Cha02 罗斯公司理财第九版原版书课后习题

- 格式:pdf

- 大小:548.63 KB

- 文档页数:10

罗斯《公司理财》(第9版)课后习题第13章风险、资本成本和资本预算一、概念题1.资产贝塔(asset beta)答:资产贝塔是指企业总资产的贝塔系数。

除非完全依靠权益融资,否则不能把资产贝塔看作普通股的贝塔系数。

其公式为:其中,β权益是杠杆企业权益的贝塔。

公式包括两部分,即负债的贝塔乘以负债在资本结构中的百分比;权益的贝塔乘以权益在资本结构中的百分比。

这个组合包括企业的负债和权益,所以组合贝塔就是资产贝塔。

在实际中,负债的贝塔很低,一般假设为零。

若假设负债的贝塔为零,则:对于杠杆企业,权益/(负债+权益)一定小于1,所以β资产<β权益,将上式变形,有:有财务杠杆的情况下,权益贝塔一定大于资产贝塔。

2.经营杠杆(operating leverage)答:经营杠杆是指由于固定成本的存在而导致息税前利润变动大于产销业务量变动的杠杆效应。

对经营杠杆的计量最常用的指标是经营杠杆系数或经营杠杆度。

经营杠杆系数,是指息税前利润变动率相当于销售量变动率的倍数。

用公式可以表示为:式中,EBIT为息税前利润;F为固定成本。

经营杠杆系数不是固定不变的。

当企业的固定成本总额、单位产品的变动成本、销售价格、销售数量等因素发生变动时,经营杠杆系数也会发生变动。

经营杠杆系数越高,对经营杠杆利益的影响就越强,经营杠杆风险也就越高。

经营杠杆越大,企业的贝塔系数就越大。

3.权益资本成本(cost of equity capital)答:权益资本成本就是投资股东要求的回报率,用CAPM模型表示股票的期望收益率为:其中,R F是无风险利率;是市场组合的期望收益率与无风险利率之差,也称为期望超额市场收益率或市场风险溢价。

所以要估计企业权益资本成本,需要知道以下三个变量:①无风险利率;②市场风险溢价;③公司权益的贝塔系数。

4.加权平均资本成本(weighted average cost of capital,r WACC)答:平均资本成本是权益资本成本和债务资本成本的加权平均,所以,通常称之为加权平均资本成本,r WACC,其计算公式如下:式中的权数分别是权益占总价值的比重,即和负债占总价值的比重,即。

第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险项目。

此外,机构投资者比私人投资者可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

罗斯《公司理财》(第9版)课后习题第1章公司理财导论一、概念题1.资本预算(capital budgeting)答:资本预算是指综合反映投资资金来源与运用的预算,是为了获得未来产生现金流量的长期资产而现在投资支出的预算。

资本预算决策也称为长期投资决策,它是公司创造价值的主要方法。

资本预算决策一般指固定资产投资决策,耗资大,周期长,长期影响公司的产销能力和财务状况,决策正确与否影响公司的生存与发展。

完整的资本预算过程包括:寻找增长机会,制定长期投资战略,预测投资项目的现金流,分析评估投资项目,控制投资项目的执行情况。

资本预算可通过不同的资本预算方法来解决,如回收期法、净现值法和内部收益率法等。

2.货币市场(money markets)答:货币市场指期限不超过一年的资金借贷和短期有价证券交易的金融市场,亦称“短期金融市场”或“短期资金市场”,包括同业拆借市场、银行短期存贷市场、票据市场、短期证券市场、大额可转让存单市场、回购协议市场等。

其参加者为各种政府机构、各种银行和非银行金融机构及公司等。

货币市场具有四个基本特征:①融资期限短,一般在一年以内,最短的只有半天,主要用于满足短期资金周转的需要;②流动性强,金融工具可以在市场上随时兑现,交易对象主要是期限短、流动性强、风险小的信用工具,如票据、存单等,这些工具变现能力强,近似于货币,可称为“准货币”,故称货币市场;③安全性高,由于货币市场上的交易大多采用即期交易,即成交后马上结清,通常不存在因成交与结算日之间时间相对过长而引起价格巨大波动的现象,对投资者来说,收益具有较大保障;④政策性明显,货币市场由货币当局直接参加,是中央银行同商业银行及其他金融机构的资金连接的主渠道,是国家利用货币政策工具调节全国金融活动的杠杆支点。

货币市场的交易主体是短期资金的供需者。

需求者是为了获得现实的支付手段,调节资金的流动性并保持必要的支付能力,供应者提供的资金也大多是短期临时闲置性的资金。

公司理财第九版罗斯课后案例答案 Case Solutions CorporateFinance1. 案例一:公司资金需求分析问题:一家公司需要资金支持其新项目。

通过分析现金流量,推断该公司是否需要向外部借款或筹集其他资金。

解答:为了确定公司是否需要外部资金,我们需要分析公司的现金流量状况。

首先,我们需要计算公司的净现金流量(净收入加上非现金项目)。

然后,我们需要将净现金流量与项目的投资现金流量进行对比。

假设公司预计在项目开始时投资100万美元,并在项目运营期为5年。

预计该项目每年将产生50万美元的净现金流量。

现在,我们需要进行以下计算:净现金流量 = 年度现金流量 - 年度投资现金流量年度投资现金流量 = 100万美元年度现金流量 = 50万美元净现金流量 = 50万美元 - 100万美元 = -50万美元根据计算结果,公司的净现金流量为负数(即净现金流出),意味着公司每年都会亏损50万美元。

因此,公司需要从外部筹集资金以支持项目的运营。

2. 案例二:公司股权融资问题:一家公司正在考虑通过股权融资来筹集资金。

根据公司的财务数据和资本结构分析,我们需要确定公司最佳的股权融资方案。

解答:为了确定最佳的股权融资方案,我们需要参考公司的财务数据和资本结构分析。

首先,我们需要计算公司的资本结构比例,即股本占总资本的比例。

然后,我们将不同的股权融资方案与资本结构比例进行对比,选择最佳的方案。

假设公司当前的资本结构比例为60%的股本和40%的债务,在当前的资本结构下,公司的加权平均资本成本(WACC)为10%。

现在,我们需要进行以下计算:•方案一:以新股发行筹集1000万美元,并将其用于项目投资。

在这种方案下,公司的资本结构比例将发生变化。

假设公司的股本增加至80%,债务比例减少至20%。

根据资本结构比例的变化,WACC也将发生变化。

新的WACC可以通过以下公式计算得出:新的WACC = (股本比例 * 股本成本) + (债务比例 * 债务成本)假设公司的股本成本为12%,债务成本为8%:新的WACC = (0.8 * 12%) + (0.2 * 8%) = 9.6%•方案二:以新股发行筹集5000万美元,并将其用于项目投资。

罗斯《公司理财》第9版精要版英文原书课后部分章节答案详细»1 / 17 CH5 11,13,18,19,20 11. To find the PV of a lump sum, we use: PV = FV / (1 + r) t PV = $1,000,000 / (1.10) 80 = $488.19 13. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for r, we get: r = (FV / PV) 1 / t –1 r = ($1,260,000 / $150) 1/112 – 1 = .0840 or 8.40% To find the FV of the first prize, we use: FV = PV(1 + r) t FV = $1,260,000(1.0840) 33 = $18,056,409.94 18. To find the FV of a lump sum, we use: FV = PV(1 + r) t FV = $4,000(1.11) 45 = $438,120.97 FV = $4,000(1.11) 35 = $154,299.40 Better start early! 19. We need to find the FV of a lump sum. However, the money will only be invested for six years, so the number of periods is six. FV = PV(1 + r) t FV = $20,000(1.084)6 = $32,449.33 20. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for t, we get: t = ln(FV / PV) / ln(1 + r) t = ln($75,000 / $10,000) / ln(1.11) = 19.31 So, the money must be invested for 19.31 years. However, you will not receive the money for another two years. From now, you’ll wait: 2 years + 19.31 years = 21.31 years CH6 16,24,27,42,58 16. For this problem, we simply need to find the FV of a lump sum using the equation: FV = PV(1 + r) t 2 / 17 It is important to note that compounding occurs semiannually. To account for this, we will divide the interest rate by two (the number of compounding periods in a year), and multiply the number of periods by two. Doing so, we get: FV = $2,100[1 + (.084/2)] 34 = $8,505.93 24. This problem requires us to find the FV A. The equation to find the FV A is: FV A = C{[(1 + r) t – 1] / r} FV A = $300[{[1 + (.10/12) ] 360 – 1} / (.10/12)] = $678,146.38 27. The cash flows are annual and the compounding period is quarterly, so we need to calculate the EAR to make the interest rate comparable with the timing of the cash flows. Using the equation for the EAR, we get: EAR = [1 + (APR / m)] m – 1 EAR = [1 + (.11/4)] 4 – 1 = .1146 or 11.46% And now we use the EAR to find the PV of each cash flow as a lump sum and add them together: PV = $725 / 1.1146 + $980 / 1.1146 2 + $1,360 / 1.1146 4 = $2,320.36 42. The amount of principal paid on the loan is the PV of the monthly payments you make. So, the present value of the $1,150 monthly payments is: PV A = $1,150[(1 – {1 / [1 + (.0635/12)]} 360 ) / (.0635/12)] = $184,817.42 The monthly payments of $1,150 will amount to a principal payment of $184,817.42. The amount of principal you will still owe is: $240,000 – 184,817.42 = $55,182.58 This remaining principal amount will increase at the interest rate on the loan until the end of the loan period. So the balloon payment in 30 years, which is the FV of the remaining principal will be: Balloon payment = $55,182.58[1 + (.0635/12)] 360 = $368,936.54 58. To answer this question, we should find the PV of both options, and compare them. Since we are purchasing the car, the lowest PV is the best option. The PV of the leasing is simply the PV of the lease payments, plus the $99. The interest rate we would use for the leasing option is the same as the interest rate of the loan. The PV of leasing is: PV = $99 + $450{1 –[1 / (1 + .07/12) 12(3) ]} / (.07/12) = $14,672.91 The PV of purchasing the car is the current price of the car minus the PV of the resale price. The PV of the resale price is: PV = $23,000 / [1 + (.07/12)] 12(3) = $18,654.82 The PV of the decision to purchase is: $32,000 – 18,654.82 = $13,345.18 3 / 17 In this case, it is cheaper to buy the car than leasing it since the PV of the purchase cash flows is lower. To find the breakeven resale price, we need to find the resale price that makes the PV of the two options the same. In other words, the PV of the decision to buy should be: $32,000 – PV of resale price = $14,672.91 PV of resale price = $17,327.09 The resale price that would make the PV of the lease versus buy decision is the FV ofthis value, so: Breakeven resale price = $17,327.09[1 + (.07/12)] 12(3) = $21,363.01 CH7 3,18,21,22,31 3. The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice this problem assumes an annual coupon. The price of the bond will be: P = $75({1 – [1/(1 + .0875)] 10 } / .0875) + $1,000[1 / (1 + .0875) 10 ] = $918.89 We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PV A equation, it is common to abbreviate the equations as: PVIF R,t = 1 / (1 + r) t which stands for Present V alue Interest Factor PVIFA R,t = ({1 – [1/(1 + r)] t } / r ) which stands for Present V alue Interest Factor of an Annuity These abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in remainder of the solutions key. 18. The bond price equation for this bond is: P 0 = $1,068 = $46(PVIFA R%,18 ) + $1,000(PVIF R%,18 ) Using a spreadsheet, financial calculator, or trial and error we find: R = 4.06% This is thesemiannual interest rate, so the YTM is: YTM = 2 4.06% = 8.12% The current yield is:Current yield = Annual coupon payment / Price = $92 / $1,068 = .0861 or 8.61% The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter: Effective annual yield = (1 + 0.0406) 2 – 1 = .0829 or 8.29% 20. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $74/2 × 2/6 = $12.33 And we calculate the clean price as: 4 / 17 Clean price = Dirty price –Accrued interest = $968 –12.33 = $955.67 21. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $68/2 × 4/6 = $22.67 And we calculate the dirty price as: Dirty price = Clean price + Accrued interest = $1,073 + 22.67 = $1,095.67 22. To find the number of years to maturity for the bond, we need to find the price of the bond. Since we already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as: Current yield = .0755 = $80/P 0 P 0 = $80/.0755 = $1,059.60 Now that we have the price of the bond, the bond price equation is: P = $1,059.60 = $80[(1 – (1/1.072) t ) / .072 ] + $1,000/1.072 t We can solve this equation for t as follows: $1,059.60(1.072) t = $1,111.11(1.072) t –1,111.11 + 1,000 111.11 = 51.51(1.072) t2.1570 = 1.072 t t = log 2.1570 / log 1.072 = 11.06 11 years The bond has 11 years to maturity.31. The price of any bond (or financial instrument) is the PV of the future cash flows. Even though Bond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is: P M = $1,100(PVIFA 3.5%,16 )(PVIF 3.5%,12 ) + $1,400(PVIFA3.5%,12 )(PVIF 3.5%,28 ) + $20,000(PVIF 3.5%,40 ) P M = $19,018.78 Notice that for the coupon payments of $1,400, we found the PV A for the coupon payments, and then discounted the lump sum back to today. Bond N is a zero coupon bond with a $20,000 par value, therefore, the price of the bond is the PV of the par, or: P N = $20,000(PVIF3.5%,40 ) = $5,051.45 CH8 4,18,20,22,244. Using the constant growth model, we find the price of the stock today is: P 0 = D 1 / (R – g) = $3.04 / (.11 – .038) = $42.22 5 / 17 18. The price of a share of preferred stock is the dividend payment divided by the required return. We know the dividend payment in Year 20, so we can find the price of the stock in Y ear 19, one year before the first dividend payment. Doing so, we get: P 19 = $20.00 / .064 P 19 = $312.50 The price of the stock today is the PV of the stock price in the future, so the price today will be: P 0 = $312.50 / (1.064) 19 P 0 = $96.15 20. We can use the two-stage dividend growth model for this problem, which is: P 0 = [D 0 (1 + g 1 )/(R – g 1 )]{1 – [(1 + g 1 )/(1 + R)] T }+ [(1 + g 1 )/(1 + R)] T [D 0 (1 + g 2 )/(R –g 2 )] P0 = [$1.25(1.28)/(.13 –.28)][1 –(1.28/1.13) 8 ] + [(1.28)/(1.13)] 8 [$1.25(1.06)/(.13 – .06)] P 0 = $69.55 22. We are asked to find the dividend yield and capital gains yield for each of the stocks. All of the stocks have a 15 percent required return, which is the sum of the dividend yield and the capital gains yield. To find the components of the total return, we need to find the stock price for each stock. Using this stock price and the dividend, we can calculate the dividend yield. The capital gains yield for the stock will be the total return (required return) minus the dividend yield. W: P 0 = D 0 (1 + g) / (R – g) = $4.50(1.10)/(.19 – .10) = $55.00 Dividend yield = D 1 /P 0 = $4.50(1.10)/$55.00 = .09 or 9% Capital gains yield = .19 – .09 = .10 or 10% X: P 0 = D 0 (1 + g) / (R – g) = $4.50/(.19 – 0) = $23.68 Dividend yield = D 1 /P 0 = $4.50/$23.68 = .19 or 19% Capital gains yield = .19 – .19 = 0% Y: P 0 = D 0 (1 + g) / (R – g) = $4.50(1 – .05)/(.19 + .05) = $17.81 Dividend yield = D 1 /P 0 = $4.50(0.95)/$17.81 = .24 or 24% Capital gains yield = .19 – .24 = –.05 or –5% Z: P 2 = D 2 (1 + g) / (R – g) = D 0 (1 + g 1 ) 2 (1 +g 2 )/(R – g 2 ) = $4.50(1.20) 2 (1.12)/(.19 – .12) = $103.68 P 0 = $4.50 (1.20) / (1.19) + $4.50(1.20) 2 / (1.19) 2 + $103.68 / (1.19) 2 = $82.33 Dividend yield = D 1 /P 0 = $4.50(1.20)/$82.33 = .066 or 6.6% Capital gains yield = .19 – .066 = .124 or 12.4% In all cases, the required return is 19%, but the return is distributed differently between current income and capital gains. High growth stocks have an appreciable capital gains component but a relatively small current income yield; conversely, mature, negative-growth stocks provide a high current income but also price depreciation over time. 24. Here we have a stock with supernormal growth, but the dividend growth changes every year for the first four years. We can find the price of the stock in Y ear 3 since the dividend growth rate is constant after the third dividend. The price of the stock in Y ear 3 will be the dividend in Y ear 4, divided by the required return minus the constant dividend growth rate. So, the price in Y ear 3 will be: 6 / 17 P3 = $2.45(1.20)(1.15)(1.10)(1.05) / (.11 – .05) = $65.08 The price of the stock today will be the PV of the first three dividends, plus the PV of the stock price in Y ear 3, so: P 0 = $2.45(1.20)/(1.11) + $2.45(1.20)(1.15)/1.11 2 + $2.45(1.20)(1.15)(1.10)/1.11 3 + $65.08/1.11 3 P 0 = $55.70 CH9 3,4,6,9,15 3. Project A has cash flows of $19,000 in Y ear 1, so the cash flows are short by $21,000 of recapturing the initial investment, so the payback for Project A is: Payback = 1 + ($21,000 / $25,000) = 1.84 years Project B has cash flows of: Cash flows = $14,000 + 17,000 + 24,000 = $55,000 during this first three years. The cash flows are still short by $5,000 of recapturing the initial investment, so the payback for Project B is: B: Payback = 3 + ($5,000 / $270,000) = 3.019 years Using the payback criterion and a cutoff of 3 years, accept project A and reject project B. 4. When we use discounted payback, we need to find the value of all cash flows today. The value today of the project cash flows for the first four years is: V alue today of Y ear 1 cash flow = $4,200/1.14 = $3,684.21 V alue today of Y ear 2 cash flow = $5,300/1.14 2 = $4,078.18 V alue today of Y ear 3 cash flow = $6,100/1.14 3 = $4,117.33 V alue today of Y ear 4 cash flow = $7,400/1.14 4 = $4,381.39 To findthe discounted payback, we use these values to find the payback period. The discounted first year cash flow is $3,684.21, so the discounted payback for a $7,000 initial cost is: Discounted payback = 1 + ($7,000 – 3,684.21)/$4,078.18 = 1.81 years For an initial cost of $10,000, the discounted payback is: Discounted payback = 2 + ($10,000 –3,684.21 –4,078.18)/$4,117.33 = 2.54 years Notice the calculation of discounted payback. We know the payback period is between two and three years, so we subtract the discounted values of the Y ear 1 and Y ear 2 cash flows from the initial cost. This is the numerator, which is the discounted amount we still need to make to recover our initial investment. We divide this amount by the discounted amount we will earn in Y ear 3 to get the fractional portion of the discounted payback. If the initial cost is $13,000, the discounted payback is: Discounted payback = 3 + ($13,000 – 3,684.21 – 4,078.18 – 4,117.33) / $4,381.39 = 3.26 years 7 / 17 6. Our definition of AAR is the average net income divided by the average book value. The average net income for this project is: A verage net income = ($1,938,200 + 2,201,600 + 1,876,000 + 1,329,500) / 4 = $1,836,325 And the average book value is: A verage book value = ($15,000,000 + 0) / 2 = $7,500,000 So, the AAR for this project is: AAR = A verage net income / A verage book value = $1,836,325 / $7,500,000 = .2448 or 24.48% 9. The NPV of a project is the PV of the outflows minus the PV of the inflows. Since the cash inflows are an annuity, the equation for the NPV of this project at an 8 percent required return is: NPV = –$138,000 + $28,500(PVIFA 8%, 9 ) = $40,036.31 At an 8 percent required return, the NPV is positive, so we would accept the project. The equation for the NPV of the project at a 20 percent required return is: NPV = –$138,000 + $28,500(PVIFA 20%, 9 ) = –$23,117.45 At a 20 percent required return, the NPV is negative, so we would reject the project. We would be indifferent to the project if the required return was equal to the IRR of the project, since at that required return the NPV is zero. The IRR of the project is: 0 = –$138,000 + $28,500(PVIFA IRR, 9 ) IRR = 14.59% 15. The profitability index is defined as the PV of the cash inflows divided by the PV of the cash outflows. The equation for the profitability index at a required return of 10 percent is: PI = [$7,300/1.1 + $6,900/1.1 2 + $5,700/1.1 3 ] / $14,000 = 1.187 The equation for the profitability index at a required return of 15 percent is: PI = [$7,300/1.15 + $6,900/1.15 2 + $5,700/1.15 3 ] / $14,000 = 1.094 The equation for the profitability index at a required return of 22 percent is: PI = [$7,300/1.22 + $6,900/1.22 2 + $5,700/1.22 3 ] / $14,000 = 0.983 8 / 17 We would accept the project if the required return were 10 percent or 15 percent since the PI is greater than one. We would reject the project if the required return were 22 percent since the PI。

公司理财罗斯第九版课后答案【篇一:罗斯公司理财第九版课后习题答案中文版】形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险项目。

此外,机构投资者比私人投资者可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

8.大型金融机构成为股票的主要持有者可能减少美国公司的代理问题,形成更有效率的公司控制权市场。

但也不一定能。

如果共同基金或者退休基金的管理层并不关心的投资者的利益,代理问题可能仍然存在,甚至有可能增加基金和投资者之间的代理问题。

9.就像市场需求其他劳动力一样,市场也需求首席执行官,首席执行官的薪酬是由市场决定的。

罗斯《公司理财》第9版笔记和课后习题(含考研真题)详解-第8篇理财专题【圣才出品】第8篇理财专题第29章收购、兼并与剥离29.1 复习笔记企业间的并购是一项充满不确定性的投资活动。

在并购决策中必须运用的基本法则是:当一家企业能够为并购企业的股东带来正的净现值时才会被并购。

因此确定目标企业的净现值显得尤为重要。

并购具有以下几个特点:并购活动产生的收益被称作协同效应;并购活动涉及复杂的会计、税收和法律因素;并购是股东可行使的一种重要控制机制;并购分析通常以计算并购双方的总价值为中心;并购有时涉及非善意交易。

1.收购的基本形式收购是指一个公司(收购方)用现金、债券或股票购买另一家公司的部分或全部资产或股权,从而获得对该公司的控制权的经济活动。

收购的对象一般有两种:股权和资产。

企业可以运用以下三种基本法律程序进行收购,即:①吸收合并或新设合并;②收购股票;③收购资产。

吸收合并是指一家企业被另一家企业吸收,兼并企业保持其名称和身份,并且收购被兼并企业的全部资产和负债的收购形式。

吸收合并的目标企业不再作为一个独立经营实体而存在。

新设合并是指兼并企业和被兼并企业终止各自的法人形式,共同组成一家新的企业。

收购股票是指用现金、股票或其他证券购买目标企业具有表决权的股票。

2.并购的分类兼并通常是指一个公司以现金、证券或其他形式购买取得其他公司的产权,使其他公司丧失法人资格或改变法人实体,并取得对这些企业决策控制权的经济行为。

兼并和收购虽然有很多不同,但也存在不少相似之处:①兼并与收购的基本动因相似。

要么为扩大企业的市场占有率;要么为扩大企业生产规模,实现规模经营;要么为拓宽企业经营范围,实现分散经营或综合化经营。

总之,企业兼并或收购都是增强企业实力的外部扩张策略或途径。

②企业兼并与收购都以企业产权交易为对象,都是企业资本营运的基本方式。

正是由于两者有很多相似之处,现实中,两者通常统称为“并购”。

按照并购双方的业务性质可以分为:(1)横向并购。

第2章会计报表与现金流量一、概念题1.资产负债表(balance sheet)答:资产负债表指反映企业某一特定日期财务状况的会计报表。

它是根据资产、负债和所有者权益之间的相互关系,按照一定的分类标准和一定的顺序,把企业一定日期的资产、负债和所有者权益各项目予以适当排列,并对日常会计核算工作中形成的大量数据进行高度浓缩整理后编制而成的。

资产负债表是企业最重要的对外报表之一,它能为投资者和企业管理当局提供有关企业的资源分布状况、债权人和股东对资产的要求权、企业的偿债能力和未来财务状况趋势等信息。

资产负债表的格式主要有账户式和垂直式两种,当前会计实务中采用较多的是账户式资产负债表。

账户式资产负债表分左右两方列示,左边列示企业的资产,右边列示负债和所有者权益,左右两方的合计数相等。

通常,资产负债表还提供期初数和期末数的比较资料。

2.损益表(income statement)答:损益表是指反映一个企业某一会计期间经营成果的会计报表,亦称“利润表”或“收益表”。

它把一定期间的收入与相关的费用进行配比,从而计算出企业一定期间的净利润(或净亏损)。

它反映企业生产经营的收入实现和成本耗费情况,表明企业的生产经营成果。

同时,通过该表提供不同时期的比较数字(如本月数、本年累计数、上年数),可以分析企业今后利润的发展趋势和获利能力。

损益表的结果可以分为多步式和单步式两种。

多步式损益表中的损益是通过多步配比而来的。

单步式损益表则是将本期所有的收入加在一起,然后将所有的费用加总在一起,通过一次配比求出本期损益。

3.现金流量(cash flow)答:现金流量是指某一段时期内企业现金流入和流出的数量。

如企业销售商品、提供劳务、出售固定资产、向银行借款等取得现金,形成企业的现金流入;购买原材料、接受劳务、购建固定资产、对外投资、偿还债务等而支付现金,形成企业的现金流出。

现金流量信息能够表明企业经营状况是否良好、资金是否紧缺、企业偿付能力大小,从而为投资者、债权人、企业管理者提供非常有用的信息。

第29章收购、兼并与剥离一、概念题1.熊式收购(bear hug)答:熊式收购是指收购方采取高溢价的敌意收购方式,即使在遭到目标公司董事会的抵制时,也能够得到目标公司一些股东的支持。

在企业收购中,一家企业获得对另一家企业的控制权,前者称为“收购公司”,后者称为“目标公司”。

收购公司首先致函目标公司的董事们,向他们表达收购的意愿,并要求他们对报价迅速作出决定。

如果董事们不同意这个收购,收购公司就可以直接通过要约收购的方式向目标公司的股东们提出收购要求。

2.资产锁定(lockup)答:资产锁定是公司赋予善意收购人(如白衣骑士)的一项选择权,当目标企业在面临敌意收购时,善意收购人可以以一个固定的价格购买目标企业的股票或部分资产(比如皇冠宝石),这只是善意收购人的权利。

由于恶意收购者在收购后,可能失去目标企业的优良资产,资产锁定降低了企业对于收购者的吸引力。

3.投标者(bidder)答:投标者是指计划接管有关企业而向其发出要约,要求用现金或证券换取该企业的股票或资产的企业。

如果该要约被接受,目标企业将会放弃对其股票或资产的控制权,将控制权转移给投标者以换取相应的报酬(如投标者的股票、债务或现金)。

4.吸收合并(merger)答:吸收合并是指一家企业被另一家企业吸收,兼并企业保持其名称和身份,并且收购被兼并企业的全部资产和负债的收购形式。

吸收合并的目标企业不再作为一个独立经营实体而存在。

5.新设合并(consolidation)答:新设合并是指兼并企业和被兼并企业终止各自的法人形式,共同组成一家新的企业。

6.毒丸计划(poison pill)答:毒丸计划包括“负债毒丸计划”和“人员毒丸计划”两种。

其中,“负债毒丸计划”是指目标企业在受到收购威胁的情况下大量增加自身负债,降低企业被收购的吸引力。

例如,发行债券并约定在企业股权发生大规模转移时,债券持有人可要求立刻兑付,从而使收购企业在收购后立即面临巨额现金支出的危险,从而降低了收购企业的收购兴趣。

1. 当你增加时间的长度时,终值会发生什么变化,现值会发生什么变化?答:当增加时间长度时根据公司PV=C/(1+r)A t得到现值会减少(dwindle,diminish),而终值FV=C*(1+r)At会增加。

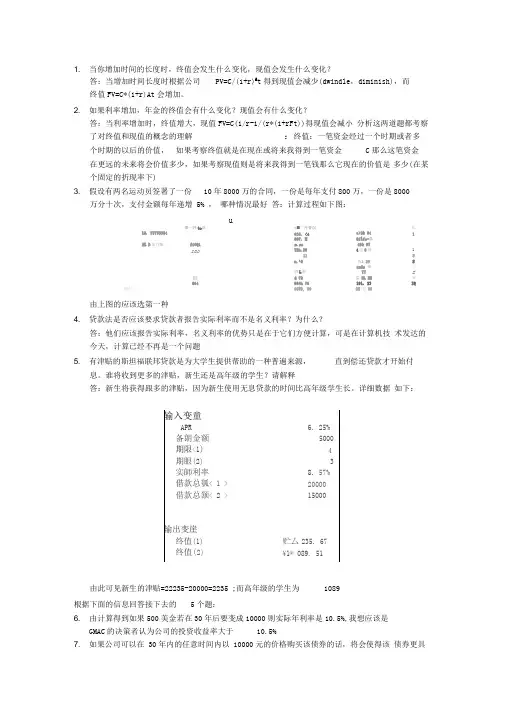

2. 如果利率增加,年金的终值会有什么变化?现值会有什么变化?答:当利率增加时,终值增大,现值FV=C(1/r-1/(r*(1+rFt))得现值会减小分析这两道题都考察了对终值和现值的概念的理解:终值:一笔资金经过一个时期或者多个时期的以后的价值,如果考察终值就是在现在或将来我得到一笔资金C那么这笔资金在更远的未来将会价值多少,如果考察现值则是将来我得到一笔钱那么它现在的价值是多少(在某个固定的折现率下)3. 假设有两名运动员签署了一份10年8000万的合同,一份是每年支付800万,一份是8000万分十次,支付金额每年递增 5% ,哪种情况最好答:计算过程如下图:u12. 5T733354舉一忡t*况*■二沖耆况63S. <4e>3& 04年1667. M Oflfc-蠹ML D虽百嘶fiOQi m.sa49& 97sao TSh.294沮0鼻1115m.^6髯& 29SzaSr 钿亍晒L弊TT E颐 d 72監BL EB审60496th 70191. 23IQ 旦计9CW0, 003H 也69由上图的应该选第一种4. 贷款法是否应该要求贷款者报告实际利率而不是名义利率?为什么?答:他们应该报告实际利率,名义利率的优势只是在于它们方便计算,可是在计算机技术发达的今天,计算已经不再是一个问题5. 有津贴的斯坦福联邦贷款是为大学生提供帮助的一种普遍来源,直到偿还贷款才开始付息。

谁将收到更多的津贴,新生还是高年级的学生?请解释答:新生将获得跟多的津贴,因为新生使用无息贷款的时间比高年级学生长。

详细数据如下:输入变童APR 6. 25%备朗金额5000期限<1) 4期眼(2) 3实師利率8. 57%借款总瓠< 1 >20000借款总颔< 2 > 15000输出变崖终值(1) 贮厶235. 67终值(2)¥1® 089. 51由此可见新生的津贴=22235-20000=2235 ;而高年级的学生为1089根据下面的信息回答接下去的5个题:6. 由计算得到如果500美金若在30年后要变成10000则实际年利率是10.5%,我想应该是GMAC的决策者认为公司的投资收益率大于10.5%7. 如果公司可以在 30年内的任意时间内以 10000元的价格购买该债券的话,将会使得该债券更具有吸引力8. 1)这500元不能影响我后面 30年的正常生活,也就是我说我是否有 500元的多余资金;2)该公司是否能够保证在30年后我能收到10000元3)当前我认为的投资收益率是否高于10.5%,若高于10.5%则不应该考虑投资该债券我的回答是:是取决的承诺偿还的人9. 财政部的发行该种债券的价格较高因为财政部在所有的债券发行者中信用最好10•价格会超过之前的500美元,因为如果随着时间的推移,该债券的价值就越接近10000 美元,如果在2010年的看价格有可能会更高,但不能确定,因为GMAC有财务恶化的可能或者资本市场上的投资收益率提高。

罗斯《公司理财》(第9版)课后习题第16章资本结构:基本概念一、概念题1.馅饼模型(pie model)答:馅饼模型是一种分析公司资本结构的模型,用来讨论公司应如何选择负债权益比的问题。

该理论将公司的筹资要求权之和比作一个馅饼,并且将公司的价值定义为负债和所有者权益之和。

该理论认为,债权人和股东将分别得到不同大小的馅饼块,但是整个馅饼的大小,也就是公司的实际价值,却完全不会受到馅饼分割方式的影响。

也就是说,公司的融资结构只影响公司利润的分配方式,即这个利润馅饼如何被分割以及由谁承担公司的风险,不会对公司的价值造成任何影响。

2.MM命题Ⅰ(MM Proposition I)答:不考虑公司所得税情况下的MM命题Ⅰ指的是,公司的价值取决于未来经营活动净收益的资本化程度,资本化率与公司的风险相一致。

这一命题有两个直接推论:a.公司的平均资本成本与公司资本结构无关;b.公司的平均资本成本等于与之风险相同的零举债公司的资本化率。

3.MM命题Ⅱ(MM Proposition II)答:不考虑公司所得税情况下的MM命题Ⅱ指的是,举债经营公司的权益资本成本等于零举债经营公司的权益资本成本加上风险报酬率。

风险报酬率的多少取决于公司举债经营的程度。

命题二表明,随着公司负债的增加,公司的权益资本成本也将提高。

4.MM命题Ⅰ(公司税)[MM Proposition I(corporate taxes)]答:MM命题一,零举债经营公司的价值是公司税后经营收益除以公司权益资本成本所得的结果,而举债经营公司的价值等于同类风险的零举债经营公司的价值加上税款节余额。

根据这一结论,当公司负债增加时,举债经营公司价值增加较快。

特别地,当公司负债筹资的比重为100%时,公司的价值最大。

5.MM命题Ⅱ(公司税)[MM Proposition II(corporate taxes)]答:MM命题二,举债公司的权益资本成本等于同类风险零举债经营公司的权益资本成本加上风险报酬率,而风险报酬率又取决于公司资本结构和公司所得税税率。

reported in the financing activity section of the accounting statement of cash flows. When Tyco received payments from customers, the cash inflows were reported as operating cash flows. Another method used by Tyco was to have acquired companies prepay operating expenses. In other words, the company acquired by Tyco would pay vendors for items not yet received. In one case, the payments totaled more than $50 million. When the acquired company was consolidated with Tyco, the prepayments reduced Tyco’s cash outflows, thus increasing the operating cash flows.Dynegy, the energy giant, was accused of engaging in a number of complex “round-trip trades.” The round-trip trades essentially involved the sale of natural resources to a counterparty, with the repurchase of the resources from the same party at the same price. In essence, Dynegy would sell an asset for $100, and immediately repurchase it from the buyer for $100. The problem arose with the treatment of the cash flows from the sale. Dynegy treated the cash from the sale of the asset as an operating cash flow, but classified the repurchase as an investing cash outflow. The total cash flows of the contracts traded by Dynegy in these round-trip trades totaled $300 million.Adelphia Communications was another company that apparently manipulated cash flows. In Adelphia’s case, the company capitalized the labor required to install cable. In other words, the company classified this labor expense as a fixed asset. While this practice is fairly common in the telecommunications industry, Adelphia capitalized a higher percentage of labor than is common. The effect of this classification was that the labor was treated as an investment cash flow, which increased the operating cash flow.In each of these examples, the companies were trying to boost operating cash flows by shifting cash flows to a different heading. The important thing to notice is that these movements don’t affect the total cash flow of the firm, which is why we recommend focusing on this number, not just operating cash flow.Summary and ConclusionsBesides introducing you to corporate accounting, the purpose of this chapter has been to teach you how to determine cash flow from the accounting statements of a typical company.1. Cash flow is generated by the firm and paid to creditors and shareholders. It can be classifiedas:1. Cash flow from operations.2. Cash flow from changes in fixed assets.3. Cash flow from changes in working capital.2. Calculations of cash flow are not difficult, but they require care and particular attention to detailin properly accounting for noncash expenses such as depreciation and deferred taxes. It is especially important that you do not confuse cash flow with changes in net working capital and net income.Concept Questions1. Liquidity True or false: All assets are liquid at some price. Explain.2. Accounting and Cash Flows Why might the revenue and cost figures shown on a standardincome statement not represent the actual cash inflows and outflows that occurred during a period?3. Accounting Statement of Cash Flows Looking at the accounting statement of cash flows,what does the bottom line number mean? How useful is this number for analyzing a company? 4. Cash Flows How do financial cash flows and the accounting statement of cash flows differ?Which is more useful for analyzing a company?5. Book Values versus Market Values Under standard accounting rules, it is possible for astockholders’ equity of Information Control Corp. one year ago:During the past year, Information Control issued 10 million shares of new stock at a total price of $43 million, and issued $10 million in new long-term debt. The company generated $9 million in net income and paid $2 million in dividends. Construct the current balance sheet reflecting the changes that occurred at Information Control Corp. during the year.8. Cash Flow to Creditors The 2009 balance sheet of Anna’s Tennis Shop, Inc., showed long-term debt of $1.34 million, and the 2010 balance sheet showed long-term debt of $1.39 million.The 2010 income statement showed an interest expense of $118,000. What was the firm’s cash flow to creditors during 2010?9. Cash Flow to Stockholders The 2009 balance sheet of Anna’s Tennis Shop, Inc., showed$430,000 in the common stock account and $2.6 million in the additional paid-in surplus account.The 2010 balance sheet showed $450,000 and $3.05 million in the same two accounts, respectively. If the company paid out $385,000 in cash dividends during 2010, what was the cash flow to stockholders for the year?10. Calculating Cash Flows Given the information for Anna’s Tennis Shop, Inc., in the previoustwo problems, suppose you also know that the firm’s net capital spending for 2010 was $875,000 and that the firm reduced its net working capital investment by $69,000. What was the firm’s 2010 operating cash flow, or OCF?INTERMEDIATE (Questions 11–24)11. Cash Flows Ritter Corporation’s accountants prepared the following financial statements foryear-end 2010:1. Explain the change in cash during 2010.2. Determine the change in net working capital in 2010.3. Determine the cash flow generated by the firm’s assets during 2010.12. Financial Cash Flows The Stancil Corporation provided the following current information:Determine the cash flows from the firm and the cash flows to investors of the firm.13. Building an Income Statement During the year, the Senbet Discount Tire Company hadgross sales of $1.2 million. The firm’s cost of goods sold and selling expenses were $450,000 and $225,000, respectively. Senbet also had notes payable of $900,000. These notes carried an interest rate of 9 percent. Depreciation was $110,000. Senbet’s tax rate was 35 percent.1. What was Senbet’s net income?2. What was Senbet’s operating cash flow?14. Calculating Total Cash Flows Schwert Corp. shows the following information on its 2010income statement: sales = $167,000; costs = $91,000; other expenses = $5,400; depreciation expense = $8,000; interest expense = $11,000; taxes = $18,060; dividends = $9,500. In addition, you’re told that the firm issued $7,250 in new equity during 2010 and redeemed $7,100 in outstanding long-term debt.1. What is the 2010 operating cash flow?2. What is the 2010 cash flow to creditors?3. What is the 2010 cash flow to stockholders?4. If net fixed assets increased by $22,400 during the year, what was the addition to networking capital (NWC)?15. Using Income Statements Given the following information for O’Hara Marine Co., calculatethe depreciation expense: sales = $43,000; costs = $27,500; addition to retained earnings = $5,300; dividends paid = $1,530; interest expense = $1,900; tax rate = 35 percent.1. What is owners’ equity for 2009 and 2010?2. What is the change in net working capital for 2010?3. In 2010, Weston Enterprises purchased $1,800 in new fixed assets. How much in fixedassets did Weston Enterprises sell? What is the cash flow from assets for the year? (The tax rate is 35 percent.)4. During 2010, Weston Enterprises raised $360 in new long-term debt. How much long-termdebt must Weston Enterprises have paid off during the year? What is the cash flow to creditors?Use the following information for Ingersoll, Inc., for Problems 23 and 24 (assume the tax rate is34 percent):23. Financial Statements Draw up an income statement and balance sheet for this company for2009 and 2010.24. Calculating Cash Flow For 2010, calculate the cash flow from assets, cash flow to creditors,and cash flow to stockholders.CHALLENGE (Questions 25–27)25. Cash Flows You are researching Time Manufacturing and have found the following accountingstatement of cash flows for the most recent year. You also know that the company paid $82 million in current taxes and had an interest expense of $43 million. Use the accounting statement of cash flows to construct the financial statement of cash flows.Nick has also provided the following information: During the year the company raised $118,000 in new long-term debt and retired $98,000 in long-term debt. The company also sold $11,000 in new stock and repurchased $40,000 in stock. The company purchased $786,000 in fixed assets and sold $139,000 in fixed assets.Angus has asked you to prepare the financial statement of cash flows and the accounting statement of cash flows. He has also asked you to answer the following questions:1. How would you describe Warf Computers’ cash flows?2. Which cash flow statement more accurately describes the cash flows at the company?3. In light of your previous answers, comment on Nick’s expansion plans.。

罗斯《公司理财》第9版笔记和课后习题(含考研真题)详解[视频详解]第1章公司理财导论[视频讲解]1.1复习笔记公司的首要目标——股东财富最大化决定了公司理财的目标。

公司理财研究的是稀缺资金如何在企业和市场内进行有效配置,它是在股份有限公司已成为现代企业制度最主要组织形式的时代背景下,就公司经营过程中的资金运动进行预测、组织、协调、分析和控制的一种决策与管理活动。

从决策角度来讲,公司理财的决策内容包括投资决策、筹资决策、股利决策和净流动资金决策;从管理角度来讲,公司理财的管理职能主要是指对资金筹集和资金投放的管理。

公司理财的基本内容包括:投资决策(资本预算)、融资决策(资本结构)、短期财务管理(营运资本)。

1.资产负债表资产负债表是总括反映企业某一特定日期财务状况的会计报表,它是根据资产、负债和所有者权益之间的相互关系,按照一定的分类标准和一定的顺序,把企业一定日期的资产、负债和所有者权益各项目予以适当排列,并对日常工作中形成的大量数据进行高度浓缩整理后编制而成的。

资产负债表可以反映资本预算、资本支出、资本结构以及经营中的现金流量管理等方面的内容。

2.资本结构资本结构是指企业各种资本的构成及其比例关系,它有广义和狭义之分。

广义资本结构,亦称财务结构,指企业全部资本的构成,既包括长期资本,也包括短期资本(主要指短期债务资本)。

狭义资本结构,主要指企业长期资本的构成,而不包括短期资本。

通常人们将资本结构表示为债务资本与权益资本的比例关系(D/E)或债务资本在总资本的构成(D/A)。

准确地讲,企业的资本结构应定义为有偿负债与所有者权益的比例。

资本结构是由企业采用各种筹资方式筹集资本形成的。

筹资方式的选择及组合决定着企业资本结构及其变化。

资本结构是企业筹资决策的核心问题。

企业应综合考虑影响资本结构的因素,运用适当方法优化资本结构,从而实现最佳资本结构。

资本结构优化有利于降低资本成本,获取财务杠杆利益。

3.财务经理财务经理是公司管理团队中的重要成员,其主要职责是通过资本预算、融资和资产流动性管理为公司创造价值。

罗斯《公司理财》(第9版)课后习题第22章期权与公司理财一、概念题1.期权(option)答:期权是指在预先约定的日期,以事先确定的价格买卖某种特定商品、金融工具或相关期货合约的权利。

期权实质上是一种选择权,其交易是一种权利的买卖。

期权对于买方来说,只是一种权利,即拥有在一定时间内以一定价格出售或购买一定数量的商品、金融工具或相关期货合约的权利,不承担必须买进或卖出的义务,其损失为购买期权的费用。

对于期权的卖方来说,由于收取了期权费,则须承担到期时或到期前由买方所选择的交割履约义务和责任。

其固定收益为期权费,而损失则是不确定的。

期权价格的变动是以其基础商品、金融工具或相关期货价格的变动为基础的。

其变动规律是:基础期货价格上涨时,买进期权的价格上涨,而卖出期权的价格下跌;反之,当基础期货价格下跌时,买进期权的价格下跌,而卖出期权的价格上涨。

期权按照交易性质可分为看涨期权(买入期权)、看跌期权(卖出期权)和双重期权三种类型;按照履约期限可分为美式期权和欧式期权。

2.美式期权(American options)答:美式期权是指买入期权的一方在合约到期日前的任何工作日包括到期日当天都可以行使的期权,其结算日在履约日之后的一天或两天。

大多数的美式期权允许持有者在交易日到履约日之间随时履约,但也有一些合同规定一段比较短的时间可以履约,如“到期日前两周”。

3.买入期权(call option)答:买入期权又称“买方期权”、“看涨期权”、“多头期权”、“敲进”。

它是期权买方在合约到期日或有效期内按照预先敲定的交割价格从期权卖方手中买入某种金融资产或商品的权利,是期权交易的种类之一。

购买这种期权以人们预测市场价格将有上涨趋势为前提。

投资者在支付一定的期权费取得该种期权后,在合约到期日或到期日之前的有效期限内,若市场价格超过协定价格与期权费之和的水平,则可通过行使期权以协定价格买入合约规定的一定数量的金融资产或商品,再以市场价格卖出,从而获利。

申明:转载自第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权别离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括防止不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品平安性的本钱是30美元万。

然而,该公司认为提高产品的平安性只会节省20美元万。

请问公司应该怎么做呢?〞5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险工程。

此外,机构投资者比私人投资者可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

罗斯《公司理财》(第9版)笔记和课后习题详解第1章公司理财导论1.1复习笔记公司的首要目标——股东财富最大化决定了公司理财的目标。

公司理财研究的是稀缺资金如何在企业和市场内进行有效配置,它是在股份有限公司已成为现代企业制度最主要组织形式的时代背景下,就公司经营过程中的资金运动进行预测、组织、协调、分析和控制的一种决策与管理活动。

从决策角度来讲,公司理财的决策内容包括投资决策、筹资决策、股利决策和净流动资金决策;从管理角度来讲,公司理财的管理职能主要是指对资金筹集和资金投放的管理。

公司理财的基本内容包括:投资决策(资本预算)、融资决策(资本结构)、短期财务管理(营运资本)。

1.资产负债表资产负债表是总括反映企业某一特定日期财务状况的会计报表,它是根据资产、负债和所有者权益之间的相互关系,按照一定的分类标准和一定的顺序,把企业一定日期的资产、负债和所有者权益各项目予以适当排列,并对日常工作中形成的大量数据进行高度浓缩整理后编制而成的。

资产负债表可以反映资本预算、资本支出、资本结构以及经营中的现金流量管理等方面的内容。

2.资本结构资本结构是指企业各种资本的构成及其比例关系,它有广义和狭义之分。

广义资本结构,亦称财务结构,指企业全部资本的构成,既包括长期资本,也包括短期资本(主要指短期债务资本)。

狭义资本结构,主要指企业长期资本的构成,而不包括短期资本。

通常人们将资本结构表示为债务资本与权益资本的比例关系(D/E)或债务资本在总资本的构成(D/A)。

准确地讲,企业的资本结构应定义为有偿负债与所有者权益的比例。

资本结构是由企业采用各种筹资方式筹集资本形成的。

筹资方式的选择及组合决定着企业资本结构及其变化。

资本结构是企业筹资决策的核心问题。

企业应综合考虑影响资本结构的因素,运用适当方法优化资本结构,从而实现最佳资本结构。

资本结构优化有利于降低资本成本,获取财务杠杆利益。

3.财务经理财务经理是公司管理团队中的重要成员,其主要职责是通过资本预算、融资和资产流动性管理为公司创造价值。

罗斯《公司理财》(第9版)配套题库【课后习题-股票估值】第9章股票估值一、概念题1.股利支付率(payout ratio)答:股利支付率一般指公司发放给普通股股东的现金股利占总利润的比例。

也即在同一报告期内公司现金股利除以公司利润。

股利支付率又称“股利发放率”,支付比率值与留存收益比率之和为1。

2.留存收益比率(retention ratio)答:留存收益比率是指留存收益与盈利的比率,即每年公司有多大比例的盈利留在公司用于扩大再生产。

其计算公式为:留存收益比率=留存收益比率与支付比率之和为1。

3.资本回报率(return on equity,ROE)答:资本回报率是指一个企业的税后净利润与股东权益的比率,表示的是股权投资所获得的回报,它是用来计量股东投资的收益情况的一个重要指标,也是投资者评价管理层业绩的重要标准,是投资决策的重要参考依据。

4.市盈率答:即股票的市盈率是三个因素的函数:(1)增长机会。

拥有强劲增长机会的公司具有高市盈率。

(2)风险。

低风险股票具有高市盈率。

(3)会计方法。

采用保守会计方法的公司具有高市盈率。

市盈率衡量投资者愿意为每股当前利润支付多少钱,因此,一般来说较高的市盈率通常意味着公司未来的成长前景不错;市值面值比即每股的市场价值比上每股的账面价值。

二、复习题1.股票价值ECY公司下一次的股利支付将为每股2.85美元,并预计公司股利将以6%的增长率永续增长。

如果ECY公司股票当前价格为每股58美元,请问必要收益率是多少?答:题目要求计算股票的必要收益率。

运用固定增长模型,可以通过公式得到R:R=D1/P0+g=2.85/58+0.06=10.91%2.股票价值在前题所述的公司中,股利收益率是多少?预期资本利得率是多少?答:股利收益率是下一年的股利除以现在的价格,所以股利收益率为:股利收益率=D1/P0=2.85/58=4.91%资本利得率或者说股票价格的增长率,和股利增长率相同,所以:资本利得率=6%3.股票估值假设你已知某公司股票当前股价为每股64美元,同时该股票的必要收益率为13%。

reported in the financing activity section of the accounting statement of cash flows. When Tyco received payments from customers, the cash inflows were reported as operating cash flows. Another method used by Tyco was to have acquired companies prepay operating expenses. In other words, the company acquired by Tyco would pay vendors for items not yet received. In one case, the payments totaled more than $50 million. When the acquired company was consolidated with Tyco, the prepayments reduced Tyco’s cash outflows, thus increasing the operating cash flows.Dynegy, the energy giant, was accused of engaging in a number of complex “round-trip trades.” The round-trip trades essentially involved the sale of natural resources to a counterparty, with the repurchase of the resources from the same party at the same price. In essence, Dynegy would sell an asset for $100, and immediately repurchase it from the buyer for $100. The problem arose with the treatment of the cash flows from the sale. Dynegy treated the cash from the sale of the asset as an operating cash flow, but classified the repurchase as an investing cash outflow. The total cash flows of the contracts traded by Dynegy in these round-trip trades totaled $300 million.Adelphia Communications was another company that apparently manipulated cash flows. In Adelphia’s case, the company capitalized the labor required to install cable. In other words, the company classified this labor expense as a fixed asset. While this practice is fairly common in the telecommunications industry, Adelphia capitalized a higher percentage of labor than is common. The effect of this classification was that the labor was treated as an investment cash flow, which increased the operating cash flow.In each of these examples, the companies were trying to boost operating cash flows by shifting cash flows to a different heading. The important thing to notice is that these movements don’t affect the total cash flow of the firm, which is why we recommend focusing on this number, not just operating cash flow.Summary and ConclusionsBesides introducing you to corporate accounting, the purpose of this chapter has been to teach you how to determine cash flow from the accounting statements of a typical company.1. Cash flow is generated by the firm and paid to creditors and shareholders. It can be classifiedas:1. Cash flow from operations.2. Cash flow from changes in fixed assets.3. Cash flow from changes in working capital.2. Calculations of cash flow are not difficult, but they require care and particular attention to detailin properly accounting for noncash expenses such as depreciation and deferred taxes. It is especially important that you do not confuse cash flow with changes in net working capital and net income.Concept Questions1. Liquidity True or false: All assets are liquid at some price. Explain.2. Accounting and Cash Flows Why might the revenue and cost figures shown on a standardincome statement not represent the actual cash inflows and outflows that occurred during a period?3. Accounting Statement of Cash Flows Looking at the accounting statement of cash flows,what does the bottom line number mean? How useful is this number for analyzing a company? 4. Cash Flows How do financial cash flows and the accounting statement of cash flows differ?Which is more useful for analyzing a company?5. Book Values versus Market Values Under standard accounting rules, it is possible for astockholders’ equity of Information Control Corp. one year ago:During the past year, Information Control issued 10 million shares of new stock at a total price of $43 million, and issued $10 million in new long-term debt. The company generated $9 million in net income and paid $2 million in dividends. Construct the current balance sheet reflecting the changes that occurred at Information Control Corp. during the year.8. Cash Flow to Creditors The 2009 balance sheet of Anna’s Tennis Shop, Inc., showed long-term debt of $1.34 million, and the 2010 balance sheet showed long-term debt of $1.39 million.The 2010 income statement showed an interest expense of $118,000. What was the firm’s cash flow to creditors during 2010?9. Cash Flow to Stockholders The 2009 balance sheet of Anna’s Tennis Shop, Inc., showed$430,000 in the common stock account and $2.6 million in the additional paid-in surplus account.The 2010 balance sheet showed $450,000 and $3.05 million in the same two accounts, respectively. If the company paid out $385,000 in cash dividends during 2010, what was the cash flow to stockholders for the year?10. Calculating Cash Flows Given the information for Anna’s Tennis Shop, Inc., in the previoustwo problems, suppose you also know that the firm’s net capital spending for 2010 was $875,000 and that the firm reduced its net working capital investment by $69,000. What was the firm’s 2010 operating cash flow, or OCF?INTERMEDIATE (Questions 11–24)11. Cash Flows Ritter Corporation’s accountants prepared the following financial statements foryear-end 2010:1. Explain the change in cash during 2010.2. Determine the change in net working capital in 2010.3. Determine the cash flow generated by the firm’s assets during 2010.12. Financial Cash Flows The Stancil Corporation provided the following current information:Determine the cash flows from the firm and the cash flows to investors of the firm.13. Building an Income Statement During the year, the Senbet Discount Tire Company hadgross sales of $1.2 million. The firm’s cost of goods sold and selling expenses were $450,000 and $225,000, respectively. Senbet also had notes payable of $900,000. These notes carried an interest rate of 9 percent. Depreciation was $110,000. Senbet’s tax rate was 35 percent.1. What was Senbet’s net income?2. What was Senbet’s operating cash flow?14. Calculating Total Cash Flows Schwert Corp. shows the following information on its 2010income statement: sales = $167,000; costs = $91,000; other expenses = $5,400; depreciation expense = $8,000; interest expense = $11,000; taxes = $18,060; dividends = $9,500. In addition, you’re told that the firm issued $7,250 in new equity during 2010 and redeemed $7,100 in outstanding long-term debt.1. What is the 2010 operating cash flow?2. What is the 2010 cash flow to creditors?3. What is the 2010 cash flow to stockholders?4. If net fixed assets increased by $22,400 during the year, what was the addition to networking capital (NWC)?15. Using Income Statements Given the following information for O’Hara Marine Co., calculatethe depreciation expense: sales = $43,000; costs = $27,500; addition to retained earnings = $5,300; dividends paid = $1,530; interest expense = $1,900; tax rate = 35 percent.1. What is owners’ equity for 2009 and 2010?2. What is the change in net working capital for 2010?3. In 2010, Weston Enterprises purchased $1,800 in new fixed assets. How much in fixedassets did Weston Enterprises sell? What is the cash flow from assets for the year? (The tax rate is 35 percent.)4. During 2010, Weston Enterprises raised $360 in new long-term debt. How much long-termdebt must Weston Enterprises have paid off during the year? What is the cash flow to creditors?Use the following information for Ingersoll, Inc., for Problems 23 and 24 (assume the tax rate is34 percent):23. Financial Statements Draw up an income statement and balance sheet for this company for2009 and 2010.24. Calculating Cash Flow For 2010, calculate the cash flow from assets, cash flow to creditors,and cash flow to stockholders.CHALLENGE (Questions 25–27)25. Cash Flows You are researching Time Manufacturing and have found the following accountingstatement of cash flows for the most recent year. You also know that the company paid $82 million in current taxes and had an interest expense of $43 million. Use the accounting statement of cash flows to construct the financial statement of cash flows.Nick has also provided the following information: During the year the company raised $118,000 in new long-term debt and retired $98,000 in long-term debt. The company also sold $11,000 in new stock and repurchased $40,000 in stock. The company purchased $786,000 in fixed assets and sold $139,000 in fixed assets.Angus has asked you to prepare the financial statement of cash flows and the accounting statement of cash flows. He has also asked you to answer the following questions:1. How would you describe Warf Computers’ cash flows?2. Which cash flow statement more accurately describes the cash flows at the company?3. In light of your previous answers, comment on Nick’s expansion plans.。