财务会计相关复习题(英文版)

- 格式:doc

- 大小:108.50 KB

- 文档页数:13

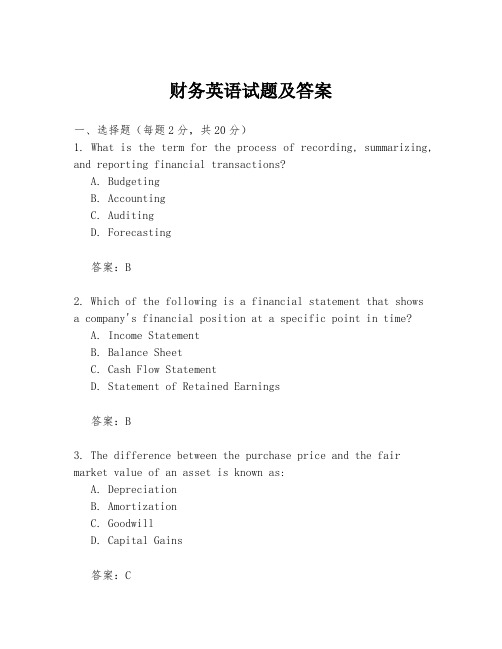

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

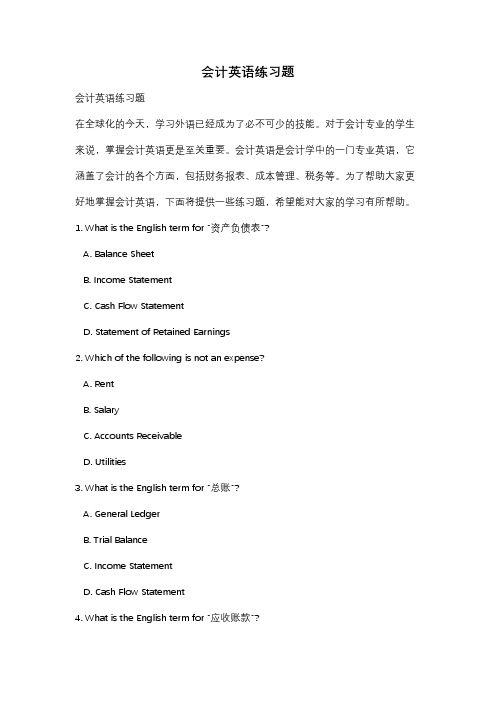

会计英语练习题会计英语练习题在全球化的今天,学习外语已经成为了必不可少的技能。

对于会计专业的学生来说,掌握会计英语更是至关重要。

会计英语是会计学中的一门专业英语,它涵盖了会计的各个方面,包括财务报表、成本管理、税务等。

为了帮助大家更好地掌握会计英语,下面将提供一些练习题,希望能对大家的学习有所帮助。

1. What is the English term for "资产负债表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings2. Which of the following is not an expense?A. RentB. SalaryC. Accounts ReceivableD. Utilities3. What is the English term for "总账"?A. General LedgerB. Trial BalanceC. Income StatementD. Cash Flow Statement4. What is the English term for "应收账款"?A. Accounts PayableB. Accounts ReceivableC. InventoryD. Prepaid Expenses5. What is the English term for "固定资产"?A. Current AssetsB. Fixed AssetsC. Intangible AssetsD. Accounts Payable6. What is the English term for "净利润"?A. Gross ProfitB. Operating IncomeC. Net IncomeD. Retained Earnings7. What is the English term for "应付账款"?A. Accounts PayableB. Accounts ReceivableC. Accrued ExpensesD. Prepaid Expenses8. What is the English term for "现金流量表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings9. What is the English term for "财务报表分析"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting10. What is the English term for "税务"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting以上是一些关于会计英语的练习题,希望大家能够认真思考并给出正确答案。

英语财务笔试题库及答案1. What is the difference between a balance sheet and an income statement?Answer: A balance sheet is a snapshot of a company's financial condition at a specific point in time, showing assets, liabilities, and equity. An income statement, on the other hand, reports a company's financial performance over a period of time, including revenues, expenses, and net income.2. Define the term 'Depreciation'.Answer: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life to reflect the consumption of the asset.3. Explain the concept of 'Accrual Accounting'.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.4. What is 'Capital Budgeting' and why is it important?Answer: Capital budgeting is the process of evaluating investment opportunities to determine whether they are financially viable and beneficial for a company. It is important as it helps in making long-term financial decisions.5. How do you calculate 'Net Present Value' (NPV)?Answer: Net Present Value (NPV) is calculated bysubtracting the present value of cash outflows (includinginitial investment) from the present value of cash inflows over a period of time, using a discount rate.6. What is 'Financial Leverage' and how does it affect a company?Answer: Financial leverage refers to the use of borrowed funds to increase the return on equity. It affects a company by increasing the risk and potential return on investment.7. Describe the 'Time Value of Money'.Answer: The time value of money is the concept that a sum of money is worth more now than the same sum in the future due to its potential earning capacity.8. What is 'Earnings Per Share' (EPS)?Answer: Earnings Per Share (EPS) is a financial metric calculated as the company's net income divided by the outstanding shares of its common stock, indicating the profit allocated to each share.9. Explain the 'Cash Conversion Cycle'.Answer: The cash conversion cycle is the length of time it takes for a company to convert its investment in inventory and receivables into cash.10. What is 'Break-Even Analysis' and how is it used?Answer: Break-even analysis is a method used to determine the number of units a company must sell to cover its costs and make a profit. It is used to evaluate the financial viability of a project or business.11. Define 'Working Capital'.Answer: Working capital is the difference between a company's current assets and current liabilities, representing the funds available for day-to-day operations.12. What is 'Liquidity Ratio' and how is it calculated?Answer: Liquidity ratio is a measure of a company'sability to pay short-term obligations. It is calculated by dividing current assets by current liabilities.13. Explain 'Return on Investment' (ROI).Answer: Return on Investment (ROI) is a financial metric that measures the profitability of an investment. It is calculated by dividing the net profit from the investment by the initial cost of the investment.14. What is 'Inflation' and how does it affect financial statements?Answer: Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. It affects financial statements by reducing the real value of assets and increasing the cost of goods and services.15. Define 'Audit' in the context of finance.Answer: An audit is a systematic review and examination of a company's financial records, typically performed by an independent third party, to ensure accuracy, compliance with regulations, and to detect fraud.。

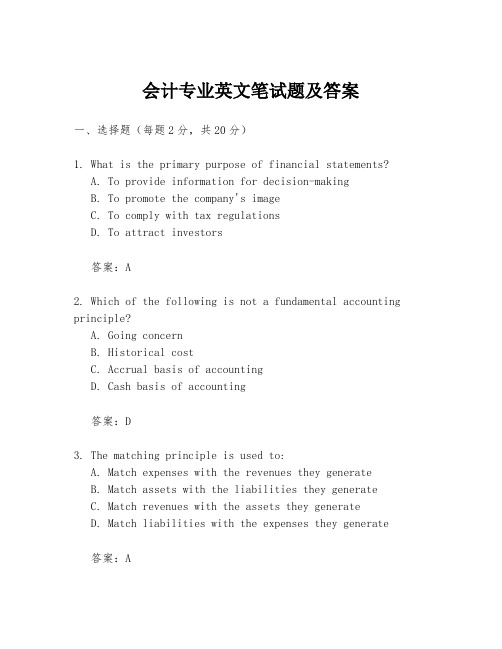

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

会计英语考试试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Payroll Report2. What is the term for the process of recording transactions in the accounting records?A. JournalizingB. PostingC. ClosingD. Adjusting3. The matching principle is a fundamental concept in accounting that requires:A. Revenues to be recognized when earnedB. Expenses to be recognized when paidC. Expenses to be recognized in the same period as the revenues they generateD. Both A and B4. What is the formula for calculating the return on investment (ROI)?A. ROI = (Net Income / Total Assets) x 100B. ROI = (Net Income / Total Liabilities) x 100C. ROI = (Net Income / Investment) x 100D. ROI = (Total Assets / Net Income) x 1005. Which of the following is not a type of depreciation method?A. Straight-lineB. Declining balanceC. Units of productionD. FIFO (First-In, First-Out)6. What is the purpose of an audit?A. To ensure that financial statements are accurate and completeB. To provide tax adviceC. To prepare financial statementsD. To manage a company's finances7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different books8. What is the accounting equation?A. Assets = Liabilities + EquityB. Revenue - Expenses = Net IncomeC. Assets - Liabilities = Net IncomeD. Assets + Liabilities = Equity9. Which of the following is not a component of the statement of cash flows?A. Operating activitiesB. Investing activitiesC. Financing activitiesD. Non-operating activities10. What is the purpose of adjusting entries?A. To correct errors in the accounting recordsB. To update the financial statementsC. To ensure that the accounting equation is balancedD. To allocate expenses and revenues to the correct accounting periods答案:1. D2. A3. C4. C5. D6. A7. B8. A9. D10. D二、简答题(每题5分,共30分)1. 简述会计的四大基本原则。

财务会计练习(英语)PRACTIC1.CHOICE QUESTIONS38. Preparing a work sheet involvesa. two steps.b. three steps.c. four steps.d. five steps.39. The adjustments entered in the adjustments columns of a work sheet area. not journalized.b. posted to the ledger but not journalized.c. not journalized until after the financial statements are prepared.d. journalized before the work sheet is completed.40. The information for preparing a trial balance on a work sheet is obtained froma. financial statements.b. general ledger accounts.c. general journal entries.d. business documents.41. An adjusted trial balancea. is prepared after the financial statements have been prepared.b. proves the equality of the debits and the credits of the ledger accounts.c. is required by GAAP.d. is prepared after the post-closing trial balance.42. The income statement columns of the DelMonico Company’s worksheet reports total debits of $50,000 and total credits of $35,000. This means thata. the company earned net income of $15,000 for the period.b. the worksheet has an error because debits do not equal credits.c. the company has a net loss of $15,000d. distributions to owners for the period totalled $15,000.43. A work sheet is a multiple column form that facilitates thea. identification of events.b. measurement process.c. preparation of financial statements.d. analysis process.44. Which of the following companies would be least likely to use a work sheet to facilitatethe adjustment process?a. Large company with numerous accountsb. Small company with numerous accountsc. All companies, since work sheets are required under generally acceptedaccounting principlesd. Small company with few accounts45. A work sheet can be thought of as a(n)a. permanent accounting record.b. optional device used by accountants.c. part of the general ledger.d. part of the journal.46. The account, Supplies, will appear in the following debit columns of the work sheet.a. Trial balanceb. Adjusted trial balancec. Balance sheetd. All of these47. When constructing a work sheet, accounts are often needed that are not listed in thetrial balance already entered on the work sheet from the ledger. Where should these additional accounts be shown on the work sheet?a. They should be inserted in alphabetical order into the trial balance accountsalready given.b. They should be inserted in chart of account order into the trial balance alreadygiven.c. They should be inserted on the lines immediately below the trial balance totals.d. They should not be inserted on the trial balance until the next accounting period.48. When using a work sheet, adjusting entries are journalizeda. after the work sheet is completed and before financial statements are prepared.b. before the adjustments are entered on to the work sheet.c. after the work sheet is completed and after financial statements have beenprepared.d. before the adjusted trial balance is extended to the proper financial statementcolumns.49. Closing entries are made for all accounts excepta. Revenuesb. Expensesc. Dividendsd. Common Stock50. Adjusting journal entries are prepared froma. source documents.b. the adjustment columns of the work sheet.c. the general ledger.d. last year's work sheet.51. The net income (or loss) for the perioda. is found by computing the difference between the income statement credit columnand the balance sheet credit column on the work sheet.b. cannot be found on the work sheet.c. is found by computing the difference between the income statement columns ofthe work sheet.d. is found by computing the difference between the trial balance totals and theadjusted trial balance totals.52. The work sheet does not showa. net income or loss for the period.b. revenue and expense account balances.c. the ending balance in the retained earnings account.d. the trial balance before adjustments.53. If the total debits exceed total credits in the balance sheet columns of the worksheet,retained earningsa. will increase because net income has occurred.b. will decrease because a net loss has occurred.c. is in error because a mistake has occurred.d. will not be affected.Use the following information for questions 54–55.The income statement and balance sheet columns of Pine Company's work sheet reflects the following totals: Income Statement Balance SheetDr. Cr. Dr.Cr.Totals $58,000 $45,000 $34,000 $47,00054. The net income (or loss) for the period isa. $45,000 income.b. $13,000 income.c. $13,000 loss.d. not determinable.55. To enter the net income (or loss) for the period into the above work sheet requires anentry to thea. income statement debit column and the balance sheet credit column.b. income statement credit column and to the balance sheet debit column.c. income statement debit column and the income statement credit column.d. balance sheet debit column and to the balance sheet credit column.56. Closing entries are necessary fora. permanent accounts only.b. temporary accounts only.c. both permanent and temporary accounts.d. permanent or real accounts only.57. Each of the following accounts is closed to Income Summary excepta. Expenses.b. Dividends.c. Revenues.d. All of these are closed to Income Summary.58. Closing entries are madea. in order to terminate the business as an operating entity.b. so that all assets, liabilities, and stockholders’ equity accounts will have zerobalances when the next accounting period starts.c. in order to transfer net income (or loss) and dividend to retained earnings.d. so that financial statements can be prepared.Use the following information from the Income Statement for the month of June, 2006 of Delgado Enterprises to answer questions 59 – 63.Revenues $7,000Expenses:Wages Expense $2,000Advertising Expense 200Rent Expense 1,000Supplies Expense 300Insurance Expense 100Total expenses 3,600Net income $3,40059. The entry to close the revenue account includesa. a debit to Income Summary for $3,400.b. a credit to Income Summary for $3,400.c. a debit to Income Summary for $7,000.d. a credit to Income Summary for $7,000.60. The entry to close the expense accounts includesa. a debit to Income Summary for $3,400.b. a credit to Rent Expense for $1,000,c. a credit to Income Summary for $3,600.d. a debit to Wages Expense for $2,000.61. After the revenue and expense accounts have been closed, the balance in IncomeSummary will bea. $0.b. a debit balance of $3,400.c. a credit balance of $3,400.d. a credit balance of $7,000.62. The entry to close Income Summary to Retained Earnings includesa. a debit to Revenue for $7,000.b. credits to Expenses totalling $3,600.c. a credit to Income Summary for $3,400d. a credit to Retained Earnings for $3,400.63. At June 1, 2006, Delgado reported Retained Earnings of $35,000. The companypaid no dividends during June. At June 30, 2006, the company will report a Retained Earnings balance ofa. $35,000 credit.b. $42,000 credit.c. $38,400 credit.d. $31,600 credit.64. Which of the following is a true statement about closing the books of a corporation?a. Expenses are closed to the Expense Summary account.b. Only revenues are closed to the Income Summary account.c. Revenues and expenses are closed to the Income Summary account.d. Revenues, expenses, and the Dividend account are closed to the IncomeSummary account.Use the following information from the Income Statement for the year 2006 of NOLA Inc. to answer questions 65 – 71. Revenues $70,000Expenses:Wages Expense $45,000Advertising Expense 6,000Rent Expense 12,000Supplies Expense 6,000Utilities Expense 2,500Insurance Expense 2,000Total expenses 73,500Net income (loss) $(3,500)65. The entry to close the revenue account includesa. a debit to Income Summary for $3,500.b. a credit to Income Summary for $3,500.c. a debit to Revenues for $70,000.d. a credit to Revenues for $70,000.66. The entry to close the expense accounts includesa. a debit to Income Summary for $3,500.b. a credit to Income Summary $3,500,c. a debit to Income Summary for $73,500.d. a debit to Wages Expense for $2,500.67. After the revenue and expense accounts have been closed, the balance in IncomeSummary will bea. $0.b. a debit balance of $3,500.c. a credit balance of $3,500.d. a credit balance of $70,000.68. The entry to close Income Summary to Retained Earnings includesa. a debit to Revenue for $70,000.b. credits to Expenses totalling $73,500.c. a credit to Income Summary for $3,500d. a credit to Retained Earnings for $3,500.69. At January 1, 2006, NOLA reported Retained Earnings of $50,000. Dividends for theyear totalled $10,000. At December 31, 2006, the company will report a Retained Earnings balance ofa. $13,500 debit.b. $36,500 credit.c. $40,000 credit.d. $43,500 credit.70. After all closing entries have been posted, the Income Summary account will have a balance ofa. $0.b. $3,500 debit.c. $3,500 credit.d. $36,500 credit.71. After all closing entries have been posted the Revenue account will have a balance ofa. $0.b. $70,000 credit.c. $70,000 debit.d. $3,500 credit.72. The Income Summary account is an important account that is useda. during interim periods.b. in preparing adjusting entries.c. annually in preparing closing entries.d. annually in preparing correcting entries.73. The balance in the income summary account before it is closed will be equal toa. the net income or loss on the income statement.b. the beginning balance in the retained earnings account.c. the ending balance in the retained earnings account.d. zero.74. After closing entries are posted, the balance in the Retained Earnings account in the ledger will be equal toa. the beginning Retained Earnings reported on the owner's equity statement.b. the amount of the Retained Earnings reported on the balance sheet.c. zero.d. the net income for the period.75. A post-closing trial balance is prepareda. after closing entries have been journalized and posted.b. before closing entries have been journalized and posted.c. after closing entries have been journalized but before the entries are posted.d. before closing entries have been journalized but after the entries are posted.76. All of the following statements about the post-closing trial balance are correct except ita. shows that the accounting equation is in balance.b. provides evidence that the journalizing and posting of closing entries have been properly completed.c. contains only permanent accounts.d. proves that all transactions have been recorded.77. A post-closing trial balance will showa. only permanent account balances.b. only temporary account balances.c. zero balances for all accounts.d. the amount of net income (or loss) for the period.78. A post-closing trial balance should be prepareda. before closing entries are posted to the ledger accounts.b. after closing entries are posted to the ledger accounts.c. before adjusting entries are posted to the ledger accounts.d. only if an error in the accounts is detected.79. A post-closing trial balance will showa. zero balances for all accounts.b. zero balances for balance sheet accounts.c. only balance sheet accounts.d. only income statement accounts.80. The purpose of the post-closing trial balance is toa. prove that no mistakes were made.b. prove the equality of the balance sheet account balances that are carried forwardinto the next accounting period.c. prove the equality of the income statement account balances that are carriedforward into the next accounting period.d. list all the balance sheet accounts in alphabetical order for easy reference.81. The balances that appear on the post-closing trial balance will match thea. income statement account balances after adjustments.b. balance sheet account balances after closing entries.c. income statement account balances after closing entries.d. balance sheet account balances after adjustments.82. Which account listed below would be double ruled in the ledger as part of the closing process?a. Cashb. Common Stockc. Dividendsd. Accumulated Depreciation83. A double rule applied to accounts in the ledger during the closing process implies thata. the account is a temporary account.b. the account is a balance sheet account.c. the account balance is not zero.d. a mistake has been made, since double ruling is prescribed.84. The heading for a post-closing trial balance has a date line that is similar to the one found ona. a balance sheet.b. an income statement.c. an owner's equity statement.d. the work sheet.85. Which one of the following is usually prepared only at the end of a company's annual accounting period?a. Preparing financial statementsb. Journalizing and posting adjusting entriesc. Journalizing and posting closing entriesd. Preparing an adjusted trial balance86. The step in the accounting cycle that is performed on a periodic basis (i.e., monthly, quarterly) isa. analyzing transactions.b. journalizing and posting adjusting entries.c. preparing a post-closing trial balance.d. posting to ledger accounts.87. Which one of the following is an optional step in the accounting cycle of a business enterprise?a. Analyze business transactionsb. Prepare a work sheetc. Prepare a trial balanced. Post to the ledger accounts88. The final step in the accounting cycle is to preparea. closing entries.b. financial statements.c. a post-closing trial balance.d. adjusting entries.89. Which of the following steps in the accounting cycle would not generally be performed daily?a. Journalize transactionsb. Post to ledger accountsc. Prepare adjusting entriesd. Analyze business transactions90. Which of the following steps in the accounting cycle may be performed more frequently than annually?a. Prepare a post-closing trial balanceb. Journalize closing entriesc. Post closing entriesd. Prepare a trial balance91. Which of the following depicts the proper sequence of steps in the accounting cycle?a. Journalize the transactions, analyze business transactions, prepare a trial balanceb. Prepare a trial balance, prepare financial statements, prepare adjusting entriesc. Prepare a trial balance, prepare adjusting entries, prepare financial statementsd. Prepare a trial balance, post to ledger accounts, post adjusting entries92. The two optional steps in the accounting cycle are preparinga. a post-closing trial balance and reversing entries.b. a work sheet and post-closing trial balances.c. reversing entries and a work sheet.d. an adjusted trial balance and a post-closing trial balance.93. The first required step in the accounting cycle isa. reversing entries.b. journalizing transactions in the book of original entry.c. analyzing transactions.d. posting transactions.94. Correcting entriesa. always affect at least one balance sheet account and one income statementaccount.b. affect income statement accounts only.c. affect balance sheet accounts only.d. may involve any combination of accounts in need of correction.95. Speedy Bike Company received a $740 check from a customer for the balance due.The transaction was erroneously recorded as a debit to Cash $470 and a credit to Service Revenue $470. The correcting entry isa. Debit Cash, $740; Credit Accounts Receivable, $740.b. Debit Cash, $270 and Accounts Receivable, $470; Credit Service Revenue, $740.c. Debit Cash, $270 and Service Revenue, $470; Credit Accounts Receivable, $740.d. Debit Accounts Receivable, $740; Credit Cash, $270 and Service Revenue, $470.96. If errors occur in the recording process, theya. should be corrected as adjustments at the end of the period.b. should be corrected as soon as they are discovered.c. should be corrected when preparing closing entries.d. cannot be corrected until the next accounting period.97. A correcting entrya. must involve one balance sheet account and one income statement account.b. is another name for a closing entry.c. may involve any combination of accounts.d. is a required step in the accounting cycle.98. An unacceptable way to make a correcting entry is toa. reverse the incorrect entry.b. erase the incorrect entry.c. compare the incorrect entry with the correct entry and make a correcting entry tocorrect the accounts.d. correct it immediately upon discovery.99. Cole Company paid the weekly payroll on January 2 by debiting Wages Expense for$40,000. The accountant preparing the payroll entry overlooked the fact that WagesExpense of $24,000 had been accrued at year end on December 31. The correctingentry isa. Wages Payable ............................................................................ 24,000Cash ................................................................................ 24,000b. Cash .......................................................................................... 16,000Wages Expense .............................................................. 16,000c. Wages Payable ............................................................................ 24,000Wages Expense .............................................................. 24,000d. Cash .......................................................................................... 24,000Wages Expense .............................................................. 24,000100. Tyler Company paid $630 on account to a creditor. The transaction was erroneously recorded as a debit to Cash of $360 and a credit to Accounts Receivable, $360. Thecorrecting entry isa. Accounts Payable (630)Cash (630)b. Accounts Receivable (360)Cash (360)c. Accounts Receivable (360)Accounts Payable (360)d. Accounts Receivable (360)Accounts Payable (630)Cash (990)101. A lawyer collected $860 of legal fees in advance. He erroneously debited Cash for $680 and credited Accounts Receivable for $680. The correcting entry isa. Cash (680)Accounts Receivable (180)Unearned Revenue (860)b. Cash (860)Service Revenue (860)c. Cash .............................................................................................180Accounts Receivable (680)Unearned Revenue (860)d. Cash (180)Accounts Receivable (180)102. All of the following are property, plant, and equipment excepta. supplies.b. machinery.c. land.d. buildings.Use the following information to answer questions 103-111.The following items are taken from the financial statements of Waters Company for the year ending 12/31/2006: Accounts payable $ 18,000Accounts receivable 11,000Accumulated depreciation – equipment 28,000Advertising expense 21,000Cash 15,000Common stock 90,000Depreciation expense 12,000Dividends 14,000Insurance expense 3,000Note payable, due 6/31/2007 70,000Prepaid insurance (12-month policy) 6,000Rent expense 17,000Retained earnings, 1/1/2006 12,000Salaries expense 32,000Service revenue 133,000Supplies 4,000Supplies expense 6,000Equipment 210,000103. What is the company’s net income for the year ending 12/31/2006?a. $133,000b. $42,000c. $28,000d. $12,000104. What is the balance that would be reported for Retained earnings at 12/31/2006?a. $12,000b. $40,000c. $42,000d. $56,000105. What are total current assets at 12/31/2006?a. $26,000b. $32,000c. $36,000d. $218,000106. What is the book value of the equipment at 12/31/2006?a. $238,000.b. $210,000c. $182,000d. $170,000107. What are total current liabililites at 12/31/2006?a. $18,000b. $70,000c. $88,000d. $0.108. What are total long-term liabilities at 12/31/2006?a. $0b. $70,000.c. $88,000d. $90,000109. What is total stockholders’ equity at 12/31/2006?a. $90,000.b. $102,000.c. $126,000.d. $130,000.110. The sub-classificatio ns for assets on the company’s classified balance sheet would include all of the following except:a. Current Assetsb. Property, Plant and Equipmentc. Intangible Assetsd. All of the above would be included as sub-classifications.111. The current assets should be listed on the balance sheet in the following order:a. cash, accounts receivable, prepaid insurance, equipmentb. cash, prepaid insurance, supplies, accounts receivablec. cash, accounts receivable, prepaid insurance, suppliesd. equipment, supplies, prepaid insurance, accounts receivable, cash112. The operating cycle of a company is the average time that is required to go from cash toa. sales in producing revenues.b. cash in producing revenues.c. inventory in producing revenues.d. accounts receivable in producing revenues.113. On a classified balance sheet, current assets are customarily listeda. in alphabetical order.b. with the largest dollar amounts first.c. in the order of liquidity.d. in the order of acquisition.114. Intangible assets include all of the following except:a. Marketable securities.b. Patents.c. Copyrights.d. Goodwill.115. The relationship between current assets and current liabilities is important in evaluating a company'sa. profitability.b. liquidity.c. market value.d. accounting cycle.116. The most important information needed to determine if companies can pay their current obligations is thea. net income for this year.b. projected net income for next year.c. relationship between current assets and current liabilities.d. relationship between short-term and long-term liabilities.a117. A reversing entrya. reverses entries that were made in error.b. is the exact opposite of an adjusting entry made in a previous period.c. is made when a business disposes of an asset it previously purchased.d. is made when a company sustains a loss in one period and reverses the effectwith a profit in the next period.a118. If a company utilizes reversing entries, they willa. be made at the beginning of the next accounting period.b. not actually be posted to the general ledger accounts.c. be made before the post-closing trial balance.d. be part of the adjusting entry process.119. The steps in the preparation of a work sheet do not includea. analyzing documentary evidence.b. preparing a trial balance on the work sheet.c. entering the adjustments in the adjustment columns.d. entering adjusted balances in the adjusted trial balance columns.120. Balance sheet accounts are considered to bea. temporary owner's equity accounts.b. permanent accounts.c. capital accounts.d. nominal accounts.121. Income Summary has a credit balance of $12,000 in J. Tayler Co. after closing revenues and expenses. The entry to close Income Summary isa. credit Income Summary $12,000, debit Retained Earnings $12,000.b. credit Income Summary $12,000, debit Dividends $12,000.c. debit Income Summary $12,000, credit Dividends $12,000.d. debit Income Summary $12,000, credit Retained Earnings $12,000.122. The post-closing trial balance contains onlya. income statement accounts.b. balance sheet accounts.c. balance sheet and income statement accounts.d. income statement, balance sheet, and owner's equity statement accounts.123. Which of the following is an optional step in the accounting cycle?a. Adjusting entriesb. Closing entriesc. Correcting entriesd. Reversing entries124. Which one of the following statements concerning the accounting cycle is incorrect?a. The accounting cycle includes journalizing transactions and posting to ledgeraccounts.b. The accounting cycle includes only one optional step.c. The steps in the accounting cycle are performed in sequence.d. The steps in the accounting cycle are repeated in each accounting period.125. Correcting entries are madea. at the beginning of an accounting period.b. at the end of an accounting period.c. whenever an error is discovered.d. after closing entries.126. On September 23, Reese Company received a $350 check from Mike Moluf for services to be performed in the future.The bookkeeper for Reese Company incorrectly debited Cash for $350 and credited Accounts Receivable for $350. The amounts have been posted to the ledger. To correct this entry, the bookkeeper shoulda. debit Cash $350 and credit Unearned Service Revenue $350.b. debit Accounts Receivable $350 and credit Unearned Service Revenue $350.c. debit Accounts Receivable $350 and credit Cash $350.d. debit Accounts Receivable $350 and credit Service Revenue $350.127. Fifth Dimension Inc. reported a balance in Retained Earnings of $45,000 on its post-closing trial balance at 12/31/2006. The company earned net income of $30,000 and paid dividends of $5,000 during the year. The 12/31/2006 balance sheet will report Retained Earnings ofa. $40,000b. $45,000c. $70,000d. $75,000128. Current liabilitiesa. must reasonably be expected to be paid from existing current assets or throughthe creation of other current liabilities.b. are listed in the balance sheet in order of their expected maturity.c. must reasonably be expected to be paid within one year or the operating cycle,whichever is shorter.d. should not include long-term debt that is expected to be paid within the next year.a129. The use of reversing entriesa. is a required step in the accounting cycle.b. changes the amounts reported in the financial statements.c. simplifies the recording of subsequent transactions.d. is required for all adjusting entries.2.MATCHING1 Match the items below by entering the appropriate code letter in the space provided.A. Intangible assets F. Book valueB. Permanent accounts G. Current assetsC. Closing entries H. Operating cycleD. Income Summary I. Current liabilitiesE. Reversing entry J. Correcting entries____ 1. Obligations expected to be paid within one year or one operating cycle out of current assets.____ 2. The difference between the cost and the accumulated depreciaion of a depreciable asset.____ 3. Noncurrent assets that do not have physical substance____ 4. A temporary account used in the closing process.____ 5. Balance sheet accounts whose balances are carried forward to the next period.____ 6. The average length of time to go from cash to cash in producing revenue.____ 7. Entries to correct errors made in recording transactions.____ 8. The exact opposite of an adjusting entry made in a previous period.____ 9. Entries at the end of an accounting period to transfer the balances of temporary accounts to a stockholders’ account. ____ 10. Resources which are expected to be realized in cash, sold, or consumed within one year of the balance sheet or the company's operating cycle,whichever is longer.2.MATCHING150. Match the items below by entering the appropriate code letter in the space provided.A. Cost of goods available for sale F. First-in, first-out (FIFO) methodB. Raw materials G. Last-in, first-out (LIFO) methodC. FOB shipping point H. Average cost methodD. FOB destination I. Inventory turnoverE. Net purchases J. Current replacement cost____ 1. Measures the number of times the inventory sold during the period.____ 2. Purchases less purchases returns and allowances and purchases discounts.____ 3. Goods that will be used in the production process but which have not yet been placed into production.____ 4. Cost of goods sold consists of the most recent inventory purchases.____ 5. Sum of beginning merchandise inventory and cost of goods purchased.____ 6. Title to the goods transfers when the public carrier accepts the goods from the seller.____ 7. Ending inventory valuation consists of the most recent inventory purchases.____ 8. The same unit cost is used to value ending inventory and cost of goods sold.____ 9. Title to goods transfers when the goods are delivered to the buyer.____ 10. The amount that would be paid at the present time to acquire an identical item.。

英语会计复习题英语会计复习题在学习会计的过程中,复习题是非常重要的一部分。

通过做题,我们可以巩固知识点,检验自己的理解程度,并且为考试做好准备。

下面是一些英语会计复习题,希望对大家的学习有所帮助。

1. What is the basic accounting equation?The basic accounting equation is Assets = Liabilities + Equity. It represents the fundamental relationship between a company's assets, liabilities, and owner's equity.2. What is the difference between accrual accounting and cash accounting? Accrual accounting records revenue and expenses when they are incurred, regardless of when the cash is received or paid. Cash accounting, on the other hand, only records revenue and expenses when the cash is actually received or paid. Accrual accounting provides a more accurate picture of a company's financial performance, while cash accounting is simpler and easier to understand.3. What is depreciation?Depreciation is the allocation of the cost of an asset over its useful life. It represents the decrease in value of an asset due to wear and tear, obsolescence, or other factors. Depreciation is recorded as an expense on the income statement and reduces the value of the asset on the balance sheet.4. What is the difference between a current asset and a fixed asset?A current asset is an asset that is expected to be converted into cash or used upwithin one year or the normal operating cycle of a business. Examples of current assets include cash, accounts receivable, and inventory. A fixed asset, on the other hand, is an asset that is used in the production of goods or services and is not expected to be converted into cash within one year. Examples of fixed assets include buildings, machinery, and vehicles.5. What is the purpose of the statement of cash flows?The statement of cash flows provides information about the cash inflows and outflows of a company during a specific period of time. It helps users of financial statements understand how a company generates and uses cash, and provides insights into its liquidity and cash flow management.6. What is the difference between gross profit and net profit?Gross profit is the difference between net sales and the cost of goods sold. It represents the profit a company makes from its core operations before deducting operating expenses. Net profit, on the other hand, is the final profit after deducting all expenses, including operating expenses, interest, and taxes. 7. What is the purpose of the balance sheet?The balance sheet provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and owner's equity, and helps stakeholders assess its solvency, liquidity, and financial stability.8. What is the difference between accounts payable and accounts receivable? Accounts payable is the amount of money a company owes to its suppliers or creditors for goods or services purchased on credit. Accounts receivable, on theother hand, is the amount of money owed to a company by its customers for goods or services sold on credit. Accounts payable represents a liability, while accounts receivable represents an asset.通过以上的复习题,我们可以回顾和巩固会计的基础知识。

会计英语考试题目及答案一、选择题(每题2分,共20分)1. Which of the following is a basic accounting principle?A. The Going Concern PrincipleB. The Historical Cost PrincipleC. Both A and BD. Neither A nor BAnswer: C. Both A and B2. What is the term for the systematic arrangement of accounts in a specific order?A. JournalB. LedgerC. Trial BalanceD. Chart of AccountsAnswer: D. Chart of Accounts3. What does the term "Debit" mean in accounting?A. An increase in assetsB. A decrease in liabilitiesC. An increase in equityD. A decrease in expensesAnswer: A. An increase in assets4. Which of the following is not a type of financialstatement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D. Payroll Report5. What is the purpose of an adjusting entry?A. To update the financial recordsB. To prepare for the next accounting periodC. To correct errors in the accounting recordsD. All of the aboveAnswer: D. All of the above6. Which of the following is an example of a current asset?A. InventoryB. LandC. EquipmentD. Bonds PayableAnswer: A. Inventory7. What is the formula for calculating the return on investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Net Income / Investment) * 100D. (Total Assets / Net Income) * 100Answer: C. (Net Income / Investment) * 1008. What is the accounting equation?A. Assets = Liabilities + EquityB. Liabilities - Equity = AssetsC. Assets + Liabilities = EquityD. Equity + Assets = LiabilitiesAnswer: A. Assets = Liabilities + Equity9. What is the purpose of depreciation?A. To reduce the value of an asset over timeB. To increase the value of an asset over timeC. To calculate the cost of an assetD. To determine the net income of a companyAnswer: A. To reduce the value of an asset over time10. Which of the following is not a function of a general ledger?A. To record daily transactionsB. To summarize financial informationC. To provide a detailed account of each transactionD. To prepare financial statementsAnswer: A. To record daily transactions二、简答题(每题5分,共30分)1. Explain the difference between an asset and a liability. Answer: An asset is a resource owned by a business that hasfuture economic benefit, such as cash, inventory, or property.A liability is an obligation or debt that a business owes to others, such as loans, accounts payable, or salaries payable.2. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specificpoint in time, showing the company's assets, liabilities, and equity.3. Define the term "revenue."Answer: Revenue is the income generated from the normal business operations of a company, such as the sale of goodsor services.4. What is the difference between a journal and a ledger?Answer: A journal is a book that records financialtransactions in chronological order, while a ledger is a book that summarizes and organizes the financial transactions by accounts.5. Explain the concept of accrual accounting.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.6. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to ensure that the total debits equal the total credits in the general ledger, indicating that the accounting records are in balance.三、案例分析题(每题25分,共50分)1. A company purchased equipment for $50,000 on January 1, 2023, with a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: Using the straight-line method, the annual depreciation expense is calculated as follows:Depreciation Expense = (Cost of Equipment - Residual Value) / Useful LifeDepreciation Expense = ($50,000 - $0) / 5 = $10,000 per year2. A company has the following transactions for the month of March 2023:- Sold goods for $20,000 on credit.- Purchased inventory for $15,000 in cash.- Paid $2,000 in salaries.- Received $18,。

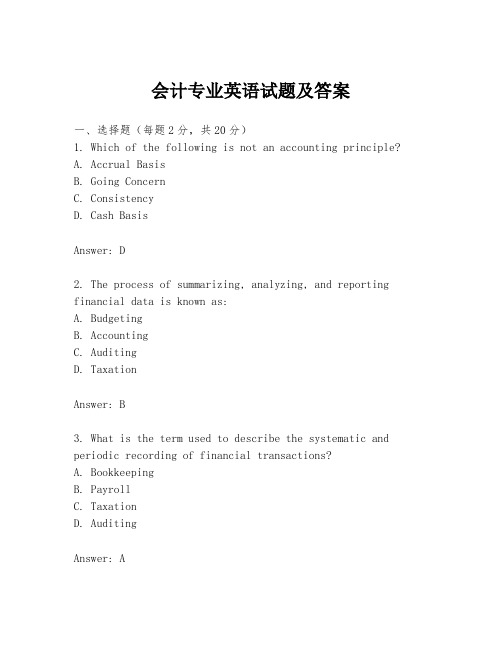

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。