信用证合同英文翻译

- 格式:doc

- 大小:63.50 KB

- 文档页数:2

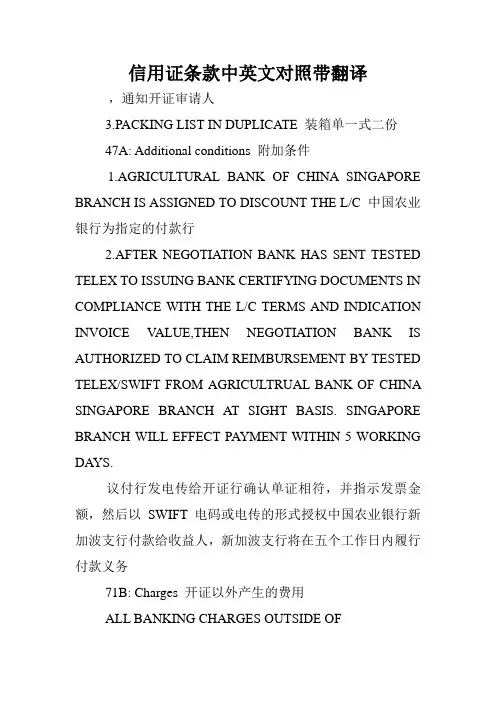

信用证条款中英文对照带翻译,通知开证审请人3.PACKING LIST IN DUPLICATE 装箱单一式二份47A: Additional conditions 附加条件1.AGRICULTURAL BANK OF CHINA SINGAPORE BRANCH IS ASSIGNED TO DISCOUNT THE L/C 中国农业银行为指定的付款行2.AFTER NEGOTIATION BANK HAS SENT TESTED TELEX TO ISSUING BANK CERTIFYING DOCUMENTS IN COMPLIANCE WITH THE L/C TERMS AND INDICATION INVOICE VALUE,THEN NEGOTIATION BANK IS AUTHORIZED TO CLAIM REIMBURSEMENT BY TESTED TELEX/SWIFT FROM AGRICULTRUAL BANK OF CHINA SINGAPORE BRANCH AT SIGHT BASIS. SINGAPORE BRANCH WILL EFFECT PAYMENT WITHIN 5 WORKING DAYS.议付行发电传给开证行确认单证相符,并指示发票金额,然后以SWIFT电码或电传的形式授权中国农业银行新加波支行付款给收益人,新加波支行将在五个工作日内履行付款义务71B: Charges 开证以外产生的费用ALL BANKING CHARGES OUTSIDE OFTHE ISSUING BANK (EXCEPT FOR THEDISCOUNT INTEREST AND DISCOUNTCHARGES) ARE FOR BENEFICIARYSACCOUNT 开证行以外产生的费用由信用证收益人负担(票据贴现利息与折扣除外)常见信用证条款要求48: Period for presentation 单据提交期限DOCUMENTS MUST BE PRESENTED WITHINXX DAYS AFTER LATEST SHIPMENT DATEBUT WITHIN THE V ALIDITY OF THIS CREDIT在信用证有效期内,最迟装运期后XX天内,向银行提交单据49: Confirmation instructionWITHOUT 不保兑53A: Reimbursement Bank 偿付行ABOCSGSG78: Instructions to pay/account/negotiation bank 指示付款行? 议付行1.A DISCREPANCY(IES) FEE OF USDXX.00 WILL BE DEDUCTED FROM THE PROCEEDS IF THE DOCUMENTS ARE PRESENTED WITH A DISCREPANCY(IES). 如果单据提交有差异,差额将从信用额里扣除2.ALL DOCUMENTSSHOULD BE DESPATCHED TO US (ADDRESS:XXXXXXX)IN ONE LOT BY COURIER SERVICE.所有单据应一次性通过快件形式发给我们72: Sender to receiver information 说明THIS CREDIT IS ISSUED SUBJECT TO UCP500 (1993 REVISION)本信用证跟据跟单信用证通一惯例UCP500(1993 年版)开出one original and four photocopies of the commercial invoice showing standard export packing and also showing non-quota when a non-quota item is shipped.出具一式四份标准出口包装的商业发票,若为无配额商品,则需另出无配额证明one origianl and three photocopies of inspection certificate issued by hymin park of min woo international inc.出具一式三份由hymin park of min woo international inc.签发的商检证书a fax letter by angela stating that one full set of non-negotiable documents was received.Angela传真声明需出具一整套不可议付之单证one origianal and three photocopies of beneficiarys certificate certifying that a production sample was sent to theattention of ruth plant or Albert elkaim of buffalo jeans ,400 L sauve west, montreal , quebec一式三份的受益人产品样品之证明书寄至工厂或是此地址: Albert elkaim of buffalo jeans ,400sauve west, montreal , quebec h3l 1z8 (好像是加拿大的一个地址)one original and three photocopies of packing list. 装箱单一式三份full set of original marine bills of lading clean on board or multimode transport documents clean on board plus 2 non-negotiable copies issued by air sea transport inc.. weihai, china made out or endorsed to order of bnp paribass(canada) marked freight collect, notify general customs brokers attn linda 514-876-1704全套清洁已装船的海运提单或是清洁已装船之多式联运提单需加两份由air sea transport inc签发的不可议付单据副本.提单需注明由bnp paribass(Canada)付费,通关联系人Linda,电话514-876-1704one original and three photocopies of certificate of export licence of textile products showing the year of quota which must correspond to the year of shipment except in the case of non-quota which an export licence is not required.出具一式三份的纺织品出品许可证明书,年度配额须与年度出货一致,其中无需配额要求除外.one original and three photocopies of certificate of origin.一式三份的原产地证书one original and three photocopies of canada customs invoice.一式三份的加拿大海关发票a fax letter by albert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton stating a sample was received.p N0_ X H:V v Balbert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton这些人传真声明的可接受之样品letter from shipper on their letterhead indicating their name of company and address,bill of lading number,container number and that this shipment,including its container,does not contain any non-manufactured wooden material, tonnage, bracing material, pallets, crating or other non-manufactured wooden packing material.托单需注明托运人公司,地址,提单号,货柜号,及装载量,包括非木质包装之排水量,托盘,板条箱或其它非木质包装材料信用证条款中英文对照DOCUMENTS REQUIRED 45A1、FULL SET CLEAN SHIPPED ON BOARD SHIPPING COS BILL OF LADING ISSUED TO THE ORDER OF OMDURMAN NATIONAL BANK, SAGGANA BRANCH MAKED FREIGHT PREPAIK AND NOTIFY APPLICANT.2、SIGNED COMMERCIAL INVOICE IN FIVE ORIGINAL AND THREE COPIES DULY CERTIFIED TRUE AND CORRECT.3、PACKING LIST IN ONE ORIGINAL AND FOUR COPIES.4、CERTIFICATE OF ORIGIN ISSUED BY CHAMBER OF COMMERCE CHINA CERTIFY THAT THE GOODS ARE OF CHINESE ORIGIN.1、全套清洁提单。

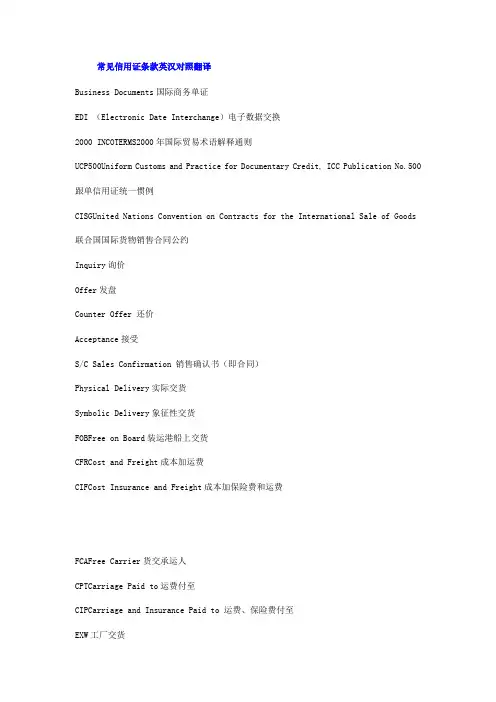

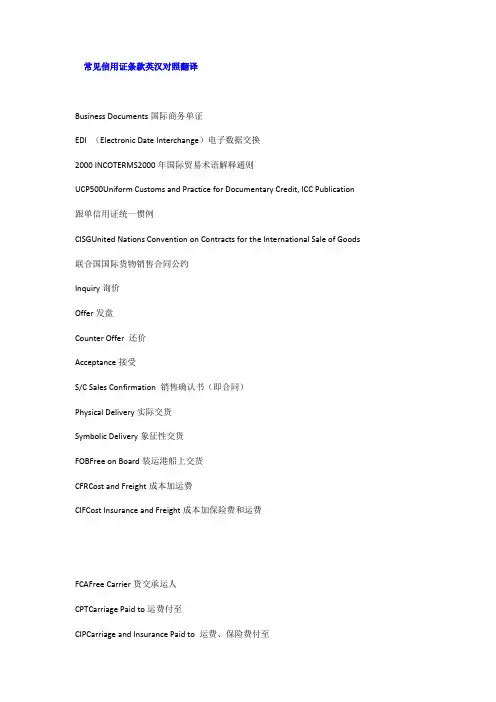

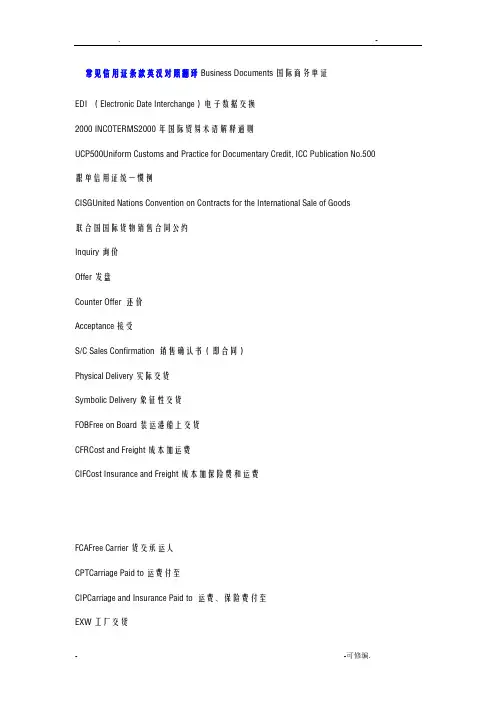

常见信用证条款英汉对照翻译Business Documents国际商务单证EDI (Electronic Date Interchange)电子数据交换2000 INCOTERMS2000年国际贸易术语解释通则UCP500Uniform Customs and Practice for Documentary Credit, ICC Publication No.500 跟单信用证统一惯例CISGUnited Nations Convention on Contracts for the International Sale of Goods 联合国国际货物销售合同公约Inquiry询价Offer发盘Counter Offer 还价Acceptance接受S/C Sales Confirmation 销售确认书(即合同)Physical Delivery实际交货Symbolic Delivery象征性交货FOBFree on Board装运港船上交货CFRCost and Freight成本加运费CIFCost Insurance and Freight成本加保险费和运费FCAFree Carrier货交承运人CPTCarriage Paid to运费付至CIPCarriage and Insurance Paid to 运费、保险费付至EXW工厂交货FAS装运港船边交货DAF边境交货DES目的港船上交货DEQ目的港码头交货DDU未完税交货DDP完税后交货Commission佣金Discount折扣Remittance汇付Remitter汇款人Payee收款人M/T Mail Transfer 信汇T/T Telegraphic Transfer电汇D/D Demand Draft票汇Payment in Advance预付货款Cash with Order随订单付款Collection 跟单托收Principal 委托人Drawee 付款人D/P Documents against Payment 付款交单D/A Documents against Acceptance承兑交单D/P at sight 即期付款交单D/P after sight远期付款交单T/R Trust Receipt信托收据L/C Letter of Credit 信用证Applicant 开证申请人Issuing Bank 开证行Advising Bank通知行Beneficiary受益人Negotiating Bank 议付行Paying Bank 付款行Documentary Credit跟单信用证Clean Credit光票信用证Irrevocable Letter of Credit不可撤销信用证Confirmed Letter of Credit 保兑信用证Sight Credit 即期信用证Usance Letter of Credit远期信用证Usance Credit Payable at Sight假远期信用证Stand-by L/C备用信用证L/G Banker’s Letter of Guarantee 银行保函Factoring国际保理O/A 挂帐,赊销(Open account)COD 货到付款(Cash on delivery)Payment by Installment分期付款Deferred Payment延期付款Sales by Quality凭现货销售Sales by Sample凭样品销售Seller’s Sample 卖方样品Buyer’s Sample 买方样品Counter Sample 对等样品Quality to be Considered as being to the Sample 品质与样品大致相同Specification 规格Grade 等级Standard 标准FAQFair Average Quality 良好平均品质,大路货Trade Mark 商标Brand Name品牌Name of Origin产地名称M/T Metric ton 公吨L/T Long ton 长吨S/T Short ton 短吨G.W.Gross Weight 毛重N.W. Net Weight 净重Gross for Net 以毛作净Tare Weight皮重More or Less Clause 溢短装条款Neutral Packing 中性包装Shipping Mark 运输标志,唛头Indicative Mark 指示性标志Warning Mark 警告性标志Product Code 条形码标志Commercial Invoice 商业发票,发票Customs Invoice海关发票Consular Invoice领事发票Manufacture’s Invoice 厂商发票Combined Invoice 联合发票Proforma Invoice 形式发票Packing list装箱单Weight List/Memo重量单Packing Specification包装说明Detailed Pack list详细包装单Specification List规格单Size/Color Assortment List尺码/颜色搭配单Measurement List尺码单Beneficiary’s Declaration/Certificate/Statement受益人证明Liner Transport 班轮运输Charter Transport 租船运输FCL 整箱货(Full Container Load)LCL 拼箱货(Less than Container Load)CY 集装箱堆场 (Container Yard)CFS集装箱货运站(Container freight station)D/R 场站收据(Dock Receipt)CLP 集装箱装箱单(Container Load Plan)Booking Note一般货物海运出口托运单Container Booking Note集装箱货物托运单S/O Shipping Order 装货单,关单M/RMate’s Receipt 收货单,大副收据B/L Ocean Bill of Lading 海运提单On Board B/L 已装船提单Received for Shipment B/L备运提单Clean B/L清洁提单Straight B/L 记名提单Open B/L不记名提单一、跟单信用证常用条款及短语(1)special additional risk 特别附加险(2)failure to delivery 交货不到险(3)import duty 进口关税险(4)on deck 仓面险(5)rejection 拒收险(6)aflatoxin 黄曲霉素险(7)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(8)survey in customs risk 海关检验险(9)survey at jetty risk 码头检验险(10)institute war risk 学会战争险(11)overland transportation risks 陆运险(12)overland transportation all risks 陆运综合险(13)air transportation risk 航空运输险(14)air transportation all risk 航空运输综合险(15)air transportation war risk 航空运输战争险(16)parcel post risk 邮包险(17)parcel post all risk 邮包综合险(18)parcel post war risk 邮包战争险(19)investment insurance(political risks) 投资保险(政治风险)(20)property insurance 财产保险(21)erection all risks 安装工程一切险(22)contractors all risks 建筑工程一切二.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People''s Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

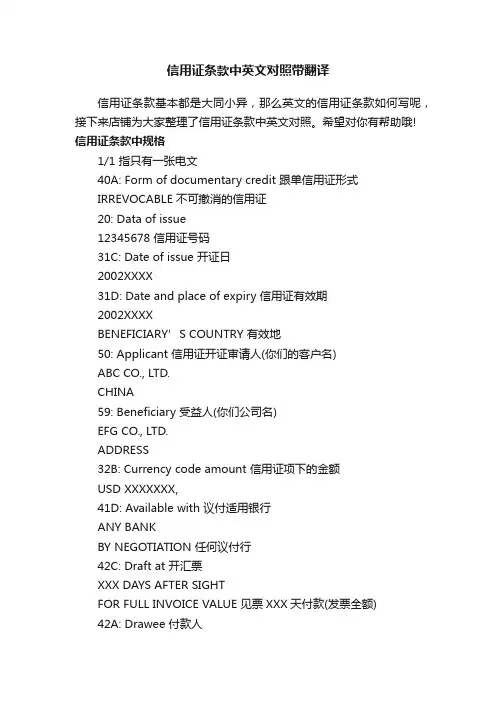

信用证条款中英文对照带翻译信用证条款基本都是大同小异,那么英文的信用证条款如何写呢,接下来店铺为大家整理了信用证条款中英文对照。

希望对你有帮助哦! 信用证条款中规格1/1 指只有一张电文40A: Form of documentary credit 跟单信用证形式IRREVOCABLE 不可撤消的信用证20: Data of issue12345678 信用证号码31C: Date of issue 开证日2002XXXX31D: Date and place of expiry 信用证有效期2002XXXXBENEFICIARY’S COUNTRY 有效地50: Applicant 信用证开证审请人(你们的客户名)ABC CO., LTD.CHINA59: Beneficiary 受益人(你们公司名)EFG CO., LTD.ADDRESS32B: Currency code amount 信用证项下的金额USD XXXXXXX,41D: Available with 议付适用银行ANY BANKBY NEGOTIATION 任何议付行42C: Draft at 开汇票XXX DAYS AFTER SIGHTFOR FULL INVOICE VALUE 见票XXX天付款(发票全额)42A: Drawee 付款人ABOCCNBJXXXAGRICULTURAL BANK OF CHINA, XXX BRANCH 某农业银行某支行43P: Partial shipment 是否允许分批装运ALLOWED 可以43T: TransshipmentALLOWED 允许转运44A: Taking charge 装船港口XXXXXX PORT44B: For transportation to 目的港CHINESE PORT44C: Latest date of shipment 最后装船期2002XXXX45A: Description goods and/or services 货物/服务描述GENERAL MERCHANDISE 日用品46A: Documents required 须提供的单据文件MERCIAL INVOICE IN TRIPLICATE 一式三份商业发票2.FULL SET OF CLEAN ON BOARD B/L MARKED FREIGHT PREPAID MADE OUT TO ORDER OF SHIPPER AND NOTIFYING APPLICANT 全套已装船清洁提单,标明运费预付,收货人一栏填根据发货人指示,通知开证审请人3.PACKING LIST IN DUPLICATE 装箱单一式二份47A: Additional conditions 附加条件1.AGRICULTURAL BANK OF CHINA SINGAPORE BRANCH IS ASSIGNED TO DISCOUNT THE L/C 中国农业银行为指定的付款行2.AFTER NEGOTIATION BANK HAS SENT TESTED TELEX TO ISSUING BANK CERTIFYING DOCUMENTS IN COMPLIANCE WITH THE L/C TERMS AND INDICATION INVOICE VALUE,THEN NEGOTIATION BANK IS AUTHORIZED TO CLAIM REIMBURSEMENT BY TESTED TELEX/SWIFT FROMAGRICULTRUAL BANK OF CHINA SINGAPORE BRANCH AT SIGHT BASIS. SINGAPORE BRANCH WILL EFFECT PAYMENT WITHIN 5 WORKING DAYS.议付行发电传给开证行确认单证相符,并指示发票金额,然后以SWIFT电码或电传的形式授权中国农业银行新加波支行付款给收益人,新加波支行将在五个工作日内履行付款义务71B: Charges 开证以外产生的费用ALL BANKING CHARGES OUTSIDE OFTHE ISSUING BANK (EXCEPT FOR THEDISCOUNT INTEREST AND DISCOUNTCHARGES) ARE FOR BENEFICIARY’SACCOUNT 开证行以外产生的费用由信用证收益人负担(票据贴现利息与折扣除外)常见信用证条款要求48: Period for presentation 单据提交期限DOCUMENTS MUST BE PRESENTED WITHINXX DAYS AFTER LATEST SHIPMENT DATEBUT WITHIN THE VALIDITY OF THIS CREDIT在信用证有效期内,最迟装运期后XX天内,向银行提交单据49: Confirmation instructionWITHOUT 不保兑53A: Reimbursement Bank 偿付行ABOCSGSG78: Instructions to pay/account/negotiation bank 指示付款行 ? 议付行1.A DISCREPANCY(IES) FEE OF USDXX.00 WILL BE DEDUCTED FROM THE PROCEEDS IF THE DOCUMENTS ARE PRESENTED WITH A DISCREPANCY(IES). 如果单据提交有差异,差额将从信用额里扣除2.ALL DOCUMENTS SHOULD BE DESPATCHED TO US (ADDRESS:XXXXXXX)IN ONE LOT BY COURIER SERVICE.所有单据应一次性通过快件形式发给我们72: Sender to receiver information 说明THIS CREDIT IS ISSUED SUBJECT TO UCP500 (1993 REVISION) 本信用证跟据跟单信用证通一惯例UCP500(1993 年版)开出one original and four photocopies of the commercial invoice showing standard export packing and also showing non-quota when a non-quota item is shipped.出具一式四份标准出口包装的商业发票,若为无配额商品,则需另出无配额证明one origianl and three photocopies of inspection certificate issued by hymin park of min woo international inc.出具一式三份由hymin park of min woo international inc.签发的商检证书a fax letter by angela stating that one full set of non-negotiable documents was received.Angela传真声明需出具一整套不可议付之单证one origianal and three photocopies of beneficiary's certificate certifying that a production sample was sent to the attention of ruth plant or Albert elkaim of buffalo jeans ,400 L sauve west, montreal , quebec一式三份的受益人产品样品之证明书寄至工厂或是此地址: Albert elkaim of buffalo jeans ,400sauve west, montreal , quebec h3l 1z8 (好像是加拿大的一个地址)one original and three photocopies of packing list. 装箱单一式三份full set of original marine bills of lading clean on board or multimode transport documents clean on board plus 2 non-negotiable copies issued by air sea transport inc.. weihai, china made out or endorsed to order of bnp paribass(canada) markedfreight collect, notify general customs brokers attn linda 514-876-1704全套清洁已装船的海运提单或是清洁已装船之多式联运提单需加两份由air sea transport inc签发的不可议付单据副本.提单需注明由bnp paribass(Canada)付费,通关联系人 Linda,电话514-876-1704 one original and three photocopies of certificate of export licence of textile products showing the year of quota which must correspond to the year of shipment except in the case of non-quota which an export licence is not required.出具一式三份的纺织品出品许可证明书,年度配额须与年度出货一致,其中无需配额要求除外.one original and three photocopies of certificate of origin.一式三份的原产地证书one original and three photocopies of canada customs invoice.一式三份的加拿大海关发票a fax letter by albert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton stating a sample was received.'p N0_ X H:V v Balbert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton这些人传真声明的可接受之样品letter from shipper on their letterhead indicating their name of company and address,bill of lading number,container number and that this shipment,including its container,does not contain any non-manufactured wooden material, tonnage, bracing material, pallets, crating or other non-manufactured wooden packing material.托单需注明托运人公司,地址,提单号,货柜号,及装载量,包括非木质包装之排水量,托盘,板条箱或其它非木质包装材料信用证条款中英文对照DOCUMENTS REQUIRED 45A1、FULL SET CLEAN SHIPPED ON BOARD SHIPPING CO’S BILL OF LADING ISSUED TO THE ORDER OF OMDURMAN NATIONAL BANK, SAGGANA BRANCH MAKED FREIGHT PREPAIK AND NOTIFY APPLICANT.2、 SIGNED COMMERCIAL INVOICE IN FIVE ORIGINAL AND THREE COPIES DULY CERTIFIED TRUE AND CORRECT.3、 PACKING LIST IN ONE ORIGINAL AND FOUR COPIES.4、CERTIFICATE OF ORIGIN ISSUED BY CHAMBER OF COMMERCE CHINA CERTIFY THAT THE GOODS ARE OF CHINESE ORIGIN.1、全套清洁提单。

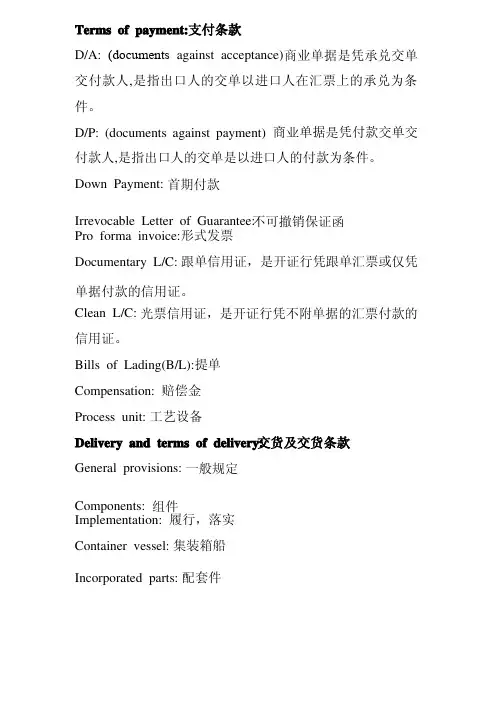

Terms of payment: 支付条款支付条款D/A: (documents against acceptance)商业单据是凭承兑交单交付款人,是指出口人的交单以进口人在汇票上的承兑为条件。

D/P: (documents against payment) 商业单据是凭付款交单交付款人,是指出口人的交单是以进口人的付款为条件。

Down Payment: 首期付款Irrevocable Letter of Guarantee: 不可撤销保证函Pro forma invoice: 形式发票形式发票Documentary L/C: 跟单信用证,是开证行凭跟单汇票或仅凭单据付款的信用证。

Clean L/C: 光票信用证,是开证行凭不附单据的汇票付款的信用证。

Bills of Lading(B/L): 提单提单Compensation: 赔偿金Process unit: 工艺设备Delivery and terms of delivery: 交货及交货条款General provisions: 一般规定Components: 组件Implementation: 履行,落实Container vessel: 集装箱船Incorporated parts: 配套件DDP: 完税后交货Packing and marking: 包装与标记包装与标记Design liaison and design review: 设计联络与设计总览Standards and inspection: 标准与检验标准与检验Erection, commissioning, and acceptance: 安装,调试与验收Liquidated damages and claims: 损失和赔偿金Force majeure clauses: 不可抗力条款不可抗力条款Demurrage: 滞留费,滞留滞留费,滞留Arbitration: 仲裁Patent infringement, secrecy, licence: 专利侵权,保密,执照Termination for default: 违约终止违约终止Coming into force: 合同生效合同生效Miscellaneous: 其他事项Contract amendments: 合同修订Assignment and subcontract: 分配与分包分配与分包Termination for insolvency: 破产终止破产终止Performance bond: 履约保证金Change orders: 变更通知书Governing language and unit of measurement: 合同语言与测量单位Correspondence: 信件Limitation of liability: 责任限制责任限制Confidentiality-use of contract documents and information: 保密-合约单据与信息的使用Spare parts: 零备件Specimen: 样票。

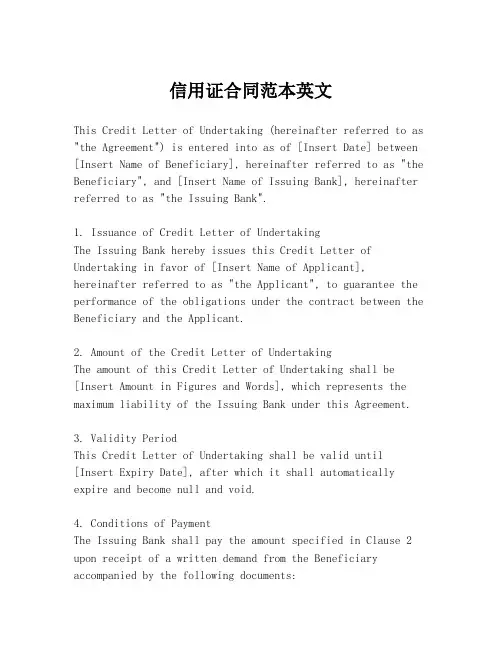

信用证合同范本英文This Credit Letter of Undertaking (hereinafter referred to as "the Agreement") is entered into as of [Insert Date] between [Insert Name of Beneficiary], hereinafter referred to as "the Beneficiary", and [Insert Name of Issuing Bank], hereinafter referred to as "the Issuing Bank".1. Issuance of Credit Letter of UndertakingThe Issuing Bank hereby issues this Credit Letter of Undertaking in favor of [Insert Name of Applicant], hereinafter referred to as "the Applicant", to guarantee the performance of the obligations under the contract between the Beneficiary and the Applicant.2. Amount of the Credit Letter of UndertakingThe amount of this Credit Letter of Undertaking shall be [Insert Amount in Figures and Words], which represents the maximum liability of the Issuing Bank under this Agreement.3. Validity PeriodThis Credit Letter of Undertaking shall be valid until [Insert Expiry Date], after which it shall automatically expire and become null and void.4. Conditions of PaymentThe Issuing Bank shall pay the amount specified in Clause 2 upon receipt of a written demand from the Beneficiary accompanied by the following documents:a. A statement certifying that the Beneficiary hasfulfilled the obligations under the contract with the Applicant.b. Any other documents as stipulated by the terms of this Agreement.5. Presentation of DocumentsThe Beneficiary shall present the demand and documents required under Clause 4 within [Insert Number of Days] days from the occurrence of the event triggering the payment.6. Auto-ExtensionShould the Beneficiary fail to present the documents within the time specified in Clause 5, this Credit Letter of Undertaking shall automatically extend for a period of [Insert Number of Days] days from the original expiry date, unless the Issuing Bank receives a written notice from the Applicant to the contrary.7. Fees and ChargesThe Beneficiary shall be responsible for all fees and charges associated with the issuance and management of this Credit Letter of Undertaking.8. Governing Law and JurisdictionThis Agreement shall be governed by and construed in accordance with the laws of [Insert Jurisdiction]. Any disputes arising out of or in connection with this Agreement shall be resolved by [Insert Method of Dispute Resolution].9. AmendmentsAny amendments to this Agreement must be made in writing and signed by both parties.10. Entire AgreementThis Agreement constitutes the entire understanding between the parties and supersedes all prior negotiations, representations, and agreements.11. NoticesAll notices under this Agreement shall be in writing andshall be deemed duly given when delivered to the addresses specified by each party for such purpose or when sent by registered mail, return receipt requested.12. WaiverThe failure of either party to enforce any provision of this Agreement shall not be construed as a waiver or limitation of that party's right to subsequently enforce and compel strict compliance with every provision of this Agreement.IN WITNESS WHEREOF, the parties have executed this Credit Letter of Undertaking on the date first above written.[Insert Name of Beneficiary][Insert Title of Authorized Signatory][Insert Signature][Insert Date][Insert Name of Issuing Bank][Insert Title of Authorized Signatory][Insert Signature] [Insert Date]。

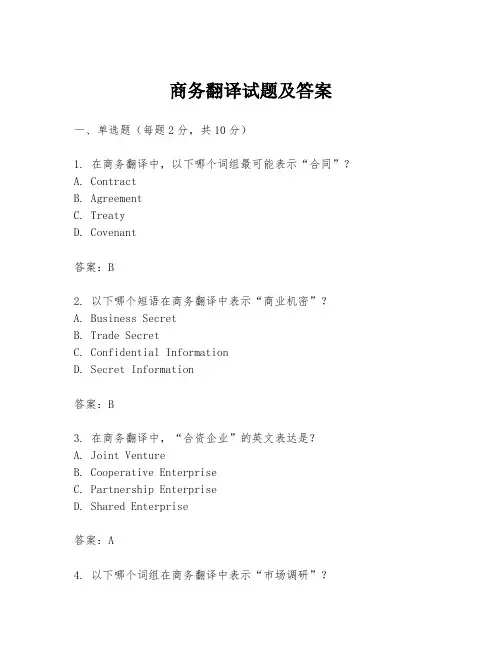

商务翻译试题及答案一、单选题(每题2分,共10分)1. 在商务翻译中,以下哪个词组最可能表示“合同”?A. ContractB. AgreementC. TreatyD. Covenant答案:B2. 以下哪个短语在商务翻译中表示“商业机密”?A. Business SecretB. Trade SecretC. Confidential InformationD. Secret Information答案:B3. 在商务翻译中,“合资企业”的英文表达是?A. Joint VentureB. Cooperative EnterpriseC. Partnership EnterpriseD. Shared Enterprise答案:A4. 以下哪个词组在商务翻译中表示“市场调研”?A. Market ResearchB. Market AnalysisC. Market StudyD. Market Investigation答案:A5. 在商务翻译中,“售后服务”的英文表达是?A. After-sales ServiceB. Post-sales ServiceC. Service After SaleD. Service Post Sale答案:A二、填空题(每题2分,共10分)1. 在商务翻译中,“报价单”通常翻译为________。

答案:Quotation2. 如果一个公司想要表达它提供的是“一站式服务”,在商务翻译中应该翻译为________。

答案:One-stop Service3. 在商务翻译中,“长期合同”可以翻译为________。

答案:Long-term Contract4. 表示“商业策略”的英文翻译是________。

答案:Business Strategy5. 在商务翻译中,“信用证”的英文表达是________。

答案:Letter of Credit三、翻译题(每题5分,共20分)1. 请将以下中文翻译成英文:“我们公司致力于提供高质量的产品和卓越的客户服务。

常见信用证条款英汉对照翻译Business Documents国际商务单证EDI (Electronic Date Interchange)电子数据交换2000 INCOTERMS2000年国际贸易术语解释通则UCP500Uniform Customs and Practice for Documentary Credit, ICC Publication 跟单信用证统一惯例CISGUnited Nations Convention on Contracts for the International Sale of Goods 联合国国际货物销售合同公约Inquiry询价Offer发盘Counter Offer 还价Acceptance接受S/C Sales Confirmation 销售确认书(即合同)Physical Delivery实际交货Symbolic Delivery象征性交货FOBFree on Board装运港船上交货CFRCost and Freight成本加运费CIFCost Insurance and Freight成本加保险费和运费FCAFree Carrier货交承运人CPTCarriage Paid to运费付至CIPCarriage and Insurance Paid to 运费、保险费付至EXW工厂交货FAS装运港船边交货DAF边境交货DES目的港船上交货DEQ目的港码头交货DDU未完税交货DDP完税后交货Commission佣金Discount折扣Remittance汇付Remitter汇款人Payee收款人M/T Mail Transfer 信汇T/T Telegraphic Transfer电汇D/D Demand Draft票汇Payment in Advance预付货款Cash with Order随订单付款Collection 跟单托收Principal 委托人Drawee 付款人D/P Documents against Payment 付款交单D/A Documents against Acceptance承兑交单D/P at sight 即期付款交单D/P after sight远期付款交单T/R Trust Receipt信托收据L/C Letter of Credit 信用证Applicant 开证申请人Issuing Bank 开证行Advising Bank通知行Beneficiary受益人Negotiating Bank 议付行Paying Bank 付款行Documentary Credit跟单信用证Clean Credit光票信用证Irrevocable Letter of Credit不可撤销信用证Confirmed Letter of Credit 保兑信用证Sight Credit 即期信用证Usance Letter of Credit远期信用证Usance Credit Payable at Sight假远期信用证Stand-by L/C备用信用证L/G Banker’s Letter of Guarantee 银行保函Factoring国际保理O/A 挂帐,赊销(Open account)COD 货到付款(Cash on delivery)Payment by Installment分期付款Deferred Payment延期付款Sales by Quality凭现货销售Sales by Sample凭样品销售Seller’s Sample 卖方样品Buyer’s Sample 买方样品Counter Sample 对等样品Quality to be Considered as being to the Sample 品质与样品大致相同Specification 规格Grade 等级Standard 标准FAQFair Average Quality 良好平均品质,大路货Trade Mark 商标Brand Name品牌Name of Origin产地名称M/T Metric ton 公吨L/T Long ton 长吨S/T Short ton 短吨Weight 毛重. Net Weight 净重Gross for Net 以毛作净Tare Weight皮重More or Less Clause 溢短装条款Neutral Packing 中性包装Shipping Mark 运输标志,唛头Indicative Mark 指示性标志Warning Mark 警告性标志Product Code 条形码标志Commercial Invoice 商业发票,发票Customs Invoice海关发票Consular Invoice领事发票Manufacture’s Invoice 厂商发票Combined Invoice 联合发票Proforma Invoice 形式发票Packing list装箱单Weight List/Memo重量单Packing Specification包装说明Detailed Pack list详细包装单Specification List规格单Size/Color Assortment List尺码/颜色搭配单Measurement List尺码单Beneficiary’s Declaration/Certificate/Statement受益人证明Liner Transport 班轮运输Charter Transport 租船运输FCL 整箱货(Full Container Load)LCL 拼箱货(Less than Container Load)CY 集装箱堆场(Container Yard)CFS集装箱货运站(Container freight station)D/R 场站收据(Dock Receipt)CLP 集装箱装箱单(Container Load Plan)Booking Note一般货物海运出口托运单Container Booking Note集装箱货物托运单S/O Shipping Order 装货单,关单M/RMate’s Receipt 收货单,大副收据B/L Ocean Bill of Lading 海运提单On Board B/L 已装船提单Received for Shipment B/L备运提单Clean B/L清洁提单Straight B/L 记名提单Open B/L不记名提单一、跟单信用证常用条款及短语(1)special additional risk 特别附加险(2)failure to delivery 交货不到险(3)import duty 进口关税险(4)on deck 仓面险(5)rejection 拒收险(6)aflatoxin 黄曲霉素险(7)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(8)survey in customs risk 海关检验险(9)survey at jetty risk 码头检验险(10)institute war risk 学会战争险(11)overland transportation risks 陆运险(12)overland transportation all risks 陆运综合险(13)air transportation risk 航空运输险(14)air transportation all risk 航空运输综合险(15)air transportation war risk 航空运输战争险(16)parcel post risk 邮包险(17)parcel post all risk 邮包综合险(18)parcel post war risk 邮包战争险(19)investment insurance(political risks) 投资保险(政治风险)(20)property insurance 财产保险(21)erection all risks 安装工程一切险(22)contractors all risks 建筑工程一切二.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the subject to根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & . as per the People''s Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

常见信用证条款英汉对照翻译Business Documents国际商务单证EDI (Electronic Date Interchange)电子数据交换2000 INCOTERMS2000年国际贸易术语解释通则UCP500Uniform Customs and Practice for Documentary Credit, ICC Publication No.500 跟单信用证统一惯例CISGUnited Nations Convention on Contracts for the International Sale of Goods联合国国际货物销售合同公约Inquiry询价Offer发盘Counter Offer 还价Acceptance接受S/C Sales Confirmation 销售确认书(即合同)Physical Delivery实际交货Symbolic Delivery象征性交货FOBFree on Board装运港船上交货CFRCost and Freight成本加运费CIFCost Insurance and Freight成本加保险费和运费FCAFree Carrier货交承运人CPTCarriage Paid to运费付至CIPCarriage and Insurance Paid to 运费、保险费付至EXW工厂交货FAS装运港船边交货DAF边境交货DES目的港船上交货DEQ目的港码头交货DDU未完税交货DDP完税后交货mission佣金Discount折扣Remittance汇付Remitter汇款人Payee收款人M/T Mail Transfer 信汇T/T Telegraphic Transfer电汇D/D Demand Draft票汇Payment in Advance预付货款Cash with Order随订单付款Collection 跟单托收Principal 委托人Drawee 付款人D/P Documents against Payment 付款交单D/A Documents against Acceptance承兑交单D/P at sight 即期付款交单D/P after sight远期付款交单T/R Trust Receipt信托收据L/C Letter of Credit 信用证Applicant 开证申请人Issuing Bank 开证行Advising Bank通知行Beneficiary受益人Negotiating Bank 议付行Paying Bank 付款行Documentary Credit跟单信用证Clean Credit光票信用证Irrevocable Letter of Credit不可撤销信用证Confirmed Letter of Credit 保兑信用证Sight Credit 即期信用证Usance Letter of Credit远期信用证Usance Credit Payable at Sight假远期信用证Stand-by L/C备用信用证L/G Banker’s Letter of Guarantee 银行保函Factoring国际保理O/A 挂帐,赊销(Open account)COD 货到付款(Cash on delivery)Payment by Installment分期付款Deferred Payment延期付款Sales by Quality凭现货销售Sales by Sample凭样品销售Seller’s Sample 卖方样品Buyer’s Sample 买方样品Counter Sample 对等样品Quality to be Considered as being to the Sample 品质与样品大致相同Specification 规格Grade 等级Standard 标准FAQFair Average Quality 良好平均品质,大路货Trade Mark 商标Brand Name品牌Name of Origin产地名称M/T Metric ton 公吨L/T Long ton 长吨S/T Short ton 短吨G.W.Gross Weight 毛重N.W. Net Weight 净重Gross for Net 以毛作净Tare Weight皮重More or Less Clause 溢短装条款Neutral Packing 中性包装Shipping Mark 运输标志,唛头Indicative Mark 指示性标志Warning Mark 警告性标志Product Code 条形码标志mercial Invoice 商业发票,发票Customs Invoice海关发票Consular Invoice领事发票Manufacture’s Invoice 厂商发票bined Invoice 联合发票Proforma Invoice 形式发票Packing list装箱单Weight List/Memo重量单Packing Specification包装说明Detailed Pack list详细包装单Specification List规格单Size/Color Assortment List尺码/颜色搭配单Measurement List尺码单Beneficiary’s Declaration/Certificate/Statement受益人证明Liner Transport 班轮运输Charter Transport 租船运输FCL 整箱货(Full Container Load)LCL 拼箱货(Less than Container Load)CY 集装箱堆场(Container Yard)CFS集装箱货运站(Container freight station)D/R 场站收据(Dock Receipt)CLP 集装箱装箱单(Container Load Plan)Booking Note一般货物海运出口托运单Container Booking Note集装箱货物托运单S/O Shipping Order 装货单,关单M/RMate’s Receipt 收货单,大副收据B/L Ocean Bill of Lading 海运提单On Board B/L 已装船提单Received for Shipment B/L备运提单Clean B/L清洁提单Straight B/L 记名提单Open B/L不记名提单一、跟单信用证常用条款及短语(1)special additional risk 特别附加险(2)failure to delivery 交货不到险(3)import duty 进口关税险(4)on deck 仓面险(5)rejection 拒收险(6)aflatoxin 黄曲霉素险(7)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到(包括九龙在)或澳门存仓火险责任扩展条款(8)survey in customs risk 海关检验险(9)survey at jetty risk 码头检验险(10)institute war risk 学会战争险(11)overland transportation risks 陆运险(12)overland transportation all risks 陆运综合险(13)air transportation risk 航空运输险(14)air transportation all risk 航空运输综合险(15)air transportation war risk 航空运输战争险(16)parcel post risk 邮包险(17)parcel post all risk 邮包综合险(18)parcel post war risk 邮包战争险(19)investment insurance(political risks) 投资保险(政治风险)(20)property insurance 财产保险(21)erection all risks 安装工程一切险(22)contractors all risks 建筑工程一切二.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoicecovering the risks of War & W.A. as per the People''s Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

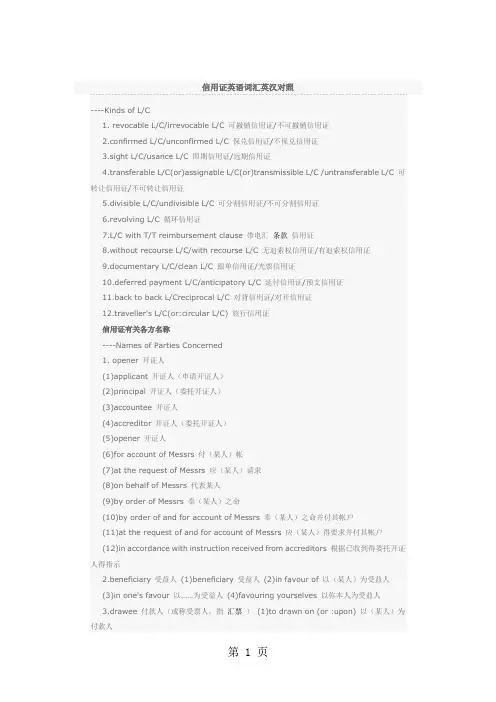

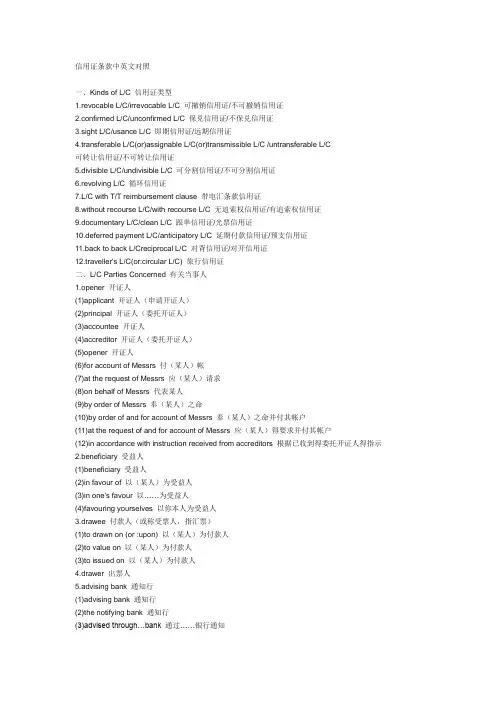

信用证英语词汇英汉对照----Kinds of L/C1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称----Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceedi ng total of JPY… 金额的总数不得超过……日元的限度----- The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……----Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts a re to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”---Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据8bined invoice is not acceptable 不接受联合发票Bill of Loading ---提单1. full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“ 班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本-----Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin "form A" “格式A”产地证明书7.genetalised system of preference certificate of origin form "A" 普惠制格式“A”产地证明书-----Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing… 详注……的装箱单3.packing list showing in detail… 注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单7.we----Other Documents1. full tet of forwarding agents'cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt show ing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A 海关发票证明书7.pure foods certificate 纯食品证书8bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书----The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to… 从中国港口发送/装运往……(2)evidencing shipment from China to… CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allo wed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运------Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4.draft(s) must be negotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiri ng) date… 满期日……14.…if negotiation on or before… 在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until… 本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents'cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付-----The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付----In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

信用证条款中英文对照一、Kinds of L/C 信用证类型1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延期付款信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证二、L/C Parties Concerned 有关当事人1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行三、Amount of the L/C 信用证金额1.amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度四、The Stipulations for the shipping Documents 跟单条款1.available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……五、Draft(Bill of Exchange) 汇票1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 原期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)”根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”六、Invoice 发票1.signed commercial invoice 已签署的商业发票in duplicate 一式两份in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be sho wed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发七、Bill of Loading 提单1.full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本八、Insurance Policy (or Certificate) 保险单(或凭证)1.Risks & Coverage 险别(1)free from particular average (F.P.A.) 平安险(2)with particular average (W.A.) 水渍险(基本险)(3)all risk 一切险(综合险)(4)total loss only (T.L.O.) 全损险(5)war risk 战争险(6)cargo(extended cover)clauses 货物(扩展)条款(7)additional risk 附加险(8)from warehouse to warehouse clauses 仓至仓条款(9)theft,pilferage and nondelivery (T.P.N.D.) 盗窃提货不着险(10)rain fresh water damage 淡水雨淋险(11)risk of shortage 短量险(12)risk of contamination 沾污险(13)risk of leakage 渗漏险(14)risk of clashing & breakage 碰损破碎险(15)risk of odour 串味险(16)damage caused by sweating and/or heating 受潮受热险(17)hook damage 钩损险(18)loss and/or damage caused by breakage of packing 包装破裂险(19)risk of rusting 锈损险(20)risk of mould 发霉险(21)strike, riots and civel commotion (S.R.C.C.) 罢工、暴动、民变险(22)risk of spontaneous combustion 自燃险(23)deterioration risk 腐烂变质险(24)inherent vice risk 内在缺陷险(25)risk of natural loss or normal loss 途耗或自然损耗险(26)special additional risk 特别附加险(27)failure to delivery 交货不到险(28)import duty 进口关税险(29)on deck 仓面险(30)rejection 拒收险(31)aflatoxin 黄曲霉素险(32)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(33)survey in customs risk 海关检验险(34)survey at jetty risk 码头检验险(35)institute war risk 学会战争险(36)overland transportation risks 陆运险(37)overland transportation all risks 陆运综合险(38)air transportation risk 航空运输险(39)air transportation all risk 航空运输综合险(40)air transportation war risk 航空运输战争险(41)parcel post risk 邮包险(42)parcel post all risk 邮包综合险(43)parcel post war risk 邮包战争险(44)investment insurance(political risks) 投资保险(政治风险)(45)property insurance 财产保险(46)erection all risks 安装工程一切险(47)contractors all risks 建筑工程一切险2.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People's Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

工程合同翻译常用词汇合同(Contract)合同协议书(Contract Agreement) 中标函(Letter of Acceptance)投标函(Letter of Tender) 规范(Specification)图纸(Drawings) 明细表(Schedules)投标书(Tender ) 投标函附录(Appendix to Tender)工程量表(Bill of Quantities) 计日工表(Daywork Schedule)合同协议书(Contract Agreement) 转让(Assignment)延误的图纸或指令(Delayed Drawings or Instructions保密事项(Confidential Details 遵守法律(Compliance with Laws)定义(Definitions)日期,检验,期间和竣工(Dates, Tests, Periods and Completion)基准日期(Base Date) 开工日期(Commencement Date)竣工时间(Time for Completion) 竣工检验(Tests on Completion)接收证书(Taking-over Certificate)竣工后检验(Tests after Completion) 履约证书(Performance Certificate) 日(day), 年(year) 款项与支付(Money and Payments)中标合同金额(Accepted Contract Amount)合同价格(Contract Price) 报表(Final Statement)外币(Foreign Currency) 期中支付证书当地币(Local Currency) 支付证书(Payment Certificate)暂定金额(Provisional Sum) 保留金(Retention Money)报表(Statement)工程与货物(Works and Goods) 承包商的设备(Contractor’s Equipment)货物(Goods) 材料(Materials)永久工程(Permanent Works) 永久设备(Plant)区段(Section) 临时工程(Temporary Works)工程(Works) 承包商的文件(Contractor’s Documents)工程所在国(Country) 业主的设备(Employer’s Equipment)不可抗力(Force Majeure) 法律(Laws)履约保证(Performance Security) 现场(Site)不可预见(Unforeseeable) 变更(Variation)通信联络(Communications) 法律与语言(Law and Language)共同的及各自的责任(Joint and Several Liability)业主(The Employer) 进入现场的权利(Right of Access to the Site) 许可证,执照或批准(Permits, Licences or Approvals)业主的人员(Employer’s Personnel)业主的财务安排(Employer’s Financial Arrangements)业主的索赔(Employer’s Claims工程师(The Engineer)工程师的职责和权力(Engineer’s Duties and Authority)工程师指令(Instructions of the Engineers)工程师的更换(Replacement of the Engineer决定(Determinations) 承包商(The Contractor)承包商的一般义务(Contractor’s General Obligations履约保证(Performance Security) 分包商(Subcontractors)分包合同权益的转让(Assignment of Benefit of Subcontract)合作(Cooperation) 放线(Setting Out)安全措施(Safety Procedure) price breakdown:价格细目表advance payment guarantee letter:预付款保证书performance bond:履约保函warranty bond:保固保证letter of credit:信用证insurance certificate:保险证明书, 保险凭证copys:副本model text:样本,模板PAC(Provisional Acceptance Certification) :临时验收Commercial Operation:商行运行 法律英语force majeure:不可抗力Liquidated Damages:违约赔偿金Liquidated Damages for Delay:延期违约赔偿performance guarantee为履约担保,可为保函,也可为保证金;performance bond为履约保证金;performance security为履约保函。

信用证合同英文翻译(共5篇)第一篇:信用证合同英文翻译STANDBY LETTER OF CREDIT[Insert Issuing Bank’s name](Issuing Bank)issues its Standby Letter of Credit(Instrument”)as follows:Type of Instrument: [Insert e.g.Performance Standby Letter of Credit, Advance PaymentStandby Letter of Credit, Tender Bond Standby Letter of Credit, FinancialStandby Letter of Credit]Instrument No:Applicant:Beneficiary: [Insert Issuing Bank’s reference number] [Insert name] of [Insert address] [Insert ANZ entity name] of [Insert address]Underlying Relationship: [Insert reference number and other information identifying contract,tender conditions or other relationship between the applicant and thebeneficiary on which the guarantee is based]Maximum Amount: [Insert currency and amount in words and(figures)]Place of Presentation: [Insert Issuing bank office address]Form of Presentation: Paper delivered personally, by courier or post to Issuing Bank’s OfficeRequired Documents: [Insert [Not applicable][name additional document(s)required to support ademand and specify whether an original or copy is required]] Required language: Demands, documents and notices issued or required in connection withthis Instrument shall be in the language of the Instrument [except for[name of required document] which will be in the language of [insertlanguage]]Expiry:Issue Date:1.On [4:00 p.m.] on [Insert DD/MM/YYYY] at the Issuing Bank’s OfficeAll chargesare for the account of the Applicant [Insert DD/MM/YYYY] Party liable for charges: The Issuing Bank irrevocably undertakes to pay the Beneficiary any sum or sums notexceeding in aggregate the Maximum Amount upon presentation in the form indicated above to the Issuing Bank of the Beneficiary’s compliant demand together with the Required Documents(if any)listed above.Demands must(i)be marked as drawn under this Instrument,(ii)request payment of all or part of the Maximum Amount,(iii)state the respect in which the Applicant is in breach of its obligations under the Underlying Relationship and(iv)specify the bank account of the Beneficiary into which payment is to be made by the Issuing Bank.Demands and Required Documents(if any)must be received at the Issuing Bank’s Office on or before the Expiry of the Instrument.The Issuing Bank will not recognise or pay a demand made after the Expiry of this Instrument.Other notices in connection with this Instrument must be signed and delivered personally, by courier or by post to the Issuing Bank’s Office.Paym ents under this Instrument will be made electronically to an account of the Beneficiary.The Beneficiary will return this Instrument to the Issuing Bank’s Office after it expires.This Instrument is subjectto International Standby Practices – ISP98 International Chamber of Commerce Brochure No 590 and construed and decided in accordance with the laws of the People’s Republic of China(PRC, for the purpose of this Instrument, not including Hong 2.3.4.5.6.7.ANZ TradeKong Special Administrative Region, Macao Special Administrative Region and Taiwan)and subject to the jurisdiction of the courts of the Beneficiary.For and on behalf of[Insert Issuing Bank’sname]Manager:______________________________________ANZ Trade and Supply Chain[V 2010_08_19] Page 2 of 2第二篇:租房合同英文翻译PREMISES LEASE CONTRACTLessor(hereinafter referred to as Party A): XXXLessee(hereinafter referred to as Party B): XXXParty A and B have, in respect of leasing the legitimate premises owned byParty A to Party B, reached an agreement through friendly consultation toconclude the following contract under the relevant national laws andregulations, as well as the relevant stipulations of the city.Party A will lease to Party B the business premises which is located at following agreements:1.The lease term is year, it will be from year))___(day)to (year)___(month)(day).Annual rent(RMB)______yuan(after-tax).2.The rent should be paid _____(it should be paid before using thepremises).If Party B doesn’t pay the rent within thestipulated period of time,then Party A will have the right to withdraw the premises.3.If there is a big change of the market rent, the two parties can negotiate toadjust the rent.4.In the case of such non-A causes as house removal conducted by thegovernment and land or houses overall transfer conducted by Party A, Party Bshould move out of the premises in time.5.Party B should pay Party A the bills for Water and Electricity on the basis of actual degrees present in water meter and electricity meter monthly.6.Once Party B pays the rent in accordance with the terms of this agreements,Party A cannot affect the normal business activities of Party B in any shape orform.Meanwhile, Party B should do business in accordance with the law.AnyEconomic and legal responsibility caused by business activities has nothing todo with Party A.7.The two parties should provide convenience for each other as far aspossible based on the good friendly relations and mutual benefits.8.During the lease term, Party B should keep interior and outdoor clean and neat, and make full preparation for fire prevention and prevention of burglary.(The expenses from “be responsible for general sanitation, green covering and keeping good social order in a designated area outside the unit building ” should be payed by Party B.)9.This contract is signed by the both parties after negotiation.It can’t be changed or terminated willfully unless there is an exceptional circumstance.If so, the party should inform the other a month in advance.Anything not covered in thiscontract will be discussed separately by both parties.10.There are 2 originals of this contract.Each party will hold 1 original (s).This contract shall be in effect after it is subscribed.Lessor (signature): XXXLessee(signature): XXX07/30/201207/31/2012第三篇:房屋租赁合同英文翻译2010—2011年第二学期《国际经贸英语合同写作》考查08英语一班解月学号:20080710820119LEASE CONTRACTLease(hereinafter referred to as Party A):Lessee(hereinafter referred to as Party B):In accordance with the relevant laws, regulations and related provisions, Party A and Party reach this contract on a equal and voluntary basis, which they, under friendly consultations, agree that Party A rent its legal ownership of house to B and Party B lease A’s house and use it.1.Property AddressParty A will take its all the house and attached facilities in__area, Shanghai to rent PartyB in good condition.2.Floor SpaceThe registration of rental house area is __square meters(covered area).3.Lease termThe lease term will be from __date__month__year to the __date__month__year,for__years.Party A shall deliver the vacated house to Party B for use before__month__year.4.Rental1)Amount:The parties agree to the rental will be__RMB per month.Party B will paythe rental to Party A in the form of__.2)Rental will be paid by month.The first installment will be paid before__ day__ month__year.Each successive installment will be paid before the__ day of each month.PartyB will pay the rental before using.(If Party B pays the rental in the form of remittance with the remit date as payment date and the remittance fee will be borne by the remitter.)Party A will issue a written receipt after receiving the rental.3)If Party B pays the rent exceeding the time limited for ten days, he will pay 0.5 percentof monthly rental as overdue fine every day;if Party B pays the rent exceeding the time limited for fifteen days, he will be regarded as automatically refund and breaking the contract.In this situation, Party A has the right to take back the house and take actions against party B‘s breach.5.Deposit1)To ensure the safety and good conditions of the house and attached facilities and the related costs of settlement during the lease term, party B will pay__RMB to party A as a deposit before__day__month__year.Party A will issue a written receipt after receiving the deposit.2)Except as otherwise agreed in this contract, Party A will return full amount of thedeposit without interest on the day when this contract expires and party B clears the house and has paid all due rental and other expenses.3)If party B breaches the provisions of this contract, Party A has right to deduct thedefault fine, compensation for damage or any other expenses from the deposit.In case the1deposit is not sufficient to cover such items, Party B should pay the insufficiency within tendays after receiving the written notice of payment from PartyA.6.Obligations of Party A1)Party A will deliver the house and attached facilities(see the appendix of furniture listfor detail)on time to Party B for using.2)In case the house andattached facilities are damaged because of quality problems,natural damages or accidents, Party A will be responsible to repair and pay the relevantexpenses.3)Party A will guarantee the lease right of the house, whereas if Party B’s interest isdamaged, Party A will be responsible to compensate party B‘s losses.7.Obligations of Party B1)Party B will pay the rental and the deposit on time as stipulated in the contract.2)Party B may add new facilities with Party A‘s approval.When this contract expires,Party B may take away the added facilities without changing the good conditions of thepremises for normal use.3)Party B will not transfer the lease of the premises or sublet it without Party A‘sapproval and should take good care of the premises.Otherwise,Party B will be responsible tocompensate any damages of the premises and attached facilities caused by its fault andnegligence.4)Party B will use the premises lawfully according to this contract without changing thenature of the premises and storing hazardous materials in it.Otherwise, Party B will beresponsible for the damages caused by it5)Party B will bear the cost of utilities such as telephone communications, water,electricity and gas on time during the lease term.8.Termination and dissolution of the contract1)Within one month before the contract expires,Party B will notify Party A if it intendsto extend the lease.In this situation, two parties will discuss matters over the extension.Underthe same terms Party B has the priority to lease the premises.2)When the lease term expires, Party B will return the premises and attached facilities toParty A within days.Any belongings left in it without Party A‘s previous understanding willbe deemed to be abandoned by Party B.In this situation, Party A has the right to dispose of itand Party A will raise no objection.3)This contract will be effective after being signed by both parties.Any party has no right to terminate this contract without another party‘s agreement.Anything not covered in thiscontract will be discussed separately by both parties.9.Breach of the contract1)During the lease term, any party who fails to fulfill any article of this contract withoutthe other party‘s understandi ng will be deemed to breach the contract.Both parties agree thatthe default fine will be.In case the default fine is not sufficient to cover the loss suffered bythe faultless party, the party in breach should pay additional compensation to the other party.2)Both parties will solve the disputes arising from execution of the contract or in connection with the contract through friendly consultation.In case the agreement cannot be reached, any party may summit the dispute to the court that has the jurisdiction over the matter.This contract will be effective after being signed by both parties.Any party has no right to terminate this contract without another party‘s agreement.Anything not covered in this contract will be discussed separately by both parties.10.Miscellaneous1)Any annex is an effective part of this contract, and it hasthe same legal effect with thecontract.2)There are 2 originals of this contract.Each party will hold one.3)If both parties have other special terms, they will be listed bellows:Party A:ID:Contact address:Telephone:Agent:Date:第四篇:英文翻译英语原文:The computer application development application significance and the prospectof developmentComputer science and technology combining of each subject, improved the research tools and methods, to promote the development of the discipline.In the past, people mainly through experiment and theoretical two ways for science and technology research.Now, calculation and simulation has become the third approach research work.The computer and the relevant experimental observations can be combined, instrument field experimental data record, sorting, processing, analysis and draw a diagram, significantly improve the quality and efficiency of experimental puter aided design has become the engineering design of the important means combination, automation.In the aspect of theory, the human brain computer is outspread, can replace the human brain function and strengthened the number.Ancient mathematical rely on paper and pen computing, now computer became the new tools, suchas math theorem proving the heavy mental work already may, by computer to complete or partial completed.Calculation and simulation, as a new research method, often makes some disciplines derive new branch discipline.For example, air dynamics, meteorology, elastic structural mechanics and application analysis etc faced by the “dyscalculia”, in a high-speed computer and relevant calculation method, and a breakthrough started after derive calculation aerodynamics, meteorological numerical prediction edge branch e computer quantitative research, not only in natural science plays a significant role in the social science and humanities subjects also is such.For example, in the census, social investigation and natural language research aspects, computer is a very effective puter wide application in all walks of life, often produce remarkable economic and social benefits, which led to the industrial structure, product structure, management and service pattern, etc of the revolution.In the industrial structure in the computer industry has a view, and knowledge and computer services industries new puter application, have computer hardware technical ability, software technology ability, 8 bits embedded microcontroller, 32-bit computer system application ability and good engineering technical ability compound talents.Maincourse: C series language program design, foundation of computer network, circuit and electronic technology and single-chip microcomputer principle and application, the sensor technology, control engineering foundation, visual programming technology, Linux operating system, answer the art, etc.After graduating in industry measurement device manufacturing enterprise, the civil electronic manufacture of various types ofenterprises are engaged in the embedded system software and hardware development work, also can be engaged in industry measurement and control device, the civil all kinds of intelligent electrical repairs.The computer or people learning tools and life tools.With home computer, personal computer, computer network, database systems and all kinds of terminal equipment, people can learn all kinds of classes, get all sorts of intelligence and knowledge, processing various kinds of life issues(such as booking tickets, shopping, different etc), can even home office.More and more people work, study and life with computer will occur directly or indirectly touch.Popularization of computer education has become an important problem.In short, the development of the computer and application has is not only a scientific technology phenomenon and is a kind of politics, economy, military and social phenomenon.Our computer application problems existing in the development of computer application in China and low level of enterprise informatization level is low, Internet enterprises and Internet families still less, information technology application in enterprise and family enough for popularity.With the developed countries and developing countries have very big gap, according to the state statistical center research, our infomationization ability not only lagging far behind Japan and other developed countries, also behind Singapore, South Korea, the Philippines, Egypt, India and other developing countries;Netizens percentage of the population of 67%, Switzerland, Sweden, Germany, China 60% to 49% only 3.5%.Domestic computer application development is not balanced, regions informatization index 20 times vary, Internet users and computer size in the eastern and western regions, and Taiwan region difference, Taiwan Internet users have5.4 million, the netizen percentage of the population of 26%, networking host 85 million, the enterprise has a 50% yourself in developing electronic commerce for e-commerce enterprise less than 10%.China's information industry is not completely satisfy informatization development and computer application on the hardware and software product demand, producttechnical level and localized market penetration, major application engineering and large application system USES software and hardware product mainly rely on foreign companies, transformation of scientific and technological achievements slow, system integration, information service level should be further enhanced, computer application related standards, norms, and neither need to be puter application, information of the market economy and policy legal environment remains to be perfect, there is lack of effective technology economics policies promote information technology is widely applied, the information organization, leadership and management system is yet to be perfected and strengthen the market management, the relevant laws and regulations, social credit system has not been fully set up, electronic commerce development need market environment still is not perfected.Enterprise management system, mechanism, management concept and organization of still can not adapt to the requirements of market economy, game lack of knowledge, some leadership to information technology application to the importance and urgency of inadequate understanding.Enterprise using information technology, high and new technology is still lack of internal drive, human, financial and material resources.Basic work is weak, information technology talents especially know both of information technology and understand industry business technologycompound talents more lack, broad worker information consciousness and information technology application knowledge lack, worker presses for improving cultural quality.The computer in the popularization and application of social fields will be rapid development area informationization, city information, community information will accelerate development.Beijing, Shanghai, guangdong pilot experience will further promote informatization in the scientific concept of development, will be built, led by some informatization demonstration provinces, cities, and areas, urban communities and villages and towns, the 2010 national regions, small and medium-sized city information will be rapid development.Social utility, public service and other public domain informationization been accelerated.Cultural and educational health, social insurance, social security, public transport, water heating power supply system, community service and other public domain will widely applied information technology, key application engineering and gold-lettered series digital Olympic victory completion, public domain informationization level will have a new stage, feed, clothe and shelter for the people provide good environment and serviceinformation technology in the home, and promote the development of family information.Intelligent building, the village promotes gradually, the telephone, mobile phone, information home appliances, home computer further popularization, make information technology entered the family and personal life, promote the development of informationization family information appliances digital, intelligent, home theater, home office will gradually popularizing, family the development of informationization will greatlyimprove the quality of life.中文译文:计算机应用的发展应用意义及其发展前景计算机科学与技术的各门学科相结合,改进了研究工具和研究方法,促进了各门学科的发展。

国际信用证合同模板英汉International Letter of Credit Contract Template。

International Letter of Credit Contract。

This International Letter of Credit Contract (the "Contract") is made and entered into as of [Date], by and between [Seller Name] (the "Seller"), a company organized and existing under the laws of [Country], and having its principal place of business at [Address], and [Buyer Name] (the "Buyer"), a company organized and existing under the laws of [Country], and having its principal place of business at [Address].1. Definitions。

(a) "Letter of Credit" means the irrevocable and unconditional letter of credit to be issued by [Bank Name], in favor of the Seller, in the amount of [Amount] USD, to secure the payment for the goods to be delivered by the Seller to the Buyer.(b) "Goods" means the products to be delivered by the Seller to the Buyer, as described in the Proforma Invoice attached hereto as Exhibit A.(c) "Delivery Date" means the date on which the Seller is required to deliver the Goods to the Buyer, as specified in the Proforma Invoice.2. Letter of Credit。