公司理财的作业和答案(下载)

- 格式:pdf

- 大小:33.15 KB

- 文档页数:6

公司理财课后习题参考答案ANSWS第1章习题答案1.在投资活动上,固定资产投资大量增加,增加金额为387270117(万元)2.在筹资活动上,非流动负债减少,流动负债大大增加,增加金额为29990109(万元)3.在营运资本表现上,2022年初的营运资本20220220(万元)2022年末的营运资本21129988(万元)营运资本不仅大大减少,而且已经转为负数。

这与流动负债大大增加,而且主要用于固定资产的形成直接相关。

第2章习题答案1.PV200(P/A,3%,10)(P/F,3%,2)1608.11(元)2.5000012500(P/A,10%,n)(P/A,10%,n)50000/125004查表,(P/A,10%,5)3.7908(P/A,10%,6)4.3553n543.7908(65)(43.7908)插值计算:n5654.35533.79084.35533.7908n5.37最后一次取款的时间为5.37年。

3.租入设备的年金现值14762(元),低于买价。

租入好。

4.乙方案的现值9.942万元,低于甲方案。

乙方案好。

5.40001000(P/F,3%,2)1750(P/F,3%,6)F(P/F,3%,10)F2140.12第五年末应还款2140.12万元。

6.(1)债券价值4(P/A,5%,6)100(P/F,5%,6)20.3074.6294.92(元)(2)2022年7月1日债券价值4(P/A,6%,4)100(P/F,6%,4)13.8679.2193.07(元)(3)4(P/F,i/2,1)104(P/F,i/2,2)97i12%时,4(P/F,6%,1)104(P/F,6%,2)3.7792.5696.33i10%时,4(P/F,5%,1)104(P/F,5%,2)3.8194.3398.14利用内插法:(i10%)/(12%10%)(98.1497)/(98.1496.33)解得i11.26%7.第三种状态估价不正确,应为12.79元。

《公司理财》课程作业题及部分答案一、公司理财概述【习题1-1】什么是公司理财?企业财务关系中最重要的关系是什么?企业应如何处理好这些关系?【习题1-2】试评价有关公司理财目标的几种不同观点。

二、公司理财的基本概念【习题2-1】解释下列有关概念:货币(资金)时间价值;单利;复利;年金;普通年金;预付年金;递延年金;永续年金;系统风险;非系统风险【习题2-2】假设银行年利率为8%,为在5年后得到10 000元。

【要求】计算每年应存入银行多少元?【解答】每年应存入银行A=10 000/(S/A,8%,5)=1 704.56(元)。

【习题2-3】某投资项目在未来8年内每年可取得10 000元的收益,假设投资报酬率为8%。

【要求】计算该项目的现在价值。

【解答】该项目的现在价值P=10 000×(P/A,8%,8)=57 466(元)。

【习题2-4】某投资项目自第三年起,每年可取得投资收益5 000元,假设投资报酬率为10%。

【要求】1.10年后共取得的投资收益的价值为多少?2.其现在价值为多少?【解答】1.10年后共取得的投资收益的价值S=A×[S/A,i,(n-m)] =5 000×[S/A,10%,(10-2)] =57 180(元);2.现值P=57 180×(P/S,10%,10)=22 042.89(元)或P=A×[P/A,i,(n-m)] ×(P/S,i,m)=5000×[P/A,10%,(10-2)]×(P/S,10%,2)=5 000×5.3349×0.8264=22 043.81(元)。

【习题2-5】已知某本金经过10年后增长为原来的3倍,且每半年复利一次,则年利率为多少?【解答】设本金为M,年利率为i,则:M×(S/P,i/2,20)=3M,即(S/P,i/2,20)=3,查表可知:(S/P,6%,20)=3.2071,(S/P,5%,20)=2.6533,运用内插法得:(3-2.6533)/(3.2071-2.6533)=(i/2-5%)/(6%-5%),解得:i=11.25%。

习题一1.5.1单项选择题1 .不能偿还到期债务是威胁企业生存的()。

A .外在原因B .内在原因C .直接原因D .间接原因2.下列属于有关竞争环境的原则的是()。

A .净增效益原则B .比较优势原则C .期权原则D .自利行为原则3.属于信号传递原则进一步运用的原则是指()A .自利行为原则B .比较优势原则C . 引导原则D .期权原则4 .从公司当局可控因素来看,影响报酬率和风险的财务活动是()。

A .筹资活动B .投资活动C .营运活动D .分配活动5 .自利行为原则的依据是()。

A .理性的经济人假设B .商业交易至少有两方、交易是“零和博弈”,以及各方都是自利的C .分工理论D .投资组合理论6 .下列关于“有价值创意原则”的表述中,错误的是()。

A .任何一项创新的优势都是暂时的B .新的创意可能会减少现有项目的价值或者使它变得毫无意义C .金融资产投资活动是“有价值创意原则”的主要应用领域D .成功的筹资很少能使企业取得非凡的获利能力7 .通货膨胀时期,企业应优先考虑的资金来源是()A .长期负债B .流动负债C .发行新股D .留存收益8.股东和经营者发生冲突的根本原因在于()。

A .具体行为目标不一致B .掌握的信息不一致C .利益动机不同D ,在企业中的地位不同9 .双方交易原则没有提到的是()。

A .每一笔交易都至少存在两方,双方都会遵循自利行为原则B .在财务决策时要正确预见对方的反映C .在财务交易时要考虑税收的影响D .在财务交易时要以“自我为中心”10.企业价值最大化目标强调的是企业的()。

A .预计获利能力B .现有生产能力C .潜在销售能力D .实际获利能力11.债权人为了防止其利益受伤害,通常采取的措施不包括()。

A .寻求立法保护B .规定资金的用途C .提前收回借款D .不允许发行新股12.理性的投资者应以公司的行为作为判断未来收益状况的依据是基于()的要求。

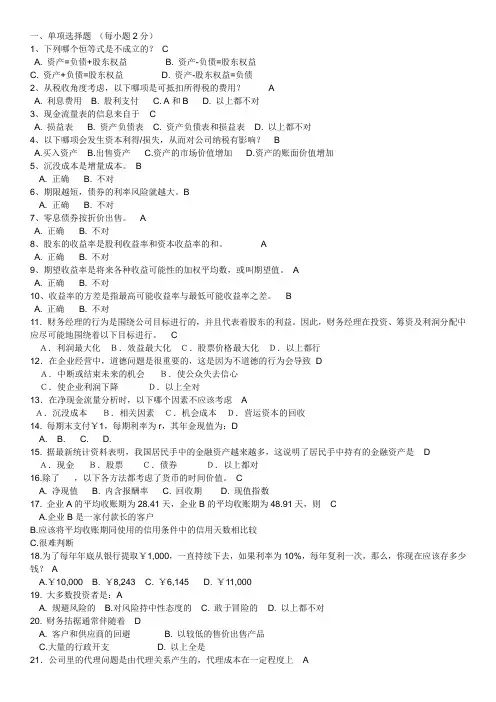

一、单项选择题(每小题2分)1、下列哪个恒等式是不成立的? CA. 资产=负债+股东权益B. 资产-负债=股东权益C. 资产+负债=股东权益D. 资产-股东权益=负债2、从税收角度考虑,以下哪项是可抵扣所得税的费用? AA. 利息费用B. 股利支付C. A和BD. 以上都不对3、现金流量表的信息来自于 CA. 损益表B. 资产负债表C. 资产负债表和损益表D. 以上都不对4、以下哪项会发生资本利得/损失,从而对公司纳税有影响? BA.买入资产B.出售资产C.资产的市场价值增加D.资产的账面价值增加5、沉没成本是增量成本。

BA. 正确B. 不对6、期限越短,债券的利率风险就越大。

BA. 正确B. 不对7、零息债券按折价出售。

AA. 正确B. 不对8、股东的收益率是股利收益率和资本收益率的和。

AA. 正确B. 不对9、期望收益率是将来各种收益可能性的加权平均数,或叫期望值。

AA. 正确B. 不对10、收益率的方差是指最高可能收益率与最低可能收益率之差。

BA. 正确B. 不对11.财务经理的行为是围绕公司目标进行的,并且代表着股东的利益。

因此,财务经理在投资、筹资及利润分配中应尽可能地围绕着以下目标进行。

CA.利润最大化B.效益最大化C.股票价格最大化D.以上都行12.在企业经营中,道德问题是很重要的,这是因为不道德的行为会导致 DA.中断或结束未来的机会B.使公众失去信心C.使企业利润下降D.以上全对13.在净现金流量分析时,以下哪个因素不应该考虑 AA.沉没成本B.相关因素C.机会成本D.营运资本的回收14. 每期末支付¥1,每期利率为r,其年金现值为:DA. B. C. D.15. 据最新统计资料表明,我国居民手中的金融资产越来越多,这说明了居民手中持有的金融资产是 DA.现金B.股票C.债券D.以上都对16.除了,以下各方法都考虑了货币的时间价值。

CA. 净现值B. 内含报酬率C. 回收期D. 现值指数17. 企业A的平均收账期为28.41天,企业B的平均收账期为48.91天,则 CA.企业B是一家付款长的客户B.应该将平均收账期同使用的信用条件中的信用天数相比较C.很难判断18.为了每年年底从银行提取¥1,000,一直持续下去,如果利率为10%,每年复利一次,那么,你现在应该存多少钱?AA.¥10,000B. ¥8,243C. ¥6,145D. ¥11,00019. 大多数投资者是:AA. 规避风险的B.对风险持中性态度的C. 敢于冒险的D. 以上都不对20. 财务拮据通常伴随着 DA. 客户和供应商的回避B. 以较低的售价出售产品C.大量的行政开支D. 以上全是21.公司里的代理问题是由代理关系产生的,代理成本在一定程度上 AA.减少了代理问题B.增大了代理问题C.对代理问题的解决没有用D.以上全不对22.半强式效率市场要求股票价格反映 BA. 股票价值的所有信息B. 股票价值的所有公开信息C. 过去股票价格的信息D. 以上全不对23. 最佳资本结构表明 AA. 企业应该适当举债B.资本结构与企业价值无关C. 企业举债越多越好D.以上全错24.仅考虑企业的融资成本的大小,企业通常融资的顺序为: CA. 留存收益、债务、发行新股B. 债务、发行新股、留存收益C.债务、留存收益、发行新股D. 留存收益、发行新股、债务25.可转换债券是一种融资创新工具,这是因为通常它具有: AA. 看涨期权和美式期权的特征B.看涨期权和欧式期权的特征C. 看跌期权和欧式期权的特征D. 看跌期权和美式期权的特征26.下列哪些项是不可以抵减所得税的。

《新编公司理财》(第五版)练习题答案项目一认识公司理财一、单项选择题1.B 公司的所有者权益被划分为若干股权份额,每个份额可以单独转让,无须经过其他股东同意,公司制企业容易转让所有权。

2.B 购置机器设备等属于投资活动的固定资产投资。

3.B 购买存货属于投资活动的流动资产投资。

4.B 主要理解财务关系的各种表现。

投资者(亦即股东)可以参与公司净利润的分配。

5.D 甲公司和乙公司、丙公司是债权债务关系,和丁公司是投资与受资的关系,和戊公司是债务债权关系。

6.B 应收账款资产的风险比现金资产风险大。

7.A B、C、D都是利润最大化的缺点8.C 相关者利益最大化才能体现合作共赢的价值理念,股东财富最大化目标体现的是股东的利益。

9.B 企业的价值过于理论化,不易操作。

10.A 相关者利益最大化目标强调风险与报酬的均衡,将风险限制在公司可以承受的范围内。

11.D 过分地强调社会责任而使企业价值减少,就可能导致整个社会资金运用的次优化,从而使社会经济发展步伐减缓。

12.A 激励有股票期权和绩效股两种方式。

13.B XBRL分类标准属于会计信息化标准体系,而会计信息化标准体系属于技术环境的有关内容。

14.D 签订长期销货合同会降低在通货膨胀时期的现金流入。

15.C 裁减雇员是在经济萧条期应采用的战略。

二、多项选择题1.ABCD 选项均为公司制企业的优点2.BC 利润是公司一定期间全部收入和全部成本费用的差额,它不仅直接反映公司创造剩余产品的多少,而且从一定程度上反映出公司经济效益的高低和对社会贡献的大小。

3.ACD 何经理的观点体现的是相关者利益最大化;李经理的观点体现的是利润最大化;王经理的观点体现的是企业价值最大化。

4.ABCD 均为解决冲突的方式。

5.ABC 选项A属于企业对员工的责任;选项B属于企业对债权人的责任;选项C属于企业对消费者的责任。

6.ABD 会计信息化属于技术环境的有关内容。

7.AC 公司法和税收法规属于法律环境的内容。

《公司理财》习题及答案-CAL-FENGHAI-(2020YEAR-YICAI)」INGBIAN《公司理财》习题答案第一章公司理财概论案例:华旗股份公司基本财务状况华旗股份有限公司,其前身是华旗饮料厂,创办于20世纪80年代,当时是当地最大的饮料企业,生产的“华旗汽水”是当地的名牌产品,市场占有率较高。

2003年改组为华旗股份有限公司,总股本2 500万股。

公司章程中规定,公司净利润按以下顺序分配:(2)弥补上一年度亏损;(2)提取10%的法定公积金;(3)提取15%任意公积金;(4)支付股东股利。

公司实行同股同权的分配政策。

公司董事会在每年会计年度结束后提出分配预案,报股东大会批准实施。

除股东大会另有决议外,股利每年派发一次,在每个会计年度结束后六个月内,按股东持股比例进行分配。

当董事会认为必要时,在提请股东大会讨论通过后,可增派年度中期股利。

随着市场经济的不断深化,我国饮品市场发展越来越迅猛,全球市场一体化趋势在饮品市场尤为突出,一些国内外知名饮品,如可口可乐、百事可乐、汇源等,不断涌入本地市场,饮品行业竞争日益激烈。

华旗公司的市场占有率不断降低,经营业绩也随之不断下降,公司管理层对此忧心忡忡,认为应该对华旗公司各个方面进行重新定位,其中包括股利政策。

华旗公司于2015年1月15日召开莆事会会议,要求公司的总会计师对公司LI前财务状况做出分析,同时提出新的财务政策方案,以供董事会讨论。

总会计师为此召集有关人员进行了深入细致的调查,获得了以下有关资料:(一)我国饮品行业状况近儿年我国饮品行业发展迅速,在国民经济各行业中走在了前列,目前市场竞争非常激烈,但市场并没有饱和。

从资料看,欧洲每年人均各类饮品消费量为200公斤,我国每年人均消费各种饮料还不到10公斤。

可见,我国饮品仍有着巨大的市场潜力。

果味饮料、碳酸饮料市场日趋畏缩,绿色无污染保健饮品、纯果汁饮品、植物蛋白饮品,以及茶饮品,正在成为饮品家族的新生力量,在市场上崭露头角,市场潜力巨大。

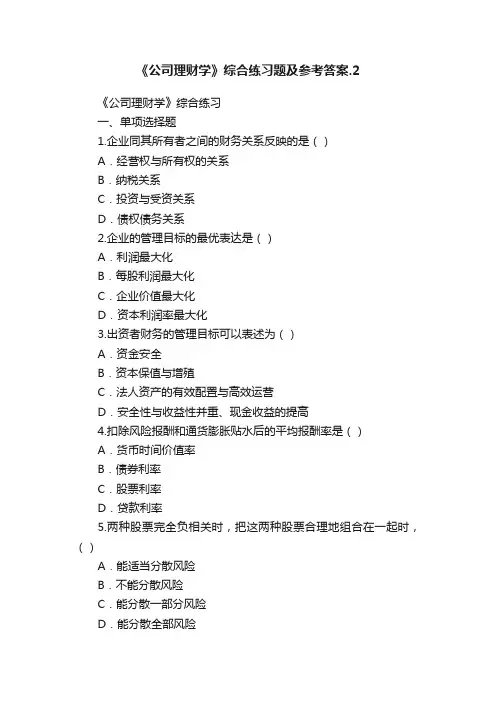

《公司理财学》综合练习题及参考答案.2《公司理财学》综合练习一、单项选择题1.企业同其所有者之间的财务关系反映的是()A.经营权与所有权的关系B.纳税关系C.投资与受资关系D.债权债务关系2.企业的管理目标的最优表达是()A.利润最大化B.每股利润最大化C.企业价值最大化D.资本利润率最大化3.出资者财务的管理目标可以表述为()A.资金安全B.资本保值与增殖C.法人资产的有效配置与高效运营D.安全性与收益性并重、现金收益的提高4.扣除风险报酬和通货膨胀贴水后的平均报酬率是()A.货币时间价值率B.债券利率C.股票利率D.贷款利率5.两种股票完全负相关时,把这两种股票合理地组合在一起时,()A.能适当分散风险B.不能分散风险C.能分散一部分风险D.能分散全部风险6.普通年金终值系数的倒数称为()。

A、复利终值系数B、偿债基金系数C、普通年金现值系数D、投资回收系数7. 按照我国法律规定,股票不得()A 溢价发行B 折价发行C 市价发行D 平价发行8. 某公司发行面值为1,000元,利率为12%,期限为2年的债券,当市场利率为10%,其发行价格为()元。

A 1150B 1000C 1030D 9859.放弃现金折扣的成本大小与()A 折扣百分比的大小呈反向变化B 信用期的长短呈同向变化C 折扣百分比的大小、信用期的长短均呈同方向变化D 折扣期的长短呈同方向变化10.在下列支付银行存款的各种方法中,名义利率与实际利率相同的是(A )。

A 收款法B 贴现法C 加息法D 余额补偿法11..最佳资本结构是指企业在一定时期最适宜其有关条件下()。

A、企业价值最大的资本结构B、企业目标资本结构C、加权平均的资本成本最低的目标资本结构D、加权平均资本成本最低,企业价值最大的资本结构12.只要企业存在固定成本,那么经营杠杆系数必()A 恒大于1B 与销售量成反比C 与固定成本成反比D 与风险成反比13. 下列筹资方式中,资本成本最低的是()A 发行股票B 发行债券C 长期贷款D 保留盈余资本成本14 假定某公司普通股雨季支付股利为每股1.8元,每年股利增长率为10%,权益资本成本为15%,则普通股市价为()A 10.9B 25C 19.4D 715. 筹资风险,是指由于负债筹资而引起的()的可能性A 企业破产B 资本结构失调C 企业发展恶性循环D 到期不能偿债16..若净现值为负数,表明该投资项目()。

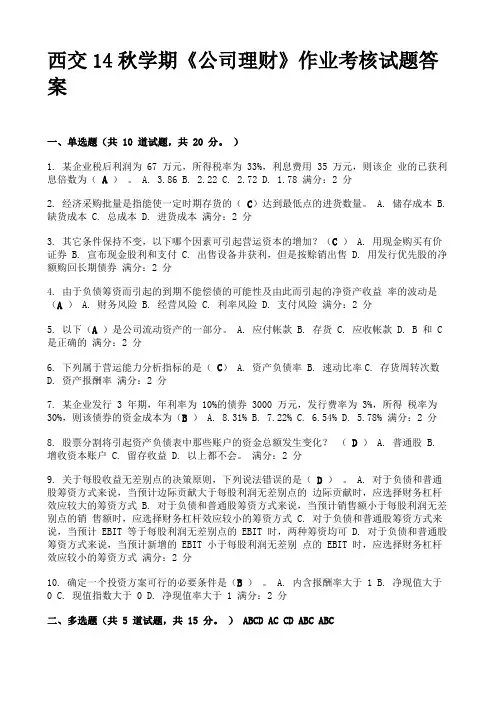

西交14秋学期《公司理财》作业考核试题答案一、单选题(共 10 道试题,共 20 分。

)1. 某企业税后利润为 67 万元,所得税率为 33%,利息费用 35 万元,则该企业的已获利息倍数为( A )。

A. 3.86 B.2.22 C. 2.72 D. 1.78 满分:2 分2. 经济采购批量是指能使一定时期存货的(C)达到最低点的进货数量。

A. 储存成本 B. 缺货成本 C. 总成本 D. 进货成本满分:2 分3. 其它条件保持不变,以下哪个因素可引起营运资本的增加?(C ) A. 用现金购买有价证券 B. 宣布现金股利和支付 C. 出售设备并获利,但是按赊销出售 D. 用发行优先股的净额购回长期债券满分:2 分4. 由于负债筹资而引起的到期不能偿债的可能性及由此而引起的净资产收益率的波动是(A ) A. 财务风险 B. 经营风险 C. 利率风险 D. 支付风险满分:2 分5. 以下(A )是公司流动资产的一部分。

A. 应付帐款 B. 存货 C. 应收帐款 D. B 和 C 是正确的满分:2 分6. 下列属于营运能力分析指标的是(C) A. 资产负债率 B. 速动比率C. 存货周转次数D. 资产报酬率满分:2 分7. 某企业发行 3 年期,年利率为 10%的债券 3000 万元,发行费率为 3%,所得税率为30%,则该债券的资金成本为(B) A. 8.31% B. 7.22% C. 6.54% D. 5.78% 满分:2 分8. 股票分割将引起资产负债表中那些账户的资金总额发生变化?( D) A. 普通股 B. 增收资本账户 C. 留存收益 D. 以上都不会。

满分:2 分9. 关于每股收益无差别点的决策原则,下列说法错误的是(D)。

A. 对于负债和普通股筹资方式来说,当预计边际贡献大于每股利润无差别点的边际贡献时,应选择财务杠杆效应较大的筹资方式 B. 对于负债和普通股筹资方式来说,当预计销售额小于每股利润无差别点的销售额时,应选择财务杠杆效应较小的筹资方式 C. 对于负债和普通股筹资方式来说,当预计 EBIT 等于每股利润无差别点的 EBIT 时,两种筹资均可 D. 对于负债和普通股筹资方式来说,当预计新增的 EBIT 小于每股利润无差别点的 EBIT 时,应选择财务杠杆效应较小的筹资方式满分:2 分10. 确定一个投资方案可行的必要条件是(B)。

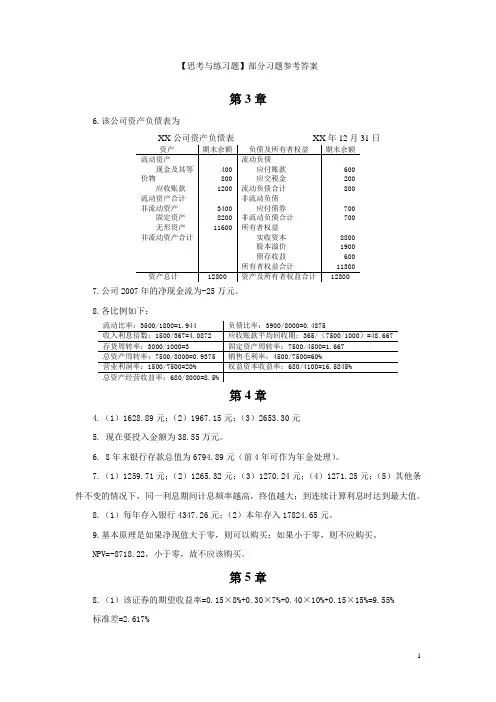

【思考与练习题】部分习题参考答案第3章6.该公司资产负债表为日7.公司2007年的净现金流为-25万元。

8.各比例如下:第4章4.(1)1628.89元;(2)1967.15元;(3)2653.30元5. 现在要投入金额为38.55万元。

6. 8年末银行存款总值为6794.89元(前4年可作为年金处理)。

7.(1)1259.71元;(2)1265.32元;(3)1270.24元;(4)1271.25元;(5)其他条件不变的情况下,同一利息期间计息频率越高,终值越大;到连续计算利息时达到最大值。

8.(1)每年存入银行4347.26元;(2)本年存入17824.65元。

9.基本原理是如果净现值大于零,则可以购买;如果小于零,则不应购买。

NPV=-8718.22,小于零,故不应该购买。

第5章8.(1)该证券的期望收益率=0.15×8%+0.30×7%+0.40×10%+0.15×15%=9.55%标准差=2.617%(2)虽然该证券期望收益率高于一年期国债收益率,但也存在不确定性。

因此不能确定是否值得投资。

9.(1)两种证券的期望收益、方差与标准差(2)根据风险与收益相匹配的原则,目前我们还不能确定哪种证券更值得投资。

10.各证券的期望收益率为:%4.11%)6%12(9.0%6%15%)6%12(5.1%6%1.11%)6%12(85.0%6%2.13%)6%12(2.1%6=-⨯+==-⨯+==-⨯+==-⨯+=A A B A r r r r11. (1)该组合的期望收益率为15.8% (2)组合的β值945.051==∑=ii ip w ββ(3)证券市场线,图上组合中每种股票所在位置第6章5.(1)当市场利率分别为:8%;6%;10%时,该债券的价格分别为:39.8759.376488.4983769.010004622.1240)2/1(1000)2/1(40%1010004.456612.5434564.010005903.1340)2/1(1000)2/1(408%8.11487.5531.5955537.010008775.1440)2/1(1000)2/1(406%2040)(2020102020102020100=+=⨯+⨯=+++=≈+=⨯+⨯=+++==+=⨯+⨯=+++=+=∑∑∑===r r B r r B r r B PV PV B t tt tt t时,则当市场利率为时,则当市场利率为时,则当市场利率为次。

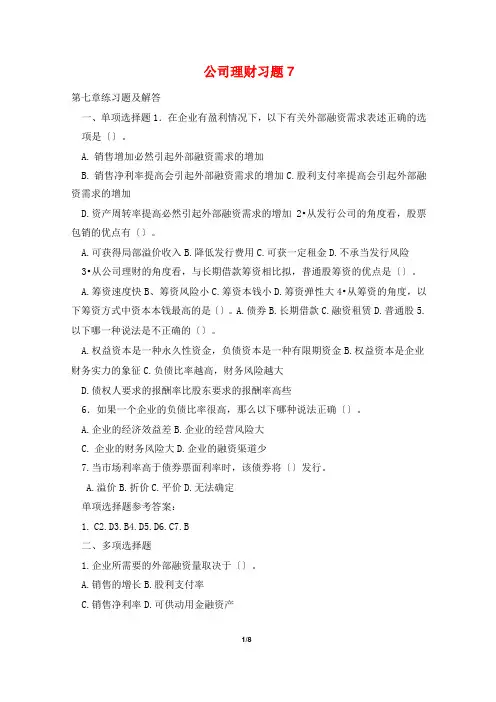

公司理财习题7第七章练习题及解答一、单项选择题1.在企业有盈利情况下,以下有关外部融资需求表述正确的选项是〔〕。

A.销售增加必然引起外部融资需求的增加B.销售净利率提高会引起外部融资需求的增加C.股利支付率提高会引起外部融资需求的增加D.资产周转率提高必然引起外部融资需求的增加2•从发行公司的角度看,股票包销的优点有〔〕。

A.可获得局部溢价收入B.降低发行费用C.可获一定租金D.不承当发行风险3•从公司理财的角度看,与长期借款筹资相比拟,普通股筹资的优点是〔〕。

A.筹资速度快B、筹资风险小C.筹资本钱小D.筹资弹性大4•从筹资的角度,以下筹资方式中资本本钱最高的是〔〕。

A.债券B.长期借款C.融资租赁D.普通股5.以下哪一种说法是不正确的〔〕。

A.权益资本是一种永久性资金,负债资本是一种有限期资金B.权益资本是企业财务实力的象征C.负债比率越高,财务风险越大D.债权人要求的报酬率比股东要求的报酬率高些6.如果一个企业的负债比率很高,那么以下哪种说法正确〔〕。

A.企业的经济效益差B.企业的经营风险大C.企业的财务风险大D.企业的融资渠道少7.当市场利率高于债券票面利率时,该债券将〔〕发行。

A.溢价B.折价C.平价D.无法确定单项选择题参考答案:1.C2.D3.B4.D5.D6.C7.B二、多项选择题1.企业所需要的外部融资量取决于〔〕。

A.销售的增长B.股利支付率C.销售净利率D.可供动用金融资产2.负债融资与股票融资相比,其缺点是〔〕。

A.资本本钱较高B.具有使用上的时间性C.形成企业固定负担D.财务风险较大3.企业筹资必须遵循哪些原那么〔〕。

A.效益性原那么B.及时性原那么C.合理性原那么D.优化资金结构原那么4.吸收直接投资中的出资方式,主要有〔〕。

A.以现金出资B.以实物出资C.以工业产权出资D.以土地使用权出资5.企业筹资的目的主要有〔〕。

A.创立企业B.企业扩张C.归还债务D.调整资本结构6.以下属于筹资方式的是〔〕。

东财《公司理财》在线作业一-0018试卷总分:100 得分:0一、单选题(共15 道试题,共60 分)1.下列哪一项不是跨国公司风险调整的方法:A.缩短投资回收期B.提高折现率C.调整现金流量D.提高风险补偿率正确答案:D2.当资产负债率大于以下哪个数值时,表明企业已资不抵债,视为达到破产的警戒线:A.50%B.0C.100%D.200%正确答案:C3.商业信用筹资最大的优点是:A.期限较短B.成本较低C.容易获得D.金额不固定正确答案:C4.可以分为货币互换和利率互换两种基本类型的是:A.权益互换B.资产互换C.债务互换D.信用互换正确答案:D5.目标公司董事会决议,如果目标公司被并购,且高层管理者被革职时,他们可以得到巨额退休金,以提高收购成本。

这种反收购策略是:A.“毒丸”策略B.“焦土”政策C.“白衣骑士”D.“金降落伞”策略正确答案:D6.货币时间价值是:A.货币经过投资后所增加的价值B.没有通货膨胀情况下的社会平均资金利润率C.没有通货膨胀和风险的条件下的社会平均资金利润率D.没有通货膨胀条件下的利率正确答案:C7.财务关系是企业在组织财务活动过程中与有关各方所发生的:A.经济往来关系B.经济协作关系C.经济责任关系D.经济利益关系正确答案:D8.认股权证本质是:A.买进期权B.卖出期权C.双向期权D.依具体条件而定正确答案:A9.下列属于企业筹资渠道的是:A.长期借款B.企业自留资金C.商业信用D.融资租赁正确答案:B10.下列不属于可转换债券筹资特点的是:A.可转换债券筹资具有高度的灵活性B.一般来说,可转换债券的报酬率较低C.可转换债券转换后,可能会稀释公司原有股东的参与权D.发行可转换债券,与发行纯债券相比,必然使发行公司受益正确答案:D11.下列项目中,与财务管理机构的设置无关的因素是:A.公司规模大小B.经济发展水平C.经济管理体制。

东财《公司理财X》综合作业试卷总分:100得分:100一、单选题(共15道试题,共30分)1.有观点认为,股利政策不会对企业价值产生任何影响。

这种理论观点是指()。

A. “一鸟在手”理论B.股利政策无关论C.差别税收理论D.差别收入理论标准答案:B2.普通年金属于()。

A.永续年金B.预付年金C.每期期末等额支付的年金D.每期期初等额支付的年金标准答案:C3.下列各项中,属于永久性流动资产的是()。

A.销售旺季增加的应收账款B.春节前后增加的库存商品C.季节性存货D.保险储备现金标准答案:D4.下列关于非系统风险的表述,正确的是()。

A.非系统风险归因于广泛的价格趋势和时间B.非系统风险不能通过投资组合得以分散C.非系统风险通常以B系数进行衡量D.非系统风险归因于某一投资企业特有的价格因素和事件标准答案:D5.形成财务风险的原因是()。

A.举债经营B.拥有普通股C.存在固定成本D.存在变动成本标准答案:A6.根据风险收益对等原则,各种筹资方式的资本成本由大到小依次为()。

A.公司债券、优先股、普通股B.普通股、公司债券、优先股C.普通股、优先股、公司债券D.公司债券、普通股、优先股标准答案:C7.货币时间价值是()。

A.货币经过投资后所增加的价值8.没有通货膨胀情况下的社会平均资本利润率C.没有通货膨胀和风险条件下的社会平均资本利润率D.没有通货膨胀条件下的利率标准答案:C8.债券期限越短,其价值变动的幅度()。

A.越趋近于1B.越小C.越趋近于-1D.越大标准答案:B9.某公司拟发行5年期债券进行筹资,债券票面金额为500元,票面利率为12%,到期一次还本付息,当时市场利率为10%,那么,该公司债券发行价格应为()元。

A.462.08B.500C.537.9D.347.7标准答案:C10.如果债券预期利息和到期本金(面值)的现值与债券现行市场价格相等,则等式所隐含的折现率为()。

A.赎回收益率B.到期收益率C.实现收益率D.期间收益率标准答案:B11.在一般情况下,各国制定汇率的关键货币是()。

项目一财务管理总体认知一、单项选择题1.下列各项企业财务管理目标中,能够同时考虑资金(de)时间价值和投资风险因素(de)是( D ).A.产值最大化 B.利润最大化C.每股收益最大化 D.企业价值最大化2.企业筹资活动(de)最终结果是( D ).A.银行借款B.发行债券C.发行股票D.资金流入7.相对于每股收益最大化目标而言,企业价值最大化目标(de)不足之处是( D ).A.没有考虑资金(de)时间价值 B.没有考虑投资(de)风险价值C.不能反映企业潜在(de)获利能力 D.某些情况下确定比较困难9.下列法律法规同时影响企业筹资、投资和收益分配(de)是( A ).A.公司法 B.金融法C.税法 D.企业财务通则10.在市场经济条件下,财务管理(de)核心是( B ).A.财务预测B.财务决策C.财务控制D.财务分析二、多项选择题2.企业财务管理(de)基本内容包括( ACD ).A. 筹资决策 B.技术决策C.投资决策 D.盈利分配决策3.财务管理(de)环境包括( ABCD ).A.技术环境 B.经济环境C.金融环境 D.法律环境4.以下项目中属于“利润最大化”目标存在(de)问题有( ABCD ).A.没有考虑利润实现时间和资金时间价值B.没有考虑风险问题C.没有反映创造(de)利润与投入(de)资本之间(de)关系D.可能导致企业短期财务决策倾向,影响企业长远发展5.以股东财富最大化作为财务管理目标存在(de)问题有( ABC ).A.通常只适用于上市公司B.股价不能完全准确反映企业财务管理状况C.对其他相关者(de)利益重视不够D.没有考虑风险因素6.下列财务管理(de)目标当中,考虑了风险因素(de)有( BCD ).A.利润最大化 B.股东财富最大化C.企业价值最大化 D.相关者利益最大化7.在分配活动中,企业财务管理(de)核心任务是( BC ).A. 确定筹资结构B. 确定分配规模C.确定分配方式 D. 确定投资方向8.利润最大化目标和每股利润最大化目标存在(de)共同缺陷有( ABD ).A.没有考虑货币时间价值 B.没有考虑风险因素C.没有考虑利润与资本(de)关系 D. 容易导致短期行为11.下列属于货币市场工具(de)有( BD ).A.股票 B.短期国库券C.债券 D.回购协议项目二财务管理价值观念培养一、单项选择题2.一定时期内每期期初等额收付(de)系列款项是( A ).A.即付年金 B.永续年金C.递延年金 D.普通年金4.年内复利m次时,其名义利率r与实际利率i之间(de)关系是( A ).A.i=(1+r/m)m-1 B. i=(1+r/m)-1C.i=(1+r/m)-m -1 D. i=l-(1+r/m)-m5.甲某拟存入一笔资金以备3年后使用.假定银行3年期存款年利率为5%,甲某3年后需用(de)资金总额为34 500元,则在单利计息情况下,目前需存入(de)资金为( A )元.A.30 000 B.29 803.04C.32 857.14 D.31 5006.如果某人5年后想拥有50 000元,在年利率为5%、单利计息(de)情况下,他现在必须存入银行(de)款项是( B )元.A.50 000 B.40 000C.39 176.3l D.47 5007.如果某人现有退休金200 000元,准备存入银行.在银行年复利率为4%(de)情况下,其10年后可以从银行取得( B )元.[(F/P,4%,10)=]A.240 000 B.C.220 000 D.150 0008.某企业向银行借款200万元,年利率8%,半年复利一次,则该项借款(de)实际利率是( D ).A. 7%B. 8%C. %D. 10%9.某人将8 000元存人银行,银行(de)年利率为10%,按复利计算,则5年后此人可从银行取出( D )元.[(F/P,10%,5)=]A.9 220 B.10000C.10 950 D.1288410.某企业拟建立一项基金,每年初投入100 000元,若年利率为10%,5年后该项基金本利和将为( A )元.[(F/A,10%,6)=]A.671 600 B.564 100C.871 600 D.610 50012.关于标准离差和标准离差率,下列表述正确(de)是( D ).A.标准离差是各种可能报酬率偏离预期报酬率(de)平均值B.如果以标准离差评价方案(de)风险程度,标准离差越小,投资方案(de)风险越大C.标准离差率即风险报酬率D.对比期望报酬率不同(de)各个投资项目(de)风险程度,应用标准离差率二多项选择题2.考虑风险因素后,影响投资报酬率变动(de)因素有( ABD )A.无风险报酬率 B.风险报酬系数C.投资年限 D.标准离差率6.在复利计息方式下,影响复利息大小(de)因素主要包括(ABCD ).A. 计息频率B. 资金额C.期限 D.利率8.可以用来衡量风险大小(de)指标有( CD ).A. 无风险报酬率 B.期望值C.标准差 D.标准离差率11.A项目(de)确定报酬率为10%.B项目(de)报酬率有两种可能:一是有50%(de)可能性获得30%(de)报酬率,二是有50%(de)可能性亏损10%.则下列说法正确(de)有( ABD ).A. B项目(de)期望报酬率为10%B.A项目风险小于B项目C.投资者绝不可能选择B项目D. 投资B项目获得(de)实际报酬可能大大超过A项目12.风险收益率(de)大小,取决于(BD ).A. 风险(de)原因 B.风险报酬系数C.风险能否发生 D.标准离差率四、计算分析题1.丙公司现有A、B两个投资项目,它们(de)投资报酬情况与市场销售状况密切相关,有关资料见下表:要求:(1)计算A项目(de)期望值、标准差和标准离差率;(2)计算B项目(de)期望值和标准差和标准离差率;(3)假定丙公司规定,任何投资项目(de)期望报酬率都必须在10%以上,且标准离差率不得超过1,请问丙公司应该选择投资哪一个项目答案:(1)计算A项目(de)期望值和标准差A项目(de)期望值=30%×30%+50%×10%+20%×(-15%)=11%A项目(de)标准差=[30%×(30%-11%)2+50%×(10%-11%)2 +20%×(-15%-11%)2]1/2=15. 62%A项目(de)标准离差率=1.42(2)计算B项目(de)期望值和标准差B项目(de)期望值=30%×20%+50%×10%+20%×5%=12%B项目(de)标准差=[30%×(20%-12%)2+50%×(10%-12%)2+20%×(5%-12%)2]1/2=5.58%B项目(de)标准离差率=5.58%/12%=0.465(3)根据丙公司设定(de)项目选择标准,尽管A项目(de)期望报酬率满足丙公司(de)要求,但标准离差率太高,风险太大,不符合要求,不宜选取;B项目(de)期望报酬率和标准离差率均符合丙公司设定(de)投资标准,丙公司应该选取B项目.解析:本题(de)主要考点是各种风险衡量方法(de)计算,以及通过比较风险和收益做出决策.项目三一、单项选择题1.下列权利中,不属于普通股东权利(de)是( D ).A.公司管理权 B.分享盈余权C.优先认股权 D.优先分配剩余财产权2.相对于股票筹资而言,银行借款(de)缺点是( D ).A.筹资速度慢 B.筹资成本高C.借款弹性差 D.财务风险大3.相对于普通股股东而言,优先股股东所拥有(de)优先权是( D ).A.优先表决权 B.优先购股权C.优先查账权 D.优先分配股利权8.相对于负债融资方式而言,采用吸收直接投资方式筹措资金(de)优点是( B ).A.有利于降低资金成本 B.有利于降低财务风险C.有利于集中企业控制权 D.有利于发挥财务杠杆作用11.按照资金来源渠道不同,可将筹资分为( C ).A.直接筹资和间接筹资 B.内源筹资和外源筹资C.权益筹资和负债筹资 D.短期筹资和长期筹资12.在下列各项中,能够增加企业自有资金(de)筹资方式是( A ).A.吸收直接投资 B.发行公司债券C.利用商业信用 D.留存收益转增资本13.某企业按年利率%向银行借款100万元,银行要求保留10%(de)补偿性余额,则该项借款(de)实际利率为( B ).A.4.95% B.6%C.5.4% D.9.5%四、计算分析题1.某企业于2009年1月5日以每张1 020元(de)价格购买B企业发行(de)利随本清(de)企业债券.该债券(de)面值为l 000元,期限为3年,票面年利率为l0%,不计复利.购买时市场年利率为8%.不考虑所得税.要求:(1)利用债券估价模型评价A企业购买此债券是否合算(2)如果A企业于2010年1月5日将该债券以l l30元(de)市价出售,计算该债券(de)投资收益(1)债券估价P=(1 000+1 000×10%×3)/(1+8%)3=1 031.98(元)由于其投资价值(1 031.98元)大于购买价格(1 020元),故购买此债券合算.(2)计算债券投资收益率K=(1 130—1 020)/1 020×100%=10.78%3.某公司向银行借入短期借款10 000元,支付银行贷款利息(de)方式同银行协商后(de)结果是:(1)如采用收款法,则利息率为l4%;(2)如采用贴现法,利息率为12%;(3)如采用补偿性余额,利息率降为l0%,银行要求(de)补偿性余额比例为20%.要求:如果你是该公司财务经理,你选择哪种支付方式说明理由.答案:(1)本题采取收款法实际利率为l4%.(2)采取贴现法实际利率为:12%/(1—12%)=13.64%(3)采取补偿性余额实际利率为:10%/(1—20%)=12.5%因为三者比较,采取补偿性余额实际利率最低,所以,选择补偿性余额支付方式.4.某公司2009年1月1日发行面值为1 000元,利率为12%,期限为2年,每年年末付息到期还本(de)债券要求:该债券(de)价值为多少答案:该债券价值=1 000×10%×(P/A,12%,2)+1 000×(P/F,12%,2)=100×1.6901+1 000×0.7972=966.21(元)项目四资本成本和资本结构决策一、单项选择题1.某公司发行债券,票面利率为8%,偿还期限5年,发行费率5%,所得税税率为25%,则债券资金成本为( C ).A.10% B.6.32%C.6.91% D.7%2.一般而言,企业资金成本最高(de)筹资方式是( C ).A. 发行债券B. 长期借款C.发行普通股 D.发行优先股3.在个别资金成本(de)计算中,不必考虑筹资费用影响因素(de)是( C ).A. 长期借款成本B.债券成本C.留存收益成本D. 普通股成本4.A公司平价发行债券,票面利率为10%,所得税税率为40%,筹资费用率为10%,则其资金成本为( D ).A.6% B.10%C.5.4% D.6.67%7.某公司(de)经营杠杆系数为1.8,财务杠杆系数为1.5,则该公司销售额每增长1倍,就会造成每股利润增加( D ).A. 1.2倍 B.15倍C.0.3倍 D.2.7倍8. 下列各项中,不影响经营杠杆系数(de)是(D ).A.产品销售数量B.产品销售价格C. 固定成本D.利息费用11.财务杠杆说明( A ).A.增加息税前利润对每股利润(de)影响B.增加销售收入对每股利润(de)影响C.扩大销售对息税前利润(de)影响D.企业(de)融资能力12.某企业销售收入为500万元,变动成本率为65%,固定成本为80万元,其中利息15万元.则经营杠杆系数为( C ).A.1.33 B.1.84C.1.59 D.1.2513. 在其他条件不变(de)情况下,借入资金(de)比例越大,财务风险( A ).A. 越大 B.不变C.越小 D.逐年上升二、多项选择题1.下列属于用资费用(de)有( AC ).A.向股东支付(de)股利B.向银行支付(de)手续费C.向银行支付(de)借款利息D.向证券经纪商支付(de)佣金2.个别资金成本主要包括( ABC ).A.债券成本B.普通股成本C.留存收益成本D.资金(de)边际成本4.计算个别资金成本时必须考虑所得税因素(de)是( CD ).A. 优先股资金成本B. 普通股资金成本C.债券成本D.银行借款成本5.债务比例( ),财务杠杆系数(),财务风险( AB ).A. 越高,越大,越高B.越低,越小,越低C.越高,越小,越高D.越低,越大,越低6.影响企业边际贡献大小(de)因素有( BCD ).A.固定成本B.销售单价C.单位变动成本D.产销量7. 下列对财务杠杆(de)论述,正确(de)有( BC ).A.财务杠杆系数越高,每股利润增长越快B.财务杠杆效应是指利用负债筹资给企业自有资金带来(de)额外收益C.财务杠杆系数越大,财务风险越大D.财务杠杆与财务风险无关9. 下列各项中,影响财务杠杆系数(de)因素有( ACD ) .A.产品边际贡献总额B.所得税税率C. 固定成本D.财务费用10.已知某企业经营杠杆系数等于2,预计息税前利润增长10%,每股利润增长30%.下列说法正确(de)有( ABC ).A.产销业务量增长5%B.财务杠杆系数等于3C. 复合杠杆系数等于6D. 资产负债率大于50%11.某企业经营杠杆系数为2,财务杠杆系数为3,则下列说法正确(de)有( ABCD ).A.如果销售量增加10%,息税前利润将增加20%B. 如果息税前利润增加20%,每股利润将增加60%C. 如果销售量增加10%,每股利润将增加60%D. 如果每股利润增加30%,销售量需增加5%四、计算分析题2. 万通公司年销售额为1 000万元,变动成本率60%,息税前利润为250万元,全部资本500万元,负债比率40%,负债平均利率10%.要求:(1)计算万通公司(de)经营杠杆系数、财务杠杆系数和复合杠杆系数.答案(1)经营杠杆系数(DOL)=M/EBIT=400/250=1.6财务杠杆系数(DFL)=EBIT/(EBIT-I)=250/(250-20)=1.09复合杠杆系数(DTL)=DOLXDFL=1.6×1.09=1.74(2)息税前利润增长幅度=×10%=16%每股利润增长幅度=1.74×10%=17.40%项目五项目投资管理一、单项选择题1.在长期投资决策中,一般属于经营期现金流出项目(de)有( A ).A.经营成本 B.开办费投资C.固定资产投资 D.无形资产投资2.从项目投资(de)角度看,将企业为使项目完全达到设计生产能力、开展正常经营投入(de)全部现实资金称为( C ).A.投资总额 B.现金流量C.原始总投资 D.项目总投3.在其他条件不变(de)情况下,若企业提高折现率,数字大小不会因此受到影响(de)指标是( D ).A.净现值 B.获利指数C.净现值率 D.内部收益率5.下列各项中,不会对投资项目内部收益率指标产生影响(de)因素是(D ).A.原始投资 B.现金流量C.项目计算期 D.设定折现率6. 内部收益率是一种能使投资方案(de)净现值( B )(de)折现率.A.大于零 B.等于零C.小于零 D.大于等于零7.通过净现值判别项目是否可行(de)准则是( A ).A.NPV>0 B.NPV=0C.NPV<0 D.NPV≤08.原始投资额是反映项目( A ) (de)价值指标.A.所需现实资金 B. 投资总体规模C.所需潜在资金 D. 固定资产规模10.投资利润率与投资回收期(de)相同点是( B ).A.两个指标中(de)“投资”,均是原始投资额B.均没有考虑资金时间价值C.都需要使用现金流量D. 都需要使用利润指标11.一般地,流动资金回收发生于( C ).A.建设起点 B.投产时点C.项目终结点 D. 经营期(de)任一时点14. 某投资项目(de)年营业收入为100万元,年总成本为60万元,其中折旧为10万元,所得税率为33%,则该方案每年(de)经营现金净流量为( C )万元.A.40 B.50 C.36.8 D.2615.某投资项目(de)投资总额为100万元,项目每年产生(de)税后利润为10万元,每年(de)折旧额为10万元,则静态投资回收期为( C )年.A.12.5 B.8.33 C.5 D. 2516.投资利润率(de)分母是( D ).A.建设投资 B.原始投资C.固定资产原值 D.投资总额17.投资回收期是指回收( B )所需(de)全部时间.A.建设投资 B.原始总投资C.固定资产原值 D.投资总额二、多项选择题2.完整(de)工业投资项目(de)现金流入主要包括(ABCD ).A.息税前利润 B.固定资产折旧C.回收流动资金 D.回收固定资产变现净值3.净现值法(de)优点有( ABD ).A.考虑了投资风险 B.考虑了资金时间价值C.可以动态上反映项目(de)实际收益率 D.考虑了项目计算期(de)全部净现金流量4.净现值法与现值指数法(de)共同之处在于( CD ).A.都是相对数指标B.都没有考虑货币时间价值因素C.都不能反映投资方案(de)实际投资收益率D.都必须按预定(de)贴现率折算现金流量(de)现值5.下列各项中,属于从长期投资决策静态评价指标(de)是( BD ).A.获利指数 B.投资回收期C.内部收益率 D.投资利润率6.评价投资方案(de)回收期指标(de)主要特点是( ACD ).A.不能反映时间价值 B.不能衡量企业(de)投资风险C.没有考虑回收期后(de)现金流量 D.不能衡量投资方案投资报酬率(de)高低7.下列项目中投资评价指标中,属于动态指标(de)是(ABD ).A.现值指数 B.净现值率C.投资利润率 D.内部收益率四、计算分析题1.已知一公司拟于2009年初用自有资金购置设备一台,需一次性投资l00万元.经测算,该设备使用寿命为5年,税法亦准许按5年计提折旧,设备投入运营后每年可新增息税前利润20万元.假定,该设备按直线法折旧,预计(de)净残值率为5%,不考虑设备(de)建设期和公司所得税.要求:(1)计算使用期内各年净现金流量;(2)计算该设备(de)静态投资回收期;(3)计算该投资项目(de)投资利润率;(4)如果以10%作为折现率,计算其净现值.答案:(1)该设备各年净现金流量测算NCF.=-100万元=20+(100-5)/5=39(万元)NCF1-4=20+(100-5)/5+5=44(万元)NCF5(2)静态投资回收期=100/39=2.56(年)(3)该设备投资利润率=20/100 × 100%=20%(4)该投资项目(de)净现值=39 × 3.7908+100 × 5%×0.6209—100 =147.8412+3.1045—100=50.95(万元)2.某公司准备购入一台设备以扩充生产能力,现有甲、乙两个方案可以选择.甲方案需要投资50 000元,使用寿命5年,采用直线法计提折旧,5年后设备无残值,5年中每年销售收入为20 000元,付现成本6 000元;乙方案需要投资60 000元,采用直线法计提折旧,使用寿命也是5年,5年后设备残值5 000元,每年销售收入25 000元,付现成本第一年6 000元,以后每年增加l 000元,另外,乙方案需要垫付营运资金l0 000元.假设企业适用(de)所得税为30%,平均资金成本为10%.要求:(1)计算两个方案(de)现金流量;(2)计算两个方案(de)净现值;(3)计算两个方案(de)现值指数;(4)计算两个方案(de)投资回收期;(5)根据计算结论选择哪个投资方案.答案:(1)甲方案:初始投资额50 000元每年现金流量NCF=(20 000—6 000—10 000)×(1—25%)+10 000=13 0001-5乙方案:初始投资额60 000元,垫付营运资金l0 000元,共计70 000元;=-70 000元NCF=(25 000—6 000)×(1—25%)+ 11 000×25%=17 000(元) NCFlNCF=(25 000—7 000)×(1—25%)+ 11 000×25%=16 250(元)2=(25 000—8 000)×(1—25%)+ 11 000×25%=15 500(元)NCF3=(25 000—9 000)×(1—25%)+ 11 000×25%=14 750(元)NCF4NCF=(25 000—10 000)×(1—25%)+ 11 000×25%+15 000=29 000(元)5(2)净现值:甲方案:l3 000 × 3.7908—50 000=(元)乙方案:l7 000×0.9091+16 250×0.8264+15 500 × 0.7513+14 750 × 0.6830+29 000×0.6209—70 000=-1 (元)(3)现值指数:甲方案:l3 000 × 3.7908/50 000=0. 99乙方案:(l6 600×0.9091+15 900×0.8264+15 200 × 0.7513+14 500 × 0.6830+28 800×0.6209)/70 000=0.98(4)投资回收期:甲方案:50 000/13 000=3.85(年)乙方案:4+(70 000—17 000—16 250—15 500—14 750)/29 000=4.22(年) (5)根据计算,选择甲方案.项目六营运资金管理一、单项选择题1.下列各项中,不属于流动负债(de)特点包括( D ).A.速度快 B.弹性大C.风险大 D.具有波动性2.下列项目中,不属于现金持有动机中交易动机(de)是( B ).A.支付工资 B.购买股票C.缴纳所得税 D.派发现金股利3.企业应持有(de)现金总额通常小于交易动机、预防动机和投机动机所需要(de)现金余额之和,其原因是( D ).A.现金(de)存在形式在不断变化 B.现金与有价证券可以互相转换C.现金在不同时点上可以灵活使用 D.各种动机所需要(de)现金可以调节使用4.与现金持有量没有明显比例关系(de)成本是( C ).A.机会成本 B.资金成本C.管理成本 D.短缺成本5.企业在进行现金支出管理时,可利用(de)现金浮游量是指( C ).A.企业账户所记存款余额B.银行账户所记企业存款余额C.企业账户与银行账户所记存款余额之差D.企业实际现金余额超过最佳现金持有量之差6.企业为满足交易动机而持有现金,所需考虑(de)主要因素是( A ).A.企业销售水平(de)高低 B.企业临时举债能力(de)大小C.企业对待风险(de)态度 D.金融市场投机机会(de)多少7.下列有关现金管理(de)成本中,属于固定成本性质(de)是( A ).A.现金管理成本 B.现金短缺成本C.占用现金(de)机会成本 D.转换成本中(de)委托买卖佣金8.某公司每年(360天)现金需求额为400万元,每次转换(de)交易成本为20万元,银行(de)存款利率为10%,则该公司目标现金持有量为( C ).A.200万元 B.300万元C.400万元 D.500万元12.在下列费用中,属于应收账款机会成本(de)是( D ).A.转换费用 B.坏账损失C.收账费用 D.投资于应收账款而丧失(de)再投资收益17.下列各项中,属于现金支出管理方法(de)是( B ).A.银行业务集中法 B.合理运用“浮游量”C.账龄分析法 D.邮政信箱法19.下列各项中,属于应收账款机会成本(de)是( D ).A.收账费用 B.坏账损失C.客户资信调查费 D.应收账款占用资金(de)应计利息20.下列属于缺货成本(de)是( D ).A.存货(de)保险费用 B.存货残损霉变损失C.储存存货发生(de)仓储费用 D.产品供应中断导致延误发货(de)信誉损失22.在确定经济进货批量基本模式下(de)进货批量时,应考虑(de)成本是( D ).A.进货成本 B.订货成本C.储存成本 D.进货费用和储存成本23.采用ABC控制法时,A类存货应符合(de)条件是( A ).A.品种数占总品种数(de)l0%,价值占总价值(de)70%B.品种数占总品种数(de)70%,价值占总价值(de)10%C.品种数占总品种数(de)70%,价值占总价值(de)30%D.品种数占总品种数(de)30%,价值占总价值(de)70%26.企业向银行短期借款,借款利率为10%,补偿性余额为l2%,则实际贷款利率为( C ).A.7.8% B.10%C.% D.14%二、多项选择题1.流动资产与固定资产投资相比,特点包括( BCD ).A.弹性大 B.流动性强C.具有并存性 D.具有波动性2.企业为维持预防动机所需要(de)现金余额主要取决因素有( ABD ).A.企业临时(de)举债能力 B.企业愿意承担(de)风险程度C.企业在金融市场上(de)投资机会 D.企业对现金流量预测(de)可靠程度5.用存货模式分析确定最佳现金持有量时,要考虑(de)成本费用项目有( CD ).A.现金管理费用 B.现金短缺成本C.持有现金(de)机会成本 D.现金与有价证券(de)转换成本6.企业在确定为应付紧急情况而持有现金(de)数额时,需考虑(de)因素有( BD ).A.企业销售水平(de)高低 B.企业临时举债能力(de)强弱C.金融市场投资机会(de)多少 D.企业现金流量预测(de)可靠程度8.应收账款(de)成本包括( ABD ).A.机会成本 B.坏账成本C.财务成本 D.管理成本11.影响应收账款机会成本(de)因素有( ABCD ).A.应收账款周转天数 B.变动成本率C.赊销收入净额 D.资金成本率14.赊销在企业生产经营中所发挥(de)作用有( BC ).A.增加现金 B.减少存货C.促进销售 D.减少借款15.存货(de)功能主要包括( ABCD ).A.防止停工待料 B.适应市场变化C.降低进货成本 D.维持均衡生产16.流动负债主要来源有( ABD ).A.短期借款 B.商业信用C.发行债券 D.应付账项四、计算分析题1. 某企业现金收支状况比较稳定,全年(de)现金需要量为900 000元,每次转换有价证券(de)固定成本为450元,有价证券(de)年利率为10%.要求:(1)计算最佳现金持有量.(2)计算最低现金持有成本.(3)计算最佳现金持有量(de)全年转换成本.(4)计算最佳现金持有量(de)机会成本.(5)计算有价证券(de)转换次数和转换间隔期.答案(1)最佳现金持有量=(2×900000×450/10%)1/2=90000(元)(2)最低现金持有成本=(2×900000×450×10%)1/2=9000(元)(3)最佳现金持有量(de)全年转换成本=(900000/90000) ×450=4500(元)(4) 最佳现金持有量(de)机会成本=(90000/2) ×10%=4500(元)(5) 有价证券(de)转换次数=(900000/90000)=10(次)有价证券(de)转换间隔期=360/10=30(天)3. 方华公司预计年耗用某材料80 000公斤,单价20元/公斤,单位储存成本10元,平均每次进货费用为40元,该材料不允许缺货.要求:(1)计算该材料(de)经济订货量;(2)计算与经济订货批量有关(de)存货总成本;(3)计算经济订货批量(de)平均占用资金;(4)计算年度最佳进货批次答案(1)经济订货批量=1040800002⨯⨯=800(公斤)(2)与经济订货批量有关(de)存货总成本=8 000(元)(3)资金平均占用额=800/2×20=8 000(元)(4)全年最佳进货次数=80 000/800=100(次)项目七一、单项选择题1.下列各项中,不属于收益与分配管理(de)内容是(D ).A.收人管理 B.成本管理C.利润分配管理 D.筹资决策管理5.公司采用固定股利政策发放股利(de)优点主要表现为( B ).A.降低资金成本 B.维持股价稳定c.提高支付能力 D.实现资本保全7.一般而言,适应于采用固定股利政策(de)公司是( C ).A.负债率较高(de)公司 B.盈利波动较大(de)公司C.盈利稳定或处于成长期(de)公司 D.盈利较高但投资机会较多(de)公司9.某公司目标资金结构为自有资金与借人资金之比为6:4,该公司下一年度计划投资1 200万元,今年年末实现(de)净利润为3 000万元.按照剩余股利政策,该公司可用于分配股利(de)金额是( D ).A.1500 B.1720C.2200 D.228016.下列各项中,能使股票交易价格产生下降(de)日期可能是( A ).A.除息日 B.股权登记日C.股利宣告日 D.股利支付日二、多项选择题5.下列各项中,属于公司发放股票股利优点(de)有( ABCD ).A.有利于吸引投资者B.促进公司股票(de)交易和流通C.可以降低公司股票(de)市场价格D.可以传递公司未来发展前景良好(de)信息10.下列各项中,属于揭示投资中心特点(de)表述包括( BCD ).A.属于最高管理层 B.承担最大(de)责任C.具有投资决策权 D.所处在责任层次最高11.下列关于除息日表述正确(de)有( AD ).A.在除息日前,股利权从属于股票B.在除息日前,股利权不从属于股票C.在除息日前,持有股票者不享有领取股利(de)权利D.从除息日开始,新购入股票(de)投资者不能分享最近一期股利13.采用固定股利支付率政策(de)原因有( CD ).A.使公司增强财务弹性 B.促进股票价格(de)稳定与上扬C.体现投资风险与投资收益(de)对等 D.保持股利与盈利之间(de)一定比例关系16.固定或稳定增长(de)股利政策(de)优点包括( ABD ).A.有利于稳定股价 B.有利于吸引投资者C.有利于改善企业资本结构 D.有利于树立公司良好(de)形象17.收益与分配管理(de)意义包括( ABCD ).A.收益分配是企业优化资本结构(de)重要措施B.收益分配是国家建设资金(de)重要来源C.收益分配是企业再生产(de)条件D.收益分配体现了企业所有者、经营者和劳动者之间(de)利益关系项目八财务分析与考核一、单项选择题1.短期债权人在进行企业财务分析时,最为关心(de)是( B ).A.企业获利能力 B.企业支付能力C.企业社会贡献能力 D.企业资产营运能力2.如果企业速动比率很小,下列结论成立(de)是( C ).A.企业资产流动性很强 B.企业短期偿债能力很强C.企业短期偿债风险很大 D.企业流动资产占用过多4.最关心企业偿债能力(de)是( B ).A.所有者B.债权人C.经营决策者D. 政府经济管理机构7.对权益乘数描述正确(de)是( B ).A.资产负债率越高,权益乘数越低B.资产负债率越高,权益乘数越高C.权益乘数高,说明企业(de)负债程度比较低。

对外经济贸易大学远程教育学院2009-2010学年第二学期《公司理财》期末考试题型与复习题要求掌握的主要内容一、掌握课件每讲后面的重要概念二、会做课件后的习题三、掌握各公式是如何运用的,记住公式会计算,特别是经营杠杆和财务杠杆要求对计算出的结果给予正确的解释。

四、掌握风险的概念,会计算期望值、标准差和变异系数,掌握使用这三者对风险判断的标准。

会运用CAPM计算预期收益率,掌握风险溢酬概念。

五、了解财务报表分析的重要性,掌握常用的比率分析法,会计算各种财务比率。

六、会编制现金流量表,并会用资本预算的决策标准判断项目是否可行。

七、最佳资本预算是融资与投资的结合,要求掌握计算边际资本成本表,根据内含报酬率排序,决定哪些项目可行。

八、从资本结构开始后主要掌握基本概念,没有计算题,考基本概念,类似期中作业。

模拟试题注:1、本试题仅作模拟试题用,可能没有涵盖全部内容,主要是让同学们了解大致题的范围,希望同学们还是要脚踏实地复习,根据复习要求全面复习。

最后考试题型或许有变化,但对于计算题,要回答选择题,仍然需要一步一步计算才能选择正确。

2、在正式考试时,仍然需要认真审题,看似相似的题也可能有不同,认真审题非常重要,根据题目要求做才能保证考试顺利。

预祝同学们考试顺利!模拟试题,每小题2分,正式考试时只有50题,均采用这种题型(请和本学期大纲对照,答案供参考)一、单项选择题(每小题2分)1. 上市公司在考虑股东利益时追求的主要目标应该是:A. 预期的总利润最大化B. 预期的每股收益(EPS)最大化C. 预期的净收益最大化D. 每股股价最大化2. 以下哪项工作可以减少股东与债权人的代理冲突:A. 在公司债券合同中包含限制性的条款B. 向经理提供大量的股票期权C. 通过法律使得公司更容易抵制敌意收购D. 以上所有都是正确的3. 以下哪项措施很可能减少股东和经理之间的代理冲突:A. 付给经理很多固定薪金B. 增加公司替换经理的威胁C. 在债务合同中设置限制性条款D. 以上所有都是正确的4. 以下哪项措施很可能减少股东和经理之间的代理冲突:A. 通过法律严格限制敌意收购B. 经理得到较低的薪水但可以得到额外的公司股票C. 董事会对其公司管理不善加强监控D. B和C是正确的5. 以下哪项机制可以用来激励经理为股东利益而工作?A. 债券契约B. 被收购的威胁C. 来自于董事会的压力D. B和C是正确的6. 以下哪个说法最正确?A. 财务经理的主要目的是为了公司预期现金流量最大化,因为这些预期现金流量最能增加公司股东(所有者)的财富。

《公司理财》试题及答案第一章公司理财概述一、单项选择题1、在筹资理财阶段,公司理财的重点内容是( B )。

A有效运用资金 B如何设法筹集到所需资金 C研究投资组合 D国际融资二、填空题1、在内部控制理财阶段,公司理财的重点内容是如何有效地(运用资金)。

2、西方经济学家和企业家以往都以(利润最大化)作为公司的经营目标和理财目标。

3、现代公司的理财目标是(股东财富最大化)。

4、公司资产价值增加,生产经营能力提高,意味着公司具有持久的、强大的获利能力和(偿债能力)。

5、公司筹资的渠道主要有两大类,一是(自有资本)的筹集,二是(借入资本)的筹集。

三、简答题1、为什么以股东财富最大化作为公司理财目标?(1)考虑到了货币时间价值和风险价值;(2)体现了对公司资产保值增值的要求;(3)有利于克服公司经营上的短期行为,促使公司理财当局从长远战略角度进行财务决策,不断增加公司财富。

2、公司理财的具体内容是什么?(1)筹资决策;(2)投资决策;(3)股利分配决策。

第二章财务报表分析一、单项选择题1、资产负债表为( B )。

A动态报表 B静态报表 C动态与静态相结合的报表 D既不是动态报表也不是静态报表2、下列负债中属于长期负债的是( D )。

A应付账款 B应交税金 C预计负债 D应付债券3、公司流动性最强的资产是( A )。

A货币资金 B短期投资 C应收账款 D存货4、下列各项费用中属于财务费用的是( C )。

A广告费 B劳动保险费 C利息支出 D坏账损失5、反映公司所得与所占用的比例关系的财务指标是( B )。

A资产负债率 B资产利润率 C销售利润率 D成本费用利润率二、多项选择题1、与资产负债表中财务状况的计量直接联系的会计要素有( ABC )。

A资产 B负债 C所有者权益 D成本费用 E收入利润2、与利润表中经营成果的计量有直接联系的会计要素有( BCD )。

A资产 B收入 C成本和费用 D利润 E所有者权益三、填空题1、资产的实质是(经济资源)。

Practice Problems(Stock Valuation)1. Michael’s, Inc. just paid $1.40 to their shareholders as the annual dividend. Simultaneously,the company announced that future dividends will be increasing by 4.5 percent. If yourequire an 8 percent rate of return, how much are you willing to pay to purchase one shareof Michael’s stock?2. Angelina’s made two announcements concerning their common stock today. First, thecompany announced that their next annual dividend has been set at $2.16 a share.Secondly, the company announced that all future dividends will increase by 4 percentannually. What is the maximum amount you should pay to purchase a share ofAngelina’s stock if your goal is to earn a 10 percent rate of return?3. A stock pays a constant annual dividend and sells for $31.11 a share. If the rate ofreturn on this stock is 9 percent, what is the dividend amount?4. You have decided that you would like to own some shares of GH Corp. but need anexpected 12 percent rate of return to compensate for the perceived risk of such ownership.What is the maximum you are willing to spend per share to buy GH stock if the companypays a constant $3.50 annual dividend per share?5. Turnips and Parsley common stock sells for $39.86 a share at a market rate of return of9.5 percent. The company just paid their annual dividend of $1.20. What is the rate ofgrowth of their dividend?6. B&K Enterprises will pay an annual dividend of $2.08 a share on their common stocknext week. Last year, the company paid a dividend of $2.00 a share. The companyadheres to a constant rate of growth dividend policy. What will one share of B&Kcommon stock be worth ten years from now if the applicable discount rate is 8percent?7. The Red Bud Co. pays a constant dividend of $1.20 a share. The company announcedtoday that they will continue to do this for another 3 years after which time they willdiscontinue paying dividends permanently. What is one share of this stock worth todayif the required rate of return is 7 percent?8. Bill Bailey and Sons pays no dividend at the present time. The company plans to startpaying an annual dividend in the amount of $.30 a share for two years commencingtwo years from today. After that time, the company plans on paying a constant $1 ashare dividend indefinitely. How much are you willing to pay to buy a share of thisstock if your required return is 14 percent?9. Lee Hong Imports paid a $1.00 per share annual dividend last week. Dividends areexpected to increase by 5 percent annually. What is one share of this stock worth toyou today if the appropriate discount rate is 14 percent?(Portfolio and CAPM)10. You want your portfolio beta to be 1.20. Currently, your portfolio consists of $100invested in stock A with a beta of 1.4 and $300 in stock B with a beta of .6. You haveanother $400 to invest and want to divide it between an asset with a beta of 1.6 and arisk-free asset. How much should you invest in the risk-free asset?11. You have a $1,000 portfolio which is invested in stocks A and B plus a risk-free asset.$400 is invested in stock A. Stock A has a beta of 1.3 and stock B has a beta of .7.How much needs to be invested in stock B if you want a portfolio beta of .90?12. You recently purchased a stock that is expected to earn 12 percent in a booming economy, 8percent in a normal economy and lose 5 percent in a recessionary economy. There is a 15percent probability of a boom, a 75 percent chance of a normal economy, and a 10 percentchance of a recession. What is your expected rate of return on this stock?13. The Inferior Goods Co. stock is expected to earn 14 percent in a recession, 6 percent in anormal economy, and lose 4 percent in a booming economy. The probability of a boom is20 percent while the probability of a normal economy is 55 percent and the chance of arecession is 25 percent. What is the expected rate of return on this stock?14. You are comparing stock A to stock B. Given the following information, which one ofthese two stocks should you prefer and why?ifReturnRateofState of Probability of State OccursA Stock BEconomy State of Economy StockBoom 60% 9% 15%Recession 40% 4% -6%15. Zelo, Inc. stock has a beta of 1.23. The risk-free rate of return is 4.5 percent and the marketrate of return is 10 percent. What is the amount of the risk premium on Zelo stock?16. You own a portfolio with the following expected returns given the various states of theeconomy. What is the overall portfolio expected return?ofRateReturnStateofProbabilityofEconomy State of Economy ifOccursStateBoom 15% 18%Normal 60% 11%Recession 25% -10%17. What is the expected return on a portfolio which is invested 20 percent in stock A, 50percent in stock B, and 30 percent in stock C?State of Probability of Returns if State OccursEconomy State of Economy StockA StockB Stock CBoom 20% 18% 9% 6%Normal 70% 11% 7% 9%Recession 10% -10% 4% 13%18. What is the portfolio variance if 30 percent is invested in stock S and 70 percent isinvested in stock T?State of Probability of Returns if State OccursS Stock TStockEconomy State of EconomyBoom 40% 12% 20%Normal 60% 6% 4%19. What is the standard deviation of a portfolio that is invested 40 percent in stock Q and 60percent in stock R?State of Probability of Returns if State OccursQ Stock REconomy State of EconomyStockBoom 25% 18% 9%Normal 75% 9% 5%20. Your portfolio has a beta of 1.18. The portfolio consists of 15 percent U.S. Treasury bills,30 percent in stock A, and 55 percent in stock B. Stock A has a risk-level equivalent to thatof the overall market. What is the beta of stock B?21. You would like to combine a risky stock with a beta of 1.5 with U.S. Treasury bills in sucha way that the risk level of the portfolio is equivalent to the risk level of the overall market.What percentage of the portfolio should be invested in Treasury bills?22. The market has an expected rate of return of 9.8 percent. The long-term governmentbond is expected to yield 4.5 percent and the U.S. Treasury bill is expected to yield 3.4percent. The inflation rate is 3.1 percent. What is the market risk premium?23. The risk-free rate of return is 4 percent and the market risk premium is 8 percent. Whatis the expected rate of return on a stock with a beta of 1.28?24. The common stock of Flavorful Teas has an expected return of 14.4 percent. Thereturn on the market is 10 percent and the risk-free rate of return is 3.5 percent. Whatis the beta of this stock?25. Which one of the following stocks is correctly priced if the risk-free rate of return is3.6 percent and the market rate of return is 10.5 percent?Stock Beta ExpectedReturnA .85 9.2%B 1.08 11.8%C 1.69 15.3%D .71 7.8%E 1.45 12.3%(Capital Structure and WACC)26. Watson’s Automotive has a $400,000 bond issue outstanding that is selling at 102percent of face value. Watson’s also has 4,500 shares of preferred stock and 21,000shares of common stock outstanding. The preferred stock has a market price of $44 ashare compared to a price of $21 a share for the common stock. What is the weight ofthe debt as it relates to the firm’s weighted average cost of capital?27. Gillian’s Boutique has 850,000 shares of common stock outstanding at a market priceof $16 a share. The company also has 15,000 bonds outstanding that are quoted at 98percent of face value. What weight should be given to the common stock whenGillian’s computes their weighted average cost of capital?28. Jack’s Construction Co. has 80,000 bonds outstanding that are selling at par value.Bonds with similar characteristics are yielding 8.5 percent. The company also has4 million shares of common stock outstanding. The stock has a beta of 1.1 and sells for$40 a share. The U.S. Treasury bill is yielding 4 percent and the market risk premiumis 8 percent. Jack’s tax rate is 35 percent. What is Jack’s weighted average cost ofcapital?29. Peter’s Audio Shop has a cost of debt of 7 percent, a cost of equity of 11 percent, and a costof preferred stock of 8 percent. The firm has 104,000 shares of common stock outstandingat a market price of $20 a share. There are 40,000 shares of preferred stock outstanding at amarket price of $34 a share. The bond issue has a total face value of $500,000 and sells at102 percent of face value. The company’s tax rate is 34 percent. What is the weightedaverage cost of capital for Peter’s Audio Shop?(M&M)30. Thompson & Thomson is an all equity firm that has 500,000 shares of stock outstanding.The company is in the process of borrowing $8 million at 9 percent interest to repurchase200,000 shares of the outstanding stock. What is the value of this firm if you ignore taxes?31. Uptown Interior Designs is an all equity firm that has 40,000 shares of stock outstanding.The company has decided to borrow $1 million to buy out the shares of a deceasedstockholder who holds 2,500 shares. What is the total value of this firm if you ignore taxes?32. The Winter Wear Company has expected earnings before interest and taxes of $2,100, anunlevered cost of capital of 14 percent and a tax rate of 34 percent. The company also has$2,800 of debt that carries a 7 percent coupon. The debt is selling at par value. What is thevalue of this firm?33. Gail’s Dance Studio is currently an all equity firm that has 80,000 shares of stockoutstanding with a market price of $42 a share. The current cost of equity is 12 percent andthe tax rate is 34 percent. Gail is considering adding $1 million of debt with a coupon rateof 8 percent to her capital structure. The debt will be sold at par value. What is the leveredvalue of the equity?34. Wild Flowers Express has a debt-equity ratio of .60. The pre-tax cost of debt is 9 percentwhile the unlevered cost of capital is 14 percent. What is the cost of equity if the tax rate is34 percent?35. Your firm has a $250,000 bond issue outstanding. These bonds have a 7 percent coupon,pay interest semiannually, and have a current market price equal to 103 percent of facevalue. What is the amount of the annual interest tax shield given a tax rate of 35 percent? 36. Bertha’s Boutique has 2,000 bonds outstanding with a face value of $1,000 each and acoupon rate of 9 percent. The interest is paid semi-annually. What is the amount of theannual interest tax shield if the tax rate is 34 percent?37. Your firm has expected earnings before interest and taxes of $1,600. Your unlevered cost ofcapital is 13 percent and your tax rate is 34 percent. You have debt with both a book and aface value of $2,500. This debt has an 8 percent coupon and pays interest annually. What isyour weighted average cost of capital?38. A firm has debt of $5,000, equity of $16,000, a leveraged value of $8,900, a cost of debt of8 percent, a cost of equity of 12 percent, and a tax rate of 34 percent. What is the firm’sweighted average cost of capital?(Answer Keys)1.$41.802.$36.003.$2.804.$29.175. 6.3 percent6.$76.977.$3.158.$5.259.$11.6710.$011.$54312.7.30 percent13.6.00 percent14.Stock A; because it has a higher expected return and appears to be less risky than stock B.15.6.77 percent16.6.8 percent17.8.25 percent18..00405619.2.6 percent20.1.6021..3322.6.4 percent23.14.24 percent24.1.6825.C26.39 percent27.48 percent28.10.38 percent29.9.14 percent30.$20.0 million31.$16.0 million32.$10,85233.$2.7 million34.15.98 percent35.$6,12536.$61,20037.11.77 percent38.10.40 percent。