THECOMPANIESACT公司法(CHAPTER50)50章章章

- 格式:pdf

- 大小:151.19 KB

- 文档页数:2

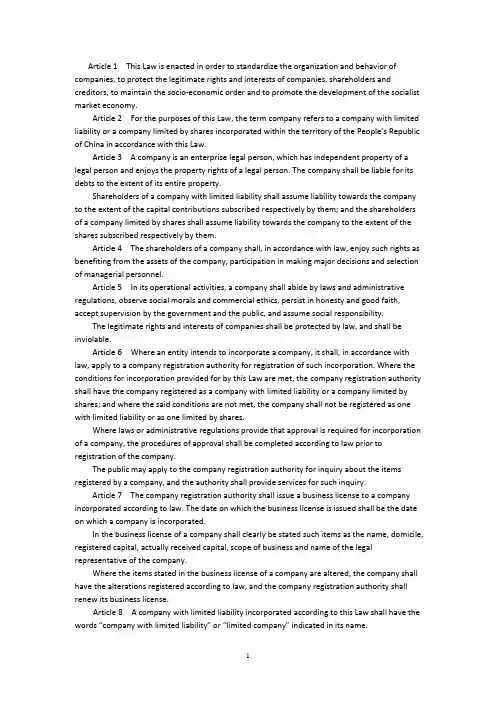

中华人民共和国公司法Company Law of the People’s Republic of China(2014年3月1日起实施)(1993年12月29日第八届全国人民代表大会常务委员会第五次会议通过根据1999年12月25日第九届全国人民代表大会常务委员会第十三次会议《关于修改〈中华人民共和国公司法〉的决定》第一次修正根据2004年8月28日第十届全国人民代表大会常务委员会第十一次会议《关于修改〈中华人民共和国公司法〉的决定》第二次修正 2005年10月27日第十届全国人民代表大会常务委员会第十八次会议修订根据2013年12月28日第十二届全国人民代表大会常务委员会第六次会议通过《关于修改<中华人民共和国海洋环境保护法〉等七部法律的决定》第三次修正于2014年3月1日起实施)(Adopted at the 5th Session of the Standing Committee of the 8th National People’s Congress on December 29, 1993。

Revised for the first time on December 25, 1999 in accordance with the Decision of the 13th Session of the Standing Committee of the Ninth People's Congress on Amending the Company Law of the People's Republic of China. Revised for the second time on August 28, 2004 in accordance with the Decision of the 11th Session of the Standing Committee of the 10th National People's Congress of the People's Republic of China on Amending the Company Law of the People's Republic of China. Revised at the 18th Session of the 10th National People's Congre ss of the People’s Republic of China on October 27, 2005. Revised for the third time on December 28, 2012 in accordance with the Decision on Amending Seven Laws Including the Marine Environment Protection Law of the People’s Republic of China at the 6th Se ssion of the Standing Committee of the 12th National People’s Congress. It is now promulgated and shall come into effect28, 2013目录Contents第一章总则Chapter I: General Provisions第二章有限责任公司的设立和组织机构Chapter II: Establishment and Organizational Structure of Limited Liability Companies 第一节设立Section 1: Establishment第二节组织机构Section 2: Organizational Structure第三节一人有限责任公司的特别规定Section 3: Special Provisions on One—person Limited Liability Companies第四节国有独资公司的特别规定Section 4: Special Provisions on Wholly State—owned CompaniesChapter III: Transfer of Equity Interests in Limited Liability Companies第四章股份有限公司的设立和组织机构Chapter IV: Establishment and Organizational Structure of Companies Limited By Shares 第一节设立Section 1: Establishment第二节股东大会Section 2: General Meeting第三节董事会、经理Section 3: Board of Directors and Manager第四节监事会Section 4: Board of Supervisors第五节上市公司组织机构的特别规定Section 5: Special Provisions on the Organizational Structure of Listed Companies 第五章股份有限公司的股份发行和转让Chapter V: Issuance and Transfer of Shares in Companies Limited by SharesSection 1: Issuance of Shares第二节股份转让Section 2: Transfer of Shares第六章公司董事、监事、高级管理人员的资格和义务Chapter VI: Qualifications and Obligations of Directors, Supervisors and Senior Officers of Companies第七章公司债券Chapter VII: Corporate Bonds第八章公司财务、会计Chapter VIII: Financial Affairs and Accounting of Companies第九章公司合并、分立、增资、减资Chapter Ix: Merger and Division, Increase and Reduction of Capital of Companies第十章公司解散和清算Chapter X: Dissolution and Liquidation of Companies第十一章外国公司的分支机构Chapter XI: Branches of Foreign CompaniesChapter XII: Legal Liability第十三章附则Chapter XIII: Supplementary Provisions第一章总则Chapter I: General Provisions第一条为了规范公司的组织和行为,保护公司、股东和债权人的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,制定本法.Article 1:The Company Law of the People’s Republic of China (hereinafter referred to a s the ”Law") has been enacted in order to standardize the organization and activities of companies, protect the lawful rights and interests of companies,shareholders and creditors, safeguard the social and economic order and promote the development of the socialist market economy。

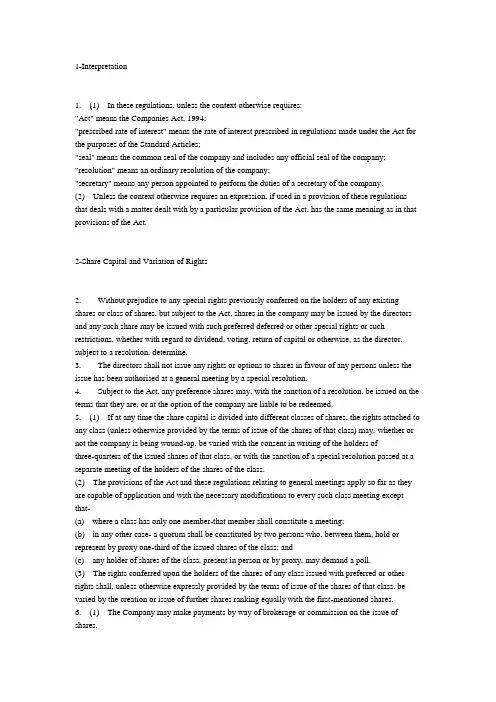

1-Interpretation1. (1) In these regulations, unless the context otherwise requires:"Act" means the Companies Act, 1994;"prescribed rate of interest" means the rate of interest prescribed in regulations made under the Act for the purposes of the Standard Articles;"seal" means the common seal of the company and includes any official seal of the company; "resolution" means an ordinary resolution of the company;"secretary" means any person appointed to perform the duties of a secretary of the company.(2) Unless the context otherwise requires an expression, if used in a provision of these regulations that deals with a matter dealt with by a particular provision of the Act, has the same meaning as in that provisions of the Act.2-Share Capital and Variation of Rights2. Without prejudice to any special rights previously conferred on the holders of any existing shares or class of shares, but subject to the Act, shares in the company may be issued by the directors and any such share may be issued with such preferred deferred or other special rights or such restrictions, whether with regard to dividend, voting, return of capital or otherwise, as the director, subject to a resolution, determine.3. The directors shall not issue any rights or options to shares in favour of any persons unless the issue has been authorised at a general meeting by a special resolution.4. Subject to the Act, any preference shares may, with the sanction of a resolution, be issued on the terms that they are, or at the option of the company are liable to be redeemed.5. (1) If at any time the share capital is divided into different classes of shares, the rights attached to any class (unless otherwise provided by the terms of issue of the shares of that class) may, whether or not the company is being wound-up, be varied with the consent in writing of the holders ofthree-quarters of the issued shares of that class, or with the sanction of a special resolution passed at a separate meeting of the holders of the shares of the class.(2) The provisions of the Act and these regulations relating to general meetings apply so far as they are capable of application and with the necessary modifications to every such class meeting except that-(a) where a class has only one me mber-that member shall constitute a meeting;(b) in any other case- a quorum shall be constituted by two persons who, between them, hold or represent by proxy one-third of the issued shares of the class; and(c) any holder of shares of the class, present in person or by proxy, may demand a poll.(3) The rights conferred upon the holders of the shares of any class issued with preferred or other rights shall, unless otherwise expressly provided by the terms of issue of the shares of that class, be varied by the creation or issue of further shares ranking equally with the first-mentioned shares.6. (1) The Company may make payments by way of brokerage or commission on the issue of shares.(2) Such payments shall not exceed the rate of 10 per cent of the price at which the shares are issued or an amount equal to 10 per cent of that price, as the case may be.(3) Such payments may be made in cash, by the allotment of fully or partly paid shares or partly by the payment of cash and partly by the allotment of fully or partly paid shares.7. (1) Except as required by law, the company shall not recognise a person as holding a share upon any trust.(2) The company shall not be bound by or compelled in any way to recognise (whether or not it has notice of the interest or rights concerned) any equitable, contingent, future or partial interest in any share or unit of a share or (except as otherwise provided by these regulations or by law) any other right in respect of a share except an absolute right of ownership in the registered holder.8. (1) A person whose name is entered as a member in the register of members shall be entitled without payment to receive a certificate in respect of the share under the seal of the company in accordance with the Act but, in respect of a share or shares held jointly by several persons, the company shall not be bound to issue more than one certificate.(2) Delivery of a certificate for a share to one of several joint holders shall be sufficient delivery to all such holders.(3) If a share certificate is defaced, lost or destroyed, it may be renewed on payment of the fee allowed by the Act, or such lesser sum, and on such terms (if any) as to evidence and the payment of costs to the company of investigating evidence as the directors decide.3-Calls on Shares9. (1) The directors may make calls upon the members in respect of any money unpaid on the shares of the members (whether on account of the nominal value of the shares or by way of premium) and not by the terms of issue of those shares made payable at fixed times, except that no call shall exceed one-quarter of the sum of nominal values of the shares or be payable earlier than one month from the date fixed for the payment of the last preceding call.(2) Each member shall, upon receiving at least fourteen days notice specifying the time or times and place of payment, pay to the company, at the time or times and place so specified the amount called on his shares.(3) The directors may revoke or postpone a call.10. A call shall be deemed to have been made at the time when the resolution of the directors authorising the call was passed and may be required to be paid by instalments.11. The joint holders of a share are jointly and severally liable to pay all calls in respect of the share.12. If a sum called in respect of a share is not paid before or on the day appointed for payment of the sum, the person from whom the sum is due shall pay interest on the sum from the day appointed for payment of the sum to the time of actual payment at such rate not exceeding the prescribed rate of interest as the directors determine, but the directors may waive payment of that interest wholly or in part.13. Any sum that, by the terms of issue of a share, becomes payable on allo tment or at a fixed date, whether on account of the nominal value of the share or by way of premium, shall for the purposes ofthese regulations be deemed to be a call duly made and payable on the date on which by the terms of issue the sum becomes payable, and, in case of non-payment, all the relevant provisions of these regulations as to payment of interest and expenses, forfeiture or otherwise apply as if the sum had become payable by virtue of a call duly made and notified.14. The directors may, on the issue of shares, differentiate between the holders as to the amount of calls to be paid and the times of payment.15. (1) The directors may accept from a member the whole or a part of the amount unpaid on a share although no part of that amount has been called up.(2) The directors may authorise payment by the company of interest upon the whole or any part of an amount so accepted, until the amount becomes payable, at a rate agreed upon between the directors and the member paying the sum subject to subregulation (3).(3) For the purposes of subregulation (2), the rate of interest shall not be greater than-(a) if the company has, by resolution, fixed a rate-rate the so fixed; and(b) in any other case the prescribed rate of interest.4-Lien16. (1) The company has a first and paramount lien on every share (not being a fully paid share) for all money (whether presently payable or not) called or payable at a fixed time in respect of that share.(2) The company also has a first and paramount lien on all shares (other than fully paid shares) registered in the name of a sole holder for all money presently payable by him or his estate to the company.(3) The directors may at any time exempt a share wholly or in part from the provisions of this regulation.(4) The company's lien (if any) on a share extends to all dividends payable in respect of the share.5-Forfeiture of Shares17. (1) If a member fails to pay a call or instalment of a call on the day appointed for payment of the call or instalment, the directors may, at any time thereafter during such time as any part of the call or instalment remains unpaid, serve a notice on him requiring payment of so much of the call or instalment as is unpaid, together with any interest that has accrued.(2) The notice shall name a further day (not earlier than the expiration of fourteen days from the date of service of the notice) on or before which the payment required by the notice is to be made and shall state that, in the event of non-payment at or before the time appointed, the shares in respect of which the call was made will be liable to be forfeited.18. (1) If the requirements of a notice served under regulation 17 are not complied with, any share in respect of which the notice has been given may at any time thereafter, before the payment required by the notice has been made, be forfeited by a resolution of the directors to that effect.(2) Such a forfeiture shall include all dividends declared in respect of the forfeited shares and not actually paid before the forfeiture.19. A forfeited share may be sold or otherwise disposed of on such terms and in such manner as the directors think fit, and, at any time before a sale or disposition, the forfeiture may be cancelled on such terms as the directors think fit.20. A person whose shares have been forfeited shall cease to be a member in respect of the forfeited shares, but shall remain liable to pay to the company all money that, at the date of forfeiture, was payable by him to the company in respect of the shares (including interest at the prescribed rate of interest from the date of forfeiture on the money for the time being unpaid if the directors think fit to enforce payment of the interest), but his liability shall cease if and when the company receives payment in full of all the money (including interest) so payable in respect of the shares.21. A statement in writing declaring that the person making the statement is a director or a secretary of the company, and that a share in the company has been duly forfeited on a date stated in the statement, shall be prima facie evidence of the facts stated in the statement as against all persons claiming to be entitled to the share.22. (1) The company may receive the consideration (if any) given for a forfeited share on any sale or disposition of the share and may execute a transfer of the share in favour of the person to whom the share is sold or disposed of.(2) Upon the execution of the transfer, the company shall register the transferee as the holder of the share.(3) The transferee shall not be bound to see to the application of any money paid as consideration.(4) The title of the transferee to the share shall not be affected by any irregularity or invalidity in connection with the forfeiture, sale or disposal of the share.23. The consideration referred in regulation 22 shall be applied by the company in payment of such part of the amount in respect of which the lien exists as is presently payable, and the residue (if any) shall (subject to any like lien for sums not presently payable that existed upon the shares before the sale) be paid to the person entitled to the shares immediately before the transfer.24. The provisions of these regulations as to forfeiture shall apply in the case of non-payment of any sum that, by the terms of issue of a share, becomes payable at a fixed time, whether on account of the nominal value of the shares or by way of premium, as if that sum had been payable by virtue of a call duly made and notified.6-Transfer of Shares25. (1) Subject to these regulations, a member may transfer all or any of his shares by instrument in writing in a form prescribed for the purposes of section fifty-seven of the Act or in any other form that the directors approve.(2) An instrument of transfer referred to in subregulation (1) shall be executed by or on behalf of both the transferor and the transferee.26. The instrument of transfer shall be left for registration at the registered office of the company, together with such fee (if any) not exceeding two monetary units as the directors require, accompanied by the the certificate of the shares to which it relates and such other information as the directorsproperly require to show the right of the transferor to make the transfer, and thereupon the company shall subject to the powers vested in the directors by these regulations, register the transferee as a shareholder.27. The directors may decline to register a transfer of shares, not being fully paid s hares, to a person of whom they do not approve and may also decline to register any transfer of shares on which the company has a lien.28. The directors may refuse to register any transfer that is not accompanied by the appropriate share certificate, unless the company has not yet issued the share certificate or is bound to issue a renewal or copy of the share certificate.29. The registration of transfers may be suspended at such times and for such periods as the directors from time to time determine, provided that the periods do not exceed in the aggregate thirty days in any year.7-Transmission of Shares30. In the case of the death of a member, the survivor where the deceased was a joint holder, and the legal personal representatives of the deceased where he was a sole holder, shall be the only persons recognised by the company as having any title to his interest in the shares, but this regulation does not release the estate of a deceased joint holder from any liability in respect of a s hare that had been jointly held by him with other persons.31. (1) Subject to any written law relating to bankruptcy, a person becoming entitled to a share in consequence of the death or bankruptcy of a member may, upon such information being produced as is properly required by the directors, elect either to be registered himself as holder of the share or to have some other person nominated by him registered as the transferee of the share.(2) If the person becoming entitled elects to be registered himself, he shall deliver or send to the company a notice in writing signed by him stating that he so elects.(3) If he elects to have another person registered, he shall execute a transfer of the share to that other person.(4) All the limitations, restrictions and provisions of these regulations relating to the right to transfer, and the registration of the transfer of share are applicable to any such notice or transfer as if the death or bankruptcy of the member had not occurred and the notice or transfer were a transfer signed by that member.32. (1) Where the registered holder of a share dies or becomes bankrupt, his personal representatives or the trustee of his estate, as the case may be, shall be upon the production of such information as is properly required by the directors, entitled to the same dividends and other advantages, and to the same rights (whether in relation to meetings of the company, or to voting or otherwise), as the registered holder would have been entitled to if he had not died or b ecome bankrupt.(2) Where two or more persons are jointly entitled to any share in consequence of the death of the registered holder, they shall, for the purposes of these regulations, be deemed to be joint holders of the shares.8-Conversion of Shares into Stock33. The company may, by resolution, convert all or any of its paid up shares into stock and reconvert any stock into paid up shares of any nominal value.34. (1) Subject to subregulation (2), where shares have been converted into stock, the provisions of these rules relating to the transfer of shares apply, so far as they are capable of application, to the transfer of the stock or of any part of the stock.(2) The directors may fix the minimum amount of stock transferable and restrict or forbid the transfer of fractions of that minimum, but the minimum shall not exceed the aggregate of the nominal values of the shares from which the stock arose.35. (1) The holders of stock shall have, according to the amount of the stock held by them, the same rights, privileges and advantages as regards dividends, voting at meetings of the company and other matters as they would have if they held the shares from which the stock arose.(2) No privilege or advantage shall be conferred by any amount of stock that would not, if existing in shares, have conferred that privilege or advantage.36. The provisions of these regulations that are applicable to paid up shares shall apply to stock, and references in those provisions to share and shareholder shall be read as including references to stock and stockholder, respectively.9-Alteration of Capital37. The company may by resolution-(a) increase its authorised share capital by the creation of new shares of such amount as is specified in the resolution;(b) consolidate and divide all or any of its authorised share capital into shares of larger amount than its existing shares;(c) subdivide all or any of its shares into shares of smaller amount than is fixed by the certificate of share capital, but so that in the subdivision the proportion between the amount paid and the amount (if any) unpaid on each such share of a smaller amount is the same as it was in the case of the share from which the share of a smaller amount is derived; and(d) cancel shares that, at the date of passing of the resolution, have not been taken or agreed to be taken by any person or have been forfeited, and reduce its authorised share capital by the amount of the shares so cancelled.38. (1) Subject to any resolution to the contrary, all unissued shares shall, before issue, be offered to such persons as at the date of the offer are entitled to receive notices from the company of general meetings in proportion, as nearly as the circumstances allow, to the sum of the nomin al values of the shares already held by them.(2) The offer shall be made by notice specifying the number of shares offered and delimiting a period within which the offer, if not accepted, will be deemed to be declined.(3) After the expiration of that period or on being notified by the person to whom the offer is made that he declines to accept the shares offered, the directors may issue those shares in such manner as they think most beneficial to the company.(4) Where, by reason of the proportion that shares proposed to be issued bear to shares already held, some of the first-mentioned shares cannot be offered in accordance with sub-regulation (1), the directors may issue the shares that cannot be so offered in such manner as they think most beneficial to the company.39. Subject to the Act, the company may, by special resolution, reduce its share capital, any capital redemption reserve fund or any share premium account.共有153页,如需要余下部分请与本人联系chinavea@。

【字体:大中小】TheCompanyLawofthePeople'sRepublicofChina(《公司法》英文版)2006年10月26日来源:国家工商总局外商投资企业注册局The Company Law of the People's Republic of China has been amended and adopted at the 18th session of the Standing Committee of the Tenth National People's Congress of the People's Republic of China on October 27, 2005. The amended Company Law of the People's Republic of China is promulgated hereby and shall go into effect as of January 1, 2006.The President of the People's Republic of China Hu JintaoOctober 27, 2005The Company Law of the People's Republic of China(revised in 2005)(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress on December 29, 1993. Revised for the first time on December 25, 1999 in accordance with the Decision of the Thirteenth Session of the Standing Committee of the Ninth People's Congress on Amending the Company Law of the People's Republic of China. Revised for the second time on August 28, 2004 in accordance with the Decision of the 11th Session of the Standing Committee of the 10th National People's Congress of the People's Republic of China on Amending the Company Law of the People's Republic of China. Revised for the third time at the 18th Session of the 10th National People's Congress of the People's Republic of China on October 27, 2005)ContentsChapter I General ProvisionsChapter II Incorporation and Organization of a Limited Liability CompanySection 1 IncorporationSection 2 OrganizationSection 3 Special Provisions on One-person Limited Liability CompaniesSection 4 Special Provisions on wholly State-owned CompaniesChapter III Transfer of Stock Right of a Limited Liability CompanyChapter IV Incorporation and Organization of a Joint Stock Limited CompanySection 1 IncorporationSection 2 Assembly of shareholdersSection 3 Board of Directors, ManagersSection 4 Board of SupervisorsSection 5 Special Provisions on the Organization of a Listed CompanyChapter V Issuance and Transfer of Shares of a Joint Stock Limited CompanySection 1 Issuance of SharesSection 2 Transfer of SharesChapter VI Qualifications and Obligations of the Directors, Supervisors and Senior Managers of a CompanyChapter VII Company BondsChapter VIII Financial Affairs and Accounting of a CompanyChapter IX Merger and Division of a Company; Increase and Deduction of Registered CapitalChapter X Dissolution and Liquidation of a CompanyChapter XI Branches of a Foreign CompanyChapter XII Legal LiabilitiesChapter XIII Supplementary ProvisionsChapter I General ProvisionsArticle 1 This Law is formulated for the purposes of regulating the organization and operation of companies, protecting the legitimate rights and interests of companies, shareholders and creditors, maintaining the socialist economic order, and promoting the development of the socialist market economy Article 2 The term "company" as mentioned in this Law refers to a limited liability company or a joint stock limited company established within the territory of the People's Republic of China in accordance with the provisions of this law.Article 3 A company is an enterprise legal person, which has independent legal person property and enjoys the property right of the legal person. And it shall bear the liabilities for its debts with all its property.As for a limited liability company, the shareholders shall be responsible for the company to the extent of the capital contributions they have paid. As for a joint stock limited company, the shareholders shall be responsible for the company to the extent of the shares they have subscribed for.Article 4 The shareholders of a company shall be entitled to enjoy the capital proceeds, participate in making important decisions, choose managers, and so on.Article 5 When undertaking business operations, a company shall comply with the laws and administrative regulations, social morality and business morality. It shall act in good faith, accept the supervision of the government and the general public, and bear social responsibilities.The legitimate rights and interests of a company shall be protected by laws and may not be infringed.Article 6 For the incorporation of a company, an application for incorporation shall be filed with the company registration authority. If the application meets the requirements of this Law, the company registration authority shall register the company as a limited liability company or a joint stock limited company. If the application fails to meet the requirements, it shall not be registered as a limited liability company or a joint stock limited company.If any law or administrative regulation stipulates that the incorporation of a company shall be subject to approval, the relevant approval formalities shall be gone through prior to the registration of the company.The general public may consult the relevant matters on company registration at company registration authority, who shall provide consulting services.Article 7 For a legally established company, the company registration authority shall issue thecompany business license to it, and the date of issuance of the company business license shall be the date of incorporation of the company. The company business license shall state the name, domicile, registered capital, paid-up capital, scope of business, the name of the legal representative and etc. If any of the items as stated in the business license is changed, the company shall apply for modification registration, and the company registration authority shall re new the business license.Article 8 For a limited liability company established according to this Law, it shall indicate in its name with the words "limited liability company" or "limited company". For a joint stock limited company established according to this Law, it shall indicate in its name the words "joint stock limited company" or "joint stock company".Article 9 The change of a limited liability company to a joint stock limited company shall satisfy the requirements as prescribed in this Law for joint stock limited companies. The change of a joint stock limited company to a limited liability company shall meet the conditions as prescribed in this Law for limited liability companies. Under any of the aforesaid circumstances, the creditor's rights and debts of the company prior to the change shall be succeeded by the company after the change.Article 10 A company shall regard the location of its principal office as its domicile.Article 11 The company established according to this law shall formulate its articles of association which are binding on the company, its shareholders, directors, supervisors and senior managers.Article 12 The company's scope of business shall be defined in its articles of association and shall be registered according to law. The company may change its scope of business by modifying its articles of association, but shall go through the modification registration. If the company’s scope of business coversany item subject to approval according to laws or administrative regulations, the approval shall be obtained beforehand.Article 13 The legal representative of a company shall, according to the provisions of its articles of association, be assumed by the chairman of the board of directors, executive director or manager, and shall be registered according to law. If the legal representative of the company is changed, the company shall go through the modification registration.Article 14 The company may set up branches. To set up a branch, the company shall file a registration application with the company registration authority, and shall obtain the business license. The branch shall not enjoy the status of an enterprise legal person, and its civil liabilities shall be born by the company.The company may set up subsidiaries which enjoy the status of an enterprise legal person and shall be independently bear civil liabilities.Article 15 A company may invest in other enterprises. However, it shall not become a capital contributor that shall bear the joint liabilities for the debts of the enterprises it invests in, unless it is otherwise provided for by any law.Article 16 Where a company intends to invest in any other enterprise or provide guarantee for others, it shall, according to the provisions of its articles of association, be decided at the meeting of the board of directors or shareholders’s meeting or shareholders' assembly. If the articles of association prescribe any limit on the total amount of investments or guarantees, or on the amount of a single investment or guarantee, the aforesaid total amount or amount shall not exceed the responsive limited amount. If a company intendsto provide guarantee to a shareholder or actual controller of the company, it shall make a resolution through the shareholder's meeting or shareholders' assembly.The shareholder as mentioned in the preceding paragraph or the shareholder dominated by the actual controller as mentioned in the preceding paragraph shall not participate in voting on the matter as mentioned in the preceding paragraph. Such matter requires the affirmative votes of more than half of the other shareholders attending the meeting.Article 17 The company shall protect the lawful rights and interests of its employees, conclude employment contracts with the employees, buy social insurances, strengthen labor protection so as to realize safe production.The company shall, in various forms, reinforce the vocational education and in-service training of its employees so as to improve their professional quality.Article 18 The employees of a company shall, according to the Labor Union Law of the People's Republic of China, organize a labor union, which shall carry out union activities and safeguard the lawful rights and interests of the employees. The company shall provide necessary conditions for its labor union to carry out activities. The labor union shall, on behalf of the employees, conclude the collective contract with the company with respect to the remuneration, working hours, welfare, insurance, operation safety and sanitation and other matters.According to the Constitution and other relevant laws, a company shall implement democratic management in the form of meeting of the representatives of the employees or any other ways.To make a decision on restructuring or any important issue related to business operation, or to formulate any important regulation, a company shall solicit the opinions of its labor union, and shall solicit the opinions and proposals of the employees through the meeting of the representatives of the employees or in any other way.Article 19 An organization of the Chinese Communist Party shall, according to the Charter of the Chinese Communist Party, be established in the company to carry out activities of the Chinese Communist Party. And the company shall provide necessary conditions for the activities of the Chinese Communist Party.Article 20 The shareholders of a company shall comply with the laws, administrative regulations and articles of association, and shall exercise the shareholder's rights according to law. None of them may injure any of the interests of the company or of other shareholders by abusing the shareholder's rights, or injure the interests of any creditor of the company by abusing the independent status of legal person or the shareholder's limited liabilities.Where any of the shareholders of a company causes any loss to the company or to other shareholders by abusing the shareholder's rights, it shall be subject to compensation.Where any of the shareholders of a company evades the payment of its debts by abusing the independent status of legal person or the shareholder's limited liabilities, and thus seriously damages the interests of any creditor, it shall bear joint liabilities for the debts of the company.Article 21 Neither the holding shareholder, nor the actual controller, any of the directors, supervisors or senior managers of the company may injure the interests of the company by taking advantage of itsconnection relationship. Anyone who has caused any loss to the company due to violation of the preceding paragraph shall be subject to compensation.Article 22 The resolution of the shareholders' meeting, shareholders’s assembly or board of directors of the company that has violated any law or administrative regulation shall be null and void.Where the procedures for convoking and the voting form of a shareholders' meeting or shareholders’s assembly or meeting of the board of directors, violate any law, administrative regulation or the articles of association, or the resolution is in violation of the articles of association of the company, the shareholders may, within 60 days as of the day when the resolution is made, request the people's court to revoke it.If the shareholders initiate a lawsuit according to the preceding paragraph, the people's court shall, in light of the request of the company, demand the shareholders to provide corresponding guarantee.Where a company has, in light of the resolution of the shareholders' meeting, shareholders’s assembly or meeting of the board of directors, completed the modification registration, and the people's court declares the resolution null and void or revoke the resolution, the company shall file an application with the company registration authority for cancelling the modification registration.Chapter II Incorporation and Organization of a Limited Liability CompanySection 1 IncorporationArticle 23 The incorporation of a limited liability company shall satisfy the following conditions:(1) The number of shareholders accords with the quorum;(2) The amount of capital contributions paid by the shareholders reaches the statutory minimum amount of the registered capital;(3) The articles of association are worked out jointly by shareholders;(4) The company has a name and its organization complies with that of a limited liability company; and(5) The company has a domicile.Article 24 A limited liability company shall be established by not more than 50 shareholders that have made capital contributions.Article 25 A limited liability company shall state the following items in its articles of association:(1) the name and domicile of the company;(2) the scope of business of the company;(3) the registered capital of the company;(4) names of shareholders;(5) forms, amount and time of capital contributions made by shareholders;(6) the organizations of the company and its formation, their functions and rules of procedure;(7) the legal representative of the company;(8) other matters deemed necessary by shareholders. The shareholders should affix their signatures or seals on the articles of association of the company.Article 26 The registered capital of a limited liability company shall be the total amount of the capital contributions subscribed for by all the shareholders that have registered in the company registration authority. The amount of the initial capital contributions made by all shareholders shall be not less than 20% of the registered capital, nor less than the statutory minimum amount of registered capital, and the margin shall be paid off by the shareholders within 2 years as of the day when the company is established; as for an investment company, it may be paid off within 5 years. The minimum amount of registered capital of a limited liability company shall be RMB 30, 000 Yuan. If any law or administrative regulation prescribes a relatively higher minimum amount of registered capital of a limited liability company, the provisions of that law or administrative regulation shall be followed.Article 27 A shareholder may make capital contributions in currency, in kind or intellectual property right, land use right or other non-currency properties that may be assessed on the basis of currency and may be transferred according to law, excluding the properties that shall not be treated as capital contributions according to any law or administrative regulation.The value of the non-currency properties as capital contributions shall be assessed and verified, which shall not be over-valued or under-valued. If any law or administrative regulation prescribes the valueassessment, such law or administrative regulation shall be followed.The amount of the capital contributions in currency paid by all the shareholders shall be not less than 30% of the registered capital of the limited liability company.Article 28 Every shareholder shall make full payment for the capital contribution it has subscribed to according to the articles of association. If a shareholder makes his/its capital contribution in currency, he shall deposit the full amount of such currency capital contribution into a temporary bank account opened for the limited liability company. If the capital contributions are made in non-currency properties, the appropriate transfer procedures for the property rights therein shall be followed according to law. Where a shareholder fails to make his/its capital contribution as specified in the preceding paragraph, it shall not only make full payment to the company but also bear the liabilities for breach of the contract to the shareholders who have make full payment of capital contributions on schedule.Article 29 The capital contributions made by shareholders shall be checked by a legally established capital verification institution, which shall issue a certification.Article 30 After the initial capital contributions made by the shareholders for the first time have been checked by a legally established capital verification institution, the representative designated by all the shareholders or the agent authorized by all the shareholders shall apply for incorporation registration with a company registration application, the articles of association, capital verification report and other documents to the company registration authority.Article 31 After the incorporation of a limited liability company, if the actual value of the capital contributions in non-currency properties is found to be apparently lower than that provided for in the articlesof association of the company, the balance shall be supplemented by the shareholder who has offered them, and the other shareholders of the company who have established the company shall bear joint liabilities.Article 32 After the incorporation of a limited liability company, every shareholder shall be issued with a capital contribution certificate, which shall specify the following:(1) the name of the company;(2) the date of incorporation of the company;(3) the registered capital of the company;(4) the name of the shareholder, the amount of his capital contribution, and the day when the capital contribution is made; and(5) the serial number and date of issuance of the capital contribution certificate. The capital contribution certificate shall bear the seal of the company.Article 33 A limited liability company shall prepare a register of shareholders, which shall specify the following:(1) the name of every shareholder and his/its domicile thereof;(2) the amount of capital contribution made by every shareholder;(3) the serial number of every capital contribution certificate.The shareholders recorded in the register of shareholders may, in light of the register of shareholders,claim to and exercise the shareholder's rights. A company shall register every shareholder's name and the amount of its capital contribution in the company registration authority. Where any of the registration particulars is changed, it shall apply for modification registration. If the company fails to do so, it shall not, on the basis of the unregistered or un-modified registration particulars, stand up to any third party.Article 34 The shareholder shall be entitled to consult and copy the articles of association, records of the shareholders' meetings, resolutions of the meetings of the board of directors, resolutions of the meetings of the board of supervisors, as well as financial reports.The shareholders may request to consult the accounting books of the company. Where a shareholder requests to consult the accounting books of the company, it shall submit to the company a written request which shall state its motives. If the company, pursuant to any justifiable reason, considers that the shareholder's request to consult the accounting books for any improper purpose may damage the legitimate interests of the company, it may reject the request of the shareholder, and shall, within in 15 days after the shareholder submits a written request, give it a written reply which shall include an explanation. If the company rejects the request of any shareholder to consult the accounting books, the shareholder may plead the people's court to demand the company to approve consultation.Article 35 The shareholders shall distribute dividends in light of the percentages of capital contributions actually made by them, unless all shareholders agree that the dividends are not distributed on the percentages of capital contributions. Where the company is to increase its capital, its shareholders have the preemptive right to contribute to the increased amount on the basis of the same percentages of the capital contributions they have already made, unless all shareholders agree that they will not contribute to theincreased amount of capital on the basis of the percentages of the capital contributions they have already made.Article 36 After the incorporation of a company, no shareholder may illegally take away the contribution capital.Section 2 Organization StructureArticle 37 The shareholders' meeting of a limited liability company shall comprise all the shareholders. It shall be the authority of the company, and shall exercise its authorities according to this Law.Article 38 The shareholders' meeting shall exercise the following authorities:(1) determining the company's operation guidelines and investment plans;(2) electing and changing the director and supervisors assumed by non-representatives of the employees, and determining the matters concerning their remuneration;(3) deliberating and approving the reports of the board of directors;(4) deliberating and approving the reports of the board of supervisors or the supervisor;(5) deliberating and approving annual financial budget plans and final account plans of the company;(6) deliberating and approving profit distribution plans and loss recovery plans of the company;(7) making resolutions on the increase or decrease of the company's registered capital;(8) making resolutions on the issuance of corporate bonds;(9) adopting resolutions on the assignment, division, change of company form, dissolution, liquidation of the company;(10) revising the articles of association of the company;(11) other functions as specified in the articles of association.Where any of the matters as listed in the preceding paragraph is consented by all the shareholders it in writing, it is not required to convene a shareholders' meeting. A decision may be made directly with the signatures or seals of all the shareholders.Article 39 The shareholders' meeting shall be convened and presided over by the shareholder who has made the largest percentage of capital contributions and shall exercise its authorities according to this Law.Article 40 The shareholders' meeting shall be classified into regular meetings and temporary meetings. The regular meetings shall be timely held in pursuance with the articles of association. Where a temporary meeting is proposed by the shareholders representing 1/10 of the voting rights or more, or by directors representing 1/3 of the voting rights or more, or by the board of supervisors, or by the supervisors of the company with no board of supervisors, a temporary meeting shall be held.Article 41 Where a limited liability company has set up a board of directors, the shareholders'meeting shall be convened by the board of directors and presided over by the chairman of the board of directors. If the chairman is unable or does not perform his duties, the meetings thereof shall be presided over by the deputy chairman of the board of directors. If the deputy chairman of the board of directors is unable or does not perform his duties, the meetings shall be presided over by a director jointly recommended by half or more of the directors. Where a limited liability company has not set up the board of directors, the shareholders' meeting shall be convened and presided over by the executive director.If the board of directors or the executive director is unable or does not perform the duties of convening the shareholders' meeting, the board of supervisors or the supervisor of the company with no board of supervisors may convene and preside over such meetings. If the board of supervisors or supervisor does not convene or preside over such meetings, the shareholders representing 1 / 10 or more of the voting rights may convene and preside over such meetings on his/its own initiative.Article 42 Every shareholder shall be notified 15 days before a shareholders' meeting is held, unless it is otherwise prescribed by the articles of association or it is otherwise contracted by all the shareholders. A shareholders' meeting shall make records for the decisions on the matters discussed at the meeting. The shareholders who attend the meeting shall affix their signatures to the records.Article 43 The shareholders shall exercise their voting rights at the shareholders' meeting on the basis of their respective percentage of the capital contributions, unless it is otherwise prescribed by the articles of association.Article 44 The discussion methods and voting procedures of the shareholders' meeting shall be prescribed in the articles of association, unless it is otherwise provided for by this Law. A resolution made ata shareholders' meeting on amending the articles of association, increasing or reducing the registered capital, merger, division, dissolution or change of the company type shall be adopted by the shareholders representing 2 / 3 or more of the voting rights.Article 45 The board of directors established by a limited liability company shall comprise 3 up to 13 members, unless it is otherwise provided for in Article 51 of this Law. If a limited liability company established by 2 or more state-owned enterprises or other state-owned investors, the board of directors shall comprise the representatives of employees of this company. The board of directors of any other limited liability company may also comprise the representatives of employees of the company concerned. The employees' representatives who are to serve as the board of directors shall be democratically elected by the employees of the company through the assembly of the representatives of employees, the assembly of employees of the company or or by any other means. The board of directors shall have one board chairman and may have one or more deputy chairman. The appointment of the chairman and deputy chairman shall be prescribed in the articles of association.Article 46 The terms of office of the directors shall be provided for in the articles of association, but each term of office shall not exceed 3 years. The directors may, after the expiry of their terms of office, hold a consecutive term upon re-election. If no reelection is timely carried out after the expiry of the term of office of the directors, or if the number of the members of the board of directors is less than the quorum due to the resignation of some directors from the board of directors prior to the expiry of their term of office, the original directors shall, before the newly elected directors assume their posts, exercise the authorities of the directors according to laws, administrative regulations as well as the articles of association.。

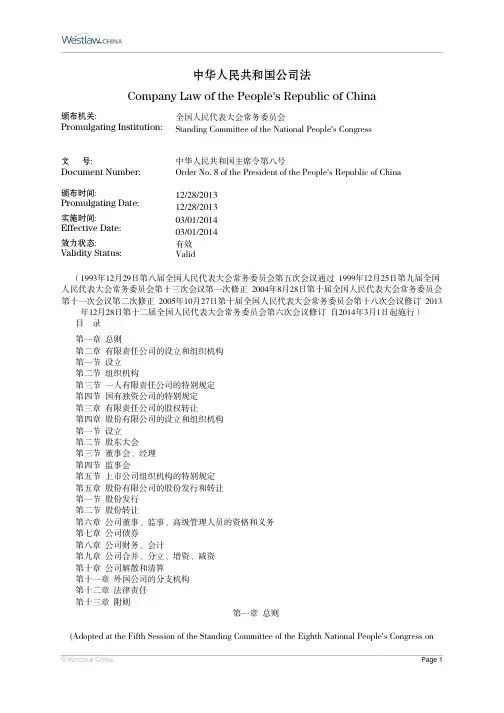

中华人民共和国公司法Company Law of the People's Republic of China颁布机关:全国人民代表大会常务委员会Promulgating Institution:Standing Committee of the National People's Congress文号:中华人民共和国主席令第八号Document Number:Order No.8of the President of the People's Republic of China颁布时间: Promulgating Date:12/28/2013 12/28/2013实施时间: Effective Date:03/01/2014 03/01/2014效力状态: Validity Status:有效Valid(1993年12月29日第八届全国人民代表大会常务委员会第五次会议通过1999年12月25日第九届全国人民代表大会常务委员会第十三次会议第一次修正2004年8月28日第十届全国人民代表大会常务委员会第十一次会议第二次修正2005年10月27日第十届全国人民代表大会常务委员会第十八次会议修订2013年12月28日第十二届全国人民代表大会常务委员会第六次会议修订自2014年3月1日起施行)目录第一章总则第二章有限责任公司的设立和组织机构第一节设立第二节组织机构第三节一人有限责任公司的特别规定第四节国有独资公司的特别规定第三章有限责任公司的股权转让第四章股份有限公司的设立和组织机构第一节设立第二节股东大会第三节董事会、经理第四节监事会第五节上市公司组织机构的特别规定第五章股份有限公司的股份发行和转让第一节股份发行第二节股份转让第六章公司董事、监事、高级管理人员的资格和义务第七章公司债券第八章公司财务、会计第九章公司合并、分立、增资、减资第十章公司解散和清算第十一章外国公司的分支机构第十二章法律责任第十三章附则第一章总则(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress onDecember29,1993;Amended for the first time at the13th Session of the Standing Committee of the Ninth National People's Congress on December25,1999;Amended for the second time at the11th Session of the Standing Committee of the Tenth National People's Congress on August28,2004;Revised at the18th Session of the Standing Committee of the Tenth National People's Congress on October27, 2005;and Revised at the6th Session of the Standing Committee of the Twelfth National People's Congress on December28,2013and shall take effect on March1,2014)Table of ContentsChapter1:General ProvisionsChapter2:Establishment and Organizational Structure of a Limited Liability CompanySection1:EstablishmentSection2:Organizational StructureSection3:Special Provisions on One-Person Limited Liability CompaniesSection4:Special Provisions on Wholly State-Owned CompaniesChapter3:Equity Transfer of a Limited Liability CompanyChapter4:Establishment and Organizational Structure of a Company Limited by SharesSection1:EstablishmentSection2:General MeetingSection3:Board of Directors;ManagersSection4:Board of SupervisorsSection5:Special Provisions on the Organizational Structure of a Listed CompanyChapter5:Issuance and Transfer of Shares of a Company Limited by SharesSection1:Issuance of SharesSection2:Transfer of SharesChapter6:Qualifications and Obligations of the Directors,Supervisors,and Senior Management Personnel of a CompanyChapter7:Corporate BondsChapter8:Finance and Accounting of a CompanyChapter9:Merger,Division or Capital Increase or Reduction of a CompanyChapter10:Dissolution and Liquidation of a CompanyChapter11:Branches of a Foreign CompanyChapter12:Legal LiabilitiesChapter13:Supplementary ProvisionsChapter1:General Provisions第一条为了规范公司的组织和行为,保护公司、股东和债权人的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,制定本法。

英国公司法(CompanyLaw)第一章注册公司的法律特征作者:明月孤岑文章来源:竹月斋发表于2006年10月12日阅读1685人次推荐级别:☆Company Law: Fundamental Principles, (2nd ed.) Stephen Griffin LLB, PITMAN Publishing, 1996THE LEGAL CHARACTERISTICS OF A REGISTERED COMPANY本章主要讲述了注册公司的基本法律特征及其发展的历史。

公司在一定意义上可以被看作是一个虚构的实体,它只不过是其管理者和员工按照团体模式经营的一种方式或手段。

依照大陆法系的分类,这种观点似乎可以被看作是法人拟制说。

但是在法律上,按照公司法的规定注册的公司,这种虚构的本质在这种程度上被忽视了,从公司成立之日起,它就是一个公司实体。

正因为如此,注册公司是一个独立的法律主体,它像一个自然人那样享有权利和承担义务。

这是公司的第一个重要的特征。

除此之外,大量的公司都具有有限责任的特点。

公司的有限责任分为股份的有限和保证的有限。

(除有特别说明,本书将主要讲股份的有限。

)有限责任是指公司股东一旦(以股票的名义价值)完全出资认购了所持有的股份,他就不再对公司的债务承担任何责任。

公司的成立导致了公司和其股东地位的分离。

因此,公司的存在不再依赖于其成员的存在于否。

成立这样一个公司最大的好处是股东的有限责任,但最大的缺点是商业隐私的缺失。

与合伙不同,注册公司必须满足许多关于披露信息的要求。

公司的概念产生于19世纪中期,但在此之前,就已存在现代公司的前身。

首先产生的是特许公司。

从17世纪起,随着世界船舶贸易的发展,特许的股份公司产生了。

股份公司是一个通过王室特许产生的,有着复杂形式的合伙企业。

特许状通常授予其在特定贸易中的垄断权。

这种公司虽然也具有独立的法律身份,但是除非特许状有特殊规定,这种企业的成员没有任何形式的有限责任。