金融英语加百力版

- 格式:ppt

- 大小:614.00 KB

- 文档页数:52

金融英语练习答案:Lesson 1I. 1.need 2.specialization 3.double coincidence of wants 4.exchange rate 5. money6.medium of exchange7. Commodity money such as cornmodity / common standard value9. store of wealth 10.parchasing power 11.Banknotes. 12.Fiduciary money 13.redemption rate 14.Fiat money 15. legal tender 16.fiduciary money 17.paper money 18.price level 19.reserve rax 20. checkII Translation:1.Money mainly serves three functions :a medium of exchange, a standard of value and a store ofwealth.2.The greater the specialization in the division of labor increased ,the more difficult in finding goodsthat have a double coincidence of wants.3.The value of money is reflected by its purchasing power.4.Fiat money is declared legal tender by the government ,meaning that creditors must accept it aspayment for debt.5.The bearers/holders of fiduciary money may require bank to redeem for gold or other valuablecommodity.6.The fractional reserve banking system requires the banks to keep certain reserve ratio.7.The money that most countries in the world use today is fiat money.8.The wide application of fiduciary money reduces that cost of transactions.9.There were several metals which have been used as commodity money in the history, such as iron,copper, gold ,silver and so on.10.The value of fiat money lies in that people believe that it can be exchanged for commodity andservice.Lesson 2:I.1.investors 2.consumoption / saving 3.enterprises 4. savings 5.investment 6.home7.loan 8.deposit 9.uill rise 10.fallII1.The interest rate refers to the ratio of the interest amount to the proceeds deposited and loaned in agiven period.2.Interest is the price of capital; which is like the market price for general commodity .Theoretically ,itis determined by demand and supply.3.China’s interest rate has been adjusted and reformed for several times .Before 1978,the policy ofgradually rising interest rate was adopted.4.The mutual relation of all kinds of interest rate comprises the structure of interest rate. Generally ,theinterest rate of longer tenor is higher than that of shorter tenor in terms of the same kind of interest rate.5.Among various interest rate, the interest rate for deposit is lower that for loan; the interest rate offeredby commercial bank is higher than discount rate offered by the central bank.6.At present ,China’s interest rate system consists of the interest rate of bank, non-bank financialinstitution, portfolio and market.7.The discount rate offered by central bank refers to the discount rate for the instrument held by thecommercial banks. it reflects the redemption rate for the amounts of rediscount instrument.8.Due to free competition ,the demand and supply of currency borrowing and lending tend to bebalanced out through market mechanism .in this case ,the market interest rate is called equilibrium rate.9.The bond interest rate is interest rate paid by the government, banks and corporation for theaccommodation in the form of issuing, securities in domestic or foreign financial markets.10.The interest rate for corporate bond is basically determined by the bond issuing corporation itself, butthe government exercises control by setting the ceiling.Lesson 3:I.1.Firrancial intermediary 2.demard deposit /checking account 3.savings and loan associations, mutual savings bank and credit union. 4.Federal reserve system ernment securities/require that member banks hold reserves equal to some fraction of their deposits. 6.Feder Reserve Board 7.Federal Open market committee 8.reserve requirements 9.the ceiling 10. interest rate level 11.portfolios 12.outstanding loans 13.were deregulated 14.deposit insurance 15.merge with other banks 16. automatic teller machines 17.By pooling funds of many share holders 18.branches 19.The banking holding company 20.financialII1.Federal Reserve System was established in 1914,with its aim to stabilize the banking system. thepower of the Federal Reserve System was enhanced and centralized after the failures of many American banks in the Great Depression. The Arts passed in1980s authorized the Federal Reserve System with the power to regulate all the saving institutions. The main powers of Federal Reserve System were:(1)guide the transactions of open market so to control supply of money by buying and selling government securities,(2)determine the reserve requirements for saving institution (3)setting rediscount rate.2.The banking regulations in Great Depression made bank a trade that closely controlled andpredictable. But the high interest rate in 1970s disturbed the peaceful days of saving institutions. But many banks still couldn’t survive in the transive period of keen competition.Lesson 4:1.as a result of /helped to /by the time2.concerned about/at the outset3.offerd to take/in dollars/departure fromTransaction account is checking account which can write checks on deposits balance. They have three forms, the first one is “Demand Deposit”which banks don’t pay explicit interest; the second one is “ other checkable deposits”, which includes NOW(Negotiable Order of Withdrawal)accounts; the third one is Money Market Deposit accounts. Although banks can’t pay explicit interest on demand deposit, they can pay implicit interest in the form of proving free services. Different from NOW accounts, commercial banks don’t need to maintain reserves, so banks pay higher interest on the NOW accounts. At present, transaction account is the second largest debt form of the commercial banks.Lesson 5I1.as well as 2.in total assets 3.intermediate 4. title 5.an agent 6.Financial instruments 7.pay 8.as par 9.documentary letters of credit 10.prof-of –shipment documents . 11. HedgingII. Translation:Lesson 6I.1.bank 2.discount 3.buyers/sellers 4.short-term 5.borrowing/lending 6.deposits7.brokers 8.loans 9.linked 10.marketII Translation:1.The activities of money market mainly aim at keeping the liquidity of assets so that they can bechanged into cash on demand.2.On one hand, the money market meets the demand for short-term money of borrowers, one the otherhand, it finds a way out for lenders who have temporary excessive money.3.The Financial instruments of money market mainly are short-term treasury bill, commercial bill, bankacceptance, certificate of deposits, the tenors of these instruments range from one day shortest to one year longest.4.The participants of buying and selling short-term assets in the money market are individuals, businessfirms, various financial institutions, and governments. They act either as the provider of funds or as the demander of funds.5.As the intermediary of money market, various financial institutions have different functions inaffecting the demand for and supply of funds in the capital market, because their stress of importance on business if different.6.The commercial banks provide the money market mainly with short-term loans mainly with themoney obtained from deposits and other sources.7.In many countries, commercial banks are in the position of key importance in the money market,while the central bank controls commercial banks by various means so as to control money market. 8.Just as a country can’t be without a government, the money market can’t be without a central bank,whose activities in money market will affect the volume of money and interest rate at any time.9.The inter-bank market refers to the market where financial institutions solve the problem of excessiveor short of money by financing one another.10.With the development of the reform of financial system in our country, the inter-bank markets startedto develop rapidly.Lesson 7I.1.firms 2.inter rate /exchange 3. regional exchange 4.negotiable 5.exchange6.bond7.funds8.outstanding9.brokers 10.dealers.II. Translation:1.According to the situation of various countries, the issuance of government bonds adopts the methodof raising money from public, which can be divided into direct and indirect ones.2.The government bonds outstanding are not all held by individuals, but by the government units,financial institutions and the public commonly.3.The government should keep a stable increase for the issuance of securities, if the market price for thegovernment bonds often fluctuate, the investors will be reluctant to hold the government bonds.4.Corporate bonds are the certificates that the business owes to the public, it is the issuing corporationthat makes a promise to pay certain amount of money plus interest at a fixed date in future.5.The better the credit standing of a company, the longer maturity of the bond is ,but the solvency ofcorporate bonds cannot be compared with that of government, so the longest tenor of corporate bond will not be very long.pared with stock investment, the holders of corporate bonds can only have the interest income asthe fixed reward for the investment, but they can’t share the profit of the corporation like share holders.pared with stocks, corporation bonds have lower risks, but the safety can’t be compared to that ofgovernments bonds, that’s why the return ration is always higher than government bonds.8.With the rapid development of capitalist industry, shareholding corporation system becomesirresistible trend.9.The price of stocks are of substantial fluctuation, which makes investment of stocks very speculative.10.The market price of stocks is subject to the status of operation, allocation of profits, as well as to theeconomical, political social factors that make the price of stocks more volatile.Lesson 8I. 1.foreign 2.activities/lend 3.standing 4.role 5.independent 6.consortium banks7.money 8.bond 9.subsidiary 10.EurocurrencyII. Translation:1.In most countries, commercial banks all establish international department or foreign department inorder to deal in foreign exchange or to raise money for foreign trade.2.Due to the development of international banking business and the establishment of the bank’soverseas network organization, commercial banks of western countries become real multinational banks.3.The international network of the multinational bank includes branch, subsidiary, correspondent,resident representative and so on.4.The activities of the multinational bank through exclusive international network are retail deposit,money market activities, foreign trade financing, corporation loans, foreign trade business, investment business, trust business and so on .5.Because most of the clients of the multinational bank are large corporations and banks, they mainlydeal in retail deposits with few retail loans.6.The multinational banks put surplus money into money market when the demand is low, but raisemoney when demand is on rise.7.The tenor of foreign trade financing is usually short with high return, mostly denominated in thecurrency other that of the country where the bank locates.8.Corporation loans refer to the loans given to private business, state-owned business, especially to themultinational corporation.9.Foreign exchange business includes buying and selling foreign exchange and hedging conducting inforeign exchange market for the clients.10.Investment business refers to the underwriting of international securities and the distribution activities,as well as advisory service for customers and governments in the issue of securities.Lesson 9I.1.short-term 2.medium-term /long-term 3.restrictions 4.deposits 5.absence6.Euro currencies7.borrowers abroad8.entities9.deposits 10. convertibleII. Translation:1.Eurodollar refers to the deposits denominated in US dollar in various banks outside USA andEuropean branches of American banks, as well as the loans obtained by these banks.2.Off-shore money market is concentrated by Eurocurrency market , which is habitually called theEurodollar market, because the currency traded in this market is mainly Eurodollar.3.Eurobanks deal in Eurocurrency business which is strictly separated from domestic banking.4.London in the largest Eurodollar market, engaging in both deposit and loan, with huge volume oftransactions.5.Eurobank’s business usually not subject to local banking rules, such as deposit rate and maturity,therefore, banks can compete freely to attract customers.6.The interest rate for Eurodollar deposit is higher than for US domestic deposit since there is noreserve requirement for Eurodollar deposit nor premium insurance.7.The emergence of Eurodollar is due to the deficit of American balance of payments The accumulationof huge deficit and the outflow of large amount of US dollar resulted in substantial increase of Eurodollar deposits.8.The brokers or dealers of American stock Exchange often borrow Eurodollars from Eurodollarmarket.9.The Eurodollar market is a short-term wholesale market of inter bank, it functions in Europe asproviding banks with liquidity like the federal fund market in USA.10.Banks put the money in the Eurodollar market when the liquidity is excessive and borrow moneywhen the liquidity is in squeeze.Lesson 10I. Part(1)1.the creation of money 2.cooperative /voluntarily 3.external/economic reforms4.the par value system5.on demand6.stable/predictable/disadvantages7.float8.quota subscriptions 9.needy/favorable 10.buying power/importsPart(2)1.subsidize 2. internal 3.bargain 4.peg 5.payments 6.assistance/sufficient7.stabilizing/strengthening 8.repay/repayment period 9.effectively11.lower/export/governmentII. Translation:1.The fund shows great concern over the internal economic policies of its member countries.2.The Fund is a cooperative institution, overseeing/supervising and monitoring the foreign exchangepolicies its member countries.3.The exchange of currency is the center of financial connection/relation among various countries, aswell as a dispensable tool of world trade.4.Due to constant fluctuation of exchange rate for major/leading currency, the dealers of foreignexchange may gain profit or suffer loss.5.The convertibility of currencies facilitates tourism, trade and investment in a worldwide scale.6.By analyzing the wealth and economic status of each member the fund determines the quotasubscription for each member. The richer the country is, the higher quota it Subscribes.7.Since the abandonment of the par value system, the membership of the Fund has agreed to allow eachmember to choose its own method of determine an exchange value for its money.8.Man large industrial nations allow their currencies to float, other countries peg the value of theircurrency to that of a major currency of a group of currencies so that, for example, as the U.S. dollar rises in value their own currencies rise too.9.The source of finance of the Fund mainly comes from the quota subscription of its member countriesat the same time, the Fund also borrows money from member governments or their monetary authorities.10.The Fund lends money according to regulation to the member countries with a payments problem,due to their expenditure in foreign exchange exceeding income.Lesson 11I. Part(1)1.catalyst 2.equity 3. creditworthy 4.reschedule/made 5.carry6.fourfold7.share8.foreign exchange9.attained 10.indexPart(2)1.productivity 2.affiliates 3.self-sustaining 4.call up 5.quota/economic strength6.a third/raised7.politicalitary/political9.enjoined 10.indexII Translation:1.The IBRD has more than 140 member countries, which all subscribe quotas to the bank.2.The IBRD gives loans only to creditworthy borrowing countries for the project that has a high realrates of economic return.3.The IDA gives loans only to poorest countries with a annual GNP per capita lower than $795.Actually, 80% of IDA’s loans are given to the countries with annual per capita GNP lower than $410.4.The IDA gives loans only to the government of the borrowing countries, with maturity of 50 years(repayable over 50 years) with grace period of 10 years, no interest.5.In the past decade, the volume of the IBRD’s loans have increased by fourfold.6.The IBRD has helped to develop agriculture, improve education, increase the output of energy,expand industry, create better urban facilities, promote family planning, extend telecommunications network, modernize transportation systems, improve water supply and sewerage facilities, and establish medical care.7.It’s hard to say that the IBRD’s decisions on loans are not influenced by the political character of theborrowing countries.8.Some of the earliest borrowing countries of the IBRD have graduated from the reliance on the IBRD’sloans, in return they become the provider of the IBRD’s finance source.9.The IBRD and IFC jointly provide funds for many projects.10.The more quota the member country subscribes, the more votes it gains.Lesson 12I . Part(1) 1.foster 2.raise 3.subregional/regional 4.multilateral 5.cost-effective6.evaluation7.weighted8.proportional9.paid in 10.developrnental Part(2) 1.equity 2.private 3.subscriptions 4.installment 5.subscribed6.coordinate7.procurement8.absorb9.pooling 10.bidsII. Translation:1.The purpose of the ADB is to provide fund and technical assistance to its developing membercountries in the Asia-Pacific region and to promote investment and foster economic growth.2.The shortage of capital, lack of skilled labor, poor technology, limited markets and the vagaries ofnature have impeded the economic development of the developing countries.3.The Bank’s Charter provides that the capital owned by the Asia-Pacific member countries should notbe less than 60% of total equity.4.Multilateral institution plays an important role in the economic development.5.The projects for bank financing are identified after strictly evaluated.6.The ADB keeps close working relationship with the United Nations as well as all kinds of specialinstitution.7.Some member countries in Asia-Pacific region voluntarily increase their subscriptions.8.The main subscribers of the ADB have no veto. In practice, decisions are reached by process ofdiscussion rather than by voting.9.The capital structure of the ADB is crucial/vital key to its loan/financing capacity.10.The ADB is authorized to make and guarantee loans to its member countries.Lesson 13I 1. surplus 2.surplus 3.deficit 4.capital 5.demand 6.supply 7.supply/demand8.outstanding 9.demand 10.supplyII. Translation:1.Just as a country’s domestic economy should have a financial record, a country’s authority should alsohave a statistical summery for all the external economic and financial transaction of its residents.2.The content of the balance of payments concept differs in different historical stage.3.In narrow sense, the balance of payments is defined as the receipts and payments arising frominternational trade or receipt and payments in foreign exchange.4.The balance of payments is a kind of statistic statement in the given period, which reflects thetransactions of goods, services and incomers of an economy.5.The statement of balance of payments is a kind of material that statistical financial transactions in thegiven period according to the form stipulated by IMF.6.The items entering into credit includes goods and services provided from abroad and so on.7.The items entering into debit includes goods and services obtained from abroad and so on.8.Receipts and payment arising from international trade is the most important item in current account,which comprise export and import of various commodities. Generally, the export and import of commodities account for the biggest proportion in the international transactions.9.Capital account reflects the changed of a country’s foreign assets and liabilities. The financial assethere doesn’t include monetary gold and Special Drawing Rights.10.In order to alter the deficits of our country’s balance of payments, the government adopts a series ofpolicies and measures, for examples, reduce domestic basis construction, adjust the structure of exporting and importing commodity, improve the environment for foreign investment, lower the exchange rate of our currency to the main currencies in the world, and so on.Lesson 14I .1.strike 2.The exchange rate 3.bank deposits 4.coordinates5.Arbitraggeurs6.discrepancies7.depreciation8.appreciation9.foreign exchange market 10.speculatorsII. Translation:1.It’s vitally important for those who are engaged in international finance to be aware of the tender offoreign exchange market.2.As long as the foreign exchange floats, there always exist the risks of change of foreign exchange rateand interest rate.3.The arbitrageurs make profits by taking advantage rate across markets to buy low and sell high.4.The buyers and sellers come to an agreement of transaction according to the exchange rate of twocurrencies.5. A greater demand for foreign goods and services means a greater demand for foreign exchange.6.The view that the price of us dollar will fall might note be wrong.7.If more people want to exchange pound into US dollar, the change of exchange rate is favorable to USdollar, and unfavorable to pound when the demand exceeds the supply.8.If the supply of certain goods is excessive, the demand for the goods will go down/decline.9.To devaluate a country’s currency can encourage export.10.There are tow ways to express foreign exchange rate.Lesson 15I. Part (1) 1. fluctuate 2.predictable 3.Capital flows 4.manufactured 5.speed6. refinements7.open/bonds/exchange8.devaluation9.nominal10.halvePart(2) 1.devalues 2.priced 3.demand 4.expectations 5.profit 6.fund7.closed 8.reduces 9.real 10.verticalII. Translation:。

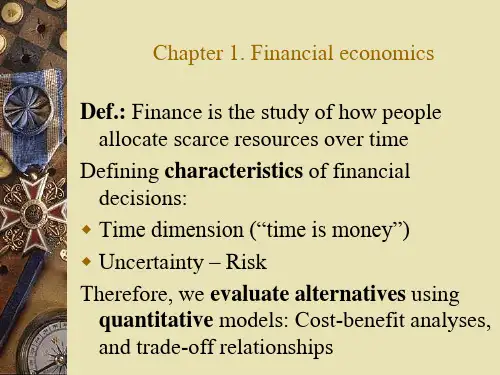

金融学第二版课后答案英文版中国人民大学Bodie2_IM_Ch01CHAPTER 1 – Financial EconomicsEnd-of-Chapter ProblemsDefining Finance1. What are your main goals in life? How does finance play a part in achieving those goals? What are the major tradeoffs you face?SAMPLE ANSWER:Finish schoolGet good paying job which I likeGet married and have childrenOwn my own homeProvide for familyPay for children’s educationRetireHow Finance Plays a Role:SAMPLE ANSWER:Finance helps me pay for undergraduate and graduate education and helps me decide whether spending the money on graduate education will be a good investment decision or not.Higher education should enhance my earning power and ability to obtain a job I like.Once I am married and have children I will have additional financial responsibilities (dependents) and I will have to learn how to allocate resources among individuals in the household and learn how to set aside enough money to pay for emergencies, education, vacations etc. Finance also helps me understand how to manage risks such as for disability, life and health.Finance helps me determine whether the home I want to buyis a good value or not. The study of finance also helps me determine the cheapest source of financing for the purchase of that home.Finance helps me determine how much money I will have to save in order to pay for my children’s education as well as my own retirement.Major Tradeoffs:SAMPLE ANSWERSpend money now by going to college (and possibly graduate school) but presumably make more money once I graduate due to my higher education.Consume now and have less money saved for future expenditures such as for a house and/or car or save more money now but consume less than some of my friendsFinancial Decisions of Households2. What is your net worth? What have you included among your assets and your liabilities? Would you list the value of your potential lifetime earning power as an asset or liability? How does it compare in value to other assets you have listed?SAMPLE ANSWER:$ ____________ (very possibly negative at this point)Assets:Checking account balanceSavings account balanceFurniture/Jewelry (watch)Car (possibly)Liabilities:Student loansCredit card balanceIf renting, remainder of rental agreement (unless sublettingis a possibility)Car payments (possibly)Students typically don’t think about the high value of their potential lifetime earning power when calculating their net worth but for young people it is often their most valuable asset.3. How are the financial decisions faced by a single person living alone different from those faced by the head of a household with responsibility for several children of school age? Are the tradeoffs they have to make different, or will they evaluate the tradeoffs differently?A single person needs only to support himself and therefore can make every financial decision on his own. If he does not want health insurance (and is willing to bear the financial risks associated with that decision) then no one will be affected by that decision other than that single person. In addition, this person needs to make no decisions about allocating income among dependents. A single person is very mobile and can choose to live almost anywhere. The tradeoffs this individual makes generally concern issues of consuming (or spending) today versus saving for consumption tomorrow. Since this person is supporting only himself, the need to save now is less important than for the head of household discussed next.T he head of household with several children must share resources (income) among dependents. This individual must be prepared to deal with risk management issues such as how to be prepared for potential financial emergencies (such as a serious health problem experienced by a member of the family or home owners insurance in case of a fire or other mishap). Because there are more people in this household than with a single person, there are greater risks that someone will get sick or injured. Andbecause there are dependents, the wage earner(s) should think carefully about life and disability insurance. In addition, the family is not as mobile as the single individual. Because of the school age children, the family might want to live near “good schools” thinking that a stronger education will eventually help those children’s future well being and financial situation. Thus, the tradeoffs for the head of household are more complex: more money is needed to consume today (he or she needs to support more dependents), but a lot more money is also needed to save for future expenses such as education and housing and more money is needed for risk management such as life and disability insurance.4. Family A and family B both consist of a father, mother and two children of school age. In family A both spouses have jobs outside the home and earn a combined income of $100,000 per year. In family B, only one spouse works outside the home and earns $100,000 per year. How do the financial circumstances and decisions faced by the two families differ?With two wage earners, there is less risk of a total loss of family income due to unemployment or disability than there is in a single wage earning household. The single wage earning family will probably want more disability and life insurance than the two wage earning family. On the flip side, however, the two wage earning family may need to spend extra money on child care expenses if they need to pay someone to watch the children after school.5. Suppose we define financial independence as the ability to engage in the four basic household financial decisions without resort to the use of relative’s resources when making financing decisions. At what age should children be expected to becomefinancially independent?Students will have differing responses to this question depending upon their specific experiences and opinions. Most will probably say independence should come after finishing their education, and they have a significant flow of income.6. You are thinking of buying a car. Analyze the decision by addressing the following issues:a.Are there are other ways to satisfy your transportation requirements besides buying a car? Make a list ofall the alternatives and write down the pros and cons.Transportation Mode Pros ConsWalking ?Takes you directly where you wantto goNo out of pocket costsConvenient ?Takes a long time ?Destination may be too far Bicycle ?Takes you directly to where youwant to goNo out of pocket marginal costsConvenient ?Requires physical strength and endurance ?Destination may be too farBus ?InexpensiveReaches more distant destinations ?May not take you directly where you want to go ?Inconvenient schedules to go ?Many stops, not efficientSubway ?InexpensiveFast ?May not take you directly where you want to goLocal destinations only on limited networkTrain ?Reaches distant destinations ?Moderately expensiveMay not take you directly whereyou want to goAirplane ?Reaches distant destinationsFast ?Most expensiveWill not take you directly where you want to gob. What are the different ways you can finance the purchase of a car?F inance through a bank loan or lease, finance through a car dealer with a loan or a lease or finance the car out of your own savings.c. Obtain information from at least three different providers of automobile financing on the terms they offer.d. What criteria should you use in making your decision?Your decision will be to select the financing alternative that has the lowest cost to you.When analyzing the information, you should consider the following:Do you have the cash saved to make an outright purchase? What interest rate would you be giving up to make that purchase? Do you pay a different price for the car if you pay cash rather than finance?For differing loan plans, what is the down payment today? What are the monthly payments? For how long? What is the relevant interest rate you will be paying? Does the whole loan get paid through monthly payments or is there a balloon payment at the end? Are taxes and/or insurance payments included in the monthly payments? ?For differing lease plans, what is the down payment today? What are the monthly payments? For how long? Do you own the car at the end of the lease? If not, what does it cost to buy the car? Do you have to buy the car at the end of the lease or is it an option? Is there a charge if you decide not to buy the car? What relevant interest rate will you be paying? Are taxesand/or insurance payments included in the monthly payments? Are there mileage restrictions?7. Match each of the following examples with one of the four categories of basic types of household financial decisions.At the Safeway paying with your debit card rather than taking the time to write a checkDeciding to take the proceeds from your winning lottery ticket and use it to pay for an extended vacation on the Italian RivieraFollowing Hillary’s advice and selling your Microsoft shares to invest in pork belly futuresHelping your 15-year old son learn to drive by letting putting him behind the wheel on the back road into townTaking up the offer from the pool supply company to pay off your new hot tub with a 15-month loan with zero payments for the first three monthsThe first is the most difficult since in practice it is simply a cash transaction involving no financing. As such the purchase is a consumption decision only and the payment choice is not a financing decision. The second is also a consumption/saving decision. The third is an exchange of one financial asset for another and therefore an investment decision. The fourth is a risk-management decision since you have subjected yourself to increased risk that is not covered by insurance. The final example is a financing decision involving a loan to finance a purchase.Forms of Business Organization8. You are thinking of starting your own business, but have no money.a.Think of a business that you could start without having to borrow any money.A ny business that involves a student’s own personal service would be cheap to start up. For instance he or she could start a business running errands for others, walking their dogs, shopping etc. Along those same lines they could start some kind of consulting business. Both of these businesses could be run out of their dorm room or their own home and could be started with very little capital. If they wanted to hire additional workers, they would have to be paid on a commission basis to limit upfront expenses.b. Now think of a business that you would want to start if you could borrow any amount of money at the going market interest rate.Certainly there are many interesting businesses that could be started if one could finance 100% of the business with borrowed capital and no equity. Since you will be able to borrow 100% of the financing, you will be willing to take a lot greater risk than if you were investing your own money.c. What are the risks you would face in this business?[Answer is, of course, dependent on answer to question “b.”]d. Where can you get financing for your new business?Depending upon the size of the financing needed, students should be looking for both debt and equity financing. The sources of this financing ranges from individuals and credit cards (for very small sums) to banks, venture capitalists, public debt and equity markets, insurance companies and pension funds9. Choose an organization that is not a firm, such as a club or church group and list the most important financial decisions it has to make. What are the key tradeoffs the organization faces? What role do preferences play in choosing among alternatives?Interview the financial manager of the organization and check to see if he or she agrees with you.SAMPLE ANSWER:Local Church group. Most important financial decisions:Whether or not to repair damage done to church and grounds during last big hurricane (specifically repairing the leaking roof)What project to put off in order to pay for repair damageHow to pay for renovations to downstairs Sunday school roomsHow to increase member attendance and contributionsHow to organize and solicit volunteers for the annual Church Sale (largest fund raiser of the year)Key Tradeoffs and Preferences:C hurch group funds are severely limited, so the organization needs to prioritize expenses based upon cost and need. Not all projects that are needed will be undertaken due to the expense involved. An equally large amount of timewill be spent trying to raise financing since funds inflow is variable. Since not all projects can be financed, preferences of different important individuals (such as the pastor) take on great significance in the decision-making process.Market Discipline: Takeovers10. Challenge Question: While there are clear advantages to the separation of management from ownership of business enterprises, there is also a fundamental disadvantage in that it may be costly to align the goals of management with those of the owners. Suggest at least two methods, other than the takeover market, by which the conflict can be reduced, albeit at some cost.One way is to provide incentives for the managers so that they increase their pay when owners interests are improved. An example would be compensating managers with stock options, the value of which increase with the market value of shareholder’s int erests. A second method is to more closely monitor the behavior of the managers. Outside management consultants and auditors serve this role in part particularly to the extent that they report their findings to representatives from ownership groups. Both of these solutions assume the management cannot effectively deceive markets or consultant/auditors through misleading information or actions to inflate the market value of the ownership shares or there performance records.11. Challenge Question:Consider a poorly run local coffee shop with its prime location featuring a steady stream of potential clients passing by on their way to and from campus. How does the longtime disgruntled, sloppy and inefficient owner-manager of Cup-a-Joe survive and avoid disciplining from the takeover market? This is not a question about a misalignment of the goals of the owner(s) and manager(s) of a firm since we have explicitly said the firm is owner-managed. If in fact the coffee shop is mismanaged the potential exists for an outsider to purchase a controlling interest in the operation and put more efficient management into place if the purchase price does not exceed the value of profits to be generated by the efficiently managed firm. If the present owner chooses not to sell he must value the firm for more than the value of the profits generated by an efficiently managed firm. Therefore his position in the firm must generate for him non-pecuniary benefits, or benefits unrelated to the firm’s profitability and he is therefore not avalue maximizer. Perhaps he enjoys making fun of his clients or takes pride in his eclectic tastes in interior decorating. In any case the takeover market does discipline him in the sense that he will be forced to pay for his non-pecuniary benefits in the sense that he trades off profits.The same could be said of an owner-manager who lacks the required specialized skills to properly run the firm but never the less continues to operate the company inefficiently because he ‘likes’ the work!The Role of the Finance Specialist in a Corporation12. Which of the following tasks undertaken within a corporate office are likely to fall under the supervision of the treasurer? The controller?Arranging to extend a line of credit from a bankArranging with an investment bank for a foreign exchange transactionProducing a detailed analysis of the cost structure of the company’s alternative product linesTaking cash payments for company sales and purchasing U.S. Treasury BillsFiling quarterly statements with the Securities and Exchange CommissionThe first two and the fourth items are responsibilities of the treasurer while the third and fifth items fall under the workload of the controller’s office.Objectivesy Define finance.y Explain why finance is worth studying.y Introduce two of the main players in the world of finance—households and firms—and the kinds of financial decisions theymake. The other main players, financial intermediaries and government, are introduced in chapter 2.Contents1.1Defining Finance1.2Why Study Finance?1.3Financial Decisions of Households1.4Financial Decisions of Firms1.5Forms of Business Organization1.6Separation of Ownership and Management1.7The Goal of Management1.8Market Discipline: Takeovers1.9The Role of the Finance Specialist in a CorporationSummaryFinance is the study of how to allocate scarce resources over time. The two features that distinguish finance are that the costs and benefits of financial decisions are spread out over time and are usually not known with certainty in advance by either the decision maker or anybody else.A basic tenet of finance is that the ultimate function of the system is to satisfy people’s consumption preferences. Economic organizations such as firms and governments exist in order to facilitate the achievement of that ultimate function. Many financial decisions can be made strictly on the basis of improving the trade-offs available to people without knowledge of their consumption preferences.There are at least five good reasons to study finance:y To manage your personal resources.y To deal with the world of business.y To pursue interesting and rewarding career opportunities.y To make informed public choices as a citizen.y To expand your mind.The players in finance theory are households, business firms, financial intermediaries, and governments. Households occupy a special place in the theory because the ultimate function of the system is to satisfy the preferences of people, and the theory treats those preferences as given. Finance theory explains household behavior as an attempt to satisfy those preferences. The behavior of firms is viewed from the perspective of how it affects the welfare of households.Households face four basic types of financial decisions:y Saving decisions: How much of their current income should they save for the future?y Investment decisions: How should they invest the money they have saved?y Financing decisions: When and how should they use other people’s money to sa tisfy their wants and needs?y Risk-management decisions: How and on what terms should they seek to reduce the economic uncertainties they face or to take calculated risks?There are three main areas of financial decision making in a business: capital budgeting, capital structure, and working capital management.There are five reasons for separating the management from the ownership of a business enterprise: y Professional managers may be found who have a superior ability to run the business.y To achieve the efficient scale of a business the resources of many households may have to be pooled.y In an uncertain economic environment, owners will want to diversify their risks across many firms. Such efficient diversification is difficult to achieve without separation ofownership and management.y To achieve savings in the costs of gathering information.y The “learning curve” or “going concern” effect: When the owner is also the manager, the new owner has to learn the business from the former owner in order to manage it efficiently. If the owner is not the manager, then when the business is sold, the manager continues in place and works for the new owner.The corporate form is especially well suited to the separation of ownership and management of firms because it allows relatively frequent changes in owners by share transfer without affecting the operations of the firm.The primary goal of corporate management is to maximize shareholder wealth. It leads managers to make the same investment decisions that each of the individual owners would have made had they made the decisions themselves.A competitive stock market imposes a strong discipline on managers to take actions to maximize the market value of the firm’s shares.。

金融英语专业大全一、金融英语入门知识1.1 金融英语的定义与作用金融英语是指在金融领域中使用的英语专业术语和表达方式。

由于金融领域的快速发展和国际化程度的提高,金融英语成为了金融从业人员必备的技能之一。

金融英语的学习和掌握可以帮助金融从业人员更好地进行跨国交流和开展国际业务。

1.2 金融英语的重要性在金融领域,准确无误的沟通和专业术语的运用至关重要。

金融英语能够帮助金融从业人员更好地理解和应用金融领域的知识,与国际同行进行有效的交流,并更好地服务于客户需求。

金融英语不仅能提高个人在金融行业中的竞争力,也是金融机构发展壮大的重要一环。

二、金融英语专业词汇2.1 金融市场与投资类词汇•Securities (证券)•Stocks (股票)•Bonds (债券)•Mutual funds (共同基金)•Futures (期货)•Options (期权)•Hedge fund (对冲基金)•Margin call (追加保证金)•Bull market (牛市)•Bear market (熊市)2.2 银行与金融机构类词汇•Bank (银行)•Credit union (信用合作社)•Commercial bank (商业银行)•Investment bank (投资银行)•Central bank (中央银行)•Mortgage (抵押贷款)•Loan (贷款)•Interest rate (利率)•ATM (自动取款机)•Credit card (信用卡)2.3 保险与风险管理类词汇•Insurance (保险)•Policy (保单)•Premium (保费)•Underwriting (承保)•Claim (索赔)•Risk management (风险管理)•Actuary (保险精算师)•Reinsurance (再保险)•Catastrophe bond (灾害债券)•Liability (责任)三、金融英语学习资源3.1 金融英语课程和培训•各大高校提供的金融英语专业课程•国际金融英语证书(IFEC)3.2 金融英语书籍与教材•《金融英语实用教程》•《金融会计学》•《金融英语词汇宝典》•《金融英语听说教程》3.3 学习网站和在线资源•Investopedia金融知识网站•Coursera在线学习平台•英语角金融英语学习社群四、金融英语实践技巧4.1 阅读金融英语资讯阅读金融英语资讯可以帮助拓宽金融行业的视野,熟悉不同领域的金融术语和表达方式。

金融英语专业资料大全1. 金融英语概述金融英语是指应用于金融领域的专业英语,包括金融专业术语、表达方式、写作技巧等。

随着全球金融市场的发展和国际间的金融交流日益频繁,金融英语作为一门特殊的语言能力得到越来越多的重视。

本文将带您了解金融英语的常用术语、语法要点和写作技巧,以便更好地应对金融领域的沟通和交流。

2. 金融英语常用术语2.1 股票市场术语•Bull Market:牛市•Bear Market:熊市•Dow Jones Industrial Average (DJIA):道琼斯工业平均指数•Stock Exchange:股票交易所•Initial Public Offering (IPO):首次公开募股•Price-Earnings Ratio (P/E):市盈率•Dividend:股息2.2 债券市场术语•Bond:债券•Treasury Bond:国债•Corporate Bond:公司债•Yield:收益率•Maturity Date:到期日•Coupon Rate:票息2.3 金融机构术语•Bank:银行•Investment Bank:投资银行•Commercial Bank:商业银行•Central Bank:中央银行•Federal Reserve System (Fed):美联储•International Monetary Fund (IMF):国际货币基金组织3. 金融英语语法要点3.1 时态•一般现在时:用于表述真理、普遍事实和描述金融市场的情况。

•过去时:用于描述过去发生的事件和情况。

•现在完成时:用于描述过去发生的影响现在的事件。

•将来时:用于描述将来发生的事件和预测。

3.2 被动语态被动语态在金融英语中应用广泛,用于描述交易、投资、金融产品等。

•The bond was issued by the government.(债券是由政府发行的。

)•The company was acquired by a foreign investor.(该公司被外国投资者收购了。

金融专业英语词汇大全一、基本金融术语1. 金融(Finance):指货币的筹集、分配和管理活动。

2. 银行(Bank):提供存款、贷款、支付结算等金融服务的机构。

3. 证券(Securities):代表财产所有权或债权的凭证,如股票、债券等。

4. 投资(Investment):将资金投入到某个项目或资产,以获取收益的行为。

5. 债务(Debt):借款人向债权人承诺在一定期限内偿还本息的义务。

6. 股票(Stock):股份有限公司发行的,代表股东对公司所有权和收益分配权的凭证。

7. 债券(Bond):债务人向债权人发行的,承诺按一定利率支付利息并在到期日偿还本金的债务凭证。

8. 利率(Interest Rate):资金的价格,反映资金借贷的成本。

9. 汇率(Exchange Rate):一种货币兑换另一种货币的比率。

10. 通货膨胀(Inflation):货币购买力下降,物价普遍持续上涨的现象。

二、金融衍生品词汇1. 金融衍生品(Financial Derivatives):基于现货金融工具派生出来的新型金融工具。

2. 期货(Futures):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

3. 期权(Options):买卖双方在未来一定期限内,按约定价格买入或卖出某种标的物的权利。

4. 掉期(Swap):双方约定在未来某一时间,相互交换一系列现金流的合约。

5. 远期合约(Forward Contract):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

三、金融机构及监管部门词汇1. 中央银行(Central Bank):国家金融政策制定和执行的机构,如中国人民银行。

2. 商业银行(Commercial Bank):以盈利为目的,提供存款、贷款、支付结算等金融服务的银行。

3. 证券公司(Securities Company):从事证券经纪、投资咨询、资产管理等业务的金融机构。

《金融英语》教学大纲一、课程基本信息1、熟悉金融行业基本的业务、常用术语及一般的业务程序与原理;2、掌握一定的金融英语词汇,提高学生的英语运用能力,能听懂金融行业日常工作会话,能用英文介绍金融行业的基本概念、基本业务和基础理论,能阅读与金融业务有关的英文资料;3、培养和提高学生的综合职业能力和素质。

三、课程目标、教学目标与毕业要求对应关系Chapter 1 International Monetary Systems1、基本要求掌握与货币有关的英语专业词汇;能用英文对货币发展史进行简单介绍。

2、主要内容Text 1 History of Modern Global Monetary OrdersText 2 International Monetary Systems and Historical OverviewListening: Call for a “New Bretton Woods”Oral English practice::The correlation between a country’s economic power and its role in the international financial system.3、作业:课后习题Chapter 2 The International Monetary Fund1、基本要求了解国际货币基金组织的基本职能;掌握本单元英语生词;能用英文简单介绍国际货币基金组织的历史、成员及基本职能。

2、主要内容Text 1 An Overview of the IMFText 2 The Membership of the IMFListening: Tackling Global ChallengesOral English practice:: How should the IMF help low-income countries?3、作业:课后习题Chapter 4 Balance of Payments1、基本要求掌握本单元生词;理解收支平衡的含义;能用英文对收支平衡、收支顺差、收支逆差、赤字等概念进行介绍2、主要内容Text 1 China's Balance of PaymentsText 2 Balance of PaymentsListening: Current Account Deficit? Not Necessarily a Bad ThingOral English practice:: The disadvantages of current account deficits?3、作业:课后习题Chapter 5 Foreign Exchange and Exchange Rate1、基本要求掌握与外汇和汇率有关的英语专业词汇;了解外汇在国际金融与国际贸易中的重要性;能用英语对外汇汇率标价方法进行介绍。

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

推荐三本金融英语学习书籍为了帮助大家学好金融英语,提高金融水平,下面小编给大家推荐三本金融英语学习书籍,希望对大家有所帮助!推荐三本金融英语学习书籍有交易者给我发邮件说看到很多财经新闻,发现大多数是翻译国外的,还不如自己去看第一手的报道。

确实如此,金融市场很多资讯,国内的财经网站绝大多数都是翻译的。

英语好的直接去国外网址看,之后我会推荐一些国外财经网站、交易论坛、交易类个人博客、交易员个人推特等。

有人说,我也想看第一手的资讯,可是我英语不够好啊。

不好你就店铺。

目标明确,不要什么听说读写全面发展,唯一目的就是看得懂财经新闻即可。

要做到这一点并不是什么很难的事情。

今天是世界读书日,推荐三本金融英语教程。

这三本书,刷几遍,再借助电子辞典,几遍可以看懂英语财经金融报道了。

当然前提是你有一定的英语基础。

第一本是英国《金融时报财经词汇》,这本小词典包含词条2800个,选自最近10年《金融时报》读者经常查询的词汇。

提供英英和英汉双解,在解释词义的同时,提供大量财经专业知识和金融学概念。

第二本是米什金的《货币金融学》英文版。

光知道一些金融词汇是不够的,还得学习一些专业知识,五星推荐这本。

既然是学习金融英语,建议买一本英文版、一本中文版,版本不重要,因为核心内容没多大的改变。

如果能买到同一版本那再好不过。

先看英文,慢慢琢磨,实在不懂再看中文。

第三本是《财经新闻英汉翻译教程》,学习专业的财经翻译。

书本很多例句,中英文对照。

而且内容细分,有货币市场新闻翻译、期货市场、债券市场、股票市场、外汇市场等等新闻翻译。

例句非常丰富。

少看些抖音快手头条,认真刷这三本书吧。

金融专业名词翻译1以监管机构评审为本 merit-based出市代表/出市员 floor trader;authorised clerk加权指数 Weighted Index(Taiwan Stock Exchange)加速折旧 accelerated depreciation包销 under write包销承担净值 net under writing commitment包销商 under writer包销银团 under writing syndicate北京产权交易所 China Beijing Equity Exchange另项投资市场(英国) Alternative Investment Market(AIM)(UK) 另选登记服务 optional registration service另类投资 alternative investment「只限长仓」期权经纪Long Only Brokers for Options(LOBO) 可分派溢利 distributable profit可用年限 useful life可行性研究 feasibility study可转换/可换股可赎回票据 convertible redeemable note可转换/可换股票据 convertible note可转换/可换股债券 convertible bond可转换/可换股证券 convertible securities可转让票据 negotiable instrument可赎回股份 redeemable share金融专业名词翻译2代收股息/债券利息服务费dividend and debt securities interest collection service fee 代履行权责服务费corporate actions service fee代客买卖agency trade代客买卖户口agency account代表委任表格proxy form代理人agent代理人户口nominee account代理户口agency account代价consideration代价股份consideration share代价发行consideration issue代办股份转让系统(中国内地)Agency Share Transfer System(Mainland China) 以先旧后新方式配售placing and top-up;top up placing以披露为本disclosure-based以物易物的虚晃交易banner barter transaction以股代息dividend inspecie;scrip dividend以股换股share exchange以信息披露为重disclosure-based以按金形式缴付的期权金margined premium以现金折算的息股证cash settled ELI以责务变更的方式进行净额结算netting by novation以最佳价格/条件执行交易的原则principle of best execution以报价/开盘带动quote-driven以买卖盘带动order-driven金融专业名词翻译3文件风险document ation risk日本中央银行Bank of Japan日本公社债研究所Japan Bond Research Institute(JBRI) 日经平均指数Nikkei Stock Average日转期汇Rolling Forex欠款arrears止蚀限价盘stop limit order止蚀盘stop order;stop-loss order牛市bull market主承销商lead under writer主板mainboard主要主管(创业板)principal supervisor(GEM)主要交易major transaction主要股东major share holder;substantial share holder 主要保荐人primary sponsor主要经办人lead manager主要经济指标leading economic indicator主权风险sovereign risk世界银行World Bank仔细审查/审核due diligence付运中货品goods-in-transit。

Part11.Multiple Choice(Part1 单选DDDAD ADABD 阅读CDDA CDBBD)(1) The People's Bank of China has been divided into ________district banks since 1999.A. 6B. 7C. 8D. 9(2) The PBC has operated as the central bank since________.A. 1987B. 1986C. 1985D. 1984(3)China formally lifted all remaining current account restrictions in _________.A. 1993B. 1994C. 1995D. 1996(4) ________remains the principle foreign exchange bank.A. The Bank of ChinaB. The Commercial and Industrial BankC. The Construction BankD. The Agricultural Bank(5) The indirect instruments such as ________have emerged as major monetary policy tools that the PBC relies on.A. required reserve ratioB. interest rate adjustmentC. open market operationsD. all of the above(6) With China's entry into WTO, China has decided to implement a phased reform of________.A. the wholly state-owned commercial banksB. the policy banksC. joint-equity commercial banksD. the non-bank financial sector(7) Banks play a unique role in the economy through ________.A. mobilizing savingsB. transmitting monetary policyC. providing a payment systemD. all of above(8) The evolution of the Chinese banking system can be broadly divided into ________phases.A. 3B.4C. 2D. 5(9) Although capital market development is expected to speed up, banks in China currently provide about________percent of aggregate financing in the economy.A. 65B. 75C. 50D. 80(10) Apart from traditional deposit taking and lending business, commercial banks now offer a broad range of intermediary services such as________.A. international settlementB. bank cardsC. private bankingD. all of the above2.True or False(1)Since the enactment of the Law of the People's Bank of China in March 1995, the PBC has no longer played the role of financing fiscal deficits in national budgetary.(2) The People's Bank of China was made as a central bank in 1948.(3) The indirect policy instruments include required reserve ratio, interest rate adjustment, and credit ceiling.(4) Before 1979 the foreign exchange control was strictly enforced.(5) The wholly state-owned commercial banks in China today used to be known as state-owned specialized banks.(6) One of the important goals of liberalizing the banking sector is to give foreign banks nationaltreatment.(7) The increase of the presence of foreign banks in China is likely to introduce new products and expertise.(8) Now China still remains some current account restrictions.(9) In recent years, there has been a great improvement in the conduct of monetary policy with great reliance on direct policy instruments.(10) Now China is an Article Ⅷ member of the International Monetary Fund.3.ClozeDirections: Read the following paragraphs and then put the suitable words or phrases into the blanks.The banking sector has played an important role in ________the implementation of the stabilization and structural measures as well as sustaining strong economic growth. The macroeconomic stability and ________improvement in turn have enabled the banking sector to________vigorously. Although capital market development is expected to speed up, banks in China, which currently provide about 75 percent of aggregate financing in the economy, are likely to continue playing a ________role in financing economic and technological development as well as the economic________ in the foreseeable future.1.facilitating2.reform3.structural4.develop5.dominantIn recent years, there has been a significant improvement in the ________of monetary policy with greater reliance on ________policy instruments. The central bank used to rely on credit ceilings for commercial banks as a major tool for monetary policy. This direct instrument has been abolished while such indirect instruments as required reserve ratio, interest rate adjustment and open market operations have ________as major monetary policy tools. The required reserve account and excess reserve account of the commercial banks with the central bank have been ________and the consolidated required reserve ratio has been reduced from 13 percent to 8 percent. Since 1996, the central bank has________ interest rates on many occasions to reflect the weakening domestic and global demand. These policy measures have helped sustain strong economic growth 1.emerged 2.conduct 3.lowered 4.indirect 5.mergedThe reform efforts have resulted in greater openness of the banking sector, integrated financial markets, increased diversification of banking institutions, strengthened competition and improved efficiency of ________allocation. Despite these achievements, the banking sector in China is faced with ________challenges, including the high level of ________loans and the need to prepare for greater competition from foreign banks, as China becomes a member of the World Trade Organization. These challenges call for ________efforts on the part of the authorities in institutional building to facilitate greater enforceability of bank claims, faster market infrastructure development and better ownership structure. These efforts have to be accompanied by parallel actions of the banks to improve corporate governance, particularly ________structure and internal controls.1.incentive2.non_performing3.resource4.formidable5.intensifying4. Translation(1) Although banks share many common features with other profit-seeking businesses, they play a unique role in the economy through mobilizing savings, allocating capital funds to finance productive investment,transmitting monetary policy, providing a payment system and transforming risks.尽管银行与其他以盈利为目的的企业具有许多共同的特征,但它在国民经济中还发挥着特殊的作用。