审计工作底稿(模板2)

- 格式:doc

- 大小:1.94 MB

- 文档页数:79

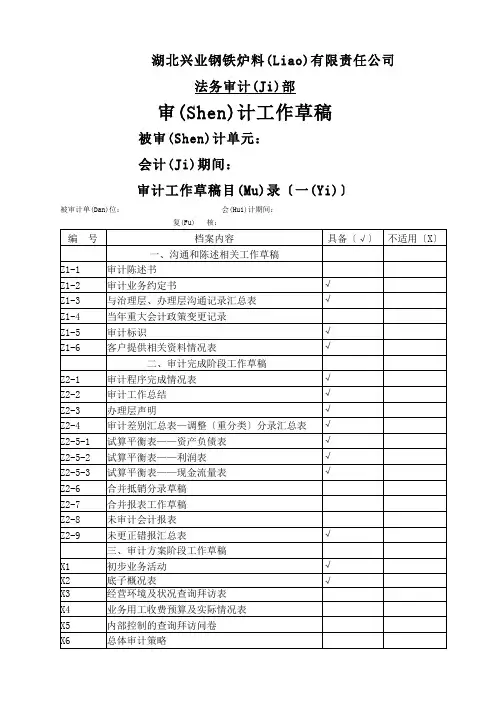

会计师事务所审计工作底稿客户名称:会计期间:审计工作底稿目录(一)客户: ABC有限责任公司会计期间:编制:复核:客户: ABC有限责任公司会计期间:编制:复核:客户: ABC有限责任公司会计期间:编制:复核:客户提供相关资料情况表被审计单位:索引号:项目:财务报表截止日/日期:编制:复核:日期:日期:被审计单位:索引号:项目:财务报表截止日/日期:编制:复核:日期:日期:被审计单位:索引号:项目:财务报表截止日/日期:编制:复核:日期:日期:业务约定书甲方:乙方:兹由甲方委托乙方对甲方年年度财务报表进行审计,经双方协商,达成以下约定:一、业务范围及目的乙方接受甲方委托:对甲方按照企业会计准则编制的年月日的资产负债表以及截止年度的利润表、股东权益变动表和现金流量表以及财务报表附注(以下统称财务报表)进行审计;乙方将根据《中国注册会计师审计准则》,通过执行审计工作,对财务报表的下列方面发表审计意见:(1)财务报表是否按照企业会计准则和相关会计制度的规定编制;(2)财务报表是否在所有重大方面公允反映甲方的财务状况、经营成果和现金流量。

二、甲方的责任与义务(一)甲方的责任1.根据《中华人民共各国会计法》及《企业财务会计报告条例》,甲方及甲方负责人保证会计资料的真实性和完整性。

因此,甲方管理层有责任妥善保存和提供会计记录,这些记录必须真实、完整地反映甲方的财务状况、经营成果和现金流量。

2.按照企业会计准则和《××会计制度》的规定编制财务报表是ABC公司管理层的责任,这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报;(2)选择和运用恰当的会计政策;(3)作出合理的会计估计。

(二))甲方的义务:1、及时为乙方的审计提供其所要求的全部会计资料和其他有关资料。

2、为乙方派出的有关人员提供必要的工作条件及合作,具体事项将由乙方审计工作人员于工作开始前提供清单。

审计工作底稿模板一、引言。

审计工作底稿是审计工作中的重要组成部分,是审计人员进行审计工作的依据和记录。

审计工作底稿的编制质量直接关系到审计工作的准确性和有效性,因此,审计工作底稿的编制要求严格、规范、全面。

本文档旨在为审计工作底稿的编制提供一个模板,以期能够帮助审计人员更好地进行审计工作。

二、审计工作底稿的编制要求。

1. 审计工作底稿的编制应当遵循审计准则和审计规范,确保审计工作的合规性和规范性。

2. 审计工作底稿的编制应当准确记录审计人员的工作过程和结论,确保审计工作的可追溯性和可复核性。

3. 审计工作底稿的编制应当全面反映审计对象的情况和问题,确保审计工作的全面性和客观性。

4. 审计工作底稿的编制应当清晰明了、统一规范,确保审计工作的清晰性和规范性。

5. 审计工作底稿的编制应当及时完成,确保审计工作的进度和效率。

三、审计工作底稿的模板。

1. 审计对象基本情况。

(1)审计对象名称:(2)审计对象性质:(3)审计对象行业:(4)审计对象规模:2. 审计工作范围。

(1)审计工作时间范围:(2)审计工作地点范围:(3)审计工作内容范围:3. 审计工作程序。

(1)审计工作计划:(2)审计工作调查:(3)审计工作取证:(4)审计工作分析:(5)审计工作结论:4. 审计工作问题记录。

(1)审计工作问题描述:(2)审计工作问题原因:(3)审计工作问题影响:(4)审计工作问题建议:5. 审计工作结论。

(1)审计工作结论概括:(2)审计工作结论依据:(3)审计工作结论建议:四、总结。

审计工作底稿的编制是审计工作中的重要环节,对审计工作的质量和效果具有重要影响。

因此,审计人员在进行审计工作底稿的编制时,应当严格按照相关要求进行,确保审计工作底稿的准确、全面、规范和清晰。

希望本文档提供的审计工作底稿模板能够对审计人员进行审计工作提供一定的帮助,使审计工作更加规范、高效。

四大审计底稿模板篇一:XX审计工作底稿模板审计署驻成都特派员办事处审计工作底稿索引号:第页(共页)附件:页[说明:审核人员提出2、3项审核意见的,审计人员应当将落实情况和结果作出书面说明,经审核人员认可并签字后,附于本底稿后。

]篇二:四大审计底稿Audit Program 31 December XXPrepared byReviewed byApproved byDateDateDateCLIENTYEAR END_____ 1. Compare the listing of cash and bank accounts with those of priorperiods and investigate any unexpected changes (,credit balances, unusual large balances, new accounts, closed accounts) or the absence of expected changes._____ 2. Review interest received in relation to the average cash and bankbalances.Cash balances_____ 3. (a) Obtain a copy of the list of balances of cash as at 31/12/1999 and31/12/XX.(b) Check casting and agree total with general ledger control account._____ 4. Scan cash entries noting any unusual items and make furtherinvestigation where considered necessary.Bank Balances_____ 5. (a) Obtain a copy of the list of balances of bank as at the period enddate; and(b) Check casting and agree total with general ledger control account.6. Bank Confirmation request (Note 2) (a) Get a standard bank confirmation request form from thestationery cupboard.(b) Fill in the client name, our reference number and the period oryear end date (please specify) for the bank to confirm.(c) Give the partial completed form to the relevant client staff . (d) Request the client to perform the following tasks:· Stamp the form with the company chop; · Have the form signed by an authorized signatory; · Fill in the balances in the appropriate boxes; · For items which are not applicable for the company, fill in “N/A” in the corresponding boxes; and · Confirm to us whether the form can be sent to the bank by mail or if the client is required to take the confirmation to the bank.CLIENTYEAR ENDBank Balances (Continued)(e) Check the completed confirmation form to ensure thefollowing: · the balances agreed to the bankstatements as at theconfirmation date; ·the form is properly signed; · the client has filled in all security and guarantee related matterson the bank confirmation; and · Send the bank confirmation form to the bank by post. OrIf the client staff has to take the confirmation to the bank, arrange a staff to go with him/her. (Note3)(f) Keep copies of the confirmation in the file until replies areobtained from the banks.(g) When replies are received, check the confirmations received toensure that: · the forms were stamped and signed by the bank on the lastpage; and ·the individual balances and information are endorsed by thebank staff personal chop. (Note 4)_____ 7. Examine the client’s bank reconciliation as at 31/12/XX asfollows:a) agree book balance to Cash Book and General Ledger;b) agree balance per bank statement to bank statement at theyear end and bank confirmation received;c) check casting of the bank reconciliation; d) vouch all lodgments / lodgments with amount greater thanRMB _____ * not clear to the cash book and bank statement in the following month ensuring all lodgments are cleared; (Note 5)e) vouch all outstanding cheques / outstanding cheques withamount greater than RMB _____ *to the cash book and to the bank statement in the following month & note down the date when they are cleared; (Note 5)f) obtain explanations from the client of all outstanding lodgments/ lodgment with amounts greater than RMB_____ *;g) investigate all stale cheques / stale cheques with amountgreater than RMB_____ * issued for more than five / ten days *, and make appropriate adjustments thereofin the cash book and ledger; (Note 6)CLIENTYEAR ENDBank Balances (Continued)h) investigate all payments / payments with amount greater than RMB_____ * recorded by the bank but not recorded by the client, and make appropriate adjustments thereof in the cash book and ledger; (Note6) andi) investigate all receipts / receipts with amount greater than RMB_____ * recorded by the bank but not recorded by the client, and make appropriate adjustments thereof in the cash book and ledger. (Note 6)_____ 8. Review the bank book for any unusual items (greater than RMB _____) such as:a)non-trading receipts or payments and b) transfers in and out of the bank accounts._____ 9. Select receipts larger than RMB ______ and payments larger than RMB ______ within ____weeks before and after the year end to ensure that they have been properly accounted for.General _____ 10. Review the cash and bank accounts in the general ledger for unusual items._____ 11. Review the cash disbursements and cash receipts registers for unusual items; investigate any such items observed._____ 12. Review bank confirmations, minutes, loan agreements and other documents for evidence of restrictions on the use of cash, or of liens, or security interests in, cash._____ 13. Consider the covenants and other narratives given in loan and other material agreements and determine compliance with the agreements and whether necessary disclosure have been made._____ 14. Consider the implications of client management practices that result in recurring short term loan to finance working capital. Consider inquiry of client management and alert your senior / executive should such short term loans be encountered in the audit.CLIENTYEAR END* Delete as appropriateNote 1i. The cash count should be performed by cashier with the presence of a staff that normally is not involved in the cashier function.ii. Cash certificate is acceptable only if the petty cash balance is considered as immaterial and / or the risk associated is low/ minimal.Note 2i. Bank confirmations are sent on an individual branch basis, one confirmation per branch. ii. Confirmation should also be sent to accounts closed during the year.iii. If either the bank or the client refuses to reply/send the confirmation, consider if there is a significant limitation of our audit scope and its implications.Note 3When it is not feasible for an EYHM staff to go with the client, we must reconsider if the confirmation obtained provides sufficient and reliable audit evidence due to the lack of independence.Note 4Alternatively, the bank may issue its own bank certificate to confirm the deposits and loans balances and confirm that no other business transactions exiting.Note 5The extent of vouching work depends on our assessment of the likelihood of errors occurring.Note 6We have to consider the effect in aggregate regarding the unadjusted items which are below the amount stipulated in this procedure whenever one is set.篇三:审计工作底稿(模板)XXX会计师事务所审计差异事项调整表编制人员:日期:// 复核人员:日期://XXX会计师事务所银行存款余额明细核对表编制人员:日期:// 复核人员:日期://XXX会计师事务所货币资金收入凭证抽查表编制人员:日期:// 复核人员:日期://XXX会计师事务所货币资金支出凭证抽查表编制人员:日期:// 复核人员:日期:// XXX会计师事务所。

专项审计底稿模板篇一:审计工作底稿会计师事务所审计工作底稿客户名称:会计期间:审计工作底稿目录(一)客户: ABC有限责任公司会计期间:编制:复核:客户: ABC有限责任公司会计期间:编制:复核:客户: ABC有限责任公司会计期间:编制:复核:客户提供相关资料情况表篇二:审计工作底稿样式审计工作底稿被审单位: 审核员:日期:索引号: A1 审查项目: 货币资金所属时期: 复核员:日期:页次:一、审计目标:①确定货币资金是否存在;②确定货币资金的收支记录是否完整;③确定库存现金、银行存款以及其他货币资金的余额是否正确;④确定货币资金在会计报表上的披露是否恰当。

二、审计程序:三、需说明的事项:四、期末余额:五、审计结论:1、本科目经审计后无调整事项,余额可以确认:2、本科目经审计调整后,审定数可以确认:?3、因__________ 原因,本科目余额不能确认: ?审计工作底稿被审单位: 审核员:日期:索引号: A1-3审查项目: 银行存款所属时期: 复核员:日期:页次:一、审计目标:①确定银行存款是否存在;②确定银行存款的收支记录是否完整;③确定银行存款的余额是否正确;④确定银行存款在会计报表上的披露是否恰当。

二、审计程序:三、需说明的事项:四、期末余额:五、审计结论:1、本科目经审计后无调整事项,余额可以确认:2、本科目经审计调整后,审定数可以确认:3、因____________原因,本科目余额不能确认: ?审计工作底稿被审单位: 审核员:日期:索引号: A7 审查项目: 应收帐款所属时期: 复核员:日期:页次:一、审计目标:①确定应收帐款是否存在;②确定应收帐款是否归被审计单位所有;③确定应收帐款增减变动的记录是否完整;④确定应收帐款是否可收回,坏帐准备的计提是否恰当;⑤确定应收帐款年末余额是否正确;⑥确定应收帐款在会计报表上的披露是否恰当。

三、需说明的事项:篇三:收支审计工作底稿审计工作底稿索引号:第页(共页)。

审计工作底稿

索引号:第页(共页)

项目名称

审计(调查)事项(按照审计实施方案确定的事项名称填写)

审计人员

编制日期

审计过程:

(说明实施审计的步骤和方法、所取得的审计证据的名称和来源。

多个底稿间共用

审计证据、且审计证据附在其他底稿后的,应当在上述内容表述完毕后,注明“其中,

**审计证据附在**号底稿后”)

审计认定的事实摘要及审计结论:

(审计结论包括未发现问题的结论和已发现问题的结论。

对已发现问题的结论,应

说明得出结论所依据的规定和标准)

审核意见:

(审核意见种类包括:1.予以认可;2.责成采取进一步审计措施,获取适当、充分

的审计证据;3.纠正或者责成纠正不恰当的审计结论)

审核人员审核日期

附件:页[说明:审核人员提出2、3项审核意见的,审计人员应当将落实情况和结果作出书面说明,经审核人员认可并签字后,附于本底稿后。

]。

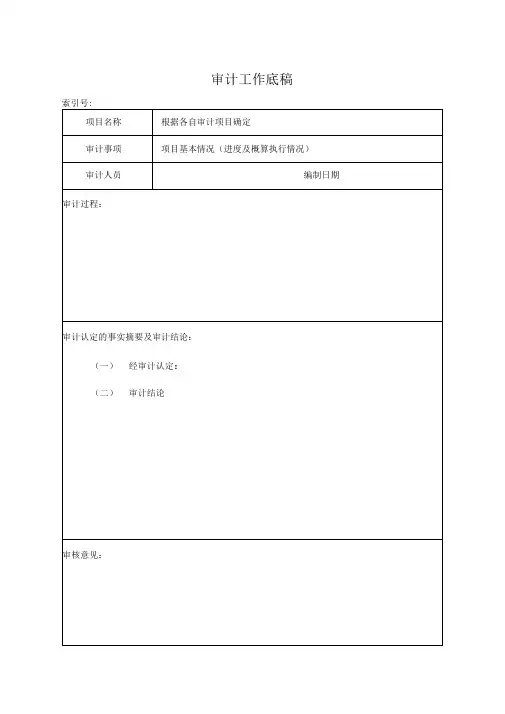

审计工作底稿

索引号:

项目名称根据各自审计项目确定

审计事项项目基本情况(进度及概算执行情况)

审计人员编制日期

审计过程:

审计认定的事实摘要及审计结论:

(一)经审计认定:

(二)审计结论

审核意见:

审核人员审核日期

共 页第 页 附件: 页

审计工作底稿

索引号:

项目名称根据各自审计项目确定

审计事项项目招投标及合同签订情况

审计人员编制日期

审计过程:

审计认定的事实摘要及审计结论:

(一)经审计认定:

(二)审计结论

审核意见:

审核人员审核日期

共 页第 页 附件: 页

审计工作底稿

索引号:

项目名称根据各自审计项目确定

审计事项项目资金到位、使用及清欠情况

审计人员编制日期

审计过程:

审计认定的事实摘要及审计结论:

(一)经审计认定:

(二)审计结论

审核意见:

审核人员审核日期

共 页第 页 附件: 页。

会计师事务所审计工作底稿客户名称:会计期间:审计工作底稿目录(一)客户: ABC有限责任公司会计期间:编制:复核:客户: ABC有限责任公司会计期间:编制:复核:客户: ABC有限责任公司会计期间:编制:复核:客户提供相关资料情况表被审计单位:索引号:项目:财务报表截止日/日期:编制:复核:日期:日期:被审计单位:索引号:项目:财务报表截止日/日期:编制:复核:日期:日期:被审计单位:索引号:项目:财务报表截止日/日期:编制:复核:日期:日期:业务约定书甲方:乙方:兹由甲方委托乙方对甲方年年度财务报表进行审计,经双方协商,达成以下约定:一、业务范围及目的乙方接受甲方委托:对甲方按照企业会计准则编制的年月日的资产负债表以及截止年度的利润表、股东权益变动表和现金流量表以及财务报表附注(以下统称财务报表)进行审计;乙方将根据《中国注册会计师审计准则》,通过执行审计工作,对财务报表的下列方面发表审计意见:(1)财务报表是否按照企业会计准则和相关会计制度的规定编制;(2)财务报表是否在所有重大方面公允反映甲方的财务状况、经营成果和现金流量。

二、甲方的责任与义务(一)甲方的责任1.根据《中华人民共各国会计法》及《企业财务会计报告条例》,甲方及甲方负责人保证会计资料的真实性和完整性。

因此,甲方管理层有责任妥善保存和提供会计记录,这些记录必须真实、完整地反映甲方的财务状况、经营成果和现金流量。

2.按照企业会计准则和《××会计制度》的规定编制财务报表是ABC公司管理层的责任,这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报;(2)选择和运用恰当的会计政策;(3)作出合理的会计估计。

(二))甲方的义务:1、及时为乙方的审计提供其所要求的全部会计资料和其他有关资料。

2、为乙方派出的有关人员提供必要的工作条件及合作,具体事项将由乙方审计工作人员于工作开始前提供清单。