英文财务指标及计算公式汇总

- 格式:docx

- 大小:19.85 KB

- 文档页数:8

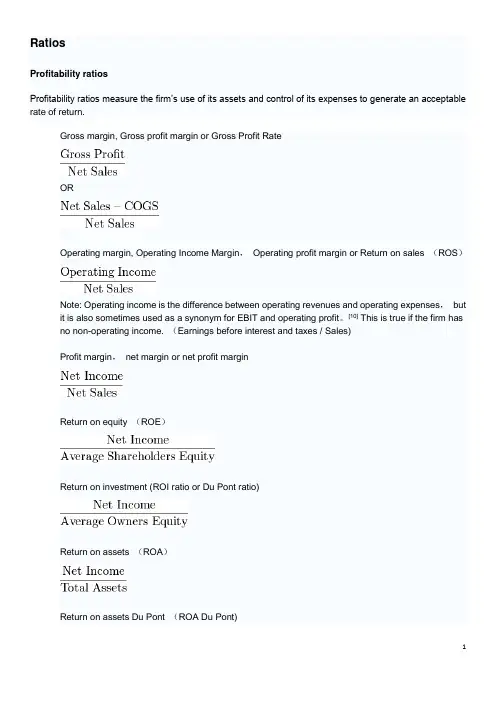

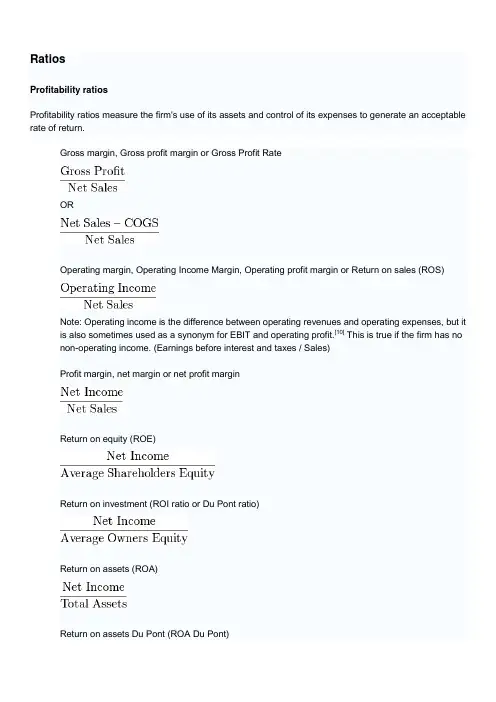

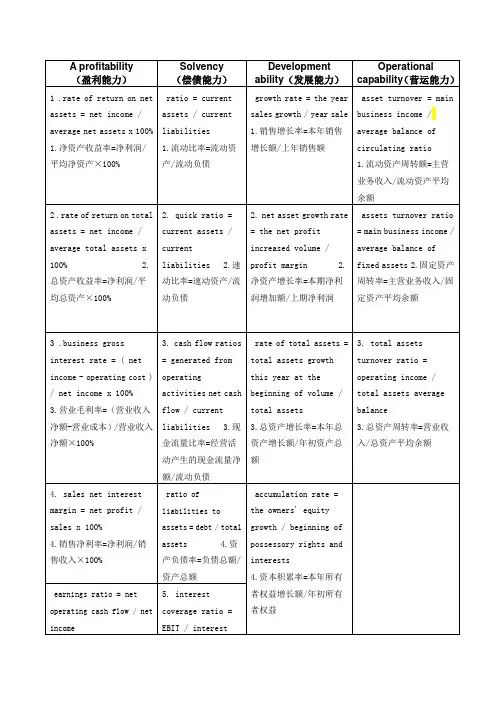

RatiosProfitability ratiosProfitability ratios measure the firm’s use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin,Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses,but it is also sometimes used as a synonym for EBIT and operating profit。

[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin,net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt。

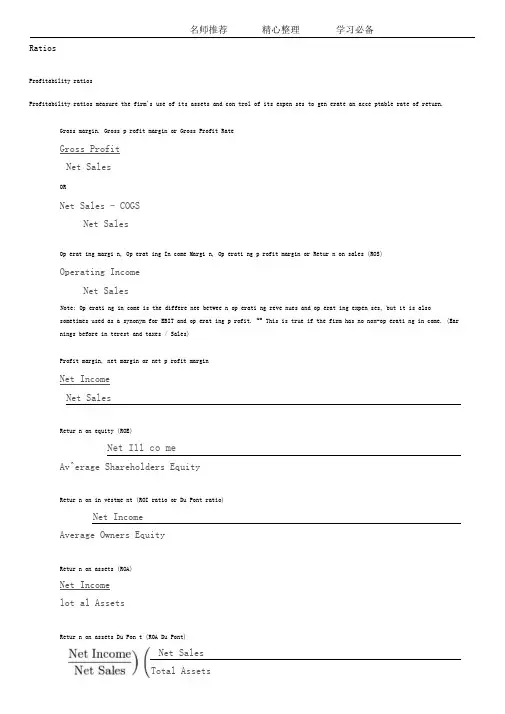

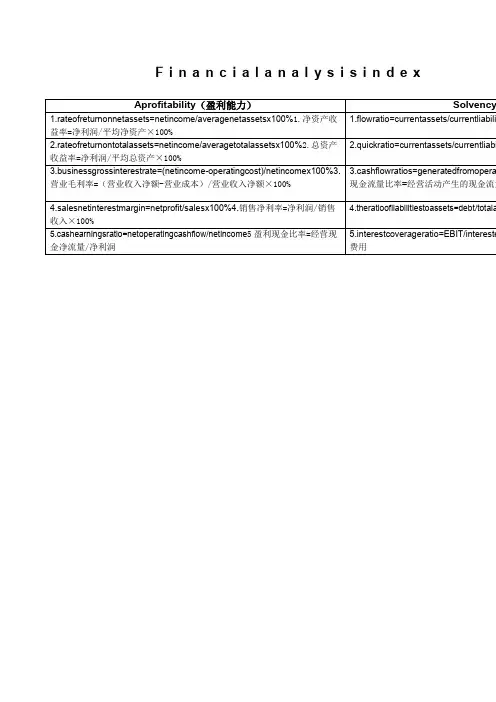

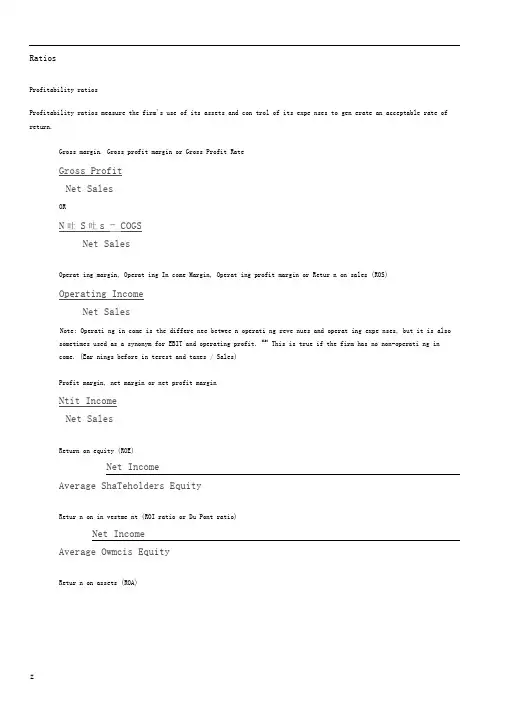

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and con trol of its expen ses to gen erate an acce ptable rate of return.Gross margin. Gross p rofit margin or Gross Profit RateGross ProfitNet SalesORNet Sales - COGSNet SalesOp erat ing margi n, Op erat ing In come Margi n, Op erati ng p rofit margin or Retur n on sales (ROS)Operating IncomeNet SalesNote: Op erati ng in come is the differe nee betwee n op erati ng reve nues and op erat ing expen ses, but it is alsosometimes used as a synonym for EBIT and op erat ing p rofit. [10] This is true if the firm has no non-op erati ng in come. (Ear nings before in terest and taxes / Sales)Profit margin, net margin or net p rofit marginNet IncomeNet SalesRetur n on equity (ROE)Net Ill co meAv^erage Shareholders EquityRetur n on in vestme nt (ROI ratio or Du Pont ratio)Net IncomeAverage Owners EquityRetur n on assets (ROA)Net Incomelot al AssetsRetur n on assets Du Pon t (ROA Du Pont)Net SalesTotal AssetsRetur n on Equity Du Pon t (ROE Du Pont) /Net Income Xet Sales I Net Sales Retur n on n et assets(RONA) Net IncomeFixed Assets + Working CapitalReturn on capi tal (ROC)Net Op erating Profit - Adjusted TaxesOwners EquityRisk adjusted return on cap ital (RAROC)Expected ReturnEconomic CapitalORExpected Rjct urnValue at. RiskRetur n on cap ital empio yed (ROCE)Net IncomeCapit al EuiployeJNote: this is somewhat similar to (ROI), which calculates Net In come per Owner's EquityCash flow return on in vestme nt (CFROI)Cash FlowMarket RecapitalksaliouEfficie ncy ratioNoii-Iiiterest. IncomeNet Interest Income + Xon-Intcrcst IncomeNet geari ng dette nette foil ds propresLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.A Z Average Assets wrage Assets/ \Average EquityCurre nt ratioCurrent AssetsCurrent LiabilitiesAcid-test ratio (Quick ratio) [17]Current Assets - (Inventories + Prepayment侶)Current LiabilitiesOp erati on cash flow ratioOp erat ion Cash FlowTotal DebtsActivity ratiosActivity ratios measure the effective ness of the firms use of resources.Average collect ion p eriodAccounts ReceivableAnnual Credit Sales -r 365 DaysDegree of Op erat ing Leverage (DOL)Percent Change in Net Operating IncomePcrcciit Change in SalosDSO RatioAccounts ReceivableTotal Annual Sales 365 DavsAverage p ayme nt p eriodAccounts PayableAnnual Credit Purdiases 十365 DavsAsset tur no verNet Saleslot al AssetsInven tory tur no ver ratioCOGSAverage InventoryReceivables Turno ver RatioNet Credit SalesAx^rage Net ReceivablesInven tory con vers ion ratio365 DaysIiiveiitorv Turnover. 7 —Inven tory con vers ion p eriod/Inventorv\ ""口I ) 365 Davs\ COGS ) '■Receivables con vers ion p eriod/ Receivables\Net Sa血365 DaysPayables con vers ion p eriodP urchases厂,,,365 DaysAAccounts Pavable /Cash Con vers ion CycleInven tory Con vers ion Period + Receivables Con versi on Period - Payables Con vers ion PeriodDebt ratios (leveragi ng ratios)Debt ratios measure the firm's ability to repay Ion g-term debt. Debt ratios measure finan cial leverage.Debt ratioTotal LiabilitiesTotal AssetsDebt to equity ratioLong-term Debt + Value of LeasesAverage Shareholders EquityLon g-term Debt to equity (LT Debt to Equity)Long-term Debt Tbtal AssetsTimes in terest-earned ratioEBITAnnual Interest ExpenseORNet IncomeAiiiiual Interest ExpeiiseDebt service coverage ratioNet Operating IncomeTotal Debt ServiceMarket ratiosMarket ratios measure in vestor response to owning a company's stock and also the cost of issu ing stock.Earnings per share (EPS)Expected EarningsNumber of SharesPayout ratioDividendsEarningsORDividendsEPSDivide nd cover (the in verse of Payout Ratio)Earnings PET ShareDiAridend per ShareP/E ratioMarket Priw per ShareDiluted EPSDivide nd yieldDividendCurrent Market PriceCash flow ratio or Price/cash flow ratioMarfeet Price per SharePresent Value of Ca^^li Flow p吃r SharePrice to book value ratio (P/B or PBV)Market Pnte per Share Balance Slieet Pne^e per SharePrice/sales ratioMarket Price per ShareGross SalesPEG ratioPnee p巴r EarningsAnnual EPS GrowthOther Market RatiosEV/EBITDAEnter prise ValueEBITDAEV/SalesEnter prise Value Net SalesCost/ In come ratioSector-s pecific ratiosEV/ca pacityEV/out put。

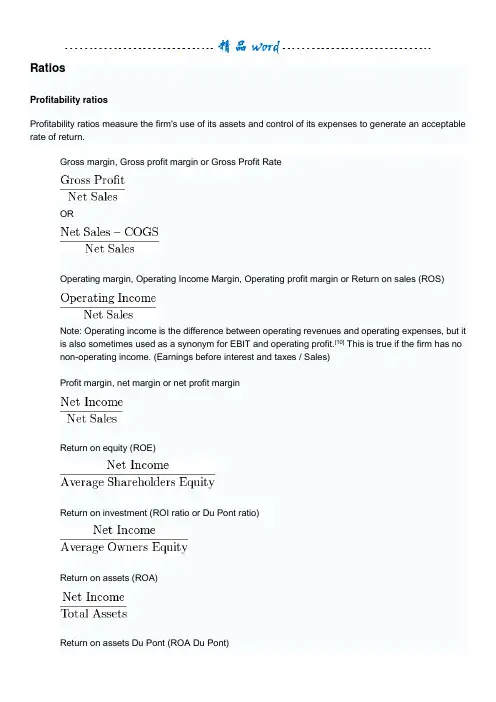

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratioSector-specific ratiosEV/capacity EV/output。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratioSector-specific ratiosEV/capacityEV/output(注:文档可能无法思考全面,请浏览后下载,供参考。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratioSector-specific ratiosEV/capacityEV/output友情提示:本资料代表个人观点,如有帮助请下载,谢谢您的浏览!。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return., Gross profit margin or Gross Profit RateOR, Operating Income Margin, Operating profit margin or Return on sales ROS Note: Operating income is the difference between operating revenues andoperating expenses, but it is also sometimes used as a synonym for EBIT and operating profit. This is true if the firm has no non-operating income. / Sales, net margin or net profit marginROEROI ratio orROAROA Du PontROE Du PontRONAROCRAROCORROCENote: this is somewhat similar to ROI, which calculates Net Income per Owner's EquityCFROILiquidity ratiosratios measure the availability of cash to pay debt.ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.DOLratioratioInventory conversion periodReceivables conversion periodPayables conversion periodInventory Conversion Period + Receivables Conversion Period - PayablesConversion PeriodDebt ratios leveraging ratiosDebt ratios measure the firm's ability to repay long-term debt. Debt ratios measure .LT Debt to EquityORMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.EPSORthe inverse of Payout RatioCash flow ratio orP/B or PBVOther Market RatiosSector-specific ratios。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return., Gross profit margin or Gross Profit RateOR, Operating Income Margin, Operating profit margin or Return on sales (ROS) Note: Operating income is the difference between operating revenues andoperating expenses, but it is also sometimes used as a synonym for EBIT and operating profit. This is true if the firm has no non-operating income. ( / Sales), net margin or net profit margin(ROE)(ROI ratio or )(ROA)(ROA Du Pont)(ROE Du Pont)(RONA)(ROC)(RAROC)OR(ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity(CFROI)Liquidity ratiosratios measure the availability of cash to pay debt.ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.(DOL)ratioratioInventory conversion periodReceivables conversion periodPayables conversion periodInventory Conversion Period + Receivables Conversion Period - PayablesConversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure .(LT Debt to Equity)ORMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.(EPS)OR(the inverse of Payout Ratio)Cash flow ratio or(P/B or PBV)Other Market RatiosSector-specific ratios。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and con trol of its expe nses to gen erate an acceptable rate of return.Gross margin. Gross profit margin or Gross Profit RateGross ProfitNet SalesORN吐S吐s - COGSNet SalesOperat ing margin, Operat ing In come Margin, Operat ing profit margin or Retur n on sales (ROS)Operating IncomeNet SalesNote: Operati ng in come is the differe nee betwee n operati ng reve nues and operat ing expe nses, but it is also sometimes used as a synonym for EBIT and operating profit. [10] This is true if the firm has no non-operati ng in come. (Ear nings before in terest and taxes / Sales)Profit margin, net margin or net profit marginNtit IncomeNet SalesReturn on equity (ROE)Net IncomeAverage ShaTeholders EquityRetur n on in vestme nt (ROI ratio or Du Pont ratio)Net IncomeAverage Owmcis EquityRetur n on assets (ROA)Net IneoineTot" AssetsReturn on assets Du Pont (ROA Du Pont)Retur n on n et assets (RONA)Not IncomoFixed Assets + Working CapitalReturn on capital (ROC)Net Operating Profit - Adjusted TaxesOwners EquityRisk adjusted return on capital (RAROC)Expected ReturnEconomic CapitalORExpected ReturnValue at RiskRetur n on capital employed (ROCE)Net IncomeCapital EmployedNote: this is somewhat similar to (ROI), which calculates Net In come per Owner's EquityCash flow return on in vestme nt (CFROI)Cash FlowMarket Recapitalisation.Efficie ncy ratioXon-Iiitcreyt IncomeNet Interest Income + Non-Interest IncomeNet geari ngdett e ncttcfonds proprcsLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Curre nt ratioCurrent. AssetsCurrent LiabilitiesAcid-test ratio (Quick ratio) [17]Curreiit Assets- (Inventories + Prepaxuients)Current. LiabilitiesOperation cash flow ratioOperation Cash FlowTotal DebtsActivity ratiosActivity ratios measure the effective ness of the firms use of resources.Average collect ion period Accounts R-eceivablcAnnual Credit Sales 中365 DaysDegree of Operat ing Leverage (DOL)Percent Change in Net Operating Income | Percent Change in SalosDSO RatioAmounts ReceivableTotal Annual Sales -4- 365 DaysAverage payme nt periodAccounts PayableA nnu A 1 Credit Purchases 子365 DavsifarAsset tur no verNet. SalesIbtail AssetsInven tory tur no ver ratioCOGSAverage InventoryReceivables Turno ver RatioXet Credit SalesAverage Net ReceirablcsInven tory con vers ion ratio365 DaysI Heritor v TurnoverInven tory con vers ion periodReceivables con vers ion periodReceivables \—一——3b5 DaysNet Sales )Payables con vers ion periodPurchasesccolintsPa\r ahle■JCash Con vers ion CycleInven tory Con vers ion Period + Receivables Con versi on Period - Payables Con vers ion Period Debt ratios (leveragi ng ratios)Debt ratios measure the firm's ability to repay Ion g-term debt. Debt ratios measure finan cial leverage.Debt ratioToted LiabilitiesTot al Asset sDebt to equity ratioLong-term Debt 十Value of Leases Average Shareholders EquityLong-term Debt to equity (LT Debt to Equity)Long-term DebtTotal AssetsTimes in terest-earned ratio________ EBIT___________Annual Interest ExpenseORNet- IncomeAnnual Interest ExpenseDebt service coverage ratioNet Operating IncomeTotal Debt ServiceMarket ratiosMarket ratios measure in vestor resp onse to owning a compa ny's stock and also the cost of issu ing stock.Earnings per share (EPS)Expected EarningsNumber of SharesPayout ratiopividendfiEarningsORDividendsEPSDivide nd cover (the in verse of Payout Ratio)Earnings per ShareDividend per ShareP/E ratioMarket Price per ShareDiluted EPSDivide nd yieldDividendCurrent Market PriceCash flow ratio or Price/cash flow ratioMarket Price per SharePresent Value of Cash Flow per ShaiePrice to book value ratio (P/B or PBV)Market Price per Share Ealance Sheet- Price per SharePrice/sales ratioMarket per ShareGross SalesPEG ratioPrice per EarningsAnnual EPS GrowthOther Market RatiosEV/EBITDAEnterprise ValueEBITDAEV/SalesEnterprise \'alneNet SaksCost/ In come ratio Sector-specific ratiosEV/capacityEV/output。

Ratios欧阳歌谷(2021.02.01)Profitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profitmargin or Return on sales (ROS)Note: Operating income is the difference between operatingrevenues and operating expenses, but it is also sometimes used asa synonym for EBIT and operating profit.[10] This is true if thefirm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates NetIncome per Owner's EquityCash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratio1 Sector-specific ratiosEV/capacityEV/output。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptablerate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses, but it[10] This is true if the firm has nois also sometimes used as a synonym for EBIT and operating profit.non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratio[17]Acid-test ratio (Quick ratio)Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratio Sector-specific ratiosEV/capacityEV/output。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratio Sector-specific ratiosEV/capacityEV/output。

英文财务指标及计算公式总结————————————————————————————————作者:————————————————————————————————日期:RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion Period Debt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratio Sector-specific ratiosEV/capacityEV/output。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and con trol of its expe nses to gen erate an acceptable rate of return.Gross margin. Gross profit margin or Gross Profit RateGross ProfitNet SalesORS吐s - GOGSNet. SalesOperat ing margin, Operat ing In come Margin, Operat ing profit margin or Retur n on sales (ROS)Operating IncomeNet SalesNote: Operati ng in come is the differe nee betwee n operati ng reve nues and operat ing expe nses, but it is also sometimes used as a synonym for EBIT and operating profit. [10] This is true if the firm has no non-operati ng in come. (Ear nings before in terest and taxes / Sales)Profit margin, net margin or net profit marginNtit IncomeNet SalesReturn on equity (ROE)Net IncomeAverage SharcholdeTS EquityRetur n on in vestme nt (ROI ratio or Du Pont ratio)Net IncomeAverage Owmeis EquityRetur n on assets (ROA)Net IncomeTot EL I AssetsReturn on assets Du Pont (ROA Du Pont)(Net Income f Net Sales \ \Retur n on Equity Du Pon t (ROE Du Pont)(Xet Income\ / Net Sales A ( Average Assets\Net Sales / \ Average Assets J \ Average Equity JRetur n on n et assets (RONA)Not IncomeFixed Assets + Working CapitaiReturn on capital (ROC)N«t Operating Profit 一Adjusted Ta^esOwners EquityRisk adjusted return on capital (RAROC)Expoctod ReturnEconomic CapitalORExpccted Ret urnValue at RiskRetur n on capital employed (ROCE)Net IncomeCapital EmployedNote: this is somewhat similar to (ROI), which calculates Net In come per Owner's EquityCash flow return on in vestme nt (CFROI)C OB I I FlowMarket RecapitalisationEfficie ncy ratioXon-Int treat IncomeNet Interest Income + Non-Interest. IncomeNet geari ngdette nettefonds propresLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Curre nt ratioCurrent. AssetsCurrent LiabilitiesAcid-test ratio (Quick ratio) [17]Current Assets - (Inventories + Pre payments )1Current. LiabilitiesOperation cash flow ratioOperation Cash FlowTotal DebtsActivity ratiosActivity ratios measure the effective ness of the firms use of resources.Average collect ion periodAccounts R-eceivablcAnnual Credit Sales H- 365 DaysDegree of Operat ing Leverage (DOL)Percent Change in Net Operating Income| Percent Change in SalosDSO RatioAcrounts RcccivabteTotal Annual Sales -4- 365 DaysAverage payme nt periodAccounts Payabl-eAnnual Credit Purchases 子365 Davs2 IAsset tur no verNet SalesTot al AssetsInven tory tur no ver ratioCOGSAverage InventoryReceivables Turno ver RatioXet Credit SalesAverage Net ReceivablesInven tory con vers ion ratio365 DaysIn\rntorv TumoveTdrInven tory con vers ion period(驛)___________________Receivables con vers ion period/Receivables \ _het Sales 365 DaySPayables con vers ion period{ Purges \ 65DavsAccounts Payable/Cash Con vers ion CycleInven tory Con vers ion Period + Receivables Con versi on Period - Payables Con vers ion PeriodDebt ratios (leveragi ng ratios)Debt ratios measure the firm's ability to repay Ion g-term debt. Debt ratios measure finan cial leverage.Debt ratioTotal Liabilities Total AssetsDebt to equity ratioLong-term Debt 十Value of LeasesAverage Shareholders EquityLong-term Debt to equity (LT Debt to Equity)Long-term DebtTotal AssetsTimes in terest-earned ratio_______ EBIT________Annual Interest ExpenseORNet- IncomeAnnual Interest ExpenseDebt service coverage ratioNet Operating IncomeTotal Debt ServiceMarket ratiosMarket ratios measure in vestor resp onse to owning a compa ny's stock and also the cost of issu ing stock.Earnings per share (EPS) Expected Earnings Numb ET of SharesPayout ratioDividpnckiEarningsORDivide nd£EPS~Divide nd cover (the in verse of Payout Ratio)Earnings per ShareDividend per ShareP/E ratioMarket Price per ShareDiluted EPSDivide nd yieldDividendCurrent Market. PriceCash flow ratio or Price/cash flow ratioMarket Price per SharePresent Value of Cash Flow per ShaiePrice to book value ratio (P/B or PBV)Market Price per ShareBalance Sheet Price per SharePrice/sales ratioMarket Price per ShareGross SalesPEG ratioPrice per EarnuigsA linual EPS Growth Other Market RatiosEV/EBITDAEnterprise ValueP EBITDAEV/SalesEnterprise \'alueNet SatesCost/ In come ratioSector-specific ratiosEV/capacity EV/output。