《中美会计准则差异(中英文对照)》

- 格式:pdf

- 大小:463.52 KB

- 文档页数:48

中国会计准则和美国会计准则差异有哪些?想考美国注会(U.S.CPA)的同学们对中美会计准则的差异非常关注,如下内容为大家揭秘:中美两国会计准则差异。

一、中美会计准则的实质性差别rulebasedvsprinciplebased美国会计准则的模式为规则导向,更容易导致机会主义和盈余管理。

目前的USGAAP共168号(新旧放在一起)不是按要素制定的,是一种救火式的准则,哪里出了问题,立马会有相应的准则制定出来。

中国会计准则的模式为原则导向,强调实质重于形式,采购谨慎性原则、减少方法的选择、充分披露,以此来克服机会主义的盈余管理。

财政部自2006年颁布新的会计准则以来,陆续颁布了“新会计准则应用指南”以及3个解释公告。

其中,在3号解释公告里提出了综合收益的(comprehensiveincome)概念。

(Tips:如何理解comprehensiveincome?如可供出售金融资产,持有时其价值变动计入资本公积,一旦出售,就会进利润表,以综合收益的形式反映。

comprehensiveincome就是用来反映未来利润的。

新准则修订了资产的定义:经济利益很可能流入企业,金额可以可靠计量,淡化了“过去交易”,主要也是为了配合“未来”交易,如亏损合同等)。

可以这样总结,会计准则未来的发展趋势是:一是从损益满计观向资本保全管转变,反映自从萨班斯法案以来国际财务界重视资产计价的趋势(典型地,如捐赠收入,债务重组收益进利润表,不再进资本公积。

目前资本公积科目得到了净化,只含“股本溢价”和“其它”两个明细);二是资产计价将存在两种模式:成本模式(costvalue)和公允价值模式(fairvalue);三是反映未来信息的新趋势(典型地,comprehensiveincome)。

二、美国会计准则总体介绍(一)制定美国公认会计准则的组织证券交易委员会(SecuritiesandExchangeCommission,SEC);美国注册会计师协会(AmericanInstituteofCertifiedPublicAccountingStandardsBoard,AICPA);财务会计准则委员会(FinancialAccountingStandardsBoard,FASB);政府会计准则委员会(GovermentalAccountingStandardsBoard,GASB)。

普华永道/cnPart II: A Comparison of PRC and US GAAP第二部分:中国企业会计准则与美国会计制度比较普华永道/cn. Similarities共同点. Differences不同点PwC普华永道Similarities共同点普华永道/cnBasic Concepts andQualitative Characteristics 基本概念与性质特征PRC中国企业会计制度US GAAP美国会计制度..Validity, Accuracy, Completenessand Timeliness合法,准确,完整,及时..Consistency 一贯性..Accrual Basis of Accounting权责发生制..Matching Principle配比原则..Going Concern Assumption持续经营假设..Similar to PRC standards与中国企业会计制度相似普华永道/cnCash and Cash Equivalents现金与现金等价物PRC中国企业会计制度..Cash comprises cash on hand anddemand deposits.货币资金包括现金和银行存款。

..Cash equivalents are short-term,highly liquid investments that arereadily convertible to knownamounts of cash and which aresubject to an insignificant risk ofchanges in value.现金等价物指持有的期限短、流动性强、易于转换为已知金额的现金及价值变动风险很小的投资。

..Similar to PRC accounting standards.与中国企业会计制度相似。

US GAAP美国会计制度普华永道/cn Accounts Receivable andBad Debt Provision应收帐款与坏帐准备PRC中国企业会计制度..Carried at original invoiced amount less an estimate made for doubtful receivables.应收帐款按实际发生额入帐,并对应收帐款的回收可能性进行评估后计提坏帐准备。

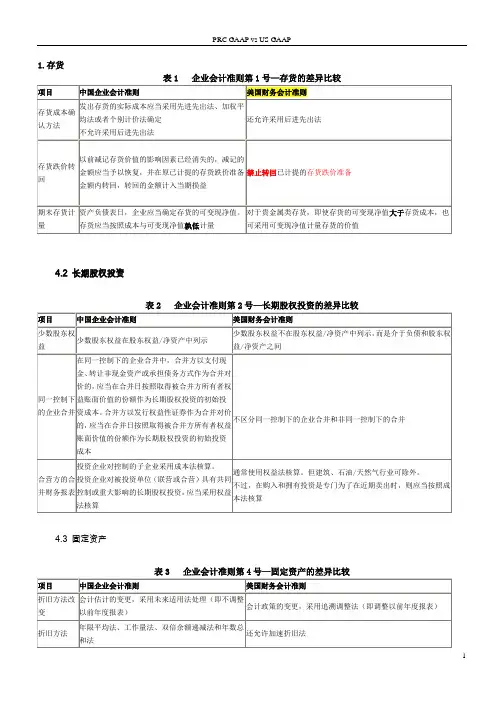

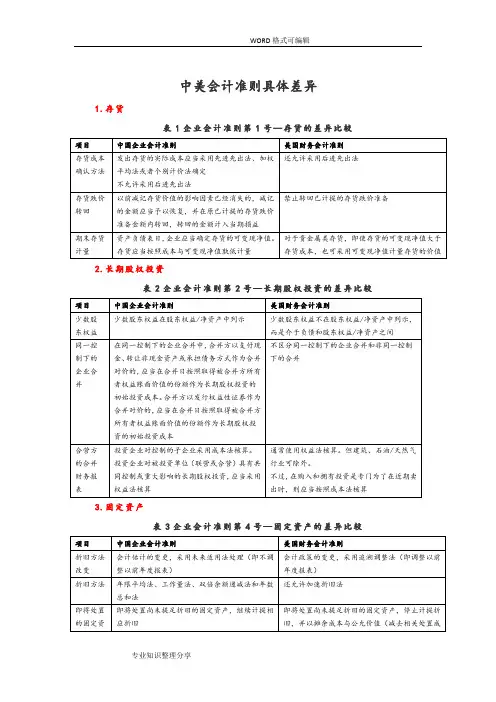

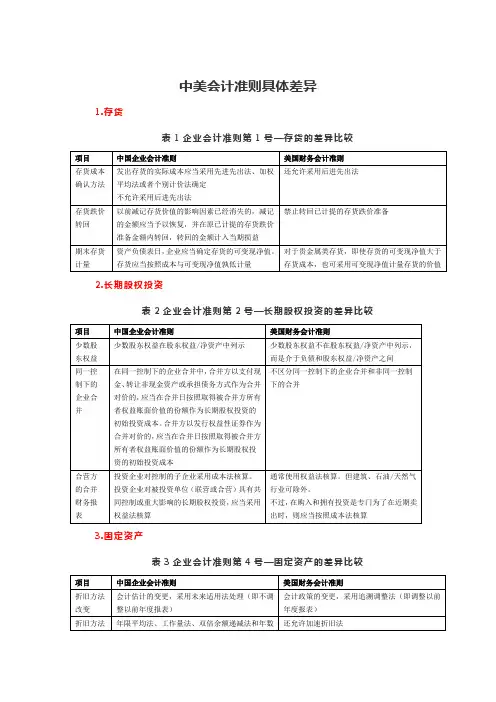

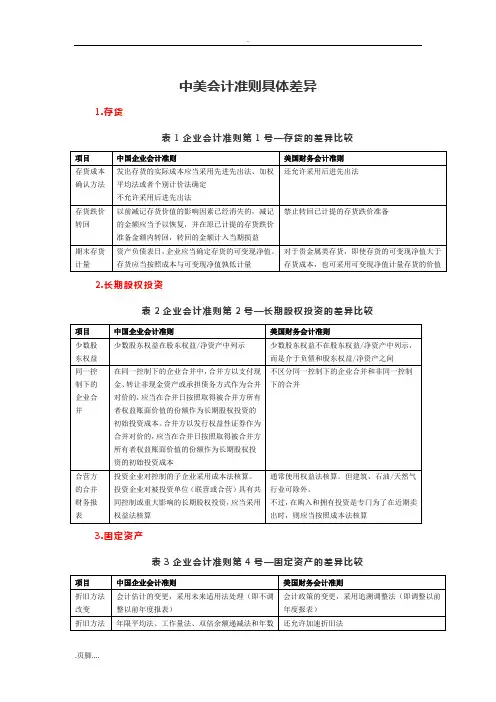

1.存货

表1 企业会计准则第1号—存货的差异比较

4.2 长期股权投资

表2 企业会计准则第2号—长期股权投资的差异比较

4.3 固定资产

表3 企业会计准则第4号—固定资产的差异比较

4.4 无形资产

表4 企业会计准则第6号—无形资产的差异比较

4.5 非货币性资产交换

4.6 雇员薪酬、福利、奖励(职工薪酬、企业年金基金、股份支付)

表6 企业会计准则第9/10/11号—雇员薪酬、福利、奖励差异的比较

4.7 收入

表7 企业会计准则第14号—收入的差异比较

4.8 建造合同

表8 企业会计准则第15号—建造合同的差异比较

4.9 政府补助

4.10 所得税

表10 企业会计准则第18号—所得税的差异比较

4.11 企业合并

表11 企业会计准则第20号—企业合并的差异比较

4.12 金融工具

表12 企业会计准则第22/23/24/37号—金融工具确认、计量、转移、套期保值及列报的差异比较

4.13 会计政策、会计估计变更和差错更正

4.14 财务报表列报

表14 企业会计准则第30号—财务报表列报的差异比较

4.15 中期财务报告

4.16 关联方披露。

New CAS vs US GAAP中国和美国会计准则差异详解By: Jeff Dong, USCPA, Zcheer lecturer22 March 2015New CAS Comparison with US GAAPContents1.Inventory2.Intangible Assets (R&D cost)3.Assets Impairment4.Cash Flow Statement5.Non Current Assets Held for Sales and Discontinued Operations6.Business Combination1. InventoryNew CAS Comparison with US GAAPNew CAS •CAS 1 InventoryUS GAAP •ASC 330 InventoryNew CAS Comparison with US GAAPMeasurement basis•NRV= the estimated selling price in the ordinary course of business less the estimated costs ofcompletion and the estimated cost necessary to make the sale.New CAS:Lower of costs or NRV•Market= replacement cost,provided that it does not exceed NRV or is not less than NRV reduced by a normal profit margin.US GAAP:Lower of cost or market.1. Inventory -continuedNew CAS Comparison with US GAAP 1. Inventory -continuedNew CAS Comparison with US GAAPReverse of inventory write-downNew CAS:Required, if certaincriteria are met.US GAAP:Prohibited LIFO as cost method New CAS:ProhibitedUS GAAP:Per mitted1. Inventory -continuedNew CAS Comparison with US GAAPPrimary literaturesNew CAS:CAS 6 Intangible assetsUS GAAP:ASC 350 Intangibles -Goodwill and OtherASC 730 Research anddevelopmentResearch and development costsNew CAS:Capitalize, if certain criteria are met.US GAAP:Expense as incurred (except for certain website development costs and certain costs associated with developing internal use software).2. Intangible Assets (R&D cost)New CAS Comparison with US GAAPNew CAS •CAS 8 Impairment of assets (non-current assets)US GAAP •ASC 350 Intangibles –Goodwill and Other •ASC 360 Property, plant and equipment3. Assets ImpairmentNew CAS Comparison with US GAAPImpairment methodology for long-term assets (other than goodwill) that are subject to amortization.•Impairment is recorded when an asset's carrying amount exceeds the higher of the asset's value-in-use (discounted present value of the asset's expected future cash flows) and fair value less costs to sell.New CAS:•Impairment is recorded when an asset's carrying amount exceeds the expected future cash flows to be derived from the asset on an undiscounted basis.US GAAP:3. Assets Impairment -continuedNew CAS Comparison with US GAAPNew CAS Impairment indicatorIf CA> Recoverable amount?If Exist thencalculatedTriggerIf < CV thencalculatedlossUS GAAPImpairmentindicatorIf CA>Undiscountedcash flow?3. Assets Impairment –continuedØImpairment methodology for long-term assets (other than goodwill) that are subject to amortizationNew CAS Comparison with US GAAP3. Assets Impairment –continuedØImpairment methodology for long-term assets (other thanNew CAS Comparison with US GAAPLevel of impairment testing for goodwill•Assets group: the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets –the lowest level at which goodwill is monitored for internal management purposes. This level cannot be larger than a segment.New CAS:•Reporting unit –either an operating segment or one organizational level below.US GAAP:3. Assets Impairment -continuedNew CAS Comparison with US GAAP New CASAt least annualtestingIf CA> Recoverableamount?Loss based on recoverable amount of assets group FrequencyTriggerImpairmentUS GAAPAt least annualtestingIf CA> Fair valueof reporting unitLoss based on“ implied “ fairvalue of goodwill3. Assets Impairment -continued ØImpairment methodology for goodwillNew CAS Comparison with US GAAP3. Assets Impairment -continuedØImpairment methodology for goodwill –ExamplesNew CAS Comparison with US GAAP150 300 325 325 0 200 900Assumption: No individualassets was triggered forimpairment503. Assets Impairment -continuedØImpairment methodology for goodwill –Examples New CASNew CAS Comparison with US GAAPAssumption: No individual assets was triggered for impairmentImpairment loss: 0( 100>50)3. Assets Impairment -continuedØImpairment methodology for goodwill –Examples US GAAPNew CAS Comparison with US GAAPPrimary LiteratureNew CAS:CAS 31 Cash flowstatementsUS GAAP:ASC 230 Statements ofCash flows Reporting cash flow from operatingactivitiesNew CAS:-Direct method-A note showingindirect reconciliationUS GAAP:-Direct or indirect-Under both methods,net income must bereconciled4. Cash Flow StatementsNew CAS Comparison with US GAAPNew CAS:Cash outflow from financing activitiesUS GAAP:Cash outflow from operating activities, and requires aseparate supplemental disclosureInterest paidNew CAS:cash inflow frominvesting or operating activitiesUS GAAP:Cash inflow from operating activitiesInterest received4. Cash Flow Statement -continuedNew CAS Comparison with US GAAP5. Noncurrent Assets Held-for-Sales and Discontinued operationsA long-lived asset (disposal group) to be sold shall be classified as held for sale in the period in which all of the following criteria are met:•a. Management, having the authority to approve the action, commits to a plan to sell the asset (disposal group).•b. The asset (disposal group) is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets (disposal groups).•c. An active program to locate a buyer and other actions required to complete the plan to sell the asset (disposal group) have been initiated.•d. The sale of the asset (disposal group) is probable, and transfer of the asset (disposal group) is expected to qualify for recognition as a completed sale, within one year.•e. The asset (disposal group) is being actively marketed for sale at a price that is reasonable in relation to its current fair value. The price at which a long-lived asset (disposal group) is being marketed is indicative of whether the entity currently has the intent and ability to sell the asset (disposal group). A market price that is reasonable in relation to fair value indicates that the asset (disposal group) is available for immediate sale, whereas a market price in excess of fair value indicates that the asset (disposal group) is not available for immediate sale.•f. Actions required to complete the plan indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn.New CAS Comparison with US GAAP 5. Noncurrent Assets Held-for-Sales and Discontinued operations -continuedAccounting Rules=> To be reported in discontinued operations if either the component :ØHas been disposed of, orØIs classified as held for sales=> Discontinued operations calculationüResults of operations of the component;üGain or loss on disposal of the component;üImpairment loss (and subsequent increases in fair value) of the component. => Depreciation and amortization -> stopNew CAS Comparison with US GAAPPrimary LiteratureNew CAS:CAS 20 BusinessCombinationCAS 33 ConsolidatedFinancial StatementsUS GAAP:ASC 805 BusinessCombinationASC 810 ConsolidationBasis for consolidationNew CAS: ControlUS GAAP:-Control-VIE model6. Business Combination (VIEs)New CAS Comparison with US GAAP6. Business Combination (VIEs)-continued1. What is VIEs?An entity is considered a VIE if: (1) it has an insufficient amount of equity at risk for the entity to carry on its principal operations without additional subordinated financial support provided by any of the parties, including equity holders, (2) as a group, the equity holders at risk lack the characteristics of a consoling financial interest, or (3) the entity is structured with non-substantive voting rights.2. Identifying a variable interest in a business entity。

美国和中国的会计准则制度的对比英语作文Title: A Comparative Analysis of US GAAP and Chinese Accounting StandardsThe financial reporting landscape across global economies is shaped by the accounting standards adopted by each nation. Among these, the United States Generally Accepted Accounting Principles (US GAAP) and the Chinese Accounting Standards (CAS) stand out as two significant frameworks. This essay aims to compare and contrast the key features of US GAAP and CAS, highlighting their similarities and differences in approach to financial reporting.1. Overview of US GAAP and CASUS GAAP: Developed by the Financial Accounting Standards Board (FASB), US GAAP is a comprehensive set of accounting rules widely used in the United States for preparing and reporting financial statements.CAS: Established by the Ministry of Finance of China, CAS is designed to align with international financial reporting standards while maintaining specific provisions tailored to the Chinese economic environment.2. Convergence and International AlignmentUS GAAP: Has historically been more independent, though recent efforts have been made to converge with International Financial Reporting Standards (IFRS).CAS: Has shown a strong commitment to convergence with IFRS, aiming to enhance comparability and transparency in financial reporting.3. Key Differences in Accounting TreatmentRevenue Recognition: US GAAP provides more detailed guidance on revenue recognition, while CAS follows a principles-based approach similar to IFRS.Inventory Valuation: Under US GAAP, companies can choose between different inventory costing methods, whereas CAS mandates the use of historical cost or market price, whichever is lower.Intangible Assets: US GAAP has stringent criteria for capitalization of intangible assets, while CAS allows for greater flexibility in this area.4. Disclosure RequirementsUS GAAP: Emphasizes extensive disclosures to provide users with a comprehensive understanding of the company's financial health.CAS: While also requiring disclosure of relevant information, may have less detailed requirements compared to US GAAP.5. Regulatory Oversight and EnforcementUS GAAP: Enforced by the Securities and Exchange Commission (SEC) and subject to rigorous auditing standards.CAS: Monitored by the Chinese regulatory authorities, with increasing emphasis on compliance and enforcement in recent years.The comparison between US GAAP and CAS reveals both commonalities and distinctions in their approaches to financial reporting. While both systems strive for accuracy and transparency, they reflect the unique contexts of their respective economies. As the world becomes increasingly interconnected, the trend towards convergence of accounting standards continues, with the potential to simplifycross-border financial analysis and investment decisions. However, it is crucial to recognize the nuances and adapt accordingly when navigating the financial statements prepared under these distinct accounting regimes.。

中美的会计准则制度的对比英语作文A Comparison of Accounting Standards and Systems between China and the United StatesIntroductionIn today's global economy, accounting standards play a crucial role in ensuring the transparency and reliability of financial reporting. China and the United States, as two of the world's largest economies, have their own unique accounting systems and standards. In this paper, we will compare the accounting standards and systems of China and the United States, highlighting the key similarities and differences between the two countries.Accounting Standards in ChinaIn China, the accounting standards are issued by the Ministry of Finance (MoF) and are known as Chinese Accounting Standards (CAS). CAS are based on a mix of international accounting standards (IAS/IFRS) and local regulations. The standards are compulsory for all enterprises in China, including foreign-invested enterprises and listed companies. CAS are aimed at improving the quality and transparency of financialreporting, enhancing the comparability of financial statements, and facilitating the development of the capital markets.One of the key characteristics of CAS is that they are more rules-based than principle-based. This means that the standards provide detailed guidelines and specific rules for financial reporting, leaving less room for interpretation. In addition, Chinese accounting standards place a strong emphasis on prudence and conservatism, which can sometimes lead to more conservative financial reporting practices.Accounting Standards in the United StatesIn the United States, accounting standards are issued by the Financial Accounting Standards Board (FASB) and are known as Generally Accepted Accounting Principles (GAAP). GAAP are considered the gold standard of accounting in the United States and are widely recognized and accepted by investors, regulators, and other stakeholders. GAAP are based on a principles-based approach, which focuses on conceptual frameworks and broad accounting principles rather than detailed rules.One of the key characteristics of GAAP is their flexibility and adaptability. GAAP allows for professional judgment and interpretation in financial reporting, which can result in more subjective accounting practices. In addition, GAAP also place astrong emphasis on fair value accounting, which values assets and liabilities at their current market prices.Comparison of Accounting SystemsWhen comparing the accounting systems of China and the United States, several key differences emerge. One of the main differences is the level of government involvement in setting accounting standards. In China, the government plays a more active role in regulating and enforcing accounting standards, while in the United States, the FASB operates independently of the government.Another difference is the level of enforcement and compliance with accounting standards. In China, there have been concerns about the quality and reliability of financial reporting, with instances of fraud and misrepresentation. In contrast, the United States has a strong regulatory framework and enforcement mechanisms to ensure compliance with GAAP.ConclusionIn conclusion, while both China and the United States have their own unique accounting standards and systems, they share a common goal of enhancing transparency and reliability in financial reporting. The differences between the two countries liein the approach to setting standards, the level of government involvement, and the emphasis on rules-based versus principles-based accounting. By understanding these differences, companies operating in both countries can navigate the complex landscape of global accounting standards and comply with the regulatory requirements of each jurisdiction.。

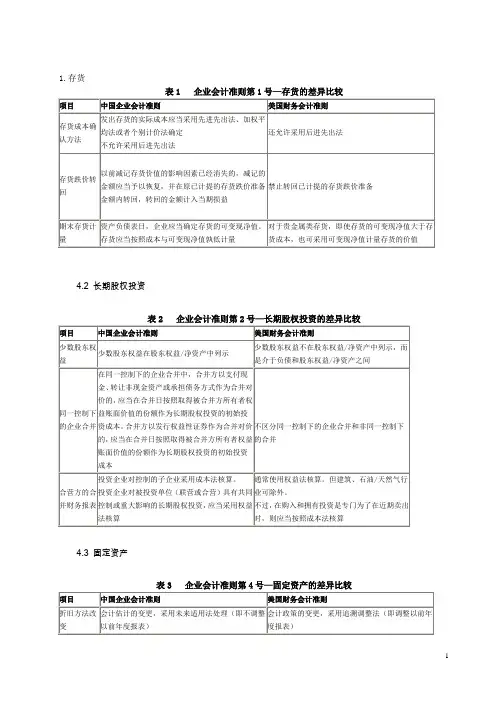

1.存货

表1 企业会计准则第1号—存货的差异比较

4.2 长期股权投资

表2 企业会计准则第2号—长期股权投资的差异比较

4.3 固定资产

表3 企业会计准则第4号—固定资产的差异比较

4.4 无形资产

4.5 非货币性资产交换

4.6 雇员薪酬、福利、奖励(职工薪酬、企业年金基金、股份支付)

4.7 收入

表7 企业会计准则第14号—收入的差异比较

4.8 建造合同

表8 企业会计准则第15号—建造合同的差异比较

4.9 政府补助

表9 企业会计准则第16号—政府补助的差异比较

4.10 所得税

4.11 企业合并

表11 企业会计准则第20号—企业合并的差异比较

4.12 金融工具

4.13 会计政策、会计估计变更和差错更正

表13 企业会计准则第28号—会计政策、会计估计变更和会计差错更正的差异比较

4.14 财务报表列报

表14 企业会计准则第30号—财务报表列报的差异比较

4.15 中期财务报告

表15 企业会计准则第29号—中期财务报告的差异比较

4.16 关联方披露

表16 企业会计准则第36号—关联方披露的差异比较。

美国会计准则与中国会计准则具体差异-列表对比1.存货表1 企业会计准则第1号—存货的差异比较项目中国企业会计准则美国财务会计准则存货成本确认方法发出存货的实际成本应当采用先进先出法、加权平均法或者个别计价法确定不允许采用后进先出法还允许采用后进先出法存货跌价转回以前减记存货价值的影响因素已经消失的,减记的金额应当予以恢复,并在原已计提的存货跌价准备金额内转回,转回的金额计入当期损益禁止转回已计提的存货跌价准备期末存货计量资产负债表日,企业应当确定存货的可变现净值。

存货应当按照成本与可变现净值孰低计量对于贵金属类存货,即使存货的可变现净值大于存货成本,也可采用可变现净值计量存货的价值4.2 长期股权投资表2 企业会计准则第2号—长期股权投资的差异比较项目中国企业会计准则美国财务会计准则少数股东权益少数股东权益在股东权益/净资产中列示少数股东权益不在股东权益/净资产中列示,而是介于负债和股东权益/净资产之间同一控制下的企业合并在同一控制下的企业合并中,合并方以支付现金、转让非现金资产或承担债务方式作为合并对价的,应当在合并日按照取得被合并方所有者权益账面价值的份额作为长期股权投资的初始投资成本。

合并方以发行权益性证券作为合并对价的,应当在合并日按照取得被合并方所有者权益账面价值的份额作为长期股权投资的初始投资成本不区分同一控制下的企业合并和非同一控制下的合并合营方的合并财务报表投资企业对控制的子企业采用成本法核算。

投资企业对被投资单位(联营或合营)具有共同控制或重大影响的长期股权投资,应当采用权益法核算通常使用权益法核算。

但建筑、石油/天然气行业可除外。

不过,在购入和拥有投资是专门为了在近期卖出时,则应当按照成本法核算项目中国企业会计准则美国财务会计准则研究和开发费用所有研发项目研究阶段的支出全部计入当期费用。

开发阶段支出如果符合特定标准(使用或出售的意图、技术可行、市场存在、资源支持)则予以资本化,确认为无形资产通常所有研究和开发支出全部作为当期费用(除部分用于网站开发及内部使用的软件开发成本可以资本化)。

中美的会计准则制度差异英语作文The Differences Between Chinese and U.S. Accounting RulesHi there! My name is Michael, and I'm going to tell you all about the differences between the accounting rules in China and the United States. Accounting is a way of keeping track of money for businesses and organizations. It's kind of like how you might keep track of your allowance money or savings. But for big companies, it's a lot more complicated!In China and the U.S., there are different sets of rules that accountants have to follow when recording money going in and out of a business. These rules are called "accounting standards." They tell accountants exactly how to write down financial information so that it's consistent and easy to understand.The reason there are different rules in different countries is that the accounting standards were developed separately over time based on each country's own business practices, laws, and traditions. It's kind of like how we might have different rules for popular games or sports in our neighborhoods or schools.Now let me explain some of the key differences between Chinese and U.S. accounting standards:Who makes the rules?In China, the accounting standards are set by the Ministry of Finance. The Ministry decides on the official rules that all companies in China must follow.In the United States, the accounting rules are made by a non-profit organization called the Financial Accounting Standards Board (FASB). The FASB members include accountants and other finance experts who regularly update and improve the standards.How strict are the rules?The accounting standards in China tend to be more rigid and rules-based. Companies have to follow the exact rules set by the government without much flexibility.In the U.S., the accounting standards are moreprinciples-based. This means companies have some room to use their own judgment in applying the rules, as long as they follow the overall principles and intentions behind the standards.Focusing on different thingsChinese accounting standards put a lot of emphasis on following tax regulations and the legal requirements set by the government. The main purpose is to ensure companies are properly paying their taxes.U.S. accounting standards focus more on providing accurate and transparent financial information to investors, lenders, and the public. The goal is to give a true picture of a company's financial health and performance.Merging with international standardsIn recent years, China has been working to revise its accounting standards to be more compatible with the International Financial Reporting Standards (IFRS), which are used by many countries around the world.The U.S. has not fully adopted IFRS yet, although the FASB and international accounting boards have been collaborating to align their standards more closely over time.Handling certain items differentlyThere are also some specific differences in how certain financial items are recorded and reported under the two sets of standards. For example:In China, companies are not allowed to revalue property and equipment to fair market value, while U.S. standards permit this in some cases.Chinese standards have stricter rules about recognizing revenue from long-term construction contracts compared to U.S. standards.The methods for calculating things like bad debt provisions, inventory valuation, and asset impairments can differ between the two systems.So in summary, while both China and the U.S. have comprehensive accounting standards, there are quite a few key differences in areas like who sets the rules, how flexible the rules are, what the main purposes are, and some of the specific accounting treatments required.As the world becomes more globally connected, there's been a push to harmonize accounting standards across countries. This would make it easier for companies to operate internationally and for investors to understand financial reports from different places.While the U.S. and China still have their own unique accounting systems today, the two sets of standards have been gradually converging over time to enhance consistency and comparability. Who knows, maybe someday all countries will follow the exact same accounting rules! But for now, these are the main differences between the Chinese and U.S. standards.I hope this essay helped explain everything in a simple way. Accounting can seem complicated, but it's just about being clear, accurate, and following the right rules when dealing with money. Let me know if you have any other questions!。

中国会计准则和美国会计准则差异分析New CAS vs US GAAP中国和美国会计准则差异详解By: Jeff Dong, USCPA, Zcheer lecturer22 March 2015New CAS Comparison with US GAAPContents1.Inventory2.Intangible Assets (R&D cost)3.Assets Impairment4.Cash Flow Statement5.Non Current Assets Held for Sales and Discontinued Operations6.Business Combination1. InventoryNew CAS Comparison with US GAAPNew CAS ?CAS 1 InventoryUS GAAP ?ASC 330 InventoryNew CAS Comparison with US GAAPMeasurement basisNRV= the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated cost necessary to make the sale.New CAS:Lower of costs or NRVMarket= replacement cost,provided that it does not exceed NRV or is not less than NRV reduced by a normal profit margin. US GAAP:Lower of cost or market.1. Inventory -continuedNew CAS Comparison with US GAAP 1. Inventory -continuedNew CAS Comparison with US GAAP Reverse of inventory write-downNew CAS:Required, if certaincriteria are met.US GAAP:Prohibited LIFO as cost method New CAS: ProhibitedUS GAAP:Per mitted1. Inventory -continuedNew CAS Comparison with US GAAP Primary literaturesNew CAS:CAS 6 Intangible assetsUS GAAP:ASC 350 Intangibles -Goodwill and OtherASC 730 Research anddevelopmentResearch and development costsNew CAS:Capitalize, if certain criteria are met.US GAAP:Expense as incurred (except for certain website development costs and certain costs associated with developing internal use software).2. Intangible Assets (R&D cost)New CAS Comparison with US GAAPNew CAS ?CAS 8 Impairment of assets (non-current assets)US GAAP ?ASC 350 Intangibles –Goodwill and Other ?ASC 360 Property, plant and equipment3. Assets ImpairmentNew CAS Comparison with US GAAPImpairment methodology for long-term assets (other than goodwill) that are subject to amortization.Impairment is recorded when an asset's carrying amount exceeds the higher of the asset's value-in-use (discounted present value of the asset's expected future cash flows) and fair value less costs to sell.New CAS:Impairment is recorded when an asset's carrying amount exceeds the expected future cash flows to be derived from the asset on an undiscounted basis.US GAAP:3. Assets Impairment -continuedNew CAS Comparison with US GAAPNew CAS Impairment indicatorIf CA> Recoverable amount?If Exist thencalculatedTriggerIf < CV thencalculatedlossUS GAAPImpairmentindicatorIf CA>Undiscountedcash flow?3. Assets Impairment –continuedImpairment methodology for long-term assets (other than goodwill) that are subject to amortizationNew CAS Comparison with US GAAP3. Assets Impairment –continuedImpairment methodology for long-term assets (other thanNew CAS Comparison with US GAAPLevel of impairment testing for goodwillAssets group: the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets –the lowest level at which goodwill is monitored for internal management purposes. This level cannot be larger than a segment.New CAS:Reporting unit –either an operating segment or one organizational level below.US GAAP:3. Assets Impairment -continuedNew CAS Comparison with US GAAP New CASAt least annualtestingIf CA> Recoverableamount?Loss based on recoverable amount of assets group FrequencyTriggerImpairmentUS GAAPAt least annualtestingIf CA> Fair valueof reporting unitLoss based on“ implied “ fairvalue of goodwill3. Assets Impairment -continued ?Impairment methodology for goodwillNew CAS Comparison with US GAAP3. Assets Impairment -continuedImpairment methodology for goodwill –ExamplesNew CAS Comparison with US GAAP150 300 325 325 0 200 900Assumption: No individualassets was triggered forimpairment503. Assets Impairment -continuedImpairment methodology for goodwill –Examples New CAS New CAS Comparison with US GAAPAssumption: No individual assets was triggered for impairmentImpairment loss: 0( 100>50)3. Assets Impairment -continuedImpairment methodology for goodwill –Examples US GAAP New CAS Comparison with US GAAPPrimary LiteratureNew CAS:CAS 31 Cash flowstatementsUS GAAP:ASC 230 Statements ofCash flows Reporting cash flow from operatingactivitiesNew CAS:-Direct method-A note showingindirect reconciliationUS GAAP:-Direct or indirect-Under both methods,net income must bereconciled4. Cash Flow StatementsNew CAS Comparison with US GAAPNew CAS:Cash outflow from financing activitiesUS GAAP:Cash outflow from operating activities, and requires aseparate supplemental disclosureInterest paidNew CAS:cash inflow frominvesting or operating activitiesUS GAAP:Cash inflow from operating activitiesInterest received4. Cash Flow Statement -continuedNew CAS Comparison with US GAAP5. Noncurrent Assets Held-for-Sales and Discontinued operationsA long-lived asset (disposal group) to be sold shall be classified as held for sale in the period in which all of the following criteria are met:a. Management, having the authority to approve the action, commits to a plan to sell the asset (disposal group).b. The asset (disposal group) is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets (disposal groups).c. An active program to locate a buyer and other actions required to complete the plan to sell the asset (disposal group) have been initiated.d. The sale of the asset (disposal group) is probable, and transfer of the asset (disposal group) is expected to qualify for recognition as a completed sale, within one year.e. The asset (disposal group) is being actively marketed for sale at a price that is reasonable in relation to its current fair value. The price at which a long-lived asset (disposal group) is being marketed is indicative of whether the entity currently has the intent and ability to sell the asset (disposal group). A market price that is reasonable in relation to fair value indicates that the asset (disposal group) is available for immediate sale, whereas a market price in excess of fair value indicates that the asset (disposal group) is not available for immediate sale.f. Actions required to complete the plan indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn.。