中级财务会计(双语)第四章

- 格式:ppt

- 大小:732.50 KB

- 文档页数:37

中级财务会计第四章中级财务会计的第四章,通常聚焦于存货这一重要的资产类别。

存货对于企业的经营运转起着至关重要的作用,它不仅直接影响到企业的生产成本和利润,还反映了企业的运营效率和资金占用情况。

存货,简单来说,就是企业在日常活动中持有以备出售的产成品或商品、处在生产过程中的在产品、在生产过程或提供劳务过程中耗用的材料和物料等。

它包括各类原材料、在产品、半成品、产成品、商品以及周转材料等。

存货的确认,需要同时满足两个条件。

一是与该存货有关的经济利益很可能流入企业,二是该存货的成本能够可靠地计量。

这两个条件缺一不可,如果不能确定经济利益很可能流入企业,或者成本无法可靠计量,就不能将其确认为存货。

存货的初始计量,是指企业取得存货应当按照成本进行计量。

存货成本包括采购成本、加工成本和其他成本。

采购成本,主要由购买价款、相关税费、运输费、装卸费、保险费以及其他可归属于存货采购成本的费用构成。

比如说,企业采购一批原材料,支付的价款、运输途中的合理损耗、入库前的挑选整理费用等,都要计入原材料的采购成本。

加工成本则包含直接人工以及按照一定方法分配的制造费用。

其他成本,是指除采购成本、加工成本以外的,使存货达到目前场所和状态所发生的其他支出。

存货发出的计价方法有多种,比如先进先出法、加权平均法、个别计价法等。

先进先出法,就是先购入的存货先发出。

这种方法在物价持续上升时,会导致发出存货成本偏低,利润偏高。

加权平均法,是根据期初存货和本期购入存货的加权平均单位成本来计算发出存货的成本。

个别计价法,适用于那些不能替代使用的存货、为特定项目专门购入或制造的存货等,能准确反映存货的实际流转情况。

在存货的期末计量中,我们要遵循谨慎性原则。

当存货的成本高于其可变现净值时,应当计提存货跌价准备,将存货的账面价值减记至可变现净值。

可变现净值,是指在日常活动中,存货的估计售价减去至完工时估计将要发生的成本、估计的销售费用以及相关税费后的金额。

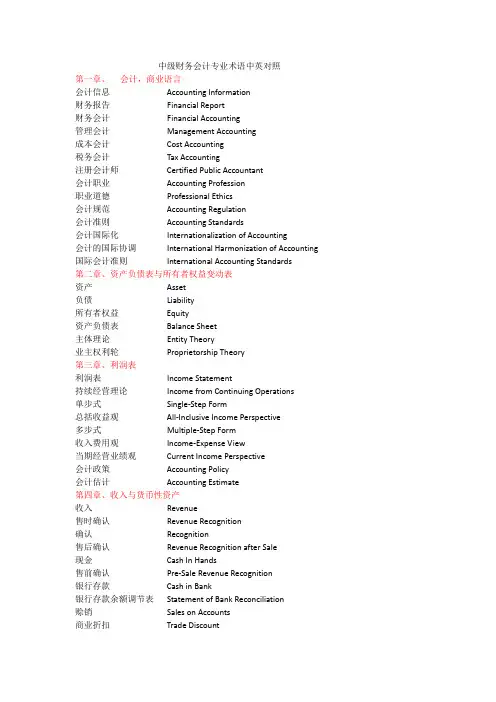

中级财务会计专业术语中英对照第一章、会计,商业语言会计信息Accounting Information财务报告Financial Report财务会计Financial Accounting管理会计Management Accounting成本会计Cost Accounting税务会计Tax Accounting注册会计师Certified Public Accountant会计职业Accounting Profession职业道德Professional Ethics会计规范Accounting Regulation会计准则Accounting Standards会计国际化Internationalization of Accounting会计的国际协调International Harmonization of Accounting 国际会计准则International Accounting Standards第二章、资产负债表与所有者权益变动表资产Asset负债Liability所有者权益Equity资产负债表Balance Sheet主体理论Entity Theory业主权利轮Proprietorship Theory第三章、利润表利润表Income Statement持续经营理论Income from Continuing Operations单步式Single-Step Form总括收益观All-Inclusive Income Perspective多步式Multiple-Step Form收入费用观Income-Expense View当期经营业绩观Current Income Perspective会计政策Accounting Policy会计估计Accounting Estimate第四章、收入与货币性资产收入Revenue售时确认Revenue Recognition确认Recognition售后确认Revenue Recognition after Sale现金Cash In Hands售前确认Pre-Sale Revenue Recognition银行存款Cash in Bank银行存款余额调节表Statement of Bank Reconciliation赊销Sales on Accounts商业折扣Trade Discount现金折扣Cash Discount销售退回与折让Sales Returns and Allowances应收票据Notes Receivable应收账款Accounts Receivable坏账Bad Debt坏账准备Allowance for Doubtful Accounts坏账费用Bad Notes Expense现金等价物Cash Equivalents备抵法Allowance Method直接核销法Specific Write-off Method预付账款Repaid Payment账龄法Aging of Accounts Receivable应收票据贴现Bank Discounting销售百分比法Percentage of Sales Method应收账款百分比法Percentage of Accounts Receivable Method第五章、销售成本与存货存货Inventory销售成本Costs of Goods Sold定期盘存制Periodic Inventory System永续盘存制Perpetual Inventory System个别计价法Specific Identification先进先出法First-in First-out Method ,FIFO后进先出法Last-in First-out Method ,LIFO加权平均法Weight Average Method可变现净值Net Realizable Value移动平均法Moving Weight Average Method稳健性原则Conservatism Principle一致性原则Consistency Principle成本与市价孰低法Lower-of-Cost-or-Market Method ,LCM第六章、长期资产及摊销长期资产Long-Term Asset摊销Amortization资本性支出Capital Expenditure收益性支出income Expenditure固定资产Fixed Assets累计折旧Accumulated Depreciation直线法Straight Line Method加速折旧法Acceleration Depreciation Method双倍余额递减法Double Declining-Balance Depreciation Method 年数总和法Sum-of-The-Years-Digits Method无形资产Intangible Assets研究开发成本Research &Development Costs商誉Goodwill自创商誉Internally Developed Goodwill外购商誉Purchased Goodwill立即注销法Immediate Write-off Method永久保留法Non-Amortization Method系统摊销法Systematical Amortization Method 递耗资产Wasting Assets折耗Depletion递延资产Deferred Assets or Deferred Charges 第七章、长期投资于企业合并投资investment短期投资short-term investment长期投资long-term investment股票投资stock investment债券投资bond investment直线法straight-line method实际利率法effective rate method成本法cost method权益法equity method可转换债券convertible bond企业合并business combination吸收合并merger创立合并consolidation控股合并acquisition of majority interest横向合并horizontal integration纵向合并vertical integration混合合并conglomeration合并财务报表consolidated financial statements购买法purchase method权益结合法pooling of interest method母公司parent company子公司subsidiary company第八章、资本来源:负债负债liabilities流动负债current liabilities长期负债long-term liabilities短期借款short-term bank loans应付票据notes payable带息票据Interest-bearing notes应付账款accounts payable不带息票据noninterest-bearing notes应付工资wages payable增值税value-added tax消费税excise应付公司债券bonds payable信用债券debenture抵押债券mortgage bonds可转换公司债券convertible bonds长期借款long-term loans复利compound interest年金annuity终值future value现值present value本金principle利息interest第九章、资本来源:所有者权益所有者权益owner’s equity实收资本paid-in capital资本公积capital reserve盈余公积surplus from profit独资企业sole proprietorship合伙企业partnership enterprise公司制企业corporate enterprise普通股common share优先股preferred share第十章、特殊会计问题:非货币性资产交换非货币性资产交换non-monetary transaction 非货币性资产non-monetary asset货币性资产monetary asset换入资产swap-in asset换出资产swap-out asset公允价值fair value账面价值book value第十一章、特殊会计问题:债务重组债务重组debt reorganization或有支出contingent payment或有收益contingent gain第十二章、特殊会计问题:或有事项或有事项contingency或有资产contingent asset或有负债contingent liability第十三章、特殊会计问题:关联方关系及交易关联方related party控制control共同控制common control重大影响material influence母公司parent company子公司subsidiary company合营企业joint venture联营企业affiliated enterprise第十四章、企业财务报告----资产负债表与利润表财务报告financial report财务信息financial information第十五章、企业财务报告----现金流量表与所有者和权益变动表现金等价物cash equivalent现金流动表cash flow statement经营活动operating activity投资活动investment activity筹资活动financing activity直接法direct method间接法indirect method工作底稿法working sheet methodT型帐户法T account method第十六章、会计调整会计调整Accounting Adjustment会计政策变更Accounting policy change追溯调整法retrospective application未来适用法prospective application会计估计变更accounting estimate change会计差错更正accounting error correction资产负债表日后事项event occurring after the balance sheet date 调整事项adjustment event非调整事项non-adjustment event第十七章、财务报表分析财务报表分析financial statements analysis结构分析法structural analysis method趋势分析法trend analysis method比率分析法ratio analysis method偿债能力debt repayment ability流动比率current ratio速动比率quick ratio资产负债率liabilities to assets ratio产权比率liabilities to equity ratio有形净值负债率liabilities to tangible assets ratio已获利息倍数interest coverage营运能力operating capacity存货周转率inventory turnover ratio应收账款周转率receivable turnover ratio营业周期operating period总资产周转率assets turnover ratio流动资产周转率current assets turnover ratio盈利能力profitability销售毛利率gross profit ratio销售净利率net income to sales ratio资产净利率rate of return on total assets净资产收益率return on shareholders’ equity权益乘数equity multiplier市场价值market value每股盈余earnings per share, EPS市盈率price earnings ratio股利支付率dividend payout ratio每股净资产net assets per share第十八章、理解财务报表财务报表附注notes to financial statements审计报告audit report审计意见audit opinion无保留意见unqualified opinion保留意见qualified opinion否定意见adverse opinion无法表示意见disclaimer opinion第十九章、传统财务报告的补充形式分部报告segmental reporting业务分部operating segmental地区分部geographical segmental报告分部reporting segmental主要报告形式principle reporting form次要报告形式secondary reporting form中期财务报告interim financial report分离观discrete view整体观integral view管理当局讨论与分析management’s discussion and analysis, MD&A 财务预测报告financial forecasted report社会责任报告social responsibility report。

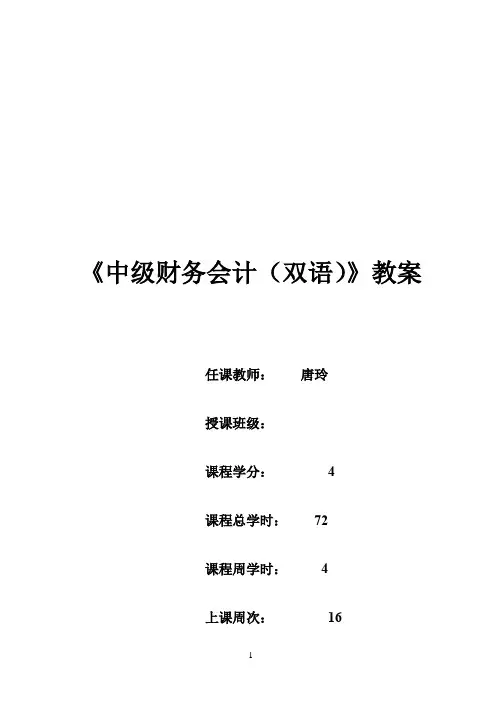

《中级财务会计(双语)》教案任课教师:唐玲授课班级:课程学分: 4课程总学时:72课程周学时: 4上课周次:16教学进度计划教学内容总学时教学手段教学环境第一章总论 4 多媒体课堂教学第二章货币与金融资产 6 多媒体课堂教学第三章应收及预付款项 4 多媒体课堂教学第四章存货 6 多媒体课堂教学第五章长期股权投资 6 多媒体课堂教学第六章固定资产8 多媒体课堂教学第七章无形资产及其他资产 4 多媒体课堂教学第八章流动负债 6 多媒体课堂教学第九章长期负债 4 多媒体课堂教学第十章所有者权益 2 多媒体课堂教学第十一章收入、费用、利润6多媒体课堂教学第十二章财务报告 6 多媒体课堂教学实习10 课堂实践合计72每节课时分配参见课程教学的基本内容。

参考书目:(一)使用教材:唐纳德.E.基索、杰里.J.韦安特著《Intermediate Accounting》中国人民大学出版社李宝珍、裴淑红编《财务会计学》中国市场出版社(二)主要参考书目:《中级会计实务》财政部会计资格评价中心编经济科学出版社《注册会计师全国统一考试辅导教材——会计》中国财政经济出版社《Financial Accounting》,沃尔特·T·小哈里森、查尔斯·T·亨格瑞,美国:清华大学出版社,课程简介中级财务会计(双语)课程是会计学专业、财务管理专业的一门专业必修课和核心课程,是会计专业知识结构中的主体部分。

本课程的任务是介绍财务会计的基本理论和实务,培养学生从事财务会计工作应具备的基本知识、基本技能和操作能力。

本课程共72学时,4.5个学分,其中62个学时为课堂讲授,10个实习课时。

通过本课程的教学,使学生能够掌握会计核算的相关知识和方法,为其进一步学习打下良好的基础。

教学中应注意对学生基本技能的培养,实现应用型人才的培养目标。

课次 1 课时 2 累计课时 2 教学目的与要求通过教学,应使学生了解该课程的内容;一般掌握理解财务会计的目标、基本假设、会计信息质量要求。

东财《中级财务会计》第四章存货课堂笔记东财《中级财务会计》第四章存货课堂笔记◆主要知识点掌握程度了解存货的概念、特征、确认条件和分类,发出存货的计价⽅法,存货估价法,存货可变现净值的确定⽅法,存货清查的⽅法。

掌握存货初始计量的基本要求及通过⾃制、投资者投⼊、接受捐款、债务重组、⾮货币性资产交换等取得存货的会计处理,周转材料的摊销⽅法,发出库存商品的会计处理,存货盘存与盘亏的会计处理。

重点掌握外购存货和委托加⼯存货的会计处理,发出原材料的会计处理,计划成本法,存货跌价准备的计提⽅法。

◆知识点整理⼀、存货及其分类(掌握)(⼀)存货的概念与特征:存货,是指企业在⽇常活动中持有以备出售的产成品或商品、处在⽣产过程中的在产品、在⽣产过程或提供劳务过程中耗⽤的材料和物料等。

特征:1、存货是⼀种具有物质实体的有形资产。

2、存货是⼀种流动资产,具有较⼤流动性。

3、存货是以在正常⽣产经营过程中被销售或耗⽤为⽬的⽽取得。

4、存货属于⾮货币性资产,存在价值减损的可能性。

(⼆)存货的确认条件:存货同时满⾜下列条件的,才能予以确认:(1)与该存货有关的经济利益很可能流⼊企业;(2)该存货的成本能够可靠地计量。

(三)存货的分类:1、按经济⽤途分:原材料、在产品、⾃制半成品、产成品、商品、周转材料。

2、按存放地点分:在库存货、在途存货、在制存货、在售存货。

3、按取得⽅式分:外购存货、⾃制存货、委托加⼯存货、投资者投⼊的存货、接受捐赠取得的存货、通过债务重组取得的存货、⾮货币性交换取得的存货、盘盈的存货等。

⼆、存货的初始计量—现购(掌握)(⼀)外购存货成本的构成存货的采购成本,包括购买价款、相关税费、运输费、装卸费、保险费以及其他可归属于存货采购成本的费⽤。

购买价款:指所购货物发票账单上列明的价款,但不包括按规定可予抵扣的增值税额。

相关税费:指进⼝关税以及购买、⾃制湖委托加⼯存货发⽣的消费税、资源税和不能从增值税销项税额中抵扣的进项税额其他可归属于存货采购成本的费⽤:指存货采购过程中发⽣的除上述各项费⽤以外的仓储费、包装费、运输途中的合理损耗、⼤宗物资的市内运杂费、⼊库前的挑选整理费⽤等可归属于存货采购成本的费⽤。

Chapter 4The Income Statement and Statement of Cash FlowsQUESTIONS FOR REVIEW OF KEY TOPICSQuestion 4-5The term earnings quality refers to the ability of reported earnings (income) to predict a company’s future earnings. After all, an income statement simply reports on events that already have occurred. The relevance of any historical-based financial statement hinges on its predictive value.Question 4-7The process of intraperiod tax allocation matches tax expense or tax benefit with each major component of income, specifically continuing operations and any item reported below continuing operations. The process is necessary to achieve the desired result of separating the total income effects of continuing operations from the two separately reported items - discontinued operations and extraordinary items, and also to show the after-tax effect of each of those two components.Question 4-9Extraordinary items are material gains and losses that are both unusual in nature and infrequent in occurrence, taking into account the environment in which the entity operates.Question 4-11GAAP permit alternative treatments for similar transactions. Common examples are the choice among FIFO, LIFO, and average cost for the measurement of inventory and the choice among alternative revenue recognition methods. A change in accounting principle occurs when a company changes from one generally accepted treatment to another.In general, we report voluntary changes in accounting principles retrospectively. This means revising all previous periods’ financial statements as if the new method were used in those periods. In other words, for each year in the comparative statements reported, we revise the balance of each account affected. Specifically, we make those statements appear as if the newly adopted accounting method had been applied all along. Also, if retained earnings is one of the accounts whose balance requires adjustment (and it usually is), we revise the beginning balance of retained earnings for the earliest period reported in the comparative statements of shareholders’ equity (or statements of retained earnings if they’re presented instead).Then we create a journal entry to adjust all account balances affected as of the date of the change. In the first set of financial statements after the change, a disclosure note would describe the change and justify the new method as preferable. It also would describe the effects of the change on all items affected, including the fact that the retained earnings balance was revised in the statement of shareholders’ equity along with the cumulative effect of the change in retained earnings.An exception is a change in depreciation, amortization, or depletion method. These changes are accounted for as a change in estimate, rather than as a change in accounting principle. Changes in estimates are accounted for prospectively. The remaining book value is depreciated, amortized, or depleted, using the new method, over the remaining useful life.Question 4-15Comprehensive income is the total change in equity for a reporting period other than from transactions with owners. Reporting comprehensive income can be accomplished with a separate statement or by including the information in either the income statement or the statement of changes in shareholders’ equity.Question 4-22U.S. GAAP designates cash outflows for interest payments and cash inflows from interest and dividends received as operating cash flows. Dividends paid to shareholders are classified as financing cash flows. IFRS allows more flexibility. Companies can report interest and dividends paid as either operating or financing cash flows and interest and dividends received as either operating or investing cash flows. Interest and dividend payments usually are reported as financing activities. Interest and dividends received normally are classified as investing activitiesBRIEF EXERCISESBrief Exercise 4-6*$850,000 x 40%Note: Restructuring costs, interest revenue, and loss on sale of investments are included in income before income taxes and extraordinary item.Brief Exercise 4-9*$5,800,000 x 30%** Loss from operations of discontinued component:Impairment loss ($8 million book value less$7 million net fair value) $(1,000,000) Operating loss (3,600,000) Total before-tax loss $(4,600,000)EXERCISES Exercise 4-3* 30% x $440,000Pretax income from continuing operations $14,000,000Income tax expense (5,600,000) Income from continuing operations 8,400,000 Less: Net income 7,200,000 Loss from discontinued operations $1,200,000 $1,200,000 60%* = $2,000,000 = before tax loss from discontinued operations.*1-tax rate of 40% = 60%Pretax income of division $4,000,000 Add: Loss from discontinued operations 2,000,000 Impairment loss $6,000,000 Fair value of division’s assets$11,000,000 Add: Impairment loss 6,000,000 Book value of division’s assets$17,000,000Requirement 1This is a change in accounting estimate.Requirement 2$2,400,000 Cost$240,000 Previous annual amortization ($2,400,000 ÷ 10 years) x 21/2 yrs. 600,000 Amortization to date (2009-2011)1,800,000 Book value÷ 5 yrs. Estimated remaining life(given)$ 360,000 New annual amortizationTiger EnterprisesStatement of Cash FlowsFor the Year Ended December 31, 2011($ in thousands)Cash flows from operating activities:Net income $ 900Adjustments for noncash effects:Depreciation expense 240Changes in operating assets and liabilities:Decrease in accounts receivable 80Increase in inventory (40)Increase in prepaid insurance (30)Decrease in accounts payable (60)Decrease in administrative and other payables (100)Increase in income taxes payable 50Net cash flows from operating activities $1,040 Cash flows from investing activities:Purchase of plant and equipment (300) Cash flows from financing activities:Proceeds from issuance of common stock 100Proceeds from note payable 200Payment of dividends (1) (940)Net cash flows from financing activities(640)Net increase in cash 100 Cash, January 1 200 Cash, December 31 $ 300(1)Retained earnings, beginning $540+ Net income 900- Dividends x x = $940Retained earnings, ending $500The T-account analysis of the transactions related to operating cash flows is shown below. To derive the cash flows, the beginning and ending balances in the related assets and liabilities are inserted, together with the revenue and expense amounts from the income statements. In each balance sheet account, the remaining (plug) figure is the other half of the cash increases or decreases.Based on the information in the T-accounts above, the operating activities section of the SCF for Tiger Enterprises would be as shown next.Exercise 4-23 (concluded)Tiger EnterprisesStatement of Cash FlowsFor the Year Ended December 31, 2011($ in thousands)Cash flows from operating activities:Collections from customers $ 7,080Prepayment of insurance (130)Payment to inventory suppliers (3,460)Payment for administrative & other exp. (1,900)Payment of income taxes (550)Net cash flows from operating activities $ 1,040CPA / CMA REVIEW QUESTIONSCPA Exam Questions1. c. U.S. GAAP requires that discontinued operations be disclosed separatelybelow income from continuing operations.2. d.Other than sales, COGS, and administrative expenses, only the gain or lossfrom disposal of equipment is considered part of income from continuingoperations. Income from continuing operations was ($5,000,000 - 3,000,000- 1,000,000 + 200,000) = $1,200,000.3. a. In a single-step income statement, revenues include sales as well as otherrevenues and gains.Sales revenue $187,000Interest revenue 10,200Gain on sale of equipment 4,700Total $201,900The discontinued operations and the extraordinary gain are reported belowincome from continuing operations.4.a.The $400,000 impairment loss and the $1,000,000 loss from operationsshould be combined for a total loss of $1,400,000.5.d. The change in the estimate for warranty costs is based on new informationobtained from experience and qualifies as a change in accounting estimate. Achange in accounting estimate affects current and future periods and is notaccounted for by restating prior periods. The accounting change is a part ofcontinuing operations.6. a. Dividends paid to shareholders is considered a financing cash flow, not anoperating cash flow.7. c. Issuing common stock for cash is considered a financing cash flow, not aninvesting cash flow.CMA Exam Questions1.d. Discontinued operations and extraordinary gains and losses are shownseparately in the income statement, below income from continuing operations.The cumulative effect of most voluntary changes in accounting principle isaccounted for by retrospectively revising prior years’ financial statements.2.c.The operating section of a retailer’s income statement includes all revenuesand costs necessary for the operation of the retail establishment, e.g., sales,cost of goods sold, administrative expenses, and selling expenses.3 a. Extraordinary items should be presented net of tax after income fromoperations.PROBLEMSProblem 4-9Requirement 1Diversified Portfolio CorporationStatement of Cash FlowsFor the Year Ended December 31, 2011Cash flows from operating activities:Collections from customers (1)$880,000Payment of operating expenses (2)(660,000)Payment of income taxes (3)(85,000)Net cash flows from operating activities $135,000Cash flows from investing activities:Sale of investments 50,000Net cash flows from investing activities 50,000Cash flows from financing activities:Proceeds from issue of common stock 100,000Payment of dividends (80,000)Net cash flows from financing activities 20,000Increase in cash 205,000Cash and cash equivalents, January 1 70,000Cash and cash equivalents, December 31 $275,000(1)$900,000 in service revenue less $20,000 increase in accounts receivable.(2) $700,000 in operating expenses less $30,000 in depreciation less $10,000 increase in accounts payable.(3)$80,000 in income tax expense plus $5,000 decrease in income taxes payable.Problem 4-9 (concluded)Requirement 2Diversified Portfolio CorporationStatement of Cash FlowsFor the Year Ended December 31, 2011Cash flows from operating activities:Net income $120,000Adjustments for noncash effects:Depreciation expense 30,000Changes in operating assets and liabilities:Increase in accounts receivable (20,000)Increase in accounts payable 10,000Decrease in income taxes payable (5,000)Net cash flows from operating activities $135,000。