9-6

股票的需求与均衡价格

DEMAND FOR STOCKS AND EQUILIBRIUM PRICES

9-7

股票的需求与均衡价格

DEMAND FOR STOCKS AND EQUILIBRIUM PRICES

The expected rates of return that Sigma used to derive its demand for shares of BU and TD were computed from the forecast of year-end stock prices and the current prices. If, say, a share of BU could be purchased at a lower price, Sigma’s forecast of the rate of return on BU would be higher. Conversely, if BU shares were selling at a higher price, expected returns would be lower. A new expected return would result in a different optimal portfolio and a different demand for shares.

9-3

股票的需求与均衡价格

DEMAND FOR STOCKS AND EQUILIBRIUM PRICES

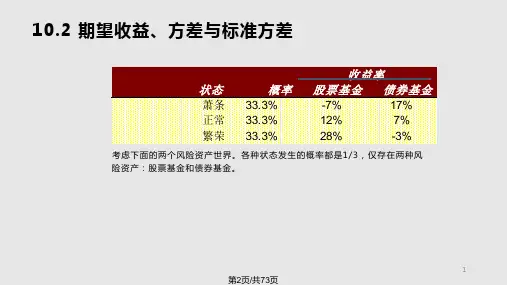

Sigma Fund is a new actively managed mutual fund that has raised $220 million to invest in the stock market. The security analysis staff of Sigma believes that neither BU nor TD will grow in the future and therefore, that each firm will pay level annual dividends for the foreseeable future. This is a useful simplifying assumption because, if a stock is expected to pay a stream of level dividends, the income derived from each share is a perpetuity. Therefore, the present value of each share often called the intrinsic value of the share equals the dividend divided by the appropriate discount rate. A summary of the report of the security analysts appears in Table 9.2.