公司理财选择1

- 格式:doc

- 大小:52.00 KB

- 文档页数:7

第12章看待风险与收益的另一种观点:套利定价理论一、选择题下列哪个不是CAPM 的假设?()A.投资者风险厌恶,且其投资行为是使其终期财富的期望效用最大B.投资者是价格承受者,即投资者的投资行为不会影响市场上资产的价格运动C.资产收益率满足多因子模型D.资本市场上存在无风险资产,且投资者可以无风险利率无限借贷【答案】C【解析】套利定价理论(APT)假设资产收益率满足多因子模型。

套利定价模型的优点之一是它能够处理多个因素,而资本资产定价模型就忽略了这一点。

根据套利定价的多因素模型,收益与风险的关系可以表示为:()()()()123123K F F F F F KR R R R βR R βR R βR R β=+-+-+-++- 式中,β1代表关于第一个因素的贝塔系数,β2代表关于第二个因素的贝塔系数,依此类推。

二、简答题1.请解释什么是证券组合的系统性风险和非系统性风险,并图示证券组合包含证券的数量与证券组合系统性风险和非系统性风险间的关系。

答:(1)系统风险亦称“不可分散风险”或“市场风险”,与非系统风险相对,指由于某些因素给市场上所有的证券都带来经济损失的可能性,如经济衰退、通货膨胀和需求变化给投资带来的风险。

这种风险影响到所有证券,不可能通过证券组合分散掉。

即使投资者持有的是收益水平及变动情况相当分散的证券组合,也将遭受这种风险。

对于投资者来说,这种风险是无法消除的。

系统风险的大小取决于两个方面,一是每一资产的总风险的大小,二是这一资产的收益变化与资产组合中其他资产收益变化的相关关系(由相关系数描述)。

在总风险一定的前提下,一项资产与市场资产组合收益变化的相关关系越强,系统风险越大,相关关系越弱,系统风险越小。

非系统风险,亦称“可分散风险”或“特别风险”,是指那些通过资产组合就可以消除掉的风险,是公司特有风险,例如某些因素对个别证券造成经济损失的可能性。

这种风险可通过证券持有的多样化来抵消,因此,非系统风险是通过多样化投资可被分散的风险。

企业购买理财方案随着企业的发展,资金管理变得越来越关键。

企业如何有效地管理资金,让企业财富最大化地发挥效益,成为了每个企业家所必须面对的重要问题之一。

在这个背景下,理财产品日益受到企业关注。

企业购买理财方案不但可以帮助企业有效地管理资金,还可以为企业带来一定的财务收益。

本文将从以下三个方面来介绍企业购买理财方案。

1. 理财产品选择企业在购买理财产品时,需要根据自身的需求和风险承受能力来选择合适的理财产品。

常见的理财产品有货币基金、债券基金、股票基金等。

货币基金风险较低,投资收益一般稳定,适合企业短期闲置资金的理财。

债券基金的风险低于股票基金,适合企业中长期的闲置资金的理财。

股票基金的风险相对较高,收益也相对较高,适合企业有一定投资经验和风险承受能力的理财。

在选择理财产品时,企业还需要根据产品的历史业绩、投资策略、管理机构等方面进行综合分析,并注意其合规性和透明度。

2. 理财方案设计在购买理财产品时,企业需要根据自身的资金规模、资金流动性、风险偏好等因素,设计合适的理财方案。

第一步是确定理财计划的规模和期限。

企业需要充分考虑自身的资金状况和运营需求,制定合理的理财计划。

第二步是确定投资策略。

企业可以选择单一的投资策略,如分散风险、定投计划等,也可以选择多元化的投资策略,如配置货币基金、债券基金、股票基金等多种理财产品,以降低投资风险。

第三步是设计好理财计划的流动性,确保企业在需要时能够及时提现。

一般来说,企业应该在理财计划中保留一定流动性,以应对可能的资金周转需求。

3. 理财方案风险控制企业购买理财产品本身就具有一定的风险。

为了降低风险,企业需要从产品选购、方案设计、资金流动、业绩监控等方面进行全面的风险控制。

首先,在选择理财产品时,企业需要调查理财产品的历史业绩、管理机构、风险水平等信息,全面评估产品的风险与收益。

其次,在方案设计中,企业需要根据自身的风险承受能力和流动性需求,制定合理的理财计划和投资策略。

CHAPTER 1Introduction to Financial Management I. DEFINITIONSTopic: CORPORATE CONTROLLER1. The corporate officer generally responsible for tasks related to tax management, cost accounting,financial accounting, and data processing is the:A) Corporate Treasurer.B) Director.C) Corporate Controller.D) Chairman of the Board.E) Vice President of Operations.Answer: CTopic: CORPORATE TREASURER2. The corporate officer generally responsible for tasks related to cash and credit management,financial planning, and capital expenditures is the:A) Corporate Treasurer.B) Director.C) Corporate Controller.D) Chairman of the Board.E) Vice President of Operations.Answer: ATopic: CAPITAL BUDGETING3. The process of planning and managing a firm's long-term investments is called:A) Working capital management.B) Financial depreciation.C) Agency cost analysis.D) Capital budgeting.E) Capital structure.Answer: DTopic: CAPITAL STRUCTURE4. The mixture of debt and equity used by the firm to finance its operations is called:A) working capital management.B) financial depreciation.C) agency cost analysis.D) capital budgeting.E) capital structure.Answer: ETopic: WORKING CAPITAL MANAGEMENT5. The management of the firm's short-term assets and liabilities is called:A) Working capital management.B) Financial depreciation.C) Agency cost analysis.D) Capital budgeting.E) Capital structure.Answer: ATopic: SOLE PROPRIETORSHIP6. A business owned by a single individual is called a(n):A) Corporation.B) Sole proprietorship.C) Partnership.D) Closed receivership.E) Open structure.Answer: BTopic: PARTNERSHIP7. A business formed by two or more individuals or entities is called a(n):A) Corporation.B) Sole proprietorship.C) Partnership.D) Closed receivership.E) Open structure.Answer: CTopic: CORPORATION8. A business created as a distinct legal entity composed of one or more individuals or entities iscalled a(n):A) Corporation.B) Sole proprietorship.C) Partnership.D) Closed receivership.E) Open structure.Answer: ATopic: PARTNERSHIP AGREEMENT9. The division of profits and losses between the members of a partnership is formalized in the:A) Indemnity clause.B) Indenture contract.C) Statement of purpose.D) Partnership agreement.E) Group charter.Answer: DTopic: ARTICLES OF INCORPORATION10. The document that legally establishes domicile for a corporation is called the:A) Indenture contract.B) Partnership agreement.C) Amended homestead filing.D) Bylaws.E) Articles of incorporation.Answer: ETopic: BYLAWS11. The rules by which corporations govern themselves are called:A) Indenture provisions.B) Indemnity provisions.C) Partnership agreements.D) Bylaws.E) Articles of incorporation.Answer: DTopic: LIMITED LIABILITY CORPORATION12. A business entity operated and taxed like a partnership, but with the limited liability feature forowners, is called a:A) Limited liability corporation.B) General partnership.C) Cartel.D) Sole proprietorship.E) Corporation.Answer: ATopic: FINANCIAL MANAGEMENT GOAL13. The primary goal of financial management is to:A) Maximize current sales.B) Maximize the current value per share of the existing stock.C) Avoid financial distress.D) Minimize operational costs.E) Maintain steady earnings growth.Answer: BTopic: AGENCY PROBLEM14. The possibility of conflict of interest between the stockholders and management of the firm iscalled:A) The shareholders' conundrum.B) Corporate breakdown.C) The agency problem.D) Corporate activism.E) Legal liability.Answer: CTopic: AGENCY COSTS15. Agency costsA) The total dividends paid to shareholders over the lifetime of the firm.B) The costs that result from default and bankruptcy of the firm.C) Corporate income subject to double taxation.D) The costs of the conflict of interest between stockholders and management.E) The total interest paid to creditors over the lifetime of the firm.Answer: DTopic: STAKEHOLDERS16. A stakeholder is:A) Given to each stockholder when they first purchase their stock.B) A proxy vote made at a shareholders meeting.C) A founding stockholder of the firm.D) An original creditor of the firm.E) A person or entity other than a stockholder or creditor who potentially has a claim on the cashflows of the firm.Answer: ETopic: PRIMARY MARKET17. The original sale of securities by governments and corporations occurs in the:A) Primary market.B) Secondary market.C) Dealer market.D) Auction market.E) Liquidation market.Answer: ATopic: SECONDARY MARKET18. The purchase and sale of securities after the original issuance occurs in the:A) Primary market.B) Secondary market.C) Dealer market.D) Auction market.E) Liquidation market.Answer: BTopic: DEALER MARKET19. A market where dealers buy and sell securities for themselves, at their own risk, is called a(n):A) Primary market.B) Secondary market.C) Dealer market.D) Auction market.E) Liquidation market.Answer: CTopic: AUCTION MARKET20. A market where trading takes place between buyers and sellers directly is called a(n):A) Primary market.B) Secondary market.C) Dealer market.D) Auction market.E) Liquidation market.Answer: DII CONCEPTSTopic: BUSINESS ORGANIZATIONS21. Which of the following does NOT offer the protection of limited liability?A) corporationB) limited liability companyC) sole proprietorshipD) limited partnershipE) S corporationAnswer: CTopic: FINANCIAL MANAGEMENT GOAL22. The fundamental goal of financial management should be to:A) Maximize sales.B) Maximize the current value per share of the existing stock.C) Avoid financial distress.D) Maintain steady earnings growth.E) Maximize profits.Answer: BTopic: FINANCIAL MANAGER23. Which of the following does NOT address the question: "What are the duties of a financialmanager?"I. Deciding how much interest to pay the holders of the corporation's bonds.II. Deciding the mix of long-term debt and equity.III. Deciding which projects a firm should undertake.IV. Deciding how much short-term debt to use.A) I onlyB) III onlyC) II and III onlyD) II, III, and IV onlyE) I, II, III, and IVAnswer: ATopic: BUSINESS ORGANIZATIONS24. Which of the following statements is true regarding the corporate form of organization compared tothat of the sole proprietorship?A) The owners of the sole proprietorship have limited liability for the firm's debts.B) The sole proprietorship is the simplest business form to start-up.C) The corporation has a limited life.D) Dividends received by the corporation's shareholders are tax-exempt.E) It is more difficult to transfer ownership in a corporation.Answer: BTopic: AGENCY COSTS25. Which of the following is NOT a type of agency cost?A) The cost of an audit of the firm's financial statements.B) The cost of a corporate jet provided to the CEO as part of her compensation package.C) Loans provided to the firm's managers at below-market interest rates.D) The costs of financing the firm.E) The cost of providing life insurance to the firm's CFO.Answer: DTopic: AGENCY THEORY26. Commtel Partners hires Smith Brothers investment bank to negotiate the purchase of the fiber opticassets of . Identify the parties to this transaction.A) Smith is the principal and Commtel is the agent.B) Commtel is the principal and Smith is the agent.C) Lightware is the principal and Commtel is the agent.D) Smith is the agent while Lightware and Commtel together are principals.E) Commtel is the principal and Lightware is the agent.Answer: BTopic: AGENCY COSTS27. The Board of Directors of Beeline, Inc. have decided to base the salary of its financial managerentirely upon the market share of the firm. Accordingly,A) the firm may incur some agency costs since the manager will be focused on the market share ofthe firm rather than acting to maximize earnings.B) the financial manager will always act in the best interest of the shareholders since all agencycosts have been eliminated through salary incentives.C) this arrangement may be unnecessary, since the goal of the firm is to maximize earnings forshareholders, and that is most likely accomplished through larger market share.D) the manager may not act to maximize the current value of the firm's stock, resulting in agencycosts for the firm's stockholders.E) the firm will incur some agency costs if the manager acts to maximize market share.Answer: DTopic: AGENCY COSTS28. Which of the following is/are correct regarding agency costs?I. Indirect costs occur when managers, acting to minimize the risk of the firm, forego investmentsshareholders would prefer they take.II. Direct costs occur when shareholders must incur costs to monitor the manager's actions.III. Direct costs occur when managers buy assets considered necessary by the firm's owners.A) I onlyB) I and II onlyC) II onlyD) II and III onlyE) I, II, and IIIAnswer: BTopic: AGENCY THEORY29. Which of the following help ensure managers act in the best interest of owners?I. A compensation package for managers that is a flat cash salary, with no bonuses or options.II. Managers are promoted only when they have worked for the firm for at least 5 years.III. The threat that if the firm does poorly, shareholders will use a proxy fight to replace theexisting management.IV. There is a high degree of likelihood the firm will become a takeover candidate if the firm performs poorly.A) I and II onlyB) II and III onlyC) III and IV onlyD) I and III onlyE) I, II, III, and IVAnswer: CTopic: STOCK EXCHANGES30. Which of the following markets is considered an auction market?A) The New York Stock ExchangeB) The over-the-counter (OTC) marketC) NASDAQAnswer: ATopic: DOUBLE TAXATION31. Why does the double taxation problem exist for corporations?A) Corporations earn taxable income, pay taxes on that income, and then pay interest to thebondholders, who also have net taxable income.B) Corporations earn taxable income and pay taxes on that income.C) Firms with depreciation expense must repay the tax deduction over time, in addition to theirnormal tax liability on taxable corporate income.D) Corporations earn taxable income, pay taxes on that income, and then pay dividends to thestockholders, who also have net taxable income.E) Stockholders are paid a dividend and they have net taxable income.Answer: DTopic: FINANCIAL MANAGEMENT32. If you are hired as the new CEO of a corporation after graduation, which of the following wouldyou consider to be your most important criterion for success from the owners perspective?A) Pursue activities that reduce the overall riskiness of the firm.B) Pursue activities that result in the largest profits for the year.C) Pursue activities that maximize your personal wealth.D) Pursue activities that maximize the current stock price.E) Pursue activities that lead to the most stable stock price for the year.Answer: DTopic: FINANCIAL MANAGEMENT33. A financial manager is responsible for deciding whether an investment in new manufacturingequipment should be financed with debt, preferred stock, or common stock. Which of the following financial management areas would be involved in the decision process?I. Capital budgetingII. Capital structure managementIII. Working capital managementA) I onlyB) II onlyC) II and III onlyD) I and III onlyE) I, II and IIIAnswer: BTopic: MARKETS34. You are interested in purchasing 100 shares of stock in a small technology firm that trades in theUnited States. You would most likely purchase the shares in ________________.A) a primary market operated as a money marketB) a primary market operated as an auction marketC) a secondary market operated as a dealer marketD) a primary market operated as a dealer marketE) a secondary market operated as a money marketAnswer: CTopic: FINANCIAL MANAGEMENT35. According to the balance sheet model of the firm, corporate finance may be thought of as theanalysis of three primary subject areas. Which of the following correctly lists these areas?A) Capital structure, capital budgeting, security analysisB) Capital budgeting, capital structure, capital spendingC) Capital budgeting, capital structure, net working capitalD) Capital structure, net working capital, capital rationingE) Capital budgeting, capital spending, net working capitalAnswer: CTopic: CORPORATE FINANCE36. Which of the following is NOT considered one of the basic questions of corporate finance?A) What long-term investments should the firm choose.B) At what rate of interest should a firm borrow.C) Where will the firm get the long-term financing to pay for its investments.D) What mixture of debt and equity should the firm use to fund its operations.E) How should the firm manage its working capital, i.e., its everyday financial activities.Answer: BTopic: BUSINESS ORGANIZATIONS37. Which of the following is a FALSE statement concerning corporations?A) The equity that can be raised by the corporation is limited to the current shareholders' personalwealth.B) The life of the corporation is unlimited.C) The corporation has unlimited liability for business debts.D) When dividends are paid, net corporate profits are essentially taxed twice.E) It is relatively simple to transfer ownership of corporate shares.Answer: ATopic: BUSINESS ORGANIZATIONS38. Which of the following statements is/are true concerning partnerships?I. Limited partners are responsible for all debts of the partnership.II. Limited partners generally do not manage the partnership.III. In a limited partnership, all partners share equally in the gains or losses.A) I onlyB) II onlyC) I and II onlyD) II and III onlyE) I, II, and IIIAnswer: DTopic: MARKETS39. Which of the following correctly finishes this sentence: In the US, ________________.A) the OTC market has a central locationB) over-the-counter markets are operated as auction marketsC) financial markets function as both primary and secondary markets for debt and equitysecuritiesD) new issues of securities occur in secondary marketsE) auction markets do not have a physical locationAnswer: CTopic: STOCK EXCHANGES40. Which of the following is a criteria that must be met in order for a firm to be listed on the New YorkStock Exchange?A) The firm must have at least 3 shareholders owning at least 10,000 shares.B) The firm must have a minimum number of shares outstanding.C) The firm must have a market value in excess of $1 billion.D) The firm must have a minimum of 5 directors.E) The firm must not have ever suffered negative net income in a given quarter.Answer: BTopic: CASH FLOWS41. In the evaluation of cash flow in a capital budgeting decision, which of the following is NOTrelevant?I. The size of the cash flow.II. The timing of the cash flow.III. The risk of the cash flow.IV. The manager responsible for the accounting of the cash flow.A) I onlyB) I and II onlyC) II onlyD) II and IV onlyE) IV onlyAnswer: ETopic: BUSINESS ORGANIZATIONS42. You want to pool your resources with your best friend and start your own telecommunications firm.However, you are concerned about the risk this business poses to your accumulated personal wealth.To limit your exposure, you and your friend should organize the business:A) As a general partnershipB) As a limited partnershipC) As a sole proprietorshipD) As a corporationE) As a real estate investment trustAnswer: DTopic: MARKETS43. Which of the following would NOT be considered a secondary market transaction?A) A buy order to a broker for shares of stock in a company on NYSE.B) A buy order to an investment banker for a new IPO stock offering.C) A buy order to a broker for shares of stock in a company on NASDAQ.D) A buy order to a dealer for outstanding bonds of a company trading OTC.E) A buy order to a broker for a stock listed on a regional exchange.Answer: BTopic: BUSINESS ORGANIZATIONS44. Unlimited liability is a characteristic of which of the following form(s) of organization?A) sole proprietorshipB) limited partnershipC) corporationD) S corporationE) limited liability companyAnswer: ATopic: BUSINESS ORGANIZATIONS45. Which of the following is a true statement concerning a general partnership?I. Partners are responsible for the debts of the partnership.II. Partners generally do not manage the partnership.III. The income of a partnership is taxed at the partners' income tax rate.A) I onlyB) III onlyC) I and II onlyD) I and III onlyE) I, II, and IIIAnswer: DTopic: FINANCIAL MANAGEMENT46. Which of the following is FALSE concerning the economics of ethical decision-making?I. The higher the probability of detection, the more likely that one will cheat.II. The higher the sanctions imposed if detected, the less likely one is to cheat.III. The expected costs of unethical behavior are lower if information about cheating is rapidly and widely distributed.A) I onlyB) II onlyC) I and II onlyD) I and III onlyE) I, II, and IIIAnswer: DTopic: MARKETS47. Which of the following is considered a secondary market transaction?I. You buy shares in the public offering of a start-up company in the computer industry.II. Your mother sells you the shares she purchased in your uncle's latest business venture.III. You buy shares in General Motors from your closest friend.A) I onlyB) II onlyC) I and II onlyD) II and III onlyE) I, II, and IIIAnswer: DTopic: MARKETS48. On a typical day in the United States, the largest number of shares are traded:A) Over the counter.B) On the New York Stock Exchange.C) On the American Stock Exchange.D) On the Philadelphia Stock Exchange.E) In primary markets.Answer: ATopic: BUSINESS ORGANIZATIONS49. The death of the firm's owner(s) effectively dissolves which type(s) of organization?I. Sole proprietorshipII. PartnershipIII. CorporationA) I onlyB) II onlyC) III onlyD) I and II onlyE) II and III onlyAnswer: DTopic: BUSINESS ORGANIZATIONS50. Which of the following is considered a disadvantage of the corporate form of organization?I. Ease of the transfer of ownershipII. Limited lifeIII. Double taxationA) I onlyB) II onlyC) III onlyD) I and II onlyE) I, II, and IIIAnswer: CTopic: MARKET TRANSACTIONS51. A(n) ________________ is a sale of securities which typically does not require registration withthe SEC and is usually sold to a large financial institution.A) initial public offeringB) over-the-counter transactionC) primary market transactionD) secondary market transactionE) private placementAnswer: ETopic: FINANCIAL MANAGEMENT52. A financial manager is responsible for determining how much long-term debt the firm should userelative to its use of short-term borrowings. Which function is this manager involved with?I. Capital budgetingII. Capital structure managementIII. Working capital managementA) I onlyB) II onlyC) III onlyD) I and II onlyE) I, II and IIIAnswer: BTopic: BUSINESS ORGANIZATIONS53. A type of small corporation that is taxed like a partnership and thus avoids double taxation is calleda ________________.A) limited partnershipB) sole proprietorshipC) S corporationD) limited liability companyE) general partnershipAnswer: CTopic: FINANCIAL MANAGEMENT54. Which of the following combinations of attributes would make a capital expenditure projectdesirable to a financial manager?I. The project has positive book value on the company's accounting statements.II. The value of the cash flow generated by the project exceeds the project's cost.III. The project's cash flows have acceptable levels of risk and size, but not timing.A) I onlyB) II onlyC) III onlyD) II and III onlyE) I, II, and IIIAnswer: BTopic: BUSINESS ORGANIZATIONS55. A ________________ can lose, in the extreme case, her entire personal net worth.I. common stockholderII. limited partnerIII. general partnerIV. sole proprietorA) I onlyB) I and II onlyC) III and IV onlyD) II, III, and IV onlyE) II and III onlyAnswer: CTopic: FINANCIAL MANAGEMENT56. The total market value of the firm's equity is determined by ________________.A) the firm's accountantsB) the firm's managementC) investors in the stock marketD) investors in the bond marketE) regulators at the Securities and Exchange Commission (SEC)Answer: CTopic: AGENCY COSTS57. Of the following, which statement regarding agency costs is true?A) An agency problem exists when there is a conflict of interest between the stockholders andmanagement of a firm.B) An agency problem does not exist when there are conflicts of interest between principals andagents.C) An indirect agency cost occurs when firm management takes on risky projects that favorablyaffect the stock price, even though the managers are worried about keeping their jobs.D) A corporate expenditure that benefits stockholders but harms management is an agency cost.E) Agency costs are directly observable in the stock market.Answer: AIII. PROBLEMSNot applicable for Chapter 1IV. ESSAYSTopic: FINANCIAL MANAGEMENT58. List and briefly describe the three basic questions a financial manager must be concerned with.Answer:The three areas are: 1. Capital budgeting: The financial manager tries to identify investmentopportunities that are worth more to the firm than they cost to acquire. 2. Capital structure: This refers to the specific mixture of long-term debt and equity a firm uses to finance its operations.3.Working capital management: This refers to a firm's short-term assets and short-term liabilities.Managing the firm's working capital is a day-to-day activity that ensures the firm has sufficient resources to continue its operations and avoid costly interruptions.Topic: BUSINESS ORGANIZATIONS59. Why is the corporate form of business organization considered to be more important than soleproprietorships or partnerships?Answer:The importance of the corporate form of organization lies in its advantages: ease of transferring ownership, the owners' limited liability for business debts, and unlimited life of the business.Topic: BUSINESS ORGANIZATIONS60. If the corporate form of business organization has so many advantages over the corporate form,why is it so common for small businesses to initially be formed as sole proprietorships?Answer:A significant advantage of the sole proprietorship is that it is cheap and easy to form. If the soleproprietor has limited capital to start with, it may not be desirable to spend part of that capital forming a corporation. Also, limited liability for business debts may not be a significant advantage if the proprietor has limited capital, most of which is tied up in the business anyway. Finally, for a typical small business, the heart and sole of the business is the person who founded it, so the life of the business may effectively be limited to the life of the founder during its early years.Topic: FINANCIAL MANAGEMENT GOAL61. What should be the goal of the financial manager of a corporation? Why?Answer:The correct goal is to maximize the current value of the outstanding stock. This focuses correctly on enhancing the returns to shareholders, the owners of the firm. Other goals, such as maximizing earnings, focus too narrowly on accounting income and ignore the importance of market values in managerial finance.Topic: AGENCY THEORY62. Do you think agency problems arise in sole proprietorships and/or partnerships?Answer:Agency conflicts typically arise when there is a separation of ownership and management of a business. In a sole proprietorship and a small partnership, such separation is not likely to exist to the degree it does in a corporation. However, there is still potential for agency conflicts. For example, as employees are hired to represent the firm, there is once again a separation of ownership and management.Topic: BUSINESS ORGANIZATIONS63. When the Small Business Administration (SBA) makes a loan to a sole proprietorship, it typicallyrequires life insurance be carried on the business owner in an amount sufficient to cover the loan.Why might the SBA demand such coverage?Answer:The SBA knows that the heart of a small business is the existence of the owner. If the owner dies, it is likely the business will be severely harmed. Thus, the SBA wants to get out in the case of such a tragedy. This also underscores the limited life of the sole proprietorship.Topic: LIMITED LIABILITY64. Assume for a moment that the stockholders in a corporation have unlimited liability for corporatedebts. If so, what impact would this have on the functioning of primary and secondary markets for common stock?Answer:With unlimited liability, you would be very careful which stocks you invest in. In particular, you would not invest in companies you expected to be unable to satisfy their financial obligations. Both the primary and secondary markets for common stock would be severely hampered if this rule existed. It would be very difficult for a young, untested business to get enough capital to grow.Topic: FINANCIAL MANAGEMENT GOALS65. Suppose you own 100 shares of IBM stock which you intend to sell today. Since you will sell it inthe secondary market, IBM will receive no direct cash flows as a consequence of your sale. Why, then, should IBM's management care about the price you get for your shares?Answer:The current market price of IBM stock reflects, among other things, market opinion about the quality of firm management. If the shareholder's sale price is low, this indirectly reflects on the reputation of the managers, as well as potentially impacting their standing in the employment market. Alternatively, if the sale price is high, this indicates that the market believes currentmanagement is increasing firm value, and therefore doing a good job.Topic: TRANSFER OF OWNERSHIP IN A CORPORATION66. One thing lenders sometimes require when loaning money to a small corporation is an assignmentof the common stock as collateral on the loan. Then, if the business fails to repay its loan, theownership of the stock certificates can be transferred directly to the lender. Why might a lender want such an assignment? What advantage of the corporate form of organization comes into playhere?Answer:In the event of a loan default, a lender may wish to liquidate the business. Often it is timeconsuming and difficult to take title of all of the business assets individually. By taking control ofthe stock, the lender is able to sell the business simply by reselling the stock in the business. This illustrates once again the ease of transfer of ownership of a corporation.Topic: EXCHANGE LISTINGS67. Why might a corporation wish to list its shares on a national exchange such as the NYSE asopposed to a regional exchange? How about being traded OTC?Answer:Being listed on a regional exchange effectively limits the capital access for the business. Plus, there is a prestige factor in being listed on one of the national exchanges. There is still a prestige factor in moving from OTC to NYSE since the NYSE has more restrictive membership requirements.However, the lure of greater prestige certainly hasn't prompted some major corporations, such as Microsoft and Apple Computer, to move to the NYSE.。

公司理财第三版答案【篇一:公司理财习题答案】>1. 代理问题谁拥有公司? 描述所有者控制公司管理层的过程。

代理关系在公司的组织形式中存在的主要原因是什么?在这种环境下,可能会出现什么样的问题?解:股东拥有公司;股东选举董事会,董事会选举管理层(股东f董事会f管理层);代理关系在公司的组织形式中存在的主要原因是所有权和控制权的分离;在这种情况下,可能会产生代理问题(股东和管理层可能因为目标不一致而使管理层可能追求自身或别人的利益最大化,而不是股东的利益最大化)。

2. 非营利企业的目标假设你是一家非营利企业(或许是非营利医院)的财务经理,你认为什么样的财务管理目标将会是恰当的?解:所有者权益的市场价值的最大化。

3. 公司的目标评价下面这句话:管理者不应该只关注现在的股票价值,因为这么做将会导致过分强调短期利润而牺牲长期利润。

解:错误; 因为现在的股票价值已经反应了短期和长期的的风险、时间以及未来现金流量。

4. 道德规范和公司目标股票价值最大化的目标可能和其他目标,比如避免不道德或者非法的行为相冲突吗?特别是,你认为顾客和员工的安全、环境和社会的总体利益是否在这个框架之内,或者他们完全被忽略了? 考虑一些具体的情形来阐明你的回答。

解:有两种极端。

一种极端,所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30 万美元。

然而,该公司认为提高产品的安全性只会节省20 万美元。

请问公司应该怎么做呢?”5. 跨国公司目标股票价值最大化的财务管理目标在外国会有不同吗?为什么?解:财务管理的目标都是相同的,但实现目标的最好方式可能是不同的(因为不同的国家有不同的社会、政治环境和经济制度)。

6. 代理问题假设你拥有一家公司的股票,每股股票现在的价格是25 美元。

公司银行存款理财方案1. 概述本文档旨在为公司员工提供银行存款理财方案,以帮助员工根据个人需求和风险承受能力选择最适合的银行存款产品。

公司银行存款理财方案旨在优化员工的财务规划,并提供可行性和灵活性,以确保资金安全和增值。

2. 目标公司银行存款理财方案的主要目标是:•提供多样化的银行存款产品,以满足不同风险承受能力的员工需求;•帮助员工充分了解不同银行存款产品的特点和风险;•为员工提供资金安全和稳定增值的渠道;3. 理财产品介绍以下是公司银行存款理财方案中推荐的几种常见理财产品:3.1 定期存款定期存款是最常见的银行存款产品之一。

它可以分为一年期、三年期、五年期等不同期限,利率通常相对稳定。

定期存款适合那些有较低风险承受能力和短期资金需求的员工。

优点包括:•资金安全性高;•利率相对稳定;•可根据个人需要选择合适的存款期限。

3.2 活期存款活期存款是一种没有固定存款期限的银行存款产品。

它可以随时进行存取款操作,非常灵活。

活期存款适合那些对资金流动性有较高要求的员工。

优点包括:•提供随时存取款操作,方便快捷;•可以用于日常资金账户,进行流动资金管理;•通常无最低存款金额限制。

3.3 理财型存款理财型存款是一种结合定期存款和理财产品特点的银行存款产品。

它可以提供相对较高的利率,并且在一定程度上保持存款的流动性。

理财型存款适合那些愿意承担一定风险,并追求较高投资收益的员工。

优点包括:•较高的利率回报;•部分产品提供一定程度的流动性;•风险相对较低,适合风险承受能力较高的员工。

4. 风险评估公司银行存款理财方案中,风险评估是非常重要的一项环节。

员工可以根据自身风险承受能力和理财需求,选择适合的银行存款产品。

4.1 风险等级划分为了更好地帮助员工了解存款产品的风险,公司将存款产品划分为低风险、中风险和高风险三个等级。

员工可以根据自身情况选择合适的风险等级。

4.2 风险回报权衡在选择银行存款产品时,员工需要对风险和回报进行权衡。

公司账户理财方法

公司账户的理财方法有很多种,根据公司的财务状况和理财目标,可以选择以下一些常见的方法:

1. 定期存款:选择适合的存款期限和利率,将资金存入银行定期存款账户,以获得固定的利息收益。

2. 货币市场基金:将资金投入货币市场基金,获得相对较高的流动性和较低的风险。

3. 债券投资:购买公司债券、政府债券或其他信用评级较高的债券,以获取稳定的利息收入。

4. 股票投资:购买股票投资,通过股票价格上涨和股息分红获得收益。

但股票投资风险较大,需要根据公司的风险承受能力做出选择。

5. 基金投资:选择适合的基金投资,如股票型基金、债券型基金、混合型基金等,以获得更加专业的投资管理和分散风险。

6. 不动产投资:公司可以选择购买办公楼、商铺或其他房地产作为投资,以获得租金收益和资产升值。

7. 私募股权投资:投资于非上市公司的股权,以获取更高的投资回报。

但此类投资风险较高,需要谨慎评估。

不同的理财方法有不同的特点和风险,选择适合公司的理财方法时,需要考虑公司的财务状况、风险偏好和投资目标,并在专业人士的指导下进行决策。

同时,定期进行资产配置和风险控制也是理财的重要环节。

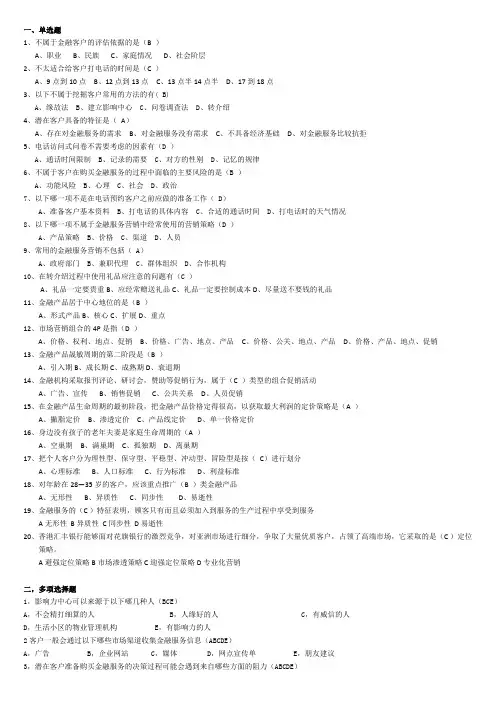

一、单选题1、不属于金融客户的评估依据的是(B )A、职业B、民族C、家庭情况D、社会阶层2、不太适合给客户打电话的时间是(C )A、9点到10点B、12点到13点C、13点半14点半D、17到18点3、以下不属于挖掘客户常用的方法的有( B)A、缘故法B、建立影响中心C、问卷调查法D、转介绍4、潜在客户具备的特征是(A)A、存在对金融服务的需求B、对金融服务没有需求C、不具备经济基础D、对金融服务比较抗拒5、电话访问式问卷不需要考虑的因素有(D )A、通话时间限制B、记录的需要C、对方的性别D、记忆的规律6、不属于客户在购买金融服务的过程中面临的主要风险的是(B )A、功能风险B、心理C、社会D、政治7、以下哪一项不是在电话预约客户之前应做的准备工作( D)A、准备客户基本资料B、打电话的具体内容C、合适的通话时间D、打电话时的天气情况8、以下哪一项不属于金融服务营销中经常使用的营销策略(D )A、产品策略B、价格C、渠道D、人员9、常用的金融服务营销不包括( A)A、政府部门B、兼职代理C、群体组织D、合作机构10、在转介绍过程中使用礼品应注意的问题有(C )A、礼品一定要贵重B、应经常赠送礼品C、礼品一定要控制成本D、尽量送不要钱的礼品11、金融产品居于中心地位的是(B )A、形式产品B、核心C、扩展D、重点12、市场营销组合的4P是指(D )A、价格、权利、地点、促销B、价格、广告、地点、产品C、价格、公关、地点、产品D、价格、产品、地点、促销13、金融产品晟敏周期的第二阶段是(B )A、引入期B、成长期C、成熟期D、衰退期14、金融机构采取报刊评论、研讨会,赞助等促销行为,属于(C )类型的组合促销活动A、广告、宣传B、销售促销C、公共关系D、人员促销15、在金融产品生命周期的最初阶段,把金融产品价格定得很高,以获取最大利润的定价策略是(A )A、撇脂定价B、渗透定价C、产品线定价D、单一价格定价16、身边没有孩子的老年夫妻是家庭生命周期的(A )A、空巢期B、满巢期C、孤独期D、离巢期17、把个人客户分为理性型、保守型、平稳型、冲动型、冒险型是按(C)进行划分A、心理标准B、人口标准C、行为标准D、利益标准18、对年龄在28—35岁的客户,应该重点推广(B )类金融产品A、无形性B、异质性C、同步性D、易逝性19、金融服务的(C )特征表明,顾客只有而且必须加入到服务的生产过程中享受到服务A无形性 B异质性 C同步性 D易逝性20、香港汇丰银行能够面对花旗银行的激烈竞争,对亚洲市场进行细分,争取了大量优质客户,占领了高端市场,它采取的是(C )定位策略。

东财《公司理财》在线作业一-0018试卷总分:100 得分:0一、单选题(共15 道试题,共60 分)1.下列哪一项不是跨国公司风险调整的方法:A.缩短投资回收期B.提高折现率C.调整现金流量D.提高风险补偿率正确答案:D2.当资产负债率大于以下哪个数值时,表明企业已资不抵债,视为达到破产的警戒线:A.50%B.0C.100%D.200%正确答案:C3.商业信用筹资最大的优点是:A.期限较短B.成本较低C.容易获得D.金额不固定正确答案:C4.可以分为货币互换和利率互换两种基本类型的是:A.权益互换B.资产互换C.债务互换D.信用互换正确答案:D5.目标公司董事会决议,如果目标公司被并购,且高层管理者被革职时,他们可以得到巨额退休金,以提高收购成本。

这种反收购策略是:A.“毒丸”策略B.“焦土”政策C.“白衣骑士”D.“金降落伞”策略正确答案:D6.货币时间价值是:A.货币经过投资后所增加的价值B.没有通货膨胀情况下的社会平均资金利润率C.没有通货膨胀和风险的条件下的社会平均资金利润率D.没有通货膨胀条件下的利率正确答案:C7.财务关系是企业在组织财务活动过程中与有关各方所发生的:A.经济往来关系B.经济协作关系C.经济责任关系D.经济利益关系正确答案:D8.认股权证本质是:A.买进期权B.卖出期权C.双向期权D.依具体条件而定正确答案:A9.下列属于企业筹资渠道的是:A.长期借款B.企业自留资金C.商业信用D.融资租赁正确答案:B10.下列不属于可转换债券筹资特点的是:A.可转换债券筹资具有高度的灵活性B.一般来说,可转换债券的报酬率较低C.可转换债券转换后,可能会稀释公司原有股东的参与权D.发行可转换债券,与发行纯债券相比,必然使发行公司受益正确答案:D11.下列项目中,与财务管理机构的设置无关的因素是:A.公司规模大小B.经济发展水平C.经济管理体制。

公司理财选择题公司理财选择题基本信息:[矩阵文本题]一、单项选择题1.在金融市场上,任何人都无法通过任何方法利用已公开或未公开的信息获得超额利润,该金融市场的效率程度是( )。

[单选题]A 弹式效率性B 半强式效率性C 强式效率性(正确答案)D 以上都不是2.下列不属于委托人与代理人之间产生矛盾或冲突的动因是( )。

[单选题]A 双方的目标函数不同B 双方信息不对称C 双方风险分担不均衡D 双方法律意识不同(正确答案)3.公司财务管理的基本决策不包括( )。

[单选题]A 投资决策B 会计核算决策(正确答案)C 收益分配决策D 融资决策4.股东是公司的所有者,是公司风险的主要承担者,因此,股东对于公司收益的索取权是( )。

[单选题]A 剩余索取权(正确答案)B 固定索取权C 法定索取权D 或有索取权5.无论从市场功能上看,还是从交易规模上看,构成整个金融市场核心部分的是( )。

[单选题]A 外汇市场B 商品期货市场C 期权市场D 有价证券市场(正确答案)6.“所有包含过去证券价格变动的资料和信息都已完全反映在证券的现行市场中;证券价格的过去变化和未来变化是不相关的”下列各项中符合这一特征的是( )。

[单选题]A 弹式效率性的市场(正确答案)B 半强式效率性市场C 强式效率性市场D 以上都不是7.在金融市场上,任何人都无法通过任何方法利用已公开或未公开的信息获得超额利润,该金融市场的效率程度是( )。

[单选题]A 弹式效率性B 半强式效率性C 强式效率性(正确答案)D 以上都不是8.下列不属于委托人与代理人之间产生矛盾或冲突的动因是( )。

[单选题]A 双方的目标函数不同B 双方信息不对称C 双方风险分担不均衡D 双方法律意识不同(正确答案)9.某基准利率又称无风险利率,即投资于风险资产而放弃无风险资产机会成本,其构成因素为( )。

[单选题]A 市场平均收益率和预期通货膨胀率B 实际收益率和预期通货膨胀率C 真实无风险利率和实际收益率D 真实无风险利率和预期通货膨胀率(正确答案)10.若债券每半年复利一次,其有效利率( )。

公司银行存款理财方案随着公司的不断发展壮大以及业务拓展,对于公司资金管理的要求也日益提高。

为了有效管理公司资金并获取更高的收益,公司需要采取一些理财措施,其中之一就是银行存款理财方案。

方案概述该银行存款理财方案是基于公司的资金规模、流动性需求以及风险偏好等因素制定的,并由经验丰富的金融专家团队实施操作。

具体方案如下:存款种类根据公司资金规模和流动性需求,推荐以下存款种类:•活期存款:用于日常资金的结算和运营,可随时提现,没有存取限制。

•定期存款:可以提供一定期限的固定收益,适合公司较为稳定的资金,一般我们建议存储1年及以上的期限。

•零存整取存款:适合有一定年金性需要的公司,每月存入相同金额,到期后获得一定收益。

存款规划公司根据自身的资金规模和财务需求,对存款的金额和期限进行规划。

具体规划如下:•活期存款:根据公司的日常资金流动情况,开立活期账户,用于工作日资金往来结算。

•定期存款:存入总额为300万元,存款期限分别为1年、2年和3年,分别按照100万元、100万元和100万元的存款构成“阶梯式”存款。

•零存整取存款:按照计划每月存入10万元,存满12个月后可获得一定收益。

据我们的历史收益数据,预计1年后可获得3.5%左右的年化收益率。

风险评估与其它理财方案相比较,银行存款理财具有较低的风险性。

然而,公司在存款类型选择及存款期限规划过程中,需要根据自身的风险偏好和与银行的合作历史,评估各种存款种类可能存在的风险。

收益分析具体存款方案的收益情况如下:•活期存款:无定期收益率。

•定期存款:1年、2年、3年期的定期存款利率分别为3.5%、4%、4.5%,到期可按期取回本金与利息;•零存整取存款:以3.5%左右的年化收益率计算,预计收益为3.5万元。

方案优势该银行存款理财方案具有以下优势:•风险低:相比于其它理财产品,银行存款理财风险相对较低,非常适合公司通过理财获取稳定收益。

•稳健收益:由于选择了较为稳定的存款类型及期限,能够为公司提供更为稳定的收益。

公司理财的一个核心,两个问题,最终目标

公司理财的一个核心是资金管理,它可以帮助公司实现以下两个主要目标:

1. 优化资金结构:公司可以通过理财来降低成本、提高收益,优化自身的资金结构,为企业的运营和发展提供更稳定的资金支持。

2. 风险管理:理财还可以帮助公司分散投资风险,保护企业资金安全,减少损失。

同时,在理财过程中,公司还可以通过对市场、行业、政策的研究,提高对宏观经济的洞察力和风险应对能力,为企业的长期发展打下更坚实的基础。

《公司理财》试题及答案第一章公司理财概述一、单项选择题1、在筹资理财阶段,公司理财的重点内容是( B )。

A有效运用资金 B如何设法筹集到所需资金 C研究投资组合 D国际融资二、填空题1、在内部控制理财阶段,公司理财的重点内容是如何有效地(运用资金)。

2、西方经济学家和企业家以往都以(利润最大化)作为公司的经营目标和理财目标。

3、现代公司的理财目标是(股东财富最大化)。

4、公司资产价值增加,生产经营能力提高,意味着公司具有持久的、强大的获利能力和(偿债能力)。

5、公司筹资的渠道主要有两大类,一是(自有资本)的筹集,二是(借入资本)的筹集。

三、简答题1、为什么以股东财富最大化作为公司理财目标?(1)考虑到了货币时间价值和风险价值;(2)体现了对公司资产保值增值的要求;(3)有利于克服公司经营上的短期行为,促使公司理财当局从长远战略角度进行财务决策,不断增加公司财富。

2、公司理财的具体内容是什么?(1)筹资决策;(2)投资决策;(3)股利分配决策。

第二章财务报表分析一、单项选择题1、资产负债表为( B )。

A动态报表 B静态报表 C动态与静态相结合的报表 D既不是动态报表也不是静态报表2、下列负债中属于长期负债的是( D )。

A应付账款 B应交税金 C预计负债 D应付债券3、公司流动性最强的资产是( A )。

A货币资金 B短期投资 C应收账款 D存货4、下列各项费用中属于财务费用的是( C )。

A广告费 B劳动保险费 C利息支出 D坏账损失5、反映公司所得与所占用的比例关系的财务指标是( B )。

A资产负债率 B资产利润率 C销售利润率 D成本费用利润率二、多项选择题1、与资产负债表中财务状况的计量直接联系的会计要素有( ABC )。

A资产 B负债 C所有者权益 D成本费用 E收入利润2、与利润表中经营成果的计量有直接联系的会计要素有( BCD )。

A资产 B收入 C成本和费用 D利润 E所有者权益三、填空题1、资产的实质是(经济资源)。

d 15. Agency costs refer to:a. the total dividends paid to stockholders over the lifetime of a firm.b. the costs that result from default and bankruptcy of a firm.c. corporate income subject to double taxation.d. the costs of any conflicts of interest between stockholders and management.e. the total interest paid to creditors over the lifetime of the firm.d 5. A(n) ____ asset is one which can be quickly converted into cash without significantloss in value.a. currentb. fixedc. intangibled. liquide. long-termc 21. Which one of the following accounts is generally the most liquid?a. inventoryb.buildingc.accounts receivabled.equipmente.patentBOOK V ALUEb 25. Book value:a. is equivalent to market value for firms with fixed assets.b.is based on historical cost.c.generally tends to exceed market value when fixed assets are included.d.is more of a financial than an accounting valuation.e.is adjusted to market value whenever the market value exceeds the stated bookvalue.a 26. When making financial decisions related to assets, you should:a.always consider market values.b.place more emphasis on book values than on market values.c.rely primarily on the value of assets as shown on the balance sheet.d.place primary emphasis on historical costs.e.only consider market values if they are less than book values.c 36. The cash flow to creditors includes the cash:a.received by the firm when payments are paid to suppliers.b.outflow of the firm when new debt is acquired.c. outflow when interest is paid on outstanding debt.d. inflow when accounts payable decreases.e. received when long-term debt is paid off.b 38. Which equality is the basis for the balance sheet?a. Fixed Assets = Stockholder's Equity + Current Assetsb. Assets = Liabilities + Stockholder's Equityc. Assets = Current Long-Term Debt + Retained Earningsd. Fixed Assets = Liabilities + Stockholder's Equitye. None of the above.b 45. Which of the following is not included in the computation of operating cash flow?a. Earnings before interest and taxesb. Interest paidc. Depreciationd. Current taxese. All of the above are included.BOOK V ALUEc 54. Martha’s Enterprises spent $2,400 to purchase equipment three years ago. Thisequipment is currently valued at $1,800 on today’s balanc e sheet but could actuallybe sold for $2,000. Net working capital is $200 and long-term debt is $800. What isthe book value of shareholders’ equity?a.$200b.$800c.$1,200d.$1,400e. The answer cannot be determined from the information provided. CORPORATIONa 9. A business created as a distinct legal entity composed of one or more individuals orentities is called a:a. corporation.b. sole proprietorship.c. general partnership.d. limited partnership.e. unlimited liability company.CORPORATIONe 36. Which of the following are advantages of the corporate form of business ownership?I. limited liability for firm debtII. double taxationIII. ability to raise capitalIV. unlimited firm lifea. I and II onlyb. III and IV onlyc. I, II, and III onlyd. II, III, and IV onlye. I, III, and IV onlyCORPORATIONa 37. Which one of the following statements is correct concerning corporations?a. The largest firms are usually corporations.b. The majority of firms are corporations.c. The stockholders are usually the managers of a corporation.d. The ability of a corporation to raise capital is quite limited.e. The income of a corporation is taxed as personal income of the stockholdersFACE V ALUEb 2. The principal amount of a bond that is repaid at the end of the loan term is calledthe bond’s:a. coupon.b. face value.c. maturity.d. yield to maturity.e. coupon rate.MATURITYc 3. The specified date on which the principal amount of a bond is repaid is called thebond’s:a. coupon.b. face value.c. maturity.d. yield to maturity.YIELD TO MATURITYd 4. The rate of return required by investors in the market for owning a bond is calledthe:a. coupon.b. face value.c. maturity.d. yield to maturity.e. coupon rate.e. coupon rate.COUPON RATEe 5. The annual coupon of a bond divided by its face value is called the bond’s:a. coupon.b. face value.c. maturity.d. yield to maturity.e. coupon rate.ZERO COUPON BONDSe 22. A bond that makes no coupon payments and is initially priced at a deep discount iscalled a _____ bond.a. Treasuryb. municipalc. floating-rated. junke. zero couponCURRENT YIELDb 27. The annual coupon payment of a bond divided by its market price is called the:a. coupon rate.b. current yield.c. yield to maturity.d. bid-ask spread.e. capital gains yield.YIELD TO MATURITY AND CURRENT YIELDe 48. All else constant, as the market price of a bond increases the current yield _____ and the yield to maturity _____a. increases; increases.b. increases; decreases.c. remains constant; increases.d. decreases; increases.e. decreases; decreases.ZERO COUPON BONDSe 61. A zero coupon bond:a. is sold at a large premium.b. has a price equal to the future value of the face amount given a specified rate ofreturn.c. can only be issued by the U.S. Treasury.d. has less interest rate risk than a comparable coupon bond.e. has implicit interest which is calculated by amortizing the loan.ZERO COUPON BONDSb 62. The total interest paid on a zero-coupon bond is equal to:a. zero.b. the face value minus the issue price.c. the face value minus the market price on the maturity date.d. $1,000 minus the face value.e. $1,000 minus the par value.YIELD TO MATURITYe 66. The yield to maturity isa. the rate that equates the price of the bond with the discounted cash flows.b. the expected rate to be earned if held to maturity.c. the rate that is used to determine the market price of the bond.d. equal to the current yield for bonds priced at par.e. All of the above.FACE V ALUEe 70. Face value isa. always higher than current price.b. always lower than current price.c. the same as the current price.d. the coupon amount.e. None of the above.YIELD TO MATURITYc 74. If its yield to maturity is less than its coupon rate, a bond will sell at a _____, andincreases in market interest rates will _____.a. discount; decrease this discount.b. discount; increase this discount.c. premium; decrease this premium.d. premium; increase this premium.e. None of the above.BOND V ALUATIONc 82. Consider a bond which pays 7% semiannually and has 8 years to maturity. Themarket requires an interest rate of 8% on bonds of this risk. What is this bond'sprice?a. $ 942.50b. $ 911.52c. $ 941.74d. $1,064.81e. None of the above.ZERO COUPON BONDa 83. The value of a 20 year zero-coupon bond when the market required rate of returnof 9% (semiannual) is ____ .a. $171.93b. $178.43c. $318.38d. $414.64e. None of the above.YIELD TO MATURITYc 84. The bonds issued by Jensen & Son bear a 6 % coupon, payable semiannually. Thebond matures in 8 years and has a $1,000 face value. Currently, the bond sells at par.What is the yield to maturity?a. 5.87 %b. 5.97 %c. 6.00 %d. 6.09 %e. 6.17 %PRICE OF COUPON BONDa 87. Wine and Roses, Inc. offers a 7 % coupon bond with semiannual payments and ayield to maturity of 7.73 %. The bonds mature in 9 years. What is the market priceof a $1,000 face value bond?a. $953.28b. $953.88c. $1,108.16d. $1,401.26e. $1,401.86NET PRESENT V ALUEd 17. If a project has a net present value equal to zero, then:I. the present value of the cash inflows exceeds the initial cost of the project.II. the project produces a rate of return that just equals the rate required to accept the project.III. the project is expected to produce only the minimally required cash inflows.IV. any delay in receiving the projected cash inflows will cause the project to have a negative net present value.a. II and III onlyb. II and IV onlyc. I, II, and IV onlyd. II, III, and IV onlye. I, II, and III onlyc 51. The average accounting return is determined by:a. dividing the yearly cash flows by the investment.b. dividing the average cash flows by the investment.c. dividing the average net income by the average investment.d. dividing the average net income by the initial investment.e. dividing the net income by the cash flow.d 54. The shortcoming(s) of the average accounting return (AAR) method is (are):a. the use of net income instead of cash flows.b. the pattern of income flows has no impact on the AAR.c. there is no clear-cut decision rule.d. All of the above.e. None of the above.A VERAGE ACCOUNTING RETURNd 89. A project has average net income of $2,100 a year over its 4-year life. The initial cost of the project is $65,000 which will be depreciated using straight-line depreciation to a book value of zero over the life of the project. The firm wants to earn a minimal average accounting return of 8.5 percent. The firm should _____ the project based on the AAR of _____a. accept; 6.46 percent.b. accept; 9.69 percent.c. accept; 12.92 percent.d. reject; 6.46 percent.e. reject; 12.92 percent.NET PRESENT V ALUEa 45. Which of the following does not characterize NPV?a. NPV does not incorporate risk into the analysis.b. NPV incorporates all relevant information.c. NPV uses all of the project's cash flows.d. NPV discounts all future cash flows.e. Using NPV will lead to decisions that maximize shareholder wealth.USE OF DEBTc 4. The use of debt is calleda. operating leverage.b. production leverage.c. financial leverage.d. total asset turnover risk.e. business riska 6. The W ACC is used to _______ the expected cash flows when the firm has____________ .a. discount; debt and equity in the capital structureb. discount; short term financing on the balance sheetc. increase; debt and equity in the capital structured. decrease; short term financing on the balance sheete. None of the above.BETAd 11. The beta of a security provides ana. estimate of the market risk premium.b. estimate of the slope of the Capital Market Line.c. estimate of the slope of the Security Market Line.d. estimate of the systematic risk of the security.e. None of the above.b 18. Beta is useful in the calculation of thea. company's variance.b. company's discount rate.c. company's standard deviation.d. unsystematic risk.e. company's market rate.。