英文版国际金融第六章-笔记翻译

- 格式:pdf

- 大小:568.32 KB

- 文档页数:16

第六章国际信贷[选择]国际商业银行贷款区别于其他国际信贷形式的特征是贷款用途不加限制。

[选择]由多家银行联合提供的中长期贷款叫辛迪加贷款。

[选择]银行同业拆借产生于存款准备金制度。

[选择]在整个短期信贷市场中占据主导地位的是银行同业拆借。

[选择]LIBOR是指伦敦银行同业拆放利率。

[选择]国际银行同业拆借的期限最长不超过6个月。

[选择]欧洲银行同业拆借的利率通常是固定利率。

[选择]国际商业贷款的主体是国际商业银行。

[选择]银团贷款产生的最根本原因是分散风险。

[选择]管理费是在银团贷款中借款人支付给牵头行。

[选择]贷款人只用款但不还本的期限是指宽限期。

[选择]对于借款人来讲,在贷款中借款一般首先选择软货币。

[选择]最简单、最普遍的国际租赁业务是全额清偿的跨国直接融资租赁。

[选择]国际租赁的租期中出租人对选择该设备的承租人所规定的用以计算租金的原始的、不可撤销的租赁期限是基本租期。

[选择]融资租赁的承租人是企业。

[选择]银行同业拆借市场的参与者包括银行、货币经纪人、中央银行、大公司、货币管理机构。

[选择]在借款人向贷款人提供的物的担保中,根据对担保物的处理权的不同,可以分为抵押、质押、留置。

[选择] -项国际租赁交易必须涉及到承租人、出租人、供货商、国际贸易合同、国际租赁合同。

[选择]从国际商业银行借款应考虑的原则借取的货币要与使用方向相衔接、借款货币应与其购买设备后所生产的产品的主要销售市场相连接、借取的货币最好选择软币,但利率较高、借款最好选择流动性较强的货币、借款货币应与产品的主要销售市场相衔接。

[选择]确定租期长短应考虑的因素包括融资租赁的目的、租赁设备的特性、出租人的融资能力、承租人的还租能丑。

[选择]租金的构成要素包括设备购置成本、融资成本、管理费、出租人期待的利润。

[判断]典型的银行间信贷以100万美元作为一个交易单位。

[判断]中长期贷款是指一年期以上的贷款。

[判断]贷款期限是指借款人提供的贷款期限。

《国际金融学》课程笔记第一章:开放经济下的国民收入账户与国际收支账户第一节开放经济下的国民收入账户一、国民收入账户的概念国民收入账户是宏观经济分析的核心工具之一,它系统地记录了一个国家在一定时期内(通常为一年)经济活动的总量和结构,包括生产、收入、支出和积累等各个方面。

二、国民收入账户的构成1. 生产账户- 国内生产总值(GDP):衡量一个国家在一定时期内生产的所有最终商品和服务的市场价值总和。

- 国民生产总值(GNP):GDP加上本国居民在国外生产的净收入,减去外国居民在本国生产的净收入。

- 增加值:生产过程中新创造的价值,等于总产出减去中间消耗。

2. 收入账户- 国民收入(NI):国内生产总值扣除折旧和间接税和企业转移支付,加上政府补助金。

- 个人收入(PI):国民收入扣除公司未分配利润、公司所得税及社会保险税费,加上政府给个人的转移支付。

- 个人可支配收入(DPI):个人收入扣除个人所得税和非税支付。

3. 资本账户- 资本形成总额:一定时期内新增固定资产和存货的总和。

- 资本存量:某一时点上的固定资产和存货的总和。

4. 财政账户- 政府收入:包括税收、非税收入等。

- 政府支出:包括政府购买、转移支付等。

5. 投资储蓄账户- 总储蓄:国民收入减去消费支出。

- 总投资:一定时期内用于增加资本存量的支出。

三、国民收入账户的计算方法1. 生产法(产出法)- 计算公式:GDP = Σ(最终商品和服务的市场价值)- 中间消耗。

- 特点:直接反映经济活动的生产成果。

2. 收入法- 计算公式:GDP = 工资+ 利息+ 租金+ 利润+ 企业转移支付+ 折旧。

- 特点:从收入角度反映经济活动的成果。

3. 支出法- 计算公式:GDP = 消费支出+ 投资支出+ 政府购买+ 净出口。

- 特点:从最终需求角度反映经济活动的成果。

四、开放经济对国民收入账户的影响1. 贸易收支- 进口和出口的变化直接影响净出口,进而影响GDP。

姜波克《国际金融新编》(第6版)笔记和课后习题(含考研真题)详解完整版>精研学习䋞>无偿试用20%资料

全国547所院校视频及题库资料

考研全套>视频资料>课后答案>往年真题>职称考试

目录

隐藏

第一章导论

1.1复习笔记

1.2课后习题详解

1.3考研真题与典型题详解

第二章国际收支和国际收支平衡表

2.1复习笔记

2.2课后习题详解

2.3考研真题与典型题详解

第三章汇率基础理论

3.1复习笔记

3.2课后习题详解

3.3考研真题与典型题详解

第四章内部均衡和外部平衡的短期调节4.1复习笔记

4.2课后习题详解

4.3考研真题与典型题详解

第五章内部均衡和外部平衡的中长期调节5.1复习笔记

5.2课后习题详解

5.3考研真题与典型题详解

第六章外汇管理及其效率分析

6.1复习笔记

6.2课后习题详解

6.3考研真题与典型题详解

第七章金融全球化对内外均衡的冲击7.1复习笔记

7.2课后习题详解

7.3考研真题与典型题详解

第八章金融全球化下的国际协调与合作8.1复习笔记

8.2课后习题详解

8.3考研真题与典型题详解。

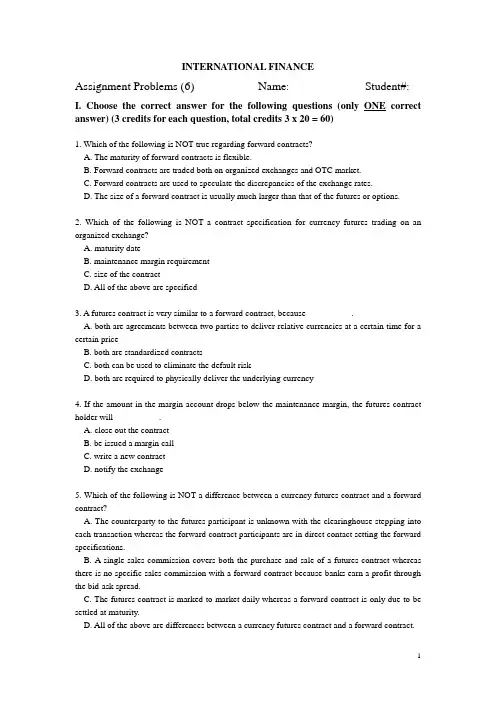

INTERNATIONAL FINANCEAssignment Problems (6) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (3 credits for each question, total credits 3 x 20 = 60)1. Which of the following is NOT true regarding forward contracts?A. The maturity of forward contracts is flexible.B. Forward contracts are traded both on organized exchanges and OTC market.C. Forward contracts are used to speculate the discrepancies of the exchange rates.D. The size of a forward contract is usually much larger than that of the futures or options.2. Which of the following is NOT a contract specification for currency futures trading on an organized exchange?A. maturity dateB. maintenance margin requirementC. size of the contractD. All of the above are specified3. A futures contract is very similar to a forward contract, because __________.A. both are agreements between two parties to deliver relative currencies at a certain time for a certain priceB. both are standardized contractsC. both can be used to eliminate the default riskD. both are required to physically deliver the underlying currency4. If the amount in the margin account drops below the maintenance margin, the futures contract holder will __________.A. close out the contractB. be issued a margin callC. write a new contractD. notify the exchange5. Which of the following is NOT a difference between a currency futures contract and a forward contract?A. The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications.B. A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread.C. The futures contract is marked to market daily whereas a forward contract is only due to be settled at maturity.D. All of the above are differences between a currency futures contract and a forward contract.6. Assume that Citibank in New York quotes a 30-day forward rate on euro of $0.7533 while the Singapore International Monetary Exchange (SIMEX) euro futures for delivery in 30 days is being quoted at $0.7522. You can make a riskless profit by __________.A. taking a short position on euro in SIMEX euro futures contract and a long position on euro in the forward contractB. taking a long position on euro in SIMEX euro futures contract and a short position on euro in the forward contractC. taking a short position on dollar in SIMEX euro futures contract and a short position on dollar in the forward contractD. taking a long position on dollar in SIMEX euro futures contract and a long position on dollar in the forward contract7. The main function of the “Marking to market” procedure comes down to __________.A. avoid default risk inherent in forward contractsB. cover risk exposure arisen from the international transactionsC. protect the contract holders from suffering the lossD. all of the above8. The buyer of a futures contract is required to put a sum of money in the exchange. This sum of money is called __________.A. down paymentB. initial marginC. premiumD. commission9. When reading the futures quotation in the newspaper, the column heading indicating the number of contracts outstanding on the previous day is called __________.A. percentage changeB. settleC. open interestD. estimated volume10. A put option on Japanese yen is written with a strike price of ¥ 88/$. Which of the following spot rate maximizes your profit if you choose to execute the contract before maturity?A. ¥70/$B. ¥80/$C. ¥90/$D. ¥100/$11. The agreed price in a currency option contract is called the __________.A. forward priceB. futures priceC. exercise priceD. spot price12. For a currency put option if the future spot rate is above the strike price, the option is said to be __________.A. in-the-moneyB. at-the-moneyC. out-of-the-moneyD. break-even13. The writer of an option contract has __________ whereas the holder has __________.A. obligation; choiceB. right; responsibilityC. choice; obligationD. priority; privilege14. Assume you bought a call option with the exercise price of $1.55/₤in Chicago Mercantile Exchange on September 6. The contract would be expired in December. If the spot exchange rate was $1.50/₤on October 10, the intrinsic value of this call option on that day would be __________.A. $0.05B. -$0.05C. $0D. None of the above, because the contract doesn’t expire on October 10.15. The foreign-currency accounts payable can be hedged by buying a __________ option on the foreign currency, whereas accounts receivable can be hedged by buying a __________ option on the foreign currency.A. call; putB. put; callC. American; EuropeanD. European; American16. Mr. Bull tries to speculate on the direction of the entire stock market, the most efficient method he should use is to acquire __________.A. a stock index futuresB. a portfolio containing stocks of all traded companiesC. a currency forward contractD. a currency futures contract17. The amount that the option purchaser must pay to obtain an option contract may be described as option __________.A. costB. premiumC. priceD. All of the above18. A Canadian dollar option quoted as “C$ Sep 9800 put” is selling on the CME at a price of $0.0026/C$. The size of the contract is C$100,000. Assume the spot exchange rate on the maturity day turns out to be $0.95/C$. You will have __________ if you hold 10 contracts.A. $30,000 net profitB. $30,000 net lossC. $27,400 net profitD. $27,400 net loss19. A fixed-to-fixed currency swap is used to __________.A. hedge currency riskB. speculate discrepancies of the exchange rateC. make a riskless profitD. All of the above20. Exxon and Chase Manhattan Bank reached an agreement. In the next two years, Exxon would pay fixed price of oil to Chase Manhattan Bank on June 30, and Chase Manhattan Bank would pay floating price of oil according to the spot price on the same day. This is an example of __________.A. fixed-for-floating currency swapB. commodity swapC. swaptionD. equity swapII. Problems (40 Credits)1. Samuel Samosir trades currencies for Peregrine Funds in Jakarta, Indonesia. He focuses nearly all of his time and attention on the U.S. dollar/Singapore dollar ($/S$) exchange rate. The current spot rate is $0.6000/S$. After considerable study this week, he has concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $0.7000/S$. He has the following options on the Singapore dollar to choose from: (3 credits for each question, total credits 3 x 5 = 15 credits)Option Strike Price PremiumPut on S$ $0.6500/S$ $0.00003/S$Call on S$ $0.6500/S$ $0.00046/S$a. Should Samuel buy a put on Singapore dollars or a call on Singapore dollar?b. Using your answer to part a, what is Samuel’s break-even price?c. Using your answer to part a, what is Samuel’s gross profit and net profit (including the premium) if the spot rate at the end of the 90 days is indeed $0.7000/S$?d. Using your answer to part a, what is Samue l’s gross profit and net profit (including the premium) if the spot rate at the end of the 90 days is indeed $0.8000/S$?e. Using your answer to part a, what is the contract’s time value at the end of the 90 days?2. Jennifer Magnussen, a currency trader for Chicago-based Black River Investments, uses the futures quotes below on the British pound to speculate on its value: (5 credits for each question, total credits 4 x 3 = 12 credits)British Pound Futures, US$/pound (CME) Contract = 62,500 pounds Initial margin: $2,500/contract Maintenance margin: $1,250Maturity Open High Low Settle Change High Low OpenInterest March 1.4246 1.4268 1.4214 1.4228 .0032 1.4700 1.3810 25,605 June 1.4164 1.4188 1.4146 1.4162 .0030 1.4550 1.3910 809a. If Jennifer buys 5 June pound futures right after CME opens, and the spot rate at maturity is $1.3980/pound, what is the value of her position?b. If Jennifer sells 12 March pound futures with the opening quote, and the spot rate at maturity is $1.4560/pound, what is the value of her position?c. If Jennifer buys 10 June pound futures at $1.3500/₤in the early afternoon, and the closing rate at the end of the day is $1.3246/pound instead of $1.4162/pound, what will happen? Explain.3. You head the currency trading desk at Bearings Bank in London. As the middleman in a deal between the U.K. and Danish government, you have just paid₤1,000,000 to the U.K. government and have been promised DKr8,438,000 from the Danish government in three months. All else constant, you wouldn’t mind leaving this long krone position open. However, next month’s referendum in Denmark may close the possibility of Denmark joining the European Union. If this happens, you expect the krone to drop on world markets. As a hedge, you are considering purchasing a call option on pounds sterling with an exercise price of DKr8.4500/₤that sells for DKr0.1464/₤. (13 credits total)a. Fill in the call option values at expiration the following table. (3 credits) Spot rate at expiration (DKr/₤): 8.00 8.40 8.42 8.44 8.46 8.48Call value at expiration (DKr/₤):b, Based on the previous information, draw the payoff profile for a long krone put option at expiration. Note that these exchange rates are reciprocals of those in problem a. (3 credits)Spot rate atexpiration (₤/DKr) .12500 .11905 .11876 .11848 .11820 .11792 Put value atexpiration (₤/DKr)c. Label your axes and plot each of the points. Draw a profit/loss graph for this long krone put at expiration. (7 credits)Answers to Assignment (6)I. (60 credits)1. B2. D3. A4.B5. D6. B7. A8. B9. C 10. A 11. C 12. C 13. A 14. C 15. A 16. A 17. D 18. C 19. A 20.BII. (40 credits)1. Option problema. Samuel should buy a call on Singapore dollar.b. Break-even exchange rate for a call option = strike price + premium= 0.6500 + 0.00046 = $0.65046/S$c. Gross profit = 0.7000 – 0.6500 = $0.05Net profit = 0.7000 – 0.65046 = $0.04954d. Gross profit = 0.8000 – 0.6500 = $0.15Net profit = 0.8000 – 0.65046 = $0.14954e. time value = 0, no time value when the contract expires.2. Futures problema. Jennifer’s loss = (1.3980 – 1.4164) x (62,500) x 5 = -$5,750Value of her position: (2,500 x 5) – 5,750 = $12,500 – 5,750 = $6,750b. Jennifer’s loss = (1.4246 – 1.4560) x (62,500 x 12 = -$23,550Value of her position: (2,500 x 12) – 23,550 = $30,000 – 23,550 = $6,450c. Jennifer’s margin account at the end of the day drops to: (1.3246 – 1.3500) x (62,500) x 10 = -$15,875 + 25,000 = $9,125Jennifer will receive a margin call from the exchange which is12,500 – 9,125 = $3,375Jennifer should bring $3,375 more to meet the maintenance margin requirement.3. Option profilea. Spot rate at expiration (DKr/₤): 8.00 8.40 8.42 8.44 8.46 8.48Call value at expiration (DKr/₤): 0 0 0 0 0.01 0.03 Call option intrinsic value at the expiration = (S DKr/₤– K DKr/₤)b. Spot rate atexpiration (₤/DKr) .12500 .11905 .11876 .11848 .11820 .11792 Put value atexpiration (₤/DKr) 0 0 0 0 0.000143 0.000423 Put option intrinsic value at the expiration = (K DKr/₤– S DKr/₤)c. K = ₤0.118343/DKrOption premium (x): 0.1464/8.45 = x/0.118343x = ₤0.002050/DKrPremium cost = 0.002050 x 8,438,000 = ₤17,298Cost of exercise = 0.118343 x 8,438,000 = ₤998,578.Profit/Loss profileBreak-even price = 0.11834 – 0.00205 = ₤0.11629/DKrIf spot exchange rate at expiration is 0.11610, net profit:(0.11629 – 0.11610) x 8,438,000 = ₤1,603If spot exchange rate at expiration is 0.118343 or below, net lossPremium cost ₤17,297.90Put t₤/DKr₤1,603 ABreak-even K S₤/DKr 00.11610 0.11629 0.11834 0.11848 0.11905-₤17,298。

(18 雷丽烨)6.16.1.1证券的定义从一般意义上说,有价证券的术语适用于多种形式的流通票据例如支票,汇票,和提货单等等,但有价证券通常用于指企业发行的股票以及国家政府和地方政府发行的债券。

这里用的有价证券的术语是狭义的。

在本质上,有价证券可以被看作是合约,其记录了持有人在未来索要经济利益的权利。

例如,债券持有者定期收到利息和当债券到期时收到票面金额。

股票持有者收到股息以及或者会实现股票增值的收益。

证券可以被分为债务型证券和权益型证券。

债务型证券是指企业和政府向公众发行的为了筹集资金来拓展业务,建设新工厂,建设机场,高速公路,铁路,购买机器和设备等等的金融工具。

债务型证券指规定借款人必须在指定日期之前,即在付清最后一笔款项之前定期向该工具持有人支付固定金额的协议。

到期日期就是指金融工具最终偿付日期,在这个时点,本金和全部剩余的利息应该被支付。

债务型工具如果期限少于一年为短期债务工具,期限为十年或者大于十年为长期债务工具。

债务型工具期限在一到十年之间的叫做中期债务工具。

权益型证券通常提供稳定的收益作为股息,但其市值会随着经济周期的上下起伏以及发行公司的财务变化而明显波动。

股票,或要求权术语通常用于描述对企业的所有权,拥有股票就表示可分享企业的净收益和资产。

如果你拥有一间公司发行的一百万股普通股票中的一股,你就对该公司的百万分之一的净收益和百万分之一的资产有权分享力。

要求权没有到期日期。

持有股票而非债务的主要劣势是股票持有人是余值索偿人,就是说,公司必须先支付给债券持有人,然后再支付给股票持有人。

优势是如果公司利润或者资产价值增加,则股票持有人可以直接从中获取收益,因为股票赋予股票持有人股票持有所有权权利。

债券持有人不可以获得这些收益,因为他们的收益是固定的。

证券可用证书,或者通常地,“无证书”表示,即仅仅以电子证券或“记账式证券”表示。

票证可以是不记名票证,指谁持有证券谁就享有证券赋予的权利。

国际金融陈雨露第六版笔记摘要:1.国际金融陈雨露第六版笔记概述2.国际金融的基本概念与原理3.金融市场的国际金融交易4.汇率与外汇市场5.国际金融风险管理6.国际金融政策与制度7.国际金融市场发展趋势正文:【国际金融陈雨露第六版笔记概述】《国际金融陈雨露第六版笔记》是一本关于国际金融领域的专业书籍,全面系统地阐述了国际金融的基本概念、原理、金融市场交易、汇率与外汇市场、风险管理、政策与制度等内容,旨在帮助读者深入理解国际金融市场的运行规律和发展趋势。

【国际金融的基本概念与原理】国际金融是指在国际范围内进行的货币、信用和资本等金融活动。

其基本概念和原理包括:国际收支、外汇、汇率、国际金融市场等。

其中,国际收支是一国居民与非居民之间的经济交易,外汇是指一国货币与其他国家货币的兑换,汇率是两种货币之间的兑换比率,国际金融市场是指在跨国范围内进行的金融活动。

【金融市场的国际金融交易】金融市场的国际金融交易主要包括外汇市场交易、国际信贷交易、国际投资交易等。

外汇市场交易是指货币兑换的活动,国际信贷交易是指国际借贷活动,国际投资交易是指跨国资本流动的活动。

【汇率与外汇市场】汇率是外汇市场的核心,其波动受多种因素影响,如国际收支、通货膨胀、利率、政策等。

外汇市场的发展为国际贸易和投资提供了便利,同时也带来了汇率风险。

【国际金融风险管理】国际金融风险主要包括汇率风险、信用风险、市场风险等。

为降低这些风险,企业和金融机构需要进行风险管理,如外汇衍生品交易、信用保险等。

【国际金融政策与制度】国际金融政策与制度包括国际货币体系、国际金融监管、国际金融合作等。

这些政策和制度对国际金融市场的稳定和发展起着重要作用。

【国际金融市场发展趋势】随着经济全球化的深入发展,国际金融市场呈现出一系列发展趋势,如金融一体化、金融创新、金融科技等。

这些趋势为国际金融市场带来了新的机遇和挑战。

International Finance 国际金融Notes to the answers:1、All the terms can be found in the text.2、The discussions can be attained by reading the original text.Chapter 1Answers:II. T T F F F T TIII. 1. reserve currency 2. appreciate 3. was pegged to 4. deficit 5. fixed exchange rates 6. floating exchange rates 7. depreciate 8. market forcesIV. 1. Confidence in the ability of the U.S. to redeem dollars for gold began to fall aspotential claims against the dollar increased and U.S. gold reserves fell.2.Under the fixed exchange rate system, the value of the dollar was tied to goldthrough its convertibility in to gold at the U.S. Treasury, and other nations ’currencies were tied to the dollar by the maintenance of a fixed rate of exchange.3.IMF has adjusted its role in the exchange rate system in view of the development ofthe situation.4.After the collapse of the Bretton Woods System, the task of “rigorous monitoring ”theexchange rate policy of member countries fell on the shoulder of IMF.5.Under normal conditions the stabilizing operations were sufficient to contain short-runfluctuations in a currency ’s price within the required bounds of 1% of par value andthereby maintain a system of fixed exchange rates.Chapter 2Answers:I. liquid, turnover, due to, hedge, cross trading, electronic broking, outright forwards,Over-the-counter, futures and options, derivatives, remainder.II.. 1. The fundamental changes occurred in post-war world economy. The internationalflow of commodities, capital and labor is intensifying, thus leading to integration ofinternational markets.1.Often referred to as “financial institutions with a soul ”, credit unions aremember-owned cooperatives that offer checking accounts, savings accounts, creditcards, and consumer loans.2.If you think the price of gold will rise, you can buy a most simple kind of financialderivative which is called “futures ”. If by that time the price really goes up, then youmake a gain. But if you make a wrong guess and the price declines, then you suffer aloss.3.Financial derivatives are financial commodities deriving from such spot marketproducts as interest rate or bond, foreign exchange or foreign exchange rate and stock or stock indexes. There are mainly three types of derivatives: futures, optionsand swaps, each of which involves a mix of financial contracts.panies and investment funds are using basic currency futures and currencyoptions, ones that are regarded as traditional hedging products for investors who want to protect their international assets from sharp gains and declines in currencyprices.Chapter 3Answers :II. 1. deposit accounts 2. securitization 3. Deregulation 4. consolidation 5. portfolio 6. thrift institutions 7. listing 8. liquidity 9. banking supervision 10. Credit riskIII. 1. Depository institutions 2. commercial banks 3. credit analysis 4. working capital 5.consolidation 6. financing 7. moral hazard 8. Bank supervision and regulation 9. Credit risk 10. Liquidity riskIV. 1. If a bank ’s base rate was below money market rates, a customer could borrow froma bank and lend these funds to the money market, thus making a profit on the deal.2. Financing of international trade is one of the basic functions of a commercial bank.Not only does it father deposits (demand, time and savings accounts), but it also grants loans.3. If you have a credit card, you buy a car, eat a dinner, take a trip,a nd even get ahaircut by charging the cost to your account.4. As the central bank and under the leadership of the State Council, the People ’s Bankof China will formulate and implement monetary policies, execute supervision and control power over the banking industry.5. One of major function of the central bank is the supervision of the clearing mechanism.A reliable clearing mechanism which can settle inter-bank transaction with highefficiency is crucial to a well-operated financial system.Chapter 4 Answers:I. 1 .integrity 2. pretext 3. released 4. produce 5. facilities 6. obliged 7. alleging8. Claims 9. cleared 10. deliveryI. 1. in favor of 2. consignment 3. undertaking, terms and conditions 4. cleared 5. regardless of 6. obliged to 7. undervalue arrangement 8. on the pretext of 9. refrain from 10. hinges onI V. 1. The objective of documentary credits is to facilitate international payment by makinguse of the financial expertise and credit worthiness of one or more banks.2. In compliance with your request, we have effected insurance on your behalf anddebited your account with the premium in the amount of $1000.3. When an exporter is trading regularly with an importer, he will offer open accountterms.4. Exporters usually insist on payment by cash in advance when they are trading withold customers.5. Cash in advance means that the exporter is paid either when the importer places hisorder or when the goods are ready for shipment.Chapter 5.II.1. b 2. c 3. c 4. a 5. b 6. b 7. a 8. cIII. 1. guaranteed 2. without recourse 3. defaults 4. on the buyer ’s account 5. is equivalent to 6. in question 7. devaluation 8. validity 9. discrepancy 10. inconsistent withChapter 6Answers:II. 1. open account, creditworthiness 2. demand 3. draw on, creditor 4. protest 5. schedule, discrepancies 6. acceptance 7. drawee 8. guranteedIII. 1. collecting bank 2. tenor 3. the proceeds 4. protest 5. deferred payment 6. presentation 7. the maturity date 8. a document of title 9. the shipping documents 10. transshipmentIV. 1. Documentary collection is a method by which the exporter authorizes the bankto collect money from the importer.2. When a draft is duly presented for acceptance or payment but the acceptance orpayment is refused, the draft is said to be dishonored.3. In the international money market, draft is a circulative and transferableinstrument. Endorsement serves to transfer the title of a draft to the transferee.4. A clean bill of lading is favored by the buyer and the banks for financial settlementpurposes.5. Parcel post receipt is issued by the post office for goods sent by parcel post. It isboth a receipt and evidence of dispatch and also the basis for claim and adjustment if there is any damage to or loss of parcels.Chapter 7II. financing, discounting, factoring, forfaiting, without recourse, accounts receivable,factor, trade obligations, promissory notes, trade receivables, specialized.III. 1. a cash flow disadvantage 2. without recourse 3. negotiable instruments 4.promissory notes 5. profit margin 6. at a discount, maturity, credit risk 7. A bill ofexchange, A promissory noteIV. 1. When a bill is dishonored by non-acceptance or by non-payment, the holder t henhas an immediate right of recourse against the drawer and the endorsers.2. If a bill of lading is made out to bearer, it can be legally transferred withoutendorsement.3. The presenting bank should endeavor to ascertain the reasons non-payment ornon-acceptance and advise accordingly to the collecting bank.4. Any charges and expenses incurred by banks in connection with any action forprotection of the goods will be for the account of the principal.5. Anyone who has a current account at a bank can use a cheque.Chapter EightStructure of the Foreign Exchange Market外汇市场的构成1. Key Terms1)f oreign exchange :“Foreign exchange ”refers to money denominated in the currency of another nation or group of nations.2)p ayment“payment ”is the transmission of an instruction to transfer value that results from a transaction in the economy.3)s ettlement“settlement ”is the final and unconditional transfer of the value specified ina payment instruction.2. True or False1) true 2) true 3) true 4) true3. Cloze1) The dollar is by far the most widely traded currency. In part, thewidespread use of the dollar reflects its substantial international roleas: “investment ”currency in many capital markets, “reserve ”currency held by many central banks, “transaction ”currency in many international commodity markets, “invoice ” currency i n many contracts, and “intervention ”currency employed by m onetary authorities in market operations to influence their own exchange rates.In addition, the widespread trading of the dollar reflects its use as a“vehicle ”currency in foreign exchange transactions, a use that reinforces, and is reinforced by, its international role in trade and finance.2)In foreign exchange trading, London benefits not only from its proximity to major Eurocurrency credit markets and other financial markets, but also from its geographical location and time zone. Inaddition to being open when the numerous other financial centers inEurope are open, London's morning hours overlap with the late hoursin a number of Asian and Middle East markets; London's afternoon sessions correspond to the morning periods in the large North American market. Thus, surveys have indicated that there is more foreign exchange trading in dollars in London than in the United States.4. Discussions1) Tell the reasons why the dollar is the market's most widely tradedcurrency?key points: U.S.A economic background; the leadership of USD inthe world economy ; the role it plays in investment , trade, etc.2) What kind of market is the foreign exchange market?Make reference to the following parts: (8.7 The Market Is Made Up of An International Network of Dealers )Chapter 91. Key Terms1) spot transaction Instruments 交易工具A spot transaction is a straightforward (or “outright ”) exchange of one currency for another. The spot rate is the current market price, the benchmark price.Spot transactions do not require immediate settlement, or payment “on the spot. ”By convention, the settlement date, or “value date, ”is the second business day after the “deal date ”(or “trade date ”) on which the transaction is agreed to by the two traders. The two-day period providesample time for the two parties to confirm the agreement and arrange the clearing and necessary debiting and crediting of bank accounts in various international locations.2) American termsThe phrase “American terms ”means a direct quote from the point ofview of someone located in the United States. For the dollar, that meansthat the rate is quoted in variable amounts of U.S. dollars and cents perone unit of foreign currency (e.g., $1.2270 per Euro).3) outright forward transactionAn outright forward transaction, like a spot transaction, is a straightforward single purchase/ sale of one currency for another. The only difference is that spot is settled, or delivered, on a value date no later thantwo business days after the deal date, while outright forward is settled onany pre-agreed date three or more business days after the deal date. Dealers use the term “outright forward ”to make clear that it is a single purchase or sale on a future date, and not part of an “FX swap ”.4) FX swapAn FX swap has two separate legs settling on two different value dates,even though it is arranged as a single transaction and is recorded in the turnover statistics as a single transaction. The two counterparties agree to exchange two currencies at a particular rate on one date (the “near date ”) and to reverse payments, almost always at a different rate, on a specified subsequent date (the “far date ”). Effectively, it is a spot transaction and an outright forward transaction going in opposite directions, or else two outright forwards with different settlement dates, and going in opposite directions. If both dates are less than one month from the deal date, it is a “short-dated swap ”; if one or both dates are one month or more from thedeal date, it is a “forward swap. ”5) put-call parity“Put-call parity ”says that the price of a European put (or call) option canbe deduced from the price of a European call (or put) option on the same currency, with the same strike price and expiration. When the strike priceis the same as the forward rate (an “at-the-money ”forward), the put and the call will be equal in value. When the strike price is not the same as the forward price, the difference between the value of the put and the value ofthe call will equal the difference in the present values of the two currencies.2. True or False1) true 2) true 3) true3. Cloze1) Traders in the market thus know that for any currency pair, if thebase currency earns a higher interest rate than the terms currency, thecurrency will trade at a forward discount, or below the spot rate; and ifthe base currency earns a lower interest rate than the terms currency,the base currency will trade at a forward premium, or above the spotrate. Whichever side of the transaction the trader is on, the trader won't gain (or lose) from both the interest rate differential and the forward premium/discount. A trader who loses on the interest rate willearn the forward premium, and vice versa.2) A call option is the right, but not the obligation, to buy the underlyingcurrency, and a put option is the right, but not the obligation, to sell the underlying currency. All currency option trades involve two sides —the purchase of one currency and the sale of another —so thata put to sell pounds sterling for dollars at a certain price is also a call tobuy dollars for pounds sterling at that price. The purchased currency isthe call side of the trade, and the sold currency is the put side of thetrade. The party who purchases the option is the holder or buyer, andthe party who creates the option is the seller or writer. The price at which the underlying currency may be bought or sold is the exercise ,or strike, price. The option premium is the price of the option that thebuyer pays to the writer. In exchange for paying the option premium upfront, the buyer gains insurance against adverse movements in the underlying spot exchange rate while retaining the opportunity to benefit from favorable movements. The option writer, on the other hand, is exposed to unbounded risk —although the writer can (andtypically does) seek to protect himself through hedging or offsetting transactions.4. Discussions1) What is a derivate financial instrument? Why is traded?2) Discuss the differences between forward and futures markets inforeign currency.3) What advantages do foreign currency futures have over foreigncurrency options?4) What is meant if an option is “in the money ”, “out of the money ”,or “at the money ”?5) What major international contracts are traded on the ChicagoMercantile Exchange ? Philadelphia Stock Exchange?Chapter 101. Key Terms Managing Risk in Foreign Exchange Trading 外汇市场交易的风险管理1) Market riskMarket risk, in simplest terms, is price risk, or “exposure to (adverse) price change. ”For a dealer in foreign exchange, two major elements of market risk are exchange rate risk and interest rate risk —that is, risks of adverse change in a currency rate or in an interest rate.2) VARVAR estimates the potential loss from market risk across an entire portfolio, using probability concepts. It seeks to identify the fundamental risks that the portfolio contains, so that the portfolio can be decomposedinto underlying risk factors that can be quantified and managed. Employing standard statistical techniques widely used in other fields, and based in part on past experience, VAR can be used to estimate the daily statistical variance, or standard deviation, or volatility, of the entire portfolio. On thebasis of that estimate of variance, it is possible to estimate the expectedloss from adverse price movements with a specified probability over a particular period of time (usually a day).3) credit riskCredit risk, inherent in all banking activities, arises from the possibilitythat the counterparty to a contract cannot or will not make the agreed payment at maturity. When an institution provides credit, whatever the form, it expects to be repaid. When a bank or other dealing institution enters a foreign exchange contract, it faces a risk that the counterparty willnot perform according to the provisions of the contract. Between the timeof the deal and the time of the settlement, be it a matter of hours, days, ormonths, there is an extension of credit by both parties and an acceptanceof credit risk by the banks or other financial institutions involved. As in thecase of market risk, credit risk is one of the fundamental risks to be monitored and controlled in foreign exchange trading.4) legal risksThere are legal risks, or the risk of loss that a contract cannot be enforced, which may occur, for example, because the counterparty is not legally capable of making the binding agreement, or because of insufficient documentation or a contract in conflict with statutes or regulatory policy.2. True or False1) True 2) true3. Translation1) Broadly speaking, the risks in trading foreign exchange are thesame as those in marketing other financial products. These risks canbe categorized and subdivided in any number of ways, depending onthe particular focus desired and the degree of detail sought. Here, thefocus is on two of the basic categories of risk —market risk and credit risk (including settlement risk and sovereign risk) —as they apply to foreign exchange trading. Note is also taken of some other importantrisks in foreign exchange trading —liquidity risk, legal risk, and operational risk2) It was noted that foreign exchange trading is subject to a particularform of credit risk known as settlement risk or Herstatt risk, which stems in part from the fact that the two legs of a foreign exchange transaction are often settled in two different time zones, with differentbusiness hours. Also noted was the fact that market participants andcentral banks have undertaken considerable initiatives in recent yearsto reduce Herstatt risk.4. Discussions2) Discuss the way how VAR works in measuring and managingmarket risk?3) Why are banks so interested in political or country risk?4) Discuss other forms of risks which you know in foreign exchange.Chapter 11The Determination of Exchange Rates汇率的决定1. Key Terms1) PPPPurchasing Power Parity (PPP) theory holds that in the long run, exchange rates will adjust to equalize the relative purchasing power of currencies. This concept follows from the law of one price, which holds thatin competitive markets, identical goods will sell for identical prices when valued in the same currency.2) the law of one priceThe law of one price relates to an individual product. A generalization ofthat law is the absolute version of PPP, the proposition that exchange rates will equate nations' overall price levels.3) FEER“fundamental equilibrium exchange rate, ”or FEER, envisaged as the equilibrium exchange rate that would reconcile a nation's internal and external balance. In that system, each country would commit itself to a macroeconomic strategy designed to lead, in the medium term, to “internal balance ”—defined as unemployment at the natural rate and minimal inflation —and to “external balance ”—defined as achieving the targeted current account balance. Each country would be committed to holding its exchange rate within a band or target zone around the FEER, or the level needed to reconcile internal and external balance during the intervening adjustment period.4) monetary approachThe monetary approach to exchange rate determination is based onthe proposition that exchange rates are established through the process of balancing the total supply of, and the total demand for, the national moneyin each nation. The premise is that the supply of money can be controlledby the nation's monetary authorities, and that the demand for money has a stable and predictable linkage to a few key variables, including an inverserelationship to the interest rate —that is, the higher the interest rate, the smaller the demand for money.5) portfolio balance approachThe portfolio balance approach takes a shorter-term view of exchange rates and broadens the focus from the demand and supply conditions for money to take account of the demand and supply conditions for other financial assets aswell. Unlike the m onetary approach, the portfolio balance approach assumes that domestic and foreign bonds are not perfect substitutes. According to the portfolio balance theory in its simplest form, firms and individuals balance their portfolios among domestic money, domestic bonds, and foreign currency bonds, and they modify their portfolios as conditions change. It is the process of equilibrating the total demand for, and supply of, financial assets in each country that determinesthe exchange rate.2. True or False1) true 2) true3. Cloze1)PPP is based in part on some unrealistic assumptions: that goods are identical; that all goods are tradable; that there are notransportation costs, information gaps, taxes, tariffs, or restrictionsof trade; and —implicitly and importantly —that exchange rates areinfluenced only by relative inflation rates. But contrary to theimplicit PPP assumption, exchange rates also can change forreasons other than differences in inflation rates. Real exchangerates can and do change significantly over time, because of suchthings as major shifts in productivity growth, advancesin technology, shifts in factor supplies, changes in marketstructure, commodity shocks, shortage, and booms.2) Each individual and firm chooses a portfolio to suit its needs, based on a variety of considerations —t he holder's wealth and tastes, thelevel of domestic and foreign interest rates, expectations of futureinflation, interest rates, and so on. Any significant change in theunderlying factors will cause the holder to adjust his portfolio andseek a new equilibrium. These actions to balance portfolios willinfluence exchange rates.4. Discussions1)How does the purchasing power parity work?2)D escribe and discuss one model for forecasting foreign exchange rates.3)M ake commends on how good are the various approaches mentioned in the chapter.4)C entral banks occasionally intervene in foreign exchange markets. Discuss the purpose of such intervention. How effective is intervention?Chapter 121. Key Terms 1)money market The Financial Markets 金融市场The money market is really a market for short-term credit, or the option to use someone else's money for a period of time in return for the payment of interest. The money market helps the participants in the economic process cope with routine financial uncertainties. It assists in bridging the differences in the timing of payments and receipts that arise in a market economy.2)c apital marketMarkets dealing in instruments with maturities that exceed one year are often referred to as capital markets.3)p rimary marketThe term “primary market ”applies to the original issuance of a credit market instrument. There are a variety of techniques for such sales,including auctions, posting of rates, direct placement, and activecustomer contacts by a salesperson specializing in the instrument4)secondary marketOnce a debt instrument has been issued, the purchaser may be able to resell it before maturity in a “secondary market. ”Again, a number of techniques are available for bringing together potential buyers andsellers of existing debt instruments. They include various types of formal exchanges, informal telephone dealer markets, and electronic trading through bids and offers on computer screens. Often, the same firms that provide primary marketing services help to create or “make ”secondary markets.5)RPsIn addition to making outright purchases and sales in the secondary market, entities with money to invest for a brief period can acquire a security temporarily, and holders of debt instruments can borrow shortterm by selling securities temporarily. These two types of transactionsare repurchase agreements (RPs) and reverse RPs, respectively. In the wholesale market, banks and government securities dealers offer RPsat competitive rates of return by selling securities under contracts providing for their repurchase from one day to several months later6)BAs 7)CDs (reference to 13.1)8)EurodollarEurodollars are U.S. dollar deposits at banking offices in a country other than the United States.9)EurobankEurobanks —banks dealing in Eurodollar or some other nonlocalcurrency deposits, including foreign branches of U.S. banks —originally held deposits almost exclusively in Europe, primarily London. Whilemost such deposits are still held in Europe, they are also held in suchplaces as the Bahamas, Bahrain, Canada, the Cayman Islands, HongKong, Singapore, and Tokyo, as well as other parts of the world.10) LIBOR (reference to 13.2.2 Certificates of Deposit)London inter-bank offer rate11) mortgage-backed securities12) Eurobond market (details make reference to13.3.3 )The Eurobond market, centered in London, is an offshore market in intermediate- and long-term debt issues. It serves as a source of capital for multinational corporations and for foreign governments. It developed afterthe United States instituted the interest equalization tax in 1963 to stemcapital outflows inspired by relatively low U.S. interest rates.2. True or False1) true 2) true 3) true3. Discussions1) Describe the characteristics of Interest Rate Swap and the role of itin the bank-related financial market.2) What risks are encountered in the swaps markets?3) Discuss one or two specific examples of derivative products andtheir use.4. Translations1) Markets dealing in instruments with maturities that exceed one yearare often referred to as capital markets, since credit to finance investmentsin new capital would generally be needed for more than one year. The time division is arbitrary. A long-term project can be started with short-term credit, with additional instruments may need to be renewed before a project is completed. Debt instruments that differ in maturity share other characteristics. Hence, the term “capital market ”could be –and occasionally is applied to some shorter maturity transactions.2) The secondary market for Treasure securities consists of a networkof dealers, brokers, and investors who effect transactions either by telephone or electronically. Telephone trades are generally between dealers and their customers. Electronics trading is arranged through screen-based systems provided by some of the dealers to their customers.It allows selected trades to take place without a conversation. When dealers trade with each other, they generally use brokers. Brokers provide information on screen, but the final trades are made by telephone.Chapter 13Concepts of Financial Assets Value金融资产价值的概念1. Key Terms1) absolute measure of valueAn absolute measure of value is used when one must compare itto a nominal amount: purchase price, amount to invest, target sum ofmoney to raise2) relative measure of valueA relative measure of rate of return is more convenient to use whenone wishes to compare one financial asset to a set of numerous alternative assets. A rate of return is the most commonly used relative measure ofvalue.3) discountingFuture benefits must be discounted (or converted) to their present (or today's) value, before they are summed. Discounting is part of the study oftime value of money, or actuarial mathematics, and a complete treatmentof it can be found in specialized textbook.4) time value of money。

第六章外汇管理制度和政策调节6.1 复习笔记一、汇率制度及其效率分析所谓汇率制度是指一国货币当局对本国汇率水平的确定、汇率变动方式等问题所作的一系列安排或规定。

最基本的汇率制度类型是固定汇率制与浮动汇率制。

固定汇率(Fixed Exchange Rate)是指政府用行政或法律手段选择一个基本参照物,并确定、公布和维持本国货币与该单位参照物之间的固定比价。

浮动汇率(Floating Exchange Rate或Flexible Exchange Rate)是指汇率水平完全由外汇市场上的供求关系决定,政府不加任何干预的汇率制度。

1.固定汇率制与浮动汇率制的优劣比较固定汇率和浮动汇率的比较主要从以下几个方面考察:(1)实现内外均衡的自动调节效率问题,主要包括:①简单性;②自发性;③微调性;④稳定性。

(2)实现内外均衡的政策利益问题①政策自主性;②政策纪律性;③政策效力的放大性。

(3)对国际经济关系的影响①对国际贸易、投资等活动的影响;②对国际间政策协调的影响。

2.不同汇率制度下宏观经济政策的相对有效性分析(1)固定汇率制下的财政政策假设经济原先在点A0处达到平衡,国内利率等于国际利率i*。

现在,政府采取扩张性的财政政策,体现为IS曲线右移到IS′(在图6-1中用①表示),产出增加到Y′。

在货币供应量不增加而产出增加的情况下,为了使货币市场平衡,利率会上升到I′,从而超过国际利率水平。

在国内利率高于国际利率的情况下,由于资本可以完全流动,所以国外的资本就会流入本国,造成资本账户顺差,在外汇市场上,形成对本国货币的需求,本国货币有升值的压力。

为了维持固定汇率制度,货币当局会在外汇市场上卖出本币,买入外币,在此过程中,货币当局不断增加货币投放,LM曲线不断右移,利率下降,直到LM曲线右移到LM′时,LM′曲线与IS′曲线决定的国内利率水平才重新等于国际利率水平,经济在点A1处重新达到内外均衡。

因为在此过程中,货币供给被动扩张了,所以此时的产出水平比封闭经济下使用财政政策所能达到的产出水平更高,达到了Y1的水平。

姜波克《国际金融新编》(第6版)笔记和课后习题(含考研真题)详解完整版>精研学习䋞>无偿试用20%资料

全国547所院校视频及题库资料

考研全套>视频资料>课后答案>往年真题>职称考试

目录

隐藏

第一章导论

1.1复习笔记

1.2课后习题详解

1.3考研真题与典型题详解

第二章国际收支和国际收支平衡表

2.1复习笔记

2.2课后习题详解

2.3考研真题与典型题详解

第三章汇率基础理论

3.1复习笔记

3.2课后习题详解

3.3考研真题与典型题详解

第四章内部均衡和外部平衡的短期调节4.1复习笔记

4.2课后习题详解

4.3考研真题与典型题详解

第五章内部均衡和外部平衡的中长期调节5.1复习笔记

5.2课后习题详解

5.3考研真题与典型题详解

第六章外汇管理及其效率分析

6.1复习笔记

6.2课后习题详解

6.3考研真题与典型题详解

第七章金融全球化对内外均衡的冲击7.1复习笔记

7.2课后习题详解

7.3考研真题与典型题详解

第八章金融全球化下的国际协调与合作8.1复习笔记

8.2课后习题详解

8.3考研真题与典型题详解。

Chapter 6 International Parity Conditions国际平价(汇率的决定因素)PART ONE 学习准备:(一)学习目标1. Examine how price levels and price level changes (inflation) in countries determine the exchange rate at which their currencies are traded.看看国家中价格水平和价格水平的变化(通货膨胀)如何决定通货贸易中本国货币的汇率2. Show how interest rates reflect inflationary forces within each country and currency说明利率如何反映每个国家通胀压力和货币3. Explain how forward markets for currencies reflect expectations held by market participants about the future spot rate解释远期市场的货币如何反映市场参与者对未来即期汇率的预期4. Analyze how, in equilibrium, the spot and forward currency markets are aligned with interest differentials分析如何现货和远期外汇市场如何在平衡中与利益差异并列。

(罗小懒)制造版权所有!期末加油)制造(罗小懒)制造 版权所有!期末加油第二部分 Purchasing Power Parity (PPP) & The Law of One Price如果一价定律对于所有产品和服务均成立,则购买力平价汇率可从任何单个价格集中获得。

通过比较以不同货币标价的同质商品,人们可以决定存在于有效市场中的“真实的”或购买力平价汇率。

这是绝对购买力平价理论。

绝对购买力平价认为,即期汇率是由相似产品集的相对价格决定的。

被《经济学人》命名的“巨无霸指数”就是一个典型的一价定律的例子。

假设巨无霸在所有国家都是相同的,它作为衡量通货是否以市场价格进行交易的指标。

假设巨无霸在中国卖11.0元(人民币),而相同的巨无霸在美国售价为3.41美元,实际汇率是7.60元人民币/美元。

(罗小懒)制造 版权所有!期末加油在这个案例里可以看到人民币被低估了58%。

巨无霸指数是一价定律的实际应用,并且能很好的测定估值,明白这一点至关重要。

首先,产品本身在各市场中是近似同一的。

这是因为产品的一致性,流程优化以及麦当劳的商誉。

同样重要的第二点是,产品中很大部分是本土原料成本和投入成本。

这意味着该产品在各国的价格代表了国内成本和价格,而并非受汇率影响的进口价。

还有一个补充公式,P126:第三部分 Relative Purchasing Power Parity 相对购买力平价(罗小懒)制造 版权所有!期末加油如果绝对购买力平价理论的假设放宽,我们观察到相对(实际)购买力平价。

1.这个想法是,购买力平价在确定今天的即期汇率时不是特别有帮助,但是一段时期内,两个国家之间的实际价格变动决定了两国间汇率的变动。

2.此外,如果两个国家之间的即期汇率在开始时处于平衡状态,它们之间的通胀率差的任何变化从长远来看,往往会被相等但相反的即期汇率的变化所抵消。

(请看书上128页对这个图的解释,我已经懒得翻译了亲爱的。

)购买力平价的主要理由是如果一国经历比其贸易伙伴国更高的通货膨胀率的话,并且汇率不变,则其出口的商品和服务与其他地方制造的商品相比竞争力减弱。

从外国进口的商品与国内的高价商品相比竞争力增强。

这些价格变动会导致国际收支经常账户赤字,除非被资本,资金流量抵消。

从这些实验中得出两个一般性结论:(该图表示日元美元和欧元在过去30年实际有效汇率的变动。

)4.除了测度购买力平价的偏差外,一国的真实有效汇率还是重要的管理工具,来预测该国国际收支及汇率所受的向上或向下的压力,并指出该国出口品的需求度。

(二)Exchange Rate Pass-Through汇率直通(小king完全没讲,书旁边也没有中文。

等我心情好了再来翻译你)第四部分Interest Rates and Exchange Rates利率与汇率以经济学家欧文-费雪命名的费雪效益认为,各国的名义利率等于要求的真实回报率加上对预期通胀率的补偿。

i是名义利率,r是真实利率,π是出借资金的这段时期的通胀率,交叉乘积项rπ是相对较小的值得下降。

如果适用于两个不同的国家,如美国和日本,费雪效应会被表述(罗小懒)制造版权所有!期末加油(罗小懒)制造 版权所有!期末加油为应该指出,这需要对未来通胀率的预测,而不是已经发生的通货膨胀,而预测未来是很困难的。

实验显示费雪效应通常存在于短期的政府证券中,如短期及中期的国库券。

该实验使用了事后的全国性通胀率。

对更长期证券的比较收到未到期债券市值波动所带来的渐增的金融风险的影响。

对私人发行的证券比较受发行人信用状况的良莠不齐的影响。

由于过去的通胀率并非未来预期通胀率的准确测度,因此所有这些实验都是不确定的。

(一)international Fisher effect (Fisher-open )国际费雪效应,指出即期汇率的变化量应等于但相反于国家之间的利率差。

如果我们用美元和日元,美元和日元之间的即期汇率的预期变动应该是(在近似形式)国际费雪效应的理由是,投资者必须被予以奖励或处罚,以抵消汇率的预期变化国际费雪效应预测到,在有无限制的资本流动的情况下,投资者应该对投资于美元或日元债券无动于衷, 因为世界各地的投资者会看到(罗小懒)制造 版权所有!期末加油同样的机会和竞争。

实验支持国际费雪效益假定的关系,尽管存在大量短期偏离。

然而,近来的研究提出一个更加严肃的质疑,他们表明大多数主要货币都存在外汇风险补偿。

而且,対无抵补套利(简略说法)的投机活动会使货币市场扭曲。

因此,汇率的预期变化可能会一直大于利差。

(三)The Forward Rate 远期汇率远期汇率1)远期利率是今天确定的在将来的某日所报的结算汇率2)货币之间的远期外汇协议规定交换的外币将在未来的某个特定日期买入或卖出远期(通常为30,60,90,180,270或360天)3)远期汇率是由相同到期日的两个主体货币的欧元货币利率比调整当前即期汇率计算远期汇率的例子有Sfr1.4800/$,4.00%年利率的90天欧元瑞士法郎存款利率的即期汇率和8.00%年利率的90天欧洲美元存款利率远期溢价或折价在每年的百分比计算所述的即期与远期汇率之(罗小懒)制造 版权所有!期末加油间的百分比差异,当间接的方式表述(每家货币单位外币,FC/$),那么公式是欧元远期汇率组的远期升水产生于欧元利率与瑞士法郎利率之间的差异,因为任何期限的远期汇率均由该期限的利率得出,所以货币的远期升贴水通常是明显的。

利率更高的货币在远期会折价出售,利率较低的货币在远期会溢价出售。

(Currency Yield Curves and the Forward Premium )(四)Interest Rate Parity (IRP)利率平价(IRP )利率平价理论提供了联系外汇市场和国际货币市场的纽带。

该理论认为:风险相同,期限相同的证券的名义利率差异应该等于负的去(罗小懒)制造 版权所有!期末加油除交易成本的外汇远期升贴水。

忽略交易成本,如果两种可选货币交易市场投资机会所得的美元收益相等,则即期、远期汇率处于汇率平价状态。

交易是抵补的,因为(将瑞士法郎)兑换回美元的汇率在90天后是确定的。

在下面的图表中,以美元为基础的投资者有100万美元投资,显示以美元计价的证券为90天赚8.00%计息,和有类似的风险及到期日的以瑞士法郎计价赚4.00%的证券没有区别when “cover” against currency risk is obtained with a forward contract。

(五)Covered Interest Arbitrage (CIA)即器和远期汇率市场并非同时处于利率平价理论描述的均衡状态。

当市场不在均衡状态时,存在无风险套利机会。

套利者识别出不均衡,利用该状态投资于抵补基础上获利最多的货币,这种行为被称为抵补套利。

(罗小懒)制造 版权所有!期末加油抵补套利过程驱使国际货币市场朝着利率平价均衡运行。

从均衡状态的微小偏离为套利者提供了小的无风险获利机会。

该偏离引致供给与需求压力,使市场移回利率平价均衡态。

经验法则:如果利率差大于远期升水(或即期汇率的预期变动),投资于收益率较高的货币。

如果利率差小于远期升水(或即期汇率的预期变动),投资于低收益货币。

(六)Uncovered Interest Arbitrage (UIA): The Yen Carry Trade(罗小懒)制造 版权所有!期末加油抵补套利的偏离形式是无抵补套利,即投资者借相对低利率的国家的国币,将收益兑换成更高利率的货币,。

该交易是无抵补的,因为投资者不卖出更高收益率的货币的远期,而选择保持无抵补状态,并接受在期末将较高收益率货币兑换成较低收益率货币的货币风险。

图6-9说明了利率和汇率均衡的必要条件。

竖轴显示了有利于外币的利率差,而横轴显示该货币的远期升贴水。

利率平价线显示了均衡状态,但交易成本使它呈带状,而不是一条细线。

第五部分 Forward Rates as an Unbiased Predictor 远期利率作为无偏预测如果外汇市场被认为是“有效的”,那么远期汇率应该是未来即期汇率的无偏预测。

这大致相当于说,远期利率可以作为未来即期汇率的预测,而且往往会“怀念”实际未来即期利率,但它会以同样的概率(方向)和大小(距离)错过。

直觉上,未来可能的真实汇率是以远期汇率为中心分布的。

但是,无偏估计并不意味着未来即期汇率会等于远期汇率所估计的。

无偏估计只意味着平均来看,远期汇率会以同样的频率和幅度高估和低估未来实际即期汇率。

事实上,远期汇率从不等于未来即期汇率。

关于两者关系的基本理论是基于外汇市场有效的假设之上的。

市场有效假定:1.所有相关信息会快速反应在即期和远期外汇市场上。

2.低交易成本3.不同货币标价的金融工具相互之间完全可以代替。

第六部分Prices, Interest Rates and Exchange Rates in Equilibrium(一)购买力平价(罗小懒)制造版权所有!期末加油(罗小懒)制造 版权所有!期末加油预计在即期汇率的通胀预期率的差异的基础上改变(二)费雪效应名义利率在每个国家都是平等的回报所需的实际利率(R )加补偿预期通货膨胀率(p )(三)国际费雪效应即期汇率的用量应等于但在国家之间的利率差的反方向变化(四)利率平价在国家利率差应等于,但迹象,远期汇率折让或溢价的外币相反,除了交易成本(五)远期利率作为无偏预测远期汇率是未来即期汇率的有效预测,假设外汇市场是相当有效率总结1.平价条件在传统上被经济学家用来帮助解释汇率的长期趋势。