国际财务管理(原书第5版)答案

- 格式:pdf

- 大小:117.67 KB

- 文档页数:2

第一章思考题1.答题要点:(1)股东财富最大化日标相比利润最人化日标具有三方而的优点:考虑现金流量的时间价值和风险因索、克服追求利润的短期行为、股东财富反映了资木与收益之间的关系;(2)通过企业投资工具模型分析,可以看出股东财富最大化目标是判断企业财务决策是否正确的标准;(3)股东财富最大化是以保证其他利益相关者利益为前提的。

2.答题要点:(1)激励,把管理层的报酬同其绩效挂钩,促使管理层更加白觉地采取满足股东财富最大化的措施:(2)股东宜接干预,持股数最较多的机构投资者成为中小股东的代言人,通过与管理层进行协商,对企业的经营捉出建议;(3)被解聘的威胁,如果管理层工作严重失误,可能会遭到股东的解聘;(4)被收购的威胁, 如果企业被敌意收购,管理层通常会失去原有的工作岗位,因此管理层具有较强动力使企业股票价格最人化。

3.答题婆点:(1)利益相关者的利益与股东利益在木质上是一致的,当企业满足股东财富最大化的同时,也会增加企业的整体财富,其他相关者的利益会得到更有效的满足:(2)股东的财务要求权是“剩余耍求权”,是在其他利益相关者利益得到满足Z后的剩余权益。

(3)企业是各种利益和关者么间的契约的组合。

(4)对股东财富最人化需要进行一定的约束。

4.答题婆点:(I)财务经理负责投资、筹资、分配和营运资金的管理;(2)财务经理的价值创造方式主要有:一是通过投资活动创造超过成木的现金收入,二是通过发行债券、股票及其他方式筹集能够带来现金增量的资金。

5.答题要点:(1)为企业筹资和投资提供场所;(2)企业可通过金融市场实现氏短期资金的互和转化:(3)金融市场为金业的理财提供相关信息。

6.答题要点:(1)利率由三部分构成:纯利率、通货膨胀补偿、风险收益;(2)纯利率是指没有风险和没有通货膨胀情况下的均衡点利率,通常以无通货膨胀情况下的无风险证券利率来代表纯利率;(3)通货膨胀情况下,资金的供应者必然要求提高利率水平來补偿购买力的损失,所以短期无风险证券利率=纯利率+通货膨胀补偿(4)风险报酬要考虑违约风险、流动性风险、期限风险,他们都会导致利率的増加。

第四章二、练习题1.答:三角公司20X9年度资本需要额为(8000-400)×(1+10%)×(1-5%)=7942(万元)。

2.答:四海公司20X9年公司销售收入预计为150000×(1+5%)=157500(万元),比20X8年增加了7500万元。

四海公司20X9年预计敏感负债增加7500×18%=1350(万元)。

四海公司20X9年税后利润为150000×8%×(1+5%)×(1-25%)=9450(万元),其中50%即4725万元留用于公司——此即第(2)问答案。

四海公司20X9年公司资产增加额则为1350+4725+49=6124(万元)——此即第(1)问答案。

即:四海公司20X9年公司资产增加额为6124万元;四海公司20X9年公司留用利润额为4725万元。

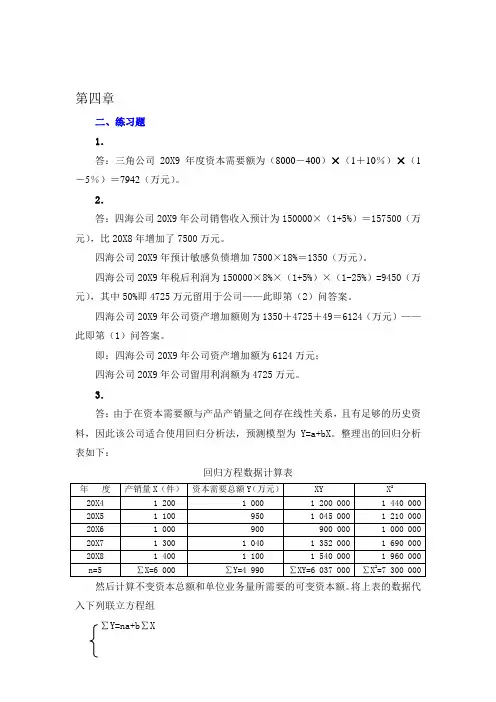

3.答:由于在资本需要额与产品产销量之间存在线性关系,且有足够的历史资料,因此该公司适合使用回归分析法,预测模型为Y=a+bX。

整理出的回归分析表如下:回归方程数据计算表然后计算不变资本总额和单位业务量所需要的可变资本额。

将上表的数据代入下列联立方程组∑Y=na+b∑X∑XY=a∑x+b∑2X有:4 990 = 5a + 6 000b6 037 000 = 6 000a + 7 300 000b求得:a = 410b = 0.49即不变资本总额为410万元,单位可变资本额为0.49万元。

3)确定资本需要总额预测模型。

将a=410(万元),b=0.49(万元)代入=,得到预测模型为:Y+bXaY = 410 + 0.49X(4)计算资本需要总额。

将20X9年预计产销量1560件代入上式,经计算资本需要总额为:410 + 0.49×1560 = 1174.4 (万元)三、案例题答:案例题答案不唯一,以下只是思路之一,仅供参考。

从案例所给的条件看,该公司目前基本状况总体较好,是一家不错的中等规模企业,财务状况在行业内有优势,但面对需求能力上升、经济稳定发展的较好的外部财务机会,其规模制约了公司的进一步盈利,但该公司在财务上的优势使得该公司的进一步扩张成为可能。

第一章思考题1.答题要点:(1)股东财富最大化目标相比利润最大化目标具有三方面的优点:考虑现金流量的时间价值和风险因素、克服追求利润的短期行为、股东财富反映了资本与收益之间的关系;(2)通过企业投资工具模型分析,可以看出股东财富最大化目标是判断企业财务决策是否正确的标准;(3)股东财富最大化是以保证其他利益相关者利益为前提的。

2.答题要点:(1)激励,把管理层的报酬同其绩效挂钩,促使管理层更加自觉地采取满足股东财富最大化的措施;(2)股东直接干预,持股数量较多的机构投资者成为中小股东的代言人,通过与管理层进行协商,对企业的经营提出建议;(3)被解聘的威胁,如果管理层工作严重失误,可能会遭到股东的解聘;(4)被收购的威胁,如果企业被敌意收购,管理层通常会失去原有的工作岗位,因此管理层具有较强动力使企业股票价格最大化。

3.答题要点:(1)利益相关者的利益与股东利益在本质上是一致的,当企业满足股东财富最大化的同时,也会增加企业的整体财富,其他相关者的利益会得到更有效的满足:(2)股东的财务要求权是“剩余要求权”,是在其他利益相关者利益得到满足之后的剩余权益。

(3)企业是各种利益相关者之间的契约的组合。

(4)对股东财富最大化需要进行一定的约束。

4.答题要点:(1)财务经理负责投资、筹资、分配和营运资金的管理;(2)财务经理的价值创造方式主要有:一是通过投资活动创造超过成本的现金收入,二是通过发行债券、股票及其他方式筹集能够带来现金增量的资金。

5.答题要点:(1)为企业筹资和投资提供场所;(2)企业可通过金融市场实现长短期资金的互相转化;(3)金融市场为企业的理财提供相关信息。

6.答题要点:(1)利率由三部分构成:纯利率、通货膨胀补偿、风险收益;(2)纯利率是指没有风险和没有通货膨胀情况下的均衡点利率,通常以无通货膨胀情况下的无风险证券利率来代表纯利率;(3)通货膨胀情况下,资金的供应者必然要求提高利率水平来补偿购买力的损失,所以短期无风险证券利率=纯利率+通货膨胀补偿;(4)风险报酬要考虑违约风险、流动性风险、期限风险,他们都会导致利率的增加。

第二章练习题1.某公司需用一台设备,买价为9000元,可用8年。

如果租用,则每年年初需付租金1500元。

假设利率8%。

要求:试决定企业应租用还是购买该设备。

解:用先付年金现值计算公式计算8年租金的现值得:V0 = A×PVIFA i,n×(1 + i)= 1500×PVIFA8%,8×(1 + 8%)= 1500×5.747×(1 + 8%)= 9310.14(元)因为设备租金的现值大于设备的买价,所以企业应该购买该设备。

2.某企业全部用银行贷款投资兴建一个工程项目,总投资额为5000万元,假设银行借款利率为16%。

该工程当年建成投产。

解:(1)查PVIFA表得:PVIFA16%,8 = 4.344。

由PVAn= A·PVIFAi,n得:A = PVA n/PVIFA i,n= 1151.01(万元)所以,每年应该还1151.01万元。

(2)由PVA n= A·PVIFA i,n得:PVIFA i,n =PVA n/A 则PVIFA16%,n = 3.333查PVIFA表得:PVIFA16%,5 = 3.274,PVIFA16%,6= 3.685,利用插值法:年数年金现值系数5 3.274n 3.333 6 3.685由以上计算,解得:n = 5.14(年) 所以,需要5.14年才能还清贷款。

3、中原公司和南方公司股票的报酬率及其概率分布如表2-18所示 解:(1)计算两家公司的预期收益率: 中原公司 = K 1P 1 + K 2P 2 + K 3P 3= 40%×0.30 + 20%×0.50 + 0%×0.20 = 22%南方公司 = K 1P 1 + K 2P 2 + K 3P 3= 60%×0.30 + 20%×0.50 +(-10%)×0.20= 26%(2)计算两家公司的标准差:中原公司的标准差为:%1420.0%)22%0(50.0%)22%20(30.0%)22%40(222=⨯-+⨯-+⨯-=σ南方公司的标准差为:%98.2420.0%)26%10(20.0%)26%20(30.0%)26%60(222=⨯--+⨯-+⨯-=σ(3)计算两家公司的变异系数: 中原公司的变异系数为: CV =14%/22%=0.64南方公司的变异系数为:CV =24.98%/26%=0.96由于中原公司的变异系数更小,因此投资者应选择中原公司的股票进行投资。

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END-OF—CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1。

Give a full definition of the market for foreign exchange。

Answer: Broadly defined, the foreign exchange (FX) market encompasses the conversion of purchasing power from one currency into another, bank deposits of foreign currency,the extension of credit denominated in a foreign currency, foreign trade financing, and trading in foreign currency options and futures contracts.2。

What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange?Answer: The market for foreign exchange can be viewed as a two-tier market。

One tier is the wholesale or interbank market and the other tier is the retail or client market。

International banks provide the core of the FX market. They stand willing to buy or sell foreign currency for their own account。

国际财务管理学第五版课后答案张先治1.简答题1、答:关于财务的定义有许多。

基本共识是:财务是关于资本的科学,财务与资本运作及管理密不可分:财务是研究个人、经济灾体和其他组织资本的科学。

如果将财务定义为关于经济文体、个人和其他组织进行资金或资本运筹的科学,财务学就是在探索资本运筹规律、追求资本运券效率、总结资本运筹观念的过程中产生和发展起来的一门科学。

或者说,财务学是研究资本运筹规律与效率的门科学。

2、答:财务学出财务经济学和财务管理学两大分支构成。

财务经济学l要借助经济学的基本原理和分析方法,研究资本筹措和投放及其配置效率的计量问题。

财务管理学涉及财务学中的政策和控制问题,包括财务经济学基本原理的实际应用。

财务经济学与财务管理学的关系可从以下三方面进行界定:第。

从经济学与管理学关系看一者的关系。

第二,从二者在财务学中的地位有二者的关系。

第二,从财务学科发展有二者的关系。

3、答:所有者为了实现白己的资本增伯日标,减少经营者偏离白己日标导致的化理风险,需要对公司的资金筹集、资金投问、收益分配政策等行为实施管用,这就足所有者财务的主要内容。

所有者财务的另一项重要内容是对经营者对白己制定的公司政策和重大决策的执行过程灾施监智和调控,对经营者的业绩进行评佔,并且确定向投资者支付的报酬。

经营者财务的主要内容包括:制定具体财务战略:审批预算方案:对预算的实施进行合现地组织和有效地控制:出任或解聘财务经理等。

财务经理财务的I要内容包括:处理与银行的关系、现会管理、筹资管理、信用管理、利润分院的实施、进行财务预测、财务计划和财务分析工作等。

4、答:资本保伯与资本保全足紧密联系但又自所区别的。

资本保值是以资本仕全理论为依据的,资本保个是资本保值的基础,没有资本保个,就谈不上资本保值。

但足,资本保个并不是资本保值的个部内涵。

资本保值应在资本保个的基础上。

进步考虑货币或资本的时间价值(《而会计上的资本保全概念并没考虑货币的时间价伯),即在资木保全的基础上,再考虑期初资木的机会成小或时间价值。

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END—OF—CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of the market for foreign exchange.Answer: Broadly defined, the foreign exchange (FX) market encompasses the conversion of purchasing power from one currency into another,bank deposits of foreign currency, the extension of credit denominated in a foreign currency, foreign trade financing, and trading in foreign currency options and futures contracts。

2。

What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange?Answer:The market for foreign exchange can be viewed as a two-tier market。

One tier is the wholesale or interbank market and the other tier is the retail or client market。

International banks provide the core of the FX market. They stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, corporations or individuals, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange。

第二章练习题1.某公司需用一台设备,买价为9000元,可用8年。

如果租用,则每年年初需付租金1500元。

假设利率8%。

要求:试决定企业应租用还是购买该设备。

解:用先付年金现值计算公式计算8年租金的现值得:V0 = A×PVIFA i,n×(1 + i)= 1500×PVIFA8%,8×(1 + 8%)= 1500×5.747×(1 + 8%)= 9310.14(元)因为设备租金的现值大于设备的买价,所以企业应该购买该设备。

2.某企业全部用银行贷款投资兴建一个工程项目,总投资额为5000万元,假设银行借款利率为16%。

该工程当年建成投产。

解:(1)查PVIFA表得:PVIFA16%,8 = 4.344。

由PVAn= A·PVIFAi,n得:A = PVA n/PVIFA i,n= 1151.01(万元)所以,每年应该还1151.01万元。

(2)由PVA n= A·PVIFA i,n得:PVIFA i,n =PVA n/A 则PVIFA16%,n = 3.333查PVIFA表得:PVIFA16%,5 = 3.274,PVIFA16%,6= 3.685,利用插值法:年数年金现值系数5 3.274n 3.3336 3.685由以上计算,解得:n = 5.14(年)所以,需要5.14年才能还清贷款。

3、中原公司和南方公司股票的报酬率及其概率分布如表2-18所示解:(1)计算两家公司的预期收益率: 中原公司 = K 1P 1 + K 2P 2 + K 3P 3= 40%×0.30 + 20%×0.50 + 0%×0.20 = 22%南方公司 = K 1P 1 + K 2P 2 + K 3P 3= 60%×0.30 + 20%×0.50 +(-10%)×0.20= 26%(2)计算两家公司的标准差:中原公司的标准差为:%1420.0%)22%0(50.0%)22%20(30.0%)22%40(222=⨯-+⨯-+⨯-=σ南方公司的标准差为:%98.2420.0%)26%10(20.0%)26%20(30.0%)26%60(222=⨯--+⨯-+⨯-=σ(3)计算两家公司的变异系数: 中原公司的变异系数为: CV =14%/22%=0.64南方公司的变异系数为:CV =24.98%/26%=0.96由于中原公司的变异系数更小,因此投资者应选择中原公司的股票进行投资。

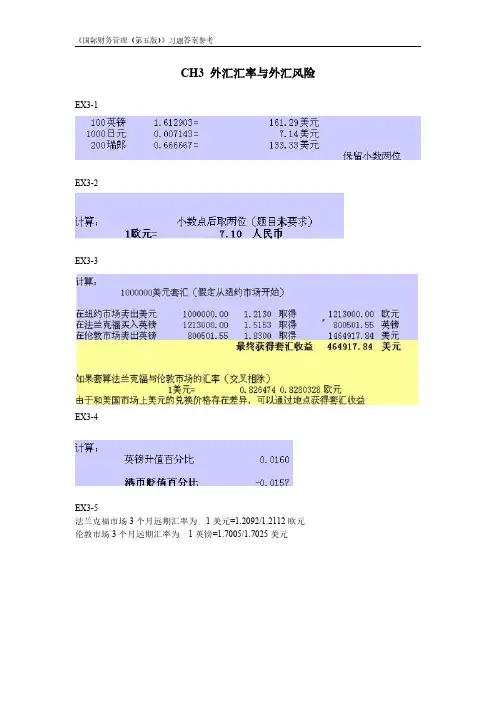

CH3外汇汇率与外汇风险EX3-1EX3-2EX3-3EX3-4EX3-5法兰克福市场3个月远期汇率为1美元=1.2092/1.2112欧元伦敦市场3个月远期汇率为1英镑=1.7005/1.7025美元EX4-1EX4-2(根据利率平价说)EX4-3EX4-4EX4-5EX4-6(1英镑=1.4美元)(1英镑=1.5美元)EX5-1EX-2EX-3EX-4CH6外汇风险管理的策略与方法EX6-1加价后的商品单价为1428加元(等值于1000美元)EX6-2汇率风险分摊后的货款为96.7994万美元美国公司损失(100-96.7994)/100*100%=3.20%甲企业损失(96.7994*6.61-6.2*100)/(6.2*100)*100%=3.20%EX6-3如果是第三版别之前的版本,请注意修改题目中的数据1欧元=10.03元人民币等讨论:(1)如果不防范需要付出人民币期望值为1006.8万元;如果订立远期合约需要确定付出1006万人民币。

(2)不防范方式支付欧元的人民币数额是可能数,具体金额取决于支付时的汇率,面临的汇率风险大,而且按照预测汇率变动情况计算,付出人民币的期望值高于远期合约方式;订立远期合约方式,到期时可以确定支付1006万元人民币。

(3)应该采用买入远期外汇方式。

EX6-5EX6-8借款与投资方式,基本确定可以收入49.9888万元人民币,风险较小其中:借款在国内投资可以获得本金50万元人民币,投资获利1.2188万元人民币,借款的B元按照远期汇率(4.92)计算利息为1.23万元人民币EX8-1公司应支付的承担费为7486.11美元EX8-2该借款的成本率为10.87%或10.88%EX8-3(1)公式2[8%*(1+2%)+2%]*(1-0.25)=7.62%(2)公式3[(1+8%)(1+2%)-1]*(1-0.25)=7.62%EX8-41256.22=95.1/(1+Kg)+99.216/(1+Kg)^2+1378.68/(1+Kg)^3利用EXCEL的IRR函数求得Kg为8.35%EX8-5(1)借入A元的成本率为30.67%,借入B元的成本率为16%,因此,应借入B元(2)平衡点时的汇率为1A元=6.2143B元EX8-6(1)日元的期望成本率为13.11%,欧元的期望成本率为10.86%(2)各占50%进行融资组合的综合成本率如下EX9-1债券的发行价格为52577.10日元EX9-2债券的发行价格为4656.26日元(注意还本后利息金额计算的基础需变化)EX9-3按照单利计算的分析法,计算债券发行价格为9666.67日元EX9-4该债券的成本率为7.56%EX9-5(1)美元债券的成本率为6.17%(其中考虑了发行费用每期抵税后的影响)(2)欧元债券的成本率为7.46%(第三版书汇率数据有变化)EX9-6该债券的税前成本率为7.88%EX9-7股票成本率为27.76%EX12-1采用间接抵免法,该子公司应向我国缴纳公司所得税额96万元人民币EX12-2采用直接抵免法,该分公司应向我国缴纳公司所得税额20万元人民币EX13-2假定生产子公司的销售收入在低价策略中为3500万元,高价策略中为4500万元,填表如下子公司经营情况表项目生产子公司(在A国,税率30%)销售子公司(在B国,税率30%)公司整体生产子公司(在A国,税率20%)销售子公司(在B国,税率40%)公司整体低价策略销售收入销售成本销售毛利经营费用税前利润所得税税后利润3500300050030020060140500035001500200130039091050003000200050015004501050350030005003002004016050003500150020013005207805000300020005001500560940高价策略销售收入销售成本销售毛利经营费用税前利润所得税税后利润450030001500300120036084050004500500200300902105000300020005001500450105045003000150030012002409605000450050020030012018050003000200050015003601140EX13-3冲销后的收支净额为55万元。

东北财经国际财务管理第五版配套答案1、.(年浙江省第二次联考)会计人员的职业道德规范不包括()[单选题] *A操守为重、不做假账(正确答案)B爱岗敬业、诚实守信C、廉洁自律、客观公正D坚持准则、提高技能2、.(年浙江省第四次联考)下列不属于决定单位是否设置会计机构需要考虑的因素的是()[单选题] *A经济业务和财务收支的繁简B单位规模的大小C投资人的需求(正确答案)D经营管理的要求3、下列各项中,不会引起无形资产账面价值发生增减变动的是()。

[单选题] *A.对无形资产计提减值准备B.转让无形资产使用权(正确答案)C.摊销无形资产D.转让无形资产所有权4、.(年浙江省第三次联考)下列项目中不需要进行会计核算的是()[单选题] *A签订销售合同(正确答案)B宣告发放现金股利C提现备发工资D结转本年亏损5、企业溢价发行股票,实收款项超过股票面值的部分,应计入()。

[单选题] *A.主营业务收入B.资本公积(正确答案)C.盈余公积D.财务费用6、A企业2014年12月购入一项固定资产,原价为600万元,采用年限平均法计提折旧,使用寿命为10年,预计净残值为零,2018年1月该企业对该项固定资产的某一主要部件进行更换,发生支出合计400万元,符合固定资产确认条件,被更换的部件的原价为300万元。

则对该项固定资产进行更换后的原价为( )万元。

[单选题] *A.210B.1 000C.820D.610(正确答案)7、某企业自创一项专利,并经过有关部门审核注册获得其专利权。

该项专利权的研究开发费为15万元,其中开发阶段符合资本化条件的支出8万元;发生的注册登记费2万元,律师费1万元。

该项专利权的入账价值为()。

[单选题] *A.15万元B.21万元C.11万元(正确答案)D.18万元8、下列交易和事项中,不应确认为营业外支出的是()。

[单选题] *A.对外捐赠支出B.债务重组损失C.计提的存货跌价准备(正确答案)D.处置报废固定资产损失9、企业生产车间使用的固定资产发生的下列支出中,直接计入当期损益的是( )。

国际财务管理(原书第5版)答案Lecture 4Exchange Rate ParityProblems: 6-2, 3, 4, 7, 8Suggested Solutions2.Option a:When you buy £35,000 forward, you will need $49,000 in three months to fulfill the forward contract. The present value of $49,000 is computed as follows: $49,000/(1.0035)3 = $48,489. Thus, the cost of Jaguar as of today is $48,489.Option b:The present value of £35,000 is £34,314 = £35,000/(1.02). To buy £34,314 today, it will cost $49,755 = 34,314x1.45. Thus the cost of Jaguar as of today is $49,755. You should definitely choose to use “option a”, and save $1,266, which is the difference between $49,755 and $48489.3.a.(1+I$) =1.02 (1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280Thus, IRP is not holding exactly.b.(1) Borrow $1,500,000; repayment will be $1,530,000.(2) Buy £1,000,000 spot using $1,500,000.(3) Invest £1,000,000 at the pound interest rate of 1.45%; maturity value will be £1,014,500.(4) Sell £1,014,500 forward for $1,542,040Arbitrage profit will be $12,040c.Following the arbitrage transactions described above,The dollar interest rate will rise; The pound interest rate will fall;The spot exchange rate will rise; The forward exchange rate will fall.These adjustments will continue until IRP holds.4.a.(1+ i $) = 1.014 < (F/S) (1+ i € ) = 1.053. Thus, one has to borrow dollars and invest in eurosto make arbitrage profit.1)Borrow $1,000,000 and repay $1,014,000 in three months.2)Sell $1,000,000 spot for €800,000.3)I nvest €800,000 at the euro interest rate of 1.35 % for three months and receive€810,800 at maturity.4)Sell €810,800 forward for $1,037,758.Arbitrage profit = $1,037,758 - $1,014,000 = $23,758.b.Follow the first three steps above. But the last step, involving exchange risk hedging, will bedifferent.5)Buy $1,014,000 forward for €792,238.Arbitrage profit = €810,800 - €792,238 = €18,5627.a.ZAR spot rate under PPP = [1.05/1.11](0.175) = $0.1655/rand.b.Expected ZAR spot rate = [1.10/1.08] (0.158) = $0.1609/rand.c.Expected ZAR under PPP = [(1.07)4/(1.05)4] (0.158) = $0.1704/rand.8.a.First, note that (1+i €) = 1.054 is less than (F/S)(1+i €) =(1.60/1.50)(1.052) = 1.1221.You should thus borrow in euros and lend in pounds.1)Borrow €1,000,000 and promise to repay €1,054,000 in one year.2)Buy ?666,667 spot for €1,000,000.3)Invest ?666,667 at the pound interest rate of 5.2%; the maturity value will be ?701,334.4)To hedge exchange risk, sell the maturity value ?701,334 forward in exchange for€1,122,134. The arbitrage profit will be the difference between €1,122,134 and€1,054,000, i.e., €68,134.b.As a result of the above arbitrage transactions, the euro interest rate will rise, the poundinterest rate will fall. In addition, the spot exchange rate (euros per pound) will rise and the forward rate will fall. These adjustments will continue until the interest rate parity is restored.c.The pound-based investor will carry out the same transactions 1), 2), and 3) in a. But tohedge, he/she will buy €1,054,000 forward in exchange for ?658,750. The arbitrage profit will then be ?42,584 = ?701,334 - ?658,750.。

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of the market for foreign exchange.Answer: Broadly defined, the foreign exchange (FX) market encompasses the conversion of purchasing power from one currency into another, bank deposits of foreign currency, the extension of credit denominated in a foreign currency, foreign trade financing, and trading in foreign currency options and futures contracts.2. What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange?Answer: The market for foreign exchange can be viewed as a two-tier market. One tier is the wholesale or interbank market and the other tier is the retail or client market. International banks provide the core of the FX market. They stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, corporations or individuals, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Retail transactions account for only about 14 percent of FX trades. The other 86 percent is interbank trades between international banks, or non-bank dealers large enough to transact in the interbank market.3. Who are the market participants in the foreign exchange market?Answer: The market participants that comprise the FX market can be categorized into five groups: international banks, bank customers, non-bank dealers, FX brokers, and central banks. International banks provide the core of the FX market. Approximately 100 to 200 banks worldwide make a market in foreign exchange, i.e., they stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, the bank customers, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Non-bank dealers are large non-bank financial institutions, such as investment banks, mutual funds, pension funds, and hedge funds, whose size and frequency of trades make it cost- effective to establish their own dealing rooms to trade directly in the interbank market for their foreign exchange needs.Most interbank trades are speculative or arbitrage transactions where market participants attempt to correctly judge the future direction of price movements in one currency versus another or attempt to profit from temporary price discrepancies in currencies between competing dealers.FX brokers match dealer orders to buy and sell currencies for a fee, but do not take a position themselves. Interbank traders use a broker primarily to disseminate as quickly as possible a currency quote to many other dealers.Central banks sometimes intervene in the foreign exchange market in an attempt to influence the price of its currency against that of a major trading partner, or a country that it “fixes〞or “pegs〞 its currency against. Intervention is the process of using foreign currency reserves to buy one’s own currency in order to decrease its supply and thus increase its value in the foreign exchange market, or alternatively, selling one’s own currency for foreign currency in order to increase its supply and lower its price.4. How are foreign exchange transactions between international banks settled?Answer: The interbank market is a network of correspondent banking relationships, with large commercial banks maintaining demand deposit accounts with one another, called correspondent bank accounts. The correspondent bank account network allows for the efficient functioning of the foreign exchange market. As an example of how the network of correspondent bank accounts facilities international foreign exchange transactions, consider a U.S. importer desiring to purchase merchandise invoiced in guilders from a Dutch exporter. The U.S. importer will contact his bank and inquire about the exchange rate. If the U.S. importer accepts the offered exchange rate, the bank will debit the U.S. importer’s account for the purchase of the Dutch guilders. The bank will instruct its correspondent bank in the Netherlands to debit its correspondent bank account the appropriate amount of guilders and to credit th e Dutch exporter’s bank account. The importer’s bank will then debit its books to offset the debit of U.S. importer’s account, reflecting the decrease in its correspondent bank account balance.5. What is meant by a currency trading at a discount or at a premium in the forward market?Answer: The forward market involves contracting today for the future purchase or sale of foreign exchange. The forward price may be the same as the spot price, but usually it is higher (at a premium) or lower (at a discount) than the spot price.6. Why does most interbank currency trading worldwide involve the U.S. dollar?Answer: Trading in currencies worldwide is against a common currency that has international appeal. That currency has been the U.S. dollar since the end of World War II. However, the euro and Japanese yen have started to be used much more as international currencies in recent years. More importantly, trading would be exceedingly cumbersome and difficult to manage if each trader made a market against all other currencies.7. Banks find it necessary to accommodate their clients’ needs to buy or sell FX forward, in many instances for hedging purposes. How can the bank eliminate the currency exposure it has created for itself by accommodating a cl ient’s forward transaction?Answer: Swap transactions provide a means for the bank to mitigate the currency exposure in a forward trade. A swap transaction is the simultaneous sale (or purchase) of spot foreign exchange against a forward purchase (or sale) of an approximately equal amount of the foreign currency. To illustrate, suppose a bank customer wants to buy dollars three months forward against British pound sterling. The bank can handle this trade for its customer and simultaneously neutralize the exchange rate risk in the trade by selling (borrowed) British pound sterling spot against dollars. The bank will lend the dollars for three months until they are needed to deliver against the dollars it has sold forward. The British pounds received will be used to liquidate the sterling loan.8. A CD/$ bank trader is currently quoting a small figure bid-ask of 35-40, when the rest of the market is trading at CD1.3436-CD1.3441. What is implied about the trader’s beliefs by his prices?Answer: The trader must think the Canadian dollar is going to appreciate against the U.S. dollar and therefore he is trying to increase his inventory of Canadian dollars by discouraging purchases of U.S. dollars by standing willing to buy $ at only CD1.3435/$1.00 and offering to sell from inventory at the slightly lower than market price of CD1.3440/$1.00.9. What is triangular arbitrage? What is a condition that will give rise to a triangular arbitrage opportunity?Answer: Triangular arbitrage is the process of trading out of the U.S. dollar into a second currency, then trading it for a third currency, which is in turn traded for U.S. dollars. The purpose is to earn an arbitrageprofit via trading from the second to the third currency when the direct exchange between the two is not in alignment with the cross exchange rate.Most, but not all, currency transactions go through the dollar. Certain banks specialize in making a direct market between non-dollar currencies, pricing at a narrower bid-ask spread than the cross-rate spread. Nevertheless, the implied cross-rate bid-ask quotations impose a discipline on the non-dollar market makers. If their direct quotes are not consistent with the cross exchange rates, a triangular arbitrage profit is possible.PROBLEMS1. Using Exhibit 5.4, calculate a cross-rate matrix for the euro, Swiss franc, Japanese yen, and the British pound. Use the most current American term quotes to calculate the cross-rates so that the triangular matrix resulting is similar to the portion above the diagonal in Exhibit 5.6.Solution: The cross-rate formula we want to use is:S(j/k) = S($/k)/S($/j).The triangular matrix will contain 4 x (4 + 1)/2 = 10 elements.¥SF £$Euro 1 1.5481 .6873Japan (100) 1.1214 .4979 .9498 Switzerland .4440 .84702. Using Exhibit 5.4, calculate the one-, three-, and six-month forward cross-exchange rates between the Canadian dollar and the Swiss franc using the most current quotations. State the forward cross-rates in “Canadian〞 terms.Solution: The formulas we want to use are:F N(CD/SF) = F N($/SF)/F N($/CD)orF N(CD/SF) = F N(CD/$)/F N(SF/$).We will use the top formula that uses American term forward exchange rates.F1(CD/SF)F3(CD/SF)F6(CD/SF) = .8573/.80573. Restate the following one-, three-, and six-month outright forward European term bid-ask quotes in forward points.Solution:One-Month 01-06Three-Month 17-27Six-Month 57-724. Using the spot and outright forward quotes in problem 3, determine the corresponding bid-ask spreads in points.Solution:Spot 5One-Month 10Three-Month 15Six-Month 205. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Canadian dollar versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,CD = [(F N($/CD) - S($/CD/$)/S($/CD)] x 360/Nf1,CD = [(.8037 - .8037)/.8037] x 360/30 = .0000f3,CD = [(.8043 - .8037)/.8037] x 360/90 = .0030f6,CD = [(.8057 - .8037)/.8037] x 360/180 = .0050The pattern of forward premiums indicates that the Canadian dollar is trading at an increasing premium versus the U.S. dollar. That is, it becomes more expensive (in both absolute and percentage terms) to buy a Canadian dollar forward for U.S. dollars the further into the future one contracts.6. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the U.S. dollar versus the British pound using European term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,$ = [(F N (£/$) - S(£/$))/S(£/$)] x 360/Nf1,$ = [(.5251 - .5242)/.5242] x 360/30 = -.0023f3,$ = [(.5268 - .5242)/.5242] x 360/90 = -.0198f6,$ = [(.5290 - .5242)/.5242] x 360/180 = -.0183The pattern of forward premiums indicates that the British pound is trading at a discount versus the U.S. dollar. That is, it becomes more expensive to buy a U.S. dollar forward for British pounds (in absolute but not percentage terms) the further into the future one contracts.7. Given the following information, what are the NZD/SGD currency against currency bid-ask quotations?American Terms European TermsBank Quotations Bid Ask Bid AskNew ZealandSingaporeSolution: Equation 5.12 from the text implies S b(NZD/SGD) = S b($/SGD) x S b(NZD/$) = .6135 x 1.3765 = .8445. The reciprocal, 1/S b(NZD/SGD) = S a(SGD/NZD). Analogously, it is implied that S a(NZD/SGD) = S a($/SGD) x S a(NZD/$) = .6140 x 1.3765 = .8452. The reciprocal, 1/S a(NZD/SGD) = S b(SGD/NZD). Thus, the NZ and.8. Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that /$1.00 and Cr/$1.00. You learn that UBS is making a direct market between the Swiss franc and the euro, w ith a current €/SF quote of .6395. Show how you can make a triangular arbitrage profit by trading at these prices. (Ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What happens if you initially sell dollars for Swiss francs? What €/SF price will eliminate triangular arbitrage?Solution: To make a triangular arbitrage profit the Deutsche Bank trader would sell $5,000,000 to Dresdner Bank at €/$1.00. This trade would yield €3,813,500= $5,000,000 x .7627. The Deutsche Banktrader would then sell the euros for Swiss francs to Union Bank of Switzerland/SF1.00, yielding SF5,963,253 = €3,813,500/.6395. The Deutsche Bank trader will resell the Swiss francs to Credit Sui, yielding a triangular arbitrage profit of $51,036.If the Deutsche Bank trader initially sold $5,000,000 for Swiss francs, instead of euros, the trade would yield S. The Swiss francs would in turn be tr aded for euros to UBS for €3,774,969= SF5,903,000 x .6395. The euros would be resold to Dresdner Bank for $4,949,481 = €3,774,969/.7627, or a loss of $50,519. Thus, it is necessary to conduct the triangular arbitrage in the correct order.The S(€/SF)cross exchange rate should be .7627/1.1806 = .6460. This is an equilibrium rate at which a triangular arbitrage profit will not exist. (The student can determine this for himself.) A profit results from the triangular arbitrage when dollars are first sold for euros because Swiss francs are purchased for euros at too low a rate in comparison to the equilibrium cross-rate, i.e., Swiss franc/SF1.00 instead of/SF1.00. Similarly, when dollars are first sold for Swiss francs, an arbitrage loss results because Swiss francs are sold for euros at too low a rate, resulting in too few euros. That is, each/SF1.00 instead of the hig/SF1.00.9. The current spot exchange r5/£ and the 0/£. Based on your analysis of the exchange rate, you are pretty confident that the2/£ in three months. Assume that you would like to buy or sell £1,000,000.a. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation?b. What would be your speculative profit in dollar terms if the spot exchange ra6/£.Solution:a. If you believe the2/£ in three months, you should0/£. Your expected profit will be:$200).b. If the spot exchange ra6/£ in three months, your loss from the long position will be:0).10. Omni Advisors, an international pension fund manager, plans to sell equities denominated in Swiss Francs (CHF) and purchase an equivalent amount of equities denominated in South African Rands (ZAR).Omni will realize net proceeds of 3 million CHF at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. The following exhibit shows current exchange rates between the ZAR, CHF, and the U.S. dollar (USD).Currency Exchange Ratesa.Describe the currency transaction that Omni should undertake to eliminate currency riskover the 30-day period.b.Calculate the following:• The CHF/ZAR cross-currency rate Omni would use in valuing the Swiss equityportfolio.• The current value of Omni’s Swiss equity portfolio in ZAR.• The annualized forward premium or discount at which the ZAR is trading versus theCHF.CFA Guideline Answer:a.To eliminate the currency risk arising from the possibility that ZAR will appreciateagainst the CHF over the next 30-day period, Omni should sell 30-day forward CHFagainst 30-day forward ZAR delivery (sell 30-day forward CHF against USD and buy30-day forward ZAR against USD).b.The calculations are as follows:• Using the currency cross rates of two forward foreign currencies and three currencies(CHF, ZAR, USD), the exchange would be as follows:--30 day forward CHF are sold for USD. Dollars are bought at the forward sellingprice of CHF1.5285 = $1 (done at ask side because going from currency intodollars)--30 day forward ZAR are purchased for USD. Dollars are simultaneously sold topurchase ZAR at the rate of 6.2538 = $1 (done at the bid side because going fromdollars into currency)--For every 1.5285 CHF held, 6.2538 ZAR are received; thus the cross currency rate is 1.5285 CHF/6.2538 ZAR = 0.244411398.• At the time of execution of the forward contracts, the value of the 3 million CHFequity portfolio would be 3,000,000 CHF/0.244411398 = 12,274,386.65 ZAR.• To calculate the annualized premium or discount of the ZAR agai nst the CHF requires comparison of the spot selling exchange rate to the forward selling price of CHF for ZAR.The premium/discount formula is:[(forward rate – spot rate) / spot rate] x (360 / # day contract) =[(0.244411398 – 0.24477912) / 0.24477912] x (360 / 30) =-1.8027126 % = -1.80% discount ZAR to CHFMINI CASE: SHREWSBURY HERBAL PRODUCTS, LTD.Shrewsbury Herbal Products, located in central England close to the Welsh border, is an old-line producer of herbal teas, seasonings, and medicines. Its products are marketed all over the United Kingdom and in many parts of continental Europe as well.Shrewsbury Herbal generally invoices in British pound sterling when it sells to foreign customers in order to guard against adverse exchange rate changes. Nevertheless, it has just received an order from a large wholesaler in central France for £320,000 of its products, conditional upon delivery being made in three months’ time and the order invoiced in euros.Shrewsb ury’s controller, Elton Peters, is concerned with whether the pound will appreciate versus the euro over the next three months, thus eliminating all or most of the profit when the euro receivable is paid. He thinks this is an unlikely possibility, but he decides to contact the firm’s banker for suggestions about hedging the exchange rate exposure.Mr. Peters learns from the banker that the current spot, thus the i nvoice amount should be €465,184. Mr. Peters also learns that the three-month forward rates for the pound and the euro ve/£1.00 and $/€1.00, respectively. The banker offers to set up a forward hedge for selling the euro receivable for pound sterling based on the €/£ forward cross-exchange rate implicit in the forward rates against the dollar.What would you do if you were Mr. Peters?Suggested Solution to Shrewsbury Herbal Products, Ltd.Note to Instructor: This elementary case provides an intuitive look at hedging exchange rate exposure. Students should not have difficulty with it even though hedging will not be formally discussed until Chapter 8. The case is consistent with the discussion that accompanies Exhibit 5.9 of the text. Professor of Finance, Banikanta Mishra, of Xavier Institute of Management –Bhubaneswar, India contributed to this solution.Suppose Shrewsbury sells at a twenty percent markup. Thus the cost to the firm of the £320,000 order is £256,000. Thus, the pound could appreciate to €465,184/£256,000 = €1.8171/1.00 before all profit was eliminated. This seems rather unlikely. Nevertheless, a ten percent appreciation of the pound (€1.4537 x 1.10) to €1.5991/£1.00 would only yield a profit of £34,904 (= €465,184/1.5991 - £256,000). Shrewsbury can hedge the exposure by selling the euros forward for British pounds at F3(€/£) = F3($/£) ÷ F3($/€)= 1.8990 ÷ 1.3154 = 1.4437. At this forward exchange rate, Shrewsbury can “lock-in〞 a price of £322,217 (= €465,184/1.4437) for the sale. The forward exchange rate indicates that the euro is trading at a premium to the British pound in the forward market. Thus, the forward hedge allows Shrewsbury to lock-in a greater amount (£2,217) than if the euro receivable was converted into pounds at the current spotIf the euro was trading at a forward discount, Shrewsbury would end up locking-in an amount less than £320,000. Whether that would lead to a loss for the company would depend upon the extent of the discount and the amount of profit built into the price of £320,000. Only if the forward exchange rate is even with the spot rate will Shrewsbury receive exactly £320,000.Obviously, Shrewsbury could ensure that it receives exactly £320,000 at the end of three-month accounts receivable period if it could invoice in £. That, however, is not acceptable to the French wholesaler. When invoicing in euros, Shrewsbury could establish the euro invoice amount by use of the forward exchange rate instead of the current spot rate. The invoice amount in that case would be €461,984 = £320,000 x 1.4437. Shrewsbury can now lock-in a receipt of £320,000 if it simultaneously hedges its euro exposure by selling €461,984 at the forward rate of 1.4437. That is, £320,000 = €461,984/1.4437.。

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1。

Give a full definition of the market for foreign exchange.Answer: Broadly defined, the foreign exchange (FX) market encompasses the conversion of purchasing power from one currency into another, bank deposits of foreign currency,the extension of credit denominated in a foreign currency,foreign trade financing, and trading in foreign currency options and futures contracts.2。

What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange?Answer:The market for foreign exchange can be viewed as a two-tier market. One tier is the wholesale or interbank market and the other tier is the retail or client market。

International banks provide the core of the FX market. They stand willing to buy or sell foreign currency for their own account。

Lecture 4

Exchange Rate Parity

Problems: 6-2, 3, 4, 7, 8

Suggested Solutions

2.

Option a:

When you buy £35,000 forward, you will need $49,000 in three months to fulfill the forward contract. The present value of $49,000 is computed as follows: $49,000/(1.0035)3 = $48,489. Thus, the cost of Jaguar as of today is $48,489.

Option b:

The present value of £35,000 is £34,314 = £35,000/(1.02). To buy £34,314 today, it will cost $49,755 = 34,314x1.45. Thus the cost of Jaguar as of today is $49,755. You should definitely choose to use “option a”, and save $1,266, which is the difference between $49,755 and $48489.

3.

a.(1+I$) =1.02 (1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280

Thus, IRP is not holding exactly.

b.(1) Borrow $1,500,000; repayment will be $1,530,000.

(2) Buy £1,000,000 spot using $1,500,000.

(3) Invest £1,000,000 at the pound interest rate of 1.45%; maturity value will be £1,014,500.

(4) Sell £1,014,500 forward for $1,542,040

Arbitrage profit will be $12,040

c.Following the arbitrage transactions described above,

The dollar interest rate will rise; The pound interest rate will fall;

The spot exchange rate will rise; The forward exchange rate will fall.

These adjustments will continue until IRP holds.

4.

a.(1+ i $) = 1.014 < (F/S) (1+ i € ) = 1.053. Thus, one has to borrow dollars and invest in euros

to make arbitrage profit.

1)Borrow $1,000,000 and repay $1,014,000 in three months.

2)Sell $1,000,000 spot for €800,000.

3)Invest €800,000 at the euro interest rate of 1.35 % for three months and receive

€810,800 at maturity.

4)Sell €810,800 forward for $1,037,758.

Arbitrage profit = $1,037,758 - $1,014,000 = $23,758.

b.Follow the first three steps above. But the last step, involving exchange risk hedging, will be

different.

5)Buy $1,014,000 forward for €792,238.

Arbitrage profit = €810,800 - €792,238 = €18,562

7.

a.ZAR spot rate under PPP = [1.05/1.11](0.175) = $0.1655/rand.

b.Expected ZAR spot rate = [1.10/1.08] (0.158) = $0.1609/rand.

c.Expected ZAR under PPP = [(1.07)4/(1.05)4] (0.158) = $0.1704/ran

d.

8.

a.First, note that (1+i €) = 1.054 is less than (F/S)(1+i €) = (1.60/1.50)(1.052) = 1.1221.

You should thus borrow in euros and lend in pounds.

1)Borrow €1,000,000 and promise to repay €1,054,000 in one year.

2)Buy ₤666,667 spot for €1,000,000.

3)Invest ₤666,667 at the pound interest rate of 5.2%; the maturity value will be ₤701,334.

4)To hedge exchange risk, sell the maturity value ₤701,334 forward in exchange for

€1,122,134. The arbitrage profit will be the difference between €1,122,134 and

€1,054,000, i.e., €68,134.

b.As a result of the above arbitrage transactions, the euro interest rate will rise, the pound

interest rate will fall. In addition, the spot exchange rate (euros per pound) will rise and the forward rate will fall. These adjustments will continue until the interest rate parity is restored.

c.The pound-based investor will carry out the same transactions 1), 2), and 3) in a. But to

hedge, he/she will buy €1,054,000 forward in exchange for ₤658,750. The arbitrage profit will then be ₤42,584 = ₤701,334 - ₤658,750.。