根据合同审核信用证

- 格式:doc

- 大小:69.50 KB

- 文档页数:12

根据外销合同审核信用证1. 引言外销合同审核信用证是国际贸易中常见的操作流程之一。

在国际贸易中,信用证的作用至关重要,它是国际贸易支付方式中最安全、最可靠的方式之一。

本文将介绍根据外销合同审核信用证的步骤和注意事项。

2. 外销合同审核信用证步骤2.1 确定信用证的类型在审核信用证之前,首先要确定信用证的类型。

常见的信用证类型有即期信用证和远期信用证。

即期信用证要求卖方在一定的时间内向开证行提交相关单据,而远期信用证给予卖方更长的时间来履行相关义务。

2.2 仔细阅读信用证文件在审核信用证之前,应仔细阅读信用证文件。

信用证文件通常包括信用证本身、外销合同、装运单据等。

务必确保信用证的内容与外销合同一致,并核对信用证中的细节是否与合同规定相符。

2.3 确认信用证的合规性审核信用证的一个重要步骤是确认信用证的合规性。

合规性主要包括几个方面:•确保信用证的开证行具备有效的信用力和可靠性。

•检查信用证是否违反国际贸易规则和相关法律法规。

•确认信用证开证日期是否在有效期内,以及单据提交期限是否合理。

2.4 核对信用证的单据要求信用证通常要求卖方提交一系列的单据,如提单、发票、装箱单等。

在审核信用证时,务必核对信用证中的单据要求,并确保能按时提供符合规定的单据。

2.5 合理订正信用证的不符点在审核信用证过程中,可能会发现信用证存在不符点。

在这种情况下,卖方需要与买方及信用证开证行进行沟通,并争取适当的订正。

这个步骤需要注意与买方的合作,并且要确保订正后的信用证符合合同要求。

3. 注意事项3.1 熟悉国际贸易规则和相关法律法规在审核信用证之前,务必熟悉国际贸易规则和相关法律法规。

对信用证的审核需要遵循国际贸易惯例,并遵守当地法律法规。

熟悉相关规则和法规,有助于提高审核的准确性和合规性。

3.2 与相关方保持良好沟通审核信用证是一个涉及多方的过程。

卖方需要与买方、信用证开证行以及装运和保险方保持良好的沟通。

及时解决问题,并确保所有相关方对信用证的规定和要求达成一致。

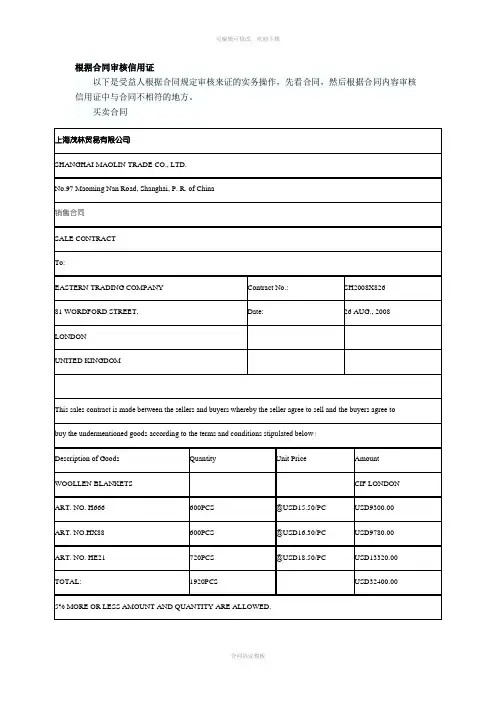

根据合同审核信用证以下是受益人根据合同规定审核来证的实务操作,先看合同,然后根据合同内容审核信用证中与合同不相符的地方。

买卖合同进口国开来的信用证:ISSUING BANK: UNITED GREAT KINGDOM BANK LTD, LONDONCREDIT NUMBER: LOD88095DA TE OF ISSUE: 2008.09.01EXPIRYDATE AND PLACE: DATE 2008.10.20 PLACE U.K.APPLICANT:EASTERN TRADING COMPANY81 WORDFORD STREET,LONDONUNITED KINGDOMBENEFICIARY:SHANGHAI MAOLIN TRADE CORP.NO.97 MAOMING NAN ROADSHANGHAI P. R. OF CHINAAMOUNT: USD32040.00 (SAY U. S. DOLLARS THIRTY TWO THOUSAND AND FORTY ONL Y)THE CREDIT IS A V AILABLE WITH ANY BANK BY NEGOTIATION DRAFTS AT 30 DAYS AFTER SIGHT FOR FULL INVOICE V ALUE DRAWN ON USPARTIAL SHIPMENT: NOT ALLOWEDTRANSHIPMENT: ALLOWEDPORT OF LOADING: SHANGHAIPORT OF DISCHARGE: LONDONLATEST SHIPMENT DA TE: 2008.10.15DESCRIPTION OF GOODS: WOOLLEN BLANKETS, CIF LONDONART. NO. H666 600PCS @USD15.50/PC USD9300.00ART. NO.HX88 600PCS @USD16.30/PC USD9780.00ART. NO. HE21 720PCS @USD18.00/PC USD12960.00TOTAL: 1920PCS USD32040.00AS PER CONTRACT NO.SH2008X806DOCUMENTS REQUIRED:*SIGNED COMMERCIAL INVOICE IN TRIPLICATE*PACKING LIST IN TRIPLICATE*FULL SET OF CLEAN ON BOARD MARINE BILLS OF LADING MADE OUT TO ORDER MARKED FREIGHT PREPAID NOTIFY APPLICANT*GSP FORM A CERTIFYING THAT THE GOODS ARE OF CHINESE ORIGIN ISSUED BY COMPETENT AUTHORITIES*INSURANCE POLICY / CERTIFICATE COVERING ALL RISKS INCLUDING WAREHOUSE TO W AREHOUSE CLAUSE UP TO FINAL DESTINATION AT LONDON FOR AT LEAST 110 PCT OF CIF V ALUE AS PER INSTITUTE CARGO CLAUSE (A)*SHIPPING ADVICES MUST BE SENT TO APPLICANT WITHIN IMMEDIATEL Y AFTER SHIPMENT ADVISING THE INVOICE V ALUE, NUMBER OF PACKAGES, GROSS AND NET WEIGHT, VESSEL NAME, BILL OF LADING NO. AND DATE, CONTRACT NO. SHOWING SHIPPING MARK AS:EASTERN2008X826LONDONNO.1-80PRESENTATION PERIOD: 10 DAYS AFTER ISSUANCE DATE OF SHIPPING DOCUMENTS BUT WITHIN THE V ALIDITY OF THE CREDITCONFIRMATION: WITHOUTINSTRUCTIONS: THIS CREDIT IS SUBJECT TO UNIFORM CUSTOMS A PRACTICE FOR DOCUMENTARY CREDIT ICC NO.600.THE NEGOTIATION BANK MUST FORWARD THE DRAFTS AND ALL DOCUMENTS BY REGISTERED AIRMAIL DIRECT TO US IN TWO CONSECUTIVE LOTS. UPON RECEIPT OF THE DRAFTS AND DOCUMENTS IN ORDER, WE WILL REMIT THE PROCEEDS AS INSTRUCTED BY THE NEGOTIATING BANK.经审核,信用证存在以下问题:1.合同规定信用证有效期为装运日后15天,即2008年10月30日,而信用证为2008年10月20日;2.根据合同信用证的到期地点不应在英国,而应在中国。

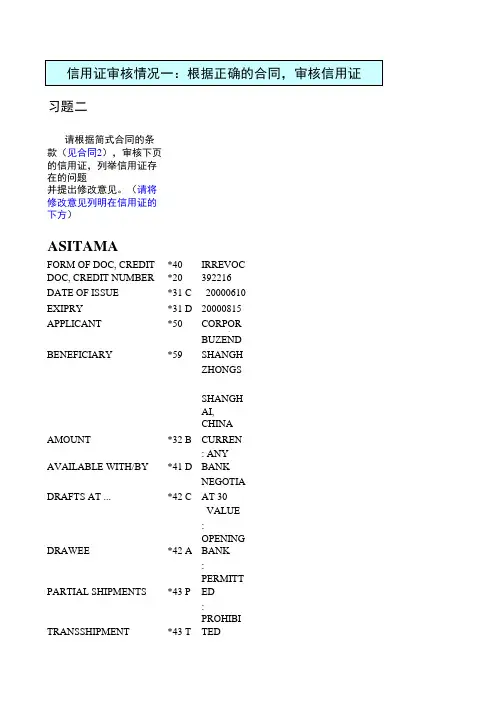

习题二:信用证审核一、思考题:1。

何谓信用证?简述其一般流程。

2.信用证方式的基本当事人有哪些?在什么情况下,又可能有什么当事人?各当事人分别承担什么责任?3。

信用证方式的主要特点是什么?4。

何谓“议付”?“议付”与“付款”有什么区别?二、操作题:1.练习目的:学会阅读信用证2.练习要求:根据下面的信用证范例找出下列内容:(1)信用证的种类(2)信用证号码(3)开证日期(4)信用证的有效期(5)信用证的到期地点(6)开证申请人名称、地址(7)受益人名称、地址(8)开证行名称(9)信用证金额及货币单位(10)分批运输(11)转运(12)装运港(地)、目的港(地)(13)最迟装运期(14)货名及规格(15)价格术语(16)交单期限(17)信用证要求的单据(18)信用证特别条款信用证范例:JUNE 5,2003 14:35:46 LOGICAL TERMINAL HN03MT S700 ISSUE OF A DOCUMENTARY CREDIT PAGE 00001FUNC HNHQP786MSGACK DWS6789 AUTH OK,KEY B003060267DE43AF,ICBKCNBJ BFDC***RECORDBASIC HEADER F01 ICBKCNBJ A367 0675 780609 APPLICATION HEADER O700 2851 030605 BFDCIE2DAXXX 5439 447618 020605 1806N* BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)USER HEADER SERVICE CODE 103BANK PRIORITY 113MSG USER REF。

108INFO. FROM CI 115TO:INDUSTRIAL AND COMMERCIAL BANK OF CHINA ZHEJIANG,CHINA(ICBKCNZJYYY)SEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT *40A :IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 : AF/651909DATE OF ISSUE 31C : 20030605EXPIRY *31D :DATE 20030810 PLACE CHINAAPPLICANT *50 :A AND D SARUE DU CHEMIN VERTCENTRE DE GROS NO。

根据外销合同审核信用证一、背景介绍外贸交易中,信用证是一种常用的支付方式。

出口商在与买家签订外销合同后,可以要求买家开立信用证作为支付保障。

然而,信用证的审核却是一个复杂而且关键的过程。

本文将介绍如何根据外销合同审核信用证,以确保交易的顺利进行。

二、外销合同审核信用证的重要性审核信用证是出口商在外贸交易过程中的重要一环。

通过审核信用证,出口商可以确保买方的支付能力,并从银行获得相应的付款保障。

同时,审核信用证也可以防止买方在支付过程中的不履约行为,保护出口商的权益。

因此,外销合同审核信用证是一个既需要注意细节又需要审慎处理的过程。

三、外销合同审核信用证的步骤1. 熟悉信用证的基本条款在审核信用证之前,出口商应该先熟悉信用证的基本条款。

这些条款包括信用证的有效期、付款方式、装运地点和文件要求等内容。

出口商需要确保信用证的条款与外销合同中的条款相符,以避免后续纠纷。

2. 检查信用证的合规性审核信用证的第一步是检查信用证的合规性。

出口商应该仔细审查信用证的文本,确保它符合国际贸易的规则和标准,如UCP600等。

出口商还需要检查信用证中的金额、货物描述等信息是否与外销合同一致。

3. 确认货物装运细节审核信用证的下一步是确认货物的装运细节。

出口商需要核实信用证中所要求的货物数量、质量要求以及装运日期等信息是否与外销合同一致。

如果有任何差异,出口商需要与买方进行协商,以确保双方达成一致。

4. 检查付款条件审核信用证的另一个重要方面是检查付款条件。

出口商应该确认信用证中规定的付款方式、付款期限以及付款金额等是否符合外销合同的约定。

如果有任何问题或疑虑,出口商可以与买方进行沟通并协商修改信用证的付款条件。

5. 确认文件要求外销合同通常规定了出口商需要向买方提供的文件,如发票、装箱单和提单等。

出口商在审核信用证时,需要核对信用证中所要求的文件清单,确保自己能够按时提供符合要求的文件。

如果有任何不清楚的地方,出口商可以与买方进行确认。

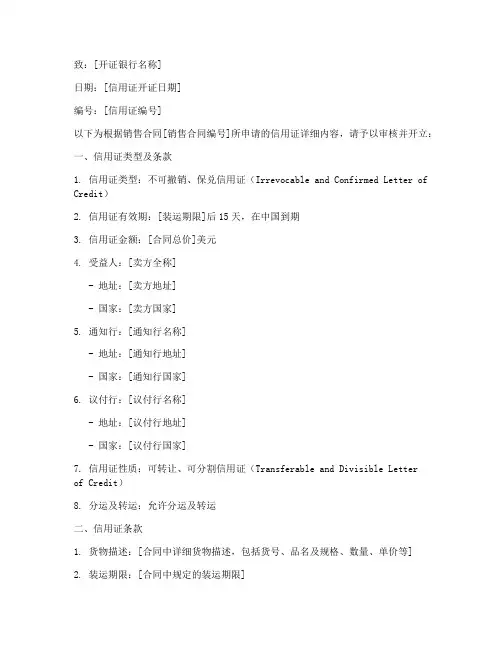

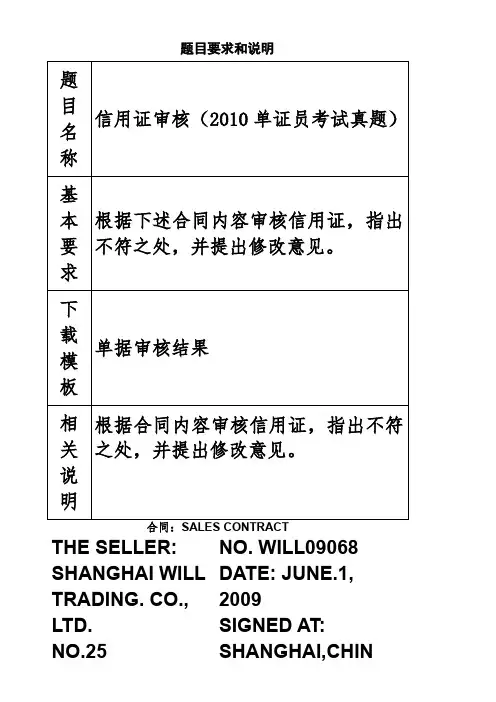

题目要求和说明合同:SALES CONTRACTTHE SELLER:SHANGHAI WILL TRADING. CO., LTD. JIANGNING ROAD, SHANGHAI, CHINA NO. WILL09068DATE: , 2009SIGNED AT: SHANGHAI,CHINATHE BUYER:NU BONNETERIE DE GROOTE.AUTOSTRADEWEG 6 9090 MEUE BELGIUMThis Sales Contract is made by and between the Sellers and the Buyers, whereby the sellers agree to sell and the Buyers agree to buy the under-mentioned goods according to the terms and conditions stipulated below:Packing: IN CARTONS OF 50 PCS EACHTime of Shipment: DURING AUG. 2009 BY SEAShipping Mark: AT SELLER’S OPTIONLoaDing Port and Destination: FROM SHANGHAI, CHINA TO ANTWERP, BELGIUMPartial Shipment and Transshipment: ARE ALLOWEDInsurance: TO BE EFFECTED BY THE SELLER FOR 110 PCT OF INVOICE VALUE AGAINST ALL RISKS AND WAR RISK AS PER CIC OF THE PICC DATED01/01/1981.Terms of Payment: THE BUYER SHALL OPEN THROUGH A BANK ACCEPTABLE TO THE SELLER ANIRREVOCABLE SIGHT LETTER OF CREDIT TO REACH THE SELLER 30 DAYS BEFORETHE MONTH OF SHIPMENT AND TO REMAIN VALID FOR NEGOTIATION IN CHINA UNTILTHE 15th DAY AFTER THE FORESAID TIME OF SHIPMENT.SELLER BUYERSHANGHAI WILL TRADING CO., LTD NU BONNETERIE DE GROOTE张平LJSKOUT59: BENEFICIARY:SHANGHAI WILL IMPORT AND EXPORT CO., LTDJIANGNING ROAD, SHANGHAI, CHINA32B: AMOUNT:CURRENCY USD AMOUNT 1941A: AVAILABLE WITH…BY BY ANY BANK IN CHINA BY NEGOTIATION42C: DRAFTS AT30 DAYS AFTER SIGHT42A: DRAWEE :NU BONNETERIE DE GROOTE.43P: PARTIAL SHIPMTS:NOT ALLOWED43T: TRANSSHIPMENT:ALLOWED44E: PORT OF LOADING:ANY CHINESE PORT44F: PORT OF DISCHARGE :ANTWERP, BELGIUM44C: LATEST DATE OF SHIPMENT:09081545A: DESCRIPTION OF GOODS:+ 3000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT PCAS PER ORDER D0900326 AND SALES CONTRACT NUMBERWILL09068.+ 5000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT PCAS PER ORDER D0900327 AND SALES CONTRACT NUMBERWILL09069.SALES CONDITIONS: CFR ANTWERPPACKING: 50PCS/CTN46A:DOCUMENTS REQUIRED: 1. SIGNED COMMERCIAL INVOICES IN 4 ORGINAL AND 4 COPIES2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OFORDER, BLANK ENDORSED, MARKED FREIGHT COLLECT NOTIFY THEAPPLICANT3. CERTIFICATE OF ORIGIN.4. PACKING LIST IN QUADRUPLICATE STATING CONTENTS OF EACHSEPARARTELY.单据审核结果。

致:[开证银行名称]日期:[信用证开证日期]编号:[信用证编号]以下为根据销售合同[销售合同编号]所申请的信用证详细内容,请予以审核并开立:一、信用证类型及条款1. 信用证类型:不可撤销、保兑信用证(Irrevocable and Confirmed Letter of Credit)2. 信用证有效期:[装运期限]后15天,在中国到期3. 信用证金额:[合同总价]美元4. 受益人:[卖方全称]- 地址:[卖方地址]- 国家:[卖方国家]5. 通知行:[通知行名称]- 地址:[通知行地址]- 国家:[通知行国家]6. 议付行:[议付行名称]- 地址:[议付行地址]- 国家:[议付行国家]7. 信用证性质:可转让、可分割信用证(Transferable and Divisible Letterof Credit)8. 分运及转运:允许分运及转运二、信用证条款1. 货物描述:[合同中详细货物描述,包括货号、品名及规格、数量、单价等]2. 装运期限:[合同中规定的装运期限]3. 装运口岸:[合同中规定的装运口岸]4. 目的口岸:[合同中规定的目的口岸]5. 保险:由卖方按发票全额110%投保至[目的口岸]为止的险种6. 单据要求:- 正本发票一份- 提单一份,注明“运费已付”或“运费预付”- 装箱单一份- 检验证书一份- 产地证明一份- 发货通知一份- 信用证项下其他单据7. 付款条件:即期付款8. 争议解决:任何争议应通过友好协商解决;如协商不成,提交[仲裁机构名称]仲裁三、其他特殊要求1. 信用证中必须注明允许分运及转运。

2. 信用证中必须注明受益人有权在信用证到期前要求提前议付。

3. 信用证中必须注明所有单据需加盖受益人公章。

四、申请理由本信用证是根据与[买方全称]签订的[销售合同编号]销售合同所申请。

为确保合同顺利履行,保障双方权益,特申请开立本信用证。

五、承诺我方承诺,在信用证有效期内,按照信用证条款要求,及时、准确地向贵行提交符合信用证要求的单据,并承担因单据不符合信用证条款而产生的所有责任。

题目要求和说明THE SELLER: SHANGHAI WILL TRADING. CO., LTD.NO.25 NO. WILL09068 DATE: JUNE.1, 2009SIGNED AT: SHANGHAI,CHINAJIANGNINGROAD,SHANGHAI,CHINATHE BUYER:NU BONNETERIE DE GROOTE. AUTOSTRADEWEG 6 9090 MEUE BELGIUMThis Sales Contract is made by and between the Sellers and the Buyers, whereby the sellers agree to sell and the Buyers agree to buy theunder-mentioned goods according to the terms and conditionsPacking: IN CARTONS OF 50 PCS EACHTime of Shipment: DURING AUG. 2009 BY SEAShipping Mark: AT SELLER’S OPTIONLoaDing Port and Destination: FROM SHANGHAI, CHINA TO ANTWERP, BELGIUMPartial Shipment and Transshipment: ARE ALLOWED Insurance: TO BE EFFECTED BY THE SELLER FOR 110 PCT OF INVOICE VALUE AGAINST ALL RISKS AND WAR RISK AS PER CIC OF THE PICC DATED01/01/1981.Terms of Payment: THE BUYERSHALL OPENTHROUGH ABANKACCEPTABLETO THE SELLERANIRREVOCABLESIGHT LETTEROF CREDIT TOREACH THESELLER 30 DAYSBEFORE THEMONTH OFSHIPMENT ANDTO REMAINVALID FORNEGOTIATION INCHINA UNTILTHE 15th DAYAFTER THEFORESAID TIMEOF SHIPMENT.SELLER BUYER SHANGHAI WILL TRADING CO., LTD NU BONNETERIE DE GROOTE张平ISSUE:40E:APPLICABLERULES:UCP LATEST VERSION31D: DATE AND PLACE OF EXPIRY:DATE 090910 PLACE IN BELGIUM51D: APPLICANT BANK: ING BELGIUM NV/SV(FORMERLY BANKBRUSSELS LAMBERT SA), GENT50: APPLICANT:NU BONNETERIE DE GROOTE AUTOSTRADEWEG 69090 MELLE BELGIUM59: BENEFICIARY:SHANGHAI WILL IMPORT AND EXPORT CO., LTD NO.25 JIANGNING ROAD, SHANGHAI, CHINA32B: AMOUNT:CURRENCY USDAMOUNT 19 500.0041A: AVAILABLE BY ANY BANK IN CHINA BY NEGOTIATIONWITH…BY42C: DRAFTSAT30 DAYS AFTER SIGHT42A: DRAWEE :NU BONNETERIE DE GROOTE.43P: PARTIALSHIPMTS:NOT ALLOWED43T:TRANSSHIPMENT:ALLOWED44E: PORT OFLOADING:ANY CHINESE PORT44F: PORT OFDISCHARGE :ANTWERP, BELGIUM44C: LATESTDATE OFSHIPMENT:09081545A: DESCRIPTION OF GOODS:+ 3000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT EUR10.50/PC AS PER ORDER D0900326 AND SALES CONTRACT NUMBERWILL09068.+ 5000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT EUR12.00/PC AS PER ORDER D0900327 AND SALES CONTRACT NUMBER WILL09069.SALES CONDITIONS: CFR ANTWERP PACKING: 50PCS/CTN46A:DOCUMEN TS REQUIRED:1. SIGNED COMMERCIAL INVOICES IN 4 ORGINAL AND 4 COPIES2. FULL SET OF CLEANOF LADING, MADE OUT TO ORDER, BLANK ENDORSED, MARKED FREIGHT COLLECT NOTIFY THE APPLICANT 3. CERTIFICATE OF ORIGIN.4. PACKING LIST IN QUADRUPLICATE STATING CONTENTS OF EACH PACKAGE SEPARARTELY.5.INSURANCEPOLICY/CERTIFICATE ISSUED IN DUPLICATE IN NEGOTIABLE FORM, COVERING ALL RISKS, FROM WAREHOUSE TO WAREHOUSE FOR 120 PCT OF INVOICE VALUE. INSURANCEPOLICY/CERTIFICATE MUST CLEARLY STATE IN THE BODY CLAIMS, IF ANY, ARE PAYABLE IN BELGIUM IRRESPECTIVE OF PERCENTAGE47A:ADDITION AL CONDITIONS:1/ ALL DOCUMENTS PRESENTED UNDER THIS LC MUST BE ISSUED IN ENGLISH.单据审核结果。

根据外销合同审核信用证一、背景说明信用证是国际贸易中的一种重要支付工具,特别是在外销合同中。

外销合同审核信用证是指根据签订的外销合同对信用证进行审核,确保信用证的条款与合同要求一致,以保障出口商的权益。

本文将从以下几个方面对根据外销合同审核信用证的过程进行详细介绍。

二、信用证审核的目的和重要性外销合同审核信用证的目的是为了保障出口商的权益,确保信用证的条款与合同要求一致,避免出口商因为信用证的条款不符合合同要求而无法获得付款。

信用证作为一种独立的支付工具,具有市场广泛认可度和可靠性,因此对信用证的审核十分重要。

1. 获取外销合同和信用证的副本首先,出口商需要从买方或银行获取外销合同和信用证的副本。

外销合同是买卖双方达成一致的文件,其中包含了交货日期、货物规格、价格等具体条款。

信用证则是银行对买方承诺支付货款的文件,其中也包含了一系列的条件和要求。

2. 仔细阅读和理解信用证的条款出口商需要仔细阅读和理解信用证的条款,包括货物描述、交货日期、付款方式、保险要求等内容。

在阅读过程中,出口商需要特别关注与合同要求不一致的地方,以便在后续进行准确的审核。

出口商需要对比外销合同和信用证的条款,确保两者一致。

如果发现有不一致的地方,出口商需要与买方或银行进行沟通,以确定解决的方案。

4. 检查信用证的有效期和修改记录出口商还需要检查信用证的有效期和修改记录。

如果信用证已经过期或存在多次修改,出口商需要与买方或银行进行确认,以确保信用证的有效性。

5. 准备审核报告最后,出口商需要准备审核报告,将外销合同和信用证的审核情况进行详细记录。

审核报告应包括审核过程中发现的不一致点以及与买方或银行的沟通记录。

这样的审核报告有助于出口商在后续与买方或银行的纠纷中提供证据。

四、审核注意事项在根据外销合同审核信用证的过程中,出口商需要注意以下几个事项:•仔细阅读和理解信用证的条款,确保与外销合同一致。

•若发现任何不一致的地方,及时与买方或银行进行沟通,并争取尽早解决。

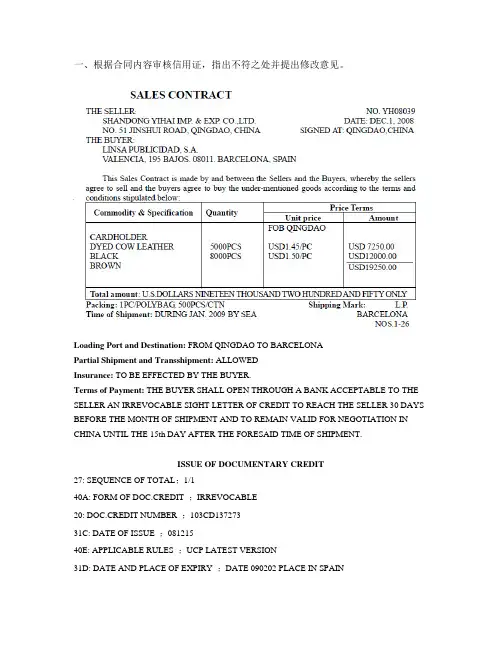

一、根据合同内容审核信用证,指出不符之处并提出修改意见。

SALES CONTRACTTHE SELLER: NO. YH08039SHANDONG YIHAI IMP. & EXP. CO.,LTD. DATE: DEC.1, 2008NO. 51 JINSHUI ROAD, QINGDAO, CHINA SIGNED AT: QINGDAO,CHINATHE BUYER:LINSA PUBLICIDAD, S.A.VALENCIA, 195 BAJOS. 08011. BARCELONA, SPAINThis Sales Contract is made by and between the Sellers and the Buyers, whereby the sellersagree to sell and the buyers agree to buy the under-mentioned goods according to the terms and conditions stipulated below:Commodity & Specification Quantity Price TermsUnit price AmountCARDHOLDERDYED COW LEATHERBLACKBROWNLoading Port and Destination: FROM QINGDAO TO BARCELONAPartial Shipment and Transshipment: ALLOWEDInsurance: TO BE EFFECTED BY THE BUYER.Terms of Payment: THE BUYER SHALL OPEN THROUGH A BANK ACCEPTABLE TO THE SELLER AN IRREVOCABLE SIGHT LETTER OF CREDIT TO REACH THE SELLER 30 DAYS BEFORE THE MONTH OF SHIPMENT AND TO REMAIN VALID FOR NEGOTIATION IN CHINA UNTIL THE 15th DAY AFTER THE FORESAID TIME OF SHIPMENT.ISSUE OF DOCUMENTARY CREDIT27: SEQUENCE OF TOTAL:1/140A: FORM OF DOC.CREDIT :IRREVOCABLE20: DOC.CREDIT NUMBER :103CD13727331C: DATE OF ISSUE :08121540E: APPLICABLE RULES :UCP LATEST VERSION31D: DATE AND PLACE OF EXPIRY :DATE 090202 PLACE IN SPAIN51D:APPLICANT BANK:BANCO SANTANDER, S.A.28660 BOADILLA DEL BARCELONA, SPAIN50: APPLICANT :LINSA PUBLICIDAD, S.A.VALENCIA, 195 BAJOS. 08011. BARCELONA, SPAIN59: BENEFICIARY :SHANDONG YIHAN IMP. & EXP. CO., LTD.NO. 51 JINSHUI ROAD, QINGDAO, CHINA32B: AMOUNT :CURRENCY EUR AMOUNT 19250.0041A:AVAILABLE WI TH…BY ANY BANK IN CHINA BY NEGOTIATION42C:DRAFTS AT… 30 DAYS AFTER SIGHT42A:DRAWEE :LINSA PUBLICIDAD, S.A.43P:PARTIAL SHIPMTS:NOT ALLOWED43T:TRANSSHIPMENT:NOT ALLOWED44E:PORT OF LOADING:ANY CHINESE PORT44F:PORT OF DISCHARGE :VALENCIA, SPAIN44C:LATEST DATE OF SHIPMENT:09011545A:DESCRIPTION OF GOODSGOODS AS PER S/C NO. YH08036 DATED ON DEC. 1, 2008 CARDHOLDER DYED COW LEATHER BLACK COLOUR/8000PCS AT USD1.45/PC FOB QINGDAO BROWNCOLOUR/5000PCS AT USD1.50/PC FOB QINGDAOPACKING: 200PCS/CTN46A:DOCUMENTS REQUIRED1. SIGNED COMMERCIAL INVOICE IN 3 COPIES2. CERTIFICATE OF ORIGIN GSP FORM A ISSUED BY OFFICIAL AUTHORITIES3. PACKING LIST IN 3 COPIES4. FULL SET CLEAN ON BOARD BILLS OF LADING MADE OUT TO ORDER MARKED FREIGHT PREPAID AND NOTIFY APPLICANT5. INSURANCE POLICY/CERTIFICATE IN DUPLICATE ENDORSED IN BLANK FOR 110% INVOICE VALUE COVERING ALL RISKS AND WAR RISK AS PER CIC.47A: ADDITIONAL CONDITIONSBILL OF LADING ONLY ACCEPTABLE IF ISSUED BY ONE OF THE FOLLOWING SHIPPING COMPANIES: KUEHNE-NAGEL (BLUE ANCHOR LINE) VILTRANS (CHINA) INT’L FORWARDING LTD. OR VILTRANS SHIPPING (HK) CO., LTD.71B: CHARGES:ALL CHARGES ARE TO BE BORN BY BENEFICIARY48: PERIOD FOR PRESENTATION:WITHIN 5 DAYS AFTER THE DATE OF SHIPMENT, BUT WITHIN THE VALIDITY OF THIS CREDIT49: CONFIRMATION INSTRUCTION:WITHOUT经审核信用证需要修改的内容如下:。

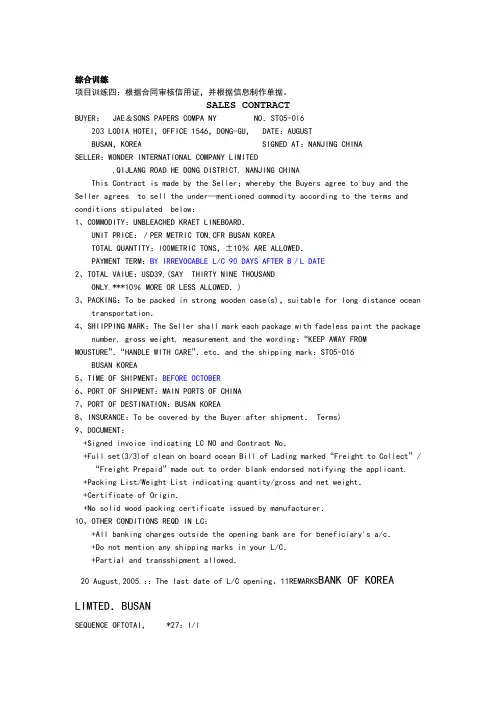

综合训练项目训练四:根据合同审核信用证,并根据信息制作单据。

SALES CONTRACTBUYER: JAE&SONS PAPERS COMPA NY NO.ST05-0l6203 LODIA HOTEI,OFFICE 1546,DONG-GU, DATE:AUGUSTBUSAN,KOREA SIGNED AT:NANJING CHINASELLER:WONDER INTERNATIONAL COMPANY LIMITED,QIJLANG ROAD HE DONG DISTRICT, NANJING CHINAThis Contract is made by the Seller;whereby the Buyers agree to buy and the Seller agrees to sell the under—mentioned commodity according to the terms and conditions stipulated below:1、COMMODITY:UNBLEACHED KRAET LINEBOARD.UNIT PRICE:/PER METRIC TON,CFR BUSAN KOREATOTAL QUANTITY:l00METRIC TONS,±10% ARE ALLOWED.PAYMENT TERM:BY IRREVOCABLE L/C 90 DAYS AFTER B/L DATE2、TOTAL VAIUE:USD39,(SAY THIRTY NINE THOUSANDONLY.***10% MORE OR LESS ALLOWED.)3、PACKING:To be packed in strong wooden case(s),suitable for long distance ocean transportation.4、SHIIPPING MARK:The Seller shall mark each package with fadeless paint the package number, gross weight, measurement and the wording:“KEEP AWAY FROM MOUSTURE”.“HANDLE WITH CARE”.etc.and the shipping mark:ST05-016BUSAN KOREA5、TIME OF SHIPMENT:BEFORE OCTOBER6、PORT OF SHIPMENT:MAIN PORTS OF CHINA7、PORT OF DESTINATION:BUSAN KOREA8、INSURANCE:To be covered by the Buyer after shipment. Terms)9、DOCUMENT:+Signed invoice indicating LC NO and Contract No.+Full set(3/3)of clean on board ocean Bill of Lading marked“Freight to Collect”/“Freight Prepaid”made out to order blank endorsed notifying the applicant.+Packing List/Weight List indicating quantity/gross and net weight.+Certificate of Origin.+No solid wood packing certificate issued by manufacturer.10、OTHER CONDITIONS REQD IN LC:+All banking charges outside the opening bank are for beneficiary's a/c.+Do not mention any shipping marks in your L/C.+Partial and transshipment allowed.20 August,2005.::The last date of L/C opening、11REMARKS BANK OF KOREA LIMTED.BUSANSEQUENCE OFT0TAI, *27:l/lIRREVOCABLE:FORM OF DOC. CREDIT *40 A.DOC. CREDIT NUMBER * 20:S 100-108085DATE OF ISSUE 3l C:EXPIRY *31 D:DATE PLACE APPLICANT'S COUNTRYAPPLICANT *50 :JAE&SONS PAPERS COMPANY203 LODIA HOTEL OFFICE ,BUSAN,KOREABENEFICIARY *59 :WONDER INTERNATIONAL COMPANY LIMITED,QIJIANG ROAD HE DONG DISTRICT,NANNING CHINAAMOUNT *32 B:CURRENCY HKD AMOUNT 39,AVAILABLE WITH/BY *4lD:ANY BANK IN CHINA BY NEGOTIATIONDRAFTS AT… 42C:DRAFT AT 90DAYS AT SIGHT FOR FULL INVOICE COSTDRAWEE 42 A:BANK OF KOREA LIMITED,BUSANPARTIAL SHIPMENTS 43 P:NOT ALLOWEDTRANSSHIPMENT 43 T:NOT ALLOWEDLOADING IN CHARGE 44A: MAINPORTS OF CHINAFOR TRANSPORT TO 44 B:MAIN PORTS OF KOREALATEST DATE OF SHIP. 44 C: 2005103lGOODS 45 A:+COMMODITY :UNBLEACHED KR AET LINEBOARD.U/P:HKD /MTTOTAL:100MT±10% ARE ALLOWED.PRICE TERM:CIF BUSAN KOREACOUNTRY OF ORIGIN: PACKNG:STANDARD EXPORT PACKINGSHIPPING MARK:ST05—016 BUSAN KOREADOCUMENTS REQUIRED 46 A:1、COMMERCIAL INVOICE IN 3 COPIES:INDICATING LC NO.& CONTRACT2、FULL SET OF CLEAN ON BOARD OCEAN BIL OF LADING MADE OUT TOORDER AND BLANK ENDORSED,MARKED FREIGHT TO COLLECT NOTIFYING THE APPLICANT.3、PACKING LIST/WEIGHT LIST IN 3 COPIES INDICATNG QUANTITY/GROSS AND NET WEIGHTS4、CERTIFICATE OF ORIGIN IN 3 COPIESADDITIONAL COND. 47 B:ALL DOCUMENTS ARE TO BE PRESENTED TOUS IN ONE LOT BY COURIER/SPEED POST.DETAILS OF CHARGES 7lB:ALL BANKING CHARGES OUTSIDE OF OPENNINGBANK ARE FOR BENEFICIARY'S ACCOUNTPRESENTATION PERIOD 48:DOCUMENTS TO BE PRESENTED WITHIN 21DAYS AFTER THE DATE OF SHIPMENT BUT WITHIN THE VALIDITYOF THE CREDITCONFIRMATION *49:WITHOUTINSTRUCTIONS 78:+WE HEREBY UNDERTAKE THAT DRAFTS DRAWN UNDER AND IN COMPLY WTTH THE TERMS AND CONDITIONS OF THIS CREDIT WILL BE PAID MATURITY.SUBJECT ICC PUBLICATION 500:SEND TO REC. INFO. 72.经审核信用证存在如下问题:补充信息:1、9月10日装箱,每箱毛重51KGS/CTN,50KGS/CTN,CTN;唛头WI05-016/BUSAN KOREA/2、同日签发号码为WI05-0l6的发票3、9月12日向南京商务局申领原产地证书,并当日获得编号为05-866888证书4、9月16在南京装上SULONG 船只,提单于9月16南京签发,集装箱号为CESU8986855,SEAL5、于9月18日提交中国银行南京分行议付项目训练五:根据合同审核信用证,并根据信息制作单据。

一、根据下述合同内容审核信用证,并指出不符之处。

(36分)1、受益人名称与合同卖方不符(合同是SHANGHAI SHENG DA CO.,LTD.,信用证SHANGHAI DA SENG CO.,LTD.)2、开证申请人的地址不符(合同是28, IMAMGONJ,信用证是26,IMAMGONJ)3、商品名称不符(合同是STEEL TAPE RULES,信用证是TAPE RULES)4、商品规格不符(合同是JH-392W和JH-380W,信用证是JH-395W和JH-386W)5、单价不符(合同是USD3.60/DOZ PAIR CFR CHITTAGONG和USD4.20/DOZ PAIRCFRCHITTAGON,信用证是HKD3.60 PER DOZEN CIF CHITTAGONG和HKD4.20 PER DOZEN CIF CHITTAGONG)6、总金额不符(合同是USD9,300.00,信用证是CURRENCY HKD AMOUNT 9800.00)7、包装不符(合同是In Cartons,信用证是PACKING: EXPORT STANDARDSEAWORTHY PACKING)8、装运期不符(合同是During May, 2008,信用证是LATEST DATE OF SHIPMET : MAY2, 2008)9、装运港不符(合同是Shanghai,信用证是ANY CHINESE PORTS)10、分批和转运要求不符(合同是Partial Shipment and Transshipment are allowed.,信用证是PARTIAL SHIPMENT: NOT ALLOWED和TRANSSHIPMENT: NOT ALLOWED)11、合同用的是CFR术语,信用证要求受益人提交保险单不符12、CFR术语,提单上要求注明“FREIGHT COLLECT”不符13、付款期限不符(合同是Sight Letter of Credit,信用证DRAFTS AT 60 DAYS SIGHT)二、根据买方订单及相关资料缮制形式发票(24分)(12) DETAILS OF OUR BANK:BANK OF CHINA, SHANGHAI BRANCH,NO.4 Zhongshan road, Shanghai ,P.R.CHINASWIFT CODE: BKCHCNBJ530BENEFICIARY: SHANGHAI LUCKY SAFETY SCREENS CO., LTDACCOUNT NO: 1281 2242012 7091 015ADDRESS: UNIT C 2/F JINGMAO TOWER SHANGHAI ,CHINASHANGHAI LUCKY SAFETY SCREENS CO., LTD三、根据合同、信用证及补充资料缮制商业发票、海运提单、汇票及普惠制产地证FORM A(共40分)凭信用证号Drawn under industrial bank of Japan,ltd.,head office L/C NO.LC196107800日期按…. .息…. 付款Dated Oct.15,2007 Payable with interest @… .. % per annum 号码汇票金额上海NO.YL71001Exchange for USD12630.00 Shanghai …DEC.05,2007……………见票…………………日后(本汇票之正本未付)付交At *** sight of this FIRST of Exchange (Second of Exchange being unpaid) Pay to the order of BANK OF CHINA,SHANGHAI BRANCH金额the sum of SAY US DOLLARS TWELVE THOUSAND SIX HUNDRED AND THIRTY ONLY此致To: INDUSTRIAL BANK OF JAPAN,HEAD OFFICESHANGHAI YILONG CO.,LTD.XXXSHANGHAI YILONG CO.,LTD.X X X.Shipper Insert Name, Address and PhoneSHANGHAI YILONG CO.,LTD.NO.91 NANING ROAD SHANGHAI ,CHINA.B/L No.TH14HK07596.Consignee Insert Name, Address and Phone TO ORDER中远集装箱运输有限公司COSCO CONTAINER LINESNotify Party Insert Name, Address and Phone(It is agreed that no responsibility shall attach to the Carrier or his agents for failure to notify)ABC COMPANY1-3 MACHI KU STREET OSAKA,JAPAN Port-to-Port or Combined Transport BILL OF LADINGLADEN ON BOARD THE VESSEL DATE:NOV29,2007BY KAOHSIUNG V.0707SCOSCO CONTAINER LINESCNS01 0108895。

国际商务单证员(单证操作与缮制)模拟试卷3(题后含答案及解析) 题型有:1. 审核信用证 4. 制单根据合同审核信用证(本题20分)1.审证资料(二)审证要求根据销售合同资料审核上述信用证内容,找出信用证内容的不符点。

正确答案:1. PRICE TERMS: CIF SHANGHAI 改为CIF OSAKA 2. PARTIAL SHIPMENT: ALLOWED 改为PROHIBITED 3. DRAFTS AT: DRAFTS AT 15 DAYS AFTER SIGHT 改为DRAFTS AT SIGHT 4. AMOUNT: CURRENCY USD AMOUNT 1250.00 改为CURRENCY USD AMOUNT 12500.00 5. INSURANCE: FOR 120 PERCENT OF THE INVOICE V ALUE COVERING ALL RISKS 改为FOR 110 PERCENT OF THE INVOICE V ALUE COVERING ALL RISKS AND WAR RISK 6. TIME OF SHIPMENT: LATEST DATE OF SHIPMENT MAY 16,2007 改为MAR.16,2007 7. ART NO. HH46: USD 5.20/PC 改为USD 5.00/PC 8. BENEFICIARY: BANK OF CHINA SHANGHAI BRANCH 改为SHANGHAI IMPORT & EXPORT TRADE CORPORATION根据已知资料制单(本题40分)ISSUING BANK: BANK OF FUKUOKA, LTD. , THE TOKYO ADVISING BANK: BANK OF CHINA, NINGBO SEQUENCE OF TOTAL: 131 FORM OF DOC. CREDIT:IRREVOCABLE DOC. CREDIT NUMBER: H612-100672 DATE OF ISSUE :050422 EXPIRY EATE :050521 PLACE: BENE’S COUNTRY APPLICANT: SAKOYI CO. , LTD. 2-7-11 DAIRITONOUE MOJI-KU KITAKYUSYU-CITY, JAPAN BENEFICIARY:ZHEJIANG WANDAO FOOK IMPORT AND EXPORT GROUP NO. 112 JIANZHONG ROAD. NINGBO, CHINA AMOUNT:CURRENCY JPY AMOUNT 1275000.00 NEGOTIATION A V AILABLE WITH/BY:ANY BANK DRAFTS AT:DRAFT AT SIGHT FOR FULL INVOICE COST DRAWEE: BANK OF FUKUOKA, LTD. , THE TOKYO PARTIAL SHIPMENTS: PERMITTED LOADING IN CHARGE: NINGBO FOR TRANSPORT TO: MOJI, JAPAN LATEST DATE OF SHIP. :050507 DESCRIPT. OF GOODS:TRADE TERM CIF MOJI JAPAN CANNED BOILED BAMBOO SHOOTS DOCUMENTS REQUIRED: + SIGNED COMMERCIAL INVOICE IN 3 COPIES INDICATING CREDIT NO. + SEAWAY BILL IN THREE COPIES + PCKING LIST IN FIVE COPIES + INSURANCE POLICY IN 2 COPIES BLANK ENDORSED COVERING ALL RISKS AND WAR RISK FOR 110% INVOICE VALUE, CLAIM IF ANY PAYABLE AT DESTINATION IN THE CURRENCY OF THE DRAFT. + BENEIFICIARY CERTIFICATE CERTIFYING THAT THREE SETS COPIES OFNON-NEGOTIABLE CHIPPING DOCUMENTS HA VE BEEN AIRMAILED DIRECTLY. ADDITIONAL COND. :REIMBURSEMENT BY TELECOMMUNICATION IS PROHIBITED DETAILS OF CHARGES: ALL BANKING CHARGES OUTSIDE JAPAN ARE FOR ACCOUNT OF THE BENEFICIARY. PRESENTATION PERIOD: DOCUMENTS TO BE PRESENTED WITHIN 15DAYS AFTER THE DATE OF SHIPMENT BUT WITHIN THE V ALIDITY OF THE CREDIT. CONFIRMATION: WITHOUT INSTRUCTIONS:DRAFT AND DOCTS TO BE SENT BY AIR-COURIER TO OUR HEAD OFFICE, FUKUOKA (ADDRESS: 13-1 ,TENJIN2-CHOME, CHUO-KU, FUKUOKA,JAPAN) CONTRACT NO. :B9A15A3025 UNIT PRICE:CIF MOJI JPY850.00PER CAN TOTAL:JPY1275000.00 PACKING:IN CANS OF 20KGS EACH G.W. :22KGS EACH MEASUREMENT 0.018Ms EACH TOTAL:27.00M3 SHIPPED PER M/V :CHANGHE V. 45 SW B/L NO.:89 INVOICE NO.: BP2011446 SHIPPING MARKS: W/DMOJL/NO.1-UP2.受益人证明正确答案:3.正确答案:4.正确答案:5.装船通知ZHEJIANG WANDAO FOOK IMPORT AND EXPORT GROUP NO. 112 JIANZHONG ROAD. NINGBO, CHINA SHIPPING ADVICE DATE: Messrs: Dear Sirs: Re:Invoice No.: L/C No.: We hereby inform you that the goods under the above mentioned credit have been shipped. The details of the shipment as stated below. Commodity: Quantity: Amount: Ocean Vessel: Bill of lading No.: E. T. D. : Port of Loading: Destination: We hereby certify that the above content is true and correct. ZHEJIANG WANDAO FOOK IMPORT AND EXPORT GROUP正确答案:装船通知ZHEJIANG WANDAO FOOK IMPORT AND EXPORT GROUP NO. 112 JIANZHONG ROAD. NINGBO, CHINA SHIPPING ADVICE MAY 7, 2005 Messre: SAKOYI CO. , LTD. Dear Sirs: Re:Invoice No.: BP2011446L/C No.: H612-100672 We hereby inform you that the goods under the above mentioned credit have been shipped. The details of the shipment as stated below. Commodity: CANNED BOILED BAMBOO SHOOTS Quantity:1500CANS Amount: JPY1275000.00 Ocean Vessel: CHANGHE V.45 Bill of lading No.: 89 E. T. D. : On / or aboutMAY 5,2005 Port of Loading: NINGBO Destination: MOJI We hereby certify that the above content is true and correct. ZHEJIANG WANDAO FOOK IMPORT AND EXPORT GROUP ×××。

贸易合同审核信用证案例贸易合同审核信用证案例

尊敬的客户:

您好!我们从贵公司委托下来的项目中,发现了一份贸易合同,请您审阅并确认。

甲方:(公司名称、注册地、联系方式等详细信息)

乙方:(公司名称、注册地、联系方式等详细信息)

鉴于以下双方基于友好精神和相互信任,达成以下协议:

第一条产品名称和规格

第二条价格和付款方式

第三条发货方式和交货期限

第四条质量检验标准和手续

第五条违约责任

第六条双方协商解决争议的方式

第七条其他双方共同协商的事项

另外,贵公司参与的本合同,需要遵守中国相关的法律法规,如《中华人民共和国合同法》、《中华人民共和国外汇管理条例》、《中华人民共和国关于进出口商品检验法》等。

甲、乙双方在本合同中明确各自的权利和义务,并同意本合同所有条款的法律效力和可执行性。

本合同经双方签字和盖章后生效,履行期限为____年/月/日至____年/月/日。

贵公司如需修改或补充本合同的任何条款,请及时向我公司提出建议,我们会及时响应并做出合理的规定。

祝商祺,

律师事务所:______

律师姓名:______

日期:______年______月______日。

根据外销合同审核信用证1. 引言外贸合同的履行过程中,信用证的审查是非常关键的一环。

在外贸业务中,信用证是一种国际贸易支付方式的安排,它是由进口商向发票人的开户银行发出的,要求该银行在发票人提供一定的文件后向收款人支付一定金额的支付工具。

因此,对于外销合同来说,审核信用证非常重要,本文将对根据外销合同审核信用证的步骤和注意事项进行介绍。

2. 外销合同审核信用证的步骤2.1 了解信用证要求在审核信用证之前,首先要仔细阅读和理解信用证的要求。

信用证是由进口商的银行开立的,其中包含了支付的金额、货物要求、文件要求等重要信息。

因此,在审核信用证之前,要对这些信息进行详细了解,确保自己清楚信用证的要求。

2.2 比对与合同的一致性审核信用证时,需要将信用证的要求与外销合同进行比对,确认其一致性。

主要包括货物描述、数量、价格和付款条件等。

如果发现任何不一致之处,应及时与进口商进行沟通,以确保双方的合同和信用证一致。

2.3 检查必备文件审核信用证还需要检查提供给开证行的必备文件。

这些文件可能包括商业发票、装箱单、提单、保险单等。

确保这些文件符合信用证的要求,并且与合同的要求一致。

2.4 检查证明文件的有效性不仅需要检查文件的存在和重要性,还需要确保文件的有效性。

例如,商业发票和提单应该是签署并加盖公司公章的,同时还要检查日期和编号是否正确。

此外,保险单要求保险金额与信用证要求的金额保持一致。

2.5 确认付款条件信用证中规定了付款的条件,包括付款日期、货物的装运日期和保险要求等。

在审核信用证时,需要确保这些条件已被满足。

特别是货物的装运日期,要确保其在信用证规定的期限内完成。

3. 注意事项3.1 与进口商的沟通在审核信用证之前,与进口商进行充分的沟通是非常重要的。

任何不一致的地方都需要及时与进口商协商解决。

确保双方对信用证的要求都有清晰的认识。

3.2 注意额外的要求有些信用证可能包含额外的要求,如出口许可证、质量检验证书等。

练习1:已知陶瓷餐茶具合同SALES CONFIFMATIONS/C NO.:SHHX98027DATE:03-APR-98The Seller:huaxin TRADING CO.,LTD. THE BUYER:JAMSBROWN &SONSADDRESS:14TH FLOOR KINGSTAR MANSION,676 JINLIN RD.,SHANGHAICHINA ADDRESS:#304-301 JALANSTREET,TORONTO,CANADATO BE PACHED IN CARTONS OF 1 SET EACH ONLY.TOTAL:1639 CARTONSPORT OF LOADING &DESTINATION:FROM:SHANGHAI TO:TORONTOTIME OF SHIPMENT: TO BE EFFECTED BEFORE THE END OF APRIL 1998 WITH PARTIALSHIPMENT ALLOWEDTERMS OF PAYMENT: THE BUYER SHALL OPEN THOUGH A BANK ACCEPTABLE TO THE SELLER AN IRREVOCABLE L/C AT SIGHT TO REACH THE SELLER BEFORE APRIL10,1998 VALID FOR NEGOTIATION IN CHINA UNTIL THE 15TH DAYAFTER THE DATE OF SHIPMENT.INSURANCE: THE SELLER SHALL COVER INSURANCE AGAINSTT WPA AND CLASH & BREAKAGE & WAR RISKS FOR 110% OF THE TOTAL INVOICE VALUE AS PER THE RELEVANT OCEAN MARINE CARGO OF P.I.C.C. DATED1/1/1981.Confirmed by:THE SELLER THE BUYERHUAXIN TRADING CO.,LTDMANAGER 赵建国(signature)(signature)REMARKS:1. The buyer shall have the covering letter of credit reach the seller 30days before shipment,failing which the seller reserves the right to rescind without further notice,or to regard as still valid whole or ant part of this contract not fulfilled by the buyer,or to lodge a claim for losses thus sustained,if any.2. In case of any discrepancy in Quality ,claim should be filled by the Buyer within 30 days after the arrival of the goods at port fo destination;while for quantity discrepancy ,claim should be filed by the Buyer within 15days after the arrival of the goods at port of destination.3. For transactions concluded on C.I.F.basis,it is understood that the insurance amount will be for 110% of the invoice value against the risksspecified in the Sales Confirmation .If additional insurance amount or coverage required .the Buyer must have the consent of the Seller before Shipment and the additional premium is to borne by the Buyer.4. The Seller shall not be held liable for non-delevery or delay in delivery of the entire lot or a portion of the goods hereunder by reasen of natural disasters,war or other causes of Force Majeure ,However, the seller shall notify the Buyer as soon as possible and furnish the Buyer within 15days by registered airmail with a certificates issued by the china Council for the Promotion of International Trade attesting such event(s).5. All deputies arising out of the performance of,or relating to this S/C,shall be settled through negotiation .In case no settlement can be reached through negotiation ,the case shall then be submitted to the China international Economic and Trade Arbitration Commission for arbitration in accordance with its arbitral rules.The arbitration shall take place in Shanghai.The arbitral award is final and binding upon both parties.6. The Buyer is requested to sign and return one copy of this S/C immediately after receipt of the same.Objection,if any ,should be raised by the Buyer within 3 woeking days.otherwise it is understood that the Buyer has accepted the terms and conditions of this contract.7. Special condition:(These shall prevail over all printed terms in case of any conflict.)1998年4月8日,华信公司收到JBS公司通过加拿大皇家银行开来的编号为98/0501-FTC的信用证信开本,在装运货物之前,华信公司需要对国外来证进行仔细的审核,指出信用证存在的问题,以便联系进口商要求修改。

根据合同审核信用证21.合同资料销售合同SALES CONTRACTContract No:RT05342 Date:,2005 Signed at: Shanghai Sellers: shanghai tool import& export co., ltd Tel: Address:31,ganxiang road shanghai ,china Fax:Buyers: mamut enterprise sav Tel:024-4536-2453 Adress:tarragona75-3er,Barcelona,spain Fax:024-4356-2452 This contract is made by and between the sellers and buyers, whereby the sellers agree to buy the under-mentioned goods according to the conditions stipulated below:(5)Packing:8pc double offset ring spannerPacked in 1plastic carton of 16 sets each;9pc extra long hex key set,12pc combination spanner,10pc combination spannerPacked in 1plastic carton of 10sets each;12pc double offset ring spannerPacked in 1plastic carton of 8 sets eachPacked in three 40’container(6)delivery form shanghai, china to Barcelona, spain(7)shipping marksBARCELONAC/(8)time of shipment: latest date of shipment ,2005(9)partial shipment: not allowed(10)transshipment: allowed(11)terms of payment: by 100% confirmed irrevocable letter of credit to be available at 30days after sight draft to be opened by the sellers L/C must mention this contract number L/C advised by bank of china shanghai branch. all banking charges outsidechina(the mainland of china)are for account of drawee.(12)arbitration: any dispute arising form the execution of or in connection with this contract shall be settled amicably through negotiation, the case shall then be submitted to china international economic& trade arbitration commission in shanghai(or in Beijing)for arbitration in accordance with its arbitration shall be borne by losingparty unless otherwise awarded.The seller: shanghai tool import & export co., ltd the burer: mamut enterprise sav2.信用证资料DOCUMENTARY CREDITSequence of total *27:1/1Form of doc, credit *40A:revocableDoc. credit number *20:31173DATE OF ISSUE 31C 050404DATE AND PLAC E OF EXPIRY *31D:DATE 050531 PLACE CHINA APPLICANT *50:MAMUT ENTERPRISESAVTARRAGONA75-3ERBARCELONA,SPAINISSUING BANK 52A:CREDIT ANDORRAANDORRA LA VELLA,ANDORRA BENEFICIARY *59:SHANGHAI TOOL IMPORT &EXPORT CO.,LTD 31,GANXIANG ROADSHANGHAI,CHINAAMOUNT *32B:CURRENCY EUR AMOUNTAVAILABLE WITH/BY *41D:ANY BANK IN CHINABY NEGOTIATIONDRAFTS AT… 42C:AT SIGHTDRAWEE 42A:CREDIT ANDORRAANDORRA LA VELLA,ANDORRAPARTIAL SHIPMENTS 43P:ALLOWEDTRANSSHIPMNNT 43T:NOT ALLOWEDLOADING ON BOARD 44A:SHANGHAIFOR TRANSPORTATION 44B:BARCELONA(SPAIN)LATEST DATE OF SHIPMENT 44C:050510DESCRUOT OF GOODS 45A:HAND TOOLSAS PER PROFORMA INVOICE NODATED MARCH 10,2005FOR BARCELONADOCUMENTS REQUIRED 46A:+SIGNED COMMERCIAL INVOICE,1 ORIGINALAND 4 COPIES.+PACKING LIST,1 ORIGINAL AND 4 COPIES+CERTIFICATE OF ORIGIN GSP CHINA FORM A,ISSUED BY THE CHAMBER OF COMMERCE OR OTHERAUTHORITY DULY ENTITLED FOR THIS PURPOSE+ FULL SET OF B/L,(2 ORIGINAL AND 5 COPIES)CLEAN ON BOARD,MARKED “FREIGHTCOLLECT”,CONSIGNED TO:MAMUTENTERPRISESAV ,TARRAGONA75-3ERBARCELIBA,SPAIN,TEL+376 823 323 FAX+376 860914-860 807,NOTIFY:BLUE WATER SHIPPINGESPANA,ER2NA,A,08003 BARCELONA(SPAIN) TEL34 93 295 4848,FAX34 93 268016 81CHARGES 71B: ALL BANKING CHARGES OUTSIDE SPAIN ARE FOR ACCOUNT OF BENEFICIARYPERIOD FOR PRESENTATION 48: DOCUMENTS MUST BE PRESETED WITHIN 15 DAYS AFTER THE DATE OF SHIPMENT BUT WITHIN THE VALIDITY OF THE CREDIT。

习题二:信用证审核一、思考题:1.何谓信用证?简述其一般流程。

2.信用证方式的基本当事人有哪些?在什么情况下,又可能有什么当事人?各当事人分别承担什么责任?3.信用证方式的主要特点是什么?4.何谓“议付”?“议付”与“付款”有什么区别?二、操作题:1.练习目的:学会阅读信用证2.练习要求:根据下面的信用证范例找出下列内容:(1)信用证的种类(2)信用证号码(3)开证日期(4)信用证的有效期(5)信用证的到期地点(6)开证申请人名称、地址(7)受益人名称、地址(8)开证行名称(9)信用证金额及货币单位(10)分批运输(11)转运(12)装运港(地)、目的港(地)(13)最迟装运期(14)货名及规格(15)价格术语(16)交单期限(17)信用证要求的单据(18)信用证特别条款信用证范例:JUNE 5,2003 14:35:46 LOGICAL TERMINAL HN03MT S700 ISSUE OF A DOCUMENTARY CREDIT PAGE 00001FUNC HNHQP786MSGACK DWS6789 AUTH OK,KEY B003060267DE43AF,ICBKCNBJ BFDC***RECORDBASIC HEADER F01 ICBKCNBJ A367 0675 780609 APPLICATION HEADER O700 2851 030605 BFDCIE2DAXXX 5439 447618 020605 1806N* BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)USER HEADER SERVICE CODE 103BANK PRIORITY 113MSG USER REF. 108INFO. FROM CI 115TO:INDUSTRIAL AND COMMERCIAL BANK OF CHINA ZHEJIANG,CHINA(ICBKCNZJYYY)SEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT *40A : IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 : AF/651909DATE OF ISSUE 31C : 20030605EXPIRY *31D :DATE 20030810 PLACE CHINAAPPLICANT *50 : A AND D SARUE DU CHEMIN VERTCENTRE DE GROS NO.102AS0678 LESQUIN CEDEX FRANCEBENEFICIARY *59 : ZHEJIANGMACHINERY IMPORT& EXPORTCORPORATION,350 WENHUI ROAD,HANGZHOU,ZHEJIANG, CHINAAMOUNT *32B : CURRENCY USD AMOUNT 17600.00AVAILABLE WITH *41D : ANY BANKBY NEGOTIATION DRAFTS AT … 42C : SIGHTDRAWEE 42D : BFDCIE2DAXXX*BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)PARTIAL SHIPMENTS 43P : NOT ALLOWED TRANSHIPMENT 43T : ALLOWED:LOADING IN CHARGE 44A :SHANGHAI CHINAFOR TRANSPORTATION TO 44B :ANTWERPLATEST DATE OF SHIPMENT 44C : 20030725DESCRIPTION OF GOODS 45A :PARTS QTY. UNIT PRICELA1 500PCS @USD10.20 USD5100.00LA2 1000PCS @USD12.50 USD12500.00TOTAL USD 17600.00AS PER PROFORMA NR ZIEG/D003021 DATED 12/05/2003 AND ORDER NBER 03-758FREE ON BOARD SHANGHAIDOCUMENTS REQUIRED 46A :+COMMERCIAL INVOICE IN 03 ORIGINAL(S) AND 00 COPIES+PACKING LIST AND WEIGHT NOTE IN 03 ORIGINAL(S) AND 00 COPIES+3/3 ORIGINAL CLEAN ON BOARD OCEAN BILL OF LADING PLUS MORE 2 COPIES, ISSUED TO ORDER OF A AND D SA, RUE DU CHEMIN VERT,CENTRE DE GROS NO.102, AS0678 LESQUIN CEDEX FRANCE AND MARKED ” FREIGHT COLLECT ” AND NOTIFY DUBOIS SA ZONE INDUSTRIELLE DU PORT FLUVIAL 3749 TOURNAI BEIGIUM+CERTIFICATE GSP FORM A 1 ORIGINAL AND 1 COPY. ADDITIONAL CONDITIONS 47A:+ALL CHARGES OF BANKS OTHER THAN OUR OWN CHARGES ARE TO BE BORNE BY BENEFICIARY+QUANTITY AND VALUE MORE OR LESS 5 PERCENT ACCEPTABLE.+SHIPPING MARKS AS STATED ON THE RELEVANT SALES CONFIRMATION(S) OR PROFORMA INVOICE(S).+THIS CREDIT IS SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (1993 REVISION) INTERNATIONAL CHAMBER OF COMMERCE, PUBLICATION NUMBER 500.PRESENTATION PERIOD 48 : DOCUMENTS MUST BE PRESENTEDWITHIN 15 DAYS AFTER THE DATEOF SHIPMENT,BUT NOT LATERTHAN THE EXPIRY DATE OFCREDIT.CONFIRMATION * 49 : WITHOUTINSTRUCTIONS 78:+ WE WILL CREDIT NEGOCIATING BANK AT ITS BEST CONVENIENCE AFTER RECEIPT AT OUR COUNTERS OF DOCUMENTS ISSUED IN STRICT COMPLIANCE WITH TERMS OF ISSUED L/C. PLEASE FORWARD US DOCUMENTS VIA ANY COURRIER SERVICE. KINDLY ACKNOWLEDGE RECEIPT OF THIS L/C QUOTING YOUR REF.SEND TO RECO INFO. 72 : KINDLY ACKNOWLEDGE RECEIPTTHIS CREDIT BY RETURN SWIFT WILLBE MUCH APPRECIATEDTRAILER : MAC 6B32791ACHK:C7C590AF567A其他参考资料:发票号码: ZJIXM0135 发票日期: 2003年7月15日提单号码: WL-5307 提单日期: 2003年7月20日船名: KAMAN V.151 装运港: 上海集装箱号: GESU5637586(40’) 货物装箱情况: 25PCS/CTN毛重: @ 50KGS/CTN 净重: @48KGS/CTN 体积: @ 0.216CBM/CTN一、根据合同审核信用证(一)合同上海远大进出口公司SHANGHAI YUANDA IMPORT & EXPORT COMPANY上海市溧阳路1088号龙邸大厦16楼16TH FLOOR, DRAGON MANSION, 1088 LIYANG ROAD ,SHANGHAI200081 CHINASALES CONTRACTNO.: YD-MDSC9811 DA TE: 2007/11/8BUYERS: MAURICIO DEPORTS INTERNA TIONAL S.A. ADDRESS: RM 1008-1011 CONVENTION PLAZA,101 HARBOR ROAD, COLON, R.P.TEL.: FAX:THE UNDERSIGNED SELLERS AND BUYERS HA VE AGREED TO CLOSE THE FOLLOWING TRANSACTION ACCORDING TO THEQUANTITY AT THE SELLER’S OPTION.PACKING: 50KGS TO ONE GUNNY BAG. TOTAL 40000BAGS. SHIPMENT: TO BE EFFECTED DURING DEC.2007 FROM SHANGHAI, CHINA TO COLON,R.P. ALLOWING PARTIAL SHIPMENTS AND TRANSHIPMENT.INSURANCE: TO BE COVERED FOR 110% OF INVOICE V ALUE AGAINST ALL RISKS AS PER AND SUBJECT TO OCEAN MARINE CARGO CLAUSES OF PICC DA TED 1/1/1981.PAYMENT: THE BUYERS SHALL OPEN THROUGH A FIRST-CLASSBANK ACCEPTABLE TO THE SELLER AN IRREVOCABLE L/C AT 30DAYS AFTER B/L DATE TO REACH THE SELLER NOV .25,2007 ANDV ALID FOR NEGOTIATION IN CHINA UNTIL THE 15TH DAY AFTERTHE DATE OF SHIPMENT.SELLERS SHANGHAI YUANDA IMPORT &EXPORT COMPANY 赵国斌BUYER: MAURICIO DEPORTS INTERNATIONAL S.A. D.H.HONENEY请指出信用证中存在的问题:模拟练习:根据合同审核信用证(一)售货确认书售货确认书SALES CONFIRMATIONNO.LT07060DATE: AUG.10, 2005The sellers: AAA IMPORT AND EXPORT CO. The buyer: BBB TRADING CO.222 JIANGUO ROAD P.O.BOX 203DALIAN, CHINA GDANSK, POLAND下列签字双方同意按以下条款达成交易:The undersigned Sellers and Buyers have agreed to close the following总值TOTAL VALUE: U.S. DOLLARS FORTY FIVE THOUSAND ANDSIX HUNDRED ONL Y.装运口岸PORT OF LOADING: DALIAN目的地DESTINA TION: GDANSK转运TRANSSHIPMENT: ALLOWED分批装运PARTIAL SHIPMENTS: ALLOWED装运期限SHIPMENT: DECEMBER, 2005保险INSURANCE: BE EFFECTED BY THE SELLERS FOR 110%INVOICE V ALUE COVERING F.P.A. RISKS OFPICC CLAUSE付款方式PAYMENT: BY TRANSFERABLE CONFIRMED L/CPAY ABLE 60 DAYS AFTER B/L DA TE,REACHING THE SELLERS 45 DAYS BEFORETHE SHIPMENT一般条款GENERAL TERMS:1. 合理差异: 质地、重量、尺寸、花形、颜色均允许合理差异,对合理范围内查里提出的索赔,概不受理。