中行基本介绍中英文版本

- 格式:doc

- 大小:23.50 KB

- 文档页数:2

大家好,很高兴由我来为大家介绍中国银行。

中国银行,全称中国银行股份有限公司,是中国大型国有控股商业银行之一。

中国银行的业务范围涵盖商业银行、投资银行和保险领域,旗下有中银香港、中银国际、中银保险等控股金融机构,在全球范围内为个人和公司客户提供全面和优质的金融服务。

中行的国际结算业务做的是比较好的,在国外一般都能看到中国银行,在国际上的知名度是很高的,一般的老外如果要和中国办理业务,都会选择中行。

如果进入中行工作,第一步我会先从柜员做起,脚踏实地从最底层做起,慢慢进入这个行业,同时,着重加强自己的工作态度,对人和善,培养更多客户。

争取在二年内做到客户经理职位。

我也会向其他同事学习,取长补短,相互交流好的工作经验,共同进步。

争取取得更好的工作成绩。

谢谢,我的演讲完了。

Ladies and Gentlemen, Today I’m so glad to introduce Bank of China to you. Bank of China Limited is one of large state-owned commercial banks in China. Its scope of business includes commercial bank, investment bank and insurance field. It contains some holding financial institutions such as Bank of China Hong Kong, Bank of China International, and Bank of China insurance and so on. It can provide comprehensive and high-quality financial service for individual and company throughout the world. International settlement business of BOC (Bank of China) is relatively excellent. You can always see BOC in foreign countries; it’s famous in the world. Generally, most foreigners will choose the BOC when they do business with Chinese.If I can work in this bank, I will be down-to-earth and start to work from the bottom as a teller. Then, I will get a better understanding of this work gradually. At the same time, I will strengthen my working attitude, and be polite to clients as wellas colleagues to perform better and better. If possible, I will try my best to be a customer manager in two years. Certainly, I will learn from others’ strong points to make up my weakness.I believe modest y makes people move forward. That’s all. Thanks for your attention.顾客Ladies and Gentlemen, Today I’m so glad to introduce Bank of China to you. Bank of China Limited is one of large state-owned commercial banks in China.International settlement business of BOC (Bank of China) is relatively excellent. You can always see BOC in foreign countries; it’s famous in the world. Generally, most foreigners will choose the BOC when they do business with Chinese.If I can work in this bank, I will be down-to-earth and start to work from the bottom as a teller.If possible, I will try my best to be a customer manager in two years. Certainly, I will learn from others’ strong points to make up my weakness. I believe modesty makes people move forward. That’s all. Thanks for your attention.maximum。

中行简介中国银行,全称中国银行股份有限公司。

中国银行业务覆盖传统商业银行、投资银行和保险业务领域,并在全球范围内为个人客户和公司客户提供全面和优质的金融服务。

在近百年的岁月里,中国银行以其稳健的经营、雄厚的实力、成熟的产品和丰富的经验深得广大客户信赖,打造了卓越的品牌,与客户建立了长期稳固的合作关系。

中国银行主营商业银行业务,包括公司、零售和金融机构等业务。

公司业务在基于银行的核心信贷产品之上,致力于为客户提供个性化、创新的金融服务。

零售业务主要针对个人客户的金融需求,提供基于银行卡之上的全套服务。

而金融机构业务则是为全球其他银行,证券公司和保险公司提供诸如国际汇兑、资金清算、同业拆借和托管等全面服务。

在多年的发展历程中,中国银行曾创造了中国银行业的许多第一,所创新和研发的一系列金融产品与服务均开创历史之先河,在业界独领风骚,享有盛誉。

目前在外汇存贷款、国际结算、外汇资金和贸易融资等领域仍居领先地位。

根据2003年英国《银行家》按核心资本排名,中国银行列全球第十五位,居中国银行业首位,是中国资本最为雄厚的银行。

以资产规模计,中国银行资产总额达38,442亿人民币,是中国第二大商业银行。

中国银行网络机构覆盖全球27个国家和地区,其中境内机构共计11,609个,境外机构共计549个,是目前我国国际化程度最高的商业银行。

中国银行有近百年辉煌而悠久的历史,在中国金融史上扮演了十分重要的角色。

中国银行于1912年由孙中山先生批准成立,至1949年中华人民共和国成立的37年间,中国银行先后是当时的国家中央银行、国际汇兑银行和外贸专业银行。

中国银行以诚信为本,以振兴民族金融业为己任,在艰难和战乱的环境中拓展市场,稳健经营,锐意改革,表现出了顽强的创业精神,银行业务和经营业绩长期处于同业领先地位,并将分支机构一直拓展到海外,在中国近现代银行史上留下了光辉的篇章。

1949年,中国银行成为国家指定的外汇外贸专业银行,为国家经济建设和社会发展作出了巨大贡献。

中国银行简介中国银行,全称中国银行股份有限公司(简称BOC),是五大国有商业银行之一,也是中国国际化和多元化程度最高的银行,其业务范围涵盖商业银行、投资银行、保险和航空租赁,旗下有中银香港、中银国际、中银保险等控股金融机构,在全球范围内为个人和公司客户提供全面的金融服务。

在一百多年的发展历程中,中国银行始终秉承追求卓越的精神,将爱国爱民作为办行之魂,将诚信至上作为立行之本,将改革创新作为强行之路,将以人为本作为兴行之基,树立了卓越的品牌形象。

2013年,中国银行在英国《银行家》(The Banker)杂志公布的“全球1000家大银行”中排名第9位。

2014年,中国银行再次入选全球系统重要性银行,成为新兴市场经济体中唯一连续4年入选的金融机构。

Bank of China, the full name of the Bank of China Co., Ltd. (BOC) is one of the five big state-owned commercial banks, is the degree of internationalization and diversification of China's top banks, its business scope covers commercial banks, investment bank, insurance and aviation leasing, its have BOC Hong Hong, BOCI, the Bank of China Insurance holding financial institutions, in the global scope to individual and corporate customers provide a comprehensive range of financial services.In more than one hundred years of development history, Bank of China has always been adhering to the pursuit of excellence, the patriotic as do the soul, the supremacy of credibility as the foundation of this, the reform and innovation as a way of force, the people-oriented as Xing based, and establish a superior brand image. 2013, Bank of China in the British "banker" (Banker The) magazine published "the world's 1000 big banks" in the ninth place. In 2014, the Bank of China was once again elected to the global system of importance, becoming the only financial institution in emerging market economies for the 4 consecutive year.。

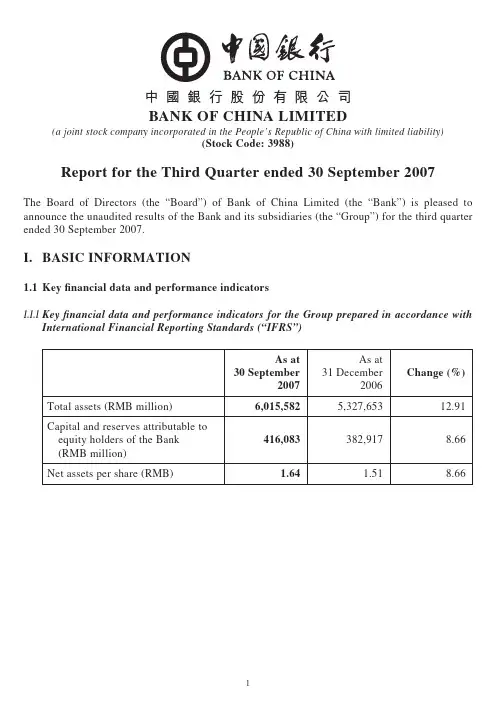

BANK OF CHINA LIMITED(a joint stock company incorporated in the People’s Republic of China with limited liability)(Stock Code: 3988)Report for the Third Quarter ended 30 September 2007The Board of Directors (the “Board”) of Bank of China Limited (the “Bank”) is pleased to announce the unaudited results of the Bank and its subsidiaries (the “Group”) for the third quarter ended 30 September 2007.I. BASIC IN FORMATION1.1 Key fi nancial data and performance indicators1.1.1 Key fi nancial data and performance indicators for the Group prepared in accordance withInternational Financial Reporting Standards (“IFRS”)As at 30 September2007As at31 December2006Change (%)Total assets (RMB million)6,015,5825,327,65312.91 Capital and reserves attributable toequity holders of the Bank(RMB million)416,083382,9178.66 Net assets per share (RMB) 1.64 1.518.66Nine-month period ended 30 September2007Nine-monthperiod ended30 September2006Change (%)Net cash outfl ow from operatingactivities (RMB million)(11,004)(88,463)-87.56Net cash outfl ow from operatingactivities per share* (RMB)(0.04)(0.35)-87.56 Profi t after tax (RMB million)49,71336,38136.65 Profi t after tax attributable to equityholders of the Bank (RMB million)45,47432,45840.10Earnings per share for profi tattributable to equity holders ofthe Bank (basic and diluted, RMB)0.180.1428.57Return on average equity (annualized)15.18%14.44%0.74percentagepointNote:N et cash outfl ow from operating activities per share is calculated based on the Bank’s total number of ordinary shares outstanding at the end of reporting period.On 16 March 2007, the National People’s Congress approved the new PRC Enterprise Income Tax Law. This legislation will reduce the enterprise income tax rate for domestic enterprises from 33% to 25% with effect from 2008. I n accordance with I nternational Accounting Standards (No. 12), the Group re-measured its net deferred tax assets of the domestic operations as at the date of pronouncement of the new I ncome Tax Law to refl ect future realisation at the newly enacted tax rate and thereby increased the tax expenses. Excluding such impact, the profi t after tax attributable to equity holders of the Bank from January to September 2007 would have increased 52.97% compared with the same period of 2006.1.1.2 Reconciliation between IFRS and CAS fi nancial informationThe reconciliations of profit after tax attributable to equity holders of the Bank for the nine-month periods ended 30 September 2006 and 2007 and consolidated equity as at30 September 2007 and 31 December 2006 prepared under I FRS to those under ChineseAccounting Standards (“CAS”) are set forth below. The financial information as at 31 December 2006 and for the nine-month period ended 30 September 2006 has been restated in accordance with CAS issued by the Ministry of Finance in February 2006 which was effective 1 January 2007.Unit: RMB millionEquity (including minority interest)Profi t after tax attributable to equity holders of the BankAs at 30 September2007As at 31December2006Nine-monthperiodended 30September2007Nine-monthperiodended 30September2006CAS fi gures450,393417,32545,74432,294 Adjustments for differencesin accounting standards:Reversal of assetr evaluation surplus,correspondingdepreciation and otheritems(6,165)(6,521)356245Deferred tax impact1,5412,152(626)(81) Sub-total(4,624)(4,369)(270)164 IFRS fi gures445,769412,95645,47432,458 1.2 Number of shareholders and top ten shareholders1.2.1As at 30 September 2007, the Bank’s total number of shareholders was 1,276,094,comprising 298,456 H-Share holders and 977,638 A-Share holders.1.2.2 Top ten A-Share holders not subject to selling restrictions as at 30 September 2007Unit: share of shareholderNumber of shares not subject to sellingrestrictions1Nuoan Stock Securities Investment Fund 122,350,0002Boshi Value Growth Securities Investment Fund 59,999,9493 E Fund 50 Index Securities Investment Fund 40,000,0004Boshi Yufu Securities Investment Fund37,784,0575Morgan Stanley Investment Management — Morgan Stanley China A Share Fund29,732,0006NCI — Profi t sharing — Personal profi t sharing — 018L — FH002 SH 27,905,1807SSE-50 Trading Open-end Index Securities Investment Fund 24,371,5758China Life Insurance Company Limited — Traditional — Ordinary insurance products — 005L — CT001 SH 16,778,1009Everbright Pramerica Advantage Allocation Stock Securities Investment Fund 16,489,94710Everbright Securities Co., Ltd16,000,500Note: S ome of the above shareholders are managed by the same legal entity. Save for that, the Bank is not aware of any connected relations and concerted action among the above-mentioned shareholders.1.2.3 Top ten H-Share holders as at 30 September 2007Unit: share of shareholder Number of shares held 1HKSCC Nominees Limited 30,724,926,1222RBS China Investments S.à.r.l.20,942,736,2363Fullerton Financial Holdings Pte. Ltd10,471,368,1184National Council for Social Security Fund, PRC 8,377,341,3295UBS AG3,377,860,6846Asian Development Bank506,679,1027The Bank of Tokyo-Mitsubishi UFJ Ltd 473,052,0008Wingreat International Limited 420,490,0009Turbo Top Limited46,526,00010Best Sense Investments Limited36,526,000Note: T he number of shares held by H-Share holders was recorded in the Register of Members maintained by theH-Share Registrar of the Bank as at 30 September 2007.II. SIGNIFICANT EVENTS2.1 Signifi cant changes in major fi nancial statement items and indicators and the reasonsthereof✔ Applicable ❏ Not ApplicableThe Group’s key fi nancial items and indicators which fl uctuated over 30% compared with those as at the end of 2006, or compared with those for the nine-month period ended 30 September 2006 are as follows:Unit: RMB millionItemsAs at 30September2007As at 31December2006Change (%)Main reasonsCash and due from banks 63,13139,81258.57Increase in depositswith fi nancialinstitutions.Derivativefi nancial instruments 35,15624,83741.55Increase in derivativetransactions.Other assets92,19653,57072.10Mainly due to increase in items in the process of clearance and settlement.Due to banks ando ther fi nancial institutions 359,091178,777100.86Increase in depositsfrom fi nancialinstitutions.Certifi cates of d eposit andplacements from banks and other fi nancial institutions 312,562146,908112.76Increase in interbankplacements fromfi nancial institutions.Undistributed profi ts 73,04638,42590.10Mainly due to theprofi t for the reportingperiod.Currencyt ranslation differences (4,301)(2,071)107.68Mainly due tofl uctuation of exchangerate during thereporting period.ItemsAs at 30September2007As at 31December2006Change (%)Main reasonsTreasury shares(12)(216)-94.44A wholly owned subsidiary of the Group held certain listed shares of the Bank in relation to its derivative and arbitrage business. The total number of treasury shares held by the subsidiary as at 30 September 2007 has decreased as compared with that as at the end of 2006.Unit: RMB millionItemsNine-monthperiod ended30 September2007Nine-monthperiod ended30 September2006Change (%)Main reasonsNet fee andc ommission income 18,92310,07287.88Due to the continuedgrowth of fee-basedbusinesses, includingagency business, etc.Net trading losses(1,455)(572)154.37Increase in costs related to foreign currency derivatives in support of the Bank’s increased foreign currency activities.Net (losses)/gainso n investment securities (2,328)1,258-285.06Due to impairmentlosses for investmentsecurities. Pleaserefer to “2.5 Othersignifi cant events”of this report foradditional information.Operating profi t74,97654,72537.01Increase in net interest income and non-interest income.ItemsNine-monthperiod ended30 September2007Nine-monthperiod ended30 September2006Change (%)Main reasonsShare of results ofa ssociates and joint ventures 866410111.22Increase in profi ts ofassociates.Profi t before income tax 75,84255,13537.56Due to theabove-mentionedfactors.Income tax expense(26,129)(18,754)39.32Due to re-measurement of net deferred tax assets and the increase of operating profi t for the period.Profi t after tax49,71336,38136.65Due to the above-mentioned factors.Profi t after taxa ttributable to equity holders of the Bank 45,47432,45840.10Due to theabove-mentionedfactors.2.2 Development of signifi cant events, related impact and resolution❏ Applicable ✔ Not Applicable2.3 Fulfi llment of undertakings by the company, shareholders and controlling parties✔ Applicable ❏ Not ApplicableBased on the best knowledge of the Bank, undertakings by the Bank, its shareholders and controlling parties were fulfi lled during the reporting period.2.4 Warnings and explanations of any forecasted losses or signifi cant changes to retainedearnings brought from the beginning of the fi nancial year to the end of next reporting period❏ Applicable ✔ Not Applicable2.5 Other signifi cant events2.5.1 Stocks of other listed companies held by the Group✔ Applicable ❏ Not ApplicableStocks of other listed companies held by the Group’s subsidiaries BOCHK Group, BOCI, BOCG Insurance and BOCG Investment during their regular business operation.No.Stock code Company nameStock held(unit: share)Proportion ofthe total shareInitialinvestment cost(unit: RMB)Accountingclassifi cation1000002 CH CHINA VANKE86,936,265 1.44%991,477,767Held for trading21088 HK CHINA SHENHUA76,588,281 2.25%581,555,917Held for trading and Available-for-sale securities38002 HK PHOENIX TV412,000,0008.33%377,396,411Available-for-sale securities40005 HK HSBC HOLDINGS2,267,6860.01%293,327,176Held for trading5000527 CH GUANGDONGMIDEA ELECTRICAPPLIANCES12,370,5960.98%286,329,633Held for trading61398 HK ICBC93,712,0000.11%282,379,769Held for trading and Available-for-sale securities7600823 CH SHANGHAISHIMAO8,135,978 1.70%217,864,848Held for trading80386 HK SINOPEC CORP28,370,4200.17%168,699,607Held for trading and Available-for-sale securities9600663 CH SHANGHAILUJIAZUIFINANCE &TRADE ZONEDEVELOPMENT6,515,1140.48%161,673,338Held for trading102006 HK JINJIANG HOTELS70,780,000 5.09%152,301,171Available-for-sale securitiesTotal3,513,005,637 Note:I nformation in the above table details the Group’s holding of stocks of other listed companies in respect of long-term equity investments, fi nancial assets available-for-sale and fi nancial assets held for trading. The top 10 stocks held by the Group are presented in the above table in descending order based on the size of initial investment cost.2.5.2 Equity investments in unlisted fi nancial institutions and companies with future intention toobtain listing held by the Group✔ Applicable ❏ Not ApplicableCompany nameInitialinvestmentcost(unit: RMB)Number ofshares held(unit: share)%equityheldCarrying valueat period end(unit: RMB)Dongfeng Peugeot CitroenAuto Finance Co., Ltd232,619,036 —50.0%250,933,564 China UnionPay Co., Ltd90,000,000 90,000,000 5.452%225,000,000JCC Financial Co., Ltd56,475,507 —20.0%62,197,599Hunan Hualing FinancialCo., Ltd28,148,117 —10.0%29,295,885CJM Insurance Brokers Ltd 726,225 2,000,00033.3%4,463,516Debt Management Company Ltd 16,074 1,66016.7%16,074Total407,984,959 571,906,638 Notes:1. Financial institutions include commercial banks, securities fi rms, insurance companies, trust companies and futurescompanies.2. The carrying value is stated after the deduction of impairment loss.3. The information stated in the above table is based on the consolidated fi nancial statements.4. Only holdings of 5% or more are listed.2.5.3Changes of shareholders holding shares of more than 5% and changes or estimatedchanges of shareholding of the actual controller of the company or its controlling situation.✔ Applicable ❏ Not ApplicablePlease refer to the announcement on Matters related to the Establishment of China InvestmentCorporation published on 9 October 2007 by the Bank.2.5.4 The statement on Subprime ABS and Subprime CDOs held by the GroupThe Group’s foreign currency denominated investment portfolio includes asset-backed securities and collateralized debt obligations supported by US subprime mortgages (Subprime ABS and Subprime CDOs). The Group has conducted assessment on these securities based on the changes in market condition of US subprime mortgages since the half-year end of 2007. According to the relevant accounting standards, the Group decided to charge additional impairment allowance of USD135 million and USD187 million against these Subprime ABS and Subprime CDOs respectively. The aggregated amounts of these allowances were USD186 million (equivalent to RMB1.395 billion) and USD287 million (equivalent to RMB2.152 billion) respectively as at 30 September 2007. The Group has also made reserve of USD321 million (equivalent to RMB2.414 billion) directly in the “Reserve for fair value changes of available-for-sale securities” under the equity, refl ecting the depreciation of the fair value of the related Subprime securities.As at 30 September 2007, the carrying value of the investment in Subprime ABS and Subprime CDOs stood at USD7,451 million (equivalent to RMB55.960 billion) and USD496 million (equivalent to RMB3.727 billion), representing 2.86% and 0.19% of the Group’s total investment securities respectively.Considering the inherent uncertainties of the US subprime mortgages market, the Group will closely monitor the future developments of the market.Board of Directors of Bank of China Limited30 October 2007IV.APPENDIX — FINANCIAL STATEMENTS (PREPARED IN ACCORDANCE WITH IFRS)Consolidated Income StatementsUnit: RMB millionThree-month period ended 30 September 2007Three-monthperiod ended 30September 2006Nine-monthperiod ended 30September 2007Nine-monthperiod ended 30September 2006(unaudited)(unaudited)(unaudited)(unaudited) Interest income67,84456,682190,347156,806 Interest expense(28,298)(24,228)(79,774)(69,529) Net interest income39,54632,454110,57387,277 Fee and commission income8,2143,85321,60212,019 Fee and commission expense(1,055)(622)(2,679)(1,947) Net fee and commission income7,1593,23118,92310,072 Net trading losses(203)(1,129)(1,455)(572) Net (losses)/gains on investmentsecurities(2,157)1,194(2,328)1,258 Other operating income 4,3152,15511,5789,373 Impairment losses on loans andadvances(1,925)(2,117)(7,169)(7,596) Operating expenses (22,074)(15,401)(55,146)(45,087) Operating profi t24,66120,38774,97654,725 Share of results of associates andjoint ventures26139866410 Profi t before income tax24,92220,42675,84255,135 Income tax expense(7,591)(6,296)(26,129)(18,754) Profi t for the period17,33114,13049,71336,381Attributable to:Equity holders of the Bank15,93112,98145,47432,458 Minority interest1,4001,1494,2393,92317,33114,13049,71336,381Earnings per share for profi ta ttributable to equity holdersof the Bank during the period(RMB per ordinary share)— Basic and diluted0.060.050.180.14Consolidated Balance SheetsUnit: RMB millionAs at 30 September 2007As at 31 December 2006(unaudited)(audited) ASSETSCash and due from banks63,13139,812 Balances with central banks474,044379,631 Placements with banks and other fi nancialinstitutions459,228399,138 Government certifi cates of indebtedness forbank notes issued34,83036,626 Precious metals39,25442,083 Trading assets and other fi nancial instrumentsat fair value through profi t or loss150,186115,828 Derivative fi nancial instruments35,15624,837 Loans and advances to customers, net2,741,7432,337,726 Investment securities— available-for-sale810,207815,178 — held-to-maturity522,678461,140— loans and receivables474,144500,336 Investment in associates and joint ventures6,7065,931 Property and equipment83,31786,200 Investment property9,3028,221 Deferred income tax assets19,46021,396 Other assets92,19653,570 Total assets6,015,5825,327,653As at 30 September 2007As at 31 December 2006(unaudited)(audited) LIABILITIESDue to banks and other fi nancial institutions359,091178,777 Due to central banks54,02942,374 Bank notes in circulation34,87136,823 Certifi cates of deposits and placements frombanks and other fi nancial institutions312,562146,908 Derivative fi nancial instruments and liabilitiesat fair value through profi t or loss118,277113,048 Due to customers4,349,2324,091,118 Bonds issued 63,55660,173 Other borrowings54,22663,398 Current tax liabilities23,07818,149 Retirement benefi t obligations6,7997,444 Deferred income tax liabilities2,9893,029 Other liabilities191,103153,456 Total liabilities5,569,8134,914,697As at 30 September 2007As at 31 December 2006(unaudited)(audited) EQUITYCapital and reserves attributable to equityholders of the BankShare capital253,839253,839 Capital reserve66,58266,617 Statutory reserves10,80310,380 General and regulatory reserves14,31713,934 Undistributed profi ts 73,04638,425 Reserve for fair value changes of available-for-sale securities1,8092,009 Currency translation differences(4,301)(2,071) Treasury shares(12)(216)416,083382,917 Minority interest29,68630,039 Total equity445,769412,956 Total equity and liabilities 6,015,5825,327,653Xiao Gang Li LihuiDirector DirectorConsolidated Cash fl ow StatementsUnit: RMB millionNine-month period ended 30 September2007Nine-month period ended 30 September2006(unaudited)(unaudited) Cash fl ows from operating activitiesProfi t before income tax75,84255,135 Adjustments:Impairment losses on loans and advances7,1697,596 Impairment losses/(write back) on investment securities andother assets3,702(6) Depreciation of property and equipment4,0723,888 Amortization of intangible assets and other assets925525 Net gains on disposal of property and equipment and otherlong-term assets(106)(238) Net gains on disposal of investments in subsidiaries,associates and joint ventures(37)(907) Share of results of associates and joint ventures(866)(410) Interest expense arising from bonds issued2,1852,105 Net changes in operating assets and liabilities:Net increase in balances with central banks(129,813)(58,503) Net (increase)/decrease in due from banks andplacements with banks and other fi nancialinstitutions(89,602)13,159 Net increase in loans and advances to customers(411,186)(206,428) Net increase in investment securities(66,845)(235,580) Net decrease/(increase) in precious metals2,873(14,490) Net increase in other assets(26,633)(16,518) Net increase in due to central banks11,65511,657 Net increase in due to banks and other fi nancialinstitutions180,31453,720 Net increase/(decrease) in certifi cates of deposits andplacements from banks and other fi nancialinstitutions165,654(44,232) Net increase in due to customers258,114347,253 Net decrease in other borrowings(9,172)(4,403) Net increase in other liabilities28,82721,408 Net cash infl ow/(outfl ow) from operating activities7,072(65,269) Income tax paid(18,076)(23,194) Net cash outfl ow from operating activities(11,004)(88,463)Consolidated Cash fl ow Statements (continued)Unit: RMB millionNine-month period ended 30 September2007Nine-month period ended 30 September2006(unaudited)(unaudited) Cash fl ows from investing activitiesProceeds from disposal of property and equipment, intangibleassets and other long-term assets3,2431,165 Proceeds from disposal of investments in subsidiaries, associatesand joint ventures651,211 Dividends received265160 Purchase of property and equipment, intangible assets and otherlong-term assets(6,728)(3,205) Payment for increase of investments in subsidiaries, associatesand joint ventures(105)(84) Net cash outfl ow from investing activities(3,260)(753) Net cash outfl ow before fi nancing activities(14,264)(89,216)Cash fl ows from fi nancing activitiesProceeds from issuance of ordinary shares—117,423 Cash received from issuance of bonds3,389—Proceeds from minority equity holders of subsidiaries2718 Proceeds from sales of treasury shares204—Payment of interest on bonds issued(2,177)(2,154) Dividends paid to equity holders of the Bank(10,154)(1,375) Dividends paid to minority interest(3,370)(3,402) Other payment for fi nancing activities(20)(261) Net cash (outfl ow)/infl ow from fi nancing activities(12,101)110,249 Effect of exchange rate changes on cash and cash equivalents(12,170)(3,043) Net (decrease)/increase in cash and cash equivalents(38,535)17,990 Cash and cash equivalents as at 1 January519,944397,112 Cash and cash equivalents as at 30 September 481,409415,102。

中国人民银行THE PEOPLE'S BANK OF CHINA(作为我国的中央银行,是我国政府部门,直属国务院管理,也是我国金融业的领导机构。

)中国工商银行INDUSTRIAL AND COMMERCIAL BANK OF CHINA (ICBC)中国建设银行CHINA CONSTRUCTION BANK (CCB)中国农业银行AGRICULTURAL BANK OF CHINA (ABC)中国银行BANK OF CHINA(BOC)政策性银行:国家开发银行CHINA DEVELOPMENT BANK中国农业发展银行AGRICULTURE DEVELOPMENT BANK OF CHINA中国进出口银行THE EXPORT-IMPORT BANK OF CHINA其他股份制商业银行:交通银行BANK OF COMMUNICATIONS (BCM)招商银行CHINA MENCHANTS BANK (CMB)中信银行CHINA CITIC BANK广东发展银行GDB(Guangdong Development Bank)上海浦东发展银行SPDB/SPDBank(Shanghai Pudong Development Bank)深圳发展银行SDB(Shenzhen Development Bank)华夏银行HUAXIA BANK中国民生银行 CHINA MINSHENG BANKING CORP.,LTD深圳发展银行 SHENZHEN DEVELOPMENT BANK CO.,LTD中国光大银行 CHINA EVERBRIGHT BANK兴业银行 INDUSTRIAL BANK CO.,LTD北京银行 BANK OF BEIJING中国银联: China UnionPay大雁塔 Great Wild Goose Pagoda小雁塔 Small Wild Goose Pagoda秦始皇兵马俑博物馆Museum of Emperor Qinshihuang’s Tomb Figures of Soldiers and Horses 秦始皇陵 The Tomb of Emperor Qinshihuang黄帝陵 The Huangdi Tomb鼓楼 The Drum Tower钟楼 The Bell Tower西安城墙 The Xi’an Circumvallation华清池 The Huaqing Pond乾陵 The Qian Tomb法门寺 The Famen Temple黄河壶口瀑布 The Huanghe Hukou Waterfall大唐芙蓉园 Lotus palace of Tang Dynasty秦始皇兵马俑 Terra-cotta warriors -- Qin Dynasty丝绸之路 The Silk Road大小雁塔 Big and Little Goose Pagodas。

中信银行英文介绍词Founded in 1996, China CITIC Bank (CNCB) is a leading commercial bank in China and is listed on both the Hong Kong Stock Exchange and the Shanghai Stock Exchange. With a focus on providing comprehensive financial services to individuals, small and medium-sized enterprises, and large corporations, CNCB has established a strong presence in the Chinese banking industry.CNCB offers a wide range of financial products and services, including personal and corporate banking, wealth management, investment banking, and international banking. The bank has a network of over 1,400 branches and outlets across China, as well as overseas branches in Hong Kong, Singapore, and other strategic locations.As a customer-centric bank, CNCB is committed to delivering innovative and high-quality financial solutions to meet the diverse needs of its clients. The bank has invested heavily in technology and digital banking capabilities to enhance customer experience and streamline its operations.In addition to its domestic operations, CNCB has been actively expanding its international presence through strategic partnerships and acquisitions. The bank has established a strong presence in the Asia-Pacific region and is actively exploring opportunities in other key global markets.中国中信银行成立于1996年,是中国领先的商业银行,同时在香港证券交易所和上海证券交易所上市。

bank of china语法

【原创版】

目录

1.银行名称:中国银行

2.语法:英语语法

3.语法规则:冠词、名词、动词、形容词等

4.实例:中国银行的英语表述

正文

中国银行,英文名为 Bank of China,是一家成立于 1912 年的国有商业银行。

在英语中,描述这家银行的语法规则主要包括冠词、名词、动词和形容词等。

首先,冠词用于表示银行名称的特指。

在这里,我们使用定冠词“the”,因此银行名称的英文表述为“the Bank of China”。

其次,名词部分为“bank”,表示银行这个概念。

紧接着是“of China”,这是一个表示所属关系的短语,其中“of”表示所属关系,而“China”则是国家名称。

将这两部分组合起来,就得到了完整的银行名称表达:“the Bank of China”。

在描述中国银行的相关业务和信息时,还需要用到动词和形容词等语法规则。

例如,用动词“provides”表示中国银行提供各种金融服务,用形容词“large”表示中国银行是一家大型商业银行等。

总之,在英语中描述中国银行时,我们需要遵循英语语法规则,包括冠词、名词、动词、形容词等。

第1页共1页。

中国银行简介公司简介中国银行(Bank Of China),全称中国银行股份有限公司,(简称BC,中行)是中国大型国有控股商业银行之一。

1912年2月,经孙中山先生批准,中国银行正式成立。

从1912年至1949年,中国银行先后行使中央银行、国际汇兑银行和外贸专业银行职能。

新中国成立后,中国银行成为国家外汇外贸专业银行。

1994年,中国银行改为国有独资商业银行。

2003年,中国银行开始股份制改造。

2004年8月,中国银行股份有限公司挂牌成立。

2006年6月、7月,先后在香港联交所和上海证券交易所成功挂牌上市,成为首家在内地和香港发行上市的中国商业银行。

中国银行主要经营商业银行业务,包括公司金融业务、个人金融业务和金融市场业务,旗下有中银香港、中银国际、中银保险等控股金融机构,在全球范围内为个人和公司客户提供全面和优质的金融服务。

按核心资本计算,2008年中国银行在英国《银行家》杂志“世界1000家大银行”排名中列第10位。

发展战略进一步明确中国银行的发展战略,按照比较优势,合理配置资源,不断推出差别性的产品与服务;调整与改进内部运行机制,进一步完善风险管理体系,使信贷决策更加科学与透明;按照审慎的会计原则处理业务,增加透明度;建立严格的目标责任制以及服务于这一制度的激励约束机制;加强教育和培训,培育中行文化。

法人治理结构是现代公司制的核心。

中国银行始终将良好公司治理作为提升股东价值和投资者信心的重要手段,在创造良好经营业绩的同时,持续完善权责明确、有效制衡、协调运转的公司治理机制。

中国银行严格遵守《公司法》、《商业银行法》等法律及监管部门的相关法规,以自身的公司治理实践经验为基础,不断制定和更新公司治理规范性文件,完善由股东大会、董事会、监事会和高级管理层构建的现代股份制公司治理架构,持续提升公司治理水平。

中国银行是借款银行中对条件要求比较严格的银行,在几乎所有的开发商那里都开展着贷款业务,一般中国银行贷款需要购房者提供相对严格的证明手续。

中国银行主要业务简介日期:2008-5-9 15:06:55中国银行简介:主要业务Brief Introduction to Bank of China:Main Businesses商业银行Commercial Banking Business公司金融Corporate Banking Business中国银行向公司客户提供贷款、票据贴现、贸易融资、存款、结算、清算、现金管理等各项金融产品和度身定制的财务综合解决方案。

The Bank provides its corporate customers with various financial products including loans, bill discounting, trade finance, deposit-taking, settlement, clearing, cash management services as well as integrated financial solutions tailor-made to meet customers’ needs.个人金融Personal Banking Business中国银行为个人客户提供一系列个人或家庭银行产品及服务,包括储蓄存款、消费信贷、支付结算、银行卡和财富管理等。

The Bank provides a broad range of personal banking products and services, including savings deposit, personal loans, payment and settlement, bank cards and wealth management services.金融市场Financial Market Business中国银行金融市场业务涵盖外汇和贵金属交易,人民币债券交易、短期融资券和票据业务,本外币债券投资,金融衍生品和商品期货,本外币理财与资产管理,基金代销和托管等。

客户简介:中国银行,全称中国银行股份有限公司,是中国四大国有商业银行之一。

业务范围涵盖商业银行、投资银行和保险领域,旗下有中银香港、中银国际、中银保险等控股金融机构,在全球范围内为个人和公司客户提供全面和优质的金融服务。

按核心资本计算,2005年中国银行在英国《银行家》杂志“世界1000家大银行”排名中列第十八位。

目前全行共有员工约二十余万人,分支机构遍布全国各省份及海外。

项目背景:中国银行原有的人力资源管理系统,是在1996年设计,1997-1998年开发完成并于1999年在全辖推广应用的人事信息系统。

系统采用总行、一级分行两层的部署模式,主要功能集中在对于数据及处理结果的记录;主要使用者是信息管理岗位的人员。

随着中国银行股份制改革以及中行在全辖开展的人力资源战略改革等工作的深入开展,原有的人事信息管理系统已经越来越不能适应中行的变化和要求,因此,建立一套集中、完善、且能适应未来中行人力资源战略的系统,势在必行。

解决方案:选择东软慧鼎(TalentBase)人力资源管理系统,建立一套面向全行应用、支持集团化管控模式与大集中部署的“集团版e-HR系统”建成后的人力资源管理系统将是一个“业界先进与系统全面、统一规范与灵活拓展、层层汇总与数据集中、全员参与与权责明确、流程优化与高效便捷、信息共享与决策支持、纵向管理与协同运作、助力变革与改善业绩”的集团化人力资源管理信息平台”。

具体而言,将会助力中国银行实现如下目标:●为人力资源管理提供技术支持平台,提高人力资源管理水平;●规范人力资源管理业务流程;●实现全辖人力资源信息的共享;●实现总行、省分行对辖内人力资源的实时监控和动态管理;●提供员工门户,实现人力资源系统的员工自助服务;●提供经理门户,为各级领导决策提供信息和工具支持;●提供人力资源战略支持功能,实现薪酬设计、人力资源规划、绩效考核和员工满意度调查支持功能。

项目特点:中国银行的e-HR系统是中行IT蓝图建设的重要组成部分,为中行的核心业务系统中的CBS、MIS等系统提供机构、岗位、人员等有关信息,是员工指纹采集的通道,是关联系统数据基础应用的支撑系统。

中国银行面试英语自我介绍* 通过自我介绍在短短的时间里给银行的面试官留下深刻的印象,并让其产生强烈的想录用你的意愿呢?为此为大家精心推荐一些中国银行面试英语自我介绍范文的优秀例文,希望对大家有帮助。

First of all thank you for your bank to give me such a opportunity to the stage to show themselves and talent, I will cherish this opportunity to improve, exercise their own.My name is XXX, XX years old this year, is a professional XX XXX XXXX college graduates. The Yangtze river water feeding me, my blood flowing in the XX special lively, cheerful personality and love spell will win the struggle spirit. With this spirit, during the period of school I study hard, hard work, with practical actions and raising fruitful for parents and teachers.During the period of school, in addition to learning I also take an active part in all kinds of social practice, theory with practice. Once the class several times, and participate in school organization of public welfare activities, such as youth volunteers assistive activities, send warm activity to yixian old man. To participate in these activities and the activities of the members get along let me learned a lot, to cultivate theirabilities and interpersonal treatment have great benefits, faster for me to the society provides a good platform.In June last year after graduation, I had the opportunity to work in XXXX co., LTD., elegant cultural environment and strong academic atmosphere, inspire me constantly struggle and enterprising. In this half a year's time, I work initiative, a strong sense of responsibility, careful and meticulous, work performance with department manager.Review of the years of work and study life, feeling very deep, but still feel harvest quite abundant. Learn not only professional knowledge, and social experience, people skills, etc., form and develop the good team cooperation spirit and the positive enterprising spirit of learning. Their knowledge level, thought state, work ability is on a new step. In addition, should also see some of my shortings, such as sometimes do things more impatient for suess, lack of practical experience in work, and so on. But no pure gold gold, nobody's perfect everyone his defects inevitably exist, there are shortings is not terrible, the key is how to treat their own shortings, only face up to its existence, through continuous efforts to learn to correct his shortings. In the future I will be more strict with myself, work hard, study hard, carry forward theadvantages, shortings, with full enthusiasm, firm belief, high sense of responsibility to meet new challenges, climbing to new heights.This time I choose the job in addition to the candidates, I think I also very like this job, I believe that it can fully realize my social ideals and reflect their own value. I think I have the ability to also have the confidence to do the job, believe in my ability, my joining will bring you the power of a suess.Finally, please allow me to wish the expensive unit enterprise progresses day by day, to the next level, at the same time also wish you all the teacher the work is smooth, smooth sailing!My name is xx, xuzhou, jiangsu province, graduated from xx university finance professionals. In addition to resume you see, I would like to say special about me to your bank to apply for this position reason:First of all, my biggest characteristics is have strong munication skills and good team spirit. In working with people, I would be very seriously listen to and analysis of the opinions of others, will not easily give up their own opinions without principle.Second, I think I have strong ability to learn and practice that faced with difficulties things will calm analysis of the state, and a variety of possible results, and strive to do your best to undertake their own responsibility. It is based on the confidence to oneself, make me have the courage to apply for the job of your bank.In addition, the bank clerk this career is sacred and great, and he asked me to not only have abundant professional knowledge, must have the noble sentiments. Therefore, in reading, I am very pay attention to their all-round development, widely develop their own interests, to study and expertise, do have a professional and expertise (focused on their own expertise), still can sing, speak, speak. In knowledge-based learning at the same time I also pay attention to cultivating their own lofty moral character, consciously bound to ply with social ethics and professional ethics, no bad habits and behavior. I think these are a financial workers should have the least quality.If, I passed the interview, bee numerous members of the bank staff team, I will continue to study hard, work hard, for home education career contribute own strength, will live up to the bank workers as an oupation.My name is * * *, this year 27 years old. July * * * *, I graduated from institute of * * * *. Due to * *, I miss the most glorious career under the sun. Fortunately, the * * *, by the people, I have a * * in * * * unit of work experience. Recall that time it's both sweet and beautiful, although the salary is low, but listen to other people's praise of the I work, looking at that pairs of eyes full of trust, my heart is full of happiness and sweetness. I wanted to, if not positive, as long as the unit needs, is when life casual I also willingly. Today, I want to pass the exam so eager desire is to be going to work again! My family has three sisters, two sisters working outside, in order to take care of elderly parents, I have been to stay in their side. I have to open a shop, first deals in Chinese arts and crafts, and then run the clothing. But no matter how business is done with ease, when a bank clerk is always dream of my heart and wish to pour dedicated his life to the pursuit of my career. I have many times for the exam, but due to various reasons and failed to realize the dream, but I told myself, as long as there is an opportunity, I have been down, until the ideal realization.Now of I, after the test of life, than I petitors in the age I no longer have an advantage, but I more than they are fora to work sense of responsibility, patience, and the units of the sincerity, more of a mature and self-confidence. Bank clerk this career is sacred and great, and he asked me to not only have abundant professional knowledge, must have the noble sentiments. Therefore, in the book, I'm very pay attention to their all-round development, widely develop their own interests, to study and expertise, do have a professional and expertise (focused on their own expertise), still can sing, speak, speak. In knowledge-based learning at the same time I also pay attention to cultivating their own lofty moral character, consciously bound to ply with social ethics and professional ethics, no bad habits and behavior. I think these are a financial workers should have the least quality.If, I passed the interview, bee numerous members of the bank staff team, I will continue to study hard, work hard, for home education career contribute own strength, will live up to the bank workers as an oupation.看了“中国银行面试英语自我介绍范文”的人还看过:1.中国银行面试自我介绍2.银行应聘英语自我介绍3.工作面试英语自我介绍4.简单的面试英语自我介绍5.英语工作面试自我介绍内容仅供参考。

中行简介中国银行,全称中国银行股份有限公司。

中国银行业务覆盖传统商业银行、投资银行和保险业务领域,并在全球范围内为个人客户和公司客户提供全面和优质的金融服务。

在近百年的岁月里,中国银行以其稳健的经营、雄厚的实力、成熟的产品和丰富的经验深得广大客户信赖,打造了卓越的品牌,与客户建立了长期稳固的合作关系。

中国银行主营商业银行业务,包括公司、零售和金融机构等业务。

公司业务在基于银行的核心信贷产品之上,致力于为客户提供个性化、创新的金融服务。

零售业务主要针对个人客户的金融需求,提供基于银行卡之上的全套服务。

而金融机构业务则是为全球其他银行,证券公司和保险公司提供诸如国际汇兑、资金清算、同业拆借和托管等全面服务。

在多年的发展历程中,中国银行曾创造了中国银行业的许多第一,所创新和研发的一系列金融产品与服务均开创历史之先河,在业界独领风骚,享有盛誉。

目前在外汇存贷款、国际结算、外汇资金和贸易融资等领域仍居领先地位。

根据2003年英国《银行家》按核心资本排名,中国银行列全球第十五位,居中国银行业首位,是中国资本最为雄厚的银行。

以资产规模计,中国银行资产总额达38,442亿人民币,是中国第二大商业银行。

中国银行网络机构覆盖全球27个国家和地区,其中境内机构共计11,609个,境外机构共计549个,是目前我国国际化程度最高的商业银行。

中国银行有近百年辉煌而悠久的历史,在中国金融史上扮演了十分重要的角色。

中国银行于1912年由孙中山先生批准成立,至1949年中华人民共和国成立的37年间,中国银行先后是当时的国家中央银行、国际汇兑银行和外贸专业银行。

中国银行以诚信为本,以振兴民族金融业为己任,在艰难和战乱的环境中拓展市场,稳健经营,锐意改革,表现出了顽强的创业精神,银行业务和经营业绩长期处于同业领先地位,并将分支机构一直拓展到海外,在中国近现代银行史上留下了光辉的篇章。

1949年,中国银行成为国家指定的外汇外贸专业银行,为国家经济建设和社会发展作出了巨大贡献。

As the most internationalized and diversified bank in China, Bank of China provides full range of financial services in China's mainland, Hong Kong, Macau and other 31 countries. It mainly operates the commercial banking business including corporate banking, personal banking and financial market business. It also conducts investment banking business via Bank of China International Holdings Limited, its wholly-owned subsidiary, as well as the insurance services via another wholly-owned subsidiary Bank of China Group Insurance Company Limited and its subordinate and associate companies. Bank of China is also engaged in fund management services via Bank of China Investment Management Co., Ltd., direct investment and investment management via Bank of China Group Investment Limited, its wholly-owned subsidiary, and aircraft leasing via Bank of China Aviation Private Limited. Bank of China ranked the eleventh in terms of core capital among the "World Top 1000 Banks" in the British magazine The Banker in 2009.Over the past century, Bank of China has won wide recognition from the industry with its brand image of pursuit to excellence, sound management, focus on customers and meticulous working manner. With the new historic opportunities, Bank of China will keep forward towards the strategic goal of a first-class international bank in a sustainable way.中国银行是中国国际化和多元化程度最高的银行,在中国内地、香港、澳门及29个国家为客户提供全面的金融服务。

主要经营商业银行业务,包括公司金融业务、个人金融业务和金融市场业务,并通过全资附属机构中银国际控股集团开展投资银行业务,通过全资子公司中银集团保险有限公司及其附属和联营公司经营保险业务,通过控股中银基金管理有限公司从事基金管理业务,通过全资子公司中银集团投资有限公司从事直接投资和投资管理业务,通过中银航空租赁私人有限公司经营飞机租赁业务。

按核心资本计算,2009年中国银行在英国《银行家》杂志“世界1000家大银行”排名中列第十一位。

在近百年的发展历程中,中国银行始终秉承追求卓越的精神,稳健经营的理念,客户至上的宗旨和严谨细致的作风,得到了业界和客户的广泛认可和赞誉,树立了卓越的品牌形象。

面对新的历史机遇,中国银行将坚持可持续发展,向着国际一流银行的战略目标不断迈进。

战略目标追求卓越,持续增长,建设国际一流银行。

战略定位以商业银行为核心、多元化服务、海内外一体化发展的大型跨国经营银行集团。

商业银行为核心,多元化发展以商业银行作为集团发展的核心与基础,拓展业务网络,扩大客户基础,增强产品创新能力,提升品牌知名度和核心竞争力。

按照统一战略、统一品牌、统一客户、统一渠道的要求,发挥多元化服务的比较竞争优势,大力发展投行、基金、保险、投资、租赁等业务,发挥多元化平台的协同效应,为客户提供全面优质的金融服务。

立足本土,海内外一体化发展加快国内业务发展,做大做强本土业务。

抓住经济全球化、中国经济与世界经济联系日益紧密的机遇,积极扩大跨国跨境经营,业务跟着客户走,延长服务链条,拓宽服务领域,构建海内外一体化发展的新格局。

做大型银行集团,长期可持续发展加快结构调整,扩大业务规模,加强风险管理,优化内部流程,提高运营效率,加快渠道建设,注重人才培养,夯实发展后劲,增强长期盈利能力和可持续发展能力。

Strategic GoalAiming at excellence, sustaining growth and building a first-class international bank. Strategic PositioningA large transnational banking group focusing on commercial banking business and providing diversified services integrated both at home and abroad.Commercial banking focused diversificationWith commercial banking business as the core and foundation of the group's development, Bank of China will keep improving its brand popularity and core competitiveness by expanding business network and customer base and enhancing product innovation. By taking advantage of the comparative competitiveness of diversified services for unified customers via unified channels under unified strategy and brand, it will strive to develop various business lines such as investment banking, fund, insurance, investment and leasing so as to create a synergistic effect on the diversified platform in the interest of comprehensive and excellent financial services for customers.Integrated development both at home and abroadBank of China will quicken the pace and strengthen the basis of domestic business. Meanwhile, with the opportunity brought by economic globalization characterized by increasingly close connections between China's economy and world economy, Bank of China will make vigorous effort in expanding transnational and cross-border business based on customers' needs so as to create a new pattern of globally integrated development with extended service chain and broadened services.Sustainable developmentBank of China will improve its long-term profit capability and achieve sustainable development by quickening its structural adjustment, expanding business scope, strengthening risk management, optimizing internal process, elevating operating efficiency and quickening network development. In addition, the bank will prepare for the future growth by strengthening talent training.中国银行拥有一个独特的全方位金融服务平台,提供商业银行、投资银行、保险、资产管理、飞机租赁和其他金融服务,能够满足不同客户的复杂业务需求。

商业银行业务商业银行业务是中国银行的传统主营业务,包括公司金融业务、个人金融业务及金融市场业务(主要指资金业务)。

With a unique and comprehensive financial service platform, Bank of China offers commercial banking, investment banking, insurance, asset management, aircraft leasing and other financial services in line with the complex demands of different customers.Commercial Banking BusinessAs the traditional major business line of Bank of China, commercial banking business includes corporate banking, personal banking and financial market business (mainly treasury business).。