外贸英语口语外贸信用证用语大全(一)

- 格式:doc

- 大小:43.50 KB

- 文档页数:5

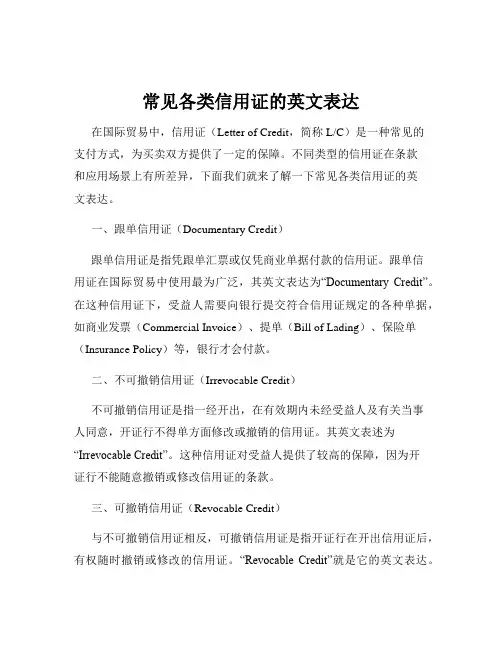

常见各类信用证的英文表达在国际贸易中,信用证(Letter of Credit,简称 L/C)是一种常见的支付方式,为买卖双方提供了一定的保障。

不同类型的信用证在条款和应用场景上有所差异,下面我们就来了解一下常见各类信用证的英文表达。

一、跟单信用证(Documentary Credit)跟单信用证是指凭跟单汇票或仅凭商业单据付款的信用证。

跟单信用证在国际贸易中使用最为广泛,其英文表达为“Documentary Credit”。

在这种信用证下,受益人需要向银行提交符合信用证规定的各种单据,如商业发票(Commercial Invoice)、提单(Bill of Lading)、保险单(Insurance Policy)等,银行才会付款。

二、不可撤销信用证(Irrevocable Credit)不可撤销信用证是指一经开出,在有效期内未经受益人及有关当事人同意,开证行不得单方面修改或撤销的信用证。

其英文表述为“Irrevocable Credit”。

这种信用证对受益人提供了较高的保障,因为开证行不能随意撤销或修改信用证的条款。

三、可撤销信用证(Revocable Credit)与不可撤销信用证相反,可撤销信用证是指开证行在开出信用证后,有权随时撤销或修改的信用证。

“Revocable Credit”就是它的英文表达。

由于可撤销信用证的不确定性较大,受益人承担的风险较高,因此在实际贸易中使用较少。

四、保兑信用证(Confirmed Credit)保兑信用证是指由另一家银行对开证行开出的信用证加以保兑,保证对符合信用证条款规定的单据履行付款义务。

其英文表述为“Confirmed Credit”。

当开证行的信誉不够好或者受益人对开证行不信任时,通常会要求开证行开出保兑信用证,以增加付款的保障。

五、即期信用证(Sight Credit)即期信用证是指开证行或付款行收到符合信用证条款的跟单汇票或装运单据后,立即履行付款义务的信用证。

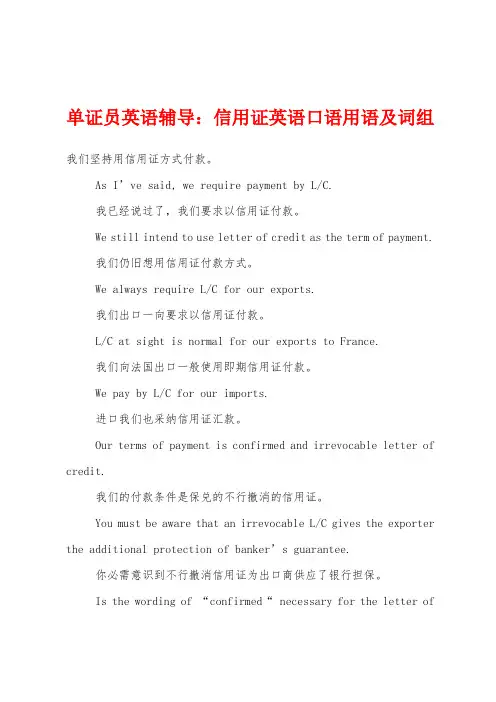

单证员英语辅导:信用证英语口语用语及词组我们坚持用信用证方式付款。

As I’ve said, we require payment by L/C.我已经说过了,我们要求以信用证付款。

We still intend to use letter of credit as the term of payment.我们仍旧想用信用证付款方式。

We always require L/C for our exports.我们出口一向要求以信用证付款。

L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

We pay by L/C for our imports.进口我们也采纳信用证汇款。

Our terms of payment is confirmed and irrevocable letter of credit.我们的付款条件是保兑的不行撤消的信用证。

You must be aware that an irrevocable L/C gives the exporter the additional protection of banker’s guarantee.你必需意识到不行撤消信用证为出口商供应了银行担保。

Is the wording of “confirmed“ necessary for the letter ofcredit?信用证上还用写明“保兑”字样吗?For payment we require 100% value, irrevocable L/C in our favour with partial shipment allowed clause available by draft at sight.我们要求用不行撤消的、允许分批装运、金额为全部货款、并以我方为抬头人的信用证,凭即期汇票支付。

What do you say to 50% by L/C and the balance by D/P?百分之五十用信用证,其余的用付款交单,您看怎么样?Please notify us of L/C number by telex immediately.。

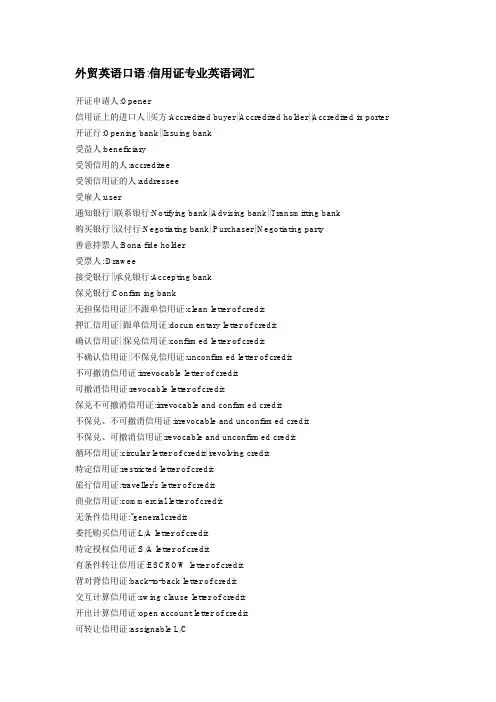

外贸英语口语:信用证专业英语词汇开证申请人:Opener信用证上的进口人||买方:Accredited buyer||Accredited holder||Accredited importer 开证行:Opening bank||Issuing bank受益人:beneficiary受领信用的人:accreditee受领信用证的人:addressee受雇人:user通知银行||联系银行:Notifying bank||Advising bank||Transmitting bank购买银行||议付行:Negotiating bank||Purchaser||Negotiating party善意持票人:Bona fide holder受票人::Drawee接受银行||承兑银行:Accepting bank保兑银行:Confirming bank无担保信用证||不跟单信用证:clean letter of credit押汇信用证||跟单信用证:documentary letter of credit确认信用证||保兑信用证:confirmed letter of credit不确认信用证||不保兑信用证:unconfirmed letter of credit不可撤消信用证:irrevocable letter of credit可撤消信用证:revocable letter of credit保兑不可撤消信用证:irrevocable and confirmed credit不保兑、不可撤消信用证:irrevocable and unconfirmed credit不保兑、可撤消信用证:revocable and unconfirmed credit循环信用证:circular letter of credit||revolving credit特定信用证:restricted letter of credit旅行信用证:traveller's letter of credit商业信用证:commercial letter of credit无条件信用证:"general credit委托购买信用证:L/A letter of credit特定授权信用证:S/A letter of credit有条件转让信用证:ESCROW letter of credit背对背信用证:back-to-back letter of credit交互计算信用证:swing clause letter of credit开出计算信用证:open account letter of credit可转让信用证:assignable L/C有权追索信用证:with recourse L/C无权追索信用证:without recourse L/C银行信用证:banker's credit||bank credit前借信用证:packing credit原始信用证:original credit开立信用证:"to open a credit在银行裁决信用证:to arrange a credit with a bank以电报开出信用证:to cable a credit开出信用证:to issue a credit修改信用证:to amend a credit将信用证有效期延长:to extend a credit增加信用证金额:to increase a credit请求开立信用证:to take out a credit收回信用证||撤回信用证:to revoke a credit信用证例文我们很高兴得知贵公司早于5月5日向旧金山美国银行开出信用证。

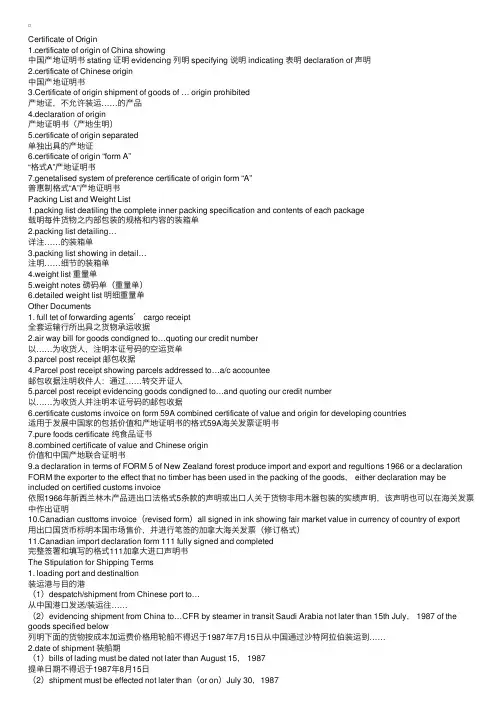

Certificate of Origin1.certificate of origin of China showing中国产地证明书 stating 证明 evidencing 列明 specifying 说明 indicating 表明 declaration of 声明2.certificate of Chinese origin中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited产地证,不允许装运……的产品4.declaration of origin产地证明书(产地⽣明)5.certificate of origin separated单独出具的产地证6.certificate of origin “form A”“格式A”产地证明书7.genetalised system of preference certificate of origin form “A”普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full tet of forwarding agents' cargo receipt全套运输⾏所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number以……为收货⼈,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee邮包收据注明收件⼈:通过……转交开证⼈5.parcel post receipt evidencing goods condigned to…and quoting our credit number以……为收货⼈并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries适⽤于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯⾷品证书bined certificate of value and Chinese origin价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice依照1966年新西兰林⽊产品进出⼝法格式5条款的声明或出⼝⼈关于货物⾮⽤⽊器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export⽤出⼝国货币标明本国市场售价,并进⾏笔签的加拿⼤海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed完整签署和填写的格式111加拿⼤进⼝声明书The Stipulation for Shipping Terms1. loading port and destinaltion装运港与⽬的港(1)despatch/shipment from Chinese port to…从中国港⼝发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below列明下⾯的货物按成本加运费价格⽤轮船不得迟于1987年7⽉15⽇从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987提单⽇期不得迟于1987年8⽉15⽇(2)shipment must be effected not later than(or on)July 30,1987货物不得迟于(或于)1987年7⽉30⽇装运(3)shipment latest date… 最迟装运⽇期:……(4)evidencing shipment/despatch on or before…列明货物在…年…⽉…⽇或在该⽇以前装运/发送(5)from China port to … not later than 31st August, 1987不迟于1987年8⽉31⽇从中国港⼝⾄……3.partial shipments and transhipment分运与转运(1)partial shipments are (not) permitted(不)允许分运(2)partial shipments (are) allowed (prohibited)准许(不准)分运(3)without transhipment不允许转运(4)transhipment at Hongkong allowed允许在⾹港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted允许分运/按⽐例装运(7)transhipment are permitted at any port against, through B/lading。

常见外贸英文术语汇总很详细的哦1. Incoterms(国际贸易术语解释):一套国际贸易合同的标准术语,用以确定买卖双方之间的责任和义务,如FOB、CIF等。

2. Letter of Credit(信用证):国际贸易中的一种支付方式,以信用证为基础,由买方银行向卖方银行发出支付指令。

3. Bill of Lading(提单):一种货物交接的证明文件,由船公司或运输公司出具,发给发货人,用于证明货物的数量、品质和交货地点。

5. Proforma Invoice(形式发票):国外买主向卖主查询其中一货物价格时,卖主为了向买主提供表面销售细节的文件。

6. Packing List(装箱单):详细列出货物包装的清单,包括货物名称、数量、重量、体积等信息,用于海关报关和物流操作。

7. Certificate of Origin(原产地证明):证明货物产地的文件,通常由出口国的商会或贸易机构出具,有利于在目的地享受关税优惠。

8. Shipment(装运):指货物从出发地到目的地的运输过程。

9. Customs Clearance(海关清关):将货物合法出入境的手续,包括申报、报关、检验、缴税等。

10. Tariff(关税):对进口或出口货物征收的税款。

11. Export License(出口许可证):一种出口货物的许可证,通常由贸易部门或政府机构颁发。

12. Import License(进口许可证):一种进口货物的许可证,通常由贸易部门或政府机构颁发。

13. Free Trade Agreement(自由贸易协定):两个或以上国家之间达成的协议,旨在减少或取消双边贸易中的关税和非关税壁垒。

14. Trade Barrier(贸易壁垒):阻碍自由贸易发展的政策措施,包括关税、配额、进出口许可证等。

15. Trade Deficit(贸易逆差):指一个国家进口商品大于出口商品的情况。

16. Trade Surplus(贸易顺差):指一个国家出口商品大于进口商品的情况。

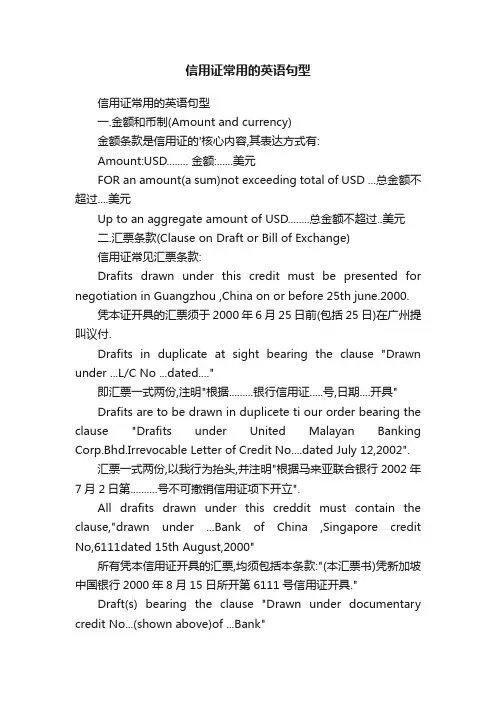

信用证常用的英语句型信用证常用的英语句型一.金额和币制(Amount and currency)金额条款是信用证的'核心内容,其表达方式有:Amount:USD........ 金额:......美元FOR an amount(a sum)not exceeding total of USD ...总金额不超过....美元Up to an aggregate amount of USD........总金额不超过..美元二.汇票条款(Clause on Draft or Bill of Exchange)信用证常见汇票条款:Drafits drawn under this credit must be presented for negotiation in Guangzhou ,China on or before 25th june.2000.凭本证开具的汇票须于2000年6月25日前(包括25日)在广州提叫议付.Drafits in duplicate at sight bearing the clause "Drawn under ...L/C No ...dated...."即汇票一式两份,注明"根据.........银行信用证.....号,日期....开具"Drafits are to be drawn in duplicete ti our order bearing the clause "Drafits under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No....dated July 12,2002".汇票一式两份,以我行为抬头,并注明"根据马来亚联合银行2002年7月2日第..........号不可撤销信用证项下开立".All drafits drawn under this creddit must contain the clause,"drawn under ...Bank of China ,Singapore credit No,6111dated 15th August,2000"所有凭本信用证开具的汇票,均须包括本条款:"(本汇票书)凭新加坡中国银行2000年8月15日所开第6111号信用证开具."Draft(s) bearing the clause "Drawn under documentary credit No...(shown above)of ...Bank"汇票注明根据"根据......银行跟单信用证......号(如上所示)项下开立"Draft(s) drawn under this credit to be marked "Drawn under ...Bank L/C No...Dated(issuing date of credit)..."根据本证开出的汇票须注明"凭......银行....年.....月......日(按开证日期)第......号不可撤消2信用证项下开立".。

外贸用语大全1. FOB(Free On Board):离岸价2. CIF(Cost, Insurance and Freight):成本、保险和运费3. EXW(Ex Works):工厂交货价4. DDP(Delivered Duty Paid):完税价交货5. L/C(Letter of Credit):信用证6. T/T(Telegraphic Transfer):电汇7. MOQ(Minimum Order Quantity):最小起订量8. OEM(Original Equipment Manufacturer):原始设备制造商9. ODM(Original Design Manufacturer):原始设计制造商10. B/L(Bill of Lading):提货单11. DOC(Documents against payment):付款交单12. D/A(Documents against acceptance):承兑交单13. CBM(Cubic Meter):立方米14. ETA(Estimated Time of Arrival):预计到达时间15. FCL(Full Container Load):整柜货运16. LCL(Less than Container Load):拼柜货运17. HS Code(Harmonized System Code):商品编码18. Incoterms(International Commercial Terms):国际贸易术语条款19. NDA(Non-disclosure Agreement):保密协议20. PI(Proforma Invoice):形式发票21. POD(Proof of Delivery):交货证明22. SV(Shipping Volume):装运体积23. MOU(Memorandum of Understanding):谅解备忘录24. AQL(Acceptable Quality Level):可接受质量水平25. GSP(Generalized System of Preferences):普遍优惠制度。

常用外贸英语口语900句外贸英语口语是国际贸易领域中的一项重要能力,熟练的口语能力可以帮助我们与海外客户和合作伙伴更好地进行沟通和合作。

下面是常用的外贸英语口语900句,希望可以帮助各位同学提高口语表达能力。

一、商务信函常用语1. I am writing to inquire about your products.2. Could you please send me your catalog?3. We are interested in establishing business relations with your company.4. I would like to know more details about the terms of payment.5. We are considering placing a trial order for your products.6. We would like to negotiate a discount if we place a larger order.7. Please provide us with a quotation for the following items.8. We are pleased to inform you that your order has been shipped.9. We would like to extend our gratitude for your prompt delivery.10. We look forward to your early reply.二、电话沟通常用语11. Hello, this is [Your Name] speaking. How can I assist you?12. Could you please hold on a moment? I will transfer your call.13. I am sorry, but Mr./Ms. [Name] is currently in a meeting. Can I take a message?14. Can you please spell your name for me?15. I'm sorry, I didn't catch your name. Could you please repeat it?16. May I know the purpose of your call?17. I will check on that and get back to you as soon as possible.18. Thank you for calling. Have a great day!三、洽谈订单常用语19. What is your target price for this product?20. Could you please send us some samples for evaluation?21. We can offer you the best price if you place a bulk order.22. Can you provide us with a product specification sheet?23. We would like to request a small modification in the product design.24. What is the minimum order quantity for this item?25. We are pleased with the quality of your samples.26. Can you guarantee the delivery time?27. We would like to negotiate the terms of payment.28. Could you please provide us with your bank account details for the payment?四、产品质量常用语29. We have strict quality control procedures in place.30. Our products are in compliance with international standards.31. We conduct regular quality inspections to ensure product reliability.32. We offer a warranty period for all our products.33. If there is any quality issue with our products, we will take full responsibility.34. We have received positive feedback from our clients regarding the quality of our products.35. We are confident in the durability and performance of our products.36. Our products have passed various quality certifications.五、支付与运输常用语37. What are your accepted payment methods?38. We prefer payment by letter of credit.39. The payment terms are negotiable.40. We can arrange the shipment by sea, air, or express delivery.41. How long does it take for the goods to reach our destination?42. We will provide you with all the necessary shipping documents.43. The shipping cost will be covered by us.44. We will handle the customs clearance process for you.45. We will notify you once the goods have been shipped.六、客户服务常用语46. How may I assist you today?47. We apologize for any inconvenience caused.48. We appreciate your feedback and will take it into consideration.49. We will follow up on your request promptly.50. Please let us know if there is any further assistance we can provide.51. Your satisfaction is our top priority.52. We strive to provide the best customer service experience.53. We are available 24/7 to address any concerns or inquiries.54. We value your business and look forward to serving you again in the future.综上所述,掌握常用的外贸英语口语对于从事国际贸易的人来说非常重要。

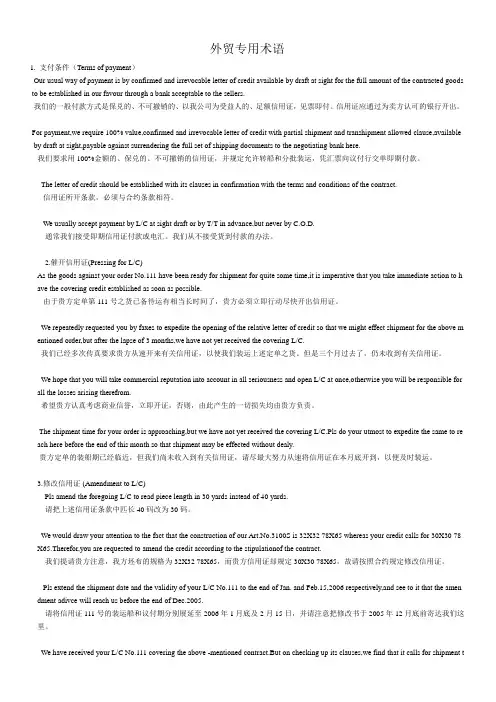

外贸专用术语1. 支付条件(Terms of payment)Our usual way of payment is by confirmed and irrevocable letter of credit available by draft at sight for the full amount of the contracted goods to be established in our favour through a bank acceptable to the sellers.我们的一般付款方式是保兑的、不可撤销的、以我公司为受益人的、足额信用证,见票即付。

信用证应通过为卖方认可的银行开出。

For payment,we require 100% value,confirmed and irrevocable letter of credit with partial shipment and transhipment allowed clause,available by draft at sight,payable against surrendering the full set of shipping documents to the negotiating bank here.我们要求用100%金额的、保兑的、不可撤销的信用证,并规定允许转船和分批装运,凭汇票向议付行交单即期付款。

The letter of credit should be established with its clauses in confirmation with the terms and conditions of the contract.信用证所开条款,必须与合约条款相符。

We usually accept payment by L/C at sight draft or by T/T in advance,but never by C.O.D.通常我们接受即期信用证付款或电汇。

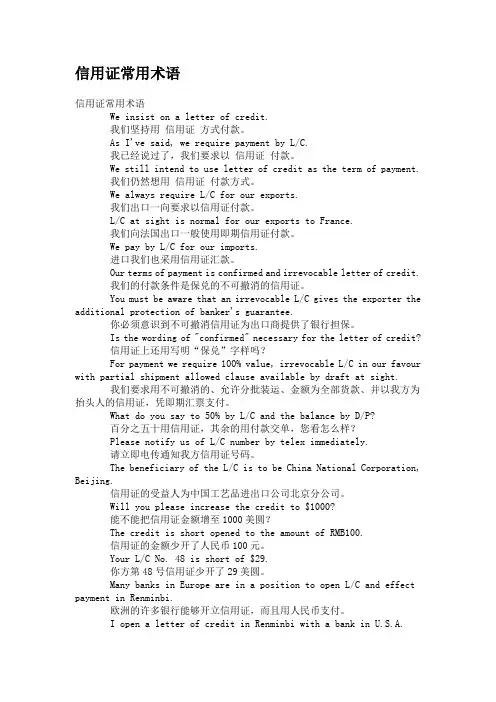

信用证常用术语信用证常用术语We insist on a letter of credit.我们坚持用信用证方式付款。

As I've said, we require payment by L/C.我已经说过了,我们要求以信用证付款。

We still intend to use letter of credit as the term of payment.我们仍然想用信用证付款方式。

We always require L/C for our exports.我们出口一向要求以信用证付款。

L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

We pay by L/C for our imports.进口我们也采用信用证汇款。

Our terms of payment is confirmed and irrevocable letter of credit.我们的付款条件是保兑的不可撤消的信用证。

You must be aware that an irrevocable L/C gives the exporter the additional protection of banker's guarantee.你必须意识到不可撤消信用证为出口商提供了银行担保。

Is the wording of "confirmed" necessary for the letter of credit?信用证上还用写明“保兑”字样吗?For payment we require 100% value, irrevocable L/C in our favour with partial shipment allowed clause available by draft at sight.我们要求用不可撤消的、允许分批装运、金额为全部货款、并以我方为抬头人的信用证,凭即期汇票支付。

英语口语如何提高,语言环境很重要英语口语训练营免费体验:/web/recent_curriculum外贸商务英语口语:信用证支付核心词汇在国际贸易中,双方交接货物后会沟通有关支付的事项,比如采用何种信用证、信用证有效期、受益人为谁、信用证性质等问题,在沟通这些问题的时候,安格英语老师认为大家必须掌握以下这些核心词汇。

manufacturer’s certificate 厂方证明acceptor n.承兑人advice n.通知advise v.通知agricultural produce 农产品amendments to a credit 信用证修改书as regards 关于at … days sight 出票后……天付款back to back L/C 背对背信用证beneficiary n.受益人bill of exchange 汇票call for 要求clean L/C 不跟单信用证commodity n.商品concerned a.有关的confirmed L/C 保兑信用证divisible L/C 可分割信用证documentary L/C 跟单信用证draft n.汇票draw v.出票drawee n.受票人drawer n.出票人effect shipment 装运establish v.开立holder/bearer 持票人in line with 与……相符in one’s favor 以……为受益人irrevocable L/C 不可撤销信用证open v.开立payee n.收款人payer n.付款人presentation n.提交reciprocal L/C 对开信用证revolving L/C 循环信用证sight bill/draft 即期汇票sight L/C 即期信用证specify v.规定standby L/C 备用信用证time draft 远期汇票transferable L/C 可转让信用证valid a.有效的那么,这些词汇要如何灵活地运用在外贸信用证支付邮件中呢?安格英语给出了三则范例。

信用证LC用语大全信用证(L/C)用语大全——Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating证明evidencing列明specifying说明indicating表明declaration of声明2.certificate of Chinese origin中国产地证明书3.Certificate of origin shipment of goods of… origin prohibited产地证,不允许装运……的产品4.declaration of origin产地证明书(产地生明)5.certificate of origin separated单独出具的产地证6.certificate of origin“form A”“格式A”产地证明书7.genetalised system of preference certificate of origin form“A”普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list重量单5.weight notes磅码单(重量单)6.detailed weight list明细重量单Other Documents1. full tet of forwarding agents' cargo receipt全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number以……为收货人,注明本证号码的空运货单3.parcel post receipt邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate纯食品证书bined certificaate of value and Chinese origin价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed完整签署和填写的格式111加拿大进口声明书The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance withthe terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified(if drawn and negotiated with in the validity date of this credit)凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms ofthis credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon(本证)无需你行保兑(4)documents must be sent by consecutive airmails单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate bysubsequent airmail单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive(or succeeding) airmails单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot用英文缮制的所有单据须一次寄交我行2.method of reimbursement索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that allterms of this letter of credit have been complied with偿付办法,由你行开出英镑即期汇票向……银行支龋在寄送汇票给我伦敦办事处时,应随附你行的证明,声明本证的全部条款已经履行(3)available by your draft at sight payable by us in London on the basis to sight draft on New York凭你行开具之即期汇票向我行在伦敦的机构索回票款,票款在纽约即期兑付(4)in reimbursement, please claim from our RMB¥account held with your banking department Bank of China Head Office Beijing with the amount of your negotiation 偿付办法,请在北京总行我人民币帐户中索回你行议付之款项(5)upon presentation of the documents to us, we shall authorize your head office backing department by airmail to debit the proceeds to our foreign business department account一俟向我行提交单证,我行将用航邮授权你总行借记我行国外营业部帐户(6)after negotiation, you may reimburse yourselves by debiting our RMB¥account with you, please forward all relative documents in one lot to us by airmail议付后请借记我行在你行开立的人民币帐户,并将全部有关单据用航邮一次寄给我行(7)all bank charges outside U.K. are for our principals account, but must claimed at the time of presentation of documents在英国境外发生的所有银行费用,应由开证人负担,但须在提交单据是索取(8)negotiating bank may claim reimbursement by T.T. on the…bank certifying that the credit terms have been complied with议付行须证明本证条款已旅行,并按电汇条款向……银行索回货款(9)negotiating bank are authorized to reimburse themselves to amount of theirnegotiation by redrawing by airmail at sight on…bank attaching to the reimbursement draft their certificate stating that all terms of the credit have been complied with and that the original and duplicate drafts and documents have been forwarded to us by consecutive airmail议付行用航邮向……银行重开一份即期汇票索取议付条款。

信用证必备英语在外贸业务中,从报价到支付条件,再到催开信用证,再到后来的单据结汇,涉及到很多专业术语,小编为大家搜罗了一些关于信用证的英语,希望外贸人士能用得上。

1. 支付条件(Terms of payment)(1) Our usual method of payment is by confirmed and irrevocable letter of credit available by draft at sight for the full amount of the contracted goods to be established in our favor through a bank acceptable to the sellers.我们的一般付款方式是保兑的、不可撤销的、以我公司为受益人的、足额信用证,见票即付。

信用证应通过为卖方认可的银行开出。

(2) For payment, we require a 100% value, confirmed and irrevocable letter of credit with partial shipment and transshipment allowed clause, available by draft at sight, payable against surrendering the full set of shipping documents to the negotiating bank here.我们要求用100%金额的、保兑的、不可撤销的信用证,并规定允许转船和分批装运,凭汇票向议付行交单即期付款。

(3) The letter of credit should be established with its clauses in confirmation with the terms and conditions of the contract.信用证所开条款,必须与合约条款相符。

信用证中常用词语英语表述从形式上来看,信用证只是一封普通的商业信函。

它的格式和内容多种多样,不同的国家、不同的银行开立的信用证各有不同。

但是其中的内容基本相同,一般可分为十大部分。

(一)、各方当事人在信用证中的表述文句(THE PARTIES CONCERNING TO THE CREDIT)⑴开证人(The Applicant for the credit)在国际贸易中,信用证的开立是由进口商向银行申请办理的。

所以开证人指的就是进口商。

信用证中用的词汇和词组常常是这样的:Applicant/Principal/Accountee/ Accreditor / OpenerAt the request of………应。

的请求By order of…………按。

的指示For account of………由。

付款At the request of and for……。

应。

的请求Account of ……。

并由。

付款By order of and for account of ………。

按。

的指示并由。

付款⑵受益人(The beneficiary)在国际贸易中,受益人一般就是出口商。

信用证中常见的词汇或词组有:Beneficiary 受益人In favour of ……。

以。

为受益人In your favour……。

以你方为受益人Transferor………转让人(可转让信用证的第一受益人)Transferee………。

受让人(可转让信用证的第二受益人)⑶开证行(The Opening Bank)应开证人要求开立信用证的银行叫开证行。

在信用证中常见的词汇和词组有:Opening BankIssuing BankEstablishing Bank①通知行(Advising Bank)开证行将信用证寄送的一家受益人所在地的银行,并通过该银行通知受益人信用证开出,这家银行就是通知行。

在信用证中常见的词汇和词组有:Advising BankNotifying BankAdvised through②议付行(The Negotiation bank)议付行就是购买出口商的汇票及审核信用证项下规定单据的银行。

常用的信用证英语口语常用的信用证英语口语从事外贸的人,对于信用证都不陌生。

信用证是一种银行开立的.有条件的承诺付款的书面文件。

今天,我们来学一些可能会用到的信用证英语口语吧。

We insist on a letter of credit.我们坚持用信用证方式付款。

As I've said, we require payment by L/C.我已经说过了,我们要求以信用证付款。

We still intend to use letter of credit as the term of payment.我们仍然想用信用证付款方式。

We always require L/C for our exports.我们出口一向要求以信用证付款。

L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

We pay by L/C for our imports.进口我们也采用信用证汇款。

Our terms of payment is confirmed and irrevocable letter of credit.我们的付款条件是保兑的不可撤消的信用证。

You must be aware that an irrevocable L/C gives the exporter the additional protection of banker's guarantee.你必须意识到不可撤消信用证为出口商提供了银行担保。

Is the wording of "confirmed" necessary for the letter of credit?信用证上还用写明“保兑”字样吗?For payment we require 100% value, irrevocable L/C in our favour with partial shipment allowed clause available by draft at sight.我们要求用不可撤消的、允许分批装运、金额为全部货款、并以我方为抬头人的信用证,凭即期汇票支付。

常见的外贸术语

1.FOB(FreeonBoard):离岸价,指卖方将货物放到船上的货物运费和费用都由买方负责。

2. CIF (Cost, Insurance and Freight):成本加保险加运费价,指卖方负责将货物运到目的港口,并承担保险费用。

3. L/C (Letter of Credit):信用证,是银行为客户开出的一种保证付款的凭证,确保卖方能够按照合同要求获得付款。

4. T/T (Telegraphic Transfer):电汇,是一种快速、安全的跨境货款支付方式,通过银行将货款直接转账给卖方。

5. B/L (Bill of Lading):提单,是货物运输过程中发货人与承运人之间的一份合同,记录了货物的数量、品质、运输方式、起止港口等重要信息。

6. Incoterms (International Commercial Terms):国际贸易术语,规定了买卖双方在国际贸易中的责任和义务,包括货物的交付、支付方式、运输费用、保险等。

7. MOQ (Minimum Order Quantity):最小订单量,指卖方在出售产品时要求买方最少购买的数量。

8. OEM (Original Equipment Manufacturer):原始设备制造商,指生产商设计和制造出口产品的制造商。

9. QC (Quality Control):质量控制,指对产品进行全面的质量检查和测试,以确保产品符合规格和要求。

10. ETA (Estimated Time of Arrival):预计到达时间,指货

物预计到达目的港口的时间。

信用证LC用语大全信用证(L/C)用语大全——Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating证明evidencing列明specifying说明indicating表明declaration of声明2.certificate of Chinese origin中国产地证明书3.Certificate of origin shipment of goods of… origin prohibited产地证,不允许装运……的产品4.declaration of origin产地证明书(产地生明)5.certificate of origin separated单独出具的产地证6.certificate of origin“form A”“格式A”产地证明书7.genetalised system of preference certificate of origin form“A”普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list重量单5.weight notes磅码单(重量单)6.detailed weight list明细重量单Other Documents1. full tet of forwarding agents' cargo receipt全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number以……为收货人,注明本证号码的空运货单3.parcel post receipt邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate纯食品证书bined certificaate of value and Chinese origin价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed完整签署和填写的格式111加拿大进口声明书The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance withthe terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified(if drawn and negotiated with in the validity date of this credit)凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms ofthis credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon(本证)无需你行保兑(4)documents must be sent by consecutive airmails单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate bysubsequent airmail单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive(or succeeding) airmails单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot用英文缮制的所有单据须一次寄交我行2.method of reimbursement索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that allterms of this letter of credit have been complied with偿付办法,由你行开出英镑即期汇票向……银行支龋在寄送汇票给我伦敦办事处时,应随附你行的证明,声明本证的全部条款已经履行(3)available by your draft at sight payable by us in London on the basis to sight draft on New York凭你行开具之即期汇票向我行在伦敦的机构索回票款,票款在纽约即期兑付(4)in reimbursement, please claim from our RMB¥account held with your banking department Bank of China Head Office Beijing with the amount of your negotiation 偿付办法,请在北京总行我人民币帐户中索回你行议付之款项(5)upon presentation of the documents to us, we shall authorize your head office backing department by airmail to debit the proceeds to our foreign business department account一俟向我行提交单证,我行将用航邮授权你总行借记我行国外营业部帐户(6)after negotiation, you may reimburse yourselves by debiting our RMB¥account with you, please forward all relative documents in one lot to us by airmail议付后请借记我行在你行开立的人民币帐户,并将全部有关单据用航邮一次寄给我行(7)all bank charges outside U.K. are for our principals account, but must claimed at the time of presentation of documents在英国境外发生的所有银行费用,应由开证人负担,但须在提交单据是索取(8)negotiating bank may claim reimbursement by T.T. on the…bank certifying that the credit terms have been complied with议付行须证明本证条款已旅行,并按电汇条款向……银行索回货款(9)negotiating bank are authorized to reimburse themselves to amount of theirnegotiation by redrawing by airmail at sight on…bank attaching to the reimbursement draft their certificate stating that all terms of the credit have been complied with and that the original and duplicate drafts and documents have been forwarded to us by consecutive airmail议付行用航邮向……银行重开一份即期汇票索取议付条款。

外贸英语口语:外贸信用证用语大全(一)信用证种类——Kinds of L/C1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称——Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit numberand the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s)to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s)drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s)so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s)bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”Invoice 1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of)the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据8.combined invoice is not acceptable 不接受联合发票Bill of Loading——提单 1. full set shipping(company's)clean on board bill(s)of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee)洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean “on board”bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked “Freight prepaid” / “Freight Payable at Destination”全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本英语口语培训/。