最新国际结算期末复习笔记-名词解释

- 格式:docx

- 大小:22.40 KB

- 文档页数:4

国际结算知识点整理一、国际结算概述。

1. 定义。

- 国际结算是指国际间由于政治、经济、文化、外交、军事等方面的交往或联系而发生的以货币表示的债权债务的清偿行为或资金转移行为。

2. 国际结算的产生与发展。

- 从早期的现金结算发展到非现金结算(票据结算等)。

- 随着国际贸易的发展,国际结算的规则和方式不断完善。

例如,从简单的商业信用结算方式(如汇款、托收)发展到银行信用介入的结算方式(如信用证)。

二、国际结算中的票据。

1. 票据的概念与特性。

- 概念:票据是出票人签发的,约定自己或委托付款人在见票时或指定日期向收款人或持票人无条件支付一定金额的有价证券。

- 特性:- 流通性:票据可以通过背书或交付而转让,受让人取得票据权利。

- 无因性:票据行为不因票据的基础关系无效或有瑕疵而受影响。

- 要式性:票据的制作、形式、文义都有法定的要求,必须符合规定。

- 文义性:票据上的权利义务关系完全依据票据上的文字记载为准。

2. 汇票(Bill of Exchange)- 定义:汇票是由出票人签发,委托付款人在见票时或者在指定日期无条件支付确定的金额给收款人或者持票人的票据。

- 汇票的内容:包括表明“汇票”的字样、无条件支付的委托、确定的金额、付款人名称、收款人名称、出票日期、出票人签章等必要记载事项。

- 汇票的种类:- 按出票人不同分为银行汇票和商业汇票。

银行汇票是银行签发的,商业汇票是企业或个人签发的。

- 按付款时间不同分为即期汇票和远期汇票。

即期汇票是见票即付的汇票,远期汇票是在指定的未来日期付款的汇票。

- 按有无附属单据分为光票和跟单汇票。

光票不附带货运单据,跟单汇票附带货运单据。

3. 本票(Promissory Note)- 定义:本票是出票人签发的,承诺自己在见票时无条件支付确定的金额给收款人或者持票人的票据。

- 本票与汇票的区别:- 出票人不同:本票的出票人是付款人本身,而汇票的出票人和付款人是不同主体。

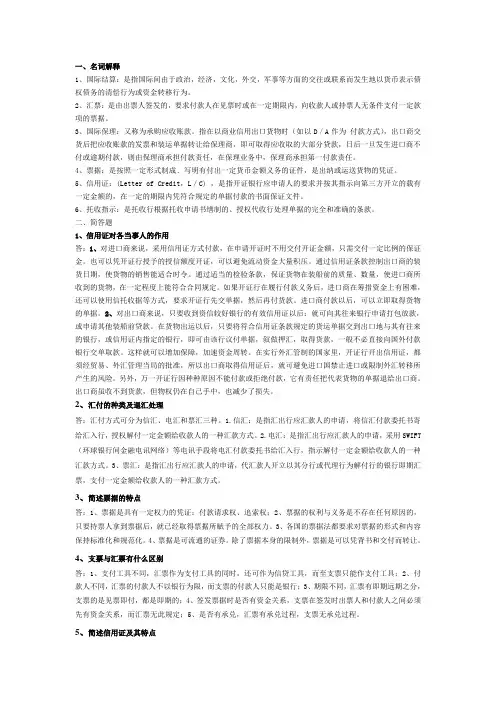

一、名词解释国际结算:是指国际间由于政治、经济、文化、外交、军事等方面的交往或联系而发生的以货币表示的债权债务的清偿行为或资金转移行为。

国际贸易结算:以票据为基础,单据为条件,银行为中枢,结算与融资相结合的非现金结算体系。

票据:是指由出票人签发的,具有一定格式,约定债务人按期无条件支付一定金额,并经过背书可转让的书面支付凭证。

(有价证券之父)汇票:是出票人签发的,委托付款人在见票时或者在指定日期无条件支付确定的金额给收款人或者持票人的票据。

本票:出票人签发的,承诺自己在见票时无条件支付确定金额给收款人或者持票人的票据。

支票:银行存款户根据协议向银行签发的即期无条件支付命令。

背书:是指持票人在票据背面签名,并交付给受让人的行为。

顺汇:系统结算工具的流向与货款的流向是同一个方向,是由债务人主动将款项交给本国银行,委托该银行通过某种结算工具的使用将汇款汇付给国外债权人或收款人。

逆汇:系统结算工具的流向与货款的流向是反方向。

是由债权人通过出具票据委托本国银行向国外债务人收取汇票金额的结算方式。

电汇(T/T):是汇出行应汇款人的申请,代其开立以汇入行为付款人的银行即期汇票,并交换汇款人,由汇款人自寄或者自带给国外收款人,由收款人到汇入行凭票取款的汇款方式。

信汇(M/T):是汇出行应汇款人的申请,用航空信函指示汇入行解付一定金额给收款人的汇款方式。

票汇(D/D):是汇出行应汇款人的申请,代其开立以汇入行为付款人的银行即期汇票,并交换汇款人,由汇款人自寄或者自带给国外收款人,由收款人到汇入行凭票取款的汇款方式。

托收:是银行根据委托人的指示处理金融单据或商业单据,目的是取得承兑或付款,并在承兑或付款后交付单据的行为。

包括光票托收和跟单托收两种基本形式。

光票托收:指不附带任何货运单据的票据的托收。

其货运单据由卖方直接寄交卖方,汇票则委托银行托收。

常见的有银行汇票、本票、支票、旅行支票和商业汇票等。

跟单托收:是随货运单据的托收,是出口商在装运货物后,将汇票(也可以不要汇票)连同货运单据交给银行,委托银行代为收款的一种结算方式。

1.国际结算:处于不同国家或不同货币区的自然人、法人或政府机关,由于经济、文化和政治的交流,产生的以货币表现的债权债务,以及通过银行办理货币收付以清算这种债权债务的业务活动。

2.国际惯例:在长期的国际交往实践中约定俗成的,是国际社会公认的国际交往行为的惯常模式、规则和原则等,对当事人之间的关系、权利和义务有明确的规范。

3.代理行:两家不同国籍的银行通过相互委托办理业务而建立往来关系。

4.票据:金融票据,即依据票据法签发和流通的、以无条件支付一定金额为目的的有价证券。

5.汇票:出票人签发的,委托付款人在见票时或者在指定日期无条件支付确定的金额给收款人或持票人的票据。

6.本票:出票人签发的,承诺自己在见票时无条件支付确定的金额给收款人或者持票人的票据。

7.支票:出票人签发的,委托办理支票存款业务的银行或者其他金融机构在见票时无条件支付确定的金额给收款人或者持票人的票据。

8.汇款:银行(汇出行)应汇款人(债务人)的要求,通过其国外联行或代理行作为付款银行(汇入行),使用合适的工具,将款项交给收款人(债权人)的一种结算方式。

9.偿付(拨头寸):汇出行办理汇出汇款业务时,应及时将汇款金额拨付给解付汇款的汇入行,这个过程叫做汇款的偿付。

10.托收:银行根据所收到的指示,处理金融单据或商业单据以便取得付款和/或承兑,或凭付款和/或承兑交出商业单据,或凭其他条款或条件交出单据。

11.信用证:一项不可撤销的安排,无论其名称或描述如何,该项安排构成开证行对相符交单予以承付的确定承诺。

12.售定:买卖双方已签订正式的销售合同,货价与支付时间也已确定,进口商收到货款后一定时期将货款汇给出口商。

13.寄售:出口商在出运货物时,还没有明确的买家,只是委托国外经销商代理销售。

14.电汇:汇款人委托银行以电报、电传或SWIFT的方式指示收款人所在地某一银行作为汇入行,解付一定金额给收款人的汇款方式。

1.国际结算的功能:清偿债权债务;方式:运用某种支付手段和支付方式办理;目的:实现货币资金的跨国转移。

国际结算1国际结算:正确答案:是指为清偿国际债权债务关系或跨国转移资金而发生在不同国家之间的货币收付活动。

2国际结算规则:正确答案:是指由国际性的商务组织或团体负责协调、统一各有关贸易方的立场, 就国际商务结算中的相关问题、程序和方式, 所达成的为各方认可、接受和将在国际结算业务中得到遵循的国际性的商务结算规定、规范、惯例和原则。

3正当持票人:正确答案:也称善意持票人,是指善意地付过全部金额的对价,取得一张表面完整、合格、不过期的票据的持票人,并且未发现这张票据曾被拒付,也未曾发现其前手在权利方面有任何缺陷。

4国际汇兑:正确答案:是指通过银行把一个国家的货币兑换为另一个国家的货币,并借助于各种信用工具(如汇票等),将货币资金转移到另一个国家,以清偿国际间由于贸易或非贸易往来所产生的债权或债务关系的专门性经营活动。

5电汇汇款:正确答案:是汇款人委托银行以电报、电传、环球同业银行金融电讯协会方式,指示出口地某一银行(其分行或代理行)作为汇入行,解付一定金额给收款人的汇款方式。

6票汇:正确答案:是汇出行应汇款人申请,代汇款人开立以其分行或代理行为解付行的银行即期汇票,支付一定金额给收款人的另一种汇款方式。

7本票:正确答案:是一项书面的、无条件的支付承诺,由一人做成,并交给另一人,经制票人签名承诺即期或定期或在可以确定的将来时间,支付一定数目的金钱给一个特定的人或其指定人或来人。

8托收:正确答案:是指出口商(或债权人)根据买卖合同先行发货,然后开立金融单据或商业单据或两者兼有,委托出口托收行通过其海外联行或代理行(进口代收行),向进口商(或债务人)收取货款或劳务费用的结算方式。

9代收行正确答案:(Collecting Bank) 是接受托收行的委托, 参与办理托收业务的一家银行, 它还是进口方银行( Importer’s Bank)、托收汇票的被背书人或收款人( Endorsee or Payee of the Collection Bill )。

国际结算名词解释汇总不同国家的当事人〔不管是个人间的、单位间的、企业间的的、或政府间的〕因为商品买卖、效劳供给、资金调拨、国际借贷,需要通过银行办理的两国间货币收付业务叫做国际结算。

或国与国之间发生的货币收付〔即结清国家之间买卖双方间以货币表现的债权债务〕就是国际结算。

票据:广义票据指代表商业权利的凭证,如发票、提单、保险单、仓单等。

该凭证的权利是可以转让,票据具有流通、转让的特性,故票据又是流通证券。

狭义票据是指以支付金钱为目的的证券。

由出票人在票据上签名,无条件地约定自己或指定他人支付一定金额,可以流通转让。

约定出票人本人付款,那么是本票,由另一人付款,那么是汇票或支票。

国际结算中的票据指的就是狭义票据既:汇票、本票和支票。

汇票:是一人开至另一人的书面的无条件命令,由发出命令的人签名,要求承受命令的人立即或在固定的时间,或在可以确定的将来时间,把一定金额货币支付给一个特定的人或他的指定人,或来人。

款人或被背书人时,要把票据权利转让给他人,必须在票据反面签字并经交付,那么汇票权利即由背书人转移至被背书人。

只有持票人,即收款人或被背书人才能有权背书汇票。

背书包括两个动作,一个是在汇票反面签字,另一个是交付给被背书人,只有经过交付,才算完成背书行为,使其背书有效和不可撤消。

票据行为:有狭义与广义之分,狭义票据行为是以负担票据上的债务为目的所做的必要形式的法律行为,那就是出票、背书、承兑、参加承兑、保证。

其中出票是主票据行为,其他行为都以“出票〞所开立的票据为根底,因此称为附属票据行为。

广义的票据行为除了上述狭义的票据行为以外,还要包括处理票据中有专门规定的行为,如提示、付款、参加付款、退票、行使追索权等行为。

票据开出是要式的,票据行为也是要式的,因此要符合票据法的规定。

承兑:远期汇票的付款人签名表示同意按照出票人命令而付款的票据行为。

提示:持票人将汇票提交付款人要求承兑或要求付款的行为叫做提示贴现:是指远期汇票承兑后尚未到期,由银行或贴现公司从票面金额中扣减按照一定贴现率计算的贴现息后,将净款付给持票人,从而贴进票据的行为。

1.国际结算:国际结算是在国际间办理货币的收付以清偿位于不同国家的两个当事人之间由于经济、政治、文化交流等引起的债权债务关系的行为。

2.票据:广义上的票据是商业上的权利凭证;狭义的票据是出票人签发的,承诺自己或委托他人在见票时或指定日期向收款人或持票人无条件支付一定金额,可以流通转让的一种有价证券。

3.汇票:汇票是由出票人向另一人签发的,要求即期、定期或在可以确定的将来的时间,向某人或其指定人或来人无条件地支付一定金额的书面命令。

4.本票:是一人向另一人签发的,承诺即期或在可以确定的将来时间无条件支付确定金额给收款人或者持票人的票据。

5.支票:是一人向另一人签发的,委托办理支票存款业务的银行或者其他金融机构在见票时无条件支付确定的金额给收款人或者持票人的票据。

6.商业发票:简称发票,它是卖方开立的凭以向买方索取货款的价目清单,是装运货物的总说明。

7.海运提单:简称提单,指出口商作为托运人,把出口货物交给作为承运人的轮船公司,由后者运抵目的港,再由承运人把货物交给作为收货人的进口方这样一种运输过程所开出的单据。

8.清洁提单:凡属包装状况良好无瑕疵、没有加上包装不良批注的提单称为清洁提单。

9.保险单:是保险人在收取保险费后,向被保险人签发的对其承保的书面证明。

10.信汇:是汇出行应汇款人的申请,用信函的方式指示汇入行解付一定金额给收款人的一种汇款方式。

11.电汇:是汇出行应汇款人的申请,通过拍发加押电报或电传指示汇入行解付一定金额给收款人的汇款方式。

12.票汇:是汇出行应汇款人的申请,代汇款人开立以其分行或代理行为解付行的银行即期汇票,并将票据交给汇款人,由汇款人自行寄送或自己携带出国交给收款人,收款人持票取款的一种汇款方式。

13.托收:是指委托人开立汇票并附带货运单据委托银行向付款人收款的方式。

14.跟单托收:跟单托收是指金融单据附有商业单据或不附有金融单据的商业单据的托收。

15.光票托收:光票托收是指金融单据不附带商业单据的托收。

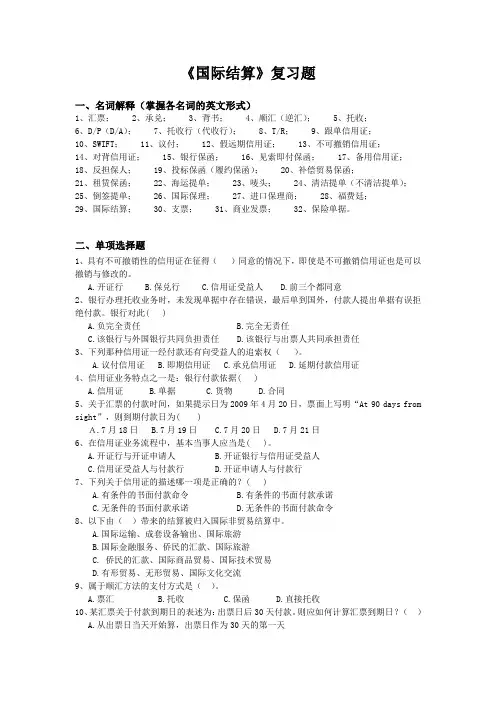

《国际结算》复习题一、名词解释(掌握各名词的英文形式)1、汇票;2、承兑;3、背书;4、顺汇(逆汇);5、托收;6、D/P(D/A);7、托收行(代收行);8、T/R;9、跟单信用证;10、SWIFT; 11、议付; 12、假远期信用证; 13、不可撤销信用证;14、对背信用证; 15、银行保函; 16、见索即付保函; 17、备用信用证;18、反担保人; 19、投标保函(履约保函); 20、补偿贸易保函;21、租赁保函; 22、海运提单; 23、唛头; 24、清洁提单(不清洁提单);25、倒签提单; 26、国际保理; 27、进口保理商; 28、福费廷;29、国际结算; 30、支票; 31、商业发票; 32、保险单据。

二、单项选择题1、具有不可撤销性的信用证在征得()同意的情况下,即使是不可撤销信用证也是可以撤销与修改的。

A.开证行B.保兑行C.信用证受益人D.前三个都同意2、银行办理托收业务时,未发现单据中存在错误,最后单到国外,付款人提出单据有误拒绝付款。

银行对此( )A.负完全责任B.完全无责任C.该银行与外国银行共同负担责任D.该银行与出票人共同承担责任3、下列那种信用证一经付款还有向受益人的追索权()。

A.议付信用证B.即期信用证C.承兑信用证D.延期付款信用证4、信用证业务特点之一是:银行付款依据( )A.信用证B.单据C.货物D.合同5、关于汇票的付款时间,如果提示日为2009年4月20日,票面上写明“At 90 days from sight”,则到期付款日为( )A.7月18日 B.7月19日 C.7月20日 D.7月21日6、在信用证业务流程中,基本当事人应当是( )。

A.开证行与开证申请人B.开证银行与信用证受益人C.信用证受益人与付款行D.开证申请人与付款行7、下列关于信用证的描述哪一项是正确的?( )A.有条件的书面付款命令B.有条件的书面付款承诺C.无条件的书面付款承诺D.无条件的书面付款命令8、以下由()带来的结算被归入国际非贸易结算中。

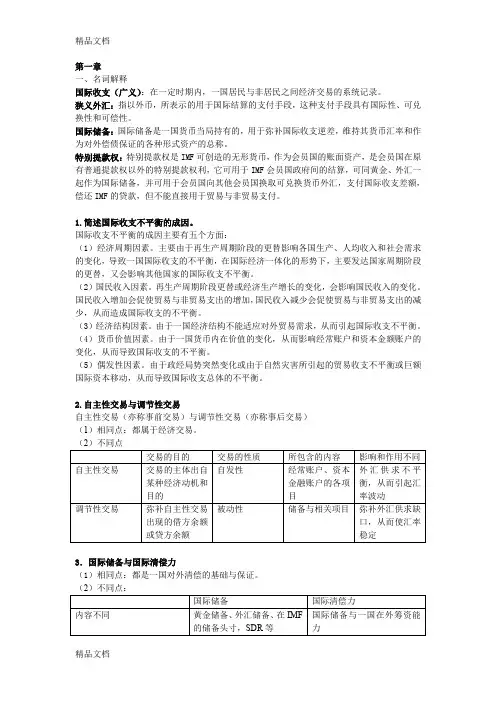

第一章一、名词解释国际收支(广义):在一定时期内,一国居民与非居民之间经济交易的系统记录。

狭义外汇:指以外币,所表示的用于国际结算的支付手段,这种支付手段具有国际性、可兑换性和可偿性。

国际储备:国际储备是一国货币当局持有的,用于弥补国际收支逆差,维持其货币汇率和作为对外偿债保证的各种形式资产的总称。

特别提款权:特别提款权是IMF可创造的无形货币,作为会员国的账面资产,是会员国在原有普通提款权以外的特别提款权利,它可用于IMF会员国政府间的结算,可同黄金、外汇一起作为国际储备,并可用于会员国向其他会员国换取可兑换货币外汇,支付国际收支差额,偿还IMF的贷款,但不能直接用于贸易与非贸易支付。

1.简述国际收支不平衡的成因。

国际收支不平衡的成因主要有五个方面:(1)经济周期因素。

主要由于再生产周期阶段的更替影响各国生产、人均收入和社会需求的变化,导致一国国际收支的不平衡,在国际经济一体化的形势下,主要发达国家周期阶段的更替,又会影响其他国家的国际收支不平衡。

(2)国民收入因素。

再生产周期阶段更替或经济生产增长的变化,会影响国民收入的变化。

国民收入增加会促使贸易与非贸易支出的增加,国民收入减少会促使贸易与非贸易支出的减少,从而造成国际收支的不平衡。

(3)经济结构因素。

由于一国经济结构不能适应对外贸易需求,从而引起国际收支不平衡。

(4)货币价值因素。

由于一国货币内在价值的变化,从而影响经常账户和资本金额账户的变化,从而导致国际收支的不平衡。

(5)偶发性因素。

由于政经局势突然变化或由于自然灾害所引起的贸易收支不平衡或巨额国际资本移动,从而导致国际收支总体的不平衡。

2.自主性交易与调节性交易自主性交易(亦称事前交易)与调节性交易(亦称事后交易)(1)相同点:都属于经济交易。

3.国际储备与国际清偿力(1)相同点:都是一国对外清偿的基础与保证。

(2)不同点:4.论国际收支不平衡对一国经济的影响国际收支不平衡包括国际收支逆差和国际收支顺差两种情况。

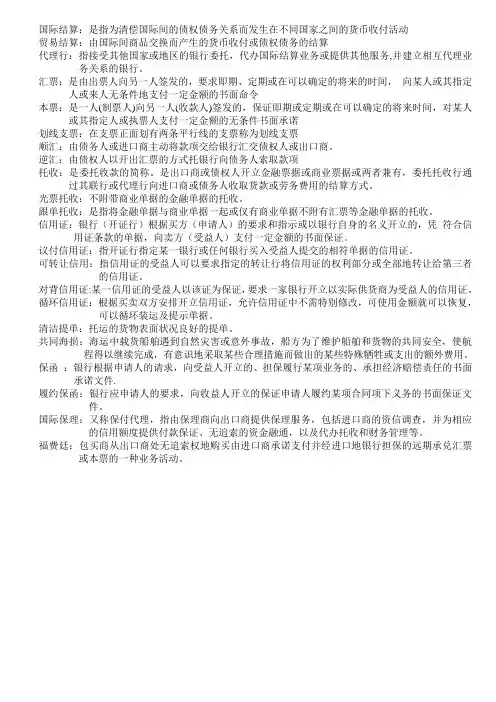

一、名词解释1、国际结算:是指国际间由于政治,经济,文化,外交,军事等方面的交往或联系而发生地以货币表示债权债务的清偿行为或资金转移行为。

2、汇票:是由出票人签发的,要求付款人在见票时或在一定期限内,向收款人或持票人无条件支付一定款项的票据。

3、国际保理:又称为承购应收账款。

指在以商业信用出口货物时(如以D/A作为付款方式),出口商交货后把应收账款的发票和装运单据转让给保理商,即可取得应收取的大部分贷款,日后一旦发生进口商不付或逾期付款,则由保理商承担付款责任,在保理业务中,保理商承担第一付款责任。

4、票据:是按照一定形式制成﹑写明有付出一定货币金额义务的证件,是出纳或运送货物的凭证。

5、信用证:(Letter of Credit,L/C) ,是指开证银行应申请人的要求并按其指示向第三方开立的载有一定金额的,在一定的期限内凭符合规定的单据付款的书面保证文件。

6、托收指示:是托收行根据托收申请书缮制的、授权代收行处理单据的完全和准确的条款。

二、简答题1、信用证对各当事人的作用答:1、对进口商来说,采用信用证方式付款,在申请开证时不用交付开证金额,只需交付一定比例的保证金。

也可以凭开证行授予的授信额度开证,可以避免流动资金大量积压。

通过信用证条款控制出口商的装货日期,使货物的销售能适合时令。

通过适当的检验条款,保证货物在装船前的质量、数量,使进口商所收到的货物,在一定程度上能符合合同规定。

如果开证行在履行付款义务后,进口商在筹措资金上有困难,还可以使用信托收据等方式,要求开证行先交单据,然后再付货款。

进口商付款以后,可以立即取得货物的单据。

2、对出口商来说,只要收到资信较好银行的有效信用证以后:就可向其往来银行申请打包放款,或申请其他装船前贷款。

在货物出运以后,只要将符合信用证条款规定的货运单据交到出口地与其有往来的银行,或信用证内指定的银行,即可由该行议付单据,叙做押汇,取得货款,一般不必直接向国外付款银行交单取款。

国际结算:是指为清偿国际间的债权债务关系而发生在不同国家之间的货币收付活动贸易结算:由国际间商品交换而产生的货币收付或债权债务的结算代理行:指接受其他国家或地区的银行委托,代办国际结算业务或提供其他服务,并建立相互代理业务关系的银行。

汇票:是由出票人向另一人签发的,要求即期、定期或在可以确定的将来的时间,向某人或其指定人或来人无条件地支付一定金额的书面命令本票:是一人(制票人)向另一人(收款人)签发的,保证即期或定期或在可以确定的将来时间,对某人或其指定人或执票人支付一定金额的无条件书面承诺划线支票:在支票正面划有两条平行线的支票称为划线支票顺汇:由债务人或进口商主动将款项交给银行汇交债权人或出口商。

逆汇:由债权人以开出汇票的方式托银行向债务人索取款项托收:是委托收款的简称。

是出口商或债权人开立金融票据或商业票据或两者兼有,委托托收行通过其联行或代理行向进口商或债务人收取货款或劳务费用的结算方式。

光票托收:不附带商业单据的金融单据的托收。

跟单托收:是指将金融单据与商业单据一起或仅有商业单据不附有汇票等金融单据的托收。

信用证:银行(开证行)根据买方(申请人)的要求和指示或以银行自身的名义开立的,凭符合信用证条款的单据,向卖方(受益人)支付一定金额的书面保证。

议付信用证:指开证行指定某一银行或任何银行买入受益人提交的相符单据的信用证。

可转让信用:指信用证的受益人可以要求指定的转让行将信用证的权利部分或全部地转让给第三者的信用证。

对背信用证:某一信用证的受益人以该证为保证,要求一家银行开立以实际供货商为受益人的信用证。

循环信用证:根据买卖双方安排开立信用证,允许信用证中不需特别修改,可使用金额就可以恢复,可以循环装运及提示单据。

清洁提单:托运的货物表面状况良好的提单。

共同海损:海运中载货船舶遇到自然灾害或意外事故,船方为了维护船舶和货物的共同安全,使航程得以继续完成,有意识地采取某些合理措施而做出的某些特殊牺牲或支出的额外费用。

国际结算复习题一、名词解释1、票据清算所(Clearing House)或清算网络是指由许多银行参加的、彼此进行资金清算的场所。

银行间的债权债务的清算通过票据清算所自动清算完成。

承兑 (Acceptance):是指远期汇票的付款人在汇票上签名,同意按出票人指示到期付款的行为。

银团银行(consortium bank):有两个以上的不同国籍的跨国银行共同投资注册而组成的公司性质的合营银行。

空白背书(Blank Endorsement)是指仅在票据背面签名,不记载被背书人的名称,而只有背书人的签字。

被背书人可继续转让。

联行(sister bank):是指银行根据业务发展的需要,在国内(Domestic Sister Bank)、国外(Oversea Sister Bank)设置的分支机构。

贴现(discount):是指持票人承兑远期汇票转让给银行或贴现公司,后者从票面金额中扣减按照一定贴现率计算的贴现息后,将余款付给持票人的行为。

贴现的实质是票据买卖业务、资金融通业务记名背书:又称特别背书(special Endorsement),完全背书,特点是:背书内容完整、全面。

记载支付给被背书人的名称,并经背书人签名。

记名背书的票据,可以继续背书转让。

支付系统(Payment System):是由提供支付清算服务的中介机构和实现支付指令传送及资金清算的专业技术手段共同组成,用以实现债权债务清偿及资金转移的一种金融安排,有时亦称清算系统(Clearing System)参加付款(Payment for Sb’s Honour):是指当持票人遭到拒付,已做成拒付证书但尚未行使追索权时,付款人以外的当事人(参加付款人)对票据进行付款的行为。

代理银行(Correspondent Banks):两家不同国籍的银行,互相委托,代办国际结算业务或提供其他服务,并建立相互代理业务关系的银行。

2、逆汇(Reverse Remittance)又称出票法。

国际结算的名词解释。

1.国际结算:对国际间由于政治经济文化等一切活动所引起的债权加以了结的一种方式。

2.汇票:是一个人向另一个人签发的,要求即期或定期或在可确定的将来时间对某人或某指定人或持票人支付一定金额的无条件书面支付命令。

3.本票:是一个人向另一个人签发的,保证即期或定期或在可确定的将来时间对某人或某指定人或执票人来支付一定金额无条件的书面承诺。

4.银行保函:指银行及其他金融机构应申请人或委托人的要求向受益人开出的书面付款保证承诺。

5.背书:汇票的持有者在汇票背面注明转让的签名并交给被背书人的行为。

6..海运提单:海运提单是海运时使用的运输工具,由承运人或其代理人根据运输合同签发给托运人的,表明接受特定的货物或货已装上船并将经海洋运至目的地交给收货人的收据和物权凭证。

.7. 多式联运单据:是在货物的运输过程中使用一种以上的运输工具,由联运经营人签发的证明多式联运合同以及证明联运经营人接管货物并按合同条款妥善交付的单据。

.8.贴现:指银行或贴现公司买进未到期票据,从票面金额中扣取贴现日至到期日的利息后,将余额付给持票人的一种业务。

9.保险单据:保险公司对被保险人的承担证明,也是双方权利和义务的契约。

10.联行:同一银行系统异地各行处之间彼此互称联行。

代理行;指与其他国家建立往来账户代理对方的一些业务为对方提供服务。

.。

名词解释1、国际结算:是对国际债权债务进行了结和清算的一种经济行为。

P12、票据:(狭义)指以支付金钱为目的的债权有价证券,是指由出票人签发的,无条件约定由自己或委托他人在一定日期支付确定金额的流通证券。

(广义)指一切有价证券和各种凭证。

P273、汇票:指出票人签发的,委托付款人在见票时或者在指定日期无条件支付确定金额给收款人或持票人的票据。

P434、本票:出票人签发的,承诺自己在见票时无条件支付确定的金额给收款人或持票人的票据。

P635、支票:出票人签发的,委托办理支票存款业务的银行或者其他金融机构在见票时五条件支付确定的金额给收款人或者持票人的票据。

P666、追索权:是指汇票遭到拒付时,持票人对其前手(背书人、出票人)有请求其偿还汇票金额及费用的权利。

7、汇付:指在签订商务合同后,进口商将货款交给进口地银行,要求银行通过一定的方式,委托在出口地的代理行或国外联行,将款项交付给出口商的一种结算方式。

P778、顺汇:是指客户主动将款项支付给银行,委托银行用某种结算工具(如汇款通知书)将款项汇往国外收款人。

结算过程中资金的流向与单据的传递方向相同。

P769、逆汇:是指债权人或收款人向银行提供收款凭证,委托银行通过国外代理行向国外债务人索取款项。

结算过程中资金的流向与单据的传递方向相反。

10、托收指示:托收行根据托收申请书缮制的、授权代收行处理单据的完全和准确的条款。

11、保证:为了担保已经存在的票据上的债务而为的票据行为。

P5712、付款交单:D/P出口商在装运货物并交付单据后,通过托收行与代收行办理托收,并要求她们在国外买方付清货款后可交付单据。

13、承兑:指经持票人提示,付款人同意按出票人指示支付票额的行为。

P5414、背书:指在汇票背面签字。

P5115、提示:指持票人将票据交付给付款人要求付款或承兑的行为。

16、空白背书:又称无记名背书或略式背书,即不记载背书人,仅背书人签名于汇票的背面。

P5317、海运提单:指用以证明海上货物运输合同和货物已经有承运人接收或者装船,以及承运人保证据以交付货物的单证。

1.国际结算:就其本质而言是对国际间由于政治、经济、文化等一切活动所引起的债权债务加以了结的一种方式。

2.国际贸易结算:国际间由于贸易活动所发生的债权债务,是通过资金调拨、货款转移的方式了结的,称为国际贸易结算。

国际贸易结算是整个国际结算的核心。

3.国际非贸易结算:国际贸易以外的其他经济活动,以及政治、文化交流活动,例如,服务供应、资金调拨、国际借贷等引起的货币收付,称为“非贸易结算”。

4.国际结算信用管理:国际结算信用管理基本是指处于国际结算过程中的企业为了增强信用能力,控制国际结算中的信用风险而实施的一套业务方案、政策以及为此而建立的一系列组织制度。

5.票据:指以支付金钱为目的的特种证券,是由出票人签名于票据上,无条件地约定由自己或由他人支付一定金额的、可以流通转让的证券。

6.汇票:汇票是由出票人向另一人签发的,要求即期、定期或在可以确定的将来的时间,向某人或其指定人或来人无条件地支付一定金额的书面命令。

7.付对价持票人:是指持票者本人或前手持票人因付出对价而取得票据。

8.正当持票人:是指在汇票流通的合理时间内,在付给对价的情况下,成为一张表面合格、完整,无任何所有权缺陷的汇票的持票人。

9.承兑人:指在票据的正面签署承诺到期支付票款的付款人。

10.背书人:指在票据的背面签署,意即将票据上的权利转让给后手的持票人。

11.承兑:指付款人在票据的正面签署,承诺到期履行支付票款之者的票据行为。

12.背书:是指转让意志的表示。

由背书人在汇票背面签署。

意即将票据上的权利转让给后手的票据行为。

13.顺汇:是指债务人使用一定方式主动将款项支付给债权人,结算过程中资金的流向与单据的传递方向相同。

14.逆汇:是指债权人主动委托第三者(一般是债权人所在地银行),向国外债务人收取款项,结算过程中资金的流向与单据的传递方向相反。

15.电汇:汇出行应汇款人的申请,用加押电报、电传或SWLFT形式指示汇入行(国外联行或代理行)解付一定数额款项给指定收款人的一种汇款方式。

《国际结算》复习名词解释联行Sister bank:一家银行总行、分行、支行之间以及分支行间的关系,联行包括国内联行与海外联行;代理行:两家不同国籍的银行通过相互委托办理代理业务建立往来关系称为代理关系,建立代理关系的银行互为代理行;账户行:代理行之间单方或双方相互在对方银行开立了账户的银行;代理行关系并不一定是账户行关系,或者说得更明确一些,代理行并不就是账户行;但是,反过来说,账户行却一定是代理行。

两家银行,只要其中一方在另一方开设账户,那么,不管另一方是否也对等地在第一方开设账户,他们之间的关系就既是代理行的关系,又是账户行的关系;当然,双方互设账户时的关系无疑更是这样。

价格术语:也称贸易术语,是规定价格的构成及买卖双方各自应承担的责任、费用、风险以及确定货物所有权转移时限的专门术语;国际商会制订,多次修订后被国际贸易实务界采用,最新规则《2010年国际贸易术语解释通则》SWIFT:环球银行金融电讯协会,一个国际银行间的非盈利合作组织,实质上是世界各国银行间的高速电讯网络;第2章票据票据 Bills :出票人承诺自己或委托他人在特定时期向某人无条件支付一定金额的书面证据。

付对价:给付票据双方当事人认可的相对应的代价,这些代价可以是一定价值的货物、服务及货币;善意持票:受让人在支付对价后取得了表面完整、合格并且未过期的票据,而且他并未发现票据本身或票据转让人的权利有缺陷或有任何可疑之处,则为善意持票;正当持票人:是指在取得票据时,善意的付了对价的持票人,其取得的是表面完整、合格、未到期的票据,不知该票据曾被退票过,也不知前手的权利有何缺陷。

善意持票人对票据拥有完全的权利,并且不受其前手权利缺陷的影响,可以取得优于前手的票据权利;票据权利:是指依票据而行使的,以取得票据金额为直接母的的权利。

票据权利是基于票据行为人的票据行为而发生的,是与票据义务而相对存在的;票据义务:是指票据债务人依票据上所载文义支付票据金额及其他金额的义务;票据是出票人委托他人或承诺自己在特定时期向指定人或持票人无条件支付一定款项的书面证据;第3章票据汇票Bill:汇票是出票人签发的,委托付款人在见票时或者指定日期无条件支付确定的金额给收款人或者持票人的票据;承兑汇票:即需要承兑的汇票,付款人在汇票上签章表示承诺将来在汇票到期时承担付款义务的远期汇票;银行承兑汇票(B/A):是指由公司、企业或个人开立的以银行为付款人并经付款银行承兑的远期汇票了;跟单汇票:是指附带有关单据的汇票,跟单汇票一般为商业汇票;本票Promissory Note:又称为期票,是出票人签发的,承诺自己在见票时无条件支付确定金额给收款人或者持票人的票据;支票Cheque/Check:是出票人签发的,委托办理支票存款业务的银行或者其他金融机构在见票时无条件支付确定的金额给收款人或者持票人的票据;它是一种特殊的汇票,是以银行为付款人的即期汇票,无远期;第4章票据票据行为:围绕票据所发生的,以确立、转移或保障票据权利义务关系为目的的法律行为,包括六种行为:出票、背书、承兑、参加承兑、保证、保付;票据义务人:凡具备票据能力、并按规定在票据上签名的人都是票据义务人,或狭义票据行为人就是票据义务人,票据义务人之间是连带义务、全部义务;第5章贸易汇款退汇:是指汇款在解付前的撤销,又叫撤销支付,退汇通常由汇款人提出,如果汇款尚未解付,银行一般会同意退汇;M/T:信汇,是汇出行应汇款人的申请,用航空信函指示汇入行解付一定金额给收款人的汇款方式;MailT/T:电汇,是汇出行应汇款人的申请,通过加押电报或电传指示汇入解付一定金额给收款人的汇款方式;TelegraphicD/D:票汇,是汇出行应汇款人的申请,开出银行即期汇票交汇款人,由其自行携带出国或寄送给收款人凭票取款的汇款方式;Remittance by Demand DraftO/A:赊销,买卖双方约定卖方先将货物交付买方,没有正式单据证明的展期信用,买方在约定的时间内付款;第6章跟单托收D/P:付款交单,是指代收行以进口商的付款为条件向进口商交单;D/A:承兑交单,是指代收行以进口商的承兑为条件向进口商交单;T/R :信托收据,是指在远期付款交单(D/P远期)的托收业务中,当货物、单据到达目的地,而付款期限未到时,进口商为尽早提货而向代收行借出单据而出具的书面凭证;URC522:托收统一规则Uniform Rules for Collection,由国际商会于1958年制订,最新版本为1996年的522号出版物,简称 URC522,该规则是办理托收业务的最重要依据,但它只具有准强制性;第7-8章信用证保兑:是指开证行以外的银行保证对信用证承担付款责任;议付:是指银行有追索权地购买跟单汇票的行为,开证行可以指定议付行,也可以不指定;付款:是指银行以汇票付款人的身份向受益人支付票款的行为;偿付:信用证中指定的银行对议付行或付款行进行清偿垫款;保兑信用证:除开证行以外,如有另一家银行保证对符合信用证条款规定的的单据履行付款责任,则该信用证就是保兑信用证;预支信用证:是允许出口商在装货交单前支取部分货款的信用证;承兑信用证:是指付款行在收到符合信用证条款的单据及远期汇票后先予以承兑,汇票到期后再付款的信用证;可转让信用证:受益人可以将信用证的权利即装运货物(交货)、交单取款的权利转让给其他人的信用证;循环信用证:是在信用证的部分金额或全部金额被使用之后能恢复原金额再被利用的信用证;其适用于大额的、长期合同下的分批交货;L/C:信用证,是银行应开证申请人(进口商)的要求,向第三者(受益人、出口商)开立的承诺在一定期限内凭规定的单据支付一定金额的书面文件;UCP600:2006年10月,国际商会巴黎年会通过了《跟单信用证统一惯例》,简称UCP600;URR525:国际商会于1996年出版了《跟单信用证项下银行间偿付同意规则》,简称URR525,对银行间的偿付进行了规定,该规则从1996年7月1号开始实施;eUCP:跟单信用证统一惯例关于电子交单的附则,ICC又于2002年制定了《eUCP》,2002年4月1日生效,对信用证业务中电子交单的有关问题作出了专门规定;ISBP:ISBP是国际商会在信用证领域编纂的国际惯例,ISBP不仅是各国银行、进出口公司信用证业务单据处理人员在工作中的必备工具,也是法院、仲裁机构、律师在处理信用证纠纷案件时的重要依据,它的生效在各国的金融界、企业界、法律界产生重大影响;第9章银行保函担保与反担保:担保,是指法律为确保特定的债权人实现债权,以债务人或第三人的信用或者特定财产来督促债务人履行债务的制度;反担保,是指由反担保人应申请人的要求向担保人开立书面反担保文件,承诺当担保人在申请人违约后作出赔偿,且申请人不能向担保人提供补偿时,由反担保人提供补偿,并赔偿担保人的一切损失;指示行与转开行:转开行,是指接受原担保行的要求,向受益人开立以原担保行为申请人及反担保行、以自身为担保行的保函的银行;转开行转开保函后,成为新的担保行,原担保行便成为保函的指示行;转开行一般为受益人所在地银行,而指示行一般为申请人所在地银行;独立性保函,是指保函根据基础合同开立后,不依附于基础合同而存在,它是具有独立性法律效力的文件,担保人对受举益人的索赔要求是否支付,只依据保函本身的条款;索偿条件:是判断是否违约和凭以索偿的证明;见索即付:当申请人违约,受益人提示符合保函要求的全套正确的单据或文件时,担保人即可认定索偿有效,应立即予以赔付,而不得以任何理由拖延;SL/C:备用信用证,又称商业票据信用证、担保信用证,是一种特殊形式的光票信用证;根据美国联邦储备委员会的解释,备用信用证是“代表开证行对受益人承担一项义务的凭证”;《见索即付保函统一规则》(URDG)最初于1991年生效,之后逐渐被全球银行家、贸易家、行业协会及众多国际组织认可和使用,并成为见索即付保函业务(Demand Guarantee)的国际性权威实务操作标准。

一.名词解释: _1 .Coirespondent Bank(代理行):The so-called correspondent bank may be defined as “ a bank having direct connection or friendly service relations with another bank.v2.Nostro account(往账):The foreign currency account (due from account) of a major bank with the foreign banks abroad to facilitate international payments and settlements3・Vostix)account(来账):An account (due to account) held by a bank on behalf of its correspondent bank4,Acceptance for honor supra protest(# ))口承兑):Acceptance for honor supra protest is an act performed by the acceptor for honor,who accepts the bill supra protest,for the honor of any party liable thereon or for the honor of the person for whose account the bill is drawn. A bill may be accepted for honor for only a part of the sum drawn payable,5,Payment for honor supra protest# 力口付款):Pay me nt for honor supra protest is an act similar to acceptance for honor supra protest in the sense that it vindicates the honor of a party liable on a bill of exchange.6.Holder for v“lue(付对价的持票人):The person who possesses an instrument for which value has been given by himself or by some other person7・Holder in due course (正出持票人): The person who is in possession of an instrument that is(1 )complete and regular on its face;(2)taken before maturity without notice of its previous dishonor;(3)taken in good faith and for value;(4)taken without notice of any infirmity in the instrument or defect in the title of the person negotiating it. He is also called a bona fide holder, who may claim payment from all parties liable on the instrument^Dishonor (拒付):If the drawee refuses to effect payment or acceptance when a bill is presented to him for payment or acceptance, the act is called dishonor.9.Crossed check(划线支票):A crossing is in effect an instruction to the paying bank from the drawer or holder to pay the fund to be a bank only.Hence, such checks will not be paid over the counter of the paying bank and must be presented for payment by a collecting bank・10<Direct bill: A bill on which the place of acceptance is not the same one as the place os payment Indirecl bill: Il'a bill on which the place of acceptance is not the same one as the place of Dayment. 11 ・Domestic bill: A bill drawn and payable in the same country Foreign bill: A bill drawn in one country and payable in another country 12-Collection: an atrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller an the buyer, and/or shipping documents are forwarded to the seller's bank with clear instructions for collection through one of its correspondent book located in the domicile of the buyer 13.Case of need(需要时代理):The case of need is the representative appointed by the principal to act as case of need in the event of non-acceptance and/or non-payment,whose power should be clearly and fully stated in the collection」4・Documcmary collection : Documentary collections may be described as collections on financial instruments being accompanied by commercial documents or collections on commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. 15,Clean collection : Clean collections are collections on financial instruments without being accompanied by commercial documents, such as invoice, bill of lading, insurance policy,etc.16.E)irect collection: Direct collection is an arrangement whereby the seller obtains his bank's pre-numbered direct collection letter, thus enabling him to send his document directly to his bank's correspondent bank for collection.This kind of collection accelerates the paperwork process」7・Outward collection: In outward collection, a bank acting as the remitting sends the draft drawn against an exporter with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank, to get the payment or acceptance from the importer Inwaixi collection: In inward collection, a bank acting as the collecting bank receives the draft with or without shipping documents attached as well as the instructions from a bank abroad, namely, the remitting bank. On behalf of the remitting bank, the collecting bank endeavors to collect the payment or obtain the acceptance from importers」8・Bill purchased: Financing by banks for exporters under documentary collection methods takes the form of collection bill purchased・ Collection bill purchased means that the remitting bank purchases the documentary bill drawn by the exporter on the imDoHeflYust receipt: Financing by banks for importers under collection methods takes the form of trust receipt. On collection terms basis, if the collecting bank has a great degree of trust in the importer, the bank may be willing to release the negotiable bill of lading, and the goods,to the importer against the signing of a trust receipt. After the importer has made hisfinal sale and received the proceeds, he can pay the collecting bankl9・Conflrmed credit: A credit that carries the comitment to pay by both the issuing bank and the advising bank. Il is advised to the beneficiary with another bank's confirmation added thereto. It constitutes a definite undertaking of the confirming bank, in addition to that of the issuing bank, provided that the stipulated documents are presented to the confirming bank or to any other nomitated bank on or before the expiry date and the terms and conditions pf the documentary credit are complied with, to pay , to accept drafts or to negotiate.20. Silent confinnation : Silent confirmation represents an agreement between a bank and the beneficiary for that bank to “add its confirmation^to the documentary credit despite not being so authorized by the issuing bank.In this case the beneficiary and the advising bank make an independent agreement that adds the bank's confirmation to the credit for a fee.21 ・ Sight cred让: A letter of credit calling for payment upon the presentation of the documents either with or without a sight draft.22. Time credit / Usance credit: A L/C calling for payment upon the presentation of the document either with or without a sight draft 23-Usance letter of credit payable at sight: under the creditthe benificiary will receive payment at sight and the discount charges and acceptance commission are for the account of the applicant 24,Transferred credit: A credit under which the beneficiary(the first beneficiary)may request the bank authorized to pay, incur a deferred payment undertaking,accept or negotiate(the transferring bank),or in the event of a freely negotiable credit,the bank specially authorized in the credit as the transferring bank to make the documentary credit available in whole or in part to one or more other beneficiary25.Acceptance credit : A credit available by acceptance, under which a bank specifically nominated therein is authorized to accept the draft drawn under the credit・ The draft there under must be a time bill drawn on the issuing bank, advising bank ,or any other drawee bank.26.Deferred payment credit: Under a deferred payment credit ,the beneficiary does not receive payment when he presents the documents, but at a later date specified in the credit ・27・Negoti“tion credit: A negotiation credit is one under which a bank specially nominated therein is authorized to negotiate or one,which is freely negotiable by any bank.28.Revolving credit: One by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required29・Back・to・b“ck documentary credit: The L/C opened by buyer infavor of sellor is used as security to establish a security to establish a second 1/c drawn on the seller in favor of his supplier 30. Reciprocal credit : A reciprocal credit is usually concerned with a barter transaction. It is in all respects similar to an ordinary commercial credit expect that opener of the original credit may assume the position of the beneficiary of the reciprocal credit, while the beneficiary of the original credit may become the opener of the reciprocal creditJL Red clause / Anticipatory credit : It is a kind of pre-shipment financing intended to assist the exporter in the production or procurement of the goods sold・It is a credit with a special clause added thereto that authorizes the advising bank or any other nominated banks to make advances to the beneficiary before his submission of docuiTients32,Factoring: a complete financial package that combines credit protection, accounts receivable bookkeeping and collection services .its the purchase of claims, arising from sales of goods, by a specialized company knownsas factoring company or factor33・Forfeiting : the purchase of obligations falling due at future date .arising from deliveries of goods and services without recourse to any previous holder of the obligation ・33・Bank guamnlee: A bank guarantee is used as an instrument for securing performance or payment especially in international business.a bank guarantee is a written promise issued by a bank at the request of its customer,undertaking to make payment to the beneficiary within the limits of a stated sum of money in the event of default by the principaL34・Coimter guarantee: A counter guarantee refers to any guarantee or other payment undertaking of the instructing party given in writing for payment of money to the guarantor on presentation in conformity with the terms of the undertaking of a writing demand for payment and other documents specified in the counter guarantee<35. Counter Guarantor: a bank or a financial institution or any other body acting as an instructing party issues a counter guarantee acting on the instruction of a principal in favor of a bank ora financial institutio n located in the beneficiary's country. 36. Accessory Guarantee : Accessory guarantee is an accessory contract by which the guarantor undertakes to answer for the debt,default or miscarriage of another person known as the principal debtor. An accessory guaranteenecessarily involves some other person being primarily liable.37. Independent guarantee: independent guarantee is a principal obligation, it is a promise to pay a sum of money against presentation of the beneficiary's demand and stipulated documentationjf any. They are independent of the underlying contract.38. Indirect guarantee: An in direct guarantee is a guarantee where a second bank is involved・This bank(usually a foreign bank located in the beneficiary^s country of domicilejwill be requested by the initiating bank to issue a guarantee in return for the risk of a loss which could result from the beneficiary submitting a claim under the foreign bank's guarantee.39. Direct guarantee : A direct guarantee occurs when the client authorizes the bank to issue a guarantee directly to the beneficiary, as the following figure shows.40^Uncpnditional bond : Unconditional bonds can be called at the sole discretion of the buyer.If payment is called for, which conforms to the terms of the bond, the bank must pay.41 .Conditional bond: Conditional bonds can be divided into two types: (a) conditional bonds requiring documentary evidence and (b) conditional bonds that do not require documentary evidence.42o Bid Bond/Tender Bond:Bid Bond/Tender Bond Bid bond is an undertaking given by a bank at the request of a tender in favor of a party inviting tenders abroad, whereby the guarantor undertakes to make payment to the beneficiary within the limit of a stated sum of money in the event of default by the principal in the obligations resulting from the submission of tender43. Performance Bond : performance guarantee (bond) is an undertaking given by a bank (the principal) to a buyer or an employer (the beneficiary), where by the guarantor undertakes to make payment to the beneficiary within the limit of a stated sum of money in the event of default by the supplier or the contractor in due performance of the terms of a contract between the principal and the beneficiary44. Advance Payment Bond :An advance payment bond is issued at the request of the exporter to the importer (the beneficiary) when the advance payment is required by the latte匚The guarantee ensures the repayment of the advance by the exporter in the event of the non-performance of his contractual obligations.45・ Repayment Guarantee : A repayment guarantee is undertaking given by a bank (the guarantor) at the request of a supplier of goods or services or other contractor (the principal) to a buyer or an employer (the beneficiary) whereby the bank undertakes to make payment to the beneficiary within the limit of a stated sum of money in the event of default by the principle to repay, in accordance with the ternis and conditions of a contract between the principcil and the beneficiary, any sum or sums advanced or paid by the beneficiary to the principal.46. Overdraft Guarantee : if a bank provides the overdraft facility for its overseas customer, sometimes a letter of guarantee to be issued by an overseas bank on behalf of this customer is needed. Under the guarantee the overseas bank undertakers to refund the bank providing the overdraft facility, should the customer fail to repay in due time the amount overdrawn in the account47e Import guarantee : It is issued at the request of the importer to guarantee his effecting payment in accordance with the terms and conditions of the relative contract48. Loan guarantee :The guarantee is issued at the request of the borrower (the principal) in favor of the lender (the beneficiary),49. Leasing guarantee : The guarantor bank guarantees to the beneficiary that lessee will pay the rent in accordance with the terms and conditions of the lease agreement 50・ Retention bonds : Retention bonds enable retention moneys, which would otherwise be held by the buyer beyond the completion of the contract, to be released early. These bonds guarantee return of these retention moneys to the buyer in the event of non-performance of pose completion obligations by the exporte5i, Standby letter of credit: The standby credit is a documentary credit or similar arrangement, however named or described, which represents an obligation to the beneficiary on the part of the issuing bank to: (1) repay money borrowed by the applicant, or advanced to or for the account of the applicant; (2) make payment on account of any indebtedness undertaken by the applicant;(3)make payment on account of any default by the applicant in the performance of an obligation. 52・Open account :Open account business is also called payment after arrival of goods・ The seller may be prepared to ship his goods on open account when the exporter is well acquainted with the financial status of the buyer and entertains no doubt about his solvency, or when the exporter sells goods to his overseas branch or subsidiary.二.汉译英(前汉后英) 商业信用:commercial credit 控制文件:control document 账户关系:account relationship 现金结算:cash settlement 金融中介:financial intermediary 一般划线支票:general crossed check 特殊划线支票:special crossing check 过期支票:post-dated check未到期支票:undated check 大小写金额:words and figures 空白背书:black endorsement 特别背书:specific endorsement 限制性背书restrictive endorsement 跟单汇票documentary bill 即期汇票:sight bill 远期汇票:usance bill 承兑汇票:acceptance bill 可确定的未来某一天:determinnable future time 光票:clean bill 流通票据:negotiable instrument 贴现行:discount house 商人银行:merchant bank无条件的付款承诺:unconditional promise of payment 负连带责任:joint and severally responsible 出票后九十天付款:payable at 90 days after date 汇款通知单:remittance advice汇出汇款:outward remittance 国际汇款单: international money order 往来账户:current account 自动支付系统:all tomated payment system 作为偿付:in cover赔偿保证书:letter of indemnity 信汇通知书:mail transfer advice汇票的不可流通副本:a non-negotiable copy of draft 首期付款:down payment 凭单付款:cash against document 商业承兑汇票:commercial acceptance bill 需要时的代理人:the case of need出口押汇:bill purchased 物权单据:title documents 以寄售方式:on consignment 直接托运:direct collection 运货单据:shipping document 付款交单:document against payment远期汇票:time bill未授权保兑:silent confirmation有效地点为开证行所在的柜台:to expire at the counters of the issuing bank平代表物权的单据付款:to pay against documents presenting the goods 信用证以银行信用代替了商业信用A letter credit places a bank credit instead of commercial credit 信用证独立于它所代表的企业合同:A letter of credit stands indipendent of the sales contract 或有负债:contingent liability信用额度: credit limit 卖方信supplier credit 无追索权的:without recourse 信用审定:credit approval资本货物:capital goods买方信贷担保:buyer credit guarantee福费廷融资便利:forfeiting facility 贸易壁垒:tnide barrier 大宗采购折扣:bulk purchase discount 履约保函:performance bond担保书:letter of guarantee 反赔偿:counter indemnity 附属包涵:accessory guarantee 备用信用证:stand-by letter of credit 工程承包:engineering contract 基础交易:underling transaction 见索即付保函:demand guarantee 延期付款保函:deferred bond payment 反担保:counter guarantee三.简答或者选择等知识点1.13 trade terms in the 2Inc(iterms 200CT1EX works;2Free Carrier;3Free Alongside ship;4Free on Board ;5Cost and Freight;6Cost Jnsurance and Freight;7Carriage Paidto;8Carriage and Insurance Paid to;9Delivered atFrontier; 1 ODelivered Ex Ship; 11 Delivered Ex Quay;12Delivered Duty Unpaid;13Delivered Duty Paid2・ Which are included in Settlement on commercial credit?Payment in advance;Open account;Remittance;Collection3, Which are included in Settlement on bank crcdit?LeUer of credit;Bankguarantee4.wha( nre included in the Control documents^?lists of specimen of authorized signatures; telegraphic test key; terms and conditions; SWIFT authentic key5. Services provided by coirespondents 1 Collecting checks ,drafts ,and other credit instruments2)making loan or investments as agents for their customer banks.3)making credit investigations on firms that borrow in the open market4)providing banks with foreign exchange facilities, including commercial and traveler^ checks5)providing banks with funds/loans in case of need6xlearing principles of international payment system: The net paying bank ,which still has net debit after netting all receivables and payables to other banks ,makes the payment to the net receiving bank,which has net credit 7> Functions of a negotiable instrumentA means of payment, A credit instrument, A transferable instrument8・ How to calculate the Time of Payment? 1 )If a bill is payable at a fixed time after sight, after date or after the happening of a specific event ,the time of payment is calculated by counting in the date of payment but counting out the accepting date, the issuing date or the date of happening of the specified event.2)If a bill is payable at a fixed time from a fixed date, then this fixed date should be counted in.3)If a bill is payable at X months after/sight/date/stated date、the word “month、' here means a calendar month and the date of payment should fall on the corresponding date of the month due・9・Types of endorsemenlSpecial endorsement; Blank endorsement; Restrictive endorsement; Conditional endorsement.JOJJnderstanding "Acts of a bill of exchange" end fill a bill of exchangeThe acts of a bill of exchange refer to the legal acts carried out to bear the obligationsto a bill of exchange .11. Classification of a bill of exchange1)According to the drawer:Banker^ draft or bank draft\ Trade bill2)According to the acceptor:Trader5s acceptance bill\Banker's acceptance bill 3)According to the tenor:Sight bill\Time bill or usance bill4)According to whether commercial documents are attached thereto:Clean bill\ Documentarybill.5)According to the cuiTency denominated:Local currency bill\ Foreign currency bill 6)According to the place of acceptance and place of payment:Direct bill\ Indirect bill7)According to the place of issue and place od payment:Inland bill or domestic bill\ Foreign bill13. DifTerence between a promissory nolc anda bill of exchangel )A promissory note is a promise to pay ,whereas a bill of exchange is an order to pay 2)There are only two immediate parties to a promissory note, namely the maker and the payee, whereas there are three basic parties to a bill of exchange,namely the drawer, the drawee and the payee.3)The maker is primarily liable on a promissory note, whereas the drawer is primarily liable, if it is a sight bill, and the acceptor becomes primarily liable, if it is a time bill.4)When issued, a promissory note has an original note only, whereas a bill of exchange may be either a sole bill or a bill in a set, ie. A bill drawn with second of exchange and third of exchange in addition to the original oneJ4, A banker's duty to honor checks Don countermanding of payment by the customer------------------- commonly known as “stop',or “stop paymenf\2)on receiving notice that the customer has died or dissolved.3)on receiving notice of bankruptcy or liquidation of the customer.4)on receiving order that is made against the custome匚5)on receiving notice of mental disorder of the customer 6)on receiving a garnishee order freezing the customer's account.7)on receiving a court order freezing the customer's account16・ Types of Crossed checksGenend crossing; Special crossing・17, Difference between a check and a bill of exchange 1)A bill of exchange may be drawn upon any person, whereas a check must be drawn upon a banker2)Unless a bill is payable on demand, it is usually accepted、whereupon the acceptor is the primarily liable party.3)A bill must be presented for payment when due , or else the drawer will be discharged.A check must be presented for payment within a reasonable time or within a certain time, such as 30 days according to the regulations of the country concemed<The drawer of a check is not discharged even though it has not been presented for payment within the stipulated time unless the delay in presentation incurs losses to the drawer.18・ Types of acceplancecondilional acceptance; partial acceptance; local acceptance; time acceptance20. comparision of M/T、T/T 、D/D(Advantages and disadvantages Of M/T、T/T、D/D)items T/T M/T D/D Methodsof transferCable/telex/SWIFTAirmail Mail orcarried byremitterTime oftransferFastest Slow SlowestMethod Test key of Authori Authoriz of SWIFT zed ed authentic Authenticati signatu signatur ation on key re e security Quite safe Reliable,butmay belost inpostStop-payment istimeconsuming charge High Low Low21 ・ Reimbursement methods "Crediting vostro account of the paying bank2)Debiting remitting bank\ nostor account3)Instructing a reimbursing bank to effect payment by debiting the remitting bank's nostro account 4)Instructing the paying bank to claim reimbursement from another branch of the same bank or another bank with which the remitting bank opens an account.5)According to the payments agreement between two country・22.Payment in advancePayment in advance signifies that the importer pays the exporters before delivery of the goods・ In facts, importers are seldom prepared to make full payment in advance of the shipment of goods.lt is more common to find that they are prepared to pay in advance only a certain percentage of the value of the goods .that is , the so called down payment.23.Types of collection 1 )In terms of documents related:clean collection 光票托收;documentary collection 跟单托收;direct collection 直接托收2)In terms of release of documents: documents against payment(D/P); documents against acceptance(D/A); 3)In termsof time to make payment: documents against payment at sight(D/P at sight); acceptance against payment(Acceptance D/P) 24・ Bank's responsibility in collectionl)Banks are only permitted to act upon the instructions given in the collection orders giving complete and precise instructions.Any deviation from these instructions at the request of the drawee will be at the responsibility of the collecting bank.2)Banks will act in good faith and exercise reasonable care and must verify that the documents received appear to be as listed in the collection order and must immediately advise the party from whom the collection order was received of any documents missing.3)Banks have no further obligation to examine the documents.25. Risks for exporter in collection and measures against risks 1 )Non-acceptance of merchandise: One common danger is that the importer may refuse to accept the merchandise.The importer may base the refusal on some small, inadvertent infraction of sales contract.2)Non-payment of trade acceptance:Generally5 shipping on a time-draft is more risky for the seller than a sight draft.3)Possession od goods:Another danger an exporter might face is that the importer, due to local regulations, can get possession of goods without paying or accepting the draft.4)Exchange restrictions: It may occur that the importer is perfectly willing to pay, but that local exchange regulations do not permit him to obtain the necessary foreign exchange.MEASURES: First, the exporter should always make sure that the overseas importer is of good reputation and of good financial standin g.Secondly, the exporter should take into account the economic and political conditions in the importing country.Thirdly, the exporter should also pay attention to the foreign exchange regulations in the importing country so that the outward payment made by the importer will present no problem.Furthermore, the exporter should take precautions, such as by hedging operations or by immediate settlement of the accounts denominated in a foreign currency, to avoid losses on foreign exchange transactions.26. Risks of importer in collection and measures against risks 1 )Payments may have to be made prior to the arrival of the goods.No opportunity is then available to inspect the goods before making paymenL2)By accepting a bill of exchange under the documents against acceptance collection, the importer incurs two separate legal liabilities; that is, he will have another legal liability on the bill of exchange besides his liability on the sales contract. 3)In some countries, if a bill of exchange is protested, this can ruin the reputation of a trader and may be considered an act of bankruptcy. 27・ Basic forms of documentary collections 1 documents against payment 凭即期付款交单2documents against acceptance 凭承兑交单28.The obligations of the trustee in Trust receipt (l )To arrange for the goods to be warehoused and insured in the bankas name;(2)To pay all the proceeds of sale to the bank or to hold them on behalf of the bank;(3)Not to put the goods in pledge to other persons;(4)To return the goods or the proceeds to the bank at any time when requested;(5)To settle claims of the bank before liquidation in case of the trusteed bankruptcy. 29,Financing Under Collection Methodsl)financing provided by the remitting bank to the exporter 2)financing provided by the collecting bank to the importer30・ Characteristics of a letter of credit(1) The issuing bank undertakes to effect payment;(2) A letter of credit stands independent of the sales contract;(3) Banks deal with documents and not with goods, services or other performances to which the documents may relate;(4)Banks assumes no responsibility for the form, sufficiency ,accuracy, genuineness, falsification or legal effect of any documents presented;(5) Banks dealing letter of credit business assume no responsibility for the acts of third parties taking part in one way or another in the credit transaction.31 ・ Benefits of the documentary creditL Facilitates financing the documentary credit 2.Provides legal protection 3・ Assures expert examination of documenls 32・Responsibilities of parties involved in a documentary credit(1) Applicant/importer/the buyer(2)Issuing/opening bank/the buyer's bank(3) Advising bank/Notifying bank (4) Beneficiary/exporter/the seller(5) Confirming bank(6) Negotiating bank (7) Paying bank (8) Accepting bank(9) Reimbursing bank33・Types of transfer 1)total transfer and partial transfer全额转让,部分金额转让2)transfer without/with substitution of documents・不替换发票转让,替换发票转让34. Rpes of negotiation credit(1 )Free negotiation credit不指定议付行的议付信用证⑵Restricted negotiation credit 指定议付银行的信用证(3)Non-negotiation credit 35・ Types of revolving credit 1) Automatic revolving ⑵ Notice revolving 通知I循环信用证(3) Periodic revolving定期循环信用证(4)。

《国际结算》复习名词解释联行Sister bank:一家银行总行、分行、支行之间以及分支行间的关系,联行包括国内联行与海外联行;代理行:两家不同国籍的银行通过相互委托办理代理业务建立往来关系称为代理关系,建立代理关系的银行互为代理行;账户行:代理行之间单方或双方相互在对方银行开立了账户的银行;代理行关系并不一定是账户行关系,或者说得更明确一些,代理行并不就是账户行;但是,反过来说,账户行却一定是代理行。

两家银行,只要其中一方在另一方开设账户,那么,不管另一方是否也对等地在第一方开设账户,他们之间的关系就既是代理行的关系,又是账户行的关系;当然,双方互设账户时的关系无疑更是这样。

价格术语:也称贸易术语,是规定价格的构成及买卖双方各自应承担的责任、费用、风险以及确定货物所有权转移时限的专门术语;国际商会制订,多次修订后被国际贸易实务界采用,最新规则《2010年国际贸易术语解释通则》SWIFT:环球银行金融电讯协会,一个国际银行间的非盈利合作组织,实质上是世界各国银行间的高速电讯网络;第2章票据票据 Bills :出票人承诺自己或委托他人在特定时期向某人无条件支付一定金额的书面证据。

付对价:给付票据双方当事人认可的相对应的代价,这些代价可以是一定价值的货物、服务及货币;善意持票:受让人在支付对价后取得了表面完整、合格并且未过期的票据,而且他并未发现票据本身或票据转让人的权利有缺陷或有任何可疑之处,则为善意持票;正当持票人:是指在取得票据时,善意的付了对价的持票人,其取得的是表面完整、合格、未到期的票据,不知该票据曾被退票过,也不知前手的权利有何缺陷。

善意持票人对票据拥有完全的权利,并且不受其前手权利缺陷的影响,可以取得优于前手的票据权利;票据权利:是指依票据而行使的,以取得票据金额为直接母的的权利。

票据权利是基于票据行为人的票据行为而发生的,是与票据义务而相对存在的;票据义务:是指票据债务人依票据上所载文义支付票据金额及其他金额的义务;票据是出票人委托他人或承诺自己在特定时期向指定人或持票人无条件支付一定款项的书面证据;第3章票据汇票Bill:汇票是出票人签发的,委托付款人在见票时或者指定日期无条件支付确定的金额给收款人或者持票人的票据;承兑汇票:即需要承兑的汇票,付款人在汇票上签章表示承诺将来在汇票到期时承担付款义务的远期汇票;银行承兑汇票(B/A):是指由公司、企业或个人开立的以银行为付款人并经付款银行承兑的远期汇票了;跟单汇票:是指附带有关单据的汇票,跟单汇票一般为商业汇票;本票Promissory Note:又称为期票,是出票人签发的,承诺自己在见票时无条件支付确定金额给收款人或者持票人的票据;支票Cheque/Check:是出票人签发的,委托办理支票存款业务的银行或者其他金融机构在见票时无条件支付确定的金额给收款人或者持票人的票据;它是一种特殊的汇票,是以银行为付款人的即期汇票,无远期;第4章票据票据行为:围绕票据所发生的,以确立、转移或保障票据权利义务关系为目的的法律行为,包括六种行为:出票、背书、承兑、参加承兑、保证、保付;票据义务人:凡具备票据能力、并按规定在票据上签名的人都是票据义务人,或狭义票据行为人就是票据义务人,票据义务人之间是连带义务、全部义务;第5章贸易汇款退汇:是指汇款在解付前的撤销,又叫撤销支付,退汇通常由汇款人提出,如果汇款尚未解付,银行一般会同意退汇;M/T:信汇,是汇出行应汇款人的申请,用航空信函指示汇入行解付一定金额给收款人的汇款方式;MailT/T:电汇,是汇出行应汇款人的申请,通过加押电报或电传指示汇入解付一定金额给收款人的汇款方式;TelegraphicD/D:票汇,是汇出行应汇款人的申请,开出银行即期汇票交汇款人,由其自行携带出国或寄送给收款人凭票取款的汇款方式;Remittance by Demand DraftO/A:赊销,买卖双方约定卖方先将货物交付买方,没有正式单据证明的展期信用,买方在约定的时间内付款;第6章跟单托收D/P:付款交单,是指代收行以进口商的付款为条件向进口商交单;D/A:承兑交单,是指代收行以进口商的承兑为条件向进口商交单;T/R :信托收据,是指在远期付款交单(D/P远期)的托收业务中,当货物、单据到达目的地,而付款期限未到时,进口商为尽早提货而向代收行借出单据而出具的书面凭证;URC522:托收统一规则Uniform Rules for Collection,由国际商会于1958年制订,最新版本为1996年的522号出版物,简称 URC522,该规则是办理托收业务的最重要依据,但它只具有准强制性;第7-8章信用证保兑:是指开证行以外的银行保证对信用证承担付款责任;议付:是指银行有追索权地购买跟单汇票的行为,开证行可以指定议付行,也可以不指定;付款:是指银行以汇票付款人的身份向受益人支付票款的行为;偿付:信用证中指定的银行对议付行或付款行进行清偿垫款;保兑信用证:除开证行以外,如有另一家银行保证对符合信用证条款规定的的单据履行付款责任,则该信用证就是保兑信用证;预支信用证:是允许出口商在装货交单前支取部分货款的信用证;承兑信用证:是指付款行在收到符合信用证条款的单据及远期汇票后先予以承兑,汇票到期后再付款的信用证;可转让信用证:受益人可以将信用证的权利即装运货物(交货)、交单取款的权利转让给其他人的信用证;循环信用证:是在信用证的部分金额或全部金额被使用之后能恢复原金额再被利用的信用证;其适用于大额的、长期合同下的分批交货;L/C:信用证,是银行应开证申请人(进口商)的要求,向第三者(受益人、出口商)开立的承诺在一定期限内凭规定的单据支付一定金额的书面文件;UCP600:2006年10月,国际商会巴黎年会通过了《跟单信用证统一惯例》,简称UCP600;URR525:国际商会于1996年出版了《跟单信用证项下银行间偿付同意规则》,简称URR525,对银行间的偿付进行了规定,该规则从1996年7月1号开始实施;eUCP:跟单信用证统一惯例关于电子交单的附则,ICC又于2002年制定了《eUCP》,2002年4月1日生效,对信用证业务中电子交单的有关问题作出了专门规定;ISBP:ISBP是国际商会在信用证领域编纂的国际惯例,ISBP不仅是各国银行、进出口公司信用证业务单据处理人员在工作中的必备工具,也是法院、仲裁机构、律师在处理信用证纠纷案件时的重要依据,它的生效在各国的金融界、企业界、法律界产生重大影响;第9章银行保函担保与反担保:担保,是指法律为确保特定的债权人实现债权,以债务人或第三人的信用或者特定财产来督促债务人履行债务的制度;反担保,是指由反担保人应申请人的要求向担保人开立书面反担保文件,承诺当担保人在申请人违约后作出赔偿,且申请人不能向担保人提供补偿时,由反担保人提供补偿,并赔偿担保人的一切损失;指示行与转开行:转开行,是指接受原担保行的要求,向受益人开立以原担保行为申请人及反担保行、以自身为担保行的保函的银行;转开行转开保函后,成为新的担保行,原担保行便成为保函的指示行;转开行一般为受益人所在地银行,而指示行一般为申请人所在地银行;独立性保函,是指保函根据基础合同开立后,不依附于基础合同而存在,它是具有独立性法律效力的文件,担保人对受举益人的索赔要求是否支付,只依据保函本身的条款;索偿条件:是判断是否违约和凭以索偿的证明;见索即付:当申请人违约,受益人提示符合保函要求的全套正确的单据或文件时,担保人即可认定索偿有效,应立即予以赔付,而不得以任何理由拖延;SL/C:备用信用证,又称商业票据信用证、担保信用证,是一种特殊形式的光票信用证;根据美国联邦储备委员会的解释,备用信用证是“代表开证行对受益人承担一项义务的凭证”;《见索即付保函统一规则》(URDG)最初于1991年生效,之后逐渐被全球银行家、贸易家、行业协会及众多国际组织认可和使用,并成为见索即付保函业务(Demand Guarantee)的国际性权威实务操作标准。

第10章国际保理FACTORING:国际保理服务,是商业银行等金融机构通过向消费品出口商购买出口债权而提供坏账担保和贸易融资等服务的综合性金融业务;FCI:国际保理商联合会,1968年11月成立于荷兰,总部设在阿姆斯特丹,其目的是为会员提供国际保理服务的统一标准、程序、法律依据和技术咨询,并负责会员公司间组织协调和技术培训工作;组织构成为:国际保理商联合会理事会、国际保理商联合会执行委员会以及国际保理商联合会秘书处;保理商:商业银行或其附属公司/保理公司第11章福费廷选期费:即包买商收取的选择期补偿费用,选择期风险承担费,48小时内一般不收取;承担费:是包买商收取的承担期补偿费用,承担交易责任、交易风险的费用,按承诺天数收取;IFA(International Forfaiting Association)国际福费廷协会:福费廷业务领域最大的国际组织,宗旨是促进福费廷业务在全球的发展,制订福费廷业务的惯例规则,便利成员间的业务合作。

国际福费廷协会市场惯例委员会于2004年通过了《IFA国际福费廷规则》和《IFA国际福费廷规则用户指南》。

规则适用于由IFA成员选择使用的全球范围内的福费廷交易;第12章国际结算方式选择顺汇:顺汇是指资金从付款一方转移到收款一方,由付款方主动t "_blank" 汇付的方式,是国际间通过银行进行资金转移的一种方式逆汇:资金流向与信用工具的传递方向相反,如信用证和托收;基本结算方式:基本结算方式即狭义国际结算方式,是以收付款为直接目的的结算方式,其主要作用是解决国际间资金划拨、转移,或资金从债务人流向债权人的途径和渠道问题,程序性很强;包括信用证、托收和汇款三种;附属结算方式:是指以基本结算方式为基础并以弥补基本结算方式缺陷为目的的一类国际结算方式;第14章单据基本单据:是交易中不可缺少的,也是出口商必须提供的单据;是出口商履约的主要证明,是进口商提取货物的物权凭证,也是银行在单据业务中审查的重点;装船提单与备运提单:装船提单,是指轮船公司已将货物装上指定船舶后所签发的提单;备运提单,又称收讫待运提单,指船公司已收到托运货物等待装运期间所签发的提单,提单上不写明装船日期和肯定的船名;清洁提单与不清洁提单:清洁提单是指不带有明确宣称货物及包装缺陷状况的条文或批注的运输单据,亦即指货物转船时“表面状况良好”;不清洁提单,又称“瑕疵提单”,是指带有承运人附加的关于货物外表状况不良或包装不当或存在缺陷等批注的提单;正常提单与过期提单:正常提单指在信用证规定的最迟交单日之前交付银行,且签单时间不超过21天的提单;过期提单指超过规定交单日期的提单,包括超过信用证规定的最后交单日和提单签发21天后交付的提单,由于单证不符,所以银行不接受过期提单;倒签提单与预借提单:倒签提单,是指承运人或其代理人应托运人的要求,在货物装船以后,以早于该批货物实际装船完毕的日期作为签发日期所签发的已装船提单;预借提单,又称无货提单,是承运人应托运人的要求,在货物尚未装船货或装船尚未完毕的情况下,预先签发的“货已装船”提单;物权凭证:代表货物所有权的凭证;证明物权人拥有物权的证明、单据、证书等书面形式的具象。