1,200,000铢的经营者,可任选支付年销售额的1.5%的税金或支付常规的增值税。

但是,经营者如果选择支付销售额1.5%的税金作为纳税额,则不得向其客户收取增值税的税金用来缴付此税款。

B. 特别免缴增值税:(1)经营人的年销售收入少于600,000铢;(2)销售或进口农产品,牲畜,及农用原料,如化肥,种子等;(3)销售或进口书籍和出版物;(4)审计,法律服务,卫生服务及其它专业服务;(5)文化及宗教服务;(6)教育服务;(7)根据雇佣合同由雇员提供的服务由皇家谕令规定的产品销售;(8)根据泰国工业区管理局规定, 免缴进口关税的货物;(9)国内运输(不包括空运)及国际运输(不包括空运及海运)。

C. 特种业务税下列业务征收约3% 的特种业务税代替增值税:(1)商业银行及类似的业务, 包括金融,证券机构及信用社;(2)固定资产的销售;(2)保险;(4)典当;(5)特种商业税参照下文介绍的税率,根据每月帐单计算而成。

D. 汇款税汇款税只适用于利润从泰国分公司汇往其海外总部。

汇款税率为税前汇款额的10%, 须由汇出资金的公司的汇款部门在款项汇出后7天内将税款付清。

但是, 用于购买货物, 一些商务费用, 及贷款本金, 资本投资回报等则不受此项课税限制。

此项课税也不适用于泰国公司或合营企业向海外汇出的红利或利息支出。

这类支出已在付款时缴过税。

根据外国法律成立的公司或合伙公司, 不在泰国经营而由泰国所取得的可估收入, 除股利收入付款人须预扣汇款额的15% 作为所得税,股利收入则预扣10%的所得税。

外国投资者在泰国股票交易市场的共同基金获得的利得及利润分成无须预扣税金。

以下情况也免于交纳增值税:(1)经营者的年销售收入少于60万铢;(2)销售或进口农产品、牲畜以及农用原料,如化肥、种子及化学药品等;(3)销售或进口出版的资料及书刊;(4)审计、法律服务、健康服务及其它专业服务;(5)文化及宗教服务;根据雇佣合同由雇员提供的服务,皇家法令规定的产品的销售,泰国工业区管理局规定免征进口关税的货物;国内运输(航空除外)及国际运输(航空及海运除外)。

下列业务加征一定比例的特种商业税来代替增值税,税率如下:(1)商业银行、金融机构、证券公司及信用社,3%;(2)生命保险, 2.5%;(3)财产保险,3%;(4)固定资产的销售,3%;(5)当铺,2.5%。

(6)交纳特别行业税时,还另须交纳该税款的10%作为地方政府税。

四.预扣算预扣税(withholding tax)是指任何业主预先扣下的税务,东道国对外国投资者所获得的股利、利息和无形资产特许使用费所计征的税种。

预扣税是一种与公司所得税相联系的特殊税种,各国的预扣税表现在对不同收入所规定的税率上有很大的差别。

分成两个:1. 增值税的预扣税:对于公司帮承包商直接交给政府的税,如果承包商是个人扣除3%,如果承包商是企业扣除5%,则经营者必须在每月后7天(每月7日之前)内主动向税务部门纳税。

2. 个人所得税的预扣税:按照泰国法律公司的所有员工必须交社会保险和个人所得税。

所有每个公司将有责任从员工的工资预扣税,算法是从一年的个人所得税按比例缴纳算出分成12个月扣除。

五、其他税收1. 印花税税收法列明需缴纳印花税的交易。

税率由交易的性质而定,对未贴印花的文件予以较重罚款。

2. 石油收入税石油收入税法代替税收条列,对在政府特许下经营与石油有关业务的公司或从这些特许公司购卖石油用于出口的公司,征收石油税。

石油公司。