德州仪器金融计算器BAII Plus教程

- 格式:pdf

- 大小:268.41 KB

- 文档页数:17

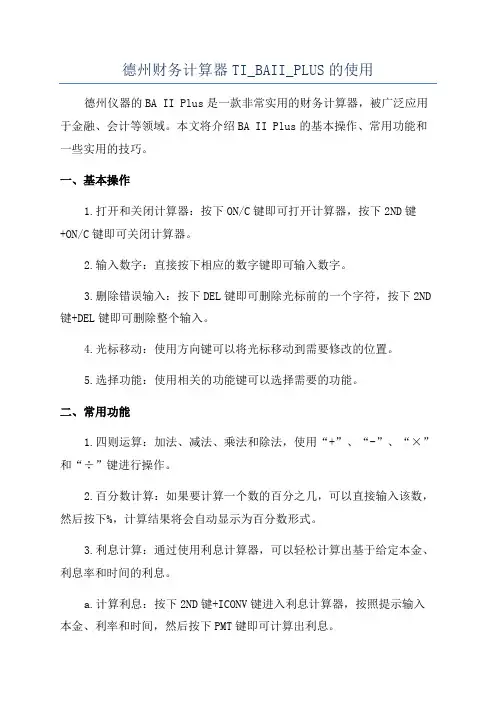

德州财务计算器TI_BAII_PLUS的使用德州仪器的BA II Plus是一款非常实用的财务计算器,被广泛应用于金融、会计等领域。

本文将介绍BA II Plus的基本操作、常用功能和一些实用的技巧。

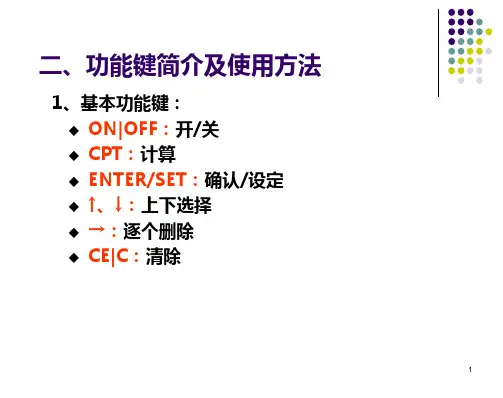

一、基本操作1.打开和关闭计算器:按下ON/C键即可打开计算器,按下2ND键+ON/C键即可关闭计算器。

2.输入数字:直接按下相应的数字键即可输入数字。

3.删除错误输入:按下DEL键即可删除光标前的一个字符,按下2ND 键+DEL键即可删除整个输入。

4.光标移动:使用方向键可以将光标移动到需要修改的位置。

5.选择功能:使用相关的功能键可以选择需要的功能。

二、常用功能1.四则运算:加法、减法、乘法和除法,使用“+”、“-”、“×”和“÷”键进行操作。

2.百分数计算:如果要计算一个数的百分之几,可以直接输入该数,然后按下%,计算结果将会自动显示为百分数形式。

3.利息计算:通过使用利息计算器,可以轻松计算出基于给定本金、利息率和时间的利息。

a.计算利息:按下2ND键+ICONV键进入利息计算器,按照提示输入本金、利率和时间,然后按下PMT键即可计算出利息。

b.计算本金:按下2ND键+ICONV键进入利息计算器,按照提示输入利率、时间和利息,然后按下PV键即可计算出本金。

c.计算利率:按下2ND键+ICONV键进入利息计算器,按照提示输入本金、时间和利息,然后按下I/Y键即可计算出利率。

d.计算时间:按下2ND键+ICONV键进入利息计算器,按照提示输入本金、利率和利息,然后按下N键即可计算出时间。

4. 净现值计算:净现值(NPV)是指未来现金流量的现值与投资成本的差额。

BA II Plus可以通过以下步骤计算净现值:a.按下CF键,然后按下CF键,依次输入每个时间点的现金流量,并使用ENTER键确认每个输入。

b.输入投资成本,使用ENTER键确认。

c.按下NPV键,然后输入所需的折现率,使用ENTER键确认即可计算出NPV。

1.Calculate the total present value of each of the cash flows, starting from period 1 (leaveout the initial outlay). Use the calculator's NPV function just like we did in Example 3, above. Use the reinvestment rate as your discount rate to find the present value.2.Calculate the future value as of the end of the project life of the present value from step1. The interest rate that you will use to find the future value is the reinvestment rate.3.Finally, find the discount rate that equates the initial cost of the investment with thefuture value of the cash flows. This discount rate is the MIRR, and it can be interpreted as the compound average annual rate of return that you will earn on an investment if you reinvest the cash flows at the reinvestment rate.Suppose that you were offered the investment in Example 3 at a cost of $800. What is the MIRR if the reinvestment rate is 10% per year?Let's go through our algorithm step-by-step:So, we have determined that our project is acceptable at a cost of $800. It has a positive NPV, the IRR is greater than our 12% required return, and the MIRR is also greater than our 12% required return.。

1.Calculate the total present value of each of the cash flows, starting from period 1 (leave

out the initial outlay). Use the calculator's NPV function just like we did in Example 3, above. Use the reinvestment rate as your discount rate to find the present value.

2.Calculate the future value as of the end of the project life of the present value from step

1. The interest rate that you will use to find the future value is the reinvestment rate.

3.Finally, find the discount rate that equates the initial cost of the investment with the

future value of the cash flows. This discount rate is the MIRR, and it can be interpreted as the compound average annual rate of return that you will earn on an investment if you reinvest the cash flows at the reinvestment rate.

Suppose that you were offered the investment in Example 3 at a cost of $800. What is the MIRR if the reinvestment rate is 10% per year?

Let's go through our algorithm step-by-step:

So, we have determined that our project is acceptable at a cost of $800. It has a positive NPV, the IRR is greater than our 12% required return, and the MIRR is also greater than our 12% required return.。