企业会计准则第11号股份支付

- 格式:pptx

- 大小:1.41 MB

- 文档页数:33

《企业会计准则解读——股份支付》考试题D3、根据《企业会计准则第11号——股份支付》规定,下列表述不正确的是( C )。

A、股份支付分为以权益结算的股份支付和以现金结算的股份支付B、除了授予后立即可行权的股份支付外,无论权益结算的股份支付还是现金结算的股份支付,企业在授予日均不做会计处理C、授予后立即可行权的换取职工服务的以权益结算的股份支付,应当在授予日按照权益工具的公允价值计入相关成本或费用,并增加应付职工薪酬D、对于权益结算的股份支付,在行权日,企业根据实际行权的权益工具数量,计算确定应转入股本的金额4、下列有关股份支付表述错误的是( C )。

A、对于以权益结算的股份支付应当以授予日权益工具的公允价值为基础来确定相关成本费用的金额B、对于以现金结算的股份支付应当以资产负债表日权益工具的公允价值为基础来确定相关成本费用的金额C、对于以权益结算的股份支付在可行权日后应针对权益工具公允价值调整相关成本费用并计入资本公积D、对于以现金结算的股份支付在可行权日后针对负债(应付职工薪酬)的公允价值变动计入公允价值变动损益5、下列关于股份支付中权益工具公允价值确定的表述中,不正确的是( C )。

A、权益工具存在市场价格的,其公允价值应以市场价格为基础予以确定B、股票期权通常难以获得市场价格,需要通过期权定价模型来估计其公允价值C、通过期权定价模型估计授予职工的股票期权的公允价值时,应以目前状况为标准,不需要考虑股价的预计波动情况D、企业在确定权益工具在授予日的公允价值时,应考虑市场条件(如股价)的影响,而不考虑非市场条件的影响6、下列关于股份支付可行权条件修改的表述中,错误的是( C )。

A、如果修改增加了所授予的权益工具的公允价值,企业应按照权益工具公允价值的增加相应地确认取得服务的增加B、如果修改增加了所授予的权益工具的数量,企业应将增加的权益工具的公允价值相应地确认为取得服务的增加C、如果修改减少了所授予的权益工具的公允价值,企业应按照权益工具公允价值的减少相应地确认取得服务的减少D、如果在等待期内取消或结算了所授予的权益工具,企业应立即确认原本应在剩余等待期内确认的金额7、关于以现金结算的股份支付,下列说法中正确的是( D )。

![企业会计准则第11号--股份支付-财会[2006]3号](https://uimg.taocdn.com/9162ce6526284b73f242336c1eb91a37f1113235.webp)

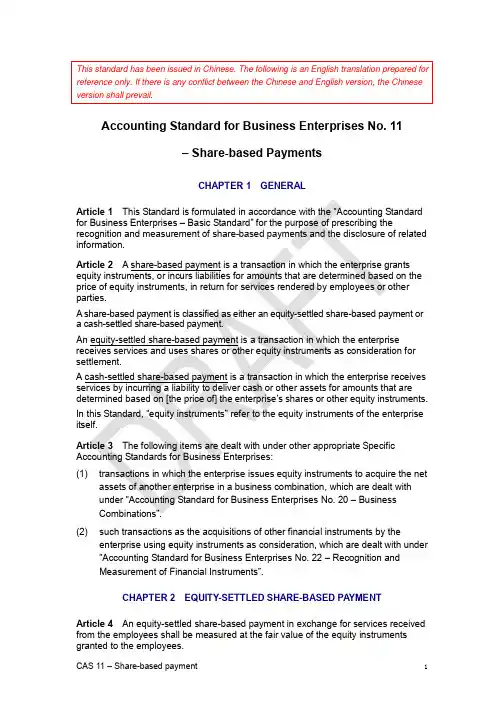

企业会计准则第11号--股份支付正文:---------------------------------------------------------------------------------------------------------------------------------------------------- 企业会计准则第11号--股份支付(财会[2006]3号二○○六年二月十五日)第一章总则第一条为了规范股份支付的确认、计量和相关信息的披露,根据《企业会计准则——基本准则》,制定本准则。

第二条股份支付,是指企业为获取职工和其他方提供服务而授予权益工具或者承担以权益工具为基础确定的负债的交易。

股份支付分为以权益结算的股份支付和以现金结算的股份支付。

以权益结算的股份支付,是指企业为获取服务以股份或其他权益工具作为对价进行结算的交易。

以现金结算的股份支付,是指企业为获取服务承担以股份或其他权益工具为基础计算确定的交付现金或其他资产义务的交易。

本准则所指的权益工具是企业自身权益工具。

第三条下列各项适用其他相关会计准则:(一)企业合并中发行权益工具取得其他企业净资产的交易,适用《企业会计准则第20号——企业合并》。

(二)以权益工具作为对价取得其他金融工具等交易,适用《企业会计准则第22号——金融工具确认和计量》。

第二章以权益结算的股份支付第四条以权益结算的股份支付换取职工提供服务的,应当以授予职工权益工具的公允价值计量。

权益工具的公允价值,应当按照《企业会计准则第22号——金融工具确认和计量》确定。

第五条授予后立即可行权的换取职工服务的以权益结算的股份支付,应当在授予日按照权益工具的公允价值计入相关成本或费用,相应增加资本公积。

授予日,是指股份支付协议获得批准的日期。

第六条完成等待期内的服务或达到规定业绩条件才可行权的换取职工服务的以权益结算的股份支付,在等待期内的每个资产负债表日,应当以对可行权权益工具数量的最佳估计为基础,按照权益工具授予日的公允价值,将当期取得的服务计入相关成本或费用和资本公积。

股份支付:现金结算与权益结算之区别与会计处理探析《企业会计准则第11号--股份支付》准则规定,股份支付是指企业为获取职工和其他方提供服务而授予权益工具或者承担以权益工具为基础确定的负债的交易。

股份支付分为以权益结算的股份支付和以现金结算的股份支付。

以权益结算的股份支付,是指企业为获取服务以期权等作为对价进行结算的交易。

以现金结算的股份支付,是指企业为获取服务承担以期权为基础计算确定的交付现金或其他资产义务的交易。

股份支付应以公允价值为基础计量。

一、股份支付的会计处理(一)授予日的处理授予后立即可行权换取职工服务的以权益结算的股份支付,应当在授予日按照权益工具的公允价值,借记“管理费用”等科目,贷记“资本公积--其他资本公积”科目。

授予后立即可行权的以现金结算的股份支付,应当在授予日以企业承担负债的公允价值计入相关成本或费用,相应增加负债,借记“管理费用”等科目,贷记“应付职工薪酬--股份支付”科目。

授予日后可立即行权的股份支付在实务中较为少见。

除了立即可行权的股份支付,无论以权益结算的股份支付或者以现金结算的股份支付,企业在授予日均不做会计处理。

(二)等待期内资产负债表日的处理职工完成约定期内的服务或达到规定业绩条件才可行权的以权益结算的股份支付,在等待期内的每个资产负债表日,应当根据最新取得的可行权数量变动等后续信息作出最佳估计,按照权益工具授予日的公允价值,确定成本费用和相应的资本公积,借记“管理费用”等科目,贷记“资本公积--其他资本公积”科目,不确认权益工具后续公允价值变动。

完成约定期内的服务或达到规定业绩条件才可行权的以现金结算的股份支付,在等待期内的每个资产负债表日,应当以对可行权情况的最佳估计为基础,按照当日权益工具的公允价值重新计量,将当期取得的服务计入成本或费用和相应的负债,借记“管理费用”等科目,贷记“应付职工薪酬--股份支付”科目。

[例]A公司董事会2007年12月批准了一项股份支付协议。

This standard has been issued in Chinese. The following is an English translation prepared for reference only. If there is any conflict between the Chinese and English version, the Chinese version shall prevail.Accounting Standard for Business Enterprises No. 11– Share-based PaymentsCHAPTER 1 GENERALArticle 1This Standard is formulated in accordance with the “Accounting Standard for Business Enterprises – Basic Standard” for the purpose of prescribing the recognition and measurement of share-based payments and the disclosure of related information.Article 2 A share-based payment is a transaction in which the enterprise grants equity instruments, or incurs liabilities for amounts that are determined based on the price of equity instruments, in return for services rendered by employees or other parties.A share-based payment is classified as either an equity-settled share-based payment or a cash-settled share-based payment.An equity-settled share-based payment is a transaction in which the enterprise receives services and uses shares or other equity instruments as consideration for settlement.A cash-settled share-based payment is a transaction in which the enterprise receives services by incurring a liability to deliver cash or other assets for amounts that are determined based on [the price of] the enterprise’s shares or other equity instruments. In this Standard, “equity instruments” refer to the equity instruments of the enterprise itself.Article 3The following items are dealt with under other appropriate Specific Accounting Standards for Business Enterprises:(1) transactions in which the enterprise issues equity instruments to acquire the netassets of another enterprise in a business combination, which are dealt withunder “Accounting Standard for Business Enterprises No. 20 – BusinessCombinations”.(2) such transactions as the acquisitions of other financial instruments by theenterprise using equity instruments as consideration, which are dealt with under “Accounting Standard for Business Enterprises No. 22 – Recognition andMeasurement of Financial Instruments”.CHAPTER 2 EQUITY-SETTLED SHARE-BASED PA YMENTArticle 4An equity-settled share-based payment in exchange for services received from the employees shall be measured at the fair value of the equity instruments granted to the employees.Fair value of equity instruments shall be determined in accordance with “Accounting Standard for Business Enterprises No. 22 – Recognition and Measurement of Financial Instruments”.Article 5If the equity instruments granted under an equity-settled share-based payment for services received from employees vest immediately, the enterprise shall, on grant date, recognise related costs or expenses at an amount equal to the fair value of the equity instruments, with a corresponding increase in capital reserve.Grant date is the date on which the share-based payment agreement is approved.Article 6If the equity instruments granted under an equity-settled share-based payment for services received from employees do not vest until the completion of services for a vesting period, or until the achievement of a specified performance condition, the enterprise shall, at each balance sheet date during the vesting period, recognise the services received for the current period as related costs or expenses, with a corresponding increase in capital reserve, at an amount equal to the fair value of the equity instruments at the grant date, based on the best estimate of the number of equity instruments expected to vest.On the balance sheet date, the estimate shall be revised if subsequent information indicates that the number of equity instruments expected to vest differs from its previous estimate. On vesting date, the enterprise shall revise the estimate to be equal to the number of equity instruments that ultimately vest.Vesting period is the period during which vesting conditions are to be satisfied.If the vesting condition of a share-based payment is a specified period of services, vesting period is from the grant date to the vesting date. If the vesting condition of a share-based payment is the achievement of a specified performance condition, the length of the vesting period shall be estimated, on the grant date, based on the most likely outcome of the performance condition.Vesting date is the date that vesting conditions are satisfied, and the employees or other parties have the rights to receive equity instruments or cash from the enterprise.Article 7After vesting date, the enterprise shall make no subsequent adjustment to related costs or expenses recognised and total owners’ equity.Article 8An equity-settled share-based payment in exchange for services from other parties shall be accounted for as follows:(1) if the fair value of services received from other parties can be measured reliably,that fair value on the date on which services are received from other parties shall be recognised as related costs or expenses, with a corresponding increase in owners’ equity.(2) if the fair value of services received from other parties cannot be measuredreliably but the fair value of the equity instruments can be measured reliably, the fair value of the equity instruments on the date on which services are received shall be recognised as related costs or expenses, with a corresponding increasein owners’ equity.Article 9On the exercise date, the enterprise shall determine the amount to be transferred to paid-in capital or share capital based on the number of equity instruments granted as a result of the rights being actually exercised, and transfer the amount to paid-in capital or share capital.Exercise date is the date on which employees or other parties exercise the rights to CHAPTER 3 CASH-SETTLED SHARE-BASED PAYMENTArticle 10 A cash-settled share-based payment shall be measured at the fair value of the liability incurred, being a liability which is determined based on the price of the enterprise’s shares or other equity instruments.Article 11If the rights under a cash-settled share-based payment vest immediately, the enterprise shall, on grant date, recognise related costs or expenses at an amount equal to the fair value of the liability incurred, with a corresponding increase in liability.Article 12 If the rights under a cash-settled share-based payment do not vest until the completion of services for a vesting period, or until the achievement of a specified performance condition, the enterprise shall, at each balance sheet date during the vesting period, recognise the services received for the current period as related costs or expenses, with a corresponding increase in liability, at an amount equal to the fair value of the liability based on the best estimate of the outcome of vesting.On the balance sheet date, the amount of the liability shall be revised if subsequent information indicates that the current fair value of the liability differs from its previous estimate. On vesting date, the enterprise shall revise the amount of the liability to the actual liability (based on the rights that ultimately vest).Article 13Until the liability is settled, the enterprise shall remeasure the fair value of the liability at each balance sheet date and at the date of settlement, with changes recognised in profit or loss for the period.CHAPTER 4 DISCLOSUREArticle 14An enterprise shall disclose the following information related toshare-based payments in the notes:(1) total amount of each type of equity instruments granted, exercised and lapsedduring the period.(2) the range of exercise prices and remaining contractual life of share options orother equity instruments outstanding at the end of the period.(3) the weighted average share price at the date of exercise for share options orother equity instruments exercised during the period.(4) the method of determining the fair value of equity instruments.For share-based payments of similar nature, the enterprise may aggregate the information for disclosure.Article 15An enterprise shall disclose in the notes the effect of share-based payment transactions on the enterprise’s financial position and operating results for the period, including at least the following information:(1) total expense recognised for the period arising from equity-settled share-basedpayments.(2) total expense recognised for the period arising from cash-settled share-basedpayments.(3) total amount of services received from employees and total amount of servicesreceived from other parties for the period in exchange for share-basedpayments.。

《企业会计准则第11号——股份支付》的应用——以伊利为例作者:许敏敏席秀华来源:《财会学习》2008年第09期早在20世纪90年代初,我国已有企业开始股权激励方面的尝试,武汉、上海、北京等地都推出了国有企业经营者股权激励的具体形式。

之后,各种文件和政策陆续确定股权激励可以作为公司高管的激励方式。

2005年8月证监会和国资委、财政部等五部委联合推出了《关于上市公司股权分置改革的指导意见》指出,完成股权分置改革的上市公司可以实施管理层股权激励,上市公司管理层股权激励的具体实施和考核办法,以及配套的监督制度由证券监管部门会同有关部门制定。

2005年11月中国证监会“关于就《上市公司股权激励规范意见》(试行)公开征求意见的通知”对上市公司实施股权激励进行明确的规范,可见股权激励在我国将会成为一种重要的激励方式。

但直到2006年2月,《企业会计准则第11号——股份支付》的发布,才有了股份支付的会计处理规范,改变了以往企业会计准则在这方面的空白。

伊利作为较早实行股权激励的上市公司,在2008年1月预亏时,引起了社会的极大反响。

因此,我们以伊利为例,来分析在股权激励的不同阶段,如何根据《企业会计准则第11号——股份支付》来进行相应的会计处理。

一、新旧会计制度对股份支付会计处理的差异股份支付,是指企业为获取职工和其他方提供服务而授予权益工具或者承担以权益工具为基础确定的负债的交易。

企业用期权来奖励员工或者作为薪酬的组成部分,是目前具有代表性的股份支付交易。

由于股份支付是以权益工具的公允价值为计量基础,《企业会计准则第9 号——职工薪酬》规定,以股份为基础的薪酬适用《企业会计准则第11号——股份支付》。

在在新会计准则颁布以前,没有专门的会计制度对股份支付进行专门的规范,我国实施股票期权计划的公司只需调整公司的权益结构,整个会计处理过程不会影响现金流量表和利润表,唯一变化的是原有股东的每股收益会被摊薄。

而新准则规定,上市公司通过股权激励所形成的股份支付,应记入股权激励期间的费用。

《企业会计准则第11号――股份⽀付》案例分析2019-10-20财政部的新准则对股份⽀付有了明确的规范,体现在新增《企业会计准则第11号――股份⽀付》⽂件上,新准则的内容和实际操作中的财税差异值得上市公司关注。

我国现⾏会计准则和制度均未对股份⽀付有明确的规范,只是对股权激励的范围在2005年11⽉中国证监会“关于就《上市公司股权激励规范意见》(试⾏)公开征求意见的通知”(以下简称“旧制度”)等⼀些相关规定中有零星分散的说明,⽽2006年财政部的新准则弥补了这⼀缺陷,新增了《企业会计准则第11号――股份⽀付》(以下简称“新准则”)。

1.计量属性不同旧制度:按实际成本计量。

新准则:以授予的权益⼯具或承担债务性⼯具的公允价值计量。

2.计量范围不同旧制度:企业以各种形式对⾼管⼈员实施的奖励。

新准则:企业为获取职⼯和其他⽅提供服务⽽授予权益⼯具或者承担以权益⼯具为基础确定的负债的交易。

3.会计处理不同旧制度:只是对⾼管层激励⽅⾯做了⼀些粗略的规定。

新准则:股份⽀付分为权益结算⽀付、现⾦结算⽀付两种;核算过程包括了授予⽇、等待⽇、⾏权⽇的处理。

详见表1:财税差异1.从范围分析新准则明确规定,股份⽀付属于职⼯薪酬的内容,是企业为获得职⼯提供的服务⽽给予的报酬。

新《中华⼈民共和国企业所得税法实施条例》第三⼗四条规定:⼯资薪⾦是指企业每⼀纳税年度⽀付给在本企业任职或者受雇的员⼯的所有现⾦形式或者⾮现⾦形式的劳动报酬,包括基本⼯资、奖⾦、津贴、补贴、年终加薪、加班⼯资以及与员⼯任职或者受雇有关的其他⽀出。

即新税法及其实施条例尚未明确规定权益结算和现⾦结算等股份⽀付作为职⼯薪酬的具体内容。

2.从确认时间分析根据《企业所得税法》第⼋条规定,由于企业实际发⽣的与取得收⼊有关的、合理的⽀出,包括成本、费⽤、税⾦、损失和其他⽀出,可以在计算应纳税所得额时扣除。

新准则在等待期内的每个资产负债表⽇,⽆论权益结算或者现⾦结算股份⽀付,都依据权责发⽣制原则按公允价值计提了成本和费⽤,但这并未实际⽀付,不得在税前扣除,需作纳税调增处理,⽽实际⾏权时,则视同发放⼯资薪⾦,应据实扣除,作纳税调减处理。

企业会计准则11号

(原创实用版)

目录

1.企业会计准则第 11 号的定义和目的

2.企业会计准则第 11 号的主要内容

3.企业会计准则第 11 号的应用范围和意义

正文

一、企业会计准则第 11 号的定义和目的

企业会计准则第 11 号,简称“股份支付”,是指企业为获取职工和其他方提供服务而授予权益工具或者承担以权益工具为基础确定的负债

的交易。

这一准则主要目的是规范企业的股份支付行为,确保企业准确计算相关成本和费用,如实反映企业的财务状况和经营成果。

二、企业会计准则第 11 号的主要内容

1.股份支付的定义:股份支付包括企业授予职工或其他方的股票、股票期权、限制性股票等权益工具,以及承担以权益工具为基础确定的负债。

2.股份支付的确认和计量:企业在进行股份支付时,应按照权益工具的公允价值确认相关成本和费用,并按照权益工具的公允价值和可行权条件进行计量。

3.股份支付的会计处理:企业应将股份支付的相关成本和费用计入当期损益,同时增加资本公积或负债。

4.股份支付的披露:企业应披露股份支付的相关信息,包括股份支付的种类、数量、公允价值、成本和费用等。

三、企业会计准则第 11 号的应用范围和意义

企业会计准则第 11 号主要适用于企业进行股份支付的相关会计处

理。

这一准则对于规范企业的股份支付行为,确保企业准确计算相关成本和费用,如实反映企业的财务状况和经营成果具有重要意义。

Accounting Standard for Business Enterprises No. 11 - Share-based Payments企业会计准则第11号——股份支付Chapter I General Provisions第一章总则Article 1 These Standards are formulated in accordance with the Accounting Standards for Enterprises - Basic Standards for the purpose of regulating the recognition, and measurement of share-based payments, and the disclosure of relevant information. .第一条为了规范股份支付的确认、计量和相关信息的披露,根据《企业会计准则——基本准则》,制定本准则。

Article 2 The term "share-based payment" refers to a transaction in which an enterprise grants equity instruments or undertakes equity-instrument-based liabilities in return for services from employee or other parties.The share-based payments shall consist of equity-settled share-based payments and cash-settled share-based payments.The term "equity-settled share-based payment" refers to a transaction in which an enterprise grants shares or other equity instruments as a consideration in return for services.The term "cash-settled share-based payment" refers to a transaction of payment of cash or any other asset obligation calculated and determined on the basis of shares or other equity instruments undertaken by the enterprise in return for services.The term "equity instrument" as mentioned in these Standards? refers to the equity instruments of the enterprise's own.第二条股份支付,是指企业为获取职工和其他方提供服务而授予权益工具或者承担以权益工具为基础确定的负债的交易。

企业会计准则第 11 号股份支付企业会计准则第 11 号股份支付(以下简称“准则 11 号”)是指企业在向员工、管理层或供应商支付报酬时使用股份或股份工具的会计处理规定。

准则 11 号的颁布对企业财务报表的编制和披露产生了重要影响,我们有必要深入了解这一准则的背景、要点和影响,以帮助我们更好地理解公司财务报表的真实情况和企业经营状况。

一、准则 11 号的背景和概述准则 11 号的制定主要是为了规范企业使用股份或股份工具支付报酬的会计处理,以确保企业财务报表的准确和透明。

随着股份支付成为越来越多企业薪酬管理的一种方式,准则 11 号的颁布填补了以往相关准则的空白,为企业和投资者提供了更清晰的会计准则。

二、准则 11 号的重要要点1. 股份支付的确认和计量根据准则 11 号,企业在向员工、管理层或供应商支付报酬时采用股份或股份工具的情况下,必须确认和计量这部分报酬的公允价值,并将其纳入财务报表中。

这就要求企业对股份支付的公允价值进行有效估计和计量,以确保报表真实和公正。

2. 股份支付的披露要求准则 11 号要求企业在财务报表中充分披露股份支付的相关信息,包括支付方式、受益人、计量依据、公允价值变动等内容。

这些披露要求为投资者和利益相关方提供了更多关于企业薪酬管理的信息,增强了财务报表的透明度。

三、准则 11 号的影响和意义准则 11 号的颁布对企业和投资者都产生了重要影响。

对于企业而言,准则 11 号的实施提高了企业薪酬管理的透明度和规范化程度,有效防范了股份支付可能带来的滥用和风险,同时也增强了员工、管理层和供应商对企业的归属感和激励效果。

对于投资者而言,准则 11 号的实施提供了更多有关企业财务状况和经营情况的信息,增强了投资者对企业的信心和对公司价值的准确评估。

个人观点和理解:准则 11 号的颁布标志着我国企业会计准则体系的不断健全和完善,为企业薪酬管理和财务报表编制提供了更明确的规范和指引。

企业会计准则第11 号股份支付股份支付是企业为了获取员工的服务或解除某些义务而向员工支付股份的一种激励机制。

在我国,企业会计准则第11号对股份支付的会计处理进行了详细规定。

一、股份支付的定义和分类股份支付是指企业以其普通股股票或其他类似权益作为支付手段,向员工、供应商、客户或其他方提供激励。

根据《企业会计准则第11号——股份支付》,股份支付分为两类:权益结算的股份支付和现金结算的股份支付。

1.权益结算的股份支付:企业以自身发行的股票或其他权益工具作为支付手段的股份支付。

2.现金结算的股份支付:企业以现金或其他货币性资产结算的股份支付。

二、股份支付的会计处理方法1.权益结算的股份支付:企业应当在授予日按照股票的公允价值计量权益工具的公允价值,并确认为费用。

后续期间,根据股票的公允价值变动,调整已确认的费用。

2.现金结算的股份支付:企业应当在结算日按照约定金额计量应付金额,并确认为费用。

同时,将现金支付给员工的股份支付与应付金额的差额确认为负债。

三、股份支付的披露要求企业应当对股份支付进行充分披露,包括:1.股份支付的计划、协议和政策;2.股份支付的类型、数量和金额;3.股份支付的公允价值计算方法;4.股份支付的结算方式和期限;5.股份支付的会计处理方法;6.股份支付的或有负债情况等。

四、实施股份支付的注意事项1.企业应建立健全股份支付制度,明确股份支付的授予条件、授予方式和结算方式等;2.企业应合理估算股份支付的公允价值,以确保会计处理的准确性;3.企业应按照会计准则和相关规定,及时、准确地进行股份支付的会计处理和披露;4.企业应关注股份支付政策的变化,及时调整相关策略。

总之,企业会计准则第11号对股份支付的定义、分类、会计处理方法和披露要求进行了明确规定。

企业在实施股份支付时,应遵循准则要求,确保会计处理的准确性和合规性。

《企业会计准则第11号——股份支付》的会计处理下载提示:该文档是本店铺精心编制而成的,希望大家下载后,能够帮助大家解决实际问题。

文档下载后可定制修改,请根据实际需要进行调整和使用,谢谢!本店铺为大家提供各种类型的实用资料,如教育随笔、日记赏析、句子摘抄、古诗大全、经典美文、话题作文、工作总结、词语解析、文案摘录、其他资料等等,想了解不同资料格式和写法,敬请关注!Download tips: This document is carefully compiled by this editor. I hope that after you download it, it can help you solve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you! In addition, this shop provides you with various types of practical materials, such as educational essays, diary appreciation, sentence excerpts, ancient poems, classic articles, topic composition, work summary, word parsing, copy excerpts, other materials and so on, want to know different data formats and writing methods, please pay attention!企业会计准则第11号——股份支付的会计处理引言企业会计准则第11号(以下简称“准则11号”)是中国财务会计领域的重要规范之一,它对企业在股份支付方面的会计处理提供了详细的指导。

企业会计准则第11 号股份支付

摘要:

1.股份支付的定义与目的

2.股份支付的分类

3.股份支付的确认与计量

4.股份支付的披露要求

5.股份支付的应用指南

正文:

企业会计准则第11 号——股份支付,是为了规范股份支付的确认、计量和相关信息的披露,根据《企业会计准则——基本准则》制定的。

股份支付是指企业为获取职工和其他方提供服务而授予权益工具或者承担以权益工具为基础确定的负债的交易。

股份支付分为以权益结算的股份支付和以现金结算的股份支付。

以权益结算的股份支付,是指企业为获取服务以股份或其他权益工具作为对价进行结算的交易。

以现金结算的股份支付,是指企业为获取服务承担以股份或其他权益工具为基础计算确定的交付现金或其他资产的交易。

在确认和计量股份支付时,企业应按照权益工具的公允价值进行。

此外,企业还需要对股份支付的相关信息进行披露,包括股份支付的种类、数量、公允价值、结算方式等。

对于股份支付的应用,企业会计准则第11 号提供了一些指南。

企业授予职工期权、认股权证等衍生工具或其他权益工具,对职工进行激励或补偿,以

换取职工提供的服务,实质上属于职工薪酬的组成部分。

企业在处理股份支付时,应按照真实公允价值进行确认和计量,并按照相关规定进行披露。

《企业会计准则第11号——股份支付》应用指南一、股份支付的含义本准则第二条规定,股份支付是指企业为获取职工和其他方提供服务而授予权益工具或者承担以权益工具为基础确定的负债的交易。

企业授予职工期权、认股权证等衍生工具或其他权益工具,对职工进行激励或补偿,以换取职工提供的服务,实质上属于职工薪酬的组成部分,但由于股份支付是以权益工具的公允价值为计量基础,因此由本准则进行规范。

二、股份支付的处理股份支付的确认和计量,应当以真实、完整、有效的股份支付协议为基础。

(一)授予日除了立即可行权的股份支付外,无论权益结算的股份支付或者现金结算的股份支付,企业在授予日都不进行会计处理。

授予日是指股份支付协议获得批准的日期。

其中“获得批准”,是指企业与职工或其他方就股份支付的协议条款和条件已达成一致,该协议获得股东大会或类似机构的批准。

(二)等待期内的每个资产负债表日股份支付在授予后通常不可立即行权,一般需要在职工或其他方履行一定期限的服务或在企业达到一定业绩条件之后才可行权。

业绩条件分为市场条件和非市场条件。

市场条件是指行权价格、可行权条件以及行权可能性与权益工具的市场价格相关的业绩条件,如股份支付协议中关于股价至少上升至何种水平才可行权的规定。

非市场条件是指除市场条件之外的其他业绩条件,如股份支付协议中关于达到最低盈利目标或销售目标才可行权的规定。

等待期长度确定后,业绩条件为非市场条件的,如果后续信息表明需要调整等待期长度,应对前期确定的等待期长度进行修改;业绩条件为市场条件的,不应因此改变等待期长度。

对于可行权条件为业绩条件的股份支付,在确定权益工具的公允价值时,应考虑市场条件的影响,只要职工满足了其他所有非市场条件,企业就应当确认已取得的服务。

1.等待期内每个资产负债表日,企业应将取得的职工提供的服务计入成本费用,计入成本费用的金额应当按照权益工具的公允价值计量。

对于权益结算的涉及职工的股份支付,应当按照授予日权益工具的公允价值计入成本费用和资本公积(其他资本公积),不确认其后续公允价值变动;对于现金结算的涉及职工的股份支付,应当按照每个资产负债表日权益工具的公允价值重新计量,确定成本费用和应付职工薪酬。