剑桥金融财务英语part2accounting

- 格式:ppt

- 大小:6.29 MB

- 文档页数:97

1Accounting会计is an information system.it measuresdata into reports,and communicates results to people2Financial accounting财务会计(外部)the branch of accounting that provides information to people outside the firmManagement accounting管理会计(内部)the branch of decision makers of a business,such as top executives. 3流动资产包括current assetsCash and Cash equivalents现金及其等价物short-term investments短期投资Inventories存货Accounts (notes) receivable应收账款(票据)prepaid expenses and other current assets预付账款(其他流动资产)4The account账户the record of the changes that have occurred in a particular asset liability,or stockholders’ equity during a period.5Assets资产(cash,accouts receivable,notesexpense,land buildings,equipment furniture fixtures)Liabilites负债(notes payable,accounts payable,accrued liabilities<payable不计,salary payable计算>)6Accounting adjustments fall into three basic catrgories 会计账项调整三类型of the p eriod,an adjustment is needed to decrease the Supplies account for the supplies used up)②depreciation(the accounting adjustment records Depreciation Expense,which decreases the book value of the asset over its life)③accruals(the adjustment debits a receiva ble and credits a revenue)7Items for reconciliation银行往来账科目①items bank(1Deposits in transit 2outstanding checks)②Items recorded by the bank but not yet recorded by the company.we may learn of these items form the bank statement(1bank collections 2electronic funds transfers 3service charge and the cost of printed checks 4interest revenue earned on checking account 5nonsufficient funds checks)③errors by the company or the bank8Treasury stock库存股a corporations own stock that it10Available-for-sale invesments可供出售投资all investments not classified as held-to-maturity or trading securities.可供出售投资的成本Available-for-sale invesments are accounted for at market value because the company expects to sell the stock at its market price.cost is used only as the initial amount for recording the investments.these investments are reported on the balance sheet as current market value.11股票股利与现金股利不同Receipt of a stock dividend is different from receipt of a cash dvidend.for a stock dividend,the investor records no dividend revenue.instead,the investor makes a memorandum entry in the accounting records to denote the new number of shares of stock held as an investment.because the number of shares of stock held has increased,the investor’s cost per share of the stock decreases.12equity method权益法the method used to account for investments in which the investor has 20-50% of the investee’s voting stock and can significantly influence the decisions of the investee.14Held-to-maturity investments持有至到期投资bonds 15amortized cost method摊销成本法16hedging套期保值to protect oneself from losingby engaging in acounterbalancing transaction17comprehensive income全面收益a company change intotal stockholder’s equity from all sources other thanfrom the owners of the business.内容①unrealizedgains(losses)on available-for-saleinvestments②foreign-currency translation adjustments18 Investing activities投资活动: Activities that increaseor available to thebusiness, a section of the statement of cash flows,Investing activities are important but they are less criticalthat operating activitiesFinancing activities筹资活动: Activities that obtain frominvestors and creditors the cash needed to launch andsustain the business, a section of the statement of cashflows, they are the least important of the threecategories of cash flows, and that’s why they come lastOperating activities经营活动: Activities that createa section of the statement of cash flows, Operatingactivities affect the income statement, Operatingactivities are the most important of the three categoriesbecause they reflect the heart of the organization, asuccessful business must generate most of its cashfrom day-to-day operation19Accounting foundation principles会计基本原则Thetheaccounting principle that ensures that accountingrecords and statements are based on the most reliabledata available) ;The cost principle;Thegoing-concept;The stable-monetary-unit concept.20Trial balance试算平衡表 a list of all the ledger21Accrual accounting权责发生制accounting thatevent as itoccurs,regardless of whether the transaction affectedcash.Cash-basis accounting收付实现制accountingthat records only transactions in which cash is receivedor paid.区别In accrual accounting,an accountantrecords the impact of a business transaction as itoccurs.when the business perfotms a service,makes asale,or incurs an expense,the accountant records thetransaction even if it receives or pays no cash.Incash-basis revenues,and cash payments are handledas accounting,the accountant records a transactiononly when it receives or pays cash22Internal control内部控制organizational plan andrelated measures adopted by an entity tosafeguard.assets,encourage adherence to compannypolicies,promote operational efficiency,and ensureaccurate and reliable accounting records目的①safeguard assets②encourage adherence tocomp any policies③promote operationalefficiency④ensure accurate and reliable accountingrecords23 LIFO(后进先出法)FIFO(先进先出法)cost ofgoods sold is highest because it is based on the mostrecent costs,gross profit is lowest .FIFO cost of goodssold is lowest because it is based on the oldestcosts,gross profit is highest .②when inventory cost are decreasing .FIFO cost ofgoods sold is highest , LIFO cost of goods sold islowest24depreciation折旧is not a process of valuation,doesnot mean setting aside cash to replace assets as theywear out三种方法①straight-line②units-of-production③double-declining-balance-an accelerated depreciation method.Comparing depreciation methods对比the DDB methodys ①Residualvalue is ignored initially ;first-years depreciation iscomputed on the asset’s full cost ②Depreciationexpense in the final year is the “Pula” amount neededto reduce the asset’s book value to the residualamount.预付费用,应计费用的定义及区别:Prepaid expense预付费用:A category of miscellancousfuture.Accrued expense应计费用:An expense incrurred(区别):a prepaid expense is an expense paid in advanceprepayment will be used up in the nearfuture.Therefore prepaid expenses are assets,becausethey provide a future benfit for the owner.The ternaccrued expense refers to a liability that arises from anexpense that has not yet been paid.25 Gross profit percentage毛利率=gross profit毛利/net-cost ofgoods sold)/net sales revenue =1-(cost of goodssold/net sales revenue)26Beginning inventory存货+purchase s购买=goodsavailable可供出售存货-cost of goods sold销售成本=Ending inventory27 net sales revenue销售收入净额=sales revenue销售收入-sales discounts销售折扣-sales returns andallowances销售和津贴28 interest expense利息费用=the preceding bond市场利率29prepaid rent预付租金Dr:prepaid rent Cr:cashDr:rent expense租金Cr:prepaid rent预付租金Supplies物料Cr:CashDr: Supplies expense物料费Cr: SuppliesAccrued revenues应计费用Dr:accounts receivable应收账款Cr:service revenue服务收入30writing off uncollectible acounts注销坏账Cr:accounts receivable 应收账款31Record the purchase stock as follows股票购买记录Dr:Treasury stock库藏股Cr:cashSale出售Dr:cashCr:treasury stockpaid-in capital from treasury stocktransactions实收资本形成库藏股业务32Three relevant dates for dividends are as follow与股利发放相关的三个日期①decl aration date june19股利宣布日6.19Dr:retained earnings留存收益Cr:dividends payable应付股利②date of record July1登记日7.1③payment date July10支付日Dr:dividends payable应付股利Cr:cash33 权益法下①to purchase equity-method investment权益投资Cr:cash②To record investment revenue记录投资收益Dr:long-term investmentCr:equity-method investment revenue权益投资收益③To receive cash dividend on equity-method investment收到权益投资的现金股利Dr:cashCr: long-term investmentsold 20% of investment出售20%的投资loss on sale of investment出售投资损失Cr: long-term investment34Taxble income所得税记录当年所得税Dr:income tax expense所得税费用Cr:income tax payable应交所得税deferred tax liability递延所得税负债(is usuallylong-term)35①折价债券发行Discount on bonds payableCr: Bonds payable②付息Discount on bonds payableCr: Cash③计息Discount on bonds payableCr: Interest payable36①溢价债券发行Cr: Bonds payablePremium on Bonds payable②付息Premium on bonds payableCr: Cash37提折旧Cr: Accumulated depreciation38预收服务收入Dr: Unearned service revenueCr: Service revenue39应计广告费用Cr: Account payable40应计利息收入Dr: Interest receivableCr: Interest revenue例题1.Issued 10000shares of$1 par common stock at $5 per shareDr: cash 50000Cr: common stock 10000Paid-in capital in excess of par 400002.Purchased 900shares of treasury stock at$7 par shareCr: cash 63003.Sold 800shares of treasury stock at$12 par share Dr: cash 9600Cr: treasury stock 5600Paid-in capital from treasury stock transaction 40004.What is the net effect on stockholders’ equity?①common stock increased by 10000②Paid-in capital in excess of par 40000③Paid-in capital from treasury stock transaction 4000Less: treasury stock 700④Net effect=10000+40000+4000-700=53300The beginning balance sheet of Charter Investments Bankers,Ltd.included the following: investment)…$657000期初长期股权余额Charter completed the following investment transactions during the year发生的投资业务:Feb.16 Purchased 5000 shares of BCM Software common stock as a long-term available-for-sale investment,paying $9.25 per share.(购买股票作为长期股权投资,每股$)May.14 Received cash dividend of $0.82 per share on the BCM investment(收到现金股利).Oct.15 Received cash dividend of $29000 from an affiliated company(从子公司收到现金股利).Dec.31 Received annual reports from affiliated companies(收到子公司的年度报表).Their total net income for the year was $620000.Of this amount,Charter’s proportionis 25%(母公司占子公司25%股权) The market values of Charter’s investments are BCM(BCM股票市价),$45100;affiliated companies(子公司市价),$947000.Required:1.Record the transations in the journal of 2.Post entries to the Long-Term Investments in Affiliates T-account and determine its balance at December 31(计算母公司对子公司长投的本年余额)①Feb.16Dr: Long-Term Investments (5,000*$9.25) 46250 Cr: Cash 46250May14 Dr: Cash (5,000 $.82) 4100Cr: Dividend Revenue 4100Oct.15 Dr: Cash 29,000Cr:Long-Term Investments in Affiliates 29,000 Dec.31 Dr: Long-Term Investments in Affiliates ($620,000 .25%) 155,000Cr:quity-Method Investment Revenue 155,000Dr: Unrealized Loss on Investment 1,150Cr: Allowance to Adjust Investment to Market ($46,250 –$45,100) 1,150②Balance=657000-29000+155000=783000 应计利息Accrued interest应收账款accounts receivable应收股利Dividend receivable应收利息Interest receivable应收票据Note receivable应收账款Account receivable其他应收款Other notes receivable物资supplies存货inventory预付租赁prepaid rent预付保险prepaid insurance短期投资short-term investments土地land家具furniture子公司投资investments in subsidiaries长期股权投资investments in stock持有至到期投资investments in bonds开办费organization cost特许权franchises专利patents融资租赁leaseholds商誉goodwill其他应收款other receivables到期应付债券current portion of bonds payable应付票据Notes payable应付工资salary/wages payable应付工资税payroll taxes payable应付职工福利费employee benefits payable应付债券Bonds payable租赁负债lease liability应付利息Interest payable应付账款Account payable预收账款Deposit received应付股利Dividends payable累计折旧Accumulated depreciation坏账准备allowance for uncollectible accounts实收资本paid-in capital资本公积Capital reserve股本溢价paid-in capital in excess of par减值准备Depreciation reserves固定资产减值准备Fixed assets depreciation reserves固定资产清理Liquidation of fixed assets待摊费用deferred and prepaid expenses应交税金Tax payable应交所得税income tax payable应交营业税Business tax payable应交消费税Consumption tax payable应交资源税Resources tax payable预提费用Drawing expense in advance债券面值Face value, Par value债券溢价Premium on bonds债券折价Discount on bonds存货跌价准备Inventory falling price reserves长期投资Long-term investment长期股权投资Long-term investment on stocks股票投资Investment on stocks递延税款Deferral taxes盈余公积Surplus reserves留存收益retained earnings股利dividends本年利润Current year profits利润分配Profit distribution少数股东权益minority interest普通股common stock普通股转增资本Common Stock dividends change to assets优先股preferred stuck股本溢价capital in excess of par未分配利润Undistributed profit利息收入interest revenue股权投资收入equity-method investment revenue销售固定资产收入gain on sale of land主营业务收入Sales revenue销售收入sales revenue销售成本cost of goods sold主营业务成本Cost of good sales营业外支出extraordinary losses管理费用General and administrative expenses佣金支出commission expense财务费用Financial expenses利息费用interest expense投资收益Investment income杂费miscellaneous expense租赁费用rent expense保险费用insurance expense物资费用supplies expense工资费用salary expense所得税费用income tax expense财产税费用property tax expense工资税支出payroll tax expense坏账损失uncollectible account expense摊销费用amortization expense折旧费用depreciation expense资产减值损失loss on sale of land非常收益/损失extraordinary gains/losses。

U1Currency Notes Banknotes CoinsCashBank deposits On paper Personal finance EarnsIncomeSalaryWages Overtime Commission BonusFeesSocial security Pension Spend Outgoings Living expenses BillsRent Mortgage Health insurance TaxU2Set upCapitalBorrowLoanInterest Shares Equities Shareholders OwnShare capital InvestorsLendBondsOwedDebt Liabilities U1货币钞票钞票纸币硬币现金银行存款在账面上个人理财赚收入薪水工资加班佣金奖金费用社会保障退休金花费支出生活费用账单租金抵押贷款健康保险税收U2创立资本借贷款利息股票股票股东自己的股本投资者借出债券欠债务债务On creditWorking capitalFundsRevenueExpensesProfitEarningsNet incomeDividendTaxRetainFinancial statements Balance sheetAssetsProfit and loss accountU3AccountingRecordingTransaction Accountancy BookkeepingFinancial accounting PreparingCreditors Management accounting AuditingAccuracyFraudInternal audit AccountantsInternal auditors External audit Independent auditors Creative accountingTrue and fair viewLawsFollow rulesStandardsApplyAnnual accountsU4Double-entry bookkeeping Bookkeepers Transactions 赊账营运资金基金收入费用利润收益纯收入股息税收保持财务报表资产负债表资产损益账户U3会计核算记录交易会计学记账财务会计准备债权人管理会计审计准确度欺诈内部审计会计人员内部审计师外部审计独立审计师创造性会计真实与公平的观点法律遵循规则标准应用年度账目U4复式记账记账人交易AccountDebitCreditRaw materialsStockDebtorsDay booksJournalsNominal ledgers CreditorsBought ledger Accounting periodTrial balanceU5PartnershipPartnersSole traderCompanyLegal entityLimited liabilityShare capitalDirectorsExecutive directors Corporate governance ChairmanManaging directorNon-executive directors Board of directors ObjectiveAudit committeeFoundArticles of association Memorandum of association Registered officePurposeAuthorized share capitalsU6Private companiesPublic limited companies Stock exchange CorporationListed companies Quarterly reports Turnover 账目借记贷记原材料库存债务人日记账日记账总分类账债权人应付账款分类账会计期试算平衡表U5合营公司合作伙伴独资经营者公司法人实体有限责任股本董事执行董事公司治理董事长总经理非执行董事董事会客观的审计委员会建立公司章程公司章程注册办事处目的注册股本U6民营企业公开股份有限公司证券交易所公司上市公司季度报告营业额Gross profitNet profitQuoted companiesInterim reportAnnual reportAuditors’ reportAnnual general meeting Extraordinary general meeting MisconductU11Balance sheetsAssetsLiabilitiesCapitalShareholders’ equityOweSuppliersGranting creditAssets equal liabilities plus capital Share capitalRetained earningsDistributedProfit and loss accountCash flow statementU12Current assetsNon-current assetsTotal assetsFixed assetsNon-current assetsCashDebtorsAnticipate the lossWrite offBad debtMake provisionsWork-in-progressLower of cost or market Tangible assetsAccumulated depreciation charges Net book valueIntangible assetsBrand namesPatents 总利润净利润上市公司中期报告年度报告审计报告年度股东大会临时股东大会不当行为U11资产负债表资产债务资本所有者权益欠供应商信贷发放资产等于负债加资本股本留存收益分配损益账户现金流量表U12流动资产非流动资产总资产固定资产非流动资产现金债务人预见损失冲销坏账制定条款半成品成本与市场孰低法有形资产累计折旧费账目净值无形资产品牌名称专利Trade marksNet worthNet assetsGoodwillU13Long-term liabilitiesNon-current liabilitiesCurrent liabilitiesCreditorsDeferred taxesAccrued expensesCharged againstShareholders’ equityShare premiumFace valueReservesU14Profit and loss accountNon-profit organizationIncome and expenditure accountSales revenueTurnoverCost of salesCost of goods soldGross profitSelling, general and administrative expenses (SG&A)EBITDAEBITNet profitBottom lineCash flow statementOperationsInvestingFinancingFunds flow statementSource and application of funds statement Statement of total recognized gains and losses (STRGL)U17Cost accountingProfitableDirect costsIndirect costs 商标净值净资产商誉U13长期负债非流动负债流动负债债权人递延税金应计费用冲抵股东权益股票溢价面值准备金U14损益账户非营利组织收支账户销售收入营业额销售成本销货成本总利润销售、一般及行政费用(SG&A)息税折旧摊销前利润息税前利润净利(收益表最后一行)净利现金流量表操作投资融资资金流量表资金来源应用表确认损益总额损益表(STRGL)U17成本核算有利可图的直接成本间接成本OverheadsFixed costsVariable costs Allocating Absorption costing Activity-based costing Cost centres Breakeven analysis Breakeven point Sales volumeCovers its costs Objectives Marketing policiesU18Mark-up pricingCost-plus pricingUnit costSales targetsProfit targetsMarket penetration LaunchMarket share Economies of scale Market skimming Market segments Monopolists Prestige pricing Image pricingTarget customers Going-rate pricing Retail pricing strategies Loss-leader pricing Odd pricingOdd-even pricing ElasticityElasticPrice variations InelasticU19Current account WithdrawInterestSavings account Deposit account 日常管理费用固定成本变动成本分配吸收成本法作业成本分析法成本中心盈亏平衡分析盈亏平衡点销售量弥补成本目标营销政策U18成本加成定价法成本加成定价法单位成本销售指标目标利润市场渗透定价法发射市场份额规模经济撇脂定价法细分市场垄断者声望定价法形象定价法目标客户随行就市定价法零售定价策略亏本销售定价策略奇数定价奇偶定价弹性定价弹性的价格变动非弹性的U19现金账户;活期存款账户取出利息储蓄账户存款账户(monthly) Statements DebitsCreditsDebit card WithdrawalsCash dispensers Credit card ChequesBank transfer Standing orders Direct debitsLoansOverdrafts Overdraw Mortgages Collateral RepossessForeign currency Traveller’s cheques Investments Private pension plans Telephone banking internet bankinge-banking branchesU20DepositBank account Commercial bank Retail bankPay interest DepositorsGrant loans TransferCreate credit assetsLiabilities ReservesReserve requirement Assess Standardized Personal customers Personal loans Terms and conditions 结算单;(对账单)借方信用借记卡取款现金提款机信用卡支票银行间转账委托书直接借记贷款透支透支抵押贷款抵押物收回外币旅行支票投资私人养老金计划电话银行业务网络银行网上银行分支机构U20存款银行账户商业银行零售银行支付利息储户发放贷款使转移信用创造资产债务储备法定准备金评估标准化个人顾客个人贷款条款和条件Risk assessment Corporate customers LiquidityMaturitiesYieldU22Raising capital IntermediariesIssuing securities UnderwriteInitial public offerings(IPOs) Raise fundsAcquireInstitutional investors Investment funds Pension funds StockbrokingDealingExecutes ordersMergersAcquisitions DivestituresSubsidiaryFeeConsulting firmStrategic planning Financial restructuring ResearchAnalystsForecastersValuation 风险评估公司客户流动性到期日资产收益率U22筹资中介机构发行证券承购,包销首次公开发行(IPO)筹集资金收购机构投资者投资基金养老基金股票经纪活动处理执行命令合并收购资产剥离附属的费用咨询公司战略规划财务重组研究分析师预报员价值评估。

Chapter 2 Talking about studyWhat’s your major? 你的专业是什么?Introduction:在雅思考试中,,作为考官对你个人背景了解之一的常问问题就是“专业”,其中包括最基本的个人专业的英文表达,选择专业的原因,是否喜爱自己的专业。

如果是高中在读的同学虽然还没有专业,不过也可以说说自己是文科生arts students还是理科生science students。

并且可以谈谈自己以后想学的专业。

在此节中重点要掌握如何表达自己的专业,和对专业喜爱的原因。

Task 1: you are going to hear two conversations, while listening, underline some useful phrases about Study.Conversation 1:Ann:Steve, who are the two women over there?Steve:Oh, their names are Shirley and Linda. Hi, Shirley. This is Ann. She is from Canada. Ann:Hello. Shirley, nice to meet you.Shirley:Hi, Ann. Nice to meet you, too. What do you study here?Ann:I’m studying Biology. And what’s your subject?Shirley:It’s engineering.Ann:Hi, Linda. What are you studying here?Linda:I’m studying Arts.Ann:Oh, that sounds interesting.Steve:Shirley. And Linda are from the UK.Ann:Oh, where are you from in the UK?Shirley:I’m from Edinburgh.Linda:And I come from Leeds.Conversation 2:Lily: What’s your major?Mike: I come to China just to study Chinese.Lily: Where are you studying now?Mike: At the Beijing Language and Culture University.Lily: How many years have you studied?Mike: I've already studied for three years. One year left for graduation.Lily: Are you going back to your country after graduation?Mike: Yes, I'll return to my country and look for a job.Lily: Is it difficult to find a job?Mike: Not very difficult, because there is not many people in my country who know Chinese.Lily: Mike, tell me why you chose to study Chinese?Mike: well, to be honest, I chose it based on my personal interest. You know, since I was a boy I have always been interested in language. And I reckon Chinese is a very interesting language to study.Lily: Good. Wish you good luck.Mike: Thanks.Task 2: Pair Work. Now, role-play the conversations in Task 1 with your partner. Then it is required for you to remember these phrases and expressions below. Inquiring about study:What are you studying? / What’s your major? / What’s your subject? 你的专业是什么What subjects do you like most and what subjects do you dislike most?你最喜欢/最不喜欢的专业是什么Why did you choose this major? 你为什么选择这个专业?What do you think of your major? 你觉得你的专业怎么样?Answering:I major in Finance. I am studying Finance. My subject is Finance. 我是金融专业的。

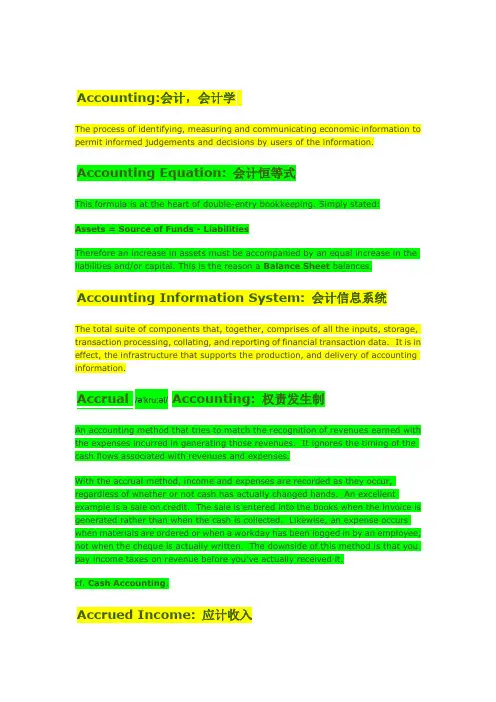

Accounting:会计,会计学The process of identifying, measuring and communicating economic information to permit informed judgements and decisions by users of the information.Accounting Equation: 会计恒等式This formula is at the heart of double-entry bookkeeping. Simply stated:Assets=Source of Funds-LiabilitiesTherefore an increase in assets must be accompanied by an equal increase in the liabilities and/or capital. This is the reason a Balance Sheet balances.Accounting Information System: 会计信息系统The total suite of components that, together, comprises of all the inputs, storage, transaction processing, collating, and reporting of financial transaction data. It is in effect, the infrastructure that supports the production, and delivery of accounting information.Accrual /ə'kru:əl/ Accounting: 权责发生制An accounting method that tries to match the recognition of revenues earned with the expenses incurred in generating those revenues. It ignores the timing of the cash flows associated with revenues and expenses.With the accrual method, income and expenses are recorded as they occur, regardless of whether or not cash has actually changed hands. An excellent example is a sale on credit. The sale is entered into the books when the invoice is generated rather than when the cash is collected. Likewise, an expense occurs when materials are ordered or when a workday has been logged in by an employee, not when the cheque is actually written. The downside of this method is that you pay income taxes on revenue before you've actually received it.cf. Cash Accounting.Accrued Income: 应计收入Accrued income is normally from a source of income, outside of the main source of business income, such as rent receivable on an unused office in the company headquarters, that was due to be received by the end of the period, but which has not been received by that date. It is added to debtors in the balance sheet.Assets: 财产,资产Generally, an asset is something that is of value to a company. An asset can then be broken down further into tangible and intangible assets.Examples of tangible assets include property, vehicles, stock, cash, money held in the bank and Debtors as they owe money from sales made by thecompany. However, these can be broken down still further into Fixed Assets and Current AssetsExamples of intangible assets include patents, copyrights, trademarks and goodwill. While these may not have value to the man on the street, these generate income for the company.Auditor: 审计员A person qualified to inspect, correct and verify business accounts.Bad Debt: 坏账A person or company who is not expected to pay his debt; for example, because the company has gone into liquidation. Bad debts must be written-off and therefore they will reduce profit.A bad debt becomes a bad debt when a business decides it is one, this decision is often based on past experience. Decisions are made by keeping a list of all debtors (aged debtors), and reviewing this list periodically.If a business is having difficulties collecting money owed from one of its customers it may decide to cancel the debt. This is called a write-off and the accounts would need to be adjusted for this write-off.A Bad Debt account would need to be set up and this would be an expense account. To account for a bad debt there are in fact three transactions involved:∙You would debit the Bad Debt account with the Net amount∙Debit the VAT account with the VAT amountCredit the Debtors Control account with the Gross amountThis type of transaction would affect both the profit and loss, and the balance sheet. The profit and loss would show the bad debt as an expense as this is money owed by a customer that cannot be collected.The transaction has previously processed as a debit to the Debtors Control account. As it is money that can no longer be collected, you would reverse this by making a credit to the Debtors Control account.A list of customers accounts are usually kept called Aged Debtors Control. A decision to write-off a bad debt would be made by reviewing the AgedDebtors/Debtors Control.Balance Sheet: 资产负债表A report that details the various assets and liabilities of a business at a point in time, usually the end of an accounting period. A Balance Sheet must always balance, i.e. debits must always equal the credits.Bank Loan: 银行贷款An amount of money advanced by a bank that has a fixed rate of interest that is charged on the full amount, and is repayable by a specified future date.Bank Payment: 银行付款方式A transaction posted that reflects the payment for goods or a service where there has either been no invoice (e.g. buying petrol for a car, the money is handed over immediately the goods have been received) or the invoice is paid as soon as it is received thereby removing the need to post an invoice onto the purchase ledger. A Bank Payment is represented in Sage by the transaction type "BP".Bank Receipt /ri'si:t/: 银行收据A transaction posted that reflects the receipt of money for goods or a service where there has either been no invoice (e.g. selling goods over the counter, the money is handed over immediately the goods have been received) or the invoice is paid as soon as it is received thereby removing the need to post an invoice onto the Sales Ledger. A Bank Receipt is represented in Sage by the transaction type "BR".Bank Reconciliation /,rekənsili'eiʃən/: 银行对账单The process of matching and comparing figures from accounting records against those presented on a bank statement. Less any items which have no relation to the bank statement, the balance of the accounting ledger should reconcile (match) to the balance of the bank statement.Bank reconciliation allows companies or individuals to compare their account records to the bank's records of their account balance in order to uncover any possible discrepancies.Since there are timing differences between when data is entered in the banks systems and when data is entered in the individual's system, there is sometimes a normal discrepancy between account balances. The goal of reconciliation is to determine if the discrepancy is due to error rather than timing.For example, simply click this link to download Excel spreadsheet.Bank Reconciliation Statement: 银行往来调节表,银行核对单A calculation comparing the Cash Book balance with the bank statement balance. Bank Statement: 银行结单A copy issued by a bank to a customer showing the customer's current account maintained at the bank.Bankrupt: 破产,破产人A person, firm, or corporation that has been declared insolvent through a court proceeding and is relieved from the payment of all debts after the surrender of all assets to a court-appointed trustee.Bankruptcy Petition/pə:'tiʃən/: 破产申请书A written application to Court by either a debtor or his creditors applying for an order to be made for the debtor to be made bankrupt.Book Keeping: 记账The process of recording data relating to accounting transactions in the accounting books, or software.Budget: 预算A forecast of expected income or expenditure over a specified period of time.Business-To-Business (B2B): 企业对企业电子商务Businesses purchase from other businesses and/or sell their goods and services to other businesses.Business-To-Customer (B2C): 企业对客户电子商务Businesses which sell to consumers.By-Product:副产品Products of minor sales value that result from the production of a main product.Capital: 资产,资本In general, capital is the money invested in the business. Shareholder’s capital employed refers to share capital and reserves only, total capital employed includes long term loans.Capital Gain: 资本利得Profit made on selling an asset for more than its original purchase price.Capital Gains Tax: 资本利得税,资本收入税Tax paid on the profit made on selling an asset for more than its original purchase price, i.e. the capital gain.Cash: 现金Cash balances and bank balances, plus funds invested in 'cash equivalents'.Cash Equivalents:现金等价物Temporary investments of cash not required at present by the business, such as funds put on short-term deposit with a bank. Such investments must be readily convertible into cash, or available as cash within three months.Cash Flow:流动资金The movement of cash in and out of a business. Profitable businesses can still fail if customers pay more slowly than the business pays its suppliers, so cash flow should always be measured.Cash Flow Forecast:现金流量预测A report which estimates the cash flow in the future (usually required by a bank before it will lend you money, or take on your account). A cash flow forecast is often used as part of a business plan.For simple example and template, simply click this link to download Excel spreadsheet.For advanced example and template, click this link instead to download Excel spreadsheet.Cash Payment:现金付款A transaction posted that reflects the payment for goods or a service where there has either been no invoice (e.g. buying petrol for a car, the money is handed over immediately the goods have been received) or the invoice is paid as soon as it is received thereby removing the need to post an invoice onto the purchase ledger. Instead of the money being paid directly out of the bank the money is paid out of either the Petty Cash account or out of the Till account. Cash Payments are reflected in Sage by the transaction type "CP".Corporation Tax: 公司税A form of direct taxation levied on the profits of (uk) companies. The rate is determined each year in the Finance Act.Cost Of Sales:销货成本The direct costs incurred as a result of making sales. For a retail company, this may mean the cost of purchasing goods, net of carriage and purchasing discounts, less the movement in the value of the stock. For a manufacturing company, it may mean the cost of producing the goods sold.Credit Card: 信用卡A card enabling the holder to make purchases and to draw cash up to apre-arranged limit. The credit granted in a period can be settled in full or in part by the end of a specified period. Many credit cards carry no annual fee.cf. Charge Card.Creditors:债权人Third parties to whom money is owed by the business.Current Asset: 流动资产A current asset is an asset that’s worth can be easily realised. It can also be termed a liquid asset, for example, money in the bank or in petty cash, debtors, prepayments, or stock.cf. Fixed AssetCurrent Liability:短期负债A current liability is a debt owed by the company, for example, creditors, accruals or an overdraft that will be cleared in the short term.cf. Long-Term LiabilitiesCurrent Ratio: 流动比率This compares assets, which will become liquid within approximately twelve months (i.e. total current assets) with liabilities which will be due for payment in the same period (i.e. total current liabilities) as is intended to indicate whether there are sufficient short-term assets to meet the short term liabilities.Current Ratio = Current Assets ÷ Current LiabilitiesThus, this ratio is an indication of the ability of a business to pay its debts when they fall due. Sometimes a ratio of 2:1 is quoted as being average. What this means, is that for every £1 of current debt, there is £2 in current assets to meet that debt.See Acid Test Radio for a comparision without the inclusion of stock. Debenture: 债券The term debenture is used when a limited company receives money on loan, and certificates called debenture certificates are issued to the lender. Interest will be paid to the holder, the rate of interest being shown on the certificate. They are not always called debentures; they are often known as loan stock or as loan capital.Debenture interest has to be paid whether profits are made or not. They are therefore different from shares, where dividends depend on profits being made. A debenture may be either:∙Redeemable, i.e repayable at or by a particular date, or∙Irredeemable, normally repayable only when the company is officially terminated by its going into liquidation. (Also sometimes referred to as'perpetual' debentures)Debit: 借方One side of the double entry process, representing positive figures on the Balance Sheet (increases in assets; reductions in liabilities and capital), and expenditures on the Profit and Loss report.Applies an increase to the PEA accounts and a decrease to the RLS accounts. See the PEARLS rule for further information.Debit Card:借记卡A card linked to a bank or building society account and used to pay for goods and services by debiting the holders account. Debit cards are usually combined with other facilities such as ATM and cheque guarantee card functions.Debtors: 债务人Third parties who owe your business payments for services rendered or goods received.Depletion/di'pli:ʃən/:损耗,消耗The wasting away of an asset as it is used up.Depreciation: 折旧,贬值A figure representing the reduction in value of a fixed asset, due to use, obsolescence etc., in the calculation of Net profit.This involves splitting the monetary value of the asset into instalments to each accounting period of its useful life.Depreciation involves estimates of life and residual values. It is common that an asset will be worth less at the end of its life expectancy than when the business first started using it, so in affect, it has cost the business money. If it has cost the business money, then it must be an expense and will therefore affect the profit and loss. The asset is also expected to be worth less, and thus also affect the balance sheet.Discount: 折扣,贴现The amount by which a bill is reduced. Discounts can be given for a variety of reasons, e.g. buying in bulk, spending large amounts, being a preferred customer (trade discounts) or settlement discount.Dissolution /,disə'lju:ʃən/:解散When a partnership firm ceases operations and its assets are disposed of.Distributable Profits:可分配利润In company accounts these are the sums that are available for dividends to shareholders. While based on the net profit, they may be increased by undistributed profits from the previous year or reduced by the need to retain some for the reserves.Dividend: 股息,红利,奖金The amount given to shareholders as their share of the profits of the company.The amount paid out per share. Usually described as a percentage of the face value (the original price) of one share. So a 10% dividend on a £2.00 share would be 20p.Equity/'ekwəti/ Accounting:产权会计,权益会计法A method of accounting for associated undertakings that brings into the consolidated profit and loss account the investor's share of the associated undertaking's results and that records the investment in the consolidated balance sheet as the investor's share of the associated undertaking's net assets including any goodwill arising to the extent that it has not previously been written off.Expenses: 费用,开支Expenses are those items that the company buys which do not go to actually create that company’s product or service. E.g. stationery, petrol, promotional goods.FIFO /'faifəu/: 先进先出法(成本方法)FIFO, or First In First Out, is an assumption that enables the cost of stock to be calculated. When sales are made the items sold are assumed to be the earliest purchased, so the cost of items in stock always reflect the most recent purchases..Financial Statements: 财务报表The more common term used to refer to statements produced at the end of accounting periods, such as the trading and profit and loss account and the balance sheet (sometimes referred to as 'Final Accounts' or simply 'The Accounts').Fixed Assets: 固定资产Assets which the business intends to retain for the coming year rather than convert into cash. Typical fixed assets include property, office equipment and motor vehicles.Assets which have a long life bought with the intention to use them in the business and not with the intention to simply resell them.cf. Current AssetForecasting: 预测,预报Taking present data and expected future trends, such as growth of a market and anticipated changes in price levels and demand, in order to arrive at a view of what the likely economic position of a business will be at some future date.General Ledger:总账A ledger for all accounts other than those for customers and suppliers. Also known as Nominal LedgerGoing Concern Concept: 持续经营概念The assumption that a business is to continue for the foreseeable future. Goodwill: 信誉,商誉An intangible asset of a business reflecting its commercial reputation, customer connections, etc. It usually isn't calculated until a business is sold.Gross/ɡrəus/:总额,总数The total amount before any deductions.Gross Loss /lɔ:s/: 损失总额Where the cost of goods sold exceeds the sales revenue.Gross Margin: 毛利,毛利率A measure of the profitability of a business by which the gross profit is divided by the sales. It is usually expressed as a percentage.Gross Profit:毛利,毛利润The difference between total revenue from sales and the total cost of purchases or materials, with an adjustment for stock.Income & Expenditure Account: 收入与开支账目An account for a non-profit-oriented organisation to find the surplus or loss made during a period.Input Tax: 进项税VAT added to the net price of inputs (i.e. purchases).Insolvent:资不抵债When liabilities are greater than assets.Intangible Assets: 无形资产Intangible assets include copyrights, patents, goodwill, etc., they are saleable but do not contain any intrinsic productive value.cf. Tangible Asset.Interest: 利息A charge made on a loan or money received on a capital investment.See Compound Interest and Simple InterestInvoice: 发票Sent out by the seller or service provider to request payment for goods or services. A contra-entry for this type of transaction would normally be a credit note.Irrelevant Costs:无关成本A managerial accounting term that represents a cost, either positive or negative, that does not relate to a situation requiring management's decision.As with relevant costs, irrelevant costs may be irrelevant for some situations but relevant for others. Examples of irrelevant costs are fixed overheads, notional (implied) costs, sunk costs and book values.Future costs that will not be affected by a decision.Ledgers: 总账The principal book in which the transactions of a business are recorded. The details of customers and their transactions are recorded in the sales ledger; suppliers and their transactions are recorded in the purchase ledger. All ledgers are amalgamated in the nominal ledger by the posting of balances from the individual ledgers. The nominal ledger also receives postings from the cash book and directly from journal entries for all other accounting transactions.Liabilities:债务Amounts owed by a business to third parties including suppliers, banks, tax authorities and employees.LIFO/'li,fəu/: 后进后出A method by which the goods sold are said to have come from the last lot of goods received.Limited Company: 有限公司Most large businesses will be formed as limited companies. A limited company is where the owners of the business are the shareholders but the business is often managed by a completely different set of people, the directors. In legal terms, a limited company is a completely separate entity from the owners, the shareholders. Many companies are run as private limited companies (Ltd), and often, the shareholders and the directors, are the same people. The largest companies however, are public limited companies (PLC), and in these companies, the shareholders and the directors are completely different. The directors run the company on behalf of the shareholders, the owners, and are accountable to the shareholders for their management of the business and stewardship of the assets.The shareholders provide the capital for the business by buying shares in the company and they share in the profits of the company by being paid dividends. The accounting records that are required for a limited company are regulated by law and most companies will tend to have a large and comprehensive accounting function.See Sole Trader and Partnership for a comparision of different business types. Limited Liability: 有限责任The main difference between the trading of a sole trader and a partnership on the one hand, and a company on the other is the concept of limited liability. If the business of a sole trader or a partnership is declared bankrupt then the owner or owners are personally liable for any outstanding debts of the business. However, the shareholders of a company have limited liability. This means that once they have fully paid for their shares, then they cannot be called upon for any more money, if the company is declared bankrupt. All they will lose is the amount they paid for their shares.Limited Partner:有限责任股东A partner whose liability is limited to the capital he or she has put into the firm. Liquidation: 清算,偿还When a business or firm is terminated or bankrupt, its assets are sold and the proceeds pay creditors. Any leftovers are distributed to shareholders.Liquidity Ratios: 流动比率,流动性比率Those ratios that relate to the cash position in an organisation and hence its ability to pay liabilities when due.Loan: 贷款,借款An arrangement in which a lender loans money or property (known as the principal or principle amount) to a borrower, and the borrower agrees to return the property or repay the money, usually along with interest, at some future point(s) in time. Usually, there is a predetermined time for repaying a loan, and generally the lender has to bear the risk that the borrower may not repay a loan.Long-Term Liabilities: 长期负债Liabilities that do not have to be paid within twelve months of the Balance Sheet date.cf. Current LiabilitiesLoss: 亏损,损失The result of selling goods for less than they cost to purchase.Main Ledger: 总账This is where the double-entry takes places of all transactions of the business.See also subsidiary or memorandum ledger.Margin: 利润,保证金The purchase and sale of a good may be shown as Cost Price + Profit = Selling Price. The profit when expressed as a fraction, or percentage, of the selling price is known as the margin.Net Current Assets: 流动资产净额Current assets minus current liabilities. The figure represents the amount of resources the business has in a form that is readily convertible into cash. Same as working capital.Net Loss:净亏损Where the cost of goods sold plus expenses is greater than the revenue.Net Profit: 净利润This is the amount earned by a company after expenses. This is calculated as; Gross Profit - Expenses = Net Profit.Nominal Account:名义账目Accounts in which expences, revenue and capital are recorded.Nominal Ledger:名目账项总账This ledger is affected by all transactions posted in all ledgers. It is the core of the accounting process. The balances on all of the nominal accounts form the Trial Balance and therefore the Profit and Loss and the Balance Sheet. Another name for the General Ledger.Opening Balance: 期初结余The balance of an account when it is initially opened, or the balance carried over from the previous accounting period, (i.e. last accounting periods’ closing b alance.)Operating Profit:营业利润,营业收益This is calculated; Gross Profit - Expenses.It is the same as net profit unless the business has other income from investments or expenditure on loan interest. These items are not considered in calculating the Operating Profit.Partnership: 合伙,合伙经营A partnership is a group of individuals who are trading together with the intention of making a profit. Partnerships are often created as a sole trader's business expands and more capital and more expertise are needed within thebusiness. Typical partnerships are those of accountants, solicitors and dentists and usually comprise between 2 and 20 partners. A partnership will tend to be larger than sole traders; there will tend to be more employees and a greater likelihood of a bookkeeper being employed to maintain the accounting records.Each of the partners will contribute capital to the business and will normally take part in the business activities. The profits of the business will be shared between the partners; setting up a partnership agreement whereby the financial rights of each partner are set out normally does this. Just as with sole traders the partners will tend to withdraw the profits due to them from the business in the form ofdrawings, although in some cases partners may also be paid a salary by the business.See Sole Trader and Limited Company for a comparision of different business types.Personal Account:个人账户Bank accounts, which contain personal funds, separate to business accounts. Personal Allowances:个人津贴Amounts each person may subtract from income in order to arrive at taxable income. The value of each allowance is set by the government following the Budget each year. They are for things like being married, caring for a dependent relative, etc.Personal Identification Number (PIN): 个人标识号,个人识别号码A secret number issued by a bank to a customer so that the customer may use a debit or credit card in an ATM.Preference Shares:优先股Shares that are entitled to an agreed rate of dividend before the ordinary shareholders receive anything.Prepayments:预付账款A payment for goods or services before they are received. e.g. Insurance paid 1 year in advance and accounted for over 12 months.Most businesses would pay for their insurance 1-year in advance. You would account for this transaction by making a credit entry to the bank account and a debit entry to the Insurance account. This transaction is quite correct from a bookkeeping point of view. However, every business is expected to present accurate accounts showing all expenses in the accounting period that thecosts/expenses relate to. If the insurance transaction were left, as it is, the cost for a whole year would be shown in one accounting period - this would give amisinterpretation of the accounts. To account for this transaction correctly the business would have a Prepayments Account.A Prepayment Account is an asset account because something has been paid for but not yet used in the business. To correctly account for the insurance that has been paid in advance you would debit the full amount to the Prepayment Account and credit the full amount to the Insurance Account.When the accounts are processed at the end of each accounting period you would credit 1/12th of the of the annual amount from the Prepayment Account and debit 1/12th of the annual amount to the Insurance Account. This would enable the business to correctly account for the insurance in each accounting period i.e. 1/12th of the annual amount would be shown in the Insurance Account each month, making the profit & loss report more accurate. The outstanding balance of the prepayment for each accounting period would be shown in the balance sheet as a current asset. This would reduce each month until the year has been fully expensed.cf. Accruals.Principal:本金,资本The loan amount, or the part of the loan amount that remains unpaid (excluding interest). Also called principal amount.Private Ledger: 秘密总账A ledger for capital and drawings accounts.Process Costing:分步成本计算A costing system that is applied when goods or services are produced in a continuous flow.Production Cost: 生产成本Prime cost plus indirect manufacturing costs.Profit: 利润The excess of revenues over costs in a business.。

5When people found or start companies, they draw up or prepare Articles of Association and a Memorandum of Association.The Articles of Association state:(公司规章制度;对内)1.the right and duties of the shareholders and directors2.the relationships among different classes of shareholder3.the relationships between shareholders and the company and its directors.The Memorandum of Association state:(公司注册证,组织大纲;对外)1.the company’s name2.the location of the company’s registered office - where to send official documents3.the company’s purpose - its aims or objectives4.the authorized share capital - the maximum share capital it can have.32Share prices depend on a number of factors:(股票价格取决于)1.the financial situation of the company2.the situation of the company3.the state of the economy in general4.the beliefs of investors - whether they believe the share price will rise or fall, and whether they believe other investors will think this.Prices can go up or down and the question for investors - and speculators - is:can these price changes be predicted, or seen in advance? When price-sensitive information - news that affects a company’s value - arrives, a share price will change. But no one knows when or what that information will be. So information about past prices will not tell you what tomorrow’s price will be.There are different theories about whether share price changes can be predicted:(股价变动是否可以预测)1.The random walk hypothesis. Prices move along a ‘random walk’- this means day-to-day changes are completely random or unpredictable.2.The efficient market hypothesis. Share prices always accurately or exactly reflect all relevant information. It is therefore a waste of time to attempt to discover patterns or trends - general changes in behavior - in price movements.3.Technical analysis. Technical analysts are people who believe that studying past share prices does allow them to forecast future price changes. They believe that market prices result from the psychology of investors rather than from real economic values, so they look for trends in buying and selling behavior, such as the ‘head and shoulders’ pattern.4.Fundamental analysis. This is the opposite of technical analysis: it ignores the behavior of investors and assumes that a share has a true or correct value, which might be different from its stock market value. This means that markets are not efficient. The true value reflects the present value of the future income from dividends.21Financial institution(金融机构)类型:Retail banks or commercial banks (individuals and small companies):received deposits; made loans.Investment banks(big company):gave financial advice; raised capital;organized mergers and takeover bids.Insurance companies:provided life insurance and pensions.Building societies:specialized in mortgages. Many have now become normal commercial banks.26Conventional banks(传统银行)1.Pay interest to depositors2.Charge interest to borrowers3.Lend money to finance personal consumption goodsIslamic banks(伊斯兰银行)1.Give no return on current accounts; share profits with holders of savings accounts and investment accounts2.Share borrowers’ profits (or losses)3.Buy items for personal customers with a leasing or hire-purchase arrangement18Companies’ price are influenced by production and distribution costs, both direct and indirect. (加成法)Mark-up or cost-plus pricing: some firms just calculate the unit cost and add a percentage.(市场渗透法)Market penetration pricing: some companies launch products at a price that only gives them a very small profit, because they want a big market share. This allows them to make profits later because of economies of scale.(市场撇脂定价)Market skimming: some customers will pay almost any price, so the company can charge a really high price, then lower it to reach other market segments.(声望定价)Prestige pricing or image pricing: products positioned at the luxury end of a market need to have a high price:the target customers probably won’t buy them if they think the price is too low.(随行就市定价)Going-rate pricing: if a product is almost identical to competitors’ products, companies might charge the same price.(亏本销售定价)Loss-leader pricing: retailers often offer some items at a very low price that isn’t profitable, to attract customers who then buy more products which are profitable.(尾数定价)Odd pricing or odd-even pricing: many producers and retailers believe a customer sees a price of 29.95 as in the 20 price range rather than the 30 one.(价格变动)Elasticity: demand is elastic if sales respond directly to price variations. If sales remain the same after a change in price, demand is inelastic.30Categories of stocks and shares:(股票的类型)Blue chips: Stocks in large companies with a reputation for quality, reliability and profitability.More than two-third of all blue chips in industrialized countries are owned by institutional investors such as insurance companies and pension funds.Growth stocks: Stocks that are expected to regularly rise in value. Most technology companies are growth stocks, and don’t pay dividends, so the shareholders’equity or owners’equity increases. This causes the stock price to rise.Income stocks: Stocks that have a history of paying consistently high dividends.Defensive stocks: Stocks that provide a regular dividends and stable earnings, but whose value is not expected to rise of fall very much.Value stock: Stocks that investors believe are currently trading for less than they are worth - when compared with the companies’ assets.41Discounted cash flows(贴现现金流)We usually calculate the discounted cash flow value of an investment. This means discounting or reducing future cash flows to get their present values. This is because the value of money decreases over time. Firstly, there’s nearly always inflation, so cash will have lower purchasing power in the future. Secondly, if you had the money now, you could get income by using or investing it. The return we could get by investing the money in other ways id the opportunity cost of capital. So waiting for money is also a cost. This is the time value of money: how much more it is worth to receive money now rather than in the future.43Balance of payments(国际收支平衡)Imports are the goods or services bought from a foreign country. Exports are the goods or services sold to a foreign country.A country that exports more goods than it imports has a positive balance of trade or a trade surplus. The opposite is a negative balance of trade or a trade deficit. Trade in goods is sometimes called visible trade. Services such as banking, insurance and tourism are sometimes called invisible imports and exports. Adding invisibles to the balance of trade gives a country’s balance of payments.45Documentary credits (跟单信用证)have a standard form. They generally contain:1.a short description of the goods2.a list of shipping documents required to obtain payment3.a final shipping date4.a final date for presenting the documents to the bank.Export ers have to prepare a number of documents to go with the shipment or transportation of goods.(出口单据)1.The commercial invoice contains details of the goods2.The bill of lading is a document signed by the carrier or transporter confirming that the goods have been received for shipment; it contains a brief description of the goods and details of where they are going.3.The insurance certificate also describes the goods and contains details of how to claim if they are lost or damaged in transit - while being transported.4.The certificate of origin states where the goods come from.5.Quality and weight certificate, issued by private inspection and testing companies, may be necessary, confirming that these are the correct goods in the right quantity.6.An export license giving the right to sell particular goods abroad is necessary in some cases.48The business cycle(商业周期)All market economies have periods when consumption - spending on goods and services - rises. Consumers buy more, companies invest more, and production, income, profits and employment increase. These periods are always followed by periods when spending and investing fall, and unemployment rises. This is the business cycle.A period during which economic activity increases and the economy is expanding is an upturn. If it lasts a long time it is called a boom. The highest point of the business cycle is a peak, which is followed by a downturn, during which the amount of economic activity decreases. If the economy keeps contracting for more than 6 months, the downturn is called a recession. A serious, long-lasting recession is called a depression. The lowest point of the business cycle is a trough, which is followed by a recovery, when economic activity increases again, and a new cycle begins. Fiscal policy(财政政策)Governments and central banks use fiscal policy, which involves changing the level of government expenditure and taxation to try to limit the extent of the business cycle.If an economy is moving into a recession, the government might have a reflationary fiscal policy. This means trying to stimulate the economy by increasing government spending, or by cutting level of direct or indirect tax so that individuals and companies have more money to spend.If an economy is overheating - expanding too quickly - it means that industry is working at full capacity and producing as much as it possible can. Because demand is greater than supply, leading to rising prices and inflation, the government might have a deflationary fiscal policy. This means trying to cool down the economy: reducing the amount of economic activity by raising tax rates or cutting government expenditure. This reduces the level of demand in the economy and helps to reduce inflation.Monetary policy(货币政策)Governments or central banks can also use monetary policy - changing interest rates and the level of the money supply - to influence the level of economy activity.They can boost or increase economic activity if the economy is a downturn by reducing interest rates and allowing the rate of growth of the money supply to increase.If the economy is growing too fast and causing inflation, they can slow it down by increasing interest rates and reducing the rate of growth of the money supply.50Business plans(商业计划)begin with a summary, often called an Executive Summary, which explains in one or two pages:Type: what sort of company it isFeatures: what the product or service is, and what is special about itManagers: who the managers areCapital: how much money you need, and what you will use it for.The company, the product and the market(介绍公司;准备出售的产品;介绍管理团队)If the company already exists, the first chapter of the business plan explains how it was started and how it has grown, and gives a history of sales and profits. It describes the company today, and the plans for the future.The second chapter describes what you already sell or want to sell. It explains what differentiates the product or service from other existing ones - what makes it unique. It focuses on the benefits or advantages for customers - how it will improve people’s live!The chapter on the market describes the industry you operate in, the market segments, the other firms in the market, changes in the industry, and projected trends and technological opportunities. It gives details of your marketing strategy(策略), including sales tactics- the ways you plan to achieve sales, advertising publicity and sales promotions - incentives to encourage customers to buy.The chapter on the management team gives details about the most important staff. The chapter on strategy outlines your strategies for marketing, pricing, distribution, sales, etc, and how you are going to implement.22Investment banking(投行)Main business: acting as intermediaries;consulting services;venture capital;mergers and acquisitions;corporate financing;asset management;Securities underwriting and broking23Central banking(央行)Main business: Keep reserves;Print and issue currency;rediscount;foreign exchange;Collect and publish financial data;Supervise banking system;Clearing cheques;Keep reserves24Interest rates and monetary policy(利率和货币政策)An interest rate is the cost of borrowing money: the percentage of the amount of a loan paid by the borrower to the lender for the use of the lender’s money. A country’s minimum interest rate is usually set by the central bank, as part of monetary policy, designed to keep inflation low. This can be achieved if demand is nearly the same as supply.If interest rates set too low, the demand for goods and services grows faster than the market’s ability to supply them. This causes prices to rise so that inflation occurs.If interest rates set too high, this lowers borrowing and spending. This brings down inflation, but also reduces output and the employment.7.Accounting policies and standards(会计政策和标准)Valuation(估值)a. Publish the value of companyb. Calculate profits or losses: so do subject=so it is the same with subjectMeasurement(计量)Choose the accounting policiesConsistency principle: Statement of Accounting Policiesa true and fair viewHistorical cost(历史成本)Record original purchase price of assets based on going concern postulateInflation accounting(通货膨胀会计)Current replacement cost based on inflation accounting8Assumption(四大假设)Separate entity;Time-period;Going concern;Unit-of-measurePrinciples (六个原则)Full-disclosure;Materiality;Conservatism;Objectivity;Revenue recognition;Matching17Although cost accounting allows companies to calculate production costs, pricing decisions also depend on:1.the level of demand2.the price of competitors’ products3.the company’s financial situation4.the company’s objectives - the aims it wants to accomplish5.the company’s marketing policies - whether it is interested in maximizing sales or maximizing profit.44An exchange rate is the price at which one currency can be exchanged for another. In theory, exchange rates should be at the level that gives purchasing power parity. This means that the cost of a given selection of goods and services would be the same in different countries. So if the price level in the country increases because of inflation, its currency should depreciate(贬值).In fact, PPP doesn’t work, as exchange rates can change due to currencyspeculation. Financial institutions, companies and rich individuals all buy currencies, looking for high interest rates or short-term capital gains if a currency appreciates(升值). This means exchange rates change due to speculation rather than PPP. Over 95% of the world’s currency transactions are purely speculative, and not related to trade. Banks and currency traders make consider able profits from the spread between a currency’s buying and selling prices.34Financial futures(金融期货)Currency futures and forwards are contracts that specify the price at which a certain currency will be bought or sold on a specified date.Interest rate futures are agreements between banks and investors and companies to issue fixed income securities at a future date.Stock futures fix a price for a stock and stock index futures fix a value for an index on a certaindate. They are alternatives to buying the stocks or shares themselves.。

accounting名词解释英语【释义】accountingn.会计,会计学;会计工作,会计职业(=accountancy);账单v.解释,说明;占(一定数量或比例)(account的现在分词形式)【短语】1Management Accounting会计管理会计;管理会计学;治理会计;会计管理2Financial Accounting会计财务会计;金融会计;财务会计学;会计核算3Accounting Manager会计部经理;会计经理;会计主管;财务经理4accounting equation会计等式;会计会计方程式;会计会计恒等式;会计程式5Cost Accounting会计成本会计;经成本核算;经济核算;会计成本会计学6accounting system会计会计系统;会计会计制度;会计体系7accounting period会计期;会计会计期间;会计报告期8accounting standard会计会计准则;会计标准;标准;会计标准会计准则9public accounting会计公共会计;公众会计;大众管帐;公家会计【例句】1The debate revolves around specific accounting techniques.这场讨论围绕具体的会计技巧。

2But full cost accounting will be introduced without delay.但是,全面成本核算马上将被采用。

3Most large companies now use computers for accounting and housekeeping operations.多数大公司现在用计算机进行会计运算和内务操作。

4An understanding of accounting techniques is a requisite for the work of the analysts.对核算技术的理解对于分析师的工作是必需的。

财务专业商业英语财务专业商业英语是财务和商业领域的专业英语,它涵盖了财务、会计、审计、投资、风险管理等方面的专业词汇和表达方式。

以下是财务专业商业英语的一些常见词汇和表达方式:1.Accounting会计2.Finance金融3.Audit审计4.Investment投资5.Risk Management风险管理6.Budget预算7.Profitability盈利能力8.Balance Sheet资产负债表9.Income Statement利润表10.Cash Flow Statement现金流量表11.Debt债务12.Equity股本13.Stock股票14.Bond债券15.Dividend股息16.Interest Rate利率17.Valuation估值18.Portfolio投资组合19.Risk-adjusted Return风险调整后的回报率20.Return on Investment(ROI)投资回报率21.Liquidity流动性22.Leverage杠杆率23.Capital Structure资本结构24.Credit Rating信用评级25.Acquisition收购26.Divestiture出售资产27.Valuation of Assets资产估值28.Cost of Capital资本成本29.Operating Expenses营业费用30.Revenue收入31.Depreciation and Amortization折旧和摊销32.Taxation税务处理33.Account Reconciliation对账34.Journal Entries日记账分录35.Statement of Cash Flows现金流量表36.Interim Financial Statements中期财务报表37.Long-term Liabilities长期负债38.Short-term Liabilities短期负债39.Capital Expenditure资本支出 Profit Margin净利润率。

会计英语21) Accounting is an information system that measures business activities & communicates the findings to decision makers.(会计是将业务活动和措施的结果传达给决策者的一种信息系统)2) A corporation is owned by shares of stock, it is a separate legal entity and is responsible for its own debts.公司是由国有股,它是一个独立的法人实体,是对自己的债务负责3) The cash flow statement shows the cash inflows and outflows from operating activities, investing activities, and financing activities.现金流量表显示经营活动,投资活动和筹资活动的现金流入和流出。

4)Bookkeeping is only the part of accounting that records transactions and events.簿记只是会计的一部分,它记录着交易和事件5) A sole proprietorship is an entity owned by one person and the owner is personally responsible for business debts.个人独资企业是由一个人拥有的实体和个人所有者对企业的债务负责6) The business entity principle requires each entity keeps accounting records asa separate entity.会计主体原则要求每个单位作为一个单独的实体进行会计记录。