倾销与反倾销英文

- 格式:pptx

- 大小:3.09 MB

- 文档页数:18

银行英语:出口信贷 export credit出口津贴 export subsidy商品倾销 dumping外汇倾销 exchange dumping优惠关税 special preferences保税仓库 bonded warehouse贸易顺差 favorable balance of trade贸易逆差 unfavorable balance of trade进口配额制 import quotas自由贸易区 free trade zone对外贸易值 value of foreign trade国际贸易值 value of international trade普遍优惠制 generalized system of preferences-GSP最惠国待遇 most-favored nation treatment-MFNT-------------------价格条件----------------------价格术语trade term (price term) 运费freight单价 price 码头费wharfage总值 total value 卸货费landing charges金额 amount 关税customs duty净价 net price 印花税stamp duty含佣价price including commission 港口税portdues回佣return commission 装运港portof shipment折扣discount,allowance 卸货港port of discharge批发价 wholesale price 目的港portof destination零售价 retail price 进口许口证inportlicence现货价格spot price 出口许口证exportlicence期货价格forward price现行价格(时价)current price prevailingprice国际市场价格 world(International)Marketprice离岸价(船上交货价)FOB-free on board成本加运费价(离岸加运费价) C&F-cost and freight到岸价(成本加运费、保险费价)CIF-cost,insurance and freight--------------------交货条件----------------------交货delivery 轮船steamship(缩写S.S)装运、装船shipment 租船charter (the chartered shep) 交货时间 time of delivery定程租船voyage charter; 装运期限time of shipment 定期租船time charter托运人(一般指出口商)shipper,consignor收货人consignee班轮regular shipping liner 驳船lighter舱位shipping space 油轮tanker报关clearance of goods 陆运收据cargo receipt提货to take delivery of goods空运提单airway bill 正本提单original B\L选择港(任意港)optional port选港费optional charges选港费由买方负担 optional charges to be borne by the Buyers 或 optional charges for Buyers account一月份装船 shipment during January 或January shipment一月底装船 shipment not later than Jan.31st.或shipment on or before Jan.31st.一/二月份装船 shipment during Jan./Feb.或 Jan./Feb. shipment在......(时间)分两批装船 shipment during....in two lots在......(时间)平均分两批装船 shipment during....in two equal lots分三个月装运 in three monthly shipments分三个月,每月平均装运 in three equal monthly shipments立即装运 immediate shipments即期装运 prompt shipments收到信用证后30天内装运 shipments within 30 days after receipt of L/C允许分批装船 partial shipment not allowed partial shipment not permittedpartial shipment not unacceptable---------------交易磋商、合同签订-----------------订单 indent 订货;订购 book; booking电复 cable reply 实盘 firm offer递盘 bid; bidding 递实盘 bid firm还盘 counter offer 发盘(发价) offer发实盘 offer firm 询盘(询价)inquiry;enquiry---------------交易磋商、合同签订-----------------指示性价格 price indication速复 reply immediately参考价 reference price习惯做法 usual practice交易磋商 business negotiation不受约束 without engagement业务洽谈 business discussion限**复 subject to reply **限* *复到 subject to reply reaching here **有效期限 time of validity有效至**: valid till **购货合同 purchase contract 销售合同sales contract购货确认书 purchase confirmation销售确认书 sales confirmation一般交易条件 general terms and conditions以未售出为准 subject to prior sale需经卖方确认 subject to sellers confirmation需经我方最后确认 subject to our final confirmation------------------贸易方式------------------------INT (拍卖auction) 寄售consignment招标invitation of tender投标submission of tender一般代理人agent 总代理人general agent代理协议agency agreement累计佣金accumulative commission补偿贸易compensation trade(或抵偿贸易)compensating/compensatory trade(又叫:往返贸易) counter trade来料加工processing on giving materials来料装配assembling on provided parts独家经营/专营权exclusive right独家经营/包销/代理协议exclusivity agreement独家代理 sole agency; sole agent; exclusive agency;exclusive agent-------------------品质条件-----------------------品质 quality 原样 original sample规格 specifications 复样 duplicate sample说明 description 对等样品countersample标准 standard type 参考样品reference sample商品目录 catalogue 封样 sealed sample宣传小册 pamphlet 公差 tolerance货号 article No. 花色(搭配)assortment样品 sample 5% 增减 5% plus or minus代表性样品 representative sample大路货(良好平均品质)fair average quality--------------------商检仲裁-----------------------索赔 claim 争议disputes罚金条款 penalty 仲裁arbitration不可抗力 force Majeure 仲裁庭arbitral tribunal产地证明书certificate of origin品质检验证书 inspection certificate of quanlity重量检验证书 inspection certificate of weight (quantity)**商品检验局 **commodity inspection bureau (*.C.I.B)品质、重量检验证书 inspectioncertificate---------------------数量条件-----------------------个数 number 净重 net weight容积 capacity 毛作净gross for net体积 volume 皮重 tare毛重 gross weight溢短装条款 more or less clause-----------------------外汇-------------------------外汇 foreign exchange 法定贬值devaluation外币 foreign currency 法定升值revaluation汇率 rate of exchange 浮动汇率floating rate国际收支 balance of payments 硬通货hard currency直接标价 direct quotation 软通货soft currency间接标价 indirect quotation 金平价gold standard买入汇率 buying rate 通货膨胀inflation卖出汇率 selling rate 固定汇率fixed rate金本位制度 gold standard 黄金输送点 gold points铸币平价 mint par 纸币制度 paper money system国际货币基金 international monetary fund黄金外汇储备 gold and foreign exchange reserve汇率波动的官定上下限 official upper and lower limits of fluctuation银行交易bank book/pass book存折open an account开户earn interest赚取利息savings account储蓄存款帐户current account活期存款帐户check/cheque account支票帐户deposit account定期存款帐户annual interest rate年利率monthly savings account按月计息帐户daily interest account按天计息帐户instant account速成户头 service charge服务费/手续费signature card签名卡 draw/withdraw 提款 order check/cheque记名支票 rubber check/cheque空头支票blank check/cheque空白支票 exchange rate汇率denomination=face value面额 four in hundred四张一百元面额give the money in fives/tens换成五元或十元面额bill钞票 change零钱cash现金 password/code 密码amount in figures小写金额 amount in words 大写金额credit card信用卡 the balance of your bank account帐户余额traveler’s check/chque 旅行支票 coin硬币penny便士 nickel(美、加)的五分硬币dime(美、加)的十分硬币 unit 货币单位value/worth面值 ounce盎司1/16磅commercial/merchant bank商业银行 full refund 全额偿还extension延期 overdraw/overdraft透支rebate回扣 payday发薪日pay slip/envelop 薪水单 mortgage抵押expense account公款支付帐户a princely sum(an excessive amount)巨款apply for/grant_______a loan申请/批准贷款debt债务 collateral担保物fill out/in填写chquebook/checkbook支票簿loan贷款 joint account联名帐户by installment分期付款cashier收银员teller银行职员 statement对帐单money order汇票 accountant会计 A.T.M自动取款机(M0)money in circulation 流通中的现金(M1) narrow money 狭义货币(M2) broad money 广义货币a minimum living standard system 最低生活保障系统Account 帐户Accounting equation 会计等式Accounting system 会计系统All Risks 一切险American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Articulation 勾稽关系Assets 资产Audit 审计bad account 坏帐Balance sheet 资产负债表bear market 熊市blank endorsed 空白背书Bookkeepking 簿记bull market 牛市Business entity 企业个体Capital stock 股本cargo receipt 承运货物收据Cash flow prospects 现金流量预测catalogue 商品目录Certificate in Internal Auditing内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant 注册会计师China Securities Regulatory Commission 中国证监会China's "Big Four" commercial banks中国四大商业银行close-ended fund 封闭式基金commission 佣金consignee 收货人Corporation 公司Cost accounting 成本会计cost and freightCFR 成本加运费价格cost insurance and freightCIF 成本加运保费Cost principle 成本原则Creditor 债权人cut a melon 分红dead account 呆帐Deflation 通货紧缩delivery 交货Disclosure 批露dividend,bonus stock 股息,红利downturn 低迷时期endorsed 背书enforce stockholding system 实行股份制Expenses 费用export department 出口部External users 外部使用者F.P.A.(Free from Particular Average) 平安险F.W.R.D.(Fresh Water Rain Damage) 淡水雨淋险face value 面值fees-for-tax reFORM 费改税Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial activities 筹资活动Financial forecast 财务预测Financial statement 财务报表foreign exchange reservers 外汇储备futures market 期货市场Generally accepted accounting principles 公认会计原则General-purpose inFORMation 通用目的信息genetically-modified products 基因改良产品Going-concern assumption 持续经营假设Government Accounting Office govern会计办公室Hook Damage 钩损险import department 进口部Income statement 损益表income tax 所得税indicative price 参考价格Inflation 通货膨涨Inquiry 询盘Institute of Internal Auditors 内部审计师协会Institute of Management Accountants管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Investing activities 投资活动knowledge-based economy 知识经济labour-intensive economy 劳动密集型经济Liabilities 负债Management accounting 管理会计marine bills of lading 海运提单national bonds 国债nationalize;nationalization 国有化Negative cash flow 负现金流量non-perFORMing loan 不良贷款non-work income 非劳动收入notify 被通知人open-ended fund 开放式基金Operating activities 经营活动order 订货outstanding of deposits 存款余额Owner's equity 所有者权益partial shipment 分批装运Partnership 合伙企业Positive cash flow 正现金流量press conference 记者招待会price list 价目表privatize;privatization 私有化proactive fiscal measures 积极的财政政策promote independent decision-making by state-owned enterprises 提高企业自主权public relations department公关部publicly owned economy 公有经济recession 衰退时期rectify the market order 整顿市场秩序reduce state's stake in listed companies 国有股减持restraint of trade 贸易管制Retained earning 留存利润Return of investment 投资回报Return on investment 投资报酬Revenue 收入Risk of Intermixture and Contamination 混杂、玷污险Risk of Leakage 渗漏险Risk of odor 串味险Risk of Rust 锈蚀险sales terms and conditions销售条件Securities and Exchange Commission 证券交易委员会shareholding system; joint-stock system 股份制shipping order 托运单Shortage Risk 短缺险Sole proprietorship 独资企业Solvency 清偿能力specification 规格Stable-dollar assumption 稳定货币假设state stock reduction 国有股减持Statement of cash flow 现金流量表Statement of financial position 财务状况表steady monetary policies 稳健的货币政策Stockholders 股东Stockholders' equity 股东权益streghten the government's macro - regulatory functions 加强govern宏观调控作用Strikes Risk 罢工险T.P.N.D.( Theft,Pilferage & Non-delivery) 偷窃提货不着险Tax accounting 税务会计technology-intensive economy 技术密集型经济the Dow Jones industrial average 道琼斯工业平均指数the first majority shareholder 第一大股东the Hang Seng index 恒生指数thin trade 交易薄弱to become the majority shareholder/to take a controlling stake 控股to expand domestic demand 扩大内需value-added tax 增值税W.A./W.P.A(With Average or With Particular Average) 水渍险War Risk 战争险Window dressing 门面粉饰year-on-year 与去年同期数字相比的bull market: 牛市,多头市场bear market :熊市,空头市场股息,红利 dividend or bonus stock国民生产总值 GNP (Gross National Product)人均国民生产总值 per capita GNP产值 output value鼓励 give incentive to投入 input宏观控制 exercise macro-control优化经济结构 optimize the economic structure输入活力 bring vigor into改善经济环境 improve economic environment整顿经济秩序 rectify economic order有效地控制通货膨胀 effectively control inflation非公有成分 non-public sectors主要成分 dominant sector实在的 tangible全体会议 plenary session解放生产力 liberate/unshackle/release the productive forces引入歧途 lead one to a blind alley举措 move实事求是 seek truth from facts引进、输入 importation和平演变 peaceful evolution试一下 have a go (at sth.)精华、精粹、实质 quintessence家庭联产责任承包制 family-contract responsibility system搞活企业 invigorate enterprises商品经济 commodity economy基石 cornerstone零售 retail发电量 electric energy production有色金属 nonferrous metals人均收入 per capita income使负担 be saddled with营业发达的公司 going concerns被兼并或挤掉 annexed or forced out of business善于接受的 receptive增额、增值、增长 increment发展过快 excessive growth抽样调查 data from the sample survey扣除物价上涨部分 price increase are deducted(excluded)实际增长率 actual growth rate国际收支 international balance of payments流通制度 circulation system总工资 total wages分配形式 FORMs of distribution风险资金 risk funds管理不善 poor management一个中心、两个基本点one central task and two basic points以经济建设为中心,坚持四项基本原则(1)社会主义道路(2)党的领导(3)人民民主专政(4)马列主义\*\*\*思想、坚持改革开放the central task refers to economic construction and two basic points are the four cardinal principles - adherence to the socialist road, to Communist Party leadership, to the people's democratic dictatorship and to Marxism-Leninism and Mao Zedong Thought - and persisting in reFORM and opening.改革是"社会主义制度的自我完善和自我发展"。

国际经济与贸易专业英语汉译英(供2011-2012学年第一学期用)1.国际贸易(International Trade )2.对外贸易(foreign trade)3.贸易量(quantity of trade)4.贸易差额(balance of trade)5.贸易顺差(favorable balance of trade)6.贸易逆差(unfavorable balance of trade)7.国际收支(balance of payment)8.贸易条件(Terms of Trade)9.对外贸易依存度(ratio of dependence on foreign trade)10.国际贸易商品结构(composition of international trade) 11.贸易的地理方向(Direction of Trade)12.出口贸易(export trade)13.进口贸易(import trade)14.过境贸易(transit trade)15.转口贸易(entreport trade)16.复出口(re-export)17.复进口(re-import)18.有形贸易(tangible goods trade)19.无形贸易(intangible goods trade)20.总贸易(general trade)21.专门贸易(special trade)22.直接贸易(direct trade)23.间接贸易(indirect trade)24.双边贸易(bilateral trade)25.多边贸易(multilateral trade)26.自由结汇贸易(free-liquidation trade)27.易货贸易(barter trade)28.水平贸易(horizontal trade)29.垂直贸易(vertical trade)30.国际分工(international division of labour)31.绝对优势(absolute advantage)32.绝对成本(absolute cost)33.比较优势(comparative advantage)34.比较成本(comparative cost)35.相互需求说(reciprocal demand doctrine)36.要素禀赋理论(treory of eadowment)37.机会成本(opportunity cost)38.生产可能性曲线(production possibility curve) 39.无差异曲线(indifference curve)40.里昂惕夫之谜(leontief paradox)41.规模经济(scale of economies)42.偏好相似理论(the preference similarity theory) 43.关税(tariff)44.关税壁垒(tariff barriers)45.财政关税(revenue tariff)46.保护关税(protective tariff)47.关税升级(tariff escalation)48.特惠税(preferential duties)49.原产地规则(rules of origin)50.出口税(export duties)国际经济与贸易专业英语汉译英(供2011-2012学年第二学期用)51.过境税(transit duties)52.进口附加税(import surtaxes)53.反倾销税(anti-dumping duties)54.反补贴税(counter vailing duties)55.差价税(variable levy)56.惩罚关税(penalty tariff)57.报复关税(retaliatory tariff)58.门槛价格(threshold price)59.从量税(specific duties)60.混合税(mixed duty)61.复合税(compound duties)62.选择税(alternative duties)63.税率(rate of duty)64.单式税则(single tariff)65.复式税则(complex tariff)66.关税水平(tariff level)67.名义保护率(nominal rate of protection-NRP)68.有效保护率(effective rate of protection-ERP)69.绝对配额(absolute quota)70.关税配额(tariff quota)71.全球配额(global quota)72.国别配额(country quota)73.自主配额(autonomous quota)74.协议配额(agreement quota)75.进口商配额(importer quota)76.“自动”出口配额(voluntary export quota)77.进口许可证制(import license system)78.外汇管制(foreign exchange control)79.进口押金(advanced deposit)80.歧视性政府采购政策(discriminatory government procurement policy) 81.海关程序(customs procedures)82.技术性贸易壁垒(technical barriers to trade)83.出口信贷(export credit)84.出口信贷国家担保制(export credit guarantee system) 85.出口补贴(export subsidy)86.关税同盟(customs union)87.普惠制 (GSP)88.经济一体化 (Economic Integration)89.绿色壁垒 (Green barriers)90.反倾销(anti-dumping)91.进口配额(import quota)92.最惠国待遇(most-favoured-nation treatment MFNT) 93.贸易额(Value of Trade)94.进口税 (Import Duties )95.非关税壁垒(Non-tarriff Barriers)96.反倾销(Anti-dumping)97.世界贸易组织(World Trade Organiztion)98.商品名称及编码协调制度(HS)99.进口配额(import quota)100.从价税 (ad valorem duties)。

反倾销的概念倾销首先是一个经济学概念,经济学上的倾销被认为是在不同市场上的价格歧视,倾销可以分为多种,按时间可以划分为突发倾销(sporadic dumping)、短期倾销(short-run dumping)和长期倾销(long-term dumping),而只有“掠夺性的倾销”(predatory dumping)才属于应当禁止的不公平贸易行为,其他种类的倾销行为不过是一种正常的竞争手段而已。

掠夺性倾销的特点是,暂时以低于成本的价格出口以抢占海外市场排挤其他竞争者,同时在国内市场维持高价,在占领海外市场后便开始提价,挽回之前的损失并谋求垄断利润。

掠夺性的倾销行为对公平的贸易竞争环境造成了损害,所以为WTO所禁止。

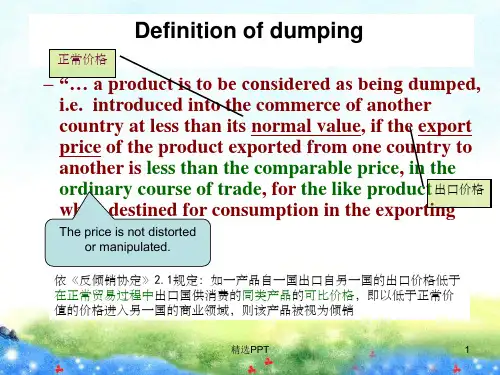

法律意义上倾销的经典定义由GATT1994第6条第1款规定:“用倾销的手段将一国产品以低于正常价值的办法挤入另一国贸易内,如因此对某一缔约国领土内已建立的某项工业造成重大的损害或产生重大威胁,或者对某一国内工业的新建产生严重阻碍”,则构成倾销。

倾销被认为是价格歧视的一种表现,这种价格歧视扭曲了自由竞争机制下的价格水平,违背了WTO的基本原则——公平竞争原则,造成了倾销产品进口国国内产业的损害,因此WTO 通过《反倾销协议》来规范这种行为,允许其成员方按照WTO的有关规定通过调查和征税等形式限制该产品的进口,以救济国内受到损害的产业,这种调查和采取措施的行政手段称之为反倾销。

倾销的确定一国对原产于他国的进口产品征收反倾销税,一般须满足以下几个条件:(1)受调查产品的出口价格低于正常价值;(2)生产“同似产品”的进口国某一国内产业受到法定的损害;(3)低价出口与进口国国内产业之损害两者之间存在因果关系。

确定倾销幅度(dumping margin)是反倾销调查中的一个核心环节。

倾销幅度是指出口价格低于正常价值(normal value, NV)的幅度,其基本计算方法为:调整后得出的正常价值与调整后的出口价格(export price,EP)之间的差额除以调整前的出口价格(中国取CIF价格)。

反倾销、反补贴、保障和特殊情况处理等(中英文对照)Anti-dumping, Subsidies, Safeguards,Contingencies, etc反倾销、反补贴、保障和特殊情况处理等英文来源:/english/thewto_e/whatis_e/tif_e/agrm8_e.htmBinding tariffs, and applying them equally to all trading partners (most-favoured-nation treatment, or MFN) are key to the smooth flow of trade in goods.约束关税及将其在全体贸易成员国之间平等地适用(即最惠国待遇,简称MFN)是保证商品交易过程畅通的关键。

The WTO agreementsuphold the principles, but they also allow exceptions — in some circumstances. Three of these issues are:世贸协议秉持着这些原则,但有时也有例外。

例如以下三种情况:actions taken against dumping (selling at an unfairly low price)1.反倾销(以不公平的低价出售商品的行为)措施;subsidies and special “countervailing” duties to offset the subsidies1.贸易补贴以及为抵消贸易补贴而征收的“反补贴”关税;emergency measures to limit imports temporarily, d esigned to “safeguard”domestic industries.1.为暂时限制进口以“保护”国内产业而采取的紧急应对措施。

Anti-dumping actions反倾销措施If a company exports a product at a price lower than the price it normally charges on its own home market, it is said to be “dumping” the product.如果某一公司以低于其在国内市场正常出售的价格出口某一产品,我们就称其“倾销”该产品。

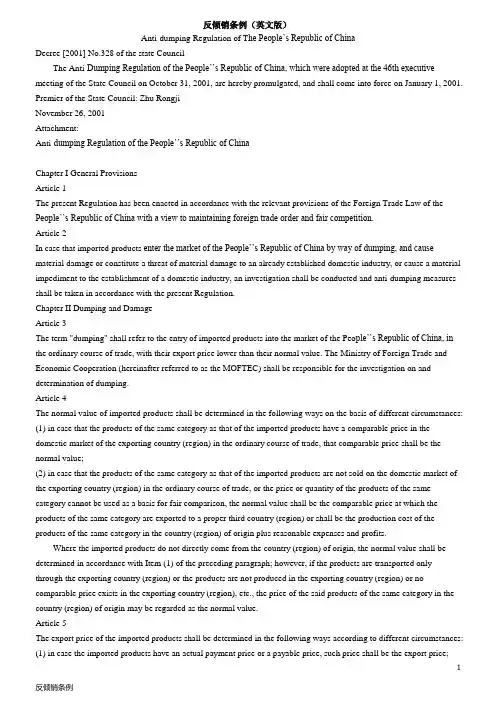

反倾销条例(英文版)Anti-dumping Regulation of T he People’s Republic of ChinaDecree [2001] No.328 of the state CouncilThe Anti-Dumping Regulation of the People’’s Republic of China, which were adopted at the 46th executive meeting of the State Council on October 31, 2001, are hereby promulgated, and shall come into force on January 1, 2001. Premier of the State Council: Zhu RongjiNovember 26, 2001Attachment:Anti-dumping Regulation of the People’’s Republic of ChinaChapter I General ProvisionsArticle 1The present Regulation has been enacted in accordance with the relevant provisions of the Foreign Trade Law of the People’’s Republic of China with a view to maintaining foreign trade order and fair competition.Article 2In case that imported products enter the market of the People’’s Republic of China by way of dumping, and cause material damage or constitute a threat of material damage to an already established domestic industry, or cause a material impediment to the establishment of a domestic industry, an investigation shall be conducted and anti-dumping measures shall be taken in accordance with the present Regulation.Chapter II Dumping and DamageArticle 3The term "dumping" shall refer to the entry of imported products into the market of the Peo ple’’s Republic of China, in the ordinary course of trade, with their export price lower than their normal value. The Ministry of Foreign Trade and Economic Cooperation (hereinafter referred to as the MOFTEC) shall be responsible for the investigation on and determination of dumping.Article 4The normal value of imported products shall be determined in the following ways on the basis of different circumstances: (1) in case that the products of the same category as that of the imported products have a comparable price in the domestic market of the exporting country (region) in the ordinary course of trade, that comparable price shall be the normal value;(2) in case that the products of the same category as that of the imported products are not sold on the domestic market of the exporting country (region) in the ordinary course of trade, or the price or quantity of the products of the same category cannot be used as a basis for fair comparison, the normal value shall be the comparable price at which the products of the same category are exported to a proper third country (region) or shall be the production cost of the products of the same category in the country (region) of origin plus reasonable expenses and profits.Where the imported products do not directly come from the country (region) of origin, the normal value shall be determined in accordance with Item (1) of the preceding paragraph; however, if the products are transported only through the exporting country (region) or the products are not produced in the exporting country (region) or no comparable price exists in the exporting country (region), etc., the price of the said products of the same category in the country (region) of origin may be regarded as the normal value.Article 5The export price of the imported products shall be determined in the following ways according to different circumstances: (1) in case the imported products have an actual payment price or a payable price, such price shall be the export price;(2) in case the imported products do not have an export price or its price is not reliable, the price presumed on the basis of the price at which the imported products are re-sold for the first time to an independent buyer shall be regarded as the export price; however, if the imported products are not re-sold to an independent buyer or not re-sold in the status when they are imported, the price presumed by the MOFTEC on a reasonable basis may be regarded as the export price. Article 6The margin between the export price of imported products which is lower than their normal value shall be the dumping margin.The export price of the imported products and the normal value shall be compared in a fair and reasonable manner by taking the various comparable factors which may impact the price into consideration.The dumping margin shall be determined with the weighted average normal value and the weighted average price of all the comparable export transactions being compared, or with the normal value and the export price being compared transaction by transaction.Where the export prices are considerably different between different buyers, regions or periods, and thus are difficult to be compared in the ways provided in the preceding paragraph, the weighted average normal value may be compared with the price of a single export transaction.Article 7The term "damage" shall refer to the fact that dumping has caused material damage or constitute a threat of material damage to an already established domestic industry, or caused a material impediment to the establishment of a domestic industry.The State Economic and Trade Commission (hereinafter referred to as the SETC) shall be responsible for the investigation on and determination of damage; while the anti-dumping investigation on the damage to a domestic industry relating to agricultural products shall be conducted by the SETC in collaboration with the Ministry of Agriculture.Article 8When determining the damage caused to a domestic industry by dumping, the following items shall be examined:(1) the quantity of the dumped imports, including a sharp increase in the absolute quantity of the dumped imports or the quantity as compared with the production or consumption of the domestic products of the same category, or the possibility of a sharp increase in the quantity of the dumped imports;(2) the price of the dumped imports, including the price cuts of the dumped imports or the impacts such as great restraint or reduction, etc. to the price of the domestic products of the same category;(3) the impacts of the dumped imports upon the relevant economic factors and targets of the domestic industry;(4) the production capacity, export capability of the exporting country (region) and the country (region) of origin on the dumped imports as well as the inventory of the investigated products;(5) other factors which cause damage to the domestic industry. The threat of material damage shall be determined on the basis of the facts instead of the accusation, presumption or minor possibility.The damage caused by dumping to a domestic industry shall be determined on the basis of affirmative evidence, and no factor other than dumping which causes damage shall be attributed to dumping.Article 9Where the dumped imports come from two or more countries (regions), and meanwhile meet the following conditions, a cumulative evaluation may be conducted upon the impacts caused by the dumped imports to a domestic industry:(1) the dumping margin of the dumped imports from each country (region) shall be no lower than 2%, and the import volume of the products may not be negligible;(2) it is proper to conduct a cumulative evaluation on the basis of the competition conditions between the dumpedimports as well as between the dumped imports and the domestic products of the same category.The term "to be negligible" shall refer to the fact that the proportion of the quantity of the dumped imports from a country (region) to the total import volume of products of the same category shall be lower than 3%; except where the total import volume lower than 3% from some countries (regions) exceeds 7% of the total import volume of the products of the same category.Article 10The evaluated impacts on the dumped imports shall be separately determined with regard to the production of the domestic products of the same category; where they may not be separately determined with regard to the production of the domestic products of the same category, the production of the narrowest product group or scope which includes the products of the same category shall be examined.Article 11Th e term "domestic industry" shall refer to all the manufacturers within the People’’s Republic of China of the domestic products of the same category or the manufacturers within the People’’s Republic of China whose total output accounts for the major part of the aggregate output of the domestic products of the same category; however, if a domestic manufacturer is associated with an export business operator or import business operator, or he himself is an import business operator of the dumped imports, he may be excluded from the domestic industry.Where, under particular circumstances, the domestic manufacturers in a regional market sell the whole or nearly the whole of the products of the same category in the said market, and the products of the same category in the said market are not mainly supplied by the domestic manufacturers of other places, they may be regarded as a separate industry. Article 12The term "products of the same category" shall refer to the products identical to the dumped imports; where there are no identical products, the products which are most similar to the features of the dumped imports shall be the products of the same category.Chapter III Anti-Dumping InvestigationsArticle 13A domestic industry or a natural person, legal person or relevant organization representing a domestic industry (hereinafter uniformly referred to as the applicant) may file a written application on anti-dumping investigation to the MOFTEC in accordance with these Rules.Article 14The application letter shall contain the following contents:(1) name, address and relevant information of the applicant;(2) complete specifications on the imported products under application for investigation, including product name, the exporting country (region) or country (region) of origin involved, the known export business operator or manufacturer, information on the price of the products when they are consumed in the domestic market of the exporting country (region) or country (region) of origin, information on export price, etc.;(3) a statement on the quantity and value of the domestic products of the same category;(4) the impacts of the quantity and price of the imported products under application for investigation on the domestic industry;(5) other contents which the applicant considers it necessary to state.Article 15The application letter shall be attached with the following evidence:(1) the existence of dumping of the imported products under application for investigation;(2) the damage to domestic industry;(3) the causal link between the dumping and damage.Article 16The MOFTEC shall, within 60 days as of its receipt of the application letter and the relevant evidence submitted by the applicant, examine whether the application is filed by the domestic industry or filed by representing the domestic industry, the contents of the application letter and the evidence attached to it, etc., and shall, upon consultation with the SETC, decide to initiate an investigation or not.The MOFTEC shall, before deciding to initiate an investigation, notify the government of the relevant exporting country (region).Article 17Where, among the manufacturers in a domestic industry who are in favor or disfavor of the application, the output of those who are in favor accounts for 50% or more of the total output of those who are in favor and disfavor, it shall be deemed that the application is filed by the domestic industry or filed by representing the domestic industry, and the anti-dumping investigation may be initiated; however, if the output of the domestic manufacturers who support the application is less than 25% of the total output of the domestic products of the same category, the anti-dumping investigation shall not be initiated.Article 18Where, under particular circumstances, the MOFTEC does not accept the written application for anti-dumping investigation, but has sufficient evidence to believe that there exist a dumping and damages and there is a causal link between the dumping and damages, it may, upon consultation with the SETC, decide to initiate an investigation.The MOFTEC or the SETC is hereinafter uniformly referred to as the investigation organ.Article 19The decisions on initiating an investigation shall be announced by the MOFTEC, and shall be notified to the applicant, the known export business operators and import business operators, the government of the exporting country (region) as well as other interested organizations or individuals (hereinafter uniformly referred to as the interested parties).Once the decisions on initiating an investigation is announced, the MOFTEC shall provide the known export business operators and the government of the exporting country (region) with a copy of the application letter.Article 20The investigation organ may obtain information from the interested parties and conduct the investigation by means of questionnaires, samples, hearings and on-the-spot checks, etc..The investigation organ shall provide the relevant interested parties with opportunities for stating their viewpoints and grounds of argument.The MOFTEC may, when considering it necessary, send functionaries to the relevant country (region) for conducting the investigation, except where the relevant country (region) concerned objects to the investigation.Article 21When the investigation organ is conducting an investigation, the interested parties shall tell the truth and provide relevant materials. Where the interested parties fail to tell the truth or fail to provide relevant materials, or fail to provide necessary information within a reasonable time limit, or seriously hamper the investigation in other forms, the investigation organ may make an adjudication on the basis of the already obtained facts and the best available information.Article 22Where the interested parties consider that the divulgence of the materials provided by them will cause seriously bad effects, they may apply to the investigation organ for treating the materials as confidential.Where the investigation organ considers the application for confidentiality is justified, it shall treat the materialsprovided by the interested parties as confidential, and meanwhile request the interested parties to provide a copy of non-confidential outline of the materials.The materials treated as confidential materials shall not be divulged without the consent of the interested parties who provide them.Article 23The investigation organ shall permit the applicant and the interested parties to have access to the relevant materials of the case, except where the materials are treated as confidential.Article 24The MOFTEC and the SETC shall, upon the investigation result, make separate an initial award on dumping and damage as well as on whether the causal link between the dumping and damage is tenable, which shall be announced by the MOFTEC.Article 25Where the initial award affirms the dumping and damage as well as the causal link between the dumping and damage, the MOFTEC and the SETC shall continue the investigation on the dumping, the dumping margin, the damage and its extent, and shall make separate a final award upon the investigation result, which shall be announced by the MOFTEC.Before the making of the final award, the MOFTEC shall notify all the known interested parties of the basic facts upon which the final award is made.Article 26An anti-dumping investigation shall be ended within 12 months as of the date of announcement of the decision on initiating the investigation; under particular circumstances, the time limit may be extended, provided that the extension shall not exceed 6 months.Article 27Under any of the following circumstances, the anti-dumping investigation shall be terminated and be announced by the MOFTEC:(1) the applicant revokes the application;(2) there is not enough evidence to prove the existence of dumping, damage or the causal link between the dumping and damage;(3) the dumping margin is lower than 2%;(4) the actual or potential import volume of the dumped imports or the damage is negligible;(5) the MOFTEC and the SETC both consider it is not appropriate to continue the anti-dumping investigation.Where the investigated products from one or more countries (regions) are under any of the circumstances listed in Items (2), (3), and (4) of the preceding paragraph, the anti-dumping investigation with regard to the involved products shall be terminated.Chapter IV Anti-Dumping MeasuresSection 1 Provisional Anti-Dumping MeasuresArticle 28Where the initial award affirms the dumping and the consequent damage to a domestic industry, the following provisional anti-dumping measures may be taken:(1) to levy provisional anti-dumping tariffs;(2) to request the provision of cash deposits, guaranty letter or other forms of guaranty. The amount of the provisional anti-dumping tariffs, the cash deposits, the guaranty letter and other forms of guaranty shall not exceed the dumping margin ascertained in the initial awards.Article 29The levy of the provisional anti-dumping tariffs shall be proposed by the MOFTEC and be decided on by the Tariff Policy Committee under the State Council upon the proposition of the MOFTEC, and shall be announced by the MOFTEC. The request for the provision of cash deposits, guaranty letter or other forms of guaranty shall be decided on and announced by the MOFTEC. The customs shall implement the decision as of the date provided in the announcement. Article 30The time limit for the provisional anti-dumping measures shall not exceed 4 months as of the date of entry into force of the announcement of the decisions on provisional anti-dumping measures; however, such time limit may be extended to 9 months under particular circumstances.No provisional anti-dumping measure shall be taken within 60 days as of the date when the decisions on initiating an anti-dumping investigation is announced.Section 2 Pricing CommitmentsArticle 31The export business operators of the dumped imports may, during the period of anti-dumping investigation, make pricing commitments to the MOFTEC on changing the price or ceasing export at a dumping price.The MOFTEC may propose suggestions on pricing commitments to the export business operators.The investigation organ may not force the export business operators to make pricing commitments.Article 32The export business operators’’ refusal to make pricing commitments or to accept the suggestions on pricing commitments shall not hamper the investigation of and determination on the anti-dumping cases. Where the export business operators continue dumping the imported products, the investigation organ shall have the right to determine that the threat of damage is more possible to arise.Article 33Where the MOFTEC considers the pricing commitments made by the export business operators are acceptable, it may, upon consultation with the SETC, decide to suspend or terminate the anti-dumping investigations, instead of taking any provisional anti-dumping measure or levying anti-dumping tariffs. The decisions on suspending or terminating the anti-dumping investigation shall be announced by the MOFTEC.Where the MOFTEC does not accept the pricing commitments, it shall state the reason to the relevant export business operators.The investigation organ shall not, before making an affirmative initial award on dumping and damage caused therefrom, seek or accept pricing commitments.Article 34After suspending or terminating the anti-dumping investigation in accordance with Paragraph 1 ofArticle 33 of the present Regulation, the investigation organ may, upon request by the export business operators or if considering it necessary, continue investigating the dumping and damage.Upon the investigation result as mentioned in the preceding paragraph, if a negative award on dumping or damageis made, the pricing commitments shall automatically become invalid; while if an affirmative award on dumping or damage is made, the pricing commitments shall continue to be valid.Article 35The MOFTEC may require the export business operators to regularly provide the relevant information and materials for implementing the pricing commitments, and may verify such information and materials.Article 36In case any export business operator violates its pricing commitments, the MOFTEC may, upon consultation with the SETC, immediately decide to resume the anti-dumping investigation in accordance with the present Regulation; and may,upon the best available information, decide to take the provisional anti-dumping measures, as well as retrospect to the levy of the anti-dumping tariffs on the products imported within 90 days before the provisional anti-dumping measures were taken, except where the products were imported before the pricing commitments are violated.Section 3 Anti-dumping tariffsArticle 37Where the final adjudication decisions establish the dumping and the consequent damage caused to the domestic industry, the anti-dumping tariffs may be levied.Article 38The levy of the anti-dumping tariffs shall be proposed by the MOFTEC and be decided on by the Tariff Policy Committee under the State Council upon the proposition of the MOFTEC, and shall be announced by the MOFTEC. The customs shall execute such levy as of the date provided in the announcement.Article 39The anti-dumping tariffs shall be applicable to the products imported after the final award has been announced, exceptfor the circumstances provided inArticle s 36, 43 and 44 of the present Regulation.Article 40The taxpayers of the anti-dumping tariffs shall be the import business operators of the dumped imports.Article 41The anti-dumping tariffs shall be separately determined on the basis of the dumping margins of different export business operators. Where the anti-dumping tariffs needs to be levied upon the dumped imports of the export business operators beyond the scope of examination, the applicable anti-dumping tariffs shall be determined in a reasonable method.Article 42The amount of anti-dumping tariffs shall not exceed the dumping margin determined in the final adjudication decision. Article 43Where the final award affirms the existence of the material damage, and prior to which a provisional anti-dumping measure has been taken, the anti-dumping tariffs may be levied in retrospect to the period of the provisional anti-dumping measure.Where the final award affirms the existence of the threat of material damage, and a provisional anti-dumping measure has been taken under the circumstance that an adjudication of material damage will be made if no provisional anti-dumping measure has been taken in advance, the anti-dumping tariffs may be levied in retrospect to the period of the provisional anti-dumping measure.Where the anti-dumping tariffs determined in the final award is higher than the paid or payable provisional anti-dumping tariffs or the amount valuated for the sake of guaranty, the difference shall not be collected; where it is lower than the paid or payable provisional anti-dumping tariffs or the amount valuated for the sake of guaranty, the difference shall be refunded upon the specific circumstance or the amount of the duty shall be re-calculated.Article 44Where the following two circumstances coexist, the anti-dumping tariffs may be retrospectively levied upon the products imported within 90 days before the provisional anti-dumping measures were taken, except for the products imported prior to the initiation of the investigation:(1) the dumped imports has a record of dumping causing damage to the domestic industry, or the import business operators of the products know or ought to know that the export business operators are dumping products and that dumping would lead to damage to domestic industry;(2) the dumped imports are massively imported within a short period, and are possible to seriously destroy the remedialeffect of the anti-dumping tariffs to be levied immediately.Article 45Where the final award determines not to levy the anti-dumping tariffs or not to retrospectively levy the anti-dumping tariffs, the levied provisional anti-dumping tariffs and the collected cash deposits shall be refunded, and the guaranty letter or other forms of guaranty shall be cancelled.Article 46Where an import business operator of dumped imports has evidence to prove that the amount of paid anti-dumping tariffs exceeds the dumping margin, he may apply to the MOFTEC for refund of the tariffs levied; after the MOFTEC has examined and verified the application and proposed the refund, the Tariff Policy Committee under the State Council may, upon the proposition of the MOFTEC, make the decision on the refund, and the customs shall execute the refund. Article 47Where, after the anti-dumping tariffs has been levied upon the imported products, a new export business operator who has not exported such products to the People’’s Republic of China within the period of investigation but could prove the irrelevance between he himself and the export business operator against who anti-dumping tariffs were levied, he may apply to the MOFTEC for separate determination of the dumping margin. The MOFTEC shall make a rapid examination and make a final award. It may, during the period of examination, take the measures provided in Item (2) of Paragraph 1 ofArticle 28 of the present Regulation, provided it shall not levy the anti-dumping tariffs upon these products.Chapter V Time Limit for and Re-examination of Anti-dumping tariffs and Pricing CommitmentsArticle 48Neither the time limit for levying the anti-dumping tariffs nor that for implementing the pricing commitments shall exceed 5 years; however, where it is re-examined and determined that the termination of the levy of the anti-dumping tariffs is possible to lead to the continuance or re-occurrence of the dumping or damage, the time limit for levying the anti-dumping tariffs may be appropriately extended.Article 49After the anti-dumping tariffs has taken effect, the MOFTEC may, with a justifiable reason and upon consultation with the SETC, decide to re-examine the necessity of continuing the levying of anti-dumping tariffs; it may also, after a reasonable period of time, upon the request of the interested parties and after having examined the corresponding evidence provided by the interested parties, decide to re-examine the necessity of continuing the levying of anti-dumping tariffs.After the pricing commitments have taken effect, the MOFTEC may, with a justifiable reason, decide to re-examine the necessity of continuing to implement the pricing commitments; it may also, after a reasonable period of time, upon the request of the interested parties and after having examined the corresponding evidence provided by the interested parties, decide to re-examine the necessity of the continuing to implement the pricing commitments.Article 50The reservation, amendment or cancellation of the anti-dumping tariffs shall be proposed by the MOFTEC upon the re-examination result and in accordance with the present Regulation, shall be decided by the Tariff Policy Committee under the State Council upon the proposition of the MOFTEC, and shall be announced by the MOFTEC. The MOFTEC may also, in accordance with the present Regulation and upon consultation with the SETC, make the decision on reserving, amending or canceling the pricing commitments and shall announce such decision.Article 51The re-examination procedures shall be followed with reference to the relevant provisions in the present Regulation on anti-dumping investigations.The time limit for re-examination shall not exceed 12 months, commencing from the date when the re-examination。

stocks存货,库存量cash sale现货purchase购买,进货bulk sale整批销售,趸售distribution channels销售渠道wholesale批发retail trade零售业hire-purchase分期付款购买fluctuate in line with market conditions随行就市unfair competition不合理竞争dumping商品倾销dumping profit margin倾销差价,倾销幅度antidumping反倾销customs bond海关担保chain debts三角债freight forwarder货运代理trade consultation贸易磋商mediation of dispute商业纠纷调解partial shipment分批装运restraint of trade贸易管制RTA(Regional Trade Arrangements)区域贸易安排favorable balance of trade贸易顺差unfavorable balance of trade贸易逆差special preferences优惠关税bonded warehouse保税仓库transit trade转口贸易tariff barrier关税壁垒tax rebate出口退税TBT(Technical Barriers to Trade)技术性贸易壁垒,贸易伙伴术语trade partner贸易伙伴manufacturer制造商,制造厂middleman中间商,经纪人dealer经销商wholesaler批发商retailer,tradesman零售商merchant商人,批发商,零售商concessionaire,licensed dealer受让人,特许权获得者consumer消费者,用户client,customer顾客,客户buyer买主,买方carrier承运人consignee收货人进出口贸易词汇commerce,trade,trading贸易inland trade,home trade,domestic trade国内贸易international trade国际贸易foreign trade,external trade对外贸易,外贸import,importation进口importer进口商export,exportation出口exporter出口商import licence进口许口证export licence出口许口证commercial transaction买卖,交易inquiry询盘delivery交货order订货make a complete entry正式/完整申报bad account坏帐Bill of Lading提单marine bills of lading海运提单shipping order托运单blank endorsed空白背书endorsed背书cargo receipt承运货物收据condemned goods有问题的货物catalogue商品目录customs liquidation清关customs clearance结关国际贸易英语词汇集锦一贸易价格术语trade term/price term价格术语world/international market price国际市场价格FOB(free on board)离岸价C&F(cost and freight)成本加运费价CIF(cost,insurance and freight)到岸价freight运费wharfage码头费landing charges卸货费customs duty关税port dues港口税import surcharge进口附加税import variable duties进口差价税commission佣金return commission回佣,回扣price including commission含佣价net price净价wholesale price批发价discount/allowance折扣retail price零售价spot price现货价格current price现行价格/时价indicative price参考价格customs valuation海关估价price list价目表total value总值贸易保险术语All Risks一切险F.P.A.(Free from Particular Average)平安险W.A./W.P.A(With Average or With Particular Average)水渍险War Risk战争险F.W.R.D.(Fresh Water Rain Damage)淡水雨淋险Risk of Intermixture and Contamination混杂、玷污险Risk of Leakage渗漏险Risk of Odor串味险Risk of Rust锈蚀险Shortage Risk短缺险T.P.N.D.(Theft,Pilferage&Non-delivery)偷窃提货不着险Strikes Risk罢工险贸易机构词汇WTO(World Trade Organization)世界贸易组织IMF(International Monetary Fund)国际货币基金组织CTG(Council for Trade in Goods)货币贸易理事会EFTA(European Free Trade Association)欧洲自由贸易联盟AFTA(ASEAN Free Trade Area)东盟自由贸易区JCCT(China-US Joint Commission on Commerce and Trade)中美商贸联委会NAFTA(North American Free Trade Area)北美自由贸易区UNCTAD(United Nations Conference on Trade and Development)联合国贸易与发展会议GATT(General Agreement on Tariffs and Trade)关贸总协定对外贸易常用英语(1)They mainly trade with Japanese firms.他们主要和日本商行进行贸易。

外贸英语中常见的税务词汇反倾销(Anti-Dumping)反倾销税(Anti-dumping Duties)从价关税(Ad Valorem Duties)单方面转移收支(Balance of Unilateral Transfers)多种汇率(Multiple Rates of Exchange)反补贴税(Counter Vailing Duties)从价(Ad Valorem)出厂价格(Cost Price)从量税(Specific Duty)初级产品(Primary Commodity)初级产品的价格(The Price of Primang Products)出口补贴(Export Subsidies)出口动物产品检疫(Quarantine of Export Animal products) 出口管制(Export Contral)出口税(Export Duty)保护关税(Protective Tariff)保税制度(Bonded System)布鲁塞尔估价定义(Brussels Definition of Value BDV)差别关税(Differential Duties)差价关税(Variable Import Levies)产品对产品减税方式(Product by Product Reduction of Tariff) 超保护贸易政策(Policy of Super-protection)成本(Cost)出口退税(Export Rebates)出口信贷(Export Finance)出口限制(Export Restriction)出口信贷国家担保制(Export credit Guarantee)出口许可证(Export Licence)储备货币(Reserve Carreacy)处于发展初级阶段(In the Early Etages of Development)处理剩余产品的指导原则(The Guiding Principle of Clealing With the Surplus Agricultural Products)关税(Customs Duty)关税和贸易总协定(The General Agreement On Tariffs And Trade)关税合作理事会(Customs Co-operation Council)关税减让(Tariff Concession)关税配额(Tariff Quota)关税升级(Tariff Escalation)关税水平(Tariff Level)关税税则(Tariff)关税同盟(Customs Union)关税和贸易总协定秘书处(Secretariat of GATT)国际价格(International Price)约束税率(Bound Rate)自主关税(Autonomous Tariff)最惠国税率(The Most-favoured-nation Rate of Duty)优惠差额(Margin of Preference)优惠税率(Preferential Rate)有效保护率(Effective Vate of Protection)https://www./。

倾销类dumping 倾销antidumping 反倾销sporadic dumping 零星倾销persistent dumping 连续性倾销intermittent dumping 间歇性倾销predatory dumping 掠夺性倾销sales below producing cost 低于成本的销售domestic industry 国内产业normal value 正常价值material injury 实质损害ordinary course 正常贸易the like product 同类产品export price 出口价格margin of dumping 倾销幅度unreliable export price 出口价格不可靠reseanable basis 合理基础domestic price 出口国价格third-country price 第三国价格constructed price 结构价格non-market economy 非市场经济sufficient evidence 证据充分positive evidence 证据确凿objective examination 客观审查the consequent impact 随继影响a significant price undercutting 明显削价depress price 抑制价格clearly forseen 可预见的special care 小心谨慎cumulation of imports 累积进口问题all interested parties 所有利害关系人questionnare 调查表best information available (BIA) 最佳现有材料judicial review 司法审查consultation 磋商panel 专家组afford sympathetic consideration 给予审慎考虑complaining party 申诉方causation 因果关系principal cause 主要原因remedy measures 救济措施provisional antidumping duty 临时反倾销税provisional measures 临时措施preliminary affirmative determination 肯定性初裁definitive antidumping duties 最终反倾销税retroactive application of anti-dumping duties 追溯征收sunset clause 日落条款price under-taking 价格承诺补贴类subsidies 补贴specificity subsidies 专项性补贴actionable subsidies 可诉的补贴unactionable subsidies 不可诉的补贴prohibited subsides 禁止的补贴export performance 出口实绩adverse effect 负面影响public body 公共机构financial contribution 财政捐助safeguard clause 保障条款Committee on Subsidies and Contervailing Measures 补贴与反补贴委员会Permanent Group of Gxperts(PGE) 常设专家组Dispute Settlement Mechanism(DSM) 争端解决机制Dispute Settlement Body(DSB) 争端解决机构Appelate Body (AB) 上诉机构。

反倾销税英语Anti-dumping DutiesIntroduction:Anti-dumping duties, also known as anti-dumping taxes, are tariffs imposed by governments on imported goods that are being sold at a price lower than their fair market value. The aim is to protect domestic industries from unfair competition caused by below-cost or subsidized imports. This article provides an overview of anti-dumping duties, including their purpose, process, impact, and criticism.Purpose of Anti-dumping Duties:The primary purpose of anti-dumping duties is to protect domestic industries from unfair trade practices. Dumping occurs when a foreign company sells its goods in another country at a price lower than their production cost or the price at which they are sold in their home market. This predatory pricing can harm domestic industries, leading to job losses and reduced competitiveness. Anti-dumping duties are imposed to offset the price disadvantage caused by such practices and to create a level playing field for domestic producers.Process of Imposing Anti-dumping Duties:The process of imposing anti-dumping duties typically involves several stages. First, the affected domestic industry files a complaint with the national authority responsible for trade remedies. The complaint must provide evidence of unfair trade practices and injury caused to the domestic industry. Upon receiving the complaint, the authority initiates an investigation to determine whether dumping has occurred and whether it has caused material injury to the domestic industry.During the investigation, the authority examines various factors, such as the price difference between the imported goods and the fair market value, the impact on domestic producers, and the extent of subsidization, if any. If the investigation confirms dumpingand injury, the authority may recommend the imposition of anti-dumping duties. The final decision is typically taken by the government, considering the overall economic impact.Impact of Anti-dumping Duties:The impact of anti-dumping duties can be both positive and negative. On the positive side, these duties can protect domestic industries and preserve jobs. By preventing unfair competition, anti-dumping duties can create a more level playing field, allowing domestic producers to compete on a fair basis. They can also serve as a deterrent to potential dumping practices and discourage unfair trade practices in the future.However, anti-dumping duties can also have unintended negative consequences. They can lead to higher prices for imported goods, reducing consumer choices and increasing costs for downstream industries that rely on these inputs. Additionally, retaliation from the exporting country can occur, resulting in a trade war that harms both economies. Moreover, anti-dumping measures can be seen as protectionist and may violate international trade laws if not applied in a non-discriminatory manner.Criticism of Anti-dumping Duties:Anti-dumping duties have faced criticism on several fronts. One criticism is that they can be subject to abuse by domestic industries seeking protection from competition rather than addressing inefficiencies. Some argue that these measures are used as a form of trade barrier rather than genuine concern for fair trade practices.Another criticism is that the process of imposing anti-dumping duties can be lengthy, costly, and subject to political influence. The investigation process may take months or even years, causing uncertainty for businesses involved. Additionally, the evidence required to prove dumping and injury can be subjective, leading to disputes between countries and potential bias in decision-making.Conclusion:Anti-dumping duties serve as a vital tool to protect domestic industries from unfair competition caused by dumping. They aim to create a level playing field for domestic producers, safeguard jobs, and prevent predatory pricing practices. However, their impact can have both positive and negative consequences, requiring a careful balance between protecting domestic industries and ensuring the overall benefits of international trade. Efforts should be made to address the criticisms and challenges associated with anti-dumping duties to promote fair trade practices and global economic growth.。

Growing globalization of trade, countries tend to protect their own industries also will be stronger, anti-dumping most of the country's main take on a trade security system. As the world continues to develop economic and trade relations, almost white-hot competition in the international market, declining levels of national tariffs and the imbalance of economic development, international fight against dumping and anti-dumping even more intense.So , what is the dumping and anti-dumping it?Dumping refers to a country or region of export operators to lower the average price of the domestic market, normal or even below cost price to sell their products to another country's market behavior, the purpose is to beat competitors to win market, and therefore to import State the same or similar product manufacturers and industry damaging.Anti-dumping, is a country (importing country) for his country for its own actions taken against dumping measures.Dumping and anti-dumping has a clear history of the occurrence and development trajectory: from the dumpingcountry point of view, dumping as industrialized countries have gradually from the initial first few extended to more countries; dumping of goods from the point of view, a product initially only a few countries manufacturers dumping, but gradually more and more countries involved manufacturers, and some products initially by the dumping of industrial countries first, but gradually turned to the future line of country-based. Since World War II, the track and dumping, anti-dumping evolution is also very consistent. Monopoly, tariff barriers, the country's policy of export promotion and import restrictions on dumping the occurrence and development, as well as dumping and anti-dumping intensification of contradictions played a very important role. But, more generally, the root cause lies with the industrial sales market competition, the popularity and becomes more intense, and with the advantages of production has a "natural" links. Anti-dumping is only a boycott of the protection measures. It seems that the dumping and anti-dumping continues to be an important future issue of international trade should be no surprising.贸易的全球化趋势越来越强,各国对本国产业的保护倾向也随之愈强,反倾销就成为大多数国家主要采取的贸易保障制度。