巴罗宏观经济学:现代观点第10章

- 格式:ppt

- 大小:477.04 KB

- 文档页数:21

第12章政府支出12.1 复习笔记考点一:政府预算约束★★★1.政府支出政府支出是指各级政府购买商品和服务、转移支付(转移支付给家庭和厂商的金额)和利息支出所付出的货币。

政府支出主要用于采购商品和服务,分为中央政府采购和地方政府采购。

2.政府预算约束的定义政府预算约束是指政府资金使用总量所受到的限制。

一般而言,政府的资金使用总量必须等于资金来源总量。

其中,政府资金主要用于购买商品和服务以及转移支付;资金来源为税收和货币创造的收入。

因此,简单的政府预算约束用方程式可以表示为:G t+V t=T t+(M t-M t-1)/P t实际采购+实际转移支付=实际税收+货币创造的实际收入其中,G t表示实际采购支出;V t表示实际转移支付;T t表示实际税收;(M t-M t-1)/P t表示货币创造的实际收入。

该式表明,政府资金使用总量等于政府资金来源总量。

通常情况下,政府印制货币的实际收入占政府总收入的很小部分,因此在模型分析中常将此忽略不计,从而政府的预算约束可以简化为:G t+V t=T t上式表明,政府的实际采购支出与实际转移支付之和等于政府的实际税收收入。

3.公共生产与公共服务通常情况下不考虑公共生产,实际上是假设政府将其所有生产分包给了私人部门,政府向私人生产者购买最终商品和服务。

公共服务包括为家庭带来效用的服务和对私人生产的投入等。

考点二:家庭预算约束(见表12-1)★★★★表12-1 家庭预算约束考点三:政府采购的持久性变化(见表12-2)★★★★表12-2 政府采购的持久性变化考点四:政府采购的暂时性变化(见表12-3)★★★★表12-3 政府采购的暂时性变化12.2 课后习题详解一、概念题1.政府的预算约束(government’s budget constraint)答:政府预算约束是指政府资金使用总量所受到的限制。

一般而言,政府的资金使用总量必须等于资金来源总量。

其中,政府资金主要用于购买商品和服务以及转移支付;资金来源为税收和货币创造的收入。

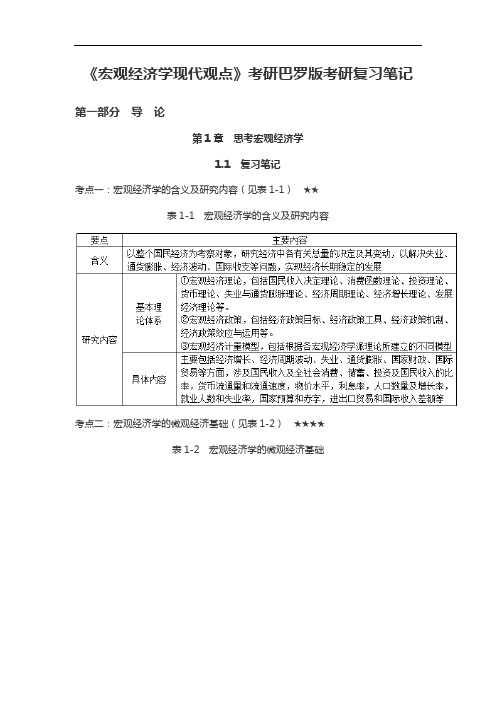

《宏观经济学现代观点》考研巴罗版考研复习笔记第一部分导论

第1章思考宏观经济学

1.1 复习笔记

考点一:宏观经济学的含义及研究内容(见表1-1)★★

表1-1 宏观经济学的含义及研究内容

考点二:宏观经济学的微观经济基础(见表1-2)★★★★

表1-2 宏观经济学的微观经济基础

考点三:经济模型与现代宏观经济学的研究方法(见表1-3)★★★

表1-3 经济模型与现代宏观经济学的研究方法

考点四:浮动价格与粘性价格★★

市场出清的隐含条件是价格能够迅速调整使得市场上供求平衡,但在现实当中,价格粘性甚至价格刚性都是存在的。

正如凯恩斯所提出的,劳动力市场通常处于非均衡的状态,因此,短期中劳动力的需求量与供给量之间总是存在着差异,工资率是粘性的,它仅作缓慢调整以便在长期中使劳动力市场出清。

近年来,一些宏观经济学家强调有些商品市场出现不均衡状态,这种分析方法称为新凯恩斯模型。

很多时候,宏观经济学家认为长期中价格或工资是充分变动的,而在短期分析当中则存在粘性。

当然,将长期增长的分析方法运用在短期分析当中将有助于理解宏观经济的短期波动。

宏观经济学家们一致认为:经济始终是在向市场出清状态接近的。

因此,不管对短期内粘性价格显著性的最终判定如何,利用市场出清模型做宏观经济分析确实是一条最佳的途径。

Exercise for MacroeconomicsChapter 8TRUE/FALSE1. Intertemporal substitution effects are substitution effects over time.2. When the marginal product of labor increases due to a positive technology change, the real wage falls.3. The model predicts that in response to a permanent positive change in technology real consumptionwill be procyclical.4. An increase in the interest rate makes future consumption cheaper and future leisure more expensive.5. The income effect on labor supply is positive.MULTIPLE CHOICE1. The cyclical part of real GDP isa. trend real GDP less real GDP. c. real GDP/trend real GDP.b. real GDP less trend real GDP. d. trend real GDP/real GDP.2. Real GDP equals:a. trend real GDP plus the cyclical part ofGDP c. trend real GDP less the cyclical part ofGDP.b. trend real GDP times the cyclical part ofGDP. d. trend real GDP divided by the cyclicalpart of GDP.3. An equilibrium business-cycle model:a. uses shocks to GDP to find equilibriumconditions. c. uses equilibrium conditions to determinehow shocks affect real GDP and othermacroeconomic variables. .b. uses GDP to find equilibrium shocks tothe economy.d. uses GDP to find equilibrium conditions.4. An increase in the level of technology, A, causes:a. an increase in the MPL c. a movement along the MPL hiring morelabor.b. a decrease in the MPL d. a movement along the MPL hiring lesslabor.5. The model predicts that an economic expansion caused by an increase in technology, A, will:a. drive down the real wage. c. drive up the real wage.b. cause labor supply to be greater than labor d. lead to a relatively low real wage.demand.6. The model predicts that in a recession caused by an decrease in technology, A, we would observe:a. a relatively low real wage. c. a relatively high real wage.b. an excess demand for labor. d. an increase in the MPL7. If technology, A, increases, then:a. the MPK and the demand for capitalservices increase. c. the MPK increases and the demand forcapital services decreases.b. the MPK and the demand for capitalservices decrease. d. the MPK decreases and the demand forcapital services increases.8. The model predicts that if there is a technology, A, shock, the real rental price of capital will:a. be relatively high during an economicexpansion or a recession. c. be relatively high during an economicexpansion and relatively low during arecession.b. be relatively low during an economicexpansion or a recession. d. be relatively low during an economicexpansion and relatively high during a recession.9. The model predicts that if there is a technology, A, shock, the interest rate, i, will be:a. relatively high during an economicexpansion or a recession. c. relatively high during an economicexpansion and relatively low during a recession.b. relatively low during an economicexpansion or a recession. d. relatively low during an economicexpansion and relatively high during a recession.10. During an economic expansion due to an increase in technology, A, consumption will:a. tend to rise due to the income effect. c. tend to fall due to the intertemporalsubstitution effect of the interest raterising.b. may rise or fall depending on whether theincome effect is greater than thesubstitution effect or not.d. all of the above.11. During an economic expansion due to an increase in technology, A, consumption will:a. tend to fall due to the income effect. c. tend to rise due to the intertemporalsubstitution effect of the interest raterising.b. may rise or fall depending on whether theincome effect is greater than thesubstitution effect or not.d. all of the above.12. During an economic expansion due to an increase in technology, A, consumption will:a. tend to rise due to the income effect. c. tend to rise due to the intertemporalsubstitution effect of the interest raterising.b. be unchanged. d. tend to fluctuate.13. During an economic expansion due to an increase in technology, A, consumption will:a. tend to fall due to the income effect. c. tend to fall due to the intertemporalsubstitution effect of the interest raterising.b. be unchanged. d. tend to fluctuate.14. If technology, A, increases permanently then we would expect:a. consumption to decrease as thesubstitution effect would be greater than the income effect of the change. c. consumption to increase as thesubstitution effect would be greater than the income effect of the change.b. consumption to increase as the incomeeffect would be greater than thesubstitution effect of the change. d. consumption to decrease as the incomeeffect would be greater than thesubstitution effect of the change.15. If there is a permanent increase in technology, A, then we expect consumption to:a. increase by more than real GDP. c. increase but by less than real GDP.b. increase by the same amount as real GDP. d. be unchanged.16. If there were a permanent increase in technology, A, we would expect real saving to:a. increase as the increase in realconsumption is less than real GDP. c. decrease as the increase in realconsumption is more than real GDP.b. increase as the increase in realconsumption is more than real GDP. d. decrease as the increase in realconsumption is less than real GDP.17. A variable that moves in the same direction as real GDP is known as:a. acyclical. c. countercyclical.b. procyclical. d. exogenous.18. A variable that has little tendency to move during a business cycle is known as:a. acyclical. c. countercyclical.b. procyclical. d. exogenous.19. A variable that moves in the opposite direction as real GDP is known as:a. acyclical. c. countercyclical.b. procyclical. d. exogenous.20. An acyclical variable is one that:a. moves the same direction as real GDP. c. moves the opposite direction as real GDP.b. has little tendency to move during abusiness cycle.d. determined outside the model.21. An procyclical variable is one that:a. moves the same direction as real GDP. c. moves the opposite direction as real GDP.b. has little tendency to move during abusiness cycle.d. determined outside the model.22. An countercyclical variable is one that:a. moves the same direction as real GDP. c. moves the opposite direction as real GDP.b. has little tendency to move during abusiness cycle.d. determined outside the model.23. US real consumer expenditure since 1954 has been:a. procyclical. c. a cyclical.b. countercyclical. d. exogenous.24. US real gross domestic private investment since 1954 has been:a. procyclical. c. a cyclical.b. countercyclical. d. exogenous.25. Since 1954, in the US:a. real gross private investment has variedmore than real GDP, while real consumerexpenditure has varied less than real GDP. c. real gross private investment has variedless than real GDP, while real consumer expenditure has varied more than realGDP.b. real gross private investment and realconsumer expenditure have varied more than real GDP. d. real gross private investment and realconsumer expenditure have varied less than real GDP.26. US real average earnings of production workers since 1954 has been:a. procyclical. c. a cyclical.b. countercyclical. d. exogenous.27. US real rental price of capital since 1954 has been:a. procyclical as the model predicts. c. procyclical rather countercyclical as themodel predicts.b. countercyclical as the model predicts. d. countercyclical rather procyclical as themodel predicts.28. An example of a temporary change in technology would be:a. a new discovery. c. a harvest failure.b. a new invention. d. all of the above.29. An example of a temporary change in technology would be:a. a new discovery. c. a new invention.b. a general strike. d. all of the above.30. With a temporary change in technology the model predicts:a. the interest rate will be procyclical. c. a higher interest rate will motivatehouseholds to increase current real saving.b. a lower interest rate will motivatehouseholds to increase current realconsumption.d. all of the above.31. With a temporary change in technology the model predicts:a. the interest rate will be procyclical. c. a higher interest rate will motivatehouseholds to decrease current real saving.b. a lower interest rate will motivatehouseholds to decrease current realconsumption.d. all of the above.32. With a temporary change in technology, we would expect:a. the income effect of consumption to belarger. c. the intertemporal substitution effect onconsumption to be larger.b. the income effect of consumption to besmaller. d. the intertemporal substitution effect onconsumption to be larger.33. With a temporary positive change in technology we would expect real current consumption:a. to increase a lot. c. to remain unchanged.b. to decrease a lot. d. to either increase or decrease a little.34. With a temporary change in technology, A, we expect little change in consumption because:a. the income effect on consumption islarger. c. the intertemporal-substitution effect islarger.b. the income effect on consumption issmaller. d. the intertemporal-substitution effect issmaller.35. The model predicts that an economic expansion caused by a temporary increase in technology, A,would lead to:a. high real GDP and investment. c. low real GDP and investment.b. low real GDP and high real investment. d. high real GDP and low real investment.36. Temporary changes in technology, A, conflict with the data in that:a. investment is clearly acyclical. c. the wage rate is clearly countercyclical.b. consumption is clearly procyclical. d. all of the above.37. A higher real wage:a. makes consumption more expensive. c. makes leisure less expensive.b. makes it a worse deal for households towork an extra hour.d. makes leisure more expensive.38. A higher real wage:a. increases the income of householdsinducing them to work more. c. increases the income of householdsinducing them to work less.b. decreases the income of householdsinducing them to work more. d. decreases the income of householdsinducing them to work less.39. The overall effect of a higher real wage is:a. to increase labor as the income andsubstitution effect reinforce each other. c. to decrease labor as the income andsubstitution effect reinforce each other.b. ambiguous on labor as the income andsubstitution effect work against eachother. d. ambiguous because the income andsubstitution effect reinforce each other.40. We expect that an increase in real wages will:a. increase labor supply, if temporary. c. increase labor supply, whether permanentor temporary.b. increase labor supply, if permanent. d. reduce labor supply, whether permanent ortemporary.41. An increase in the interest rate induces worker to:a. work more in the current period and lessin the future. c. work less in the current period and morein the future.b. work more in the current period and in thefuture. d. work less in the current period and in thefuture.42. A higher interest rate makes:a. future consumption cheaper. c. current consumption more expensive.b. future leisure cheaper. d. all of the above.43. A higher interest rate makes:a. future consumption and leisure moreexpensive.c. future consumption and leisure cheaper.b. future consumption cheaper and futureleisure more expensive. d. future consumption more expensive andfuture leisure cheaper.44. A higher interest rate makes:a. current consumption and leisure moreexpensive.c. current consumption and leisure cheaper.b. current consumption cheaper and current.leisure more expensive. d. current consumption more expensive andcurrent leisure cheaper.45. A higher interest rate makes:a. current consumption and future leisuremore expensive. c. current consumption and future leisurecheaper.b. current consumption cheaper and future.leisure more expensive. d. current consumption more expensive andfuture leisure cheaper.46. Intertemporal substitution effects motivate households to:a. supply more labor when the wage rate istemporarily low. c. supply less labor when the wage rate istemporarily low.b. supply more labor when the wage rate ispermanently low. d. supply more labor when the wage rate ispermanently low.47. In the US since 1964 total hours worked and employment have been:a. acyclical. c. procyclical.b. countercyclical. d. exogenous.48. The measure of labor productivity used in the popular media is:a. Y/L c. procyclical.b. average product of labor. d. all of the above.49. In the model with an upward sloping supply curve of labor and increase demand for labor due to apositive technological, A, change:a. increases employment and the real wage. c. decreases employment and the real wage.b. decreases employment and increases thereal wage. d. decreases employment and increases thereal wage.50. When the labor supply of households is allowed to slope upward:a. the model predictions match the observeddata that employment and real wages arecountercyclical. c. the model predictions do not match theobserved data that employment and real wages are procyclical.b. the model predictions do not match theobserved data that employment and real wages are countercyclical. d. the model predictions match the observeddata that employment and real wages areprocyclical.SHORT ANSWER1. If there is a positive technological change, what happens in the labor market?2. What does the model predict about investment when technology increases and why and what do thedata show about investment in the US?3. What happens to consumption when there is a permanent and temporary increase in technology, A,and why?4. What is the relationship between real GDP and the cyclical part of GDP?5. What happens in the model, if a temporary technology change increase real wages temporarily?。

目 录第一部分 导 论第1章 思考宏观经济学第2章 国民收入核算:国内生产总值和物价水平第二部分 经济增长第3章 经济增长导论第4章 运用索洛增长模型第5章 有条件趋同和长期经济增长第三部分 经济波动第6章 市场、价格、供给和需求第7章 消费、储蓄和投资第8章 均衡经济周期模型第9章 资本的利用和失业第四部分 货币和价格第10章 货币需求和物价水平第11章 通货膨胀、货币增长和利率第五部分 政府部门第12章 政府支出第13章 税 收第14章 公共债务第六部分 货币与经济周期第15章 货币与经济周期Ⅰ:价格错觉模型第16章 货币与经济周期Ⅱ:粘性价格与名义工资率第七部分 国际宏观经济学第17章 商品和信贷的世界市场第18章 汇 率第一部分 导 论第1章 思考宏观经济学一、概念题1景气(boom)答:景气(或繁荣)是指在经济周期中,经济活动处于全面扩张,不断达到新的高峰的阶段。

一个完整的经济周期包括繁荣、衰退、萧条、复苏四个阶段。

有时也将复苏阶段和繁荣阶段合称扩张阶段。

经济学家们构建了若干指标来判断经济是否处于景气期,如采购经理人指数(PMI)等。

2经济周期(商业周期)(business cycle)答:经济周期又称经济波动或国民收入波动,指总体经济活动的扩张和收缩交替反复出现的过程。

现代经济学中关于经济周期的论述一般是指经济增长率的上升和下降的交替过程,而不是经济总量的增加和减少。

一个完整的经济周期包括繁荣、衰退、萧条、复苏(也可以称为扩张、持平、收缩)四个阶段。

在繁荣阶段,经济活动全面扩张,不断达到新的高峰。

在衰退阶段,经济短时间内保持均衡后出现紧缩的趋势。

在萧条阶段,经济出现急剧的收缩和下降,很快从活动量的最高点下降到最低点。

在复苏阶段,经济从最低点恢复并逐渐上升到先前的活动量高度,进入繁荣。

衡量经济周期处于什么阶段,主要依据国民生产总值、工业生产指数、就业和收入、价格指数、利息率等综合经济活动指标的波动。

第十单元宏观经济学主要流派本单元所涉及到的主要知识点:1.古典学派与凯恩斯经济学;2.正统凯恩斯主义;3.货币主义;4.供给学派;5.新古典宏观经济学;6.新凯恩斯主义。

一、单项选择1.萨伊定律在货币经济中表现为()。

a.投资恒等于储蓄;b.投资等于储蓄;c.货币供给恒等于货币需求;d.货币供给等于货币需求。

2.古典经济学说与凯恩斯主义经济学说争论的焦点是()。

a.市场机制能否自动实现充分就业均衡;b.市场机制能否自动合理配置资源;c.需求管理政策比供给管理政策是否更有效果;d.货币政策比财政政策是否更有效果。

3.强调市场经济具有自我矫正机制、能够自动实现充分就业均衡的学说叫做()。

a.凯恩斯经济学;b.凯恩斯主义;c.新凯恩斯主义;d.古典经济学。

4.强调市场经济不能自动实现充分就业均衡的学说通常叫做()。

a.凯恩斯主义;b.货币主义;c.古典学说;d.新古典宏观经济学。

5.古典经济学的理论基础是()。

a.奥肯定律;b.蒙代尔定律;c.萨伊定律;d.李嘉图等价定理。

6.在欧文·费雪的交易方程与剑桥方程中,货币数量的变动仅仅影响()。

a.实际收入;b.名义收入;c.一般价格水平;d.总就业量。

7.凯恩斯主义认为,货币数量的变动()a.仅仅影响价格水平;b.会同时影响价格水平和实际收入;c.仅仅影响实际收入;d.对价格水平和实际收入没有任何影响。

8.货币主义认为,货币数量的变动()。

a.在短期,会影响价格水平与实际收入;b.在长期,会影响价格水平与实际收入;c.在短期仅仅影响一般价格水平;d.在长期仅仅影响实际收入。

9.货币主义者相信货币流通速度()。

a.相当易变;b.短期内比较稳定,在长期会剧烈变动;c.相当稳定;d.短期内剧烈变动,在长期比较稳定。

10.古典经济学认为()。

a.货币数量的变动不影响真实变量值;b.货币数量的变动影响真实变量值;c.货币数量的变动影响就业量;d.货币数量的变动影响商品的相对价格。

第5章有条件趋同和长期经济增长5.1复习笔记1.实际中的有条件趋同以人均资本增长率表示的条件趋同:()()()/0,k k k k ϕ*-+∆=⎡⎤⎣⎦,由于生产函数()y A f k =⋅,则可以用将/y y ∆替换/k k ∆,用()0y 替换()0k ,y *替换k *,得到实际GDP 表示的条件趋同方程式:()()()/0,y y y y ϕ*-+∆=⎡⎤⎣⎦因为现实当中对于人均实际资本占有量的统计相对于人均实际GDP 更繁琐,实践操作上一般直接采用以实际GDP 表示的条件趋同方程。

该方程式有两条结论:(1)当y *保持不变时,每个工人的实际GDP 增长率/y y ∆应该表示出趋同:较低的()0y 对应较高的/y y ∆。

(2)对于给定的()0y ,任何提高或降低y *的因素都会相应地提高或降低/y y ∆。

2.AK 模型(1)AK 模型简介AK 模型是在索洛模型的基础上,假设不变的外生储蓄率和固定的技术水平,从而解释消除报酬递减后将如何导致内生增长的经济增长模型。

(2)AK 模型的基本内容设生产函数为Y AK =,A 为反映技术水平的常数,K 为资本存量,则人均产出为y Ak =,k 为人均资本存量。

该生产函数的两个性质为:第一,规模报酬不变,即()Y A K λλ=;第二,资本的边际产品不变,为常数。

将人均产出方程变形可得/y k A =,将/y k A =代入核心方程()//k k s y k s n δ∆=--,则索洛模型的关键方程转化为:/k k sA s n δ∆=--,/k k ∆变为一条水平的直线,人均资本以sA s n δ--速度维持增长。

图5-1资本的平均产品不变的经济增长如图5-1所示,AK 模型中,/y k 等于技术水平A ,因而()/s y k 曲线变成水平线sA 。

如果sA 大于s n δ+,每个工人的资本增长率/k k ∆是一个正的常数,为sA s n δ--,即图5-1中两条水平线之间的垂直距离。