第10章米什金货币金融学西南财经大学

- 格式:ppt

- 大小:3.23 MB

- 文档页数:41

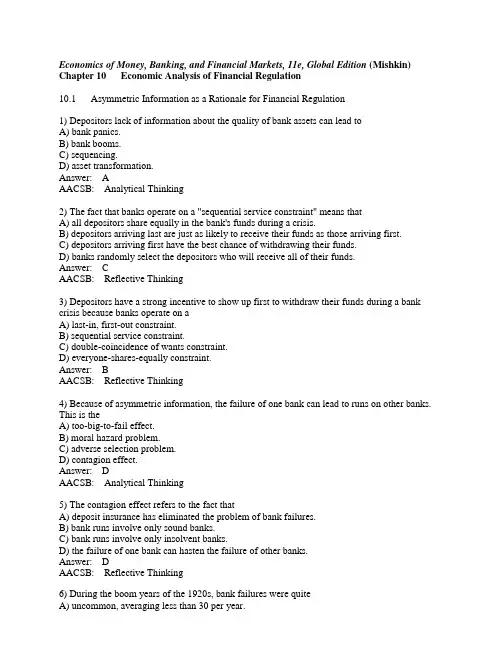

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 10 Economic Analysis of Financial Regulation10.1 Asymmetric Information as a Rationale for Financial Regulation1) Depositors lack of information about the quality of bank assets can lead toA) bank panics.B) bank booms.C) sequencing.D) asset transformation.Answer: AAACSB: Analytical Thinking2) The fact that banks operate on a "sequential service constraint" means thatA) all depositors share equally in the bank's funds during a crisis.B) depositors arriving last are just as likely to receive their funds as those arriving first.C) depositors arriving first have the best chance of withdrawing their funds.D) banks randomly select the depositors who will receive all of their funds.Answer: CAACSB: Reflective Thinking3) Depositors have a strong incentive to show up first to withdraw their funds during a bank crisis because banks operate on aA) last-in, first-out constraint.B) sequential service constraint.C) double-coincidence of wants constraint.D) everyone-shares-equally constraint.Answer: BAACSB: Reflective Thinking4) Because of asymmetric information, the failure of one bank can lead to runs on other banks. This is theA) too-big-to-fail effect.B) moral hazard problem.C) adverse selection problem.D) contagion effect.Answer: DAACSB: Analytical Thinking5) The contagion effect refers to the fact thatA) deposit insurance has eliminated the problem of bank failures.B) bank runs involve only sound banks.C) bank runs involve only insolvent banks.D) the failure of one bank can hasten the failure of other banks.Answer: DAACSB: Reflective Thinking6) During the boom years of the 1920s, bank failures were quiteA) uncommon, averaging less than 30 per year.B) uncommon, averaging less than 100 per year.C) common, averaging about 600 per year.D) common, averaging about 1000 per year.Answer: CAACSB: Application of Knowledge7) To prevent bank runs and the consequent bank failures, the United States established the________ in 1934 to provide deposit insurance.A) FDICB) SECC) Federal ReserveD) ATMAnswer: AAACSB: Application of Knowledge8) The primary difference between the "payoff" and the "purchase and assumption" methods of handling failed banks isA) that the FDIC guarantees all deposits when it uses the "payoff" method.B) that the FDIC guarantees all deposits when it uses the "purchase and assumption" method.C) that the FDIC is more likely to use the "payoff" method when the bank is large and it fears that depositor losses may spur business bankruptcies and other bank failures.D) that the FDIC is more likely to use the purchase and assumption method for small institutions because it will be easier to find a purchaser for them compared to large institutions.Answer: BAACSB: Reflective Thinking9) Deposit insurance has not worked well in countries withA) a weak institutional environment.B) strong supervision and regulation.C) a tradition of the rule of law.D) few opportunities for corruption.Answer: AAACSB: Reflective Thinking10) When one party to a transaction has incentives to engage in activities detrimental to the other party, there exists a problem ofA) moral hazard.B) split incentives.C) ex ante shirking.D) pre-contractual opportunism.Answer: AAACSB: Ethical understanding and reasoning abilities11) Moral hazard is an important concern of insurance arrangements because the existence of insuranceA) provides increased incentives for risk taking.B) is a hindrance to efficient risk taking.C) causes the private cost of the insured activity to increase.D) creates an adverse selection problem but no moral hazard problem.Answer: AAACSB: Reflective Thinking12) When bad drivers line up to purchase collision insurance, automobile insurers are subject to theA) moral hazard problem.B) adverse selection problem.C) assigned risk problem.D) ill queue problem.Answer: BAACSB: Reflective Thinking13) Deposit insurance is only one type of government safety net. All of the following are types of government support for troubled financial institutions EXCEPTA) forgiving tax debt.B) lending from the central bank.C) lending directly from the government's treasury department.D) nationalizing and guaranteeing that all creditors will be repaid their loans in full.Answer: AAACSB: Reflective Thinking14) Although the FDIC was created to prevent bank failures, its existence encourages banks toA) take too much risk.B) hold too much capital.C) open too many branches.D) buy too much stock.Answer: AAACSB: Reflective Thinking15) A system of deposit insuranceA) attracts risk-taking entrepreneurs into the banking industry.B) encourages bank managers to decrease risk.C) increases the incentives of depositors to monitor the riskiness of their bank's asset portfolio.D) increases the likelihood of bank runs.Answer: AAACSB: Reflective Thinking16) The government safety net creates ________ problem because risk-loving entrepreneurs might find banking an attractive industry.A) an adverse selectionB) a moral hazardC) a lemonsD) a revenueAnswer: AAACSB: Reflective Thinking17) Since depositors, like any lender, only receive fixed payments while the bank keeps any surplus profits, they face the ________ problem that banks may take on too ________ risk.A) adverse selection; littleB) adverse selection; muchC) moral hazard; littleD) moral hazard; muchAnswer: DAACSB: Reflective Thinking18) Acquiring information on a bank's activities in order to determine a bank's risk is difficult for depositors and is another argument for governmentA) regulation.B) ownership.C) recall.D) forbearance.Answer: AAACSB: Reflective Thinking19) The existence of deposit insurance can increase the likelihood that depositors will need deposit protection, as banks with deposit insuranceA) are likely to take on greater risks than they otherwise would.B) are likely to be too conservative, reducing the probability of turning a profit.C) are likely to regard deposits as an unattractive source of funds due to depositors' demands for safety.D) are placed at a competitive disadvantage in acquiring funds.Answer: AAACSB: Reflective Thinking20) In May 1991, the FDIC announced that it would sell the government's final 26% stake in Continental Illinois, ending government ownership of the bank that it had rescued in 1984. The FDIC took control of the bank, rather than liquidate it, because it believed that Continental IllinoisA) was a good investment opportunity for the government.B) could be the Chicago branch of a new governmentally-owned interstate banking system.C) was too big to fail.D) would become the center of the new midwest region central bank system.Answer: CAACSB: Reflective Thinking21) If the FDIC decides that a bank is too big to fail, it will use the ________ method, effectivelyensuring that ________ depositors will suffer losses.A) payoff; largeB) payoff; noC) purchase and assumption; largeD) purchase and assumption; noAnswer: DAACSB: Reflective Thinking22) Federal deposit insurance covers deposits up to $250,000, but as part of a doctrine called "too-big-to-fail" the FDIC sometimes ends up covering all deposits to avoid disrupting the financial system. When the FDIC does this, it uses theA) "payoff" method.B) "purchase and assumption" method.C) "inequity" method.D) "Basel" method.Answer: BAACSB: Application of Knowledge23) The result of the too-big-to-fail policy is that ________ banks will take on ________ risks, making bank failures more likely.A) small; fewerB) small; greaterC) big; fewerD) big; greaterAnswer: DAACSB: Reflective Thinking24) A problem with the too-big-to-fail policy is that it ________ the incentives for ________ by big banks.A) increases; moral hazardB) decreases; moral hazardC) decreases; adverse selectionD) increases; adverse selectionAnswer: AAACSB: Reflective Thinking25) The too-big-to-fail policyA) reduces moral hazard problems.B) puts large banks at a competitive disadvantage in attracting large deposits.C) treats large depositors of small banks inequitably when compared to depositors of large banks.D) allows small banks to take on more risk than large banks.Answer: CAACSB: Reflective Thinking26) The government safety net creates both an adverse selection problem and a moral hazard problem. Explain.Answer: The adverse selection problem occurs because risk-loving individuals might view the banking system as a wonderful opportunity to use other peoples' funds knowing that those funds are protected. The moral hazard problem comes about because depositors will not impose discipline on the banks since their funds are protected and the banks knowing this will be tempted to take on more risk than they would otherwise.AACSB: Reflective Thinking10.2 Types of Financial Regulation1) Regulators attempt to reduce the riskiness of banks' asset portfolios byA) limiting the amount of loans in particular categories or to individual borrowers.B) encouraging banks to hold risky assets such as common stocks.C) establishing a minimum interest rate floor that banks can earn on certain assets.D) requiring collateral for all loans.Answer: AAACSB: Reflective Thinking2) A well-capitalized financial institution has ________ to lose if it fails and thus is ________ likely to pursue risky activities.A) more; moreB) more; lessC) less; moreD) less; lessAnswer: BAACSB: Reflective Thinking3) A bank failure is less likely to occur whenA) a bank holds less U.S. government securities.B) a bank suffers large deposit outflows.C) a bank holds fewer excess reserves.D) a bank has more bank capital.Answer: DAACSB: Reflective Thinking4) The leverage ratio is the ratio of a bank'sA) assets divided by its liabilities.B) income divided by its assets.C) capital divided by its total assets.D) capital divided by its total liabilities.Answer: CAACSB: Application of Knowledge5) To be considered well capitalized, a bank's leverage ratio must exceedA) 10%.B) 8%.C) 5%.D) 3%.Answer: CAACSB: Application of Knowledge6) The FDIC must take steps to close down banks whose equity capital is less than ________ of assets.A) 4%B) 3%C) 2%D) 1%Answer: CAACSB: Application of Knowledge7) Off-balance-sheet activitiesA) generate fee income with no increase in risk.B) increase bank risk but do not increase income.C) generate fee income but increase a bank's risk.D) generate fee income and reduce risk.Answer: CAACSB: Reflective Thinking8) The Basel Accord, an international agreement, requires banks to hold capital based onA) risk-weighted assets.B) the total value of assets.C) liabilities.D) deposits.Answer: AAACSB: Application of Knowledge9) The Basel Accord requires banks to hold as capital an amount that is at least ________ of their risk-weighted assets.A) 10%B) 8%C) 5%D) 3%Answer: BAACSB: Application of Knowledge10) Under the Basel Accord, assets and off-balance sheet activities were sorted according to________ categories with each category assigned a different weight to reflect the amount of________.A) 2; adverse selectionB) 2; credit riskC) 4; adverse selectionD) 4; credit riskAnswer: DAACSB: Application of Knowledge11) The practice of keeping high-risk assets on a bank's books while removing low-risk assets with the same capital requirement is known asA) competition in laxity.B) depositor supervision.C) regulatory arbitrage.D) a dual banking system.Answer: CAACSB: Application of Knowledge12) Banks engage in regulatory arbitrage byA) keeping high-risk assets on their books while removing low-risk assets with the same capital requirement.B) keeping low-risk assets on their books while removing high-risk assets with the same capital requirement.C) hiding risky assets from regulators.D) buying risky assets from arbitragers.Answer: AAACSB: Reflective Thinking13) Because banks engage in regulatory arbitrage, the Basel Accord on risk-based capital requirements may result inA) reduced risk taking by banks.B) reduced supervision of banks by regulators.C) increased fraudulent behavior by banks.D) increased risk taking by banks.Answer: DAACSB: Reflective Thinking14) One of the criticisms of Basel 2 is that it is procyclical. That means thatA) banks may be required to hold more capital during times when capital is short.B) banks may become professional at a cyclical response to economic conditions.C) banks may be required to hold less capital during times when capital is short.D) banks will not be required to hold capital during an expansion.Answer: AAACSB: Reflective Thinking15) Overseeing who operates banks and how they are operated is calledA) prudential supervision.B) hazard insurance.C) regulatory interference.D) loan loss reserves.Answer: AAACSB: Application of Knowledge16) The chartering process is especially designed to deal with the ________ problem, and regular bank examinations help to reduce the ________ problem.A) adverse selection; adverse selectionB) adverse selection; moral hazardC) moral hazard; adverse selectionD) moral hazard; moral hazardAnswer: BAACSB: Analytical Thinking17) The chartering process is similar to ________ potential borrowers and the restriction of risk assets by regulators is similar to ________ in private financial markets.A) screening; restrictive covenantsB) screening; branching restrictionsC) identifying; branching restrictionsD) identifying; credit rationingAnswer: AAACSB: Reflective Thinking18) Banks will be examined at least once a year and given a CAMELS rating by examiners. The L stands forA) liabilities.B) liquidity.C) loans.D) leverage.Answer: BAACSB: Application of Knowledge19) The federal agencies that examine banks includeA) the Federal Reserve System.B) the Internal Revenue Service.C) the SEC.D) the U.S. Treasury.Answer: AAACSB: Application of Knowledge。

《货币金融学》西财笔记共83页《货币金融学》笔记第一部分基本概念第二章货币一)名词解释1、货币货币是固定充当一般等价物的特殊商品。

(价值的发展经历了从简单或偶然的价值交换、扩大的物物交换、一般等价物到货币的四个阶段)1)货币是一般等价物,它具有和商品直接交换的能力;2)货币是固定充当一般等价物的特殊商品;3)作为一般等价物,货币是一般财富的象征。

2、代用货币(货币的发展经历了实物货币、金属货币、代用货币、信用货币和电子货币五阶段)代用货币即代替贵金属货币来执行货币相关功能的货币,主要指的是政府或银行发行的纸币(不足值的铸币也应属于代用代币)3、银行券银行券是典型的代用货币,是银行以自身信用为基础而签发的债务凭证。

4、信用货币信用货币也称不兑现的纸币,是指以信用为基础,通过信用(贷)程序发行的、在流通中执行交易媒介和延期支付功能的信用凭证。

主要特征有:1)除少数国家和地区外,信用货币通常是由中央银行垄断发行的不可兑现的、具有无限法偿能力的货币;2)信用货币是一种独立的货币形态(不再依附于贵金属);3)信用货币是管理通货;4)信用货币是债务货币;(发行者负债,持有者是债权)5)从货币可接受的交易媒介和支付角度来说,其在现代经济社会中主要有两种存在形式,即现金和银行活期存款;6)以活期存款为基础的非现金计算居主导地位;7)信用货币的发行主要遵循的是经济发行的原则。

5、管理通货管理通货是一种这样的通货:相对于贵金属货币与代用货币,信用货币不再具有自动调节货币流通量的作用,发行过多的信用货币会沉淀在流通领域当中,政府在信用货币面前,可以根据经济形势的变化,通过对货币量的调节来实现自己的政策意图。

6、电子货币电子货币就是利用现代电子计算机技术对存款货币进行储存和处理,目前主要有智能卡和网络货币两种类型1)智能卡也称电子钱包,它实际上是由金融机构发行的一种金融卡,通过此卡,用户可以完成交易、提取现金和办理转账等功能;2)网络货币是依附电子计算机网络的出现而产生的数学货币。

西南财经大学金融专硕考研历年分数线及复习经验解读————————————————————————————————作者:————————————————————————————————日期:ﻩ2019西南财经大学金融专硕考研历年分数线及复习经验解读2019考研的小伙伴已经开始准备考研了,金融专硕作为热门专业之一成为很多考研儿的目标专业,但是刚开始都不知道去哪里查询院校的相关信息,感到很迷茫,接下来跨考考研老师将重点讲解2019西南财经大学金融专硕考研相关的信息。

考研儿可以作为备考的参考。

西南财大是教育部直属的国家“211工程”和“985工程”优势学科创新平台建设的全国重点大学,曾属于中国人民银行管,加上近年来大量引入海归老师,师资实力雄厚,金融专业为国家重点学科。

西南财大地处成都,相对于北京和上海,有地缘上的劣势,但是西南财大校友圈资源丰富,就业非常棒,很多毕业生毕业后在深圳发展。

目前,西南财大学生在深圳实力强大,就业非常不错。

1.关于西南财经大学金融专硕考研辅导班目前市面上经济学考研辅导班的有很多机构,但从近三年的通过成绩来看,跨考教育以郑炳带头辅导效果最好。

一方面在全国唯一按照院校进行定校辅导的教学体系,其教材教义也是行业独家——《金融硕士真题解析与习题详解》,尤其最后考前最后三套卷更是受学生追捧。

目前清华北大人民东财央财等经济学名校50%都是郑炳弟子。

2.考试科目101思想政治理论;204英语二;303数学三;431金融学综合3.西南财经大学金融专硕考研专业课参考书目西南财大金融专硕不指定参考书。

根据历年真题及跨考高分学员复习用书等,我们推荐参考书:(1)殷孟波《货币金融学》:市面上有三个版本,推荐大家用最新的版本,即中国金融出版社出版的书。

(2)米什金《货币金融学》:这本书一定要看,西南财大金融专硕专业课越来越重视这本书。

(3)罗斯《公司理财》:罗斯《公司理财》一共31章,从考试大纲看,重点考前面19章!西南财大金融专硕有指定的考试大纲,建议大家参照考试大纲复习,历年考题也是参照考试大纲出题。

Chapter1物价总水平资产预算赤字预算盈余经济周期资产转换逆向选择信息不对称道德风险货币市场场外市场商品货币通货流动性价值储藏记账单位交易媒介基点统一公债/永续债券指数化债券利率风险名义利率贴现发行债券(零息债券)到期收益率固定支付贷款不变价回报需求曲线预期回报率可贷资金可贷资金理论市场均衡流动性偏好理论供给曲线普通股财政政策外汇市场金融中介金融市场Chapter2股利一级市场风险分担交易成本承销Chapter3M1 M2M3恶性通货膨胀货币总量收入Chapter4普通贷款贴现收益率现期贴现值实际利率息票债券当期收益息票利率率现值资本利得率Chapter5资产需求理论机会成本风险超额需求超额供给费雪效应Chapter6无违约风险债券预期理论翻转的收益率曲线流动性溢价理论期限优先理论适应性预期现金流量股利有效市场假定随机游走戈登增长模型市场基本面代理理论银行业恐慌现金流量抵押品债务萎缩金融危机搭便车鼓励相容啄食顺序假定资产管理资产负债表资本充足性管理补偿余额信用配给信用风险存款外流贴现贷款贴现率久期分析股本乘数超额准备金缺口分析利率风险风险溢价利率的风险结构分割市场理论利率的期限结构收益率曲线Chapter7最优预测未被利用的盈利机会理性预期剩余索取权有效资本市场理论推广的股利估值模型Chapter8委托-代理理论限制性条款担保债务高额核实成本资不抵债净值无担保债务风险投资公司Chapter9负债管理流动性管理贷款承诺贷款出售表外业务法定准备金率法定准备金准备金资产回报率股权回报率二级准备金 T账户库存现金Chapter10自动银行机自动提款机存款利率上限脱媒银行破产银行监管巴塞尔协议商誉年金封闭式基金共同保险免赔额固定受益型计划固定缴费型计划足额基金对冲基金美式期权套利买入期权货币互换欧式期权执行价格衍生金融工具金融期货合约金融期货期权远期合约避险远期利率合约利率互换公开市场操作目标独立性贴现率金融衍生工具期货合约证券化Chapter11杠杆比率表外业务监管套利监管宽容Chapter12初次公开发行(IPO)付佣基金非付佣基金开放式基金再保险适时发行不足额基金承销商Chapter13长头寸综合避险保证金盯市单个避险名义本金未平仓合约期权期权费卖出期权短头寸股票期权互换Chapter14工具独立性Chapter15超额准备金浮款高能货币基础货币多倍存款创造公开市场操作公开市场购买货币乘数防御性市场操作贴现窗口能动性公开市场操作联邦基金率工具指标中介指标国际政策协调自然失业率非加速型通货膨胀失业率升值资本流动性贬值有效汇率指数配额现汇率汇率汇率超调外汇市场国际收支平衡表资本账户固定汇率制度国际货币基金组织官方储备交易余额特别提款权非冲销性外汇干预国际收支危机经常账户公开市场出售法定准备金率法定准备金准备金简单存款乘数Chapter16非借入基础货币Chapter17最后贷款人再买回交易(反回购协议)一级交易商回购协议Chapter18操作指标菲利普斯曲线真实票据原则泰勒规则Chapter19远期汇率现汇交易关税远期交易利息平价条件一价定律货币中性购买力平价理论Chapter20外汇干预国际储备储备货币冲销性外汇干预世界银行布雷顿森林体系法定贬值金本位制度有管理的浮动制度法定升值货币局美元化铸币税交易方程式货币理论实际货币余额总需求总需求函数浮躁情绪自主性消费支出净出口存货投资消费函数可支配收入总需求曲线长期货币中性积极干预主义者总需求总需求曲线总供给总供给曲线浮躁情绪自我纠错机制供给冲击货币流通速度后遗效应凯恩斯主义者长期总供给曲线现代货币数量论耐用消费品支出贸易余额Chapter21名义锚时间一致性问题Chapter22流动性偏好理论货币数量论货币流通速度Chapter23支出乘数固定投资消费支出计划投资支出 LS曲线 LM曲线边际消费倾向政府支出Chapter24总产出的自然水平完全挤出Chapter25货币主义者完全挤出效应消费支出交易方程式政府支出非加速通货膨胀型失业率非积极干预主义者部分挤出效应计划投资支出真是经济周期理论总产出的自然率水平净出口Chapter26消费信用途径消费简化形式实证分析适应性政策单一货币增长规则成本推进型通货膨胀需求拉动型通货膨胀计量经济模型政策无效命题结构模型实证分析货币政策传导机制 Chapter27 政府预算约束债务货币化李嘉图平衡式政府印钞 Chapter28。

第10章 金融监管的经济学分析一、概念题1.商誉(goodwill)答:商誉是一种无形价值,指由企业的良好信誉、产品的较高质量和市场占有率、可靠的销售网络、有效的内部管理、先进的技术、优越的地理位置等因素形成,属于不可辨认的无形资产。

其特征是:①商誉与企业整体相关,不能单独存在;②形成商誉的因素无法单独计值;③商誉与形成商誉过程中所发生的成本无关,它是一种获得超额收益的能力。

商誉只有在企业兼并、联营,或以全部产权有偿转让时,经评估才能作为无形资产。

2.监管宽容答:监管宽容是指监管者尽量不行使将破产银行逐出行业外的权力。

由于金融对于经济增长具有不容替代的支撑作用,因此,各国中央政府乃至地方政府都充分认识到金融资源对于经济发展的重要意义,因而,作为金融控制的主体也使得金融监管者本身在监管过程中存在监管宽容。

监管宽容是世界各国银行存在的通病,尤其在政府持银行产权比重高的国家更甚。

一旦国有银行出现问题,“大而不倒”的观念根深蒂固,很容易产生“监管宽容”,监管宽容的存在致使市场惩戒机制不力,金融监管的效率无从保障,道德风险的激励会危害整个金融体系。

二、选择题1.商业银行的资本充足率指( )。

A.资本和期限加权资产的比率B.资本和风险加权资产的比率C.资本和期限加权负债的比率D.资本和风险加权负债的比率【答案】B【解析】商业银行的资本充足率是指商业银行持有的符合相关规定的资本与商业银行风险加权资产之间的比率。

2.下列说法不正确的是( )。

A.金融全球化促进金融业提高效率B.金融全球化增强国家宏观经济政策的效率C.金融全球化会加大金融风险D.金融全球化会增加国际金融体系的脆弱性【答案】B【解析】金融全球化的积极影响主要有:提高金融市场运作的效率;促进资金在全球范围内的有效配置;促进了国际投资和贸易的迅速发展以及促进了金融体制与金融结构的整合。

同时金融全球化的负面影响主要有:导致国际金融体系和金融机构内在脆弱性的加深,削弱国家货币政策的自主性,加大了各国金融监管的难度以及使资产价格过度波动的破坏性大。

第一章:1.什么是金融市场,金融市场的基本功能是什么?金融市场是资金由盈余单位向短缺单位转移的市场。

金融市场履行的基本经济功能是:从那些由于支出少于收入而积蓄了盈余资金的人那里把资金引导到那些由于支出超过收入而资金短缺的人那里。

第二章:金融体系概述1.金融市场的种类划分(1) 股权市场和债权市场。

(按契约的性质)(2) 一级市场和二级市场。

(按在发行和交易中的地位)(3) 场内交易市场和场外交易市场。

(按交易的地点和场所)(4) 货币市场和资本市场。

(按所交易金融工具的期限长短)2.主要的货币市场工具和资本市场工具有哪些?货币市场工具:(1)美国国库券(贴现发行)(2)可转让银行定期存单(3)商业票据(4)回购协议(5)联邦基金资本市场工具:(1)股票(2)抵押贷款(3)公司债券(4)美国政府债券(5)美国政府机构债券(6)州和地方政府债券3.金融中介机构的概念和类型概念:金融中介机构是通过发行负债工具筹集资金,并且通过运用这些资金购买证券或者发放贷款来形成资产的金融机构。

(1)存款机构(商业银行,储贷协会,互助储蓄银行,信用社)(2)契约型储蓄机构(保险公司,养老金,退休金)(3)投资中介机构(财务公司,共同基金,货币市场共同基金,投资银行)4.直接融资和间接融资的区别(1)在直接融资中,借款人通过将证券卖给贷款人,直接从贷款人那里取得资金;在间接融资中,金融机构居于贷款人和借款人之间,帮助实现资金在二者之间的转移。

(2)直接融资的优点:短缺单位可以节约一定的融资成本,盈余单位可以获得较高的资金报酬。

缺点:盈余单位需要有一定专业知识和能力且负担的风险高;对短缺单位来说,直接融资市场门槛较高。

(3)间接融资的优点或功能:降低交易成本,实现规模经济;有助于降低投资者面临的风险;解决信息不对称问题(交易发生前:逆向选择;交易发生后:道德风险)(4)需要注意的是区别这两种融资不在于是否有金融机构的介入,而在于金融机构是否发挥了信用中介作用。

第1章为什么研究货币,银行和金融市场?2。

图1,2,3和4的数据表明,实际产出,通货膨胀率和利率都将下降。

4。

你可能会更倾向于购买房子或汽车,因为他们的融资成本将下降,或你可能不太容易保存,因为你赚你的储蓄少。

6。

号的人借钱来购买房子或汽车,这是事实,更糟糕,因为它花费他们更多的资助他们购买,然而,储户的利益,因为他们可以赚取更高的储蓄利率。

7。

银行的基本业务是接受存款和发放贷款。

8。

他们的人不必为他们的生产使用的人的渠道资金,从而导致更高的经济效益。

9。

三个月期国库券利率比其他利率波动更是平均水平。

巴阿企业债券的利率平均高于其他利率。

10。

较低的价格为一个公司的股份,意味着它可以筹集的资金数额较小,所以在设施和设备投资将下降。

11。

较高的股票价格上涨意味着消费者的财富,是更高的,他们将更有可能增加他们的消费。

12。

这使得外国商品更加昂贵,因此,英国消费者将购买较少的外国商品和更多的国内商品。

13。

它使英国商品相对美国商品更加昂贵。

因此,美国企业会发现它更容易在美国和国外出售他们的货物,并为他们的产品的需求将上升。

14。

在中期到20世纪70年代末,在20世纪80年代末和90年代初,美元的价值低,使得出国旅游相对较昂贵,因此,它是在美国度假的好时机,看到大峡谷。

随着美元的价值在20世纪80年代初兴起,出国旅游变得相对便宜,使它成为一个很好的时间来参观伦敦塔。

15。

当美元价值的增加,外国商品相对美国商品变得更便宜,因此,你是更倾向于购买法国制造的牛仔裤比美国制造的牛仔裤。

在美国制造的牛仔裤的需求下降,因为强势美元造成伤害美国牛仔裤制造商。

另一方面,美国公司进口到美国的牛仔裤现在发现,其产品的需求上升,因此它是更好时,美元强劲。

第2章金融体系概述1。

微软股票的份额是其所有者的资产,因为它赋予雇主微软的收入和资产的份额。

份额是微软的责任,因为它是一个由该雇主的份额,其收入和资产的索赔。

2。

是的,我应该采取的贷款,因为我这样做的结果会更好。

1,measurement of moneyM0:流通中的现金Currency in circulation refers to that circulated in nonbank publics, this is the money in the narrowest sense,We use M 0 to denote. Eg: coins, paper moneyM1: narrow money 狭义货币currency in circulation and checkable deposits 反应了社会的直接购买支付能力M2: broad money 广义货币 M 1+Saving deposits既反映了现实的购买力也反映了潜在的购买力,中央银行货币政策调节的主要中介目标2,function definition:(会判断)Measurement of money 价值尺度Medium of exchange 流通手段Medium of payment 支付手段Means of storage 储藏手段World currency 世界货币3,Gold standard 大致了解Gold coin standard is the typical example (金铸币本位制)4,fiat money standard (不兑现信用货币制度)Lecture2 money and monetary systems2011年11月20日0:231,components of financial system 看一下定义2,funds flows 流动的载体、原则、监管Indirect financing 间接融资:●3,直接融资和间接融资(了解)Indirect financing is a means of financing via financial intermediaries which mainly includes commercial banks.Commercial banks, insurance companies, investment funds, etc., are bridges for indirect financing.Theory of financial intermediation focusing on the reason why there is financial intermediary, the nature of financial intermediary, and the division of labor between financial markets and intermediaries.Direct financing●Financing activities between demanders for funds and suppliers of funds are conducted in financial markets directly.It is worth pointing out that direct financing also involves financial institutions such as investment banks, security brokers, and market makers, etc.Financial market theory focusing on allocation efficiency of capitals, and asset pricing, etc.Disadvantages of direct financing●Advantages vs. disadvantages of different financingsExpertise requirementsHigher risks involvedIndirect financing●Tough requirements for issuersReducing information and contract costsReducing risks by diversificationsTransformation of maturities4,两种结构,大致理解比较bank-based and market-based市场,伙伴关系相对少,股权分散银行,贷款,商业往来,合作伙伴,允许交叉持股直接融资:市场间接融资:银行Lecture3 financial system and financial structure2011年12月9日15:495,中国的金融体系概览(有所了解)A glimpse at china's financial system中国以商业银行主导的间接融资模式为主● 非简单的银行主导,政府干预太多在直接融资中,通过发行企业债券方式所筹集的资金比例低于股票融资。

货币金融学第一章为什么研究货币、银行和金融市场?金融市场债券市场股票市场外汇市场……………..证券(security)又称金融工具,是对发行人未来收入与资产的的索取权。

债券是债务证券,承诺在特定的时间段的定期支付,是决定利率的场所,所以利率决定理论,无论是债券需求理论还是流动性偏好理论,都是将债券作为利率的传导机制。

股票,代表的是所有权,是对公司收益和资产的索取权。

金融市场中,资金从拥有闲置货币的人手中转移到资金短缺的人手中,债券市场和股票市场等金融市场将资金从没有生产用途的人转向有生产用途的人手中。

经济周期的误解,经济周期是不规则的,无法预测的,时间跨度变幻不定的,因为有时候经济周期也被称为经济波动。

金融机构银行保险公司共同基金其他金融机构货币经济周期(货币的供给变动是经济周期波动的推动力之一)通货膨胀(货币的持续增加是无价水平持续上涨的一个重要原因)利率货币政策国际金融外汇市场第二章金融体系概览金融市场的功能金融市场最基本的功能就是实现资金盈余者和资金短缺者之间的资金转移,通过直接融资(借款人直接发行债券)或者间接融资,完成了资本的合理配置(包括生产性用途或者物质消费)金融市场的结构债务市场和股权市场一级市场和二级市场交易所和场外市场货币市场和资本市场金融市场工具货币市场工具美国国库券可转让存单商业票据回购协议联邦基金(容易困惑,不是联邦,而是银行间的贷款)资本市场工具股票抵押贷款企业债券美国政府债券美国政府机构债券州和地方政府债券消费者贷款和商业银行贷款金融中介机构的功能为什么金融中介结构和间接融资对金融市场而言如此重要?交易成本(金融中介具有降低成本的专门技术和规模经济)风险分担(资产转换和资产组合多样化)信息不对称造成的逆向选择和道德风险(甄别信贷风险技术和监督)而金融机构为经济社会提供了流动性服务,承担风险分担职能,并解决信息问题,金融中介机构的类型存款机构商业银行储蓄和贷款协会和互助储蓄银行信用社契约性储蓄机构保险公司和养老基金人寿保险公司火灾和意外伤害保险公司养老基金和政府退休基金投资中介机构财务公司共同基金货币市场共同基金投资银行金融体系的监管金融体系受到最严格的监管,旨在帮助投资者获得更多的信息和确保金融体系的健全性。

西南财经大学—金融学西南财经大学金融专硕431专业课完备学习计划三叶考研教研中心一、专业课复习全年规划1、基础+强化复习阶段(开始复习-年9月)本阶段主要用于跨专业考生学习指定参考书,要求吃透参考书内容,做到准确定位,事无巨细地对涉及到的各类知识点进行地毯式的复习,夯实基础,训练思维,掌握一些基本概念和基本模型,本专业考生要在抓好专业课课堂学习的基础上温习指定参考书。

考生要对指定参考书进行深入复习,加强知识点的前后联系,建立整体框架结构,分清重难点,对重难点基本掌握,并完成参考书配有的习题训练。

2、真题训练阶段(年月-年月)总结所有重点知识点,包括重点概念、理论和模型等,查漏补缺,回归教材。

开始真题训练课程,主要以往年真题为准,讲解真题答题方式,包括:不同题型答题时间、掌握真题答题方式、排版、内容、扩展等。

这一阶段是对第一阶段的深化,需要闭卷答题,了解整个真题答题标准和过程。

二、参考资料1.专业课指定(或建议)参考书目米什金《货币金融学》罗斯《公司理财》殷孟波《货币金融学》2.专业课扩展参考资料知识点重点,难点详解课后题解析货币金融学习题册西财真题,其他高校真题三、学习方法解读1.参考书的阅读方法(1)目录法:先通读各本参考书的目录,对于知识体系有着初步了解,了解书的内在逻辑结构,然后再去深入研读书的内容。

(2)体系法:为自己所学的知识建立起框架,否则知识内容浩繁,容易遗忘,最好能够闭上眼睛的时候,眼前出现完整的知识体系。

(3)问题法:将自己所学的知识总结成问题写出来,每章的主标题和副标题都是很好的出题素材。

尽可能把所有的知识要点都能够整理成问题。

2. 学习笔记的整理方法(1)通过目录法、体系法的学习形成框架后,在仔细看书的同时应开始做笔记,笔记在刚开始的时候可能会影响看书的速度,但是随着时间的发展,会发现笔记对于整理思路和理解课本的内容都很有好处。

(2)做笔记的方法不是简单地把书上的内容抄到笔记本上,而是把书上的内容整理成为一个个小问题,按照题型来进行归纳总结。

货币金融学课后答案1、假如我今天以5000美元购买一辆汽车;明年我就可以赚取10000额外收入;因为拥有了这辆车;我就可以成为推销员..假如没有人愿意贷款给我;我是否应该从放高利贷者拉利处以90%的利率贷款呢你能否列出高利贷合法的依据我应该去找高利贷款;因为这样做的结果会更好..我支付的利息是450090%×5000;但实际上;我赚了10000美元;所以我最后赚得了5500美元..因为拉利的高利贷会使一些人的结果更好;所以高利贷会产生一些社会效益..一个反对高利贷的观点认为它常常会造成一种暴利活动..2、“在没有信息和交易成本的世界里;不会有金融中介机构的存在..”这种说法是正确的、错误的还是不确定说明你的理由..正确..如果没有信息和交易成本;人们相互贷款将无成本无代价进行交易;因此金融机构就没有存在的必要了..3、风险分担是如何让金融中介机构和私人投资都从中获益的风险分担是指金融中介机构所设计和提供的资产品种的风险在投资者所承认的范围之内;之后;金融中介机构将销售这些资产所获取的资产去购买风险大得多的资产..低交易成本允许金融中介机构以较低的成本进行风险分担;使得它们能够获取风险资产的收益与出售资产的成本间的差额;这也是金融中介机构的利润.. 对投资者而言;金融资产被转化为安全性更高的资产;减少了其面临的风险..4、在美国;货币是否在20世纪50年代比70年代能更好地发挥价值储藏的功能为什么在哪一个时期你更愿意持有货币在美国;货币作为一种价值储藏手段;在20世纪50年代比70年代好..因为50年代比70年代通货膨胀率更低;货币贬值的贬值程度也较低..货币作为价值储藏手段的优劣取决于物价水平;因为货币价值依赖于价格水平..在通货膨胀时期;物价水平迅速上升;货币也急速贬值;人们也就不愿意以这种形式来持有财富..因此;人们在物价水平比较稳定的时期更愿意持有货币..5、为什么有些经济学家将恶性通货膨胀期间的货币称做“烫手的山芋”;在人们手中快速传递在恶性通货膨胀期间;货币贬值速度非常快;所以人们希望持有货币的时间越短越好;因此此时的货币就像一个烫手的山芋快速的从一个人手里传到另一个人手里..6、巴西在1994年之前经历快速通货膨胀;很多交易时通过美元进行的;而不是本国货币里亚尔;为什么因为巴西快速的通货膨胀;国内的货币里亚尔实际上的储藏价值很低;所以人们宁愿持有美元;美元有更好的储藏价值;并在日常生活中用美元支付..7、为了支付大学学费;你获得一笔1000美元的政府贷款..这笔贷款需要你每年支付126美元共25年..不过;你不必现在就开始偿还贷款;而是从两年后你大学毕业时才开始..通常每年支付126美元共25年的1000美元固定支付贷款的到期收益率为12%;但是为何上述政府贷款的到期收益率一定低于12% 如果利润率是12%;由于是在毕业两年后而不是现在开始贷款;那么政府贷款的限期贴现值必然小于1000美元..因此;到期收益率要低于12%的折现价值这一款项总计才能达到达1000美元..8、假如利率下跌;你愿意持有长期债券还是短期债券为什么哪一种债券的利率风险更大如果利率下降;你应该持有长期债权..因为利率下降会使长期债权的价格上升快于短期债券;从而使得持有长期债权能够获得更高的回报率..9、如果贷款利率从5%上升到10%;但预期房价价格增长率从2%上涨到9%;人们更愿意还是不愿意购买住房人们更愿意购买住房..购买住房的实际利率从3%5%-2%降低到1%10%-9%..虽然抵押贷款利率上升了;但购房融资的实际成本变小了假如允许对支付的利息来抵免税收;人们就更可能购买住房了..10、20世纪80年代中期的利率低于20世纪70年代晚期;但是很多经济学家都认为20世纪80年代中期的实际利率事实上远高于20世纪70年代晚期..这种观点有道理吗你认为这些经济学家的观点正确吗经济学家是正确的..原因是:20世纪70年代末;名义利率低于预期通货膨胀率;所以实际利率为负数..而在80年代中期;由于预期通货膨胀率下降的速度比名义利率快;从而使名义利率超过了预期通货膨胀率;实际利率变为正数..11、联邦储备体系减少货币供给的一个重要途径是向公众销售债务..运用债券供给分析来说明这种行为对利率的影响..这与你采用流动性偏好理论得出的结论是一样的吗根据可贷资金理论;美联储向公众出售债券;会增加债券供给;从而推动移动曲线Bs向右移..结果是;供给曲线Bs与需求曲线Bd在较低的价格和较高的均衡利率处更高的均衡点相交;使得均衡利率上升..根据流动性偏好理论;货币供给减少会推动货币供给曲线Ms向左位移;均衡利率上升..通过根据可贷资金理论得出的答案与根据流动性偏好得出的答案一致..12、利用债券供求理论和流动性偏好理论;说明当债券风险增加时;对利率产生的影响..运用这两种理论所得到的分析结果是一样的吗根据可贷资金理论;债券风险的增加会使债券的需求减少;需求曲线Bd向左位移;均衡利率上升..根据流动性偏好理论;可以得出相同的答案..债券相对于货币的风险增大;会使货币的需求增加;货币需求曲线Md向右位移;均衡利率上升..可见;两种理论的结论是一致的..13、假如货币供给保持不变;而下一年物价水平下跌;然后保持不变;那么利率在接下来的两年里会发生什么变化提示:同时考虑物价效应和通货膨胀预期效应价格水平的影响在第一年末达到最大;由于物价水平不再持续下降;在物价水平效应的影响下;利益率不会进一步下降..另一方面;第二年的预期通货膨胀为零..因而;预期通货膨胀效应也将为零..由于导致低利率的影响因素消失了;在第二年中;利息率会在第二年年末的低水平上有所上升..14、美国总统再一次记者招待会上宣布;他将采取一项新的反通货膨胀计划来对抗高涨的通货膨胀率..如果公众新任总统;预期利率将会发生什么变化..如果公众信任总统的计划将会成功;利润率将会下降..总统的宣布将会降低预期的通货膨胀;这使得实物资产的预期收益率相对与债券减少;引起债券的需求增加和债券需求曲线Bd向右移位;对于一个给定的名义利率;预期通货膨胀率降低意味着实际利率上升;这使得借贷成本上升;债券的供给下降;债券供给曲线向左..债券供给曲线左移和债券供给曲线右移的结果是均衡利率下降..15、一些经济学家认为;中央银行应该在故事失控之前;刺破泡沫;以防泡沫破裂后引发更大的灾难..如何用货币政策在刺破泡沫利用戈登增长模型来说明如何达到这一目的..股市泡沫可能发生;如果市场参与者认为;股息将快速增长或如果他们大大降低要求回报他们的股权投资;从而降低分母的戈登模型;从而导致股票价格上升..通过提高利率;央行可以导致所需的股本收益率提高;从而使股票价格攀升一样..也可以帮助减缓加息的预期增长率的经济;因此股利;因此也保持股票价格攀升..16、“预言家对通货膨胀的预测十分不准确;简直就是名声狼藉;因此他们对通胀的预期是非理性的..”这种说法是正确的、错误的还是不确定解释你的答案..错..预期可能很不准确;但仍然是理性的;因为最优预测不一定是准确的;如果与测试最可能发生的结果;即使误差很大;也仍是最优的..17、“假如股票价格不遵守随机游走的方式;那么市场上会存在未被利用的盈利机会..”这种说法是正确的、错误的还是不确定解释你的答案..正确..根据有效市场理论;股票价格总是遵循随机游动:股票价格未来变化情况对任何使用实用而言都是不可预测的..因为股票市场内有成千上万的精明人士;每一个懂得分析;而且资料流入市场都是公开的;多有人都知道;并无秘密可言..因此;股票现在的价格反映了市场上所有的公开信息;反映了供求关系;或者本身价值不会太远..因此;股票价格的随机游动意味着股票市场上不存在未被利用的盈利机会..如果股票的价格不再遵循随机漫步;则股票的价格可能会存在一定的规律性;人们可以利用自己所掌握的信息;在预测股票的波动规律;从而实现盈利..如果股票价格大幅度变动能够被预测;股票的最优预测不等于股票的均衡回报..在这种情况下;市场上有潜在的利润机会;预期将是非理性的..股票价格的小幅波动将是可以预期的;最优预测等于均衡回报..在这种情况下;不存在潜在的利润机会..18、“如果股票市场上大多数的参与者不关心货币总量的变化;那么普通股的价格中就不能完全反映这类信息..”这种说法是正确的、错误的还是不确定的解释你的答案..错误..根据股票的随机漫步理论;因为股票市场内有成千上万的精明人士;每一个懂得分析;而且资料流入市场都是公开的;多有人都知道;并无秘密可言..因此;股票现在的价格反映了供求关系;或者本身价值不会太远..现时股票的价格反映了市场上所有的公开信息..因此;尽管大多数股民并不注意货币供给总量等变化;但是;只要股民市场存在着许多专业分析师等精明人士;股票的价格就会反映关于他们的相关信息..19、如果较高的货币增长率与未来较高的通货膨胀率紧密相关;那么若公告的货币增长率很高;但人低于市场预期;你认为长期债权价格会发生何种变化长期债权的价格将会下降..如果货币的增长极快;但是低于市场预期时;市场预期的通货膨胀率将高于实际通货膨胀率..根据费雪效应;实际利率=名义利率-预期的通货膨胀率;当前的实际利率低于长期的实际利率..从长期看;当前的实际利率将趋向于长期的实际利率..而债券的价格与实际利率水平成反比;因此;随着当前的实际利率水平向长期的实际利率水平上升;长期债权的价格将会下降..20、信息不对称的存在如何为政府对金融市场的监管提供理论依据因为信息不对称和免费搭车的问题;金融市场上的信息不足..因此;政府就有了通过管理金融市场增加信息的理论基础;以帮助帮助投资者识别好坏公司;减轻逆向选择问题..政府也可以通过加强会计准则和对欺诈的惩罚来提高金融市场的运行效率;减少道德风险..21、免费搭车者问题是怎样进一步恶化金融市场中的逆向选择和道德风险问题的免费搭便车问题意味着信息的私人生产者不能充分获得生产活动的全部收益;因此;信息的生产将会减少..这意味着用来区分好坏的信息减少;从而使逆向选择问题恶化;并且随着对借款人的监管减少;道德风险问题也将进一步增加..22、金融危机更可能发生在通货膨胀还是通货紧缩时期请解释你的答案..金融危机更容易发生在通货紧缩时期..当出现通货紧缩时;公司债务的负担加重;但公司资产的实际价值并不会增加..因此;公司的净值下降;贷方面临的逆向选择和道德风险问题加剧;这就使金融市场不能有效地将资金从储蓄者流入到生产性投资机会的入手中;金融危机就发生了..余剑答案:金融危机更有可能出现在通货膨胀转向通货紧缩时期.. 23、为什么银行家必须具备包打听的特征对银行家而言;为了减少逆向选择;他必须从预期借款者那里获得尽可能多的信息;以便将风险大的贷款从风险小的贷款中筛选出来..类似的为了尽量减少道德风险他必须不断监控贷款者以保证他们严格遵守限制性契约..因此说银行家具备包打听的特征..24、“由于多样化是规避风险的良好政策;因此;银行专事发放某种特殊类型的贷款总是没有道理的”;这种观点是正确的、错误的还是不确定请解释你的答案..错误的..虽然多样化是规避风险的良好政策;但银行贷款专业化对银行也有重要意义..例如;银行可能会在某一方面的贷款中形成筛选和监控的专门技术;从而提高其逆向选择和道德风险问题使的处理能力..25、假如你是某银行的经理;该银行拥有1500万美元固定利率资产;3000万美元利率敏感型资产;2500万美元固定利率负债;2000万美元利率敏感型负债..对银行进行缺口分析;说明如果利率上升5个百分点;该银行的利率会发生什么变化..要想降低银行的利率风险;你应该采取什么措施缺口是1000万美元3000万美元的利率敏感性资产减去2000万美元的利率敏感性负债;利率的上升给银行带来的改变是其利润增加了50万美元5%×1000万美元..通过把利率敏感性负债增加到3000万美元或把利率敏感性资产降低到2000万美元来消除利率风险..另外;你可以进行利率互换来减少利率风险;即以1000万美元的利率敏感性资产的利率来互换其他银行的1000万美元的固定资产利率..26、美国为何是最后成立中央银行的工业化国家之一略..美国的农业和其他利益集团对中央集权抱有相当可疑的态度;一直反对建立一个中央银行..27、“加拿大商业银行业的竞争性不如美国的商业银行;这是因为在加拿大只有很少的几家银行主宰着整个行业;而美国大约有7500家商业银行..”这种说法正确、错误还是不确定请解释你的答案..错误..虽然美国银行数量比加拿大多的多;但这不意味着美国的银行更具竞争性;美国银行数量庞大的因为恰恰在于银行反竞争规则的存在..例如正是因为存在对设立分行机构的种种限制条款;才使许多小银行得以生存..28、如果未来采纳一些经济学家的建议;取消法定准备金制度;这对货币银行市场共同基金的规模会产生什么影响货币市场共同基金主要投资于货币市场上短期有价证券;如国库券、商业票据、银行定期存单、政府短期债券、企业债券、同业存款等..取消存款准备金;将削弱商业银行作为总信用创造源泉的重要作用;导致通过总资产回报率ROA和股权回报率ROE衡量的银行收益率下降;从20世纪80年代开始的银行衰弱将以更高的速率继续..29、“如果没有20世纪六七十年代的通货膨胀上涨;那么今天的银行业或许会更加健康..”这种说法是正确、错误还是不确定解释你的答案..正确..高通货膨胀率导致利率上升;而利率上升继而造成储蓄存款向直接证券投资的转化;这种现象的发生引起了货币共同基金的产生..作为一种金融创新;货币共同基金能够使存款者在获得类似银行支票服务的同时;能赚取高于银行的利息收益;因此;银行资产负债表负债方面的成本优势遭到削弱;并由此创造了一个不太健康的银行业..所以说;如果二十世纪六七十年代通货膨胀不恶化;银行业如今或许会更健康..但是;信息技术的发展仍然会降低银行资产负债表资本方面的收益优势;因此;银行业地位仍会有所下降..30、哪种银行监管旨在减少存款保险中的逆向选择问题其效果如何开办银行需要批准设立这样的监管条例有助于防止存款保险的逆向选择问题;因为通过详细审查其方案;能够阻止骗子和倾向于从事高风险活动的企业加控制银行..但这一规定并不总是起到作用;因为骗子和倾向于从事高风险活动的企业家总有隐瞒本性的激励;因此其可能从审查程序中通过..31、“银行太大不能倒闭”政策的成本和好处是什么大银行不能倒闭的保护政策的好处是减少银行危机的可能性;它使得银行经济大恐慌几乎不可能发生..它的政策成本是增加了道德风险的动机;那些大银行知道储户没有监测银行从事冒险活动的动力..另外;这是一个不公平的政策因为这是对小银行的歧视..32、为什么监管宽容对于存款保险机构而言是一个危险的政策监管宽容是一个危险的策略;因为一旦银行破产;它有更强的动力承担道德风险并承担过度风险..如果这个冒险活动失败;它不会有任何损失;但如果危险活动取得成功将会获得巨额回报..从事过高的风险活动的结果是存款保险机构很可能将遭受更巨大的损失..33、“银行太大不能倒闭”的政策如何限制了《联邦存款保险公司改善法》的效力限制使用“银行太大不能倒闭”的政策如何减少未来发生银行业危机的可能性略..联邦存款保险公司必须用最昂贵的方法来关闭银行;从而使没有保险的存款人更容易蒙受损失;结果;如果银行承担太多的风险;存款人有更大的激励监督大银行和拿出自己的钱..因此;大银行将较少鼓励承担风险;从而使银行系统更安全;更健全以及减少未来银行业危机的概率..34、美联储是独立性最强的美国机构..它与其他政府之间的哪些主要差别可以解释它较强的独立性..美联储之所以拥有较强的独立性;是因为他从其特有的证券核对银行的贴现贷款中获得大量收入;这使它能够控制其预算..35、在经济大萧条时期;超额准备金率e急剧上升..你认为货币供给将发生什么变化;为什么银行相对于支票存款持有的超额存款准备金上升;意味着银行体系实际上支持支票存款的准备金减少了..因此;货币乘数减小、货币供给下降..36、如果预期通货膨胀率突然下跌;你预测货币供给将发生何种变化政府将会采取一定程度根据通货膨胀率的变化幅度的扩张银根和降低利率等扩张性货币政策;以便达到治理预期通货膨胀下跌的预期政策目标..因此预测货币供给会一定程度的增加;预期具体增加的量将根据之前通货膨胀率的变化、政府出台的货币政策、以及一段时间内货币政策达到的效果和后来发生的时事继续一个长期的判断..37、运用美联储贴现操作防止银行恐慌;其益处是显而易见的;但其代价是什么其成本是经营管理很差的银行本该从行业中淘汰;但由于美联储防止银行危机;38、“美联储能够影响介入准备金规模的唯一方式是调整贴现率..”这种说法正确、错误还是不确定解释你的答案..错误..美联储可以通过直接限制每家银行可以利用的贴现贷款数量来影响贴现贷款水平..39、“失业率是一件很糟糕的事情;政府应该尽一切努力来消灭它..”你同意这种观点吗请解释..不同意..某些失业比如摩擦性失业对经济而言是有利的..因为空缺职位的存在使得工人更可能找到合适的岗位;也是的雇主更可能找到合适该项工作的雇员..40、“由于通货膨胀指标制得关注点在于通货膨胀指标的实现;因此它会引发过度的产业波动..”这种看法正确、错误还是不确定解释你的答案..错误..通货膨胀的关注点并不在于通货膨胀指标的实现..实际上;通货膨胀指标制不会引起产出波动;反而会减少产出的波动..这是因为允许货币政策制定者更积极的回应对需求的下降;因为他们不必担心由此产生的夸张性货币政策导致通货预期..41、“如果货币疲软;该国的经济状况会变坏..”这种说法正确、错误还是不确定解释你的答案..42、如果进口关税提高的同时;对该国进口的需求减少;长期内该国货币的汇率是升高还是降低43、20世纪70年代中后期;日元相对于美元升值;但日本的通货膨胀率高于美国..日本企业相对于美国企业生产能力的提高如何解释这一现象44、在金本位制度下;如果英国相对于美国的生产能力提高;对两国的货币供给将有什么影响为什么货币供给的变动有助于维持两国之间的固定汇率45、在布雷顿森林体系的固定汇率制期间;如果一国的汇率平价被低估;该国的中央银行将被被迫采取何种干预措施他会对其国际储备和货币供给产生什么影响46、“如果一国想阻止汇率变化;它必须在一定程度上放弃对货币供给的控制..”这种说法正确、错误还是不确定解释你的答案..47、“联邦储备体系反映了权利的制约与平衡;这一点类似于美国宪法..”讨论这一观点..。