公司法和商法(双语)讲义 第7章Corporate and Business Law Chapter 7

- 格式:doc

- 大小:29.00 KB

- 文档页数:4

公司法讲义第一章公司法概述l 共四节:l 第一节、公司的法律界定l 第二节、公司法的概念与性质l 第三节、公司法的历史沿革与发展趋势l 第四节、公司法的基本原则l 本章重点讲授:公司的法律界定、公司法的基本原则第一节公司的法律界定一、公司的概念1、“公司”词义英文中“公司”对应的词有两个,但其外延均比我国公司概念大:一个是company,通常指社团,不问其是否以营利为目的,或是否为法人;另一个是corporation,专指法人社团,也不以营利性为其特征,商业性的公司,应该称为Business corporation。

Company多为西欧国家所习惯使用,而corporation多为美国所习惯使用。

l 日本称公司为“会社”。

2、公司的一般定义l 大陆法系公司的概念,可以简单概括为:依法设立的营利性社团法人。

l 英美法系国家没有明确的公司的定义,但其内涵、特征与大陆法系相似。

3、我国公司的法定定义l 我国《公司法》第2条规定:“本法所称公司是指依照本法在中国境内设立的有限责任公司和股份有限公司。

”l 第3条规定:“公司是企业法人,有独立的法人财产,享有法人财产权。

公司以其全部资产对公司的债务承担责任。

”“有限责任公司的股东以其出资额为限对公司承担责任;股份有限公司的股东以其认购股份为限对公司承担责任。

”4、学理定义l 【公司】是指股东依照公司法的规定,以出资方式设立,股东以其出资额或所持股份为限对公司承担责任,公司以其全部资产对公司债务承担责任的企业法人。

(见赵旭东《公司法学》P2)l *参考概念:公司是指由两个或两个以上的股东出资组成的,从事营利性经济活动的企业法人。

(见范健《商法》P90)对于“法人”概念的理解包含两层含义:第一,依法定程序和法定条件设立的法律主体;第二,具有独立的法律人格,可以依法独立享有民事权利并承担民事义务。

二、公司的特征l 1.营利性——l 2.社团性——l 3.法人性——第一、关于营利性------------------------社会责任一、概念广义:是指公司不能仅仅以最大限度地为股东们营利或赚钱作为自己的唯一存在目的,而应当最大限度地增进股东利益之外的其他所有社会利益,这种社会利益包括雇员利益、消费者利益、债权人利益、中小竞争者利益、当地社区利益、环境利益、社会弱者利益以及整个社会公共利益等内容,既包括自然人的人权尤其是《经济、社会和文化权利国际公约》中规定的社会、经济、文化权利,也包括自然人之外的法人和非法人组织的权利和利益。

25 Capital maintenance and dividendsOverviewGENERAL PRINCIPLEProtection of PrincipleCreditors effects1 IntroductionGeneral principle1.1 When members contribute capital to the company it forms what is known as the creditors’ buffer.1.2 A com pany’s capital (creditors’ buffer) consists of its share capital and undistributable reserves.1.3 These funds cannot be ‘distributed’ i.e. given back to the members.Development of the principle1.4 Three main areas are covered:(a) Payment of dividends.(b) Reduction of capital.(c) Assisting others to acquire its own shares.2 Distributable profitsPayment of dividends2.1 (a) The power to declare a dividend is given to the directors by the articles.(b) Members do not have a right to be paid a dividend. They must approve the dividend at a G.M.(they cannot increase it).(c) Dividends are normally declared payable on the paid up amount of share capital and may bein cash or otherwise.(d) (i) A dividend is a debt only when it is declared and due for payment.(ii) If declared and unpaid it is a deferred debt.(iii) An unclaimed dividend becomes statute barred after six years.Basic rules2.2 The basic rules contained are set out in ss.263 and 264.s.263 –Basic restrictions which apply to public and private companies.s.264 –Further restrictions applying to public companies only.Basic restriction applicable to all non-investment companies s.2632.3 (a) Distributable profits are defined as:Accumulated realised profits– accumulated realised losses.(b) Accumulated: this means the company cannot take one year in isolation. It must take allprofits/losses since commencement.(c)Realised profits and losses:(i) There is no distinction between capital and revenue profits.(ii) The Act does not define realised profits precisely but implies that they are what aprudent accountant would apply (ultimately the court will decide). Any profit is ofcourse realised at the point of sale.(iii) Any provision, whether for doubtful debts or depreciation, must be treated as arealised loss.Further restriction applicable to public companies only s.2642.4 (a) Net assets must always be at least equal to called up share capital plus undistributablereserves.(b) Undistributable reserves are:(i) share premium account;(ii) capital redemption reserve;(iii) the surplus of unrealised profits – unrealised losses (revaluation reserve);(iv) any other controlled reserve (this could be defined in the memorandum or articles or come from statute).(c) The practical effect of this is to make plcs take unrealised losses into account whencalculating the amount to distribute.(d) NB. Financial accounting practice treats private companies in the same way on grounds ofprudence.ExampleThe table below has information about the financial status of two companies, Black and White, as at the year ending 31.12.200X.Black White£m £m UnrealisedRevaluation reserve 350 (300)Realised capitalProfits 250 150Realised revenueProfits b/fwd 150 150Profit/loss for year 50 (50)Assuming Black is a private company, what profits are available for distribution? Would your answer be the same if Black was a plc?Now do the same exercise for White.AnswerBlack Ltd250 + 150 + 50 = 450mBlack plc = 450mWhite Ltd150 + 150 – (50) = 250mWhite plc150 + 150 – (50) – (300) = 0mConsequences of making an unlawful distribution (s.277)2.5 (a) If a company makes an unlawful payment then any shareholder knowing it is unlawful mustpay it back.(b) Strangely, no specific liability attaches to directors by statute.However, directors could be regarded as failing in their duty and would then be liable to indemnify the company.3 Reduction in issued share capitalThree authorities are needed to reduce capital3.1 (a) Power in the articles;(b) A special resolution;(c) Sanction of the court.The section suggests three circumstances when capital may be reduced:3.2 (a) To cancel future calls on unpaid capital.(b) To repay capital that is surplus to the company’s requirements.(c) To write off share capital that is permanently lost.Role of court in reductions3.3 Creditors may object to reduction under (a) or (b) above but obviously not (c). They can demandrepayment or a guarantee. (s.136 CA 1985).4 Purchase or redemption of shares – public andprivate companies (ss.159/162)OverviewPURCHASE/REDEMPTION OF SHARESGeneral Ltd Corules exceptionGeneral rules4.1 (a) The issue of redeemable shares must be authorised by the articles(Table A gives authority).(b) Redeemable shares may ONLY be issued if there are some non-redeemable shares inissue.(c) Any company may purchase its own shares if authorised to do so by its articles (Table Agives authority)(d) After the re-purchase some non redeemable shares must remain in issue.(e) Redeemable shares must be fully paid up before being redeemed.Effect on the creditors’ buffer4.2 If the purchasing company is a plc the creditors’ buffer must be maintained, this can be achieved bya fresh issue or if necessary by transferring profits to an undistributable Capital Redemption Reserve Transfer to the capital redemption reserve4.3 ExampleX plc wants to repurchase 50 shares at par value of £50. It has distributable profits of £5,000. Show how the transaction would be represented.BEFORE BUY BACK AFTER BUY BACKShare capital 100Share premium 50Revaluation reserve –Capital redemption reserve –150DP’s500AnswerAFTER BUY BACKShare capital 50Share premium 50Revaluation reserve –Capital redemption reserve 50150DP’s450Premium on redemption4.4 This may be charged to the share premium account and may not exceed the lower of:(a) the proceeds of any fresh issue; and(b) the premium received on the original issue of the shares being redeemed; and(c) the balance of the share premium account (including the premium of any fresh issue). Conditions4.5 (a) These depend upon whether it is(i) a market purchase, or(ii) an off-market purchase.(b) Market Purchase(i) This requires an ordinary resolution(ii) The resolution must be delivered to the Registrar within 15 days.(c) Off-Market Purchase(i) This requires a special resolution. s.164(2)(ii) The resolution must state "the terms of the contract".(iii) VotingVoting is by show of hands or a poll (which any member can demand).A vendor cannot vote. s.164(5)(d) Details to be delivered to the Registrar s.169All companies must send full details within 28 days of the purchase.5 Redemption/purchase of own shares – procedureavailable to private companies only (s.171) Introduction5.1 (a) Private companies are permitted to purchase/redeem their own shares without the need tomaintain capital provided they have authority in their articles – Table A gives this.(b) As before, a transfer to CRR is required which will use up distributable profits.(c) The transfer need not compensate completely for the net reduction in share capital i.e.: thecreditors’ buffer may be reduced. This reduction is known as the Permissible CapitalPayment.(d) The practical effect is that a private company with low P&L reserves may purchase/redeemmore shares than a public company in the same position.Conditions5.2 (a) Distributable profits must be determined(b) A statutory declaration by directors is also requiredThis specifies the amount of the P.C.P. and states that the directors have made full enquiriesinto the affairs and prospects of the company and are of the opinion that:-(i) the company will be able to meet its debts immediately after the payment out of capitaland(ii) it will continue as a going concern for the next 12 months after the payment and will be able to pay its debts as they fall due.(c) An auditors' report must be attached to the Statutory Declaration:The auditors must state that:(i) They have enquired into the company’s state of affairs.(ii) The amount of the PCP has been correctly determined.(iii) They are not aware of anything to indicate that the directors' opinion is unreasonable.(d) A special resolution is required:(i) Voting is as before (vendors may not vote)(ii) The resolution must be passed within 1 week after the date of the statutorydeclaration.(iii) The payment out of capital must take place not earlier than 5 weeks and not later than7 weeks after the date of the special resolution.(e) Publicity for proposed payment out of capital s.175:(i) Notice must be given within 1 week of resolution.(ii) Notice is required in a national newspaper OR written notice to each creditor.(iii) Notice must also be placed in the London Gazette.(f) The statutory declaration and auditors' report:(i) copies must be delivered to the Registrar not later than the date on which notice is firstpublished/given.(ii) they must be available at the registered office during business hours for inspection by any member or creditor during the 5 week period after the date of the specialresolution.(iii) they must be available for inspection by members at the meeting to pass the special resolution.(g) Objections by members or creditors s.176:(i) Any member (who did not vote in favour) or creditor may apply to the court within 5weeks of the special resolution for its cancellation.(ii) The company must give immediate notice of the application to the Registrar anddeliver a copy of any court order to the Registrar within 15 days.Civil liability of past shareholders and directors5.3 (a) If the company starts winding up within 1 year of making a payment out of capital and itcannot meet its debts then the following are liable to contribute to the assets of the company:(i) the vendor shareholders.(ii) the directors (who signed the statutory declaration – unless they can show there were reasonable grounds for the opinion expressed).(b) Liability:(i) vendors are liable for the amount they were paid.(ii) directors are liable jointly and severally with each vendor shareholder.Criminal liability for contraventions5.4 If they had no reasonable grounds for their opinion in the statutory declaration – director(s) are liableto a fine and/or prison. s.173(6)Default5.5 Shareholders can apply for an order of specific performance if directors fail to redeem/purchaseshares.6 Financial assistance for the acquisition of acompany's own sharesOverviewFINANCIAL ASSISTANCE – DIRECTLY OR INDIRECTLYGeneral Ltd CoExceptions exceptionBasic rule (s.151)6.1 (a) It is illegal for any company DIRECTLY or INDIRECTLY, to provide financial assistance of anysort for the acquisition of shares in itself or its holding company.(b) It is irrelevant whether the financial assistance is given before, at the same time, or after theacquisition.General exceptions (s.153)6.2 (a) If financial assistance is not the principal purpose of the transaction, or the assistance is justan incidental part of some larger purpose;ANDthe financial assistance is in good faith.(b) If the company lends money in the ordinary course of business (e.g., banks lending to buyshares in themselves).(c) Employees’ share scheme(d) Loans to employees (but not directors)6.3 In the case of a PUBLIC COMPANY the last three exceptions ONLY apply if:–the company’s net assets are not reduced (e.g. loan).or–if they are reduced it is only by a gift of cash "out of distributable profits". s.154Private companies – relaxation of restrictions (s.155 )6.4 (a) Private companies may give financial assistance if they follow the correct procedure.(b) Conditions:(i) Net assets must not be reduced (or the reduction must be out of distributable profits).(ii) Directors must make a statutory declaration stating:-–that in their opinion, the company will be able to meet liabilities for the next 12months.–to whom the assistance is given.(iii) Members must pass a special resolution.(iv) An auditors' report is required on the statutory declaration saying:-–that the opinion expressed by the directors is reasonable.–there is nothing they are aware of which would affect the opinion.(v) All three must be filed with the Registrar within 15 days of the resolution being passed.(vi) Financial assistance must be given:–not before 4 weeks after the resolution.–not after 8 weeks post the statutory declaration. s.158Rights of minority shareholders to object (s.157)6.5 (a) A minimum of 10% of any class may object to the resolution.(b) They must not have voted in favour.(c) They must apply to the court within 28 days.(d) The court may do as it thinks fit.Criminal liability for contravention of these provisions6.6 (a) Contravention of s.151 (General prohibition)(i) The company is liable to a fine.(ii) Officers in default are liable to a fine and/or prison.(b) Contravention of provisions for private companies(i) For non-delivery of documents to the Registrar: the company and its officers will beliable to a fine: s.156;(ii) For making the statutory declaration without reasonable grounds: any such director may be fined and/or imprisoned. s.156.Civil liability6.7 (a) Directors who breach these provisions become personally liable for losses to the company asa result.(b) The contract itself is illegal (i.e. void and unenforceable).。

9Terms of the contract1 Certainty of terms1.1 Once a contract has been made its important to ascertain its content. The content of a contract isits terms. N.B. mere representations made pre contract are not part of the contractual terms.OverviewTYPES OF TERMSConditions Warranties Innominateterms2 Conditions and warranties2.1 A condition is a core element of a contract. It is fundamental to the existence of the contract.Breach of a condition entitles the injured party to:(i) repudiate the contract (ie. treat contract as discharged); and(ii) claim rescission which would enable him to receive property transferred; and(iii) claim damages: Poussard v. Spiers.2.2 A warranty is "collateral to the main purpose of the contract". It is not essential.Breach of a warranty entitles the injured party to claim damages only: Bettini v. Gye.2.3 Innominate terms: is a term which cannot be categorised at the start of the contract. The court willlook at the effect of the breach: Hong Kong Fir Shipping Company v Kawasaki Kisen Kaisha.OverviewTERMSExpress Implied3 Express and implied terms3.1 An express term is one which has been clearly stated orally or in writing, or may be by reference atthe time of contract:3.2 An implied term is one which the court will allow because:(a) It has to as the term is statutory (e.g. Sale of Goods Act 1979 as amended); This states thatit will be a condition of the contract that (inter alia);(i) the seller had title to the goods,(ii) the goods are of satisfactory quality and fit for purpose,(iii) the goods correspond with their description.(b) It is necessary for the efficacy of the particular contract: The Moorcock; or(c) It is customary through trade us age. Terms implied by custom cannot override the expressterms of an agreement.(d) Also where the parties have had previous dealing on the basis of an exclusion clause, thatclause may be included in later contracts.OverviewFORMALITIESIn writing By deed Other4 FormalitiesCertain contracts have to be made in a formal way:4.1 Some contracts must be in writing:(a) consumer credit agreements(b) transfer of company shares(c) money lending contracts(d) contract for the sale or other disposition of land e.g. leases: LP(MP)A'894.2 Some contracts do not have to be in writing. But written evidence must be available to enable anaction to be brought. eg. Contract of guarantee.4.3 Certain contracts must be executed as a Deed (and are called speciality contracts):(a) Gratuitous promises: Deeds of Covenant(b) Transfers of a legal estate in land4.4 Contracts of employment need not be in writing or evidenced in writing but the main details must beoutlined.5 Terms in restraint of trade5.1 Contracts or contract terms in restraint of trade are prima facie void but will be upheld if there is alegitimate proprietary interest to protect and the term is reasonable between the parties and for the community.Legitimate Proprietary Interest5.2 The following are legitimate proprietary interests:-(a) Trade Secrets.(b) Business Goodwill.5.3 It is not legitimate to restrain the use of personal skills.Reasonableness5.4 The clause must only be sufficiently wide to protect the legitimate proprietary interest and no wider.5.5 Factors to consider:(a) Area.(b) Duration.(c) Activity (i.e. the drafting must restrict the specific activity and no other).5.6 The burden of proof is on the claimant.The bargaining position of the parties is taken into account.Severance5.7 The court will not rewrite a restraint which is too wide: Office Angels Ltd v Rainer-Thomas andO’Connor.5.8 (a) The court may apply the "blue pencil test" if clauses are severable; Home Counties Dairies vSkilton.(b) The blue pencil test will not be used if the restraint is really one covenant.。

![[法学]公司法讲义英文版](https://uimg.taocdn.com/d2ea5ef2195f312b3069a51e.webp)

THE LAW OF CORPORATIONS (For teaching purpose only)by Zhaibaohong2010. 08. 26OUTLINEChapter1 Concept of corporation (2)Section 1 Corporation and other forms (2)Section 2 Limited liability companies (7)Section 3 Piercing the corporate veil (12)Chapter 2 Establishment of corporation (15)Chapter 3 The Corporate Structure (20)Section 1 Traditional corporate structure (20)Section 2 The structure of companies limited by shares (23)Section 3 Code of Corporate Governance for Listed Companies (23)Chapter 4 The duty of care and loyalty (33)Section 1 Duty of care (33)Section 2 The business judgment rule (34)Section 3 Duty of loyalty (36)Chapter 5 Merger and consolidation (39)Chapter 6 Dividend policy, termination (41)Section 1 Concept, forms of dividend (41)Section 2 Dividend in China (42)Section 3 Termination (43)Consultative Materials1. ROBERT W. HAMILTON, THE LAW OF CORPORATIONS (4th), WEST PUBLISHING CO. 1996.2. BLACK’S LAW OF DISCTIONARY(7th), WEST GROUP, 1999.3. Merriam-Webster’s Dictionary of Law, Merriam-Webster, Incorporated, 1996.4. DELAWARE GENERAL CORPORATION LAW. MAINE BUSINESS CORPORATION ACT. TEXAS BUSINESS CORPORATION ACT (GENERAL).5. COMPANY LAW OF CHINA, INDEPENDENT DIRECTORS RULE OF CHINA, CODE OF CORPROATE GOVERNNACE FOR LISTED COMPANIES, AND OTHER CHINESE LAWS, REGULATIONS.Chapter 1 The Concept of CorporationSection 1 Corporation and other business forms1. Partnership vs (versus). corporationChoosing a form (种类)of organization(组织)usually comes down to choosing between a partnership and a corporation(合伙企业和公司), the third form of business is proprietorship(独资企业).A corporation is an entity (usually a business) having authority under law (法定权利) to act as a single person distinct from (separate from) the shareholders (股东)who own it and having rights to issue stock (发行股份)and exist indefinitely; or a group of persons established in accordance with legal rules into a legal or juristic person (法人)that has legal personality distinct from the natural persons(自然人)who make it up, exists indefinitely apart from them, and has the legal powers that its constitution (章程)gives it.A partnership is an association of two or more persons or entities that conduct a business for profit as co-owners. In American, except in civil law (民法)as practiced inLouisiana, where a partnership, like a corporation, is considered as a legal person, a partnership is traditionally viewed as an association of individuals rather than as an entity with a separate and independent existence. A partnership cannot exist beyond the lives ofthe partners. (合伙人死后,合伙企业不能继续存在。

Order of the President(No. 42 [2005])The Company Law of the People's Republic of China was amended and adopted at the 18th session of the Standing Committee of the Tenth National People's Congress of the People's Republic of China on October 27, 2005. The amended Company Law of the People's Republic of China is hereby promulgated and shall come into force on January 1, 2006.President of the People's Republic of China Hu JintaoOctober 27, 2005Company Law of the People's Republic of China(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress on December 29, 1993. Revised for the first time on December 25, 1999 according to the Decision of the Thirteenth Session of the Standing Committee of the Ninth People's Congress on Amending the Company Law of the People's Republic of China. Revised for the second time on August 28, 2004 according to the Decision of the 11th Session of the Standing Committee of the 10th National People's Congress of the People's Republic of China on Amending the Company Law of the People's Republic of China. Revised for the third time at the 18th Session of the 10th National People's Congress of the People's Republic of China on October 27, 2005)ContentsChapter I General ProvisionsChapter II Establishment and Organizational Structure of A Limited Liability Company中华人民共和国主席令(第42号)《中华人民共和国公司法》已由中华人民共和国第十届全国人民代表大会常务委员会第十八次会议于2005年10月27日修订通过,现将修订后的《中华人民共和国公司法》公布,自2006年1月1日起施行。

《瑞典公司法》第七章第六节第二段下载提示:该文档是本店铺精心编制而成的,希望大家下载后,能够帮助大家解决实际问题。

文档下载后可定制修改,请根据实际需要进行调整和使用,谢谢!本店铺为大家提供各种类型的实用资料,如教育随笔、日记赏析、句子摘抄、古诗大全、经典美文、话题作文、工作总结、词语解析、文案摘录、其他资料等等,想了解不同资料格式和写法,敬请关注!Download tips: This document is carefully compiled by this editor. I hope that after you download it, it can help you solve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you! In addition, this shop provides you with various types of practical materials, such as educational essays, diary appreciation, sentence excerpts, ancient poems, classic articles, topic composition, work summary, word parsing, copy excerpts, other materials and so on, want to know different data formats and writing methods, please pay attention!瑞典公司法是瑞典法律体系中对公司设立、运营及解散等方面的法规。

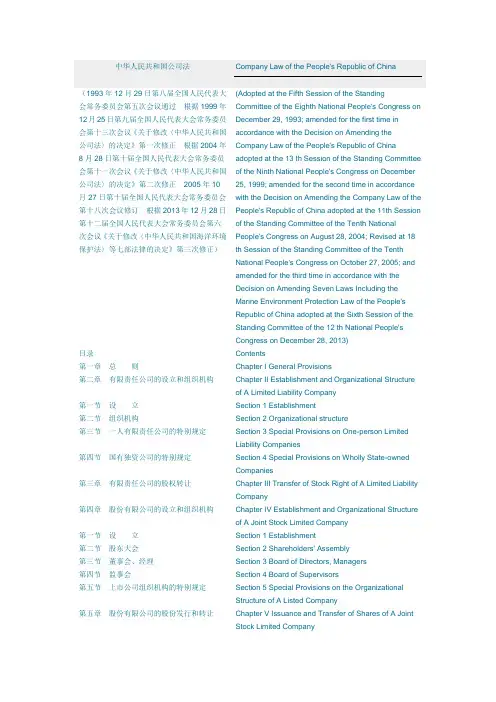

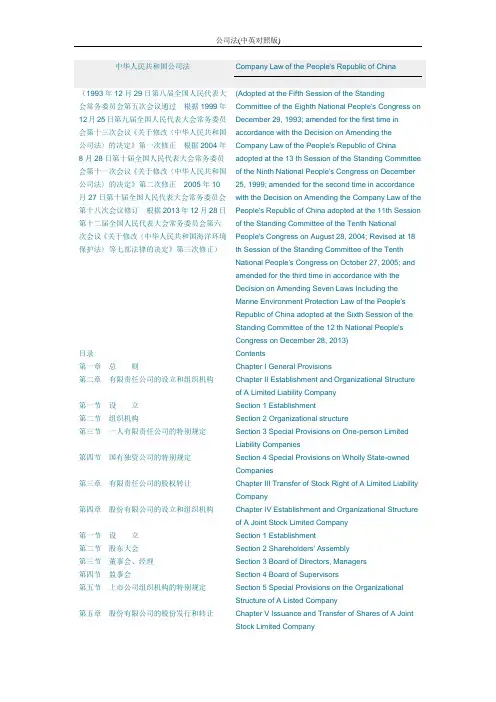

中华人民共和国公司法Company Law of the People's Republic of China(1993年12月29日第八届全国人民代表大会常务委员会第五次会议通过根据1999年12月25日第九届全国人民代表大会常务委员会第十三次会议《关于修改〈中华人民共和国公司法〉的决定》第一次修正根据2004年8月28日第十届全国人民代表大会常务委员会第十一次会议《关于修改〈中华人民共和国公司法〉的决定》第二次修正2005年10月27日第十届全国人民代表大会常务委员会第十八次会议修订根据2013年12月28日第十二届全国人民代表大会常务委员会第六次会议《关于修改〈中华人民共和国海洋环境保护法〉等七部法律的决定》第三次修正)(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress on December 29, 1993; amended for the first time in accordance with the Decision on Amending the Company Law of the People's Republic of China adopted at the 13 th Session of the Standing Committee of the Ninth National People's Congress on December 25, 1999; amended for the second time in accordance with the Decision on Amending the Company Law of the People's Republic of China adopted at the 11th Session of the Standing Committee of the Tenth National People's Congress on August 28, 2004; Revised at 18 th Session of the Standing Committee of the Tenth National People's Congress on October 27, 2005; and amended for the third time in accordance with the Decision on Amending Seven Laws Including the Marine Environment Protection Law of the People's Republic of China adopted at the Sixth Session of the Standing Committee of the 12 th National People's Congress on December 28, 2013)目录Contents第一章总则Chapter I General Provisions第二章有限责任公司的设立和组织机构Chapter II Establishment and Organizational Structureof A Limited Liability Company第一节设立Section 1 Establishment第二节组织机构Section 2 Organizational structure第三节一人有限责任公司的特别规定Section 3 Special Provisions on One-person LimitedLiability Companies第四节国有独资公司的特别规定Section 4 Special Provisions on Wholly State-ownedCompanies第三章有限责任公司的股权转让Chapter III Transfer of Stock Right of A Limited LiabilityCompany第四章股份有限公司的设立和组织机构Chapter IV Establishment and Organizational Structureof A Joint Stock Limited Company第一节设立Section 1 Establishment第二节股东大会Section 2 Shareholders' Assembly第三节董事会、经理Section 3 Board of Directors, Managers第四节监事会Section 4 Board of Supervisors第五节上市公司组织机构的特别规定Section 5 Special Provisions on the OrganizationalStructure of A Listed Company第五章股份有限公司的股份发行和转让Chapter V Issuance and Transfer of Shares of A JointStock Limited Company第一节股份发行Section 1 Issuance of Shares 第二节股份转让Section 2 Transfer of Shares第六章公司董事、监事、高级管理人员的资格和义务Chapter VI Qualifications and Obligations of the Directors, Supervisors and Senior Managers of A Company第七章公司债券Chapter VII Corporate Bonds第八章公司财务、会计Chapter VIII Financial Affairs and Accounting of ACompany第九章公司合并、分立、增资、减资Chapter IX Merger and Split-up of Company; Increaseand Deduction of Registered Capital第十章公司解散和清算Chapter X Dissolution and Liquidation of A Company 第十一章外国公司的分支机构Chapter XI Branches of Foreign Companies第十二章法律责任Chapter XII Legal Liabilities第十三章附则Chapter XIII Supplementary Provisions第一章总则Chapter I General Provisions第一条为了规范公司的组织和行为,保护公司、股东和债权人的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,制定本法。

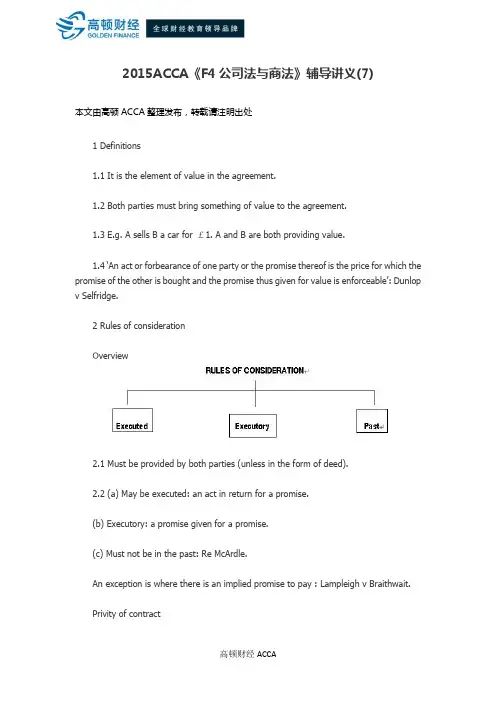

2015ACCA《F4公司法与商法》辅导讲义(7)本文由高顿ACCA整理发布,转载请注明出处1 Definitions1.1 It is the element of value in the agreement.1.2 Both parties must bring something of value to the agreement.1.3 E.g. A sells B a car for £1. A and B are both providing value.1.4 ‘An act or forbearance of one party or the promise thereof is the price for which the promise of the other is bought and the promise thus given for value is enforceable’: Dunlop v Selfridge.2 Rules of considerationOverview2.1 Must be provided by both parties (unless in the form of deed).2.2 (a) May be executed: an act in return for a promise.(b) Executory: a promise given for a promise.(c) Must not be in the past: Re McArdle.An exception is where there is an implied promise to pay : Lampleigh v Braithwait.Privity of contract2.3 Only a party to a contract may sue on that contract – 'Privity of Contract'. Dunlop v. Selfridge.There are a number of exceptions:(a) persons entitled to benefit under third party motor insurance can sue the insurer directly: Road Traffic Act 1972.(b) a principal where his agent was the party entering into the contract.(c) a special relationship exists between the parties (eg acting as executor of a deceased's estate).(d) where there has been an assignment of the benefit of the contract. The burden can only be assigned with the consent of the other party.2.4 Also be aware of Contracts (Rights of Third Parties) Act 1999.This has a fundamental effect on the rule of privity of contract and sets out the circumstances in which a third party may enforce a contract term.(a) the third party must be expressly identified in the contract.(b) the contract must give an express or implied right to the third party to enforce the term.更多ACCA资讯请关注高顿ACCA官网:。

中华人民共和国公司法Company Law of the People's Republic of China(1993年12月29日第八届全国人民代表大会常务委员会第五次会议通过根据1999年12月25日第九届全国人民代表大会常务委员会第十三次会议《关于修改〈中华人民共和国公司法〉的决定》第一次修正根据2004年8月28日第十届全国人民代表大会常务委员会第十一次会议《关于修改〈中华人民共和国公司法〉的决定》第二次修正2005年10月27日第十届全国人民代表大会常务委员会第十八次会议修订根据2013年12月28日第十二届全国人民代表大会常务委员会第六次会议《关于修改〈中华人民共和国海洋环境保护法〉等七部法律的决定》第三次修正)(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress on December 29, 1993; amended for the first time in accordance with the Decision on Amending the Company Law of the People's Republic of China adopted at the 13 th Session of the Standing Committee of the Ninth National People's Congress on December 25, 1999; amended for the second time in accordance with the Decision on Amending the Company Law of the People's Republic of China adopted at the 11th Session of the Standing Committee of the Tenth National People's Congress on August 28, 2004; Revised at 18 th Session of the Standing Committee of the Tenth National People's Congress on October 27, 2005; and amended for the third time in accordance with the Decision on Amending Seven Laws Including the Marine Environment Protection Law of the People's Republic of China adopted at the Sixth Session of the Standing Committee of the 12 th National People's Congress on December 28, 2013)目录Contents第一章总则Chapter I General Provisions第二章有限责任公司的设立和组织机构Chapter II Establishment and Organizational Structureof A Limited Liability Company第一节设立Section 1 Establishment第二节组织机构Section 2 Organizational structure第三节一人有限责任公司的特别规定Section 3 Special Provisions on One-person LimitedLiability Companies第四节国有独资公司的特别规定Section 4 Special Provisions on Wholly State-ownedCompanies第三章有限责任公司的股权转让Chapter III Transfer of Stock Right of A Limited LiabilityCompany第四章股份有限公司的设立和组织机构Chapter IV Establishment and Organizational Structureof A Joint Stock Limited Company第一节设立Section 1 Establishment第二节股东大会Section 2 Shareholders' Assembly第三节董事会、经理Section 3 Board of Directors, Managers第四节监事会Section 4 Board of Supervisors第五节上市公司组织机构的特别规定Section 5 Special Provisions on the OrganizationalStructure of A Listed Company第五章股份有限公司的股份发行和转让Chapter V Issuance and Transfer of Shares of A JointStock Limited Company第一节股份发行Section 1 Issuance of Shares 第二节股份转让Section 2 Transfer of Shares第六章公司董事、监事、高级管理人员的资格和义务Chapter VI Qualifications and Obligations of the Directors, Supervisors and Senior Managers of A Company第七章公司债券Chapter VII Corporate Bonds第八章公司财务、会计Chapter VIII Financial Affairs and Accounting of ACompany第九章公司合并、分立、增资、减资Chapter IX Merger and Split-up of Company; Increaseand Deduction of Registered Capital第十章公司解散和清算Chapter X Dissolution and Liquidation of A Company 第十一章外国公司的分支机构Chapter XI Branches of Foreign Companies第十二章法律责任Chapter XII Legal Liabilities第十三章附则Chapter XIII Supplementary Provisions第一章总则Chapter I General Provisions第一条为了规范公司的组织和行为,保护公司、股东和债权人的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,制定本法。

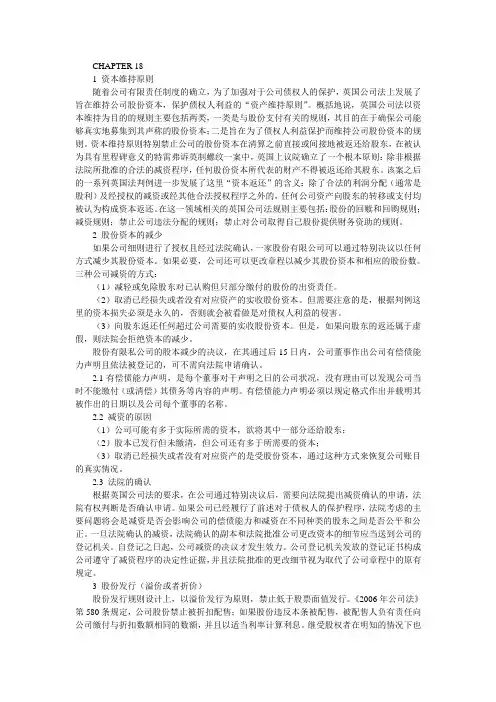

CHAPTER 181 资本维持原则随着公司有限责任制度的确立,为了加强对于公司债权人的保护,英国公司法上发展了旨在维持公司股份资本,保护债权人利益的“资产维持原则”。

概括地说,英国公司法以资本维持为目的的规则主要包括两类,一类是与股份支付有关的规则,其目的在于确保公司能够真实地募集到其声称的股份资本;二是旨在为了债权人利益保护而维持公司股份资本的规则。

资本维持原则特别禁止公司的股份资本在清算之前直接或间接地被返还给股东,在被认为具有里程碑意义的特雷弗诉英制螺纹一案中,英国上议院确立了一个根本原则:除非根据法院所批准的合法的减资程序,任何股份资本所代表的财产不得被返还给其股东。

该案之后的一系列英国法判例进一步发展了这里“资本返还”的含义:除了合法的利润分配(通常是股利)及经授权的减资或经其他合法授权程序之外的,任何公司资产向股东的转移或支付均被认为构成资本返还。

在这一领域相关的英国公司法规则主要包括:股份的回赎和回购规则;减资规则;禁止公司违法分配的规则;禁止对公司取得自己股份提供财务资助的规则。

2 股份资本的减少如果公司细则进行了授权且经过法院确认,一家股份有限公司可以通过特别决议以任何方式减少其股份资本。

如果必要,公司还可以更改章程以减少其股份资本和相应的股份数。

三种公司减资的方式:(1)减轻或免除股东对已认购但只部分缴付的股份的出资责任。

(2)取消已经损失或者没有对应资产的实收股份资本。

但需要注意的是,根据判例这里的资本损失必须是永久的,否则就会被看做是对债权人利益的侵害。

(3)向股东返还任何超过公司需要的实收股份资本。

但是,如果向股东的返还属于虚假,则法院会拒绝资本的减少。

股份有限私公司的股本减少的决议,在其通过后15日内,公司董事作出公司有偿债能力声明且依法被登记的,可不需向法院申请确认。

2.1有偿债能力声明,是每个董事对于声明之日的公司状况,没有理由可以发现公司当时不能缴付(或清偿)其债务等内容的声明。

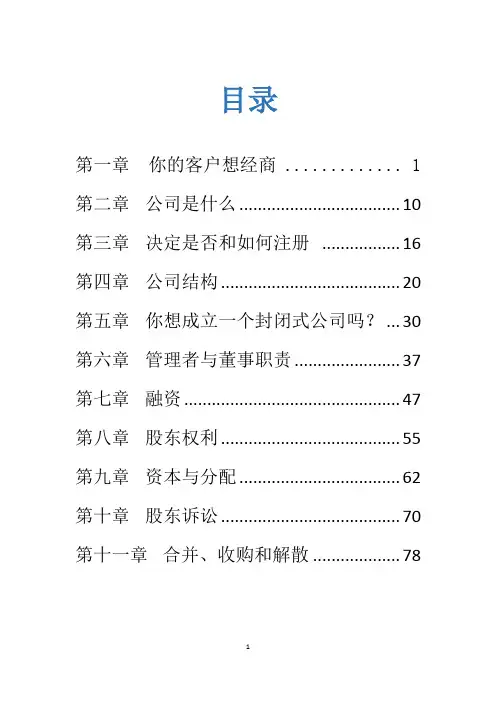

目录第一章你的客户想经商 (1)第二章公司是什么 (10)第三章决定是否和如何注册 (16)第四章公司结构 (20)第五章你想成立一个封闭式公司吗? (30)第六章管理者与董事职责 (37)第七章融资 (47)第八章股东权利 (55)第九章资本与分配 (62)第十章股东诉讼 (70)第十一章合并、收购和解散 (78)第一章你的客户想经商P1一个律师被一个想经商的客户保留下来。

有几种类型的商业实体(经商方法;公司与合伙企业是许多选择中的两种)。

法律秘书和律师助理协助律师在客户面前面谈,获得事实和信息,准备适当的形式和协议,进行法律研究和记录文件。

有必要找出客户有什么样的实力。

然后,你必须与律师讨论适合的实力选择。

律师向客户解释了不同的方式去经营业务,每一个优点和缺点,然后决定与客户的最佳运载工具,以实现客户的目标。

P2商业实体的类型:独资经营一般合伙企业有限责任合伙公司企业封闭式公司股份有限公司有限责任合伙合资企业,商业信托,专业公司,非营利性公司和公营公司不是法律公司的。

日常工作,更属于专业领域。

独资经营:独资企业是由一个人拥有的企业。

它很容易成立并且一般在口头上就能成立。

通常,国家和市政机构没有必要提交申请。

它不是法人实体。

这意味着你不能以公司的名义请求、被请求或者买卖财产。

例如,ABC披萨店被史密斯先生拥有,你要经营的话就必须请求史密斯先生。

琼斯想要作为一个独资经营者从事管道业务。

他租了一个仓库并把名字放在窗户上。

“琼斯的管道”。

他现在是一个独自经营者,他接收所有他公司的利润。

他经营者公司,雇佣、解雇以及做一切商业决定。

如果公司有亏损,他承受损失。

琼斯可能投资了500美元开始他的事业。

不管引发多少数量的债务,他都以个人名义承担。

独资经营主要的劣势是个人的无限责任。

如果管道业务经营者驾驶他的车去顾客家修理管道,但是却发生了意外,撞伤一个人,导致这个人将不能再走路、工作,那么这个哪位经营者将个人承担大量的赔偿。

13Employment1 The contract of employmentOverview: Determining statusEMPLOYEE vs INDEPENDENT CONTRACTORDistinction Importance The testsDefinition1.1 An employment relationship exists where one person (the employee) supplies skill and labour toanother (the employer) in return for payment.1.2 Distinguish Employee from Independent Contractor. (Contract of Service vs Contract forServices.)Determining status1.3 An Employment Tribunal (ET) may apply one or more of the four tests listed below, note that noone test is likely to be conclusive Ready Mixed Concrete v Minister of Pensions:(a) Control test.(b) Integration Test:Is this party fully integrated into the organisation?(c) Multiple Test:ET looks at all the relevant factors. Now the most widely used test it considers:(i) Method of payment: periodic and prolonged, or lump sum?(ii) Method of selection and termination of relationship;(iii) Organisation of the work: can the individual choose hours and methods of working, or delegate?(iv) Provision of tools and equipment and;(v) Deduction of tax and N.I.(d) Mutuality of obligations test.2 TermsOverviewTERMSExpress Implied Maternity rights andWork-life balance2.1 Express terms(a) No requirement for formal written contract.(b) Under Employment Rights Act 1996 (ERA 1996) employer must provide written particularsto employee within 8 weeks of starting employment. Note this is not a contract but willconstitute strong prima facie evidence of the contractual terms.Particulars must include inter alia:• Details of remuneration and procedure for calculation.• Hours and place of work• Holidays and holiday pay• Situation if unable to work (sick pay/leave)• Length of notice• Disciplinary and grievance procedures.Any change to the particulars must be notified within one month.2.2 Implied termsEmployee is also protected by common law and statutory implied terms. Note that as with anycontract terms can be implied by custom and practice.2.3 Employer’s d uties to:(i) Provide remuneration:•Amount decided by contract or collective agreement. Common law provides that it must be reasonable now subject to National Minimum Wage Act 1998.(ii) Provide holidays and holiday pay and comply with Working Time Regulations:•Limit average weekly working time to 48 hours. The average is taken over a reference period of 17 weeks. (There is an opt out provision but this does not detract from theoverriding duty to provide a safe system of work.)•Limit on night workers average working time to 8 hours.•Minimum rest periods of at least 20 minutes for every 6 hours of work and a break away from work for 11 hours each day.•Right to paid annual leave allowing the worker to be away from work for 4 weeks. The right to leave starts to accrue from the first day of employment.(iii) Provide sick pay:•Employer provides statutory sick pay on behalf of the government•No general duty to provide sick pay from his own funds(iv) Provide a safe system of work: Johnstone –v– Bloomsbury Health Authority(v) Provide work:•No duty to provide work unless employee is paid by commission or on piece work, or where work has to be done to keep skills current.(vi) Indemnify employee(vii) Conduct his business in a ‘trustworthy’ manner. Breach of an implied duty of trust and confidence may give rise to “stigma” damages: BCCI v Malik. Must also treat employees with respect.(viii) Allow women maternity rights: ERA 1996 (see paragraph 2).(ix) Allow time off for union duties(x) Allow time off to seek work to redundant employees(xi) Provide itemised pay slips: ERA 1996(xii) Avoid discrimination:Sex Discrimination Acts 1975 and 1986Race Relations Act 1976Disability Discrimination Act 1995It is unlawful to discriminate:Against an applicant for a job or existing employee.In selection for a post or in access to promotion, training or other benefits.On grounds of sex, marital status, colour, race, nationality or disability.Unless (for sex and race) a genuine occupational qualification ((GOQ) exists:These include selection to preserve decency and privacy, or authenticity in entertainment(xiii) Pay the same rate of pay to men and women engaged in:like work orwork rated as equivalent(xiv) Disability Discrimination:•Creates a right not to be discriminated against on grounds of disability in employment.Disability is defined as a physical or mental impairment, which has a substantialadverse effect on a person’s ability to carry out normal day to day activities.•The DDA95 applies to employers who employ 15 or more people. It seeks to protect the disabled employee in all aspects of the employment relationship from recruitmentto dismissal. S5 however allows the employer to justify less favourable treatment ongrounds that are both ‘material to the particular case and substantial’.•Employers are also now required to 'make reasonable adjustments' to accommodate disabled persons. It should be noted that S5 allows an employer to justify a failure tocomply. In effect changes are only requ ired if ‘reasonable’ taking into account cost andpracticability.•Disability Rights Commission Act 1999 established a Disability Rights Commission.(xv) References:(a) No legal requirement to provide a reference or testimonial.(b) Giving a false reference is a criminal offence.(c) In civil law employer may also be liable in damages to:(i) A subsequent employer.(ii) The former employee for libel or slander and in negligence:(d) Data Protection Act 1998 allows employees to see manual and computer personnelfiles and take steps to force the employer to correct any inaccuracies.(xvi) Comply with various new regulations:The Fixed Term Employees (Prevention of less favourable treatment) Regulationsprevent fixed term employees being treated less favourably than similar permanentemployees.Under the Gender Reassignment Regulations it is unlawful to discriminate against anyone on the grounds of gender reassignment.There are also Regulations that make it unlawful to discriminate against an employeebecause of their actual (or perceived) sexual orientation, religion or beliefs.(xvii) Employer is protected by the employee’s duties to:(i) Use reasonable skill and care.(ii) Carry out lawful and reasonable instructions.(iii) Give faithful service: to pre serve the confidentiality of employer’s business.A serious breach will be a justified reason for dismissal.3 Maternity rights and the ‘work-life balance’3.1 Pregnant women have the following rights:(a) Right to time off for ante-natal care.(b) Maternity leave:–every woman is given ordinary maternity leave of 26 weeks–women employed continuously for 26 weeks have a right to additional maternity leave of 26 weeks(c) Right to return to work:–an employee on ordinary maternity leave has the right to return to work in the job she had before her absence–an employee on additional maternity leave has the same rights except if it is notpracticable for her to return to the same job. If this applies she has the right to a jobthat is suitable and appropriate to her. This must be on the same terms andconditions.(d) Maternity pay:–Statutory maternity pay is paid during an employees ordinary maternity leave.Additional maternity leave is unpaid.3.2 Fathers of children have the following rights:(a) Paternity leave:Provided that the employee is:–the biological father of the child or the mother's husband or partner–has or expects to have responsibility for the child's upbringing–has 26 weeks continuous service.He will be eligible to take either one or two consecutive weeks paid paternity leave. This mustbe taken within 56 days of the actual birth.(b) Paternity pay:This will be paid during the paternity leave.3.3 Adoptive parents have the following rights:(a) Adoption leaveThe Employment Act 2002 gives similar rights to adoptive parents as is given to pregnantwomen. However, the rights only extend to one of the adopting couple not both. The adoptingparents must have 26 weeks of continuous employment.3.4 All parents have the right to parental leave(a) Parents with one year's continuous service have a right to 13 weeks unpaid leave during achild's first years. It applies to children born after 15 December 1999. Time off in any one yearis limited to four weeks, and leave has to be taken in blocks of one week. Employers areentitled to 21 days notice.(b) Reasonable time off is to be allowed for 'family emergencies'.3.5 Right to flexible workingQualifying employees now have the right to request a change in working hours and place of workwhich must not be unreasonably refused.(a) Qualifying employeeTo qualify the employee must:–have a child under age of 6 (or 18 if disabled)–have 26 weeks continuous employment–have, or expect to have, responsibility for child's upbringing–be making the application in order to care for the child–not have made an application for flexible working in the previous 12 months(b) Grounds for reasonable refusal include:–burden of additional cost–detrimental effect on ability to meet customer demand–inability to re-organise work amongst existing staff or recruit additional staff(c) Effect of unreasonable refusal:Complaint can be made either to E.T. or ACAS. Compensation is limited to a maximum of 8 weeks pay that cannot exceed a statutory limit – currently £260 per week.4 Termination of contract4.1 A contract can be terminated in the following ways.•Dismissal on notice•Resignation•Dismissal without notice (summary dismissal)•Termination by agreement•Expiry of fixed term without renewal•Constructive dismissal:(i) the employer commits a serious breach of contract(ii) the employee leaves because of that breach(iii) the employee has not waived the breach4.2 Termination can give rise to both common law and statutory claims by the employee.OverviewTERMINATION CLAIMSWrongful Unfair Redundancydismissal dismissal5 Wrongful dismissal5.1 Where there has been a termination in breach of a contract by the employer, the employee mayclaim damages for wrongful dismissal.•There is no period of eligibility•Employee is entitled to damages which put him in the position he would have been in had the contract been performed ie. notice had been given•Employer will lose the right to enforce post termination covenantsDefences5.2 Employer must show that summary dismissal or dismissal with insufficient notice was justified.6 Unfair dismissal and redundancy: ERA 19966.1 Protection of the employee(a) An employee may have two potential statutory claims against an employer following dismissal,unfair dismissal and redundancy.(b) In both cases (unfair dismissal and redundancy) it is first necessary to establish a dismissaland that the applicant was employed under an employment contract.6.2 Unfair dismissal(a) As a general rule, every employee has the right not to be unfairly dismissed.(b) Exceptions:(i) Those who have been continuously employed for less than one year, (“the qualifyingperiod”). Employment will be continuous despite absences of up to 26 weeks forsickness or injury.(ii) Those above normal retirement age.(iii) Where there is a fixed term contract for one year or more and the parties have agreed in writing that the unfair dismissal provisions do not apply; (i.e. non-renewal will notgive rise to a claim).(c) The employer must show that the dismissal was "fair".(d) Justified reasons for dismissal:Capability/Qualifications: Assessed by reference to skill, aptitude, health or any otherphysical or mental quality. Qualification means degrees,diplomas or relevant technical or professional qualifications.Misconduct: Dependent on nature of employers business. In somecompanies, for example, drinking during working hours is asackable offence.Redundancy: See postLegal prohibition inemployment: For example, where a doctor has been struck off, or the loss ofa driving licence where this is essential.Other substantial reason: In employer’s discretion.PLUSEmployer acted reasonably eg. – followed ACAS Code of Conduct.“Did the employer act reasonably or unreasonably in treating the reason for dismissal assufficient for dismissing the employee?”(e) Certain reasons are automatically unfair:(i) pregnancy (unless this makes her incapable of adequately doing her job);(ii) membership of independent trade union (TULR(c)A 92).(iii) dismissal because employee brings proceedings against an employer to enforce a statutory right.The eligibility criteria does not apply to automatically unfair reasons.(f) Application to Employment Tribunal.Made within 3 months of dismissal.After this employee’s claim is time barred (unless the tribunal waives the time limit).(g) Remedies:ReinstatementRe-engagementor Compensation (Basic + compensatory + punitive)Employees must take steps to mitigate losses.Basic award:the basic award depends on the age of the employee, his weekly pay andthe length of his continuous employment.1½ week's payFor each year of employment, whereemployee is wholly over the age of 411 week's payFor each year of employment, whereemployee is below the age of 41 but overthe age of 21½ week's payFor each year of employment, whereemployee is below age 226.3 Redundancy(a) An employer may fairly dismiss for reasons of redundancy.(b) An employee may then claim statutory compensation for redundancy.(c) Entitled if continuously employed for 2 years or more since age of eighteen; and(d) dismissed by reason of redundancy:(i) employer has ceased/intends to cease carrying on business;(ii) requirements for employees have ceased or diminished.(e) Employee will not be entitled to a redundancy payment if:(i) employer renews the contract of employment; or(ii) makes an offer of renewal or re-engagement which the employee unreasonablyrefuses.(f) Remedies– compensation (basic award only ante).If an employee fulfils the qualifying criteria but was not dismissed by reason of redundancy hemay be able to claim unfair dismissal.(g) TUPE Regulations 1981. On transfer of a business the contracts of employment ofemployees are automatically transferred to the transferee.7 Occupational safety7.1 The main legislation is contained in the Health and Safety at Work Act 1974 as supplemented by theManagement of Health and Safety at Work Regulations. Enforcement is the responsibility of theHealth and Safety Executive.7.2 The Regulations impose duties upon employers to make a suitable and sufficient assessment of therisks likely to arise in the workplace. Measures must be taken to eliminate or reduce these risks. If the risks cannot be negated the employer must provide protective equipment. Safety procedures andtraining must also be provided.7.3 Employees also have duties to co-operate with the employer on safety matters.7.4 Remember that in addition to having to comply with statute employers have a common law duty toprovide a safe system of work.8 Liability for injuries at work8.1 Employees may face both criminal and civil liability for breaches of Health and Safety laws. Civilliability may lie contract or tort.8.2 With regard to the duty of care in tort it is owed in three respects:•ER must take care to select staff properly, give proper instructions and training and dismiss those whose behaviour is dangerous.•Equipment must be properly maintained.•Provide a safe system of work.14。

公司法和商法(双语)讲义第16章Corporate and Business Law Chapter 16 16 Memorandum of association1 Introduction1.1 The memorandum defines the company's relationships with third parties.Specimens are in the Companies Act.There are six principal clauses:-1.2 (a) name(b) registered office(c) objects(d) limited liability(e) share capital(f) association.NB: Plc’s will also have a clause declaring their status.2 Name clauseOverviewNAME CLAUSERefusal to Passing-off ChangeregisterBasic objective2.1 This obviously sets out the company's name.Refusal to register2.2 By S.26 the Registrar may refuse to register a name which is:(a) offensive (in the opinion of the Secretary of State)(b) constitutes an offence (ie, prohibited by statute: Banks must be registered under theBanking Acts)(c) the same as an existing corporation (although a person can use his/her own name)(d) where the words require permission and this has not been provided. There are two types ofsuch words:(i) those which imply a connection with the government or civil service.(ii) those mentioned in the list in the Business Names Act 1985 and The Company and Business Names (Amendments) Regulations 1992.Passing-Off2.3 (a) There is a tort (called passing-off) where a person carries on a business under a name thatwould mislead the public into believing the business is conducted by another person.(b) The most common method is to trade under a similar name.(c) The injured party must prove that there is a genuine possibility of confusion.(d) Remedies:(i) an injunction to prevent further violation.(ii) damages.(e) The court tends to allow the use of a person's name who is directly involved with thecompany.Changes of name2.4 (a) The name clause can be changed by special resolution.(b) The Secretary of State can order a company to change its name(i) Within 12 months if the company has been inadvertently issued with a name similar tothat of an existing company. s.28(2)(ii) Within 5 years if misleading information was supplied. s.28(3)(iii) At any time if the use of the name is likely to cause harm to the public. s.32(c) Action of company (whether acting voluntarily or by direction).A copy of the special resolution and the revised memorandum must be sent to the Registrarwithin 15 days.(d) Action of Registrar:(i) He alters the register.(ii) He issues a new certificate of incorporation.(iii) He advertises issue of the certificate of incorporation in the London Gazette.(e) Two further points:(i) The change of name does not affect rights or obligations under the old name.(ii) The change of name takes effect from the date of issue of the new certificate.Publication of the name2.5 (a) The name must appear legibly and conspicuously:-(i) outside the registered office and all place of business. s.348(ii) on the common seal. s.350 (if the company has one).(iii) on all business letters, notices and official publications.(iv) on all bills of exchange, cheques, promissory notes, orders, receipts and invoices signed or issued on the company's behalf. s.349(b) Penalties:(i) a fine for every officer wilfully authorising or permitting it.(ii) personal liability for any person issuing any bill of exchange, promissory note, cheque or order for money/goods without the company name: Penrose v MartyrLimited Liability2.6 (a) The name of a private company limited by shares must end with 'Limited' or Ltd'. (s.25)(b) The name of a public company must end with the words 'public limited company' or p.l.c.(s.25)(c) 'Limited', 'Ltd', 'public limited company' or 'plc' must not appear anywhere except at the end ofthe name. (s.26)3 Registered office clauseOverviewREGISTERED OFFICE CLAUSEDomicile SpecificaddressLocation – Domicile3.1 (a) To be registered, the company's registered office must be in England and Wales orScotland and the memorandum must say so.(b) No alteration of a company's memorandum re (a) above is permitted except by Act ofParliament.Location – Precise3.2 (a) Address of the registered office must be notified to the Registrar on registration. It is thecompany's official address. it is not unlike domicile, contained in the memorandum.(b) The address must be within the country of domicile given in the memorandum.(c) The Registrar must be told of any changes.(d) The change takes effect upon the notice being registered by the Registrar, but until the end ofthe period of 14 days beginning with the date on which it is registered a person may validlyserve any document on the company at its previous registered office.(e) The choice of location is the directors' responsibility (unless the articles say otherwise).(f) All business forms of the company must state the address of the registered office in legiblecharacters.Function of the registered office3.3 (a) As the company's official address it is where legal documents, notices, and othercommunications may be served.(b) The following statutory books must be kept at the registered office:(i) register of charges affecting the company's property together with copies ofinstruments creating the charges(ii) minutes of general meetings(iii) register of directors and secretaries.(c) The Register of Members (and index) need not be kept at the registered office if it is made upelsewhere (e.g. at professional registrars).(d) The following books must be kept at either the registered office or with the register ofmembers:(i) register of debenture holders(ii) register of directors' interests in shares/debentures of the company.(iii) copies of directors' service contracts.(iv) register of substantial shareholdings.(e) All the registers and other documents must be kept open for inspection for at least 2 hours onevery business day.(f) Members can inspect the registers free of charge and obtain copies for a 'reasonable' fee.4 Objects clauseOverviewOBJECTS CLAUSEPurpose Remedies ChangePurpose4.1 (a) This sets out the objects (ie purpose) of the company and defines the company'scontractual capacity.(b) This was designed to protect shareholders.(c) Prior to the Companies Acts 1985 and 1989, if a company entered into a contract which wasoutside its objects ("ultra vires") that contract was void and unenforceable by either party toit.(d) This rule could operate unfairly on third parties entering into transactions with the companysince they were deemed to have 'constructive notice' of the memorandum. Companies Act 19894.2 (a) A company may in effect opt out of the ultra vires rule all together by stating that the object ofthe company is to carry on business as 'a general commercial company' (s .3A).(b) However, many companies still have "traditional" objects clauses, and therefore the rules asto "ultra vires" transactions are still relevant.Remedies for an ultra vires transaction – S 35 CA '854.3 (a) Remedies for shareholders(i) Shareholders can restrain an ultra vires act by seeking an injunction. This can onlybe done before the act becomes binding(ii) They can sue directors for breach of duty(iii) They can ratify the ultra vires act by special resolution (NB. they require a separate special resolution to absolve the directors from liability for breach of duty)(b) Remedies for third parties(i) The doctrine of ultra vires has effectively been abolished(ii) 'The validity of an act done by a company shall not be called into question on thegrounds of lack of capacity by reason of anything in the company's memorandum'.(iii) Constructive notice no longer applies.Alteration of the objects clause4.4 (a) The objects can be altered by a special resolution (s.4)(b) A copy of the resolution must be sent to the Registrar within 15 days of its adoption; he willpublish it in the London Gazette.(c) Minority protection (s.5)(i) Persons eligible:Dissenting membersHolding 15% of NV of any issued share(ii) Procedure:Application to court21 days from SR to do so(iii) Outcome:Court does “as it thinks fit”(d) A copy of the amended memorandum must be sent to the Registrar after the 21 day periodhas expired.5 Limited liability clause5.1 This serves as a general notice to those dealing with the company.5.2 The liability of the members is limited to the amount unpaid on their shares.If a member's shares are fully paid up he or she has no further liability.6 Capital clause6.1 This must state:-(a) the amount of the share capital in £'s.(b) The number of shares into which the share capital is divided.(c)The nominal value of each share.7 Association clause7.1 This is a record and it cannot be altered. The subscribers simply sign to say that they are taking up ashare in the company.8 Other clauses8.1 Plcs must state that they are plcs in the memorandum.。