(完整版)国际贸易实务(周瑞琪等)_课后答案详解

- 格式:doc

- 大小:89.51 KB

- 文档页数:12

国际贸易实务第二章课后习题答案一、单项选择题1.C2. B3. D4. A5. D二、多选题1.ABC2.ABCDE三、简答题1、答案要点:我国进出口商品的作价原则是:在贯彻平等互利的原则下根据国际市场价格水平,结合国别地区政策,并按照我们的购销意图确定适当的价格。

由于价格构成因素不同,影响价格变化的因素也多种多样。

因此在确定进出口商品价格时,必须充分考虑影响价格的种种因素,并注意同一商品在不同情况下应有合理的差价,防止出现不区分情况,采取全球同一价格的错误做法。

2、答案要点.1)考虑商品的质量和档次2)考虑运输距离3)要考虑交货地点和交货条件4)考虑季节性需求的变化5)考虑成交数量6)考虑支付条件和汇率变动的风险此外,交货期的远近,市场销售习惯和消费者的爱好与否等因素,对确定价格也有不同程度的影响。

3.答案要点:固定价格即固定作价法,是指买卖双方在签订合同时,将货物价格一次“订死“,不再变动。

这种作价办法比较适合交易量不大、市场价格变动不大、交货期较短的商品交易。

在大宗交易时,一般应加订保值条款,规定如果计价和支付货币币值发生变动,价格可根据保值货币相应调整,以防止汇率变动可能产生的风险损失。

4、答案要点:(1)凡价格中包含佣金的,称为“含佣价”。

含佣价可用文字表示。

如USD per metric ton CIF New York including 2% commission 。

(2)也可在贸易术语后面加注佣金的英文缩写字母“C”,并注明佣金的百分比来表示,如USD per metric ton CIFC2% New York 。

(3)明佣的表示方法一般是在价格之后加列一定百分比的佣金率,如USD27.50 per piece CIFC5 New York ,这里的C5指5%commission ,即佣金率。

(4)除用百分比表示外,也可以用绝对数来表示,如“每公吨付佣金25美元”。

如中间商为了从买卖双方获取“双头佣金”或为了逃税,有时要求在合同中不规定佣金,而另按双方暗中达成的协议支付。

国际贸易实务习题答案第二章(一)货物描述 - 品质条款一、单选题1.大路货是指( D )。

A •适于商销B •上好可销品质C .质量劣等D •良好平均品质2.某美国客商到我国一家玩具厂参观,之后对该厂的部分产品很感兴趣,于是立即签定购买合同, 批量购买他所见到的那部分产品,决定按实物样品作为合同中交收货物的品质要求。

这种表示品质 的方法是( B )。

A •看货购买B •凭卖方样品C .凭买方样品D •凭对等样品3•凭样品买卖时,如果合同中无其他规定,那么卖方所交货物( B )。

A •可以与样品大致相同B •必须与样品完全一致C .允许有合理公差D .允许在包装规格上有一定幅度的差异4 •外商在收到我方寄送的样品后,来电表示愿意按我所提交易条件成交,并嘱其签订销售合同。

我 方在合同内详细列出该商品的品质规格,经对方签字后寄回无误。

我方按约装船,忽然接到对方来 电:“你方所装货物品质是否与样品相符。

”我方的正确答复应该是( D )。

A •我方所装货物品质与样品相符 B •我方所装货物品质与样品大致相符 C •我方所装货物品质与样品完全相符D •我方所装货物品质以合同为准,样品仅供参考 5 .对等样品也称之为( B )。

A .复样 B .回样C .卖方样品D .买方样品6 •在国际贸易中造型上有特殊要求或具有色香味方面特征的商品适合于(A )。

A •凭样品买卖B •凭规格买卖C •凭等级买卖D .凭产地名称买卖 7 •凡货样难以达到完全一致的,不宜采用( A )。

A •凭样品买卖B •凭规格买卖C •凭等级买卖D .凭说明买卖&凭卖方样品成交时,应留存(C)以备交货时核查之用。

A .对等样品B .回样C .复样D .参考样品9 •在品质条款的规定上,对某些比较难掌握其品质的工业制成品或农副产品,我们多在合同中规定 ( C )。

A .溢短装条款B .增减价条款C •品质公差或品质机动幅度D •商品的净重10 •若合同规定有品质公差条款,则在公差范围内,买方(A )oA •不得拒收货物B •可以拒收货物C •可以要求调整价格D •可以拒收货物也可以要求调整价格二、多选题1 •表示品质方法的分类可归纳为( BC A.凭样品表示商品的品质 B C.凭说明表示商品的品质D2 •卖方根据买方来样复制样品,寄送买方并经其确认的样品,被称为( BD)oA •复样B •回样C .原样3 •凭商品或牌号买卖,一般只适用于( A. —些品质稳定的工业制成品 C •机器、电器和仪表等技术密集产品 三、判断题1 •某外商来电要我提供大豆,按含油量18%,含水份14%,不完全粒7%,杂质1%的规格订立合)。

国际贸易实录第一章1、试举例说明贸易术语在国际贸易业务中的作用答:贸易术语,用以说明价格的构成及买卖双方有关费用、风险和责任的划分,以确定买卖双方在交货和接货过程中应尽的义务。

国际贸易术语的作用主要表现在下列几个方面:(一)有利于买卖双方洽商交易和订立合同由于每种贸易术语都有其特定的含义,因此,买卖双方只要商定按何种贸易术语成交,即可明确彼此在交接货物方面所应承担的责任、费用和风险。

这就简化了交易手续,缩短了洽商交易的时间,节约了费用开支,从而有利于买卖双方迅速达成交易和订立合同。

(二)有利于买卖双方核算价格和成本由于贸易术语表示价格构成因素,所以,买卖双方确定成交价格时,必然要考虑采用的贸易术语中包含哪些从属费用,这就有利于买卖双方进行比价和加强成本核算。

(三)有利于妥善解决贸易争议买卖双方商订合同时,如对合同条款考虑欠周,使对某些涉及当事人权利和义务的问题规定得不明确,致使履约当中产生的争议不能依据合同的规定解决,在此情况下,可以援引有关贸易术语的一般解释来处理。

因为,易术语的一般解释已成为国际惯例,它是大家所遵循的一种类似行为规范的准则。

2、贸易惯例与习惯做法有何联系与区别联系:贸易惯例是在习惯做法的基础上产生的;贸易惯例是国际组织根据国际贸易实践中逐渐形成的一般习惯做法制定成文的规则,这些规则,根据当事人意思自治的原则,被国际上普遍接受和广泛使用,而成为公认的国际贸易惯例。

区别:贸易惯例的层次高于习惯做法;尽管二者有联系,但不能把贸易惯例和习惯做法等同起来,贸易惯例的层次高于习惯做法,贸易惯例是指国际组织编纂成文的规则,凡未成文的国际贸易中的习惯做法,不能称为贸易惯例。

4、你如何理解国际贸易惯例对合同当事人的约束力问题国际贸易惯例的适用是以当事人的意思自治为基础的,因为,惯例本身不是法律,它对贸易双方不具有强制性约束力,故买卖双方有权在合同中做出与某项惯例不一致的规定。

但是,国际贸易管理对贸易实践仍具有较重要的规范作用。

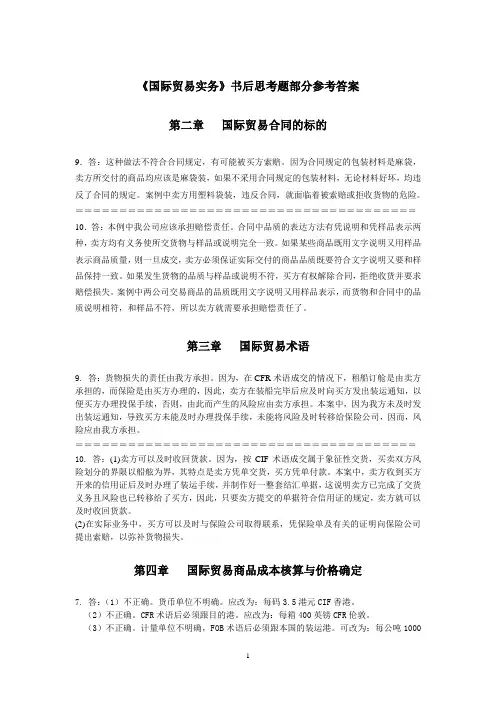

《国际贸易实务》书后思考题部分参考答案第二章国际贸易合同的标的9.答:这种做法不符合合同规定,有可能被买方索赔。

因为合同规定的包装材料是麻袋,卖方所交付的商品均应该是麻袋装,如果不采用合同规定的包装材料,无论材料好坏,均违反了合同的规定。

案例中卖方用塑料袋装,违反合同,就面临着被索赔或拒收货物的危险。

=======================================10.答:本例中我公司应该承担赔偿责任。

合同中品质的表达方法有凭说明和凭样品表示两种,卖方均有义务使所交货物与样品或说明完全一致。

如果某些商品既用文字说明又用样品表示商品质量,则一旦成交,卖方必须保证实际交付的商品品质既要符合文字说明又要和样品保持一致。

如果发生货物的品质与样品或说明不符,买方有权解除合同,拒绝收货并要求赔偿损失。

案例中两公司交易商品的品质既用文字说明又用样品表示,而货物和合同中的品质说明相符,和样品不符,所以卖方就需要承担赔偿责任了。

第三章国际贸易术语9. 答:货物损失的责任由我方承担。

因为,在CFR术语成交的情况下,租船订舱是由卖方承担的,而保险是由买方办理的,因此,卖方在装船完毕后应及时向买方发出装运通知,以便买方办理投保手续,否则,由此而产生的风险应由卖方承担。

本案中,因为我方未及时发出装运通知,导致买方未能及时办理投保手续,未能将风险及时转移给保险公司,因而,风险应由我方承担。

=======================================10. 答:(1)卖方可以及时收回货款。

因为,按CIF术语成交属于象征性交货,买卖双方风险划分的界限以船舷为界,其特点是卖方凭单交货,买方凭单付款。

本案中,卖方收到买方开来的信用证后及时办理了装运手续,并制作好一整套结汇单据,这说明卖方已完成了交货义务且风险也已转移给了买方,因此,只要卖方提交的单据符合信用证的规定,卖方就可以及时收回货款。

(2)在实际业务中,买方可以及时与保险公司取得联系,凭保险单及有关的证明向保险公司提出索赔,以弥补货物损失。

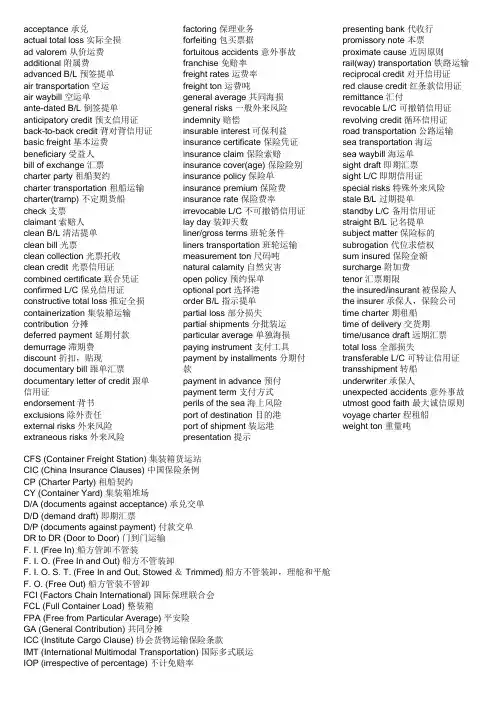

acceptance 承兑actual total loss 实际全损ad valorem 从价运费additional 附属费advanced B/L 预签提单air transportation 空运air waybill 空运单ante-dated B/L 倒签提单anticipatory credit 预支信用证back-to-back credit 背对背信用证basic freight 基本运费beneficiary 受益人bill of exchange 汇票charter party 租船契约charter transportation 租船运输charter(tramp) 不定期货船check 支票claimant 索赔人clean B/L 清洁提单clean bill 光票clean collection 光票托收clean credit 光票信用证combined certificate 联合凭证confirmed L/C 保兑信用证constructive total loss 推定全损containerization 集装箱运输contribution 分摊deferred payment 延期付款demurrage 滞期费discount 折扣,贴现documentary bill 跟单汇票documentary letter of credit 跟单信用证endorsement 背书exclusions 除外责任external risks 外来风险extraneous risks 外来风险factoring 保理业务forfeiting 包买票据fortuitous accidents 意外事故franchise 免赔率freight rates 运费率freight ton 运费吨general average 共同海损general risks 一般外来风险indemnity 赔偿insurable interest 可保利益insurance certificate 保险凭证insurance claim 保险索赔insurance cover(age) 保险险别insurance policy 保险单insurance premium 保险费insurance rate 保险费率irrevocable L/C 不可撤销信用证lay day 装卸天数liner/gross terms 班轮条件liners transportation 班轮运输measurement ton 尺码吨natural calamity 自然灾害open policy 预约保单optional port 选择港order B/L 指示提单partial loss 部分损失partial shipments 分批装运particular average 单独海损paying instrument 支付工具payment by installments 分期付款payment in advance 预付payment term 支付方式perils of the sea 海上风险port of destination 目的港port of shipment 装运港presentation 提示presenting bank 代收行promissory note 本票proximate cause 近因原则rail(way) transportation 铁路运输reciprocal credit 对开信用证red clause credit 红条款信用证remittance 汇付revocable L/C 可撤销信用证revolving credit 循环信用证road transportation 公路运输sea transportation 海运sea waybill 海运单sight draft 即期汇票sight L/C即期信用证special risks 特殊外来风险stale B/L 过期提单standby L/C 备用信用证straight B/L 记名提单subject matter 保险标的subrogation 代位求偿权sum insured 保险金额surcharge 附加费tenor 汇票期限the insured/insurant 被保险人the insurer 承保人,保险公司time charter 期租船time of delivery 交货期time/usance draft 远期汇票total loss 全部损失transferable L/C 可转让信用证transshipment 转船underwriter 承保人unexpected accidents 意外事故utmost good faith 最大诚信原则voyage charter 程租船weight ton 重量吨CFS (Container Freight Station) 集装箱货运站CIC (China Insurance Clauses) 中国保险条例CP (Charter Party) 租船契约CY (Container Yard) 集装箱堆场D/A (documents against acceptance) 承兑交单D/D (demand draft) 即期汇票D/P (documents against payment) 付款交单DR to DR (Door to Door) 门到门运输F. I. (Free In) 船方管卸不管装F. I. O. (Free In and Out) 船方不管装卸F. I. O. S. T. (Free In and Out, Stowed & Trimmed) 船方不管装卸,理舱和平舱F. O. (Free Out) 船方管装不管卸FCI (Factors Chain International) 国际保理联合会FCL (Full Container Load) 整装箱FPA (Free from Particular Average) 平安险GA (General Contribution) 共同分摊ICC (Institute Cargo Clause) 协会货物运输保险条款IMT (International Multimodal Transportation) 国际多式联运L/C (letter of credit) 信用证L/G (letter of guarantee) 保函LCL (Less than Container Load) 拼装箱M (Measurement) 尺码M/T (mail transfer) 信汇MTO (Multimodal Transportation Operator) 多式联运经营人PICC (the People’s Insurance Company of China) 中国人民保险公司SRCC (strikes, riots and civil commotions) 罢工,暴动,民变脸T/T (telegraphic transfer) 电汇TPND (theft, pilferage and non-delivery) 偷窃提货不着险UCP 600 (Uniform Customs and Practice for Documentary Credit 600) 跟单信用证统一惯例 600URC 522 (Uniform Rules for Collection 522) 托收统一规则W (Weight) 重量W/W Clause (Warehouse to Warehouse Clause) 仓至仓条款WPA (With Particular Average) 水渍险Chapter 51. In international cargo transportation, the most widely adopted bill of lading is D. order bill oflading.2. In DES contracts, a reasonable order for time of shipment and time of delivery is B. June 1 andJuly 1.3. A bill of lading is C. ante-dated B/L when its date of shipment is indicated earlier than the actualtime of shipment.4. A (An) D. bill of lading represents title to the cargo.5. In the import and export business, B. an ocean B/L can be made out to negotiable document.6. The bill of lading presented to the consignee or buyer or his bank after the stipulated expiry dateof presentation or after the goods are due at the port of destination is a A. stale B/L.7. A “freight to be collected” B/L is acceptable to the buyer when the contract is based on A. FOB.8. A C. conference liner normally has regular scheduled departures, specified routes andcomparatively fixed freight rates.9. An order B/L with blank endorsement is a B/L showing B. neither the name of consignee northe name of transferee.10. A(n) A. straight B/L refers to one that is made out to a designated consignee.Chapter 61. The main document adopted by the insured to make claims against the insurer is D. insurancedocument.2. Perils of the sea, such as vessel being stranded or grounded covered in an insurance policy areone kind of B. fortuitous accidents.3. According to “Ocean Marine Cargo Clause of the People’s Insurance Company of China”, thecoverage which cannot be effected independently is C. War Risk.4. Company A exported 5 metric tons of tea. The tea suffered heavy storm in transit. The sea waterin the ship’s hold led to the deterioration in the quality of part of the tea exported. This kind of loss is D. particular average.5. The insurance document that is acceptable mostly in Hong Kong of China, Singapore andMalaysia is C. combined certificate.6.7. Risks such as “failure to delivery risk” or “rejection risk” fall within the category of B. specialextraneous risks.8. According to “Ocean Marine Cargo Clause of the People’s Insurance Company of China”, thebasic coverage that is the least extensive is A. FPA.9. In the case of air freight, if the subject matter insured failed to reach the warehouse at destinationstipulated in the insurance policy, the expiration of the insurance is B. 30 days after completion of discharge overside from the overseas vessel at the final port of discharge.10. Under C. ICC(C) coverage of London Institute Cargo Clause, only major casualties are covered,but not natural calamities.1. If there is no specific provision, the draft under a letter of credit should draw on the B. issuingbank.2. The draft used in collection is D. a commercial draft, based on commercial credit.3. A standby credit B. is a special clean credit.4. Under collection once the importer refuses to pay, the C. principal will be responsible for thecargo release, customs clearance, warehousing, and reselling in the importing country.5. The bill of exchange used in D/A must be a D. usance bill.6. If a bank other than the issuing bank guarantees the payment under an L/C, this L/C is A. aconfirmed credit.7. A C. reciprocal credit is normally used in processing trade.8. Which of the following statements is NOT true about remittance? A. It provides highest securityto the buyer but not the seller.9. B. packing loan is a L/C based financing which will provide the exporter funds before the goodsare produced.10. If the exporter finds out mistakes on a received L/C, he should contact the B. importer at the firstplace.Chapter 5T 1 .Liner freight has covered the loading and unloading fee.F 2. When the ship-owner speeds up his ship and arrives at the destination at an earlier date than stipulated, he can obtain dispatch money from the charterer.T 3. When the charterer fails to load or unload the goods within the stipulated period of time, he has to pay demurrage to the ship owner.F 4. Ocean bills of lading, air waybills and rail waybills are property documents presenting title to cargoes, so they are all negotiable.T 5. Bills of lading are usually made out in a full set including several originals and copies.F 6. Since straight B/L bears higher risk than the open B/L , it is rarely used in international transportation.F 7. A clean B/L is issued by the seller to the buyer to certify that the goods delivered are in apparent goods condition.F 8. In international trade practice, the time of shipment is actually the time of delivery.T 9. Sometimes when the buyer cannot determine a specific port of discharge during negotiation, he may require two or three ports to be written on the contract as optional ports.T 10. UCP 600 stipulates that partial shipment and transshipment are allowed unless it is stipulated otherwise.Chapter 6F 1. In marine cargo insurance, general average is to be borne by the carrier, who may, upon presentation of evidence of the loss, recover the loss from the insurance underwriter.F 2. In Chinese insurance practice, open policy is the same as the insurance certificate.T 3. Special additional coverages such as war risks, strikes and so on must be taken out together with FPA, WPA or ALL Risks.F 4. In ocean marine insurance, natural calamities include heavy weather, earthquake, tsunami, flood, collision, etc.T 5. The coverage of Land Transportation Risk and Air Transportation Risk are almost equivalent to WPA in marine cargo insurance.F 6. Subrogation Principle states that in the event of loss of or damage to the subject matter insured resulting from an insured peril, the insured is placed in the same position that he enjoyed immediately before the loss occurred.T 7. The 10% markup rate of the commercial invoice value in an insurance policy is to cover an anticipated profit as well as other additional costs involved.T 8. Under a deductible franchise, where the loss or damage exceeds the percentage allowed, the insurance company needs merely indemnify the exceeding part to the insured.F 9. Ocean marine insurance covers ships and their cargo only on the high seas and not on inland waterways.F 10. The claimant is the party who suffers loss of or damage to the subject matter insured byChapter 7F 1. If the remittance is m ade by a banker’s demand draft, this payment is based on bank credit.T 2. For a confirmed credit, the confirming bank holds the same liability as the issuing bank.T 3. A letter of credit which does not indicate whether it is revocable or not is regarded as irrevocable.F 4. A letter of credit not mentioning ti is non-transferable will be seen as transferable.F 5. Using a third currency in collecting payment is the best protection against currency risk for the seller.T 6. Since under L/C the seller gets payment from a party independent of the buyer, it is the safest mode for him.T 7. Open account and payment in advance indicate the minimum and maximum risk for the importer.F 8. Dishonor only refers to the rejection to the presentation for payment, but not rejection to the presentation for acceptance.T 9. Under collection though the seller collects payment through banks, it is not guaranteed that he will receive the money as collection is still based on commercial credit.F 10. In international trade clean collection is more frequently used than documentary collection. Chapter 51. Under what circumstances does the time of shipment equal to the time of delivery?Time of shipment refers to the time limit for loading the goods on board the vessel at the port of shipment while time of delivery refers to the time limit during which the seller shall deliver the goods to the buyer at the agreed place.For all shipment contracts, time of shipment equals to time of delivery, and according to Incoterms 2010, contracts concluded on the basis terms like FOB, CFR, CIF, FCA, CPT, CIP are shipment contracts. Under the shipment contract, the seller fulfills his obligation of delivery when the goods are shipped on board the vessel or delivered to the carrier and the seller only bears all risks prior to shipment.2. What are the functions of a bill of a lading?A cargo receipt, evidence of a contract of carriage, a document of title to the goods.3. What are the main types of bills of lading?·According to whether the goods have been loaded on board the carrying vessel: Shipped B/L and received for shipment B/L·According to the apparent condition of the received cargo: Clean B/L and Unclean B/L,·According to the address of the consignee: Straight B/L, Order B/L and Bear B/L,·According to whether transshipment is involved in transit: Direct B/L and Transshipment B/L, ·According to the perplexity or simplicity of the bill content: Long term B/L and Short term B/L, ·According to the payment condition of freight: Freight prepaid B/L and Freight to be Collected B/L ·According to the validity: Original B/L and Copy B/L·Other forms of bill of lading also exist according to different circumstances: Stale B/L, Ante-dated B/L, Advanced B/L, On-deck B/L.4. What are the ways of dividing charges of loading and unloading in a charter party?·Liner Terms/ Gross Terms or In and out: The ship-owner bears loading and unloading cost.·Free in: The ship-owner is only responsible for unloading cost.·Free out: The ship-owner is only responsible for loading cost.·Free in and out: The ship-owner does not bear loading and unloading cost. OR F. I. O. S. T.: The ship-owner does not bear loading and unloading cost, not even bear the expenses of stowing and trimming.Time of delivery(time of shipment), port (place) of shipment and port (place) of destination, partial shipment, transshipment, or lay days, demurrage and dispatch money.Chapter 61. What are the differences between general average and particular average?Although both general average and particular average belong to the category of partial loss, there is still some differences between them:·Causes: Particular average is a kind of cargo loss usually caused directly by sea perils, while general average is caused by intentional measures taken to save the common interest. ·Indemnification: Particular average is often borne by the party whose cargo is damaged, while general average should be proportionally contributed among all parties benefited from the intentional measures.2. What are the conditions for general average?·The danger that threatens the common safety of cargo and/or vessel shall be materially existent and is not foreseen.·The measures taken by the master shall be aimed to remove the common danger of both vessel and cargo and shall be undertaken deliberately and reasonably for common safety.·The sacrifice shall be specialized and not caused by perils directly and the expense incurred shall be additional expense which is not within the operation budget.·The actions of the ship’s master shall be successful in saving the voyage3. What are the differences between the scope of ICC(B) and ICC(C)?The scope of ICC(C) covers loss of damage to the cargo attributable to fire or explosion, vessel of craft being stranded, grounded, sunk or capsized, overturning or derailment of land conveyance, collision or contract of vessel, craft or conveyance with any external object other than water, or discharge of cargo at a port of distress, general average sacrifice, or jettison.Apart from those covered under ICC(C), the scope of ICC(B) also covers loss of or damage to the subject matter insured attributable to earthquake, volcanic eruption or conveyance, container, liftvan or place of storage, or total loss of any package lost overboard or dropped whilst loading onto or unloading form, vessel or craft.4. What are the risks that are known as general additional coverage1)T.P.N.D(Theft, Pilferage and Non-delivery), 2)Fresh Water Rain Damage, 3)Risk of Shortage,4)Risk of Inter Mixture and Contamination, 5)Risk of Leakage, 6)Risk of Clash and Breakage,7)Risk of Odor, 8)Heating and Sweating Risk, 9)Hook Damage, 10)Risk of Rust, 11)Breakage ofPacking Damage5. What are the main expenses involved in ocean marine insurance? How to define them?Marine cargo insurance also covers the expenses incurred to avoid or reduce the damage to or loss of the subject matter insured. There are mainly two types of expenses. One is Sue and labor expense, the other is salvage charges.Sue and labor expense are extraordinary expenses made in a time of peril by the insured to act to avert, or minimize any loss of or damage to the subject matter insured. Salvage charges are expenses resulting from measures properly taken by a third party other than the insured, his agent, or any person employed by them to preserve maritime property from peril at sea.6. What documents are needed when an insurance claim is made?·Original bill of lading or other transport document·Commercial invoice·Packing list·Certificate of Loss(Survey)·The landing account or weight notes(notes on weight) at destination·Any correspondence with the carrier or any other party who could be responsible for the loss or damage·Master’s protest.Chapter 71. After Bank X advised exporter Y of the L/C, the shipment was made. When the cargo was onthe way, the importer filed for bankruptcy. Is Y out luck of collecting the payment? Can the opening bank refuse to make reimbursement to the negotiating bank? Why or why not?No, exporter Y does not need to worry about the payment. Because the payment is by L/C, the issuing bank is responsible for making payment regardless of the importer’s situation. But the condition is that exporter Y can fulfill all the requirements listed on the L/C. According to UCP600,a credit constitutes a definite undertaking of the opening bank to pay or to pay at maturity in caseof acceptance. Therefore once the stipulated documents are presented to the opening bank and the terms and conditions of the credit are complied with, the opening bank cannot refuse to make reimbursement to the negotiating bank.2. An L/C does not indicate whether it is revocable or not. Is it revocable? Can a revocablecredit be transferable?According to UCP600, if an L/C does not indicate whether it is irrevocable or not, it will beconsidered as irrevocable. And a transferable L/C must be irrevocable.3. After a gullible importer paid Bank C against the seemingly correct shipping documents, hewent to take the delivery, but found out that the goods were inferior counterfeits. Is Bank C liable under UCP600? Can the importer do anything in order to recover the loss?Bank C is not liable in this case because UCP600 stipulates that in credit operations all parties concerned deal with documents, and not with goods, services and/or other performances to which the documents may relate. In order to recover the loss, the importer should rely on the sales contract and seek for solution.4. An exporter, Wu Co., received an L/C issued by Bank B and confirmed by Bank K. After Wushipped the goods, Bank B declared bankruptcy. Will Wu have sleepless nights?No, Wu Co. Does not need to worry about the payment. When the L/C is confirmed, the confirming bank holds the same definite undertaking as the issuing bank to pay or to pay at maturity in case of acceptance.5. Does a payment credit differ from a sight credit?A payment credit could be settled by sight payment or deferred payment. In both cases, a draftdrawn on the issuing bank may not be necessary. While when a sight credit is used, payment would be made immediately against a sight draft and required commercial documents.6. Are the following credits transferable? (A)This L/C assignable; (B)This L/C is transmissible;(C)This L/C is fractionable; (D)This L/C is divisible.According to UCP600, a credit can be transferred only if it is expressly designated as“transferable” by the issuing bank. Terms such as “divisible”, “fractionable”, “assignable”, and “transmissible” do not render the Credit transferable.7. Under an anticipatory credit, the exporter made an advance, but disappeared withoutpresenting the documents as required. Who is liable for repayment of the advance?The special clause is required by the applicant, as a result he has to make repayment of the advances if the beneficiary fails to present documents for settlement.8. Why a back-to-back credit is needed? Give an example.A back-to-back credit is normally used by middleperson for the protection of his interest. Forexample, agent A received a documentary credit from the end buyer B, A can use this credit as a backup to apply for the opening of a new credit in favor of the end supplier C. By doing so A can be sure that neither B nor C would know each other, therefore well protecting A’s businessconfidentiality.9. What is the difference between a back-to-back credit and a transferable credit?When a back-to-back credit is used, there actually involve two credits. When a transferable credit is used, operation is based on only one credit.Chapter 51. The price quoted by an exporter was “USD38 per case FOB Liverpool”. The importerrequested a revised CFR Liverpool price. If the size of each case was 50cm*40cm*30cm, gross weight per case was 40kg, freight basis was W/M and the quotation for London is USD100 per ton of carriage, plus 20% bunker adjustment factor (BAF) and 10% currency adjustment factor (CAF), what would be the CFR price?W=40kg=0.04M/T M=50cm*40cm*30cm=0.5*0.4*0.3=0.06cm3 M>WM will be used as freight basis for freight calculation.Freight per case=M*basic freight*(1+BAF rate)=0.06*100*(1+20%)=USD 7.2Total freight per case=7.2*(1+10%)=USD 7.92CFR=FOB+Freight=38+7.92=USD 45.92The CFR price would be USD 45.92 per case CFR Liverpool2. There is one consignment of 10 cartons of leather shoes, measurement of each carton is50*50*50cm, gross weight of each is 15KG. The air freight are quoted for the flight required is USD1.3KG. How much air freight should be paid to the carrier?W=15kg M= (50*50*50)/6000=20.83kg M>WFreight=USD 1.3/kg*20.83*10 cartons=USD 270.79The air freight is USD 270.793. Suppose: Company A exports 1000 cases of Commodity Y to London. The volume per caseis 40cm x 30cm x 20cm, and the gross weight is 30kg per case. For Commodity Y, the freight rate basis is W/M, and the Freight Tariff (China —London) is USD230, with a 10% port surcharge. How much is the total freight?Total weight: 0.03 M/T*1000 cases=30M/T Total measurement: 0.4x0.3x0.2*1000cases=24M3W > M, “W” is the freight basisTotal Freight=Total weight× Basic Freight Rate×(1+ Surcharge)=30×230×(1+10%)= USD 7590 The total freight cost is USD7590.4. Company A wants to send one consignment to Sydney, Australia. The goods are packed in50 cartons, each weighing 15kgs, with measurement as 50 x 40 x 30cm. The air freight rateis quoted at USD2.00/KG (W/M). How much would the total air freight cost?W: 15 kg M: (50x40x30)/6000=10kg W> M, so W will be adopted for the calculation of air freightAir freight=Total Quantity× Basic Freight Rate=50 cartons×15kg×USD2.00/kg =USD 15005. Suppose the working period at Port X is 8 hours a day and 7 days in a week. If there are four rainy hours unable for loading and unloading in a week, how many standard days are there under the above three methods of stipulation for lay time respectively?Days or Running Days or Consecutive Days=7 days Weather Working Days of 24 Hours=8*7- 4(rainy hours)=52 hours=2 61 days Weather Working Days of 24 Consecutive Hours=7*24-4=164 hours=6 65 days Chapter 611. A Chinese company offered to a British counterpart at USD500 per case FOB Shanghai. The British importer asked the exporter to offer a CIF price. Suppose the freight is USD 50 per case and premium rate is 0.6%, what would the new offer be?CIF=(FOB+F)/(1-110%*R)=(500+50)/(1-110%*0.5%)=USD 533The new offer is USD 533 per case CIF Shanghai.12. Company A transacted with Company B, exporting frozen food under CIF. The total amount of the invoice value was USD 10 000. The premium rate was 0.4% and the goods were insured for FPA with a markup of 10%. Please calculate the insurance amount and insurance premium respectively?Insurance amount=CIF*(1+markup rate)=10 000*110%=USD 1100Insurance premium=CIF insurance amount*insurance rate=1100*0.4%=USD 44The insurance amount and insurance premium are USD 1100 and USD 44 respectively.13. Our exporting company offered light industrial products to a British importer at GBP10 000 per metric ton CIF London (insurance for All Risks with 10% markup and 1% premium rate). However, the importer intended to effect insurance by himself, as a result, he count-offered CFR price. What is the CFR price? How much premium should the exporter need to deduct from the CIF price?CFR=CIF*(1-110%*R)=10 000*(1-110%*1%)=GBP 9890Insurance premium=CIF-CFR=10 000-9890=GBP 110The CFR price is GBP 9890 per metric ton CFR London and the exporter need to deduct GBP 110 from the CIF price as the premium.14. Suppose a cargo vessel loaded with cargo of Party A and Party B stranded in transit. To save the vessel as well as the goods on it, the master ordered to throw 1000 cases of goods to the sea. The value of the goods thrown overboard for Party A is 20% of his goods (the total value of his goods is CNY20000) and that for Party B is 10% of his goods (the total value of his goods is CNY60000). Extra wages for the seamen to perform the act amounted to CNY5000. The value of the vessel is about CNY5000000. Based on the information above what is the G.A. contribution for each party involved?Total GA loss=20000x20%+60000x10%+5000=CNY 15000Total GA contributory value=20 000x 80%+ 60 000x90%+5 000 000+15 000= CNY 5 080 000 GA percentage = (Total GA loss / GA Total Benefit) x 100%=(15 000/5 080 000)x100%=0.295% GA Contribution by Party A=20 000 x 0.295% = CNY 59GA Contribution by Party B=60 000 x 0.295% = CNY 177GA Contribution by the Carrier=5 000 000x0.295% =CNY 1475015. Suppose the CIF invoice value is USD50 000 and goods are insured against All Risks and War Risks with premium rate to be 0.5% and 0.05% respectively. If markup rate is 10%, the insurance premium will be:Insurance Premium (I)=50 000*(1+10%)*(0.5%+0.05%)=55 000*0.0055=USD 302.5Chapter 51. ABC Co. signed a contract to export 200 M/T of beans. The letter of credit stipulated, “Partial shipment not allowed”. When the shipment was being made, the exporter loaded 100 M/T each on board the same vessel for the same voyage at the port of Shanghai and the port of Dalian. The shipment document was clearly marked with the ports of shipment and the dates of shipment. Did the exporter violate the terms of the L/C?析:No, 卖方没有违反信用证“不允许装船” 的规定。

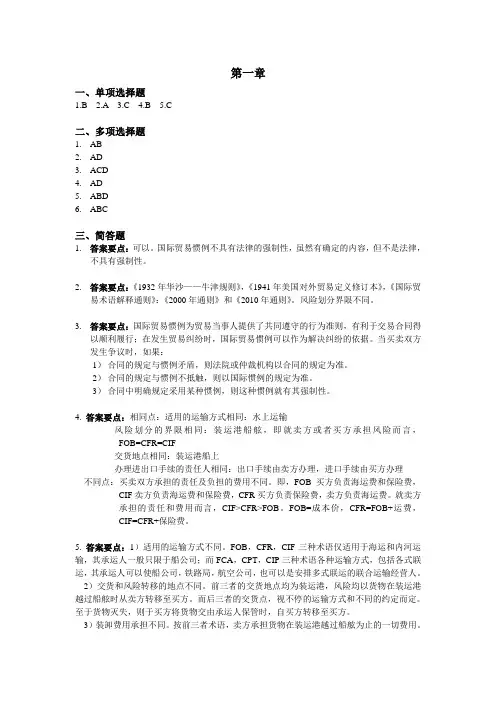

第一章一、单项选择题1.B2.A3.C4.B5.C二、多项选择题1.AB2.AD3.ACD4.AD5.ABD6.ABC三、简答题1.答案要点:可以。

国际贸易惯例不具有法律的强制性,虽然有确定的内容,但不是法律,不具有强制性。

2.答案要点:《1932年华沙——牛津规则》,《1941年美国对外贸易定义修订本》,《国际贸易术语解释通则》:《2000年通则》和《2010年通则》。

风险划分界限不同。

3.答案要点:国际贸易惯例为贸易当事人提供了共同遵守的行为准则,有利于交易合同得以顺利履行;在发生贸易纠纷时,国际贸易惯例可以作为解决纠纷的依据。

当买卖双方发生争议时,如果:1)合同的规定与惯例矛盾,则法院或仲裁机构以合同的规定为准。

2)合同的规定与惯例不抵触,则以国际惯例的规定为准。

3)合同中明确规定采用某种惯例,则这种惯例就有其强制性。

4.答案要点:相同点:适用的运输方式相同:水上运输风险划分的界限相同:装运港船舷,即就卖方或者买方承担风险而言,FOB=CFR=CIF交货地点相同:装运港船上办理进出口手续的责任人相同:出口手续由卖方办理,进口手续由买方办理不同点:买卖双方承担的责任及负担的费用不同。

即,FOB买方负责海运费和保险费,CIF卖方负责海运费和保险费,CFR买方负责保险费,卖方负责海运费。

就卖方承担的责任和费用而言,CIF>CFR>FOB。

FOB=成本价,CFR=FOB+运费,CIF=CFR+保险费。

5. 答案要点:1)适用的运输方式不同。

FOB,CFR,CIF三种术语仅适用于海运和内河运输,其承运人一般只限于船公司;而FCA,CPT,CIP三种术语各种运输方式,包括各式联运,其承运人可以使船公司,铁路局,航空公司,也可以是安排多式联运的联合运输经营人。

2)交货和风险转移的地点不同。

前三者的交货地点均为装运港,风险均以货物在装运港越过船舷时从卖方转移至买方。

而后三者的交货点,视不停的运输方式和不同的约定而定。

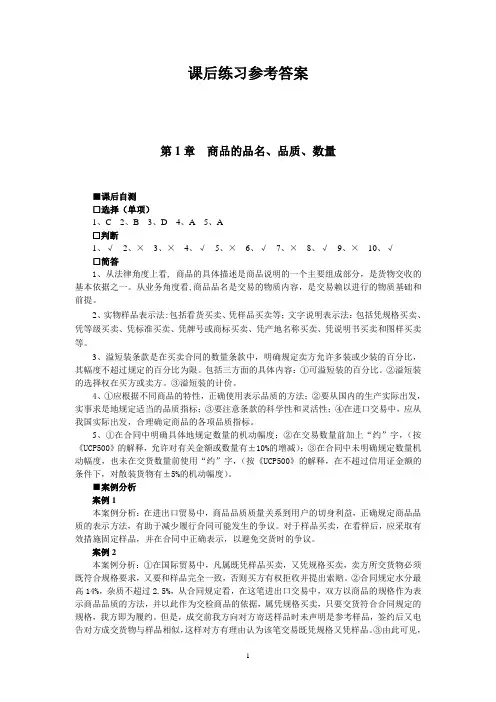

课后练习参考答案第1章商品的品名、品质、数量■课后自测□选择(单项)1、C2、B3、D4、A5、A□判断1、√2、×3、×4、√5、×6、√7、×8、√9、×10、√□简答1、从法律角度上看, 商品的具体描述是商品说明的一个主要组成部分,是货物交收的基本依据之一。

从业务角度看,商品品名是交易的物质内容,是交易赖以进行的物质基础和前提。

2、实物样品表示法:包括看货买卖、凭样品买卖等;文字说明表示法:包括凭规格买卖、凭等级买卖、凭标准买卖、凭牌号或商标买卖、凭产地名称买卖、凭说明书买卖和图样买卖等。

3、溢短装条款是在买卖合同的数量条款中,明确规定卖方允许多装或少装的百分比,其幅度不超过规定的百分比为限。

包括三方面的具体内容:①可溢短装的百分比。

②溢短装的选择权在买方或卖方。

③溢短装的计价。

4、①应根据不同商品的特性,正确使用表示品质的方法;②要从国内的生产实际出发,实事求是地规定适当的品质指标;③要注意条款的科学性和灵活性;④在进口交易中,应从我国实际出发,合理确定商品的各项品质指标。

5、①在合同中明确具体地规定数量的机动幅度;②在交易数量前加上“约”字,(按《UCP500》的解释,允许对有关金额或数量有±10%的增减);③在合同中未明确规定数量机动幅度,也未在交货数量前使用“约”字,(按《UCP500》的解释,在不超过信用证金额的条件下,对散装货物有±5%的机动幅度)。

■案例分析案例1本案例分析:在进出口贸易中,商品品质质量关系到用户的切身利益,正确规定商品品质的表示方法,有助于减少履行合同可能发生的争议。

对于样品买卖,在看样后,应采取有效措施固定样品,并在合同中正确表示,以避免交货时的争议。

案例2本案例分析:①在国际贸易中,凡属既凭样品买卖,又凭规格买卖,卖方所交货物必须既符合规格要求,又要和样品完全一致,否则买方有权拒收并提出索赔。

国际贸易实务(英文版) International Trade Practice周瑞琪王小欧徐月芳编著Chapter twoIV. Short questions1.Who pays for loading for shipment under FOB?答:Seller.2.Who pays for unloading under CIF?答:Buyer.pare and contrast FOB, CFR and CIF?答:Similarities: a. Sel ler’s risk will be transferred to the buyer when the goods pass the ship’s rail. b. Seller is responsible for export customs formalities while buyer is responsible for import customs formalities. c. Buyer is responsible for unloading the goods at the port of destination. d. All three terms can only be used for waterway transportation. Differences: a. FOB requires the buyer to arrange and pay for the ocean transportation; CFR requires the seller to arrange and pay for the ocean transportation; CIF requires the seller to arrange and pay for the ocean transportation and insurance against the buyer’s risk.4.What are the two types of trade terms concerning the transfer of risks?答:Shipment contract terms vs. arrival contract terms. Under shipment contract terms s eller’s risk will be transferred to the buyer before the goods depart from the place/port of shipment. Under arrival contract terms seller will bear the risk of the goods until the goods arrive the destination.5.What are the differences and similarities between CPT and CFR?答:Major similarities: a. seller should contract and pay for themajor carriage. b. Seller is not taking the risk of loss or damage to the goods during the transportation. Difference: a. CPT is applicable to any kind of transportation mode while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the first carrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the s hip’s rail.6.What are the differences and similarities between CIP and CIF?答:Major similarities: a. seller should contract and pay for the major carriage. b. Seller is not taking the risk of loss or damage to the goods during the transportation. c. Seller must obtain insurance against buyer’s risk. Difference: a. CPT is applicable to any kind of transportation mode while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the first carrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the ship’s rail.7.If you trade with an American, is the sales contract subject to Incoterms without any doubt? What should you do?答:No. The Revised American Foreign Trade Definitions 1941 is still in use, especially among the North American area. It has different interpretation about some trade terms. The traders should clarify the choice of rules before any further discussion.8.What are the most commonly used trade terms?答:FOB,CFR & CIF.9.Who is responsible for carrying out customs formalities for exports under an FOB contract?答:Seller. According to Incoterms 2000, except EXW and DDP these two terms, all the other eleven terms require the seller to handle the export customs formalities, while buyer the import customs formalities.10.If a Chinese trader signs a FOB Hamburg contract, is he exporting or importing?答:Importing. FOB should be used with a “named port of shipment”, if Hamburg is the port of shipment, from the Chinese trader’s perspective, he is importing.V.Case Studies1. An FOB contract stipulated, "The shipment will be effected in March 2008. If the vessel fails to arrive at the port of shipment on time, the seller agrees to set aside the goods for additional 27 days, and the buyer will bear all costs of delay." it turned out that under the seller's repeated requests, the vessel named by the buyer finally arrived at the port of shipment on May 1. As a result, the seller refused to make the shipment.(1)Was the seller entitled to compensation for thewarehouse rent, insurance and interest due to the delay?(2)If the seller had sold the goods to a third party onApril 25, should the buyer pay for the delay?(3)If the seller had sold the goods to a third party onMay 1 with a better price, was he entitled to any compensation?析: a案例中提到“shipment will be effected in March 2008”,这种确定装运时间的方式允许在整个3月份期间的任何时间进行装运。

国际贸易实务课后答案详解第十七章索赔第十七章索赔一、思考题1.简述在国际货物买卖中争议产生的原因。

答:国际货物买卖中,争议的产生往往是因买卖双方的各自的权利、义务问题而引起的,甚至导致发生仲裁、诉讼等情况。

买卖双方发生争议的原因有很多,主要可归结为以下三种情况:(1)卖方不履行或不完全履行合同规定的义务。

例如,不交付货物或虽然交货但所交货物的品质、数量、包装等不符合合同规定。

(2)买方不履行或不完全履行合同规定的义务。

例如,不能按照合同规定派船接货、指定承运人、支付货款或开出信用证,无理拒收货物等。

(3)合同中所订条款欠明确。

例如,“立即装运”、“即期装运”,在国际贸易中无统一解释,买卖双方对此理解不一致或从本身的利益出发各执一词。

2.各国法律对于违约行为的区分方法有哪些区别?对于不同违约行为的违约责任又是如何规定的?答:(1)我国《合同法》的相关规定我国《合同法》第8条规定:“依法成立的合同,对当事人具有法律约束力。

当事人应当按照约定履行自己的义务,不得擅自变更或者解除合同。

”第107条规定:“当事人一方不履行合同义务或者履行合同义务不符合约定的,应当承担继续履行、采取补救措施或者赔偿损失等违约责任。

”我国《合同法》规定:当事人一方迟延履行合同义务或者有其他违约行为致使不能实现合同目的,对方当事人可以解除合同;当事人一方迟延履行主要债务,经催告后在合同期间内仍未履行的,对方当事人可以解除合同。

《合同法》又规定,合同解除后,尚未履行的,终止履行;已经履行的,根据履行情况和合同性质,当事人可以要求恢复原状、采取其他补救措施,并有权要求赔偿损失。

(2)英国法律的相关规定英国的法律规定,当事人一方“违反要件”,受损害一方除可要求损害赔偿外,还有权解除合同;当事人一方“违反担保”或“违反随附条件”,受损害一方有权请求违约的一方给予损害赔偿,但不能解除合同;当事人一方“违反中间性条款或无名条款”,违约方应承担的责任须视违约的性质及其后果是否严重而定。

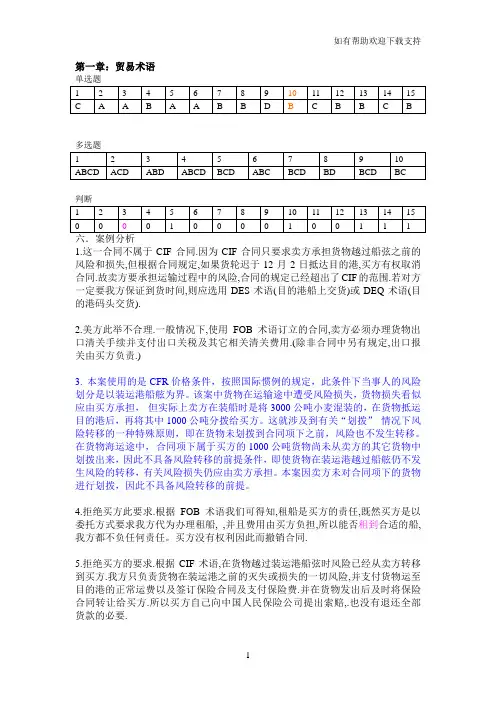

第一章:贸易术语1.这一合同不属于CIF合同.因为CIF合同只要求卖方承担货物越过船弦之前的风险和损失,但根据合同规定,如果货轮迟于12月2日抵达目的港,买方有权取消合同.故卖方要承担运输过程中的风险,合同的规定已经超出了CIF的范围.若对方一定要我方保证到货时间,则应选用DES术语(目的港船上交货)或DEQ术语(目的港码头交货).2.美方此举不合理.一般情况下,使用FOB术语订立的合同,卖方必须办理货物出口清关手续并支付出口关税及其它相关清关费用.(除非合同中另有规定,出口报关由买方负责.)3.本案使用的是CFR价格条件,按照国际惯例的规定,此条件下当事人的风险划分是以装运港船舷为界。

该案中货物在运输途中遭受风险损失,货物损失看似应由买方承担,但实际上卖方在装船时是将3000公吨小麦混装的,在货物抵运目的港后,再将其中1000公吨分拨给买方。

这就涉及到有关“划拨”情况下风险转移的一种特殊原则,即在货物未划拨到合同项下之前,风险也不发生转移。

在货物海运途中,合同项下属于买方的1000公吨货物尚未从卖方的其它货物中划拨出来,因此不具备风险转移的前提条件,即使货物在装运港越过船舷仍不发生风险的转移,有关风险损失仍应由卖方承担。

本案因卖方未对合同项下的货物进行划拨,因此不具备风险转移的前提。

4.拒绝买方此要求.根据FOB术语我们可得知,租船是买方的责任,既然买方是以委托方式要求我方代为办理租船, ,并且费用由买方负担,所以能否租到合适的船,我方都不负任何责任。

买方没有权利因此而撤销合同.5.拒绝买方的要求.根据CIF术语,在货物越过装运港船弦时风险已经从卖方转移到买方.我方只负责货物在装运港之前的灭失或损失的一切风险,并支付货物运至目的港的正常运费以及签订保险合同及支付保险费.并在货物发出后及时将保险合同转让给买方.所以买方自己向中国人民保险公司提出索赔,.也没有退还全部货款的必要.6.为了减少货物存在仓库的风险,我可以应采用FCA或CIP,CPT术语签订合同.这样,当货物在交往湛江码头仓库或者承运人时风险就从我方转移至卖方,则发生此事故,货物的损失就不用我方承担.;7.按CFR术语,合同规定保险由买方自理.但我方有义务在货物装船后及时向买方发去装船通知,使买方及时购买保险,但上述案例中卖方由于未及时向买方发去装船通知,使买方无法及时购买保险,这是由于我方的失误造成的,货物在海上灭失,卖方应承担所有的损失.8.由于日本客商坚持由自己办理运输,所以采用EXW术语可以使双方都满意.第二章合同单选题判断1.由于凭样品交货时,所交货物品质必须与样品完全一致.所以虽然B交货的质量太好,但不符合合同中品质条款的规定,所以B的做法属于违约行为,如果上诉到法院,B必须赔偿A由于交货品质与样品不同而造成的全部损失.2.A公司在与外商洽谈过程中,表现出了以样品表示品质的倾向,而在合同中又用文字方法表示商品的具体规格,这两种表示方法本来就难两全,很容易让外商抓住两者之间的矛盾点,仲裁机构则认为A公司在此项交易中必须做到按样品交货,同时货物也要符合合同的品质条款,而外商的商检证书则证明A公司的货物不符合样品的要求,所以仲裁机构判决卖方没有完成交货义务,须赔付买方的品质公差. 教训:订立合同品质条款中,以上两种品质表示方法只能二者择其一,或者寄送样品时,注明“样品仅供参考,以合同品质条款为准”3.合同中规定的溢短装条款,并不适合那些可以非常明晰表示的货物计量方法,类似以件计算,以打计算,所以卖方提出的依据本身就是不合理的.在议付过程中出现了单证不符的现象,所以遭到银行的议付.教训:为了顺利完成议付,完成合同规定的卖方应负的义务,卖方应尽量做到单单相符,单证相符,单据与合同相符.4.为了时卖方在利用信用证议付时能顺利取得货款,卖方应严格按照合同以及信用证的要求,做到单单相符,单证相符,单据与合同相符.避免不必要的麻烦与损失.5.银行的拒付有理,因为数量上可以有10%的溢短装是直货物在重量上存在溢短,并不是允许能明晰表现的数量存在溢短.卖方的做法使得单证不符,必然遭到议付行的拒付.6.我方应具体分析,看卖方提出索赔时是否已经超出了索赔期,如果超出索赔期,我方则可以拒绝赔偿,但如果在索赔期内,我方应要求买方出具具体的商检证书以及证明期面料确实为我方出口给买方的那几批纺织品.如果确实责任在我方,则我方需赔偿买方的损失.7.我方应尽量不接受,因为这涉及到知识产权的问题.同时,在有些国家,没有进口商的原产地证书,有些货物是不允许销售的.这将对我方造成一定的损失.8.我方装出22公吨货物,总金额超出了信用证的最高金额,不能做到单证相符,所以遭到议付行的拒付.第三章运输单选题多选题六、计算题P16 第2题50美元+(200+200*10%)*0.05=X*(1-3%)解得X=62.9美元七.案例分析1.船公司的做法成立.因为签订的是联运提单,每个承运人只对其航程负责.但船公司仍有识别提单是否是正本(只有提正本提单,才能提取货物)的义务.所以我方应通过船公司想最后议程的承运人索赔.2.银行有拒付的权利.因为倒签提单银行是不接受,受益人也不可援引不可抗力条款,信用证的不可抗力条款只适用于银行。

国际贸易实务(英文版) International Trade Practice周瑞琪王小欧徐月芳编著Chapter twoIV. Short questions1.Who pays for loading for shipment under FOB?答:Seller.2.Who pays for unloading under CIF?答:Buyer.pare and contrast FOB, CFR and CIF?答:Similarities: a. Sel ler’s risk will be transferred to the buyer when the goods pass the ship’s rail. b. Seller is responsible for export customs formalities while buyer is responsible for import customs formalities. c. Buyer is responsible for unloading the goods at the port of destination. d. All three terms can only be used for waterway transportation. Differences: a. FOB requires the buyer to arrange and pay for the ocean transportation; CFR requires the seller to arrange and pay for the ocean transportation; CIF requires the seller to arrange and pay for the ocean transportation and insurance against the buyer’s risk.4.What are the two types of trade terms concerning the transfer of risks?答:Shipment contract terms vs. arrival contract terms. Under shipment contract terms s eller’s risk will be transferred to the buyer before the goods depart from the place/port of shipment. Under arrival contract terms seller will bear the risk of the goods until the goods arrive the destination.5.What are the differences and similarities between CPT and CFR?答:Major similarities: a. seller should contract and pay for the major carriage. b.Seller is not taking the risk of loss or damage to the goods during the transportation. Difference: a. CPT is applicable to any kind of transportation mode while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the firstcarrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the ship’s rail.6.What are the differences and similarities between CIP and CIF?答:Major similarities: a. seller should contract and pay for the major carriage. b.Seller is not taking the risk of loss or damage to the goods during the transportation. c. Seller must obtain insurance against buyer’s risk. Difference: a.CPT is applicable to any kind of transportation mode while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the first carrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the ship’s rail.7.If you trade with an American, is the sales contract subject to Incoterms withoutany doubt? What should you do?答:No. The Revised American Foreign Trade Definitions 1941 is still in use, especially among the North American area. It has different interpretation about some trade terms. The traders should clarify the choice of rules before any further discussion.8.What are the most commonly used trade terms?答:FOB,CFR & CIF.9.Who is responsible for carrying out customs formalities for exports under an FOBcontract?答:Seller. According to Incoterms 2000, except EXW and DDP these two terms, all the other eleven terms require the seller to handle the export customs formalities, while buyer the import customs formalities.10.If a Chinese trader signs a FOB Hamburg contract, is he exporting or importing? 答:Importing. FOB should be used with a “named port of shipment”, if Hamb urg is the port of shipment, from the Chinese trader’s perspective, he is importing.V.Case Studies1. An FOB contract stipulated, "The shipment will be effected in March 2008. If thevessel fails to arrive at the port of shipment on time, the seller agrees to set aside the goods for additional 27 days, and the buyer will bear all costs of delay." it turned out that under the seller's repeated requests, the vessel named by the buyer finally arrived at the port of shipment on May 1. As a result, the seller refused to make the shipment.(1)Was the seller entitled to compensation for the warehouse rent, insurance andinterest due to the delay?(2)If the seller had sold the goods to a third party on April 25, should the buyerpay for the delay?(3)If the seller had sold the goods to a third party on May 1 with a better price,was he entitled to any compensation?析:a案例中提到“shipment will be effected in March 2008”,这种确定装运时间的方式允许在整个3月份期间的任何时间进行装运。

国际贸易实务习题答案 HUA system office room 【HUA16H-TTMS2A-HUAS8Q8-HUAH1688】《国际贸易实务》第二章思考题答案要点1.不同点(1)适用的运输方式不同;(2)买卖双方的风险划分界限不同。

2.卖方承担的风险不同,同时CIF为象征性交货术语,DES为实际交货术语。

3.(1)可以简化交易内容,缩短谈判时间、节省交易费用,促进成交,有利于国际贸易的发展。

(2)可以表示商品价格的构成,有利于买卖双方核算价格和成本。

(3)可以表明商品风险和所有权转移的界线,有利于解决履约中的争议。

4.FOB、CFR、CIF异同点一览表5.均为象征性交货术语,卖方办理出口报关,买方办理进口报关,均为卖方办理运输。

6. 不同点(1)适用的运输方式不同;(2)买卖双方的风险划分界限不同。

相同点主要表现在买卖双方的责任义务近似。

7.不是真正的CIF合同。

(1)按照CIF术语成交的合同属于“装运合同”,卖方只保证按时装运,并承担货物在装运港越过船舷以前的风险,而并不保证货物按时到达目的港。

(2)按照CIF 合同成交是典型的象征性的交货,在象征性交货方式下,卖方是凭单交货,买方是凭单付款,只要卖方如期向买方提交了合同规定的全套合格单据,即使货物在运输途中损坏或灭失,买方也必须履行付款义务。

(3)可以选择DES贸易术语。

8.合理。

(1)按照《1941年美国对外贸易定义修定本》对FOB Vessel解释,在买方责任中:第四条---支付出口税及因出口而征收的其他税捐;第六条---支付因领取由原产地或装运地国家签发的,为货物出口或在目的地进口所需的各种证件而发生的一切费用,但清洁的轮船收据或提单除外,上述费用均由买方负担。

(2)在本案例中,对美按上述价格术语洽谈进口交易和签定合同时,还应明确买方应负责办理各种出口证件和负担一切有关签证费用。

即使对于出口税及因出口而征收的其他税款也应注明须由买方负担。

国际贸易实务课后习题参考答案国际贸易术语复习思考:1.答:国际贸易术语是随着国际贸易的发展和长期的实践所形成的,用简短的概念或字母表示商品价格构成,说明交货地点和确定风险和责任、费用划分等问题的专用术语。

2.答:FOB、CFR、CIF的共同点:(1)三种价格术语交货性质相同,都是凭单交货,凭单付款象征性交货(2)三种价格术语都适用于海运和内河运输,其承运人一般只限于船公司。

(3)三种价格术语交货点均为装运港船舷。

(4)三种价格术语风险点均以在装运港越过船舷即从卖方转移至买方。

(5)三种价格术语办理出,进口清关手续相同:目的港的进口清关,费用等均由买方负责办理;装运港的装船,陆运,出口报关,办理许可证等均由卖方办理。

(6)三种价格术语成交方式相同:签订的都属于装运合同。

FOB、CFR和CIF价格术语的不同点:(1)费用构成不一样,报价不一样。

FOB价格是考虑货物从原料购进、生产直到出口报关货物装到买方指定船舱同的一切费用和利润为止,而CFR是在FOB价格的基础上再加上海运费,CIF则是在FOB价格的基础上再加上海运费和保险费。

(2)运输办理不同:FOB租船订舱由买方办理;CFR、CIF租船订舱由卖方办理并支付运费。

保险费支付、办理不同:FOB、CFR保险由买方办理,卖方应于装船前通知买方;CIF保险由卖方办理并支付保险费,卖方按合同条款,保险条款办理保险并将保险单交给买方。

(3)价格术语后港口性质不一样,FOB后的港口指卖方所在国的港口,而CFR 与CIF后的港口指买方所在国的港口。

3.答:应考虑以下因素:(1)运输方式与货源情况(2)运费变动因素(3)运输过程中的风险(4)办理进出口货物清关手续有无困难4.答:DAT术语卖方负责卸;DAP术语卖方不负责卸货。

案例分析:1.答:(1)不需要,因为采用FCA术语(货交承运人),卖方只要将货物在指定的地点交给买方指定的承运人并办理了出口清关手续,就完成了交货,即只要货交承运人风险就转移给买方,所以不用承担案中的损失。

国际贸易实务课后答案整理版P27 2.合同中规定商品质量的方法有哪几种.答:在国际货物买卖中,商品种类纷繁复杂,商品本身的特点,制造加工情况,市场交易习惯等各不一样,规定商品质量的方法也多种多样。

归纳起来,主要分为以下两大类:〔1〕用实物样品表示商品质量的方法用实物样品表示商品质量的方法包括看货成交和凭样品成交。

其中,在凭样品成交中,可以采用以卖方样品为准,或以买方样品为准,也可以凭对等样品即确认样品买卖。

〔2〕用文字说明表示商品的质量“凭文字说明买卖〞是指用文字说明表示商品质量的方法。

在国际货物买卖中,大多数商品采用文字说明来规定其质量,具体有以下几种方式:①凭规格买卖;②凭等级买卖;③凭标准买卖;④凭牌名或商标买卖;⑤凭产地名称或凭地理标志买卖;⑥凭说明书和图样买卖。

4.“凭卖方样品买卖〞时应注意哪些问题.答:“凭卖方样品买卖〞是指样品由卖方提供并以此作为交货依据的买卖方式。

“凭卖方样品买卖〞时,应注意以下几个方面的问题:〔1〕卖方应在原样和留存的复样上编制一样的,注明样品提交买方的具体日期,以便日后联系、洽谈交易时参考。

5.“凭买方样品买卖〞时应注意哪些问题.试述在买方来样时,使用“对等样品〞的意义。

答:〔1〕“凭买方样品买卖〞时应注意的问题在我国,“凭买方样品买卖〞也称为“来样成交〞或“来样制作〞,是指样品由买方提供并以此作为交货依据的买卖方式。

“凭买方样品买卖〞时,应注意以下几个方面的问题:①在确认按买方提交的样品成交之前,卖方必须充分考虑按来样制作特定产品所需的原材料供给、加工技术、设备和生产安排的可行性,以确保日后得以正确履约;②卖方应在合同中明确规定,如果发生由买方来样引起侵犯第三者工业产权的事情,概由买方负责,与卖方无涉,进而预防被卷入侵犯第三者工业产权的纠纷。

〔2〕买方来样时使用“对等样品〞的意义在国际贸易中,慎重的卖方往往不愿意承接凭买方样品交货的交易,以免因交货品质与买方样品不符而招致买方索赔甚至退货的危险,在此情况下,卖方可根据买方来样仿制或从现有货物中选择品质相近的样品提交买方,即“对等样品〞或“回样〞。

国际贸易实务(英文版) International Trade Practice周瑞琪王小欧徐月芳编著Chapter twoIV. Short questions1.Who pays for loading for shipment under FOB?答:Seller.2.Who pays for unloading under CIF?答:Buyer.pare and contrast FOB, CFR and CIF?答:Similarities: a. Sel ler’s risk will be transferred to the buyer when the goods pass the ship’s rail. b. Seller is responsible for export customs formalities while buyer is responsible for import customs formalities. c. Buyer is responsible for unloading the goods at the port of destination. d. All three terms can only be used for waterway transportation. Differences: a. FOB requires the buyer to arrange and pay for the ocean transportation; CFR requires the seller to arrange and pay for the ocean transportation; CIF requires the seller to arrange and pay for the ocean transportation and insurance against the buyer’s risk.4.What are the two types of trade terms concerning the transfer of risks?答:Shipment contract terms vs. arrival contract terms. Under shipment contract terms s eller’s risk will be transferred to the buyer before the goods depart from the place/port of shipment. Under arrival contract terms seller will bear the risk of the goods until the goods arrive the destination.5.What are the differences and similarities between CPT and CFR?答:Major similarities: a. seller should contract and pay for the major carriage. b.Seller is not taking the risk of loss or damage to the goods during the transportation. Difference: a. CPT is applicable to any kind of transportation mod e while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the firstcarrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the s hip’s rail.6.What are the differences and similarities between CIP and CIF?答:Major similarities: a. seller should contract and pay for the major carriage. b.Seller is not taking the risk of loss or damage to the goods during the transportation. c. Seller must obtain insurance against buyer’s risk. Difference: a.CPT is applicable to any kind of transportation mode while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the first carrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the ship’s rail.7.If you trade with an American, is the sales contract subject to Incoterms withoutany doubt? What should you do?答:No. The Revised American Foreign Trade Definitions 1941 is still in use, especially among the North American area. It has different interpretation about some trade terms. The traders should clarify the choice of rules before any further discussion.8.What are the most commonly used trade terms?答:FOB,CFR & CIF.9.Who is responsible for carrying out customs formalities for exports under an FOBcontract?答:Seller. According to Incoterms 2000, except EXW and DDP these two terms, all the other eleven terms require the seller to handle the export customs formalities, while buyer the import customs formalities.10.If a Chinese trader signs a FOB Hamburg contract, is he exporting or importing? 答:Importing. FOB should be used with a “named port of shipment”, if Hamburg is the port of shipment, from the Chinese trader’s perspective, he is importing.V.Case Studies1. An FOB contract stipulated, "The shipment will be effected in March 2008. If thevessel fails to arrive at the port of shipment on time, the seller agrees to set aside the goods for additional 27 days, and the buyer will bear all costs of delay." it turned out that under the seller's repeated requests, the vessel named by the buyer finally arrived at the port of shipment on May 1. As a result, the seller refused to make the shipment.(1)Was the seller entitled to compensation for the warehouse rent, insurance andinterest due to the delay?(2)If the seller had sold the goods to a third party on April 25, should the buyerpay for the delay?(3)If the seller had sold the goods to a third party on May 1 with a better price,was he entitled to any compensation?析:a案例中提到“shipment will be effected in March 2008”,这种确定装运时间的方式允许在整个3月份期间的任何时间进行装运。

国际贸易实务(英文版) International Trade Practice周瑞琪王小欧徐月芳编著Chapter twoIV. Short questions1.Who pays for loading for shipment under FOB?答:Seller.2.Who pays for unloading under CIF?答:Buyer.pare and contrast FOB, CFR and CIF?答:Similarities: a. Sel ler’s risk will be transferred to the buyer when the goods pass the ship’s rail. b. Seller is responsible for export customs formalities while buyer is responsible for import customs formalities. c. Buyer is responsible for unloading the goods at the port of destination. d. All three terms can only be used for waterway transportation. Differences: a. FOB requires the buyer to arrange and pay for the ocean transportation; CFR requires the seller to arrange and pay for the ocean transportation; CIF requires the seller to arrange and pay for the ocean transportation and insurance against the buyer’s risk.4.What are the two types of trade terms concerning the transfer of risks?答:Shipment contract terms vs. arrival contract terms. Under shipment contract terms s eller’s risk will be transferred to the buyer before the goods depart from the place/port of shipment. Under arrival contract terms seller will bear the risk of the goods until the goods arrive the destination.5.What are the differences and similarities between CPT and CFR?答:Major similarities: a. seller should contract and pay for the major carriage. b.Seller is not taking the risk of loss or damage to the goods during the transportation. Difference: a. CPT is applicable to any kind of transportation mode while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the firstcarrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the ship’s rail.6.What are the differences and similarities between CIP and CIF?答:Major similarities: a. seller should contract and pay for the major carriage. b.Seller is not taking the risk of loss or damage to the goods during the transportation. c. Seller must obtain insurance against buyer’s risk. Difference: a.CPT is applicable to any kind of transportation mode while CFR is only used for waterway transport. b. Under CPT seller’s risk will be transferred to the buyer when the goods are handed over to the first carrier nominated by seller. Under CFR seller’s risk will be transferred when the goods pass over the ship’s rail.7.If you trade with an American, is the sales contract subject to Incoterms withoutany doubt? What should you do?答:No. The Revised American Foreign Trade Definitions 1941 is still in use, especially among the North American area. It has different interpretation about some trade terms. The traders should clarify the choice of rules before any further discussion.8.What are the most commonly used trade terms?答:FOB,CFR & CIF.9.Who is responsible for carrying out customs formalities for exports under an FOBcontract?答:Seller. According to Incoterms 2000, except EXW and DDP these two terms, all the other eleven terms require the seller to handle the export customs formalities, while buyer the import customs formalities.10.If a Chinese trader signs a FOB Hamburg contract, is he exporting or importing? 答:Importing. FOB should be used with a “named port of shipment”, if Hamb urg is the port of shipment, from the Chinese trader’s perspective, he is importing.V.Case Studies1. An FOB contract stipulated, "The shipment will be effected in March 2008. If thevessel fails to arrive at the port of shipment on time, the seller agrees to set aside the goods for additional 27 days, and the buyer will bear all costs of delay." it turned out that under the seller's repeated requests, the vessel named by the buyer finally arrived at the port of shipment on May 1. As a result, the seller refused to make the shipment.(1)Was the seller entitled to compensation for the warehouse rent, insurance andinterest due to the delay?(2)If the seller had sold the goods to a third party on April 25, should the buyerpay for the delay?(3)If the seller had sold the goods to a third party on May 1 with a better price,was he entitled to any compensation?析:a案例中提到“shipment will be effected in March 2008”,这种确定装运时间的方式允许在整个3月份期间的任何时间进行装运。

也即是说,装运的最后期限为08年3月31日。

b文中提到的“additional 27 days”,根据合同卖方同意在买方船期延误的情况下为其将货物保留到4月27日。

(1)答案:Yes。

答题切入点:a FOB术语关于双方费用划分的规定;b 合同本身的条款规定。

(2)答案:No。

答题切入点:合同本身的条款规定。

(3)这题与第一题相比,不同的一点在于“with a better price”。