迈克尔版本微观经济学 第六章 Chapter6_SM

- 格式:ppt

- 大小:1.38 MB

- 文档页数:33

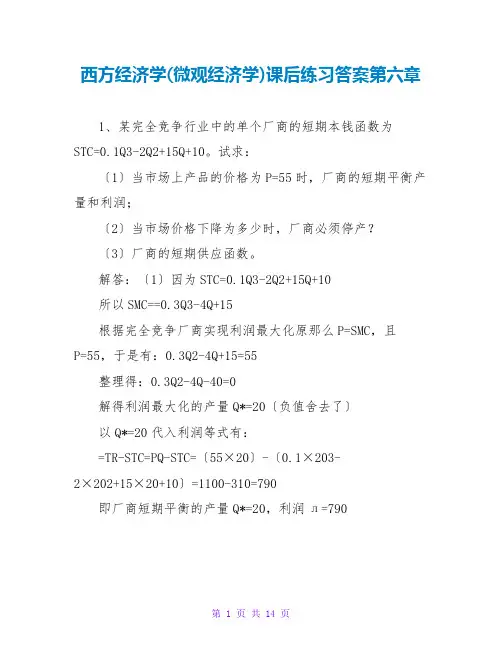

西方经济学(微观经济学)课后练习答案第六章1、某完全竞争行业中的单个厂商的短期本钱函数为STC=0.1Q3-2Q2+15Q+10。

试求:〔1〕当市场上产品的价格为P=55时,厂商的短期平衡产量和利润;〔2〕当市场价格下降为多少时,厂商必须停产?〔3〕厂商的短期供应函数。

解答:〔1〕因为STC=0.1Q3-2Q2+15Q+10所以SMC==0.3Q3-4Q+15根据完全竞争厂商实现利润最大化原那么P=SMC,且P=55,于是有:0.3Q2-4Q+15=55整理得:0.3Q2-4Q-40=0解得利润最大化的产量Q*=20〔负值舍去了〕以Q*=20代入利润等式有:=TR-STC=PQ-STC=〔55×20〕-〔0.1×203-2×202+15×20+10〕=1100-310=790即厂商短期平衡的产量Q*=20,利润л=790〔2〕当市场价格下降为P小于平均可变本钱AVC即PAVC 时,厂商必须停产。

而此时的价格P必定小于最小的可变平均本钱AVC。

根据题意,有:AVC==0.1Q2-2Q+15令,即有:解得 Q=10且故Q=10时,AVC〔Q〕达最小值。

以Q=10代入AVC〔Q〕有:最小的可变平均本钱AVC=0.1×102-2×10+15=5于是,当市场价格P5时,厂商必须停产。

〔3〕根据完全厂商短期实现利润最大化原那么P=SMC,有:0.3Q2-4Q+15=p整理得 0.3Q2-4Q+〔15-P〕=0解得根据利润最大化的二阶条件的要求,取解为:考虑到该厂商在短期只有在P>=5才消费,而P<5时必定会停产,所以,该厂商的短期供应函数Q=f〔P〕为:,P>=5Q=0 P<52、某完全竞争的本钱不变行业中的单个厂商的长期总本钱函数LTC=Q3-12Q2+40Q。

试求:〔1〕当市场商品价格为P=100时,厂商实现MR=LMC时的产量、平均本钱和利润;〔2〕该行业长期平衡时的价格和单个厂商的产量;〔3〕当市场的需求函数为Q=660-15P时,行业长期平衡时的厂商数量。

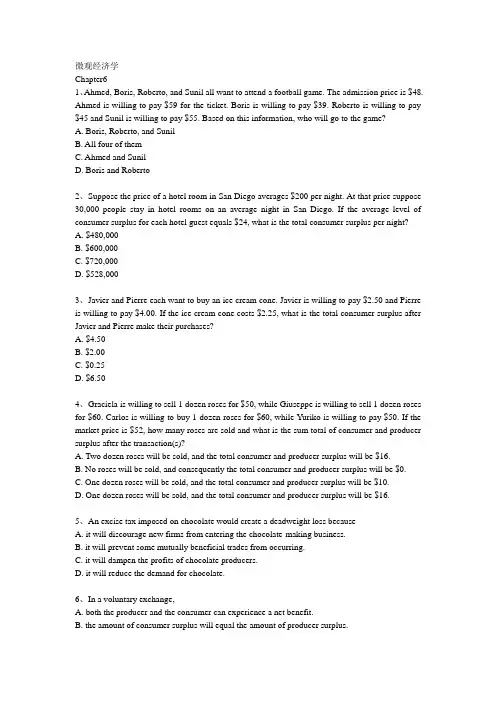

微观经济学Chapter61、Ahmed, Boris, Roberto, and Sunil all want to attend a football game. The admission price is $48. Ahmed is willing to pay $59 for the ticket. Boris is willing to pay $39. Roberto is willing to pay $45 and Sunil is willing to pay $55. Based on this information, who will go to the game?A. Boris, Roberto, and SunilB. All four of themC. Ahmed and SunilD. Boris and Roberto--------------------------------------------------------------------------------2、Suppose the price of a hotel room in San Diego averages $200 per night. At that price suppose 30,000 people stay in hotel rooms on an average night in San Diego. If the average level of consumer surplus for each hotel guest equals $24, what is the total consumer surplus per night?A. $480,000B. $600,000C. $720,000D. $528,000--------------------------------------------------------------------------------3、Javier and Pierre each want to buy an ice cream cone. Javier is willing to pay $2.50 and Pierre is willing to pay $4.00. If the ice cream cone costs $2.25, what is the total consumer surplus after Javier and Pierre make their purchases?A. $4.50B. $2.00C. $0.25D. $6.50-----------------------------------------------------------------------------4、Graciela is willing to sell 1 dozen roses for $50, while Giuseppe is willing to sell 1 dozen roses for $60. Carlos is willing to buy 1 dozen roses for $60, while Yuriko is willing to pay $50. If the market price is $52, how many roses are sold and what is the sum total of consumer and producer surplus after the transaction(s)?A. Two dozen roses will be sold, and the total consumer and producer surplus will be $16.B. No roses will be sold, and consequently the total consumer and producer surplus will be $0.C. One dozen roses will be sold, and the total consumer and producer surplus will be $10.D. One dozen roses will be sold, and the total consumer and producer surplus will be $16.--------------------------------------------------------------------------------5、An excise tax imposed on chocolate would create a deadweight loss becauseA. it will discourage new firms from entering the chocolate-making business.B. it will prevent some mutually beneficial trades from occurring.C. it will dampen the profits of chocolate producers.D. it will reduce the demand for chocolate.--------------------------------------------------------------------------------6、In a voluntary exchange,A. both the producer and the consumer can experience a net benefit.B. the amount of consumer surplus will equal the amount of producer surplus.C. if the consumer derives consumer surplus, the supplier will derive no producer surplus.D. if the supplier derives producer surplus, the consumer will derive no consumer surplus.--------------------------------------------------------------------------------7、Suppose at a price of $1.73 per gallon, residents of Tacoma purchase 1 million gallons of gas every week and enjoy a total consumer surplus of $730,000. If gas prices increase to $2.46 per gallon and the demand for gas is perfectly inelastic in Tacoma, residents of Tacoma will end up with a total consumer surplus equal toA. $2,460,000.B. $0.C. $.73 per gallon.D. $730,000.--------------------------------------------------------------------------------8、Which of the following statements is TRUE?A. The amount of deadweight loss resulting from an excise tax will increase as the demand becomes more inelastic.B. An excise tax does not create a deadweight loss if the taxed good is a necessity.C. An excise tax does not create a deadweight loss if the taxed good is a luxury.D. The amount of deadweight loss resulting from an excise tax will increase as the demand becomes more elastic.--------------------------------------------------------------------------------9、The amount of the deadweight loss resulting from an excise tax isA. the difference between the government revenue from an excise tax and the reduction in total surplus resulting from imposition of the tax.B. the difference between the amount of consumer surplus and the amount of producer surplus remaining after imposition of the tax.C. independent of the elasticity of demand for the taxed good.D. the amount of revenue collected from the tax.--------------------------------------------------------------------------------10、Some proponents of an excise tax on cigarettes argue that it will discourage smoking. Others argue that it will collect revenue for the government. Given the economic model of supply and demand, which of the following is true?A. The less elasticity there is in the supply of and demand for cigarettes, the more revenue will be collected from the tax.B. A tax that discourages smoking will not cause a deadweight loss.C. The more the tax discourages smoking, the more revenue it will collect for the government.D. The more elasticity there is in the supply of and demand for cigarettes, the more revenue will be collected from the tax.--------------------------------------------------------------------------------11、Which area on a graph represents producer surplus?A. The area above the supply curve up to a line indicating priceB. The area under the demand curve down to a line indicating priceC. The area between the supply and demand curves to the left of the equilibrium pointD. The area between the supply and demand curves to the right of the equilibrium point--------------------------------------------------------------------------------12、Consumer surplus isA. the amount of revenue collected from an excise tax.B. the difference between the price that consumers are willing to pay for a good and the amount they actually pay.C. the difference between the quantity of a good demanded and the quantity supplied.D. the quantity.Of a good that remains on the market in instances of market failure.--------------------------------------------------------------------------------13、Samia is willing to pay $10 for one bracelet and $5 for a second. Isabella is willing to pay $12 for one bracelet and $2 for a second. If the price is currently $8 per bracelet, what is the total consumer surplus after Samia and Isabella make their purchases?A. $5B. $7C. $6D. $8--------------------------------------------------------------------------------14、Which of the following is NOT a predictable result from imposition of an excise tax?A. The quantity demanded decreases.B. The quantity supplied decreases.C. A deadweight loss results.D. Producer profits increase.--------------------------------------------------------------------------------15、Mario is willing to mow one lawn for $18; he will mow a second for $22, and a third for $28. Assume that the market rate for lawn mowing is $24. How many lawns will Mario mow? What will be his total revenue? What will be his producer surplus?A. Mario will mow two lawns for a total revenue of $48, and his producer surplus will be $2.B. Mario will mow three lawns for a total revenue of $72, and his producer surplus will be $4.C. Mario will mow two lawns for a total revenue of $48, and his producer surplus will be $8.D. Mario will mow three lawns for a total revenue of $72, and his producer surplus will be $2.--------------------------------------------------------------------------------16、Economic theory asserts thatA. the equilibrium market price will maximize consumer surplus and minimize producer surplus.B. both producers and consumers gain from trade.C. all consumers have the same willingness to pay for a good.D. all producers have the same cost of providing a good.--------------------------------------------------------------------------------17、An efficient outcome is one in whichA. no individual seller could be made better off.B. no individual can be made better off without making someone else worse off.C. all consumers who desire the good can afford it at the current price.D. no individual buyer could be made better off.--------------------------------------------------------------------------------18、In 1990 the U.S. government imposed a special sales tax on yachts with a price of at least $100,000. The tax was repealed in 1993 since it generated far less revenue than expected and led to significant job losses in the yacht building industry. The sales tax was unsuccessful becauseA. the supply and the demand for yachts were relatively inelastic.B. the tax rate was too low.C. the supply and the demand for yachts were relatively elastic.D. yachts are luxury goods.--------------------------------------------------------------------------------19、Which of the following is NOT an instance of market failure?A. A bad harvest increases the price of oranges.B. Production of a good generates pollution.C. Consumption of a good generates pollution.D. Precious gems are sold under monopoly conditions.--------------------------------------------------------------------------------20、Market failure arises when the market fails toA. provide a profit for all firms who produce the good.B. provide the good for all consumers who desire it.C. achieve an efficient outcome.D. prevent the price of a good from rising in response to an increase in demand.。