国际结算练习答案

- 格式:doc

- 大小:133.00 KB

- 文档页数:14

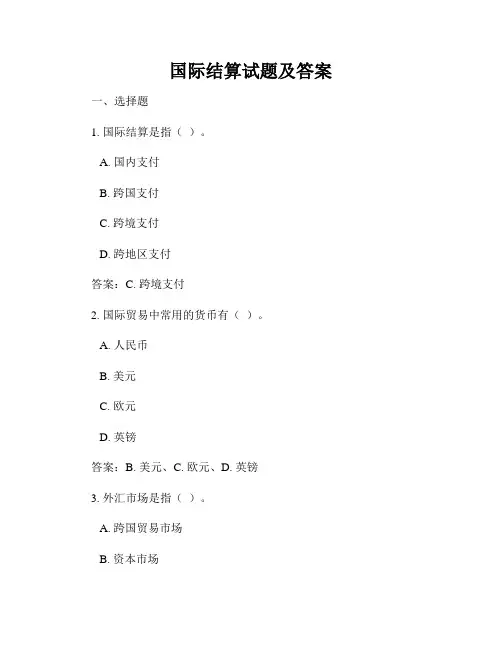

国际结算试题及答案一、选择题1. 国际结算是指()。

A. 国内支付B. 跨国支付C. 跨境支付D. 跨地区支付答案:C. 跨境支付2. 国际贸易中常用的货币有()。

A. 人民币B. 美元C. 欧元D. 英镑答案:B. 美元、C. 欧元、D. 英镑3. 外汇市场是指()。

A. 跨国贸易市场B. 资本市场C. 货币兑换市场D. 国内金融市场答案:C. 货币兑换市场4. 发票是国际结算中的重要凭证,以下关于发票的说法正确的是()。

A. 发票是买方向卖方索取的B. 发票是卖方主动提供给买方的C. 发票是国际结算的唯一凭证D. 发票不需要保存备查答案:A. 发票是买方向卖方索取的5. 信用证是国际贸易中常用的支付方式,下列说法正确的是()。

A. 信用证由买方开立并通知给卖方B. 信用证由卖方开立并通知给买方C. 信用证是买卖双方共同开立的D. 信用证不需要经过银行承兑答案:A. 信用证由买方开立并通知给卖方二、填空题1. 国际结算中,常用的结算方式有()和()。

答案:电汇、信用证2. 外汇市场的重要参与者包括()、()和()。

答案:商业银行、中央银行、投资者3. 在信用证中,开证行是指(),通知行是指()。

答案:买方银行、卖方银行4. 国际结算中,应收账款指的是卖方向买方销售货物或提供劳务而产生的()。

答案:应收款项5. 外汇交易的买入价和卖出价之间的差额称为()。

答案:汇率点差三、简答题1. 请简述电汇的工作原理。

电汇是一种常用的国际结算方式,其工作原理如下:首先,买方将支付款项交给本国的银行,填写有关电汇信息,并提供卖方的银行账号和国际银行账号。

然后,买方的银行根据这些信息,向卖方的银行发送支付指令,并扣除相应款项。

卖方的银行收到支付指令后,将款项划转至卖方账户,并通知卖方款项到账的消息。

最后,卖方确认收到款项后,交付货物或提供服务,完成交易。

2. 请简述信用证的优缺点。

信用证是一种常用的国际贸易支付方式,其优点和缺点如下:优点:- 买卖双方都能获得支付保障,减少交易风险。

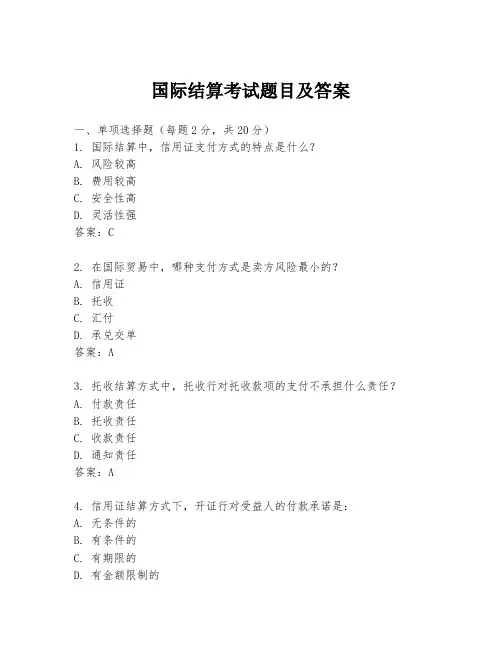

国际结算考试题目及答案一、单项选择题(每题2分,共20分)1. 国际结算中,信用证支付方式的特点是什么?A. 风险较高B. 费用较高C. 安全性高D. 灵活性强答案:C2. 在国际贸易中,哪种支付方式是卖方风险最小的?A. 信用证B. 托收C. 汇付D. 承兑交单答案:A3. 托收结算方式中,托收行对托收款项的支付不承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:A4. 信用证结算方式下,开证行对受益人的付款承诺是:A. 无条件的B. 有条件的C. 有期限的D. 有金额限制的答案:B5. 信用证结算方式中,受益人提交的单据不符合信用证条款,开证行将如何处理?A. 拒绝付款B. 接受单据C. 与申请人协商D. 要求修改信用证答案:A6. 汇付结算方式中,汇入行对汇入款项的支付不承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:A7. 在国际贸易中,哪种支付方式是买方风险最小的?A. 信用证B. 托收C. 汇付D. 承兑交单答案:C8. 信用证结算方式下,开证行对受益人的付款承诺是基于什么条件的?A. 单据相符B. 货物相符C. 合同相符D. 信用相符答案:A9. 托收结算方式中,托收行对托收款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:B10. 汇付结算方式中,汇入行对汇入款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:C二、多项选择题(每题3分,共15分)1. 信用证结算方式中,受益人需要提交的单据通常包括哪些?A. 发票B. 装运单据C. 保险单D. 信用证副本答案:A B C2. 在国际贸易中,常见的结算方式有哪些?A. 信用证B. 托收C. 汇付D. 承兑交单答案:A B C D3. 信用证结算方式下,开证行对受益人的付款承诺是基于什么条件的?A. 单据相符B. 货物相符C. 合同相符D. 信用相符答案:A4. 托收结算方式中,托收行对托收款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:B C5. 汇付结算方式中,汇入行对汇入款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:A C三、判断题(每题1分,共10分)1. 信用证是一种无条件的付款承诺。

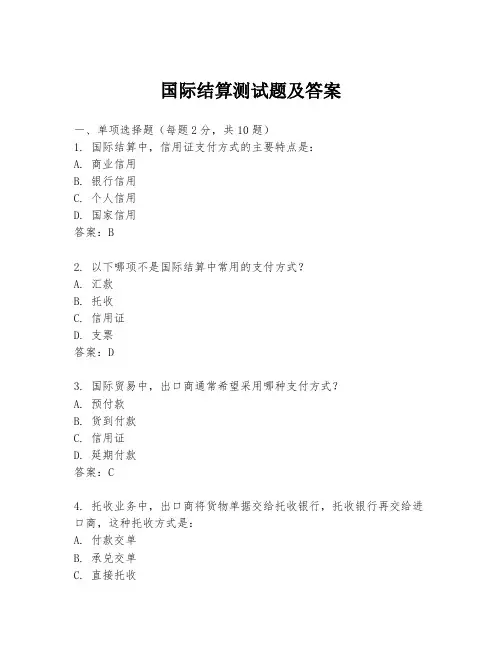

国际结算测试题及答案一、单项选择题(每题2分,共10题)1. 国际结算中,信用证支付方式的主要特点是:A. 商业信用B. 银行信用C. 个人信用D. 国家信用答案:B2. 以下哪项不是国际结算中常用的支付方式?A. 汇款B. 托收C. 信用证D. 支票答案:D3. 国际贸易中,出口商通常希望采用哪种支付方式?A. 预付款B. 货到付款C. 信用证D. 延期付款答案:C4. 托收业务中,出口商将货物单据交给托收银行,托收银行再交给进口商,这种托收方式是:A. 付款交单B. 承兑交单C. 直接托收D. 间接托收答案:A5. 信用证中的“不可撤销”意味着:A. 信用证一经开出,不能更改或撤销B. 信用证可以由开证行随时撤销C. 信用证只能在特定条件下撤销D. 信用证的金额可以随意更改答案:A6. 在国际结算中,汇票的持票人向付款人提示汇票,要求付款的行为称为:A. 提示B. 承兑C. 贴现D. 背书答案:A7. 国际结算中,出口商为了减少汇率风险,可能采用的结算方式是:A. 即期信用证B. 远期信用证C. 汇款D. 托收答案:B8. 国际贸易中,如果出口商希望尽快获得货款,他们可能会选择:A. 信用证B. 托收C. 汇款D. 延期付款答案:C9. 在国际结算中,银行保函是一种:A. 支付承诺B. 信用证C. 担保文件D. 汇票答案:C10. 国际结算中,如果出口商希望减少信用风险,他们可能会要求:A. 提前付款B. 信用证支付C. 托收D. 延期付款答案:B二、多项选择题(每题3分,共5题)1. 国际结算中,以下哪些因素会影响结算方式的选择?A. 交易双方的信用状况B. 货物的性质和价值C. 交易双方的关系D. 汇率波动答案:ABCD2. 信用证结算方式中,以下哪些文件是必须提交的?A. 发票B. 提单C. 装箱单D. 汇票答案:ABCD3. 托收结算方式中,以下哪些是付款交单(D/P)和承兑交单(D/A)的主要区别?A. 付款时间B. 风险承担C. 单据传递方式D. 银行费用答案:AB4. 国际结算中,以下哪些是汇款方式的特点?A. 快速B. 灵活C. 费用较低D. 风险较高答案:ABCD5. 国际结算中,以下哪些是信用证结算方式的优点?A. 降低信用风险B. 提高交易效率C. 增加交易成本D. 保护买卖双方利益答案:ABD结束语:以上是国际结算测试题及答案,希望能够帮助您更好地理解和掌握国际结算的相关知识。

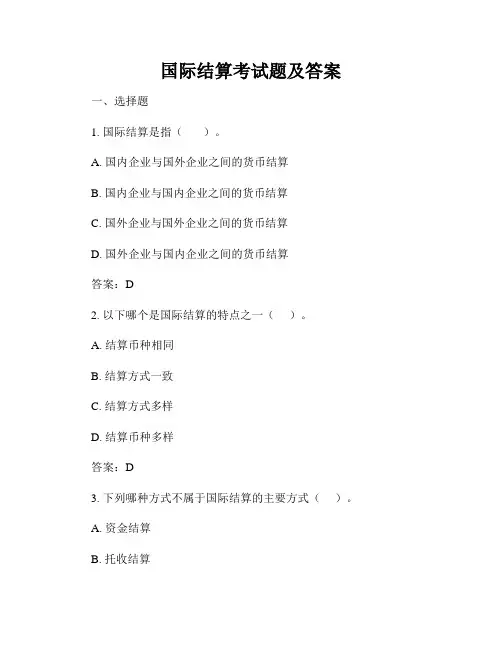

国际结算考试题及答案一、选择题1. 国际结算是指()。

A. 国内企业与国外企业之间的货币结算B. 国内企业与国内企业之间的货币结算C. 国外企业与国外企业之间的货币结算D. 国外企业与国内企业之间的货币结算答案:D2. 以下哪个是国际结算的特点之一()。

A. 结算币种相同B. 结算方式一致C. 结算方式多样D. 结算币种多样答案:D3. 下列哪种方式不属于国际结算的主要方式()。

A. 资金结算B. 托收结算C. 信用证结算D. 缴纳税款答案:D4. 以下哪个不是外汇市场的主要参与者()。

A. 商业银行B. 中央银行C. 政府机构D. 零售客户答案:D5. 外汇市场的主要参与者通过()进行交易。

A. 交割行B. 交易平台C. 清算行D. 结算行答案:B二、简答题1. 请简要介绍国际结算的分类方式。

答:国际结算可以按照结算币种、结算方式和结算地点等进行分类。

按照结算币种可以分为单币结算和多币结算;按照结算方式可以分为付款结算、托收结算、信用证结算等;按照结算地点可以分为跨境结算和同城结算。

2. 请简要说明托收结算的流程。

答:托收结算是指出口商通过银行将出口商品的单据托收给进口商的银行,进口商的银行负责收款并通知进口商。

托收结算流程一般包括出口商将单据交给本地银行,本地银行经过审核后将单据发送到进口商的银行,进口商的银行收到单据后通知进口商进行付款,最后进口商付款给进口商的银行,进口商的银行再将款项转给出口商的银行。

三、应用题某公司与境外供应商A签订了一份货物销售合同,合同金额为50,000美元,合同约定采用信用证结算方式。

合同条款如下:1. 信用证金额:50,000美元2. 信用证有效期:2019年1月1日至2019年12月31日3. 装运期限:2019年3月1日至2019年3月31日4. 单据要求:商业发票、装箱单、产地证明等请回答以下问题:1. 请列出双方在信用证结算方式下的权利和义务。

答:供应商A的权利:在合同有效期内向信用证银行提交符合信用证要求的单据,并获得款项支付。

国际结算复习课件参考答案第一章导论一、选择题1、B2、B3、C4、ABD5、ABCD6、ABCD 【解析】指定可代理业务的分支行:例如,中国银行和花旗银行为自己在美国的代理行,那中国银行必须指定美国的那个州的花旗银行为自己的代理行,例如,指定华盛顿的花旗银行为自己的代理行;规定相互代理业务的范围:中国银行要求花旗银行代理信用证的通知、汇款的解付业务;开立账户:中国银行和花旗银行必须互相告知各自的账户行及帐号;控制文件:授权签字样本、密押、费率表。

二、判断题1、错误。

2、正确。

3、错误。

4、正确。

5、正确。

6、错误。

7、正确。

8、正确。

三、简答题1、答:分行不独立,子银行独立。

2、答:相同点:都为独立法人。

不同点:国内银行的控制权不同。

子银行——国内银行控制其大部分股权,对其拥有控制权;联营银行——国内银行控制其部分股权,不拥有其控制权。

第二章票据一、选择题1、A D2、ABF3、DE4、BC 【解析】直接汇票:汇票当事人都在同一个地方;间接汇票:承兑地和付款地不在同一个地方。

5、ABD6、B7、D8、ACD9、C10、B11、B二、判断题1、错误。

【解析】出票人一般是出口商,出口商开具一种变形汇票;指己汇票:出票人和收款人为同一个人。

2、错误。

【解析】承兑以前,出票人是主债务人;承兑后,承兑人是主债务人。

持票人应在汇票的到期日之内或合理时期向付款人提示承兑和付款,否则出票人和前手。

3、正确。

4、正确。

5、正确。

【解析】背书人是债权人还是债务人?背书前是债权人,背书后是债务人;被背书人在再次背书前是债权人,他如果再将票据背书转让,则他又成为了债务人;在汇票承兑以前,出票人是汇票的主债务人,承兑后,承兑人变成主债务人。

6、正确。

7、正确。

【解析】出票人在破产前出票,则这张汇票是有效的,汇票的收款人可以作为债权人参加财产的清算;出票人在破产后出票,则这张汇票是无效汇票三、填空题1、见票即付:银行作为付款人2、银行汇票:商业汇票3、见票即付四、案例分析题1、一般汇票:B公司开出汇票,受票人为新加坡西门子,收款人为B公司的往来银行;对己汇票:西门子上海分公司开出汇票,受票人为新加坡西门子,收款人为B公司;指己汇票:B公司开出汇票,受票人为新加坡西门子,收款人为B公司自己;(对己汇票:出票人、受票人为同一人;指己汇票:出票人、收款人为同一人;)五、计算题1、算尾不算头,3月5日,见票后三天后付款,应是6、7、8,8号付款;4.16---4.30:30-16+1=15天5.1---5.31 31天466.1---6.30 30天767.1---7.14 14天90以到期月份的相应日期为到期日,若没有相应日期,则以该月的最后一日为到期日。

国际结算题库(含参考答案)一、单选题(共30题,每题1分,共30分)1、信用证业务中,( )不承担审查单据的责任。

A、保兑行B、议付行C、开证行D、偿付行正确答案:D2、L/C、D/P和D/A三种支付方式下,就买方风险而言,按由大到小顺序排列,应为( D )。

A、L/C>D/ A>D/PB、L/C>D/P>D/AC、D/A>D/P>L/CD、D/P>D/A>L/C正确答案:D3、某银行议付即期信用证项下单据一套并于5月3日寄出开证行于5月7日(星期五)签收单据,单证相符最迟付款日为( )。

A、5月15日B、5月19日C、5月10日D、5月18日正确答案:D4、信用证受益人审查信用证的重点是( )。

A、开证行的政治背景B、信用证的可信度C、信用证内容与合同内容是否一致D、开证行的资信正确答案:C5、根据贸易方式和信用证的特点转口贸易应用( )信用证。

A、对开B、背对背C、可转让D、循环正确答案:B6、因付款人拒付,代收行按托收行指示将单据退回.单据存根旧途中遗失的风险由( )承担。

A、托收行B、代收行C、委托人D、付款人正确答案:C7、对于出口商来说,( )最符合安全及时收汇的原队A、付款文单托收B、远期付款信用证C、即期付款信用证D、附有电资条款的信用证正确答案:C8、跟单托收中,银行办理了出口押汇,风险在于( )。

A、托收行B、委托人C、付款人D、代收行正确答案:B9、承兑是( ) 对远期汇票表示承担到期付款责任的行为。

A、持票人B、收款人C、受益人D、受票人正确答案:A10、对于受益人来说.下列种类信用证中( )最为有利。

A、不可撤销承兑B、不可撤销远期付款C、不可撤销议付D、不可撤销即期付款正确答案:D11、当中央银行要紧缩银根时,将( )票据的再贴现率。

A、提高B、降低正确答案:A12、即期付款信用证项下,可以用来取代汇票的是( )。

A、海运提单B、商业发票C、保险单D、商品检验单正确答案:B13、在下列“可撤销信用证的描述中错误的是( )。

国际结算综合练习题答案一、单项选择题1. 国际结算中,信用证是一种由银行出具的什么?A. 付款承诺B. 收款保证C. 贸易合同D. 债务证明答案:A2. 托收结算方式中,D/P和D/A分别代表什么?A. 付款交单和承兑交单B. 承兑交单和付款交单C. 承兑交单和承兑交单D. 付款交单和付款交单答案:A3. 以下哪种结算方式风险最低?A. 信用证B. 托收C. 汇款D. 现金交易答案:A4. 国际结算中的“跟单信用证”是指什么?A. 银行对买方的信用B. 银行对卖方的信用C. 银行对交易双方的信用D. 银行对货物的信用答案:B5. 国际结算中,SWIFT是什么意思?A. 世界贸易组织B. 国际货币基金组织C. 国际银行金融电信协会D. 国际结算协会答案:C二、多项选择题6. 以下哪些属于国际结算中的支付方式?A. 信用证B. 托收C. 汇款D. 现金交易答案:A, B, C7. 国际结算中,哪些因素可能影响信用证的开立?A. 交易双方的信用状况B. 货物的种类和数量C. 交易的货币种类D. 交易的地理位置答案:A, B, C, D8. 托收结算方式中,以下哪些是卖方需要提供的文件?A. 发票B. 装箱单C. 运输单据D. 保险单答案:A, B, C9. 在国际结算中,以下哪些是银行可能提供的服务?A. 信用证开立B. 托收服务C. 汇款服务D. 现金交易答案:A, B, C10. 国际结算中,以下哪些是汇款方式?A. 电汇B. 信汇C. 票汇D. 现金交易答案:A, B, C三、判断题11. 信用证是一种无条件的支付承诺。

()答案:错误12. 托收结算方式中,D/P和D/A的主要区别在于付款时间。

()答案:正确13. 信用证可以保证卖方按时收到款项,但不能保证货物的质量。

()答案:正确14. SWIFT是一个国际银行金融电信协会,提供金融信息传递服务。

()答案:正确15. 汇款方式中,电汇是最快的汇款方式。

国际结算题库(含答案)一、单选题(共33题,每题1分,共33分)1.托收指示中规定托收手续费由受票人负担,但受票人对此表示拒付,则银行应( )这项费用。

A、向委托人收取、C.转向必要时的代理人收取B、坚持受票人支付正确答案:A2.如果信用证未注明可转让,则该信用证( )。

A、不可转让B、需明确可否转让C、可部分转让D、可转让正确答案:A3.在下列托收业务中,进口商可凭信托收据向银行借单极传的任是A、D/P at sightB、D/P after sightC、D/AD、D/A after sight正确答案:B4.信用证业务中的“严格相符’是指( )相符。

A、信用证与相关货物B、单据与货物C、信用证与贸易合同D、单据与信用证正确答案:D5.信用证要求受益人提交的提单L注明了“Freight collected”则该商品交易双方是以( )价格成交的。

A、FOBB、CFRC、CIF正确答案:A6.跟单信用证业务中,在审单时要求“单单一致”的核心单据是( )。

A、货运单据一B、商业发票C、保险单据D、汇票正确答案:B7.偿付行( )是对偿付行的不正确说法。

A、负有审核单据的责任B、的付款并非终局性的C、受开证行的委托而付款D、受议付行或付款行的‘索汇指示”而付款正确答案:A8.由出口商签发的、要求银行在一定时间内付款、并经受票人承兑的汇票。

A、既是商业汇票,又是银行承兑汇票B、既是银行汇票,又是商社汇票C、是商业即期汇票D、是银行远期汇票正确答案:A9.商品出口届,外贸公司可以最早从银行收到票款的结汇方式是( )。

A、出口押汇B、定期结汇C、收妥结汇正确答案:A10.票汇结算的信用基础是汇款人与收款人之间的商业信用,办理中使用的是.汇票是( )A、银行即期B、商业远期C、商业即期D、银行远期正确答案:A11.所谓福费廷业务,其实质是( )。

A、一种特殊的远期票据贴现方式,向进口商提供的中长期对外贸易融资B、一种以包买远期票据的方式,向出口商提供的中期对外贸易融资C、一种以远期票据贴现方式,向出口商提供的短期对外贸易融资D、一种特殊的远期票据贴现方式,向出口商提供的长期对外贸易融资正确答案:B12.福费廷业务虽然是直接向出口商融资但对于出口商来说,( )。

国际结算复习题含答案一、单项选择题1. 国际结算中,信用证支付方式下,开证行对受益人付款的保证是基于()。

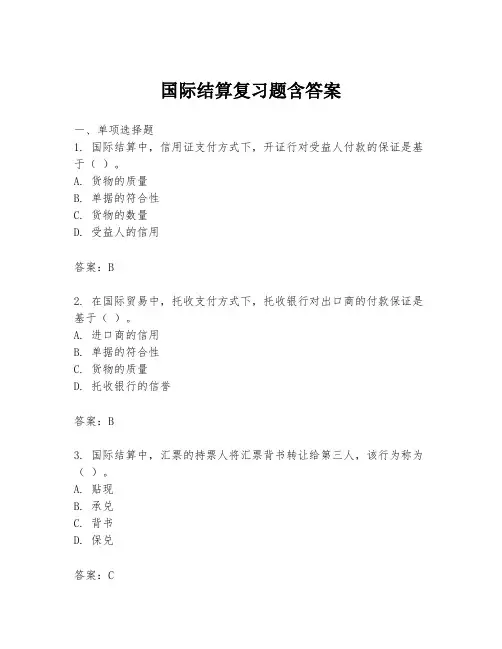

A. 货物的质量B. 单据的符合性C. 货物的数量D. 受益人的信用答案:B2. 在国际贸易中,托收支付方式下,托收银行对出口商的付款保证是基于()。

A. 进口商的信用B. 单据的符合性C. 货物的质量D. 托收银行的信誉答案:B3. 国际结算中,汇票的持票人将汇票背书转让给第三人,该行为称为()。

A. 贴现B. 承兑C. 背书D. 保兑答案:C4. 信用证结算方式下,受益人提交的单据必须符合()。

A. 开证行的要求B. 出口商的要求C. 进口商的要求D. 国际商会的规定答案:A5. 国际结算中,银行保函是银行对()的一种保证。

A. 货物的质量B. 单据的符合性C. 交易双方的信用D. 交易双方的履约答案:D二、多项选择题1. 国际结算中,以下哪些属于支付方式?()A. 信用证B. 托收C. 汇款D. 保函答案:ABCD2. 国际结算中,以下哪些因素会影响汇票的贴现?()A. 汇票的面额B. 贴现率C. 汇票的到期日D. 贴现银行的信誉答案:ABC3. 国际结算中,以下哪些属于信用证的特点?()A. 银行信用B. 单据交易C. 独立性原则D. 无条件付款承诺答案:ABCD三、判断题1. 信用证结算方式下,只要单据符合信用证条款,开证行必须无条件付款。

()答案:正确2. 托收结算方式下,托收银行对出口商的付款没有保证。

()答案:正确3. 汇票的贴现是指持票人将未到期的汇票转让给银行,银行扣除贴现利息后支付给持票人。

()答案:正确四、简答题1. 简述国际结算中信用证结算方式的主要特点。

答案:信用证结算方式的主要特点包括银行信用、单据交易、独立性原则和无条件付款承诺。

在信用证结算方式下,开证行对受益人付款的保证是基于单据的符合性,而不是货物的质量或数量,也不是受益人的信用。

2. 描述国际结算中托收结算方式的基本流程。

国际结算试题库(含参考答案)一、选择题1. 国际结算是指不同国家的当事人之间因商品交易、资本流动、债务偿还等经济往来的资金清算和货币支付活动。

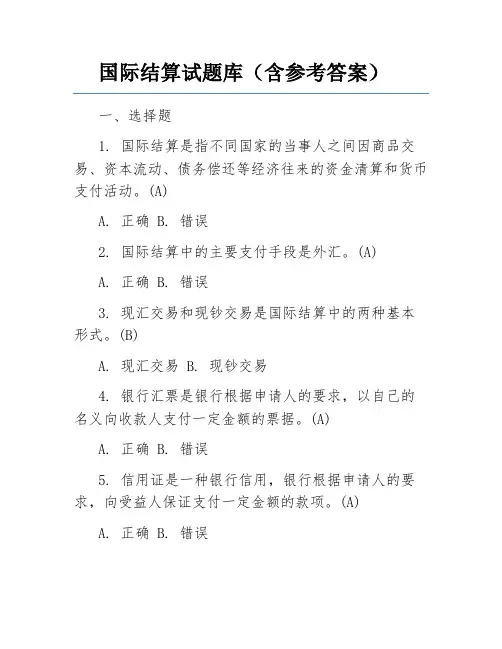

(A)A. 正确B. 错误2. 国际结算中的主要支付手段是外汇。

(A)A. 正确B. 错误3. 现汇交易和现钞交易是国际结算中的两种基本形式。

(B)A. 现汇交易B. 现钞交易4. 银行汇票是银行根据申请人的要求,以自己的名义向收款人支付一定金额的票据。

(A)A. 正确B. 错误5. 信用证是一种银行信用,银行根据申请人的要求,向受益人保证支付一定金额的款项。

(A)A. 正确B. 错误6. 托收是银行代理收款人收取款项的一种结算方式。

(A)A. 正确B. 错误7. 在国际结算中,汇款是指银行根据汇款人的要求,将一定金额的款项支付给收款人的一种结算方式。

(A)A. 正确B. 错误8. 银行汇票的付款人是银行。

(A)A. 正确B. 错误9. 信用证的受益人是指在信用证项下有权收取款项的人。

(A)A. 正确B. 错误10. 汇票的出票人是指承担付款责任的人。

(B)A. 付款人B. 出票人二、填空题1. 国际结算是指不同国家的当事人之间因商品交易、资本流动、债务偿还等经济往来的资金清算和货币支付活动。

2. 现汇交易是指以外汇作为支付手段的国际结算方式。

3. 现钞交易是指以纸币或硬币作为支付手段的国际结算方式。

4. 银行汇票是银行根据申请人的要求,以自己的名义向收款人支付一定金额的票据。

5. 信用证是一种银行信用,银行根据申请人的要求,向受益人保证支付一定金额的款项。

6. 托收是银行代理收款人收取款项的一种结算方式。

7. 汇款是指银行根据汇款人的要求,将一定金额的款项支付给收款人的一种结算方式。

8. 银行汇票的付款人是承担付款责任的人。

9. 信用证的受益人是指在信用证项下有权收取款项的人。

10. 汇票的出票人是指承担付款责任的人。

三、简答题1. 请简述国际结算的含义及其主要支付手段。

国际结算考试题及答案一、单项选择题(每题2分,共20分)1. 国际结算中,信用证的开证行是()。

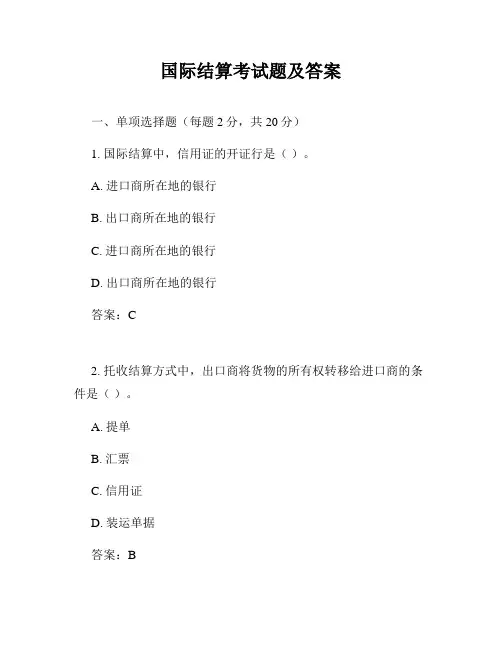

A. 进口商所在地的银行B. 出口商所在地的银行C. 进口商所在地的银行D. 出口商所在地的银行答案:C2. 托收结算方式中,出口商将货物的所有权转移给进口商的条件是()。

A. 提单B. 汇票C. 信用证D. 装运单据答案:B3. 国际结算中,汇票的出票人是()。

A. 出口商B. 进口商C. 银行D. 承运人答案:A4. 国际结算中,银行承兑汇票的承兑人是()。

A. 出口商B. 进口商C. 银行D. 承运人答案:C5. 国际结算中,远期信用证的有效期一般为()。

A. 30天B. 60天C. 90天D. 120天答案:C6. 国际结算中,信用证的到期地点通常在()。

A. 出口国B. 进口国C. 出口商所在地D. 进口商所在地答案:B7. 国际结算中,银行保函的开立银行是()。

A. 出口商所在地的银行B. 进口商所在地的银行C. 出口商所在地的银行D. 进口商所在地的银行答案:B8. 国际结算中,汇款结算方式中,汇出行是()。

A. 出口商所在地的银行B. 进口商所在地的银行C. 出口商所在地的银行D. 进口商所在地的银行答案:A9. 国际结算中,信用证结算方式中,受益人是()。

A. 出口商B. 进口商C. 银行D. 承运人答案:A10. 国际结算中,托收结算方式中,代收行是()。

A. 出口商所在地的银行B. 进口商所在地的银行C. 出口商所在地的银行D. 进口商所在地的银行答案:B二、多项选择题(每题3分,共15分)11. 国际结算中,信用证结算方式的特点包括()。

A. 安全性高B. 费用较高C. 灵活性强D. 手续繁琐答案:ABD12. 国际结算中,汇款结算方式的特点包括()。

A. 手续简单B. 费用较低C. 安全性低D. 灵活性强答案:ABCD13. 国际结算中,托收结算方式的特点包括()。

A. 手续简单B. 安全性低C. 费用较低D. 灵活性强答案:BCD14. 国际结算中,银行保函的类型包括()。

国际结算业务试题及答案一、单项选择题(每题2分,共10分)1. 国际结算中,信用证支付方式的主要风险承担者是:A. 出口商B. 进口商C. 开证行D. 通知行答案:C2. 托收结算方式中,代收行的责任是:A. 保证付款B. 保证交单C. 仅代为收款D. 仅代为交单答案:C3. 国际结算中,汇票的出票人是:A. 付款人B. 收款人C. 出票人自己D. 银行答案:C4. 国际结算中,远期信用证与即期信用证的主要区别在于:A. 信用证的有效期B. 付款的时间C. 信用证的金额D. 信用证的类型答案:B5. 国际结算中,银行保函的有效期通常由:A. 银行决定B. 申请人决定C. 受益人决定D. 开证行决定答案:B二、多项选择题(每题3分,共15分)1. 以下哪些属于国际结算中的支付工具?A. 汇票B. 本票C. 支票D. 信用证答案:A, B, C, D2. 国际结算中,信用证的特点包括:A. 银行信用B. 单据交易C. 无条件付款D. 可转让性答案:A, B3. 托收结算方式中,代收行可能采取的行动包括:A. 直接付款B. 直接交单C. 代为收款D. 代为交单答案:C, D4. 国际结算中,汇票的背书人可以:A. 转让汇票B. 放弃汇票C. 保证付款D. 保证交单答案:A, B5. 国际结算中,银行保函的作用包括:A. 保证付款B. 保证交货C. 保证履约D. 保证质量答案:C, D三、简答题(每题5分,共20分)1. 简述信用证结算方式的流程。

答案:信用证结算方式的流程通常包括申请开证、开证行审核、通知信用证、出口商准备单据、提交单据至银行、银行审核单据、付款或承兑汇票、通知收款人。

2. 托收结算方式与信用证结算方式的主要区别是什么?答案:托收结算方式中,银行不承担付款责任,仅提供服务;而信用证结算方式中,开证行承担付款责任。

3. 汇票的出票人和承兑人分别承担哪些责任?答案:汇票的出票人负责签发汇票并承诺在到期时支付票面金额;承兑人则在汇票上签字,承诺在汇票到期时支付票面金额。

国际结算各章试题及答案一、单项选择题1. 国际结算中,信用证支付方式的特点不包括以下哪一项?A. 银行信用B. 贸易双方信用C. 独立性D. 统一性答案:B2. 国际结算中,汇款方式的特点是:A. 简便快捷B. 风险较高C. 费用较低D. 全部正确答案:D3. 托收结算方式中,付款交单(D/P)是指:A. 银行收到货款后,通知出口商发货B. 银行收到货物后,通知进口商付款C. 银行收到货款后,通知进口商提货D. 银行收到货物后,通知出口商收款答案:C二、多项选择题1. 以下哪些属于国际结算中常用的支付方式?A. 信用证B. 汇款C. 托收D. 现金交易答案:A、B、C2. 信用证结算方式中,常见的类型包括:A. 即期信用证B. 远期信用证C. 可转让信用证D. 保兑信用证答案:A、B、C、D三、判断题1. 信用证结算方式下,银行只负责审核单据,不负责审核货物的质量。

答案:正确2. 汇款结算方式下,出口商承担的风险较小。

答案:错误四、简答题1. 简述信用证结算方式的优点。

答案:信用证结算方式的优点包括:(1)银行信用担保,降低了贸易双方的风险;(2)单据审核独立于货物,简化了结算流程;(3)提供了标准化的结算程序,便于国际贸易的进行。

2. 汇款结算方式下,汇款人需要注意哪些事项?答案:汇款人需要注意以下事项:(1)选择可靠的汇款渠道;(2)了解汇款费用及汇率;(3)确保收款人信息的准确性;(4)注意汇款的安全性和及时性。

五、案例分析题某公司通过信用证方式向国外出口一批货物,信用证要求提供商业发票、提单、装箱单等单据。

货物装船后,公司发现提单上的货物数量与实际不符,但货物已经发运。

问:该公司应如何处理?答案:该公司应立即通知银行和进口商,说明情况并请求修改提单。

同时,应与船运公司协调,确保提单信息的准确性。

如果进口商同意接受不符点,可以提供不符点说明和相应的证明文件,以便银行接受不符点并支付货款。

如果进口商不同意接受不符点,公司可能需要承担货物退回或重新发运的风险和费用。

《国际结算》作业考核试题及答案一、选择题(每题2分,共20分)1. 国际结算的基本方式不包括以下哪一项?A. 汇票B. 托收C. 信用证D. 直接汇款答案:D2. 以下哪种结算方式属于商业信用?A. 汇票B. 托收C. 信用证D. 担保答案:B3. 国际结算中,信用证的主要当事人不包括以下哪一项?A. 开证行B. 通知行C. 申请人D. 被保险人答案:D4. 以下哪个国际组织负责制定国际结算规则?A. 国际货币基金组织(IMF)B. 国际商会(ICC)C. 世界银行(WB)D. 联合国国际贸易法委员会(UNCITRAL)答案:B5. 以下哪种货币在国际结算中地位最高?A. 美元B. 欧元C. 英镑D. 日元答案:A二、填空题(每题3分,共30分)1. 国际结算业务中,汇票分为______和______两种。

答案:即期汇票,远期汇票2. 国际结算中,信用证分为______、______和______三种。

答案:不可撤销信用证,可撤销信用证,保兑信用证3. 国际结算中,托收分为______和______两种。

答案:直接托收,间接托收4. 信用证中的开证行、通知行、申请人、受益人和议付行分别承担______、______、______、______和______的责任。

答案:开证责任,通知责任,申请责任,受益责任,议付责任5. 国际结算中,汇票的付款人可以是______、______和______。

答案:出票人,付款人,收款人三、简答题(每题10分,共30分)1. 简述国际结算的基本原则。

答案:国际结算的基本原则包括:(1)合同原则:国际结算应当遵循合同规定,按照双方约定的方式进行;(2)信用原则:国际结算应当遵循信用原则,保证结算过程中的资金安全;(3)效率原则:国际结算应当遵循效率原则,提高结算速度,降低交易成本;(4)合法性原则:国际结算应当遵循合法性原则,遵守有关法律法规。

2. 简述信用证的主要特点。

国际结算练习题库+答案一、单选题(共30题,每题1分,共30分)1、跟单信用证项下办理出口押汇的对象是( )。

A、通知行B、开证行C、信用证受益人D、开证申请人正确答案:C2、在( )下,担保人承担的付款责任是以合同条款的实际执行情况来判定是否对受益人的索赔给予支付。

A、透支保函B、从属性保函C、预付性保函D、十独立性保函正确答案:B3、在信用证业务中,受益人开立的汇票被开证申请人拒付则( )有追索权。

A、议付行B、通知行C、开证行D、保兑行正确答案:A4、信用证受益人审查信用证的重点是( )。

A、信用证的可信度B、信用证内容与合同内容是否一致C、开证行的资信D、开证行的政治背景正确答案:B5、信用证项下的海运提单上的 Notify Party,应是( )。

A、信用证的受益人B、开证银行C、开证申请人D、船公司正确答案:C6、在一项国际贸易中,进出口双方商定采用信用证和付款变单托收各半的付款方式。

受益人为了收汇安全,应在合同中规定( )。

A、开立两张汇票,备随附一套等价的货运单据B、开立两张汇票其中信用证项下用光系,托收项下用眼单汇票C、开立两张汇票,其中信用证项下用跟单汇票,托收项下用光系正确答案:A7、当前业务覆盖面最大的银行间电讯网络是( )。

A、CHIPSB、CHAPSC、SWIFT正确答案:C8、福费延业务中的包买商通常是( )。

A、信托公司B、政府设立的专门的出口信贷机构C、金融公司D、商业银行正确答案:D9、巴基斯坦国民银行开立一份循环信用证,内容包括:(1)开证日期1998年4月四日;(2)有效期:1999年4月30日;(3)金额: USD50 000;(4)特殊条款:非积累自动循环,自 1998年5月 1日起每月循环一次每月最多装运价值为 USD50 000的货物;(5)装运:每月一批;(6)货物:化学品;(7)保兑:请通知行加具保兑。

通知行的保兑金额应为( )。

A、USD500000B、USD100000C、USD400000D、USD600000正确答案:D10、在国际结算方式中,托收是商业信用,信用证是银行信用,( )。

国际结算考试题和答案一、单项选择题(每题2分,共20分)1. 国际结算中,信用证的开证行对受益人的付款责任是()。

A. 无条件的B. 有条件的C. 有选择的D. 有限制的答案:A2. 根据《跟单信用证统一惯例》(UCP600),信用证到期地点通常是()。

A. 开证行所在地B. 受益人所在地C. 议付行所在地D. 申请人所在地答案:A3. 在国际贸易中,托收结算方式下,代收行对出口商的付款责任是()。

A. 无条件的B. 有条件的C. 有选择的D. 有限制的答案:D4. 国际结算中,银行承兑汇票的承兑人是()。

A. 出口商B. 进口商C. 开证行D. 议付行5. 在国际贸易中,采用D/P即期结算方式,出口商的风险主要来自于()。

A. 运输途中货物损失B. 进口商拒付C. 汇率变动D. 政治风险答案:B6. 根据《国际贸易术语解释通则》(Incoterms),CIF术语下,卖方必须负责()。

A. 货物运输到目的港B. 货物运输到目的港并投保C. 货物运输到目的港并支付运费D. 货物运输到目的港并支付运费及保险费7. 国际结算中,银行保函通常用于()。

A. 贸易融资B. 信用证结算C. 保证合同履行D. 托收结算答案:C8. 在国际贸易中,采用D/A即期结算方式,出口商的风险主要来自于()。

A. 运输途中货物损失B. 进口商拒付C. 汇率变动D. 政治风险答案:B9. 国际结算中,SWIFT系统的主要功能是()。

A. 资金划拨A. 信息传递C. 贸易融资D. 信用证开立答案:B10. 根据《国际贸易术语解释通则》(Incoterms),FOB术语下,卖方必须负责()。

A. 货物运输到目的港B. 货物运输到目的港并投保C. 货物运输到目的港并支付运费D. 货物装上船答案:D二、多项选择题(每题3分,共15分)11. 国际结算中,以下哪些属于信用证结算的特点?()A. 银行信用B. 单据交易C. 无条件付款D. 贸易双方直接结算答案:A、B、C12. 在国际贸易中,以下哪些属于信用证结算的风险?()A. 信用证欺诈B. 单据不符C. 汇率变动D. 政治风险答案:A、B13. 国际结算中,以下哪些属于托收结算的特点?()A. 商业信用B. 单据交易C. 有条件付款D. 银行不承担付款责任答案:A、B、C、D14. 在国际贸易中,以下哪些属于D/P即期结算方式的特点?()A. 出口商风险较低B. 进口商风险较高C. 出口商风险较高D. 进口商风险较低答案:C、D15. 国际结算中,以下哪些属于银行保函的类型?()A. 投标保函B. 履约保函C. 预付款保函D. 信用证保函答案:A、B、C三、判断题(每题2分,共20分)16. 信用证结算方式下,出口商必须严格按照信用证条款提交单据,否则银行有权拒付。

国际结算试题及答案解析一、单项选择题1. 国际结算中,信用证是一种()。

A. 银行信用B. 商业信用C. 个人信用D. 政府信用答案:A解析:信用证是一种银行信用,由银行出具,保证在符合信用证条款的情况下支付款项。

2. 托收结算方式中,出口商将汇票连同货运单据交给()。

A. 开证行B. 托收行C. 议付行D. 代收行解析:在托收结算方式中,出口商将汇票连同货运单据交给托收行,由托收行代为向进口商收取款项。

3. 根据《跟单信用证统一惯例》(UCP600),信用证到期地点通常为()。

A. 开证行所在地B. 受益人所在地C. 议付行所在地D. 申请人所在地答案:A解析:根据UCP600的规定,信用证到期地点通常为开证行所在地。

4. 国际结算中,汇票的出票人是()。

A. 付款人B. 收款人C. 承兑人答案:A解析:汇票的出票人是付款人,即承诺在汇票到期时支付款项的人。

5. 国际结算中,银行保函是一种()。

A. 银行信用B. 商业信用C. 个人信用D. 政府信用答案:A解析:银行保函是一种银行信用,由银行出具,保证在符合保函条款的情况下支付款项。

二、多项选择题6. 国际结算中,以下哪些属于支付方式?()A. 汇款B. 托收C. 信用证D. 银行保函答案:ABCD解析:汇款、托收、信用证和银行保函都是国际结算中常见的支付方式。

7. 信用证结算方式中,以下哪些是开证行的责任?()A. 审核单据B. 支付款项C. 审核信用证条款D. 审核货物质量答案:ABC解析:开证行在信用证结算方式中负责审核单据、支付款项和审核信用证条款,但不负责审核货物质量。

8. 托收结算方式中,以下哪些是托收行的责任?()A. 审核单据B. 代为收款C. 审核信用证条款D. 审核货物质量答案:AB解析:托收行在托收结算方式中负责审核单据和代为收款,但不负责审核信用证条款和货物质量。

9. 国际结算中,以下哪些属于汇票的当事人?()A. 出票人B. 付款人C. 收款人D. 持票人答案:ABCD解析:汇票的当事人包括出票人、付款人、收款人和持票人。

Chapter One1. Fill in the blanks to complete each sentence.(1) local legal system, political, exchange risks(2) open account, advance payment, remittance and collection(3) letter of credit, bank guarantee(4) price terms, delivery terms(5) least/minimum, most/maximum(6) advance payment(7) open account(8) clean collection, documentary collection2. 略3. Translate the following terms into English.(1) settlement on bank credit(2) the potential for currency fluctuation(3) to clear the goods for export(4) to pay the insurance premium(5) to carry out export formalities(6) the major participants in international trade(7) the commodity inspection clause(8) to fulfill the obligation to deliver the goods(9)t he goods have passed over the ship’s rail(10)I nternational contract is concluded in a completely different context thandomestic ones4.Decide whether the following statements are true or false.(1) F (2) F (3) T (4) T (5) T(6) T (7) F (8) T (9) T (10) F5. Choose the best answer to each of the following statements(1)-(5) BCCBD (6)-(10) DACCC(11)-(15) BDDCD (16)-(20) DCACDChapter Two1. Fill in the blanks to complete each sentence.(1) barter(2) medium of exchange(3) expensive, risky(4) our(5) V ostro(6) vostro(7) nostro(8) specimen of authorized signatures, telegraphic test keys, terms and conditions, Swift authentic keys2. Define the following terms(1) Correspondent relationship 〖A bank having direct connection or friendly service relationswith another bank.〗(2) International settlements〖International settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them. 〗(3) Visible trade〖The exchange of goods and commodities between the buyer and the seller across borders.〗(4) Financial transaction〖International financial transaction covers foreign exchange market transactions, government supported export credits, syndicated loans, international bond issues, etc.〗(5). V ostro account〖Vostro account is an account held by a bank on behalf of a correspondent bank.〗3. Translate the following terms into English.(1) commercial credit(2) control documents(3) account relationship(4) cash settlement(5) financial intermediary(6) credit advice(7) agency arrangement(8) credit balance(9)reimbursement method(10) test key/code4.Decide whether the following statements are true or false.(1) T (2) F (3) F (4) T (5) F5. Choose the best answer to each of the following statements(1)-(5) BCDAD (6)-(10) BBDABChapter Three1. Define the following Terms:(1) Negotiable instrument〖“A negotiable instrument is a chose in action, the full and legal title to which is transferable by delivery of the instrument (p ossibly with the transferor’s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the transferee, providing the latter takes the instrument in good faith and for value.” 〗(2) Bill of exchange〖A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum certain in money, to or to the order of a specified person, or to bearer. 〗(3) Check〖A check is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer. 〗(4) Documentary bill〖It is a bill with shipping documents attached thereto. 〗(5) Crossing〖A crossing is in effect an instruction to the paying bank from the drawer or holder topay the fund to a bank only. 〗2. Translate the following terms into English.(1) 一般划线支票〖generally crossed check〗(2) 特殊划线支票〖specially crossed check〗(3) 过期支票〖a check that is out of date〗(4) 未到期支票〖post dated check〗(5) 大小写金额〖amount in words〗(6) 白背书〖blank endorsement〗(7) 特别背书〖special endorsement〗(8) 限制性背书〖restrictive endorsement〗(9) 跟单汇票〖documentary bill〗(10) 即期汇票〖sight draft〗(11) 远期汇票〖usance/term bill〗(12) 承兑汇票〖acceptance bill〗(13) 可确定的未来某一天〖determinable future date〗(14) 光票〖clean bill〗(15) 流通票据〖negotiable instrument〗(16) 贴现行〖discounting house 〗(17) 商人银行〖merchant bank〗(18) 无条件的付款承诺〖unconditional promise of payment〗(19) 负连带责任〖jointly and severally responsible〗(20) 出票后90天付款〖payable 90 days after date〗3. Decide whether the following statements are true or false.(1) T (2) F (3) T (4) T (5) T(6) F (7) T (8) T (9) T (10) T(11) F (12) T (13) T (14) F (15) T(16) T (17) T (18) F (19) F (20) F4. Choose the best answer to each of the following statements(1)-(5) CACBC (6)-(10) BACBB(11)-(15) BDCCC (16)-(20) BBAAC5-7 略Chapter Four1. Fill in the blanks to complete each sentence.(1) beneficiary(2) payment order / mail advice / debit advice(3) the remittance amount is large / the transfer of funds is subject to a time limit / test key(4) sell it to his own bank for crediting his account(5) debits / credits(6) demand draft(7) act of dishonor(8) swiftness / reliability / safety / inexpensiveness(9) debiting remitting bank’s nostro account(10) delivery of the goods2. Define the following Terms.(1)International remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad by one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the r emitting bank’s overseas branch or its correspondent with a nostro account.(2) Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or its branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.(3) A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.(4) Demand draft transfer is a remittance method using a bank demand draft. It is a negotiable instrument drawn by one bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.(5) Cancellation of the reimbursement under mail transfer or telegraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.3. Translate the following terms into English.(1) 汇款通知单remittance advice (2) 汇出汇款outward remittance (3) 国际汇款单international money order (4) 往来账户current account(5) 自动支付系统automated payment system (6) 作为偿付in cover(7) 赔偿保证书letter of indemnity (8) 信汇通知书 mail advice(9) 汇票的不可流通副本non-negotiable copy of draft (10) 首期付款down payment4. Choose the best answer to each of the following statements(1)-(5) BCABD (6)-(10) BBBAAChapter Five1. Fill in the blanks to complete each sentence.(1) presenting bank(2) title documents / pays the draft / accepts the obligation to do so(3) legal / the exchange control authorities(4) the payment is made(5) open account / advance payment(6) Inward collection(7). the remitting bank(8) trust receipt(9) D/P at sight(10) documents, draft, and collection order2. Define the following terms(1) Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent banks located in the domicile of the buyer.(2) The case of need is the representative appointed by the principal to act as case of need in theevent of non-acceptance and/or non-payment, whose power should be clearly and fully stated in the collection.(3) Documentary collection is a collection of financial instruments being accompanied by commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. Alternatively, the documentary collection is a payment mechanism that allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.(4) Outward collection is a banking business in which a bank acting as the remitting bank sends the draft drawn against an export with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer. (5) Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee. 3. Translate the following terms into English.(1) 承兑交单acceptance against documents (2) 商业承兑汇票 trade acceptance(3) 需要时的代理人case of need (4) 出口押汇export bill purchased(5) 物权单据 title document (6) 以寄售方式on consignment(7) 直接托收direct collection (8) 货运单据shipping documents(9) 付款交单documents against payment (10) 远期汇票time/ tenor/term/ usance draft 4. Choose the best answer to each of the following statements(1)-(5) ABCAB (6)-(10) ACAADChapter Six1. Define the following terms:(1) Letter of credit 〖The Documentary Credit or letter of credit is an undertaking issued by a bank for the account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with. 〗(2) Confirmed letter of credit 〖A credit that carries the commitment to pay by both the issuing bank and the advising bank. 〗(3) Revolving credit 〖A credit by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required. 〗(4) Confirming bank 〖A bank, usually the advising bank, which adds its undertaking to those of the issuing bank and assumes liability under the credit.〗(5) Applicant of the credit〖The applicant is always an importer or a buyer, who fills out and signs an application form, requesting the bank to issue a credit in favor of an exporter or a seller abroad.〗2. Translate the following terms or sentences into English.(1) 未授权保兑〖silent confirmation 〗(2) 有效地点为开证行所在地的柜台〖to expire at the counters of the issuing bank 〗(3) 凭代表物权的单据付款〖to pay against documents representing the goods〗(4) 信用证以银行信用代替了商业信用。