公司金融英文版

- 格式:ppt

- 大小:602.00 KB

- 文档页数:18

常见的金融词汇中英对照1. 金融市场 (Financial Markets)金融市场是指用于实现资金交易和资金融通的场所,包括股票市场、债券市场、外汇市场和商品市场等。

•股票市场 (Stock Market): the market for buying and selling shares of publicly traded companies.•债券市场 (Bond Market): the market for buying and selling bonds.•外汇市场 (Foreign Exchange Market): the market for trading foreign currencies.•商品市场 (Commodity Market): the market for trading commodities such as oil, gold, and agricultural products.2. 资本市场 (Capital Market)资本市场是指长期融资和投资的市场,包括股票市场和债券市场等。

•股票市场 (Stock Market): the market for buying and selling shares of publicly traded companies.•债券市场 (Bond Market): the market for buying and selling bonds.3. 证券 (Securities)证券是指可以转让和交易的金融工具,包括股票、债券、证券投资基金等。

•股票 (Stocks): shares of ownership in a company that can be bought and sold on a stock market.•债券 (Bonds): debt securities issued by governments, corporations, or other organizations to raise capital.•证券投资基金 (Mutual Funds): investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, orother securities.4. 风险管理 (Risk Management)风险管理是指识别、评估和处理金融交易和投资中的各种风险,以减少损失和提高效益。

1.贷方Credit:A credit item (+) is a flow for which the country is paid.e.g. …is what we give up in the transaction…it creates a monetary claims on a foreigner…someone in this country is entitled to receive payment from a foreigner.2.借方Debit:A debit item (-) is a flow for which the country must pay.e.g. …is what we receive in the transaction…it creates a monetary claims owed to a foreigner.…someone in this country is obligated to make a payment to a foreigner.3.国际收支Balance of payments :The systematic set of accounts that records all economictransactions between residents of a country and the rest of the world during a given period of time.4.官方国际储备资产Official international reserve assetsAre money-like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them. (课件The changes in domestic official reserve assets and in domestic official liquid liabilities to foreign officials. It is derived by dividing private transactions from official “accommodative” t ransactions in the balance of payments accounts.)5.官方结算差额Official settlements balanceAlso called the “official balance,” this is the sum of the current account balance plus the private financial account balance. An imbalance in the official balance must be paid for through official reserves transactions.6.资本外逃Capital flight: The secret sending of wealth to foreign countries, away from thesupervision of one’s home government.7.国际投资头寸International investment positionThe international investment position is a statement of the stocks of a country's foreign assets and foreign liabilities at a point in time. These stocks are changed each year by the flows of private and official assets measured in the balance of payments. As a result of large current account deficits since the early 1980s, the United States switched from being the world's largest net creditor to being its largest net debtor.8.经常项目/账户Current accountRecords the values of goods and services sold and purchased abroad, plus net interest and other factor payments and net unilateral transfers and gifts. A current account surplus shows that a country has positive net foreign investment.9.国际汇兑/外汇Foreign exchange:Foreign exchange is the act of trading differentcountries’ moneys. 汇兑Foreign exchange also refers to holdings of foreign currencies. 外汇10.汇率Exchange rateThe price of one country’s currency expressed in terms of another coun try’s currency. (Note that, in this text, the exchange rate is expressed in terms of domestic currency units required to purchase one unit ofa foreign currency.)11.即期汇率Spot exchange rate:The rate applicable to foreign exchange transactionsrequiring contemporaneous delivery and payment.12.远期汇率Forward exchange rate : The exchange rate applicable to foreign exchangetransactions agreed upon today for later delivery (usually in 30, 90, or 180 days).13.三角套汇Triangular arbitrageThe process that ensures consistency among the sets of bilateral “cross rates” of the world’s traded currencies. For example, if the British pound trades for US$2, and 100 Japanese yen trade for US$1, the exchange rate between the yen and the pound must be 200 yen per pound. Otherwise, there is an opportunity for an arbitrageur to buy a currency cheaply in one market and sell it for a higher price in another market.14.套汇ArbitrageThe process of buying and selling to make a nearly riskless pure profit ensures that rates in different locations are essentially the same, and that rates and cross-rates are related and consistent among themselves.15.外汇风险Exchange rate risk:W hen the value of an economic agent’s income, wealth, ornet worth changes as exchange rates change unpredictably in the future.16.套期保值Hedging: T he act of exactly matching assets and liabilities, such as foreigncurrencies, so as to avoid exchange rate risk. is the act of balancing your assets and liabilities in a foreign currency to become immune to risk resulting from future changes in the value of foreign currency.17.投机Speculating:Deliberately assuming a net asset (long) position or net liability (short)position in an asset, such as a foreign currency, in the hope of profiting from price changes. Speculating means taking a long or a short position in a foreign currency, thereby gambling on its future exchange value. There are a number of ways to hedge or speculate in foreign currency. Speculating means committing oneself to an uncertain future value of one’s net worth in terms of home currency.18.远期外汇合同Forward foreign exchange contractis an agreement to exchange one currency for another on some date in the future at a price set now ( the forward exchange rate) is an agreement to buy or sell a foreign currency for future delivery at a price ( the forward exchange rate) set now19.远期汇率Forward exchange rateare the price that are agreed today for exchanges of moneys that will take place at a specified time in the future, such as 30, 90 or 180days from now.20.多头头寸Long positionsholding net assets in foreign currency。

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

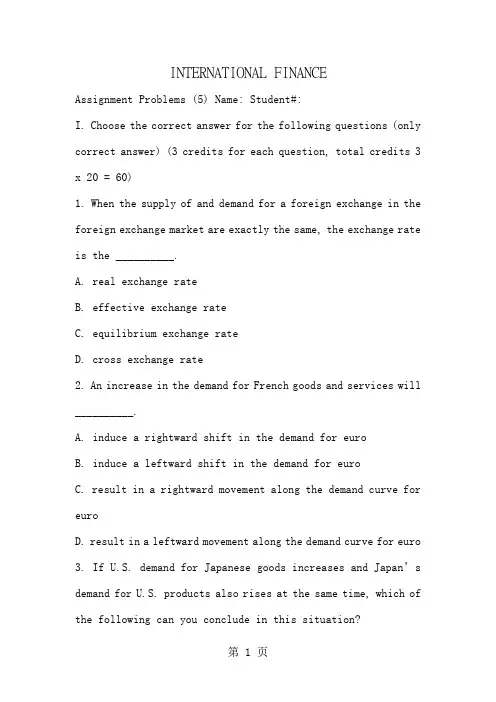

INTERNATIONAL FINANCEAssignment Problems (5) Name: Student#:I. Choose the correct answer for the following questions (only correct answer) (3 credits for each question, total credits 3 x 20 = 60)1. When the supply of and demand for a foreign exchange in the foreign exchange market are exactly the same, the exchange rate is the __________.A. real exchange rateB. effective exchange rateC. equilibrium exchange rateD. cross exchange rate2. An increase in the demand for French goods and services will __________.A. induce a rightward shift in the demand for euroB. induce a leftward shift in the demand for euroC. result in a rightward movement along the demand curve for euroD. result in a leftward movement along the demand curve for euro3. If U.S. dem and for Japanese goods increases and Japan’s demand for U.S. products also rises at the same time, which of the following can you conclude in this situation?A. The U.S. dollar will appreciate against the yen.B. The U.S. dollar will depreciate against the yen.C. The U.S. dollar will not change relative to the yen.D. The U.S. dollar may appreciate, depreciate, or remain unchanged against theyen.4. If the price of a pair of Nike sneakers costs $85 in U.S, and the price of the same sneakers is €80 in Pari s, the spot rate is $1.35 per euro, the euro __________.A. is correctly valued according to PPPB. is correctly valued according to relative PPPC. is undervalued according to PPPD. is overvalued according to PPP5. If the expected exchange rate E (SB/A) according to the relative purchasing power parity is lower than the spot exchange rate (SB/A), we may conclude that __________.A. country B is expected to run huge BOP surplus with country AB. country A’s interest rate is going to be lower than that of country B’sC. the expected inflation rate in country A is higher than the expected inflation rate in country BD. the expected inflation rate in country A is lower than the expected inflation rate in country B6. Assume that PPP holds in the long run. If the price of a tradable good is $20 in the U.S. and 100 pesos in Mexico; and the exchange rate is 7 pesos/$ right now, which of the following changes might we expect in the future?A. an increase in the price of the good in the U.SB. a decrease in the price of the good in MexicoC. an appreciation of the peso in nominal termsD. a depreciation of the peso in nominal terms7. Which basket of goods would be most likely to exhibit absolute purchasing power parity?A. Highly tradable commodities, such as wheatB. The goods in the Consumer Price indexC. Specialized luxury goods, which are subject to different tax rates across countriesD. Locally produced goods, such as transportation services, which are not easily traded8. The absolute purchasing power parity says that the exchange rate between the two currencies should be determined by the __________ .A. relative inflation rate of the two currenciesB. relative price level of the two countriesC. relative interest rate of the two currenciesD. relative money supply of the two countries9. According to the relative PPP, if country A’s inflation rate is higher than country B’s inflation rate by 3%, __________.A. country A’s currency should depreciate against country B’s currency by 3%B. country A’s currency should appreciate against country B’s currency by 3%C. it is hard to say whether country A’s currency should appreciate or depreciate against country B’s currency. The exchange rate is influenced by many factorsD. none of the above is true10. If the law of one price holds for a particular good, we may conclude that __________.A. there is no trade barriers for the good among the different nationsB. the price of the good is the same ignoring the other expensesC. arbitrage for the good does not existD. all of the above are true11. An investor borrows money in one market, sells the borrowed money on the spot market, invests the proceeds of the sale inanother place and simultaneously buys back the borrowed currency on the forward market. This is called __________.A. uncovered interest arbitrageB. covered interest arbitrageC. triangular arbitrageD. spatial arbitrage12. Real return equalization across countries on similar financial instruments is called __________.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity13. In which of the following situations would a speculator wish to sell foreign currency on the forward market?14. According to IRP, if the interest rate in country A is higher than that in country B, the forward exchange rate, defined as F1A/B is expected to be __________.A. lower than the spot rate S0A/BB. the same as the spot rate S0A/BC. higher than the spot rate S0A/BD. necessary the same as the future spot rate S1A/B15. For arbitrage opportunities to be practicable, __________.A. arbitragers must have instant access to quotesB. arbitragers must have instant access to executionsC. arbitragers must be able to execute the transactions without an initial sum of money relying on their bank’s credit standingD. All of the above must be true.16. The __________ states that the forward exchange rate quoted at time 0 for delivery at time t is equal to what the spot rate is expected to be at time t.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity17. Assume expected value of the U.S. dollar in the future is lower than that now compared to the value of the Japanese yen. The U.S. inflation rate must be higher than Japan’s inflation rate according to __________.A. relative PPPB. Fisher equationC. International Fisher relationD. IRP18. According to covered interest arbitrage if an investor purchases a five-year U.S. bond that has an annual interest rateof 5% rather than a comparable British bond that has an annual interest rate of 6%, then the investor must be expecting the __________ to __________ at a rate at least of 1% per year over the next 5 years.A. British pound; appreciateB. British pound; revalueC. U.S. dollar; appreciateD. U.S. dollar; depreciate19. Covered interest arbitrage moves the market __________ equilibrium because __________.A. toward; investors are now more willing to invest in risky securitiesB. toward; purchasing a currency on the spot market and selling in the forward market narrows the differential between the twoC. away from; purchasing a currency on the spot market and selling in the forward market increases the differential between the twoD. away from; demand for the stronger currency forces up the interest rates on the weaker security20. If the forward exchange rate is an unbiased predictor of the expected future spot rate, which of the following is NOT true?A. The future spot rate will actually be equal to what the forward rate predictsB. The forward premium or discount reflects the expected change in the spot exchange rate.C. Speculative activity ensures that the forward rate does not diverge too far from the market’s consensus expectation.D. All of the above are true.II. Problems (40 credits)1. The Argentine peso was fixed through a currency board at Ps1.00/$ throughout the 1990s. In January 2019 the Argentine peso was floated. On January 29, 2019, it was trading at Ps3.20/$. During that one year period Argentina’s inflation rate was 20% on an annualized basis. Inflation in the United States during that same period was2.2% annualized. (10 credits)a. What should have been the exchange rate in January 2019 if purchasing power parity held?b. By what percentage was the Argentine peso undervalued on an annualized basis?2. Assume that the interest rate paid by an American borrower on a ten-year foreign bond is 10% if the bond is sold in Denmark and 7% if the bond is sold in the Netherland. Will the expectedinflation rate in the Netherlands likely be higher than the expected inflation rate in Denmark? Will the Danish kroner be expected to increase in value against the Dutch guilder? Explain your answer. (5 credits)3. Suppose S = $1.25/₤and the 1-year forward rate is F = $1.20/₤. The real interest rate on a riskless government security is 2 percent in both England and the United States. The U.S. inflation rate is 5 percent. (5 credits)a. What is England’s nominal required rate of return on riskless government securities?b. What is England’s inflation rate if the equilibrium relationships hold?4. Akira Numata, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,000,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: (12 credits)5. On a particular day, the spot rate between Czech koruna (CKR) and the U.S. dollar is CKR30.35/$, while the interest rate ona one-year financial instrument in Czech is7.5% and 3.5% in U.S. (8 credits)a. What is your expected spot exchange rate a year later?b. You’re concerned your investment in the Czech Republic because of the economic uncertainty in that country. When you expect the future value of the koruna, you require a risk premium of 2%. What is the expected future spot rate supposed to be?Answers to Assignment Problems (5)Part II1. a. inflation differential (20% -2.2%) = 17.8%U.S. should have appreciated by 17.8%Implied exchange rate 1(1 + 17.8%) = Ps1.178/$b. (1.178 – 3.2 ) / 3.2 = -63.19%2. a. According to international Fisher equation: (1 + id) / (1 + if) = (1 + E[πd]) / (1 + E[πf])id: interest rate in Denmarkif: interest rate in Netherlandπd: Danish inflation rateπf Dutch inflation rateSince (1 + id) / (1 + if) = (1 +10%)/(1 + 7%) > 0So, (1 + E[πd]) / (1 + E[πf]) >0, which means the expected inflation rate in Denmark would be greater than that in Netherland.b. If Danish inflation is higher than Dutch inflation, Danish kroner will be expected to decrease in value against the Dutch guilder. (relative PPP theory)第 11 页。

![公司金融(基础篇)(英文版 原书第12版 BMA_32_Final[5页]](https://uimg.taocdn.com/1528e510ef06eff9aef8941ea76e58fafbb04544.webp)

CHAPTER 32Corporate RestructuringThe values shown in the solutions may be rounded for display purposes. However, the answers were derived using a spreadsheet without any intermediate rounding.Answers to Problem Sets1. a. LBO – Purchase of a business using mostly debt financing. Thecompany goes private so that its stock no longer trades in the openmarket.b. MBO – An LBO that is undertaken by existing management.c. Spin-off – A parent company creates a new company with part of itsassets and operations. Shares in the new business are distributed to theparent’s stockholders.d. Carve-out – Like a spin-off, but shares in the new business are sold in apublic offering.e. Asset sale – A sale of specific assets rather than the entire firm.f. Privatization – The purchase of a government-owned business by privateinvestors.g. Leveraged restructuring – A company increases its debt, pays the debtproceeds to stockholders, and thereby increases its debt–equity ratio. Est. Time: 06 - 102. a. Trueb. False; The most successful LBOs and MBOs go public again as soon asdebt has been paid down sufficiently and improvements in operatingperformance have been demonstrated.c. Trued. False; Carried interest is earned by general partners on profits made byan organization. It is a call option that gives the general partners apotentially significant upside and provides incentives to take risks.e. Truef. False; Investors often see the announcement of a spin-off as good news.Often, spin-offs allow a company to focus on its core business therebyincreasing the value of the company.g. False; Privatized companies generally operate more efficiently and thusreduce employment, but they also grow faster, which thereby increasesemployment. In many cases the net effect of these factors is an increasein employment.h. TrueEst. Time: 01 - 053. Increased efficiency, broader share ownership, and revenue for the government Est. Time: 01 - 054. In the 1960s and 1970s, when public conglomerations were at their height, thefollowing advantages were claimed: First, diversification across industries wassupposed to stabilize earnings and reduce risk. Second, a widely diversified firm can operate as its own internal capital market, thereby reducing the need forfinancing from outside investors. Third, the company’s managers arguably know more about investment opportunities than outside investors. In addition,transaction costs of issuing new securities are avoided.Est. Time: 01 - 055. Internal capital markets often misallocate capital. The market values of theconglomerate’s divisions can’t be observed separately, so it’s hard to setincentives and to reward risk taking. Internal politics may also interfere withcapital efficiency. In addition, investors can often diversify more easily on theirown.Est. Time: 01 - 056. The limited life of a private-equity partnership reassures the limited partners thatthe cash flow will not be reinvested in a wasteful manner. It also tends to ensure that partnerships focus on opportunities to reorganize poorly performingbusinesses and to provide them with new management before selling them off. In addition, the carried interest owned by private equity partnerships providesincentives for taking risk.Est. Time: 01 - 057. Chapter 7 usually leads to liquidation. Chapter 11 protects the firm from itscreditors while a reorganization plan is developed.Est. Time: 01 - 058. a. False. It is in shareholders’ interests to attempt to rehabilitate the firm. Theyhave nothing to lose if rehabilitation efforts fail (in which case the firm wouldfile for bankruptcy anyways), but everything to gain if rehabilitation effortssucceed.b. Truec. Trued. False (tax-loss carry-forwards do not survive liquidation)Est. Time: 01 - 059. There is always a chance that the company can recover, allowing creditors to bepaid off and leaving something for shareholders. Also, the court may not observeabsolute priority, so shareholders may be given some crumbs in a Chapter 11reorganization.Est. Time: 01 - 0510. a. True. Carve-out or spin-off of a division improves incentives for thedivision’s managers. If the businesses are independent, it is easier tomeasure the performance of the division’s managers.b. False. The limited life of a private-equity partnership reassures the limitedpartners that the cash flow will not be reinvested in a wasteful manner. Italso tends to ensure that partnerships focus on opportunities to reorganizepoorly performing businesses and to provide them with new managementbefore selling them off.c. True. The remuneration package for the general partners typicallyincludes a 20% carried interest. This is equivalent to a call option on thepartnership’s value and, as is the case for all options, this option is morevaluable when the value of the assets is highly variable.Est. Time: 01 - 0511. In general, firms with narrow margins in highly competitive environments are notgood candidates for an LBO or an MBO. These firms are often highly efficientand do not have excess assets or unnecessary capital expenditures. Further,the thinness of the margins limits the amount of debt capacity.Est. Time: 01 - 0512. RJR issued a lot of debt and repurchased shares to reduce the equity base.Sealed Air issued a lot of debt and paid a special dividend to all shareholders to reduce the equity base. RJR was seen as a company that needed to streamline operations and reexamine its capital expenditures and asset holdings. The firmwas in a highly competitive environment, but had the advantage of brand namerecognition for its products. Sealed Air needed to streamline its operationsbecause it had grown inefficient due to the patent protection it had for itsproducts. Sealed Air remained public in order to increase the pressure to perform by continuing to be exposed to buying and selling pressure in the market.Est. Time: 06 - 1013. Answers will vary depending upon the examples chosen.Est. Time: 11 - 1514. The story told in Barbarians at the Gate is a very complicated one. Those whofavor mergers can find much evidence in this story to support their position, ascan those who oppose mergers. In a similar fashion, those who espouse oneparticular theory or another as to why companies merge can find evidence here to support their position (and evidence to refute the positions of others). Thus,the answer will vary, depending on one’s views.Est. Time: Not applicable; requires further reading.15. Private-equity partnerships are usually run by professional equity managersrepresenting larger institutional investors. The institutional investors act as thelimited partners while the professional managers act as general partners in thelimited partnership. The general partners are companies that focus on fundingand managing equity investments in closely held firms. The incentive for general partners is a management fee plus a share in the company profits, called“carried interest,”that they can increase if they successfully “fix” the firm. Thelimited partners get paid first, but are not entitled to all the profits. Further, thelimited life of the partnership precludes wasteful reinvestment. Thesepartnerships are designed to make investments in various types of firms fromventure capital start-ups to mature firms that need to reinvigorate management. Est. Time: 06 - 1016. In a private-equity partnership, the carried interest represents the generalpartners’ call option. The exercise price of this call option is the dollar amount of the limited partners’ investment in the partnership. In order for the generalpartners’ call option to be in the money, the general partners must earn backmore than the limited partners’ investment. Therefore, the general partnersclearly have an incentive to earn a profit on the limited partners’ investment.On the other hand, the general partners also have an incentive to take on risk;increased volatility increases the value of the call option, so the generalpartners might choose a risky investment over a less risky investment with agreater expected NPV.Est. Time: 06 - 1017. Although agency costs can be significant for public companies, anyone who hasdealt with a governmental institution (or, for that matter, a nonprofit organization) has undoubtedly experienced the far greater problem of agency costs inorganizations outside the private sector. Privatization can substantially reducethese costs, resulting in much greater efficiency. Competition in the private sectorimposes a greater discipline within the enterprise, while also eliminating theimpact of political influence. Management and other employees are often offered stronger incentives in a private enterprise than would be possible in agovernmental organization.Est. Time: 06 - 1018. Many of the problems with Chapter 11 bankruptcy could be mitigated bynegotiating a prepackaged bankruptcy. Many problems arise from the fact thatthe two goals of Chapter 11 bankruptcy are often in conflict with each other:(1) to satisfy creditors and (2) to allow the firm to resolve its problems andcontinue to function as an ongoing business. Furthermore, there are conflictswithin the different classes of securities holders. Senior creditors tend to favor a liquidation of the company so that their claims will be satisfied immediately, while junior creditors favor a reorganization of the business in the hope that they willreceive some portion of their claims. There is also a conflict between securedcreditors, who receive interest while the company is in Chapter 11 bankruptcy,and unsecured creditors who do not receive interest. These numerous conflicts increase the likelihood that extensive litigation will drain resources from thecompany while these issues are resolved. A prepackaged bankruptcy resolvesthese issues with a negotiated settlement.Est. Time: 06 - 10。

金融数据概要模型解析英文版The pony was revised in January 2021William H. Inmon - Data ModelsBanking and FinancePlease drill down to each mid-level section of Banking/Finance for more detail. ?Mid-Level Data Model - Banking/FinanceEconomic Indicatoreconomic indicator经济指标?Mid-Level Data Model - Banking/FinancePackage??Mid-Level Data Model - Banking/FinanceProduct (1 of 7)??Mid-Level Data Model - Banking/FinanceProduct (2 of 7)??Mid-Level Data Model - Banking/FinanceProduct (3 of 7)??Mid-Level Data Model - Banking/FinanceProduct (4 of 7)??Mid-Level Data Model - Banking/FinanceProduct (5 of 7)??Mid-Level Data Model - Banking/FinanceProduct (6 of 7)??Mid-Level Data Model - Banking/FinanceProduct (7 of 7)??Mid-Level Data Model - Banking/FinanceCustomer (1 of 2)??Mid-Level Data Model - Banking/FinanceCustomer (2 of 2)?Mid-Level Data Model - Banking/FinanceTransaction (1 of 4)?Mid-Level Data Model - Banking/FinanceTransaction (2 of 4)?Mid-Level Data Model - Banking/FinanceTransaction (3 of 4)?Mid-Level Data Model - Banking/FinanceTransaction (4 of 4)?Mid-Level Data Model - Banking/FinanceAccount (1 of 7)?Mid-Level Data Model - Banking/FinanceAccount (2 of 7)??Mid-Level Data Model - Banking/FinanceAccount (3 of 7)?Mid-Level Data Model - Banking/FinanceAccount (4 of 7)??Mid-Level Data Model - Banking/FinanceAccount (5 of 7)??Mid-Level Data Model - Banking/FinanceAccount (6 of 7)??Mid-Level Data Model - Banking/FinanceAccount (7 of 7)??Mid-Level Data Model - Banking/FinanceProperty?Mid-Level Data Model - Banking/FinanceManaging Officer??Mid-Level Data Model - Banking/FinanceEmployee??Mid-Level Data Model - Banking/FinanceCountry???Mid-Level Data Model - Banking/FinanceRegulatory Agency??Mid-Level Data Model - Banking/FinanceMarketing Program??Mid-Level Data Model - Banking/FinanceFinancial Institution (1 of 7)?Mid-Level Data Model - Banking/FinanceFinancial Institution (2 of 7)?Mid-Level Data Model - Banking/FinanceFinancial Institution (3 of 7)?Mid-Level Data Model - Banking/FinanceFinancial Institution (4 of 7)??Mid-Level Data Model - Banking/FinanceFinancial Institution (5 of 7)?Mid-Level Data Model - Banking/FinanceFinancial Institution (6 of 7)?Mid-Level Data Model - Banking/FinanceFinancial Institution (7 of 7)?。

CHAPTER 1Introduction to Corporate FinanceThe values shown in the solutions may be rounded for display purposes. However, the answers were derived using a spreadsheet without any intermediate rounding.Answers to Problem Sets1. a. realb. executive airplanesc. brand namesd. financiale. bonds*f. investment or capital budgeting*g. capital budgeting or investmenth. financing*Note that f and g are interchangeable in the question.Est time: 01-052. A trademark, a factory, undeveloped land, and your work force (c, d, e, and g) are all real assets.Real assets are identifiable as items with intrinsic value. The others in the list are financial assets, that is, these assets derive value because of a contractual claim.Est time: 01-053. a. Financial assets, such as stocks or bank loans, are claims held by investors.Corporations sell financial assets to raise the cash to invest in real assets such as plantand equipment. Some real assets are intangible.b. Capital budgeting means investment in real assets. Financing means raising the cash forthis investment.b. The shares of public corporations are traded on stock exchanges and can be purchasedby a wide range of investors. The shares of closely held corporations are not publiclytraded and are held by a small group of private investors.d. Unlimited liability: I nvestors are responsible for all the firm’s debts. A sole proprietor hasunlimited liability. Investors in corporations have limited liability. They can lose theirinvestment, but no more.Est time: 01-054. Items c and d apply to corporations. Because corporations have perpetual life, ownership can betransferred without affecting operations, and managers can be fired with no effect on ownership.Other forms of business may have unlimited liability and limited life.Est time: 01-055. Separation of ownership and management typically leads to agency problems,where managers prefer to consume private perks or make other decisions for their privatebenefit—rather than maximize shareholder wealth.Est time: 01-056. a. Assuming that the encabulator market is risky, an 8% expected return onthe F&H encabulator investments may be inferior to a 4% return on U.S.government securities.b. Unless their financial assets are as safe as U.S. government securities, their cost ofcapital would be higher. The CFO could consider what the expected return is on assetswith similar risk.Est time: 01-057. Shareholders will only vote to maximize shareholder wealth. Shareholders can modify theirpattern of consumption through borrowing and lending, match risk preferences, and hopefullybalance their own checkbooks (or hire a qualified professional to help them with these tasks).Est time: 01-058. If the investment increases the firm’s wealth, it will increase the value of the firm’s shares. Ms.Espinoza could then sell some or all of these more valuable shares in order to provide for herretirement income.Est time: 06-109. As the Goldman Sachs example illustrates, the firm’s value typically falls by significantly morethan the amount of any fines and settlements. The firm’s reputation suffers in a financial scandal, and this can have a much larger effect than the fines levied. Investors may also wonder whether all of the misdeeds have been contained.Est time: 01-0510. Managers would act in shareholders’ interests because they have a legal duty to act in theirinterests. Managers may also receive compensation, either bonuses or stock and option payouts whose value is tied (roughly) to firm performance. Managers may fear personal reputationaldamage that would result from not acting in shareholders’ interests. And m anagers can be fired by the board of directors, which in turn is elected by shareholders. If managers still fail to act in shareholders’ interests, sharehold ers may sell their shares, lowering the stock price andpotentially creating the possibility of a takeover, which can again lead to changes in the board of directors and senior management.Est time: 01-0511. Managers that are insulated from takeovers may be more prone to agency problems andtherefore more likely to act in their own interests rather than in shareholders’. If a firm instituted anew takeover defense, we might expect to see the value of its shares decline as agencyproblems increase and less shareholder value maximization occurs. The counterargument is that defensive measures allow managers to negotiate for a higher purchase price in the face of atakeover bid —to the benefit of shareholder value.12. Answers will vary. The principles of good corporate governance discussed in the chapter shouldapply.Est time: 06-10Appendix Questions :1. Both would still invest in their friend’s business. A invests and receives $121,000 for hisinvestment at the end of the year —which is greater than the $120,000 that would be received from lending at 20% ($100,000 × 1.20 = $120,000). G also invests, but borrows against the$121,000 payment, and thus receives $100,833 ($121,000 / 1.20) today.Est time: 01-052. a. He could consume up to $200,000 now (forgoing all future consumption) or up to $216,000next year ($200,000 × 1.08, forgoing all consumption this year). He should invest all of his wealth to earn $216,000 next year. To choose the same consumption (C ) in both years, C = ($200,000 – C ) × 1.08 = $103,846.203,704200,000 220,000216,000Dollars Next YearDollars Nowb. He should invest all of his wealth to earn $220,000 ($200,000 × 1.10) next year. If heconsumes all this year, he can now have a total of $203,703.70 ($200,000 × 1.10/1.08) this year or $220,000 next year. If he consumes C this year, the amount available for next year’sconsumption is ($203,703.70 – C ) × 1.08. To get equal consumption in both years, set theamount consumed today equal to the amount next year:C = ($203,703.70 – C ) × 1.08C = $105,769.20Est time: 06-10。

汽车金融公司管理办法(英文版)中国银行业监督管理委员会China Banking Regulatory Commission No. 4 OrderUpon the approval of the State Council, the Administrative Rules Governing the Auto Financing Company is now promulgated by the China Banking Regulatory Commission.Chairman Liu MingkangOctober 3, 2003Administrative Rules Governing the Auto Financing CompanyChapter I General ProvisionsArticle 1 The Administrative Rules Governing the Auto Financing Company (hereinafter referred to as the Rules) is stipulated in accordance with relevant laws and regulations to serve the need of developing auto financing business and regulating the business activities of the non-bank financial institutions engaging in auto financing business.Article 2 Auto financing companies referred to in the Rules are defined as non-bank financial legal entities charted by the China Banking Regulatory Commission in compliance with relevant laws, regulations and the Rules to provide loans for auto buyers and dealers in the mainland of China.Article 3 Auto financing companies are supervised and regulated by the China Banking Regulatory Commission.Chapter II Incorporation, Change and TerminationArticle 4 The establishment of an auto financing company shall be subject to the approval of the China Banking Regulatory Commission.Without the approval of the China Banking Regulatory Commission, no individual or entity shall be allowed to establish an auto financing company, or engage in auto financing business, or includein the name of a company such names as “auto financing” or “auto loan” that indicate the company’s engagement in auto financing businessArticle 5 An investor of an auto financing company shall satisfy following requirements: (a) It shall be a corporate legal entity incorporated in and outside China.If the investor is a non-financial entity, its total assets of the previous year shall be no less than RMB4 billion yuan or an equivalent amount in convertible currencies; its annual business revenue of the previous year shall be no less than RMB2 billion yuan or an equivalent amount in convertible currencies.If the investor is a non-bank financial institution, its registered capital shall be no less than RMB300 million yuan or an equivalent amount in convertible currencies;(b) It shall have sound business performance and remain profitable for the last three consecutive years;(c) It shall comply with the laws of the countries where it is incorporated and shall have a clean record;(d) In case of the largest investor, it shall be an auto enterprise or a non-bank financial institution.The auto enterprise refers to an enterprise that manufactures and sells the whole unit of an automobile.The largest investor refers to the investor with the largest share of capital and its capital contribution accounting for no less than 30 percent of the total equity of the auto financing company;(e) It shall not invest in more than one auto financing company; and(f) It shall satisfy other prudential supervisory requirements set forth by the China Banking Regulatory Commission.Article 6 An auto financing company shall satisfy the following conditions in order to be incorporated:a) the minimum amount of registered capital required by the Rules;b) Articles of Association that complies with relevant laws including the Company Law of the People’s Republic of China and the Rules;c) senior management familiar with auto financing and other related business;d) a sound organizational structure, management and risk control systems;e) proper business premises, safety measures and other facilities for business operations; andf) other conditions set out by the China Banking Regulatory Commission.Article 7 The minimum registered capital of an auto financing company shall be no less than RMB500 million yuan or an equivalent amount in convertible currencies. Registered capital shall be paid-in capital.The China Banking Regulatory Commission shall have the power to adjust the minimum registered capital of an auto financing company in line with the developments of auto financing business and the prudential requirements, but the adjusted floor shall not be lower than the amount provided in this Article.Article 8 The establishment of an auto financing company shall cover two stages, i.e. the preparation stage and the business commencement stage. The Chinese text of all application documents for the preparation and the business commencement stages shall prevail.Article 9 To apply for the preparation of a prospective auto financing company, the largest investor of the company shall act as the applicant and submit the following documents to the China Banking Regulatory Commission:(a) an application letter, including the auto financing company’s name, location of incorporation, registered capital, business scope and investors’ names and amounts of investment, etc.;(b) a feasibility study on establishing the auto financing company, including a market analysis, a business plan, the organizational structure, an assessment of the company’s risk control capability, the proforma balance sheet and profits in the following three years after the business commencement;(c) an Articles of Association of the auto financing company (a draft note);(d) basic information of each investor of the auto financing company, including name, legal representative, location of incorporation, a photocopy of the business license and a summary of business performance, etc.;(e) the investor’s balance sheet, profit and loss statement and cash flow statement for the latest three years audited by qualified auditing firms;(f) name and resume of the person in charge of the preparation; and(g) other documents required by the China Banking Regulatory Commission.If the applicant is a foreign non-bank financial institution, it shall submit the consent of its home country supervisory authority in writing. If the applicant is a non-financial entity, it shall submit the credit rating report of the previous year by a rating agency.Article 10 The China Banking Regulatory Commission, upon receiving a complete set of application documents for the preparation of an auto financing company, shall provide its decision of approval or denial in writing within six months.Article 11 The applicant shall, upon receiving the approval letter from the China Banking Regulatory Commission, complete the preparation within six months. If the applicant has justification for prolonging the preparation stage beyond the prescribed period, it shall submit a written application to the China Banking Regulatory Commission before the original deadline falls due, and may extend the preparation stage for up to three months subject to the approval.If the applicant fails to apply for business commencement upon the completion of the preparation stage or the extended preparation stage, the original approval document for the preparation shall become void automatically.During the preparation stage, the applicant shall not conduct any auto financing business.Article 12 The applicant shall, before the deadline of the preparation stage or the extended preparation stage, apply for business commencement to the China Banking Regulatory Commission with the following attachments:(a) a report on completion of the preparation and an application letter for business commencement;(b) a certification of paid-in capital issued by a qualified Chinese certifying agency, and a registration certificate issued by the State Administration of Industry and Commerce;(c) articles of Association of the auto financing company;(d) names and detailed resumes of proposed senior managerial personnel;(e) name and capital contribution of each shareholder;(f) proposed business rules and procedures and internal controls;(g) verification documents on business premises and other business-related facilities issued by relevant authorities; and(h) other documents required by the China Banking Regulatory Commission.Article 13 The China Banking Regulatory Commission, upon receiving a complete set of business commencement application documents, shall provide its decision of approval or denial of the application within three months. If the application is approved, the applicant shall receive a written approval letter attached with a license to conduct financial business with the prescribed business scope. If the application is denied, the applicant shall receive a written notice in which reasons for denial are provided.The applicant shall, before commencing operations, register with the State Administration of Industry and Commerce with the presentation of the license to conduct financial business, and receive a corporate legal entity business License.The China Banking Regulatory Commission shall revoke the license to conduct financial businessand issue a public notice of the revocation if the auto financing company, after receiving the business license, fails without justification to open business within three months, or, without approval, stops operation for six consecutive months after business commencement.Article 14 An auto financing company shall not set up any branch or subsidiary.Article 15 The appointment of the senior managerial personnel of an auto financing company shall be either subject to the qualification review by the China Banking Regulatory Commission or filed with the China Banking Regulatory Commission for record.The chairman of the board of directors, general manager and deputy general manager, executive directors, and chief financial officer of an auto financing company are subject to the qualification view by the China Banking Regulatory Commission. The qualifications of these senior managerial personnel and procedures relating to qualification review and filing for record shall be issued separately.Article 16 An auto financing company, in case of any of the following changes, shall seek the approval of the China Banking Regulatory Commission:(a) change of company name;(b) change of registered capital;(c) change of business premises;(d) change of business scope;(e) change of organizational structure;(f) change of equity structure;(g) revision of Articles of Association;(h) change of senior managerial personnel;(i) merger or split; and(j) other changes that require the approval of the China Banking Regulatory Commission.Article 17 The liquidation of an auto financing company whose operation is terminated because of dissolution, closure or bankruptcy, shall be carried out in compliance with relevant laws and regulations.Chapter III Business Scope and SupervisionArticle 18 An auto financing company may conduct all or part of the following lines of Renminbi business with the approval of the China Banking Regulatory Commission:(a) taking deposits with maturity of no less than three months from its shareholders in the mainland of China;(b) extending loans for auto purchase;(c) extending loans to auto dealers for purpose of purchasing automobiles or facilities for operations (including the show-room construction, purchase of spare parts and equipment repairs);(d) transferring and selling auto loan receivables;(e) borrowing from financial institutions;(f) providing guarantee for auto purchase financing;(g) agency business relating to auto purchase financing; and(h) other loan business approved by The China Banking Regulatory Commission.Article 19 An auto financing company, in case of extending loans to a natural person for auto purchase, shall observe relevant rules governing the auto loans to individual buyers promulgated by the relative supervisory authority. In case of extending auto loans to a legal entity or other organizations, an auto financing company shall observe relevant rules set out by General Provisions of Loans and other regulations.Article 20 An auto financing company, without the approval of relevant regulatory authorities, shall not issue bonds or borrow funds from overseas. When an auto financing company’s establishment and business operations involve currency exchange, outward repatriation of profits, provision of auto loans for non-residents, capital management or other business transactions relating to foreign exchange administration, the company shall be subject to relevant regulations to be jointly issued by relative regulatory authorities and the State Administration of Foreign Exchange.Article 21 An auto financing company shall meet the requirement on the capital to risk assets ratio, and the capital adequacy ratio shall not be less than ten percent. The China Banking Regulatory Commission may increase the minimum requirement of capital adequacy ratio of an individual company in line with the company’s risk profile and risk management capability. Other requirements on risk control and management relating to various kinds of assets shall be issued separately by the China Banking Regulatory Commission.Article 22 An auto financing company shall adopt relevant accounting rules for financial institutions.Article 23 An auto financing company shall compile in required format and submit to the China Banking Regulatory Commission the balance sheet, the profit and loss Statement, the cash flow statement and other statements required by the China Banking Regulatory Commission, and submit the financial statements of the previous year within three months after the end of each accounting year.An auto financing company shall not provide false financial statements, or statements in which important facts are concealed.Article 24 An auto financing company shall establish and improve various business management systems and internal controls in line with Guidelines on Strengthening Internal Controls of Commercial Banks issued by the People’s Bank of China, and report the systems to the China Banking Regulatory Commission before their implementation.Article 25 An auto financing company shall accept the on-site examination and the off-site surveillance by the China Banking Regulatory Commission.Article 26 The China Banking Regulatory Commission may call the legal representatives or other senior managerial personnel of an auto financing company for inquiries into problems discovered during regular examinations, and demand the company to correct within a prescribed time frame.Article 27 An auto financing company shall establish a system of external audit on a regular basis and submit to the China Banking Regulatory Commission annual auditor’s report signed by the company’s legal representative within six months after the end of each accounting year.Article 28 An auto financing company, in case of encountering payment difficulties or other emergencies, shall take remedial actions, and promptly report to the China Banking Regulatory Commission.Article 29 The China Banking Regulatory Commission shall demand remedial actions by an auto financing company in case of the following circumstances:(a) The company suffers from a loss in the current year of above 50 percent of the registered capital or losses in the last three consecutive years of above 10 percent of the registered capital;(b) The company is in payment difficulties; and(c) The company faces other major operational risks that the China Banking Regulatory Commission deems necessary to issue an order for corrective actions.Article 30 The China Banking Regulatory Commission, after issuing an order for corrective actions to an auto financing company, may take the following enforcement actions:(a) demanding or prohibiting the change of the company’s senior managerial personnel;(b) suspending part of the company’s business or prohibiting the company’s engagement in new business lines;(c) demanding an increase of the company’s capital within a prescribed time frame;(d) demanding the company to change its equity structure or implement other forms of restructuring;(e) prohibiting the dividend distribution; and(f) other enforcement actions that the China Banking Regulatory Commission deems necessary.Article 31 An auto financing company, when receiving an order for remedial actions, shall not resume normal business operations until the following conditions are met and are approved by the China Banking Regulatory Commission:(a) Solvency is restored;(b) Losses are covered; and(c) Major operational risks are addressed.Article 32 The maximum time limit that an auto financing company is allowed for corrective actions shall not exceed one year. If the company fails to meet the objectives of remedial actions within the prescribed time limit, its operation shall be terminated in accordance with relevant laws and regulations.Article 33 Auto financing companies may establish a trade association for self-regulation purposes. The activities of the trade association are subject to the guidance and oversight of the China Banking Regulatory Commission.Chapter IV Legal LiabilitiesArticle 34 Any establishment of an auto financing company or any auto financing business without the approval of the China Banking Regulatory Commission shall be banned. If the case constitutes a crime, criminal liabilities shall be investigated. If the case dose not constitute a crime, the China Banking Regulatory Commission shall confiscate the illegal earnings and impose a fine between one to five times the illegal earnings. If no illegal earnings are involved, the ChinaBanking Regulatory Commission shall issue an order for remedial actions and impose a fine of no less than RMB100,000 yuan and no more than RMB500,000 yuan.Article 35 The China Banking Regulatory Commission shall demand correction and impose a fine of RMB1000 yuan if a company, without the approval of the China Banking Regulatory Commission, includes in its name such words as “auto finance”, “auto loan”, etc. that indicate the company’s engagement in auto financing business.Article 36 In case of an auto financing company being found to engage in business activities beyond its prescribed business scope, the China Banking Regulatory Commission shall issue a warning against the company, confiscate the illegal earnings and impose a fine in a range of one to five times the illegal earnings. If no illegal earnings are involved, the China Banking Regulatory Commission imposes a fine of no less than RMB100,000 yuan and no more than RMB500,000 yuan. If the case constitutes a crime, the criminal liabilities shall be investigated.Article 37 In case of an auto financing company being found in violation of relevant provisions of the Rules to provide false financial statements or statements in which important facts are concealed, the China Banking Regulatory Commission shall issue a warning against the company, and impose a fine of no less than RMB100,000 yuan and no more than RMB500,000 yuan. If the case constitutes a crime, the criminal liabilities shall be investigated.Article 38 In case of an auto financing company being found in violation of relevant provisions of the Rules to reject or impede the examinations and oversight by the supervisor, the China Banking Regulatory Commission shall issue a warning against the company, and impose a fine of no less than RMB10,000 yuan and no more than RMB30,000 yuan.Article 39 An auto financing company, in case of being found in violation of the Rules, shall be punished in accordance with the provisions of Article 34 to Article 38. If the violation is a serious one, the China Banking Regulatory Commission may ban the company’s senior managerial personnel from holding senior management position for one to ten years, or in some particular case, for life.Article 40 An auto financing company, in case of being found in violation of other Chinese laws and regulations, shall be subject to enforcement actions by relevant regulatory authorities.Chapter V Supplementary ProvisionsArticle 41 The Rules is applicable to all auto financing companies incorporated in the mainland of China funded by investors from Hong Kong Special Administrative Region, Macao Special Administrative Region and Taiwan province.Article 42 The Rules enters into effect on October 3, 2003, and the power of the interpretation rests with the China Banking Regulatory Commission。

公司金融英文版教材Corporate Finance: English Edition TextbookIntroduction:Welcome to the English edition of the Corporate Finance textbook. This comprehensive guide is designed to help you understand the fundamental principles and concepts of corporate finance in a global business environment. Whether you are a student or a professional seeking to enhance your knowledge, this textbook will provide you with the necessary tools to excel in the field of corporate finance.Chapter 1: Introduction to Corporate Finance- Role and importance of corporate finance in business- Financial objectives of a firm and shareholder value maximization- Understanding the key financial decisions and their impact on the firmChapter 2: Financial Statements and Analysis- Understanding the income statement, balance sheet, and cash flow statement- Financial ratio analysis and its interpretation- Evaluating the financial health and performance of a firm Chapter 3: Time Value of Money- Understanding the concept of time value of money- Calculating present value, future value, and annuity payments- Applying time value of money principles in investment decision makingChapter 4: Capital Budgeting- Evaluating investment projects and capital budgeting techniques - Net present value (NPV), internal rate of return (IRR), and profitability index- Assessing risk and uncertainty in investment decisionsChapter 5: Cost of Capital- Determining the cost of debt, equity, and weighted average cost of capital (WACC)- Importance of cost of capital in investment decisions and firm valuation- Estimating the cost of capital using various approaches Chapter 6: Capital Structure- Understanding the capital structure and its impact on firm value - Modigliani-Miller theorem and its implications- Determining the optimal capital structure and the tradeoff between debt and equityChapter 7: Dividend Policy- Role and significance of dividend policy in corporate finance- Dividend theories and factors influencing dividend decisions- Dividend payout ratios, stock repurchases, and dividend reinvestment plansChapter 8: Working Capital Management- Managing short-term assets and liabilities- Cash conversion cycle and its optimization- Credit policies, inventory management, and cash flow forecastingChapter 9: Financial Planning and Forecasting- Importance of financial planning in corporate finance- Developing financial forecasts and budgeting processes- Variance analysis and monitoring financial performance Chapter 10: Corporate Valuation- Different approaches to valuing a firm: discounted cash flow (DCF), relative valuation, and market multiples- Understanding the concept of free cash flow and economic value added (EVA)- Valuation models and their application in mergers and acquisitionsConclusion:This Corporate Finance textbook provides a comprehensive understanding of the key principles and concepts in corporate finance. Whether you are a student aspiring to pursue a career in finance or a professional seeking to enhance your knowledge, this textbook will equip you with the necessary tools to make informed financial decisions and create value for the firm.。