金融专业英语及翻译

- 格式:doc

- 大小:41.50 KB

- 文档页数:23

ETF Exchange Traded Fund的英文缩写,中译为“业务型绽放式指数基金”,又称业务所业务基金。

LOF:“listed open-ended fund”,中文称为“上市绽放式基金”,也便是上市绽放式基金刊行结果后,投资者既可以在指定网点申购与赎回基金份额,也可以在业务所交易该基金。

只是投资者假如是在指定网点申购的基金份额,想要上彀抛出,须处理必定的转托管手续;同样,假如是在业务所网上买进的基金份额,想要在指定网点赎回,也要处理必定的转托管手续。

LME伦敦金属业务所(London Metal Exchange)CPI耗费者物价指数(Consumer Price Index),是反响与住民生存相关的商品及劳务价钱统计出来的物价变更指标,通常作为察看通货扩张程度的重要指标。

假如耗费者物价指数升幅过大,证明通胀已经成为经济不稳固因素,央行会有紧缩泉币政策和财务政策的危机,从而造成经济远景不明亮。

PPI(英文全称Producer Price Index):创造者物价指数,是权衡产业企业产物出厂价钱变更趋向和变更水平的指数,是反响某临时期生产范畴价钱变更状况的重要经济指标,也是制定相关经济政策和黎民经济核算的重要依据。

现在,我国PPI的观察产物有4000多种(含规格品9500多种),遮盖全部39个产业行业大类,涉及观察种类186个。

创造者物价指数主要的目标在于权衡各类商品在差别的生产阶段的价钱改变景象。

GDP gross domestic product的缩写,也便是国内生产总值,(港台地域有翻译为国内生产茂额、当地生产总值)。

通常对GDP的界说为:必定时期内(一个季度或一年),一个国度或地域的经济中所生产出的全部最终产物和提供劳务的市场价格的总值。

在经济学中,常用GDP和GNI(黎民总收入,gross national Income)协同来权衡该国或地域的经济成长综合程度通用的指标。

GNP(英文全称Gross National Product):黎民生产总值,是指一个国度悉数常住住民在必定时期内所生产的最终产物和所提供的泉币价格总和。

金融专业英语术语翻译(英译中):1.Tranches (股票的)份额2.Collateral debt obligation 债券凭证;担保债权凭证3.T-bond 国债4.Repo 回购ernment sponsored entities 政府资助实体6.Financial derivatives 金融衍生品7.Federal funds rate 联邦基金利率8.Default risk 违约(拖欠)风险9.Yield to maturity 到期收益率10.Negotiable certificate of deposit 可转让定期存单英文回答:1、How is LIBOR calculated?According to different currencies and maturity dates, the highest quarter and the lowest quarter of the market quotations are ignored, and then the remaining quotations are averaged to obtain the official interest rate, which is displayed in 5 decimal places.2、What are the expectation,volatility,skewness and kurtosis? Expectation:Refers to the weighted average of a random variable in terms of its corresponding probability.Volatility:Volatility is a measure of the change in the return on investment of the underlying asset.From a statistical point of view,it is the standard deviation of the return on investment of the underlying asset in terms of compound interest.Skewness:Skewness is the measurement of the direction and degree of the statistical data distribution skew, and it is the digital feature of the asymmetry degree of the statistical data distribution.Kurtosis:Kurtosis refers to the number of features indicating the peak value of the probability density distribution curve at the average value. Intuitively, kurtosis reflects the sharpness of the peak, which is calculated by the ratio of the fourth-order central moment of the random variable to the square of the variance. The formula is to change the power of the skewness formula to 4.3、Why should we worry about a rising TED spread?The TED spread is an indicator of perceived credit risk in the general economy, since T-bills are considered risk-free while LIBOR reflects the credit risk of lending to commercial banks.An increase in the TED spread is a sign that lenders believe the risk of default on interbank loans (also known as counterparty risk) is increasing. Interbank lenders, therefore, demand a higher rate of interest, or accept lower returns on safe investments such as T-bills. When the risk of bank defaults is considered to be decreasing, the TED spread decreases.3、What are the key features of the structured finance?(1) Securities are issued through a special organization, namelySPV or spe;(2)The accounting treatment of issuing structured financing securities is asset sale rather than debt financing;(3) Structured financing securities must provide investors with "servicing" of underlying assets;(4) The credit of structured financing securities mainly depends on the credit of basic mortgage assets;5、What is TED spread? Suppose the TED spread is rising, what do youthink have caused the rising TED spread?The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills"). TED is an acronym formed from T-Bill and ED, the ticker symbol for the Eurodollar futures contract.6、Why is the name money market misleading?Money market and financial duration are easily confused. Financial market is the market of financing. It includes money, capital and foreign exchange markets, and sometimes gold and insurance markets. It can also be said that the market with money as the object can be classified into the category of financial market. The money market is mainly a market where the loan period is one year or less. It mainly includes: interbank lending, repurchase agreement, bill market, large amount transferable certificate of deposit market or short-term government bond market.7、What are the instruments traded in the money market and who are big players in the monetary market?The main money market instruments consist of short-term treasury bonds, large negotiable certificates of deposit, commercial paper, bank acceptance, repurchase agreement and other money market instruments.The big players in monetary market are mainly institutions and professionals specialized in money market business. Institutional participants include commercial banks, central banks, non bank financial institutions, governments and non-financial enterprises; money market professionals include brokers, dealers and underwriters.8、How is an OIS is set up?OIS (overnight index swap) is a contract that exchanges a fixed interest rate over a period of time with the geometric average of the overnight interest rate (brokered).OIS rate in the market refers to the fixed interest rate in the swap contract. Similar to the basic interest rate swap, OIS swap rate is equivalent to the overnight rate updated every day according to the view of Collin Dufresne et al. A OIS futures contract is an interest rate future; i.e. a future contract whose value is based on a fixed-income security or interest rate. The underlying interest rate for the OIS futures contract is the average daily over-night interest rate for the delivery month. The final settlement price for a contract is 100 minus this average rate.。

金融学名词中英对照金融学是研究资金获取、管理和投资的学科。

下面是一些常用的金融学名词及其英文对照。

1.资本市场 - Capital Market 资本市场是一种长期融资的机制,包括股票市场和债券市场。

在资本市场上,公司和政府可以通过出售股票和债券来筹集资金。

2.风险管理 - Risk Management 风险管理是为了最小化或规避金融活动中的潜在风险而采取的一系列措施。

风险管理涉及确定和评估风险,并采取相应的措施来管理和控制风险。

3.投资组合 - Investment Portfolio 投资组合是指一个人或机构所拥有的各种不同类型的投资资产。

投资组合可以包括股票、债券、房地产和其他金融产品。

4.资本结构- Capital Structure 资本结构是指一个公司资本的组成方式,即债务和股权的比例。

通过调整债务和股权的比例,公司可以影响其财务风险和股东权益回报率。

5.效用函数 - Utility Function 效用函数是一个数学函数,用于衡量个人或企业对不同选择的偏好程度。

效用函数可以用来分析消费决策和资产配置。

6.期权 - Option 期权是一种金融合约,赋予持有人在未来特定时间内买入或卖出某个标的资产的权利。

期权常用于对冲风险、套利和投机。

7.利率 - Interest Rate 利率是在一定时期内贷款所需支付的费用。

利率的水平对经济和金融市场有重大影响,也是央行货币政策的重要工具之一。

8.资产负债表 - Balance Sheet 资产负债表是企业或个人在特定时间点上的资产、负债和所有者权益的总结表。

资产负债表能够反映一个实体的财务状况和偿债能力。

9.证券 - Securities 证券是可供买卖的金融资产,包括股票、债券、期权和衍生品。

证券市场是进行证券交易的地方。

10.财务分析 - Financial Analysis 财务分析是通过分析财务报表和其他财务信息,评估一个企业或项目的财务状况和业绩。

金融学专业术语中英文B 半强式效率semi-strong efficiency 指在证券价格充分反映了所有的公开信息(包括历史价格和交易情况,但不局限于此。

)半通货膨胀Semi-inflation 当经济逐渐接近充分就业时,货币供给增加所形成的过度总需求一方面使产出增加,另一方面又使价格逐渐上升。

保险合约insurance contract 是保险公司与被保险人之间签订的当某一事件发生时按约定的费率给予被保险人赔偿的合约。

本金principal 本期收益率current yield 本位币standard money 按照国家规定的金属、单位货币的名称和重量铸造的货币。

边际储蓄倾向Marginal Propensity to Save ,MPS 反映可支配收入每增加以单位时储蓄支出增加的数量。

边际消费倾向Marginal Propensity to Concume ,MPC 反映可支配收入每增加一个单位时小分支出增加的数量。

补偿性公共支出compensatory public spending 政府财政预算应于社会经济条件保持相同的步调,即政府应在萧条期间实施结构性预算赤字的政策,而在经济繁荣时,就要保持适当的盈余。

不动产信用控制real estate credit control 指中央银行对商业银行等金融机构向客户提供不动产抵押贷款的管理 措施。

C 财富效应wealth effect 财富变动对消费和储蓄倾向的影响。

财务担保guarantee 贷款人要求担保人为借款人的借款提供经济担保,当借款人无力偿还借款时,由担保人负责偿还的一种经济合同。

财务公司financial company 通过发行商业票据、股票或从银行借款获得资金,再利用这些资金对个人或企业进行小额贷款。

财政赤字论fiscal deficit theory 克鲁格曼(Krugman,1979)提出财政赤字导致货币危机的理论。

财政性通货膨胀理论fiscal inflation theory 通过财政政策来鼓励通货膨胀的理论。

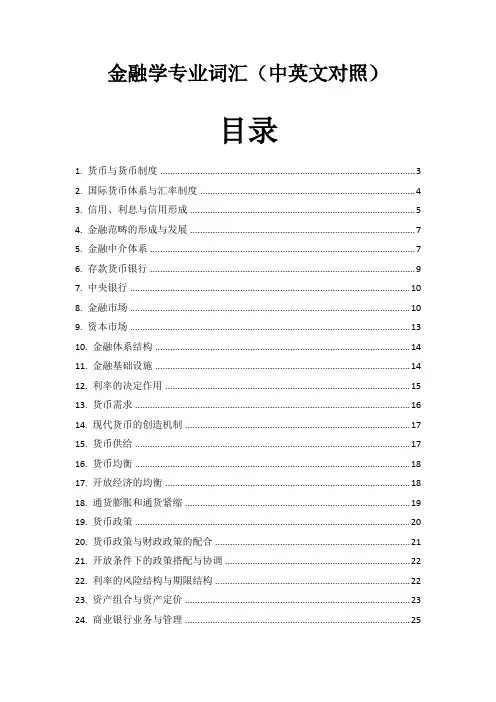

金融学专业词汇(中英文对照)目录1. 货币与货币制度 (3)2. 国际货币体系与汇率制度 (4)3. 信用、利息与信用形成 (5)4. 金融范畴的形成与发展 (7)5. 金融中介体系 (7)6. 存款货币银行 (9)7. 中央银行 (10)8. 金融市场 (10)9. 资本市场 (13)10. 金融体系结构 (14)11. 金融基础设施 (14)12. 利率的决定作用 (15)13. 货币需求 (16)14. 现代货币的创造机制 (17)15. 货币供给 (17)16. 货币均衡 (18)17. 开放经济的均衡 (18)18. 通货膨胀和通货紧缩 (19)19. 货币政策 (20)20. 货币政策与财政政策的配合 (21)21. 开放条件下的政策搭配与协调 (22)22. 利率的风险结构与期限结构 (22)23. 资产组合与资产定价 (23)24. 商业银行业务与管理 (25)25. 货币经济与实际经济 (26)26. 金融发展与经济增长 (26)27. 金融脆弱性与金融危机 (27)28. 金融监管 (27)1.货币与货币制度货币:(currency)外汇:(foreign exchange)铸币:(coin)银行券:(banknote)纸币:(paper currency)存款货币:(deposit money)价值尺度:(measure of values)货币单位:(currency unit)货币购买力:(purchasing power of money)购买力平价:(purchasing power parity,PPP)流通手段:(means of circulation)购买手段:(means of purchasing)交易的媒介:(media of exchange)支付手段:(means of payment)货币需求:(demand for money)货币流通速度:(velocity of money)保存价值:(store of value)汇率:(exchange rate)一般等价物:(universal equivalent)流动性:(liquidity)通货:(currency)准货币:(quasi money)货币制度:(monetary system)本位制:(standard)金本位:(gold standard)造币:(coinage)铸币税:(seigniorage)本位币:(standard money)辅币:(fractional money)货币法偿能力:(legal tender powers)复本位制:(bimetallic standard)金汇兑本位:(gold exchange standard)金平价:(gold parity)金块本位制:(gold bullion standard)2.国际货币体系与汇率制度浮动汇率制:(floating exchange rate regime)货币局制度:(currency board arrangement)联系汇率制度:(linked exchange rate system)美元化:(dollarization)最优通货区理论:(theory of optimum currency area)货币消亡:(money disappearance)外汇:(foreign currency)外汇管理:(exchange regulation)外汇管制:(exchange control)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(current account)资本项目:(capital account)汇率:(exchange rate)牌价:(posted price)直接标价法:(direct quotation)间接标价法:(indirect quotation)单一汇率:(unitary exchange rate)多重汇率:(multiple exchange rate)市场汇率:(market exchange rate)官方汇率:(official exchange rate)黑市:(black market)固定汇率:(fixed exchange rate)浮动汇率:(floating exchange rate)管理浮动:(managed float)盯住汇率制度:(pegged exchange rate regime)固定钉住:(fixed peg)在水平带内的盯住:(pegged within horizontal bands)爬行钉住:(crawling peg)外汇指定银行:(designated foreign exchange bank)货币的对外价值:(external value of exchange)货币的对内价值:(internal value of exchange)名义汇率:(nominal exchange rate)实际汇率:(real exchange rate)铸币平价:(mint parity)金平价:(gold parity)黄金输送点:(gold transport point)国际借贷说:(theory of international indebtedness)流动债权:(current claim)流动负债:(current liablity)国际收支说:(theory of balance payment)汇兑心理说:(psychology theory of exchange rate)货币分析说:(monetary approach)金融资产说:(portfolio theory of exchange rate determination)利率平价理论:(theory of interest rate parity)外汇风险:(exchange risk)中国的外汇调剂:(foreign exchange swap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalization of interest)高利贷:(usury)利率:(interest rate)债权:(claim)债务:(debt obligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporal budget constraint)资金流量:(flow of funds)部门:(sector)借贷资本:(loan capital)实体:(real)商业信用:(commercial credit)银行信用:(bank credit)本票:(promissory note)汇票:(bill of exchange)商业本票:(commercial paper)商业汇票:(commercial bill)承兑:(acceptance)背书:(endorsement)直接融资:(direct finance)间接融资:(indirect finance)短期国库卷:(treasury bill)中期国库卷:(treasury note)长期国库卷:(treasury bond)国债:(national debt)公债:(public debt)资本输出:(export of capital)国际资本流动:(international capital flow)国外商业性借贷:(foreign direct investment,FDI)国际游资:(hot money)4.金融范畴的形成与发展财政:(public finance)公司理财:(corporate finance)投资:(investment)保险:(insurance)财产保险:(property insurance)人身保险:(mutual life insurance)相互人寿保险:(mutual life insurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financial intermediary)金融机构:(financial institution)借者:(borrower)贷者:(lender)货币中介:(monetary intermediation)权益资本:(equity capital)中央银行:(central bank)货币当局:(monetary authority)存款货币银行:(deposit money bank)商业银行:(commercial bank)投资银行:(investment bank)商人银行:(merchant bank)财务公司:(financial companies)储蓄银行:(saving bank)抵押银行:(mortgage bank)信用合作社:(credit cooperative)保险业:(insurance industry)跨国银行:(multinational bank)代表处:(representative office)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortium bank)中国人民银行:(People’s Bank of China)政策性银行:(policy banks)国有商业银行:(state-owned commercial banks)资产管理公司:(assets management company)证券公司:(securities company)券商:(securities dealer)农村信用合作社:(rural credit cooperatives)城市信用合作社:(urban credit cooperatives)信托投资公司:(trust and investment companies)信托:(trust)金融租赁:(financial leasing)邮政储蓄:(postal savings)财产保险:(property insurance)商业保险:(commercial insurance)社会保险:(social insurance)保险深度:(insurance intensity)保险密度:(insurance density)投资基金:(investment funds)证券投资基金:(security funds)封闭式基金:(closed-end investment funds)开放式基金:(open-end investment funds)私募基金:(private placement)风险投资基金:(venture funds)特别提款权:(special drawing right,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(money dealer)银行业:(banking)贴现率:(discount rate)职能分工型商业银行:(functional division commercial bank)全能型商业银行:(multi-function commercial bank)综合性商业银行:(comprehensive commercial bank)单元银行制度:(unit banking system)总分行制度:(branch banking system)代理行制度:(correspondent banking system)银行控股公司制度:(share holding banking system)连锁银行制度:(chains banking system)金融创新:(financial innovation)自动转账制度:(automatic transfer services,ATS)可转让支付命令账户:(negotiable order of withdrawal account,NOW)货币市场互助基金:(money market mutual fund,MMMF)货币市场存款账户:(money market deposit account,MMDA)不良债权:(bad claim)坏账:(bad loan)不良贷款:(non-performing loans,NPL)存款保险制度:(deposit insurance system)金融资本:(financial capital)7.中央银行中央银行:(central bank)一元式中央银行制度:(unit central bank system)二元式中央银行制度:(dual central bank system)复合中央银行制度:(compound central bank system)跨国中央银行制度:(multinational central bank system)发行的银行:(bank of issue)银行的银行:(bank of bank)最后贷款人:(lender of last resort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(the state bank)8.金融市场金融市场:(financial market)证券化:(securitization)金融资产:(financial assets)金融工具:(financial instruments)金融产品:(financial products)衍生金融产品:(derivative financial products)原生金融产品:(underlying financial products)流动性:(liquidity)变现:(encashment)买卖差价:(bid-ask spread)做市商:(market marker)到期日:(due date)信用风险:(credit risk)市场风险:(market risk)名义收益率:(nominal yield)现时收益率:(current yield)平均收益率:(average yield)内在价值:(intrinsic value)直接融资:(direct finance)间接融资:(indirect finance)货币市场:(money market)资本市场:(capital market)现货市场:(spot market)期货市场:(futures market)机构投资人:(institutional investor)资信度:(credit standing)融通票据:(financial paper)银行承兑票据:(bank acceptance)贴现:(discount)大额存单:(certificates of desposit,CDs)回购:(counterpurchase)回购协议:(repurchase agreement)隔夜:(overnight)银行同业间拆借市场:(interbank market)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(call option)看跌期权:(put option)期权费:(option premium)互换:(swap)投资基金:(investment funds)契约型基金:(contractual type investment fund)单位型基金:(unit funds)基金型基金:(funding funds)公司型基金:(corporate type investment fund)投资管理公司:(investment management company)共同基金:(mutual fund)对冲基金:(hedge fund)风投基金:(venture fund)权益投资:(equity investment)收益基金:(income funds)增长基金:(growth funds)长期增长基金:(long-term growth funds)高增长基金:(go-go groeth funds)货币市场基金:(money market funds)养老基金:(pension fund)外汇市场:(foreign exchange market)风险资本:(venture capital)权益资本:(equity capital)私人权益资本市场:(private equity market)有限合伙制:(limited partnership)交易发起:(deal origination)筛选投资机会:(screening)评价:(evaluation)交易设计:(deal structure)投资后管理:(post-investment activities)创业板市场:(growth enterprise market,GEM)二板市场:(secondary board market)金融创新:(financial innovation)金融自由化:(financial liberalization)全球化:(globalization)离岸金融市场:(off-shore financial center)9.资本市场权益:(equity)剩余索取权:(residual claims)证券交易所:(stock exchange)交割:(delivery)过户:(transfer ownership)场外交易市场:(over the counter,OTC)金融债券:(financial bond)抵押债券:(mortgage bond)担保信托债券:(collateral trust bonds)信用债券:(trust bonds)次等信用债券:(subordinated debenture)担保债券:(guaranteed bonds)初级市场:(primary market)二级市场:(secondary market)公募:(public offering)私募:(private offering)有价证券:(security)面值:(face value)市值:(market value)股票价格指数:(share price index)有效市场假说:(effective market hypothesis)弱有效市场:(weak efficient market)中度有效市场:(semi-efficient market)强有效市场:(strong efficient market)股份公司:(stock certificate)股票:(stock certificate)股东:(stock holder)所有权:(ownership)经营权:(right of management)10.金融体系结构功能主义金融观:(perspective of financial function)金融体系格局:(pattern of financial system)激励:(incentive)公司治理:(corporate governance)路径依赖:(path dependency)市场主导型:(market-oriented type)银行主导型:(banking-oriented type)参与成本:(participative cost)影子银行体系:(the shadow banking system)11.金融基础设施金融基础设施:(financial infrastructures)支付清算系统:(payment and clearing system)跨境支付系统:(cross-border inter-bank payment system,CIPS)全额实时结算:(real time gross system)净额批量清算:(bulk transfer net system)大额资金转账系统:(whole sale funds transfer system)小额定时结算系统:(fixed time retail system)票据交换所:(clearing house)金融市场基础设施:(financial market infrastructures)中央交易对手:(central counterparties,CCPs)双边清算体系:(bilateral clearing system)系统重要性支付体系核心原则:(the core principles for systemically important payment system)证券清算体系建议:(the recommendations for central counterparties)中央交易对手建议:(the recommendations for central counterparties)金融业标准:(financial standards)盯市:(mark-to-market)公允价值:(fair value)金融部门评估规划:(financial sector assessment program)12.利率的决定作用可贷资金论:(loanable funds theory of interest)储蓄的利率弹性:(interest elasticity of saving)投资的利率弹性:(interest elasticity of investment)本金:(principal)回报率:(returns)基准利率:(benchmark interest rate)无风险利率:(risk-free interest rate)补偿:(compensation)风险溢价:(risk premium)实际利率:(real interest rate)名义利率:(nominal interest rate)固定利率:(fixed interest rate)浮动利率:(floating rate)官定利率:(official interest rate)行业利率:(trade-regulated rate)一般利率:(general interest rate)优惠利率:(preferential interest rate)贴息贷款:(loan of interest subsidy)年利率:(annual interest rate)月利率:(monthly interest rate)日利率:(daily interest rate)拆息:(call money interest)13.货币需求货币需求:(demand for money)货币数量论:(quantity theory of money)货币必要量:(volume of money needed)货币流通速度:(velocity of money)交易方程式:(equation of exchange)剑桥方程式:(equation of Cambridge)现金交易说:(cash transaction approach)现金余额说:(cash balance theory)货币需求动机:(motive of the demand for money)交易动机:(transaction motive)预防动机:(precautionary motive)投机动机:(speculative motive)流动性偏好:(liquidity preference)流动性陷阱:(liquidity trap)平方根法则:(square-root rule)货币主义:(monetarism)恒久性收入:(permanent income)机会成本变量:(opportunity cost variable)名义货币需求:(nominal demand for money)实际货币需求:(real demand for money)客户保证金:(customer’s security marign)金融资产选择:(portfolio selection)14.现代货币的创造机制纯流通费用:(pure circulation cost)原始存款:(primary deposit)派生存款:(derivative deposit)派生乘数:(withdrawal multiplier)现金损露:(loss of cashes)提现率:(withdrawal rate)创造乘数:(creation multiplier)现金:(currency)基础货币:(base money)高能货币:(high-power money)货币乘数:(money multiplier)铸币收入:(seigniorage revenue)15.货币供给货币供给:(money supply)准货币:(quasi money)名义货币供给:(nominal money supply)实际货币供给:(real money supply)股民保证金:(shareholder’s security margin)货币存量:(money stock)公开市场操作:(open-market operation)贴现政策:(discount policy)再贴现率:(rediscount rate)法定准备金率:(legal reserve ratio)财富效应:(wealth effect)预期报酬率变动效应:(effect of expected yields change)现金持有量:(currency holdings)超额准备金:(excess reserves)外生变量:(exogenous variable)内生变量:(endogenous variable)16.货币均衡均衡:(equilibrium)投资饥渴:(huger for investment)软预算约束:(soft budget constraint)总需求:(aggregate demand)总供给:(aggregate supply)面纱论:(money veil theory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balance of payments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statement for balance of payments)经常项目:(current account)资本和金融项目:(capital and financial account)储备资产:(reserve assets)净误差与遗漏:(net errors and missions)自主性交易:(autonomous transaction)调节性交易:(accommodating transaction)偿债率:(debt service ratio)顺差:(surplus)逆差:(deficit)最后清偿率:(last liquidation ratio)资本流动:(capital movements)项目融资:(project finance)外债:(external debt)资本外逃:(capital flight)冲销性操作:(sterilized operation)非冲销性操作:(unsterilized operation)债务率:(debt ratio)负债率:(liability ratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation)恶性通货膨胀:(rampant inflation)爬行通货膨胀:(creeping inflation)温和通货膨胀:(moderate inflation)公开性通货膨胀:(open inflation)显性通货膨胀:(evident inflation)隐蔽性通货膨胀:(hidden inflation)输入型通货膨胀:(import of inflation)结构性通货膨胀:(structural inflation)通货膨胀率:(inflation rate)居民消费物价指数:(CPI)零售物价指数:(RPI)批发物价指数:(WPI)冲减指数:(deflator)需求拉上型通货膨胀:(demand-pull inflation)成本推动型通货膨胀:(cost-push inflation)工资-价格螺旋上升:(wage-price spiral)强制储蓄:(forced saving)收入分配效应:(distributional effect of income)财富分配效应:(distributional effect of wealth)滞胀:(stagflation)工资膨胀率:(wage inflation)紧缩性货币政策:(tight monetary policy)紧缩银根:(tight money)紧缩信贷:(tight squeeze)指数化:(indexation)通货紧缩:(deflation)19.货币政策货币政策:(monetary policy)金融政策:(financial policy)货币政策目标:(goal of monetary policy)通货膨胀目标制:(inflation targeting)逆风向原则:(principle of leaning against the wind)反周期货币政策:(counter cycle monetary policy)相机抉择:(discretionary)单一规则:(single rule)告示效应:(bulletin effects)直接信用控制:(direct credit)信用配额:(credit allocation)流动性比率:(liquidity ratio)间接信用控制:(indirect credit control)道义劝告:(moral suasion)窗口指导:(window guidence)信用贷款:(lending)传导机制:(conduction mechanism)中介指标:(intermediate target)信贷配给:(credit rationing)资产负债表渠道:(balance sheet channel)时滞:(time lag)预期:(expectation)透明度:(transparency)信任:(credibility)软着陆:(soft landing)20.货币政策与财政政策的配合赤字:(deficit)经常性收入:(current revenue)税:(tax)费:(fee)经常性支出:(current expenditure)资本性收入:(capital revenue)补助:(grant)资本性支出:(capital expenditure)账面赤字:(book deficit)隐蔽赤字:(hidden deficit)预算外:(off-budget)透支:(overdraft)净举债:(net fiancing)未清偿债券:(outstanding debt)或有债务:(contingent liability)准备货币:(reserve money)国债依存度:(public debt dependency)国债负担率:(public debt-to-GDP ratio)国债偿债率:(government debt-service ratio)财政政策:(fiscal policy)补偿性财政货币政策:(compensatory fiscal and monetary policy) 21.开放条件下的政策搭配与协调米德冲突:(Meade’s conflict)国际政策协调:(international policy coordination)信息交换:(information exchange)危机管理:(crisis management)避免共享目标变量的冲突:(avoiding conflicts over shared targets)合作确定中介目标:(cooperation intermediate targeting)部分协调:(full coordination)汇率目标区:(target zone of exchange rate)马歇尔-勒纳条件:(Marshall-Lerner condition)J曲线效应:(J curve effect)22.利率的风险结构与期限结构单利:(simple interest)复利:(compound interest)现值:(present value)终值:(future value)竞价拍卖:(open-outcry auction)贴现值:(present discount value)利率管制:(interest rate control)利率管理体制:(interest rate regulation system)存贷利差:(interest rate regulation system)利率风险结构:(risk structure of interest rates)违约风险:(default risk)利率期限结构:(term structure of interest rates)即期利率:(spot rate of interest)远期利率:(forward rate of interest)到期收益率:(yield to maturity)现金流:(cash floe)预期理论:(expectation theory)流动性理论:(liquidity theory)偏好理论:(preferred habitat theory)市场隔断理论:(market segmentation theory) 23.资产组合与资产定价市场风险:(market risk)信用风险:(credit risk)流动性风险:(liquidity risk)操作风险:(operational risk)法律风险:(legal risk)政策风险:(policy risk)道德风险:(moral hazard)主权风险:(sovereign risk)市场流动性风险:(product liquidity)现金流风险:(cash flow)执行风险:(execution risk)欺诈风险:(fraud risk)遵守与监管风险:(compliance and regulatory risk)资产组合理论:(portfolio theory)系统性风险:(systematic risk)非系统性风险:(nonsystematic risk)效益边界:(efficient frontier)价值评估:(evaluation)市盈率:(price-earning ratio)资产定价模型:(asset pricing model)资本资产定价模型:(capital asset pricing model,CAPM)无风险资产:(risk-free assets)市场组合:(market portfolio)多要素模型:(multifactorCAPM)套利定价理论:(arbitrage pricing theory,APT)期权加价:(option premium)内在价值:(intrinsic value)时间价值:(time value)执行价格:(strike price)看涨期权:(call option)看跌期权:(put option)对冲型的资产组合:(hedge portfolios)套利:(arbitrage)无套利均衡:(no-arbitrage equilibrium)均衡价格:(equilibrium price)多头:(long position)空头:(short position)动态复制:(dynamic replication)头寸:(position)风险偏好:(risk preference)风险中性:(risk neutral)风险厌恶:(risk averse)风险中性定价:(risk-netural pricing)24.商业银行业务与管理银行负责业务:(liability business)存款:(deposit)活期存款:(demand deposit)支票存款:(check deposit)透支:(overdraft)定期存款:(time deposit)再贴现:(rediscount)金融债券:(financial bond)抵押贷款:(mortgage loan)信用贷款:(credit loan)通知贷款:(demand loan)真实票据论:(real bill doctrine)商业贷款理论:(commercial loan theory)证券投资:(portfolio investment)中间业务:(middleman business)表外业务:(off-balance sheet business)无风险业务:(risk-free business)汇款:(remittance)信用证:(letter of credit)商品信用证:(commercial letter of credit)代收业务:(business of collection)代客买卖业务:(business of commission)承兑网络银行:(internet bank)虚拟银行:(virtual bank)企业对个人:(B2C)企业对企业:(B2B)挤兑:(bank runs)资产管理:(assets management)自偿性:(self-liquidation)可转换性理论:(convertibility theory)预期收入理论:(anticipated income theory)负债管理:(liability management)资产负债综合管理:(comprehensive management of assets and liability)风险管理:(risk management)在险价值:(value at risk,VAR)25.货币经济与实际经济两分法:(dichotomy)实际经济:(real economy)货币经济:(monetary economy)虚拟资本:(monetary capital)泡沫经济:(bubble economy)虚拟经济:(virtual economy)货币中性:(neutrality of money)相对价格:(relative price)货币面纱:(monetary veil)瓦尔拉斯均衡:(Walras equilibrium)一般均衡理论:(theory of general equilibrium)超中性:(super-neutrality)26.金融发展与经济增长金融发展:(financial development)金融自由化:(financial liberalization)金融深化:(financial deepening)金融压抑:(financial repression)金融机构化:(financial institutionalization)分层比率:(gradation ratio)金融相关率:(financial interrelation ratio,FIR)货币化率:(monetarization ratio)脱媒:(distintermediation)导管效应:(tube effect)27.金融脆弱性与金融危机金融脆弱性:(financial fragility)金融风险:(financial risk)长周期:(long cycles)安全边界:(margins of safety)汇率超调理论:(theory of exchange rate over shooting)金融危机:(financial crises)资产管理公司:(asset management corporation,AMC)金融恐慌:(financial panic)优先/次级抵押贷款债券:(senior/subordinate structure) 28.金融监管金融监管:(financial regulation)公共选择:(public choice)最低资本要求:(minimum capital requirements)监管当局的监管:(supervisory review process)市场纪律:(market discipline)宏观审慎框架:(macro-prudential framework)分行:(branch)子行:(subsidiary)并表监管:(consolidated supervision)。

□英译汉1.For example pay ments facilities through banks convenient savings and access to home loans from building societies and car h ouse or life insurance. ——例如银行提供的付款工具、建房互助会或储贷协会提供便利储蓄和住房信贷以及汽车、房屋或人寿保险。

2.All these financial institutions and markets fit together into a network which comprises the financial system. ——所有的这些金融机构和金融市场会聚在一起交织成网便构成了金融体系。

1.By their very nature financial institutions attract criticism: bankers would not be doing their jobs if they did not turn down some requests for loans and those who are denied funds sometimes feel hard done by and are vociferous in their complaints. ——金融机构天生就容易招惹批评如果银行家不拒绝几份贷款请求那他就不是在认真工作而那些被拒绝了的借款人有时会觉得十分委屈甚至大为光火大叫大嚷抱怨不停。

2. It is the ultimate savers and ultimate borrowers who are as it were on the periphery of the financial system whose needs it serves provide the rationale for its existence. ——可以说最终储蓄者和最终借款人处于金融体系的最边缘金融体系为他们的需求服务他们是金融体系存在的最根本理由。

金融专业词汇English Terms中文翻译详情解释/例子AcceleratedDep reciation 加快折旧任何基于会计或税务原因促使一项资产在较早期以较大金额折旧的折旧原则Accidentand Heal th Benefits 意外与健康福利为员工提供有关疾病、意外受伤或意外死亡的福利。

这些福利包括支付医院及医疗开支以及有关时期的收入。

Accounts Receivable(AR) 应收账款客户应付的金额.拥有应收账款指公司已经出售产品或服务但仍未收取款项Accretive Acquisition 具增值作用的收购项目能提高进行收购公司每股盈利的收购项目AcidTest酸性测试比率一项严谨的测试,用以衡量一家公司是否拥有足够的短期资产,在无需出售库存的情况下解决其短期负债。

计算方法:(现金+应收账款+短期投资)ﻫ‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾流动负债Act of God Bond 天灾债券保险公司发行的债券,旨在将债券的本金及利息与天然灾害造成的公司损失联系起来Active BondCrowd活跃债券投资者在纽约股票交易所内买卖活跃的定息证券ActiveIncome 活动收入来自提供服务所得的收入,包括工资、薪酬、奖金、佣金,以及来自实际参与业务的收入Active Investing 积极投资包含持续买卖行为的投资策略。

主动投资者买入投资,并密切注意其走势,以期把握盈利机会ActiveManagement 积极管理寻求投资回报高于既定基准的投资策略Activity BasedBudge ting 以活动为基础的预算案一种制定预算的方法,过程为列举机构内每个部门所有牵涉成本的活动,并确立各种活动之间的关系,然后根据此资料决定对各项活动投入的资源Activity Based Management 以活动为基础的管理利用以活动为基础的成本计算制度改善一家公司的运营Activity Ratio活动比率一项用以衡量一家公司将其资产负债表内账项转为现金或营业额的能力的会计比率Actual Return实际回报一名投资者的实际收益或损失,可用以下公式表示:预期回报加上公司特殊消息及总体经济消息Actuary 精算保险公司的专业人员,负责评估申请人及其医疗纪录,以预测申请人的寿命Acquisition 收购一家公司收购另一家公司的多数股权Acquisition Premium收购溢价收购一家公司的实际成本与该公司收购前估值之间的差额Affiliated Companies联营公司一家公司拥有另一家公司少数权益(低于50%)的情况,或指两家公司之间存在某些关联Affiliated Person 关联人士能影响一家企业活动的人士,包括董事、行政人员及股东等After Hours Trading 收盘后交易主要大型交易所正常交易时间以外进行的买卖交易After Tax OperatingIncome- ATOI税后营运收入一家公司除税后的总营运收入。

金融英语词汇大全1. Introduction金融英语是指与金融相关的英语表达和词汇。

在全球化的经济和金融市场中,金融英语的学习和应用显得尤为重要。

本文将为您提供一个综合的金融英语词汇大全,帮助您更好地了解和应用金融英语。

2. Banking and Finance2.1 基本金融词汇•Bank - 银行•Deposit - 存款•Withdraw - 取款•Account - 账户•Transaction - 交易•Credit - 信贷•Debit - 借记•Interest - 利息•Loan - 贷款•Invest - 投资•Exchange - 兑换•Stock - 股票•Bond - 债券•Mortgage - 抵押贷款•Insurance - 保险•Asset - 资产•Liability - 负债•Interest Rate - 利率•Inflation - 通货膨胀•Market - 市场•Economy - 经济•Currency - 货币•Exchange Rate - 汇率2.2 金融机构和职位•Banker - 银行家•Investor - 投资者•Broker - 经纪人•Accountant - 会计师•Economist - 经济学家•Trader - 交易员•Analyst - 分析师•Auditor - 审计员•Financial Planner - 理财规划师•Risk Manager - 风险经理•Asset Manager - 资产经理•Underwriter - 承销商•Teller - 出纳员2.3 金融活动和操作•Open an Account - 开户•Close an Account - 销户•Make a Deposit - 存款•Withdraw Money - 取钱•Transfer Funds - 转账•Take out a Loan - 借款•Pay off a Loan - 还款•Invest in Stocks - 投资股票•Buy Bonds - 购买债券•Trade on the Stock Market - 在证券市场交易•Issue Shares - 发行股票•Apply for Insurance - 申请保险•Calculate Interest - 计算利息•Analyze Financial Statements - 分析财务报表•Audit Financial Records - 审计财务记录•Manage Risk - 管理风险•Plan for Retirement - 规划退休3. Investment and Trading3.1 投资和交易相关词汇•Portfolio - 投资组合•Dividend - 股息•Capital Gain - 资本收益•Hedge Fund - 对冲基金•Short Sell - 卖空•Day Trading - 日内交易•Leverage - 杠杆•Margin - 保证金•Diversification - 分散化投资•Blue-chip Stock - 蓝筹股•Bull Market - 牛市•Bear Market - 熊市•Volatility - 波动性•Volatility Index (VIX) - 波动率指数•Option - 期权•Futures - 期货•Commodity - 商品•Exchange-traded Fund (ETF) - 交易所交易基金3.2 金融市场•Stock Market - 股票市场•Bond Market - 债券市场•Forex Market - 外汇市场•Commodity Market - 商品市场•Derivatives Market - 衍生品市场•Cryptocurrency Market - 加密货币市场4. Risk Management4.1 风险管理相关词汇•Risk - 风险•Risk Assessment - 风险评估•Risk Tolerance - 风险承受能力•Risk Appetite - 风险偏好•Risk Mitigation - 风险缓解•Risk Diversification - 风险分散•Credit Risk - 信用风险•Market Risk - 市场风险•Operational Risk - 运营风险•Systemic Risk - 系统性风险•Liquidity Risk - 流动性风险•Reputation Risk - 声誉风险•Counterparty Risk - 对手方风险•Risk Management Plan - 风险管理计划•Risk Control - 风险控制5. Conclusion通过阅读和学习这个金融英语词汇大全,您已经了解了金融英语中最常用的词汇和表达方式。

金融专业英语词汇大全一、基本金融术语1. 金融(Finance):指货币的筹集、分配和管理活动。

2. 银行(Bank):提供存款、贷款、支付结算等金融服务的机构。

3. 证券(Securities):代表财产所有权或债权的凭证,如股票、债券等。

4. 投资(Investment):将资金投入到某个项目或资产,以获取收益的行为。

5. 债务(Debt):借款人向债权人承诺在一定期限内偿还本息的义务。

6. 股票(Stock):股份有限公司发行的,代表股东对公司所有权和收益分配权的凭证。

7. 债券(Bond):债务人向债权人发行的,承诺按一定利率支付利息并在到期日偿还本金的债务凭证。

8. 利率(Interest Rate):资金的价格,反映资金借贷的成本。

9. 汇率(Exchange Rate):一种货币兑换另一种货币的比率。

10. 通货膨胀(Inflation):货币购买力下降,物价普遍持续上涨的现象。

二、金融衍生品词汇1. 金融衍生品(Financial Derivatives):基于现货金融工具派生出来的新型金融工具。

2. 期货(Futures):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

3. 期权(Options):买卖双方在未来一定期限内,按约定价格买入或卖出某种标的物的权利。

4. 掉期(Swap):双方约定在未来某一时间,相互交换一系列现金流的合约。

5. 远期合约(Forward Contract):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

三、金融机构及监管部门词汇1. 中央银行(Central Bank):国家金融政策制定和执行的机构,如中国人民银行。

2. 商业银行(Commercial Bank):以盈利为目的,提供存款、贷款、支付结算等金融服务的银行。

3. 证券公司(Securities Company):从事证券经纪、投资咨询、资产管理等业务的金融机构。

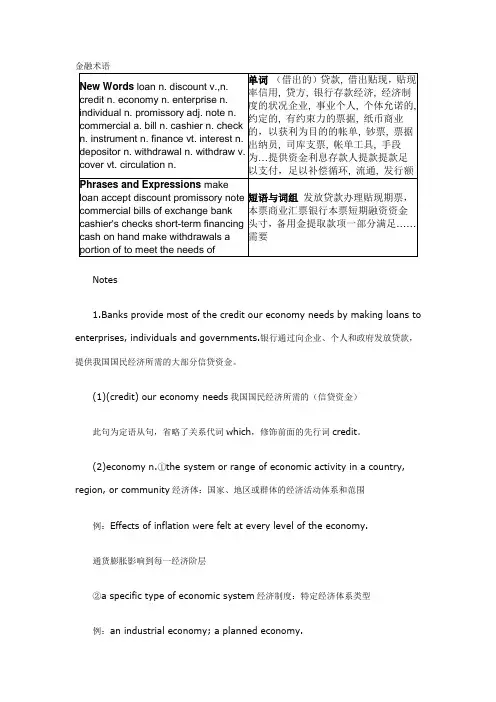

金融术语Notes1.Banks provide most of the credit our economy needs by making loans to enterprises, individuals and governments.银行通过向企业、个人和政府发放贷款,提供我国国民经济所需的大部分信贷资金。

(1)(credit) our economy needs我国国民经济所需的(信贷资金)此句为定语从句,省略了关系代词which,修饰前面的先行词credit。

(2)economy n.①the system or range of economic activity in a country, region, or community经济体:国家、地区或群体的经济活动体系和范围例:Effects of inflation were felt at every level of the economy.通货膨胀影响到每一经济阶层②a specific type of economic system经济制度:特定经济体系类型例:an industrial economy; a planned economy.工业经济体制;计划经济体制(3)by making loans to enterprises, individuals and governments是介词短语,在句中做状语。

by prep. with the use or help of; through借助于;通过(4)making (loans to…)是动名词,做介词by的宾语。

2.The interest that borrowers pay for their loans or for their notes discounted forms the major source of banks' income.借款人支付贷款或贴现票据的利息形成了银行主要收入的来源。

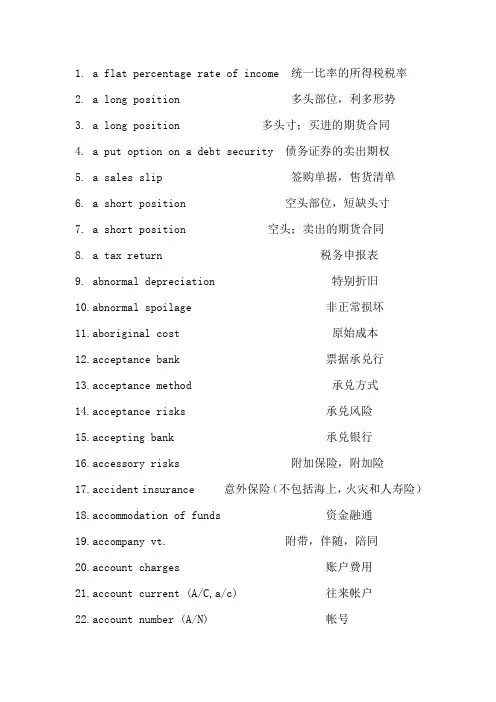

1.a flat percentage rate of income 统一比率的所得税税率2.a long position 多头部位,利多形势3.a long position 多头寸;买进的期货合同4.a put option on a debt security 债务证券的卖出期权5.a sales slip 签购单据,售货清单6.a short position 空头部位,短缺头寸7.a short position 空头;卖出的期货合同8.a tax return 税务申报表9.abnormal depreciation 特别折旧10.abnormal spoilage 非正常损坏11.aboriginal cost 原始成本12.acceptance bank 票据承兑行13.acceptance method 承兑方式14.acceptance risks 承兑风险15.accepting bank 承兑银行16.accessory risks 附加保险,附加险17.accident insurance 意外保险(不包括海上,火灾和人寿险)18.accommodation of funds 资金融通19.accompany vt. 附带,伴随,陪同20.account charges 账户费用21.account current (A/C,a/c) 往来帐户22.account number (A/N) 帐号23.account statement 帐户清单24.accounting exposure 会计风险25.accounting risks 会计风险26.accounting value 帐面价值27.accounts of assured 保险帐户28.accrued bond interest 应计债券利息29.accrued depreciation 应计折旧30.accrued dividend 应计股利31.acknowledgement of declaration (under op预约保险申报确认书32.active securities 热头股票,活跃的证券33.actual cash value (保险用语)实际现金价值34.actual rate 实际汇率35.adaptive expectations 适应性预期36.additional insurance 加保,附加保险37.additional reserve 追加准备金38.adjustable policy 可调整的保险单39.adjustable premium 可调整的保险费40.adjusted debit balance 已调整的借方余额41.advance payment of premium 预缴保险费42.advance-decline theory 涨跌理论43.adverse exchange 逆汇、逆汇兑44.advice of drawing 提款通知书45.advising bank 通知银行46.affiliated bank 联行47.affiliated person 关联人48.aftermarket 次级市场49.agent for collection 托收代理银行50.Agricultural Bank of China 中国农业银行51.agricultural loans 农业贷款52.agricultural(animal husbandry)tax 农(牧)业税53.allowance for doubtful debt 备抵呆帐款项54.alternative (either/or) order 选择指令55.American Express card 运通卡56.American terms 美国标价法57.amount in figures 小写金额58.amount in words 大写金额59.annual membership dues 年费60.application form for a banking account 银行开户申请书61.appointed bank 外汇指定银行62.appreciation of exchange rate 汇率升值63.arbitrage 套利64.arbitrage 套购,套利,套汇65.arbitrage of exchange 套汇66.arbitrage of exchange or stock 套汇或套股67.arbitrage opportunity 套价机会68.arbitrage risks 套汇风险69.as agent 做代理70.as principal 做自营n Development Fund (ADB) 亚洲开发银行72.ask price = asking price = offer price 出售价,报价,开价,出价73.ask-bid system 竞价系统74.assessment of loss 估损75.assets insurance 资产保险76.assignment of policy 保单转让77.assumption of risk 承担风险78.asymmetry 不对称79.at owner's risk 风险由货主负担80.at-the-close order 收盘指令81.at-the-market 按市价82.at-the-money 平值期权83.at-the-opening (opening only) order 开盘指令84.auction marketplace 拍卖市场85.automated teller machines (24 hours a day) 自动取款机(24小时服务)86.automatic transfers between accounts 自动转帐87.average 平均数88.baby bond 小额债券89.back spreads 反套利90.back wardation 现货溢价91.balance n. 结余,差额,平衡92.bank balance 存款余额93.bank balance over required reserves 超出法定(必备)储备的银行存款余额94.bank deposit 银行存款95.Bank of China 中国银行96.Bank of Communications 交通银行97.bank of deposit 存款银行98.bank of the government 政府的银行99.banker's association 银行协会100.banker's bank 中央银行101.banker's guarantee 银行担保102.bank's buying rate 银行买入价103.bank's selling rate 银行卖出价104.banks with business dealing with the center中央银行的往来银行105.Barclay card 巴克莱银行信用卡106.base rate 基本汇价107.basis order 基差订单108.basis risk 基差风险109.bear market 熊市110.bear operation 卖空行为111.bear raiders 大量抛空者112.beneficial owner 受益所有人113.beneficiary of insurance 保险金受益人114.best-efforts offering 尽力推销(代销)发行115.bid and ask prices 买入和卖出价116.bid and ask spread 买卖差价117.bid price = buying price 买价118.bid-ask spread 递盘虚盘差价119.big board 大行情牌120.big slump 大衰退(暴跌)121.bill-paying services 代付帐款122.black market 黑市123.black market financing 黑市筹资124.black money 黑钱125.blanket mortgage 总括抵押126.block positioner 大宗头寸商127.blowout 畅销128.blue-chip stocks 蓝筹股129.board of arbitration 仲裁委员会130.board of governors 理事会131.bond fund 债券基金132.borrowing from affiliates 向联营公司借款133.borrowing power of securities 证券贷款能力134.borrowing risks 借款风险135.bought deal 包销136.bread and butter business 基本业务137.breadth index 宽度指数138.break-even 不亏不盈,收支相抵139.breakout 突破140.bridging finance 过渡性融资141.broker 经纪人,掮客142.brokerage 经纪人佣金143.brokerage 经纪业;付给经纪人的佣金144.brokerage firm 经纪商(号)145.broker's loan 经纪人贷款146.broking house 经纪人事务所147.building agreement 具有约束力的协定148.building tax (tax on construction)建筑税149.bullish 行情看涨150.business insurance 企业保险151.business risk 营业风险152.business savings 企业储蓄153.business tax 营业税154.business term loan 企业长期贷款155.bust-up risks 破产风险156.buyer's risks 买方风险157.call (option) 买方期权,看涨期权158.call and put options 买入期权和卖出期权159.call for funds 控股、集资160.call loan transaction 短期拆放往来161.call market 活期存款市场162.call money 拆放款163.call options on an equity 权益(证券)的买入期权164.call-options 认购期权165.cancellation 取消166.cancellation money 解约金167.cap 带利率上限的期权168.capital assets 资本资产169.capital lease 资本租赁170.capital market 信贷市场、资本市场171.capital resources 资本来源172.capital surplus 资本盈余173.capital transfer 资本转移174.capital turnover rate 资本周转率175.card issuing institution 发卡单位176.carefully selected applicant 经仔细选定的申请人177.cargo insurance 货物保险178.cash 现金,现款v.兑现,付现款179.cash a cheque 支票兑现180.cash account 现金帐户181.cash advance 差旅预支款182.cash against bill of lading 凭提单付现183.cash against documents()凭单付现,凭单据付现金=document against cash184.cash and carry 付现自运;现金交易和运输自理;现购自运商店185.cash and carry wholesale 付现自运批发186.cash assets 现金资产187.cash audit 现金审核188.cash audit 现金审核,现金审计189.cash balance 现金余额,现款结存190.cash basis 现金制191.cash basis 现金制,现金基础192.cash basis accounting 现金收付会计制193.cash before delivery()空货前付款,付款后交货,付现款交货194.cash bonus 现金红利195.cash book 现金簿;现金帐;现金出纳帐196.cash boy 送款员197.cash budget 现金预算198.cash card1 (银行)自动提款卡199.cash card2 现金卡200.cash claim 现金索赔201.cash collection basis 收现法,收现制202.cash credit 活期信用放款,现金付出203.cash credit slip 现金支出传票204.cash currency 现金通货205.cash cycle 现金循环,现金周期206.cash day 付款日207.cash debit slip 现金收入传票208.cash department (商业机构中的)出纳部=counting-house209.cash deposit 现金存款;保证金210.cash deposit as collateral 保证金,押金211.cash desk (商店、饭馆的)付款处212.cash disbursements 现金支出213.cash discount .) 现金折扣,付现折扣=settlement discount214.cash dispenser (美)自动提款机=cashomat215.cash dividend 现金股利216.cash down 即付,付现217.cash equivalent value 现金等值,现金相等价值218.cash flow 资金流动219.cash flow 现金流动220.cash flow stream 现金流(量)221.cash holdings 库存现金222.cash holdings 库存现金223.cash in advance 预付现金224.cash in bank 存银行现金,银行存款225.cash in hand (商行的)手头现金,库存现金=cash on hand 226.cash in transit 在途现金,在运现金227.cash in transit policy 现金运送保险单228.cash in treasury 库存现金229.cash invoice 现购发票230.cash items 现金帐项,现金科目231.cash journal 现金日记簿232.cash liquidity 现金流动(情况);现金周转233.cash loan 现金贷款234.cash management services 现金管理业务235.cash market 现金交易市场,现货市场,付现市场236.cash nexus 现金交易关系237.cash on arrival 货到付现,货到付款238.cash on bank 银行存款;银行付款;现金支票付款239.cash on deliver (英)交货付款,现款交货=collect on delivery240.cash on delivery (COD) 交割付款241.cash order(C/O)现金订货242.cash paid book 现金支出簿243.cash payment 现金支付244.cash payment 现金付款,现付245.cash payments journal 现金支出日记帐246.cash position 头寸247.cash position 现金状况,现金头寸248.cash price 现金售价,现金付款价格249.cash purchase 现购,现金购买250.cash railway (商店中的)货款传送线251.cash ratio 现金比率252.cash receipts (CR) 现金收入253.cash receipts journal 现金收入日记帐254.cash records 现金记录255.cash register 现金登记机,现金收入记录机,收银机256.cash remittance 汇款单;解款单257.cash remittance note 现金解款单,解款单258.cash requirement 现金需要量259.cash reserve 现金储备(金)260.cash resources 现金资源,现金来源261.cash resources (reserves) 现金准备262.cash sale 现售,现金销售=sale by real cash 263.cash sale invoice 现销发票,现售发票264.cash settlement 现金结算,现汇结算265.cash short and over 现金尾差,清点现金余差;现金短溢266.cash slip 现金传票267.cash statement 现金报表,(现金)库存表268.cash ticket 现销票,门市发票269.cash transaction 现金交易270.cash verification 现金核实,现金核查271.cash voucher 现金凭单;现金收据272.cash with order (订货时付款,订货付现,落单付现273.cash without discount 付现无折扣274.cash yield discount 现金获利率,现金收益率275.cash-and-carry arbitrage 现货持有套利276.cashier 出纳员,收支员277.cashier's cheque .) 银行本票=cashier's order 278.central rate 中心汇率(一国货币对美元的汇率,并据此计算对其他货币的汇率)279.certificate of balance 存款凭单280.Certificate of Deposits (CDs) 大额定期存款单281.certificated security 实物证券282.certificates of deposit (CDs) 大面额存款单283.certifying bank 付款保证银行284.change hands 交换,换手285.chartered bank 特许银行286.chattel 动产287.chattel mortgage 动产抵押288.chattel mortgage 动产抵押289.chattel mortgage bond (美)动产抵押(公司)债券290.chattel personal (私人)动产291.chattel real 准不动产(土地权等)292.check certificate 检验证明书293.check deposit 支票存款294.check list (核对用的)清单295.check sheet 对帐单296.checking account 支票帐户297.checking deposits 支票存款,活期存款298.checking reserve 支票现金储备299.checkstand (超级市场的)点货收款台300.cheque (payable) to bearer 来人支票,不记名支票301.cheque book 支票簿302.cheque book stub 支票簿存根303.cheque card 支票卡304.cheque collection 支票兑取305.cheque collector 支票兑取人306.cheque crossed 划线支票307.cheque crossed generally 普通划线支票308.cheque crossed specially 特别划线支票309.cheque deposit 支票存款310.cheque drawer 支票出票人311.cheque holder 支票执票人312.cheque only for account 转帐支票313.cheque payable at sight 见票即付支票314.cheque protector 支票银码机315.cheque rate 票据汇兑汇率,票汇价格=sight rate ,short rate316.cheque register 支票登记簿317.cheque returned 退票,退回的支票318.cheque signer 支票签名机319.cheque stub 支票存根320.cheque to order 记名支票,指定人支票321.China Investment Bank 中国投资银行322.circulation risks 流通风险323.circulation tax (turnover tax)流转税324.city bank 城市银行325.claim a refound 索赔326.clean collections 光票托收327.clearing bank 清算银行328.clearing house 清算所329.clearinghouse 清算公司,票据交换所330.close out 平仓,结清(账)331.closed and mortgage 闭口抵押332.closing order 收市价订单333.closing rate 收盘价334.closing transaction 平仓交易335.collar 带利率上下限的期权336.collateral loan 抵押借款337.collecting bank 托收银行338.collecting bank 托收银行339.collecting bank 代收行340.collection instructions 委托(托收的)单据341.collection items 托收业务,托收项目342.collection of trade charges 托收货款343.collection on clean bill 光票托收344.collection on documents 跟单托收345.collection order 托收委托书346.collection risk 托收风险347.collection risks 托收风险348.collection service 托收服务349.collective-owned enterprise bonus tax 集体企业奖金税350.collective-owned enterprise income tax 集体企业所得税mercial and industrial loans 工商贷款mercial deposit 商业存款mercial paper 商业票据mercial paper house 经营商业票据的商号mercial risk 商业风险mercial terms 商业条件mission 佣金modity futures 商品期货modity insurance 商品保险mon collateral 共同担保mon fund 共同基金mon stock 普通股mon trust fund 共同信托基金pensatory financing 补偿性融资petitive risks 竞争风险posite depreciation 综合折旧pound interest 复利pound rate 复利率pound rate deposit 复利存款prehensive insurance 综合保险371.condominium 公寓私有共有方式372.confirming bank 保兑银行373.congestion area 震荡区374.congestion tape 统一自动行情显示375.conservatism and liquidity 稳健性与流动性376.consortium bank 银团银行377.constructure risk 建设风险378.consumer financing 消费融资379.contingent risks 或有风险380.contract money 合同保证金381.contract size 合约容量382.contracts of difference 差异合约383.contractual value 合同价格384.controlled rates 控制的汇率385.converge 集聚,(为共同利益而)结合一起386.conversion 汇兑、兑换387.convertible currency 可兑换的货币388.cooling-off period 等待期389.cooperative financing 合作金融390.cornering the market 操纵市场391.corners 垄断392.corporate deposits 法人存款393.correspondent 代理行394.cost of maintenance 维修费395.counter-inflation policy 反通货膨胀对策396.cover 弥补,补进(卖完的商品等)397.cover 弥补(损失等);负担(开支);补进(商品或股票等);保险398.coverage 承保险别;保险总额;范围保险399.coverage ratio 偿债能力比率400.cover-note 暂保单;投保通知单401.credit 信用,信贷402.credit account ., C/A) 赊帐=open account2 403.credit agreement 信贷协定404.credit amount 信贷金额;赊帐金额;信用证金额405.credit analysis 信用分析406.credit balance 贷方余额,结欠,贷余407.credit bank 信贷银行408.credit beneficiary 信用证受益人409.credit business 赊售,信用买卖410.credit buying 赊购411.credit capital 信贷资本412.credit cards 信用卡413.credit control 信用控制414.credit control instrument 信用调节手段415.credit expansion 信用扩张416.credit extending policy 融资方针417.credit facility 信用透支418.credit limit 信用额度419.credit restriction 信用限额420.credit risk 信用风险421.credit union 信用合作社422.creditor bank 债权银行423.crop up (out) 出现,呈现424.cross hedge 交叉套做425.cross hedging 交叉保值426.cum dividend 附息427.cum rights 含权428.cumulative preferred stock 累积优先股429.currency futures 外币期货430.currency futures contract 货币期货合约431.current fund 流动基金432.current futures price 现时的期货价格433.current ratio 流动比率434.customize 按顾客的具体要求制作435.customs duty(tariffs)关税436.D/D (Banker's Demand Draft) 票汇437.daily interest 日息438.daily limit 每日涨(跌)停板439.date of delivery 交割期440.dealers 批发商441.death and gift tax 遗产和赠与税442.debt of honour 信用借款443.debtor bank 借方银行444.decision-making under risk 风险下的决策445.deed 契约446.deed tax 契税447.deferred savings 定期存款448.deficit covering 弥补赤字449.deficit-covering finance 赤字财政450.deflation 通货紧缩451.delivery date 交割日452.demand pull inflation 需求拉动通货膨胀453.demand-deposit or checking-accounts 活期存款或支票帐户454.deposit account (D/A) 存款帐户455.deposit at call 通知存款456.deposit bank 存款银行457.deposit money 存款货币458.deposit rate 存款利率459.deposit turnover 存款周转率460.depreciation risks 贬值风险461.derivative deposit 派生存款462.derived deposit 派生存款463.designated currency 指定货币464.deutsche marks (=DM) 西德马克465.devaluation of dollar 美元贬值466.developer 发展商467.Development Bank 开发银行468.development financing 发展融资469.devise 遗赠470.die intestate 死时没有遗嘱471.Diners card 大莱信用卡472.direct exchange 直接汇兑473.direct financing 直接融资474.direct hedging 直接套做475.direct leases 直接租赁476.direct taxation 直接税477.discount credit 贴现融资478.discount market 贴现市场479.discount on bills 票据贴现480.discount paid 已付贴现额481.discounted cash flow 净现金量482.discounting bank 贴现银行483.dishonour risks 拒付风险484.disintermediation 脱媒485.distant futures 远期期货486.diversification 分散投资487.dividends 红利488.document of title 物权单据489.documentary collection 跟单托收490.Documents against Acceptance,D/A 承兑交单491.Documents against Payment,D/P 付款交单492.domestic correspondent 国内通汇银行493.domestic deposit 国内存款494.domestic exchange 国内汇兑495.double leasing 双重租赁496.double mortgage 双重抵押497.double option 双向期权498.Dow Jones average 道·琼斯平均数499.down payment 首期500.downgrade 降级501.downside 下降趋势502.downtick 跌点交易503.Dragon card 龙卡504.draw 提款505.draw cheque 签发票据506.drawee bank 付款银行507.drawing account 提款帐户508.dual exchange market 双重外汇市场509.dual trading 双重交易510.due from other funds 应收其他基金款511.due to other funds 应付其他基金款512.dumping 抛售513.early warning system 预警系统514.easy credit 放松信贷515.economic exposure 经济风险516.efficient portfolio 有效证券组合517.electronic accounting machine 电子记帐机518.electronic cash 电子现金519.electronic cash register 电子收款机520.electronic debts 电子借贷521.electronic funds transfer 电子资金转帐522.electronic transfer 电子转帐523.emergency tariff 非常关税524.encumbrance 债权(在不动产上设定的债权)525.endorsement for collection 托收背书526.engage in arbitrage (to) 套汇527.entity n. 单位,整体,个体528.entrance fee 申请费529.equalization fund (外汇)平衡基金530.equipment leasing services 设备租赁业务531.equity portfolio 股票资产532.establishing bank 开证银行533.ethics risks 道德风险534.Euro-bank 欧洲银行535.Eurocard 欧洲系统卡536.European terms 欧洲标价法537.evaluation of property 房产估价538.evasion of foreign currency 逃汇539.exception clause 免责条款540.excess insurance 超额保险541.exchange adjustment 汇率调整542.exchange alteration 更改汇率543.exchange arbitrage 外汇套利544.exchange bank 外汇银行545.exchange broker 外汇经纪人546.exchange brokerage 外汇经纪人佣金547.exchange business 外汇业务548.exchange clearing agreement 外汇结算协定549.exchange clearing system 汇结算制550.exchange competition 外汇竞争551.exchange contract 外汇成交单552.exchange control 外汇管制553.exchange convertibility 外汇兑换554.exchange customs 交易所惯例555.exchange depreciation 外汇下降556.exchange dumping 汇率倾销557.exchange fluctuations 汇价变动558.exchange for forward delivery 远期外汇业务559.exchange for spot delivery 即期外汇业务560.exchange freedom 外汇自由兑换561.exchange loss 汇率损失562.exchange parity 外汇平价563.exchange position 外汇头寸564.exchange position 外汇头寸;外汇动态565.exchange premium 外汇升水566.exchange profit 外汇利润567.exchange proviso clause 外汇保值条款568.exchange quota system 外汇配额制569.exchange rate 汇价570.exchange rate fluctuations 外汇汇价的波动571.exchange rate parity 外汇兑换的固定汇率572.exchange rate risks 外汇汇率风险573.exchange reserves 外汇储备574.exchange restrictions 外汇限制575.exchange risk 外汇风险576.exchange risk 兑换风险577.exchange settlement 结汇578.exchange speculation 外汇投机579.exchange stability 汇率稳定580.exchange surrender certificate 外汇移转证581.exchange transactions 外汇交易582.exchange value 外汇价值583.exchange war 外汇战584.excise 货物税,消费税585.exercise date 执行日586.exercise price, striking price 履约价格,认购价格587.expenditure tax 支出税588.expenditure tax regime 支出税税制589.expenses incurred in the purchase 购买物业开支590.expiration date 到期日591.export and import bank 进出口银行592.export gold point 黄金输出点593.exposure 风险594.external account 对外帐户595.extraneous risks 附加险596.extrinsic value 外在价值597.face value 面值598.facultative insurance 临时保险599.fair and reasonable 公平合理600.far future risks 长远期风险601.farm subsidies 农产品补贴602.farmland occupancy tax 耕地占用税603.favourable exchange 顺汇604.fax base 税基605.feast tax 筵席税606.feathered assets 掺水资产607.fee 不动产608.fee interest 不动产产权609.fictions payee 虚构抬头人610.fictitious assets 虚拟资产611.fictitious capital 虚拟资本612.fiduciary a. 信托的,信用的,受信托的(人)613.fiduciary field 信用领域,信托领域614.finance broker 金融经纪人615.financial advising services 金融咨询服务616.financial arrangement 筹资安排617.financial crisis 金融危机618.financial forward contract 金融远期合约619.financial futures 金融期货620.financial futures contract 金融期货合约621.financial insolvency 无力支付622.financial institutions' deposit 同业存款623.financial lease 金融租赁624.financial risk 金融风险625.financial statement analysis 财务报表分析626.financial system 金融体系627.financial transaction 金融业务628.financial unrest 金融动荡629.financial world 金融界630.first mortgage 第一抵押权631.fiscal and monetary policy 财政金融政策632.fixed assets 固定资产633.fixed assets ratio 固定资产比率634.fixed assets turnover ratio 固定资产周转率635.fixed capital 固定资本636.fixed costs 固定成本637.fixed deposit (=time deposit) 定期存款638.fixed deposit by installment 零存整取639.fixed exchange rate 固定汇率640.fixed par of exchange 法定汇兑平价641.fixed savings withdrawal 定期储蓄提款642.fixed-rate leases 固定利率租赁643.flexibility and mobility 灵活性与机动性644.flexibility of exchange rates 汇率伸缩性645.flexible exchange rate 浮动汇率646.floating exchange rate 浮动汇率647.floating policy 流动保险单648.floating-rate leases 浮动利率租赁649.floor 带利率下限的期权650.floor broker 场内经纪人651.fluctuations in prices 汇率波动652.foregift 权利金653.foreign banks 外国银行654.foreign correspondent 国外代理银行655.foreign currency futures 外汇期货656.foreign enterprises income tax 外国企业所得657.foreign exchange certificate 外汇兑换券658.foreign exchange crisis 外汇危机659.foreign exchange cushion 外汇缓冲660.foreign exchange dumping 外汇倾销661.foreign exchange earnings 外汇收入662.foreign exchange liabilities 外汇负债663.foreign exchange loans 外汇贷款664.foreign exchange parity 外汇平价665.foreign exchange quotations 外汇行情666.foreign exchange regulations 外汇条例667.foreign exchange reserves 外汇储备668.foreign exchange restrictions 外汇限制669.foreign exchange retaining system 外汇留存制670.foreign exchange risk 外汇风险671.foreign exchange services 外汇业务672.foreign exchange transaction centre 外汇交易中心673.forward exchange 期货外汇674.forward exchange intervention 期货外汇干预675.forward exchange sold 卖出期货外汇676.forward foreign exchange 远期外汇汇率677.forward operation 远期(经营)业678.forward swap 远期掉期679.fraternal insurance 互助保险680.free depreciation 自由折旧681.free foreign exchange 自由外汇682.freight tax 运费税683.fringe bank 边缘银行684.full insurance 定额保险685.full payout leases 充分偿付租赁686.full progressive income tax 全额累进所得税687.fund 资金、基金688.fund account 基金帐户689.fund allocation 基金分配690.fund appropriation 基金拨款691.fund balance 基金结存款692.fund demand 资金需求693.fund for relief 救济基金694.fund for special use 专用基金695.fund in trust 信托基金696.fund liability 基金负债697.fund obligation 基金负担698.fund raising 基金筹措699.fundamental insurance 基本险700.funds statement 资金表701.futures commission merchants 期货经纪公司702.futures contract 期货合约703.futures delivery 期货交割704.futures margin 期货保证金705.futures market 期货市场706.futures price 期货价格707.futures transaction 期货交易708.FX futures contract 外汇期货合约709.galloping inflation 恶性通货膨胀710.gap 跳空711.general endorsement 不记名背书712.general fund 普通基金713.general mortgage 一般抵押714.Giro bank 汇划银行715.given rate 已知汇率716.go long 买进,多头717.go short 短缺;卖空,空头718.going away 分批买进719.going rate 现行汇率720.Gold Ear Credit Card 金穗卡ernment revenue 政府收入722.graduated reserve requirement 分级法定准备金723.Great Wall card 长城卡724.gross cash flow 现金总流量725.guarantee of payment 付款保证726.guaranteed fund 保证准备金727.hammering the market 打压市场728.handling charge 手续费729.harmony of fiscal and monetary policies 财政政策和金融政策的协调730.hedge 套头交易731.hedge against inflation 为防通货膨胀而套购732.hedge buying 买进保值期货733.hedge fund 套利基金734.hedging mechanism 规避机制735.hedging risk 套期保值风险736.hire purchase 租购737.hit the bid 拍板成交738.hoarded money 储存的货币739.holding the market 托盘740.horizontal price movement 横盘741.hot issue 抢手证券742.hot money deposits 游资存款743.hot stock 抢手股票744.house property tax 房产税745.hypothecation 抵押746.idle capital 闲置资本747.idle cash (money) 闲散现金,游资748.idle demand deposits 闲置的活期存款749.immobilized capital 固定化的资产750.immovable property 不动产751.import regulation tax 进口调节税752.imposition 征税;税;税款753.imprest bank account 定额银行存款专户754.in force (法律上)有效的755.in the tank 跳水756.inactive market 不活跃市场757.income in kind 实物所得758.income tax liabilities 所得税责任,所得税债务759.income taxes 所得税760.indemnity 赔偿,补偿761.indirect arbitrage 间接套汇762.indirect finance 间接金融763.indirect hedging 间接套做764.indirect leases 间接租赁(即:杠杆租赁)765.indirect rate 间接汇率766.indirect taxation 间接税767.individual income regulation tax 个人调节税768.individual income tax 个人所得税769.individual savings 私人储蓄770.Industrial and Commercial Bank of China 中国工商银行771.industrial financing 工业融资772.industrial-commercial consolidated tax 工商统一税773.industrial-commercial income tax 工商所得税774.industrial-commercial tax 工商税775.inflation 通货膨胀776.inflation rate 通货膨胀率777.inflationary spiral 螺旋式上升的通货膨胀778.inflationary trends 通货膨胀趋势779.infrastructure bank 基本建设投资银行780.initial margin 初始保证金781.initial margin 期初保证权782.initial margins 初始保证金783.initial reserve 初期准备金784.insider 内幕人785.installment savings 零存整取储蓄786.institution 机构投资者787.insurance appraiser 保险损失评价人788.insurance broker 保险经纪人789.insurance contract 保险契约,保险合同790.insurance saleman 保险外勤791.insurance services 保险业务792.insure against fire 保火险793.insured 被保险人794.interbank market 银行同业市场795.inter-business credit 同行放帐796.interest on deposit 存款利息797.interest per annum 年息798.interest per month 月息799.interest rate futures contract 利率期货合约800.interest rate policy 利率政策801.interest rate position 利率头寸802.interest rate risk 利率风险803.interest restriction 利息限制804.interest subsidy 利息补贴805.interest-rate risk 利息率风险806.interim finance 中间金融807.intermediary bank 中间银行808.intermediate account 中间帐户809.internal reserves 内部准备金810.international banking services 国际银行业务811.International Investment Bank (IIB) 国际投资银行812.international leasing 国际租赁813.in-the-money 有内在价值的期权814.intraday 日内815.intrinsic utility 内在效用816.intrinsic value 实际价值,内部价值817.inward documentary bill for collection 进口跟单汇票,进口押汇(汇票)818.isolation of risk 风险隔离819.issue bank 发行银行820.JCB card JCB卡821.joint financing 共同贷款822.key risk 关键风险823.kill a bet 终止赌博nd use tax 土地使用税rge deposit 大额存款rge leases 大型租赁tent inflation 潜在的通货膨胀tent inflation 潜在的通货膨胀829.lease agreement 租约830.lease and release 租借和停租831.lease broker 租赁经纪人832.lease financing 租赁筹租833.lease immovable 租借的不动产834.lease in perpetuity 永租权835.lease insurance 租赁保险836.lease interest insurance 租赁权益保险837.lease land 租赁土地838.lease mortgage 租借抵押839.lease out 租出840.lease property 租赁财产841.lease purchase 租借购买842.lease rental 租赁费843.lease territory 租借地844.leaseback 回租845.leasebroker 租赁经纪人846.leased immovable 租借的不动产847.leasehold 租赁土地848.leasehold 租借期,租赁营业,租赁权849.leasehold property 租赁财产850.leaseholder 租赁人851.leaseholder 承租人,租借人852.leases agent 租赁代理853.leases arrangement 租赁安排854.leases company 租赁公司855.leases structure 租赁结构856.leasing 出租857.leasing agreement 租赁协议858.leasing amount 租赁金额859.leasing asset 出租财产,租赁财产860.leasing clauses 租赁条款861.leasing consultant 租赁顾问862.leasing contract 租赁合同863.leasing cost 租赁成本864.leasing country 承租国865.leasing division 租赁部866.leasing equipment 租赁设备867.leasing industry 租赁业868.leasing industry (trade) 租赁业869.leasing money 租赁资金870.leasing period 租赁期871.leasing regulations 租赁条例872.legal interest 法定利息873.legal tender 法定货币874.legal tender 本位货币,法定货币875.lessee 承租人,租户876.lessor 出租人877.letter of confirmation 确认书878.letter transfer 信汇879.leveraged leases 杠杆租赁880.lien 扣押权,抵押权881.life insurance 人寿保险882.life of assets 资产寿命883.limit order 限价指令884.limited floating rate 有限浮动汇率885.line of business 行业,营业范围,经营种类886.liquidation 清仓887.liquidity 流动性888.liquidity of bank 银行资产流动性889.listed stock 上市股票890.livestock transaction tax 牲畜交易税891.loan account 贷款帐户892.loan amount 贷款额893.loan at call 拆放894.loan bank 放款银行895.loan volume 贷款额896.loan-deposit ratio 存放款比率897.loans to financial institutions 金融机构贷款898.loans to government 政府贷款899.local bank 地方银行900.local income tax (local surtax) 地方所得税901.local surtax 地方附加税902.local tax 地方税903.long arbitrage 多头套利904.long position 多头头寸905.long position 多头寸;买进的期货合同906.long-term certificate of deposit 长期存款单907.long-term credit bank 长期信用银行908.long-term finance 长期资金融通909.loss leader 特价商品,亏损大项910.loss of profits insurance 收益损失保险911.loss on exchange 汇兑损失912.low-currency dumping 低汇倾销913.low-currency dumping 低汇倾销914.M/T (= Mail Transfer) 信汇915.main bank 主要银行916.maintenance margin 最低保证金,维持保证金917.major market index 主要市场指数918.management risk 管理风险919.managing bank of a syndicate 财团的经理银行920.manipulation 操纵921.margin 保证金922.margin call 保证金通知923.margin call 追加保证金的通知924.margin money 预收保证金,开设信用证保证金925.margin rate 保证金率926.markdown 跌价927.market discount rate 市场贴现率928.market expectations 市场预期929.market makers 造市者930.market order 市价订单931.market risk 市场风险932.marketability 流动性933.market-clearing 市场结算934.Master card 万事达卡935.matching 搭配936.mature liquid contracts 到期合约937.maximum limit of overdraft 透支额度938.measures for monetary ease 金融缓和措施939.medium rate 中间汇率940.medium-term finance 中期金融941.member bank 会员银行lion card 百万卡943.minimum cash requirements 最低现金持有量(需求)944.minimum reserve ratio 法定最低准备比率945.mint parity 法定平价946.monetary action 金融措施947.monetary aggregates 货币流通额948.monetary and credit control 货币信用管理949.monetary and financial crisis 货币金融危机950.monetary area 货币区951.monetary assets 货币性资产952.monetary base 货币基础953.monetary circulation 货币流通954.monetary device 金融调节手段955.monetary ease 银根松动956.monetary market 金融市场957.monetary market 金融市场958.monetary risk 货币风险959.monetary stringency 银根奇紧960.monetary unit 货币单位961.money capital 货币资本962.money collector 收款人963.money credit 货币信用964.money down 付现款965.money equivalent 货币等价966.money paid on account 定金967.money-flow analysis 货币流量分析968.money-over-money leases 货币加成租赁969.moral hazard 道德风险970.mortgage bank 抵押银行971.motor vehicle and highway user tax 机动车和公路使用税972.movables all risks insurance 动产综合保险973.movables insurance 动产保险974.multinational bank 跨国银行975.multiunit 公寓楼976.mutual insurance company 相互保险公司977.national bank 国家银行978.nationalized bank 国有化银行979.near money 准货币。

经济金融术语中英文对照D (1)E (3)F (3)G (4)J (6)K (9)L (9)M (10)N (11)P (11)Q (12)R (13)W (13)X (14)Y (16)Z (17)D打白条 issue IOU大额存单 certificate of deposit(CD)大额提现 withdraw deposits in large amounts大面积滑坡 wide-spread decline大一统的银行体制 (all—in—one)mono-bank system呆账(请见“坏账”) bad loans呆账准备金 loan loss reserves(provisions)呆滞贷款 idle loans贷款沉淀 non—performing loans贷款分类 loan classification贷款限额管理 credit control;to impose credit ceiling贷款约束机制 credit disciplinary(constraint)mechanism代理国库 to act as fiscal agent代理金融机构贷款 make loans on behalf of other institutions戴帽贷款 ear-marked loans倒逼机制reversed transmission of the pressure for easing monetary condition道德风险 moral hazard地区差别 regional disparity第一产业 the primary industry第二产业 the secondary industry第三产业 the service industry;the tertiary industry递延资产 deferrable assets订货不足 insufficient orders定期存款 time deposits定向募集 raising funds from targeted sources东道国(请见“母国”) host country独立核算 independent accounting短期国债 treasury bills对冲操作 sterilization operation;hedging对非金融部门债权 claims on non-financial sector多种所有制形式 diversified ownershipE恶性通货膨胀 hyperinflation二级市场 secondary marketF发行货币 to issue currency发行总股本 total stock issue法定准备金 required reserves;reserve requirement法人股 institutional shares法人股东 institutional shareholders法治 rule of law房地产投资 real estate investment放松银根 to ease monetary policy非现场稽核 off-site surveillance(or monitoring)非银行金融机构 non-bank financial institutions非赢利性机构 non-profit organizations分税制 assignment of central and local taxes;tax assignment system分业经营 segregation of financial business(services);division of business scope based on the type of financial institutions风险暴露(风险敞口) risk exposure风险管理 risk management风险意识 risk awareness风险资本比例 risk-weighted capital ratios风险资本标准 risk-based capital standard服务事业收入 public service charges;user’s charges扶贫 poverty alleviation负增长 negative growth复式预算制 double-entry budgeting;capital and current budgetary account G改革试点 reform experimentation杠杆率 leverage ratio杠杆收购 leveraged buyout高息集资 to raise funds by offering high interest个人股 non-institutional shares根本扭转 fundamental turnaround(or reversal)公开市场操作 open market operations公款私存 deposit public funds in personal accounts公用事业 public utilities公有经济 the state—owned sector;the public sector公有制 public ownership工业成本利润率 profit—to—cost ratio工业增加值 industrial value added供大于求 supply exceeding demand;excessive supply鼓励措施 incentives股份合作企业 joint—equity cooperative enterprises股份制企业 joint-equity enterprises股份制银行 joint—equity banks固定资产贷款 fixed asset loans关税减免 tariff reduction and exemption关税减让 tariff concessions关税优惠 tariff incentives;preferential tariff treatment规范行为 to regularize(or standardize)…behavior规模效益 economies of scale国计民生 national interest and people’s livelihood国家对个人其他支出 other government outlays to individuals 国家风险 country risk国际分工 international division of labor国际收支 balance of payments国有独资商业银行 wholly state—owned commercial banks国有经济(部门) the state-owned(or public)sector国有企业 state-owned enterprises(SOEs)国有制 state-ownership国有资产流失 erosion of state assets国债回购 government securities repurchase国债一级自营商 primary underwriters of government securities 过度竞争 excessive competition过度膨胀 excessive expansionH合理预期 rational expectation核心资本 core capital合资企业 joint—venture enterprises红利 dividend宏观经济运营良好 sound macroeconomic performance宏观经济基本状况 macroeconomic fundamentals宏观调控 macroeconomic management(or adjustment)宏观调控目标 macroeconomic objectives(or targets)坏账 bad debt还本付息 debt service换汇成本 unit export cost;local currency cost of export earnings 汇兑在途 funds in float汇兑支出 advance payment of remittance by the beneficiary's bank 汇率并轨 unification of exchange rates活期存款 demand deposits汇率失调 exchange rate misalignment混合所有制 diversified(mixed)ownership货币政策态势 monetary policy stance货款拖欠 overdue obligations to suppliers过热J基本建设投资 investment in infrastructure基本经济要素 economic fundamentals基本适度 broadly appropriate基准利率 benchmark interest rate机关团体存款 deposits of non-profit institutions机会成本 opportunity cost激励机制 incentive mechanism积压严重 heavy stockpile;excessive inventory挤提存款 run on banks挤占挪用 unwarranted diversion of(financial)resources(from designated uses)技改投资 investment in technological upgrading技术密集型产品 technology—intensive product计划单列市 municipalities with independent planning status计划经济 planned economy集体经济 the collective sector加大结构调整力度 to intensify structural adjustment加工贸易 processing trade加快态势 accelerating trend加强税收征管稽查 to enhance tax administration加权价 weighted average price价格放开 price liberalization价格形成机制 pricing mechanism减亏 to reduce losses简化手续 to cut red tape;to simplify(streamline)procedures交投活跃 brisk trading缴存准备金 to deposit required reserves结构扭曲 structural distortion结构失调 structural imbalance结构性矛盾突出 acute structural imbalance结构优化 structural improvement(optimization)结汇、售汇 sale and purchase of foreign exchange金融脆弱 financial fragility金融动荡 financial turbulence金融风波 financial disturbance金融恐慌 financial panic金融危机 financial crisis金融压抑 financial repression金融衍生物 financial derivatives金融诈骗 financial fraud紧缩银根 to tighten monetary policy紧缩政策 austerity policies;tight financial policies经常账户可兑换 current account convertibility经济特区 special economic zones(SEZs)经济体制改革 economic reform经济增长方式的转变 change in the main source of economic growth(from investment expansion to efficiency gains)经济增长减速 economic slowdown;moderation in economic growth经济制裁 economic sanction经营自主权 autonomy in management景气回升 recovery in business activity境外投资 overseas investment竞争加剧 intensifying competition局部性金融风波 localized(isolated)financial disturbance迹象 signs of overheatingK开办人民币业务 to engage in RMB business可维持(可持续)经济增长 sustainable economic growth可变成本 variable cost可自由兑换货币 freely convertible currency控制现金投放 control currency issuance扣除物价因素 in real terms;on inflation-adjusted basis库存产品 inventory跨国银行业务 cross-border banking跨年度采购 cross—year procurement会计准则 accounting standardL来料加工 processing of imported materials for export离岸银行业务 off-shore banking(business)理顺外贸体制 to rationalize foreign trade regime利率杠杆的调节作用 the role of interest rates in resource allocation利润驱动 profit-driven利息回收率 interest collection ratio联行清算 inter—bank settlement连锁企业 franchise(businesses);chain businesses良性循环 virtuous cycle两极分化 growing income disparity;polarization in income distribution 零售物价指数 retail price index(RPI)流动性比例 liquidity ratio流动资产周转率/流通速度 velocity of liquid assets流动资金贷款 working capital loans流通体制 distribution system流通网络 distribution network留购(租赁期满时承租人可购买租赁物) hire purchase垄断行业 monopolized industry(sector)乱集资 irregular(illegal)fund raising乱收费 irregular(illegal)charges乱摊派 unjustified(arbitrary)leviesM买方市场 buyer's market卖方市场 seller’s market卖出回购证券 matched sale of repo贸易差额 trade balance民间信用 non-institutionalized credit免二减三 exemption of income tax for the first two years ofmaking profit and 50% tax reduction for thefollowing three years明补 explicit subsidy明亏 explicit loss名牌产品 brand products母国(请见“东道国”) home countryN内部控制 internal control内部审计 internal audit内地与香港 the mainland and Hong Kong内债 domestic debt扭亏为盈 to turn a loss-making enterprise into a profitable one扭曲金融分配 distorted allocation of financial resources农副产品采购支出 outlays for agricultural procurement农村信用社 rural credit cooperatives(RCCs)P泡沫效应 bubble effect泡沫经济 bubble economy培育新的经济增长点 to tap new sources of economic growth片面追求发展速度 excessive pursuit of growth平衡发展 balanced development瓶颈制约 bottleneck(constraints)平稳回升 steady recovery铺底流动资金 initial(start-up)working capital普遍回升 broad—based recovery配套改革 concomitant(supporting)reforms配套人民币资金 lQ企业办社会 enterprises burdened with social responsibilities企业集团战略 corporate group strategy企业兼并重组 company merger and restructuring企业领导班子 enterprise management企业所得税 enterprise(corporate)income tax企业效益 corporate profitability企业资金违规流入股市 irregular flow of enterprise funds into the stock market欠税 tax arrears欠息 overdue interest强化税收征管 to strengthen tax administration强制措施 enforcement action翘尾因素 carryover effect切一刀 partial application清理收回贷款 clean up and recover loans(破产)清算 liquidation倾斜政策 preferential policy区别对待 differential treatment趋势加强 intensifying trend全球化 globalization权益回报率 returns on equity(ROE)缺乏后劲 unsustainable momentumR绕规模贷款 to circumvent credit ceiling人均国内生产总值 per capita GDP人均收入 per capita income人民币升值压力 upward pressure on the Renminbi(exchange rate)认缴资本 subscribed capital软贷款 soft loans软预算约束 soft budget constraint软着陆 soft landingocal currency funding of…W外部审计 external audit外国直接投资 foreign direct investment (FDI)外汇储备 foreign exchange reserves外汇调剂 foreign exchange swap外汇占款the RMB counterpart of foreign exchange reserves;the RMB equivalent of offcial foreign exchange holdings外向型经济 export—oriented economy外债 external debt外资企业 foreign-funded enterprises完善现代企业制度 to improve the modern enterprise system完税凭证 tax payment documentation违法经营 illegal business委托存款 entrusted deposits稳步增长 steady growth稳健的银行系统 a sound banking system稳中求进 to make progress while ensuring stability无纸交易 book-entry(or paperless/scriptless)transaction物价监测 price monitoringX吸纳流动性 to absorb liquidity稀缺经济 scarcity economy洗钱 money laundering系统内调度 fund allocation within a bank系统性金融危机 systemic financial crisis下岗工人 laid-off employees下游企业 down—stream enterprises现场稽核 on-site examination现金滞留(居民手中) cash held outside the banking system乡镇企业 township and village enterprises(TVEs)消费物价指数 consumer price index(CPI)消费税 excise(consumption)tax消灭财政赤字 to balance the budget;to eliminate fiscal deficit销货款回笼 reflow of corporate sales income to the banking system销售平淡 lackluster sales协议外资金额 committed amount of foreign investment新经济增长点 new sources of economic growth新开工项目 new projects;newly started projects新增贷款incremental credit; loan increment;credit growth; credit expansion新增就业位置 new jobs;new job opportunities信贷规模考核 review the compliance with credit ceilings信号失真 distorted signals信托投资公司 trust and investment companies信息不对称 information asymmetry信息反馈 feedback(information)信息共享系统 information sharing system信息披露 information disclosure信用扩张 credir expansion信用评级 credit rating姓“资”还是姓“社” pertaining to socialism or capitalism;socialist orcaptialist行政措施 administrative measures需求膨胀 demand expansion; excessive demand虚伪存款 window-dressing deposits削减冗员 to shed excess labor force寻租 rent seeking迅速反弹 quick reboundY养老基金 pension fund一刀切 universal application;non-discretionary implementation一级市场 primary market应收未收利息 overdue interest银行网点 banking outlets赢利能力 profitability营业税 business tax硬贷款(商业贷款) commercial loans用地审批 to grant land use right有管理的浮动汇率 managed floating exchange rate证券投资 portfolio investment游资(热钱) hot money有市场的产品 marketable products有效供给 effective supply诱发新一轮经济扩张 trigger a new round of economic expansion逾期贷款 overdue loans;past-due loans与国际惯例接轨 to become compatible with internationally accepted与国际市场接轨 to integrate with the world market预算外支出(收入) off—budget (extra—budgetary) expenditure(revenue)预调 pre-emptive adjustment月环比 on a month-on-month basis; on a monthly basisZ再贷款 central bank lending在国际金融机构储备头寸reserve position in international financial institutions在人行存款 deposits at (with) the central bank在途资金 fund in float增加农业投入 to increase investment in agriculture增势减缓 deceleration of growth;moderation of growthmomentum增收节支措施 revenue—enhancing and expenditure control measures增长平稳 steady growth增值税 value—added tax(VAT)涨幅偏高 higher-than—desirable growth rate;excessive growth账外账 concealed accounts折旧 depreciation整顿 retrenchment;consolidation政策工具 policy instrument政策性业务 policy-related operations政策性银行 policy banks政策组合 policy mix政府干预 government intervention证券交易清算 settlement of securities transactions证券业务占款 funding of securities purchase支付困难 payment difficulty支付能力 payment capacity直接调控方式向 to increase the reliance on indirect policy instruments 间接调控方式转变职能转换 transformation of functions职业道德 professional ethics指令性措施 mandatory measures指令性计划 mandatory plan;administered plan制定和实施货币政策 to conduct monetary policy;to formulate and implement monetary policy滞后影响 lagged effect中介机构 intermediaries中央与地方财政 delineation of fiscal responsibilities分灶吃饭重点建设 key construction projects;key investment project周期谷底 bottom(trough)of business cycle周转速度 velocity主办银行 main bank主权风险 sovereign risk注册资本 registered capital逐步到位 to phase in;phased implementation逐步取消 to phase out抓大放小 to seize the big and free the small(to maintain close oversighton the large state—ownedenterprises and subject smaller ones to market competition)专款专用 use of funds as ear—marked转贷 on-lending转轨经济 transition economy转机 turnaround转折关头 turning point准财政赤字 quasi—fiscal deficit准货币 quasi-money资本不足 under—capitalized资本充足率 capital adequacy ratio资本利润率 return on capital资本账户可兑换 capital account convertibility资不抵债 insolvent;insolvency资产负债表 balance sheet资产负债率 liability/asset ratio;ratio of liabilities to assets资产集中 asset concentration资产贡献率 asset contribution factor资产利润率 return on assets (ROA)资产质量 asset quality资产组合 asset portfolio资金成本 cost of funding;cost of capital;financing cost资金到位 fully funded (project)资金宽裕 to have sufficient funds资金利用率 fund utilization rate资金缺口 financing gap资金体外循环 financial disintermediation资金占压 funds tied up自筹投资项目 self-financed projects自有资金 equity fund综合国力 overall national strength(often measured by GDP)综合效益指标 overall efficiency indicator综合治理 comprehensive adjustment(retrenchment);over—haul 总成交额 total contract value总交易量 total amount of transactions总成本 total cost最后贷款人 lender of last resort。

常用的金融英语带翻译在日常生活中,我们能见到各种各样的英语,可见英语的使用范文很广。

小编在此献上金融英语,希望对大家有所帮助。

房地产行业话术:房屋贷款Al and Virginia Baxter are talking to their banker ,T ony Flora ,about a housing loan.艾尔和弗吉尼亚·巴克斯特正和他们的银行家托尼·费洛拉洽谈有关房屋贷款之事。

Al:We'd like to get some information about mortgage loans,Mr.Flora.艾尔:我们希望得到一些有关抵押贷款方面的知识,弗洛拉先生。

We found a house that we'd like to buy.我们找到了一所我们想买的房子。

Flora:Well,Mr.Baxter,we generally lend 80% of the bank's appraised value on 30-,35-or 40-year mortgages if the house is less than 10 years old .弗洛拉:好的,巴克斯特先生。

如果房屋从建成至今尚未超过10年,我们一般借给买房者的数额是银行对房屋估价的80%,而贷款期为30、35或40年。

Baxter:Oh ,it's almost a brand-new house .I think it was built two years ago .巴克斯特:哦,这几乎是一所全新的房子,我认为是两年前修建的。

A:Yes,it's a real good deal .The price is just right .艾尔:是的,这真是的桩合适的买卖,价钱也很合理。

F:Bank appraisals are usually slightly lower than the actual market prices,Mr.Baxter,弗洛拉,银行的估价总是低于实际市场价格的,巴克斯特先生。

这里汇聚了金融领域的大部分英语词汇和详细解说,如果要查询相关词汇,你可以点此word文档工具栏的“编辑”,找到“查找”,然后点开输入你要查询的词汇就可以查询了。