市场结构与市场势力(产业组织理论—大连理工大学,陈艳莹)选读

- 格式:ppt

- 大小:366.00 KB

- 文档页数:28

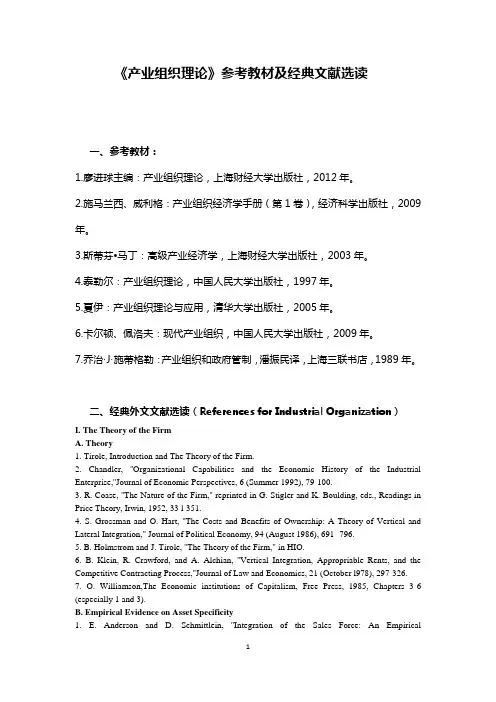

《产业组织理论》参考教材及经典文献选读一、参考教材:1.廖进球主编:产业组织理论,上海财经大学出版社,2012年。

2.施马兰西、威利格:产业组织经济学手册(第1卷),经济科学出版社,2009年。

3.斯蒂芬•马丁:高级产业经济学,上海财经大学出版社,2003年。

4.泰勒尔:产业组织理论,中国人民大学出版社,1997年。

5.夏伊:产业组织理论与应用,清华大学出版社,2005年。

6.卡尔顿、佩洛夫:现代产业组织,中国人民大学出版社,2009年。

7.乔治·J·施蒂格勒:产业组织和政府管制,潘振民译,上海三联书店,1989年。

二、经典外文文献选读(References for Industrial Organization)I. The Theory of the FirmA. Theory1. Tirole, Introduction and The Theory of the Firm.2. Chandler, ''Organizational Capabilities and the Economic History of the Industrial Enterprise,''Journal of Economic Perspectives, 6 (Summer 1992), 79-100.3. R. Coase, ''The Nature of the Firm,'' reprinted in G. Stigler and K. Boulding, eds., Readings in Price Theory, Irwin, 1952, 33 l-351.4. S. Grossman and O. Hart, ''The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration," Journal of Political Economy, 94 (August 1986), 691 -796.5. B. Holmstrom and J. Tirole, ''The Theory of the Firm," in HIO.6. B. Klein, R. Crawford, and A. Alchian, ''Vertical Integration, Appropriable Rents, and the Competitive Contracting Process,''Journal of Law and Economics, 21 (October l978), 297-326.7. O. Williamson,The Economic institutions of Capitalism, Free Press, 1985, Chapters 3-6 (especially 1 and 3).B. Empirical Evidence on Asset Specificity1. E. Anderson and D. Schmittlein, ''Integration of the Sales Force: An EmpiricalExamination,"Rand Journal of Economics,15(Autumn 1984), 327-343.2. P. Joskow, ''Vertical Integration and Long Term Contracts: The Case of Coal-Burning Electric-Generating Plants,"Journal of Law, Economics and Organization, I (Spring 1985), 33-80.3. P. Joskow, ''Contract Duration and Relationship-Specific Investments: Empirical Evidence from Coal Markets,"American Economic Review, 77 (March 1987), 168-l85.4. P. Joskow, ''Asset Specificity and the Structure of Vertical Relationships: Empirical Evidence," Chapter 8 in O. Williamson and S. Winter,The Nature of the Firm:Origins, Evolution, and Development,Oxford 1993, 117-137.5. K. Monteverde and D. Teece, ''Supplier Switching Costs and Vertical Integration in the Automobile Industry,''BellJournal of Economics, 13 (Spring 1982), 206-213.6. A. Shepard, "Contractual Form, Retail Pricing and Asset Characteristics in Gasoline Retailing,"Rand Journal of Economics, 24(Spring 1993), 58-77.II. Monopoly PricingA. Basic Monopoly Pricing and Durable Goods1. Tirole, Chapter 1 (including supplementary section).2. M. Pesendorfer, ``Retail Sales. A Study of Pricing Behavior in Supermarkets,'' mimeo.B. First and Third Degree Price Discrimination1. Tirole, Sections 3.0 - 3.22. Katz, M., "The Welfare Effects of Third-Degree Price Discrimination in Intermediate Goods Markets,"American Economic Review, 77, (March 1 987), pp. 154-67.3. Schmalensee, R., ''Output and Welfare Implications of Monopolistic Third-Degree Price-Discrimination,''American Economic Review,71 (March 1981), pp. 242-47.4. Varian, H., ''Price Discrimination and Social Welfare,''American Economic Review, 75 (September 1985), pp. 870-5.5. Perry, Martin, ''Forward Integration by ALCOA: 1888-1930,"Journal of Industrial Economics,29 (l), September 1980, pp. 37-53.C. Second Degree Price Discrimination1. Tirole, Sections 3.3 - 3.5.2. Maskin, E. And J. Riley, "Monopoly with Incomplete Information,"Rand Journal of Economics15 (Summer 1984), pp. 171-96,3. Oi, W., ''A Disneyland Dilemma: Two-Part Tariffs for a Mickey-Mouse Monopoly,''Quarterly Journal of Economics,85 (February 197l), pp. 77-96.4. McAfee, P., J. McMillan, and M. Whinston, ''Multiproduct Monopoly, Commodity Bundling, and Correlation of Values,''Quarterly Journal of Economics, 104 (May 1989), pp. 37l-83.5. Blackstone, E., ''Restrictive Practices in the Marketing of Electrofax Copying Machines. The SCM Corporation Case,''Journal of Industrial Economics, 23 (March 1975), pp. 189-202.6. Shepard, A., ''Price Discrimination and Retail Configuration,''Journal of Political Economy, 99 (February 1991), pp. 30-53.7. I. Ayers, and P. Siegelman, "Race and Gender Discrimination in Bargaining for a New Car,''American Economic Review, 85 (June 1995), 304-321.8. Borenstein, S. and N. Rose, "Competition and Price Dispersion in the U.S. Airline Industry,"Journal of Political Economy, 102 (August 1994), 653-683.III. Estimating Demand (and Supply)1. Deaton and J. Muellbauer,Economics and Consumer Behavior, Parts 1 and2.2. S. Anderson, A. De Palma and J. Thisse,Discrete Choice Theory of Product Differentiation, Chapters 2-5.3. D. Epple, "Hedonic Prices and Implicit Markets: Estimating Demand and Supply Functions for Differentiated Products,Journal of Political Economy, 95 (February 1987), 59-80.4. Berry, S., J. Levinsohn, and A. Pakes, ''Automobile Prices in Market Equilibrium,"Econometrica, Vol. 63, No. 4, July 1995, pp. 841-890.5. A. Petrin, "Quantifying the Benefits of New Products: The Case of the Minivan'', mimeo.6. Goldberg, P.K., ''Product Differentiation and Oligopoly in international Markets: The Case of the U.S. Automobile Industry,''Econometrica, Vol. 63, No. 4, July 1995, pp. 891-952.7. S. Ellison, I. Cockburn, Z. Griliches and J. Hansman, "Characteristics of Demand for Pharmaceutical Products: An Examination of Four Cephalosporins,''Rand Journal of Economics, 28, Autumn 1997, 426-446.8. J. Hausman, "Valuation of New Goods under Perfect and Imperfect Competition,'' inTheEconomics of New Goods, T. Bresnahan and R. Gordon (eds.) and comment by T. Bresnahan.9. J. Hansman, "Reply to Prof. Bresnahan," mimeo.10. T. Bresnahan, "The Apple-Cinnamon Cheerios War: Valuing New Goods, Identifying Market Power, and Economic Measurement," mimeo.IV. Introduction to Strategic Behavior and Static CompetitionA. Introduction to Strategic Behavior1. D. Fudenberg and J. Tirole, ''Noncooperative Game Theory for Industrial Organization: An Introduction and Overview,'' inHIO.2. Tirole, pp. 205-208 and Chapter 11.B. Prices and Output1. C. Shapiro, ''Theories of Oligopoly Behavior," inHIO.2. Tirole, Chapters 2.1 and 5.3. D. Kreps and J. Scheinkman, ''Quantity Precommitment and Bertrand Competition Yield Cournt Outcomes,"BellJournal of Economics,14 (Autumn 1983), 326-337.4. Klemperer, P., "The Competitiveness of Markets with Switching Costs,"Rand Journal of Economics, 18 (Spring 1987), pp. 138-50.5. Sutton, J., and A. Shaked, ''Relaxing Price Competition through Product Differentiation,''Review of Economic Studies,49 (January 1982), pp. 3- 14.6. D. Stalil, "Oligopolistic Pricing with Heterogeneous Consumer Search,''International Journal of Industrial Organization, 14 (April 1996), 243-268.V. Dynamic CompetitionA. Theory1. Tirole, Chapter 6.2. Rotemberg, J. J. and G. Saloner, "A Supergame-Theoretic Model of Price Wars During Booms,''American Economic Review, 76 (June 1986), 390-407.3. K. Bagwell and R. W. Staiger, "Collusion over the Business Cycle,''Rand Journal of Economics, (Spring 1997), 82-106.4. Brock, W. and J. Scheinkman, "Price-Setting Supergames with Capacity Constraints,''Review of Economic Studies, 52 (1985), pp. 37 l-82.5. Green, E. and R. Porter, ''Non-cooperative Collusion Under Imperfect PriceInformation,''Econometrica, 52 (January 1984), pp. 87-100.6. Maskin, E. and J. Tirole, "A Theory of Dynamic Oligopoly II: Price Competition, Kinked Demand Curves, and Edgeworth Cycles,"Econometrica, 56 (May 1988), pp.571 -99.7. Bernheim and M. Whinston, "Multimarket Contact and Collusive Behavior,"Rand Journal of Economics, 21 (Spring 1990), l-26.8. Stigler, G.J., "A Theory of Oligopoly,"Journal of Political Economy, 72 (February l964), pp. 44-61.B. Empirical Evidence1. R. Porter, ''A Study of Cartel Stability: The Joint Economic Committee, 1880-l886,"Bell Journal of Economics, 14 (Autumn 1983), 301-314.2. G. Ellison, ''Theories of Cartel Stability and the Joint Executive Committee,''Rand Journal of Economics, 25 (Spring 1994), 37-57.3. D. Genesove and W. Mullin, "Narrative Evidence on the Dynamics of Collusion: The Sugar Institute Case, " mimeo.4. R. Grether and C. Plott, ''The Effects of Market Practices in Oligopolistic Markets: An Experimental Examination of the Ethyl Case,''Economic inquiry, 22 (October l984), 479-507.5. M. Levenstein, "Price Wars and the Stability of Collusion: A Study of the PreWorld War I Bromine industry,''The Journal of Industrial Economics, June 1997, 117-138.6. S. Borenstein and A. Shepard, ''Dynamic Pricing in Retail Gasoline Markets,''The Rand Journal of Economics, Autumn 1996, Vol. 27, No. 3, pp. 429-451.VI. Empirical Studies of Firm ConductA. Inter-Industry Studies1. F. M. Scherer and D. Ross, Industrial Market Structure and Economic Performance, Chapter 11.2. R. Schmalensee, ''Interindustry Studies of Structure and Performance,'' inHIO.3. Demsetz, H., "Industry Structure, Market Rivalry and Public Policy,''Journal of Law and Economics, 16, (1973), l-10.4. I. Domowitz, R. Hubbard and B. Petersen, "Business Cycles and the Relationship Between Concentration and Price-Cost Margins,"Rand Journal of Economics, 17(Spring 1986), 1-17.5. R. Schmalensee, ''Do Markets Differ Much?"American Economic Review, 75 (June 1985), 341-351.6. M. Salinger, "The Concentration-Margin Relationship Reconsidered,''Brookings Papers on Economic Activity: Microeconomics,1990, 287-335.B. Theory of Conduct Parameters1. T. Bresnahan, "The Oligopoly Solution Concept is Identified,"Economics Letters, 10, 1982, 87-92.2. L. Lau, "On Identifying the Degree of Competitiveness from Industry Price and Output Data,''Economics Letters, 10, 1982, 93-99.3. J. Panzar and J. Rosse, "Testing for 'Monopoly' Equilibrium,"Journal of Industrial Economics, 35 (June 1987), 443-456.4. K. Corts, "Conduct Parameters and the Measurement of Market Power,''Journal of Econometrics???C. Industry-Specific Studies of Firm Conduct1. T. Bresnahan, "Empirical Studies of Industries with Market Power,'' inHIO.2. R. Coterill, "Market Power in the Retail Food Industry: Evidence from Vermont,"Review ofEconomics and Statistics, 68 (August 1986), 379-386.3. A. Nevo, "Measuring Market Power in the Ready-to-Eat Cereal Industry,'' mimeo.4. T. Bresnahan, "Competition and Collusion in the American Automobile Industry: The 1955 Price War,''Journal of Industrial Economics, 35 (June 1987), 457-482.5. D. Genesove and W. Mullin, "Testing Oligopoly Models: Conduct and Cost in the Sugar Industry, 1898-1914,''Rand Journal of Economics,29 (Summer 1 998), 355-377.6. C. Wolfram, "Measuring Duopoly Power in the British Electricity Spot Market,'' mimeo.7. Baker, J. and T. Bresnahan, ''Empirical Methods of Identifying and Measuring Market Power,"Antitrust Law Journal,Vol.61, 1992,pp.3-16.VII. EntryA. Basic Theory1. Tirole, Sections 7.l-7.22. Mankiw, N.G. and M.D. Whinston, "Free Entry and Social Inefficiency,''Rand Journal of Economics,17 (Spring 1986), pp. 48-58.3. Anderson, S., A. de Palma, and Y. Nesterov, "Oligopolistic Competition and the Optimal Provision of Products,"Econometrica, Vol. 63, No. 6, November 1995, pp.l281-1302.4. Sutton, J.,Sunk Costs and Market Structure, MIT Press, 1991, Chapters l-2.5. B. Jovanovic, ''Selection and the Evolution of Industry,"Econometrica, (May 1982), 649-670.6. Banmol, W.K., J.C. Panzar, and R.D. Willig, ''On the Theory of Perfectly Contestable Markets," in J.E. Stiglitz and G.F. Mathewson, eds.,New Developments in the Analysis of Market Structure, MIT Press, 1986.B . Empirical Evidence1. T. Bresnahan and P. Reiss, ''Entry and Competition in Concentrated Markets,'' Journal of Political Economy, 99 (October 1991), 977- 009.2. Comments on Bresnahan and Reiss,Brookings Papers on Economic Activity: Special Issue on Microeconomics, 3 (1987), 872-882.3. T. Dunne, M. Roberts, and L. Samuelson, ''Patterns of Firm Entry and Exit in U.S. Manufacturing,''Rand Journal of Economics, 19 (Winter 1988), 495-515.4. Berry, S. and J. Waldfogel, ''Free Entry and Social Inefficiency in Radio Broadcasting," June 1996.5. S. Berry, ''Estimation of a Model of Entry in the Airline industry, "Econometrica, 60 (July 1992), 889-918.VIII. Strategic InvestmentA. General Considerations1. Tirole, pp. 207-8, Chapter 8.2. J. Bulow, J. Geanakoplos and P. Klemperer, '`Multimarket Oligopoly: Strategic Substitutes and Complements,"Journal of Political Economy,93 (June 1985), 488-511.3. D. Fudenberg and J. Tirole, "The Fat Cat Effect, the Puppy Dog Ploy and the Lean and Hungry Look,''American Economic Review, 74 (May 1 984), 36 1 -366.4. R. Gilbert, ''Mobility Barriers and the Value of Incumbency," inHIO.B. Capacity, Product Differentiation, beaming Curves, Contracts1. A. Dixit, ''The Role of Investment in Entry Deterrence,''Economic Journal, 90 (March l980), 95-106.2. R. Schmalensee, ''Economies of Scale and Barriers to Entry,''Journal of Political Economy, 89(December 1981), pp. 1228-38.3. J.R. Gelman and S.C. Salop, ''Judo Economics. Capacity Limitation and Coupon Competition,''BellJournal of Economics, 14 (Autumn 1983), pp. 315-25.4. D. Fudenberg and J. Tirole, "Capital as a Commitment: Strategic Investment to Deter Mobility,''Journal of Economic Theory,31 (December 1983), 227-250.5. R. Schmalensee, ''Entry Deterrence in the Ready-to-Eat Breakfast Cereal Industry,''BellJournal of Economics, 9 (Autumn 1978), pp. 305-27.6. K. Judd, ''Credible Spatial Preemption,"Rand Journal of Economics,16 (Summer 1985), pp. 153-66.7. D. Fudenberg and J. Tirole, "Learning by Doing and Market Performance,''BellJournal of Economics,14 (Autumn 1983), pp. 522-30.8. P. Aghion and P. Bolton, "Entry Prevention Through Contracts with Customers,''American Economic Review, 77, June 1987, pp. 388-401.9. T.E. Cooper, "Most-Favored Customer Pricing and Tacit Collusion,''Rand Journal of Economics, 17 (Autumn 1986), pp. 377-88.10. J. J. Laffont, P. Rey and J. Tirole, "Network Competition I: Overview and Nondiscriminatory Pricing,''Rand Journal of Economics, 29 (Spring 1 998), l -37.C. Empirical Evidence on Strategic Investment1. J. Chevalier, "Capital Structure and Product Market Competition: Empirical Evidence from the Supermarket Industry,''American Economic Review, June 1995.2. M. Lieberman, "Post Entry investment and Market Structure in the Chemical Processing Industry,"Rand Journal of Economics, 18 (Winter 1987), 533-549.3. G. Hurdle, et al., "Concentration, Potential Entry, and Performance in the Airline Industry,''Journal of Industrial Economics,38 (December 1989), 119-140.4. R. Smiley, "Empirical Evidence on Strategic Entry Deterrence,''International Journal of Industrial Organization, 6 (June 1988), 167- 180.IX. Information and Strategic BehaviorA. Limit Pricing1. Tirole, Sections 9.0 - 9.4.2. P. Milgrom and J. Roberts, ''Limit Pricing and Entry Under Incomplete Information: An Equilibrium Analysis,''Econometrica, 50 (March 1982), 443-460.B. Predation1. Tirole, Sections 9.5 - 9.7.2. P. Milgrom and J. Roberts, ''Predation, Reputation, and Entry Deterrence,"Journal of Economic Theory,27 (August 1982), pp. 288-312.3. G. Saloner, ''Predation, Merger, and Incomplete information,"RandJournal of Economics,18 (Summer 1987), pp. 165-186.4. D. Fudenberg and J. Tirole, ''A 'Signal-Jamming' Theory of Predation,''Rand Journal of Economics, 17 (Autumn 1986), pp. 366-76.5. P. Bolton and D. Scharfstein, ''A Theory of Predation Based on Agency Problems in Financial Contracting,''American Economic Review, 80 (March 1 990), pp. 93- 106.6. Benoit, J.P., ''Financially Constrained Entry in a Game of Incomplete Information,"Rand Journal of Economics,15, pp. 490-99.7. J. Oulover and G. Saloner, ''Predation, Monopolization and Antitrust," inHIO.C. Empirical Studies of Information Asymmetries and Predation1. D. Cooper, S. Garvin and J. Kagel, "Signaling and Adaptive Learning in an Entry Limit Pricing Game,''Rand Journal of Economics, 28 (Winter 1997), 662-683.2. D. Genesove, "Adverse Selection in the Wholesale Used Car Market,''Journal of Political Economy,101 (August 1993), 644-665.3. M. Doyle and C. Snyder, "Information Sharing and Competition in the Motor Vehicle Industry," mimeo.4. T. Hubbard, "Consumer Beliefs and Buyer and Seller Behavior in the Vehicle Inspection Market,'' mimeo.5. J. McGee,'' Predatory Price Cutting The Standard Oil (NJ) Case,''Journal of Law and Economics, l (October 1958), 137-169.6. D. Genesove and W. Mullin, "Predation and Its Rate of Return: The Sugar industry, l887- 1914,"NBER Working Paper6032, 1997.7. D. Weiman and R. Levin, ''Preying for Monopoly: Southern Bell,"Journal of Political Economy,102 (February 1994), 103-26.8. Kadiyali, V., ''Entry, Its Deferrence, and its Accommodation: A Study of the U.S. Photographic Film Industry,"The Rand Journal of Economics, Autumn 1 996, Vol. 27,X. Advertising1. Tirole, Sections2.2-2.4, 7.32. M. Stegeman, ''Advertising in Competitive Markets,''American Economic Review, 81 (March 1991), 210-223.3. F. M. Scherer and D. Ross,Industrial Market Structure and Economic Performance, Chapter 18.4. Kwoka, J. ''Advertising the Price and Quality of Optometric Services,''American Economic Review Papers and Proceedings, 1984, 211 -216.5. P. Ippolito and A. Mathios, ''Information, Advertising and Health: A Study of the Cereal Market,''Rand Journal of Economics,21 (Autumn 1 990), 459-480.6. D. Ackerberg, "Advertising, Learning, and Consumer Choice in Experience Good Markets: An Empirical Examination,'' mimeo.XI. Auctions1. P. McAfee and J. McMillan, ''Auctions and Bidding,"JEL, June 1987, pp. 699-738.2. P. Milgrom, "Auctions and Bidding: A Primer,"JEP, Summer 1989, pp. 3-22.3. K. Hendricks and R. Porter, ''An Empirical Study of an Auction with Asymmetric Information,''American Economic Review, December 1 988, pp. 865-83.4. R. Porter, ''The Role of Information in U.S. Offshore Oil and Gas Lease Auctions,"Econometrica, 63 (January 1995), pp. 1-27.5. R. Porter and D. Zona, "Detection of Bid Rigging in Procurement Auctions,"JPE, June 1993, pp.5 18-38.6. P. Bajari, "Econometrics of the First Price Auction with Asymmetric Bidders," mimeo.7. J.-J. Laffont, H. Ossard, and Q. Vuong, ''Econometrics of First Price Auctions,''EM, July 1995, pp. 953-80.8. J. Kagel, R. Harstad and D. Levin, ''Information Impact and Allocation Rules in Auctions with Affiliated Private Values: A Laboratory Study, "Econometrica, 55 (1987), pp. 1275- 1304.9. J. Kagel, ''Auctions: A Survey of Experimental Research,'' in J. Kagel and A. Roth, eds.,The Handbook of Experimental Economics.XII. Technological ChangeA. Research and Development1. Tirole, Sections 10.l - 10.5, 8. l.32. G. C. Loury, ''Market Structure and Innovation,''Quarterly Journal of Economics, 93 (1979), pp. 395-410.3. D. Fudenberg, R. Gilbert, J. Stiglitz, and J. Tirole, "Preemption, Leapfrogging, and Competition in Patent Races,"European Economic Review, 22 (1983), pp. 3-31.4. D. Fudenberg and J. Tirole, ''Preemption and Rent Equalization in the Adoption of New Technology,''Review of Economic Studies, 52 (1985), pp. 383-401.5. Symposium on Patent Policy,Rand Journal of Economics, 21 (Spring 1990).B. Standardization1. J. Farrell and G. Saloner, "Standardization, Compatibility, and Innovation,''Rand Journal of Economics, 16 (1985), pp. 70-83.2. M. Katz and C. Shapiro, ''Technology Adoption in the Presence of Network Externalities,"Journal of Political Economy, 94 (1986), pp. 822-841.C. Diffusion of Technologies1. Rogers and Shoemaker,The Diffusion of Innovation: A Cross-Cultural Approach, Free Press, 1971.2. G. Ellison and D. Fudenberg, "Rules of Thumb for Social Learning,"Journal of Political Economy, 101 (1993), pp. 612-643.D. Empirical Studies1. A. Pakes, "Patents as Options: Some Estimates of the Value of Holding European Patent Stocks,Econometrica, 54 (July 1986), 755-784.2. M. Trajtenberg, "The Welfare Analysis of Product Innovations with an Application to Computed Tomography Scanners,"Journal of Political Economy, 97 (April 1989), 444-479.3. G. Saloner and A. Shepard, "Adoption of Technologies with Network Effects: An Empirical Examination of the Adoption of Automated Teller Machines,"Rand Journal of Economics, 13 (Autumn 1995), 479-501.4. T. Hubbard, "Why Are Process Monitoring Technologies Valuable? The Use of On-Board Information Technology in the Trucking Industry," mimeo.5. E. Mansfield, "How Rapidly Does New industrial Technology Leak Out?"Journal of Industrial Economics, 34 (December 1985), 217-223.6. N. L. Rose and P. L. Joskow, ''The Diffusion of New Technologies. Evidence from the Electric Utility industry,"Rand Journal of Economics, 21 (Autumn 1990), 354-373.XIII. Managerial incentives and Firm Behavior1. Tirole, pages 34-55.2. B. Holmstrom, "Managerial Incentive Problems - A Dynamic Perspective,'' inEssays in Honor of Lars Wahlbeck,1982.3. S. Grossman and O. Hart, "Takeover Bids, the Free-Rider Problem and the Theory of the Corporation,''BellJournal of Economics, 11 (Spring 1980), 42-64.4. A. Shleifer and R. Vishny, "Large Shareholders and Corporate Control,''Journal of Political Economy, 94 (June 1996), 461-488.5. O. Hart, "The Market Mechanism as an Incentive Scheme,''BellJournal of Economics,14 (Autumn 1983), 366-382.6. C. Fershtman and K. Judd, "Equilibrium Incentives in Oligopoly,"American Economic Review, 77(December 1987), 927-940.7. R. Masson, "Executive Motivation, Earnings, and Consequent Equity Performance,"Journal of Political Economy, 79 (December 1971), 1278- 1292.8. P. Healy, "The Effect of Bonus Schemes on Accounting Decisions,''Journal of Accounting and Economics,7 (April 1985), 85-107.XIV. Antitrust: Overview1. Kaye, Scholer, Fierman, Hays & Handler, 1992, "Executive Summary of the Antitrust Laws."Kaye, Scholer's Antitrust Deskbook, NY, pp. 319.2. Kaye, Scholer, Fierman, Hays & Handler, 1992, "Introduction to EC Competition Law,''Kaye, Scholer's Antitrust Deskbook, NY, pp. 237-242.XV. Antitrust: Horizontal MergersA. Policy Issues1. Materials on Time-Warner/Turner Merger (mimeo).Available from Graphic Arts as Part A of the 14.272 Readings Packet.B. Theory and Evidence1. J. Farrell & C. Shapiro, "Horizontal Mergers: An Equilibrium Analysis,"American Economic Review, 80 (March 1990), 107-126.2. Robert D. Willig, "Merger Analysis, Industrial Organization Theory, and Merger Guidelines,"Brookings Papers on Economic Activity: Microeconomics, 1991, pp. 281-332.3. B.E. Eckbo, "Mergers and Market Concentration Doctrine Evidence from the Capital Market,"Journal of Business,58 (July 1985), 325-349.4. R. McAfee & M. Williams, "Can Event Studies Detect Anticompetitive Merger?"Economic Letters, (1988), 199-203.5. R.A. Prager, "The Effects of Horizontal Mergers on Competition: The Case of the Northern Securities Company,"Rand Journal of Economics, 23 (Spring 1992), 123-133.6. G.L. Mullin, J.C. Mullin, and W.P. Mullin, "The Competitive Effects of Mergers: Stock Market Evidence from the U.S. Steel Dissolution Suit,"Rand Journal of Economics, 26 (Summer 1995), 314-330.7. S. Bhagat, A. Shleifer, & R.W. Wishny, "Hostile Takeovers in the 1980s: The Return to Corporate Specialization,"Brookings Papers on Economic Activity. Microeconomics, 1990. 1-84.8. M. Pesendorfer, "Horizontal Mergers in the Paper industry,''NBER Working Paper6751. October 1988C. Horizontal Merger Policy1. US Department of Justice,Horizontal Merger Guidelines(revised April 1992).2. J. Hausman and G. Leonard, "Economic Analysis of Differentiated Product Mergers Using Real World Data," mimeo, October 25, 1996.3. David Scheffman and Pablo Spiller, "Econometric Market Delineation,''Managerial and Decision Economics, Vol. 17, 165-178 (1996)4. G.J. Werden and L.M. Froeb, "The Effects of Mergers in Differentiated Products Industries: Logit Demand and Merger Policy,''Journal of Law, Economics, and Organization,10 (October 1994), 407-26.5. S.C. Salop, L.J. White, F. M. Fisher, & R. Schmalensee, "Symposium: Horizontal Mergers and Antitrust,"Journal of Economic Perspectives, 1 (Fail 1987), 3-54.6. S. Dalkir & F.R. Warren-Boulton, "Prices, Market Definition, and the Effects of Merger: Staples-Office Depot (1997),'' in J.E. Kwoka, Jr. and L.J. White, eds.,The Antitrust Revolution: Economics, Competition, and Policy,3rded. Oxford: Oxford University Press (1999), pp. 143-165. XVI. Antitrust: Vertical Relations & Vertical Restraints1. Tirole, Chapter 4 (including supplementary section).2. J.A. Ordover, G. Saloner, & S.C. Salop, "Equilibrium Vertical Foreclosure,"American Economic Review,80 (March 1990), 127-142.3. Benjamin Klein, "Market Power in Aftermarkets,"Managerial and Decision Economics, Vol. 17, 143-164 (1996).4. Carl Shapiro, "Aftermarkets and Consumer Welfare: Making Sense of Kodak,''Antitrust Law Journal, Vol. 63 at 483 (1995).5. O. Hart and J. Tirole, "Vertical Integration and Market Foreclosure,"Brookings Papers on Economic Activity: Microeconomics, 1990, 205-286.6. P. Rey and J. Stiglitz, " The Role of Exclusive Territories in Producers' Competition,"Rand Journal of Economics, 26 (Autumn 1995), 431-451.7. M. B. Lieberman, "Determinants of Vertical Integration: An Empirical Test,"Journal of Industrial Economics,39(September 1991), 451-466.8. S.J. Ornstein & D.M. Hanssens, "Resale Price Maintenance: Output Increasing or Restructuring? The Case of Distilled Spirits in the United States,"Journal of Industrial Economics, 36 (September 1987), 1-18.9. F. Lafontaine, "Agency Theory and Franchising: Some Empirical Results,''Rand Journal of Economics,23 (Summer 1992) 263-283.XVII. The Political Economy of Regulation1. R. G. Noll, ''Economic Perspectives on the Politics of Regulation,'' in R. Schmalensee & R. D. Willig (eds.),Handbook of Industrial Organization,Volume 2, Amsterdam North- Holland, 1989, Ch. 22, 1253-1287.2. Armstrong et al, Chapter 1.3. G.J. Stigler, "The Theory of Economic regulation,''Bell Journal of Economics, 2 (Spring 1971), 3-21.4. S. Peltzman, ''The Economic Theory of regulation after a Decade of Deregulation,"Brookings Papers on Economic Activity: Microeconomics, 1989, 1-60.5. R.A. Posner, ''Taxation by Regulation,''BellJournal of Economics, 2 (Spring 1971 ), 22-50.6. R.A. Posner, ''Theories of Economic Regulation,"BellJournal of Economics,5 (Autumn 1974), 335-358.7. J.Q. Wilson, "The Politics of Regulation," in J.Q. Wilson (Ed.),The Politics of Regulation,Cambridge: Harvard University Press, 1980.8. J.P. Kalt & M. A. Zupan, "Capture and Ideology in the Economic Theory of Politics,"American Economic Review, 74 (June 1984), 279-300.9. R. Prager, "Using Stock Price Data to Measure the Effects of Regulation The Interstate Commerce Act and the Railroad industry,''Rand Journal of Economics, 20 (Summer 1989), 280-290.10. T. Romer de H. Rosenthal, "Modern Political Economy and the Study of Regulation," in E. E. Bailey (ed.),Public Regulation: Perspectives on Institutions and Policies, Cambridge: MIT Press, 1987, 73-116.。

需求扩张对产业市场结构的影响:中国生产性服务业的实证研究陈艳莹,夏一平(大连理工大学经济学院,大连,116023)摘要:需求扩张时产业会更加趋向于垄断还是竞争是一个颇受关注的问题。

本文将行业的进入壁垒作为需求扩张对市场结构影响机制中的重要因素,研究进入壁垒不同的情况下需求扩张是如何影响市场结构的。

文章通过定性和定量地分析,解释了在进入壁垒较低的行业,需求扩张更容易导致产业趋向于竞争,而在进入壁垒较高的产业,这种影响机制作用较弱。

本文最后采用2004年至2008年我国生产性服务业12个行业的面板数据进行实证研究,证明了这一结论。

关键词:需求扩张;市场结构;进入壁垒一、引言市场需求的扩张往往引起产业内企业数量的改变,使得竞争与垄断程度产生变化,从而影响市场结构,进而决定着产业绩效。

因此,有关市场需求与市场结构的关系研究具有重大的意义。

国内外关于需求扩张对产业市场结构的影响研究,一直存在争议。

早期的观点认为市场需求的扩张会导致产业趋向于集中,如Pryor(1972)对12个国家20个不同行业的集中度和市场规模进行比较,证明了行业的市场规模越大其集中度也越高的结论[1]。

而近期的研究主要有两种观点。

一是市场需求的扩张使得产业的集中度降低,如余小华和魏晓宁(2003)以期初产业集中度、最小经济规模、市场规模、市场需求量、产品差异性、新厂商加入率和利润率为解释变量,采用我国汽车产业1992年至2002年的数据验证了汽车产业的市场需求与产业集中度呈现负向关系。

由此他认为,市场需求扩张使得进人壁垒降低,从而给汽车行业带来更大的竟争空间,导致集中度下降[2]。

冠瑞(2006)市场容量的增长会降低市场集中度,但前提条件是市场容量的增长率要超出大企业扩张的速率,他以2001年以来我国软件业发展的数据解释了这一点[3]。

杜立辉等(2008)以1990年至2007年间我国钢铁产业的CR4和CR10指数数据,描述分析了我国钢铁行业需求不断扩张的同时,产业的集中度呈现下降趋势[4]。

关系投资、市场化程度与研发服务企业利润——基于中国第二次经济普查数据的实证研究陈艳莹;候志敏;杨文璐【摘要】从理论上探究了关系投资在市场化程度的调节下对研发服务企业利润的影响作用,并利用中国2008年31个省份75 827家研发服务企业的横截面数据进行了实证检验.结果表明,关系投资对我国研发服务企业的利润率有显著的正向作用,而且,研发服务企业所处地区的市场化程度越高,关系投资对企业利润的正向促进作用越弱.为了保证研发服务企业的健康发展,必须进一步完善知识产权保护制度,建立研发服务企业的资格认证体系,加快发展要素市场,提高地区的市场化程度,缩小政府的经济干预空间.【期刊名称】《大连理工大学学报(社会科学版)》【年(卷),期】2017(038)002【总页数】5页(P40-44)【关键词】关系投资;研发服务企业;市场化程度【作者】陈艳莹;候志敏;杨文璐【作者单位】大连理工大学管理与经济学部,辽宁大连116024;大连理工大学管理与经济学部,辽宁大连116024;大连理工大学管理与经济学部,辽宁大连116024【正文语种】中文【中图分类】F062.9关系投资是指企业为获取“获得性关系”而进行的以经济利益为基础的有意识的策略性投资行为。

在中国当前的社会环境下,作为企业的非生产性支出,关系投资是各大行业重要的选择,其中值得关注的是,中国研发服务业关系投资在收入中的比例约为制造业关系投资占收入比例的3倍。

按照经济学理论,理性的企业总会为自己谋取最大福利,研发服务业选择关系投资进行大规模的非生产性投资是否真的能为企业带来额外利润是本文重点探讨的问题。

实际上,作为社会资本的载体,关系网络受到了学术界与企业界的广泛关注,尤其在中国这样的关系本位社会,社会关系网络已发展成为企业重要的战略资源。

在企业内部,高层管理的社会网络关系普遍能够提升企业的业绩[1];在企业外部,关系投资作为一种营销策略,通过影响顾客的忠诚度能够带来企业收入的增加[2]。

产业经济学第二讲:市场结构和市场势力一、市场结构的概述市场结构是指市场中企业间的竞争关系,以及这种关系对企业行为和市场绩效的影响。

市场结构可以从多个维度进行分类,包括企业数量、产品差异化程度、市场进入和退出壁垒、信息透明度等。

不同的市场结构对企业的定价策略、产品创新、市场占有率等方面产生重要影响。

1. 完全竞争市场完全竞争市场是指企业数量众多、产品同质化、市场进入和退出壁垒较低、信息完全透明的市场。

在完全竞争市场中,企业是价格的接受者,无法通过调整价格来影响市场,因此只能通过提高生产效率、降低成本来获得竞争优势。

2. 垄断市场垄断市场是指市场中只有一个或少数几个企业掌握着市场供应,其他企业难以进入。

在垄断市场中,企业可以通过调整价格来影响市场,因此具有较大的市场势力。

然而,垄断市场可能导致资源配置效率低下,消费者福利受损。

3. 垄断竞争市场垄断竞争市场是指企业数量较多、产品具有一定差异化、市场进入和退出壁垒较低、信息不完全透明的市场。

在垄断竞争市场中,企业具有一定的市场势力,可以通过产品差异化、品牌营销等手段来吸引消费者,提高市场占有率。

4. 寡头市场寡头市场是指市场中只有少数几个企业掌握着市场供应,其他企业难以进入。

在寡头市场中,企业之间的竞争关系复杂,可能存在合作、竞争、共谋等多种行为。

寡头市场中的企业可以通过调整价格、产量、产品策略等手段来影响市场,具有较大的市场势力。

二、市场势力的概念和影响因素市场势力是指企业在市场中影响价格、产量、产品质量等方面的能力。

市场势力的大小取决于市场结构、企业规模、产品差异化程度、市场进入和退出壁垒等因素。

1. 市场结构市场结构对市场势力的影响最为直接。

在垄断市场中,企业具有较大的市场势力;在完全竞争市场中,企业几乎没有市场势力。

在垄断竞争市场和寡头市场中,企业的市场势力取决于其市场份额、产品差异化程度等因素。

2. 企业规模企业规模越大,其市场势力往往越大。