投资学论述题

- 格式:docx

- 大小:13.53 KB

- 文档页数:2

第一章股票一、名词解释1.股份有限公司由一定人数的发起人组成,将公司的全部注册资本划分为等额股份,股东就其所认购的股份承担有限责任,公司以其全部的财产为限承担有限责任的企业法人。

2.独立董事概念:独立董事又称作外部董事、独立非执行董事。

独立董事独立于公司的管理和经营活动,以及那些有可能影响他们做出独立判断的事务之外,不能与公司有任何影响其客观、独立地做出判断的关系,在公司战略、运作、资源、经营标准以及一些重大问题上做出自己独立的判断3.股票:股票是股份有限公司发行的用以证明股东入股份数并到期取得股息和红利的书面证明。

4.普通股与优先股普通股:就是持有这种股票的股东都享有同等的权利,他们都能参与公司的经营决策,其所分取的股息红利随着股份公司经营利润的多寡而变化。

如国有股、法人股及流通股。

优先股:指股份有限公司在筹集资本时给予认购者某些优先条件的股票。

5.国有股、法人股、公众股及外资股国有股:是指有权代表国家投资的部门或机构以国有资产向公司投资形成的股份,包括公司现有国有资产折算成的股份法人股:是指企业法人或具有法人资格的事业单位和社会团体以其依法可支配的资产向股份有限公司非上市流通股权部分投资所形成的股份。

法人持股所形成的也是一种所有权关系,是法人经营自身财产的一种投资行为。

法人股股票以法人记名。

公众股也可以称为个人股,它是指社会个人或股份公司内部职工以个人合法财产投入公司形成的股份。

公众股有两种基本形式:公司职工股和社会公众股外资股是指股份公司向外国和我国香港、澳门、台湾地区投资者发行的股票。

这是我国股份公司吸收外资的一种方式。

外资股按上市地域可以分为境内上市外资股和境外上市外资股。

6.绩优股和垃圾股绩优股:业绩优良的上市公司股票。

一般为行业龙头,如格力电器,中集集团,五粮液,长城电脑等。

衡量的指标是每股收益0.45元与净资产收益率10%以上。

垃圾股:业绩较差的公司股票。

行业前景不好,经营管理不善造成的。

证券投资学复习一、计算题1.债券收益率计算P170-176 参考P171-172例:某债券在第一年年初的价格为1000元, 在这一年年末, 该债券以950元的价格出售。

这种债券在这一年年末支付了20元的利息。

这一年的持有期利率为多少?解: 持有期利率=(950-1+20)/1000= -3%P171题4-1:某债券面值为1000元, 5年期, 票面利率为10%, 现以950元的发行价向全社会公开发行, 则投资者在认购债券后到持至期满时可获得的直接收益率为:Yd=×100%=10.53%P172题4-2:在例4-1中的债券若投资者认购后持至第三年末以995元市价出售, 则持有期收益率为:Yh=×100%=12.11%P172题4-3:某债券面值为1000元, 还有5年到期, 票面利率为5%, 当前的市场价格为1019.82元, 投资者购买该债券的预期到期收益率为:1019.82=++++Y=4.55%P173题4-4:某附息债券, 面值为1000元, 每年付一次利息, 年利率为12%, 期限为10年。

某投资者在二级市场上以960元的价格买入, 4年后该债券到期, 投资者在这4年中利用所得利息进行再投资的收益率为10%。

投资者持有该债券的复利到期收益率为:Yco={-1 }×100%=12.85%2.债券发行价格计算P233-P236页例如:零息债券, 为1000元, 3年期, 发行时市场利率为6%, 请问该债券的发行价格应为多少?解: 发行价格=1000/(1+6%3=839.6P236例6-2:某息票债券, 面值1000元, 3年期, 每年付一次利息, 票面利息为10%, 当市场利率也为10%时, 发行价为:P=1000×10% /(1+10%)+1000×10% /(1+10%)2+1000×10% /(1+10%)3+1000 /(1+10%)3=1000(元)在例6-2中, 若债券发行时市场利率为12%, 则债券发行价为:P=1000×10% /(1+12%)+1000×10% /(1+12%)2+1000×10% /(1+12%)3+1000 /(1+12%)3=951.98(元)在例6-2中, 如果债券实际发行时市场利率为8%, 则债券发行价格为:P=1000×10% /(1+8%)+1000×10% /(1+8%)2+1000×10% /(1+8%)3+1000 /(1+8%)3=1051.54(元)3.股利贴现模型计算P252页1)、某公司2006年每股收益为4元, 其中50%收益用于派发股息, 近3年公司的股息保持10%的增长率, 且将保持此速度增长。

1. 为何说通胀无牛市?表面上看,权益价值=资产价值-负债价值,通货膨胀期间资产价值上升,负债价值不变,推得权益价值上升。

但实际上,这一公式是从会计角度评价权益价值,是以历史成本来衡量。

①从投资学的角度分析,股票是未来预期的现值,与重置成本(历史成本)无关。

现实意义在于,虽然公司资产价格上涨,但上涨结构不平衡,虽然销售收入增加,但是销售成本也增加,收入增加不能弥补成本增加,生产中断。

②当投资者预期未来持续通货膨胀时,会要求更高的风险回报率,此时分母的折现率提高,权益价值下降。

进一步地,若通胀加息,则整个股市估值体系下移。

③在社会再生产链条中,行业附加值呈现U型结构,两端(上游:研发,原材料;末端:品牌)价值高,两端剥削中间,中端无定价权,两端发通胀财。

(例如08年种子煤炭等能源价值上涨,则为通胀推动型)→普通股价值取决于未来收益,因为:①价值是未来预期的折现值,不是以往收益所能涵盖的。

既往收益仅仅预示着未来收益趋势变化的可能性,而非必然性;②股息率与股票价值相关性很小;③有形资产价值与未来盈利没有关系。

这一观点的缺陷在于:①抹杀投资和投机的根本区别——投资即是成功的投机②忽视股票的购买价格2.牛市两大主线/投资领域两大周期:(1)两大主线:技术进步(生产力提高→经济增长);制度创新(生产关系改善→资源优化配置)(2)内在逻辑是:金融创新推动科技进步,科技进步带动经济增长,经济增长造就人类物质文明进步。

(or经济增长期,政府追求业绩,扩大投资,增加政府借贷,从而导致货币超发)3.优先股能否成为中小股东利益保护的工具?①以公开发行为主,向原股东优先配售,可为普通股股东特别是中小普通股股东投资优先股创造条件。

②优先股公开发行采取优先认股权证的方式进行。

普通股股东可凭所持权证参与认购或以一定价格转让给他人,或者让权证作废。

有利于中小股东行权。

③优先股发行事宜须经中小股东表决通过。

4.公司治理:资本市场的三大支柱:(1)良好的治理结构:可以创造价值,最基础、最核心(2)有效的交易机制:通过价值信号的变化引导资源配置不断优化,实现动态均衡(3)健全的监管机制:确定市场规则,维护市场秩序三者相互联系,相互补充,构成一个有机整体。

自考国际投资学试题及答案一、单项选择题(每题1分,共10分)1. 国际投资的主要类型包括直接投资和()。

A. 间接投资B. 长期投资C. 短期投资D. 股权投资2. 在国际投资中,跨国并购属于()。

A. 直接投资B. 间接投资C. 证券投资D. 商业投资3. 国际投资的风险不包括()。

A. 政治风险B. 汇率风险C. 市场风险D. 技术风险4. 国际投资学研究的核心问题是()。

A. 投资收益最大化B. 风险管理C. 资本流动D. 投资决策5. 根据国际货币基金组织(IMF)的定义,国际投资不涉及()。

A. 资本的跨国流动B. 跨国公司的设立C. 国际金融市场的参与D. 国际贸易的结算6. 国际直接投资与间接投资的主要区别在于()。

A. 投资的规模B. 对企业的控制权C. 投资的期限D. 投资的地域7. 国际投资中,投资者面临的汇率风险可以通过()来降低。

A. 多元化投资B. 对冲交易C. 长期投资D. 短期投资8. 在国际投资中,东道国政府对外国投资者的限制通常被称为()。

A. 贸易壁垒B. 投资壁垒C. 技术壁垒D. 资本壁垒9. 国际投资的收益通常与()成正比。

A. 投资风险B. 投资成本C. 投资规模D. 投资期限10. 国际投资项目评估时,净现值(NPV)法考虑的是()。

A. 现金流的时间价值B. 投资的绝对收益C. 投资的相对收益D. 投资的固定收益二、多项选择题(每题2分,共10分)11. 国际投资的资金来源主要包括()。

A. 内部融资B. 外部融资C. 政府援助D. 国际金融市场12. 国际投资的风险管理策略包括()。

A. 风险分散B. 风险转移C. 风险规避D. 风险接受13. 国际投资对东道国的积极影响包括()。

A. 增加就业机会B. 提高技术水平C. 增加政府税收D. 引发通货膨胀14. 国际投资对母国的积极影响包括()。

A. 增加外汇储备B. 提高国际竞争力C. 促进国际贸易D. 增加国内失业率15. 在国际投资中,以下哪些因素会影响投资决策()。

证券投资学试题课程名称: 证券投资学;试卷编号: ;考试时间: 分钟1.一、名词解释(每题5分, 共30分)2.商品证券3.股票4.可转换债券5.基金管理人6.交易所交易基金7.私募证券1.二、选择题(每题1分, 共10分)2.具备安全性高、流通性强、收益稳定及免税待遇等几个特征的有价证券最有可能的是()。

3. A. 金融债券 B. 公债 C. 公司债券 D. 证券投资基金4.由证券公司办理的证券发行称为()。

5. A. 直接融资 B. 间接融资 C. 资金融通 D. 回购6.股票的收益要分成两类: 第一类来自于股份公司, 领取股息和分享公司的红利;第二类来自于()。

A. 股票流通B. 股票发行C. 股票回购D. 股票赎回在国际上, 国库券是()的常见形式。

7. A. 短期国债 B. 中期国债 C. 长期国债 D. 无期国债8.下列债券属于欧洲债券的是()。

A. 美国在欧洲发行的美元债券B. 美国在欧洲发行的欧元债券C. 除美国外的其他国家在欧洲发行的欧元债券D. 除美国外的其他国家在欧洲发行的美元债券对于基金管理人和基金托管人之间的关系, 下列说法不正确的是()。

A. 管理人与托管人的关系是所有者与经营者的关系;B.对基金管理人而言, 处理有关证券、现金收付的具体事务交由基金托管人办理, 自己就可以专心从事资产的运用和投资决策;9. C. 基金管理人和基金托管人均对基金持有人负责;10.D. 两者在财务上、人事上、法律地位上应该完全独立。

11.()的买卖价格受市场供求关系的影响。

A. 开放式基金B. 封闭式基金12.C. 契约式基金 D. 公司型基金13.()是指期权的买方具有在约定期限内按敲定价格买入一定数量金融资产的权利。

14.A. 卖出期权 B. 欧式期权 C. 美式期权 D. 看涨期权15.可转换债券实质上是一种()。

A. 债券的看涨期权B. 债券的看跌期权16.C. 股票的看涨期权 D. 股票的看跌期权17.()不属于证券投资的非系统风险。

大一投资学考试题及答案一、单项选择题(每题2分,共20分)1. 投资学中,投资组合的风险主要来源于()。

A. 系统性风险B. 非系统性风险C. 市场风险D. 利率风险答案:B2. 根据资本资产定价模型(CAPM),下列哪项不是决定资产预期收益率的因素?()A. 无风险利率B. 市场风险溢价C. 资产的贝塔系数D. 资产的流动性答案:D3. 在现代投资理论中,下列哪项不是有效市场假说(EMH)的类型?()A. 弱式有效市场B. 半强式有效市场C. 强式有效市场D. 完全有效市场答案:D4. 以下哪项不是投资学中的风险度量指标?()A. 方差B. 标准差C. 夏普比率D. 收益率答案:D5. 投资组合理论中,投资者通过分散投资可以降低的是()。

A. 系统性风险B. 非系统性风险C. 市场风险D. 利率风险答案:B6. 根据债券定价理论,下列哪项不是影响债券价格的因素?()A. 利率水平B. 债券的信用等级C. 债券的到期时间D. 债券的面值答案:D7. 股票的股息贴现模型(DDM)中,下列哪项不是决定股票内在价值的因素?()A. 预期股息B. 贴现率C. 股票的面值D. 股息增长率答案:C8. 在投资中,下列哪项不是财务杠杆的作用?()A. 增加收益B. 增加风险C. 减少收益D. 增加风险和收益的潜力答案:C9. 投资学中,下列哪项不是投资决策的基本原则?()A. 风险与回报的权衡B. 多元化投资C. 市场时机选择D. 长期投资答案:C10. 投资学中,下列哪项不是投资分析的主要方法?()A. 基本分析B. 技术分析C. 宏观经济分析D. 行为分析答案:D二、多项选择题(每题3分,共15分)11. 投资学中,下列哪些因素会影响股票价格?()A. 公司的盈利能力B. 利率水平C. 通货膨胀率D. 投资者情绪答案:ABCD12. 投资组合管理中,下列哪些是风险管理策略?()A. 资产配置B. 风险预算C. 衍生品对冲D. 市场时机选择答案:ABC13. 根据资本资产定价模型(CAPM),下列哪些因素会影响资产的预期收益率?()A. 无风险利率B. 市场风险溢价C. 资产的贝塔系数D. 资产的流动性答案:ABC14. 投资学中,下列哪些是影响债券价格的主要因素?()A. 利率水平B. 债券的信用等级C. 债券的到期时间D. 债券的面值答案:ABC15. 投资学中,下列哪些是投资分析的主要方法?()A. 基本分析B. 技术分析C. 宏观经济分析D. 行为分析答案:ABC三、判断题(每题2分,共10分)16. 投资组合理论认为,通过分散投资可以消除所有风险。

一、名词说明:1.第一次发行:是指新组建股分公司时或原非股分制企业改制为股分公司时或原私人持股公司要转为公众持股公司时,公司第一次发行股票。

2黑幕交易:指黑幕人员和以不合法手腕获取黑幕信息的其他人员违背法律,依照黑幕信息生意证券或像他人提诞生意证券建议的行为。

3.停止损失委托指令:是一种特殊的限制性的市价委托,它是指投资者托经纪人在证券市场价钱上升到或超过指定价钱时依照市场价钱买进证券,或是在证券市场价钱下降到或低于指定价钱时依照市场价钱卖出证券。

4.市价委托指令:是指投资者只提出交易数量而不指定成交价钱的指令。

5.指令驱动:又称委托驱动、定单驱动,在竞价市场中,证券交易价钱由生意两边的委托指令一起驱动形成,即投资者将自己的交易意愿以委托指令的方式委托给证券经纪商,证券经纪商持委托指令进入市场,以生意两边的报价为基础进行撮合产生成交价。

其特点是:证券成交价由生意两边的力量对照决定;交易在投资者之间进行。

6.期货交易:是生意两边约定在以后某个日期按成交时两边商定的条件交割必然数量某种商品的交易方式。

7.期权交易:又称选择权,是指它的持有者在规定的期限内具有按交易两边商定的价钱购买或出售必然数量某种金融资产的权利。

8.技术分析:是以证券价钱的动态转变和变更规律为分析对象,借助图表和各类指标,通过对证券市场行为的分析,预测证券市场以后变更趋势的分析方式。

9.套期保值:指套期保值者借助期货交易的盈亏来冲销其资产或欠债价值变更的行为,它是转嫁风险的重要手腕。

10.深圳综合指数:是深圳证券交易所编制的、以深圳证券交易所挂牌上市的全数股票为计算范围、以发行量为权数的加权综合股价指数,用以综合反映深圳证券交易所全数上市股票的股价走势。

二、简答:1.证券交易所的特点和功能特点:证券交易所作为一个高度组织化的市场,它的要紧特点是:(1)有固定的交易场所和严格的交易时刻;(2)交易采取经纪制,一样投资者不能直接进入交易所生意证券,只能委托具有资格的会员证券公司间接交易;(3)交易对象限于合乎必然标准的上市证券;(4)交易量集中,具有较高的成交速度和成交率;(5)对证券交易实行严格治理,市场秩序化。

投资学考试试题及答案一、选择题(每题4分,共40分)1. 投资学是研究什么问题的学科?A. 资金的筹集和分配B. 资产的收益和风险C. 经济发展和社会进步D. 企业管理和决策2. 股票的收益主要由以下哪些因素决定?A. 利润收益B. 股息收益C. 股价上涨收益D. 所有选项都正确3. 以下哪种投资组合可以实现风险分散?A. 只投资一种股票B. 只投资一种债券C. 投资多种不同类型的资产D. 所有选项都无法实现风险分散4. 在现金流折现决策中,下列哪个指标可用来评估投资项目的收益性?A. 净现值B. 内部收益率C. 投资回收期D. 所有选项都正确5. 风险资产的预期收益率和风险程度之间的关系是:A. 收益率越高,风险越低B. 收益率越低,风险越低C. 收益率越高,风险越高D. 收益率与风险无关6. 以下哪个指标用于评估投资组合的风险和收益之间的关系?A. 夏普比率B. 贝塔系数C. 布朗修正系数D. 所有选项都正确7. 在股票市场上,以下哪个指标用于衡量股票价格波动的大小?A. 均值B. 方差C. 标准差D. 所有选项都正确8. 资产组合的有效前沿是指:A. 所有可行的资产组合构成的曲线B. 高收益率资产构成的曲线C. 低风险资产构成的曲线D. 所有选项都不正确9. 什么是资本资产定价模型(CAPM)?A. 一种基于资产收益率和市场风险的定价模型B. 一种用于计算股票价格的模型C. 一种用于计算债券收益率的模型D. 所有选项都不正确10. 标准差衡量的是:A. 资产的期望收益B. 资产的风险敞口C. 资产的现金流D. 所有选项都不正确二、判断题(每题4分,共20分)1. 长期债券的价格波动较大,风险相对较高。

( )2. 投资组合的风险可以通过对冲来降低。

( )3. 投资组合的效用函数反映了投资者对风险和收益的偏好。

( )4. 若两个资产间的相关系数为-1,则它们的收益率具有正相关关系。

( )5. 在投资组合理论中,有效前沿上的资产组合都具有最大效用。

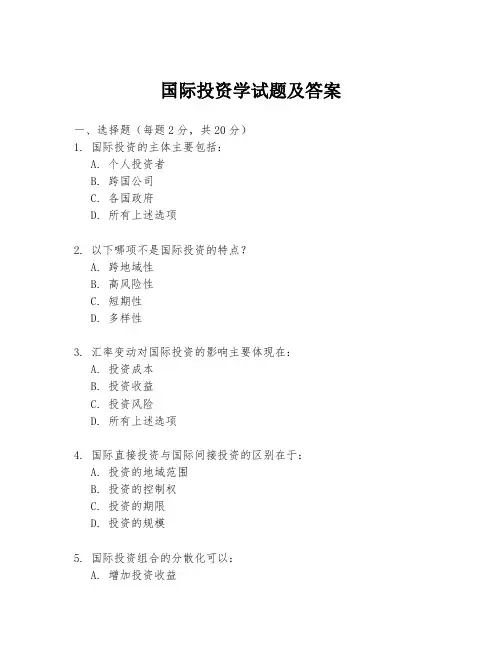

国际投资学试题及答案一、选择题(每题2分,共20分)1. 国际投资的主体主要包括:A. 个人投资者B. 跨国公司C. 各国政府D. 所有上述选项2. 以下哪项不是国际投资的特点?A. 跨地域性B. 高风险性C. 短期性D. 多样性3. 汇率变动对国际投资的影响主要体现在:A. 投资成本B. 投资收益C. 投资风险D. 所有上述选项4. 国际直接投资与国际间接投资的区别在于:A. 投资的地域范围B. 投资的控制权C. 投资的期限D. 投资的规模5. 国际投资组合的分散化可以:A. 增加投资收益B. 降低投资风险C. 增加投资成本D. 减少投资机会二、简答题(每题10分,共30分)6. 简述国际投资的动机有哪些?7. 解释什么是“货币风险”及其对国际投资的影响。

8. 描述国际投资中的风险管理策略。

三、计算题(每题25分,共50分)9. 假设某公司计划在海外投资100万美元,当前汇率为1美元兑换6.5元人民币。

如果一年后汇率变动为1美元兑换7元人民币,不考虑其他因素,该公司的汇率变动收益是多少?10. 某投资者购买了两种不同国家的债券,A国债券的收益率为5%,B 国债券的收益率为7%,投资者将资金平均分配到两种债券上。

如果投资者面临5%的通货膨胀率,计算实际收益率。

四、论述题(共30分)11. 论述国际投资对东道国经济发展的积极和消极影响。

答案一、选择题1. D2. C3. D4. B5. B二、简答题6. 国际投资的动机包括寻求更高的投资回报、分散投资风险、获取资源和市场、技术转移和学习、响应政府政策和法规等。

7. 货币风险是指由于汇率变动导致投资价值波动的风险。

它对国际投资的影响主要体现在投资成本和收益的不确定性,增加了投资决策的复杂性。

8. 国际投资中的风险管理策略包括:多元化投资、对冲、保险、风险评估和监控等。

三、计算题9. 汇率变动收益 = 100万美元 * (7 - 6.5) = 500,000元人民币。

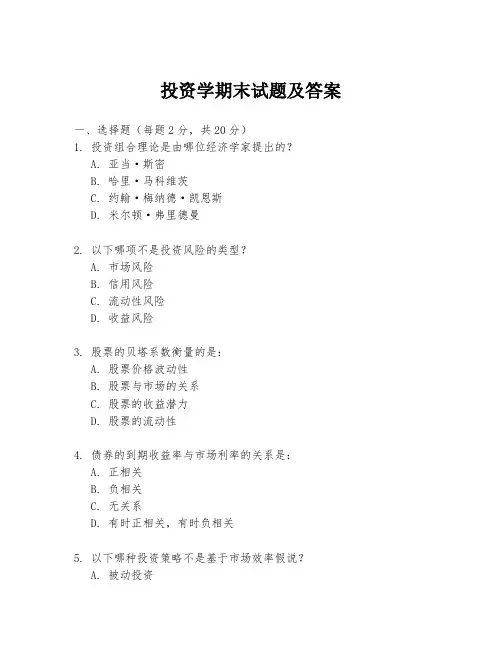

投资学期末试题及答案一、选择题(每题2分,共20分)1. 投资组合理论是由哪位经济学家提出的?A. 亚当·斯密B. 哈里·马科维茨C. 约翰·梅纳德·凯恩斯D. 米尔顿·弗里德曼2. 以下哪项不是投资风险的类型?A. 市场风险B. 信用风险C. 流动性风险D. 收益风险3. 股票的贝塔系数衡量的是:A. 股票价格波动性B. 股票与市场的关系C. 股票的收益潜力D. 股票的流动性4. 债券的到期收益率与市场利率的关系是:A. 正相关B. 负相关C. 无关系D. 有时正相关,有时负相关5. 以下哪种投资策略不是基于市场效率假说?A. 被动投资B. 技术分析C. 基本面分析D. 指数基金投资二、简答题(每题10分,共30分)1. 请简述资本资产定价模型(CAPM)的基本假设和公式。

2. 什么是有效市场假说(EMH)?它对投资者的决策有何影响?3. 请解释什么是杠杆收购(LBO)以及它在投资中的作用。

三、计算题(每题25分,共50分)1. 假设你拥有一个包含两种股票的投资组合,股票A和股票B。

股票A的预期收益率为12%,股票B的预期收益率为15%。

如果股票A占投资组合的60%,股票B占40%,计算投资组合的预期收益率。

2. 某公司发行了一张面值为1000美元,期限为10年,年利率为5%的债券。

如果市场利率为6%,计算该债券的当前价格。

四、论述题(共30分)1. 论述私募股权投资与公开市场投资的主要区别,并分析它们各自的优点和局限性。

2. 请结合当前市场环境,讨论投资者如何平衡风险与回报。

答案:一、选择题1. B2. D3. B4. A5. B二、简答题1. 资本资产定价模型(CAPM)的基本假设包括:市场是有效的,投资者是理性的,不存在交易成本和税收,投资者可以无限制地借贷资金等。

CAPM的公式为:E(Ri) = Rf + βi * (E(Rm) - Rf),其中E(Ri)是资产i的预期收益率,Rf是无风险利率,βi是资产i的贝塔系数,E(Rm)是市场组合的预期收益率。

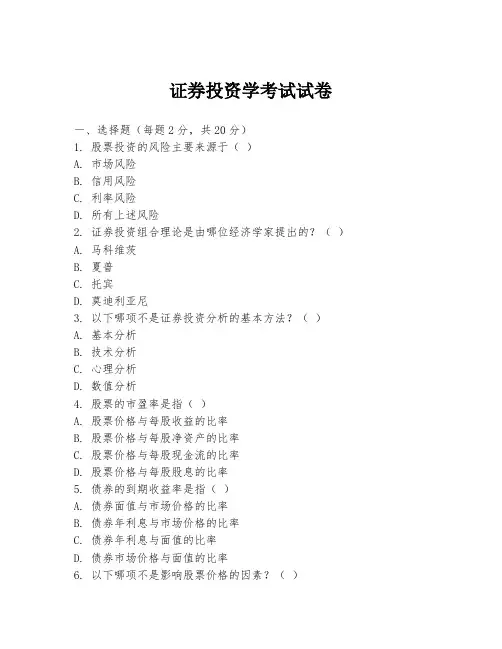

证券投资学考试试卷一、选择题(每题2分,共20分)1. 股票投资的风险主要来源于()A. 市场风险B. 信用风险C. 利率风险D. 所有上述风险2. 证券投资组合理论是由哪位经济学家提出的?()A. 马科维茨B. 夏普C. 托宾D. 莫迪利亚尼3. 以下哪项不是证券投资分析的基本方法?()A. 基本分析B. 技术分析C. 心理分析D. 数值分析4. 股票的市盈率是指()A. 股票价格与每股收益的比率B. 股票价格与每股净资产的比率C. 股票价格与每股现金流的比率D. 股票价格与每股股息的比率5. 债券的到期收益率是指()A. 债券面值与市场价格的比率B. 债券年利息与市场价格的比率C. 债券年利息与面值的比率D. 债券市场价格与面值的比率6. 以下哪项不是影响股票价格的因素?()A. 公司业绩B. 市场利率C. 通货膨胀D. 月球引力7. 证券投资基金的主要类型不包括()A. 开放式基金B. 封闭式基金C. 私募基金D. 公募基金8. 以下哪项不是证券投资的风险管理工具?()A. 期货B. 期权C. 互换D. 股票9. 股票的股息政策通常由()A. 股东大会决定B. 董事会决定C. 管理层决定D. 监管机构决定10. 以下哪项不是债券的基本特征?()A. 面值B. 利率C. 期限D. 投票权二、判断题(每题1分,共10分)1. 股票的市场价格总是等于其内在价值。

()2. 技术分析认为市场价格反映了所有信息。

()3. 债券的信用等级越高,其收益率也越高。

()4. 股票的股息率是固定的,不会随市场价格波动。

()5. 证券投资组合的多样化可以完全消除非系统性风险。

()6. 封闭式基金的份额在基金成立后不能增加或减少。

()7. 利率上升会导致债券价格下降。

()8. 股票的贝塔系数大于1意味着该股票的风险高于市场平均水平。

()9. 期货合约是一种远期合约。

()10. 私募基金只面向特定的投资者群体。

()三、简答题(每题5分,共20分)1. 简述股票与债券的主要区别。

《投资学》试题及答案题型;一、选择题6分二、计算题78分三、论述题16分(主要是有效市场假说)1.假设某一中期国债每12个月的收益率是6%,且该国债恰好还剩12个月到期。

那么你预期一张12个月的短期国库券的售价将是多少?解:P=面值/(1+6%)2.某投资者的税率等级为20%,若公司债券的收益率为9%,要想使投资者偏好市政债券,市政债券应提供的收益率最低为多少?解:9%×(1-20%)=7.2%3.下列各项中哪种证券的售价将会更高?a.利率9%的10年期长期国债和利率为10%的10年期长期国债。

b. 期限3个月执行价格为50美元的看涨期权和期限3个月执行价格为45美元的看涨期权。

c. 期限3个月执行价格为40美元的看跌期权和期限3个月执行价格为35美元的看跌期权。

解:a.利率为10%的10年期长期国债b.3个月执行价格为45美元的看涨期权c.期限3个月执行价格为40美元的看跌期权4.若预期股市将会大幅度上涨,股票指数期权市场上的下列哪项交易的风险最大?a.出售一份看涨期权 b出售一份看跌期权c购买一份看涨期权 d购买一份看跌期权解:a.出售一份看涨期权5.短期市政债券的收益率为4%,应税债券的收益率为6%,当你的税率等级分别为下列情况时,哪一种债券可以提供更高的税后收益率?a.0b.10%c.20%d.30%解:当短期市政债券收益率与应税债券收益率税后收益率相等时,设税率为X,则:6%(1-X)=4%,解得:X=33.3%由于0、10%、20%、30%都小于33.3%所以在0、10%、20%、30%的税率时,应税债券可以提供更高的税后收益率。

6.免税债券的利率为6.4%,应税债券的利率为8%,两种债券均按面值出售,当投资者的税率等级为多少时投资两种债券是无差别的?解:设税率等级为X,则:8%(1-X)=6.4%,解得X=20%7.假设你卖空100股IBM的股票,其当前价格为每股110美元。

一、利用中国证券市场的实力,说明证券投资的基本分析、财务分析等方法如何使用(宏观经济分析和财务分析怎么使用,公式举例,财务数据)1、基本分析的第一步就是要分析和判断投资的经济环境。

宏观经济分析是判断证券市场发展趋势和投资价值的基础。

宏观经济的发展趋势决定证券市场的发展方向;宏观经济的增长速度和质量,决定证券市场的投资价值。

宏观经济是个体经济的综合,不同行业、不同部门所有企业的业绩共同形成了社会经济的发展速度和质量,而宏观经济的发展状况又是企业投资价值的综合反映。

投资者通过宏观经济分析,判断经济运行目前处于什么阶段,预测经济形势将会发生什么变化,从而作出投资方向的决策。

在我国证券市场中,投资者进行投资时就要考虑社会经济发展速度和经济结构分析,投资规模分析,消费分析,经济周期分析,财政收支和财政政策分析,货币指标和货币政策分析,国际收支分析,物价分析等。

2、财务分析是证券投资分析的主要内容,分析对象的上市公司定期公布的财务报表。

财务报表能综合反映公司在一定会计期间内资金流转、财务状况和盈利水平的全貌,是公司向有关方面传递经济信息的主要手段。

在我国证券市场中,投资者通过阅读我国上市公司的财务报表,就账面会计数据间的相互关系、在一定时期内的变动趋势和量值进行分析比较,以判断公司的财务状况和经营状况是否良好,并以此为一句预测公司的未来发展以及作出投资决策。

二、投资学中的内在价值分析方法模型有哪些(3个公式)1、债券的定价模型每年付一次利息的息票债券价格计算公式:半年付息债券的价格计算公式:累息债券的价格计算公式:零息债券的价格计算公式:2、股利贴现模型预期现金流量的现值公式:零增长模型:不变增长模型:多元增长模型:3、优先认股权价值:权证的价值:可转换债券的价值三、财务分析的基本内容(1)短期偿债能力分析。

对短期偿债能力的分析主要是着眼于对公司流动资产和流动负债之间关系的分析,主要的分析指标是流动比率和速动比率。

1、如何看待风投行业?从投资行为的角度来讲,风险投资是把资本投向蕴藏着失败风险的高新技术及其产研究开发领域,旨在促使高新技术成果尽快商品化、产业化,以取得高资本收益的一种投资过程。

从运作方式来看,是由专业化人才管理下的投资中介向特别具有潜能的高新技术企业投入风险资本的过程,也是协调风险投资家、技术专家、投资者的关系,利益共享,风险共担的一种投资方式。

风险投资不需要抵押,也不需要偿还。

如果投资成功,投资人将获得几倍、几十倍甚至上百倍的回报;如果失败,投进去的钱就算打水漂了。

对创业者来讲,使用风险投资创业的最大好处在于即使失败,也不会背上债务。

这样就使得年轻人创业成为可能。

总的来讲,这几十年来,这种投资方式发展得非常成功。

风险投资是由资金、技术、管理、专业人才和市场机会等要素所共同组成的投资活动,具有以下六个特点:1.以投资换股权方式,积极参与对新兴企业的投资;2.协助企业进行经营管理,参与企业的重大决策活动;3.投资风险大、回报高;并由专业人员周而复始地进行各项风险投资;4.追求投资的早日回收,而不以控制被投资公司所有权为目的;5.风险投资公司与创业者的关系是建立在相互信任与合作的基础之上的;6.投资对象一般是高科技、高成长潜力的企业。

在投资领域方面,20世纪90年代,VC在中国所投资的企业几乎全部都是互联网企业,比如耳熟能详的新浪、搜狐、阿里巴巴等互联网企业都是在这一时期得到风险投资的青睐。

但与以往扎堆投资互联网行业不同,新一轮VC投资潮热衷传统项目,教育培训、餐饮连锁、清洁技术、汽车后市场等都是投资热点。

传统行业一旦形成连锁品牌,很容易形成整体效应,而且像餐饮连锁、连锁酒店等行业在中国市场前景广阔,属于成长性很好且回报非常稳定,受到风投青睐势在必然。

今后十年被认为是中国风险投资“由弱到强”、飞速发展的“黄金十年”,需要以长远眼光和全球视野来正视中国风险投资事业所面临的发展机遇。

期望在未来十年内中国能成为仅次于美国和欧洲的风险投资大国。

投资学A一、单选题1、( )是股份有限公司的最高权利机构。

A、董事会B、股东大会C、总经理D、监事会2、证券发行市场是指()A、一级市场B、二级市场C、国家股票交易所D、三级市场3、连续竞价时,某只股票的卖出申报价格为15元,市场即时的最低买入申报价格为14.98元,则成交价格为()A、15元B、14.98元C、4.99元D、不能成交4、可以被分散掉的风险叫做( )A、非系统风险B、市场风险C、系统风险D、违约风险5、债券能为投资者带来一定收入,即债权投资的报酬是指债券的( )A、偿还性B、流动性C、安全性D、收益性6、市盈率衡量的是()A、股利与市场价格的关系B、市场价格与EPS的比C、每股收益D、以上都不正确7、在计算优先股的价值时,最适用股票定价模型的是 ( )A、零增长模型B、不变增长模型C、可变增长模型D、二元增长模型8、预计某股票明年每股支付股利2美元,并且年末价格将达到40美元。

如果必要收益率是15%,股票价值是()A、33.54美元B、36.52美元C、43.95美元D、47.88美元9、下列债券中风险最小的是()A、国债B、政府担保债券C、金融债券D、公司债券10、假设必要收益率是12%,那么每年支付股利7.5美元,面值为100美元的优先股的价值是()A、100美元B、62.5美元C、72.5美元D、50美元11、确定基金价格最基本的依据是()A、基金的盈利能力B、基金单位资产净值及其变动情况C、基金市场的供求关系D、基金单位收益和市场利率12、市场预期收益率是16%,无风险利率6%,Zebra公司贝塔值比市场总体高出20%,公司必要收益率是()A、14%B、15%C、18%D、12%13、根据债券定价原理,如果一种附息债券的市场价格高于其面值,则其到期收益率()其票面利率A、大于B、小于C、等于D、不确定14、交易最活跃的衍生工具是以()资产为基础资产的合约。

A、金融的B、农产品相关的C、能源相关的D、金融相关的15、如果某可转换债券面额为2000元,转换价格为40元,当股票的市价为60元时,则该债券当前的转换价值为( )元。

证券投资学期末考论述题and综合分析题一.试述证券投资基本分析的主要内容。

Ps:定义1。

证券投资的基本分析主要是通过对决定证券投资价值及价格的基本要素的分析,评价证券的投资价值,判断证券的合理价位及其变动趋势,从而提出相应投资建议的一种分析方法.①宏观经济分析:主要分析经济指标和经济政策对证券市场价格的影响,是基础分析。

经济指标分为用来判断经济增长与经济周期的主要指标,包括GDP、经济增长率、失业率、通货膨胀等和用来判断金融市场形势的主要指标,包括货币供应量、利率、汇率等,运用AD—AS模型分析宏观经济形势。

经济政策主要包括货币政策、财政政策、产业政策、汇率政策、收入分配政策等.②产业分析:主要分析产业不同的基本特征、不同的生命周期、不同的结构对证券市场价格的影响,是中间层次分析。

产业的基本特征分析主要是对产业的类型、产业特性和发展规模以及产业所处的政策、技术等环境的分析.产业结构分析包括产业市场结构,如寡头垄断、完全竞争市场等的分析和产业竞争结构,如供应商议价能力等的分析。

③公司分析:主要是通过定性的分析公司的基本情况、公司的战略定位以及公司的竞争优势等来判断公司证券市场价格的变动,是基本分析的重点。

基本的竞争战略包括成本领先战略、差异化战略和聚焦战略。

公司主要的竞争优势包括企业的资源和核心能力。

二.试述证券投资技术分析的三大假定与四大要素。

三大假设:假设一:市场行为包括一切信息.假设二:价格沿趋势波动,并保持趋势。

股票价格的运动有保持惯性的特点。

假设三:历史会重复。

四大要素:价格、成交量、时间和空间。

三.谈谈你对股价变动影响因素的一般认识与对A股的独特认识。

股价变动影响因素主要有:1.宏观因素:①经济周期:宏观经济周期一般经历萧条、复苏、繁荣、衰退四个阶段,表现在许多经济数据的波动上,如GDP、失业率等。

经济繁荣,证券价格上涨;经济衰退,证券价格下跌.②物价:一般而言,商品价格上升时,公司的产品能够以较高的价格水平售出,盈利相应增加,公司股价上涨。

《投资学》习题及其参考答案《投资学》习题第1章投资概述《》一、填空题1、投资所形成的资本可分为和。

2、资本是具有保值或增值功能的。

3、按照资本存在形态不同,可将资本分为、、、等四类。

4、根据投资所形成资产的形态不同,可以将投资分为、、三类。

5、按研究问题的目的不同,可将投资分成不同的类别。

按照投资主体不同,投资可分为、、、四类。

6、从生产性投资的每一次循环来,一个投资运动周期要经历、、、等四个阶段。

二、判断题1、资本可以有各种表现形态,但必须有价值。

()2、无形资本不具备实物形态,却能带来收益,在本质上属于真实资本范畴。

()3、证券投资是以实物投资为基础的,是实物投资活动的延伸。

()4、直接投资是实物投资。

()5、投机在证券交易中既有积极作用,又有消极作用。

()6、投资所有者主体、投资决策主体、投资实施主体、投资存量经营主体是可以分离的。

()三、多项选择题1、投资主体包括()A.投资所有者主体B.投资决策主体C.投资实施主体D.投资存量经营主体E.投资收益主体2、下列属于真实资本有()A.机器设备B.房地产C.黄金D.股票E.定期存单3、下列属于直接投资的有()A.企业设立新工厂B.某公司收购另一家公司51%的股权C.居民个人购买1000股某公司股票D.发放长期贷款而不参与被贷款企业的经营活动E.企业投资于政府债券4、下列属于非法投机活动是()A.抢帽子B.套利C.买空卖空D.操纵市场E.内幕交易四、名词解释投资投资主体产业投资证券投资直接投资间接投资五、简答题1、怎样全面、科学的理解投资的内涵?2、投资有哪些特点?3、投资的运动过程是怎样的?4、投资学的研究对象是什么?5、投资学的研究内容是什么?6、试比较主要西方投资流派理论的异同?第2章市场经济与投资决定一、填空题1、投资制度主要由、、等三大要素构成。

2、一般而言,投资制度分为和两类。

3、投资主体可以按照多种标准进行分类,一种较为常用的分类方法是根据其进行投资活动的目标,把投资主体划分为和。

1.Discuss the industry life cycle, how this concept can be used by security analysts. The industry life cycle transitions through start-up, consolidation, maturity and relative decline phases.1. In start-up period, stock prices growth is rapid and increasing, and is suitable for ordinary investors but not for speculators.2. In consolidation period, stock prices growth is stable, and is suitable for persistent investor but not for value investors.3. In maturity period, stock prices growth is slowing, and is suitable for Income or value investors but not for persistent investor.4. In relative decline period, stock prices growth is minimal or negative, and is suitable for speculators but not for ordinary investors .2.With regard to semi-strong-form efficient market, what is meant by the term”anomaly”? Give three examples of market anomalies and explain why each is considered to be an anomaly?4.Briefly describe what are the market anomalies regarding the empirical tests of semi-strong form efficient market?Anomalies are patterns that should not exist if the market is truly efficient. Investors might be able to make abnormal profits by exploiting the anomalies, which doesn’t make sense in an efficient market.1. The small-firm effect, average annual returns are consistently higher for small-firm portfolios, even when adjusted for risk by using the CAPM.2. The liquidity effect, investors demand a return premium to invest in less-liquid stocks. This is related to the small-firm effect and the neglected-firm effect. These stocks tend to earn high risk-adjusted rates of return.3. The neglected-firm effect, small firms tend to be ignored by large institutional traders and stock analysts. This lack of monitoring makes them riskier and they earn higher risk-adjusted returns.3.Discuss what is the protective put option strategy.The protective put, or put hedge, is a hedging strategy where the holder of a security buys a put to guard against a drop in the stock price of that security. A protective put strategy is usually employed when the options trader is still bullish on a stock he already owns but wary of uncertainties in the near term. It is used as a means to protect unrealized gains on shares from a previous purchase.5: discuss what fundamental analysis is and what information it needs.That is the analysis of the determinants of value such as earning prospects. Ultimately, the business success of the firm determines the dividends it can pay to shareholders and the price it will command in the stock market.In doing fundamental analysis we need information. Such as1. The global economy (exchange rate)2.The domestic macroeconomy (gross domestic product, employment, unemployment rate, inflation, interest rates, budget deficit, sentiment.)3. Enterprise quality, Political factors, Industry factors, Market factors,Investment psychological factors.6: discuss the various forms of market efficiency. Also discuss the implications for the various forms of market efficiency for the various types of securities` analysts.1. The weak from the efficient market hypothesis states that stock prices immediately reflect market data. Market data refers to stock prices and trading volume. Technicians attempt to predict future stock prices based on historic stock price movements. Thus, if the weak from of the EMH holds, the work of the technician is of no value.2. The semi-strong from of the EMH states that stock prices include all public information. This public information includes market data and all other publicly available information, and all information reported in the press relevant to the firm. Thus, market information is a subset of all public information. As a result, if the semi-strong form holds, then the fundamentalist, who attempts to identify undervalued securities by analyzing public information, is unlikely to do so consistently over time. In fact, the work of the fundamentalist may make the markets even more efficient.3. The strong form of the EMH states that all information is immediately reflected in stock prices. Public information is a subset of all information, thus if the strong form of the EMH holds, the semi-strong form must hold also. The strong form of the EMH states that even with inside information, one cannot expect to outperform the market consistently over time.。