企业环境成本会计中英文对照

- 格式:doc

- 大小:59.50 KB

- 文档页数:11

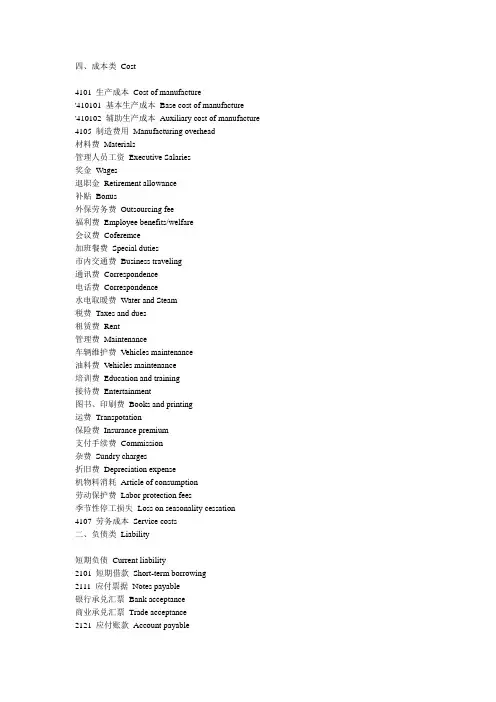

四、成本类Cost4101 生产成本Cost of manufacture'410101 基本生产成本Base cost of manufacture'410102 辅助生产成本Auxiliary cost of manufacture 4105 制造费用Manufacturing overhead材料费Materials管理人员工资Executive Salaries奖金Wages退职金Retirement allowance补贴Bonus外保劳务费Outsourcing fee福利费Employee benefits/welfare会议费Coferemce加班餐费Special duties市内交通费Business traveling通讯费Correspondence电话费Correspondence水电取暖费Water and Steam税费Taxes and dues租赁费Rent管理费Maintenance车辆维护费Vehicles maintenance油料费Vehicles maintenance培训费Education and training接待费Entertainment图书、印刷费Books and printing运费Transpotation保险费Insurance premium支付手续费Commission杂费Sundry charges折旧费Depreciation expense机物料消耗Article of consumption劳动保护费Labor protection fees季节性停工损失Loss on seasonality cessation4107 劳务成本Service costs二、负债类Liability短期负债Current liability2101 短期借款Short-term borrowing2111 应付票据Notes payable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance2121 应付账款Account payable2131 预收账款Deposit received2141 代销商品款Proxy sale goods revenue2151 应付工资Accrued wages2153 应付福利费Accrued welfarism2161 应付股利Dividends payable2171 应交税金Tax payable'217101 应交增值税value added tax payable'21710101 进项税额Withholdings on VAT'21710102 已交税金Paying tax'21710103 转出未交增值税Unpaid VAT changeover'21710104 减免税款Tax deduction'21710105 销项税额Substituted money on VAT'21710106 出口退税Tax reimbursement for export'21710107 进项税额转出Changeover withnoldings on VAT'21710108 出口抵减内销产品应纳税额Export deduct domestic sales goods tax'21710109 转出多交增值税Overpaid VAT changeover'21710110 未交增值税Unpaid VAT'217102 应交营业税Business tax payable'217103 应交消费税Consumption tax payable'217104 应交资源税Resources tax payable'217105 应交所得税Income tax payable'217106 应交土地增值税Increment tax on land value payable'217107 应交城市维护建设税Tax for maintaining and building cities payable'217108 应交房产税Housing property tax payable'217109 应交土地使用税Tenure tax payable'217110 应交车船使用税Vehicle and vessel usage license plate tax(VVULPT) payable '217111 应交个人所得税Personal income tax payable2176 其他应交款Other fund in conformity with paying2181 其他应付款Other payables2191 预提费用Drawing expense in advance其他负债Other liabilities2201 待转资产价值Pending changerover assets value2211 预计负债Anticipation liabilities长期负债Long-term Liabilities2301 长期借款Long-term loans一年内到期的长期借款Long-term loans due within one year三、所有者权益类OWNERS' EQUITY资本Capita3101 实收资本(或股本) Paid-up capital(or stock)实收资本Paicl-up capital实收股本Paid-up stock3103 已归还投资Investment Returned公积3111 资本公积Capital reserve'311101 资本(或股本)溢价Cpital(or Stock) premium'311102 接受捐赠非现金资产准备Receive non-cash donate reserve'311103 股权投资准备Stock right investment reserves'311105 拨款转入Allocate sums changeover in'311106 外币资本折算差额Foreign currency capital'311107 其他资本公积Other capital reserve3121 盈余公积Surplus reserves'312101 法定盈余公积Legal surplus'312102 任意盈余公积Free surplus reserves'312103 法定公益金Legal public welfare fund'312104 储备基金Reserve fund'312105 企业发展基金Enterprise expension fund'312106 利润归还投资Profits capitalizad on return of investment利润Profits3131 本年利润Current year profits3141 利润分配Profit distribution'314101 其他转入Other chengeover in'314102 提取法定盈余公积Withdrawal legal surplus'314103 提取法定公益金Withdrawal legal public welfare funds'314104 提取储备基金Withdrawal reserve fund'314105 提取企业发展基金Withdrawal reserve for business expansion'314106 提取职工奖励及福利基金Withdrawal staff and workers' bonus and welfare fund'314107 利润归还投资Profits capitalizad on return of investment'314108 应付优先股股利Preferred Stock dividends payable'314109 提取任意盈余公积Withdrawal other common accumulation fund'314110 应付普通股股利Common Stock dividends payable'314111 转作资本(或股本)的普通股股利Common Stock dividends change to assets(or stock) '314115 未分配利润Undistributed profit一年后到期的长期借款Long-term loans due over one year2311 应付债券Bonds payable'231101 债券面值Face value, Par value'231102 债券溢价Premium on bonds'231103 债券折价Discount on bonds'231104 应计利息Accrued interest2321 长期应付款Long-term account payable应付融资租赁款Accrued financial lease outlay一年内到期的长期应付Long-term account payable due within one year一年后到期的长期应付Long-term account payable over one year2331 专项应付款Special payable一年内到期的专项应付Long-term special payable due within one year一年后到期的专项应付Long-term special payable over one year2341 递延税款Deferral taxes五、损益类Profit and loss收入Income业务收入OPERATING INCOME5101 主营业务收入Prime operating revenue产品销售收入Sales revenue服务收入Service revenue5102 其他业务收入Other operating revenue材料销售Sales materials代购代售包装物出租Wrappage lease出让资产使用权收入Remise right of assets revenue返还所得税Reimbursement of income tax其他收入Other revenue5201 投资收益Investment income短期投资收益Current investment income长期投资收益Long-term investment income计提的委托贷款减值准备Withdrawal of entrust loans reserves 5203 补贴收入Subsidize revenue国家扶持补贴收入Subsidize revenue from country其他补贴收入Other subsidize revenue5301 营业外收入NON-OPERATING INCOME非货币性交易收益Non-cash deal income现金溢余Cash overage处置固定资产净收益Net income on disposal of fixed assets出售无形资产收益Income on sales of intangible assets固定资产盘盈Fixed assets inventory profit罚款净收入Net amercement income支出Outlay业务支出Revenue charges5401 主营业务成本Operating costs产品销售成本Cost of goods sold服务成本Cost of service5402 主营业务税金及附加Tax and associate charge营业税Sales tax消费税Consumption tax城市维护建设税Tax for maintaining and building cities资源税Resources tax土地增值税Increment tax on land value5405 其他业务支出Other business expense销售其他材料成本Other cost of material sale其他劳务成本Other cost of service其他业务税金及附加费Other tax and associate charge费用Expenses5501 营业费用Operating expenses代销手续费Consignment commission charge运杂费Transpotation保险费Insurance premium展览费Exhibition fees广告费Advertising fees5502 管理费用Adminisstrative expenses职工工资Staff Salaries修理费Repair charge低值易耗摊销Article of consumption办公费Office allowance差旅费Travelling expense工会经费Labour union expenditure研究与开发费Research and development expense福利费Employee benefits/welfare职工教育经费Personnel education待业保险费Unemployment insurance劳动保险费Labour insurance医疗保险费Medical insurance会议费Coferemce聘请中介机构费Intermediary organs咨询费Consult fees诉讼费Legal cost业务招待费Business entertainment技术转让费Technology transfer fees矿产资源补偿费Mineral resources compensation fees排污费Pollution discharge fees房产税Housing property tax车船使用税Vehicle and vessel usage license plate tax(VVULPT) 土地使用税Tenure tax印花税Stamp tax5503 财务费用Finance charge利息支出Interest exchange汇兑损失Foreign exchange loss各项手续费Charge for trouble各项专门借款费用Special-borrowing cost5601 营业外支出Nonbusiness expenditure捐赠支出Donation outlay减值准备金Depreciation reserves非常损失Extraordinary loss处理固定资产净损失Net loss on disposal of fixed assets出售无形资产损失Loss on sales of intangible assets固定资产盘亏Fixed assets inventory loss债务重组损失Loss on arrangement罚款支出Amercement outlay5701 所得税Income tax以前年度损益调整Prior year income adjustment 61 推销费用 selling expenses615~618 推销费用 selling expenses6151 薪资支出 payroll expense6152 租金支出 rent expense, rent6153 文具用品 office supplies (expense)6154 旅费 travelling expense, travel6155 运费 shipping expenses, freight6156 邮电费 postage (expenses)6157 修缮费 repair(s) and maintenance (expense) 6159 广告费 advertisement expense, advertisement 6161 水电瓦斯费 utilities (expense)6162 保险费 insurance (expense)6164 交际费 entertainment (expense)6165 捐赠 donation (expense)6166 税捐 taxes6167 呆帐损失 loss on uncollectible accounts6168 折旧 depreciation expense6169 各项耗竭及摊提 various amortization6172 伙食费 meal (expenses)6173 职工福利 employee benefits/welfare6175 佣金支出 commission (expense)6176 训练费 training (expense)6188 其它推销费用 other selling expenses62 管理及总务费用 general & administrative expenses625~628 管理及总务费用 general & administrative expenses 6251 薪资支出 payroll expense6252 租金支出 rent expense, rent6253 文具用品 office supplies6254 旅费 travelling expense, travel6255 运费 shipping expenses,freight6256 邮电费 postage (expenses)6257 修缮费 repair(s) and maintenance (expense)6259 广告费 advertisement expense, advertisement6261 水电瓦斯费 utilities (expense)6262 保险费 insurance (expense)6264 交际费 entertainment (expense)6265 捐赠 donation (expense)6266 税捐 taxes6267 呆帐损失 loss on uncollectible accounts6268 折旧 depreciation expense6269 各项耗竭及摊提 various amortization6271 外销损失 loss on export sales6272 伙食费 meal (expenses)6273 职工福利 employee benefits/welfare6274 研究发展费用 research and development expense6275 佣金支出 commission (expense)6276 训练费 training (expense)6278 劳务费 professional service fees6288 其它管理及总务费用 other general and administrative expenses 63 研究发展费用 research and development expenses635~638 研究发展费用 research and development expenses6351 薪资支出 payroll expense6352 租金支出 rent expense, rent6353 文具用品 office supplies6354 旅费 travelling expense, travel6355 运费 shipping expenses, freight6356 邮电费 postage (expenses)6357 修缮费 repair(s) and maintenance (expense)6361 水电瓦斯费 utilities (expense)6362 保险费 insurance (expense)6364 交际费 entertainment (expense)6366 税捐 taxes6368 折旧 depreciation expense6369 各项耗竭及摊提 various amortization6372 伙食费 meal (expenses)6373 职工福利 employee benefits/welfare6376 训练费 training (expense)6378 其它研究发展费用 other research and development expenses。

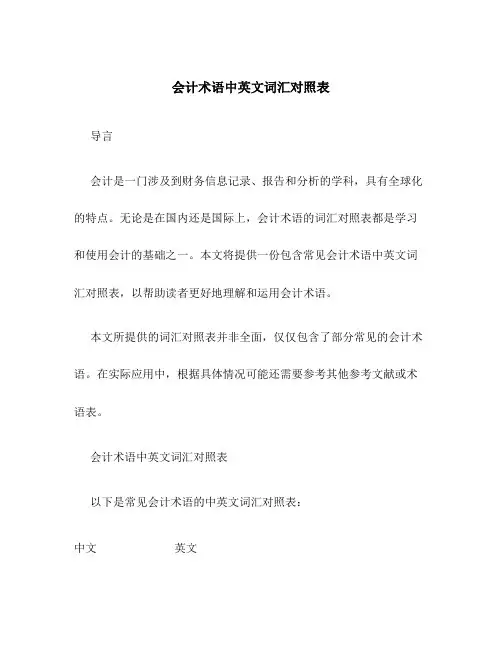

会计术语中英文词汇对照表导言会计是一门涉及到财务信息记录、报告和分析的学科,具有全球化的特点。

无论是在国内还是国际上,会计术语的词汇对照表都是学习和使用会计的基础之一。

本文将提供一份包含常见会计术语中英文词汇对照表,以帮助读者更好地理解和运用会计术语。

本文所提供的词汇对照表并非全面,仅仅包含了部分常见的会计术语。

在实际应用中,根据具体情况可能还需要参考其他参考文献或术语表。

会计术语中英文词汇对照表以下是常见会计术语的中英文词汇对照表:中文英文会计Accounting财务Finance资产Asset负债Liability所有者权益Owner’s Equity收入Revenue支出Expense成本Cost利润Profit费用Fee报表Financial Statement 资产负债表Balance Sheet损益表Income Statement现金流量表Cash Flow Statement营业收入Operating Revenue营业成本Operating Cost资产减值损失Impairment Loss无形资产摊销费用Amortization Expense递延所得税资产Deferred Tax Asset递延所得税负债Deferred Tax Liability预付账款Prepaid Expenses结语会计术语是会计学习和实践中的重要一环,准确理解和运用这些术语对于从事会计相关工作的人员至关重要。

希望本文所提供的会计术语中英文词汇对照表能为读者提供帮助。

同时也提醒读者要根据具体情况和实际需求,进一步扩充和完善自己的会计术语词汇库,以应对各种会计场景。

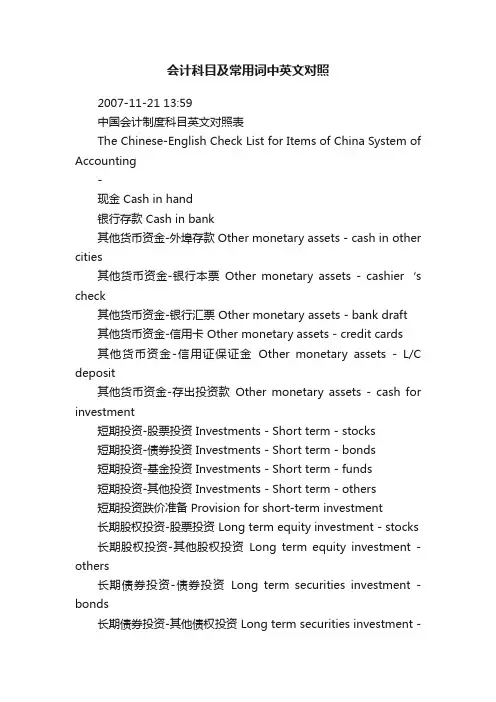

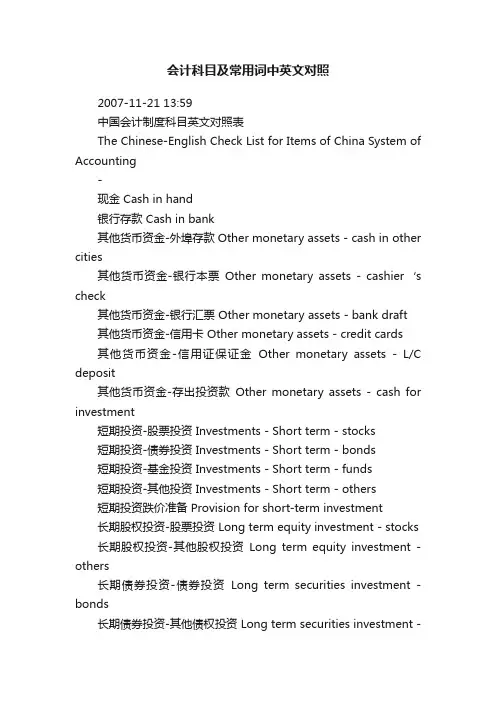

会计科目及常用词中英文对照2007-11-21 13:59中国会计制度科目英文对照表The Chinese-English Check List for Items of China System of Accounting-现金 Cash in hand银行存款 Cash in bank其他货币资金-外埠存款Other monetary assets - cash in other cities其他货币资金-银行本票Other monetary assets - cashier‘s check其他货币资金-银行汇票 Other monetary assets - bank draft其他货币资金-信用卡 Other monetary assets - credit cards其他货币资金-信用证保证金Other monetary assets - L/C deposit其他货币资金-存出投资款Other monetary assets - cash for investment短期投资-股票投资 Investments - Short term - stocks短期投资-债券投资 Investments - Short term - bonds短期投资-基金投资 Investments - Short term - funds短期投资-其他投资 Investments - Short term - others短期投资跌价准备 Provision for short-term investment长期股权投资-股票投资 Long term equity investment - stocks 长期股权投资-其他股权投资Long term equity investment - others长期债券投资-债券投资Long term securities investment - bonds长期债券投资-其他债权投资 Long term securities investment -others长期投资减值准备 Provision for long-term investment应收票据 Notes receivable应收股利 Dividends receivable应收利息 Interest receivable应收帐款 Trade debtors坏帐准备- 应收帐款Provision for doubtful debts - trade debtors预付帐款 Prepayment应收补贴款 Allowance receivable其他应收款 Other debtors坏帐准备- 其他应收款Provision for doubtful debts - other debtors其他流动资产 Other current assets物资采购 Purchase原材料 Raw materials包装物 Packing materials低值易耗品 Low value consumables材料成本差异 Material cost difference自制半成品 Self-manufactured goods库存商品 Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资 Consigned processing material委托代销商品 Consignment-out受托代销商品 Consignment-in分期收款发出商品 Goods on instalment sales存货跌价准备 Provision for obsolete stocks待摊费用 Prepaid expenses待处理流动资产损益 Unsettled G/L on current assets待处理固定资产损益 Unsettled G/L on fixed assets委托贷款-本金 Consignment loan - principle委托贷款-利息 Consignment loan - interest委托贷款-减值准备 Consignment loan - provision固定资产-房屋建筑物 Fixed assets - Buildings固定资产-机器设备 Fixed assets - Plant and machinery固定资产-电子设备、器具及家具Fixed assets - Electronic Equipment, furniture and fixtures固定资产-运输设备 Fixed assets - Automobiles累计折旧 Accumulated depreciation固定资产减值准备 Impairment of fixed assets-工程物资-专用材料 Project material - specific materials工程物资-专用设备 Project material - specific equipment工程物资-预付大型设备款Project material - prepaid for equipment工程物资-为生产准备的工具及器具 Project material - tools and facilities for production在建工程 Construction in progress在建工程减值准备 Impairment of construction in progress固定资产清理 Disposal of fixed assets无形资产-专利权 Intangible assets - patent无形资产-非专利技术Intangible assets - industrial property and know-how无形资产-商标权 Intangible assets - trademark rights无形资产-土地使用权 Intangible assets - land use rights无形资产-商誉 Intangible assets - goodwill无形资产减值准备 Impairment of intangible assets长期待摊费用 Deferred assets未确认融资费用 Unrecognized finance fees其他长期资产 Other long term assets递延税款借项 Deferred assets debits应付票据 Notes payable应付帐款 Trade creditors预收帐款 Advance from customers代销商品款 Consignment-in payables其他应交款 Other payable to government其他应付款 Other creditors应付股利 Proposed dividends待转资产价值 Donated assets预计负债 Accrued liabilities应付短期债券 Short-term debentures payable其他流动负债 Other current liabilities预提费用 Accrued expenses应付工资 Payroll payable应付福利费 Welfare payable短期借款-抵押借款 Bank loans - Short term - pledged短期借款-信用借款 Bank loans - Short term - credit短期借款-担保借款 Bank loans - Short term - guaranteed一年内到期长期借款 Long term loans due within one year一年内到期长期应付款 Long term payable due within one year 长期借款 Bank loans - Long term应付债券-债券面值 Bond payable - Par value应付债券-债券溢价 Bond payable - Excess应付债券-债券折价 Bond payable - Discount应付债券-应计利息 Bond payable - Accrued interest长期应付款 Long term payable专项应付款 Specific payable其他长期负债 Other long term liabilities应交税金-所得税 Tax payable - income tax应交税金-增值税 Tax payable - VAT应交税金-营业税 Tax payable - business tax应交税金-消费税 Tax payable - consumable tax应交税金-其他 Tax payable - others递延税款贷项 Deferred taxation credit股本 Share capital已归还投资 Investment returned利润分配-其他转入 Profit appropriation - other transfer in利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金 Profit appropriation - reserve fund利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金 Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润 Retained earnings, beginning of the year资本公积-股本溢价 Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donationreserve资本公积-接受现金捐赠 Capital surplus - cash donation资本公积-股权投资准备 Capital surplus - investment reserve 资本公积-拨款转入 Capital surplus - subsidiary资本公积-外币资本折算差额 Capital surplus - foreign currency translation资本公积-其他 Capital surplus - others盈余公积-法定盈余公积金 Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金 Surplus reserve - reserve fund盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资 Surplus reserve - return investment by investment主营业务收入 Sales主营业务成本 Cost of sales主营业务税金及附加 Sales tax营业费用 Operating expenses管理费用 General and administrative expenses财务费用 Financial expenses投资收益 Investment income其他业务收入 Other operating income营业外收入 Non-operating income补贴收入 Subsidy income其他业务支出 Other operating expenses营业外支出 Non-operating expenses所得税Income tax际会计常用术语中英翻译-Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Income statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会Statement of cash flow 现金流量表Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owner's equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设Stockholders 股东Stockholders' equity 股东权益Window dressing 门面粉饰Account 帐户会计&财务术语的中英对照[url=/cat.10514222.html][/url]-a payment or serious payments 一次或多次付款abatement 扣减absolute and unconditional payments 绝对和无条件付款accelerated payment 加速支付acceptance date 接受日acceptance 接受accession 加入accessories 附属设备accountability 承担责任的程度accounting benefits 会计利益accounting period 会计期间accounting policies 会计政策accounting principle 会计准则accounting treatment 会计处理accounts receivables 应收账款accounts 账项accredited investors 经备案的投资人accumulated allowance 累计准备金acknowledgement requirement 对承认的要求acquisition of assets 资产的取得acquisitions 兼并Act on Product Liability (德国)生产责任法action 诉讼actual ownership 事实上的所有权additional filings 补充备案additional margin 附加利差additional risk附加风险additions (设备的)附件adjusted tax basis 已调整税基adjustment of yield 对收益的调整administrative fee管理费Administrative Law(美国)行政法advance notice 事先通知advance 放款adverse tax consequences 不利的税收后果advertising 做广告affiliated group 联合团体affiliate 附属机构African Leasing Association 非洲租赁协会after-tax rate 税后利率aggregate rents 合计租金aggregate risk 合计风险agreement concerning rights of explore natural resources 涉及自然资源开发权的协议agreement 协议aircraft registry 飞机登记airframe (飞机的)机身airports 机场airworthiness directives (飞机的)适航指令alliances 联盟allocation of finance income 财务收益分配allowance for losses on receivables 应收款损失备抵金alternative uses 改换用途地使用amenability to foreign investment 外国投资的易受控制程度amendment 修改American Law Institute 美国法学会amortization of deferred loan fees and related consideration 递延的贷款费和相关的报酬的摊销amortization schedule 摊销进度表amortize 摊销amount of recourse 求偿金额amount of usage 使用量AMT (Alternative Minimum Tax) (美国)可替代最低税analogous to类推为annual budget appropriation 年度预算拨款appendix (契约性文件的)附件applicable law 适用法律applicable securities laws适用的证券法律applicable tax life 适用的应纳税寿命appraisal 评估appraisers 评估人员appreciation 溢价appropriation provisions 拨款条例appropriation 侵占approval authority 核准权approval 核准approximation近似arbitrary and artificially high value (承租人违约出租人收回租赁物时法官判决的)任意的和人为抬高的价值arbitration 仲裁arm''s length transaction 公平交易arrangement 安排arrest 扣留Article 2A 美国统一商法典关于法定融资租赁的条款articles of incorporation 公司章程AsiaLeaae 亚洲租赁协会assess 评估asset manager 设备经理asset risk insurance 资产风险保险asset securitization 资产证券化asset specificity 资产特点asset tracking 资产跟踪asset-backed financing 资产支持型融资asset-based lessor 立足于资产的出租人asset-oriented lessor (经营租赁中的)资产导向型出租人asset 资产assignee 受让人assignment 让与association 社团at the expiry 期限届满时ATT (automatic transfer of title) 所有权自动转移attachments 附着物attributes 属性auction sale 拍卖audits 审计authenticate 认证authentication 证实authority 当局authorize 认可availability of fixed rate medium-term financing 固定利率中期融资可得到的程度available-for-sale securities 正供出售证券average life 平均寿命average managed net financed assets 所管理的已筹资金资产净额平均值aviation authority 民航当局backed-up servicer 替补服务者backhoe反铲装载机balance sheet date 资产负债表日bandwidth 带宽bank affiliates 银行的下属机构bank quote 银行报价bankruptcy cost 破产成本bankruptcy court 破产法院bankruptcy law 破产法bankruptcy proceedings 破产程序bankruptcy 破产bareboat charterer 光船承租人bargain renewal option廉价续租任择权basic earnings per share每股基本收益basic rent基本租金(各期应付的租金)beneficiaries受益人big-ticket items大额项目bill and collect开票和收款binding agreement有约束力的协议blind vendor discount卖主暗扣bluebook蓝皮书(美国二手市场设备价格手册)book income账面收入book loses账面亏损borrower借款人BPO(bargain purchase option)廉价购买任择权bridge facility桥式融通bridge桥梁broker fee经纪人费brokers经纪人build-to-suit leases(租赁物由承租人)承建或承造的租赁协议bulldozer推土机bundled additional services捆绑(在一起的)附加服务bundling捆绑(服务)business acquisition业务收购business and occupation tax营业及开业许可税business generation业务开发business trust商业信托by(e)-laws细则。

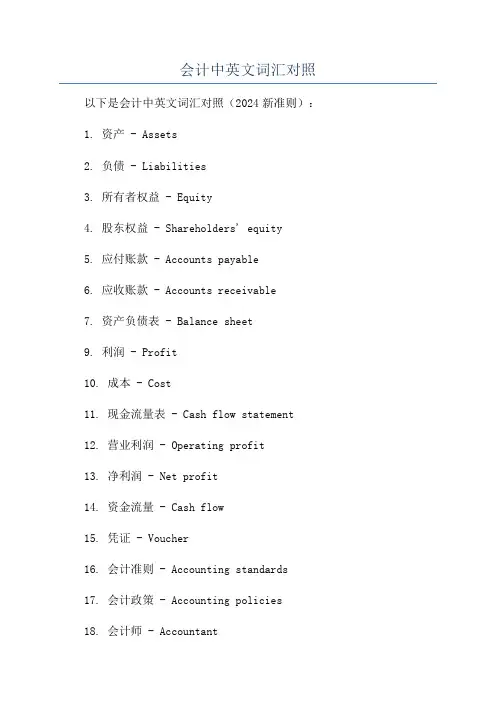

会计中英文词汇对照以下是会计中英文词汇对照(2024新准则):1. 资产 - Assets2. 负债 - Liabilities3. 所有者权益 - Equity4. 股东权益 - Shareholders' equity5. 应付账款 - Accounts payable6. 应收账款 - Accounts receivable7. 资产负债表 - Balance sheet9. 利润 - Profit10. 成本 - Cost11. 现金流量表 - Cash flow statement12. 营业利润 - Operating profit13. 净利润 - Net profit14. 资金流量 - Cash flow15. 凭证 - Voucher16. 会计准则 - Accounting standards17. 会计政策 - Accounting policies18. 会计师 - Accountant19. 年度报表 - Annual report20. 资本 - Capital21. 借方 - Debit22. 贷方 - Credit23. 折旧 - Depreciation24. 减值 - Impairment25. 公允价值 - Fair value26. 经营活动现金流量 - Cash flow from operating activities27. 投资活动现金流量 - Cash flow from investing activities28. 筹资活动现金流量 - Cash flow from financing activities29. 现金及现金等价物 - Cash and cash equivalents30. 投资 - Investment31. 融资 - Financing32. 业务周期 - Business cycle33. 长期负债 - Long-term liabilities34. 短期负债 - Short-term liabilities35. 固定资产 - Fixed assets36. 流动资产 - Current assets37. 其他应收款 - Other receivables38. 存货 - Inventory39. 预付账款 - Prepaid expenses。

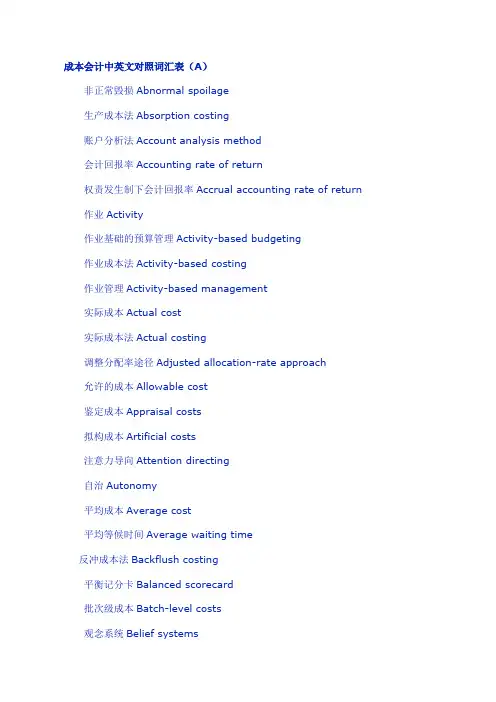

成本会计中英文对照词汇表(A)非正常毁损Abnormal spoilage生产成本法Absorption costing账户分析法Account analysis method会计回报率Accounting rate of return权责发生制下会计回报率Accrual accounting rate of return 作业Activity作业基础的预算管理Activity-based budgeting作业成本法Activity-based costing作业管理Activity-based management实际成本Actual cost实际成本法Actual costing调整分配率途径Adjusted allocation-rate approach允许的成本Allowable cost鉴定成本Appraisal costs拟构成本Artificial costs注意力导向Attention directing自治Autonomy平均成本Average cost平均等候时间Average waiting time反冲成本法Backflush costing平衡记分卡Balanced scorecard批次级成本Batch-level costs观念系统Belief systems标杆管理Benchmarking账面价值Book value瓶颈Bottleneck边界系统Boundary systems盈亏平衡点Breakeven point预算Budget预算成本Budgeted cost预算松弛Budgetary slack预算间接成本分配率Budgeted indirect-cost rate捆绑产品Bundled product业务功能成本Business function costs副产品ByproductsGrace:We‘re going to have a problem meeting the budget fo r the production of our new sound board.葛蕾丝:我们拨给新声卡产品的预算会有问题。

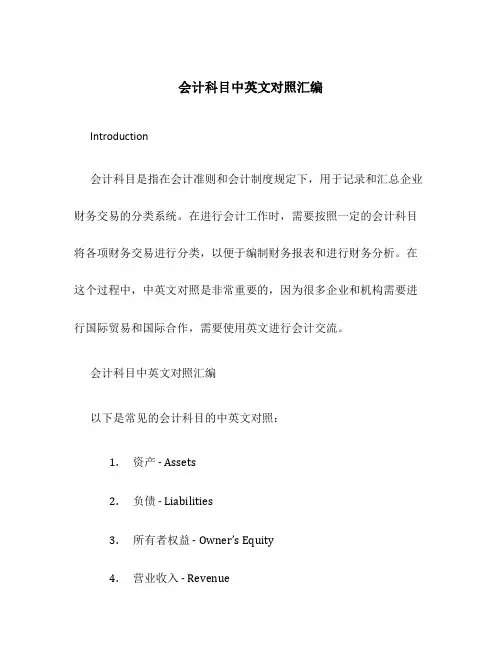

会计科目中英文对照汇编Introduction会计科目是指在会计准则和会计制度规定下,用于记录和汇总企业财务交易的分类系统。

在进行会计工作时,需要按照一定的会计科目将各项财务交易进行分类,以便于编制财务报表和进行财务分析。

在这个过程中,中英文对照是非常重要的,因为很多企业和机构需要进行国际贸易和国际合作,需要使用英文进行会计交流。

会计科目中英文对照汇编以下是常见的会计科目的中英文对照:1.资产 - Assets2.负债 - Liabilities3.所有者权益 - Owner’s Equity4.营业收入 - Revenue5.营业成本 - Cost of Goods Sold6.销售费用 - Sales Expenses7.管理费用 - Administrative Expenses8.财务费用 - Financial Expenses9.其他收益 - Other Income10.其他支出 - Other Expenses11.现金 - Cash12.库存 - Inventory13.应收账款 - Accounts Receivable14.预付账款 - Prepaid Expenses15.固定资产 - Fixed Assets16.短期借款 - Short-term Borrowings17.长期借款 - Long-term Borrowings18.应付账款 - Accounts Payable19.递延收益 - Deferred Revenue20.所得税费用 - Income Tax Expenses以上仅为常见的会计科目中英文对照,实际情况可能有所不同,需要根据具体的会计准则和会计制度进行相应的调整和补充。

使用注意事项在进行会计科目中英文对照时,需要注意以下几点:1.确保准确性:确保中英文对照的准确性,以免在对外交流和会计处理中产生误解和错误。

2.更新及时:随着会计准则和会计制度的不断变化和更新,会计科目中英文对照也需要及时进行更新和调整,以确保与最新的法规和规定相符。

会计专业专业术语中英文对照一、会计与会计理论会计accounting决策人Decision Maker投资人Investor股东Shareholder债权人Creditor财务会计Financial Accounting管理会计Management Accounting成本会计Cost Accounting私业会计Private Accounting公众会计Public Accounting注册会计师CPA Certified Public Accountant国际会计准则委员会IASC美国注册会计师协会AICPA财务会计准则委员会FASB管理会计协会IMA美国会计学会AAA税务稽核署IRS独资企业Proprietorship合伙人企业Partnership公司Corporation会计目标Accounting Objectives会计假设Accounting Assumptions会计要素Accounting Elements会计原则Accounting Principles会计实务过程Accounting Procedures财务报表Financial Statements财务分析Financial Analysis会计主体假设Separate-entity Assumption货币计量假设Unit-of-measure Assumption持续经营假设Continuity(Going-concern) Assumption会计分期假设Time-period Assumption资产Asset负债Liability业主权益Owner's Equity收入Revenue费用Expense收益Income亏损Loss历史成本原则Cost Principle收入实现原则Revenue Principle配比原则Matching Principle全面披露原则Full-disclosure (Reporting) Principle 客观性原则Objective Principle一致性原则Consistent Principle可比性原则Comparability Principle重大性原则Materiality Principle稳健性原则Conservatism Principle权责发生制Accrual Basis现金收付制Cash Basis财务报告Financial Report流动资产Current assets流动负债Current Liabilities长期负债Long-term Liabilities投入资本Contributed Capital留存收益Retained Earning二、会计循环会计循环Accounting Procedure/Cycle会计信息系统Accounting information System帐户Ledger会计科目Account会计分录Journal entry原始凭证Source Document日记帐Journal总分类帐General Ledger明细分类帐Subsidiary Ledger试算平衡Trial Balance现金收款日记帐Cash receipt journal现金付款日记帐Cash disbursements journal销售日记帐Sales Journal购货日记帐Purchase Journal普通日记帐General Journal本票Promissory note贴现Discount背书Endorse拒付费Protest fee com四、存货存货Inventory商品存货Merchandise inventory产成品存货Finished goods inventory在产品存货Work in process inventory原材料存货Raw materials inventory起运地离岸价格F.O.B shipping point目的地抵岸价格F.O.B destination寄销Consignment寄销人Consignor承销人Consignee定期盘存Periodic inventory永续盘存Perpetual inventory购货Purchase购货折让和折扣Purchase allowance and discounts 存货盈余或短缺Inventory overages and shortages 分批认定法Specific identification加权平均法Weighted average先进先出法First-in, first-out or FIFO后进先出法Lost-in, first-out or LIFO移动平均法Moving average成本或市价孰低法Lower of cost or market or LCM 市价Market value重置成本Replacement cost可变现净值Net realizable value上限Upper limit下限Lower limit毛利法Gross margin method零售价格法Retail method成本率Cost ratio五、长期投资长期投资Long-term investment长期股票投资Investment on stocks长期债券投资Investment on bonds成本法Cost method权益法Equity method合并法Consolidation method股利宣布日Declaration date股权登记日Date of record除息日Ex-dividend date付息日Payment date债券面值Face value, Par value债券折价Discount on bonds债券溢价Premium on bonds票面利率Contract interest rate, stated rate市场利率Market interest ratio, Effective rate普通股Common Stock优先股Preferred Stock现金股利Cash dividends股票股利Stock dividends清算股利Liquidating dividends到期日Maturity date到期值Maturity value直线摊销法Straight-Line method of amortization实际利息摊销法Effective-interest method of amortization 六、固定资产固定资产Plant assets or Fixed assets原值Original value预计使用年限Expected useful life预计残值Estimated residual value折旧费用Depreciation expense累计折旧Accumulated depreciation帐面价值Carrying value应提折旧成本Depreciation cost净值Net value在建工程Construction-in-process磨损Wear and tear过时Obsolescence直线法Straight-line method (SL)工作量法Units-of-production method (UOP)加速折旧法Accelerated depreciation method双倍余额递减法Double-declining balance method (DDB)年数总和法Sum-of-the-years-digits method (SYD)以旧换新Trade in经营租赁Operating lease融资租赁Capital lease廉价购买权Bargain purchase option (BPO)资产负债表外筹资Off-balance-sheet financing最低租赁付款额Minimum lease payments七、无形资产无形资产Intangible assets专利权Patents商标权Trademarks, Trade names著作权Copyrights特许权或专营权Franchises商誉Goodwill开办费Organization cost租赁权Leasehold摊销Amortization八、流动负债负债Liability流动负债Current liability应付帐款Account payable应付票据Notes payable贴现票据Discount notes长期负债一年内到期部分Current maturities of long-term liabilities 应付股利Dividends payable预收收益Prepayments by customers存入保证金Refundable deposits应付费用Accrual expense增值税value added tax营业税Business tax应付所得税Income tax payable应付奖金Bonuses payable产品质量担保负债Estimated liabilities under product warranties 赠品和兑换券Premiums, coupons and trading stamps或有事项Contingency或有负债Contingent或有损失Loss contingencies或有利得Gain contingencies永久性差异Permanent difference时间性差异Timing difference应付税款法Taxes payable method纳税影响会计法Tax effect accounting method递延所得税负债法Deferred income tax liability method 九、长期负债长期负债Long-term Liabilities应付公司债券Bonds payable有担保品的公司债券Secured Bonds抵押公司债券Mortgage Bonds保证公司债券Guaranteed Bonds信用公司债券Debenture Bonds一次还本公司债券Term Bonds分期还本公司债券Serial Bonds可转换公司债券Convertible Bonds可赎回公司债券Callable Bonds可要求公司债券Redeemable Bonds记名公司债券Registered Bonds无记名公司债券Coupon Bonds普通公司债券Ordinary Bonds收益公司债券Income Bonds名义利率,票面利率Nominal rate实际利率Actual rate有效利率Effective rate溢价Premium折价Discount面值Par value直线法Straight-line method实际利率法Effective interest method到期直接偿付Repayment at maturity提前偿付Repayment at advance偿债基金Sinking fund长期应付票据Long-term notes payable抵押借款Mortgage loan十、业主权益权益Equity业主权益Owner's equity股东权益Stockholder's equity投入资本Contributed capital缴入资本Paid-in capital股本Capital stock资本公积Capital surplus留存收益Retained earnings核定股本Authorized capital stock实收资本Issued capital stock发行在外股本Outstanding capital stock库藏股Treasury stock普通股Common stock优先股Preferred stock累积优先股Cumulative preferred stock非累积优先股Noncumulative preferred stock完全参加优先股Fully participating preferred stock部分参加优先股Partially participating preferred stock非部分参加优先股Nonpartially participating preferred stock 现金发行Issuance for cash非现金发行Issuance for noncash consideration股票的合并发行Lump-sum sales of stock发行成本Issuance cost成本法Cost method面值法Par value method捐赠资本Donated capital盈余分配Distribution of earnings股利Dividend股利政策Dividend policy宣布日Date of declaration股权登记日Date of record除息日Ex-dividend date股利支付日Date of payment现金股利Cash dividend股票股利Stock dividend拨款appropriation十一、财务报表财务报表Financial Statement资产负债表Balance Sheet收益表Income Statement帐户式Account Form报告式Report Form编制(报表)Prepare工作底稿Worksheet多步式Multi-step单步式Single-step十二、财务状况变动表财务状况变动表中的现金基础SCFP.Cash Basis(现金流量表)财务状况变动表中的营运资金基础SCFP.Working Capital Basis (资金来源与运用表)营运资金Working Capital全部资源概念All-resources concept直接交换业务Direct exchanges正常营业活动Normal operating activities财务活动Financing activities投资活动Investing activities十三、财务报表分析财务报表分析Analysis of financial statements比较财务报表Comparative financial statements趋势百分比Trend percentage比率Ratios普通股每股收益Earnings per share of common stock股利收益率Dividend yield ratio价益比Price-earnings ratio普通股每股帐面价值Book value per share of common stock资本报酬率Return on investment总资产报酬率Return on total asset债券收益率Yield rate on bonds已获利息倍数Number of times interest earned债券比率Debt ratio优先股收益率Yield rate on preferred stock营运资本Working Capital周转Turnover存货周转率Inventory turnover应收帐款周转率Accounts receivable turnover流动比率Current ratio速动比率Quick ratio酸性试验比率Acid test ratio十四、合并财务报表合并财务报表Consolidated financial statements吸收合并Merger创立合并Consolidation控股公司Parent company附属公司Subsidiary company少数股权Minority interest权益联营合并Pooling of interest购买合并Combination by purchase权益法Equity method成本法Cost method十五、物价变动中的会计计量物价变动之会计Price-level changes accounting一般物价水平会计General price-level accounting货币购买力会计Purchasing-power accounting统一币值会计Constant dollar accounting历史成本Historical cost现行价值会计Current value accounting现行成本Current cost重置成本Replacement cost物价指数Price-level index国民生产总值物价指数Gross national product implicit price deflator (or GNP deflator) 消费物价指数Consumer price index (or CPI)批发物价指数Wholesale price index货币性资产Monetary assets货币性负债Monetary liabilities货币购买力损益Purchasing-power gains or losses资产持有损益Holding gains or losses未实现的资产持有损益Unrealized holding gains or losses。

会计科目及常用词中英文对照2007-11-21 13:59中国会计制度科目英文对照表The Chinese-English Check List for Items of China System of Accounting-现金 Cash in hand银行存款 Cash in bank其他货币资金-外埠存款Other monetary assets - cash in other cities其他货币资金-银行本票Other monetary assets - cashier‘s check其他货币资金-银行汇票 Other monetary assets - bank draft其他货币资金-信用卡 Other monetary assets - credit cards其他货币资金-信用证保证金Other monetary assets - L/C deposit其他货币资金-存出投资款Other monetary assets - cash for investment短期投资-股票投资 Investments - Short term - stocks短期投资-债券投资 Investments - Short term - bonds短期投资-基金投资 Investments - Short term - funds短期投资-其他投资 Investments - Short term - others短期投资跌价准备 Provision for short-term investment长期股权投资-股票投资 Long term equity investment - stocks 长期股权投资-其他股权投资Long term equity investment - others长期债券投资-债券投资Long term securities investment - bonds长期债券投资-其他债权投资 Long term securities investment -others长期投资减值准备 Provision for long-term investment应收票据 Notes receivable应收股利 Dividends receivable应收利息 Interest receivable应收帐款 Trade debtors坏帐准备- 应收帐款Provision for doubtful debts - trade debtors预付帐款 Prepayment应收补贴款 Allowance receivable其他应收款 Other debtors坏帐准备- 其他应收款Provision for doubtful debts - other debtors其他流动资产 Other current assets物资采购 Purchase原材料 Raw materials包装物 Packing materials低值易耗品 Low value consumables材料成本差异 Material cost difference自制半成品 Self-manufactured goods库存商品 Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资 Consigned processing material委托代销商品 Consignment-out受托代销商品 Consignment-in分期收款发出商品 Goods on instalment sales存货跌价准备 Provision for obsolete stocks待摊费用 Prepaid expenses待处理流动资产损益 Unsettled G/L on current assets待处理固定资产损益 Unsettled G/L on fixed assets委托贷款-本金 Consignment loan - principle委托贷款-利息 Consignment loan - interest委托贷款-减值准备 Consignment loan - provision固定资产-房屋建筑物 Fixed assets - Buildings固定资产-机器设备 Fixed assets - Plant and machinery固定资产-电子设备、器具及家具Fixed assets - Electronic Equipment, furniture and fixtures固定资产-运输设备 Fixed assets - Automobiles累计折旧 Accumulated depreciation固定资产减值准备 Impairment of fixed assets-工程物资-专用材料 Project material - specific materials工程物资-专用设备 Project material - specific equipment工程物资-预付大型设备款Project material - prepaid for equipment工程物资-为生产准备的工具及器具 Project material - tools and facilities for production在建工程 Construction in progress在建工程减值准备 Impairment of construction in progress固定资产清理 Disposal of fixed assets无形资产-专利权 Intangible assets - patent无形资产-非专利技术Intangible assets - industrial property and know-how无形资产-商标权 Intangible assets - trademark rights无形资产-土地使用权 Intangible assets - land use rights无形资产-商誉 Intangible assets - goodwill无形资产减值准备 Impairment of intangible assets长期待摊费用 Deferred assets未确认融资费用 Unrecognized finance fees其他长期资产 Other long term assets递延税款借项 Deferred assets debits应付票据 Notes payable应付帐款 Trade creditors预收帐款 Advance from customers代销商品款 Consignment-in payables其他应交款 Other payable to government其他应付款 Other creditors应付股利 Proposed dividends待转资产价值 Donated assets预计负债 Accrued liabilities应付短期债券 Short-term debentures payable其他流动负债 Other current liabilities预提费用 Accrued expenses应付工资 Payroll payable应付福利费 Welfare payable短期借款-抵押借款 Bank loans - Short term - pledged短期借款-信用借款 Bank loans - Short term - credit短期借款-担保借款 Bank loans - Short term - guaranteed一年内到期长期借款 Long term loans due within one year一年内到期长期应付款 Long term payable due within one year 长期借款 Bank loans - Long term应付债券-债券面值 Bond payable - Par value应付债券-债券溢价 Bond payable - Excess应付债券-债券折价 Bond payable - Discount应付债券-应计利息 Bond payable - Accrued interest长期应付款 Long term payable专项应付款 Specific payable其他长期负债 Other long term liabilities应交税金-所得税 Tax payable - income tax应交税金-增值税 Tax payable - VAT应交税金-营业税 Tax payable - business tax应交税金-消费税 Tax payable - consumable tax应交税金-其他 Tax payable - others递延税款贷项 Deferred taxation credit股本 Share capital已归还投资 Investment returned利润分配-其他转入 Profit appropriation - other transfer in利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金 Profit appropriation - reserve fund利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金 Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润 Retained earnings, beginning of the year资本公积-股本溢价 Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donationreserve资本公积-接受现金捐赠 Capital surplus - cash donation资本公积-股权投资准备 Capital surplus - investment reserve 资本公积-拨款转入 Capital surplus - subsidiary资本公积-外币资本折算差额 Capital surplus - foreign currency translation资本公积-其他 Capital surplus - others盈余公积-法定盈余公积金 Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金 Surplus reserve - reserve fund盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资 Surplus reserve - return investment by investment主营业务收入 Sales主营业务成本 Cost of sales主营业务税金及附加 Sales tax营业费用 Operating expenses管理费用 General and administrative expenses财务费用 Financial expenses投资收益 Investment income其他业务收入 Other operating income营业外收入 Non-operating income补贴收入 Subsidy income其他业务支出 Other operating expenses营业外支出 Non-operating expenses所得税Income tax际会计常用术语中英翻译-Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Income statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会Statement of cash flow 现金流量表Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owner's equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设Stockholders 股东Stockholders' equity 股东权益Window dressing 门面粉饰Account 帐户会计&财务术语的中英对照[url=/cat.10514222.html][/url]-a payment or serious payments 一次或多次付款abatement 扣减absolute and unconditional payments 绝对和无条件付款accelerated payment 加速支付acceptance date 接受日acceptance 接受accession 加入accessories 附属设备accountability 承担责任的程度accounting benefits 会计利益accounting period 会计期间accounting policies 会计政策accounting principle 会计准则accounting treatment 会计处理accounts receivables 应收账款accounts 账项accredited investors 经备案的投资人accumulated allowance 累计准备金acknowledgement requirement 对承认的要求acquisition of assets 资产的取得acquisitions 兼并Act on Product Liability (德国)生产责任法action 诉讼actual ownership 事实上的所有权additional filings 补充备案additional margin 附加利差additional risk附加风险additions (设备的)附件adjusted tax basis 已调整税基adjustment of yield 对收益的调整administrative fee管理费Administrative Law(美国)行政法advance notice 事先通知advance 放款adverse tax consequences 不利的税收后果advertising 做广告affiliated group 联合团体affiliate 附属机构African Leasing Association 非洲租赁协会after-tax rate 税后利率aggregate rents 合计租金aggregate risk 合计风险agreement concerning rights of explore natural resources 涉及自然资源开发权的协议agreement 协议aircraft registry 飞机登记airframe (飞机的)机身airports 机场airworthiness directives (飞机的)适航指令alliances 联盟allocation of finance income 财务收益分配allowance for losses on receivables 应收款损失备抵金alternative uses 改换用途地使用amenability to foreign investment 外国投资的易受控制程度amendment 修改American Law Institute 美国法学会amortization of deferred loan fees and related consideration 递延的贷款费和相关的报酬的摊销amortization schedule 摊销进度表amortize 摊销amount of recourse 求偿金额amount of usage 使用量AMT (Alternative Minimum Tax) (美国)可替代最低税analogous to类推为annual budget appropriation 年度预算拨款appendix (契约性文件的)附件applicable law 适用法律applicable securities laws适用的证券法律applicable tax life 适用的应纳税寿命appraisal 评估appraisers 评估人员appreciation 溢价appropriation provisions 拨款条例appropriation 侵占approval authority 核准权approval 核准approximation近似arbitrary and artificially high value (承租人违约出租人收回租赁物时法官判决的)任意的和人为抬高的价值arbitration 仲裁arm''s length transaction 公平交易arrangement 安排arrest 扣留Article 2A 美国统一商法典关于法定融资租赁的条款articles of incorporation 公司章程AsiaLeaae 亚洲租赁协会assess 评估asset manager 设备经理asset risk insurance 资产风险保险asset securitization 资产证券化asset specificity 资产特点asset tracking 资产跟踪asset-backed financing 资产支持型融资asset-based lessor 立足于资产的出租人asset-oriented lessor (经营租赁中的)资产导向型出租人asset 资产assignee 受让人assignment 让与association 社团at the expiry 期限届满时ATT (automatic transfer of title) 所有权自动转移attachments 附着物attributes 属性auction sale 拍卖audits 审计authenticate 认证authentication 证实authority 当局authorize 认可availability of fixed rate medium-term financing 固定利率中期融资可得到的程度available-for-sale securities 正供出售证券average life 平均寿命average managed net financed assets 所管理的已筹资金资产净额平均值aviation authority 民航当局backed-up servicer 替补服务者backhoe反铲装载机balance sheet date 资产负债表日bandwidth 带宽bank affiliates 银行的下属机构bank quote 银行报价bankruptcy cost 破产成本bankruptcy court 破产法院bankruptcy law 破产法bankruptcy proceedings 破产程序bankruptcy 破产bareboat charterer 光船承租人bargain renewal option廉价续租任择权basic earnings per share每股基本收益basic rent基本租金(各期应付的租金)beneficiaries受益人big-ticket items大额项目bill and collect开票和收款binding agreement有约束力的协议blind vendor discount卖主暗扣bluebook蓝皮书(美国二手市场设备价格手册)book income账面收入book loses账面亏损borrower借款人BPO(bargain purchase option)廉价购买任择权bridge facility桥式融通bridge桥梁broker fee经纪人费brokers经纪人build-to-suit leases(租赁物由承租人)承建或承造的租赁协议bulldozer推土机bundled additional services捆绑(在一起的)附加服务bundling捆绑(服务)business acquisition业务收购business and occupation tax营业及开业许可税business generation业务开发business trust商业信托by(e)-laws细则。

【财务会计管理】企业环境成本会计外文翻译xxxx年xx月xx日xxxxxxxx集团企业有限公司Please enter your company's name and contentvIMPLEMENTING ENVIRONMENTAL COSTACCOUNTING IN SMALL AND MEDIUM-SIZEDCOMPANIES1.ENVIRONMENTAL COST ACCOUNTING IN SMESSince its inception some 30 years ago, Environmental Cost Accounting (ECA) has reached a stage of development where individual ECA systems are separated from the core accounting system based an assessment of environmental costs with (see Fichter et al., 1997, Letmathe and Wagner , 2002).As environmental costs are commonly assessed as overhead costs, neither the older concepts of full costs accounting nor the relatively recent one of direct costing appear to represent an appropriate basis for the implementation of ECA. Similar to developments in conventional accounting, the theoretical and conceptual sphere of ECA has focused on process-based accounting since the 1990s (see Hallay and Pfriem, 1992, Fischer and Blasius, 1995, BMU/UBA, 1996, Heller et al., 1995, Letmathe, 1998, Spengler and H.hre, 1998).Taking available concepts of ECA into consideration, process-based concepts seem the best option regarding the establishment of ECA (see Heupel and Wendisch , 2002). These concepts, however, have to be continuously revised to ensure that they work well when applied in small and medium-sized companies.Based on the framework for Environmental Management Accounting presented in Burritt et al. (2002), our concept of ECA focuses on two maingroups of environmentally related impacts. These are environmentally induced financial effects and company-related effects on environmental systems (see Burritt and Schaltegger, 2000, p.58). Each of these impacts relate to specific categories of financial and environmental information. The environmentally induced financial effects are represented by monetary environmental information and the effects on environmental systems are represented by physical environmental information. Conventional accounting deals with both –monetary as well as physical units –but does not focus on environmental impact as such. T o arrive at a practical solution to the implementation of ECA in a company’s existing accounting system, and to comply with the problem of distinguishing between monetary and physical aspects, an integrated concept is required. As physical information is often the basis for the monetary information (e.g. kilograms of a raw material are the basis for the monetary valuation of raw material consumption), the integration of this information into the accounting system database is essential. From there, the generation of physical environmental and monetary (environmental) information would in many cases be feasible. For many companies, the priority would be monetary (environmental) information for use in for instance decisions regarding resource consumptions and investments. The use of ECA in small and medium-sized enterprises (SME) is still relatively rare, so practical examples available in the literature are few and far between. One problem is that the definitions of SMEs vary between countries (see Kosmider, 1993 and Reinemann,1999). In our work the criteria shown in Table 1 are used to describe small and medium-sized enterprises.Table 1. Criteria of small and medium-sized enterprisesNumber of employees TurnoverUp to 500 employees Turnover up to EUR 50mManagement Organization- Owner-cum-entrepreneur -Divisional organization is rare- Varies from a patriarchal management -Short flow of information stylein traditional companies and teamwork -Strong personal commitmentin start-up companies -Instruction and controlling with- Top-down planning in old companies direct personal contact- Delegation is rare- Low level of formality- High flexibilityFinance Personnel- family company -easy to survey number ofemployees- limited possibilities of financing -wide expertise-high satisfaction of employeesSupply chain Innovation-closely involved in local -high potential of innovationeconomic cycles in special fields- intense relationship with customersand suppliersKeeping these characteristics in mind, the chosen ECA approach should be easy to apply, should facilitate the handling of complex structures and at the same time be suited to the special needs of SMEs.Despite their size SMEs are increasingly implementing Enterprise Resource Planning (ERP) systems like SAP R/3, Oracle and Peoplesoft. ERP systems support business processes across organizational, temporal and geographical boundaries using one integrated database. The primary use of ERP systems is for planning and controlling production and administration processes of an enterprise. In SMEs however, they are often individually designed and thus not standardized making the integration of for instance software that supports ECA implementation problematic. Examples could be tools like the “eco-efficiency” approach of IMU (2003) or Umberto (2003) because these solutions work with the database of more comprehensive software solutions like SAP, Oracle, Navision or others. Umberto software for example (see Umberto, 2003) would require large investments and great backgroundknowledge of ECA – which is not available in most SMEs.The ECA approach suggested in this chapter is based on an integrative solution –meaning that an individually developed database is used, and the ECA solution adopted draws on the existing cost accounting procedures in the company. In contrast to other ECA approaches, the aim was to create an accounting system that enables the companies to individually obtain the relevant cost information. The aim of the research was thus to find out what cost information is relevant for the company’s decision on environmental issues and how to obtain it.2.METHOD FOR IMPLEMENTING ECASetting up an ECA system requires a systematic procedure. The project thus developed a method for implementing ECA in the companies that participated in the project; this is shown in Figure 1. During the implementation of the project it proved convenient to form a core team assigned with corresponding tasks drawing on employees in various departments. Such a team should consist of one or two persons from the production department as well as two from accounting and corporate environmental issues, if available. Depending on the stage of the project and kind of inquiry being considered, additional corporate members may be added to the project team to respond to issues such as IT, logistics, warehousing etc.Phase 1: Production Process VisualizationAt the beginning, the project team must be briefed thoroughly on thecurrent corporate situation and on the accounting situation. To this end, the existing corporate accounting structure and the related corporate information transfer should be analyzed thoroughly. Following the concept of an input/output analysis, how materials find their ways into and out of the company is assessed. The next step is to present the flow of material and goods discovered and assessed in a flow model. T o ensure the completeness and integrity of such a systematic analysis, any input and output is to be taken into consideration. Only a detailed analysis of material and energy flows from the point they enter the company until they leave it as products, waste, waste water or emissions enables the company to detect cost-saving potentials that at later stages of the project may involve more efficient material use, advanced process reliability and overview, improved capacity loads, reduced waste disposal costs, better transparency of costs and more reliable assessment of legal issues. As a first approach, simplified corporate flow models, standardized stand-alone models for supplier(s), warehouse and isolated production segments were established and only combined after completion. With such standard elements and prototypes defined, a company can readily develop an integrated flow model with production process(es), production lines or a production process as a whole. From the view of later adoption of the existing corporate accounting to ECA, such visualization helps detect, determine, assess and then separate primary from secondary processes.Phase 2: Modification of AccountingIn addition to the visualization of material and energy flows, modeling principal and peripheral corporate processes helps prevent problems involving too high shares of overhead costs on the net product result. The flow model allows processes to be determined directly or at least partially identified as cost drivers. This allows identifying and separating repetitive processing activity with comparably few options from those with more likely ones for potential improvement.By focusing on principal issues of corporate cost priorities and on those costs that have been assessed and assigned to their causes least appropriately so far, corporate procedures such as preparing bids, setting up production machinery, ordering (raw) material and related process parameters such as order positions, setting up cycles of machinery, and order items can be defined accurately. Putting several partial processes with their isolated costs into context allows principal processes to emerge; these form the basis of process-oriented accounting. Ultimately, the cost drivers of the processes assessed are the actual reference points for assigning and accounting overhead costs. The percentage surcharges on costs such as labor costs are replaced by process parameters measuring efficiency (see Foster and Gupta, 1990).Some corporate processes such as management, controlling and personnel remain inadequately assessed with cost drivers assigned to product-related cost accounting. Therefore, costs of the processes mentioned, irrelevant to the measure of production activity, have to be assessed and surcharged with aconventional percentage.At manufacturing companies participating in the project, computer-integrated manufacturing systems allow a more flexible and scope-oriented production (eco-monies of scope), whereas before only homogenous quantities (of products) could be produced under reasonable economic conditions (economies of scale). ECA inevitably prevents effects of allocation, complexity and digression and becomes a valuable controlling instrument where classical/conventional accounting arrangements systematically fail to facilitate proper decisions.Thus, individually adopted process-based accounting produces potentially valuable information for any kind of decision about internal processing or external sourcing (e.g. make-or-buy decisions).Phase 3: Harmonization of Corporate Data – Compiling and Acquisition On the way to a transparent and systematic information system, it is convenient to check core corporate information systems of procurement and logistics, production planning, and waste disposal with reference to their capability to provide the necessary precise figures for the determined material/energy flow model and for previously identified principal and peripheral processes. During the course of the project, a few modifications within existing information systems were, in most cases, sufficient to comply with these requirements; otherwise, a completely new software module would have had to be installed without prior analysis to satisfy the data requirements.Phase 4: Database conceptsWithin the concept of a transparent accounting system, process-based accounting can provide comprehensive and systematic information both on corporate material/ energy flows and so-called overhead costs. To deliver reliable figures over time, it is essential to integrate a permanent integration of the algorithms discussed above into the corporate information system(s). Such permanent integration and its practical use may be achieved by applying one of three software solutions (see Figure 2).For small companies with specific production processes, an integrated concept is best suited, i.e. conventional and environmental/process-oriented accounting merge together in one common system solution.For medium-sized companies, with already existing integrated production/ accounting platforms, an interface solution to such a system might be suitable. ECA, then, is set up as an independent software module outside the existing corporate ERP system and needs to be fed data continuously. By using identical conventions for inventory-data definitions within the ECA software, misinterpretation of data can be avoided.Phase 5: Training and CoachingFor the permanent use of ECA, continuous training of employees on all matters discussed remains essential. T o achieve a long-term potential of improved efficiency, the users of ECA applications and systems must be able to continuously detect and integrate corporate process modifications andchanges in order to integrate them into ECA and, later, to process them properly.中小企业环境成本会计的实施一、中小企业的环境成本会计自从成立三十年以来,环境成本会计已经发展到一定阶段,环境会计成本体系已经从以环境成本评估为基础的会计制度核心中分离出来(参考Fichter et al., 1997, Letmathe 和Wagner , 2002)。

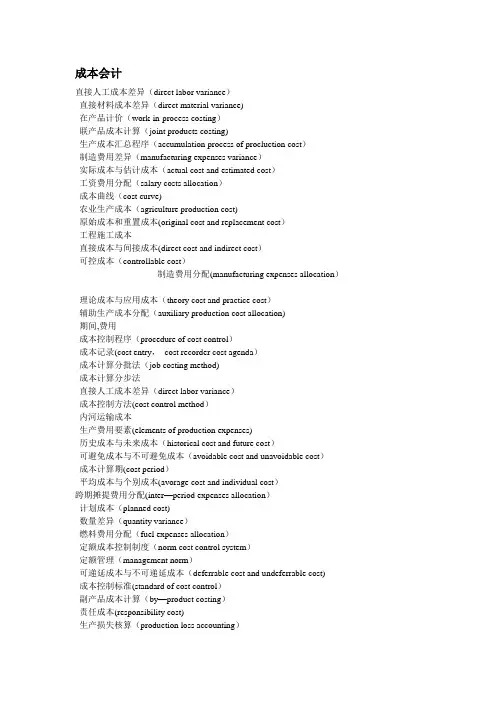

成本会计直接人工成本差异(direct labor variance)直接材料成本差异(direct material variance)在产品计价(work-in-process costing)联产品成本计算(joint products costing)生产成本汇总程序(accumulation process of procluction cost)制造费用差异(manufacturing expenses variance)实际成本与估计成本(actual cost and estimated cost)工资费用分配(salary costs allocation)成本曲线(cost curve)农业生产成本(agriculture production cost)原始成本和重置成本(original cost and replacement cost)工程施工成本直接成本与间接成本(direct cost and indirect cost)可控成本(controllable cost)制造费用分配(manufacturing expenses allocation)理论成本与应用成本(theory cost and practice cost)辅助生产成本分配(auxiliary production cost allocation)期间,费用成本控制程序(procedure of cost control)成本记录(cost entry,cost recorder cost agenda)成本计算分批法(job costing method)成本计算分步法直接人工成本差异(direct labor variance)成本控制方法(cost control method)内河运输成本生产费用要素(elements of production expenses)历史成本与未来成本(historical cost and future cost)可避免成本与不可避免成本(avoidable cost and unavoidable cost)成本计算期(cost period)平均成本与个别成本(avorage cost and individual cost)跨期摊提费用分配(inter—period expenses allocation)计划成本(planned cost)数量差异(quantity variance)燃料费用分配(fuel expenses allocation)定额成本控制制度(norm cost control system)定额管理(management norm)可递延成本与不可递延成本(deferrable cost and undeferrable cost)成本控制标准(standard of cost control)副产品成本计算(by—product costing)责任成本(responsibility cost)生产损失核算(production loss accounting)生产成本(production cost)预计成本(predicted cost)成本结构(cost structure)房地产开发成本主要成本与加工成本(prime costs and processing costs) 决策成本(cost of decision making)成本计算品种法(category costing method)在产品成本(work-in—process cost)工厂成本(factory cost)成本考核(cost assess )制造费用(manufactruing expenses)动力费用分配(power expenses allocation)趋势分析法(trend analysis approach)成本计算简单法(simple costing method)责任成本层次(levels of responsibility cost)对比分析法(comparative analysis approach)约当产量比例法(equivalent units method)原始记录(original record)可比产品成本分析(general product cost analysis)成本计算方法(costing method)成本计算对象(costing objective)成本计算单位(costing unit)成本计划完成情况分析成本计划管理体系(planned management system of cost) 成本计划(cost plan)成本会计(cost accounting)成本核算原则(principle of costing)成本核算程序(cost accounting qrocedures)成本核算成本(costing account)成本核算(costing)成本归集(cost accumulation)成本管理(cost management)成本分析(cost analysis)成本分配(ocst allocation)成本分类账(cost ledger)成本分类(cost classifiction)成本费用界限成本调整(cost adjustment)成本差异(cost variance)成本报告(costing report)成本(cost)车间成本(workshop cost)厂内经济核算制(internal business accounting system)厂内结算价格(internal settlement prices)产品寿命周期成本(product life cycle cost)产品成本项目(cost items of product)产品成本技术经济分析产品成本计划(the plan of product costs)产品成本(product cost)初级会计汇总原始凭证(cumulative source document)汇总记账凭证核算形式(bookkeeping procedure using summary ovchers)工作底稿(working paper)复式记账凭证(mvltiple account titles voucher)复式记账法(Double entry bookkeeping)复合分录(compound entry)划线更正法(correction by drawing a straight ling)汇总原始凭证(cumulative source document)会计凭证(accounting documents)会计科目表(chart of accounts)会计科目(account title)红字更正法(correction by using red ink)会计核算形式(bookkeeping procedures)过账(posting)会计分录(accounting entry)会计循环(accounting cycle)会计账簿(Book of accounts)活页式账簿(loose-leaf book)集合分配账户(clearing accounts)计价对比账户(matching accounts)记账方法(bookkeeping methods)记账规则(recording rules)记账凭证(voucher)记账凭证核算形式(Bookkeeping proced ureusing vouchers)记账凭证汇总表核算形式(bookkeeping procedure using categorized account summary) 简单分录(simple entry)结算账户(settlement accounts)结账(closing account)结账分录(closing entry)借贷记账法(debit—credit bookkeeping)通用日记账核算形式(bookkeeping procedure using general journal)外来原始凭证(source document from outside)现金日记账(cash journal)虚账户(nominal accounts)序时账簿(book of chronological entry)一次凭证(single—record document)银行存款日记账(deposit journal)永续盘存制(perpetual inventory system)原始凭证(source document)暂记账户(suspense accounts)增减记账法(increase—decrease bookkeeping)债权结算账户(accounts for settlement of claim)债权债务结算账户(accounts for settlement of claim and debt)债务结算账户(accounts for settlement of debt)账户(account)账户编号(Account number)账户对应关系(debit—credit relationship)账项调整(adjustment of account)专用记账凭证(special—purpose voucher)转回分录(reversing entry)资金来源账户(accounts of sources of funds)资产负债账户(balance sheet accounts)转账凭证(transfer voucher)资金运用账户(accounts of applications of funds)自制原始凭证(internal source document)总分类账簿(general ledger)总分类账户(general account)附加账户(adjunct accounts)付款凭证(payment voucher)分类账簿(ledger)中级会计固定资产(fixed assets)利润总额利益分配(profit distribution)应计费用(accrued expense)商标权(trademarks and tradenames)全部履行法净利润(net income)应付利润(profit payable)未分配利润收益债券(income bonds)货币资金利息资本化(capitalization of interests)公益金工程物资预付账款(advance to supplier)其他应收款(other receivables)现金(cash)预收账款公司债券发行(corporate bond floatation)应付工资(wages payable)实收资本(paid—in capital)盈余公积(surplus reserves)管理费用土地使用权股利(dividend)应交税金(taxes payable)流动资金负商誉(negative goodwill)费用的确认(recognition of expense)短期投资(temporary investment)专项资产【旧】专有技术(know—how)专营权(franchises)资本公积(capital reserves)资产负债表法资金占用和资金来源[旧]自然资源(natural resources)存货(inventory)车间经费【旧】偿债基金(sinking fund)长期应付款(long-term payables)长期投资(long—term investments)长期借款(long—term loans)长期负债(long—term liability of long-term debt) 财务费用(financing expenses)拨定留存收益(appropriated retained earnings)标准成本法(standard costing)变动成本法(variable costing)比例履行法包装物版权(copyrights)高级会计期货交易市场(market of futures transaction)期货交易(futures transaction)举债经营融资租赁(leveraged lease)金融工具(financial instruments)企业集团(business qroup)年度报告(annual report)内部往来(transactions between home office and branches)合伙企业(partnership enterprise)合并资产负债表(consolidated balance sheet)合并主体的所得税会计(accounting for income taxes of consolidated entities)(美)合并现金流量表(consolidated statement of cash flow)合并价差(cost—book value differentials)合并会计报表(consolidated financial statements)购买法(purchase methed)企业整体价值(the value of an enterprise as a whole)权益结合法(pooling of interest method)期内所得税分摊(intraperiod tax allocation)(美)期末存货的未实现损益(unrealized profit in ending inventory)公司间的长期资产业务(intercompany transactions in long-term assets)名义货币保全(maintaining capital in units of money)基金论(the fund theory)功能性货币(functional currency)(美)汇兑损益(exchange gains or losses)合并财务状况变动表(consolidated statement of changes in financial poition)合并财务状况变动表(consolidated statement of changes in financial poition)换算损益(translation gains or losses)举债经营收购(Leveraged buyouts,简称LBC)(美)母公司持股比例变动(change in ownership percentage held by parent)交互分配法(reciprocal allocation approach)(美)货币项(monetary items)合伙清算(partnership liquidation全面分摊法(comprehensive allocation)固定资产投资方向调节税合并费用(expenses related to combinations)间接标价法(indirect quotation)买入汇率(buying rate)期货合约(futrues contract)混合合并(conglomeration)控投公司(holding company)股票指数期货(stock index futrues)横向销售(crosswise sale)固定汇率(fixed rate)纳税影响法(tax effect method)记账汇率(recording rate)横向合并(horizontal integration)合并前股利(preacquisition dividends)可变现净值(net realizable)企业合并会计(accounting for business combination)平仓盈亏(offset gain and loss)卖出汇率(selling rate)金融期货交易(financial futures transaction)会计利润(accounting income)合并损益表(consolidated income statement)公允价值(fair value)期权(options)间接控股(indirect holding)两笔交易观(two-transaction opinion)破产清算(bankrupcy liquidation)企业合并(business combination)企业论(the enterprise theory)商品寄销(consignment)个人所得税(personal income tax)个人财务报表(personal financial state—ments)(美)改组计划(reorganization plan)(美)改组(reorganization)复杂权益法(complex equity method)附属公司(associated company)负权人偿金(dividend)浮动汇率(floating rate)分支机构会计(accounting for branch)推定赎回损益(constructive gains and losses on bonds)推定赎回(constructive retirement)投机(spculation)贴水(discount)特定物价指数(specific price index)分支机构(branch)分期收款销货(installment sales)分次清算(installment liquidation)分部报告(segmental reporting)房地产收入(real estate revenue)房地产成本(cost of real setate)房地产(real estate)多种汇率法(multiply exchange rate)对境外实体的净投资(net investment in foreign entities)订量单位:(units of measurement)递延法(deffered method)当代理论(contemporary theory)单一汇率法(singal method)退休金(pension plan)退休金会计(accounting for pension plan)(美)退休金给付义务(pension benefit obligations)(美)外币(foreign currency)外币业务(foreign currency transaction)吸收合并(merger)物价变动会计(accounting for price changes)无偿债能力(insolvency)完全合并(full consolidation)物价指数(price index)物价变动(price changes)完全应计法(full accrual method)物价总指数(general price index)外汇期货交易(foreign exchange frtrues transaction)下推会计(push—down accounting)(美)先折算后调整法(translation—remeasurement method)现行成本/稳值货币会计(current cost/general purchasing power accountin)现行成本(crurent cost)现行成本会计(current cost accounting)先调整后折算法(remeasurement—translation method)销售代理处(sales agency)相互持股(mutual holdings)相对账户调节(reconciliation of home office and branch accounts)新合伙人入伙(admission of a new parther)向上销售(upstream sale)衍生金融工具(derivative financial instru—ments)销售式融资租赁(sales-type financing lease)向下销售(downstream sale)消费税(consumer tax)一笔交易观(one—transaction opinion)业主权论(the proprietorship theory)一般物价水准会计(general price level accounting)一般购买力单位(units of general purchasing power)招股说明书(prospectus)中间汇率(middle rate)中期报告(interim reporting)重置成本(replacement cost)转租赁(subleases)准改组(quasi—reorbganization)(美)资本保全(capital maintenance)资本化价值(capitalized value)资本因素(capital factor)资产负债法(asset/libility method)存货转让价格(inventory transfer price)创立合并(consolidation)出租人会计(accounting for leases-lessor)持有(产)损益(holding gains losses)持仓盈亏(opsition gain and loss)承租人会计(accounting for leases—leasee)成本回收法(cost recovery method)纵向合并(Vertical integration)综合变动(general change)子公司权益变动(change in ownership of a subsidiary) 子公司(subsidiary company)资源税(resources tax)成本法(cost method)财产信托会计(fiduciary accounting)(美)财产税(property tax)部分分摊法(partial allocation)不合并子公司(unconsolidated subsidiaries)最低退休金负债(minimum liability)(美)租赁(leases)租金(rents)企业会计企业财务(business finance)期权市场(option market)期货市场(future market)可转让定期存单市场(negotiable CDmarket)货币市场(money market)黄金市场(gold market)国有独资公司股份有限公司(company limited by shares)股份两合公司(limited pactnership)公司(company)二级市场(security secondary market)独资企业(sole proprietorship)店头市场(over-the —counter—market)承兑市场(acceptance market)拆借市场(lending market)财务制度(financial regulations)财务政策(financial policy)财务预测(financial forecast)财务控制(financial control)金融市场(financial market)财务决策(financial decision)财务监督(financial cupervision)财务计划(financial planning)财务活动(financial activities)财务管理组织(organization of financial management) 一级市场(security primary market)无限责任公司(company of unlimited liability)外汇市场(foreign exchange market)贴现市场(dixcount market)企业组织形式(forms of enterprise organization)政府会计企业财务(business finance)期权市场(option market)期货市场(future market)可转让定期存单市场(negotiable CDmarket)货币市场(money market)黄金市场(gold market)国有独资公司股份有限公司(company limited by shares)股份两合公司(limited pactnership)公司(company)二级市场(security secondary market)独资企业(sole proprietorship)店头市场(over—the —counter-market)承兑市场(acceptance market)拆借市场(lending market)财务制度(financial regulations)财务政策(financial policy)财务预测(financial forecast)财务控制(financial control)金融市场(financial market)财务决策(financial decision)财务监督(financial cupervision)财务计划(financial planning)财务活动(financial activities)财务管理组织(organization of financial management)一级市场(security primary market)无限责任公司(company of unlimited liability)外汇市场(foreign exchange market)贴现市场(dixcount market)企业组织形式(forms of enterprise organization)事业单位会计(accounting for non—profit organizations)事业单位固定资产(fixed assets for non-profit organizations)事业单位固定基金(fixed funds non—profit organizations)事业单位负债(liabilities for non—profit organizations)事业单位对外投资(outside investments for non-profit organizations) 事业单位财务清算(liquidation of non—profit organization)上缴上级支出(payment to the higher authority)上级补助收入(grant from the higher authority)其他收入(miscellaneous gains)科学事业单位资产(scientific research instifutes’assets)科学事业单位支出(scientific research institutes’expenditures)科学事业单位预算(scientific research institutes’budgeting)科学事业单位收入(scientific research institutes'revenues)科学事业单位结余(scientific research institutes'surplus)科学事业单位会计制度(accointing regulations for scientific research instifutes)科学事业单位会计报表分析(scientific research institutes—analysis of accounting statements) 科学事业单位会计(sicentific research institute accounting)科学事业单位成本费用管理(scientific research institutes—cost maragement)科学事业单位财务制度(financial regulations for scientific research institutes)经营支出(orerating expense )经营收入(operating revenue)基金预算支出(fund budget expenditure)基金预算收入(fund budget revenue)基金预算结余(surplus of fund budget)国家预算(state budget)国家决算(final accounts of state revenue and expenditure)高等学校资产(colleges and universities assets)高等学校支出(colleges and universities expenditures)高等学校预算管理方式(budget management method of colleges and universities)高等学校收入(colleges and universities revenues)专用基金支出(expenditure on special purpose fund)专用基金收入(proceeds from special purpose fund)专用基金结余(surplus of special purpose funds)中华人民共和国预算法(the budget law of the people's Republic of China)资金调拨支出(expenditure on allocated and transeferred fund)财政收入(public finance-revemue)财政净资产(public finance—net assets)财政负债(public finance—liabilities)财政补助收入(grant from the state)拨入专款(restricted appropriation)dsa管理会计政治风险(political risk)再开票中心(reinvoicing center)现代管理会计专门方法(special methods of modern management accounting)现代管理会计(modern management accounting)提前与延期支付(Leads and Lags)特许权使用管理费(fees and royalties)跨国资本成本的计算(the cost of capital for foreign lnuertments)跨国运转资本会计(multinational working capital management)跨国经营企业业绩评价(multinational performance evaluation)经济风险管理(managing economic exposure )交易风险管理(managing transaction exposure)换算风险管理(managing translation exposure)国际投资决策会计(foreign project appraisal)国际管理会计(international management)国际存货管理(international inventory management)股利转移(dividend kemittances)公司内部贷款(intercompany loans)冻结资金转移(repatriating blocked funds)冻结资金保值(maintaining the value of blocked funds)调整后的净现值(adjusted net present value)。

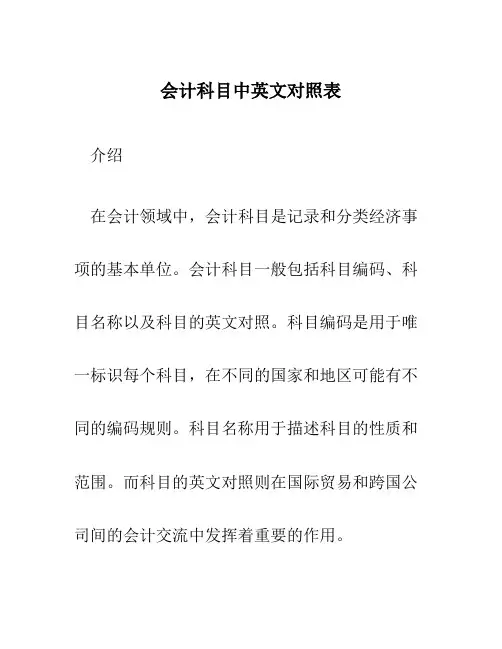

会计科目中英文对照表介绍在会计领域中,会计科目是记录和分类经济事项的基本单位。

会计科目一般包括科目编码、科目名称以及科目的英文对照。

科目编码是用于唯一标识每个科目,在不同的国家和地区可能有不同的编码规则。

科目名称用于描述科目的性质和范围。

而科目的英文对照则在国际贸易和跨国公司间的会计交流中发挥着重要的作用。

本文档将提供一个包含常见会计科目的中英文对照表,帮助读者在进行会计相关工作时更好地理解和运用会计科目。

会计科目中英文对照表科目编码中文科目名称英文科目名称1001 流动资产Current assets1002 非流动资产Non-current assets 2001 流动负债Current liabilities 2002 非流动负债Non-current liabilities3001 所有者权益Owner’s equity 4001 营业收入Operating revenue 5001 营业成本Operating expenses 6001 税前利润Profit before tax 7001 净利润Net profit8001 现金流量表Cash flow statement 9001 资产负债表Balance sheet 10001 利润表Income statement科目解析流动资产 (Current assets)流动资产指的是企业在经营过程中短期内能够转化为现金或者在一年内使用的资产。

常见的流动资产包括现金、应收账款、存货等。

流动资产的增减反映了企业的经营活动和财务状况。

非流动资产 (Non-current assets)非流动资产指的是企业在经营过程中长期内使用的资产,无法迅速转化为现金。

常见的非流动资产包括固定资产、无形资产、长期投资等。

非流动资产的增减体现了企业在长期内的投资决策和资本运作。

流动负债 (Current liabilities)流动负债指的是企业在经营过程中应于一年内偿还的债务。

有关环境的会计英文Environmental accounting refers to the incorporation of environmental costs and benefits into an organization's financial reporting and decision-making processes. It involves tracking and assessing the environmental impact of an organization's activities, as well as the costs associated with environmental compliance and conservation efforts.There are several types of environmental accounting, including:1. Environmental cost accounting: This involves identifying and accounting for the costs associated with environmental protection and compliance, such as pollution control measures, waste disposal, and environmental remediation.2. Environmental performance accounting: This focuses on measuring and tracking an organization's environmental performance, such as energy consumption, greenhouse gas emissions, water usage, and waste generation, and reporting this information both internally and externally.3. Natural capital accounting: This involves valuing and accounting for the economic contribution of natural resources, such as forests, ecosystems, and biodiversity, and their depletion or degradation due to an organization's activities.4. Environmental risk accounting: This identifies and assesses the financial risks associated with an organization's exposure to environmental risks, such as climate change, natural disasters, and regulatory changes.Environmental accounting provides a comprehensive picture of an organization's environmental impact and helps address sustainability challenges. It can inform strategic decision-making, resource allocation, and risk management, and also allows organizations to demonstrate their commitment to environmental stewardship to stakeholders, investors, and customers.。

会计英语中英文对照会计方面专业术语的英文翻译acceptance承兑account账户accountant会计员accounting会计accountingytem会计制度accountpayable应付账款accountreceivable应收账款accumulatedprofit累积利益adjutingentry调整记录adjutment调整adminitratione某pene管理费用advance预付advertiinge某pene广告费agency代理agent代理人agreement契约allotment分配数allowance津贴amalgamation合并amortization摊销amortizedcot应摊成本annuitie年金appliedcot已分配成本appliede某pene已分配费用appliedmanufacturinge某pene己分配制造费用apportionedcharge摊派费用appreciation涨价articleofaociation公司章程aement课税aet资产attorneyfee律师费audit审计auditor审计员average平均数averagecot平均成本baddebt坏账balance余额yybalanceheet资产负债表bankaccount银行账户bankbalance银行结存bankcharge银行手续费bankdepoit银行存款bankdicount银行贴现bankdraft银行汇票bankloan银行借款bankoverdraft银行透支bankeracceptance银行承兑bankruptcy破产bearer持票人beneficiary受益人bequet遗产bill票据billofe某change汇票billoflading提单billdicounted贴现票据billpayable应付票据billreceivable应收票据boardofdirector董事会bond债券bonu红利bookvalue账面价值bookkeeper簿记员bookkeeping簿记branchofficegeneralledger支店往来账户broker经纪人broughtdown接前broughtforward接上页budget预算by-product副产品by-productale副产品销售capital股本capitaloutlay资本支出capitaltock股本capitaltockcertificate股票carrieddown移后carriedforward移下页cah现金cahaccount现金账户cahinbank存银行现金cahondelivery交货收款cahonhand库存现金cahpayment现金支付cahpurchae现购cahale现沽cahier出纳员cahiercheck本票certificateofdepoit存款单折certificateofindebtedne借据certifiedcheck保付支票certifiedpublicaccountant会计师charge费用chargeforremittance汇水手续费charter营业执照charteredaccountant会计师chattle动产check支票checkbooktub支票存根cloedaccount己结清账户cloing结算cloingentrie结账纪录cloingtock期末存货cloingthebook结账columnarjournal多栏日记账conignee承销人conignment寄销conignor寄销人conolidatedbalanceheet合并资产负债表conolidatedprofitandloaccount合并损益表conolidation合并contructioncot营建成本contructionrevenue营建收入contract合同controlaccount统制账户copyright版权corporation公司cot成本cotaccounting成本会计cotoflabour劳工成本cotofproduction生产成本cotofmanufacture制造成本cotofale销货成本cotprice成本价格credit贷方creditnote收款通知单creditor债权人croedcheck横线支票currentaccount往来活期账户currentaet流动资产currentliability流动负债currentprofitandlo本期损益debit借方debt债务debtor债务人deed契据deferredaet递延资产deferredliabilitie递延负债delivery交货deliverye某pene送货费deliveryorder出货单demanddraft即期汇票demandnote即期票据demurragecharge延期费depoit存款depoitlip存款单depreciation折旧directcot直接成本directlabour直接人工director董事dicount折扣dicountonpurchae进货折扣dicountonale销货折扣dihonouredcheck退票diolution解散dividend股利dividendpayable应付股利documentarybill押汇汇票document单据doubleentrybookkeeping复式簿记draft汇票drawee付款人drawer出票人drawing提款duplicate副本dutieandta某e税捐earning业务收益endorer背书人entertainment交际费enterprie企业equipment设备etate财产etimatedcot估计成本etimate概算e某change兑换e某changelo兑换损失e某penditure经费e某pene费用e某tenion延期facevalue票面价值factor代理商fairvalue公平价值financialtatement财务报表financialyear财政年度finihedgood制成品finihedpart制成零件fi某edaet固定资产fi某edcot固定成本fi某eddepoit定期存款fi某ede某pene固定费用foreman工头franchie专营权freight运费fund资金furnitureandfi某ture家俬及器具gain利益generale某pene总务费用generalledger总分类账good货物goodintranit在运货物goodwill商誉governmentbond政府债券groprofit毛利guarantee保证guarantor保证人importduty进口税indirectcot间接成本indirecte某pene间接费用indirectlabour间接人工indorement背书intallment分期付款inurance保险intangibleaet无形资产interet利息interetrate利率interetreceived利息收入interofficeaccount内部往来intrinicvalue内在价值inventory存货invetment投资invoice发票item项目job工作jobcot工程成本jointventure短期合伙journal日记账labour人工labourcot人工成本land土地leae租约leaehold租约ledger分类账legale某pene律师费letterofcredit信用状liability负债limitedliability有限负债limitedpartnerhip有限合夥liquidation清盘loan借款longtermliability长期负债lo损失loone某change兑换损失machineryequipment机器设备manufacturinge某pene制造费用manufacturingcot制造成本marketprice市价material原村料materialrequiition领料单medicalfee医药费merchandie商品micellaneoue某pene杂项费用mortgage抵押mortgagor抵押人mortgagee承押人movableproperty动产netamount净额netaet资产净额netlo净亏损netprofit纯利netvalue净值note票据notepayable应付票据notereceivable应收票据openingtock期初存货operatinge某pene营业费用order订单organizatione某pene开办费originaldocument原始单据outlay支出output产量overdraft透支openingtock期初存货operatinge某pene营业费用order订单organizatione某pene开办费originaldocument原始单据outlay支出output产量overdraft透支quotation报价rate比率rawmaterial原料rebate回扣receipt收据receivable应收款recoup补偿redemption偿还refund退款remittance汇款rent租金repair修理费reerve准备reidualvalue剩余价值retailer零售商return退货revenue收入alary薪金ale销货alereturn销货退回aledicount销货折扣alvage残值amplefee样品crap废料crapvalue残余价值ecuritie证券ecurity抵押品ellinge某pene销货费用ellingprice售价harecapital股份harecertificate股票hareholder股东horttermloan短期借款oleproprietorhip独资parepart配件tandardcot标准成本tock存货tocktake盘点tockheet存货表ubidie补助金undrye某pene杂项费用upportingdocument附表urplu盈余upeneaccount暂记账户ta某ableprofit可徵税利润ta某税捐temporarypayment暂付款temporaryreceipt暂收款total合计totalcot总成本tradecreditor进货客户tradedebtor销货客户trademark商标tranaction交易tranfer转账tranfervoucher转账传票tranportation运输费travelling差旅费trialbalance试算表trut信托turnover营业额unappropriatedurplu未分配盈余unitcot单位成本unlimitedliability无限责任unpaiddividend未付股利valuation估价value价值vendor卖主voucher传票wagerate工资率wage工资wageallocationheet工资分配表warehouereceipt仓库收据welfaree某pene褔利费wearandtear秏损workorder工作通知单yearend年结Account帐户Accountingytem会计系统AmericanAccountingAociation美国会计协会AmericanIntituteofCPA美国注册会计师协会Audit审计Balanceheet资产负债表Bookkeepking簿记Cahflowpropect现金流量预测CertificateinInternalAuditing内部审计证书CertificateinManagementAccounting管理会计证书CertificatePublicAccountant注册会计师Cotaccounting成本会计E某ternaluer外部使用者Financialaccounting财务会计FinancialAccountingStandardBoard财务会计准则委员会Financialforecat财务预测Generallyacceptedaccountingprinciple公认会计原则General-purpoeinformation通用目的信息GovernmentAccountingOffice政府会计办公室IntituteofInternalAuditor内部审计师协会IntituteofManagementAccountant管理会计师协会Integrity整合性Internalauditing内部审计Internalcontroltructure内部控制结构InternalRevenueService国内收入署Internaluer内部使用者Managementaccounting管理会计Returnofinvetment投资回报Returnoninvetment投资报酬Statementofcahflow现金流量表Statementoffinancialpoition财务状况表Ta某accounting税务会计Accountingequation会计等式Articulation勾稽关系Aet资产Buineentity企业个体Capitaltock股本Corporation公司Cotprinciple成本原则Creditor债权人Deflation通货紧缩Dicloure批露E某pene费用Financialtatement财务报表Financialactivitie筹资活动Going-concernaumption持续经营假设Inflation通货膨涨Invetingactivitie投资活动Liabilitie负债Negativecahflow负现金流量Operatingactivitie经营活动Owner"equity所有者权益Partnerhip合伙企业Poitivecahflow正现金流量Retainedearning留存利润Revenue收入Soleproprietorhip独资企业Solvency清偿能力Stable-dollaraumption稳定货币假设Stockholder股东Stockholder"equity股东权益Windowdreing门面粉饰。