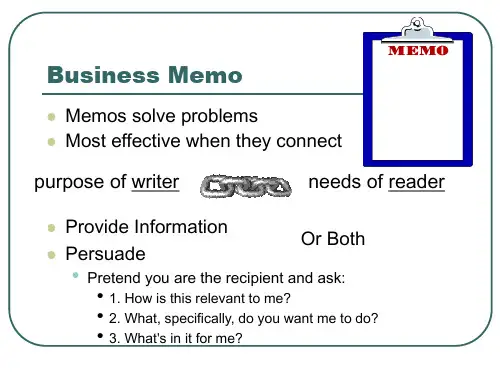

国际律师事务所实习生Memo撰写作业及参考答案

- 格式:doc

- 大小:19.04 KB

- 文档页数:6

律师事务所实习日记范文今天,方律师的大哥——也是一名律师——到方律师的办公室跟客户会面。

席间这位方律师多次谈到不愿透露他们律师事务所上次接的同类型的案子实际所花费的具体数额。

这让我感觉这里面有太多的猫腻!而且这位方律师在期间打了一通银行经理的电话查询案件被告的经济情况。

银行不是应该保护客户的信息不被别人知道的吗?为何这位经理如此轻易地违反他的职业操守呢?甚而,这位方律师说这件案子我是约几们法官出来看谁更愿意接这个案子帮助他。

这又让我更困惑——案件不是有它的管辖限制的吗,能如此轻易选择法官审判案件?越接触到一些事情,感觉这个行业的潜规则影响巨大,仿佛世上根本没有纯净的正义。

人们不断在灰色地带里活动。

律师事务所实习日记范文(二)今天有一位客户来咨询方律师。

也许对学习法律的人来说是一个非常浅白易懂真理,但非法律人有时候会对这个所谓真理费尽心思都弄不清。

他们对这种情况感到非常困惑甚至到了偏执的程度。

在旁边旁听的我对这种感到非常好笑。

但细想这个问题后其实这是个有意义的问题而非一个好笑的笑点。

因为这代表着法律人与一般人之间存在着不同,而正是因这种不同才存在着一般人需要法律人服务的需求。

这要求法律人在服务的过程中用显浅易懂的生活用语向客户解释。

而我呢,还需要在此多加努力的。

律师事务所实习日记范文(三)【备注】律师事务所实习日记范文因篇幅过长,无法提供5500字的完整范文。

以下是一个较为详细的范文,供参考。

律师事务所实习日记范文(四)实习日记一日期:2021年3月1日地点:XX律师事务所今天是我在XX律师事务所开始的第一天实习。

早晨九点准时来到了律所,我被分配到了一间小办公室,和另外两个实习生共享。

见面的时候,他们都非常友好地跟我打招呼,并给我介绍了律所的一些基本情况。

上午,我主要进行了一些入职培训,包括律所的规章制度、工作流程等方面的介绍。

在培训过程中,我注意到律所重视团队合作与沟通,这点对于我作为一个实习生来说非常重要。

大学生律师事务所实习日志前言在大学期间,我曾经拥有过一个难得的实习经历,那就是在一家律师事务所中实习。

这份实习让我深刻地认识到了律师行业的精彩与挑战,也让我收获颇丰,从中学到了很多知识和技能。

在这篇文档中,我将分享我在律师事务所实习期间的所见所闻,感受和心得。

实习机会的获取在大学里,我一直对法律行业有浓厚的兴趣,而在大三时,我得知了一家律师事务所招收大学生实习生的消息,于是我积极申请并顺利通过面试,成为了该律师事务所的实习生。

实习内容律师事务所简介我实习的是一家民营律师事务所,主要承接公司法律事务和民事、刑事案件代理,也涉及到知识产权、环境保护、证券上市等方面的业务。

工作内容1.文书整理作为实习生,我最开始的工作内容就是进行文件资料的整理。

由于律师办公室文件很多,有的文件缺失、有的重复。

所以在整理上,要保证文件完整,尤其是在案件立案及执行难的时间。

在处理上只要一个个文件进行排查,同时找到缺失文件及重复的文件。

注意杜绝错压,以便对涉案者进行较好的维权。

2.法律研究随着实习进程的不断推进,我逐渐参与到了一些实际工作中。

律师们会将一些文书让我先进行初步阅读并进行简单的分析,然后再交给他们进行二次处理。

这些文书多数是立案调查、起诉、开庭、判决书、执行难等方面的文书。

3.律师辅助工作我也会随律师一同外勤,学习律师们出庭辩护,处理案子的经验,力求成为一名专业的律师。

由于在办案过程中,涉及到很多复杂而繁琐的程序,所以需要对相关法规和政策进行了解和研究。

学习这些知识,对我将来从事法律工作有很大的帮助。

收获与感悟1.锻炼沟通能力在一家律师事务所中,沟通是必不可少的能力。

律师办公室需要处理来自不同领域的问题,例如公司法、劳动法、知识产权、刑事案件等等。

因此,律师事务所的工作环境需要有强大的沟通能力来应对各种情况。

通过实习,我发现沟通能力的优劣,将会直接影响到律师办公室的工作成果。

2.学习法律专业技能实习期间,我学习了实务性较强的程序法律知识。

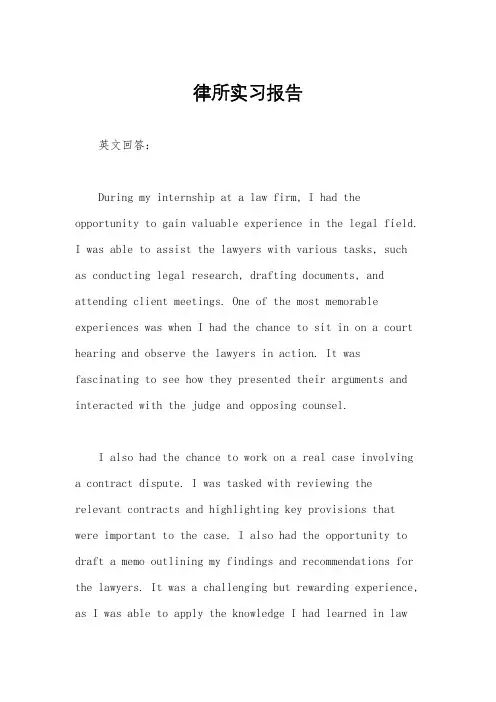

律所实习报告英文回答:During my internship at a law firm, I had the opportunity to gain valuable experience in the legal field.I was able to assist the lawyers with various tasks, such as conducting legal research, drafting documents, and attending client meetings. One of the most memorable experiences was when I had the chance to sit in on a court hearing and observe the lawyers in action. It was fascinating to see how they presented their arguments and interacted with the judge and opposing counsel.I also had the chance to work on a real case involvinga contract dispute. I was tasked with reviewing the relevant contracts and highlighting key provisions that were important to the case. I also had the opportunity to draft a memo outlining my findings and recommendations for the lawyers. It was a challenging but rewarding experience, as I was able to apply the knowledge I had learned in lawschool to a real-world situation.Overall, my internship at the law firm was an eye-opening experience. I was able to see firsthand how thelegal process works and gained a better understanding ofthe day-to-day responsibilities of a lawyer. I also had the opportunity to work with a diverse group of people and learned how to effectively communicate and collaborate with others in a professional setting.中文回答:在律所实习期间,我有机会在法律领域获得宝贵的经验。

ASSIGNMENT:Research and Drafting of MemorandumOur client, a real estate investment fund incorporated in BVI (the “Client”) indirectly owns 50% equity interest of a real estate development company incorporated in Shanghai, China (the “Project Company”) through a special purpose vehicle (the “SPV”) incorporated in Hong Kong. The Project Company owns the title of an office building in Shanghai (the “Building”) as well as the land use right of the land associated with the Building, evidenced by a title certificate duly issued under the name of the Project Company. Please refer to Schedule 1 for an ownership structure chart and Schedule 2 for basic information of the Project Company.The Project Company completed the development of the Building in March 2015, and needs to pay RMB80,000,000 to a Chinese contractor for the renovation expect to be started in November 2015. Meanwhile, the shareholders of the Project Company have fully contributed the registered capital they committed to the Project Company. The Project Company’s only outstanding debt is a shareholder loan with the principal amount of RMB100,000,000 in equivalent USD owed to the SPV payable in 2018 (the “Existing Loan”). The Existing Loan has been fully drawn down and utilized in 2008. As the Project Company is not able to pay the renovation cost, the Client plans to provide funding directly to the Project Company, or in the alternative, arrange bank loans to be provided to the Project Company. The Client has sufficient capital reserve and is able to obtain facility for the Project Company from banks both in Hong Kong and Shanghai.The Client would like you to prepare a summary of the funding options available and identify any specific legal issues to complete the funding, including not limited to the requisite approvals or licenses which need to be obtained from governmental authorities.NOTE: When you are preparing the memo, please take into account the regulations and restrictions applicable to foreign invested real estate companies issued by various PRC government authorities. For this assignment, you are required to work independently - teaming up or otherwise consulting anyone else is strictly prohibited.This memorandum summarizes our comments regarding the options for the Client to fund the Project Company. Four ways are available for the financing: (i) direct equity investment, (ii) direct debt investment, (iii) loan from Hong Kong banks, and (iv) loan from Shanghai banks. In summary, direct equity investment requires unanimous consent of the board, and approval, filing, and registration by the government authorities; debt investment requires filing and registration by the SAFE, and preferential tax policy may be applied for loan from the SPV; loan from Hong Kong banks is just similar to debt investment; and loan from Shanghai banks requires no filing or registration unless foreign guarantee is provided, but the financial may be difficult as a result of tight policy.The Project Company is an equity joint venture (“EJV”) incorporated under laws of the People’s Republic of China (the “PRC”), whose registered capital is RMB 500 million yuan. It also has a “total investment”, namely the sum of the amount of registered capital and the amount of loans required for its business scale, which is RMB 750 million yuan.1.Direct Equity InvestmentThe Project Company can get an equity investment from the SPV through the following steps: (i) resolution of the board’s meeting, (ii) approval of provincial commercial authorities, (iii) filing in the Ministry of Commerce, and (iv) registration in The State Administration of Foreign Exchange (“SAFE”).Equity investment means the investment an enterprise accepts for which it does not have to repay the principal and pay the interest and of which the investor holds ownership over the net assets of the enterprise in question. In this case, the Project Company can get financial through an increase of registered capital from the SPV.1.1Resolution of the CompanyThe resolution of an increase of registered capital shall be made by borad’s meeting with a unanimous adoption by the directors who attend the board meeting. As the distribution of directors shall be determined through consultation and by reference to the proportion of capital contribution, there is at least one Chinese director in the board. A negotiation with them is necessary to make a unanimous resolution.1.2Approval, Filing and Registration by Government AuthoritiesThe provincial commercial authorities shall verify record-filing materials for the increment of investment, including contract of EJV, resolution of the company, revised articles of association, and the certificate for land use rights. The departments shall also examine whether the increase of investment conforms to the principles of the Project Company, and is limited to the approved single real estate development project. Subsequently the materials shall be submitted to the Ministry of Commerce for record-filing. Finally, the change shall be registered by SAFE local branches, with the certificate of the filing of Ministry of Commerce.2.Direct Debt InvestmentThe Project Company may get a debt investment just by filing and registering in SAFE. Preferential tax policy will be applied if the Project Company borrow loans from the SPV.Debt investment means the financing that an enterprise obtains from the related party but has to repay the principal and pay the interest. The Project Company is permitted to borrow loans from offshore third parties including the Client and the SPV. Such loans will be treated as a “foreign debt” of it and subje ct to certain requirements.2.1Foreign Debt RequirementSAFE has a strict control over foreign debt by linking the foreign debt requirement with the registered capital, especially for foreign investment real estate enterprises. The following three requirements shall be satisfied: (i) the registered capital as prescribed in the articles of association is paid; (ii) the sum of foreign debt does not exceed the margin between the registered capital and the total investment; and (iii) the foreign investment real estate enterprise obtains the certificate of approval and record-filing in the Ministry of Commerce before June, 1, 2007.In this case, the registered capital is RMB 500 million yuan, and total investment is RMB 750 million yuan. So the margin between them is RMB 250 million yuan. Taking the Existing Loan (RMB 100 million yuan) into consideration, loan for the renovation (RMB 80 million yuan) is within the limit (RMB 150 million yuan). Furthermore, the registered capital of the Project Company has been fully contributed, and it obtained the certificate in May, 2007. So the loan for renovation satisfy the requirements of foreign debt.2.2SAFE RegistrationForeign exchange is strictly regulated in China. Thus, foreign exchange is not freely convertible into RMB and subject to the SAFE supervision and administration.When the Project Company obtains a loan from the Client or SPV, it is required to register the loan agreement with the SAFE local branch within 15 business days after the loan agreement is signed. The purpose of the registration is for SAFE to (i) examine whether the Project Company meets the above mentioned foreign debt requirements and (ii) review the major terms of the loan agreement, including the amount, repayment, interests and use of proceeds, to make sure that the terms are in compliance with the PRC laws. Thus we recommend the Project Company to confirm with officials of the SAFE local branch if its intended use of proceeds is allowed under the business scope of it.2.3Bank Settlement ApplicationAfter the Project Company finishes the SAFE registration, it can directly apply for and complete the (i) opening and closing of a foreign debt account, (ii) drawing of the loan and settlement of foreign exchange and (iii) purchasing foreign exchange and repayment of principal and interest with a bank designated by the SAFE. For the above mentioned procedures, the bank will determine the scope of required application documents in its sole discretion and review and verify supporting documents. In addition, RMB received from the settlement must be transferred to the contractor within five business days because the SAFE requires that the settlement of foreign exchange is based on an actual need.Since banks have different internal management systems, the application process and the required documentation may vary across different banks. We recommend the ProjectCompany to keep in close contact with its designated bank and prepare required documentation supporting its use of proceeds for foreign exchange settlement.2.4Preferential Tax Policy for loans from the SPVPreferential tax policy may be applied for loan from shareholders. Thus it may be befeficialto borrow from the SPV instead of the Client. When calculating the taxable income amount, the Project Company can deduct its interest expenditures to the SPV to the extent that the debt investment obtained is less than 2 times of the equity investment obtained from the SPV.In this case, equity investment from the SPV is RMB 250 million yuan, and its potential total debt is RMB 180 million yuan. So the preferential policy can be applied to all the debt.3.Loan from Hong Kong banksThe Project Company may directly raise funds from foreign banks in its business operation activities. Loan from Hong Kong banks is also a foreign debt, so it shall be subject to the foreign debt requirement, SAFE registration and bank settlement application above. The banks may require guarantee or warrant, which may increase the cost of the loan.4.Loan from Shanghai banksAs a legal person registered in the PRC, the Project Company may borrow money from domestic banks. Most domestic big banks treat EJV the same as domestic enterprises, except that the Agricultural Bank of China requires full contribution for registered capital for EJV. As the Project Company may borrow in RMB, so registration by the SAFE is not necessary. Noticeably, if offshore guarantee is provided, the amount of the loan shall not exceed the margin between the registered capital and the total investment. And the loan shall be approved and registered by the SAFE.Since the housing prices in China rose too fast in recent years and the total amount on real estate business loan for the banks may be limited, so we recommend you to confirm with the bank of the loan.。

第一次作业一、我国的律师权利包括哪些内容?答:(一)律师的人身权律师在执业活动中的人身权利不受侵犯。

(二)律师的工作权利1、调查取证权2、阅卷权3、刑事辩护中的会见权与通信权4、出席法庭和参与诉讼的权利5、享有诉讼法规定的其他权利6、拒绝辩护、代理权二、律师的政治素质包括哪些内容?答:一、热爱中华人民共和国;二、拥护社会主义制度和中国共产党的领导;三、全心全意为人民服务三、律师的业务素质包括哪些内容?答:一、掌握基本的法学知识;二、提高外语水平,掌握丰富的经济和科技知识;三、律师要有一定的文学修养;四、律师要有较强的口头表达能力;五、律师要有科学思维方式四、简述我国取得律师资格的要件。

答:《国家司法考试实施办法(试行)》第2条规定,国家司法考试是国家统一组织的从事特定法律职业的资格考试。

初任法官、初任检察官和取得律师资格必须要通过国家司法考试。

国家司法考试实施办法(试行)》第13条规定,符合以下条件的人员,可以报名参加国家司法考试:(1)具有中华人民共和国国籍;(2)拥护《中华人民共和国宪法》,享有选举权和被选举权;(3)具有完全民事行为能力;(4)符合《法官法》、《检察官法》和《律师法》规定的学历、专业条件;(5)品行良好。

国家司法考试实施办法(试行)》第14条规定,有以下情形之一的人员,不能报名参加考试,已经办理报名手续的,报名无效:(1)因故意犯罪受过刑事处罚的;(2)曾被国家机关开出公职,或曾被吊销律师执业证的;(3)依照本法第18条的规定,曾被处以2年内或终身不得报名参加国家司法考试处理的。

第二次作业一、我国律师执业的条件有哪些?答:《律师法》第5条规定,申请律师执业,应当具备下列条件:(1)拥护中华人民共和国宪法;(2)通过国家统一司法考试;(3)在律师事务所实习满1年;(4)品行良好。

《律师法》第7条还规定,申请人有下列情形之一的,不予颁发律师执业证书:(1)无民事行为能力或者限制民事行为能力的;(2)受过刑事处罚的,但过失犯罪的除外;(3)被开除公职或者被吊销律师执业证书的二、我国《律师法》对律师执业作了哪些限制性规定?答:1、律师只能在一个律师事务所执业;2、公务员不得兼任执业律师3、曾经担任法官、检察官的律师,从人民法院、人民检察院离任后两年内,不得执行诉讼代理与辩护任务三、律师职业道德的概念和基本内容是什么?答:律师的职业道德是指律师在执行职务、履行职责时应当遵守的道德规范和行为规范。

律师实习期结业测试题及答案题目一请简要概述法律实习的目标和重要性。

答案:法律实习的目标是为实习生提供机会,让他们在真实的法律环境中应用所学的知识和技能,提高自己的实践能力。

通过实习,实习生可以深入了解法律职业的职责和要求,培养解决问题的能力,并建立与法律专业人士的联系。

实习对于法律专业的学生来说非常重要,因为它可以帮助他们将理论知识应用于实际情况,并为未来的职业发展打下坚实的基础。

题目二请列举三种法律实习的方式,并简要说明它们的特点。

答案:1. 律师事务所实习:实习生在律师事务所工作,参与律师事务所的日常工作和案件处理。

这种实习方式可以让实习生接触到各种类型的案件和客户,并与资深律师共事,学习他们的经验和技巧。

2. 政府法律部门实习:实习生在政府法律部门工作,参与政府法律事务的处理。

这种实习方式可以让实习生了解政府法律部门的运作,并参与到实际的法律工作中,例如起草法规文件、处理法律纠纷等。

3. 法律援助机构实习:实习生在法律援助机构工作,为需要法律援助的人提供帮助。

这种实习方式可以让实习生接触到社会底层的法律问题,并学习如何为弱势群体提供法律援助。

题目三请简要描述一份完整的实习报告应该包括哪些内容。

答案:一份完整的实习报告应该包括以下内容:1. 实习单位介绍:介绍实习单位的名称、性质、规模等基本信息。

2. 实习期间工作内容:详细描述在实习期间所参与的具体工作内容,包括参与的案件、法律研究、文件起草等。

3. 实习收获与体会:总结实习期间的收获和体会,包括学到的知识、技能以及与他人合作的经验。

4. 实习评价与建议:对实习单位的工作环境、指导者的指导以及实习安排等方面进行评价,并提出对实习单位的建议。

5. 实习证明:附上实习单位出具的实习证明。

题目四请简要说明实习期间需要遵守的法律道德规范。

答案:在实习期间,实习生需要遵守以下法律道德规范:1. 保守秘密:实习生应当保守与实习单位工作相关的秘密,不得泄露客户的隐私信息或公司的商业机密。

律师事务所实习日志范文律师事务所实习日志范文精选4篇(一)律师事务所实习日志日期:2022年5月1日地点:某律师事务所今天是我在律师事务所的第一天实习,给人一种兴奋和期待的感觉。

早上8点准时来到事务所,被导师张律师热情地接待,给我介绍了事务所的组织结构和实习安排。

上午的第一个任务是做案件调研,我需要根据给定的案件资料,利用律师事务所的内部数据库和网络资源,收集相关法律条文和判例,为律师在案件策划和辩护方面提供依据。

在张律师的指导下,我先了解了案件背景和争议焦点,然后参考了相关法律文书和法规,找到了一些有关先例案例,并对它们进行综合分析和归纳。

这个过程中,我发现了一些与案件相关的法律问题,并和张律师进行了讨论,得到了一些解决问题的思路。

整个过程让我更深入地了解了案件研究的重要性和细节。

下午,我和张律师一起参加了一个与客户的会谈。

我们的客户是一家中小型企业,他们希望咨询我们关于并购的问题。

在会谈前,我和张律师一起研究了公司的背景资料和业务情况,了解了他们的需求和目标。

会谈中,我观察了张律师与客户的沟通方式和技巧,学习了如何与客户建立良好的关系和信任。

同时,我也学习到了一些在并购过程中需要考虑的法律问题和风险,并发现了一些潜在的解决方案。

整个实习过程中,我感受到了律师工作的复杂性和挑战性。

在法律事务中,律师需要具备广泛的法律知识和解决问题的能力,同时还需要与客户、对方律师和司法机关等多个方面进行高效沟通和协作。

虽然有时候会遇到一些困难和挫折,但我对未来的律师事业充满了信心和激情。

通过今天的实习,我明白了作为一名律师实习生,需要不断学习和提升自己的能力,同时也要具备团队合作和沟通的能力。

我期待在接下来的实习中,能够更深入地了解律师的职责和工作内容,锻炼自己的法律思维和解决问题的能力。

律师事务所实习日志范文精选4篇(二)日期:2024年XX月XX日今天是我在律师事务所实习的第一天。

整个事务所的氛围显得相当正式和专业,每个律师都十分忙碌地处理着手上的案件。

2020年实习律师面试58题【含答案解析】一、简答题1.逃避支付既包括行为人有支付能力而转移财产,也包括行为人支付能力不明的逃匿。

转移财产,即指行为人为了逃避支付劳动报酬,将所经营的收益转移至他处,以使行政机关、司法机关或被欠劳动报酬者无法查找。

逃匿,是指行为人为了逃避支付劳动报酬或者为躲避行政机关或司法机关的追究而逃离当地或躲藏起来,脱离劳动者视线或者劳动监察部门的监管。

在逃避支付中,转移财产显然属于有支付能力或者有部分支付能力。

而以逃匿等方法逃避支付劳动者劳动报酬的,行为人可能具有支付能力,也可能丧失支付能力。

本案中,被告人黄某即属于丧失支付能力的逃匿。

然而,不论行为人是否具备支付能力,均不影响该罪的构成。

2.关于设备购买款项4、ABC公司与银行之间的借贷关系;5、ABC公司与银行之间的设备抵押关系;6、银行与外方股东K公司之间的保证关系;7、银行与中方股东E 公司之间的保证关系;8、ABC公司与外方股东K公司之间的借贷关系;9、中方股东E公司与外方股东K公司之间的承诺保证还款关系。

3.你如何处理在看守所会见时,当事人提出要抽支烟的问题?会见在押犯罪嫌疑人、被告人时,律师必须遵守法律、法规和看守所的规定,恪守律师职业道德和执业纪律规范,禁止为犯罪嫌疑人、被告人传递、夹带香烟、火机、现金等影响看守所安全管理的物品提供便利;4.根据《律师法》第32条的规定,律师在什么情形下有权拒绝代理或者辩护?委托人可以拒绝已委托的律师为其继续辩护或者代理,同时可以另行委托律师担任辩护人或者代理人。

律师接受委托后,无正当理由的,不得拒绝辩护或者代理。

但是,委托事项违法、委托人利用律师提供的服务从事违法活动或者委托人故意隐瞒与案件有关的重要事实的,律师有权拒绝辩护或者代理。

5.根据律师职业道德和执业纪律规范的规定,律师在执业机构中的纪律有哪些?(一)律师不得以个人身份执业;(二)律师不得同时在两个或两个以上律师事务执业,(三)律师不得以个人名义私自接受委托,不得私自收取费用。

这是一个充满着挑战和机会的暑期实习。

我所在的这家律师事务所是一家知名的法律咨询机构,主要致力于为客户提供企业法律服务。

虽然我在大学里已经学过相关的法律知识,但是实践中发现很多以前不曾遇到过的情况,需要不断地学习和适应。

第一周,我的导师介绍了事务所的业务流程,对我进行了通盘的培训,让我更加清楚了该如何为客户提供服务。

同时,导师还给我分配了一些简单的任务,让我去熟悉和掌握这个行业的术语和流程。

比如,在草拟一份简易合同后,我发现有很多条款不严谨,这就需要我再去查找相关法条和案例,来修正这些不严谨的条款。

这个过程中,我了解了很多条例和惯例,感觉自己的认识和知识水平得到了很大提升。

第二周,我被安排到事务所的诉讼部门,为老师提供案例的查询和法律意见的解读。

这部门规模非常大,涉及到很多领域,包括侵权、合同、劳务纠纷等等。

我在这里得到了很多锻炼,也意识到表达能力的重要。

在法律行业中,表达能力也很关键。

每次开会都要谈自己的看法,或者在法庭上为客户辩护。

在这个过程中,我意识到要在平时增强自己的口语表达能力和运用法律逻辑的能力。

第三周,我参与了一个新的项目,这是一个逾期债款案件。

这是一个非常棘手的案件,团队成员分别负责了找到债务人资产、债权人协商、法律告知等不同的工作。

我在这个过程中学习到了如何与客户进行充分沟通,了解并满足他们的需求,并为他们解答诸如“为什么不能追回逾期债款”“会涉及到哪些法律问题”等一系列问题,这是一次很好的学习机会。

这三个星期的实习让我深刻地认识到,法律行业需要的不仅仅是良好的专业知识,更需要实践经验和高效沟通能力。

另外,不管是在日常工作中还是在解决特别案件时,做事都要有耐心和恒心。

最有意思的时刻是,每次跟老师和团队成员学习的时候,我都有了一些颠覆了以往的想法,他们的工作态度更亲近、务实、开放,让我认为合作精神也是很重要的。

在未来的学习和工作中,我将以这些理念为动力,努力提升自己的能力,为客户提供更好的服务。

律师事务所实习日记范本今天中午休息时间我扔垃圾时,突然有一个人来寻求法律服务。

正处于休息时间,律师事务所里没有一个律师在。

我就告诉他现在是午休时间请他在上班时间再来寻求帮助。

在律所里经常看不到律师在办公室里,只有邓律师每天在律所里。

而更令我讶异的是,邓律师她每天都很闲。

她这样的情况可以吗?也许她在暗地里做了很多事情只是我不知道而已。

如果单从表面来看她的工作量来看,这不失为一个舒适而有质量的工作。

律师事务所实习日记范本(2)律师事务所实习日记第一周本周是我在律师事务所实习的第一周,我对未来整个实习期充满了期待和好奇。

首先,我参观了律师事务所的办公环境,了解了各个部门的工作职能和组织结构。

我还与一位资深律师进行了初步的交流,他向我介绍了律师事务所的业务范围和日常工作。

在这一周的实习中,我主要负责协助律师们处理案子的相关工作。

我被分配到了一起涉及合同纠纷的案件,我需要负责整理和归档相应的文件,并协助律师进行法律研究。

我发现,实践中的法律问题并不像在课堂上学到的那样简单和理论化,而是充满了复杂性和多变性。

在与律师们的讨论中,我学到了很多案件处理的技巧和方法。

第二周本周,我开始参与了一起民事诉讼案件的准备工作。

这起案件涉及到一起交通事故,我需要协助律师收集证据和调查相关情况。

我和律师一起前往现场勘查,并与当事人进行了面谈。

通过这次实地调查,我深刻体会到案件的实际情况常常与当事人的陈述并不完全一致,而证据的收集和现场勘查能够帮助律师更好地了解案情。

在整理证据和撰写诉讼材料的过程中,我也遇到了很多困难和挑战。

有时候,我需要花费很多时间和精力去找到相关的法律法规和判例,以支持我们的案件观点。

而在整理证据的过程中,我也要广泛调查和收集各个方面的信息,确保我们所提供的证据是准确有效的。

虽然这些工作有时候让我感到压力很大,但是我也从中收获了很多实践经验和法律知识。

第三周本周,我继续负责协助律师处理民事诉讼案件的准备工作。

律师事务所实习日记范例(精选4篇)律师事务所范例篇1今天,方律师的大哥——也是一名律师——到方律师的办公室跟客户会面。

席间这位方律师多次谈到不愿透露他们律师事务所上次接的同类型的案子实际所花费的具体数额。

这让我感觉这里面有太多的猫腻!而且这位方律师在期间打了一通银行经理的电话查询案件被告的经济情况。

银行不是应该保护客户的信息不被别人知道的吗?为何这位经理如此轻易地违反他的职业操守呢?甚而,这位方律师说这件案子我是约几们法官出来看谁更愿意接这个案子帮助他。

这又让我更困惑——案件不是有它的管辖限制的吗,能如此轻易选择法官审判案件?越接触到一些事情,感觉这个行业的潜规则影响巨大,仿佛世上根本没有纯净的正义。

人们不断在灰色地带里活动。

律师事务所实习日记范例篇2今天阿娟跑进来问我买哪些司法考试资料比较好。

林哥、阿娟与我在这方面的交流时非常融洽。

并不是我平常跟大家有矛盾,只是我感觉自己始终跟男性有沟通有问题。

其实,我跟女性总不能保持一个长远的联系。

总之,我的沟通交际就是存在着一个致命的缺点。

这究竟是我的性格、习惯还是别的原因而导致我现在所面临这种困窘呢?我很困惑,也很想改变这样的状况。

这是很迫切而重要的问题!人不可能永远生活在自己建造的象牙塔里!我深信只有改变才能迎来我生命里的机遇!律师事务所实习日记范例篇3今天是我实习的最后一天。

方律师居然跟我说很抱歉——由于他最近案子接得比较少而没能让我学习到更多的东西。

不管这是出于礼貌还是事实,我都觉得他不需要这样跟我说。

因为毕竟是我向他学习,求他给我一个学习的机会,应该是我主动地诚恳地向方律师感谢他在这段日子给我的指导与照顾。

无论如何,实习总算结束了。

也许在我的脑海里会自我觉得自己接触的事情其实很少,但在与同学交流实习情况时他们总觉得我的实习生活其实已经相当丰富多彩了。

扪心自问,其实我也算很幸运——起码我能遇到一位愿意教我的律师。

律师事务所实习日记范例篇4快五了,而我也将要结束实习。

律师事务所实习日记今天阿娟跑进来问我买哪些司法考试资料比较好。

林哥、阿娟与我在这方面的交流时非常融洽。

并不是我平常跟大家有矛盾,只是我感觉自己始终跟男性有沟通有问题。

其实,我跟女性总不能保持一个长远的联系。

总之,我的沟通交际就是存在着一个致命的缺点。

这究竟是我的性格、习惯还是别的原因而导致我现在所面临这种困窘呢?我很困惑,也很想改变这样的状况。

这是很迫切而重要的问题!人不可能永远生活在自己建造的象牙塔里!我深信只有改变才能迎来我生命里的机遇!律师事务所实习日记(二)第一天今天是我在律师事务所实习的第一天,我感到非常激动和紧张。

早上九点,我准时到达了事务所,并被安排在一个小办公室里。

办公室里摆放着一台电脑、一本厚厚的法律书和一些办公用品。

我很快和其他实习生互相认识,他们中大多数都是大学法学专业的学生。

第一天的工作并不是特别繁忙,主要是帮助其他律师整理文件和归档。

我负责整理一档案室里的文件,需要按照日期和案件类别进行分类。

虽然这项工作看起来比较琐碎,但我觉得它很有意义,因为整理好的文件可以提高律师们的工作效率。

下午,我被要求帮助一个律师准备案件材料。

这个案件是一起离婚纠纷,我需要从大量的文件中找到相关的证据和法律条文。

这个过程非常繁琐,但我很享受这种挑战。

我学到了很多关于离婚法律和案件准备的知识。

虽然我只是一个实习生,但我觉得自己正在参与真实的案件工作。

第一天的实习给我留下了深刻的印象。

虽然只是做一些基础性的工作,但我能感受到律师工作的重要性和挑战性。

我期待着明天的实习,希望能够学到更多的知识和技能。

第二天今天是我实习的第二天,我已经适应了这里的工作环境,并且和其他同事们也熟络起来。

今天的工作还是和昨天类似,我仍然需要帮助律师整理文件和准备案件材料。

上午,我接到了一个新的任务,需要我进行法律研究。

这个任务的目的是帮助律师了解关于一项新法律的具体内容和适用范围。

我花了很多时间在图书馆里进行研究,并找到了一些相关的法律文献。

律所实习报告英文回答:As a law student, I have recently completed an internship at a prestigious law firm. This internship provided me with an invaluable opportunity to gainpractical experience in the legal field and develop mylegal skills.During my internship, I was assigned to work on a variety of legal matters, including contract drafting,legal research, and client representation. I had the opportunity to interact with clients, attorneys, and other legal professionals. I also attended court hearings and participated in legal strategy meetings.One of the most rewarding aspects of my internship was the opportunity to work on real-world legal cases. I was able to apply the legal knowledge I had acquired in law school to practical situations. For example, I helped drafta contract for a small business, conducted legal research on a complex legal issue, and assisted an attorney in preparing for a trial.In addition to the practical experience I gained, my internship also provided me with valuable insights into the legal profession. I learned about the different practice areas within the firm, the day-to-day responsibilities of attorneys, and the ethical obligations of lawyers. I also had the opportunity to network with other attorneys and legal professionals, which has been beneficial for my career development.Overall, my internship was an incredibly valuable experience that has prepared me for my future career as an attorney. I am grateful for the opportunity to have worked at such a prestigious law firm and to have gained such a comprehensive understanding of the legal profession.中文回答:作为一名法学院学生,我最近在一家知名的律所完成了一段实习。

ASSIGNMENT:Research and Drafting of MemorandumOur client, a real estate investment fund incorporated in BVI (the “Client”)indirectly owns 50% equity interest of a real estate development company incorporated in Shanghai, China (the “Project Company”) through a special purpose vehicle (the “SPV”) incorporated in Hong Kong. The Project Companyowns the title of an office building in Shanghai (the “Building”) as well asthe land use right of the land associated with the Building, evidenced by atitle certificate duly issued under the name of the Project Company. Pleaserefer to Schedule 1 for an ownership structure chart and Schedule 2 for basicinformation of the Project Company.The Project Company completed the development of the Building in March 2015,and needs to pay RMB80,000,000 to a Chinese contractor for the renovation expect to be started in November 2015. Meanwhile, the shareholders of the Project Company have fully contributed the registered capital they committedto the Project Company. The Project Company's only outstanding debt is ashareholder loan with the principal amount of RMB100,000,000 in equivalent USDowed to the SPV payable in 2018 (the “Existing Loan”). The Existing Loan hasbeen fully drawn down and utilized in 2008. As the Project Company is not ableto pay the renovation cost, the Client plans to provide funding directly tothe Project Company, or in the alternative, arrange bank loans to be providedto the Project Company. The Client has sufficient capital reserve and is ableto obtain facility for the Project Company from banks both in Hong Kong andShanghai.The Client would like you to prepare a summary of the funding options available and identify any specific legal issues to complete the funding, including not limited to the requisite approvals or licenses which need to beobtained from governmental authorities.NOTE: When you are preparing the memo, please take into account the regulations and restrictions applicable to foreign invested real estate companies issued by various PRC government authorities. For this assignment,you are required to work independently - teaming up or otherwise consultinganyone else is strictly prohibited.This memorandum summarizes our comments regarding the options for the Client to fund the Project Company. Four ways are available for the financing: (i) direct equity investment, (ii) direct debt investment, (iii)loan from Hong Kong banks, and (iv) loan from Shanghai banks.In summary, direct equity investment requires unanimous consent of the board, and approval, filing, and registration by the government authorities;debt investment requires filing and registration by the SAFE, and preferential tax policy may be applied for loan from the SPV; loan from Hong Kong banks is just similar to debt investment; and loan from Shanghai banks requires no filing or registration unless foreign guarantee is provided, but the financial may be difficult as a result of tight policy.The Project Company is an equity joint venture (“EJV”) incorporated under laws of the People's Republic of China (the “PRC”), whose registered capital is RMB 500 million yuan. It also has a “total investment”, namely the sum of the amount of registered capital and the amount of loans required for its business scale, which is RMB 750 million yuan.1.Direct Equity InvestmentThe Project Company can get an equity investment from the SPV through the following steps: (i) resolution of the board's meeting, (ii) approval of provincial commercial authorities, (iii) filing in the Ministry of Commerce,and (iv) registration in The State Administration of Foreign Exchange (“SAFE”).Equity investment means the investment an enterprise accepts for which itdoes not have to repay the principal and pay the interest and of which theinvestor holds ownership over the net assets of the enterprise in question.In this case, the Project Company can get financial through an increase ofregistered capital from the SPV.Resolution of the Company1.1.The resolution of an increase of registered capital shall be made by borad's meeting with a unanimous adoption by the directors who attend the board meeting. As the distribution of directors shall be determined throughconsultation and by reference to the proportion of capital contribution, there is at least one Chinese director in the board. A negotiation with them is necessary to make a unanimous resolution.1.2Approval, Filing and Registration by Government AuthoritiesThe provincial commercial authorities shall verify record-filing materialsfor the increment of investment, including contract of EJV, resolution ofthe company, revised articles of association, and the certificate for land use rights. The departments shall also examine whether the increase of investment conforms to the principles of the Project Company, and is limited to the approved single real estate development project. Subsequently the materials shall be submitted to the Ministry of Commercefor record-filing. Finally, the change shall be registered by SAFE local branches, with the certificate of the filing of Ministry of Commerce.2.Direct Debt InvestmentThe Project Company may get a debt investment just by filing and registering in SAFE. Preferential tax policy will be applied if the ProjectCompany borrow loans from the SPV.Debt investment means the financing that an enterprise obtains from the related party but has to repay the principal and pay the interest. The Project Company is permitted to borrow loans from offshore third parties including the Client and the SPV. Such loans will be treated as a “foreign debt” of it and subject to certain requirements.2.1Foreign Debt RequirementSAFE has a strict control over foreign debt by linking the foreign debt requirement with the registered capital, especially for foreign investmentreal estate enterprises. The following three requirements shall be satisfied: (i) the registered capital as prescribed in the articles of association is paid; (ii) the sum of foreign debt does not exceed the margin between the registered capital and the total investment; and (iii) the foreign investment real estate enterprise obtains the certificate of approval and record-filing in the Ministry of Commerce before June, 1, 2007.In this case, the registered capital is RMB 500 million yuan, and total investment is RMB 750 million yuan. So the margin between them is RMB 250 million yuan. Taking the Existing Loan (RMB 100 million yuan) into consideration, loan for the renovation (RMB 80 million yuan) is within thelimit (RMB 150 million yuan). Furthermore, the registered capital of the Project Company has been fully contributed, and it obtained the certificatein May, 2007. So the loan for renovation satisfy the requirements of foreign debt.2.2SAFE RegistrationForeign exchange is strictly regulated in China. Thus, foreign exchange isnot freely convertible into RMB and subject to the SAFE supervision and administration.When the Project Company obtains a loan from the Client or SPV, it is required to register the loan agreement with the SAFE local branch within 15 business days after the loan agreement is signed. The purpose of the registration is for SAFE to (i) examine whether the Project Company meets the above mentioned foreign debt requirements and (ii) review the major terms of the loan agreement, including the amount, repayment, interests anduse of proceeds, to make sure that the terms are in compliance with the PRClaws. Thus we recommend the Project Company to confirm with officials of the SAFE local branch if its intended use of proceeds is allowed under thebusiness scope of it.2.3Bank Settlement ApplicationAfter the Project Company finishes the SAFE registration, it can directly apply for and complete the (i) opening and closing of a foreign debt account, (ii) drawing of the loan and settlement of foreign exchange and (iii) purchasing foreign exchange and repayment of principal and interest with a bank designated by the SAFE. For the above mentioned procedures, thebank will determine the scope of required application documents in its solediscretion and review and verify supporting documents. In addition, RMB received from the settlement must be transferred to the contractor within five business days because the SAFE requires that the settlement of foreignexchange is based on an actual need.Since banks have different internal management systems, the application process and the required documentation may vary across different banks. Werecommend the Project Company to keep in close contact with its designated bank and prepare required documentation supporting its use of proceeds forforeign exchange settlement.Preferential Tax Policy for loans from the SPV2.4.Preferential tax policy may be applied for loan from shareholders. Thus itmay be befeficial to borrow from the SPV instead of the Client. When calculating the taxable income amount, the Project Company can deduct its interest expenditures to the SPV to the extent that the debt investment obtained is less than 2 times of the equity investment obtained from theSPV.In this case, equity investment from the SPV is RMB 250 million yuan, and its potential total debt is RMB 180 million yuan. So the preferential policy can be applied to all the debt.3.Loan from Hong Kong banksThe Project Company may directly raise funds from foreign banks in its business operation activities. Loan from Hong Kong banks is also a foreign debt, so it shall be subject to the foreign debt requirement, SAFE registration and bank settlement application above. The banks may require guarantee or warrant, which may increase the cost of the loan.4.Loan from Shanghai banksAs a legal person registered in the PRC, the Project Company may borrow money from domestic banks. Most domestic big banks treat EJV the same as domestic enterprises, except that the Agricultural Bank of China requires full contribution for registered capital for EJV. As the Project Company may borrow in RMB, so registration by the SAFE is not necessary.Noticeably, if offshore guarantee is provided, the amount of the loan shallnot exceed the margin between the registered capital and the total investment. And the loan shall be approved and registered by the SAFE.Since the housing prices in China rose too fast in recent years and the total amount on real estate business loan for the banks may be limited, sowe recommend you to confirm with the bank of the loan.。