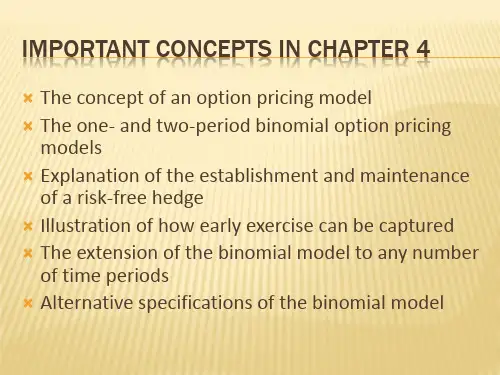

Conditions and assumptions

One period, two outcomes (states) S = current stock price u = 1 + return if stock goes up d = 1 + return if stock goes down r = risk-free rate

h

Cu Su

Cd Sd

,

hu

Cu2 Su 2

Cud Sud

,

hd

Cud Sud

Cd2 Sd2

THE TWO-PERIOD BINOMIAL MODEL (CONTINUED)

An Illustrative Example

Su2 = 100(1.25)2 = 156.25 Sud = 100(1.25)(.80) = 100 Sd2 = 100(.80)2 = 64 The call option prices are as follows

Value of investment: V = 556($100) 1,000($14.02) = $41,580. (This is how much money you must put up.)

Stock goes to $125

Value of investment = 556($125) - 1,000($25) = $44,500

V(1+r) = Vu (or Vd)

Substituting for V and Vu

(hS - C)(1+r) = hSu - Cu

THE ONE-PERIOD BINOMIAL MODEL (CONTINUED)