CFA考试一级章节练习题精选0330-9(附详解)

- 格式:docx

- 大小:51.60 KB

- 文档页数:3

CFA考试一级章节练习题精选0330-46(附详解)1、An analyst does research about equity indices.The beginning value for an indexis 2029 and the ending value is 2132.If the income for the period is 35 points,the price return of the index is closest to:【单选题】A.4.8%B.5.1%C.6.8%正确答案:B答案解析:(2 132 - 2 029)/2 029 = 5.1%。

题目中要求的是,指数的价格回报而不是总回报,所以不需要考虑该阶段的收入。

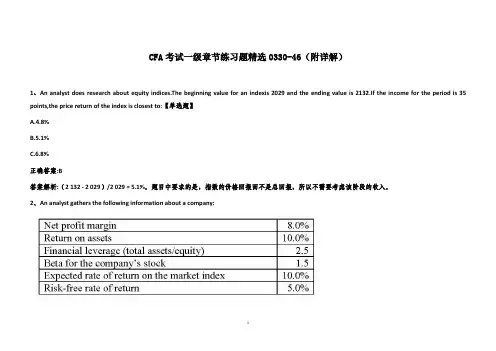

2、An analyst gathers the following information about a company:The analyst expects the information above to accurately reflect the future. If the company wants to achieve a growth rate of 15% without changing its capital structure or issuing new equity, the company’s maximum dividend payout ratio (in %) is closest to:【单选题】A.25.B.40.C.60.正确答案:B答案解析:“Financial Analysis Techniques,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA2010 Modular Level I, Vol. 3, pp. 342-347“An Introduction to Security Valuation,” Frank K. Reilly, CFA and Keith C. Brown, CFA2010 Modular Level I, Vol. 5, pp. 158-159Study Session 8-35-e, f; 14-56-gDemonstrate how ratios are related and how to evaluate a company using a combination of different ratios.Demonstrate the application of and interpret changes in the component parts of the DuPont analysis (the decomposition of return on equity).Describe a process for developing estimated inputs to be used in the DDM, including the required rate of return and expected growth rate of dividends.ROE = ROA x Financial leverage; Retention ratio = growth rate / ROE;Payout ratio = 1 – Retention ratioROE = (10.0%)(2.5) = 25%; Retention ratio = 0.15/0.25 = 0.60;Payout ratio = 1 – 0.60 = 40.0%3、The behavioral bias in which investors tend to avoid realizing losses but rather seek to realize gainsis best described as:【单选题】。

CFA考试《CFA一级》历年真题精选03(附详解)1、A company determines that the quantity demanded of a product increases by 5% when price is reduced by 10%. The product’s price elasticity of demand is best described as:【单选题】A.elastic.B.inelastic.C.perfectly elastic.正确答案:B答案解析:“Elasticity,” Michael ParkinWhen the price elasticity of demand is between 0 and 1, the good is said to have an inelastic demand. In this case, the price elasticity of demand is calculated as 5% / 10% = 0.5.2、A local laundry and dry cleaner collects the following data on its workforce productivity. Workers always work in teams of two, and the laundry earns $3.00 of revenue for each shirt laundered.The marginal revenue product ($ per worker) for hiring the fifth and sixth workers is closest to:【单选题】A.14.B.21.C.42.正确答案:B答案解析:“Demand and Supply Analysis: The Firm,” Gary L. Arbogast and Richard V. EastinIn this problem, the marginal product of hiring the 5th and 6th workers (ΔL = 2) is 14 shirts per hour/2 workers = 7 shirts per hour/worker. With each shirt resulting in $3 of revenue, the MRP is 7 shirts per hour/worker × $3/shirt = $21 per worker.3、The following selected data are available for a firm:If the firm’s tax rate is 40%, the free cash flow to the firm (FCFF) is closest to:【单选题】A.57.9.B.74.7.C.87.7.正确答案:B答案解析:“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A Broihahn, CFA4、An analyst has gathered the following information:Based on the arbitrage-free valuation approach, a $1,000 face value bond that pays a 5 percent annual coupon and matures in 3 years has a current market value closest to:【单选题】A.$1,027.75.B.$1,028.67.C.$1,034.85.正确答案:B答案解析:“Introduction to the Valuation of Debt Securities,” Frank J. Fabozzi5、A company pays its workers on the 1st and the 15th of each month. Employee wages earned from the 15th to the 30th of September are best described as a(n):【单选题】A.accrued expense.B.prepaid expense.C.unearned expense.正确答案:A答案解析:Wage expenses that have been incurred but not yet paid are an example of an accrued expense: a liability that has not yet resulted in a cash payment.Section 5.16、With respect to the portfolio management process, the execution step most likely includes:【单选题】A.developing the investment policy statement.B.portfolio monitoring.C.asset allocation.正确答案:C答案解析:Asset allocation is part of the execution step of the portfolio management process. The execution step also includes security analysis and portfolio construction.Section 47、Which of the following statements does not accurately represent the objectives of Global InvestmentPerformance Standards (GIPS)? The GIPS standards:【单选题】A.ensure consistent, accurate investment performance data in the areas of reporting, records,marketing, and presentations.B.obtain global acceptance of calculation and presentation standards in a fair, comparable formatwith full disclosure.C.promote fair competition among investment management firms in all markets by requiringcommon fee structures.正确答案:C答案解析:One of the objectives of the GIPS standards is to promote fair competition among investmentmanagement firms in all markets; this objective does not require unnecessary entry barriers orhurdles for new firms, such as common fee structures.Fundamentals of Compliance8、According to CFA Institute of Professional Conduct (the Standards) , which ofthe following is NOT a recommendation procedure for compliance with the Standardsrelating to fair dealing?【单选题】A.Limit the number of people involved.B.Maintain a list of clients and their holdings.C.Prolong the time frame between decision and dissemination.正确答案:C答案解析:当投资建议将要发布时,限制参与的人数,以及保留客户的名单和他们持股情况都是CFA协会推荐的做法。

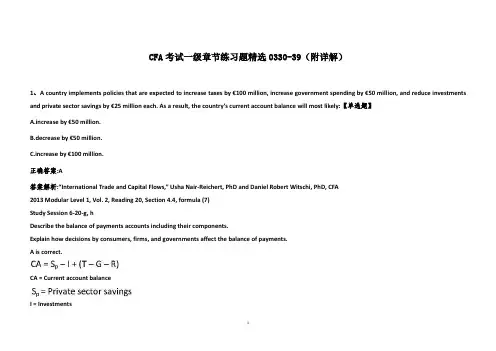

CFA考试一级章节练习题精选0330-39(附详解)1、A country implements policies that are expected to increase taxes by €100 million, increase government spending by €50 mill ion, and reduce investments and private sector savings by €25 million each. As a result, the country’s current account balance will most likely:【单选题】A.increase by €50 million.B.decrease by €50 million.C.increase by €100 million.正确答案:A答案解析:“International Trade and Capital Flows,” Usha Nair-Reichert, PhD and Daniel Robert Witschi, PhD, CFA2013 Modular Level 1, Vol. 2, Reading 20, Section 4.4, formula (7)Study Session 6-20-g, hDescribe the balance of payments accounts including their components.Explain how decisions by consumers, firms, and governments affect the balance of payments.A is correct.CA = Current account balanceI = InvestmentsT = TaxesG = Government spendingR = TransfersΔCA = –25 – (–25) + (100 – 50 – 0) = 50.1、If a central bank reduces the money supply, this move will most likely lead to a:【单选题】A.rise in nominal interest rates and a decline in aggregate price level.B.decline in nominal interest rates and a rise in aggregate price level.C.rise in nominal interest rates and a rise in aggregate price level.正确答案:A答案解析:A reduction in the money supply (leftward shift) leads to an increase in nominal rates. Furthermore, on the basis of the quantity theory of money, a reduced money supply makes money more valuable (thus a higher interest rate), which reduces aggregate price levels.2014 CFA Level I"Monetary and Fiscal Policy," by Andrew Clare and Stephen ThomasSections 2.1.61、An analyst does research about demand for labor.All else remaining the same, afirm's demand curve for labor will least likely shift in response to a changein the:【单选题】A.wage rate of labor.B.price of the firm's output.。

CFA考试一级章节练习题精选0330-33(附详解)1、Compared to classifying a lease as a financing lease, if a lessee reports the lease as an operating lease it will most likely result in a:【单选题】A.lower return on assets.B.higher debt-to-equity ratio.C.lower cash from operations.正确答案:C答案解析:“Non-Current (Long-ter m) Liabilities,” Elizabeth A. Gordon and Elaine Henry, CFA2011 Modular Level 1, Vol.3, p. 521-522, 537Study Session: 9-39-g, h, lDistinguish between a finance lease and an operating lease from the perspectives of the lessor and the lessee.Determine the initial recognition and measurement and subsequent measurement of finance leases.Calculate and interpret leverage and coverage ratios.The cash from operations is lower if the lease is classified as an operating lease, because the full lease payment is shown as an operating cash outflow. If it were classified as a financing lease, only the portion of the lease payment relating to interest expense reduces the operating cash flow and the portion of the lease payment that reduces the lease liability is class ified as a financing cash flow. Therefore, the lessee’s cash from operations tends to be lower under operating leases.1、The following information (U.S. $ millions) for two companies operating in the same industry during the same time period is available:If both companies achieve a return on equity of 15% for the period, which of the following statements is most likely correct? Compared to Company B, Company A has a:【单选题】A.higher net profit margin.B.higher total asset turnover.C.lower financial leverage multiplier.正确答案:A答案解析:“Financial Analysis Techniques”, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, R. Elaine Henry, CFA, and Michael A. Broihahn, CFA Modular 2010 Level I, Vol. 3 pp.342-344“Financial Statement Analysis”, Pamela P. Peterson, CFA2010 Modular Level I, Vol. 4, pp.142-146Study Session 8-35-d, f, 11-47Calculate, classify, and interpret activity, liquidity, solvency, profitability, and valuation ratios。

CFA考试一级章节练习题精选0330-48(附详解)1、With respect to capital project, if the discount rate decrease, which of the followingabout the internal rate of return (IRR) and net present value (NPV) aremost accurate?【单选题】A.Both IRR and NPV increase.B.IRR remains unchanged and NPV increases.C.Both IRR and NPV remain unchanged.正确答案:B答案解析:IRR的定义是,使得NPV = 0时的折现率,计算时与项目的必要回报率无关。

而项目的必要回报率下降,会导致项目的净现值上升。

1、An analyst gathers the following information about two mutually exclusive projectsof a company:If the cost of capital used is 10% , the most appropriate decision for the companyis to accept:【单选题】A.Project 1 only.B.Project 2 only.C.both Project 1 and Project 2.正确答案:A答案解析:对于独立项目(independent project),如果NPV > 0,就可以接受该项目;如果NPV 0的项目中选择NPV最大的项目。

当IRR与NPV对作决策有冲突时,以NPV为准。

1、A trader buys 500 shares of a stock on margin at $36 a share using an initial leverage ratio of 1,66.The maintenance margin requirement for the position is 30%. The stock price at which the margincall will occur is closest to:【单选题】A.$25.20.B.$30.86.C.$20.57.正确答案:C答案解析:Initial equity (%) in the margin transaction=1/Leverage ratio=1/1.66=0.60;Initial equity per share at the time of purchase=$36 × 0.60=$21.60;Price (P) at which margin call occurs:Equity per share/Price per share=Maintenance margin (%)=($21.60+P-$36)/P=0.30;0.7P=$14.40;P=$20.57.CFA Level I"Market Organization and Structure," Larry HarrisSection 5.21、An analyst does research about the cost of capital and gathers the followinginformation about a company:● Current share price is $60● Current annual dividend per share is $1.50● Stable retention ratio is 40%● Historical return on equity is 12%Using the dividend discount model approach, the cost of equity is closest to:【单选题】A.7.30%B.7.42%C.9.88%正确答案:B答案解析:使用股利贴现模型(Dividend Discount Model)的计算公式:g = (return on equity)x(retention ratio),由此得:g = 12% × 0.4 = 4.8%,所以= $1.5 × (1 + 4.8%)/$60 + 4.8% = 7.42%.1、A firm is uncertain about both the number of units the market will demand and the price it will receive for them. This type of risk is best described as:【单选题】A.sales risk.B.business risk.C.operating risk.正确答案:A答案解析:“Measures of Leverage,” Pamela Peterson Drake, CFA, Raj Aggarwal, CFA, Cynthia Harrington, CFA, and Adam Kobor, CFA 2013 Modular Level I, Vol. 4, Reading 38, Section 3.1, 3.2Study Session 11-38-aDefine and explain leverage, business risk, sales risk, operating risk, and financial risk, and classify a risk, given a description.A is correct. Sales risk is associated with uncertainty with respect to total revenue, which in turn, depends on price and units sold.。

CFA考试一级章节练习题精选0330-11(附详解)1、Michael Allen, CFA, works for an investment management company and managesportfolios for a variety of retail and institutional clients for his firm, includinghis wealthy uncle, all of whom pay a management fee for his wrenceBrown, an analyst at a brokerage firm has recommended Allen a high yield hedgefund based on its historical performance.Allen purchases a large block of thishedge fund and allocates proportionately to all client portfolios, including hisuncle's portfolio.Has Allen most likely violated the Standards of ProfessionalConduct?【单选题】A.No.B.Yes, relating to suitability.C.Yes, relating to fair dealing.正确答案:B答案解析:因为Allen的叔叔也是他的客户,所以Allen需要公平地对待所有客户,包括他的叔叔。

题目中,按比例(proportionately)分配并没有违反公平对待的行为标准。

但是,不根据客户的投资目标和限制而盲目给所有的客户进行购买,违反了合适性原则。

2、Gardner Knight, CFA, is a product development specialist at an investment bank. Knight is responsible for creating and marketing collateralized debt obligations (CDOs) consisting of residential mortgage bonds. In the marketing brochure for his most recent CDO, Knight provided a list of the mortgage bonds that the CDO was created from. The brochure also states “an independent third party, the collateral manager, had sole authori ty over the selection of all mortgage bonds used as collateral in the CDO.” However, Knight met with the collateral manager and helped her select the bonds for the CDO. Knigh t is least likely to be in violation of which of the following CFA Institute Standards of Professional Conduct?【单选题】A.SuitabilityB.Conflicts of InterestC.Client Communication正确答案:A答案解析:CFA Institute Standards2012 Modular Level I, Vol. 1, pp. 78, 116–117, 123–125Study Session 1-2-bDistinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.A is correct because there is no indication the investment is unsuitable for investors and in violation of Standard III (C) Suitability.3、Sherry Buckner, CFA manages equity accounts for government entities whose portfolios are conservative and risk averse. Since the objective of her clients is to maximize returns with the lowest possible risk, Buckner considers adding to their holdings a new, thinly-traded, leveraged derivative product which she believes has the potential for high returns. To make her investment decision, Buckner relies upon comprehensive research from an investment bank that has a solid reputation for top quality research. After her review of that research, Buckner positions her accounts so that each has a 10% allocation to the derivative product. Did Buckner most likely violate any CFA Institute Standards of Professional Conduct by purchasing the derivative for her clients?【单选题】A.No.B.Yes, related to Suitability.C.Yes, related to Loyalty, Prudence and Care.正确答案:B答案解析:"Guidance for Standards I-VII CFA Institute"2011 Modular Level I, Vol. 1, pp. 78-81Study Session 1-2-bDistinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.B is correct as Buckner is in violation of Standard III (C) since she did not consider issues such as the limited liquidity or any potential leverage of this new product when she invested a substantial percentage of her client's portfolios in these instruments.4、Amanda Covington, CFA, works for McJan Investment Management. McJan employees must receive prior clearance of their personal investments in accordance with McJan's compliance procedures. To obtain prior clearance, McJan employees must provide a written request identifying the security, the quantity of the security to be purchased, and the name of the broker through which the transaction will be made. Precleared transactions are approved only for that trading day. As indicated below, Covington received prior clearance.Two days after she received prior clearance, the price of Stock B decreased, so Covington decided to purchase 250 shares of Stock B only. In her decision to purchase 250 shares of Stock B only, did Covington violate any CFA Institute Standards of Professional Conduct?【单选题】A.NoB.Yes, relating to diligence and reasonable basisC.Yes, relating to her employer's compliance procedures正确答案:C答案解析:Prior-clearance processes guard against potential and actual conflicts of interest; members are required to abide by their employer's compliance procedures (Standard VI (B)).2014 CFA Level I"Guidance for Standards I-VII," CFA InstituteStandard V(A), Standard VI(B)5、Helen Hawke, CFA, a verifier of the GAPS? standards.With respect to theGlobal Investment Performance Standards (the GAPS? Standards), which of thefollowing statements is least accurate? The GAPS? Standards:【单选题】A.are ethical standards for investment performance presentation to ensure fairrepresentation and full disclosure of investment performance.B.will ensure full disclosure and fair representation if minimum requirementsof the GAPS? standards are adhered.C.rely on the integrity of input data.正确答案:B答案解析:只遵守GAPS?标准的最低要求并不能保证公允地陈述和充分地披露业绩,公司应该同时遵守推荐的做法来更好地计算和陈述业绩,所以B错。

CFA考试一级章节练习题精选0330-55(附详解)1、Teresa Staal, CFA is an investment officer in a bank trust department. She manages money for celebrities and public figures, including an influential local politician. She receives a request from the politician’s political party headquarters to disclose his stock holdings. The req uest indicates local law requires the disclosure. What steps should Staal most likely take to ensure she does not violate any CFA Institute Standards of Professional Conduct?【单选题】A.Provide the information and inform her client.B.Send the requested documents and inform her supervisor.C.Check with her firm's compliance department to determine her legal responsibilities.正确答案:C答案解析:"Guidance for Standards I-VII CFA Institute"2011 Modular Level I, Vol. 1, pp. 88-89Study Session 1-2-cRecommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.C is correct. In order to avoid violating Standard III (E) Staal should determine if applicable securities regulations require disclosing the records before she provides the confidential information concerning her client's investments.1、Several years ago, Leo Peek, CFA, co-founded an investment club. The club is fully invested but has not actively traded its account for at least a year and does not plan to resume active trading of the account. Peek's employer requires an annual disclosure of employee stock ownership. Peek discloses all of his personal trading accounts but does not disclose his holdings in the investment club. Peek's actions are least likely to be a violation of which of the CFAInstitute Standards of Professional Conduct?【单选题】A.MisrepresentationB.Transaction priorityC.Conflicts of interest正确答案:B答案解析:There is no indication that the investment club is trading ahead of clients. See Standard VI(B). 2014 CFA Level I "Guidance for Standards I-VII," CFA Institute Standard I(C), Standard VI(A), Standard VI(B)1、While at a bar in the financial district after work, Ellen Miffitt, CFA overhears several employees of a competitor discuss how they will manipulate down the price of a thinly traded micro cap stock's price over the next few days. Miffitt's clients have large positions of this stock so when she arrives at work the next day she immediately sells all of these holdings. Because she has determined that the micro cap stock was suitable for all of her accounts at its previously higher price, Miffitt buys back her client's original exposure at the end of the week at the new, lower price. Which CFA Institute Standards of Professional Conduct did Miffitt least likely violate?【单选题】A.Market ManipulationB.Preservation of ConfidentialityC.Material Non Public Information正确答案:B答案解析:"Guidance for Standards I-VII CFA Institute"2011 Modular Level I, Vol. 1, pp. 49-52, 59-60, 88。

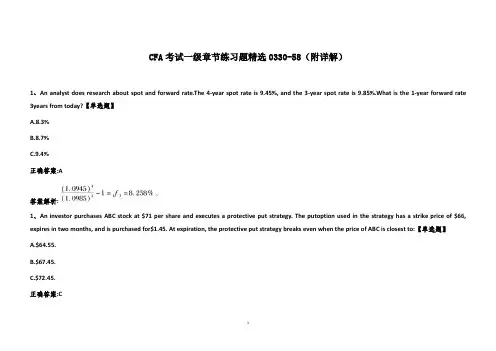

CFA考试一级章节练习题精选0330-58(附详解)1、An analyst does research about spot and forward rate.The 4-year spot rate is 9.45%, and the 3-year spot rate is 9.85%.What is the 1-year forward rate 3years from today?【单选题】A.8.3%B.8.7%C.9.4%正确答案:A答案解析:1、An investor purchases ABC stock at $71 per share and executes a protective put strategy. The putoption used in the strategy has a strike price of $66, expires in two months, and is purchased for$1.45. At expiration, the protective put strategy breaks even when the price of ABC is closest to:【单选题】A.$64.55.B.$67.45.C.$72.45.正确答案:C答案解析:To break even, the underlying stock must be at least as high as the amount expended up front toestablish the position. To establish the protective put, the investor would have spent $71+$1.45=$72.45.CFA Level I"Risk Management Applications of Option Strategies," Don M. ChanceSection 2.2.21、An analyst does research about moneyness of an option.An investor owns aput option with the following terms:If the underlying is currently priced at $ 75.21, the moneyness of the optionfor this investor is closest to:【单选题】A.- $ 0.73B.$ 0C.$ 6.55正确答案:C答案解析:期权的价值(moneyness)要看其行权价和当前价格,以及该期权是看涨还是看跌,不考虑期权本身的价格。

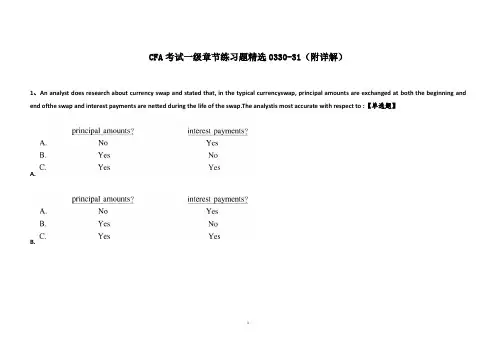

CFA考试一级章节练习题精选0330-31(附详解)1、An analyst does research about currency swap and stated that, in the typical currencyswap, principal amounts are exchanged at both the beginning and end ofthe swap and interest payments are netted during the life of the swap.The analystis most accurate with respect to :【单选题】A.B.C.正确答案:B答案解析:货币互换是两种不同的货币之间的相互交换,通常本金在期初期末要进行交换,期间的利息支付不可以相互抵消。

2、Based on put-call parity for European options, a synthetic put is most likely equivalent to a:【单选题】A.long call, short underlying asset, long bond.B.long call, long underlying asset, short bond.C.short call, long underlying asset, short bond.正确答案:A答案解析:Derivative Markets and Instruments,” Don M. Chance2011 Modular Level I, Vol. 6, pp 110-113Study Session 17-71-mExplain put-call parity for European options, and relate put-call parity to arbitrage and to the construction of synthetic options.A is correct. A Synthetic Put is equivalent to a Long Call + Short Underlying + Long Bond.3、Two parties agree to a forward contract on a non-dividend paying stock at a price of $103.00. At contract expiration the stock trades at $105.00. In a cash-settled forward contract, the:【单选题】。

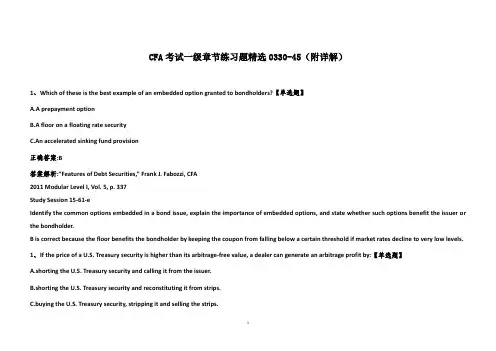

CFA考试一级章节练习题精选0330-45(附详解)1、Which of these is the best example of an embedded option granted to bondholders?【单选题】A.A prepayment optionB.A floor on a floating rate securityC.An accelerated sinking fund provision正确答案:B答案解析:“Features of Debt Securities,” Frank J. Fabozzi, CFA2011 Modular Level I, Vol. 5, p. 337Study Session 15-61-eIdentify the common options embedded in a bond issue, explain the importance of embedded options, and state whether such options benefit the issuer or the bondholder.B is correct because the floor benefits the bondholder by keeping the coupon from falling below a certain threshold if market rates decline to very low levels.1、If the price of a U.S. Treasury security is higher than its arbitrage-free value, a dealer can generate an arbitrage profit by:【单选题】A.shorting the U.S. Treasury security and calling it from the issuer.B.shorting the U.S. Treasury security and reconstituting it from strips.C.buying the U.S. Treasury security, stripping it and selling the strips.正确答案:B答案解析:“Introduction to the Valuation of Debt Securities,” Frank J. Fabozzi, CFA2011 Modular Level I, Vol. 5, pp. 507-510Study Session 16-65-fExplain the arbitrage-free valuation approach and the market process that forces the price of a bond toward its arbitrage-free value, and explain how a dealer can generate an arbitrage profit if a bond is mispriced.B is correct because strips can be purchased to create a synthetic U.S. Treasury security to cover the short at a price lower than the price at which the U.S. Treasury security was shorted, generating a profit.1、An analyst does research about a floating rate securities.All else being equal, theprice of a floating-rate security is most likely to react in the same way to changesin market interest rates as a fixed-rate coupon bond if market rates:【单选题】A.increase between coupon reset dates.B.are substantially below the floating rate security's cap rate.C.are substantially above the floating rate security's cap rate.正确答案:C答案解析:浮动利率证券的利率会随着市场利率的变化而进行调整,从而使利率风险减少,但是并不能完全消除。

CFA考试一级章节练习题精选0331-9(附详解)1、An analyst does research about duration.Which of the following measure is thelowest for a currently callable bond?【单选题】A.Macaulay duration.B.Effective duration.C.Modified duration.正确答案:B答案解析:可赎回债券(callable bond)和可回售债券(putable bond)比不含权债券对于利率的敏感性更低,因此,用有效久期来衡量可赎回债券比用麦考林久期和修正久期来衡量的数值更小。

有内嵌式权利的债券,都要用有效久期衡量。

1、A 10-year bond is issued on January 1, 2010. Its contract requires that its coupon rate change over time as shown in the following table:This security is best described as an example of a:【单选题】A.step-up note.B.floating-rate bond.C.deferred coupon bond.正确答案:A答案解析:“Features of Debt Securities,” Frank J. Fabozzi, CFA2011 Modular Level I, Vol. 5, p. 326Study Session 15-61-bDescribe the basic features of a bond, the various coupon rate structures, and the structure of floating-rate securities.A is correct because a step-up note has contractually mandated changes in its coupon rate.1、One advantage of the full valuation approach to measuring interest rate risk relative to theduration/convexity approach is that the full valuation approach:【单选题】A.increases measurement accuracy.B.is easier to model than scenario analysis.C.requires the yield curve to change in a parallel fashion.正确答案:A答案解析:“Introduction to the Measurement of Interest Rate Risk”, Frank J. Fabozzi, CFA2013 Modular Level I, Vol. 5, Reading 58, Section 2Study Session 16-58-aDistinguish between the full valuation approach (the scenario analysis approach) and theduration/convexity approach for measuring interest rate risk, and explain the advantage of usingthe full valuation approach.A is correct because the full valuation approach allows modeling of the response to both paralleland non-parallel yield curve changes and will reflect cash flows that change when interest rateschange, whereas the duration/convexity approach assumes parallel yield curve changes andfixed cash flows.1、The bonds of Whakatane and Co. are priced for settlement on 15 July 2014 and have the following features.On the basis of this information, the difference between the full and flat prices is closest to:【单选题】A.1.333.B.2.667.C.0.917.正确答案:A答案解析:The difference between the full and flat prices is the accrued interest, which is computed as follows. Based on the Actual/Actual day convention, the number of days between the coupon periods is 183 days. Also, using the Actual/Actual day count convention, the number of days between 15 May 2014 and15 July 2014 is 16 days remaining in May + 30 days in June + 15 days in July = 61 days. Accrued interest (per $100 par value) = (61/183)(8.00/2) = 1.333.2014 CFA Level I"Introduction to Fixed-Income Valuation," by James F. Adams and Donald J. SmithSection 3.11、Which of the following is least likely a tool used by the U.S. Federal Reserve Bank to directly influence the level of interest rates?【单选题】A.Verbal persuasionB.Open market operationsC.Setting the rate on 30-year bonds正确答案:C答案解析:“Understanding Yield Spreads,” Frank J. Fabozzi2012 Modular Level I, Vol. 5, pp. 448–449Study Session 15-56-aIdentify the interest rate policy tools available to a central bank.C is correct because the U.S. Federal Reserve Bank (Fed) uses policy tools to directly influence short-term interest rates. It only indirectly influences long-term interest rates. The market, not the Fed, sets rates on 30-year bonds.。

CFA考试一级章节练习题精选0330-24(附详解)1、An analyst does research about various risks of investing in bonds.Investors inU.S.Treasury Inflation-Protected Securities are most likely to be exposed to:【单选题】A.credit risk.B.reinvestment rate risk.C.purchasing power risk.正确答案:B答案解析:美国政府的通货膨胀保护证券信用极好,所以没有违约风险。

同时,由于通货膨胀保护证券的本金会随着通货膨胀率调整,所以大幅度减少了购买力风险。

但通货膨胀保护证券所拿到的利息会面临再投资风险。

1、Duration is most accurate as a measure of interest rate risk for a bond portfolio when the slope ofthe yield curve:【单选题】A.stays the same.B.increases.C.decreases.正确答案:A答案解析:Duration measures the change in the price of a portfolio of bonds if the yields for all maturities changeby the same amount; that is, it assumes theslope of the yield curve stays the same.CFA Level 1"Understanding Fixed-Income Risk and Return," James F. Adams and Donald J. SmithSection 31、All else being equal, in a rising interest rate environment, the price of a floating-ratesecurity will most likely decline if:【单选题】A.there is no cap.B.the margin required by investors declines.C.the coupon is reset every six months rather than monthly.正确答案:C答案解析:如果没有利率顶(CAP)就会降低利率风险,利率上升,息票率也随之上升,价格不会下跌。

CFA考试一级章节练习题精选0330-54(附详解)1、An analyst compares different real estate valuation methods.A factor common tothe sales comparison approach and the income approach is that both approachesrequire :【单选题】A.identification of benchmark properties.B.knowledge of investor's marginal tax rate.C.calculation of the property's net operating income.正确答案:A答案解析:销售比较法(sales comparison approach)不需要计算房地产项目的经营性净收入(NOI),所以也不需要知道投资者的边际税率(marginal tax rate)。

但销售比较法和收入法都需要定义一个标的资产,销售比较法需要寻找基准的房地产用来得到其销售价格,并用以计算该房地产的价格;收入法需要寻找基准的房地产用来得到市场的资本化率(marketcapitalization rate),并用来折现该房地产的经营性净收入,得到房地产的价格。

2、The real estate valuation approach that uses a perpetuity discount type model is the:【单选题】A.cost approach.B.income approach.C.sales comparison approach.正确答案:B答案解析:“Alternative Investments”, Global Investments, Sixth Edition, by Bruno Solnik and Dennis McLeavey, CFA2011 Modular Level I, Volume 6, p. 205Study Session 18-74-eDescribe the various approaches to the valuation of real estate.B is correct. The income approach to real estate valuation values a property using a perpetuity discount type of model.3、Which of the following is least likely an aggregation vehicle for real estate ownership?【单选题】A.Leveraged equity rightsB.Real estate investment trusts (REITs)C.Real estate limited partnerships (RELPs)正确答案:A答案解析:“Alternative Investments,” Bruno Solnik and Dennis McLeavey2012 Modular Level I, Vol. 6, pp. 201–202Study Session 18-66-eDescribe the forms of real estate investment, and explain their characteristics as an investable asset class.A is correct because leveraged equity rights is not an aggregation vehicle. Leveraged equity does not give investors collective access to real estate investments.4、Adding alternative investments to a portfolio of traditional investments will most likely result in a new combined portfolio with returns and standard deviation that are, respectively:【单选题】A.B.C.正确答案:B答案解析:“Introduction to Alternative Investments”, Terri Duhon, George Spentzos, CFA, and Scott D. Stewart, CFA 2013 Modular Level I, Vol. 6, Reading 66, Section 2.3Study Session 18-66-cDescribe potential benefits of alternative investments in the context of portfolio management.B is correct because the risk/return profile of the overall portfolio will potentially improve. The overall risk will most likely drop, and the overall return will most likely rise.5、An analyst does research about interest rate risk of fixed income securities andgathers the following information about three option-free bonds selling at par:The bond with the lowest interest rate risk is:【单选题】A.Bond 1.B.Bond 2.C.Bond 3.正确答案:B答案解析:息票率(Coupon Rate)越低,利率风险越大,因为大部分比例的现金流在未来造成价格变动的可能性增加。

CFA考试一级章节练习题精选0330-60(附详解)1、An analyst does research about accrual accounting.The accrued expense accountis most likely recorded:【单选题】A.as an asset on the balance sheet.B.on the income statement.C.as a liability on the balance sheet.正确答案:C答案解析:权责发生制(accruals)共包括以下4种情况:(1)预收账款(unearnedrevenue)——负债类账户已经收到现金,但是没有确认销售收入,因为销售的过程还没有完成。

(2)待摊费用(prepaid expense)——资产类账户现金已经支付,但费用不能马上全部确认,而是应该在一定期限内分摊。

(3)应计收入(accruedrevenue)——资产类账户企业已经提供产品或服务,但现金还没有收到。

(4)应计费用(accruedexpense)——负债类账户企业当期应支付,但尚未支付的费用。

2、The following information is available about a manufacturing company:If the company is using International Financial Reporting Standards (IFRS), instead of U.S. GAAP, its cost of goods sold ($ millions) is most likely:【单选题】A.the same.B.0.3 lower.C.0.3 higher.正确答案:A答案解析:“Inventories,” Michael A. Broihahn2012 Modular Level I, Vol. 3, pp. 416–418Study Session: 9-29-fDescribe the measurement of inventory at the lower of cost and net realisable value.A is correct. Under IFRS, the inventory would be written down to its net realizable value ($4.1 million), whereas under U.S. GAAP, market is defined as current replacement cost and hence would be written down to its current replacement cost ($3.8 million). The smaller write down under IFRS will reduce the amount charged to the cost of goods sold, as compared with U.S. GAAP, and result in a lower cost of goods sold of $0.3 million.3、A company is buying back its stocks to offset the dilution of earnings from its stock option program. Which of the following statements best describes the effect on the financial statements of the amount spent to buy back the stocks? The amount spent reduces:【单选题】 income.B.cash from operating activities.C.cash from financing activities.正确答案:C答案解析:“Understanding the Cash Flow Statement” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, R Elaine Henry, CFA, and Michael A. Broihahn, CFA2020 Modular Level I, Vol. 3, pp. 251-252“Accounting Shenanigans on the Cash Flow Statement,” Marc A. Siegel2010 Modular Level I, Vol. 3, p. 595-598Study Session 8-34-a, 10-41Compare and contrast cash flows from operating, investing and financing activities and classify cash flow items as relating to one of these three categories, given a description of the items.The candidate should be able to analyze and discuss the following ways to manipulate thecash flow statement: ·stretching out payables, ·financing of payables, ·securitization of receivables, and ·using stock buybacks to offset dilution of earnings The amount spent to buy back stocks to offset dilution is classified as a financing activity on the cash flow statement and therefore cash from financing decreases.4、The following common-size income statement data and tax rates are available on a company.The profitability ratio that had the largest absolute increase in value in the current year is the:【单选题】A.operating profit margin. profit margin.C.gross profit margin.正确答案:C答案解析:The gross profit margin increased the most in the current year:CFA Level I"Understanding Income Statements," Elaine Henry and Thomas R. RobinsonSections 5.5, 7.2"Financial Analysis Techniques," Elaine Henry, Thomas R. Robinson, and Jan Hendrik van GreuningSection 4.55、The financial statement that would be most helpful to an analyst in understanding the changes that have occurred in a company’s retained earnings over a year is the statement of:【单选题】A.changes in equity.B.financial position.prehensive income.正确答案:A答案解析:“Financial Statement Analysis: An Introduction,” Elaine Henry and Thomas R. Robinson2012 Modular Level I, Vol. 3, pp. 21–22Study Session 7-22-bDescribe the roles of the key financial statements (statement of financial position, statement of comprehensive income, statement of changes in equity, and statement of cash flows) in evaluating a company’s performance and position.A is correct. The statement of changes in equity reports the changes in the components of shareholders’ equity over the year, which would include the retained earnings account.。

CFA考试一级章节练习题精选0330-59(附详解)1、Last year, a portfolio manager earned a return of 12%. The portfolio’s beta was 1.5. For the same period, the market return w as 7.5% and the average risk-free rate was 2.7%. Jensen’s alpha for this portfolio is closest to:【单选题】A.0.75%.B.2.10%.C.4.50%.正确答案:B答案解析:“Portfolio Risk and Return Part II,” Vijay Singal2012 Modular Level I, Vol. 4, pp. 429–432Study Session 12-45-hDescribe and demonstrate applications of the CAPM and the SML.B is correct. Jensen’s alpha = 0.12 – [0.027 + 1.5(0.075 – 0.027)] = .021 or 2.10%.2、A portfolio with equal parts invested in a risk-free asset and a risky portfolio will most likely lie on:【单选题】A.the efficient frontier.B.the security market line.C.a capital allocation line.1正确答案:C答案解析:“Portfolio Risk and Return: Part II”, by Vijay Singal.2011 Modular Level I, Vol. 4, pp. 392-400Study Session 12-53-bExplain and interpret the capital allocation line (CAL) and the capital market line (CML).C is correct. A capital allocation line shows possible combinations of a risky portfolio and the risk-free asset.3、An analyst does research about the portfolio's standard deviation of return.Aportfolio consisting of two securities has the following characteristics:If the correlation of returns between the two securities is -0.25, the portfolio'sstandard deviation of return is closest to:【单选题】A.12.22%B.14.78%C.14.93%正确答案:A答案解析:投资组合的方差- 2 × 0.35 × 0.55 × 0.16 × 0.19 × 0.25 = 0.00314 +0.01525 - 0.00346 = 0.01493。

CFA考试一级章节练习题精选0330-34(附详解)1、The bonds issued by ALS Corp. are curren tly priced at 108.00 and are option free. Based on a portfolio manager’s valuation model, a 10 basis points rise in interest rates will result in the bond price falling to 106.50 while a 10 basis points fall in interest rates will result in the bond price rising to 110.00. The market value of the portfolio manager’s holdings of ALS bonds is $2 million. The expected change in the market value of this holding for a 100 basis point change in interest rates will be closest to:【单选题】A.$124,000.B.$322,600.C.$645,200.正确答案:B答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi, CFA2013 Modular Level I, Vol. 5, Section 2.5Study Session 15-53-fCalculate and interpret the duration and dollar duration of a bond.B is correct because the bond’s duratio n is computed using:The approximate percent change in the value of the holdings (the dollar duration) is:0.1613 × 2,000,000 = $322,600.2、When a bank creates a collateralized loan obligation (CLO) to divest of commercial loans that it owns, the process is best described as a(n):【单选题】A.arbitrage transaction.B.balance sheet transaction.C.capital infusion transaction.正确答案:B答案解析:“Overview of Bond Sectors and Instruments,” Frank J. Fabozzi2012 Modular Level I, Vol. 5, pp. 426–427Study Session 15-55-jDescribe collateralized debt obligations.B is correct because a balance sheet transaction is one that removes assets from the balance sheet of the institution and is often motivated by the desire to reduce the institution’s risk.3、An analyst does research about difference between an option-free bond and acallable pared to an otherwise identical option-free bond, a callablebond is least likely to have:【单选题】A.a more uncertain cash flow pattern.B.less price appreciation potential as interest rates fall.C.more price depreciation potential as interest rates rise.正确答案:C答案解析:相对于不含权的债券,可赎回债券的现金流由于其可能被赎回而更加不确定。

CFA考试一级章节练习题精选0330-9(附详解)

1、An analyst does research about the limitations of cash flow yield.Which of thefollowing statements is least accurate to be a shortcoming in application of thecash flow yield measure?【单选题】

A.The projected cash flows are assumed to be reinvested at the cash flowyield.

B.The mortgage-backed or asset-backed security is assumed to be held untilthe final payoff of all the loans, based on some prepayment assumption.

C.Because of principle prepayments, in order to project cash flow it is necessaryto make an assumption about the rate at which principle prepaymentswill occur.

正确答案:C

答案解析:选项A和B都是现金流收益率的局限性。

其中一个缺陷是现金流收益率假设以该收益率获得再投资收入,而实际情况可能不同。

另外一个缺陷是假设根据提前偿付的假设持有到期,但有可能会提前偿还本金。

选项C则不是现金流收益率的局限性。

2、An analyst does research about exchange trade funds (ETFs).Which of thefollowing statements is least accurate to describe exchange trade funds' characteristics?【单选题】

A.Portfolio holdings of ETFs are transparent.

B.ETF's structure prevents a significant premium or discount to NAV.

C.Dividends are reinvested annually for open-end ETFs.

正确答案:C

答案解析:ETF不收取申购和赎回费用,可以卖空或者融资交易,同时组合的持仓是透明的。

ETF的申购和赎回机制使得其交易价格十分接近净资产值,没有显著的溢价或折价。

开放式ETF的股利会被立即进行再投资,而不是每年。

3、All else being equal, an option-free bond least likely has greater:【单选题】

A.interest rate risk than a callable bond.

B.reinvestment risk than a callable bond.

C.price appreciation potential than a callable bond.

正确答案:B

答案解析:可赎回债券与不可赎回债券相比有更低的利率风险,因为可赎回债券有赎回价格,价格波动的幅度被限制住了,但是可赎回债券有可能提前被赎回,投资者得到本金后,会有更高的再投资风险,可赎回债券价格上涨的潜力被限制在赎回价格以下,所以不可赎回债券的价格上升潜力要大于可赎回债券。

题目中说非含权债券比可赎回债券有更大的再投资风险是错误的。

4、Which of the following most likely exhibits negative convexity?【单选题】

A.A putable bond

B.A callable bond

C.An option-free bond

正确答案:B

答案解析:“Introduction to the Measurement of Interest Rate Risk” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 58, Section 3.2

Study Session 16-58-b, c

Describe the price volatility characteristics for option-free, callable, prepayable, and putable bonds when interest rates change.

Describe positive convexity and negative convexity, and their relation to bond price and yield.

B is correct because a callable bond exhibits negative convexity at low yield levels and positive convexity at high yield levels.

5、A bond is selling for 98.2. It is estimated that the price will fall to 96.6 if yields rise 30 bps and that the price will rise to 100.1 if yields fall 30 bps. Based on these estimates, the duration of the bond is closest to:【单选题】

A.1.78.

B.5.94.

C.11.88.

正确答案:B

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi, CFA

2011 Modular Level I, Vol. 5, pp. 357-358

Study Session 15-62-f

Calculate and interpret the duration and dollar duration of a bond.

B is correct because the duration equals。