金融市场学第8章

- 格式:ppt

- 大小:469.00 KB

- 文档页数:35

金融市场学名词解析第一章金融市场概述1 金融市场:交易金融工具的场所2 分类对象:货币市场、债券市场、股票市场、基金市场外汇市场、黄金市场、金融衍生工具市场时间:货币市场(六大市场)、资本市场(债券市场、股票市场)融资:直接和间接(是否金融机构参与,主要是银行)直接(股票、政府债券、公司债券、商业票据等)间接(金融债券、银行票据、存单等)国内和国外,国外包括外国和境外(离岸)3 金融工具特征偿还性:期限性(不是所有金融工具都有期限性,比如股票)流动性:资产变现的能力收益性:收益率(收益/本金,收益:利息和资本利得)风险性:用方差度量第二章货币市场同业拆借市场:同业拆借市场利率(IBOR),基准利率、浮动利率LIBOR, HIBOR, SIBOR回购协议:正回购、逆回购短期政府债券:国库券票据市场:汇票、本票、支票大额可转让存单:CDs货币市场基金市场第三章债券市场1根据计息方式不同,债券不同类型的定价公式现金流贴现求和V—面值,c—票面利率,i—市场利率,n—期限r—到期收益率,P—价格现值(1)附息债券P=Vc/(1+i)+Vc/(1+i)2 +…+Vc/(1+i)n+ V/(1+i) nVc=C, i=r(到期收益率)P=C/(1+r)+C/(1+r)2 +…+C/(1+r)n + V/(1+r) n (2)一次性还本付息债券P=(V+nVc)/(1+i)nP=(1000+Vnc)/(1+i)n(3)贴现债券P= V/(1+d)n d? P61(4)零息债券P= V/(1+i)n例题某息票债券面值1000元,票面利率10%,期限3年,每半年计息一次,市场利率6%,求该债券理论市场价值。

解:根据附息债券的定价公式,可知P=某一次性还本付息债券面值1000元,票面利率10%,期限3年,市场利率6%,求该债券理论市场价值。

现金流某零息债券面值1000元,期限3年,市场利率6%,求该债券理论市场价值。

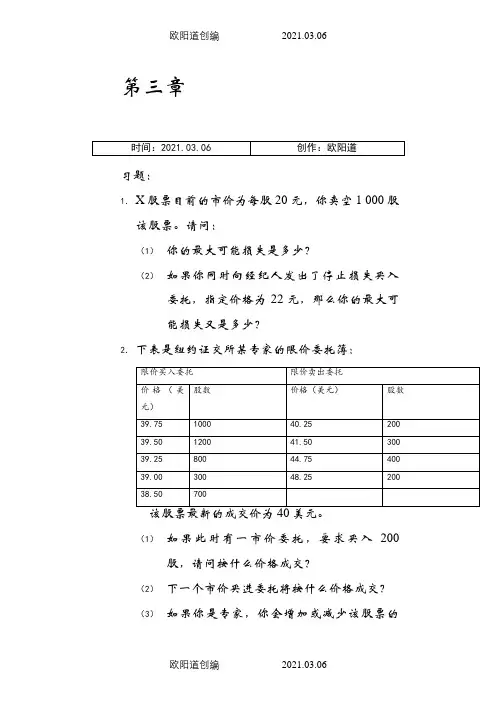

第三章习题:1.X股票目前的市价为每股20元,你卖空1 000股该股票。

请问:(1)你的最大可能损失是多少?(2)如果你同时向经纪人发出了停止损失买入委托,指定价格为22元,那么你的最大可能损失又是多少?2.下表是纽约证交所某专家的限价委托簿:(1)如果此时有一市价委托,要求买入200股,请问按什么价格成交?(2)下一个市价买进委托将按什么价格成交?(3)如果你是专家,你会增加或减少该股票的存货?3.假设A公司股票目前的市价为每股20元。

你用15 000元自有资金加上从经纪人借入的5000元保证金贷款买了1000股A股票。

贷款年利率为6%。

(1)如果A股票价格立即变为①22元,②20元,③18元,你在经纪人账户上的净值会变动多少百分比?(2)如果维持保证金比率为25%,A股票价格可以跌到多少你才会收到追缴保证金通知?(3)如果你在购买时只用了10 000元自有资金,那么第(2)题的答案会有何变化?(4)假设该公司未支付现金红利。

一年以后,若A股票价格变为:①22元,②20元,③18元,你的投资收益率是多少?你的投资收益率与该股票股价变动的百分比有何关系?4.假设B公司股票目前市价为每股20元,你在你的经纪人保证金账户中存入15000元并卖空1000股该股票。

你的保证金账户上的资金不生息。

(1)如果该股票不付现金红利,则当一年后该股票价格变为22元、20元和18元时,你的投资收益率是多少?(2)如果维持保证金比率为25%,当该股票价格升到什么价位时你会收到追缴保证金通知?(3)若该公司在一年内每股支付了0.5元现金红利,(1)和(2)题的答案会有什么变化?5.下表是2002年7月5日某时刻上海证券交易所厦门建发的委托情况:(1)13.18元的价格卖出1000股,请问能否成交,成交价多少?(2)此时你输入一笔限价买进委托,要求按13.24元买进10000股,请问能成交多少股,成交价多少?未成交部分怎么办?6.3月1日,你按每股16元的价格卖空1000股Z 股票。

第一章本章小结1.金融市场是指以金融资产为交易对象而形成的供求关系及其机制的总和。

2.金融市场可以按多种方式进行分类,其中最常用的是按交易的标的物划分为货币市场、资本市场、外汇市场和黄金市场。

3.金融市场的主体有筹资者、投资者(投机者)、套期保值者、套利者和监管者。

4.金融市场在经济系统中具有聚敛功能、配置功能、调节功能和反映功能。

5.资产证券化、金融全球化、金融自由化和金融工程化是金融市场的发展趋势。

本章重要概念金融市场金融资产金融工具套期保值者套利者投资者投机者货币市场资本市场外汇市场直接金融市场间接金融市场初级市场二级市场第三市场第四市场公开市场议价市场有形市场无形市场现货市场衍生市场资产证券化金融全球化金融自由化金融工程化思考题:1.什么是金融市场,其含义可包括几个层次?2.从金融市场在储蓄一投资转化机制中的重要作用这一角度理解“金融是现代经济的核心”。

3.金融市场有哪些分类,哪些主体?4.理解金融市场的经济功能,其聚敛功能、配置功能、调节功能和反映功能各表现在哪些方面?5.结合实际经济生活把握金融市场的四大发展趋势:资产证券化、金融全球化、金融自由化和金融工程化。

第二章本章重要概念同业拆借市场回购协议逆回购协议商业票据银行承兑票据大额可转让定期存单政府债券货币市场共同基金思考题:1.货币市场的界定标准是什么?它包括哪些子市场?2.同业拆借市场的主要参与者、交易对象及利率形成机制?3.回购市场的交易原理,及其与同业拆借市场的区别?4.商业票据市场和银行承兑票据市场的联系和区别?5.大额存单市场是如何产生的,有哪些特征?6.为什么国库券市场具有明显的投资特征?7.了解货币市场共同基金的动作及其特征。

第三章简短小结1.资本市场通常由股票市场、债券市场和投资基金三个子市场构成。

2.股票是投资者向公司提供资金的权益合同,是公司的所有权凭证,按剩余索取权和剩余控制权的不同有不同种类的股票,最基本的分类是普通股和优先股。

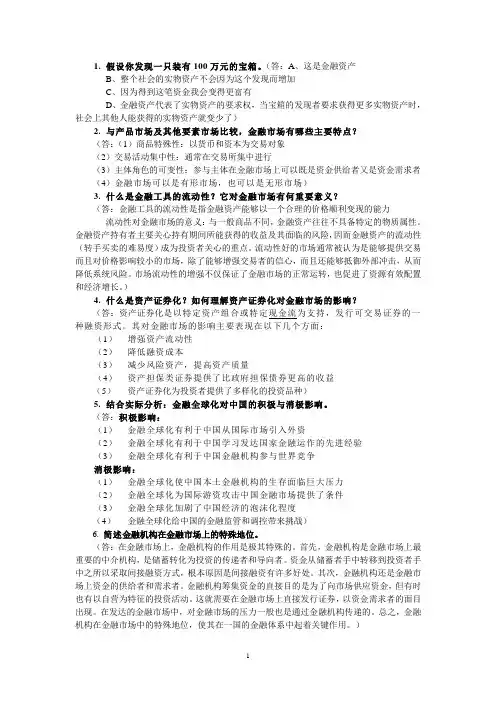

1. 假设你发现一只装有100万元的宝箱。

(答:A、这是金融资产B、整个社会的实物资产不会因为这个发现而增加C、因为得到这笔资金我会变得更富有D、金融资产代表了实物资产的要求权,当宝箱的发现者要求获得更多实物资产时,社会上其他人能获得的实物资产就变少了)2. 与产品市场及其他要素市场比较,金融市场有哪些主要特点?(答:(1)商品特殊性:以货币和资本为交易对象(2)交易活动集中性:通常在交易所集中进行(3)主体角色的可变性:参与主体在金融市场上可以既是资金供给者又是资金需求者(4)金融市场可以是有形市场,也可以是无形市场)3. 什么是金融工具的流动性?它对金融市场有何重要意义?(答:金融工具的流动性是指金融资产能够以一个合理的价格顺利变现的能力流动性对金融市场的意义:与一般商品不同,金融资产往往不具备特定的物质属性。

金融资产持有者主要关心持有期间所能获得的收益及其面临的风险,因而金融资产的流动性(转手买卖的难易度)成为投资者关心的重点。

流动性好的市场通常被认为是能够提供交易而且对价格影响较小的市场,除了能够增强交易者的信心,而且还能够抵御外部冲击,从而降低系统风险。

市场流动性的增强不仅保证了金融市场的正常运转,也促进了资源有效配置和经济增长。

)4. 什么是资产证券化?如何理解资产证券化对金融市场的影响?(答:资产证券化是以特定资产组合或特定现金流为支持,发行可交易证券的一种融资形式。

其对金融市场的影响主要表现在以下几个方面:(1)增强资产流动性(2)降低融资成本(3)减少风险资产,提高资产质量(4)资产担保类证券提供了比政府担保债券更高的收益(5)资产证券化为投资者提供了多样化的投资品种)5. 结合实际分析:金融全球化对中国的积极与消极影响。

(答:积极影响:(1)金融全球化有利于中国从国际市场引入外资(2)金融全球化有利于中国学习发达国家金融运作的先进经验(3)金融全球化有利于中国金融机构参与世界竞争消极影响:(1)金融全球化使中国本土金融机构的生存面临巨大压力(2)金融全球化为国际游资攻击中国金融市场提供了条件(3)金融全球化加剧了中国经济的泡沫化程度(4)金融全球化给中国的金融监管和调控带来挑战)6. 简述金融机构在金融市场上的特殊地位。

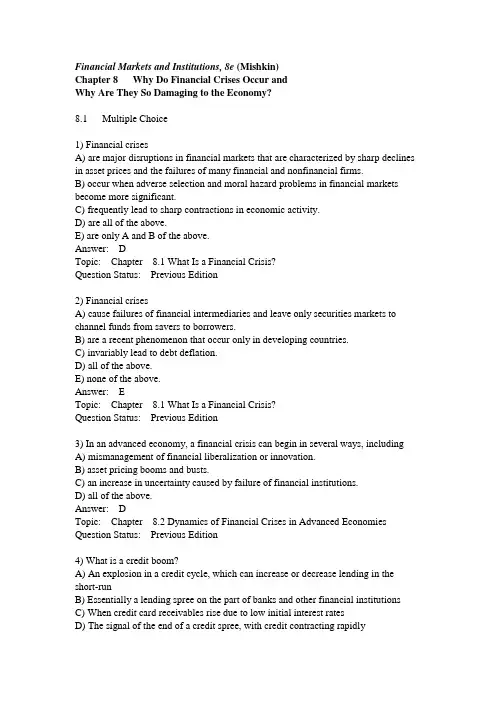

Financial Markets and Institutions, 8e (Mishkin)Chapter 8 Why Do Financial Crises Occur andWhy Are They So Damaging to the Economy?8.1 Multiple Choice1) Financial crisesA) are major disruptions in financial markets that are characterized by sharp declines in asset prices and the failures of many financial and nonfinancial firms.B) occur when adverse selection and moral hazard problems in financial markets become more significant.C) frequently lead to sharp contractions in economic activity.D) are all of the above.E) are only A and B of the above.Answer: DTopic: Chapter 8.1 What Is a Financial Crisis?Question Status: Previous Edition2) Financial crisesA) cause failures of financial intermediaries and leave only securities markets to channel funds from savers to borrowers.B) are a recent phenomenon that occur only in developing countries.C) invariably lead to debt deflation.D) all of the above.E) none of the above.Answer: ETopic: Chapter 8.1 What Is a Financial Crisis?Question Status: Previous Edition3) In an advanced economy, a financial crisis can begin in several ways, includingA) mismanagement of financial liberalization or innovation.B) asset pricing booms and busts.C) an increase in uncertainty caused by failure of financial institutions.D) all of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition4) What is a credit boom?A) An explosion in a credit cycle, which can increase or decrease lending in the short-runB) Essentially a lending spree on the part of banks and other financial institutionsC) When credit card receivables rise due to low initial interest ratesD) The signal of the end of a credit spree, with credit contracting rapidlyAnswer: BTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition5) The process of deleveraging refers toA) cutbacks in lending by financial institutions.B) a reduction in debt owed by banks.C) both A and B.D) none of the above.Answer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition6) When asset prices fall following a boom,A) moral hazard may increase in companies that have lost net worth in the bust.B) financial institutions may see the assets on their balance sheets deteriorate, leading to deleveraging.C) both A and B are correct.D) none of the above are correct.Answer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition7) During the 1800s, many U.S. financial crises were precipitated by an increase in ________, often originating in London.A) interest ratesB) housing pricesC) gasoline pricesD) heating oil pricesAnswer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8) Stage Two of a financial crisis in an advanced economy usually involves a________ crisis.A) currencyB) stock marketC) bankingD) commoditiesAnswer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition9) Stage Three of a financial crisis in an advanced economy featuresA) a general increase in inflation.B) debt deflation.C) an increase in general price levels.D) a full-fledged financial crisis.Answer: BTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition10) Debt deflation refers toA) an increase in net worth, leading to a relative fall in general debt levels.B) a decline in general debt levels due to deleveraging.C) a decline in bond prices as default rates rise.D) a decline in net worth as price levels fall while debt burden remains unchanged. Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition11) Factors that lead to worsening conditions in financial markets includeA) increases in interest rates.B) declining stock prices.C) increasing uncertainty in financial markets.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition12) Factors that lead to worsening conditions in financial markets includeA) declining interest rates.B) anticipated increases in the price level.C) bank panics.D) only A and C of the above.E) only B and C of the above.Answer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition13) Most financial crises in the United States have begun withA) a steep stock market decline.B) an increase in uncertainty resulting from the failure of a major firm.C) a steep decline in interest rates.D) all of the above.E) only A and B of the above.Answer: ETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition14) In addition to having a direct effect on increasing adverse selection problems, increases in interest rates also promote financial crises by ________ firms' and households' interest payments, thereby ________ their cash flow.A) increasing; increasingB) increasing; decreasingC) decreasing; increasingD) decreasing; decreasingAnswer: BTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition15) Adverse selection and moral hazard problems increased in magnitude during the early years of the Great Depression asA) stock prices declined to 10 percent of their levels in 1929.B) banks failed.C) the aggregate price level declined.D) a result of all of the above.E) a result of A and B of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition16) Stock market declines preceded a full-blown financial crisisA) in the United States in 1987.B) in the United States in 2000.C) in the United States in 1929.D) in all of the above.E) in none of the above.Answer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Updated from Previous Edition17) Which of the following factors led up to the Greece debt crisis in 2009-2010?A) Speculative attacks on the euro and a rise in actual and expected inflationB) A decline in tax revenues resulting from a contraction in economic activityC) A double-digit budget deficitD) All of the aboveE) only B and C of the aboveAnswer: ETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Updated from Previous Edition18) What is a collateralized debt obligation?A) A tranche of an SPV that has been setup based on default riskB) An agreement to exchange interest payments when one party defaultsC) A type of insurance against defaultsD) A contract between credit rating agenciesAnswer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question19) Which of the following led to the U.S. financial crisis of 2007-2009?A) Financial innovation in mortgage marketsB) Agency problems in mortgage marketsC) An increase in moral hazard at credit rating agenciesD) All of the aboveE) only A and B of the aboveAnswer: ETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition20) Approximately how large was the U.S. subprime mortgage market in 2007?A) $100 millionB) $100 billionC) $500 billionD) $1 trillionAnswer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition21) When we refer to the shadow banking system, what are we talking about?A) Hedge funds, investment banks, and other nonbank financial firms that supply liquidityB) The "underground" banking system used for illegal activitiesC) The subsidiaries of depository institutionsD) None of the aboveAnswer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition22) The impact of the 2007-2009 financial crisis was widespread, includingA) the first major bank failure in the UK in over 100 years.B) the failure of Bear Stearns, the fifth-largest U.S. investment bank.C) the bailout of Fannie Mae and Freddie Mac by the U.S. Treasury.D) all of the above.E) only B and C of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8.2 True/False1) A financial crisis occurs when information flows in financial markets experience a particularly large disruption.Answer: TRUETopic: Chapter 8.1 What Is a Financial Crisis?Question Status: New Question2) Factors that can lead to worsening conditions in financial markets include increasing interest rates and asset price booms.Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition3) During a bank panic, many banks fail in a very short time period.Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition4) The failure of Ohio Life Insurance and Trust in 1857 did not signal the start of a recession due to prompt actions by the Fed.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition5) Bank failures have been a feature of all U.S. financial crises from 1800 to 1944. Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition6) Debt deflation refers to the decline in debt values as creditors agree to lower interest rates as an alternative to defaults.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition7) The Internet stock market bubble of the late 1990s led to one of the worst financial crises in U.S. history. Banks lost billions of dollars as Internet companies went bankrupt.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8) An unusual feature of the "Great Recession" in the U.S. from 2007-2009 was that the crisis did not spread to European nations.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question9) In Europe, Greece was the first nation to face a debt crisis.Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question8.3 Essay1) Explain the relationship between agency theory and a financial crisis.Topic: Chapter 8.1 What Is a Financial Crisis?Question Status: New Question2) Describe the sequence of events in a financial crisis in an advanced economy and explain why they can cause economic activity to decline.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition3) What is the problem with government safety nets, such as deposit insurance, during the formative stages of a financial crisis?Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition4) Discuss why some view the Fed as a culprit in the U.S. housing bubble during the 2000s.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition5) Describe a special purpose vehicle. How are they related to the creation of collateralized debt obligations?Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question6) Discuss some of the financial innovations in mortgage markets that led to the U.S. financial crisis in 2007.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition7) Why was the shadow banking system important during the 2007-2009 U.S. financial crisis?Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8) Describe how the European debt crisis evolved.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question。

《金融市场学》作业参考答案第一章基本训练三、单项选择题1、金融市场的客体是指金融市场的( A )。

A.金融工具 B.金融中介机构C.金融市场的交易者 D.金融市场价格2、现货市场的实际交割一般在成交后( A )内进行。

A.2日 B.5日C.1周 D.1月3、下列属于所有权凭证的金融工具是( C ).A.商业票据 B.企业债券C.股票 D.可转让大额定期存单4、在金融市场发达国家,许多未上市的证券或者不足一个成交批量的证券,也可以在市场进行交易,人们习惯于把这种市场称之为( A )。

A.店头市场B.议价市场C.公开市场D.第四市场5、企业是经济活动的中心,因此也是金融市场运行的( B )。

A.中心 B.基础C.枢纽 D.核心6、世界上最早的证券交易所是( A )。

A.荷兰阿姆斯特丹证券交易所B.英国伦敦证券交易所C.德国法兰克福证券交易所D.美国纽约证券交易所7、专门融通一年以内短期资金的场所称之为( A )。

A.货币市场B.资本市场C.现货市场D.期货市场8、旧证券流通的市场称之为( B )。

A.初级市场B.次级市场C.公开市场D.议价市场四、多项选择题1、下面( BCD )属于金融衍生工具的交易种类.A.现货交易 B.期货交易C.期权交易 D.股票指数交易 E.贴现交易2、金融市场的参与者包括( ABCDE )。

A.居民个人 B.商业性金融机构C.中央银行 D.企业 E.政府3、下列金融工具中,没有偿还期的有( AE ).A.永久性债券 B.银行定期存款C.商业票据 D.CD单 E.股票4、机构投资者一般主要包括( ABCDE )。

A.共同基金B.保险公司C.信托投资公司D.养老金基金E.投资银行5、货币市场具有( ACD )的特点.A.交易期限短 B.资金借贷量大C.流动性强 D.风险相对较低 E.交易工具收益较高而流动性差6、资本市场的特点是( ABD )。

A.金融工具期限长 B.资金借贷量大 C.流动性强D.为解决长期投资性资金的供求需要E.交易工具有一定的风险性和投机性7、金融工具一般具有的特征:( BCDE )。

第一章金融市场概论1.金融市场是指以金融资产为交易对象而形成的供求关系及其机制的总和2.金融资产是指一切代表未来收益或资产合法要求权的凭证,亦称为金融工具或证券3.金融工具也叫信用工具,指以书面形式发行和流通,能够证明金融交易的金额、期限和价格,借以保证债权债务双方权利和义务的具有法律效力的凭证4.套期保值者是指利用金融市场转嫁自己所承担的风险的主体5.套利者是利用市场定价的低效率来赚取无风险利润的主体6.投资者是指为获取预期收益或效益,将货币或资源等经济要素投入某一领域的主体7.投机者是指在证券投资中,甘愿冒证券市场风险,通过短期操作,来谋取买卖差价收益的投资主体8.货币市场是指期限在一年及一年以下的金融资产为交易标的物的短期金融市场9.资本市场是指期限在一年以上的金融资产交易的市场10.外汇市场是指从事外汇买卖的交易场所,即各种不同货币彼此进行交换的场所,是金融市场的重要组成部分11.衍生工具市场是各种衍生金融工具进行交易的市场12.直接金融市场指的是资金需求者直接从资金所有者那里融通资金的市场13.间接金融市场则是以银行等信用中介机构作为媒介来进行资金融通的市场14.初级市场是指资金需求者将金融资产首次出售给公众时所形成的交易市场15.二级市场是证券发行后,各种证券在不同的投资者之间买卖流通所形成的市场16.第三市场是原来在交易所上市的证券移到场外进行交易所形成的市场17.第四市场是投资者和证券的出卖者直接交易形成的市场18.公开市场指金融资产的交易价格通过众多的买主和卖主公开竞价而形成的市场19.议价市场指金融资产的定价与成交通过私下协商或面对面的讨价还价方式进行的市场20.有形市场是指有固定交易场所的市场21.无形市场则是指在证券交易所外进行金融资产交易的总称22.资产证券化是指把流动性较差的资产,通过商业银行或投资银行的集中及重新组合,以这些资产作抵押来发行债券,实现相关债券的流动化23.金融全球化指金融国际化在全球发展的高级阶段,各国高度依存,是诸多个体国际化的总和,是一个整体的概念24.金融自由化的趋势是指20世纪70年代中期以来在西方国家,特别是发达国家所出现的一种逐渐放松甚至取消金融活动的一些管制措施的过程25.金融工程化,是指将工程思维引入金融领域,综合采用各种工程技术方法设计、开发新型的金融产品,创造性地解决金融问题第二章货币市场1.同业拆借市场是指金融机构之间以货币借贷方式进行短期资金融通活动的市场2.回购协议也称再购回协议,指在出售证券的同时,与证券的购买商签订协议,约定在一定的期限后按原定价格或约定价格购回所卖证券,从而获取即时可用资金的一种交易行为3.逆回购协议中,买入证券的一方同意按约定期限以约定价格出售其所买入证券4.商业票据是大公司为了筹措资金,以贴现方式出售给投资者的一种短期无担保承诺凭证5.银行承兑票据是指银行作为汇票的承兑人,在票面上办过承兑手续的汇票6.大额可转让定期存单是由商业银行发行的、固定面额、固定期限、可以在市场上转让的存款凭证7.短期政府债券是政府部门以债务人身份承担到期偿付本息责任的期限在一年及一年以内的债务凭证8.货币市场共同基金是将众多的小额投资者的资金集合起来,由专门的经理人在货币市场上进行市场运作,赚取收益后按一定的期限及持有的份额进行分配的一种金融组织形式第三章资本市场1.普通股是在优先股要求权得到满足之后才参与公司利润和资产分配的股票合同2.剩余索取权是指股东的权益在利润和资产分配上表现为索取公司对债务还本付息后的剩余收益3.剩余控制权是指股东对公司的控制表现为合同所规定的经理职责范围之外的决策权4.优先认股权是指当公司增发新的普通股时,现有股东有权按其原来的持股比例认购新股,以保持对公司所有权的现有比例5.优先股是指在剩余索取权方面较普通股优先的股票,这种优先权表现在分得固定股息并且在普通股之前收取股息6.累积优先股是指如果公司在某个时期内所获盈利不足以支付优先股股息时,则累积到次年或以后某一年盈利时,在普通股的红利发放之前,连同本年优先股的股息一并发放7.非累积优先股是指当公司盈利不足以支付优先股的全部股息时,非累积优先股股东不能要求公司在以后年度补发其所欠部分8.可转换优先股指在规定的时间内,优先股股东可以按一定的转换比率把优先股换成普通股9.可赎回优先股即允许公司按发行价格加上一定比例的补偿收益予以赎回的优先股10.公募是指面向市场上大量的非特定的投资者公开发行股票11.私募是指只向少数特定的投资者发行股票,其对象主要有个人投资者和机构投资者两类12.包销是指承销商以低于发行定价的价格把公司发行的股票全部买进,再转卖给投资者,这样承销商就承担了在销售过程中股票价格下跌的全部风险13.承销是证券发行人委托具有证券销售资格的金融机构,按照协议由金融机构向投资者募集资金并交付证券的行为和制度14.证券交易所是由证券管理部门批准的,为证券的集中交易提供固定场所和有关设施,并制定各项规则以形成公正合理的价格和有条不紊的秩序的正式组织15.场外交易市场是指在证券交易所之外进行股票交易的市场16.第三市场是原来在证交所上市的股票移到场外进行交易所形成的市场17.第四市场是指大机构和富有的个人绕开通常的经纪人,彼此之间利用电子通信网络直接进行的证券交易18.做市商交易制度也称报价驱动制度在典型的做市商制度下,证券交易的买卖价格均由做市商给出,买卖双方并不直接成交,而向做市商买进或卖出证券19.专家经纪人又称佣金经纪人,是证券交易所指定的特种会员,其主要职责是维持一个公平而有次序的市场,即为其专营的股票交易提供市场流通性并维持价格的连续和稳定20.竞价交易制度也称委托驱动制度,在此制度下,买卖双方直接进行交易或将委托通过各自的经纪商送到交易中心,由交易中心进行撮合成交21.连续竞价制度是指证券交易可在交易日的交易时间内连续进行22.集合竞价制度也称间断性竞价交易制度在该制度下,交易中心(如证券交易所的主机)对规定时段内收到的所有交易委托并不进行一一撮合成交,而是集中起来在该时段结束时进行23.市价委托,是指委托人自己不确定价格,而委托经纪人按市面上最有利的价格买卖证券24.限价委托,是指投资者委托经纪人按他规定的价格,或比限定价格更有利的价格买卖证券25.停止损失委托,是一种限制性的市价委托,是指投资者委托经纪人在证券价格上升到或超过指定价格时按市价买进证券,或在证券价格下跌到或低于指定价格时按市价卖出证券26.停止损失限价委托,是停止损失委托与限价委托的结合当市价达到指定价格时,该委托就自动变成限价委托27.金融市场的深度是指市场中是否存在足够大的经常交易量,可以保证某一个时期,一定范围内的成交量变动不会导致市价的失常波动28.市场广度是指市场参与者的类型和复杂程度29.弹性指一个变量相对于另一个变量发生的一定比例的改变的属性30.信用交易又称保证金交易,是指证券买者或卖者通过交付一定金额的保证金,得到证券经纪人的信用而进行的证券买卖31.保证金购买又称为信用买进交易,是指对市场行情看涨的投资者交付一定比例的初始保证金,由经纪人垫付其余价款,为他买进指定证券32.卖空交易又称为信用卖出交易,是指对市场行情看跌的投资者本身没有证券,就向经纪人交纳一定比率的初始保证金借入证券,在市场上卖出,并在未来买回该证券还给经纪人33.股价指数是反映不同时点上股价变动情况的相对指标34.股价平均数是指反映一定时点上市场股票价格绝对水平的一种价格平均数35.派许指数是指以报告期成交股数(或总股本)为权数的加权股价指数36.拉斯拜尔指数是指以基期成交股数(或总股本)为权数的加权股价指数37.股票是投资者向公司提供资金的权益合同,是公司的所有权凭证38.债券是投资者向政府、公司或金融机构提供资金的债权债务合同39.可转换债券是指公司债券附加可转换条款,赋予债券持有人按预先确定的比例(转换比率)转换为该公司普通股的选择权40.可赎回债券是指公司债券附加早赎和以新偿旧条款,允许发行公司选择于到期日之前购回全部或部分债券41.零息债券是指以低于面值的贴现方式发行,到期按面值兑现,不再另付利息的债券42.投资基金是指通过发行基金券将投资者分散的资金集中起来,由专业管理人员分散投资于股票债券或其他金融资产,并将投资收益分配给基金持有者的一种投资制度43.开放型基金是指基金可以无限地向投资者追加发行股份,并且随时准备赎回发行在外的基金股份,因此其份额总数是不固定的44.封闭型基金是基金份额总数固定,且规定封闭期限,在封闭期限内投资者不得向基金管理公司提出赎回,而只能寻求在二级市场上挂牌转让45.公司型基金是依据公司法成立的、以营利为目的的股份有限公司形式的基金46.契约型基金是依据一定的信托契约组织起来的基金47.对冲基金又称套期保值基金,是在金融市场上进行套期保值交易,利用现货市场和衍生市场对冲的基金第五章债券价值分析1.收入资本化法认为任何资产的内在价值均取决于该资产预期的未来现金流的现值2.贴现债券,又称零息债券,是一种以低于面值的贴现方式发行,不支付利息,到期按债券面值偿还的债券3.直接债券,又称定息债券或固定利息债券,按照票面金额计算利息,票面上可附有作为定期支付利息凭证的息票,也可不附息票4.统一公债是一种没有到期日的特殊的定息债券5.息票率是指证券的标定利率,它等于证券的年利息额除以票面价值6.可赎回条款,即规定在一定时间内发行人有权赎回债券的条款7.可赎回收益率是指在债券可赎回或者在到期日之前可撤回的情况下债券的平均回报率8.债券的流通性,或者流动性,是指债券投资者将手中的债券变现的能力9.债券的违约风险是指债券发行人未履行契约规定支付的债券本金和利息,给债券投资者带来损失的可能性10.信用评级是指信用评估机构对企业、各种债券、贷款申请者和金融机构等的信用度进行测定、评价,并划分等级11.债券的可转换性是指可转换债券的持有者可用债券来交换一定数量的普通股股票的特性12.可延期债券给予持有者终止或继续拥有债券的权利13.债券定价原理:①债券的价格与债券的收益率成反比例关系即当债券价格上升时,债券的收益率下降;当债券价格下降时,债券的收益率上升②当市场预期收益率变动时,债券的到期时间与债券价格的波动幅度之间成正比关系到期时间越长,价格波动幅度越大;到期时间越短,价格波动幅度越小③随着债券到期时间的临近,债券价格的波动幅度减少,并且是以递增的速度减少;反之,到期时间越长,债券价格波动幅度增加,并且是以递减的速度增加④对于期限既定的债券,由收益率下降导致的债券价格上升的幅度大于同等幅度的收益率上升导致的债券价格下降的幅度即对于同等幅度的收益率变动,收益率下降给投资者带来的利润大于收益率上升给投资者带来的损失⑤对于给定的收益率变动幅度,债券的息票率与债券价格的波动幅度成反比例关系即息票率越高,债券价格的波动幅度越小14.马考勒久期,是马考勒使用加权平均数的形式计算出的债券的平均到期时间15.修正久期表示利率敏感性资产价值变动的百分比对利率变动的一阶敏感性,久期越大,资产的利率风险越大;反之则越小16.债券的凸度是债券价格变动率与收益率变动关系曲线的曲度17.免疫技术是投资者或金融机构用来保护他们的全部金融资产免受利率波动影响的策略第六章普通股价值分析1.股息贴现模型是收入资本化法运用于普通股价值分析中的模型2.内部收益率是指当净现值等于零时的一个特殊的贴现率3.零增长模型是股息贴现模型的一种特殊形式,它假定股息是固定不变的4.不变增长模型有三个假定:①股息的支付在时间上是永久性的,即t趋向于无穷大(t→∞);②股息的增长速度是一个常数;②模型中的贴现率大于股息增长率5.三阶段增长模型将股息的增长分成了三个不同的阶段:在第一个阶段(期限为A),股息的增长率为一个常数(ga);第二个阶段(期限为A+1到B-1)是股息增长的转折期,股息增长率以线性的方式从ga变化为gn,gn是第三阶段的股息增长率。

1、第二章:2、同业拆借市场:也称同业拆放市场,指金融机构之间以货币借贷方式进行短期资金融通市场。

3、回购协议:指在出售证券的同时,与证券的购买商签订协议,约定在一定期限后按原定价格或约定价格购回所卖证券,从而获取即时可用资金的一种交易行为4、逆回购协议:买入证券的一方同意按预定期限以约定价格卖出其所买入证券5、出票:指出票人签发票据并将其交付给收款人的票据行为。

6、承兑:指汇票付款人承诺在汇票到期日支付汇票金额的票据行为。

7、转贴现:指办理贴现业务的银行将其贴现收到的未到期票据,再向其他银行或贴现机构进行贴现的票据转让行为,是金融机构之间相互融通资金的一种形式。

8、再贴现:指商业银行及其他金融机构将贴现所获得的未到期汇票向中央银行再次贴现的票据转让行为。

9、共同基金:指将众多的小额投资者的资金集合起来,由专门的经理人进行市场运作,赚取收益后按一定得期限及持有的份额进行分配的一种金融组织形式。

10、第三章11、剩余索取权:指股东索取公司对债务还本付息后的剩余收益的权利。

12、剩余控制权:表现为合同所规定的经理职责范围之外的决策权。

13、信用交易:又称垫头交易和保证金交易,指证券买者或卖者通过交付一定数额的保证金,得到证券经纪人的信用而进行的证券买卖。

14、保证金购买:又称信用买进交易,指对市场行情看涨的投资者交付一定比例的初始保证金,由经纪人垫付其余价款为他买进证券。

15、卖空交易:又称信用卖出交易,指对市场行情看跌的投资者本身没有证券,就向经纪人交纳一定比例的初始保证金借入证券,在市场上卖出,并在未来买回该证券还给经纪人。

16、优先股:在剩余索取权方面较普通股优先的股票,这种优先性表现在分得固定股息并且在普通股之前收取股息。

17、累积优先股:如果公司在某个时期内所获盈利不足以支付优先股股息时,则累积到次年或某一年盈利时,在普通股的盈利发放之前,连同本年优先股的股息一起发放。

18、可转换债券:指公司债券附加可转换条款,赋予债券持有人按预先确定的比例转换为该公司普通股的选择权。