罗斯公司理财题库全集

- 格式:doc

- 大小:92.50 KB

- 文档页数:31

Chapter 22Options and Corporate Finance Multiple Choice Questions1. A financial contract that gives its owner the right, but not the obligation, to buy or sell a specified asset at an agreed-upon price on or before a given future date is called a(n) _____ contract.A. optionB. futuresC. forwardD. swapE. straddle2. The act where an owner of an option buys or sells the underlying asset, as is his right, is called ______ the option.A. strikingB. exercisingC. openingD. splittingE. strangling3. The fixed price in an option contract at which the owner can buy or sell the underlying asset is called the option's:A. opening price.B. intrinsic value.C. strike price.D. market price.E. time value.4. The last day on which an owner of an option can elect to exercise is the _____ date.A. ex-paymentB. ex-optionC. openingD. expirationE. intrinsic5. An option that may be exercised at any time up to its expiration date is called a(n) _____ option.A. futuresB. AsianC. BermudanD. EuropeanE. American6. An option that may be exercised only on the expiration date is called a(n) _____ option.A. EuropeanB. AmericanC. BermudanD. futuresE. Asian7. A _____ is a derivative security that gives the owner the right, but not the obligation, to buy an asset at a fixed price for a specified period of time.A. futures contractB. call optionC. put optionD. swapE. forward contract8. A _____ is a derivative security that gives the owner the right, but not the obligation, to sell an asset at a fixed price for a specified period of time.A. futures contractB. call optionC. put optionD. swapE. forward contract9. A trading opportunity that offers a riskless profit is called a(n):A. put option.B. call option.C. market equilibrium.D. arbitrage.E. cross-hedge.10. The value of an option if it were to immediately expire, that is, its lower pricing bound, is called an option's _____ value.A. strikeB. marketC. volatilityD. timeE. intrinsic11. The relationship between the prices of the underlying stock, a call option, a put option, anda riskless asset is referred to as the _____ relationship.A. put-call parityB. covered callC. protective putD. straddleE. strangle12. The effect on an option's value of a small change in the value of the underlying asset is called the option:A. theta.B. vega.C. rho.D. delta.E. gamma.13. An option that grants the right, but not the obligation, to sell shares of the underlying asset on a particular date at a specified price is called:A. either an American or a European option.B. an American call.C. an American put.D. a European put.E. a European call.14. Which one of the following provides the option of selling a stock anytime during the option period at a specified price even if the market price of the stock declines to zero?A. American callB. European callC. American putD. European putE. either an American or a European put15. Given an exercise price, time to maturity, and European put-call parity, the present value of the strike price plus the call option is equal to:A. the current market value of the stock.B. the present value of the stock minus a put option.C. a put option minus the market value of the share of stock.D. the value of a U.S. Treasury bill.E. the share of stock plus the put option.16. You can realize the same value as that derived from stock ownership if you:A. sell a put option and invest at the risk-free rate of return.B. buy a call option and write a put option on a stock and also borrow funds at the risk-free rate.C. sell a put and buy a call on a stock as well as invest at the risk-free rate of return.D. lend out funds at the risk-free rate of return and sell a put option on the stock.E. borrow funds at the risk-free rate of return and invest the proceeds in equivalent amounts of put and call options.17. Which one of the following statements correctly describes your situation as the owner of an American call option?A. You are obligated to buy at a set price at any time up to and including the expiration date.B. You have the right to sell at a set price at any time up to and including the expiration date.C. You have the right to buy at a set price only on the expiration date.D. You are obligated to sell at a set price if the option is exercised.E. You have the right to buy at a set price at any time up to and including the expiration date.18. Jeff opted to exercise his August option on August 10 and received $2,500 in exchange for his shares. Jeff must have owned a (an):A. warrant.B. American call.C. American put.D. European call.E. European put.19. Jillian owns an option which gives her the right to purchase shares of WAN stock at a price of $20 a share. Currently, WAN stock is selling for $24.50. Jillian would like to profit on this stock but is not permitted to exercise her option for another two weeks.Which of the following statements apply to this situation?I. Jillian must own a European call option.II. Jillian must own an American put option.III. Jillian should sell her option today if she feels the price of WAN stock will decline significantly over the next two weeks.IV. Jillian cannot profit today from the price increase in WAN stock.A. I and III onlyB. II and IV onlyC. I and IV onlyD. II and III onlyE. I, III, and IV only20. The difference between an American call and a European call is that the American call:A. has a fixed exercise price while the European exercise price can vary within a small range.B. is a right to buy while a European call is an obligation to buy.C. has an expiration date while the European call does not.D. is written on 100 shares of the underlying security while the European call covers 1,000 shares.E. can be exercised at any time up to the expiration date while the European call can only be exercised on the expiration date.21. If a call has a positive intrinsic value at expiration the call is said to be:A. funded.B. unfunded.C. at the money.D. in the money.E. out of the money.22. A put option with a $35 exercise price on ABC stock expires today. The current price of ABC stock is $36.The put is:A. funded.B. unfunded.C. at the money.D. in the money.E. out of the money.23. The maximum value of a call option is equal to:A. the strike price minus the initial cost of the option.B. the exercise price plus the price of the underlying stock.C. the strike price.D. the price of the underlying stock.E. the purchase price.24. The lower bound on a call's value is either the:A. strike price or zero, whichever is greater.B. stock price minus the exercise price or zero, whichever is greater.C. strike price or the stock price, whichever is lower.D. strike price or zero, whichever is lower.E. stock price minus the exercise price or zero, whichever is lower.25. The lower bound of a call option:A. can be a negative value regardless of the stock or exercise prices.B. can be a negative value but only when the exercise price exceeds the stock price.C. can be a negative value but only when the stock price exceeds the exercise price.D. must be greater than zero.E. can be equal to zero.26. The intrinsic value of a call is:I. the value of the call if it were about to expire.II. equal to the lower bound of a call's value.III. another name for the market price of a call.IV. always equal to zero if the call is currently out of the money.A. I and III onlyB. II and IV onlyC. I and II onlyD. II, III, and IV onlyE. I, II, and IV only27. The intrinsic value of a put is equal to the:A. lesser of the strike price or the stock price.B. lesser of the stock price minus the exercise price or zero.C. lesser of the stock price or zero.D. greater of the strike price minus the stock price or zero.E. greater of the stock price minus the exercise price or zero.28. Which of the following statements are correct concerning option values?I. The value of a call increases as the price of the underlying stock increases. II. The value of a call decreases as the exercise price increases.III. The value of a put increases as the price of the underlying stock increases. IV. The value of a put decreases as the exercise price increases.A. I and III onlyB. II and IV onlyC. I and II onlyD. II and III onlyE. I, II, and IV only29. The value of a call increases when:I. the time to expiration increases.II. the stock price increases.III. the risk-free rate of return increases.IV. the volatility of the price of the underlying stock increases.A. I and III onlyB. II, III, and IV onlyC. I, III, and IV onlyD. I, II, and III onlyE. I, II, III, and IV30. Which one of the following will cause the value of a call to decrease?A. lowering the exercise priceB. increasing the time to expirationC. increasing the risk-free rateD. lowering the risk level of the underlying securityE. increasing the stock price31. Assume that you own both a May 40 put and a May 40 call on ABC stock. Which one of the following statements is correct concerning your option positions? Ignore taxes and transaction costs.A. An increase in the stock price will increase the value of your put and decrease the value of your call.B. Both a May 45 put and a May 45 call will have higher values than your May 40 options.C. The time premiums on both your put and call are less than the time premiums on equivalent June options.D. A decrease in the stock price will decrease the value of both of your options.E. You cannot profit on your position as your profits on one option will be offset by losses on the other option.32. You own both a May 20 call and a May 20 put. If the call finishes in the money, then the put will:A. also finish in the money.B. finish at the money.C. finish out of the money.D. either finish at the money or in the money.E. either finish at the money or out of the money.33. You own stock in a firm that has a pure discount loan due in six months. The loan has a face value of $50,000. The assets of the firm are currently worth $62,000. The stockholders in this firm basically own a _____ option on the assets of the firm with a strike price of ______A. put; $62,000.B. put; $50,000.C. warrant; $62,000.D. call; $62,000.E. call; $50,000.34. The owner of a call option has the:A. right but not the obligation to buy a stock at a specified price on a specified date.B. right but not the obligation to buy a stock at a specified price during a specified period of time.C. obligation to buy a stock on a specified date but only at the specified price.D. obligation to buy a stock sometime during a specified period of time at the specified price.E. obligation to buy a stock at the lower of the exercise price or the market price on the expiration date.35. In the Black-Scholes option pricing formula, N(d1) is the probability that a standardized, normally distributed random variable is:A. less than or equal to N(d2).B. less than one.C. equal to one.D. equal to d1.E. less than or equal to d1.36. To compute the value of a put using the Black-Scholes option pricing model, you:A. first have to apply the put-call parity relationship.B. first have to compute the value of the put as if it is a call.C. compute the value of an equivalent call and then subtract that value from one.D. compute the value of an equivalent call and then subtract that value from the market price of the stock.E. compute the value of an equivalent call and then multiply that value by e-RT.37. If you consider the equity of a firm to be an option on the firm's assets then the act of paying off debt is comparable to _____ on the assets of the firm.A. purchasing a put optionB. purchasing a call optionC. exercising an in-the-money put optionD. exercising an in-the-money call optionE. selling a call option38. For every positive net present value project that a firm undertakes, the equity in the firm will increase the most if the delta of the call option on the firm's assets is:A. equal to one.B. between zero and one.C. equal to zero.D. between zero and minus one.E. equal to minus one.39. Shareholders in a leveraged firm might wish to accept a negative net present value project if:A. it increases the standard deviation of the returns on the firm's assets.B. it lowers the variance of the returns on the firm's assets.C. it lowers the risk level of the firm.D. it diversifies the cash flows of the firm.E. it decreases the risk that a firm will default on its debt.40. Which of the following statements is true?A. American options are options on securities of U.S. corporations, and the options are traded on American exchanges. European options are options on securities of U.S. corporations, but the options are traded on European exchanges.B. American options are options on securities which are traded on American exchanges. European options, also traded on American exchanges, are options on European corporations.C. American options give the holder the right to the dividend payment. European options do not.D. American options may be exercised anytime up to expiration. European options may be exercised only at expiration.E. None of the above.41. An out-of-the-money call option is one that:A. has an exercise price below the current market price of the underlying security.B. should not be exercised.C. has an exercise price above the current market price of the underlying security.D. Both A and B.E. Both B and C.42. Which of the following is not true concerning call option writers?A. Writers promise to deliver shares if exercised by the buyer.B. The writer has the option to sell shares but not an obligation.C. The writer's liability is zero if the option expires out-of-the-money.D. The writer receives a cash payment from the buyer at the time the option is purchased.E. The writer has a loss if the market price rises substantially above the exercise price.43. An in-the-money put option is one that:A. has an exercise price greater than the underlying stock price.B. has an exercise price less than the underlying stock price.C. has an exercise price equal to the underlying stock price.D. should not be exercised at expiration.E. should not be exercised at any time.44. Which of the following statements is true?A. At expiration the maximum price of a call is the greater of (Stock Price - Exercise) or 0.B. At expiration the maximum price of a call is the greater of (Exercise - Stock Price) or 0.C. At expiration the maximum price of a put is the greater of (Stock Price - Exercise) or 0.D. At expiration the maximum price of a put is the greater of (Exercise - Stock Price) or 0.E. Both A and D.45. Put-call parity can be used to show:A. how far in-the-money put options can get.B. how far in-the-money call options can get.C. the precise relationship between put and call prices given equal exercise prices and equal expiration dates.D. that the value of a call option is always twice that of a put given equal exercise prices and equal expiration dates.E. that the value of a call option is always half that of a put given equal exercise prices and equal expiration dates.Tele-Tech Com announces a major expansion into Internet services. This announcement causes the price of Tele-Tech Com stock to increase, but also causes an increase in price volatility of the stock.46. Which of the following correctly identifies the impact of these changes on a call option of Tele-Tech Com?A. Both changes cause the price of the call option to decrease.B. Both changes cause the price of the call option to increase.C. The greater uncertainty will cause the price of the call option to decrease. The higher price of the stock will cause the price of the call option to increase.D. The greater uncertainty will cause the price of the call option to increase. The higher price of the stock will cause the price of the call option to decrease.E. The greater uncertainty has no direct effect on the price of the call option. The higher price of the stock will cause the price of the call option to decrease.47. Which of the following correctly identifies the impact of these changes on a put option of Tele-Tech Com?A. Both changes cause the price of the put option to decrease.B. Both changes cause the price of the put option to increase.C. The greater uncertainty will cause the price of the put option to decrease. The higher price of the stock will cause the price of the put option to increase.D. The greater uncertainty will cause the price of the put option to increase. The higher price of the stock will cause the price of the put option to decrease.E. The greater uncertainty has no direct effect on the price of the put option. The higher price of the stock will cause the price of the put option to decrease.48. The delta of a call measures:A. the change in the ending stock value.B. the change in the ending option value.C. the swing in the price of the call relative to the swing in stock price.D. the ratio of the change in the exercise price to the change in the stock price.E. None of the above.49. The Black-Scholes option pricing model is dependent on which five parameters?A. Stock price, exercise price, risk free rate, probability, and time to maturityB. Stock price, risk free rate, probability, time to maturity, and varianceC. Stock price, risk free rate, probability, variance and exercise priceD. Stock price, exercise price, risk free rate, variance and time to maturityE. Exercise price, probability, stock price, variance and time to maturity50. What is the cost of five November 25 call option contracts on KNJ stock given the following price quotes?A. $615B. $660C. $2,500D. $3,075E. $3,30051. What is the value of one November 35 put contract?A. $70B. $460C. $510D. $4,600E. $5,10052. What is the intrinsic value of the August 25 call?A. $0.10B. $5.86C. $6.15D. $10.00E. $25.0053. You purchased six TJH call option contracts with a strike price of $40 when the option was quoted at $1.30. The option expires today when the value of TJH stock is $41.90. Ignoring trading costs and taxes, what is your total profit or loss on your investment?A. $60B. $320C. $360D. $420E. $54054. You purchased four WXO 30 call option contracts at a quoted price of $.34. What is your net gain or loss on this investment if the price of WXO is $33.60 on the option expiration date?A. -$1,576B. -$136C. $1,304D. $1,440E. $1,57655. You wrote ten call option contracts on JIG stock with a strike price of $40 and an option price of $.40. What is your net gain or loss on this investment if the price of JIG is $46.05 on the option expiration date?A. -$6,450B. -$5,650C. $400D. $5,650E. $6,45056. The market price of ABC stock has been very volatile and you think this volatility will continue for a few weeks. Thus, you decide to purchase a one-month call option contract on ABC stock with a strike price of $25 and an option price of $1.30. You also purchase aone-month put option on ABC stock with a strike price of $25 and an option price of $.50. What will be your total profit or loss on these option positions if the stock price is $24.60 on the day the options expire?A. -$180B. -$140C. -$100D. $0E. $18057. Several rumors concerning Wyslow, Inc. stock have started circulating. These rumors are causing the market price of the stock to be quite volatile. Given this situation, you decide to buy both a one-month put and a one month call option on this stock with an exercise price of $15. You purchased the call at a quoted price of $.20 and the put at a price of $2.10. What will be your total profit or loss on these option positions if the stock price is $4 on the day the options expire?A. -$230B. $870C. $890D. $910E. $1,31058. Three months ago, you purchased a put option on WXX stock with a strike price of $60 and an option price of $.60. The option expires today when the value of WXX stock is $62.50. Ignoring trading costs and taxes, what is your total profit or loss on your investment?A. -$310B. -$60C. $0D. $60E. $19059. You sold ten put option contracts on PLT stock with an exercise price of $32.50 and an option price of $1.10. Today, the option expires and the underlying stock is selling for $34.30 a share. Ignoring trading costs and taxes, what is your total profit or loss on this investment?A. -$2,900B. -$1,100C. $700D. $1,100E. $2,90060. You sold a put contract on EDF stock at an option price of $.40. The option had an exercise price of $20. The option was exercised. Today, EDF stock is selling for $19 a share. What is your total profit or loss on all of your transactions related to EDF stock assuming that you close out your positions in this stock today? Ignore transaction costs and taxes.A. -$140B. -$60C. $40D. $60E. $14061. You own two call option contracts on ABC stock with a strike price of $15. When you purchased the contracts the option price was $1.20 and the stock price was $15.90. What is the total intrinsic value of these options if ABC stock is currently selling for $14.50 a share?A. -$280B. -$180C. -$100D. $0E. $10062. You own five put option contracts on XYZ stock with an exercise price of $25. What is the total intrinsic value of these contracts if XYZ stock is currently selling for $24.50 a share?A. -$250B. -$50C. $0D. $50E. $25063. Last week, you purchased a call option on Denver, Inc. stock at an option price of $1.05. The stock price last week was $28.10. The strike price is $27.50. What is the intrinsic value per share if Denver, Inc. stock is currently priced at $29.03?A. -$1.05B. $0C. $.48D. $.93E. $1.5364. Three weeks ago, you purchased a July 45 put option on RPJ stock at an option price of $3.20. The market price of RPJ stock three weeks ago was $42.70. Today, RPJ stock is selling at $44.75 a share and the July 45 put is priced at $.80. What is the intrinsic value of your put contract?A. -$295B. -$210C. $0D. $25E. $11065. You own a call option on Jasper Co. stock that expires in one year. The exercise price is $42.50. The current price of the stock is $56.00 and the risk-free rate of return is 3.5%. Assume that the option will finish in the money. What is the current value of the call option?A. $13.04B. $13.50C. $13.97D. $14.94E. $15.4666. You currently own a one-year call option on Way-One, Inc. stock. The current stock price is $26.50 and the risk-free rate of return is 4%. Your option has a strike price of $20 and you assume that it will finish in the money. What is the current value of your call option?A. $6.25B. $6.50C. $6.76D. $7.13E. $7.2767. The common stock of Mercury Motors is selling for $43.90 a share. U.S. Treasury bills are currently yielding 4.5%. What is the current value of a one-year call option on Mercury Motors stock if the exercise price is $37.50 and you assume the option will finish in the money?A. $6.12B. $6.40C. $6.69D. $7.67E. $8.0168. The common stock of Winsson, Inc. is currently priced at $52.50 a share. One year from now, the stock price is expected to be either $54 or $60 a share. The risk-free rate of return is 4%. What is the value of one call option on Winsson stock with an exercise price of $55?A. $0.39B. $0.41C. $0.45D. $0.48E. $0.5169. You own one call option with an exercise price of $30 on Nadia Interiors stock. This stock is currently selling for $27.80 a share but is expected to increase to either $28 or $34 a share over the next year. The risk-free rate of return is 5% and the inflation rate is 3%. What is the current value of your option if it expires in one year?A. $0.76B. $0.79C. $0.89D. $0.92E. $0.9570. The assets of Blue Light Specials are currently worth $2,100. These assets are expected to be worth either $1,800 or $2,300 one year from now. The company has a pure discount bond outstanding with a $2,000 face value and a maturity date of one year. The risk-free rate is 5%. What is the value of the equity in this firm?A. $166.67B. $231.42C. $385.71D. $405.00E. $714.2971. Big Ed's Electrical has a pure discount bond that comes due in one year and has a face value of $1,000. The risk-free rate of return is 4%. The assets of Big Ed's are expected to be worth either $800 or $1,300 in one year. Currently, these assets are worth $1,140. What is the current value of the debt of Big Ed's Electrical?A. $222.46B. $370.77C. $514.28D. $769.23E. $917.5472. Martha B's has total assets of $1,750. These assets are expected to increase in value to either $1,800 or $2,400 by next year. The company has a pure discount bond outstanding with a face value of $2,000.This bond matures in one year. Currently, U.S. Treasury bills are yielding 6%. What is the value of the equity in this firm?A. $16.98B. $34.59C. $36.67D. $37.08E. $51.8973. Tru-U stock is selling for $36 a share. A 3-month call on Tru-U stock with a strike price of $40 is priced at $1. Risk-free assets are currently returning 0.25% per month. What is the price of a 3-month put on Tru-U stock with a strike price of $40?A. $2.98B. $3.00C. $4.03D. $4.70E. $4.9074. GS, Inc. stock is selling for $28 a share. A 3-month call on GS stock with a strike price of $30 is priced at $1.50. Risk-free assets are currently returning 0.3% per month. What is the price of a 3-month put on GS stock with a strike price of $30?A. $0.50B. $2.02C. $2.73D. $3.23E. $4.0275. J&L, Inc. stock has a current market price of $55 a share. The one-year call on J&L stock with a strike price of $55 is priced at $2.50 while the one-year put with a strike price of $55 is priced at $1. What is the risk-free rate of return?A. 2.71%B. 2.76%C. 2.80%D. 2.84%E. 2.87%76. What is the value of d2 given the following information on a stock?Stock price $63Exercise price $60Time to expiration .50Risk-free rate 6%Standard deviation 20%d1 .627841A. .3133B. .4864C. .5460D. .6867E. .734977. Given the following information, what is the value of d2 as it is used in the Black-Scholes Option Pricing Model?Stock price $42Time to expiration .25Risk-free rate .055Standard deviation .50d1 .375161A. .021608B. .125161C. .175608D. .200161E. .25016178. What is the value of a 9-month call with a strike price of $45 given the Black-Scholes Option Pricing Model and the following information?Stock price $48Exercise price $45Time to expiration .75Risk-free rate .05N(d1) .718891N(d2) .641713A. $2.03B. $4.86C. $6.69D. $8.81E. $9.2779. Assume that the delta of a call option on a firm's assets is .792. This means that a $50,000 project will increase the value of equity by:A. $27,902.B. $39,600.C. $43,820.D. $63,131.E. $89,600.80. The current market value of the assets of Bigelow, Inc. is $86 million, with a standard deviation of 15% per year. The firm has zero-coupon bonds outstanding with a total face value of $45 million. These bonds mature in 2 years. The risk-free rate is 4% per year compounded continuously. What is the value of d1?A. 3.54B. 3.62C. 3.68D. 3.71E. 3.75。

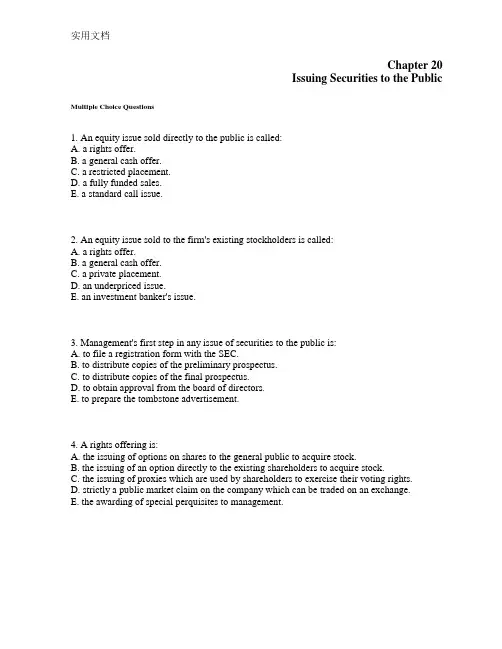

Chapter 20Issuing Securities to the Public Multiple Choice Questions1. An equity issue sold directly to the public is called:A. a rights offer.B. a general cash offer.C. a restricted placement.D. a fully funded sales.E. a standard call issue.2. An equity issue sold to the firm's existing stockholders is called:A. a rights offer.B. a general cash offer.C. a private placement.D. an underpriced issue.E. an investment banker's issue.3. Management's first step in any issue of securities to the public is:A. to file a registration form with the SEC.B. to distribute copies of the preliminary prospectus.C. to distribute copies of the final prospectus.D. to obtain approval from the board of directors.E. to prepare the tombstone advertisement.4. A rights offering is:A. the issuing of options on shares to the general public to acquire stock.B. the issuing of an option directly to the existing shareholders to acquire stock.C. the issuing of proxies which are used by shareholders to exercise their voting rights.D. strictly a public market claim on the company which can be traded on an exchange.E. the awarding of special perquisites to management.5. Companies use tombstone advertisements in the financial press to:A. announce the death of the company.B. announce the failure of a financial strategy.C. announce the availability of a new issue of a corporate security.D. notify the public of foreclosure.E. None of the above.6. The first public equity issue made by a company is a(n):A. initial private offering.B. initial public offering.C. secondary offering.D. seasoned new issue.E. None of the above.7. The first public equity issue that is made by a company is referred to as:A. a rights issue.B. a general cash offer.C. an initial public offering.D. an unseasoned issue.E. Both C and D.8. A new public equity issue from a company with equity previously outstanding is called a(n):A. initial public offering.B. seasoned equity issue.C. unseasoned equity issue.D. private placement.E. syndicate.9. The green shoe option is used to:A. cover oversubscription.B. cover excess demand.C. provide additional reward to the investment bankers for a risky issue.D. provide additional reward to the issuing firm for a risky issue.E. Both A and B.10. Dilution refers to:A. the increase in stock value due to wider ownership of stock.B. the loss in existing shareholder's equity.C. the loss in new shareholder's equity.D. the loss in all shareholder's equity, both existing shareholders and new shareholders.E. None of the above.11. During the SEC waiting period the potential issuing company can issue a preliminary prospectus which contains:A. exactly the same information as the final prospectus except an indication of SEC approval.B. all the information as the final prospectus including red writing stating it is a red herring.C. very limited financial information and red writing stating it is preliminary.D. only a description of what the funds are to be used for.E. information very similar to the final prospectus without a price nor with SEC approval.12. A company must file a registration statement with the SEC providing various financial and company history information. The registration statement does not need to be filed if:A. the issue is less than $50 million.B. the loan matures within 9 months.C. the issue is less than $5.0 million.D. Both A and B.E. Both B and C.13. Regulation A security issues are exempt from full SEC registration filing and use only a brief offering statement if:A. the issue is for less than $5,000,000.B. insiders sell no more than $1,500,000 of stock.C. insiders sell no more than 100,000,000 shares.D. Both A and C.E. Both A and B.14. Potential investors learn of the information concerning the firm and its new issue from the:A. pre-underwriting negotiating meeting.B. red herring.C. letter of commitment.D. emails from their former finance professor.E. rights offering.15. A registration statement is effective on the 20th day after filing unless:A. the SEC is backlogged with statements.B. a tombstone ad is issued indicating its demise.C. a letter of comment suggesting changes is issued by the SEC.D. a syndicate can be formed sooner.E. None of the above.16. Investment banks perform which of the following services for corporate issuers:A. formulating the method used to issue the securities.B. pricing the new securities.C. selling the new securities.D. All of the above.E. None of the above.17. A group of investment bankers who pool their efforts to underwrite a security are known as a(n):A. amalgamate.B. conglomerate.C. green shoe group.D. klatch.E. syndicate.18. A firm commitment arrangement with an investment banker occurs when:A. the syndicate is in place to handle the issue.B. the spread between the buying and selling price is less than one percent.C. the issue is solidly accepted in the market evidenced by a large price increase.D. when the investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them.E. when the investment banker sells as much of the security as the market can bear without a price decrease.19. Which of the following is not normally an example of the services offered by investment bankers?A. Aiding in the sale of securitiesB. Facilitating mergersC. Acting as brokers to both individuals and institutional clientsD. Offering checking accounts to corporationsE. Both C and D20. In a best efforts offering the investment banker makes their money primarily by:A. earning the spread between the buying and offering price.B. earning a commission on each share sold.C. earning the discount between the buying and offering price.D. charging a flat fee for all services.E. None of the above.。

Chapter 23 Options and Corporate Finance: Extensions and Applications Answer KeyMultiple Choice Questions1. The option to abandon is:A. a real option.B. usually of little value because of the cost associated with abandonment.C. irrelevant in capital budgeting analysis.D. nearly always less relevant the option to expand.E. All of the above.Difficulty level: MediumTopic: OPTION TO ABANDONType: DEFINITIONS2. An example of a special option is:A. an executive stock option.B. the embedded option in a start-up company.C. the option in simple business contracts.D. the option to shut down and reopen a project.E. All of the above.Difficulty level: MediumTopic: SPECIAL OPTIONType: DEFINITIONS3. Executives can not exercise their options for a fixed period of time. This is the:A. investing period.B. freeze-out period.C. valuation period.D. guaranteed growth period.E. strike period.Difficulty level: MediumTopic: FREEZE-OUT PERIODType: DEFINITIONS4. The NPV approach must be:A. augmented by added analysis if there are a few embedded options.B. augmented by added analysis if a decision has significant embedded options.C. jettisoned if there are any embedded options.D. computed carefully to identify the options.E. None of the above.Difficulty level: MediumTopic: EMBEDDED OPTIONSType: CONCEPTS5. Options are granted to top corporate executives because:A. executives will make better business decisions in line with benefiting the shareholders.B. executive pay is at risk and linked to firm performance.C. options are tax-efficient and taxed only when they are exercised.D. All of the above.E. None of the above.Difficulty level: MediumTopic: EXECUTIVE OPTIONSType: CONCEPTS6. The call option on a dividend paying stock compared to a non-dividend paying stock is:A. more valuable because of the extra dividend payment.B. equal in value because cash dividends are paid on stock only.C. less valuable because cash dividends are paid on stock only.D. less valuable if the dividend paying stock is in-the-money while the non-dividend paying stock if out-of-the-money.E. None of the above.Difficulty level: ChallengeTopic: CALL OPTION ON DIVIDEND PAYING STOCKType: CONCEPTS7. The value of the options awarded executives is much less than face value to the executives because:A. the value to the executive depends on the stock price being greater than the exercise price.B. the options must be held beyond the freeze-out period.C. a highly undiversified portfolio can have a large drop in value with high variance stocks.D. All of the above.E. None of the above.Difficulty level: MediumTopic: EXECUTIVE OPTIONSType: CONCEPTS8. By rewarding executives with large option positions, corporations:A. cause the executives to hold highly undiversified portfolios.B. put the firm in a risky position to pay off the options.C. cause the value of the stock to fall because the options are theft.D. are really valueless because most options are never exercised.E. None of the above.Difficulty level: ChallengeTopic: EXECUTIVE OPTIONSType: CONCEPTS9. Investing in a negative NPV project today is a feasible choice if:A. there are future option alternatives.B. investing is sequentially limited.C. the discount rate is low.D. Both A and B.E. Both A and C.Difficulty level: MediumTopic: NEGATIVE NPV PROJECTS AND REAL OPTIONSType: CONCEPTS10. The opportunity to defer investing to a later date may have value because:A. the cost of capital may decline in the near future.B. certainty may be reduced in the future.C. investment costs fluctuate in time.D. All of the above.E. None of the above.Difficulty level: EasyTopic: OPTION TO DEFERType: CONCEPTS11. Rejecting an investment today forever may not be a good choice because:A. the size of the firm will decline.B. there are always errors in the estimation of NPVs.C. the option value is negative.D. the company's foregoing the future rights or option to the investment.E. None of the above.Difficulty level: MediumTopic: REAL OPTIONSType: CONCEPTS12. A financial manager who does not follow the general constraints of the NPV rule may:A. accept a negative NPV project for fear of losing an investment opportunity.B. accept a marginally acceptable NPV project limiting the corporation's ability to choose a competing project.C. not consider all options available in a capital budgeting decision.D. not take a positive NPV project even if the NPV is adequate reward to forego the option.E. All of the above.Difficulty level: MediumTopic: REAL OPTIONSType: CONCEPTS13. The volatility of interest rates can affect the value of the project by:A. increasing the value as volatility increases.B. increasing the value as volatility decreases.C. decreasing the value as volatility increases.D. interest rate volatility does not affect value.E. None of the above.Difficulty level: MediumTopic: INTEREST RATE VOLATILITYType: CONCEPTS14. Which of the following statements is true?A. The Black Scholes model is the simplest to use and best used for complex situations.B. The binomial model does not handle options with dividend payments prior to expiration date.C. The Black Scholes model adequately handles the valuation of an American put.D. The binomal model is better for complex situations and is the simplest tool to use.E. The Black Scholes model is simpler to use, but for complex situations, the binomial model is the necessary tool.Difficulty level: MediumTopic: OPTION PRICING TOOLSType: CONCEPTS15. If a project has optionality:A. the shorter the available life of the project the less valuable the project is.B. the longer the available life of the project the less valuable the project is.C. the shorter the available life of the project the more valuable the project is.D. available project life does not change optionality.E. None of the above.Difficulty level: EasyTopic: OPTIONALITYType: CONCEPTS16. The equal rate of price change from each subsequent up state and fixed rate price change from each subsequent down state are reasonable if:A. there is a constant variability.B. any new information impacting prices is similar period to period.C. interest or discount rates are constant.D. Both A and C.E. Both A and B.Difficulty level: MediumTopic: VARIABILITY AND INFORMATIONType: CONCEPTS17. The most correct method to determine the current value of future payoffs would be to:A. take the discounted expected value at the risk-free rate.B. take the expected value using the probabilities.C. take the discounted expected value using the risk-neutral probabilities and the risk free rate.D. sum the payoffs discounted at the risk free rate.E. None of the above.Difficulty level: MediumTopic: VALUATION OF FUTURE PAYOFFSType: CONCEPTS18. The risk-neutral probabilities for an asset, with a current value equal to the present value of future payoffs are:A. given by the probability of each state occurring.B. given by the value of the underlying asset under good news and the risk free rate.C. given by the value of the underlying asset under good news and bad news.D. given by the value of the underlying asset under good news, bad news, and the risk free rate.E. None of the above.Difficulty level: ChallengeTopic: VALUATION OF FUTURE PAYOFFSType: CONCEPTS19. A branching tree for the binomial model:A. should capture all possible futures paths for the asset.B. has a move down followed by a move up on a subsequent branch to end at the same value as the reverse path.C. has a move down followed by a move up on a subsequent branch to end at a lower value than a move up then a move down.D. Both A and C.E. Both A and B.Difficulty level: ChallengeTopic: BINOMIAL MODELType: CONCEPTS20. Increasing the number of intervals in the binomial model causes the price shift parameters to change. New estimates are related to:A. the standard deviation of the underlying asset.B. the up state multiplier equals the standard deviation divided by root n.C. the number of intervals in a year.D. All of the above.E. None of the above.Difficulty level: MediumTopic: BINOMIAL MODELType: CONCEPTS21. Which of the following is not part of the Black Scholes option pricing model?A. Standard deviationB. Time to maturityC. Exercise priceD. Par value of the company's stockE. Interest rateDifficulty level: MediumTopic: BLACK SCHOLES OPTION PRICING MODELType: CONCEPTS22. What are the u, the up state multiplier, and d, the down state multiplier, if there are monthly intervals and the standard deviation is .38?A. 1.1159; .8961B. .0317; 31.5789C. .0317; .9683D. .2193; .7807E. None of the aboveDifficulty level: MediumTopic: BLACK SCHOLES OPTION PRICING MODELType: CONCEPTS23. On the notion of embedded options, which of the following is/are true?A. If virtually all projects have embedded options, ignoring options is likely to lead to serious undervaluation.B. There are at least two possible outcomes for virtually every business idea.C. Virtually every business has both the option to abandon and the option to expand.D. All of the above.E. Both B and C.Difficulty level: MediumTopic: EMBEDDED OPTIONSType: CONCEPTS24. A firm in the extraction industry whose major assets are cash, equipment and a closed facility may appear to have extraordinary value. This value can be primarily attributed to:A. the potential sale of the company.B. the low exercise price held by the shareholders.C. the option to open the facility when prices rise dramatically.D. All of the above.E. None of the above.Difficulty level: MediumTopic: REAL OPTIONSType: CONCEPTSNote: Correct answers to later questions are dependent on correct answers to earlier questions. Ima Greedy, the CFO of Financial Saving Techniques has been granted options on 200,000 shares. The stock is currently trading at $22 a share and the options are at the money. The variance of the stock has been about .07 on an annual basis over the last several years. The options mature in 3 years and the risk free rate is 4%.25. What is d1?A. .1842B. .4102C. .4583D. .4909E. .5412d1 = [ln(22/22) + [.04 + (.50x.07)(3)]/ (.07)3d1 = .225/.4583 = .4909Difficulty level: MediumTopic: BLACK SCHOLES OPTION PRICING MODELType: PROBLEMS26. What is d2?A. .0121B. .0252C. .0326D. .0452E. .0525d2 = d1 - √σ2t = .4909 - √(.07)(3) = .4909 - .4583 = .0326 Difficulty level: MediumTopic: BLACK SCHOLES OPTION PRICING MODELType: PROBLEMS27. What is e-rt?A. .6087B. .7087C. .7952D. .8476E. .8869e-.04(3) = .8869Difficulty level: MediumTopic: BLACK SCHOLES OPTION PRICING MODELType: PROBLEMS28. Calculate N(d1).A. .5054B. .6508C. .6882D. .7047E. .8096N(d1) = .50 + .1882 = .6882Difficulty level: MediumTopic: BLACK SCHOLES OPTION PRICING MODELType: PROBLEMSChapter 23 - Options and Corporate Finance: Extensions and Applications29. Calculate N(d2).A. .5130B. .5578C. .6085D. .7085E. .7142N(d2) = .50 + .0130 = .5130Difficulty level: MediumTopic: BLACK SCHOLES OPTION PRICING MODELType: PROBLEMS30. What is the value of a call option?A. $4.14B. $4.86C. $5.13D. $5.62E. $6.1623-11。

Chapter 20Issuing Securities to the Public Multiple Choice Questions1. An equity issue sold directly to the public is called:A. a rights offer.B. a general cash offer.C. a restricted placement.D. a fully funded sales.E. a standard call issue.2. An equity issue sold to the firm's existing stockholders is called:A. a rights offer.B. a general cash offer.C. a private placement.D. an underpriced issue.E. an investment banker's issue.3. Management's first step in any issue of securities to the public is:A. to file a registration form with the SEC.B. to distribute copies of the preliminary prospectus.C. to distribute copies of the final prospectus.D. to obtain approval from the board of directors.E. to prepare the tombstone advertisement.4. A rights offering is:A. the issuing of options on shares to the general public to acquire stock.B. the issuing of an option directly to the existing shareholders to acquire stock.C. the issuing of proxies which are used by shareholders to exercise their voting rights.D. strictly a public market claim on the company which can be traded on an exchange.E. the awarding of special perquisites to management.5. Companies use tombstone advertisements in the financial press to:A. announce the death of the company.B. announce the failure of a financial strategy.C. announce the availability of a new issue of a corporate security.D. notify the public of foreclosure.E. None of the above.6. The first public equity issue made by a company is a(n):A. initial private offering.B. initial public offering.C. secondary offering.D. seasoned new issue.E. None of the above.7. The first public equity issue that is made by a company is referred to as:A. a rights issue.B. a general cash offer.C. an initial public offering.D. an unseasoned issue.E. Both C and D.8. A new public equity issue from a company with equity previously outstanding is called a(n):A. initial public offering.B. seasoned equity issue.C. unseasoned equity issue.D. private placement.E. syndicate.9. The green shoe option is used to:A. cover oversubscription.B. cover excess demand.C. provide additional reward to the investment bankers for a risky issue.D. provide additional reward to the issuing firm for a risky issue.E. Both A and B.10. Dilution refers to:A. the increase in stock value due to wider ownership of stock.B. the loss in existing shareholder's equity.C. the loss in new shareholder's equity.D. the loss in all shareholder's equity, both existing shareholders and new shareholders.E. None of the above.11. During the SEC waiting period the potential issuing company can issue a preliminary prospectus which contains:A. exactly the same information as the final prospectus except an indication of SEC approval.B. all the information as the final prospectus including red writing stating it is a red herring.C. very limited financial information and red writing stating it is preliminary.D. only a description of what the funds are to be used for.E. information very similar to the final prospectus without a price nor with SEC approval.12. A company must file a registration statement with the SEC providing various financial and company history information. The registration statement does not need to be filed if:A. the issue is less than $50 million.B. the loan matures within 9 months.C. the issue is less than $5.0 million.D. Both A and B.E. Both B and C.13. Regulation A security issues are exempt from full SEC registration filing and use only a brief offering statement if:A. the issue is for less than $5,000,000.B. insiders sell no more than $1,500,000 of stock.C. insiders sell no more than 100,000,000 shares.D. Both A and C.E. Both A and B.14. Potential investors learn of the information concerning the firm and its new issue from the:A. pre-underwriting negotiating meeting.B. red herring.C. letter of commitment.D. emails from their former finance professor.E. rights offering.15. A registration statement is effective on the 20th day after filing unless:A. the SEC is backlogged with statements.B. a tombstone ad is issued indicating its demise.C. a letter of comment suggesting changes is issued by the SEC.D. a syndicate can be formed sooner.E. None of the above.16. Investment banks perform which of the following services for corporate issuers:A. formulating the method used to issue the securities.B. pricing the new securities.C. selling the new securities.D. All of the above.E. None of the above.17. A group of investment bankers who pool their efforts to underwrite a security are known as a(n):A. amalgamate.B. conglomerate.C. green shoe group.D. klatch.E. syndicate.18. A firm commitment arrangement with an investment banker occurs when:A. the syndicate is in place to handle the issue.B. the spread between the buying and selling price is less than one percent.C. the issue is solidly accepted in the market evidenced by a large price increase.D. when the investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them.E. when the investment banker sells as much of the security as the market can bear without a price decrease.19. Which of the following is not normally an example of the services offered by investment bankers?A. Aiding in the sale of securitiesB. Facilitating mergersC. Acting as brokers to both individuals and institutional clientsD. Offering checking accounts to corporationsE. Both C and D20. In a best efforts offering the investment banker makes their money primarily by:A. earning the spread between the buying and offering price.B. earning a commission on each share sold.C. earning the discount between the buying and offering price.D. charging a flat fee for all services.E. None of the above.21. Under the _____ method, the underwriter buys the securities for less than the offering price and accepts the risk of not selling the issue, while under the _____ method, the underwriter does not purchase the shares but merely acts as an agent.A. best efforts; firm commitmentB. firm commitment; best effortsC. general cash offer; best effortsD. competitive offer; negotiated offerE. seasoned; unseasoned22. Professor Jay Ritter found best-efforts offerings are:A. reserved for the premier customers because they deserve 'best-efforts'.B. used most often with seasoned equity issues.C. used with small IPO issues.D. attractive because of price stability.E. None of the above.23. Empirical evidence suggests that new equity issues are generally:A. priced efficiently by the market.B. overpriced by investor excitement concerning a new issue.C. overpriced resulting from SEC regulation.D. underpriced, in part, to counteract the winner's curse.E. underpriced resulting from SEC regulation.24. The diagonal listing of investment bankers on tombstone advertisements reflects their ____ relative to the other investment bankers listed below.A. prestigeB. ability to manage selling syndicatesC. role as a firm commitment buyerD. role as a best efforts sellerE. None of the above25. The reputational capital of investment bankers is based on their roles as intermediaries with more in-depth knowledge of the issuer. Investment bankers maintain their reputation by:A. certifying the issue.B. monitoring the issuing firm's management and performance.C. pricing issues fairly.D. All of the above.E. None of the above.26. The key difference between a negotiated offer and a competitive offer is that:A. the underwriters can not set the spread in a negotiated bid but can in a competitive offer.B. the issuing firm can offer its securities to the highest bidder in a competitive bid but in a negotiated bid only one investment banker is used.C. the issuing firm works the underwriter for the best spread in a negotiated bid which will be less than that available in a competitive offer.D. the underwriter will not do a full investigation in a negotiated bid because the company is at their mercy, while in a competitive bid the underwriter must be extra diligent.E. None of the above.27. The offering price is set to make an issue attractive to the market and provide a good price to the issuer. Which of the following is/are true?A. Empirical studies by Ritter have shown that the average firm commitments have had a17.8% underpricing on the first day of trading.B. Empirical studies have shown that best efforts sales have underpricing on the first day of trading.C. Some issues which rose dramatically on the first day of trading were viewed as successfully priced by the underwriter because it helped build a long-term investment base.D. All of the above.E. None of the above.28. Empirical evidence suggests that upon announcement of a new equity issue, current stock prices generally:A. drop, perhaps because the new issue reflects management's view that common stock is currently overvalued.B. remain about the same since an efficient market anticipates a new equity issue.C. increase, perhaps because the issues are associated with positive NPV projects.D. increase, because the market supply is always less than demand.E. increase, because underwriters exercise their green shoe option.29. Underpricing can possibly be explained by:A. oversubscription of an issue.B. strong demand by investors.C. undersubscription of an issue.D. Both B and C.E. Both A and B.30. Debt capacity is often given as a reason for the value of the stock falling when equity is issued. The reason for this is:A. the high issue costs of a debt offering must be paid by the shareholders.B. the priority position of the equity is lowered.C. management has information that the probability of default has risen, limiting the debt capacity and causing the firm to raise equity capital.D. All of the above.E. None of the above31. A study by Lee, Lockhead, Ritter, and Zhao that examined the underwriting discount and other direct costs of going public with a debt or equity offering, found:A. the direct expenses are higher for equity than debt offerings.B. substantial economies of scale are prevalent.C. underpricing, on average, is similar in magnitude to total direct expenses.D. All of the above.E. None of the above.32. The six components that make up the total costs of new issues are:A. the spread; other direct expenses such as filing fees; indirect expenses such as management time; economies of scale; abnormal returns and the Green Shoe option.B. the discount; other direct expenses such as filing fees; indirect expenses such as management time; due diligence costs; abnormal returns and the Green Shoe option.C. the spread; other direct expenses such as filing fees; indirect expenses such as management time; abnormal returns; underpricing and the Green Shoe option.D. the spread; other direct expenses such as filing fees; economies of scale; due diligence costs; abnormal returns and underpricing.E. None of the above.33. In comparison to debt issuance expenses, the total direct costs of equity issues are:A. considerably less.B. about the same.C. meaningless.D. considerably greater.E. None of the above.34. To determine the value of a rights offering, the stockholder needs to know the following two pieces of information in addition to the current stock price:A. the subscription price and the number of rights needed to acquire a new share.B. the amount of new equity to be raised and the number of rights needed to acquire a new share.C. the amount of new equity to be raised and standby fee.D. the detachment date and the subscription price.E. None of the above.35. Assuming everything else is constant, when a stock goes ex-rights its price should:A. decrease since the stockholder is losing an option.B. increase since the corporation no longer has the right to force the stockholder to convert.C. remain the same since an efficient market would anticipate this change.D. move up or down depending on whether a small investor wanted to exercise his/his rights.E. None of the above.36. If a shareholder or investor wants to acquire new stock under a rights plant they must:A. acquire new stock in the market to get a controlling fraction of shares to be eligible for rights.B. simply pay a registration fee and turn in the subscription price.C. acquire the correct rights per share desired, then turn the rights and the total subscription price into the subscription agent.D. acquire the correct rights and wait for the company to send you the stock.E. call their broker and sell some CBOE options to make any money.37. Which of the following statements is true?A. The subscription price is generally above the old stock price.B. The subscription price is generally above the ex-rights price.C. The subscription price is generally below the old stock price.D. Both A and B.E. Both B and C.38. A shareholder who has rights is:A. always better off to exercise the rights.B. always better off to sell the rights into the market.C. able to exercise their rights or sell them.D. never in the same ownership position again with rights.E. None of the above.39. A standby underwriting arrangement provides the:A. company with methods to cancel the offering.B. company with an alternate investment banker if there is conflict between the issuer and the agent.C. investment banker with an oversubscription privilege to ensure profits are earned.D. company with an alternative avenue of sale to ensure success of the rights offering.E. investment bankers with an added syndication for the rights offering.40. Professor Clifford W. Smith, in evaluating issuance costs from underwritten issues, rights issues with standby underwriting, and a pure rights issues, found that 90% of the issues are underwritten, which was the most expensive method. This is done because:A. investment bankers know more than CFOs and they may buy the issue at an agreed upon price and disburse the funds sooner.B. investment bankers can increase the price received by increasing confidence in the issue, and they will buy the issue at an agreed upon price and disburse the cash sooner.C. investment bankers provide other services including price counseling, increasing public confidence, and providing funds to the issuer sooner.D. investment bankers know how to price the issue, and would not need to set as low as a price as the subscription price and provide price counseling.E. None of the above.41. Corporations use the shelf registration method of security sales because:A. preregistered securities can be quickly brought to market.B. the main registration process is eliminated for up to two years.C. their stock is below investment grade.D. Both A and B.E. Both B and C.42. In terms of costs of issuing equity, Professor Clifford W. Smith finds that the ranking of methods, from cheapest to most expensive, is:A. rights issue with standby underwriting, equity issue with underwriting, pure rights issue.B. pure rights issue, rights issue with standby underwriting, equity issue with underwriting.C. pure rights issue, preferred stock and debt issue with underwriting for an IPO, rights issue with standby underwriting.D. equity issue with underwriting, rights issue with standby underwriting, pure rights issue.E. equity issue with underwriting, pure rights issue, rights issue with standby underwriting.43. Arguments to explain why most equity issues are underwritten versus sold through a rights offering are:A. underwriters buy at an agreed upon price and bear some risk of selling the issue.B. cash proceeds are available sooner in underwriting and the issue is available to a wider market.C. investment bankers can provide market advice and certify the issue for potential investors.D. All of the above.E. None of the above.44. Corporations are allowed to use the shelf registration method if they:A. are rated investment grade and have aggregate market stock value of more than $150 million.B. have not violated the 1934 Securities Act in the past 12 months.C. have not defaulted on its debt in the past 3 years.D. All of the above.E. None of the above.45. Arguments against the use of the shelf-registration are:A. only technology and manufacturing-based firms can use it.B. less current information available to investors might raise the cost of debt.C. possible market overhang from future issues depressing price.D. Both A and C.E. Both B and C.46. The market for venture capital refers to the:A. private financial marketplace for servicing small, young firms.B. bond markets.C. market for selling rights to individuals who already own shares.D. market for selling equity securities for firms with equity already outstanding.E. None of the above.47. Rule 144A provides the framework for the issuance of private securities to qualified institutional investors. To buy private securities, institutional investors:A. must be willing to hold a less liquid security and manage a fund.B. must be willing to make a market in the security and be a primary market dealer.C. must be a limited partner in the issue and willing to reduce the illiquidity of the security.D. must be willing to hold a less liquid security and have $100 million under management.E. None of the above.48. Venture capitalists provide financing for new firms from the seed and start-up stage all the way to mezzanine and bridge financing. In exchange for financing, entrepreneurs give:A. a high interest rate debt instrument and control.B. an equity position and usually board of director positions.C. up the right to have an initial public offering.D. control to a court appointed trustee.E. the venture capitalists jobs as CEOs and CFOs.49. An IPO of a firm formerly financed by venture capital is carried out for what primary purposes?A. Insiders can sell their shares or cash outB. Generate cash to pay down bank indebtednessC. To establish a market value for the equity and provide funds for operationsD. All of the above.E. None of the above.50. Which of the following is not one of the four main functions that underwriters provide?A. Risk bearingB. MarketingC. Auditing the financial statementsD. CertificationE. Monitoring51. Types of dilution include:A. dilution of percentage ownershipB. dilution of market shareC. dilution of book value and earnings per shareD. A and CE. All of the above52. The Wordsmith Corporation has 10,000 shares outstanding at $30 each. They expect to raise $150,000 by a rights offering with a subscription price of $25. How many rights must you turn in to get a new share?A. 0.60B. 1.20C. 1.67D. 2.00E. Insufficient data to determine53. Assuming everything else is constant, if a stock's old price is $25 and the ex-rights or new stock price is $19, then the value of the right is:A. $-6.B. $6.C. impossible to determine without the subscription price.D. impossible to determine without the number of rights needed to buy one share.54. The LaPorte Corporation has a new rights offering that allows you to buy one share of stock with 3 rights and $20 per share. The stock is now selling ex-rights for $26. The price rights-on is:A. $22.00B. $24.00C. $26.00D. $28.00E. impossible to determine without the cum-rights price.55. Regional Power wants to raise $10 million in new equity. The subscription price is $20. There are currently 3 million shares outstanding, each with 1 right. How many rights are needed to purchase 1 share?A. 1B. 3C. 5D. 6E. 856. The Overland Corporation intends to issue 50,000 new shares to raise funds for expansion of current plant facilities. The current share price is $40 and there are 500,000 shares outstanding. The number of rights needed to buy a share of stock should be:A. 1B. 10C. 40D. 400E. indeterminate without the subscription price.57. The Schroeder Corporation has 20,000 shares outstanding at $20 each. They expect to raise $200,000 by a rights offering with a subscription price of $25. How many rights must you turn in to get a new share?A. 1.25B. 1.50C. 2.00D. 2.50E. Insufficient data to determine58. Assuming everything else is constant, if a stock's old price is $40 and the ex-rights or new stock price is $32, then the value of the right is:A. $-8.B. $8.C. impossible to determine without the subscription price.D. impossible to determine without the number of rights needed to buy one share.59. The Holly Corporation has a new rights offering that allows you to buy one share of stock with 4 rights and $25 per share. The stock is now selling ex-rights for $30. The price rights-on is:A. $21.00B. $25.00C. $30.00D. $31.25E. impossible to determine without the cum-rights price.60. Bradley Power wants to raise $40 million in new equity. The subscription price is $25. There are currently 5 million shares outstanding, each with 1 right. How many rights are needed to purchase 1 share?A. 1.000B. 3.000C. 3.125D. 4.525E. 6.52561. The Shields Corporation intends to issue 100,000 new shares to raise funds for expansion of current plant facilities. The current share price is $20 and there are 500,000 shares outstanding. The number of rights needed to buy a share of stock should be:A. 1B. 5C. 20D. 50E. indeterminate without the subscription price.62. For a particular stock the old stock price is $20, the ex-rights price is $15, and the number of rights needed to buy a new share is 2. Assuming everything else constant, the subscription price is ______ .A. $5B. $13C. $17D. $18E. $20Essay QuestionsThe Holyoke Corporation has 120,000 shares outstanding with a current market price of $8.10 per share. The company needs to raise an additional $36,000 to finance new expenditures, and has decided on a rights issue. The issue will allow current stockholders to purchase one additional share for 20 rights at a subscription price of $6 per share.63. Calculate the ex-rights price that would make a new stockholder indifferent between buying shares at the old stock price and exercising the rights or buying the shares ex-rights.64. If the ex-rights price were set at $7.90, would you as a potential new stockholder choose to buy shares ex-rights or buy shares at the old price and exercise your rights?65. Suppose that the company was also considering structuring the rights issue to allow for an additional share to be purchased for 10 rights at a subscription price of $3. Prove that a stockholder with 100 shares would be indifferent between purchasing a new share for 10 rights at $3 or purchasing a new share for 20 rights at $6.66. Explain the advantages of a shelf-registration to an issuer. How can timeliness of disclosure and a potential market overhang work against a shelf-registration?67. The evidence on IPO sales is varied from issue to issue, but there are three common themes; underpricing, underperformance, and the reasons for going public. Explain these three themes.68. The Direct Interactive Publishing Company is planning to raise $200 million dollars in new capital. There are currently 50 million shares outstanding with an estimated market price of $60 each. The corporate officers are debating whether to use a rights offering (with or without a standby underwriting) or have the issue fully underwritten. The company is currently listed on a regional exchange and plans to list on a national exchange after the security issue. List and explain three advantages/disadvantages of each method.69. Discuss what a Dutch auction is and how it works.70. Lamar Inc. is attempting to raise $5,000,000 in new equity with a rights offering. The subscription price will be $40 per share. The stock currently sells for $50 per share and there are 250,000 shares outstanding. How many rights are needed to buy a new share?71. Lamar Inc. is attempting to raise $5,000,000 in new equity with a rights offering. The subscription price for the 125,000 new shares will be $40 per share. The stock currently sells for $50 per share and there are 250,000 shares outstanding. What will the price per share be if all rights are exercised?Chapter 20 Issuing Securities to the Public Answer KeyMultiple Choice Questions1. An equity issue sold directly to the public is called:A. a rights offer.B. a general cash offer.C. a restricted placement.D. a fully funded sales.E. a standard call issue.Difficulty level: EasyTopic: EQUITY ISSUEType: DEFINITIONS2. An equity issue sold to the firm's existing stockholders is called:A. a rights offer.B. a general cash offer.C. a private placement.D. an underpriced issue.E. an investment banker's issue.Difficulty level: EasyTopic: RIGHTS OFFERType: DEFINITIONS3. Management's first step in any issue of securities to the public is:A. to file a registration form with the SEC.B. to distribute copies of the preliminary prospectus.C. to distribute copies of the final prospectus.D. to obtain approval from the board of directors.E. to prepare the tombstone advertisement.Difficulty level: EasyTopic: SECURITY ISSUANCEType: DEFINITIONS4. A rights offering is:A. the issuing of options on shares to the general public to acquire stock.B. the issuing of an option directly to the existing shareholders to acquire stock.C. the issuing of proxies which are used by shareholders to exercise their voting rights.D. strictly a public market claim on the company which can be traded on an exchange.E. the awarding of special perquisites to management.Difficulty level: MediumTopic: RIGHTS OFFERINGType: DEFINITIONS5. Companies use tombstone advertisements in the financial press to:A. announce the death of the company.B. announce the failure of a financial strategy.C. announce the availability of a new issue of a corporate security.D. notify the public of foreclosure.E. None of the above.Difficulty level: EasyTopic: NEW ISSUANCEType: DEFINITIONS6. The first public equity issue made by a company is a(n):A. initial private offering.B. initial public offering.C. secondary offering.D. seasoned new issue.E. None of the above.Difficulty level: EasyTopic: INITIAL PUBLIC OFFERINGType: DEFINITIONS7. The first public equity issue that is made by a company is referred to as:A. a rights issue.B. a general cash offer.C. an initial public offering.D. an unseasoned issue.E. Both C and D.Difficulty level: MediumTopic: INITIAL PUBLIC OFFERINGType: DEFINITIONS8. A new public equity issue from a company with equity previously outstanding is called a(n):A. initial public offering.B. seasoned equity issue.C. unseasoned equity issue.D. private placement.E. syndicate.Difficulty level: EasyTopic: SEASONED EQUITY OFFERINGType: DEFINITIONS9. The green shoe option is used to:A. cover oversubscription.B. cover excess demand.C. provide additional reward to the investment bankers for a risky issue.D. provide additional reward to the issuing firm for a risky issue.E. Both A and B.Difficulty level: MediumTopic: GREEN SHOE PROVISIONType: DEFINITIONS。