Key Terms国际结算英语词汇

- 格式:doc

- 大小:63.00 KB

- 文档页数:6

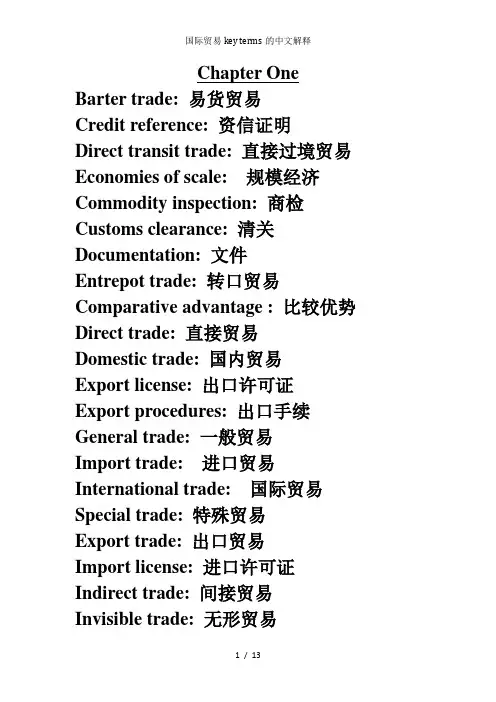

Chapter One Barter trade: 易货贸易Credit reference: 资信证明Direct transit trade: 直接过境贸易Economies of scale: 规模经济Commodity inspection: 商检Customs clearance: 清关Documentation: 文件Entrepot trade: 转口贸易Comparative advantage : 比较优势Direct trade: 直接贸易Domestic trade: 国内贸易Export license: 出口许可证Export procedures: 出口手续General trade: 一般贸易Import trade: 进口贸易International trade: 国际贸易Special trade: 特殊贸易Export trade: 出口贸易Import license: 进口许可证Indirect trade: 间接贸易Invisible trade: 无形贸易Transit trade: 过境贸易Free-liquidation trade: 自由结算贸易Import procedures: 进口手续Indirect transit trade: 间接过境贸易Payment: 支付Visible trade: 有形贸易Chapter TwoActual delivery: 实际交货Appropriation: 划拨Arrival contract: 到达合同(或目的地契约)Customary practice: 报关实务Customs clearance: 清关Customs formalities: 报关Delivery: 交货Inspection: 商检Means of transport: 运输工具Mode of transport: 运输方式Obligation: 义务Shipment contract: 转运合同Shipment notice: 转船通知Symbolic delivery:象征性交货Transfer of risk: 风险转移Chapter Three Acceptance: 受盘Commission: 佣金Counter-offer: 还盘Discount:折扣;贴现Enquiry: 询盘Export cost for foreign: exchange: 出口换汇成本Exchange: 汇兑Export profit margin:出口盈亏率Final price: 最终价格Total price: 总价Unfixed price: 非固定价Firm offer: 实盘Initial price: 最初价格Irrevocable offer: 不可撤销发盘Material price index: 原材料价格指数Money of account: 计价货币Money of payment: 支付货币Net price: 净价Non-firm offer: 虚盘Unit price: 单价Validity period: 有效期Offer: 发盘;报盘Offeree: 受盘者Offeror: 发盘者Price adjustment clause: 价格调整条款Price including commission: 含佣价Quotation: 配额Rebate: 回扣Revocation of an offer: 撤销报盘Wage index: 工资指数Withdrawal of an offer: 撤回报盘Chapter FourBar code: 条形码Conditioned weight: 公量Confirming sample: 确认样Counter sample: 回样/ 对等样Gross for net: 以毛作净Gross weight: 毛重Indicative mark: 指示性标志More or less clause: 溢短装条款Net weight: 净重Quality tolerance: 品质公差Quantity latitude: 数量机动幅度Reference sample: 参考样Regain: 回潮率Sale by actual commodity: 凭实际货物买卖Sale by actual quality: 凭实际品质买卖Sale by description or illustrations: 凭说明书或图样买卖Sale by grade: 凭等级买卖Sale by origin: 凭产地名称买卖Sale by sample: 凭样品买卖Sale by specifications: 凭规格买卖Sale by standard: 凭标准买卖Sale by trade mark or brand name: 凭商标或品牌买卖Shipping mark: 运输标志Shipping package: 运输包装Shipping sample: 装船样Tare: 皮重Neutral packing: 中性包装Chapter FiveSea transportation:海运Air transportation: 空运Rail(way )transportation: 铁路运输Road transportation:陆路运输Measurement ton:尺码吨Freight ton:运费吨Ad valorem: 从价运费Charter(tramp):不定期货船Voyage charter:程租船Time charter:期租船Liner/gross terms:班轮条件Containerization: 集装箱运输Liners transportation: 班轮运输Charter transportation:租船运输Freight rates:运费率Lay day:装卸天数Demurrage: 滞期费Straight B/L: 记名提单Order B/L:指示提单Stale B/L:过期提单Ante-dated B/L:倒签提单Advanced B/L:预签提单Surcharge:附加费Additional:附加费Basic freight:基本运费Weight ton:重量吨Sea waybill: 海运单Air waybill:空运单Partial shipments:分批装运Transshipment: 转船Time of delivery: 交货期Port of shipment: 装运港Port of destination:目的港Optional port: 选择港Chapter Six Actual total loss: 实际全损Fortuitous accidents: 意外事故Insurance coverage: 保险险别Claimant: 索赔人Franchise: 免赔率Insurance policy: 保险单Combined certificate: 联合凭证General average: 共同海损Insurance premium: 保险费Constructive total loss: 推定全损General risks: 一般外来风险Insurance rate: 保险费率Contribution: 分摊Indemnity: 赔偿金Natural calamity: 自然灾害Exclusions: 除外责任Insurable interest: 保险标的物Open policy: 预约保单External risks: 外部风险Insurance certificate: 保险凭证Partial loss: 部分损失Extraneous risks: 外来风险Insurance claim: 保险索赔Particular average: 单独海损Perils of the sea: 海上风险Proximate cause: 近因(原则)Special risks: 特殊外来风险Subject matter: 保险标的Subrogation: 代为求偿权Sum insured: 投保金额The insured/insurant: 被保险人The insurer: 保险人Total loss: 全部损失Underwriter: 承保人Unexpected accidents: 意外事故Utmost good faith: 最大诚信原则Chapter Seven Acceptance: 承兑Anticipatory credit: 预支信用证Back-to-back credit: 背对背信用证Beneficiary: 受益人Bill of exchange: 汇票Check: 支票Clean bill: 光票Clean credit: 光票信用证Confirmed L/C: 保兑信用证Deferred payment: 延期付款Discount: 折扣,贴现Documentary bill:跟单汇票Documentary letter of credit: 跟单信用证Endorsement: 背书Factoring: 保理业务Forfeiting: 包买票据Irrevocable L/C: 不可撤销信用证Paying instrument: 支付工具Payment by installments: 分期付款Payment in advance: 预付Payment term: 支付方式Presentation: 提示Promissory note: 本票Reciprocal credit: 对开信用证Red clause credit: 红条款信用证Remittance: 汇付Revocable L/C: 可撤销信用证Revolving credit: 循环信用证Sight draft: 即期汇票Sight L/C: 即期信用证Standby L/C: 备用信用证Tenor: 汇票期限Time/usance draft: 远期汇票Transferable L/C: 可转让信用证Chapter EightBill of exchange(a draft): 汇票Bill of lading:海运提单Booking note:托运单Certificates of origin:原产地证明书Cleanness: 清洁Commercial invoice: 商业发票Completeness: 完整性Conciseness:简洁性Consular invoices:领事发票Correctness: 准确性Customs declaration:报关Customs invoices: 海关发票Export license: 出口许可证Inspection certificate:检验证书Insurance policy: 保险单Letters of credit: 信用证Packing list: 装箱单Proforma invoices: 形式发票Promptness:敏捷Sales of contract: 销售合同Shipping advice: 装船通知Shipping order:装货单Chapter Nine Arbitration 仲裁Arbitration agreement: 仲裁协议Arbitration award: 仲裁裁决Arbitration body: 仲裁机构Arbitration tribunal: 仲裁法庭Arbitration hearing: 仲裁审理Arbitrator: 仲裁员Breach of contract: 违约Claim: 索赔Claimant: 索赔人Claimee: 被索赔人Dispute:纠纷Force majeure: 不可抗力Inspection: 检验Inspection certificate:检验证书Inspection body: 检查局Litigation: 诉讼Mediation: 调停Negotiation: 谈判Non-statutory inspection: 非法定检验statutory inspection: 法定检验panel of arbitration: 仲裁小组penalty clause: 罚金条款。

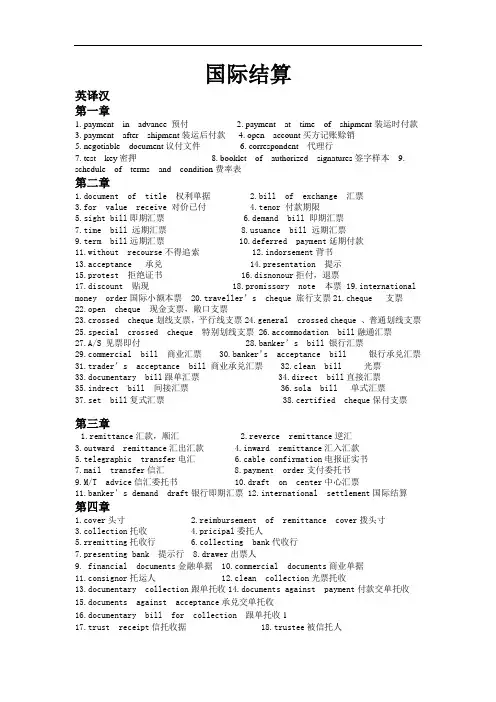

国际结算英译汉第一章1. payment in advance 预付2. payment at time of shipment装运时付款3. payment after shipment装运后付款4. open account买方记账赊销5. negotiable document议付文件6. correspondent 代理行7. test key密押8. booklet of authorized signatures签字样本9. schedule of terms and condition费率表第二章1.document of title 权利单据2.bill of exchange 汇票3.for value receive 对价已付4.tenor 付款期限5.sight bill即期汇票6.demand bill 即期汇票7.time bill 远期汇票 uance bill 远期汇票9.term bill远期汇票 10.deferred payment延期付款11.without recourse不得追索 12.indorsement背书13.acceptance 承兑 14.presentation 提示15.protest 拒绝证书 16.disnonour拒付,退票17.discount 贴现 18.promissory note 本票 19.international money order国际小额本票 20.traveller’s cheque 旅行支票21.cheque 支票22.open cheque 现金支票,敞口支票23.crossed cheque划线支票,平行线支票24.general crossed cheque 、普通划线支票25.special crossed cheque 特别划线支票 26.accommodation bill融通汇票27.A/S 见票即付 28.banker’s bill 银行汇票mercial bill 商业汇票 30.banker’s acceptance bill 银行承兑汇票31.trader’s acceptance bill 商业承兑汇票 32.clean bill 光票33.documentary bill跟单汇票 34.direct bill直接汇票35.indrect bill 间接汇票 36.sola bill 单式汇票37.set bill复式汇票 38.certified cheque保付支票第三章1.remittance汇款,顺汇2.reverce remittance逆汇3.outward remittance汇出汇款4.inward remittance汇入汇款5.telegraphic transfer电汇6.cable confirmation电报证实书7.mail transfer信汇 8.payment order支付委托书9.M/T advice信汇委托书 10.draft on center中心汇票11.banker’s demand draft银行即期汇票 12.international settlement国际结算第四章1.cover头寸2.reimbursement of remittance cover拨头寸3.collection托收4.pricipal委托人5.rremitting托收行6.collecting bank代收行7.presenting bank 提示行 8.drawer出票人9. financial documents金融单据 mercial documents商业单据11.consignor托运人 12.clean collection光票托收13.documentary collection跟单托收14.documents against payment付款交单托收15.documents against acceptance承兑交单托收16.documentary bill for collection 跟单托收117.trust receipt信托收据 18.trustee被信托人19.bailee代保管人 20.Drawee付款人21.collection instruction托收指示第五章1.documentary credit跟单信用证2.credit available by payment at sight即期付款信用证3.issuing bank开证行4.credit available by deferred payment延期付款信用证5.triangular contractual arrangement三角契约安排6.beneficiary受益人7.credit available by acceptance承兑信用证8.redit available by negotiation议付信用证9.onfirming bank保兑行10.pplicant开证申请人11.soft cause软条款 12.certificate of compliance软条款相符证明书13.advising bank通知行 14.reimbursing bank偿付行15.claiming bank索偿行 16.remitting bank寄单行17.nominated bank指定银行 18.primary liability for payment 第一性付款责19.accepting bank承兑行20.letter of credit信用证21.irrevocable credit不可撤销信用证 22.revocable credit可撤销信用证23.undertaking clause承兑条款 24.confirmed credit保兑信用证25.sight payment credit即期付款信用证26.unconfirmed credit 不保兑信用证27.deferred payment credit延期付款信用证 28.acceptance creditt承兑信用证29.negotiation credi议付信用证30.uncommodation draft 非融通汇票31.freely negotiable credit自由议付信用证 32.sight credit即期信用证ance credit 远期信用证34.documentary remittance寄单面函35.stand-by credit备用信用证ance credit payment at sight 即期付款的远期信用37.transferable credit可转让信用证38.assigment of proceeds 款项的让渡39.reciprocal credit对开信用证40.subsidiary credit补助信用证41.back-to-back credit背对背信用证 42.anticipatory credit信用证的撤销43.clean payment credit全部预付信用证 44.partial payment in advance credit部分预付信用证45.red clause credit红条款信用证 46.green clause credit绿条款信用证47.revolving credit循环信用证48.cumulative revolving credit积累循环信用证49.teletransmission credit电传方式信用证50.doctrine of strict compliance严格一致的原则51.check memo审单记录表 52.letter of indemnity赔偿保证书53.injunction order禁止付款令54.letter of guarantee for the release of goods担保提货书55.schedule of negotiation议付通知书,寄单面函第六章1.bill of lading海运提单2.clean B/L清洁提单3.unclean B/L不洁提单4.on board B/L已装船提单5.shipped B/L已装船提单6.received for shipment B/L收讫备运提单7.direct B/L直运提单8.transhipment B/L装运提单(转船提单) d B/L记名提单10.order B/L指示提单 11.current B/L正常提单12.fresh B/L正常提单 13.unstale B/L正常提单14.stale B/L过期提单 15.ante-dated B/L倒签提单16.short form B/L简式(略式)提单 17.long form B/L繁式(全式)提单18.document of title物权凭证 19.shipper托运人20.consignee收货人 21.notify party被通知人22.air way bill航空运单 23.air transport document空运单据24.air consignement note空运发货单25.IATA国际空运协会26.truck waybill铁路运单 27.rail waybill公路运单28.desk-to-desk service“桌至桌”服务 29.post receipt邮政收据30.certificate of posting、邮寄证书31.courier service document专递机构单据32.drawn clause出票条款mercial invoice商业发票 34.certificate invoice证实发票35.manufacturers’invoice制造厂商发票 36.receipted invoice 、收妥发票37.insurance policy、保险单 38.insurance certificat承保证明39.insurance declaration保险声明 bined certificate联合凭证41.risk note承保证明 42.marine transportation海洋运输43.all risks一切险 44.war risk战争险45.risks of strike、riots and civil commotion罢工、暴动与民变险46.consular invoice领事发票47.China Insurance Clauses---C.I.C中国人民保险公司保险条款48.Institute Cargo Clause---I.C.C.英国保险学会货运险条款49.customs invoice海关发票50.certificate of origin 原产地证书51.inspection certificate (商品)检验证书52.Generalised System of Preference -------G.S.P.普遍优惠制53.pecking list包装单54.weight list重量单55.measurement list尺码单。

1、correspondent bank 代理银行2、clean collection 光票托收3、commitment fee 承诺费4、letter of credit 信用证5、letter of guarantee 担保书、保函6、single factoring (保理)7、Financial documents 金融单据8、reimbursement of remittance cover 汇款的偿付9、Accommodating draft 融通汇票10、expiry date 到期日11、Certificate of origin 原产地证书12、bill of lading 海运提单13、Promissory note 本票14、insurance policy 保险单15、Commercial check 商业汇票16、Credit is available for acceptance of your drafts at 90 days sight drawn on us本信用证可以凭你方对我方开立的90天期汇票承兑17、Beneficiary's drafts is negotiable at sight by the negotiating bank .受益人的汇票可由议付行见票即付18、Usance draft to be negotiated at sight basis远期汇票将即期议付19、Although drafts are drawn at 90 days sight ,they will receive payment at sight upon presentation of document in full compliance with l/c terms90天期远期汇票如单证相符可以即期付款20、Drawings against this credit are authorized only up to 97% of this face amount of the invoice submitted该信用证汇票金额应为所提交发票面值的97%。

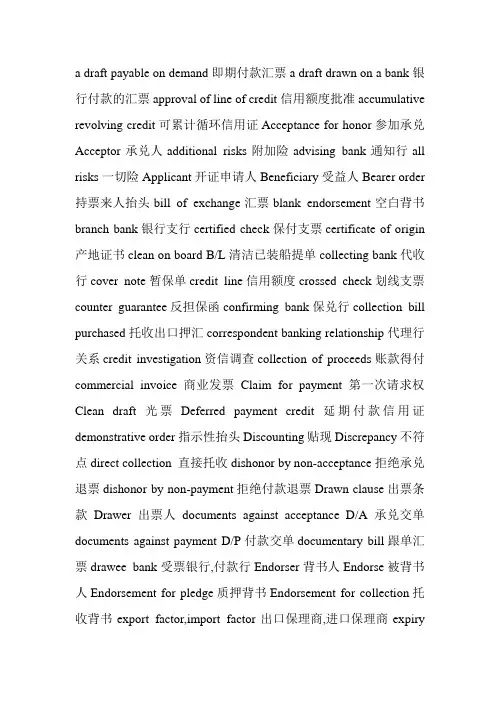

a draft payable on demand即期付款汇票a draft drawn on a bank银行付款的汇票approval of line of credit信用额度批准accumulative revolving credit可累计循环信用证Acceptance for honor参加承兑Acceptor承兑人additional risks附加险advising bank通知行all risks一切险Applicant开证申请人Beneficiary受益人Bearer order 持票来人抬头bill of exchange汇票blank endorsement空白背书branch bank银行支行certified check保付支票certificate of origin 产地证书clean on board B/L清洁已装船提单collecting bank代收行cover note暂保单credit line信用额度crossed check划线支票counter guarantee反担保函confirming bank保兑行collection bill purchased托收出口押汇correspondent banking relationship代理行关系credit investigation资信调查collection of proceeds账款得付commercial invoice商业发票Claim for payment第一次请求权Clean draft光票Deferred payment credit延期付款信用证demonstrative order指示性抬头Discounting贴现Discrepancy不符点direct collection 直接托收dishonor by non-acceptance拒绝承兑退票dishonor by non-payment拒绝付款退票Drawn clause出票条款Drawer出票人documents against acceptance D/A承兑交单documents against payment D/P付款交单documentary bill跟单汇票drawee bank受票银行,付款行Endorser背书人Endorse被背书人Endorsement for pledge质押背书Endorsement for collection托收背书export factor,import factor出口保理商,进口保理商expirydate到期日free negotiation credit自由付议信用证free from particular average,FPA 平安险forfeiting包买票据general acceptance一般性承兑G.S.P from A普惠制产地证Guarantor保证人holder for value付对价持票人holder in due course,bona-fide holder正当持票人/善意持票人insurance policy保险单insurance certificate保险证明,保险凭证inspection certificate商品检验证书irrevocable credit不可撤销信用证latest date for shipment最迟装运日letter of guarantee,L/G保函letter of credit,L/C信用证line B/L班轮提单mail transfer信汇negotiation bank议付行negotiable instrument流通票据non-causative nature无因性nostro account and vostro account往帐和来帐non-cash settlement非现金结算notice of dishonor退票通知ocean/marine bill of lading海运提单open account记账赊销方式open cover,open policy预约保单order B/L 提示提单payment in due course正当付款payment for honor参加付款payment in advance预付货款Payer/drawee付款人Payee收款人Payment order/p.o.支付授权书Paying bank汇入行performance guarantee履约保函period of presentation of documents支单期限promissory note本票Protest拒绝证书Principal委托人Presenting bank提示行proforma invoice,customs,consular,consular invoice形式发票,海关发票,领受发票qualified acceptance限制性,保留性承兑requisite in form要式性restricted order限制性抬头remittance by banker’s demand draft通过银行即期汇票汇款reciprocal credit对开信用证remitting bank寄单行/托收行reimbursement of remittance cover偿付汇票头寸reimbursing bank偿付行Recourse for payment 第二次请求权Referee in case of need预备付款人Reverse remittance逆汇Remitter/importer汇款人Release of goods against guarantee担保提货restricted negotiation credit限制支付信用证red-clause credit红条款信用证right of dishonor追索权special endorsement特别背书,正式背书SWIFT环球银行间金融电讯协会Sub-branch bank支行specimen of authorized signature授权签名样本schedule of terms and conditions费率表sight bill ,demand draft 即期汇票straight B/L直交式提单standby credit备用信用证tender guarantee,bid bond投标保函Tenor付款期限Trust receipt T/R信托收据test key密押term draft, usance bill远期汇票telegraphic transfer电汇transmitting bank专递行transferable credit可转让信用证usance credit payable at sight,buyer’s usance credit假远期信用证/买方远期信用证value date起息日with particular average,WPA/WA水渍险。

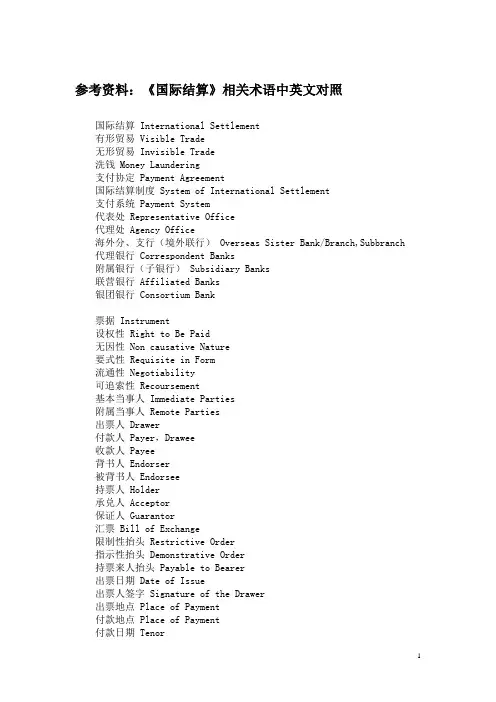

参考资料:《国际结算》相关术语中英文对照国际结算 International Settlement有形贸易 Visible Trade无形贸易 Invisible Trade洗钱 Money Laundering支付协定 Payment Agreement国际结算制度 System of International Settlement支付系统 Payment System代表处 Representative Office代理处 Agency Office海外分、支行(境外联行) Overseas Sister Bank/Branch,Subbranch 代理银行 Correspondent Banks附属银行(子银行) Subsidiary Banks联营银行 Affiliated Banks银团银行 Consortium Bank票据 Instrument设权性 Right to Be Paid无因性 Non causative Nature要式性 Requisite in Form流通性 Negotiability可追索性 Recoursement基本当事人 Immediate Parties附属当事人 Remote Parties出票人 Drawer付款人 Payer,Drawee收款人 Payee背书人 Endorser被背书人 Endorsee持票人 Holder承兑人 Acceptor保证人 Guarantor汇票 Bill of Exchange限制性抬头 Restrictive Order指示性抬头 Demonstrative Order持票来人抬头 Payable to Bearer出票日期 Date of Issue出票人签字 Signature of the Drawer出票地点 Place of Payment付款地点 Place of Payment付款日期 Tenor见票即付 At Sight or on Demand定日付款 At a Fixed Date见票后定期付款 At a Fixed Period after Sight出票后定期付款 At a Fixed Period after Date付一不付二 Pay This First/Second Bill担当付款人 Person Designated as payer预备付款人 Referee in Case of Need必须提示承兑 Presentment for Acceptance Required 不得提示承兑 Acceptance Prohibited付对价持票人 Holder for Value正当持票人Holder in Due Course/Bona Fide Holder 银行汇票 Banker’s Draft商业汇票 Trade Bill承兑汇票Acceptance Bill银行承兑汇票 Banker’s Acceptance Bill商业承兑汇票 Trade’s Acceptance Bill即期汇票 Sight Draft ,Demand Draft远期汇票 Time Bill, Usance Bill光票 Clean Bill跟单汇票 Documentary Bill本票 Promissory Note商业本票Promissory Note银行本票 Cashier’s Order/Check国际汇票 Overseas Money Order支票 Cheque or Check出票 Issue背书 Indorsement承兑 Acceptance保证 Guarantee保付 Certified to Pay提示 Presentation付款 Payment拒付 Dishonour追索 Recourse顺汇 Remittance逆汇 Reverse Remittance汇款人 Remitter汇出行 Remitting Bank汇入行 Paying Bank收款人 Payee电汇 Telegraphic Transfer信汇 Mail Transfer票汇 Remittance by Banker’s Demand Draft预付货款 Payment in Advance货到付款 Payment after Arrival of the Goods托收 Collection委托人 Principal托收行 Remitting Bank代收行 Collecting Bank付款人 Drawee提示行 Presenting Bank托收申请书 Collection Application托收委托书 Collection Advice信用证 Letter of Credit议付行 Negotiating Bank偿付行 Reimbursing Bank开证申请人Applicant开证行 Issuing Bank受益人 Beneficiary通知行 Advising Bank保兑行 Confirming Bank付款行 Paying Bank光票信用证 Clean Credit跟单信用证 Document Credit不可撤销信用证Irrevocable Credit可撤销信用证 Revocable Credit保兑信用证 Confirmed Credit不保兑信用证 Unconfirmed Credit即期付款信用证 Sight Payment Credit延期付款信用证 Deferred Payment Credit承兑信用证 Acceptance Credit转让信用证 Transferable Credit不可转让信用证 Nor-transferable Credit背对背信用证 Back to Back Credit循环信用证 Revolving Credit预支信用证 Anticipatory Credit银行保函 Letter of Guarantee申请人 Applicant/Principal受益人 Beneficiary担保行 Guarantor Bank通知行 Advising Bank转开行 Reissuing Bank反担保行 Counter Guarantor Bank保兑行 Confirming Bank投标保函 Tender Gurantee履约保函 Performance Gurantee预付款保函 Advanced Payment Gurantee质量保函Quality Gurantee关税保付保函 Customs Gurantee付款保函 Payment Gurantee延期付款保行 Defeerd Payment Gurantee补偿贸易保函 Compensation Gurantee来料加工保函 Processing Gurantee租赁保函 Lease Gurantee借款保函 Loan Gurantee保释金保函 Bail Bond票据保付保函Gurantee For Bill费用保付保函 Payment Gurantee for Commission 备用信用证 Stand-by Letter of Credit单据 Documents商业发票 Commercail Invoice首文 Heading正文Body海关发票 Customs Invoice形式发票 Proforma Invoice领事发票 Consular Invoice样品发票 Sample Invoice广商发票 Manufacturer Invoice证实发票 Certified Invoice货物运输单据 Transport documents海运提单Marine Bill of Loading托运人 Shipper/Consignor承运人 Carrier收货人 Consignee受让人 Transferee or Assignee已装船提单 Shipped on Board待运提单 Received for Shipment直达提单Direct B/L转船提单 Transshipmen B/L联运提单 Through B/L清洁提单 Clean B/L不清洁提单 Unclean B/L记名提单 Straight B/L不记名提单 Open B/L指示性提单 Order B/L简式提单 Short Form B/L全式提单 Long Form B/L班轮提单 Liner B/L租船提单 Charter B/L运输代理行提单 Horse B/L过期提单 Stale B/L倒签提单Anti-dated B/L集装箱运输提单 Container B/L多式运输 Multimodal Transport多是运输单据Multimodal Transport Document不可流通转让的海运单 Non-negotiable Sea Waybill租船合约提单 Charter Party Bill of Lading航空运单 Airway Bill基本险 Chief Risk一般附加险 Additional Risk特殊附加险 Special Additional Risk保险单 Insurance Policy预约保险单Open Policy of Open Cover保险凭证 Insurance Certificate保险声明 Insurance Declaration联合凭证 Combined Certificate暂保单 Cover Note商品验证说明 Inspection Certificate产地证明书 Certificate of Origin包装单据 Packing Document装货箱 Packing List重量单 Weight List打包贷款 Packing Credit/Loan出口押汇 Outward Bill质押书 Letter of Hypothecation出口托收押汇 Advance against Documentary Collection 银行承兑 Bank’s Acceptance票据贴现 Bill Discount出口发票 Invoice Discounting进口开证额度 Limits for Issuing of Credit信托收据 Trust Receipt, T.R, T/R留置权书 Letter of Lien进口押汇 Inward Bills进口信用证押汇 Inward Bill Receivables买房远期信用证 Buyer’s Usance L/C提货担保 Delivery against Bank Guarantee国际保理 International Factoring销售分户账管理 Maintenance of The Sales Ledger债款回收 Collection from Debtors信用销售控制 Credit Control坏账担保 Full Protection Against Bad Debts贸易融资 Trade Financing福费廷 Forfaiting贴现率 Discount Rate承诺费 Commitment Fee利息补贴 Interest Make-up侨汇 Overseas Chinese Remittance外币兑换业务 Exchange of Foreign Currency旅行支票 Traveler’s Cheque信用卡 Credit Card万事达卡 Master Card维萨卡 VISA Card运通卡 American Express Card大莱卡 Diners Club Car国际贸易结算:以票据为基础,单据为条件,银行为中枢,结算与融资相结合的非现金结算体系。

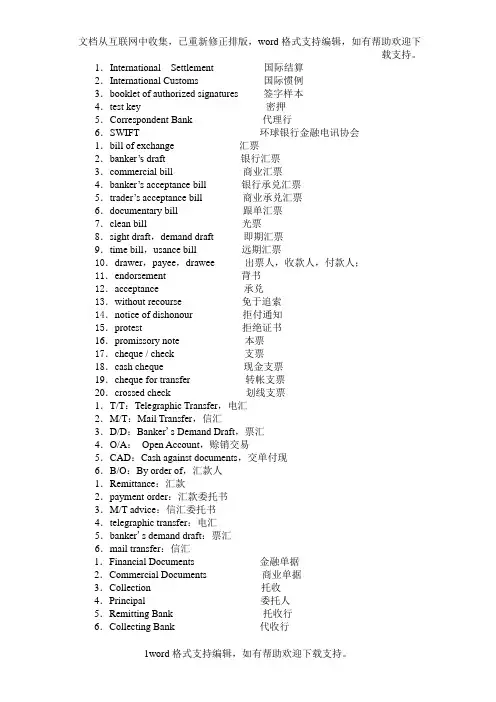

1.International Settlement 国际结算2.International Customs 国际惯例3.booklet of authorized signatures 签字样本4.test key 密押5.Correspondent Bank代理行6.SWIFT 环球银行金融电讯协会1.bill of exchange 汇票2.b anker’s draft 银行汇票3.commercial bill 商业汇票4.banker’s acceptance bill 银行承兑汇票5.trader’s acceptance bill 商业承兑汇票6.documentary bill 跟单汇票7.clean bill 光票8.sight draft,demand draft 即期汇票9.time bill,usance bill 远期汇票10.drawer,payee,drawee 出票人,收款人,付款人;11.endorsement 背书12.acceptance 承兑13.without recourse 免于追索14.notice of dishonour 拒付通知15.protest 拒绝证书16.promissory note 本票17.cheque / check 支票18.cash cheque 现金支票19.cheque for transfer 转帐支票20.crossed check 划线支票1.T/T:Telegraphic Transfer,电汇2.M/T:Mail Transfer,信汇3.D/D:Banker's Demand Draft,票汇4.O/A:Open Account,赊销交易5.CAD:Cash against documents,交单付现6.B/O:By order of,汇款人1.Remittance:汇款2.payment order:汇款委托书3.M/T advice:信汇委托书4.telegraphic transfer:电汇5.banker's demand draft:票汇6.mail transfer:信汇1.Financial Documents金融单据2.Commercial Documents 商业单据3.Collection 托收4.Principal 委托人5.Remitting Bank 托收行6.Collecting Bank 代收行7.Clean Collection光票托收8.Documentary C ollection 跟单托收9.Documents against Payment 付款交单10.Documents against Acceptance 承兑交单11.Trust Receipt 信托收据12.Outward Bills 出口押汇13.Uniform Rules for Collection 托收统一规则14.Documentary Bill for Collection 跟单托收1.Documentary Credit 跟单信用证2.Cover Letter或Bill of Purchase 寄单面函3.Credit Opened by Mail 信开本信用证4.Credit Opened by Teletransmission 电开本信用证5.Operative Instrument 有效文本6.Expiry Date and Plac e 有效日期和地点7.Nominated Bank 指定银行8.Partial Shipment 分批装运9.Special Condition 特别条款10.Discrepancy 不符点11.Issuing Bank 开证行12.Applicant 申请人13.Advising Bank 通知行14.Beneficiary 受益人15.Negotiating Bank 议付行16.Confirming Bank 保兑行17.Reimbursing Bank 偿付行18.Sight Payment Credit 即期付款信用证19.Deferred Payment Credit 迟期付款信用证20.Acceptance Credit 承兑信用证21.Confirmed Credit 保兑信用证22.Usance Credit Payable at Sight 假远期信用证23.Anticipatory Credit 预支信用证24.Transferable Credit 可转让信用证25.Back to Back Credit 背对背信用证26.Reciprocal Credit 对开信用证27.Revolving Credit 循环信用证28.Strict Compliance 严格相符29.Substantial Compliance 实质相符30.Fraud Exception Principle 欺诈例外原则五、将下列英文译成中文1.Independent guarantee:独立性保函2.Accessory Guarantee:从属性保函3.reissuing bank:转开行4.counter-guarantor:反担保人5.Standby letter of credit:备用信用证六、将下列英文译成中文1.International Factoring 国际保理2.Credit Control 信用销售控制3.Collection of Receivables 带收账款4.Financed Factoring 融资保理5.Non-Financed Factoring非融资保理6.Maturity Factoring 到期保理7.Non-Recoursed Factoring无追索权保理8.Recoursed Factoring 有追索权保理9.Disclosed Factoring公开型保理10.Undisclosed Factoring 隐蔽型保理11.Two Factor System双保理商保理型式12.Single Factor System 单保理商保理型式13.Maintenance of Sales Ledger 销售账务管理14.Protection for buyer's Credit 信用担保15.Export Trade Finance 贸易融资16.Application for a Credit Approval 信用额度申请表1.Commercial Invoice 商业发票2.Transport Documents 运输单据3.Insurance Documents 保险单据4.Receipt Invoice 收妥发票5.Shipping Mark 唛头6.Ocean Bill of Lading 海运提单7.Shipped B/L 已装船提单8.Received for Shipment B/L 备运提单9.Transshipment B/L 转船提单10.Through B/L 联运提单11.Direct B/L 直达提单12.Order B/L 指示提单13.Anti-dated B/L 倒签提单14.Non-negotiable Sea Waybill 不可转让海运单15.Air Waybill 空运运单16.Master Air Waybill 主运单17.Cargo Receipt,C/R 承运货物收据18.Parcel Post Receipt 邮包收据19.Insurance Policy 正式保险单20.Multimodal Transport Document 多式运输单据21.Insurance Certificate 保险凭证22.Open Policy 预约保险单23.Insurance Declaration 保险声明24.Cover Note, Binder 暂保单25.Certificate of Origin 原产地证明书26.Inspection Certificate 检验证明书。

国际结算:International Settlement《托收统一规则》:URC522 Uniform Rules for Collection《跟单信用证统一惯例》:UCP600 Uniform Customs and Practice for Documentary Credits 汇票:Bill of Exchange,B/E,Draft,Bill,ExchangeSWIFT:Society for Worldwide International Financial Telecommunication 环球银行金融电讯协会即期付款交单:D/P at Sight远期付款交单:D/P after SightCOVER:拨交头寸信汇:Mail Transfer,M/T电汇:Telegraphic Transfer,T/T票汇:Remittance by Banker’s Demand Draft,D/D国际贸易结算:Settlement of International Trade非贸易结算:Non-trade Settlement现金结算(货币结算):Cash Settlement or Cash on Delivery,COD票据结算:Settlement by Negotiable Instrument国际商会:(ICC) The International Chamber of Commerce《审核跟单信用证项下单据的国际标准银行实务》:ISBP International Standard Banking Practice for the Examination of Documents under Documentary Credits《跟单票据争议解决专家意见规则》:DOCDEX设权证券:Rights of a Holder有价证券:Valuable Documents,Papers ,Securities金钱证券:Pecuniary Benefits文义证券:Written Confirmation要式证券:Requisite in Form;Solemnity无因证券:Abstract,Unconditional Contract流通证券:Negotiability出票人:Drawer付款人(受票人):Drawee,Payer收款人(受款人):Payee银行汇票:Banker’s Draft商业汇票:Trade Bill光票汇票:Clean Bill跟单汇票:Documentary Bill即期汇票:Demand draft,Sight Bill远期汇票:Usance Bill,Time Bill,Time Draft银行承兑汇票:Banker’s Acceptance Bill商业承兑汇票:Trader’s Acceptance Bill无条件支付命令或委托:Unconditional Order to Pay汇票的支付命令或委托通常用:pay……or order,pay to the order of……,on demand pay to the order of,at sight pay to the order of……drawn under/against……记名收款人:Pay A Company only,Pay A Company not transferable指定的人:Pay to the order of A Company,Pay to A Company or order来人或持票人:Pay bearer,Pay to A Compan or bearer出票日期:Date of Issue出票人签字:Signature of the Drawer相对必要记载事项:Relative Requisites for a B/E出票地:Place of Issuing付款地:Place of Payment到期日:Tenor汇票的出票:Issue汇票的背书:Endorsement汇票的承兑:Acceptance汇票的保证:Guarantee汇票的付款:Payment汇票No.由出票人自行编号填入Exchange for 货币缩写和用阿拉伯数字表示金额小写数字at ____sight... 付款期限Pay to the Order of 受款人,也称“抬头人”或“抬头”the sum of 汇票金额填大写金额Drawn under 支付行L/C No. 信用证号码Dated 开证日期To 被出票人For 出票人,即出口商签字,填写公司名称汇付:Remittance汇款人(付款人):Remitter汇出行:Remitting Bank支付授权书:Payment Order,P.O.汇入行(解付行):Paying Bank汇款的偿付:Reimbursement of Remittance of Cover信汇委托书:M/T Advice密押:Test Key预付货款:Payment in Advance货到付款:Payment after Arrival of the Goods托收:Collection商业信用:Commercial Credit委托人:Principal托收行:Remitting Bank代收行:Collection Bank提示行:Presenting Bank托收指示:Collection Instruction光票托收:Clean Bill for Collection跟单托收:Documentary Bill for Collection付款交单:Documents against Payment,D/P承兑交单:Documents against Acceptance,D/A承付:Honour商业信用证:Commercial Credit光票信用证:Clean Credit跟单信用证:Documentary Credit开证申请人:Applicant开证行:Issuing Bank;Opening Bank,Establishing Bank通知行:Advising Bank;Notifying Bank受益人:Beneficiary议付行:Negotiating Bank;Negotiation Bank保兑行:Confrming Bank商业发票:Commercial Invoice海关发票:Customs Invoice领事发票:Consular Invoice税务发票:Tax Invoice最终发票:Final Invoice厂商发票:Manufactures Invoice出票人:Issuer发票名称:Commercial Invoice收货人:To发票号:Invoice No.发票日期:Date信用证号、合同号:L/C No. and S/C No.运输标志和件号(唛头和件号):Shipping Marks and Numbers 汇票的期限:Tenor提单:Bill of Lading,B/L托运人:Shipper收货人:Consignee被通知人:Notify Party航名及航次:Ocean Vessel,V oy.No.转船港:Port of Transhipment提单签发地点与时间:Place and Date of Issue已装船提单:Shipped B/L备运提单:Received for shipment B/L清洁提单:Clean B/L不清洁提单:Unclean B/L记名提单:Straight B/L不记名提单:Bearer B/L指示提单:Order B/L运输及部分转运:Transhipment and Partial Shipment货物涉及多套提单:Goods Covered by more than One Bill of Lading 原产地证书:Certificate of Origin装箱单:Packing List,P/L重量单/尺码单:Weight List/Measurement List顺汇:Remittance 逆汇:Honour or draft;reverse remittance。

International settlement 国际结算money transfer 资金转移3. settle accounts 结清帐款4. debts 欠债5. claims 债权6. international trade 国际贸易7. tangible goods 有形商品8. intangible service transactions 无形服务贸易9. international lending and investments 国际借贷和投资10. international aids and grants 国际援助11. cross-border personal remittance 跨国个人汇款12. international commercial settlement 国际贸易结算13. international non-commercial settlement 国际非贸易结算14. payment methods 支付方式15. sales amount 销售金额16. currency 货币17. make payments 进行支付18. collect payments 收取货款19. cash payments 现金支付20. sales contract 销售合同21. financial instrument 金融单据22. commercial document 商业单据23. Instrument Act 票据法24. bills of exchange 汇票25. cheque 支票26. promissory note 本票27. commercial invoice 商业发票28. packing list 装箱单29. bill of lading 提单30. insurance policy 保险单31. inspection certificate 检验证书32. certificate of origin 原产地证书33. collection 托收34. international factoring国际保理35. letter of credit 信用证36. letter of guarantee 保函37. internationalconvertible currency 国际可兑货币38. medium of exchange交换的媒介39. intermediary 中间人40. title 物权41. constructive delivery象征性交货42. actual delivery 实际交货43. price terms / incoterms价格术语44. FAS 船边交货价45. FOB 离岸价46. CFR 成本加运费价47. CIF 到岸价/成本、保险加运费价48. quoted price 报价49. port of loading 装运港50. port of destination 目的港51. certificate of deposit大额存单52. treasury bills 国库券53. bearer securities 不记名债券54. draw (a bill ) by sb. 由某人出票55. draw (a bill ) on sb. 以某人为付款人56. (a bill ) payable to sb. 付款给57. drawer 出票人58. drawee 受票人59. payee 收款人60. bearer 持票来人61. to debit 借记62. to credit 贷记63. drawn under 在…….开立64. drawn clause 出票条款65. tenor 期限66. on demand 即期67. a fixed or determinablefuture time 在固定的或可以确定的未来某一日68. due date / maturity date到期日69. demand /sight bill 即期汇票70. usance / time / term bill远期汇票71. to accept (a bill) 承兑72. a valid bill 有效汇票73. an invalid bill 无效汇票74. interest 利息75. the amount in words大写金额76. the amount in figures小写金额77. negotiation 流通转让;议付78. restrictive order 限制性抬头79. demonstrative /indicative order 指示性抬头80. bearer order 持票来人抬头81. endorsement 背书82. delivery of a bill 汇票的交付83. in alternative 有选择性的84. in sequence 按先后顺序85. value received 对价付讫86. a set of bill 一套汇票87. acceptor 承兑人88. to honor a bill 兑付汇票89. to dishonor a bill 退票90. endorser 背书任91. endorsee 被背书人92. holder 持票人93. prior party 前手94. subsequent party 后手95. right of recourse 追索权96. to issue a bill 出票97. special endorsement 特别背书98. blank endorsement 空白背书99. to sign 签名100. the authorized signature 有权签名101. presentment 提示102. general acceptance 普通承兑103. qualified acceptance 限制性承兑104. payment in due course 正当付款105. discharge 注销106. notice of dishonor 拒付通知107. protest 拒绝证书108. notary party 公证人109. domestic / inland bill 国内汇票110. foreign bill 国际汇票111. banker’s / bank draft 银行汇票112. banker’s acceptance bill 银行承兑汇票113. commercial / trader’s bill 商业汇票114. trader’s accep tance bill 商业承兑汇票115. clean bill 光票116. documentary bill 跟单汇票117. finance 融资118. discounting 贴现119. discount house 贴现行120. net proceeds 净款121. balance 余额122. discount interest 贴现息123. face value 面值124. discounting days 贴现天数125. discounting rate 贴现率126. forfeiting 弗费廷/票据包买127. correspondentbanking relationship 代理行关系128. correspondent bank代理行129. representative office代表处130. subsidiary 字银行131. affiliate 附属行132. branch 分行133. accept deposits 接受存款134. issue loans 发放贷款135. a separatelyincorporated bank 一家独立注册的银行136. conduct bankingbusiness 叙作银行业务137. agency 代理138. control documents 控制文件139. test key 密押140. schedule of terms andconditions 费率表141. mail message 信函信息142. telegraphic message电子信息143. authenticate 验证144. sign a cooperateagreement 签定合作协议145. maintain / opencurrent accounts 开立活期帐户146. deposit accounts 存款帐户147. initial deposit 开户存款额148. minimum creditbalance 最底贷方余额149. statement of balance对帐单150. your account / vostroaccount 你帐151. our account / nostroaccount 我帐152. principal 委托人153. beneficiary 受益人154. trader’s credit 商业信用155. banker’s credit 银行信用156. remittance 顺汇;汇款157. reverse remittance 逆汇158. remitter 汇款人159. the remitting bank 汇出行160. the paying bank 解付行161. remittance by airmail(M/T) 信汇162. remittance bytelegraphic transfer (T/T) 电汇163. remittance bybanker’s demand draft (D/D) 票汇164. clean collection 光票托收165. documentarycollection 跟单托收166. documents releaseconditions 交单条件167. documents againstpayment at sight (D/P sight) 即期付款交单168. documents againstpayment after sight (D/P aftersight) 远期付款交单169. D/P after sight againsttrust receipt (D/P, T/R) 凭信托收据远期付款交单170. Documents agaistacceptance (D/A) 承兑交单171. collection order 托收指示172. application form for collection 托收申请书173. L/C applicant 信用证申请人174. undertaking 承诺175. L/C issuing bank 信用证开证行176. the advising bank 通知行177. the confirming bank 保兑行178. the negotiating bank 议付行179 the paying bank 付款行180. the accepting bank 承兑行181. the reimbursing bank 偿付行182. the nominated bank 指定银行183. credit number 信用证号码184. date of expiry 到期日185. place of expiry 到期地点186. the validity of a credit 信用证有效期187. partial shipment 分船装运188. transhipment 转船装运189. clean credit 光票信用证190. documentary credit 跟单信用证191. irrevocable credit 不可撤消信用证192. revvocable credit 可撤消信用证193. confirmed credit 保兑信用证194. unconfirmed credit 不保兑信用证195. sight payment credit 即期付款信用证196. deferred payment credit 延期付款信用证197. acceptance credit 承兑信用证198. negotiation credit 即期信用证199. sight /demand credit远期信用证200. time / usance credit201. marine insurance 海上保险202. contract of indemnity赔付契约203. the insurer 保险人204. the insured 投保人205. premium 保费206. the amount insured保险金额207. risks to be covered 承保险别208. maritime losses 海上损失209. total loss 全部损失210. actual total loss 实际全损211. constructive total loss推定全损212. total loss of aproportional part 部分全损213. patial loss / average部分损失214. general average (G.A.)共同海损215. particular average(P.A) 单独海损216. external losses 外来险217. general risks 一般险218. TPND 偷窃、提货不着险219. risk of leakage 渗漏险220. risk of clash andbreakage 碰撞破碎险221. risk of hook damage钩损险222. FWRD 淡水雨淋险223. risk of shortage 短量险224. risk of inermixtureand contamination 混杂污染险225. risk of taint of odor串味险226. risk of sweat andheating 受潮受热险227. risk of rust 锈损险228. risk of breakage ofpacking 包装破损险229. special risks 特别险230. failure to diliver 提货不着231. import duty 进口税232. on deck 仓面险233. rejection 拒收险234. aflatoxin 黄曲酶素险235. FREC存仓火险责任扩展条约236. war risk 战争险237. risk of import duty 进口税险238. SRCC 罢工、暴动、内乱险239. coverage 险别240. basic marine insuracecoverage 基本险241. FPA (free fromparticular average) 单独海损不赔/平安险242. WA/WPA (withaverage / with particular average)单独海损要赔/ 水渍险243. All risks 一切险244. additional risks 附加险245. insurance clause 保险条款246. London InstituteCargo Clause 伦敦协会条款247. underwriter 保险商248. claim payableat 索赔地点249. International Chamberof Commerce 国际商会。

国际结算常用的英语单词及缩写目录第一部分常用英语单词及术语第二部分单证词汇第三部分单证常用缩写第一部分常用英语单词及术语A中国农业银行ABC (Agriculture Bank of China)承兑Acceptance承兑汇票Acceptance Bill承兑信用证Acceptance Credit不得提示承兑Acceptance Prohibited承兑行Accepting Bank承兑人Acceptor融通票据折现Accommodation Bills for Discounting融通汇票Accommodation Draft账户A/C(Account)往来账户A/C(Account Current)接受开户行Accepting Bank从属的付款责任Accessory Obligation美国自动清算所系统ACH(Automated Clearing House)保险回执Acknowledgement of Insurance自动清算所ACS(Automated Clearing House)实际全损Actual Total Loss亚洲开发银行ADB(Asian Development Bank)附加单据Additional Document一般附加险Additional Risks签发address托收垫款Advance against Collection出口托收押汇Advance against Documentary Collection 预付保理Advanced Factoring预付款保函Advanced Payment Guarantee汇票通知书,票根Advice of Drawing通知行Advising Bank联营银行Affiliated Banks出票日后定期付款After Date见票后定期付款After Sight代理合约Agency Arrangement代理处Agency Office航空提单Air Waybill美国运通卡American Express Card预支信用证Anticipatory Credit倒签提单Anti-dated B/L开证申请人applicant, opener开证申请书Application and Security Agreement申请开户行Applying Bank核准approval核准应收账款Approved Receivables一切险AR(All Risks)来件装配保函Assembly Guarantee可过户assignable受让人Assignee/transferee权利转让,转让证书assignment款项让渡Assignment of Proceeds板期,定日付款At a Fixed Date出票后定期付款,出票远期付款At a Fixed Period after Date见票后定期付款,见票远期付款At a Fixed Period after sight即期汇票,见票即付At Sight or On Demand自动柜员机系统ATM(Automated Teller Machine)证实authenticate自动循环信用证Automatic Revolving Credit海损average全水路A/W(All Water)B背对背信用证Back to Back Credit保释金保函Bail Bond资产负债表Balance Sheet银行居家系统Bank-at-home System银行承兑Banker's Acceptance银行承兑汇票Banker's Acceptance Bill银行支票Banker's Check银行汇票Banker's Draft银行本票,银行券Banker's Note法国东方汇理银行Banque de I'IndoChine劣质信用证Bastard Letter of Credit北京市商业银行BCCB(Beijing City Commercial Bank)交通银行BCM(Bank of Communications)英国1882年《票据法》BEA(Bills of exchange Act)持票来人Bearer受益人,收款人beneficiary, payee, recipient投标保函Bid Guarantee招标人bidder汇票Bill of Exchange出口押汇,买单,买票,议付Bill Purchased, Outward Bill国际清算银行BIS(Bank for International Settlements)海运提单,提单B/L(Marine Bill of Lading/Ocean Bill of Lading)空白背书Blank Endorsement统保单Blank Policy美洲银行BOA(Bank of America)北京银行BOB(Bank of Beijing)中国银行BOC(Bank of China)日本银行金融网络系统BOJ-NET(The Bank of Japan Financial Network System)簿记book-keeping出口寄单议付通知书BP(Bill of Purchase)简电本Brief Cable净额批量结算Bulk Transfer Net System买方buyer买方远期信用证,假远期信用证Buyer's Usance Credit or L/CC电开本cable电报证实书Cable Confirmation承运人Carrier现金结算Cash-Settlement,又称COD结算(Cash on Delivery)银行本票Cashier's Order/Check中国建设银行CBC/CCB (Construction Bank of China)估价和原产地联合证明书C.C.V.O (Combined Certificate of Value and Origin)国家开发银行CDB (China Development Bank)中国光大银行CEB(China Everbright Bank)企业电子转账服务CEFTS(Corporate EFT Services)中央银行本票Central Banker's Note根据某国海关法令签发的证实发票Certificate Invoice in Accordance保付支票Certified Check证实发票Certified Invoice保付Certified to Pay成本加运费价CFR(Cost and Freight)英国伦敦票据交换所银行同业支付系统CHAPS(Clearing House Automated Payment System)租船提单Charter Party B/L大通银行Chase Bank香港票据交换所自动转账系统CHA TS(Clearing House Automated Transfer System)支票Check,Cheque支票卡Check Card支票兑取check collection基本险Chief Risk兴业银行CIB(Industrial Bank)成本加运费加保险费CIF(Cost Insurance and Freight)运费、保险费付至……价CIP (Carriage and Insurance Paid to)花旗银行Citi Bank(National City Bank of New York)索赔claim索偿行Claiming Bank光票Clean Bill洁净提单Clean B/L光票托收Clean Collection光票信用证Clean Credit清算账户Clearing Account清算公司,票据交换所clearinghouse清偿信用证Clearing Reimbursement Credit 清算制度,清算系统Clearing System招商银行CMBC(China Merchants Bank)民生银行CMSB (China Min Sheng Bank) 代收银行collecting bank托收collection托收委托书Collection Advice托收申请书Collection Application托收出口押汇Collection Bill Purchased债款回收Collection from Debtors委托(托收的)单据Collection Instructions托收业务,托收项目Collection Items收取应收账款Collection of Receivables托收货款Collection of Trade Charges联合凭证Combined Certificate商业银行本票Commercial Banker's Note 商业发票,发票Commercial Invoice商业票据信用证Commercial Paper L/C佣金commission承担费Commitment Fee申请承诺书Commitment Letter补偿贸易保函Compensation Guarantee一致,相符compliance附带条件背书Conditional Endorsement有条件付款保函Conditional L/G保兑信用证Confirmed Credit保兑行,第二担保行Confirming Bank对价consideration寄售consignment委托人consignor, principal托运人consignor/shipper收货人consignee银团银行Consortium Bank推定全损Constructive Total Loss领事发票Consular Invoice集装箱运输提单Container B/L签约人contractor控制文件,票根Control Documents自由外汇convertibility商品的成本价值Cost/ Value of Goods抵押信用证Counter Credit反担保函Counter Guarantee反担保行Counter Guarantor Bank反担保counter indemnity复签counter signature商品的生产国家Country of Origin of Goods头寸cover, position寄单面函Cover Letter暂保单Cover Note运费付至……价CPT(Carriage Paid to)贷记报单Credit Advice信用卡Credit Card信用销售控制Credit Control信用保函Credit L/G全电开证credit opened by full cable/telex信开信用证credit opened by mail电开信用证credit opened by the teletransmission代理银行Correspondent Banks划线支票Crossed Check积累性循环信用证Cumulative Revolving Credit活期存款账户Current a/c需要时的代理Customer's Representative in Case of Need关税保付保函Customs Guarantee海关发票Customs InvoiceD承兑交单D/A(Documents against Acceptance)边境交货价DAF(Delivered At Frontier)出票日期,开证日期Date of Issue票汇D/D(Remittance by Banker's Demand Draft, Demand Draft)完税后交货价DDP(Delivered Duty Paid)未完税交货价DDU(Delivered Duty Unpaid)借记报单Debit Advice违约default延期付款Deferred Payment延期付款信用证Deferred Payment Credit延期付款保函Deferred Payment Guarantee提交,交货deliver交割delivery即期汇票Demand Bill,Sight Draft见索即付保函Demand Guarantee指示性抬头Demonstrative Order总计单deposit transmittal存款人depositor存款行Depositor Bank, 即申请开户行账户行,甲种代理行Depository bank, 即接受开户行目的港码头交货价DEQ(Delivered Ex Quay)目的港船上交货价DES(Delivered Ex Ship)货物的描述description of goods卸货港,目的地Destination, Port of Discharge德意志银行Deutsche Bank信使专递DHL(Dalsey, Hillblom and Lynn, founders of DHL Worldwide Express) 大莱信用卡Diners Club Card直达提单Direct B/L直接托收Direct Collection不洁净提单Dirty B/L , Unclean B/L注销discharge公开保理Disclosed Factoring贴现率Discount Rate不符点discrepancy拒付,退票dishonor拒绝承兑Dishonor by non-acceptance拒绝付款Dishonor by non-payment可分割divisible单据documents跟单汇票Documentary Bill跟单托收Documentary Collection跟单信用证Documentary Credit, Documentary L/C国内汇票Domestic Bill of Exchange国内保理Domestic Factoring双保理Double Factoring预付订金down payment付款交单D/P(Documents against Payment)汇票draft/bill of exchange付款人drawee付款行,受票行Drawee Bank出票人drawer支款单drawing slip出票条款Drawn ClauseE电子银行业务Electronic Banking电子银行协会Electronic Banking Association电子数据交换系统EDI(Electronic Data Interchange)电子资金转账EFT(Electronic Fund Transfer)电子支付Electronic Payment雇主employer邮政特快专递服务EMS (Express Mail Service)被背书人,受让人Endorsee背书Endorsement, Indorsement委托取款背书Endorsement for Collection背书人Endorser保证条款Engagement/Undertaking Clause委托entrust伊士克罗信用证Escrow Credit审核examine外币兑换Exchange of Foreign Currency信用证有效期限Expiry Date, Terms of Validity出口保理商export factor出口保理export factoring黑字环流贷款Export Industry Promotion Programme under the Financial Recycling Scheme 出口贸易融资export trade finance出口商签章exporter's signature外来风险Extraneous Risks工厂交货价EXW(Ex Works)F保理商factor保理factoring装运港船边交货价FAS(Free Alongside Ship)货交承运人价FCA(Free Carrier)国际保理联合会FCI (Factors Chain International)美联储资金电化系统FEDWIRE(Federal Reserves Wire Transfer System)融资保理Financed Factoring金融信托公司financial trust定日付款,板期Fixed Date小额定时结算Fixed Time Retail System流动保单Floating Policy装运港船上交货价FOB(Free on Board)国外汇票Foreign Bill外币汇票Foreign Money Bill福费廷forfaiting信用证形式Form of Credit可分拆fractionable平安险FPA(Free from Particular Average)运费到付提单Freight Collect B/L运费预付提单Freight Prepaid B/L全电本Full Cable坏账担保Full Protection Against Bad DebtsG共同海损General Average一般划线支票General Crossed Cheque多收期Grace Days赠予成分GE(Grant Element)绿条款信用证Green Clause Credit普惠制产地证G.S.P FORM A(Generalized System of Preferences Certificate of Origin)保证Guarantee担保信用证Guarantee L/C保证人,融资担保人Guarantor担保行Guarantor BankH《海牙规则》(统一提单的若干法律规则的国际公约)Hague Rules(International Convention for the Unification of Certain Rules of Law Relating to Bill of Lading)《汉堡规则》(1978年联合国海上货物运输公约)Hamburg Rules(United Nations Convention on the Carriage of Goods by Sea,1978)硬币hard/strong currency家庭银行HB(Home Bank)受益人抬头信用证Head-on Credit赫斯塔特风险(巨额跨境结算风险)Herstatt Risk持票人,持有人Holder付对价持票人Holder for V alue正当(善意)持票人Holder in Due Course/Bona Fide Holder本币汇票Home Money Bill付款honor运输代理行提单Horse B/L汇丰银行HSBC (The HongKong and Shanghai Bank Corporation)I国际复兴开发银行IBRD(International Bank for Reconstruction and Development)进口代收,对内代收IC(Inward Collection)中国工商银行ICBC (Industry and Commercial Bank of China)国际商会ICC(International Chamber of Commerce)印度工业信贷投资银行ICICI Bank国际开发协会IDA(International Development Association)基本当事人Immediate Parties进口保理商import factor进口保理import factoring国际商务术语规则INCOTERMS(International Commercial Terms, International Rules for the Interpretation of Trade Terms)独立付款承诺Independent Undertaking of Payment背书Indorsement, Endorsement初签Initial Signature国内汇票Inland Bill指示条款Instructions保险凭证Insurance Certificate保险单据Insurance Policy保险人Insurer无形贸易Invisible Trade发票invoice出口发票贴现Invoice Discounting进口押汇Inward Bills商检证书Inspection Certificate兽医检验证书Inspection Certificate of Veterinary出票Issue发行人,开证行Issuer开证行Issuing Bank出具贷记通知issuing credit note指示行Instructing Bank票据Instrument利息贴补Interest Make-up国际汇票International Bill of Exchange国际汇兑International Exchange国际保理International Factoring国际统一私法协会International Institute for the Unification of Private Law 国际小额本票International Money Order国际结算International Settlement无形贸易Invisible Trade不可撤销信用证Irrevocable Credit国际标准化组织ISO(International Organization for Standardization)J日本JCB卡JCB CardK通用货币Key CurrencyL装运期限Latest Date of Shipment信用证L/C(Letter of Credit)信用证金额L/C Amount信用证号码L/C Number租赁保函Lease Guarantee出租人lessor保函,银行保证书L/G(Letter of Guarantee)质押权利设定书,质押书L/H(Letter of Hypothecation)保证书Letter of Indemnity转让书Letter of Transfer承诺书Letter of Undertaking班轮提单Liner B/L借款保函Loan Guarantee全式提单Long Form B/LM维修保函Maintenance Guarantee销售分帐户管理Maintenance of The Sales Ledger出票人Maker厂商发票Manufacturer Invoice万事达卡Mater Card到期保理Maturity Factoring英国伦敦米德兰银行Midland Bank铺底资金Minimum Balance镜子账户Mirror a/c混合贷款Mixed Credit洗钱Money Laundering信汇M/T(Mail Transfer)信汇委托书M/T Advice多式联运单据MTD(Multimodal Transport Document)多式联运营运人MTO(Multimodal Transport Operator)N流通性Negotiability议付行Negotiation Bank议付信用证Negotiation Credit非单据条件no-documentary condition指定的nominated指定银行Nominated Bank非自动循环信用证Non-automatic Revolving Credit无因性Non-causative Nature非积累性循环信用证Non-cumulative Revolving Credit非账户行,乙种代理行Non-depository Correspondent未生效信用证Non-effective L/C无追索权保理Non-recourse Factoring非贸易结算Non-trade Settlement不可转让信用证Non-transferable Credit往账Nostro Account,Nostro a/c,即我行设在你行的帐(Our a/c with you)款项让渡通知书Notification of Assignment基金批准书Notice of Approval of Contract拒付通知Notice of DishonorO责任obligation分支行联网系统OBS(On-Line Branch System)对外托收OC(Outward Collection)报盘Offer不记名提单Open B/L未划线支票Open Check, Uncrossed Check预约保险单Open Policy of Open Cover开证申请人opener, applicant联行往来Operating among the Chain Banks即期汇票,见票即付On Demand or At Sight赊账交易,记账赊销O/A ( Open Account Transaction)指示性提单Order B/L原始信用证Original Credit正收条Original Receipt其他特别条款Other Special Condition支票过期Out of Date出口押汇,买单,买票Outward Bill, Bill Purchased账户透支保函Overdraft Guarantee侨汇,华侨汇款Overseas Chinese Remittance日本海外经济协力基金OECF(Overseas Economic Cooperation Funds)国际汇票Overseas Money Order海外分支行/境外联行Overseas Sister Bank/Branch, Sub-branch超营运资金经营overtrandingP打包贷款Packing Credit包装单据Packing Document装箱单Packing List邮包收据Parcel Post Receipt部分损失Partial Loss可否分批转运Partial Shipment Permitted/not Permitted部分转让Partial Transfer风险参与银行Participating Bank单独海损Particular Average一拍即付Pay Pass持票来人抬头Payable to Bearer见索即付Payable Upon First Simple Demand收款人payee, beneficiary, recipient付款人payer付款payment货到付款Payment after Arrival of the Goods付款类保函Payment L/G结算货币Payment Currency预付货款Payment in Advance国外兑付点Paying Agent汇入行,解付行,付款行Paying Bank支付系统Paying System参加付款Payment for Sb's Honor付款保函Payment Guarantee结算工具Payment Instruments/Means参加付款人Payor for Sb's Honor中国人民银行PBC(The People's Bank of China)履约保证金Performance Bond履约保函Performance Guarantee海上风险Perils of Sea担当付款人Person Designated as Payer被担保人Person Guaranteed出票地点Place of Issue付款地点Place of Payment第一性付款责任Primary Obligation, Primary Liability for Payment 支付委托书PO(Payment Order)本票Promissory Note拒绝证书Protest卸货港,目的地Port of Discharge of Destination装运港port of loading/shipment零售点系统Point-of-sale System头寸position, cover未到期支票Post-dated Check预先信用额度评估Preliminary Credit Assessment承兑提示Presentation for Acceptance付款提示Presentation for Payment必须提示承兑Presentment for Acceptance Required提示presentation提示行Presenting Bank价格货币Price Currency贸易术语,价格术语/条件Price Terms委托人principal, consignor前手Prior Parties来料加工保函Processing Guarantee形式发票Pro-forma Invoice买方信用担保Protection for Buyer's Credit购买人PurchaserQ质量保函Quality GuaranteeR铁路提单Rail Waybill真实账户Real a/c待运提单Received for Shipment B/L收款人Recipient, payee, beneficiary对开信用证Reciprocal Credit追索Recourse有追索权保理Recourse Factoring可追索性Recoursement红条款信用证Red Clause Credit重复开票Redrawn预备付款人Referee in Case of Need偿还refund担保协议Reimbursing Agreement偿付行Reimbursing Bank偿付授权书Reimbursement Authorization索偿书Reimbursement Claim拨头寸,头寸偿付Reimbursement of Remittance Cover 转开行Reissuing Bank放单,解付release汇款,顺汇remittance汇款人remitter汇出行Remitting Bank托收银行,寄单行Remitting Bank附属当事人Remote Parties代表处Representative Office支款请求书Request for Disbursement要式性Requisite in Form限制性背书Restrictive Endorsement限制性抬头Restrictive Order信用证的再转让Retransfer of Credit逆汇Reverse Remittance可撤销信用证Revocable Credit循环信用证Revolving Credit设权性Right to Be Paid风险参与Risk Participation全额实时结算RTGS(Real Time Gross Settlement)空头支票rubber chequeS救助费用Salvage Charge当天资金Same Day Funds样品发票Sample Invoice特别买方信贷限额SBCL(Special Buyer Credit Limit)渣打银行SCB(Standard Chartered Bank)仔细检查scrutinize海运单Sea Waybill从属信用证Secondary/Subsidiary Credit第二性偿付责任Secondary Obligation开证担保Secured Agreement卖方seller销售代理Selling Agent赊销sell-on credit半自动循环信用证Semi-automatic Revolving Credit独立的separate结算方式settlement methods已装船提单Shipped on Board B/L托运人shipper/consignor运输单据shipping document唛头shipping mark简式提单Short Form B/L瑞士跨行清算系统SIC(Swiss Interbank Clearing System)即期信用证Sight Credit即期汇票Sight Draft,Demand Bill即期付款信用证Sight Payment Credit出票人签字Signature of the Drawer修改的沉默接受Silent Acceptance of Amendment缄默保兑,局外保兑Silent Confirmation单保理single factoring备用信用证SLC, SL/C(Stand-by Letter of Credit)三井住友银行SMBC(Simitomo Mitsui Banking Corporation)软条款soft clause软币soft/weak currency特别划线支票Special Crossed Cheque特别提款权SDRs(Special Drawing Rights)记名背书Special Endorsement特别指示Special Instruction Under OECF Loan印鉴样本Specimen Signature, Booklet of Authorized Signatures过期提单Stale B/L记名提单Straight B/L直接付款信用证Straight Credit硬币strong/hard currency后手Subsequent Parties附属银行/子银行Subsidiary Banks从属信用证Subsidiary/ Secondary Credit施救费用Sue and Labor Expenses简表Summary Sheet环球金融电讯协会SWIFT(Society for Worldwide International Financial Telecommunications)象征性交货Symbolic DeliveryT欧元自动拨付与清算系统TARGET(Trans-European Automated Real Time Gross Settlement Express Transfer)投标保函Tender Guarantee付款到期日Tenor限期汇票Tenor Draft费率表Terms and Conditions信用证有效期限Terms of Validity, Expiry Date密押Test Key被保险人,保户the insured三方汇票three party draft联运提单Through B/L挂钩贷款Tied-aid Credit远期汇票Time Bill,Usance Bill物权title贷方总额total credits借方总额total debits全损total loss总价total price全部转让total transfer旅游外汇Tourist Foreign Exchange信托收据T/R(Trust Receipt)商业汇票Trade Bill贸易融资Trade Financing贸易网络Trade Net贸易结算Trade Settlement商业承兑汇票Trader's Acceptance Bill可转让信用证Transferable Credit受让人transferee/Assignee转让行Transferring Bank可否转运Transshipment Allowed/not Allowed可转移transmissible转递行Transmitting Bank运输细节transport details运输单据,发货清单transport documents转运transshipment转船提单transshipment B/L旅行支票Traveler's Check/Cheque旅行信用证Traveler's Letter of Credit信托公司trust company银行的信托部trust institution电汇T/T(Telegraphic Transfer)双方汇票two party draft双方即期汇票two-party sight draftU瑞士联合银行UBS(Switzerland, Union Bank of)美国1952年《统一商法典》UCC(Uniform Commercial Code)跟单信用证统一惯例UCP(Uniform Customs and Practice for Documentary Credit)《日内瓦统一汇票和本票法》ULB(Uniform Law for Bills of Exchange and Promissory Note ,Signed at Geneva,1931)《日内瓦统一制票法公约》ULC(Uniform Law for Cheques, Signed at Geneva,1931)不洁净提单Unclean B/L, Dirty B/L无条件付款承诺Unconditional L/G不保兑信用证Unconfirmed Credit未划线支票Uncrossed Check, Open Check保证条款Undertaking /Engagement Clause隐蔽保理Undisclosed Factoring单价unit price《托收统一规则》URC(Uniform Rules for Collection)《合约保函统一规则》URCG (Uniform Rules for Contract Guarantees)《见索即付保函统一规则》URDG(Uniform Rules for Demand Guarantees)远期汇票Usance Bill, Time Bill远期信用证Usance CreditV起息日Value Date商品的成本价值Value/Cost of Goods《维斯比规则》(修改统一提单的若干法律规定的国际公约的议定书)Visby Rules(Protocol to Amend the International Convention for the Unification of Certain Rules of Law Relating to Bill of Lading)维萨卡VISA Card有形贸易Visible Trade、来账V ostro Account, V ostro a/c,即你行设在我行的帐(Your a/c with us)W软币weak/soft currency重量单Weight List大额资金转账系统Whole Sale Funds Transfer System支取withdraw水渍险WPA(With Particular Average)仓至仓条款W/W(Warehouse to Warehouse Clause)Z无金额信用证Zero L/C第二部分单证词汇船舶登记证书Certificate of Registry船用物品申报单ship's stores declaration出口许可证export license出口许可证申请表export license application出口结汇核销单exchange control declaration, exportT出口单证(海关转运报关单)(欧共体用)dispatch note model TT1出口单证(内部转运报关单)(欧共体用)dispatch note model T1T2出口单证(原产地证明书)dispatch note model T2T5管理单证(退运单证)(欧共体用)control document T5铁路运输退运单re-sending consignment noteT2L出口单证(原产地证明书)(欧共体用)dispatch note model T2L分析证书certificate of analysis一致性证书certificate of conformity质量证书certificate of quality测试报告test report产品性能报告product performance report产品规格型号报告product specification report工艺数据报告process data report首样测试报告first sample test report价格/销售目录price/sales catalogue参与方信息party information农产品加工厂证书mill certificate重量证书weight certificate证书certificate价值与原产地综合证书combined certificate of value and origin数量证书certificate of quantity质量数据报文quality data message查询query查询回复request to query订购单purchase order制造说明manufacturing instructions领料单stores requisition产品售价单invoicing data sheet包装说明packing instruction内部运输单internal transport order统计及其他管理用内部单证statistical and other administrative internal documents 直接支付估价单direct payment valuation直接支付估价申请direct payment valuation request临时支付估价单provisional payment valuation支付估价单payment valuation数量估价单quantity valuation数量估价单申请quantity valuation request数量单(BOQ)bill of quantities合同数量单contract bill of quantities不计价投标数量单un-priced tender BOQ标价投标数量单priced tender BOQ询价单enquiry临时支付申请interim application for payment支付协议agreement to pay意向书letter of intent订单order总订单blanket order现货订单spot order租赁单lease order紧急订单rush order修理单repair order分订单call-off order寄售单consignment order样品订单sample order换货单swap order订购单变更请求change request purchase order订购单回复purchase order response租用单hire order备件订单spare parts order交货说明delivery instructions交货计划表delivery schedule按时交货delivery just-in-time发货通知delivery release交货通知delivery note发盘/报价offer/quotation报价申请request for quote合同contract订单确认acknowledgement of order部分发票partial invoice操作说明operating instructions铭牌name/product plate交货说明请求request for delivery instructions订舱申请booking request装运说明shipping instructions托运人说明书(空运)shipper's letter of instructions(air) 短途货运单cartage order/local transport待运通知ready for dispatch advice发运单dispatch order发运通知dispatch advice单证分发通知advice of distribution of document贷记单credit note佣金单commission note借记单debit note更正发票corrected invoice合并发票consolidated invoice预付发票prepayment invoice租用发票hire invoice税务发票tax invoice自用发票self-billed invoice保兑发票delcredere invoice代理发票factored invoice租赁发票lease invoice寄售发票consignment invoice代理贷记单factored credit note银行转账指示instructions for bank transfer银行汇票申请书application for banker's draft托收支付通知书collection payment advice跟单信用证支付通知书documentary credit payment advice跟单信用证承兑通知书documentary credit acceptance advice跟单信用证议付通知书documentary credit negotiation advice银行担保申请书application for banker's guarantee银行担保banker's guarantee跟单信用证赔偿单documentary credit letter of indemnity信用证预先通知书pre-advice of a credit托收单collection order单证提交单document presentation form付款单payment order扩展付款单extended payment order多重付款单multiple payment order贷记通知书credit advice扩展贷记通知书extended credit advice借记通知书debit advice借记撤消reversal of debit贷记撤消reversal of credit跟单信用证申请书documentary credit application跟单信用证documentary credit跟单信用证通知书documentary credit notification跟单信用证转让通知documentary credit transfer advice跟单信用证更改通知书documentary credit amendment notification 跟单信用证更改单documentary credit amendment汇款通知remittance advice银行汇票banker's draft汇票bill of exchange本票promissory note账户财务报表financial statement of account账户报表报文statement of account message保险申报单(明细表) insurance declaration sheet (bordereau)保险人发票insurer's invoice承保单cover note货运说明forwarding instructions货运代理给进口代理的通知forwarder's advice to import agent货运代理给出口商的通知forwarder's advice to exporter货运代理发票forwarder's invoice货运代理收据证明forwarder's certificate of receipt托运单shipping note货运代理人仓库收据forwarder's warehouse receipt货物收据goods receipt港口费用单port charges document入库单warehouse warrant提货单delivery order装卸单handling order通行证gate pass运单waybill通用(多用)运输单证universal (multipurpose) transport document.承人货物收据goods receipt, carriage全程运单house waybill主提单master bill of lading提单bill of lading正本提单bill of lading original副本提单bill of lading copy空集装箱提单empty container bill油轮提单tanker bill of lading海运单sea waybill内河提单inland waterway bill of lading不可转让的海运单证(通用) non-negotiable maritime transport document (generic) 大副据mate's receipt全程提单house bill of lading无提单提货保函letter of indemnity for non-surrender of bill of Lading货运代理人提单forwarder's bill of lading铁路托运单(通用条款) rail consignment note (generic term)陆运单road list-SMGS押运正式确认escort official recognition分段计费单证recharging document公路托运单road consignment note主空运单master air waybill分空运单substitute air waybill出国人员物品申报crew's effects declaration乘客名单passenger list铁路运输交货通知delivery notice(rail transport)邮递包裹投递单dispatch note (post parcels)多式联运单证(通用) multimodal/combined transport document (generic) 直达提单through bill of lading货运代理人运输证书forwarder's certificate of transport联运单证(通用) combined transport document.nbsp(generic)多式联运单证(通用) multimodal transport document.nbsp(generic)多式联运提单combined transport bill of lading/multimodal bill of lading 订舱确认booking confirmation要求交货通知calling forward notice运费发票freight invoice货物到达通知arrival notice (goods)无法交货的通知notice of circumstances preventing delivery (goods)无法运货通知notice of circumstances preventing transport (goods)交货通知delivery notice (goods)载货清单cargo manifest载货运费清单freight manifest公路运输货物清单bordereau集装箱载货清单container manifest (unit packing list)铁路费用单charges note托收通知advice of collection船舶安全证书safety of ship certificate无线电台安全证书safety of radio certificate设备安全证书safety of equipment certificate油污民事责任书civil liability for oil certificate载重线证书loading document.免于除鼠证书derat document航海健康证书maritime declaration of health船舶登记证书certificate of registry船用物品申报单ship's stores declaration出口货物报关单goods declaration for exportation离港货物报关单cargo declaration(departure)货物监管证书申请表application for goods control certificate货物监管证书申请表goods control certificate植物检疫申请表application for phytosanitary certificate植物检疫证书phytosanitary certificate卫生检疫证书sanitary certificate动物检疫证书veterinary certificate商品检验申请表application for inspection certificate商品检验证书inspection certificate原产地证书申请表certificate of origin, application for地区名称证书regional appellation certificate优惠原产地证书preference certificate of origin普惠制原产地证书certificate of origin form GSP危险货物申报单dangerous goods declaration出口统计报表statistical document, export国际贸易统计申报单intrastate declaration交货核对证明delivery verification certificate进口许可证import license进口许可证申请表application for import license无商业细节的报关单customs declaration without commercial detail有商业细节和项目的报关单customs declaration with commercial and item detail 无项目细节的报关单customs declaration without item detail有关单证related documents海关收据customs receipt调汇申请application for exchange allocation调汇许可foreign exchange permit(进口)外汇管理申报(import) exchange control declaration进口货物报关单goods declaration for importation内销货物报关单goods declaration for home use海关即刻放行报关单customs delivery note(到港)货物报关单(arrival) cargo declaration货物价值申报清单value declaration(邮包)报关单(post parcels) customs declaration(增值税)申报单(value added tax) declaration(普通)税申报单(general) tax declaration催税单tax demand禁运货物许可证embargo permit海关转运货物报关单goods declaration for customs transitTIF国际铁路运输报关单TIF formTIR国际公路运输报关单TIR carnet欧共体海关转运报关单EC carnetEUR1欧共体原产地证书EUR 1 certificate of origin暂准进口海关文件ATA carnet欧共体统一单证single administrative documents(海关)一般回复(customs) general response(海关)公文回复(customs) document response(海关)误差回复(customs) error response(海关)一揽子回复(customs) package response(海关)计税/确认回复(customs) tax calculation/confirmation response配额预分配证书quota prior allocation certificate最终使用授权书end use authorization政府合同government contract进口统计报表import statistical documents跟单信用证开证申请书application for documentary credit先前海关文件/报文previous customs documents/message第三部分单证常用缩写A@ ——at每;以(价格)& ——and和AA ——Automatic Approval 自动许可证a. a.——after arrival 到达以后A.A.R.; aar ——against all risks 承保一切险abt.——about 大约A/C.——Account Current 往来帐户A/C.——Account 帐户, 帐Acc.——Acceptance 承兑; Accepted 接受; account 帐户; Accident 意外事故(保险用语) acpt.——acceptance 承兑ACN.——Air Consignment Note 空运托运单A/D.——after date 期后A.D.——anno domini (L.) 公元(后)ad; advt. ——advertisement 广告Adval. ——Advalorem(according to value)从价计算add.——Address 住址adv.——advice 通知A.F. ——Advanced freights 预付运费A.F.B. ——air freight bill 空运提单Ag. ——Agreement 同意;Agent 代理人A.l ——first-class 一等;一流amt. ——amount 金额;总数;共计anon. ——anonymous 不记名a/c; acc/o ——account of...某人账户a/or ——and/or 与/或A/P ——Authority to Purchase 委托购买证a.p, ——abitional premium 附加费A/P; a.p.——Additional Premium 附加保险费; 额外保险费A.P.L.; a.p.l.——as per list 按照表所列出的app.——appendix 附录approx. ——approximately; approximate 大约Apr. ——April 四月A.R. ——All Risks 一切险arr. ——arrival; arrived 抵达a.s——after sight 见票后a/s.——alongside 船边ass mt. ——assortment 各种类; 各色asst. ——assorted 分类; 花式搭配。

国际结算英文术语国际结算英文术语国际结算(International settlement) 贸易(Trade Settlement) 非贸易(Non-Trade Settlement) EDI (Electro nic Data In tercharge )电子数据交换,控制文件(Control Documents ) 有权签字人的印鉴(Specimen Sig natures ) 密押(Test Key) 费率表(Terms and Condition )货物单据化,履约证书化,(cargo documentation , guarantee certification)权利单据(document of title )流通转让性(Negotiability ) 让与(Assignment) 转让(Transfer ) 流通转让(Negotiation ) 汇票的定义是: A bill of exchange is an uncon diti onal order in writ ing, addressed by one person to another,signed by thepers on giv ing it, requiri ng the pers on to whom it is addressed to pay on dema nd or at a fixed or determ in able future time a sum certa in in money to the order or specified pers on or to bearer.“汇票” (bill of exchange , exchange 或draft) 无条件支付命令(unconditional order to pay) 出票条款(drawn clause )利息条款(with interest )分期付款(by stated instalment)支付等值其它货币(pay the other curre ncy according to an indicated rate of exchange) 付款人(payer) 受票人(drawee) 付款期限(time of payment )或(tenor) 即期(at sight, on dema nd, on prese ntati on )付款。

International Settlements termsChapter one Brief introduction to international trade transshipmen 转运capacity容量,生产量inspection检查,视察,检验,商检arbitration仲裁,公断inquiry质询,调查,询盘,问价quotation价格,报价单,行情表,报价facilitate便利,使容易1oan facility贷款便利domestic家庭的,国内的domestic product国内生产的产品consideration体谅,考虑,需要考虑的事项,报酬,因素dimension尺寸,尺度,维(数),体积warehouse 仓库v.存仓premises房屋及周围的土地,这里表示“公司或企业的所在地”amendment改善,改正,修改update使现代化,使跟上最新的发展reversal颠倒,逆转,反转,倒转fulfill履行,实现,完成(计划等)fulfill ones obligation履行(职责)formality拘谨,礼节,正式手续quay码头procure获得,取得to procure marine insurance 办理海上保险to procure ship租船breach n.违背,破坏,破裂breach of the contract毁约frontier国境,边疆,边境adjoin邻接,临近,毗邻adjoining邻接的,隔壁的,临近的the adjoining room隔壁的房子adjoining country邻国furnish供应,提供,deficiency缺乏,不足jurisdiction权限,司法权,裁判权fluctuation波动,起伏variation变更,变化,变异,变种permutation置换,彻底改变,兑变commitment委托事项,许诺,承担义务,承诺domicile住处,法定居住地currency/foreign exchange fluctuation汇率波动multi—modal transportation多式联运percentage of insurance投保比率force majeure不可抗力opposing party对方delivery arrangement交货安排sales contract销售合同respective obligation各自的责任International Chamber of Commerce国际商会(1920年在巴黎设立的重要工商组织,1946年成为联合国经社理事会的咨询机构,下设许多机构从事有关金融、贸易、税收、运输、商务仲裁、工业产权保护等专门研究。

国际结算英文专业术语词汇国际结算专业词汇AAcceptanceThe act of giving a written undertaking on the face of a usance bill of exchange to pay a stated sum on the maturity date indicated by the drawee of the bill, (usually in exchange for documents of title to goods shipped on D/A terms) - see Collections Introduction.Acceptance CreditA documentary credit which requires the beneficiary to draw a usance bill for subsequent acceptance by the issuing bank or the advising bank or any other bank as the credit stipulates - see Documentary Credits.Accommodation BillIn the context of fraud, a bill drawn without a genuine underlying commercial transaction. AccounteeAnother name for the applicant/opener of a documentary credit i.e. the importer = the person for whose account the transaction is made.Advice of FateThe Collecting Bank informs the Remitting Bank of non- payment/non-acceptance or (for D/A bills) of acceptance and the bill maturity date - see Handling Import Collections.AdvisingAct of conveying the terms and conditions of a DC to the beneficiary. The advising bank is the issuing bank agent, usually located in the beneficiary country - see Export - DC Advising.Advising also involves authentication i.e. advising bank should take reasonable care to check theAmendmentAlteration to the terms of a DC; amendments must stem from the applicant, be issued and advised to the beneficiary; the beneficiary has the right to refuse an amendment if the credit is irrevocable - see Amendments to DCs.ApplicantOne who applies to his bank to issue a documentary credit; in the majority of credits issued the applicant is an importer of goods.AvaliseThe act by a bank in guaranteeing payment of a bill of exchange or promissory note by endorsing the reverse with the words good per aval and signed by the bank, or by the issuance of a separate guarantee. BACK TO TOP--------------------------------------------------------------------------------BBack-to-Back CreditA credit issued against the security back of another credit (master credit) on the understanding that reimbursement will stem from documents eventually presented under the first credit (master credit) issued - see Special DCs. It follows therefore that each side of a B/B transaction covers the shipment of the same goods.BeneficiaryA payee or recipient, usually of money.A party in whose favour a documentary credit is established, usually the exporter.Bill for Collection (BC)Document(s) or cheque submitted through a bank for collection of payment from the drawee.Bill of Exchange (B/E)An unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at fixed or determinable future time a sum certain in money to or to the order of a specified person, or to bearer.Bill of Lading (B/L)A receipt for goods for shipment by sea. It is a Document of Title: see Documents.Bill Receivable (BR)Bills which are financed by the receiving branch, whether drawn under a DC or not, are treated as BRs by both the remitting branch and the receiving branches - see Bills Receivable.Blank EndorsedWhen a bill of lading is made out to order or shipper order and the shipper has signed on the back of it, it is said to be blank endorsed. The bill of lading then becomes a bearer instrument and the holder can present it to the shipping company to take delivery of the goods.BACK TO TOP--------------------------------------------------------------------------------CCarrierPerson or company undertaking for hire the conveyance of goods e.g. shipping companyCase of NeedAgent nominated by a principal, to whom the collecting bank may refer in specified circumstances concerning collections - see the sections on Collections.ChaserReminder sent by the collecting (or DC issuing) bank to the importer, repeating a request for payment - see Handling Import Collections.CleanUsed to describe a draft/cheque with no shipping documents - see Collections Introduction.Used to describe a bill of lading without clauses that expressly declare a defective condition of the goods or the packing.Clean Bill PurchasedA collection bill purchased with no shipping Purchase documents - see Financing Export Collections. Clean Bill Receivable (CBR)BR (Bill Receivable) with no shipping documents. The term is more often used for non-trade bills such as travellers cheques.Clean CollectionA draft with no documents Collection attached - see Collections ?Introduction?Clean Import Loan (CIL)A loan granted to an importer for payment of import bills, without the Bank having any claim to the goods.Collection BankBank in the drawee country that is instructed to collect payment from the drawee - see Collections Introduction.Collection OrderForm submitted, with documents, to the Remitting/Negotiating Bank by an exporter with his instructions - see Collections ?Introduction.ConfirmingAct of a bank other than the issuing bank assuming the liability for payment, acceptance or negotiation of correctly presented documents under a DC - see Confirmation of DCs.ConsigmentShipment of goods.ConsigneeThe person/company/bank to whom the goods are delivered - usually the importer or the Collecting Bank - see Handling Import Collections.ConsignorAlso called shipper, is the person/company who sends goods by ship, by land or air.Contingent LiabilityA liability that arises only under specified conditions, e.g. when a bank opens a DC it incurs an obligation to make a future payment on condition that the terms are fully met.BACK TO TOP--------------------------------------------------------------------------------DC BillsBills drawn under documentary credits.Deferred Payment Credit (DPC)A DC which allows the nomination of a bank, or the issuing bank to effect payment against stipulated documents at a maturity date as specified or determinable from the wording of the credit.DemurrageA charge made by a shipping company or a port authority for failure to load or remove goods within the time allowed.DiscountingAct of purchasing an accepted usance bill of exchange at an amount less than the face value. DiscrepancyAny deviation from the terms and conditions of a DC, or the documents presented thereunder, or any inconsistency between the documents themselves - see Negotiation under DCs.DishonourNon-payment or non-acceptance.Documentary Credit (DC)A conditional undertaking by a bank to make payment, often abbreviated to credit. More precisely, it is a written undertaking by a bank (issuing bank) given to the seller (beneficiary) at the request of the buyer (applicant) to pay a sum of money against presentation of documents complying with the terms of the credit within a set time limit.DocumentsThe characteristics and importance of the various documents associated with Import/Export operations are explained and illustrated in Deciding on Documents.Documents Against Acceptance (D/A)Instruction for commercial documents to be released to the drawee on acceptance of the Bill of Exchange - see Collections ?Introduction.Documents Against Payment (D/P)Instruction for documents to be released to the drawee only on payment - see Collections ?Introduction. Documents of TitleDocuments that give their owner the right to the goods, i.e. Bill of Lading.DraftBill of exchange issued by an exporter and submitted to his bank for collection, or under a DC - usually submitted with attached shipping documents - not to be confused with a bankers draft which is sometimes used as a vehicle for reimbursement.DraweeParty on whom a bill is drawn and the one to whom presentation is to be made according to the collection order - the importer (NB: for DC bills, the drawee is usually the DC issuing bank).DrawerThe exporter, who draws the Bill of Exchange/draft which in itself is a claim for payment.Due DateMaturity date for paymentBACK TO TOP--------------------------------------------------------------------------------EExpiry DateLatest date, usually in the country of the beneficiary, on which negotiation/payment of a DC can take place.BACK TO TOP--------------------------------------------------------------------------------FFinanced BillsBills sent on collection in which the remitting branch has a financial interest.Foreign Bill Purchased (FBP)A bill remitted to a correspondent bank in which the remitting branch is financing the exporter - see Financing Export Collections.Forward Exchange ContractContract between the Bank and its customer to buy/sell a fixed amount of foreign currency at a future date at a specified rate. This could be for a customer to make payment under a DC or to sell the proceeds received from an export negotiation.FreightGoods OR the cost of transporting goods.BACK TO TOP--------------------------------------------------------------------------------GGeneral AverageLoss which is the result of a sacrifice voluntarily made or an expense incurred; for the sole purpose of saving a ship and its cargo in face of a common danger (e.g. jettison of cargo to lighten a ship in distress). The loss is borne proportionately by ship and cargo owners according to their respective interests in the voyage.Gross WeightThe weight of the merchandise in its shipping form, i.e. including all its packaging.BACK TO TOP--------------------------------------------------------------------------------IICC 322Uniform Rules for CollectionsICC 323Standard Forms for Issuing Documentary CreditsICC 420Guide to the Prevention of International Trade Fraud.ICC 460Incoterms 1990. Explains the 13 standard Incoterms.ICC 500Uniform Customs and Practice for Documentary Credits (1993 revision) replaced the previous ICC 400 as from 1 January 1994.ICC 522Uniform Customs and Practice for Documentary Credits (1995 revision) replaced the previous ICC 322 as from 1 January 1996.Import LicenseA permit issued by the importing country'S authorities in respect of goods subject to import licensing restrictions.IncotermsShipping Terms - see Introduction to International Trade.IndemnityAlso known as Letter of Guarantee (L/G), it is an undertaking given in respect of discrepancies in documents presented under a credit. The beneficiary who issues the indemnity is primarily liable to repay funds received from the negotiating bank in settlement under the credit, if the negotiating bank cannot obtain reimbursement from the issuing bank as a result of documents being rejected by the applicant.Inherent ViceThe propensity of a commodity to self-destruction which gives rise to a high insurance risk, therefore cover is given only after payment of an additional premium (e.g. fruit rots, coal-dust spontaneously ignites).International Chamber of Commerce (ICC)The international body which promotes and facilitates world trade, and which codifies world trade practices in various publications - see ICC Rules?under Introduction to International Trade. Irrevocable CreditConstitutes a definite undertaking of the issuing bank and the confirming bank, if any, to honour the credit provided the terms of the credit are observed. It may be advised to the beneficiary without engagement by the advising bank, and cannot be amended or cancelled unless the issuing bank, the confirming bank and the beneficiary agree.Issuing BankThe bank that opens a documentary credit at the request of its customer, the applicant.BACK TO TOP--------------------------------------------------------------------------------LLetter of Credit (L/C)American term for documentary credit. In the United States, the terms D/C can often be confused for documentary collection.Letter of HypothecationA promise to hold goods as security taken from customers who are granted loans against goods imported on a collection basis.Loan Against Imports (LAI)Loans granted to import customers for payment of bills.BACK TO TOP--------------------------------------------------------------------------------MMaster CreditIn back-to-back operations, the original export credit against which the second credit is opened MaturityDue date of payment of a usance bill or promissory note.BACK TO TOP--------------------------------------------------------------------------------NNegotiable/Non-NegotiableUsually used with regard to Bills of Lading: a negotiable B/L is a valid document of title, while a non-negotiable B/L is not - the beneficiary of a DC (the exporter) may send the importer a non-negotiableB/L for information.NegotiationPurchase of drafts under a documentary credit which the issuing bank has undertaken to pay.Net WeightThe weight of the merchandise before any packaging.Non-DC BillsBills not drawn under DC i.e. sent on a collection basis (D/P or D/A). In common usage we distinguish between Non DC bills which are financed collections and DCs which are non-financed.Non-Financed BillsBills sent on collection in which the remitting branch has no financial interest.NotingThe first stage in protest of a dishonoured bill: if instructed to protest for non-payment/non- acceptance, the collecting bank must send the bill to a notary public who will represent it to the drawee on the same day it was refused, or the next business day. If the drawee still refuses the bill the notary public notes on the bill: the amount of his charges, the date and his initials. The reason for refusal is shown on a note attached to the bill. The bill is then protested - see Protest.BACK TO TOP--------------------------------------------------------------------------------OOpenerSee Applicant.Opening BankThe phrase To Order is sometimes shown on Bills of Lading against consignee: this means that the Bill of Lading must be endorsed in blank by the shipper (i.e. not to any particular named party which makes it bearer document and it becomes transferable by delivery.)BACK TO TOP--------------------------------------------------------------------------------PPacking CreditA loan given to the beneficiary by the bank to enable him to purchase raw materials. The beneficiary is usually requested to deposit the DC with the bank as security.Past DueBill or loan that has not been paid on the maturity date/due date.Paying BankThe bank that makes payment to the beneficiary of a payment DC after presentation to it of documents stipulated in the DC.Perils of the SeasThey are accidents or casualties of the sea. The ordinary actions of the winds and waves are not included. Heavy or tempestuous weather on a voyage is of sufficient violence to constitute a peril of the sea. Power of AttorneyAct of requesting the importer抯 payment/acceptance of an import bill. - See Handling Import Collections.Presenting BankThe bank that requests payment of a collection bill - may be the Collecting Bank or its nominated branch or local correspondent, which is better placed to contact the importer.PrincipalThe exporter in collection transactions, being the initiator of the transaction, whose instructions are followed at all stages (may be used to refer to any customer who initiates a transaction e.g. the opener of a DC).Promissory NoteA signed statement containing a written promise to pay a stated sum to specified person at a specified date or on demand.ProtestThe formal representation of a dishonoured bill of exchange: the bill is presented by a notary public to the drawee - if refused again, it is noted?- see noting. The notary public then issues a formal protest, an official certificate that the bill has been refused: the drawer can use this certificate to sue the drawee in court.BACK TO TOP--------------------------------------------------------------------------------RRecourseThe right to claim a refund from another party which has handled a bill at an earlier stage.Red Clause CreditA credit with a clause which authorises the advising bank to make an advance payment to the beneficiary - see special DCs.Reimbursing BankThe bank nominated by the DC issuing bank that will pay the value of the DC to the negotiating/paying bank.Remitting BankThe exporter's bank in collection transactions, which remits the bill to the collecting bank.The exporter's bank in DC transactions, which dispatches the documents to the issuing bank. RetirementThe act of paying or settling an outstanding bill or import loan; i.e. payment by the importer to the Bank. Revocable CreditOne that may be amended or cancelled without notice to the beneficiary.Revolving CreditA credit automatically reinstated after each drawing or upon receipt of authorisation from DC issuing bank, with limits as to the duration of the facility and as to the (cumulative or non-cumulative) amount involved for each drawing - see Special DCs.BACK TO TOP--------------------------------------------------------------------------------SScheduleThe Remitting/Negotiating Bank's letter covering a bill sent to the Collecting/Issuing Bank, which lists the documents attached and gives collection and/or payment instructions.Self-LiquidatingA transaction is said to be self-liquidating when there is a known source of funds available for its settlement on due date.Shipment DateThe date inserted on the bills of lading evidencing goods received on board is regarded for documentary credit purposes as being the date of shipment.ShipperSee consignorShipping Guarantee (SG)Guarantees of this nature are required to enable customers to obtain goods before the arrival of the documents of title, and are issued to the shipping companies by the Bank against an undertaking to forward the bills of lading when they are received. The Bank normally take 100% cash margin against the value of the goods if the customer does not have T/R facility.Shipping TermsSee IncotermsSightA bill payable at sight is payable on presentation to the drawee i.e. on demand.SnagsIrregular bills; import and export.Standby CreditThis may be established as security for facilities granted at another branch or bank, usually to a subsidiary of the DC applicant. - see Special DCs.Status ReportProduced by a bank's TCI department or a credit information bureau, giving details of the creditworthiness and business background of traders and manufacturers.SubstitutionThe act whereby the prime beneficiary substitutes his own documents i.e. invoices and drafts, in back-to-back and transferable credit operations prior to negotiation of the master credits.BACK TO TOP--------------------------------------------------------------------------------TTenorTerm or Period of credit granted by the drawer. See Usance Bill.TracerSee Chaser.Trade and Credit Information (TCI)A bank department that prepares and distributes status reports on its own customers, and maintains records of traders and manufacturers with whom its customers deal.Transferable CreditPermits the beneficiary to transfer all or some of the rights and obligations under the credit to a second beneficiary or beneficiaries - see Special DCs.TransfereeA party (2nd beneficiary) to whom a transferable credit is transferred in whole or in part.TransferorA party (1st beneficiary) at whose request a transferable credit is transferred to a second beneficiary in whole or in part.BACK TO TOP--------------------------------------------------------------------------------UUniform Customs and Practice for DCsSee ICC 500Uniform Rules for CollectionsSee ICC 522Usance BillA Bill of Exchange which allows the drawee a term or period of credit (this period is also called usance).精品好文档,推荐学习交流The term is usually stated in days (e.g. 30 days) or months and starts either from the date of the bill (e.g.30 days date) or from the date of bill of lading, or from sight by the drawee (e.g. 30 days sight) which in practice means from the date of acceptance.An essential feature of acceptance credits and D/A collections.BACK TO TOP--------------------------------------------------------------------------------WWaiveTo relinquish a right: used in collections with BC charges and/or interest to be collected from the drawee: these can be waived in certain circumstances as set out in ICC 522.BACK TO TOP仅供学习与交流,如有侵权请联系网站删除谢谢19。