双语会计

- 格式:ppt

- 大小:5.35 MB

- 文档页数:44

会计双语教学中存在的问题及对策探析摘要:为适应教学模式的国际化发展,许多高校在某些专业上采用了双语教学模式,本文以黑龙江外国语学院会计专业为背景详细的阐述了会计双语教学的含义和会双语教学中存在的问题及对策。

关键词:会计双语教学问题对策双语教学的模式有很多,对于会计专业而言,采用的双语教学模式为汉语与英语的教学模式。

这种模式也可以理解为会计专业语言与相关的英语会计语言模式。

采用这种模式教学的最终目的是将学生培养成既可以熟练的掌握会计专业知识又可以用英语进行会计知识交流的综合型人才。

对于黑龙江外国语学院来说,其学院的人才培养模式就是采用的专业+外语的人才培养模式,英语专业的师资力量、外教教师队伍和实践教学基地与其他同等院校相比都处于领先地位。

所以采用双语教学模式是非常容易且可行的。

但在会计专业双语教学的过程中还是存在着许多问题,这也是学院迫切需要解决的。

1 会计双语教学的含义很多人认为,双语教学就是将学生的专业知识用英语在讲述一遍,这样的理解是不对的,双语教学的模式有很多,不只限于英语。

也可以理解为是除专业语言以外的第二种语言,这里所说的第二种语言起到的应是辅助的作用。

双语教学的目的是让学生将另外一种语言作为工具,用另外一种视觉来理解自己的专业知识。

所以,双语教学的意义是为了使学生更好的、以多种角度、多方面信息来看待和学习自己的专业。

为使自己能成为综合型人才打下夯实的基础。

2 会计双语教学中存在的问题2.1 综合型教师较少无论是黑龙江外国语学院的英语专业教师还是会计专业教师,教师的教学水平都是毋庸置疑的。

但学校里综合型教师的教师队伍和师资力量相对较弱。

这里的综合型教师是指既可以掌握会计专业知识又可以教授学生英语知识的教师。

因为综合型教师相对较少,学校为了可以开展双语教学模式只能采取专业知识由会计专业教师来讲解,而相关的英语知识由英语教师来讲。

但这样的教学方式达到的教学效果并不明显,因为,会计知识和英语知识是在两堂课进行讲解的,这就缺乏了课堂的连贯性,给学生们的印象也不是很深刻,学生会觉得只不过上了一节专业课和一节英语课罢了,两节课之间没什么太大关系。

会计的英语是什么会计和英语专业都是比较热门的专业,因此找工作的竞争也会很激烈。

下面店铺为大家带来会计的英语意思和相关用法,欢迎大家一起学习!会计的英语意思accounting会计的英语例句那个会计向营业部的职员介绍了自己的工作情况。

The accountant described his work to the sales staff.雇会计划得来。

It would pay (you) to use an accountant.他已由仓库调到会计室任职。

He has transferredfrom the warehouse to the accounts office.会计拐走了俱乐部的资金。

The treasurer has run off with the club's funds.会计科已完全计算机化了。

The accounts section has been completely computerized.我们的经理精通会计制度。

Our manager is conversant with account system.通过分析虚假会计报告的成因,提出了治理会计报告中虚假会计信息的对策。

The ctmse of the mendacious financial report is analyzed in this paper.会计信息资源是通过会计核算建造的人造资源;It is manmade resources by the wag of accounting.会计学就是一部会计伦理学。

Accounting science is accounting ethics.会计的双语例句1. The unemployed executives include former salesmanagers, directors and accountants.被解雇的管理人员包括前销售经理、主管和会计。

会计的英文会计是众多职业中的一种,那么会计的英文翻译是什么你了解吗那么现在来学习关于会计的英语知识及一些相关例句吧,希望能够帮到大家!会计的英文翻译会计[kuài jì]accounting:会计;会计学;记账。

accountant:会计人员,会计师。

accountancy:会计学;会计工作,会计职业。

bookkeeper:(商人的)记账人,(政府机关等的)簿记员,会计。

bursar:(大学等的)财务主管;奖学金获得者。

会计的网络解释1. Accountant:[问题] 有税务代开的做路劳务发票(Invoice)入账的.盼高人指点 [以下内容仅供参考] 如果金...[问题] 我们是小公司 1.职工李四用自己的现金(cash)为公司垫付给b公司账款5000,b公司发票(Invoice)没到2.收到b公司开来发票(Invoice)5000 ,3.偿还李四现金(cash)5000 会计(accountant)分录怎么做谢谢.2. accountancy:2023年3月,ICAEW的会刊会计 (Accountancy)公布了一份由独立机构所作的问卷调查. 该问卷以反对合并的ICAEW 会员为对象,了解他们反对的理由. 问卷显示,64%是担心合并会稀释C.A.在市场上的含金量,这事关会员的身份与地位.3. treasurer:办公室由会长(President)、副会长(Vice President)、秘书、会计(Treasurer)及其他所需人员组成. 会长是业主协会的法人代表. 会长和副会长必须是理事会理事,会长人选必须具有1年以上理事工作经验. 会长的任期为1年,只可以连任1届.会计的双语例句1. 据世界著名会计师事务所德勤评估,巨人网络员工平均收入水平位于行业高端。

The average salary of Giant"s employees tops others"in the same industry, according to Deloitte, one of the world"s leading accounting firms.2. 公司内部组织机构健全,内部管理规范有序,公司主要管理制度有:公司管理手册、人事管理手册、行政后勤管理手册,工程招标代理管理手册,财务会计管理手册,公司员工业绩考评管理手册等。

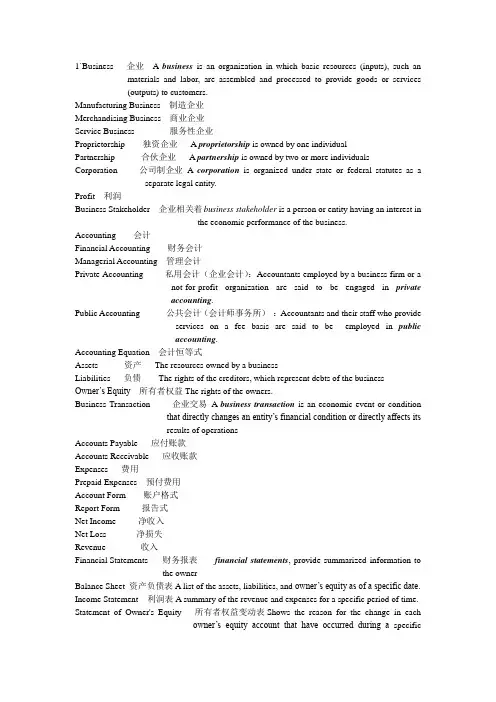

1`Business 企业 A business is an organization in which basic resources (inputs), such an materials and labor, are assembled and processed to provide goods or services(outputs) to customers.Manufacturing Business 制造企业Merchandising Business 商业企业Service Business 服务性企业Proprietorship 独资企业 A proprietorship is owned by one individualPartnership 合伙企业 A partnership is owned by two or more individuals Corporation 公司制企业A corporation is organized under state or federal statutes as a separate legal entity.Profit 利润Business Stakeholder 企业相关着business stakeholder is a person or entity having an interest inthe economic performance of the business.Accounting 会计Financial Accounting 财务会计Managerial Accounting 管理会计Private Accounting 私用会计(企业会计):Accountants employed by a business firm or anot-for-profit organization are said to be engaged in privateaccounting.Public Accounting 公共会计(会计师事务所):Accountants and their staff who provideservices on a fee basis are said to be employed in publicaccounting.Accounting Equation 会计恒等式Assets 资产The resources owned by a businessLiabilities 负债The rights of the creditors, which represent debts of the business Owner’s Equity所有者权益The rights of the owners.Business Transaction 企业交易A business transaction is an economic event or conditionthat directly changes an entity’s financial condition or directly affects itsresults of operationsAccounts Payable 应付账款Accounts Receivable 应收账款Expenses 费用Prepaid Expenses 预付费用Account Form 账户格式Report Form 报告式Net Income 净收入Net Loss 净损失Revenue 收入Financial Statements 财务报表financial statements, provide summarized information tothe ownerBalance Sheet 资产负债表A list of the assets, liabilities, and owner’s equity as of a specific date. Income Statement 利润表A summary of the revenue and expenses for a specific period of time. Statement of Owner's Equity 所有者权益变动表Shows the reason for the change in eachowner’s equity account that have occurred during a specificperiod of time.Generally Accepted Accounting Principles (GAAP) 公认会计原则Statement of Cash Flows 现金流量表A summary of the cash receipts and disbursements for a specific period of time.Certified Public Accountant (CPA) 注册会计师2`Account 账户An account is a separate record to show the increase and decrease of each financial statement item.Ledger 分类账A group of accounts for a business entity is called a ledgerChart of Accounts 科目表A list of the accounts in the ledger is called a chart of account Revenues 收入类账户Expenses 资产消耗Drawing 提款账户Balance of the Account 账户余额Debits 借方金额Credits 贷方金额T Account T 型帐 An account can be drawn to resemble the letter T, it is called a T account. Double-Entry Accounting 复式记账会计Journal Entry 日记账分录Journal 日记账Journalizing 日记簿记账2Posting 过账Two-Column Journal 二栏式日记账Unearned Revenue 预收收入The liability created by receiving the cash in advance of providing the service is called unearned revenve.Trial Balance 试算平衡3`Cash Basis 现今制(收付实现制)period in which cash is received or paidAccrual Basis 应计制(权责发生制)period in which they are earnedAdjusting Process 调整程序Accruals 应计项目Deferrals 递延项Deferred Expenses 递延费用(预付费用)have been initially recorded as assets but areexpected to become expensesAccrued Expenses 应计费用(accrued liabilities)Deferred Revenues 递延收入(预收收入)have ben initially recorded as liability bu areexpected to become revenuesAccrued Revenues 应计收入(accrued assets)Prepaid Expenses 预付费用Adjusting Entries 调整账户Unearned Expenses 预收费用?Adjusted Trial Balance 调整试算平衡Accumulated Depreciation累计折旧Depreciation 折旧Book Value of the Asset 资产账面价值Depreciation Expense 折旧费用Contra Accounts 备抵账户accumulated depreciation accountsFixed Assets 固定资产(plant assets)4`Accounting Cycle 会计循环Work Sheet 工作底稿Current Assets 流动资产Cash and other assets that are expected to be converted into cash,sold, or used up usually in less than a year are current assets.Current Liabilities 流动负债Long-Term Liabilities 长期负债Post-Closing Trial Balance 结账后试算表Closing Entries 结账分录Real Account 实账户Temporary Accounts (Nominal Accounts ) 虚账户(类似过渡账户)Income Summary 损益表(反应某一特定时期收入费用状况的报表)5`Accounting System 会计系统General Ledger 总分类账Accounts Payable Subsidiary Ledger 应付账款明细账Accounts Receivable Subsidiary Ledger 应收账款明细账Purchases Journal 赊购日记账The purchases journal is designed for recording allpurchases on account.Cash Payments Journal 现金支出日记账Revenue Journal 赊销日记账Cash Receipts Journal 现金收入日记账All transactions that involve the receipt of cash arerecorded in the cash receipts journalSpecial Journals 特种日记账Controlling Account 控制账户General Journal 普通日记账6` Multiple-Step Income Statement 多步式损益表Single-Step Income Statement 单步式损益表Sales 销售额Sales Discounts 销售折扣Sales Returns & Allowances 销售退回及折让Purchase 购买额Purchase Discount 购货折扣Purchase Returns & Allowances 购货退回或折让Periodic Method 实地盘存制Perpetual Method 永续盘存制Merchandise Inventory 商品存货Cost of Merchandise Sold 商品销售成本Gross Profit 毛利润Administrative Expenses管理费用Selling Expenses 销售费用Income from Operations 营业收入Other Expense 其他费用Other Income 其他收益Invoice 发票Credit Memorandum 贷项通知单Debit Memorandum 借项通知单FOB Destination 目的地交货FOB Shipping Point 船上交货Trade Discounts 商业折扣7` Cash 现金Bank Reconciliation 银行存款余额调节表Check 支票Remittance advice 汇款通知Transactions register 交易登记册(交易账簿)Deposit ticket 存款票据Signature card 签名卡Drawee 付款人Drawer 发票人Payee 收款人8` Accounts Receivable 应收账款Notes Receivable 应收票据Allowance Method 备抵法Uncollectible Accounts Expense 坏账损失Direct Write-Off Method 直接冲销法Aging the Receivables 应收账款账龄分析法Net Realizable Value 可变现价值Maturity Value 到期价值Promissory Note 本票9`Inventory 存货Periodic Inventory System 实地盘存制Perpetual Inventory System 永续盘存制Average Cost Method 加权平均法First-in, First-out (FIFO) Method 先进先出法Last-in, First-out (LIFO) Method 后进先出法Lower-of-Cost-or-Market (LCM) Method 成本与市价孰低法Gross Profit Method 毛利率法Retail Inventory Method 零售价法10`Fixed assets 固定资产损失Depreciation 折旧Residual Value 剩余价值Book Value 账面价值Accelerated Depreciation Method 加速折旧法Straight-Line Method 直线法Declining-Balance Method 余额递减法Units-of-Production Method 工作量法Trade-in Allowance 交换折价Depletion 折耗Amortization 摊销Intangible Assets 无形资产Copyright 版权Patents 专利Goodwill 商誉Trademark 商标Boot 补价(附得利益)11`Discount 折价Discount Rate 贴现率Proceeds 应收票据贴现率Gross Pay 毛工资Net Pay 净薪资Payroll 薪酬Defined Contribution Plan 确定投入计划Defined Benefit Plan 确定收益计划12`Stock 股份Stockholders 股东Stockholders’Equity 股东权益Retained Earnings 留存收益Paid-in Capital 实收资本Common Stock 普通股Preferred Stock 优先股Par 平价Cumulative Preferred Stock 累积优先股Nonparticipating Preferred StockStated Value 设定价值Outstanding Stock发行在外股票Premium 溢价Treasury Stock 库藏股票Stock Split 股票分割Cash Dividend 现金股利Stock Dividend 股票股利。

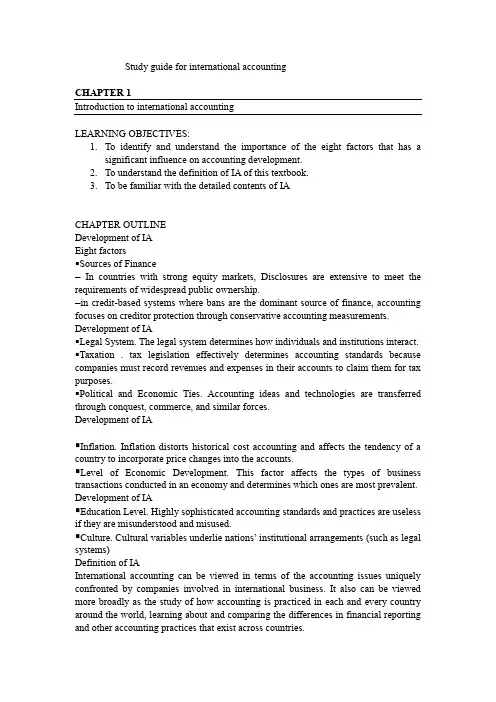

Study guide for international accountingCHAPTER 1Introduction to international accountingLEARNING OBJECTIVES:1.To identify and understand the importance of the eight factors that has asignificant influence on accounting development.2.To understand the definition of IA of this textbook.3.To be familiar with the detailed contents of IACHAPTER OUTLINEDevelopment of IAEight factors▪Sources of Finance–In countries with strong equity markets, Disclosures are extensive to meet the requirements of widespread public ownership.–in credit-based systems where bans are the dominant source of finance, accounting focuses on creditor protection through conservative accounting measurements. Development of IA▪Legal System. The legal system determines how individuals and institutions interact. ▪Taxation . tax legislation effectively determines accounting standards because companies must record revenues and expenses in their accounts to claim them for tax purposes.▪Political and Economic Ties. Accounting ideas and technologies are transferred through conquest, commerce, and similar forces.Development of IA▪Inflation. Inflation distorts historical cost accounting and affects the tendency of a country to incorporate price changes into the accounts.▪Level of Economic Development. This factor affects the types of business transactions conducted in an economy and determines which ones are most prevalent. Development of IA▪Education Level. Highly sophisticated accounting standards and practices are useless if they are misunderstood and misused.▪Culture. Cultural variables underlie nations’ institutional arrangements (such as legal systems)Definition of IAInternational accounting can be viewed in terms of the accounting issues uniquely confronted by companies involved in international business. It also can be viewed more broadly as the study of how accounting is practiced in each and every country around the world, learning about and comparing the differences in financial reporting and other accounting practices that exist across countries.Definition of IAThis book is designed to be used in a course that attempts to provide an overview of the broadly defined area of international accounting, and that focuses on the International Financial Reporting Standards (IFRSs) issued by International Accounting Standards Board (IASB) and some international hot topics.Detailed Contents on IA▪International accounting is a well-established specialty area within accounting and has two major dimensions:▪Comparative: Examining how and why accounting principles differ from country to country▪Pragmatic: accounting for the operational problems and issues encountered by individuals and firms in international business.Detailed Contents on IA▪L. Radebaugh and S. Gray (1993, p. 9) also write that the study of international accounting involves two major areas:▪descriptive/comparative accounting and the accounting dimensions of international transactions/multinational enterprises.▪principally covers the problems encountered by multinational corporations: Financial reporting problems, translation of foreign currency financial statements, information systems, budgets and performance evaluation, audits, and taxes.Objectives of Research on IA▪Global Harmonization. As business entities increasingly operate in multiple counties, they encounter the cost of dealing with diversity in financial reporting requirements. ▪Financial Reporting in Emerging Economics. As ever increasing amounts of capital are invested in countries with emerging economics, the quality of financial reporting in these countries is coming under the microscope.Objectives of Research on IA▪Social and Environmental Reporting. One of the consequences of the globalization of business enterprises is that companies now have stakeholders not just in their home country but in all the countries where they operate.CHAPTER 2International accounting harmonizationLEARNING OBJECTIVES:1. Recognize the arguments for and against harmonization.2. Identify the pressures for and the obstacles to harmonization.3. Become familiar with the main organizations involved in harmonization.CHAPTER OUTLINEHistory and Recent Developments▪Prior to 1960, there was little effort devoted to the international harmonization of accounting standards. Efforts have been made by a number of organizations to reduce the differences between accounting systems since then.Main International Bodies InvolvedPrinciples-Based vs. Rules-Based Approaches▪Principles-based standards represent the best approach for guiding financial reporting and standard setting, of any given transaction.▪Rules-based standards provide companies the opportunity to structure transactions to meet the requirements for particular accounting treatments.Obstacles to Harmonization▪Differences in the regulatory framework .▪The "true and fair view" .▪The various interpretation of fundamental principle .▪A binding tax accounting linkLikely future trends▪The convergence of IAS and national accounting standards is, and always has been one of the IASB's key objectives. Three basic future roles exist for the IASB:✓Producing standards for those countries that have no standards of their own✓Assisting in the reduction of diverse national practices✓Acting as an umbrella organizing for national standard settersImplication▪The demand of international capital markets helps to drive harmonization. IASB has become more cognizant of the need to work with national standard setters and bring them into membership of IASB, which may be possible to eliminate the differences between national and international standards. The current agreement could then be viewed as the first step in a much longer process.IASB ( International Accounting Standards Board)▪IASB's responsibilities:✓Develop and issue International Financial Reporting Standards and Exposure Drafts, and✓Approve Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC).CHAPTER 3ACCOUNTING FOR FOREIGN CURRENCYLEARNING OBJECTIVES:▪ 1. Provide an overview of foreign exchange markets and define related terminology.▪ 2. Describe the different types of foreign exchange exposure and exchange difference.▪ 3. Understand some of the more common foreign currency transactions. CHAPTER OUTLINEAccounting for Foreign Currency Transactions▪a transaction that requires payment or receipt (settlement) in a foreign currency is called a foreign currency transaction.▪Exchange difference is the difference resulting from reporting the same number of units of a foreign currency in the reporting currency at different exchange rates. Accounting for Foreign Currency Transactions▪Importing or Exporting of Goods or Services✓At the date the transaction is first recognized.✓At each balance sheet date that occurs between the transaction date and the settlement date.✓At the settlement date.Accounting for Foreign Currency Transactions▪Recognition of Exchange Differences✓the single- transaction approach✓the two- transaction approachHedging Foreign Exchange Rate Risk▪A derivative instrument may be defined as a financial instrument that by its terms at inception or upon occurrence of a specified event, provides the holder (or writer) with the right (or obligation) to participate in some or all of the price changes of another underlying value of measure, but does not require the holder to own or deliver the underlying value of measure.Hedging Foreign Exchange Rate Risk▪two broad categories✓Forward-based derivatives, such as forwards, futures, and swaps, in which either party can potentially have a favorable or unfavorable outcome, but not both simultaneously (e.g., both will not simultaneously have favorable outcomes).✓Option-based derivatives, such as interest rate caps, option contracts, and interest rate floors, in which only one party can potentially have a favorable outcome and it agrees to a premium at inception for this potentiality; the other party is paid the premium, and can potentially have only an unfavorable outcome.Hedging Foreign Exchange Rate Risk▪Forward Exchange Contracts▪Options▪Fair Value Hedge – Using a Forward Contract▪Hedging an Identifiable Foreign Currency Commitment Using a Forward Contract (A Fair Value Hedge)▪Hedging a Forecasted Transaction Using an Option (Cash Flow Hedge) Translation Of Foreign Financial Statements▪Derivation of the Issue of Foreign Currency Translation✓Translation exposure, sometimes also called accounting exposure, refers to gains or losses caused by the translation of foreign currency assets and liabilities into the currency of the parent company for accounting purposes.✓The choice of any method for the translation of the financial statements of a foreign business operation involves two basic questions:(i) how shall foreign currency financial statements be translated——in particular what exchange rates are to be used for different assets/liabilities/equity accounts?(ii) how and when shall foreign exchange gains or losses be recognized?CHAPTER 4Business combinationsLEARNING OBJECTIVES:•(1)Understand the economic motivations underlying business combinations.•(2)Learn about the alternative forms of business combinations, from both the legal and accounting perspectives.•(3)Introduce concepts of accounting for business combinations;•(4)emphasizing the purchase method.•(5)See how firms make cost allocatCHAPTER OUTLINE4.1 The Accounting Concept of Business Combinations4.2 The Legal Form of Business Combinations4.3 Reasons for Business Combinations4.4 Accounting for Business Combinations Under the Purchase Method4.5 The measurement of Goodwill and ControversyCHAPTER 5Consolidated financial statementsLEARNING OBJECTIVES:•(1)Recognize the benefits and limitations of consolidated financial statements.•(2)Understand the requirements for inclusion of a subsidiary in consolidated financial statements.•(3)Apply the consolidation concepts to parent company recording of the investment in a subsidiary at the date of acquisition.•(4)Allocate the excess of the fair value over the book value of the subsidiary at the date of acquisition.CHAPTER OUTLINE5.1 Demand from IAS 275.2 The adjustment of Intercompany Transactions5.3 Parent Company Recording and Consolidated Statement of financialposition at Acquisition Date5.4 Subsequent Statement of financial positionCHAPTER 6Accounting for changing priceLEARNING OBJECTIVES:▪ 1. Explain basic concepts relating to inflation accounting. Understand the distinction between changes in the general level of prices in an economy, which affect the purchasing power of the measuring unit, and changes in the prices of specific assets and liabilities, which affect balance sheet valuations and income measurement.▪ 2. Explain the underlying thoughts and methods of dealing with inflation.▪ 3. Restate conventional financial statements based on historical costs to a common measuring unit.CHAPTER OUTLINEDefects of historical cost accounting▪The results of comparison of performance and position statements over time will be unreliable, because amounts are not valued in terms of common units.▪Borrowings are shown in monetary terms, but in a time of rising prices a gain is actually made (or a loss in times of falling prices) at the expense of the lender as, in real terms, the value of the loan has decreased or increased.▪Conversely, gains arising from holding assets are not recognized.▪Depreciation writes off the historical cost over time, but, where asset values are low (because based on outdated historical costs), depreciation will be correspondingly lower, so that a realistic charge for asset consumption is not matched against revenue in the performance statements.Overview of Accounting for changing prices▪Changing prices affect financial reports in two principal ways:✓Measuring unit problem✓Valuation problemAccounting Measurement Alternatives▪Acquisition Cost/Nominal Dollar Accounting▪Acquisition Cost/Constant Dollar Accounting▪Current Cost/Nominal Dollar Accounting▪Current Cost/Constant Dollar AccountingRestatement of Monetary and Non-monetary Items▪A monetary item is a claim receivable or payment in a specified number of dollars, regardless of changes in the purchasing power of the dollar.▪A non-monetary item is any asset, liability, or shareholders’ equity account that has no claim to or for a specified number of dollars.Evaluation of Acquisition Cost/Constant Dollar Accounting▪When compared with current-cost accounting (discussed next), constant-dollar accounting carries a higher level of objectivity. Independent accountants can examine canceled checks, invoices, and other documents to verify acquisition-cost valuations and transaction dates. The restatements to constant dollars use general price indexes published by governmental bodies.Evaluation of Current Cost/Nominal Dollar Accounting▪Current-cost accounting measures performance and financial position in terms of the current market prices. Managers likely make decisions in terms of current costs, not out-of-date acquisition costs. Thus, for assessing management’s actions, current-cost financial statements provide information on the same basis that management used to make decisions.▪Critics note two shortcomings of current cost/nominal dollar accounting:✓auditors cannot as easily verify current-replacement-cost valuations as they can acquisition-cost valuations.✓the use of nominal dollars means that the measuring unit underlying current-replacement-cost valuations varies across time.CHAPTER 7Accounting for financial instrumentLEARNING OBJECTIVES:1. Examine budgeting and performance evaluation issues for international firms.2. Discuss global risk management tools and strategies including multinational capitalbudgeting and foreign exchange risk management.3. Identify the main constituents of cross-border transfer pricing policies, define thetransfer pricing methods, and consider the issues in devising a transfer pricing strategy.4. Recognize the critical role of information technology systems in the effectiverecording, processing and dissemination of financial and managerial accounting information.CHAPTER OUTLINE1 Challenge for the accounting profession2 Accounting and Reporting for Financial Instruments: International Developments ▪In the process of completing the most recent series of amendments, the IASB conducted an extensive due process, which began in 2001 and included the following: ▪(1) Conducting numerous board deliberations prior to the June 2002 exposure drafts;2.1 Overview of IAS 32▪The following are the major U.S. standards that address financial instruments accounting and reporting:▪(1) SFAS 107, Disclosures About Fair Value of Financial Instruments.▪(2) SFAS 133, Accounting for Derivative Financial Instruments and Hedging Activities.▪(3) SFAS 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.▪(4) SFAS 150, Accounting for Certain Financial Instruments with Characteristics of Both Debt and Equity.2.2 Overview of IAS 392.3 Recognition and Derecognition of Financial Assets and Liabilities2.4 Hedge Accounting Guidance2.5 Impairment of Financial Instruments2.6 Convergence with U.S. GAAP3 Financial instruments3.1 Illustration of Traditional Financial Instrument3.2 Illustration of Derivative Financial Instrument4 DERIV ATIVES USED FOR HEDGING▪SFAS No. 133 established accounting and reporting standards for derivative financial instruments used in hedging activities. Special accounting is allowed for two types of hedges—fair value and cash flow hedges.4.1 Fair Value Hedge4.2 Illustration of Interest Rate Swap4.3 Cash Flow Hedge5 OTHER REPORTING ISSUES▪Additional issues of importance are as follows:▪(1) The accounting for embedded derivatives.▪(2) Qualifying hedge criteria.▪(3) Disclosures about financial instruments and derivatives.Chapter 8 financial reporting in different countriesLearning objectives:•Identify the major policy-setting bodies and their role in the standard-setting process.•Appreciate US GAAP .•Understand convergence of US GAAP to IFRSs.Chapter outline:Parties Involved in Standard SettingSecurities and Exchange CommissionAmerican Institute of CPAsFinancial Accounting Standards BoardFinancial Accounting Standards BoardDue ProcessTypes of PronouncementsGovernmental Accounting Standards Board Generally Accepted Accounting PrinciplesIssues in Financial ReportingIssues in Financial ReportingConceptual FrameworkDevelopment of Conceptual FrameworkChapter 9 corporate governanceLearning objectives:1.describe the definition of corporate governance2.describe some corporate governance theory3.describe the principle of corporate governance chapter outline:2 What is corporate governance?3 Corporate governance theoryPrincipal-agent theoryClassical Stewardship Theory3.3 Modern Stewardship Theory3.4 Stakeholder TheoryPrinciples of corporate governanceCorporate governance modelsMechanisms and controls of corporate governance Features of poor corporate governance。

《国际会计》(双语)课程教学大纲课程编号:02133制定单位:会计学院制定人(执笔人):宋京津,王宏*******制定(或修订)时间:2011年8月26日江西财经大学教务处《国际会计》(双语)课程教学大纲一、课程总述本课程大纲是以2011年国际会计(双语)本科专业人才培养方案为依据编制的。

二、教学时数分配三、单元教学目的、教学重难点和内容设置Study guide for international accountingCHAPTER 1Introduction to international accountingLEARNING OBJECTIVES:1.To identify and understand the importance of the eight factors that has asignificant influence on accounting development.2.To understand the definition of IA of this textbook.3.To be familiar with the detailed contents of IACHAPTER OUTLINEDevelopment of IAEight factors▪Sources of Finance–In countries with strong equity markets, Disclosures are extensive to meet the requirements of widespread public ownership.–in credit-based systems where bans are the dominant source of finance, accounting focuses on creditor protection through conservative accounting measurements. Development of IA▪Legal System. The legal system determines how individuals and institutions interact.▪Taxation . tax legislation effectively determines accounting standards because companies must record revenues and expenses in their accounts to claim them for tax purposes.▪Political and Economic Ties. Accounting ideas and technologies are transferred through conquest, commerce, and similar forces.Development of IA▪Inflation. Inflation distorts historical cost accounting and affects the tendency of a country to incorporate price changes into the accounts.▪Level of Economic Development. This factor affects the types of business transactions conducted in an economy and determines which ones are most prevalent.Development of IA▪Education Level. Highly sophisticated accounting standards and practices are useless if they are misunderstood and misused.▪Culture. Cultural variables underlie nations’ institutional arrangements (such as legal systems)Definition of IAInternational accounting can be viewed in terms of the accounting issues uniquely confronted by companies involved in international business. It also can be viewed more broadly as the study of how accounting is practiced in each and every country around the world, learning about and comparing the differences in financial reporting and other accounting practices that exist across countries.Definition of IAThis book is designed to be used in a course that attempts to provide an overview of the broadly defined area of international accounting, and that focuses on the International Financial Reporting Standards (IFRSs) issued by International Accounting Standards Board (IASB) and some international hot topics.Detailed Contents on IA▪International accounting is a well-established specialty area within accounting and has two major dimensions:▪Comparative: Examining how and why accounting principles differ from country to country▪Pragmatic: accounting for the operational problems and issues encountered by individuals and firms in international business.Detailed Contents on IA▪L. Radebaugh and S. Gray (1993, p. 9) also write that the study of international accounting involves two major areas:▪descriptive/comparative accounting and the accounting dimensions of international transactions/multinational enterprises.▪principally covers the problems encountered by multinational corporations: Financial reporting problems, translation of foreign currency financial statements, information systems, budgets and performance evaluation, audits, and taxes.Objectives of Research on IA▪Global Harmonization. As business entities increasingly operate in multiple counties, they encounter the cost of dealing with diversity in financial reporting requirements.▪Financial Reporting in Emerging Economics. As ever increasing amounts of capital are invested in countries with emerging economics, the quality of financial reporting in these countries is coming under the microscope. Objectives of Research on IA▪Social and Environmental Reporting. One of the consequences of the globalization of business enterprises is that companies now have stakeholders not just in their home country but in all the countries where they operate.CHAPTER 2International accounting harmonizationLEARNING OBJECTIVES:1. Recognize the arguments for and against harmonization.2. Identify the pressures for and the obstacles to harmonization.3. Become familiar with the main organizations involved in harmonization. CHAPTER OUTLINEHistory and Recent Developments▪Prior to 1960, there was little effort devoted to the international harmonization of accounting standards. Efforts have been made by a number of organizations to reduce the differences between accounting systems since then.Main International Bodies InvolvedPrinciples-Based vs. Rules-Based Approaches▪Principles-based standards represent the best approach for guiding financial reporting and standard setting, of any given transaction.▪Rules-based standards provide companies the opportunity to structure transactions to meet the requirements for particular accounting treatments.Obstacles to Harmonization▪Differences in the regulatory framework .▪The "true and fair view" .▪The various interpretation of fundamental principle .▪ A binding tax accounting linkLikely future trends▪The convergence of IAS and national accounting standards is, and always has been one of the IASB's key objectives. Three basic future roles exist for the IASB:✓Producing standards for those countries that have no standards of their own✓Assisting in the reduction of diverse national practices✓Acting as an umbrella organizing for national standard settersImplication▪The demand of international capital markets helps to drive harmonization. IASB has become more cognizant of the need to work with national standard setters and bring them into membership of IASB, which may be possible to eliminate the differences between national and international standards. The current agreement could then be viewed as the first step in a much longer process.IASB ( International Accounting Standards Board)▪IASB's responsibilities:✓Develop and issue International Financial Reporting Standards and Exposure Drafts, and✓Approve Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC).CHAPTER 3ACCOUNTING FOR FOREIGN CURRENCYLEARNING OBJECTIVES:▪ 1. Provide an overview of foreign exchange markets and define related terminology.▪ 2. Describe the different types of foreign exchange exposure and exchange difference.▪ 3. Understand some of the more common foreign currency transactions. CHAPTER OUTLINEAccounting for Foreign Currency Transactions▪ a transaction that requires payment or receipt (settlement) in a foreign currency is called a foreign currency transaction.▪Exchange difference is the difference resulting from reporting the same number of units of a foreign currency in the reporting currency at different exchange rates. Accounting for Foreign Currency Transactions▪Importing or Exporting of Goods or Services✓At the date the transaction is first recognized.✓At each balance sheet date that occurs between the transaction date and the settlement date.✓At the settlement date.Accounting for Foreign Currency Transactions▪Recognition of Exchange Differences✓the single- transaction approach✓the two- transaction approachHedging Foreign Exchange Rate Risk▪A derivative instrument may be defined as a financial instrument that by its terms at inception or upon occurrence of a specified event, provides the holder (or writer) with the right (or obligation) to participate in some or all of the price changes of another underlying value of measure, but does not require the holder to own or deliver the underlying value of measure.Hedging Foreign Exchange Rate Risk▪two broad categories✓Forward-based derivatives, such as forwards, futures, and swaps, in which either party can potentially have a favorable or unfavorable outcome, but not both simultaneously (e.g., both will not simultaneously have favorable outcomes).✓Option-based derivatives, such as interest rate caps, option contracts, and interest rate floors, in which only one party can potentially have a favorable outcome and itagrees to a premium at inception for this potentiality; the other party is paid the premium, and can potentially have only an unfavorable outcome.Hedging Foreign Exchange Rate Risk▪Forward Exchange Contracts▪Options▪Fair Value Hedge – Using a Forward Contract▪Hedging an Identifiable Foreign Currency Commitment Using a Forward Contract (A Fair Value Hedge)▪Hedging a Forecasted Transaction Using an Option (Cash Flow Hedge) Translation Of Foreign Financial Statements▪Derivation of the Issue of Foreign Currency Translation✓Translation exposure, sometimes also called accounting exposure, refers to gains or losses caused by the translation of foreign currency assets and liabilities into the currency of the parent company for accounting purposes.✓The choice of any method for the translation of the financial statements of a foreign business operation involves two basic questions:(i) how shall foreign currency financial statements be translated——in particular what exchange rates are to be used for different assets/liabilities/equity accounts?(ii) how and when shall foreign exchange gains or losses be recognized?CHAPTER 4Business combinationsLEARNING OBJECTIVES:•(1)Understand the economic motivations underlying business combinations.•(2)Learn about the alternative forms of business combinations, from both the legal and accounting perspectives.•(3)Introduce concepts of accounting for business combinations;•(4)emphasizing the purchase method.•(5)See how firms make cost allocatCHAPTER OUTLINE➢ 4.1 The Accounting Concept of Business Combinations➢ 4.2 The Legal Form of Business Combinations➢ 4.3 Reasons for Business Combinations➢ 4.4 Accounting for Business Combinations Under the Purchase Method ➢ 4.5 The measurement of Goodwill and ControversyCHAPTER 5Consolidated financial statementsLEARNING OBJECTIVES:•(1)Recognize the benefits and limitations of consolidated financial statements.•(2)Understand the requirements for inclusion of a subsidiary in consolidated financial statements.•(3)Apply the consolidation concepts to parent company recording of the investment in a subsidiary at the date of acquisition.•(4)Allocate the excess of the fair value over the book value of the subsidiary at the date of acquisition.CHAPTER OUTLINE➢ 5.1 Demand from IAS 27➢ 5.2 The adjustment of Intercompany Transactions➢ 5.3 Parent Company Recording and Consolidated Statement of financial position at Acquisition Date➢ 5.4 Subsequent Statement of financial positionCHAPTER 6Accounting for changing priceLEARNING OBJECTIVES:▪ 1. Explain basic concepts relating to inflation accounting. Understand the distinction between changes in the general level of prices in an economy, which affect the purchasing power of the measuring unit, and changes in the prices of specific assets and liabilities, which affect balance sheet valuations and income measurement.▪ 2. Explain the underlying thoughts and methods of dealing with inflation.▪ 3. Restate conventional financial statements based on historical costs to a common measuring unit.CHAPTER OUTLINEDefects of historical cost accounting▪The results of comparison of performance and position statements over time will be unreliable, because amounts are not valued in terms of common units.▪Borrowings are shown in monetary terms, but in a time of rising prices a gain is actually made (or a loss in times of falling prices) at the expense of the lender as, in real terms, the value of the loan has decreased or increased.▪Conversely, gains arising from holding assets are not recognized.▪Depreciation writes off the historical cost over time, but, where asset values are low (because based on outdated historical costs), depreciation will becorrespondingly lower, so that a realistic charge for asset consumption is not matched against revenue in the performance statements.Overview of Accounting for changing prices▪Changing prices affect financial reports in two principal ways:✓Measuring unit problem✓Valuation problemAccounting Measurement Alternatives▪Acquisition Cost/Nominal Dollar Accounting▪Acquisition Cost/Constant Dollar Accounting▪Current Cost/Nominal Dollar Accounting▪Current Cost/Constant Dollar AccountingRestatement of Monetary and Non-monetary Items▪ A monetary item is a claim receivable or payment in a specified number of dollars, regardless of changes in the purchasing power of the dollar.▪ A non-monetary item is any asset, liability, or shareholders’ e quity account that has no claim to or for a specified number of dollars.Evaluation of Acquisition Cost/Constant Dollar Accounting▪When compared with current-cost accounting (discussed next), constant-dollar accounting carries a higher level of objectivity. Independent accountants can examine canceled checks, invoices, and other documents to verify acquisition-cost valuations and transaction dates. The restatements to constant dollars use general price indexes published by governmental bodies. Evaluation of Current Cost/Nominal Dollar Accounting▪Current-cost accounting measures performance and financial position in terms of the current market prices. Managers likely make decisions in terms of current costs, not out-of-date acquisition costs. Thus, for asses sing management’s actions, current-cost financial statements provide information on the same basis that management used to make decisions.▪Critics note two shortcomings of current cost/nominal dollar accounting:✓auditors cannot as easily verify current-replacement-cost valuations as they can acquisition-cost valuations.✓the use of nominal dollars means that the measuring unit underlying current-replacement-cost valuations varies across time.CHAPTER 7Accounting for financial instrumentLEARNING OBJECTIVES:1. Examine budgeting and performance evaluation issues for international firms.2. Discuss global risk management tools and strategies including multinational capitalbudgeting and foreign exchange risk management.3. Identify the main constituents of cross-border transfer pricing policies, define thetransfer pricing methods, and consider the issues in devising a transfer pricing strategy.4. Recognize the critical role of information technology systems in the effectiverecording, processing and dissemination of financial and managerial accounting information.CHAPTER OUTLINE1 Challenge for the accounting profession2 Accounting and Reporting for Financial Instruments: International Developments▪In the process of completing the most recent series of amendments, the IASB conducted an extensive due process, which began in 2001 and included the following:▪(1) Conducting numerous board deliberations prior to the June 2002 exposure drafts;2.1 Overview of IAS 32▪The following are the major U.S. standards that address financial instruments accounting and reporting:▪(1) SFAS 107, Disclosures About Fair Value of Financial Instruments.▪(2) SFAS 133, Accounting for Derivative Financial Instruments and Hedging Activities.▪(3) SFAS 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.▪(4) SFAS 150, Accounting for Certain Financial Instruments with Characteristics of Both Debt and Equity.2.2 Overview of IAS 392.3 Recognition and Derecognition of Financial Assets and Liabilities2.4 Hedge Accounting Guidance2.5 Impairment of Financial Instruments2.6 Convergence with U.S. GAAP3 Financial instruments3.1 Illustration of Traditional Financial Instrument3.2 Illustration of Derivative Financial Instrument4 DERIV ATIVES USED FOR HEDGING▪SFAS No. 133 established accounting and reporting standards for derivative financial instruments used in hedging activities. Special accounting is allowed for two types of hedges—fair value and cash flow hedges.4.1 Fair Value Hedge4.2 Illustration of Interest Rate Swap4.3 Cash Flow Hedge5 OTHER REPORTING ISSUES▪Additional issues of importance are as follows:▪(1) The accounting for embedded derivatives.▪(2) Qualifying hedge criteria.▪(3) Disclosures about financial instruments and derivatives.Chapter 8 financial reporting in different countriesLearning objectives:•Identify the major policy-setting bodies and their role in the standard-setting process.•Appreciate US GAAP .•Understand convergence of US GAAP to IFRSs.Chapter outline:Parties Involved in Standard SettingSecurities and Exchange CommissionAmerican Institute of CPAsFinancial Accounting Standards BoardFinancial Accounting Standards BoardDue ProcessTypes of PronouncementsGovernmental Accounting Standards BoardGenerally Accepted Accounting PrinciplesIssues in Financial ReportingIssues in Financial ReportingConceptual FrameworkDevelopment of Conceptual FrameworkChapter 9 corporate governanceLearning objectives:1.describe the definition of corporate governance2.describe some corporate governance theory3.describe the principle of corporate governancechapter outline:2 What is corporate governance?3 Corporate governance theoryPrincipal-agent theoryClassical Stewardship Theory3.3 Modern Stewardship Theory3.4 Stakeholder TheoryPrinciples of corporate governanceCorporate governance modelsMechanisms and controls of corporate governance Features of poor corporate governance。

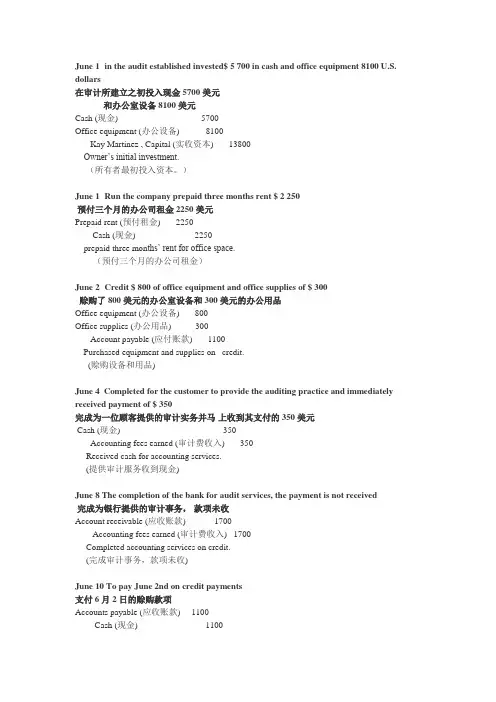

June 1in the audit established invested$ 5 700 in cash and office equipment 8100 U.S. dollars在审计所建立之初投入现金5700美元和办公室设备8100美元Cash (现金) 5700Office equipment (办公设备) 8100Kay Martinez , Capital (实收资本) 13800Owner’s initial investment.(所有者最初投入资本。

)June 1Run the company prepaid three months rent $ 2 250预付三个月的办公司租金2250美元Prepaid rent (预付租金) 2250Cash (现金) 2250prepaid three mon ths’ rent for office space.(预付三个月的办公司租金)June 2Credit $ 800 of office equipment and office supplies of $ 300赊购了800美元的办公室设备和300 美元的办公用品Office equipment (办公设备) 800Office supplies (办公用品) 300Account payable (应付账款) 1100Purchased equipment and supplies on credit.(赊购设备和用品)June 4 Completed for the customer to provide the auditing practice and immediately received payment of $ 350完成为一位顾客提供的审计实务并马上收到其支付的350美元Cash (现金) 350Accounting fees earned (审计费收入) 350Received cash for accounting services.(提供审计服务收到现金)June 8 The completion of the bank for audit services, the payment is not received完成为银行提供的审计事务,款项未收Account receivable (应收账款) 1700Accounting fees earned (审计费收入) 1700Completed accounting services on credit.(完成审计事务,款项未收)June 10 To pay June 2nd on credit payments支付6月2日的赊购款项Accounts payable (应收账款) 1100Cash (现金) 1100Paid for credit purchase of June 2.(支付6月2日的赊购款项)June 14 Prepaid annual insurance $ 1,400 a year premium 支付一年的保险费1400美元Prepaid insurance (预付保险费) 2400Cash (现金) 2400.June 18 收到银行一支付的6月8日完成的审计费Cash (现金) 1700Account receivable (应收账款) 1700Received cash from customer.(收到客户的赊购款)June 24 完成为Turner建筑公司提供的审计事务,款项未收Account receivable (应收账款) 400Accounting fees earned (审计费收入) 400Completed accounting services on credit.(完成审计事务,款项未收)June 28 Martine从事务所提取了1000美元支付个人花费Kay Martinez ,Withdrawals (提存) 1000Cash (现金) 1000Owner withdrawal.(所有者提存)June 29 追加购买办公用品120美元,款项未付Office supplies (办公用品) 120Accounts payable (应收账款) 120Purchased office supplies on credit.(赊购办公用品)June 30 支付6月份的公共事业费210元Utilities expense (公共事业费) 210Cash (现金) 210Paid the June utility.(支付6月份的公共事业费210元)三、书P109 3-1Required(要求):1.根据前面所给的信息,把20x3年12月31日的调整分录计入日记账(记账凭证)2.做发生在12月31日,但在一月份收付的分录a.办公用品账户起初余额80美元,本年度购入490美元,年末库存140美元Dec 31 :Supplies expense (物料费用) 430Office supplies (办公用品) 43080+490-140=430b.保单购买日保单期限购买价1 20x2.9.1 3年 2700美元2 20x3.3.1 2年 3480美元3 20x3.7.1 1年 540美元Dec 31 :Insurance expense (保险费用) 2620Prepaid insurance (预付保险费) 2620保单1:2700 / 3 = 900保单2:3480/ 2 / 12 * 10 = 1450保单3:540 / 12 * 6 = 270c.公司的三个雇员一天的工资分别为60美元、70美元、120美元。

推荐双语会计英语作文As an accountant, it is essential to have a good command of both English and accounting. Therefore, I highly recommend studying bilingual accounting English.Firstly, bilingual accounting English can help usbetter communicate with international clients. Nowadays, with the globalization of the economy, more and more companies are doing business with foreign clients. As an accountant, we need to communicate with them in English to understand their needs and provide them with professional services. Bilingual accounting English can improve our communication skills and help us better serve our clients.Secondly, bilingual accounting English can help us better understand international accounting standards. International accounting standards are becomingincreasingly important in today's global economy. By studying bilingual accounting English, we can better understand these standards and apply them to our work. Thiscan improve the quality of our work and help us stay competitive in the industry.Thirdly, bilingual accounting English can help us expand our career opportunities. With the rise of globalization, there is a growing demand for bilingual accountants who can work in international companies and provide professional services to international clients. By studying bilingual accounting English, we can improve our language skills and increase our chances of finding better job opportunities.In conclusion, studying bilingual accounting English is essential for accountants who want to succeed in today's global economy. It can help us better communicate with international clients, understand international accounting standards, and expand our career opportunities. Therefore, I highly recommend studying bilingual accounting English to all accountants who want to stay competitive in the industry.。

accountant是什么意思accountant中文意思_词组_同根词accountant n. 会计师;会计人员accountant【释义】英[ə'kaʊntənt] 美[ə'kaʊntənt]n.会计人员;会计师【变形】名词: accountancy【词组短语】chartered accountant 特许会计师; 会计师; 注册会计师; 特许管帐师Assistant Accountant 助理会计师; 助理会计; 会计助理; 财务助理Junior Accountant 初级会计; 初级会计师; 助理会计员; 初级会计员General Accountant 总会计师; 总会计; 普通会计人员; 总账会计AP Accountant 应付会计; 应付账款会计; 应付帐款会计; 应付款会计Accountant goal 会计目标; 会计目标; 会计accountant genaral 会计主任; 管帐主任certified accountant 注册会计师; 审定会计师; 会计师; 执业会计师Treasury Accountant 库务会计师; 资金会计; 库务管帐师【同根词】词根:accountantn.accounting 会计,会计学;帐单accountancy 会计工作;会计学;会计师之职accountantship 会计职务v.accounting 解释(account的ing形式);叙述【双语例句】用作名词(n.)He was deep in conversation with his accountant.他与会计深入交谈。

The accountant described his work to the sales staff.那个会计向营业部的职员介绍了自己的工作情况。