《国际经济学》讲义+答案Chapter4

- 格式:doc

- 大小:901.50 KB

- 文档页数:11

国际经济学克鲁格曼课后习题答案章集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?6.答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

7.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

8.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

第一章练习与思考参考答案1.答:生产可能性曲线相同且为直线。

在自给自足经济下,各国将在生产可能性曲线与其社会无差异曲线的切点,E A 和E B 上达到均衡。

需求条件的不同导致了各国在自给自足经济下的生产与消费的不同选择,但这些不同并不会引起两国之间相对价格的差异,两国的国内价格水平是相同的。

因此,不存在着贸易的基础。

2.答:因为,相对价格使得国际贸易成了物物交换的世界,消除了货币幻觉。

3.答:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

小国福利改善程度更明显些。

4.答:(1)在没有国际贸易的情况下,均衡要求国内需求数量与国内供给数量相等。

设两个方程相等,我们可以求出没有贸易情况下的均衡价格。

无贸易情况下的均衡价格为100,均衡数量为300。

(2)当价格为120时,A 国的需求数量为290,它的供给数量为400。

在自由贸易条件下,A 国将出口110个单位的产品。

(3)A 国的消费者剩余将减少。

在无贸易情况下,由需求曲线与数值为100的价格线围成的是一个更大的三角形。

在自由贸易情况下,由需求曲线与数值为120的价格线围成的是一个更小的三角形。

A 国的生产者剩余将增加。

在无贸易情况下,由供给曲线与数值为100的价格线围成的是一个更小的小三角形。

在自由贸易情况下,由供给曲线与数值为120的价格线围成的是一个更大的三角形。

整个国家从贸易中获得的净收益为生产者剩余的增加量与消费者剩余的减少量之差。

这一收益的大小等于一个三角形的面积:它的底边是产品贸易数量(110),它的高是价格的变化量(120-100=20)。

因此,总收益为1100。

5.答:他们的损失为,继续在国内销售480亿立方米木材价值的损失,加上少销售的40亿立方米木材价值总量的损失。

两者相加,共损失25亿美元。

6.答:(1)在自由贸易及每桶18美元价格下,国内生产数量Q S 为18=0.6+6Q S ,或Q S =29亿桶。

国内消费数量18=42-4Q D ,或Q D =60亿桶。

CHAPTER 4RESOURCES AND TRADE: THE HECKSCHER-OHLIN MODEL Chapter OrganizationA Model of a Two-Factor EconomyAssumptions of the ModelFactor Prices and Goods PricesResources and OutputEffects of International Trade Between Two-Factor EconomiesRelative Prices and the Pattern of TradeTrade and the Distribution of IncomeFactor Price EqualizationCase Study: North-South Trade and Income InequalityEmpirical Evidence on the Heckscher-Ohlin ModelTesting the Heckscher-Ohlin ModelImplications of the TestsSummaryAppendix: Factor Prices, Goods Prices and Input ChoicesChoice of TechniqueGoods Prices and Factor PricesCHAPTER OVERVIEWIn Chapter 2, trade between nations was motivated by differences internationally in the relative productivity of workers when producing a range of products. In Chapter 3, labor was no longer the only factor used in production. Specific though immobile factors of production were introduced and some distributional effects of alterations in sector specific factors and prices were discussed. In Chapter 4, this analysis goes a step further by introducing the Heckscher-Ohlin theory.In Chapter 4, the Heckscher-Ohlin theory considers the pattern of production and trade which will arise when countries have different endowments of factors of production, such as labor,capital, and land. The basic point is that countries tend to export goods that are intensive in the factors with which they are abundantly supplied. Trade has strong effects on the relative earnings of resources, and tends to lead to equalization across countries of prices of the factors of production. These theoretical results and related empirical findings are presented in this chapter.The chapter begins by developing a general equilibrium model of an economy with two goods which are each produced using two factors according to fixed coefficient production functions. The assumption of fixed coefficient production functions provides an unambiguous ranking of goods in terms of factor intensities. (The appendix develops the model when the production functions have variable coefficients.) Two important results are derived using this model. The first is known as the Rybczynski effect. Increasing the relative supply of one factor, holding relative goods prices constant, leads to a biased expansion of production possibilities favoring the relative supply of the good which uses that factor intensively.The second key result is known as the Stolper-Samuelson effect. Increasing the relative price of a good, holding factor supplies constant, increases the return to the factor used intensively in the production of that good by more than the price increase, while lowering the return to the other factor. This result has important income distribution implications.It can be quite instructive to think of the effects of demographic/ labor force changes on the supply of different products. For example, how might the pattern of production during the productive years of the "Baby Boom" generation differ from the pattern of production for post Baby Boom generations. What does this imply for returns to factors and relative price behavior?The central message concerning trade patterns of the Heckscher-Ohlin theory is that countries tend to export goods whose production is intensive in factors with which they are relatively abundantly endowed. This is demonstrated by showing that, using the relative supply and relative demand analysis introduced in Chapter 2, the country relatively abundantly endowed with a certain factor will produce that factor more cheaply than the other country. International trade leads to a convergence of goods prices. Thus, the results from the Stolper-Samuelson Theory demonstrate that owners of a country's abundant factors gain from trade but owners of a country's scarce factors lose. The extension of this result is the important Factor Price Equalization Theorem, which states that trade in (and thus priceequalization of) goods leads to an equalization in the rewards to factors across countries. The political implications of factor price equalization should be interesting to students.Empirical results concerning the Heckscher-Ohlin theory, beginning with the Leontief paradox and extending to current research, do not support its predictions concerning resource endowments explaining patterns of trade. This observation has motivated many economists to consider motives for trade between nations that are not exclusively based on differences across countries. These concepts will be explored in later chapters. Despite these shortcomings, important and relevant results concerning income distribution are obtained from the Heckscher-Ohlin theory.ANSWERS TO TEXTBOOK PROBLEMS1. The definition of cattle growing as land intensive depends on the ratio of land to laborused in production, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries too if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. Comparisons between another country and the United States is less relevant for this purpose.2. a. The box diagram has 600 as the length of two sides (representing labor) and 60 as thelength of the other two sides (representing land). There will be a ray from each of the two corners representing the origins. To find the slopes of these rays we use the information from the question concerning the ratios of the production coefficients.The question states that a LC / a TC = 20 and a LF / a TF = 5.a LC / a TC = (L C /Q C) / (T C /Q C) =L C /T C we have L C =20T C. Using the sameSincereasoning, a LF / a TF = (L F /Q F) / (T F /Q F) =L F /T F and since this ratio equals 5, we L F =5T F. We can solve this algebraically since L=L C+L F=600 and T=T C+T F=60. haveThe solution is L C=400, T C=20, L F=200 and T F=40.b. The dimensions of the box change with each increase in available labor but the slopesof the rays from the origins remain the same. The solutions in the different cases are as follows.L=800: T C=33.33, L C=666.67, T F=26.67, L F=133.33T C=46.67, L C=933.33, T F=13.33, L F=66.67L=1000:T C=60, L C=1200, T F=0, L F=0. (complete specialization).L=1200:c. At constant factor prices, some labor would be unused, so factor prices would have tochange, or there would be unemployment.3. This question is similar to an issue discussed in Chapter 2. What matters is not theabsolute abundance of factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries. 4. In the Ricardian model, labor gains from trade through an increase in its purchasingpower. This result does not support labor union demands for limits on imports from less affluent countries. Labor may gain or lose from trade in the context of the Immobile Factors model. Purchasing power in terms of one good will rise, but in terms of the other good it will decline. The Heckscher-Ohlin model directly addresses distribution by considering the effects of trade on the owners of factors of production.In the context of this model, unskilled U.S. labor loses from trade since this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits.5. Conditions necessary for factor price equalization include both countries (or regions)produce both goods, both countries have the same technology of production, and the absence of barriers to trade. The difference between wages different regions of the United States may reflect all of these reasons; however, the barriers to trade are purely "natural" barriers due to transportation costs. U.S. trade with Mexico, by contrast, is also subject to legal limits; together with cultural differences that inhibit the flow of technology, this may explain why the difference in wage rates is so much larger.6. The factor proportions theory states that countries export those goods whoseproduction is intensive in factors with which they are abundantly endowed. One would expect the United States, which has a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods. Bowen, Leamer and Sveikauskas found for the world as a whole the correlation between factor endowment and trade patterns to be tenuous. The data do not support the predictions of the theory that countries' exports and imports reflect the relative endowments of factors.7. If the efficiency of the factors of production differ internationally, the lessons of theHeckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be more successful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled worker could earn twice what lower skilled workers do and the price of one effective unit of labor would still be equalized.FURTHER READINGSAlan Deardorff. "Testing Trade Theories and Predicting Trade Flows." in Ronald W. Jones and Peter B. Kenen, eds. Handbook of International Economics. vol. 1 Amsterdam: North-Holland, 1984.Ronald W. Jones. "Factor Proportions and the Heckscher-Ohlin Theorem." Review of Economic Studies 24 (1956) pp. 1-10.Ronald W. Jones. "The Structure of Simple General Equilibrium Models." Journal of Political Economy 73 (1965) pp.557-572.Ronald W. Jones and J. Peter Neary. "The Positive Theory of International Trade." in Ronald W. Jones and Peter B. Kenen, eds. Handbook of International Economics. vol. 1 Amsterdam: North-Holland, 1984.Bertil Ohlin. Interregional and International Trade. Cambridge: Harvard University Press, 1933.Robert Reich. The Work of Nations. New York: Basic Books, 1991.Paul Samuelson. "International Trade and the Equalization of Factor Prices." Economic Journal 58 (1948) pp.163-184.Paul Samuelson. "International Factor Price Equalization Once Again." Economic Journal 59 (1949) pp.181-196.。

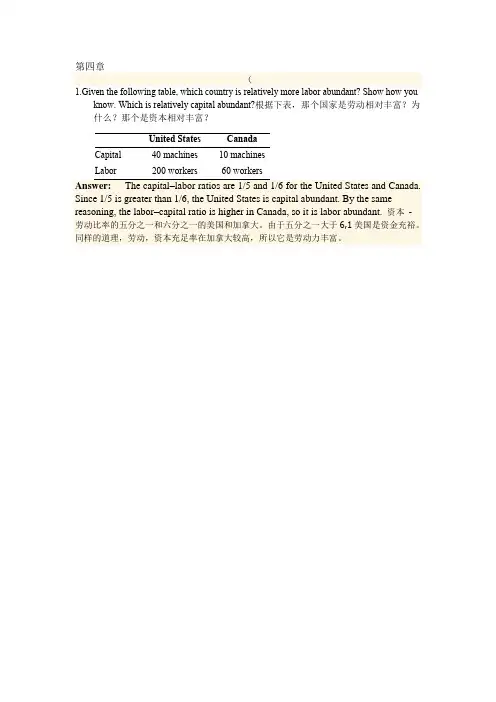

第四章(1.Given the following table, which country is relatively more labor abundant? Show how youknow. Which is relatively capital abundant?根据下表,那个国家是劳动相对丰富?为什么?那个是资本相对丰富?United States CanadaCapital 40 machines 10 machinesLabor 200 workers 60 workers2. Suppose that the United States and Canada have the factor endowments given in thetable in Question 1. Suppose further that the production requirements for a unit of steel is two machines and eight workers, and the requirement for a unit of bread is onemachine and eight workers.假设美国和加拿大在表中问题1给出的要素禀赋进一步假设生产要求对钢铁的单位是两台机器和八名工人,和面包一个单位的要求是一台机器,八工人。

a. Which good, bread or steel, is relatively intensive in the use of capital? In labor?Show how you know.b. Which country would export bread? Why?Answers:a. The capital–labor ratio to make steel is 1/4; to make bread it is 1/8. Hence steel ismore capital intensive and bread is more labor intensive.资本- 劳动比率,使钢的四分之一;做面包是八分之一。

international(国际经济学)课后习题及答案----------------------- Page 1-----------------------Review Questions and Condensed Answers forInternational Trade TheoriesChapter 1 World Trade and the National EconomyReview Questions::::1( What features distinguish international from domestic transactions?2( What can you say about the growth of world trade in both nominal and real terms? Was itfaster than the growth of output?3( Evaluate the statement,” the United States is a closed economy, hence foreign trade is ofno consequence to it.”4( Distinguish between export industries, import-competing industries and nontraded goods.Give examples of each.5( Using the figure in table 1-3, what can you say about the trade structure of the USA andJapan.Condensed Answers to Review Questions::::1. The text discusses ways that international transactions differfrom domestic ones.i. International trade requires that transactions be conductedbetween twocurrencies mediated by an exchange rate. Domestic transactions are conductedin a single currency.ii. Commercial policies that operate to restrict international transactions cannot, ingeneral, be imposed on domestic trade. Such policies include tariffs, quotas,voluntary export restraints, export subsidies, and exchange controls.iii. Countries pursue different domestic macroeconomic policieswhich result indivergent rates of economic growth, inflation, and unemployment.iv. More statistical data exist on the nature, volume, and value of internationaltransactions than exist in domestic trade.v. Factors of production are more mobile domestically than internationally.vi. Countries exhibit different demand patterns, sales techniques,and marketingrequirements. Many of these are due to culture and custom. Someresult fromdifferences in government regulations. Included here are health, safety,environmental, and technical rules.2. The real volume of world exports grew at an annual rate of more than 6 percent between1950 and 2000. Global output grew at an annual rate of 4 percent. Export growth inexcess of output growth reflects the increased openness to trade of many countries.3. The United States is a relatively closed economy since the share of trade in GDP issmaller than that of most other industrial nations. In 2000, U.S. exports of goods andservices were 11 percent of GDP. The U.S. economy is less dependent on the foreignsector than other major economies, but to say that foreign trade is of no consequence is anexaggeration. The U.S. economy has become increasingly open and, therefore, moreimpacted by trade developments over time. This trend is likely to continue. Curtailingimports would, for example, have a big effect on consumers' ability to buy some goods----------------------- Page 2-----------------------(e.g. tropical products) and would raise the prices of others. The absence of certain keycommodities and material inputs would greatly disrupt areas of U.S. industry.4. a. Export industries send a substantial share of their output abroad. Ratios ofexports to GDP are much higher than the average ratio for all industries. Netexporting industries are those for which exports exceed imports. U.S. netexporting industries include farm products, chemicals, certain types of machinery,and aerospace products.b. Import-competing industries are domestic industries that sharethe domesticmarket with a substantial import presence. These activities haveratios ofimports to GDP that are much higher than the average ratio for all industries.U.S. import-competing industries include fuels, automobiles,clothing, footwear,and iron and steel.c. Nontraded goods are those which, because of their nature and characteristics, arenot easily exported or imported. Examples are hair-dressing, movie theaters,meals, construction activity, and health-care.5. Table 1.3 contains figures on the trade structure of the U.S. and Japan. The U.S. is a netexporter of food, certain ores, chemicals, and other machinery and transport equipment,and is a net importer of raw materials, mining products, fuels, nonferrous metals, iron andsteel, semimanufactures, office and telecommunications equipment, automotive products,textiles and clothing, and other consumer goods. Japan is a net exporter of iron and steel,chemicals, semimanufactures, office and telecommunications equipment, automotiveproducts, other machinery and transport equipment, and other consumer goods. Importsexceed exports in food, raw materials, and textiles and clothing.----------------------- Page 3-----------------------Chapter 2 Why Nations TradeReview Questions::::1( a. In what sense are the cost data of footnote 4 related to the figures of scheme 1?b. Based on the figures of footnote 4, determine the:Direction of trade once it develops.Limits to mutually beneficial trade.Limits to a sustainable exchange trade.2. Evaluate the following statements:a. In international trade, domestic cost ratios determine the limits of mutually beneficial trade,whereas demand considerations show where, within these limits, the actual exchange ratio will lie.b. Comparative advantage is a theoretical concept. It cannot be used to explain any real-worldphenomena.c. The opening up of trade raises the price of export goods; hence trade is inflationary.d. The concept of absolute advantage offers explainations for East Germany’s high unemploymentrates in the 1990s.3. a. Use the theory of comparative advantage to explain why it pays for:The USA to export grains and import oil.Russia to export oil and import grains.b. Why does the popular press believe that grain exports are inflnationary? What is wrongwith this porposition?Condensed Answers to Review Questions:1. a. Scheme 1 is based on labor productivity comparisons, while Footnote 4presentsper unit cost data. Production cost ratios are inversely related to productivitymeasures.b. i. Textiles will be exported from the U.K. and wheat from the U.S.ii. The U.S. will trade only if one yard of textiles costs less than3 bushels ofwheat. The U.K. will trade only if 1 yard of textiles can be exchangedfor more than 2 bushels of wheat.iii. The value of the ? must be between $1 and $1.502. a. Consider Figure 2.2. The domestic cost ratios define limits of mutually beneficialtrade. Within the region of mutually beneficial trade the actual exchange rate willbe determined by the relative intensity of each country's demand for the othercountry's product. A full analysis requires an understanding of reciprocal demandcurves, but the following general principle might help heuristically. If the Britishare more eager to buy U.S. wheat than the Americans are eager for British textiles,the exchange ratio falls close to the U.K. domestic cost ratio and the U.S. can beviewed as capturing a greater share of the gains from trade.b. Since the real world does not conform to the convenienttwo-country, two-goodassumptions, the simple theoretical model is not immediately applicable.However, we can generalize the model to many goods and many nations. Thefundamental truth remains. Countries export those goods in which their relativeproduction costs are lower and import those goods for which the relative costs arehigher.----------------------- Page 4-----------------------c. While trade tends to raise the prices of exportables in the domestic economy, theeffect of trade is to lower the average price level of all goods. Trade givesconsumers an opportunity to consume at lower world prices. Many goods will becheaper when purchased from foreign supply sources. Trade also conveysprocompetitive effects, stimulates the adoption of new technologies, and allowsfirms to achieve efficient scale production levels. Thus, trade is anti-inflationary.d. The reunification of the Germany economy in 1990 was undertaken on the basisthat a unit of the deutschmark, the West German currency, should be equal in valueto a unit of the ostmark, the East German currency. At this exchange rate, goodsproduced in East Germany were almost universally more expensive to producethan their counterparts in the West. Labor productivity in East Germanmanufacturing was found to be about 35% of the West German level. Underthese conditions the East German manufacturing sector collapsed. Investors werereluctant to purchase East German factories and large scale closures and dismissalsresulted.3. a. The U.S. enjoys a comparative advantage in grains. It also produces oil, but will gain byspecializing in grain production and using proceeds of exported agriculturalproducts to purchase oil from nations that produce oil relatively more efficiently.Russia is relatively more efficient in the production of oil and will gain bypurchasing grain from the U.S. in exchange for oil.b. The popular press asserts that by exporting grain from the U.S. (say to the former U R)we are lowering the domestic supply of grain and raising the domestic U.S. price of grain. Sincegrain is an important ingredient in many food products, grain exports are believed to increase theprice of those products. However, the price of grain is determined in world markets. U.S.exports alone cannot permanently raise the domestic U.S. price. If the domestic U.S. grainpricerose above the world price, the U.S. would be a net importer of grains and the domestic price wouldfall.----------------------- Page 5-----------------------Chapter 3 The Commodity Composition of TradeReview Questions::::1( Does the factor proportions theory provide a good explanation of intraindustry trade? Ifnot, can you outline an alternative explaination for the growing phenomenon?2( Explain the dynamic nature of comparative advantage using Japan’s experience as anexample.3( Once the United States acquires a comparative advantage in jet aircraft production it canbe sure of a dominant position in the global market forever. Do you agree with thisstatement? Explain.Condensed Answers to Review Questions1. The factor proportions theory is better suited to explain interindustry trade, or the exchangebetween countries of totally different commodities, than intraindustry trade, which is thetwo-way trade of similar commodities. The growth of intraindustry trade is greatest inimperfectly competitive industries characterized by economies of scale. Here, scaleeconomies force firms in each industry to specialize in a narrow range of products withineach industry to achieve efficient scale operations. Intraindustry specialization combinedwith diverse consumer tastes gives rise to two-way trade within the same industryclassification.2. Japan's comparative advantage in the immediate post-war period was in labor intensivegoods. The high level of saving and investment transformed Japan into a relatively capitalabundant country. Its advantage in the labor-intensive industries was lost as wages rose.Moreover, Japan increased its technological capability through high spending on R&D.Now Japan's advantage lies in the production of high-tech, capital intensive goods similar tothe U.S. This in large part explains the increasing trade friction between the twocountries.3. Once the U.S. acquires a comparative advantage in jet aircraft, it is likely to enjoy a dominantposition in the global marketplace for years, but not forever. Jet aircraft production is characterizedby huge economies of scale due largely to research and development costs. High capitalrequirements and scale economies pose large entry barriers. It is extremely difficult for a countryto enter into aircraft production once the U.S. has the lead. The new firm would initially have asmall market share and would be unable to compete on a cost basis. The new market entrant wouldrequire considerable government support and encouragement. This was the case with the EuropeanAirbus.----------------------- Page 6-----------------------Chapter 4 Protection of Domestic Industries: The TariffReview Questions::::1( A tariff on textiles is equivalent to a tax on consumers and a subsidy to the textileproducers and workers.2( Explain the concept of effective rate of protection.a. What does the effective rate on final goods depend upon and how?b. In what way does the effective rate analysis help to illuminate these policy issues:Deepening of production in LDCsEscalation of tariff rates by degree of processing in industrial countries3. A tariff lowers the real income of the country, while at the same time it distributes income fromconsumers to the governments and to the import-competing industry.Condensed Answers to Review Questions:1. The effect of a tariff is comparable to the combined effects of a tax on consumers and a subsidy toproducers. Using Figure 4.3, one can show a tariff results in a transfer of resources from theconsumers (who lose P P fd ) to the producers (who gain P P ec). With a non-prohibitive tariff, the2 3 2 3government will also gain revenue efmn. Whether the two schemes are equivalent depends on theexact nature of the tax and subsidy scheme.2. a. The effective rate of protection measures the percentage increase in domesticvalue added per unit of output made possible by tariffs on the output and onmaterial inputs. Determinants of the effective rate include thetariff on the finalproduct, tariffs on the imported material inputs, and the free trade value added perunit of output which is influenced by intermediate input coefficients. Effectiverates are positively related to the tariff on the final product and negatively related toboth tariffs on imported inputs and the free trade value added. A derivation ofthe formula appears in footnote 10, and footnote 12 interprets that formula.b. "Deepening" of production in LDCs involves import substitution industrializationpolicy. A final assembly plant is given a protective tariff and imported inputs areaccorded duty free treatment. As a second stage, the LDC begins to deepenproduction by manufacturing inputs and according them protection. By imposingtariffs on imported inputs, the LDC is reducing effective protection for the finalgood.Because of relatively high rates of protection on finished goods and low protectionon unfinished goods and raw materials, effective tariff rates in developed countriesmay be as much as double their nominal counterparts. Developing countriesmaintain that such tariff structures fatally harm their efforts to increase exports offinished manufactures.3. Again using Figure4.3, the loss in real income is shown by triangles cen and mfd.Redistribution has been given in 8a.----------------------- Page 7-----------------------Chapter 5 Nontariff Barriers (NTBs) to TradeReview Question::::Suppose the USA steel industry is seeking protection from foreign imports. Compare andcontrast the following measures of restricting steel industries: a tariff, a quota, and voluntaryexport restraints.Condensed Answers to Review Question:There are a variety of ways in which a tariff may be considered to be less harmful than an equivalentquota:i. The revenue effect. Tariffs provide revenue. Quotas do not automatically providerevenue. Under a quota, revenue accrues to holders of import licenses.Depending on the quota scheme, licenses may be held by domestic importers, foreign exporters, foreign governments, or domestic officialswho may use them to encourage bribery. Only through auctioning or selling licenses can the government capture quota rents.ii. Performance under demand and supply changes. Any amount of imports can enterunder a tariff, but with a quota import volumes are fixed. When demandgrows, or there is a shortfall in supply, the quota does not permit a quantityadjustment. The domestic price can depart significantly from the worldprice. Under a tariff, the domestic price cannot rise above the worldprice by more than the tariff rate. Thus, a tariff is less harmful than aquota.iii. Impact on Exporters. When a tariff is levied on an imported good it is usually rebatedwhen the good is exported. The same is not true for a quota. Quotas maytherefore be more harmful to export performance.iv. Curbing monopoly power. Quotas curtail monopoly power less than an equivalent tariff.v. Terms of Trade Effects. Quotas provide no incentive for exporting nations to absorb partof the price increase; tariffs do if the exporting nation wishes to retainmarket share.vi. Quality Upgrading. Quotas give an incentive for the exporting country to engage in qualityupgrading. Ad valorem tariffs do not provide an incentive for this behavior but specific duties do.VERs share all of the undesirable effects of quotas. When the exporter does the restricting, there isno opportunity to sell import licenses. Quota rents accrue toforeign exporters orgovernments under a VER. Therefore, VERs are more costly to society than anequivalent quota with licenses sold or a tariff. Quantitative restrictions like VERsare discriminatory. VERs are also hard to monitor. Since shipments from thirdparty countries are unrestricted, transshipment throughnonrestricted countries is amajor problem. One advantage of VERs is they do not invite retaliation sincethey are profitable to foreign exporters and governments.Tariffs, quotas and VERs may be equivalent in terms of effects on the domestic price and thevolumeof imports. This may be shown using diagram 5-1. However, there are important differencesdiscussed in 1a. above.----------------------- Page 8-----------------------Chapter 6 International and Regional Trade Organizations Among Developed CountriesReview Questions::::1. Explain the following terms:Trade creation of a customs union.Trade diversion of a customs union.2.What are the conflicts between the WTO and the environmental movement?Condensed Answers to Review Questions:1. Trade creation refers to the replacement of high cost production in each member by importsfrom another member. This effect is favorable to world welfare. Tradediversion is the diversion of trade from a nonmember to a higher cost member.This is unfavorable because it reduces worldwide resource allocative efficiency(See Figure 4-8).The basic approach to calculating welfare effects associated with customs union formation is toconstruct hypothetical estimates of what member country trade patterns wouldhave been in the absence of integration, comparing these with actual trade flows,and attributing any difference to integration. Effects ofintegration can be isolatedby using trade flow data pertaining to nonmember "normalizer" countries over thesame period to suggest what trade patterns would have been expected for memberswithout integration. Assume, in the absence of integration, both total (internalplus external) and external member imports would have grown at the same rates asthe corresponding imports in the normalizer. The normalizer's external importsrefer to its imports from third countries (i.e. intra-trade is excluded). Thenormalizer's internal imports are imports of normalizer countries from each other(e.g. intra-trade). The preintegration member country total import level ismultiplied by the corresponding normalizer import growth rate to yield an estimateof hypothetical total imports without integration. When compared with actualtotal imports, an estimate of trade creation is obtained. Trade diversion isestimated by multiplying the member country preintegration external import levelby the normalizer's rate of change of external imports to yield hypothetical membercountry external imports. The excess of hypothetical over actual external importsconstitutes trade diversion. The European Union (EU) is a customs unioncomprised of 15 West European countries.2. WTO rules often conflict with both international environmental agreements and nationalenvironmental laws. For example, a 1991 GATT panel upheld a Mexican challenge to aU.S. law banning importation of tuna caught indolphin-killing purse-seine nets.GATT/WTO provisions are concerned with products and not production methods.----------------------- Page 9-----------------------Chapter 7 International Mobility of Productive FactorsReview Question::::What is the meaning of DFI? List some of the factors that induce companies to invest abroad.Condensed Answers to Review Question:Direct Foreign Investment refers to international capital movement that gives a company controlover a foreign subsidiary. It may be the purchase of an existing company, a substantial part of itsshares, or the establishment of a new enterprise. It should be contrasted with portfolio investmentthat gives, by and large, no control over foreign assets.The motives are diverse and any particular investment may involve one or more of the followingi. investment in extractive industries to secure raw material supplies;ii. investment in manufacturing industry to take advantage of cheaper foreign labor;iii. to locate production close to foreign markets and avoid transportation costs;iv. to take advantage of incentives offered by host countries;v. to circumvent tariff barriers;vi. changes in the exchange values of currencies; andvii. marketing considerations.。

*CHAPTER 4(Core Chapter)THE HECKSCHER-OHLIN AND OTHER TRADE THEORIESOUTLINE4.1 Introduction4.2 Factor Endowments and the Heckscher-Ohlin Theory4.3 The Formal Heckscher-Ohlin ModelCase Study 4-1 The Revealed Comparative Advantage of Various Countries and Regions4.4 Factor-Price Equalization and Income DistributionCase Study 4-2 Has International Trade Increased U.S. Wage Inequalities?4.5 Empirical Tests of the Heckscher-Ohlin Theory4.6 Economies of Scale and International TradeCase Study 4-3 The New International Economies of Scale4.7 Trade Based on Product DifferentiationCase Study 4-4 Growth of Intra-Industry Trade4.8 Technological Gap and Product Cycle ModelsCase Study 4-5: The United States as the Most Competitive Economy in the World4.9 Transportation Costs and International Trade4.10 Environmental Standards and International TradeAppendix The Specific-Factors Model and Intra-Industry Trade ModelsA4.1 The Specific-Factors ModelA4.2 A Model of Intra-Industry TradeKey TermsInternationalofscaleeconomies pricesRelativefactorproducts Heckscher–Ohlin (H–O) theory DifferentiatedtradeIntra-industryHeckscher–Ohlintheorem(H–O)Factor-proportions or factor-endowment theory Technological gap modelcyclemodelProductFactor–price equalization theoremcostsTransportationStolper-Samuelsontheoremmodel Nontraded goods and services Specific-factorsparadox Environmental standardsLeontiefMonopolisticcompetitionscalereturnsIncreasingtoLecture Guide1. This is one of the most important and difficult chapters in the book. It is also a long chapter andrequires four lectures to cover adequately.2. In the first lecture, I would cover sections 1-3. Section 3 is one of the most important sections inthe book because it presents the H-O model. I would proceed slowly and carefully in explaining Figure 4.1 and compare it to the standard trade model of Figure 3.4.3. In the second lecture, I would cover sections 4 and 5. Section 4 on the factor-price equalizationtheorem and income distribution is a difficult section. Case Study 4-2 should be of great interest to the students and give rise to a great deal of class discussion.4. In third lecture, I would cover sections sections 6-7, paying a great deal of attention to section 7on trade in differentiated products.5. In fourth lecture, I would cover the rest of the chapter.Answers to Review Questions and Problems1. a. The Heckscher–Ohlin (H-0) theorem postulates that a nation will export those commodi- ties whose production requires the intensive use of the nation’s relatively abundant and cheap factor and import the commodities whose production requires the intensive useof the nation’s relatively scarce and expensive factor. In short, the relatively labor-richnation exports relatively labor-intensive commodities and imports the relativelycapital-intensive commodities.b. Heckscher and Ohlin identify the relative difference in factor endowments amongnations as the basic determinant of comparative advantage and international trade.c. The H-O Theory represent an extension of the standard trade model because it explains the basis for comparative advantage (classical economists, such as Ricardo had assumed it) and examines the effect of international trade on factor prices and income distribution (which classical economists had left unanswered).2. See Figure 1 on the next page.3. a. The factor–price equalization theorem postulates that international trade will bring about the equalization of the returns to homogeneous or identical factors across nations.b. The Stopler-Samuelson theorem postulates that free international trade reduces the realincome of the nation’s relatively scarce factor and increases the real income of the nation’s relatively abundant factor.Fig 4.1Fig 4.2XXb. The specific-factors model postulates that the opening of trade (1) benefits the specific factorused in the production of the nation’s export commodity, (2) harms the specific factor used in the production of the nation’s import-competing industry, and (3) leads to an ambiguouseffect (i.e., it may benefit or harm) the mobile factor.c. Trade acts as a substitute for the international mobility of factors of production in itseffect on factor prices. With perfect mobility, labor would migrate from the low-wagenation to the high-wage nation until wages in the two nations are equalized. Similarly,capital would move from the low-interest to the high-interest nation until the rate ofinterest was equalized in the two nations.4. a. The Leontief paradox refers to the original Leontief’s finding that U.S. import substituteswere more K-intensive than U.S. exports. This was the opposite of what the H-O theorempostulated.b. The Leontief paradox was resolved by including human capital into the calculations andexcluding industries based on natural resources. Recent research using data on many sectors, for many countries, over many years, and considering that countries could specialize in aparticular subset or group of commodities that were best suited to their specific factorendowments, provides strong support for the H-O theorem.c. The Hecksher-Olhin theory remains the centerpiece of modern trade theory for explaininginternational trade today. To be sure, there are other forces (such as economies of scale,product differentiation, and technological differences across countries) that provide additional reasons and explanations for some international trade not explained by the basic H-O model.These other trade theories complement the basic H-O model in explaining the pattern ofinternational trade in the world today.5. International trade with developing economies, especially newly industrializing economies (NIEs), contributed in two ways to increased wage inequalities between skilled and unskilled workers in the United States during the past two decades. Directly, by reducing the demand for unskilledworkers as a result of increased U.S. imports of labor-intensive manufactures and, indirectly, byspeeding up the introduction of labor-saving innovations, which further reduced the U.S.demand for unskilled workers. International trade, however, was only a small cause of increased wage inequalities in the United States. The most important cause was technological change.6. a. Economies of scale refer to the production situation where output grows proportionatelymore than the increase in inputs or factors of production. For example, output may morethan double with a doubling of inputs.b. Even if two nations were identical in every respect, there is still a basis for mutually bene-ficial trade based on economies of scale. When each nation specializes in the production of one commodity, the combined total world output of both commodities will be greater thanthan without specialization when economies of scale are present. With trade, each nationthen shares in these gains.c. The new international economies of scale refers to the increase in productivity resultingfrom firms purchasing parts and components from nations where they are made cheaperand better, and by establishing production facilities abroad-26-7. a. Product differentiation refers to products that are similar, but not identical. Intra-industrytrade refers to trade in differentiated products, as opposed to inter-industry trade incompletely different products.b. Intra-industry trade arises in order to take advantage of important economies of scale inproduction. That is, with intra-industry trade each firm or plant in industrial countries canspecialize in the production of only one, or at most a few, varieties and styles of the sameproduct rather than many different varieties and styles of a product and achieve economies of scale.c. With few varieties and styles, more specialized and faster machinery can be developedfor a continuous operation and a longer production run. The nation then imports othervarieties and styles from other nations. Intra-industry trade benefits consumers because ofthe wider range of choices (i.e., the greater variety of differentiated products) available atthe lower prices made possible by economies of scale in production.8. a. According to the technological gap model, a firm exports a new product until imitators incountries take away its market. In the meantime, the innovating firm will have introduced a new product or process.b. The criticism of the technological gap model are that it does not explain the size of techno- logical gaps and does not explore the reason for technological gaps arising in the first place, or exactly how they are eliminated over time.c. The five stages of the product cycle model are: the introduction of the product, expansion of production for export, standardization and beginning of production abroad through imitation, foreign imitators underselling the nation in third markets, and foreigners underselling theinnovating firms in their home market as well.9. See Figure 2 on page 25.10. A nation with lower environmental standards can use the environment as a resource endow-ment or as a factor of production in attracting polluting firms from abroad and achieving acomparative advantage in the production of polluting goods and services. This can lead totrade disputes with nations with more stringent environmental standards.-27-Multiple-Choice Questions1. The H-O model extends the classical trade model by:a. explaining the basis for comparative advantageb. examining the effect of trade on factor prices*c. both a and bd. neither a nor b2. A nation is said to have a relative abundance of K if it has a:a. greater absolute amount of Kb. smaller absolute amount of Lc. higher L/K ratio*d. lower price of K in relation to the price of L3. A difference in relative commodity prices between nations can be based on a difference in:a. technologyb. factor endowmentsc. tastes*d. all of the above4. In the H-O model, international trade is based mostly on a difference in:a. technology*b. factor endowmentsc. economies of scaled. tastes5. According to the H-O theory, trade reduces international differences in:a. commodity pricesb. in factor prices*c. both commodity and factor pricesd. neither relative nor absolute factor prices6. According to the Stolper-Samuelson theorem, international trade leads toa. reduction in the real income of the nation’s relatively abundant factor*b. reduction in the real income of the nation’s relatively scarce factorc. increase in the real income of the nation’s relatively scarce factord. none of the above7. Which of the following is false with regard to the specific factors theorem, international trade *a. harms the immobile factors that are specific to the nation’s export commodities or sectorsb. harms the immobile factors that are specific to the nation’s import-competing commoditiesc. has an ambiguous effect on the nation’s mobile factorsd. may benefit or harm the nation’s mobile factors8. Perfect international mobility of factors of productiona. leads to a reduction in international differences in the returns to homogenous factorsb. acts as a substitute for international trade in its effects on factor pricesc. operates on the supply of factors in affecting factor prices*d. all of the above9. The Leontief paradox refers to the empirical finding that U.S.*a. import substitutes were more K-intensive than exportsb. exports were more L-intensive than importsc. exports were more K-intensive than import substitutesd. all of the above10. From empirical studies, we conclude that the H-O theory:a. must be rejectedb. must be accepted without reservations*c. can generally be acceptedd. explains all international trade11. International trade can be based on economies of scale even if both nations have identical:a. factor endowmentsb. tastesc. technology*d. all of the above12. A great deal of international trade:a. is intra-industry tradeb. involves differentiated productsc. is based on monopolistic competition*d. all of the above13. Intra-industry trade takes place:a. because products are homogeneous*b. in order to take advantage of economies of scalec. because perfect competition is the prevalent form of market organizationd. all of the above14. Which of the following statements is true with regard to the product-cycle theory?a. it depends on differences in technological changes over time among countriesb. it depends on the opening and the closing of technological gaps among countriesc. it postulates that industrial countries export more advanced products to lessadvanced countries*d. all of the above15. Transport costs:a. increase the price in the importing countryb. reduces the price in the exporting countryc. falls less heavily on the nation with the more elastic demand and supply curves of the traded commodity*d. all of the above-30-ADDITIONAL ESSAYS AND PROBLEMS FOR PART ONE1. Assume that both the United States and Germany produce beef and computer chips with the following costs:United States Germany(dollars) (marks)Unit cost of beef (B) 2 8Unit cost of computer chips (C) 1 2(a) What is the opportunity cost of beef (B) and computer chips (C) in each country?(b) In which commodity does the United States have a comparative cost advantage?What about Germany?(c) What is the range for mutually beneficial trade between the United States and Germanyfor each computer chip traded?(b) How much would the United States and Germany gain if 1 unit of beef is exchangedfor 3 chips?Answ. (a) In the United States:the opportunity cost of one unit of beef is 2 chips;the opportunity cost of one chip is 1/2 unit of beef.In Germany:the opportunity cost of one unit of beef is 4 chips;the opportunity cost of one chip is 1/4 unit of beef.(b) The United States has a comparative cost advantage in beef with respect to Germany,while Germany has a comparative cost advantage in computer chips.(c) The range for mutually beneficial trade between the United States and Germany foreach unit of beef that the United States exports is2C < 1B < 4C(d) Both the United States and Germany would gain 1 chip for each unit of beef traded.2. Given: (1) two nations (1 and 2) which have the same technology but different factor costs conditions, and (3) no transportation costs, tariffs, or other obstructions to trade.Prove geometrically that mutually advantageous trade between the two nations is possible.Note: Your answer should show the autarky (no-trade) and free-trade points of production and consumption for each nation, the gains from trade of each nation, and express the equilibrium condition that should prevail when trade stops expanding.)Ans.: See the figure below.Fig 4.3Fig 4.4Nations 1 and 2 have different production possibilities curves and different community indifference maps. With these, they will usually end up with different relative commodity prices in autarky, thus making mutually beneficial trade possible.In the figure, Nation 1 produces and consumes at point A and Px/Py=P A in autarky, while Nation 2 produces and consumes at point A' and Px/Py=P A'. Since P A < P A', Nation 1 has a comparative advantage in X and Nation 2 in Y. Specialization in production proceeds until point B in Nation 1 and point B' in Nation 2, at which P B =P B' and the quantity supplied for export of each commodity exactly equals the quantity demanded for import.Thus, Nation 1 starts at point A in production and consumption in autarky, moves to point B in production, and by exchanging BC of X for CE of Y reaches point E in consumption. E > A since it involves more of both X and Y and lies on a higher community indifference curve.Nation 2 starts at A' in production and consumption in autarky, moves to point B' in production, and by exchanging B'C' of Y for C'E' of X reaches point E'in consumption (which exceeds A').At Px/Py=P B =P B', Nation 1 wants to export BC of X for CE of Y, while Nation 2 wants to export B'C' (=CE) of Y for C'E' (=BC) of X. Thus, P B =P B' is the equilibrium relative commodity price because it clears both (the X and Y) markets.3. (a) Identify the conditions that may give rise to trade between two nations. (b) What aresome of the assumptions on which the Heckscher-Ohlin theory is based? (c) What does this theory say about the pattern of trade and effect of trade on factor prices?Ans. (a) Trade can be based on a difference in factor endowments, technology, or tastesbetween two nations. A difference either in factor endowments or technology results in a different production possibilities frontier for each nation, which, unlessneutralized by a difference in tastes, leads to a difference in relative commodity price and mutually beneficial trade. If two nations face increasing costs and have identical production possibilities frontiers but different tastes, there will also be a differencein relative commodity prices and the basis for mutually beneficial trade between the two nations. The difference in relative commodity prices is then translated into adifference in absolute commodity prices between the two nations, which is the immediate cause of trade.(b) The Heckscher-Ohlin theory (sometimes referred to as the modern theory – asopposed to the classical theory - of international trade) assumes that nations have the same tastes, use the same technology, face constant returns to scale (i.e., a givenpercentage increase in all inputs increases output by the same percentage) but differ widely in factor endowments. It also says that in the face of identical tastes or demand conditions, this difference in factor endowments will result in a difference in relative factor prices between nations, which in turn leads to a difference in relativecommodity prices and trade. Thus, in the Heckscher-Ohlin theory, the internationaldifference in supply conditions alone determines the pattern of trade. To be noted is that the two nations need not be identical in other respects in order for internationaltrade to be based primarily on the difference in their factor endowments.(c) The Heckscher-Ohlin theorem postulates that each nation will export the commodityintensive in its relatively abundant and cheap factor and import the commodityintensive in its relatively scarce and expensive factor. As an important corollary, itadds that under highly restrictive assumptions, trade will completely eliminate thepretrade relative and absolute differences in the price of homogeneous factors amongnations. Under less restrictive and more usual conditions, however, trade will reduce, but not eliminate, the pretrade differences in relative and absolute factor prices among nations. In any event, the Heckscher-Ohlin theory does say something very useful onhow trade affects factor prices and the distribution of income in each nation. Classical economists were practically silent on this point.-33-4. Suppose that tastes change in Nation 1 (the L-abundant and L-cheap nation) so that consumers demand more of commodity X (the L-intensive commodity) and less of commodity Y (the K- intensive commodity). Suppose that Nation 1 is India, commodity X is textiles, and commodi- ty Y is food. Starting from the no-trade equilibrium position and using the Heckscher-Ohlinmodel, trace the effect of this change in tastes on India's (a) relative commodity prices anddemand for food and textiles, (b) production of both commodities and factor prices, and(c) comparative advantage and volume of trade. (d) Do you expect international trade to leadto the complete equalization of relative commodity and factor prices between India and theUnited States? Why?Ans. (a) The change in tastes can be visualized by a shift toward the textile axis in India'sindifference map in such a way that an indifference curve is tangent to the steepersegment of India's production frontier (because of increasing opportunity costs) after the increase in demand for textiles. This will cause the pretrade relative commodity price of textiles to rise in India.(b) The increase in the relative price of textiles will lead domestic producers in India toshift labor and capital from the production of food to the production of textiles. Since textiles are L-intensive in relation to food, the demand for labor and therefore the wage rate will rise in India. At the same time, as the demand for food falls, thedemand for and thus the price of capital will fall. With labor becoming relative more expensive, producers in India will substitute capital for labor in the production of both textiles and food.(c) Even with the rise in relative wages and in the relative price of textiles, India stillremains the L-abundant and low-wage nation with respect to a nation such as theUnited States. However, the pretrade difference in the relative price of textilesbetween India and the United States is now somewhat smaller than before the change in tastes in India. As a result the volume of trade required to equalize relativecommodity prices and hence factor prices is smaller than before. That is, India need now export a smaller quantity of textiles and import less food than before for therelative price of textiles in India and the United States to be equalized. Similarly, the gap between real wages and between India and the United States is now smaller and can be more quickly and easily closed (i.e., with a smaller volume of trade).(d) Since many of the assumptions required for the complete equalization of relativecommodity and factor prices do not hold in the real world, great differences can be expected and do in fact remain between real wages in India and the United States.Nevertheless, trade would tend to reduce these differences, and the H-O model does identify the forces that must be considered to analyze the effect of trade on thedifferences in the relative and absolute commodity and factor prices between Indiaand the United States.-34-5. (a) Explain why the Heckscher-Ohlin trade model needs to be extended. (b) Indicate in what important ways the Heckscher-Ohlin trade model can be extended. (c) Explain what ismeant by differentiated products and intra-industry trade.Ans. (a) The Heckscher-Ohlin trade model needs to be extended because, while generallycorrect, it fails to explain a significant portion of international trade, particularly the trade in manufactured products among industrial nations.(b) The international trade left unexplained by the basic Heckscher-Ohlin trade model canbe explained by (1) economies of scale, (2) intra-industry trade, and (3) trade based on imitation gaps and product differentiation.(c) Differentiated products refer to similar, but not identical, products (such as cars,typewriters, cigarettes, soaps, and so on) produced by the same industry or broadproduct group. Intra-industry trade refers to the international trade in differentiated products.-35-。

第4章资源、比较优势与收入分配一、概念题1.充裕要素(abundant factor)答:充裕要素是“稀缺要素”的对称,是指一国相对充裕的生产要素。

充裕要素的“充裕”是相对的,指的并不是一国所拥有的该生产要素的绝对数量的充裕,而是该生产要素相对于其他生产要素的相对充裕。

充裕要素是以资源禀赋解释国际贸易的赫克歇尔-俄林定理中的重要概念。

根据赫克歇尔-俄林定理,各国倾向于生产并出口国内充裕要素密集型的产品,一国充裕要素的所有者能够从国际贸易中获利。

2.要素价格(factor prices)答:要素价格即生产要素的价格,是指每一单位的生产要素在一定时期内给所有者带来的收入。

生产要素主要有四种:劳动力、土地、资本和企业家才能。

相应地,其价格分别称为工资、地租、利息和利润。

生产要素价格同产品的价格一样,主要是由生产要素市场上供求的相互作用决定的。

在市场经济中,工资主要由劳动力市场上的供求关系决定;地租主要由土地市场上的供求关系决定;利息主要由资本市场上的供求关系决定;利润作为企业家收入,主要由企业家市场上的供求关系决定。

3.生产可能性边界的偏向性扩张(biased expansion of production possibilities)答:生产可能性边界的偏向性扩张是指生产可能性边界在一个方向上扩张的幅度大于在另一方向上扩张的幅度,如图4-1所示。

图4-1(a)说明了生产可能性曲线偏向于X的扩张,图4-1(b)则说明了生产可能性曲线偏向Y的扩张。

图中的生产可能性边界都从1TT移到了2TT。

图4-1 生产可能性边界的偏向性扩张4.要素比例理论(factor-proportions theory)答:要素比例理论又称“赫克歇尔-俄林理论”、“生产要素禀赋理论”,是指从资源禀赋角度对国际贸易中生产成本和价格的差异做出解释的国际贸易理论。

要素比例理论的主要内容是:国际贸易源于不同国家之间商品的价格存在差异,而价格差异的原因在于不同国家生产成本有高有低,生产成本的高低又是因为各国生产要素价格有差别,生产要素价格的差别又与各国生产要素丰裕程度密切相关。