财务估价模型的比较分析报告

- 格式:doc

- 大小:225.00 KB

- 文档页数:41

第1篇一、报告概述本报告旨在通过对我国某两家上市公司A公司和B公司的财务状况进行比较分析,揭示两家公司在财务状况、经营成果和现金流量等方面的异同,为投资者、管理层和相关部门提供决策依据。

报告选取了A公司和B公司近三年的财务报表数据,包括资产负债表、利润表和现金流量表,运用财务比率分析法、趋势分析法等方法,对两家公司的财务状况进行深入剖析。

二、财务比率分析1. 盈利能力分析(1)A公司A公司近三年的营业收入分别为:100亿元、110亿元、120亿元;净利润分别为:5亿元、6亿元、7亿元。

营业收入和净利润均呈逐年增长趋势。

(2)B公司B公司近三年的营业收入分别为:90亿元、95亿元、100亿元;净利润分别为:4亿元、5亿元、6亿元。

营业收入和净利润也呈逐年增长趋势。

通过对比两家公司的盈利能力,我们可以发现A公司盈利能力略优于B公司。

2. 偿债能力分析(1)A公司A公司近三年的流动比率分别为:2.0、2.1、2.2;速动比率分别为:1.5、1.6、1.7。

流动比率和速动比率均呈逐年上升趋势。

(2)B公司B公司近三年的流动比率分别为:1.8、1.9、2.0;速动比率分别为:1.4、1.5、1.6。

流动比率和速动比率也呈逐年上升趋势。

通过对比两家公司的偿债能力,我们可以发现A公司偿债能力略强于B公司。

3. 运营能力分析(1)A公司A公司近三年的总资产周转率分别为:1.0、1.1、1.2;应收账款周转率分别为:5.0、5.5、6.0。

总资产周转率和应收账款周转率均呈逐年上升趋势。

(2)B公司B公司近三年的总资产周转率分别为:0.9、1.0、1.1;应收账款周转率分别为:4.5、5.0、5.5。

总资产周转率和应收账款周转率也呈逐年上升趋势。

通过对比两家公司的运营能力,我们可以发现A公司运营能力略优于B公司。

4. 现金流量分析(1)A公司A公司近三年的经营活动现金流量净额分别为:10亿元、12亿元、15亿元;投资活动现金流量净额分别为:5亿元、6亿元、7亿元;筹资活动现金流量净额分别为:3亿元、4亿元、5亿元。

第1篇一、摘要本报告通过对某公司近三年的财务数据进行深入分析,旨在揭示公司的财务状况、盈利能力、偿债能力、运营能力和成长能力。

通过对财务数据的建模与分析,为公司管理层提供决策依据,为投资者提供投资参考。

二、数据来源与说明本报告所使用的财务数据来源于公司年度报告、季报及半年报,数据涵盖了公司的资产、负债、所有者权益、收入、成本、费用等财务指标。

为确保数据的准确性和可靠性,我们对原始数据进行了一定程度的清洗和整理。

三、财务状况分析1. 资产结构分析从公司近三年的资产负债表可以看出,公司的资产总额逐年增长,其中流动资产占比最大,非流动资产占比逐年提高。

具体如下:(1)流动资产:主要包括货币资金、应收账款、存货等。

近三年,流动资产占比逐年上升,说明公司在短期内具有较好的偿债能力。

(2)非流动资产:主要包括固定资产、无形资产等。

近三年,非流动资产占比逐年提高,说明公司对长期发展投入较大。

2. 负债结构分析从公司近三年的资产负债表可以看出,公司的负债总额逐年增长,其中流动负债占比最大,非流动负债占比逐年提高。

具体如下:(1)流动负债:主要包括短期借款、应付账款等。

近三年,流动负债占比逐年上升,说明公司在短期内具有较好的偿债能力。

(2)非流动负债:主要包括长期借款、长期应付款等。

近三年,非流动负债占比逐年提高,说明公司对长期发展投入较大。

3. 所有者权益分析从公司近三年的资产负债表可以看出,公司的所有者权益逐年增长,其中实收资本占比最大,资本公积、盈余公积等占比逐年提高。

具体如下:(1)实收资本:近三年,实收资本占比逐年上升,说明公司吸引投资者投资的能力较强。

(2)资本公积、盈余公积:近三年,占比逐年提高,说明公司盈利能力较强。

四、盈利能力分析1. 盈利能力指标分析通过对公司近三年的财务数据进行分析,我们可以得出以下结论:(1)营业收入:近三年,营业收入逐年增长,说明公司市场竞争力较强。

(2)营业成本:近三年,营业成本逐年增长,但增速低于营业收入增速,说明公司成本控制能力较好。

第1篇一、报告概述本报告旨在通过对某公司财务模型的深入分析,评估其财务状况、盈利能力、偿债能力、运营能力和成长性等方面,为投资者、管理层和相关部门提供决策参考。

报告采用定量分析与定性分析相结合的方法,对公司的财务报表、现金流量表和资产负债表进行综合分析。

二、公司概况(一)公司简介某公司成立于XX年,主要从事XX行业产品的研发、生产和销售。

公司总部位于我国某一线城市,注册资本为XX万元,现有员工XX人。

公司经过多年的发展,已形成较为完善的产业链,产品远销国内外市场。

(二)行业背景XX行业近年来发展迅速,市场需求旺盛。

随着我国经济的持续增长,消费者对XX产品的需求不断增加,为公司提供了良好的发展机遇。

然而,市场竞争也日益激烈,公司需不断提升产品品质和创新能力,以保持竞争优势。

三、财务模型分析(一)盈利能力分析1. 毛利率分析某公司近年来毛利率波动较大,主要原因是原材料价格波动和市场竞争加剧。

近年来,公司毛利率保持在30%左右,与行业平均水平相当。

2. 净利率分析某公司近年来净利率波动较大,主要受毛利率、期间费用和营业外收支的影响。

近年来,公司净利率保持在10%左右,低于行业平均水平。

(二)偿债能力分析1. 流动比率分析某公司流动比率近年来保持稳定,说明公司短期偿债能力较强。

近年来,公司流动比率保持在2.0左右,高于行业平均水平。

2. 速动比率分析某公司速动比率近年来保持稳定,说明公司短期偿债能力较强。

近年来,公司速动比率保持在1.5左右,高于行业平均水平。

3. 资产负债率分析某公司资产负债率近年来保持稳定,说明公司长期偿债能力较好。

近年来,公司资产负债率保持在50%左右,低于行业平均水平。

(三)运营能力分析1. 存货周转率分析某公司存货周转率近年来有所下降,主要原因是公司加大了库存管理力度,确保产品供应。

近年来,公司存货周转率保持在4次/年,高于行业平均水平。

2. 应收账款周转率分析某公司应收账款周转率近年来有所下降,主要原因是市场竞争加剧,部分客户回款速度变慢。

第1篇一、摘要本报告通过对XX公司、YY公司和ZZ公司三家公司近三年的财务报表进行对比分析,旨在揭示三家公司财务状况的异同,分析其盈利能力、偿债能力、运营能力和成长能力等方面的表现,为投资者、管理层和相关部门提供决策参考。

二、公司简介1. XX公司XX公司成立于2005年,主要从事XX行业的生产、销售和研发。

公司注册资本为XX万元,总部位于XX市。

经过多年的发展,公司已成为该行业领军企业之一。

2. YY公司YY公司成立于2007年,主要从事YY行业的生产、销售和研发。

公司注册资本为XX万元,总部位于XX市。

近年来,YY公司在该行业市场占有率逐年上升,成为行业佼佼者。

3. ZZ公司ZZ公司成立于2008年,主要从事ZZ行业的生产、销售和研发。

公司注册资本为XX万元,总部位于XX市。

ZZ公司凭借其先进的技术和优质的产品,在行业内具有较高的知名度。

三、财务报表比较分析1. 盈利能力分析(1)营业收入比较从近三年的营业收入来看,XX公司、YY公司和ZZ公司的营业收入均呈上升趋势。

其中,YY公司营业收入增长最快,增速达到XX%。

XX公司和ZZ公司营业收入增速相对较慢,分别为XX%和XX%。

(2)净利润比较在净利润方面,YY公司表现最为突出,近三年净利润分别为XX万元、XX万元和XX万元,同比增长率分别为XX%、XX%和XX%。

XX公司和ZZ公司净利润分别为XX 万元、XX万元和XX万元,同比增长率分别为XX%、XX%和XX%。

2. 偿债能力分析(1)流动比率比较从流动比率来看,XX公司、YY公司和ZZ公司的流动比率分别为XX、XX和XX。

YY公司的流动比率最高,表明其短期偿债能力较强。

XX公司和ZZ公司的流动比率相对较低,但仍处于合理范围内。

(2)速动比率比较速动比率方面,XX公司、YY公司和ZZ公司的速动比率分别为XX、XX和XX。

YY公司的速动比率最高,表明其短期偿债能力较强。

XX公司和ZZ公司的速动比率相对较低,但仍处于合理范围内。

第1篇一、报告概述本报告旨在通过对甲、乙两公司财务数据的对比分析,揭示两家公司在财务状况、经营成果、现金流量等方面的差异,为投资者、管理层及相关部门提供决策依据。

报告选取了甲、乙两家公司近三年的财务报表数据,包括资产负债表、利润表和现金流量表,通过对各项财务指标的计算和比较,分析两家公司的财务状况。

二、财务指标分析1. 资产负债表分析(1)资产结构分析甲公司近三年资产总额分别为:2019年1000万元,2020年1200万元,2021年1500万元;乙公司近三年资产总额分别为:2019年800万元,2020年900万元,2021年1100万元。

从资产总额来看,甲公司资产规模逐年增长,乙公司资产规模增长速度较慢。

甲公司2019年资产结构中,流动资产占比为60%,非流动资产占比为40%;2020年流动资产占比为65%,非流动资产占比为35%;2021年流动资产占比为70%,非流动资产占比为30%。

乙公司2019年资产结构中,流动资产占比为50%,非流动资产占比为50%;2020年流动资产占比为55%,非流动资产占比为45%;2021年流动资产占比为60%,非流动资产占比为40%。

从资产结构来看,甲公司流动资产占比逐年上升,说明公司短期偿债能力较强;乙公司流动资产占比相对稳定,短期偿债能力一般。

(2)负债结构分析甲公司近三年负债总额分别为:2019年500万元,2020年600万元,2021年700万元;乙公司近三年负债总额分别为:2019年400万元,2020年500万元,2021年600万元。

从负债总额来看,甲公司负债规模逐年增长,乙公司负债规模增长速度较慢。

甲公司2019年负债结构中,流动负债占比为60%,非流动负债占比为40%;2020年流动负债占比为65%,非流动负债占比为35%;2021年流动负债占比为70%,非流动负债占比为30%。

乙公司2019年负债结构中,流动负债占比为50%,非流动负债占比为50%;2020年流动负债占比为55%,非流动负债占比为45%;2021年流动负债占比为60%,非流动负债占比为40%。

第1篇一、引言随着我国经济的快速发展,企业竞争日益激烈,财务分析在企业决策中的作用日益凸显。

财务模型估算分析作为一种重要的财务分析方法,能够为企业提供准确的财务数据,帮助企业了解自身财务状况,为决策提供有力支持。

本报告旨在通过对某企业财务模型的估算分析,为企业决策提供参考。

二、企业概况某企业成立于2000年,主要从事电子产品研发、生产和销售。

经过多年的发展,企业规模不断扩大,产品线日益丰富。

截至2020年,企业总资产为10亿元,营业收入为5亿元,净利润为0.5亿元。

三、财务模型估算分析1. 资产负债表分析(1)流动资产分析根据企业2020年资产负债表,流动资产总额为3亿元,主要包括货币资金、应收账款、存货等。

其中,货币资金1亿元,占比30%;应收账款1.5亿元,占比50%;存货0.5亿元,占比17%。

从数据来看,企业流动资产结构较为合理,但应收账款占比过高,存在一定的坏账风险。

(2)非流动资产分析非流动资产主要包括固定资产、无形资产等。

2020年,企业非流动资产总额为7亿元,其中固定资产6亿元,占比86%;无形资产1亿元,占比14%。

从数据来看,企业固定资产占比过高,存在一定的折旧风险。

(3)负债分析企业负债主要包括短期借款、长期借款、应付账款等。

2020年,企业负债总额为6亿元,其中短期借款2亿元,占比33%;长期借款4亿元,占比67%。

从数据来看,企业负债结构较为合理,长期借款占比较高,有利于企业长期发展。

2. 利润表分析(1)营业收入分析2020年,企业营业收入为5亿元,同比增长10%。

从数据来看,企业营业收入保持稳定增长,市场竞争力较强。

(2)成本费用分析2020年,企业成本费用总额为4亿元,同比增长5%。

其中,主营业务成本3亿元,占比60%;销售费用0.5亿元,占比10%;管理费用0.5亿元,占比10%。

从数据来看,企业成本费用控制较好,但销售费用和管理费用仍有下降空间。

(3)净利润分析2020年,企业净利润为0.5亿元,同比增长10%。

(完整版)财务分析模型财务分析模型是一种用于评估和分析企业财务状况的工具。

通过运用财务比率、财务指标和财务比较的方法,财务分析模型能够帮助投资者、分析师和决策者更好地了解企业的经营现状和未来发展趋势。

本文将介绍财务分析模型的基本概念和常用方法,并探讨其在实际应用中的优势和局限性。

首先,财务分析模型的基本概念。

财务分析模型是指一系列用于分析企业财务状况的工具和方法。

它可以通过对企业的财务报表进行定量分析,从而对企业的经营状况、盈利能力、偿债能力和运营效率等方面进行评估。

常用的财务分析模型包括比率分析、趋势分析和竞争对标分析。

这些模型可以帮助人们更好地了解企业的财务状况,并为投资决策和管理决策提供依据。

其次,财务分析模型的常用方法。

比率分析是财务分析模型中最常用的方法之一。

它通过计算和比较不同的财务比率,从而评估企业的财务状况。

常见的财务比率包括盈利能力比率、偿债能力比率和运营效率比率等。

盈利能力比率可以帮助人们了解企业的盈利能力,偿债能力比率可以评估企业的偿债能力,运营效率比率可以判断企业的运营效率。

趋势分析是另一种常用的财务分析方法,它通过比较不同期间的财务数据,分析企业的财务状况的变化趋势。

竞争对标分析是一种将企业与同行业竞争对手进行比较的方法,通过比较企业与竞争对手的财务数据,评估企业在同行业中的竞争优势和劣势。

财务分析模型的优势是可以帮助人们全面、客观地了解企业的财务状况。

通过比较不同的财务指标和财务比率,人们可以得到一个全面的、立体化的企业财务画像。

这有助于投资者和分析师做出准确的投资决策,并帮助企业管理者了解企业的优势和不足,及时采取调整措施。

此外,财务分析模型还可以帮助企业和投资者发现企业的潜在问题,预测企业的未来发展趋势。

然而,财务分析模型也存在一定的局限性。

首先,财务分析模型只是对企业财务状况的一种评估工具,是以历史数据为基础进行分析的。

在当前快速变化的商业环境下,财务数据往往无法完全反映企业的实际状况和未来发展趋势。

财务预测模型的比较与评价在企业的经营过程中,财务预测模型的比较与评价是一项非常重要的工作。

通过对不同财务预测模型的比较与评价,企业可以选择适合自身情况的模型,提高财务决策的准确性和可靠性。

本文将从几个方面对财务预测模型进行比较与评价,帮助企业更好地进行财务决策。

我们可以从预测的准确性来评价财务预测模型。

准确性是一个财务预测模型最基本的要求之一,也是企业选择模型的关键因素之一。

因此,在比较和评价财务预测模型时,准确性是我们需要重点关注的指标之一。

第二,模型的适用范围也是比较和评价财务预测模型的重要因素之一。

不同的财务预测模型可能适用于不同的企业情况和行业特点。

因此,在比较和评价财务预测模型时,我们需要考虑模型是否适用于企业的具体情况,是否能够满足企业的需求。

第三,模型的可解释性也是一个需要考虑的因素。

财务预测模型的可解释性指的是模型结果能否被解释和理解。

对于企业而言,财务预测模型的可解释性非常重要,因为只有能够理解和解释模型结果,企业才能更好地制定财务决策和调整经营战略。

第四,模型的稳定性和可靠性也是比较和评价财务预测模型的关键因素之一。

财务预测模型的稳定性指的是在不同情况下,模型的预测结果是否一致和可靠。

对于企业而言,稳定性和可靠性是企业选择财务预测模型的重要考虑因素之一,只有在模型稳定可靠的基础上,企业才能更加准确地预测未来的财务情况,做出正确的财务决策。

第五,模型的易用性也是比较和评价财务预测模型的重要因素之一。

企业在使用财务预测模型时,希望能够使用简便、操作方便。

因此,模型的易用性是企业选择财务预测模型时需要考虑的重要因素之一。

我们还可以从模型的可比性和可复制性来评价财务预测模型。

财务预测模型的可比性指的是不同模型之间的比较是否具有可比性,是否可以进行有效的比较和评价。

财务预测模型的可复制性指的是模型是否可以被其他企业复制和使用。

财务预测模型的可比性和可复制性是企业选择模型时需要考虑的重要因素之一,只有具有可比性和可复制性的模型才能帮助企业进行准确的财务预测和决策。

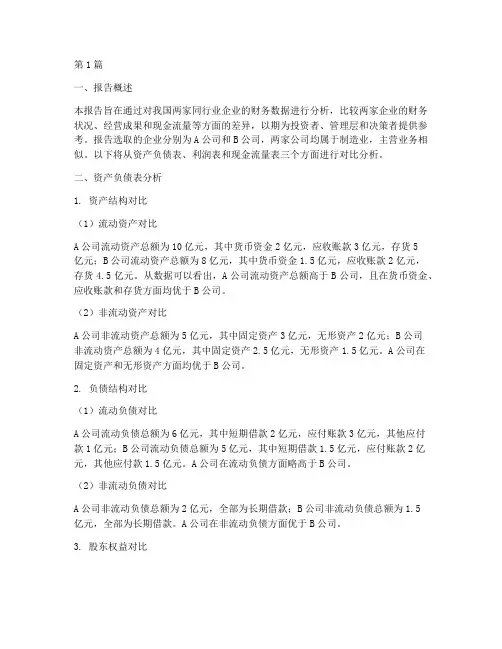

第1篇一、报告概述本报告旨在通过对我国两家同行业企业的财务数据进行分析,比较两家企业的财务状况、经营成果和现金流量等方面的差异,以期为投资者、管理层和决策者提供参考。

报告选取的企业分别为A公司和B公司,两家公司均属于制造业,主营业务相似。

以下将从资产负债表、利润表和现金流量表三个方面进行对比分析。

二、资产负债表分析1. 资产结构对比(1)流动资产对比A公司流动资产总额为10亿元,其中货币资金2亿元,应收账款3亿元,存货5亿元;B公司流动资产总额为8亿元,其中货币资金1.5亿元,应收账款2亿元,存货4.5亿元。

从数据可以看出,A公司流动资产总额高于B公司,且在货币资金、应收账款和存货方面均优于B公司。

(2)非流动资产对比A公司非流动资产总额为5亿元,其中固定资产3亿元,无形资产2亿元;B公司非流动资产总额为4亿元,其中固定资产2.5亿元,无形资产1.5亿元。

A公司在固定资产和无形资产方面均优于B公司。

2. 负债结构对比(1)流动负债对比A公司流动负债总额为6亿元,其中短期借款2亿元,应付账款3亿元,其他应付款1亿元;B公司流动负债总额为5亿元,其中短期借款1.5亿元,应付账款2亿元,其他应付款1.5亿元。

A公司在流动负债方面略高于B公司。

(2)非流动负债对比A公司非流动负债总额为2亿元,全部为长期借款;B公司非流动负债总额为1.5亿元,全部为长期借款。

A公司在非流动负债方面优于B公司。

3. 股东权益对比A公司股东权益总额为8亿元,B公司股东权益总额为6.5亿元。

A公司在股东权益方面优于B公司。

三、利润表分析1. 营业收入对比A公司营业收入为15亿元,B公司营业收入为12亿元。

A公司在营业收入方面优于B公司。

2. 营业成本对比A公司营业成本为10亿元,B公司营业成本为8亿元。

A公司在营业成本方面高于B公司。

3. 利润总额对比A公司利润总额为5亿元,B公司利润总额为4亿元。

A公司在利润总额方面优于B 公司。

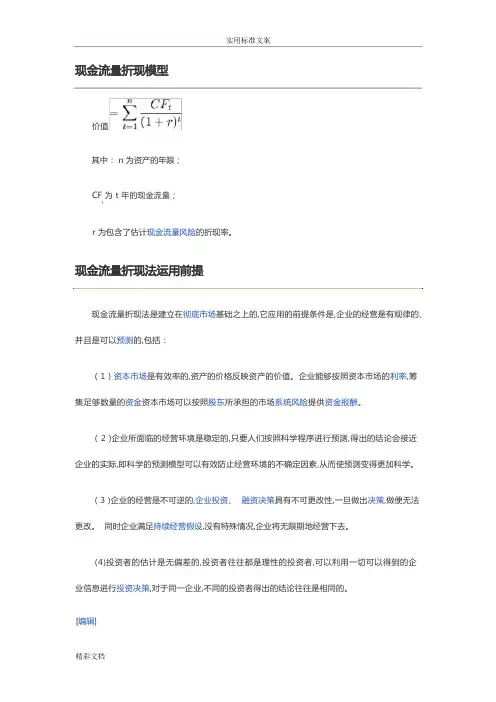

价值其中: n 为资产的年限;CF 为 t 年的现金流量;tr 为包含了估计现金流量风险的折现率。

现金流量折现法是建立在彻底市场基础之上的,它应用的前提条件是,企业的经营是有规律的、并且是可以预测的,包括:( 1 ) 资本市场是有效率的,资产的价格反映资产的价值。

企业能够按照资本市场的利率,筹集足够数量的资金资本市场可以按照股东所承担的市场系统风险提供资金报酬。

( 2 )企业所面临的经营环境是稳定的,只要人们按照科学程序进行预测,得出的结论会接近企业的实际,即科学的预测模型可以有效防止经营环境的不确定因素,从而使预测变得更加科学。

( 3 )企业的经营是不可逆的,企业投资、融资决策具有不可更改性,一旦做出决策,做便无法更改。

同时企业满足持续经营假设,没有特殊情况,企业将无限期地经营下去。

(4)投资者的估计是无偏差的,投资者往往都是理性的投资者,可以利用一切可以得到的企业信息进行投资决策,对于同一企业,不同的投资者得出的结论往往是相同的。

[编辑]由于目前的现金流量折现方法存在种种假设前提,而现实的资本市场和投资者素质往往无法达到其要求的条件,因此在利用现金流量折现方法进行评估时会浮现各种问题,主要表现在:( 1 )没有反映现金流量的动态变化由于企业的现金流量时刻处干变化之中,而且现金流量是时间、销售收入等参数的变化函数,必然导致依赖于现金流量的企业价值也处于动态变化之中。

但是在前面的评估模型中,忽视了现金流量的动态变化,单单依靠线性关系来确定现金流量,使评估结果更多地表现为静态结论。

( 2 )不能反映企业财务杠杆的动态变化由于企业在经营中会根据环境的变化而改变企业的举债数额和负债比率,引起财务杠杆的波动,从而使企业的风险发生波动。

普通情况下,这种风险的变化要在现金流量或者折现率中得到反映。

但是目前的评估模型只是从静止的观点进行价值评估, 忽视了这种财务杠杆和财务风险的变化。

( 3 )现金流量的预测问题目前的现金流量预测是将现金流量与销售收人和净利润的增长联系起来,虽然从表面上看两者具有相关性,但是在实际中,净利润与现金流量是相关的,这其中主要是企业对会计政策的调整以及避税等手段的运用,浮现净利润、销售收人与现金流量不配比的现象。

财务估价模型的比较分析1. 引言财务估价模型是用来评估和估计企业或资产的价值的工具。

在投资决策、并购、估值和风险评估等领域,财务估价模型被广泛应用。

本文将对几种常见的财务估价模型进行比较分析,包括贴现现金流量模型(DCF)、市盈率模型和资本资产定价模型(CAPM)。

2. 贴现现金流量模型(DCF)贴现现金流量模型是一种以现金流量为基础的估价模型。

它的核心思想是将未来的现金流量贴现到现值,以确定资产的现值。

DCF模型包含两个主要步骤:预测未来现金流量和确定贴现率。

优点是能够考虑到资产的时间价值和风险。

然而,DCF模型需要对未来现金流量和贴现率进行估计,这可能存在主观性和不确定性。

3. 市盈率模型市盈率模型是一种通过利用企业市场价值与盈利能力之间的关系来估价的模型。

它基于企业的市盈率以及预期盈利水平来确定企业的价值。

市盈率模型的优点是简单易懂,便于快速估值。

然而,它没有考虑到企业的财务状况、增长潜力和风险水平等因素,因此可能忽略了一些重要的价值影响因素。

4. 资本资产定价模型(CAPM)资本资产定价模型是一种用来确定资产当前风险调整回报率的模型。

它基于市场风险溢价、资产贝塔系数和无风险利率等因素来决定资产的期望回报率。

CAPM模型的优点是能够考虑到资产的系统性风险和市场因素。

然而,CAPM模型的核心假设包括市场的完全理性和无摩擦交易等,在实际应用中可能存在一定的限制。

5. 比较分析对于财务估价模型的比较分析,我们可以从多个维度进行评估。

首先是精度和可靠性方面。

DCF模型在理论上是最准确和可靠的,因为它基于现金流量的贴现和风险调整。

市盈率模型相对来说比较简单,但它对企业的财务状况和风险等因素没有进行充分考虑,因此可能精度较低。

CAPM模型在考虑了资产的系统性风险后能够提供相对准确的估值。

其次是应用范围和难度方面。

DCF模型可以适用于各种类型的企业和项目,但需要对未来现金流量进行预测和确定合适的贴现率,因此相对较为复杂。

第1篇一、引言随着我国经济的快速发展,企业竞争日益激烈,财务管理在企业运营中的重要性日益凸显。

为了提高财务管理水平,许多企业开始运用模型分析方法来预测、评估和优化财务状况。

本报告旨在通过对公司财务部的模型进行分析,评估其有效性,并提出改进建议。

二、公司财务部模型概述1. 模型背景公司财务部模型是针对公司财务状况进行的一种预测和评估工具,主要包括收入预测模型、成本预测模型、现金流预测模型、资产负债表预测模型等。

通过这些模型,财务部可以对企业未来的财务状况进行预测,为管理层提供决策依据。

2. 模型构成(1)收入预测模型:主要包括销售额预测、利润预测等。

(2)成本预测模型:主要包括直接成本、间接成本、变动成本、固定成本等。

(3)现金流预测模型:主要包括经营活动、投资活动和筹资活动的现金流预测。

(4)资产负债表预测模型:主要包括资产、负债和所有者权益的预测。

三、模型分析1. 收入预测模型分析(1)模型方法:采用历史数据趋势分析、市场调研、专家意见等方法进行预测。

(2)模型效果:模型预测结果与实际收入存在一定偏差,主要原因是市场环境变化、竞争对手策略调整等因素。

(3)改进建议:结合市场动态,优化模型参数,提高预测准确性。

2. 成本预测模型分析(1)模型方法:采用回归分析、时间序列分析等方法进行预测。

(2)模型效果:模型预测结果与实际成本基本吻合,说明模型具有较强的预测能力。

(3)改进建议:关注成本构成变化,优化模型参数,提高预测准确性。

3. 现金流预测模型分析(1)模型方法:采用现金流量表分析、现金流量预测模型等方法进行预测。

(2)模型效果:模型预测结果与实际现金流存在一定偏差,主要原因是预测期间的市场环境变化。

(3)改进建议:关注市场动态,优化模型参数,提高预测准确性。

4. 资产负债表预测模型分析(1)模型方法:采用资产负债表分析、财务比率分析等方法进行预测。

(2)模型效果:模型预测结果与实际资产负债表基本吻合,说明模型具有较强的预测能力。

财务风险评估模型的比较研究在当今市场经济中,财务风险评估对企业的经营管理至关重要。

针对不同类型的企业,有许多不同的财务风险评估模型可供选择。

本文旨在比较并分析几种常用的财务风险评估模型,以便企业能更好地选择适合自身的模型。

一、财务比率分析模型财务比率分析模型是最常见也是最简单的风险评估模型之一。

该模型通过计算企业在财务方面的指标,如流动比率、速动比率和资产负债率等来评估财务风险。

这些指标可以帮助企业了解其短期偿债能力、经营活动的回报以及负债结构是否健康。

优点:财务比率分析模型简单易行,不需要复杂的计算和数据,能够提供直观的风险评估结果。

缺点:财务比率分析模型只能提供静态的财务信息,无法反映企业的经营变化和未来趋势,对缺乏规范财务数据的企业效果不佳。

二、贝塔系数模型贝塔系数模型是一种风险评估模型,主要用于评估股票的风险。

该模型通过计算一个资产相对于市场的波动性,来评估该资产的系统性风险。

贝塔系数越高,表示该资产对市场的波动性敏感程度越高。

优点:贝塔系数模型能够帮助企业评估资产在整体市场中的风险水平,对于投资决策和资产配置具有指导意义。

缺点:贝塔系数模型过于依赖市场波动性,忽视了企业经营活动和内部因素对风险的影响,对于非股票类资产的评估效果有限。

三、实证模型实证模型通过对历史数据的统计分析,建立模型来预测未来的财务风险。

常用的实证模型包括回归模型、时间序列模型和灰色预测模型等。

这些模型通过对已有数据的拟合和分析,提供了一种有科学依据的财务风险评估结果。

优点:实证模型基于历史数据和统计分析,能够提供相对准确的财务风险预测结果,对于企业决策具有指导作用。

缺点:实证模型建立在历史数据的基础上,无法预测未来的市场变化和突发事件,对于市场整体风险的评估有一定局限性。

综上所述,根据企业的特点和需求,选择适合自身的财务风险评估模型非常重要。

财务比率分析模型适用于数据规范、稳定的企业;贝塔系数模型适用于股票和资本市场相关的风险评估;实证模型适用于通过历史数据进行风险预测的企业。

第1篇一、引言随着我国经济的快速发展,企业面临着日益复杂的市场环境和激烈的市场竞争。

在这种情况下,财务管理作为企业管理的重要组成部分,其作用愈发凸显。

为了提高企业的财务管理水平,许多企业开始引入先进的财务管理模型,以期实现财务管理的科学化、精细化。

本文将针对某企业所采用的财务管理模型进行深入分析,以期为我国企业的财务管理提供参考。

二、模型概述本报告所分析的财务管理模型为某企业所采用的全面预算管理模型。

该模型以预算为核心,将企业的财务、业务、人力资源等各个方面进行整合,通过预算编制、执行、监控、分析等环节,实现对企业财务状况的全面把握和有效控制。

三、模型结构1. 预算编制预算编制是全面预算管理模型的基础环节。

该环节主要包括以下内容:(1)目标设定:根据企业的战略目标和年度经营计划,确定各预算期的财务目标。

(2)预算分解:将财务目标分解到各部门、各岗位,明确责任人和预算指标。

(3)预算编制:各部门根据预算指标和业务计划,编制本部门的预算。

(4)预算汇总:将各部门预算汇总形成企业整体预算。

2. 预算执行预算执行是全面预算管理模型的核心环节。

该环节主要包括以下内容:(1)预算下达:将编制好的预算下达给各部门、各岗位。

(2)预算控制:对预算执行过程中的各项费用进行控制,确保预算目标的实现。

(3)预算调整:根据实际情况,对预算进行调整,以适应市场变化。

3. 预算监控预算监控是全面预算管理模型的重要环节。

该环节主要包括以下内容:(1)预算执行情况分析:对预算执行过程中的各项指标进行监控和分析,找出存在的问题。

(2)预算预警:对预算执行过程中的异常情况发出预警,提醒相关部门采取措施。

(3)预算考核:对各部门、各岗位的预算执行情况进行考核,以激励各部门更好地完成预算目标。

4. 预算分析预算分析是全面预算管理模型的总结环节。

该环节主要包括以下内容:(1)预算执行情况总结:对预算执行情况进行总结,找出成功经验和不足。

公司财务资产评估报告

尊敬的公司领导和相关部门:

根据对公司财务资产的全面评估,我们得出以下结论:

1. 财务资产总额,根据最新的财务报表和资产清单,公司的财务资产总额为XXX万元。

2. 资产构成,公司的财务资产主要包括现金及现金等价物、应收账款、存货、固定资产、投资等。

3. 资产负债比,公司的资产负债比为XX%,表明公司的资产相对于负债较为充裕。

4. 资产流动性,公司的资产流动性良好,现金及现金等价物占比较高,可以满足日常经营和投资需求。

5. 资产价值变动,部分固定资产和投资的市值可能会受到市场波动的影响,需要定期进行评估和调整。

综上所述,公司的财务资产总体处于稳健状态,但仍需密切关注资产负债比、资产流动性和资产价值变动等方面的风险。

我们建议公司在资产管理和财务规划方面继续加强,以确保公司财务资产的稳健增长和风险控制。

谢谢。

人力资源行政专家签字,__________。

日期,__________。

财务分析模型引言概述:财务分析模型是一种用于评估和分析企业财务状况的工具。

通过运用不同的财务分析模型,可以匡助投资者、管理者和其他利益相关者了解企业的盈利能力、偿债能力和运营能力等方面的情况。

本文将介绍五种常用的财务分析模型,分别是比率分析模型、现金流量分析模型、成本效益分析模型、财务比较分析模型和趋势分析模型。

一、比率分析模型:1.1 偿债能力比率:包括流动比率、速动比率和现金比率等,用于评估企业偿付债务的能力。

1.2 盈利能力比率:包括毛利率、净利率和投资回报率等,用于评估企业盈利能力和投资回报情况。

1.3 运营能力比率:包括资产周转率、应收账款周转率和存货周转率等,用于评估企业运营效率和资产利用情况。

二、现金流量分析模型:2.1 现金流量表:通过分析现金流量表中的经营活动、投资活动和筹资活动,了解企业现金流量的来源和运用情况。

2.2 自由现金流量:计算企业的自由现金流量,评估企业的现金生成能力和资本支出情况。

2.3 现金流量比率:包括经营现金流量比率、投资现金流量比率和筹资现金流量比率等,用于评估企业现金流量的稳定性和健康程度。

三、成本效益分析模型:3.1 投资回收期:计算企业投资项目的回收期,评估项目的盈利能力和回报周期。

3.2 净现值:计算企业投资项目的净现值,评估项目的投资价值和可行性。

3.3 内部收益率:计算企业投资项目的内部收益率,评估项目的盈利能力和回报率。

四、财务比较分析模型:4.1 横向比较分析:通过比较同一企业不同期间的财务数据,了解企业的发展趋势和变化情况。

4.2 纵向比较分析:通过比较不同企业同一期间的财务数据,了解企业在同行业中的相对表现和竞争力。

4.3 对标分析:通过将企业的财务数据与同行业的平均水平进行对照,了解企业在行业中的地位和优势。

五、趋势分析模型:5.1 财务比率趋势分析:通过比较企业财务比率在一段时间内的变化情况,了解企业财务状况的趋势和发展方向。

5.2 现金流量趋势分析:通过比较企业现金流量在一段时间内的变化情况,了解企业现金流量的趋势和稳定性。