2011年银行理财产品市场年报

- 格式:doc

- 大小:15.50 KB

- 文档页数:3

中国农业银行股份有限公司AGRICULTURAL BANK OF CHINA LIMITED(A股股票代码:601288)2011年年度报告摘要§1重要提示1.1本行董事会、监事会及其董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

本年度报告摘要摘自年度报告全文,报告全文同时刊载于上海证券交易所网站以及本行网站。

投资者欲了解详细内容,应当仔细阅读年度报告全文。

1.2 3月22日,本行董事会2012年第4次会议审议通过了本行《2011年年度报告》正文及摘要。

本行全体董事出席了会议。

1.3 本行按中国会计准则和国际财务报告准则编制的2011年度财务报告已经德勤华永会计师事务所有限公司和德勤·关黄陈方会计师行分别根据中国和国际审计准则审计,并出具标准无保留意见的审计报告。

1.4本行法定代表人蒋超良、主管财会工作副行长潘功胜及财会机构负责人张克秋保证年度报告中财务报告的真实、完整。

§2公司基本情况2.1 基本情况简介A股H股股票简称农业银行农业银行股票代码601288 1288 上市证券交易所上海证券交易所香港联合交易所有限公司2.2联系人和联系方式董事会秘书、公司秘书姓名李振江联系地址中国北京市东城区建国门内大街69号电话86-10-85109619传真86-10-85108557电子信箱ir@§3会计数据和财务指标摘要3.1财务数据200920112010 报告期末数据(人民币百万元)资产总额 11,677,577 10,337,406 8,882,588发放贷款和垫款净额 5,398,863 4,788,008 4,011,495投资净额 2,628,0522,527,431 2,616,672负债总额 11,027,789 9,795,170 8,539,663吸收存款 9,622,026 8,887,905 7,497,618归属于母公司股东的权益649,601 542,071 342,819年度经营业绩(人民币百万元)利息净收入 307,199 242,152 181,639手续费及佣金净收入 68,75046,128 35,640业务及管理费 135,561 112,071 95,823资产减值损失 64,225 43,412 40,142净利润 121,956 94,907 65,002归属于母公司股东的净利润121,927 94,873 64,992扣除非经常性损益后归属于母公司股120,727 93,757 60,305东的净利润经营活动产生的现金流量净额223,004 (89,878) (21,025)3.2财务指标201120102009盈利能力 (%)平均总资产回报率1 1.11 0.99 0.82加权平均净资产收益率220.4622.49 20.53扣除非经常性损益后加权平均净资产收益率220.2622.23 19.05净利息收益率3 2.85 2.57 2.28净利差4 2.73 2.50 2.20加权风险资产收益率5 1.91 1.76 1.49手续费及佣金净收入比营业收入18.2015.88 16.03成本收入比635.89 38.59 43.11每股数据(人民币元)基本每股收益20.380.330.25扣除非经常性损益后基本每股收益20.370.330.23每股经营活动产生的现金流量净额0.69(0.28)(0.08)2011年12月31日2010年12月31日2009年12月31日资产质量 (%)不良贷款率7 1.55 2.03 2.91拨备覆盖率8263.10 168.05 105.37贷款总额准备金率9 4.08 3.40 3.06资本充足情况 (%)核心资本充足率109.509.75 7.74资本充足率1011.9411.59 10.07总权益对总资产比率 5.56 5.25 3.86加权风险资产占总资产比率54.7152.08 49.23每股数据(人民币元)归属于母公司股东的每股净资产 2.00 1.67 1.32注:1、净利润除以年初和年末资产总额的平均值。

中国建设银行股份有限公司2011年年度报告摘要1 重要提示1.1 本行董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。

本年度报告摘要摘自年度报告全文,根据中国会计准则编制的2011年年度报告亦刊载于上海证券交易所()及本行网站()。

投资者欲了解详细内容,应当仔细阅读年度报告全文。

1.2 本行于2012年3月23日召开的董事会审议通过了本年度报告正文及其摘要。

本行13名董事亲自出席董事会会议,张建国先生委托王洪章先生代为出席并表决,朱小黄先生委托李晓玲女士代为出席并表决。

1.3 本集团2011年度按照中国会计准则编制的财务报告经普华永道中天会计师事务所审计,按照国际财务报告准则编制的财务报告经罗兵咸永道会计师事务所审计,并出具标准无保留意见的审计报告。

中国建设银行股份有限公司董事会2012年3月23日本行法定代表人王洪章、首席财务官曾俭华、财务会计部总经理应承康保证本年度报告中财务报告的真实、完整。

2 公司基本情况简介2.1 基本情况简介股票简称 建设银行(A股) 建设银行(H股)股票代码 601939 939上市交易所 上海证券交易所 香港联合交易所有限公司 2.2 联系人和联系方式董事会秘书 证券事务代表 姓名 陈彩虹 徐漫霞联系地址 中国北京市西城区金融大街25号 电话 86-10-66215533传真 86-10-66218888电子信箱 ir@3 会计数据和财务指标摘要3.1 主要会计数据及财务指标本年度报告所载财务资料按照中国会计准则编制,除特别注明外,为本集团数据,以人民币列示。

(除特别注明外,以人民币百万元列示) 2011年2010年变化(%)2009年 2008年2007年全年利息净收入 304,572251,50021.10211,885 224,920 192,775手续费及佣金净收入 86,99466,13231.5548,059 38,446 31,313其他营业收入 5,5245,857(5.69)7,240 4,141 (4,629)营业收入397,090323,48922.75267,184 267,507 219,459业务及管理费 (118,294)(101,793)16.21(87,900) (82,162) (78,825)资产减值损失 (35,783)(29,292)22.16(25,460) (50,829) (27,595)营业利润 217,672173,70425.31137,602 118,607 100,535利润总额219,107175,15625.09138,725 119,741 100,816净利润 169,439135,03125.48106,836 92,642 69,142归属于本行股东的净利润 169,258134,84425.52106,756 92,599 69,053扣除非经常性损益后归属于本行股东的净利润1168,152133,83425.64105,547 95,825 68,815经营活动产生的现金流量净额125,014259,361(51.80)423,579 180,646 294,314于12月31日客户贷款和垫款净额 6,325,1945,526,02614.464,692,947 3,683,575 3,183,229资产总额 12,281,83410,810,31713.619,623,355 7,555,452 6,598,177客户存款 9,987,4509,075,36910.058,001,323 6,375,915 5,329,507负债总额 11,465,17310,109,41213.419,064,335 7,087,890 6,175,896股东权益 816,661700,90516.52559,020 467,562 422,281归属于本行股东权益 811,141696,79216.41555,475 465,966 420,977股本 250,011250,011-233,689 233,689 233,689核心资本 750,660634,68318.27491,452 431,353 386,403附属资本 189,855144,90631.02139,278 86,794 83,900资本净额 924,506762,44921.25608,233 510,416 463,182加权风险资产 6,760,1176,015,32912.385,197,545 4,196,493 3,683,123每股计(人民币元)基本和稀释每股收益20.680.5621.430.45 0.40 0.30扣除非经常性损益后的基本和稀释每股收益20.670.5619.640.44 0.41 0.30当年已宣派中期现金股息 --不适用- 0.1105 0.067于资产负债表日后每股拟派末期现金股息 0.23650.212211.450.202 0.0837 0.065当年已宣派特别现金股息 --不适用- - 0.072716每股净资产 3.27 2.8016.79 2.39 2.00 1.81归属于本行股东的每股净资产 3.24 2.7916.13 2.38 1.99 1.80每股经营活动产生的现金流量净额 0.50 1.04(51.92) 1.81 0.77 1.301. 非经常性损益的项目和相关金额请参见财务报表补充资料 1。

老客硬件呼死你《2011中国理财行业发展报告》预发布2011年11月27日,2011第二届国家理财规划师年会暨第六届全国十佳理财师大赛颁奖大典在北京隆重举行。

新浪财经对会议进行了独家直播。

以下为北京东方华尔金融咨询有限责任公司研发部高级顾问、英属哥伦比亚大学经济学博士李晨先生所做的2011中国理财行业发展报告预报告发布。

以下为报告全文:各位领导,各位嘉宾大家下午好!我是东方华尔研发部总监李晨,今天我很荣幸,代表我们东方华尔为大家做一个2011年中国理财行业发展报告预报告。

一,2011年中国行业发展基本现状。

2011年中国理财产品市场整体发展状况,2011年上半年面对复杂多变的国际形势和国内经济运行出现的新情况,新问题。

党中央国务院坚持实施积极的财政政策和稳健的货币政策。

经济运行总体良好,继续朝着宏观调控预期方向发展。

2011年上半年国内生产总值20.44万元。

按可比价格计算,同比增长9.6%;其中,一季度增长9.7%,二季度增长9.5%,分产业看,第一产业增加值1.57万亿元。

增长3.2%;第二产业增加值10.22%万亿元,增长11.0%;第三产业增加值8.66万亿元,增长9.2%。

2011年前三季度我国国内生产总值为32.07万亿元,按可比价格计算,同比增长9.4%;分季度看,一季度同比增长9.7%,二季度增长9.5%,三季度增长9.1%,呈现逐季回落态势。

分产业看,第一产业增加值3.03万亿元,增长3.8%;第二产业增加值15.48万亿元,增长10.8%;第三产业增加值13.56万亿元,增长9.0%;此外从环比看,2011年三季度国内生产总值增长2.3%。

2011年前三季度固定资产投资21.23万亿元,同比名义增长24.9%,比上半年回落0.7个百分点。

2011年1—9月份,全国规模以上工业企业实现利润3.68万亿元,同比增长27%。

在规模以上工业企业中,国有及国有控股企业实现利润1.15万亿元,同比增长19.8%;集体企业实现利润598亿元,同比增长33.6%;股份制企业实现利润2.1万亿元,同比增长32.4%;外商及港澳台商投资企业实现利润9581亿元,同比增长12.9%;私营企业实现利润1.03万亿元,同比增长44.7%。

招商银行公布2011年度全年业绩经营效率持续改善二次转型成效进一步体现2011年度全年业绩摘要●归属于本行股东净利润人民币361.29亿元,同比增加40.20%●归属于本行股东基本每股盈利人民币1.67元,同比增加35.77%●净利息收益率为3.06%,同比增加41个基点●总资产为人民币27,949.71亿元,较上年末上升16.34%●资本充足率为11.53%,较上年末增加0.06个百分点●核心资本充足率为8.22%,较上年末增加0.18个百分点●不良贷款总额为91.73亿元,比上年末减少5.13亿元;不良贷款率0.56%,比上年末下降0.12个百分点●不良贷款拨备覆盖率为400.13%,比上年末增加97.72个百分点(注:招商银行A股的2011年度全年财务报告是按中国会计准则编制,除特别标示外,以上资料均为本集团口径资料,及以人民币为单位。

按国际财务报告编制的H股财务数据如果与A 股财务数据不同,则另行标示。

)2012年3月28日─ 招商银行(「招行」或「本公司」或「本行」);上海:600036;香港:3968;连同其附属公司合称「本集团」),今天公布2011年度全年业绩。

一、效益、质量、规模持续均衡发展2011年,在国外经济金融形势错综复杂、国内经济增长略为趋缓的情况下,招商银行扎实推进二次转型,盈利稳步增长且经营效率持续改善,实现了效益、质量、规模持续均衡发展。

1.盈利能力稳步上升。

2011年本集团实现归属于本行股东净利润361.29亿元,比上年增加103.60亿元,增幅40.20%;实现净利息收入763.07亿元,比上年增加192.31亿元,增幅33.69%;实现非利息净收入198.50亿元,比上年增加55.49亿元,增幅38.80% (H股:非利息净收入203.59亿元,比上年增加56.79亿元,增幅38.69%)。

归属于本行股东的平均总资产收益率(ROAA)和归属于本行股东的平均净资产收益率(ROAE)分别为1.39%和24.17%,较2010年分别提高0.24个百分点和1.44个百分点。

2011金融理财产品分析报告【摘要】银行理财产品,按照标准的解释,应该是商业银行在对潜在目标客户群分析研究的基础上,针对特定目标客户群开发设计并销售的资金投资和管理计划。

在理财产品这种投资方式中,银行只是接受客户的授权管理资金,投资收益与风险由客户或客户与银行按照约定方式承担。

本文主要介绍了现行银行理财产品的分类,收益水平,发展趋势以及作者个人的想法和政策建议。

一、银行理财产品的分类一般根据本金与收益是否保证,我们将银行理财产品分为保本固定收益产品、保本浮动收益产品与非保本浮动收益产品三类。

另外按照投资方式与方向的不同,新股申购类产品、银信合作品、QDII产品、结构型产品等,也是我们经常听到和看到的说法。

1、保证收益理财计划保本收益理财计划是指商业银行按照约定条件向客户承诺支付固定收益,银行承担由此产生的投资风险,或银行按照约定条件向客户承诺支付最低收益并承担相关风险,其他投资收益由银行和客户按照合同约定分配,并共同承担相关投资风险的理财计划。

保证收益产品包含两类产品:保本固定收益产品和保证最低收益产品。

保本固定收益产品指银行按照合同约定的事项向投资者支付全额本金和固定收益的产品。

投资者买这类产品到期获得固定收益,投资风险全由银行承担。

但投资者并不是完全无条件地获得固定收益,监管层规定银行不能无条件地承诺固定收益,以防银行高息揽储。

因而,在固定收益产品中,合约中规定银行在特定时间或特定条件下拥有提前终止产品的权利,而投资者并不享有。

由于固定收益理财产品投资风险均由银行承担,而投资者主要关注的是产品提前终止风险,而这类风险发生的概率较低。

因此,投资者在选择固定收益产品主要把握两个比较:第一,同类产品比较,同期限产品选年收益率高者,不同期限产品,在考虑流动性需要和利率政策的基础上进行选择;第二,与定期存款比较,投资者之所以选银行理财产品,特别是固定收益产品,重要因素是其收益水平高于存款利息。

保证最低收益产品指银行按照合同约定事项支付投资者全额本金、最低固定收益以及其他或有投资收益的产品。

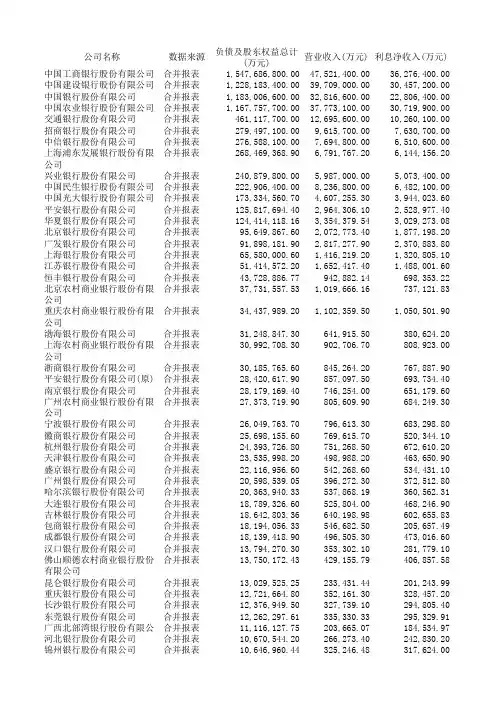

公司名称数据来源负债及股东权益总计(万元)营业收入(万元)利息净收入(万元)中国工商银行股份有限公司合并报表1,547,686,800.0047,521,400.0036,276,400.00中国建设银行股份有限公司合并报表1,228,183,400.0039,709,000.0030,457,200.00中国银行股份有限公司合并报表1,183,006,600.0032,816,600.0022,806,400.00中国农业银行股份有限公司合并报表1,167,757,700.0037,773,100.0030,719,900.00交通银行股份有限公司合并报表461,117,700.0012,695,600.0010,260,100.00招商银行股份有限公司合并报表279,497,100.009,615,700.007,630,700.00中信银行股份有限公司合并报表276,588,100.007,694,800.006,510,600.00上海浦东发展银行股份有限公司合并报表268,469,368.906,791,767.206,144,156.20兴业银行股份有限公司合并报表240,879,800.005,987,000.005,073,400.00中国民生银行股份有限公司合并报表222,906,400.008,236,800.006,482,100.00中国光大银行股份有限公司合并报表173,334,560.704,607,255.303,944,023.60平安银行股份有限公司合并报表125,817,694.402,964,306.102,528,977.40华夏银行股份有限公司合并报表124,414,118.163,354,379.543,029,273.08北京银行股份有限公司合并报表95,649,867.602,072,773.401,877,198.20广发银行股份有限公司合并报表91,898,181.902,817,277.902,370,883.80上海银行股份有限公司合并报表65,580,000.601,416,219.201,320,805.10江苏银行股份有限公司合并报表51,414,572.201,652,417.401,488,001.60恒丰银行股份有限公司合并报表43,728,886.77942,882.14698,353.22合并报表37,731,557.531,019,666.16737,121.83北京农村商业银行股份有限公司合并报表34,437,989.201,102,359.501,050,501.90重庆农村商业银行股份有限公司渤海银行股份有限公司合并报表31,248,847.30641,915.50380,624.20合并报表30,992,708.30902,706.70808,923.00上海农村商业银行股份有限公司浙商银行股份有限公司合并报表30,185,765.60845,264.20767,887.90平安银行股份有限公司(原)合并报表28,420,617.90857,097.50693,734.40南京银行股份有限公司合并报表28,179,169.40746,254.00651,179.60合并报表27,373,719.90805,609.90684,249.30广州农村商业银行股份有限公司宁波银行股份有限公司合并报表26,049,763.70796,613.30683,298.80徽商银行股份有限公司合并报表25,698,155.60769,615.70520,344.10杭州银行股份有限公司合并报表24,393,726.80751,268.50672,610.20天津银行股份有限公司合并报表23,535,998.20498,988.20463,650.90盛京银行股份有限公司合并报表22,116,956.60542,268.60534,431.10广州银行股份有限公司合并报表20,598,539.05396,272.30372,512.80哈尔滨银行股份有限公司合并报表20,363,940.33537,868.19360,562.31大连银行股份有限公司合并报表18,789,326.60525,804.00468,246.90吉林银行股份有限公司合并报表18,642,803.36640,198.98602,655.83包商银行股份有限公司合并报表18,194,056.33546,682.50205,657.49成都银行股份有限公司合并报表18,139,418.90496,505.30473,016.60汉口银行股份有限公司合并报表13,794,270.30353,302.10281,779.10合并报表13,750,172.43429,155.79406,857.58佛山顺德农村商业银行股份有限昆仑银行股份有限公司合并报表13,029,525.25233,431.44201,243.99重庆银行股份有限公司合并报表12,721,664.80352,161.30328,457.20长沙银行股份有限公司合并报表12,376,949.50327,739.10294,805.40东莞银行股份有限公司合并报表12,262,297.61335,330.33295,329.91广西北部湾银行股份有限公司合并报表11,116,127.75203,665.07184,534.97河北银行股份有限公司合并报表10,670,544.20266,273.40242,830.20锦州银行股份有限公司合并报表10,646,960.44325,246.48317,624.00华融湘江银行股份有限公司合并报表10,429,979.49212,539.49143,022.69西安银行股份有限公司合并报表10,235,305.67261,319.39250,728.35合并报表8,979,871.30308,955.65297,084.36杭州联合农村商业银行股份有限合并报表8,867,398.58347,966.76290,268.02武汉农村商业银行股份有限公司南昌银行股份有限公司合并报表8,807,833.05331,019.25240,849.95广东南粤银行股份有限公司合并报表8,324,066.00212,785.48110,053.56富滇银行股份有限公司合并报表8,301,065.90228,206.40218,209.00贵阳银行股份有限公司合并报表8,206,646.20270,109.40188,820.10晋商银行股份有限公司合并报表7,778,732.49210,798.96194,137.75青岛银行股份有限公司合并报表7,702,567.70248,499.50229,961.00南充市商业银行股份有限公司合并报表7,575,455.20200,905.70145,342.50兰州银行股份有限公司合并报表7,540,951.04204,607.15157,225.42郑州银行股份有限公司合并报表7,248,547.22220,381.98158,840.01厦门银行股份有限公司合并报表7,008,123.38128,764.03127,779.47温州银行股份有限公司合并报表6,565,157.90227,533.35218,744.79九江银行股份有限公司合并报表6,417,960.98258,945.33123,486.01洛阳银行股份有限公司合并报表6,219,936.20203,759.10190,016.10合并报表6,206,186.85226,265.86199,608.24浙江稠州商业银行股份有限公司福建海峡银行股份有限公司合并报表6,178,964.54192,967.75188,669.00台州银行股份有限公司合并报表5,719,182.47309,892.56276,389.90合并报表5,632,710.88191,894.79184,035.92江苏江阴农村商业银行股份有限威海市商业银行股份有限公司合并报表5,627,629.88152,556.02118,792.37宁夏银行股份有限公司合并报表5,598,421.50240,486.80232,102.60合并报表5,400,317.60171,045.10164,328.20江苏吴江农村商业银行股份有限营口银行股份有限公司合并报表5,366,031.18202,317.57186,089.50柳州银行股份有限公司合并报表5,173,298.10107,520.3087,674.86长安银行股份有限公司合并报表5,122,987.92165,859.17150,380.48鞍山银行股份有限公司合并报表4,893,593.60168,979.06144,398.25赣州银行股份有限公司合并报表4,816,623.68129,253.3972,389.31合并报表4,783,120.18264,311.42234,301.30浙江泰隆商业银行股份有限公司内蒙古银行股份有限公司合并报表4,693,761.22183,153.46144,960.01潍坊银行股份有限公司合并报表4,620,036.65176,042.52147,160.36辽阳银行股份有限公司合并报表4,488,288.81138,603.58123,335.14合并报表4,443,927.69134,381.32121,082.83攀枝花市商业银行股份有限公司桂林银行股份有限公司合并报表4,273,065.68124,241.7889,053.77华商银行合并报表4,243,951.0799,671.3988,915.25齐商银行股份有限公司合并报表4,182,566.63179,569.00171,667.25日照银行股份有限公司合并报表3,948,914.09169,893.45153,554.69绍兴银行股份有限公司合并报表3,905,068.93111,450.88107,202.39德阳银行股份有限公司合并报表3,727,892.31111,200.72107,560.98合并报表3,583,346.85161,425.66133,031.53张家口市商业银行股份有限公司莱商银行股份有限公司合并报表3,481,404.22140,790.44120,043.41鄂尔多斯银行股份有限公司合并报表3,194,527.23210,556.55183,436.53嘉兴银行股份有限公司合并报表2,877,216.6199,656.8796,604.56金华银行股份有限公司合并报表2,849,599.9595,549.9379,753.32沧州银行股份有限公司合并报表2,793,317.53114,559.80113,582.34东营银行股份有限公司合并报表2,574,473.06111,321.93107,494.09绵阳市商业银行股份有限公司合并报表2,338,437.9382,493.9563,948.14大同市商业银行股份有限公司合并报表2,223,143.8444,133.9146,476.51上饶银行股份有限公司合并报表2,190,156.6576,872.3153,306.23承德银行股份有限公司合并报表2,121,329.9182,090.5668,205.82泉州银行股份有限公司合并报表1,958,050.8367,772.8866,676.26济宁银行股份有限公司合并报表1,787,465.58100,663.2895,457.26开封市商业银行股份有限公司合并报表1,535,152.7938,079.7932,415.55新乡银行股份有限公司合并报表1,395,967.5968,870.5862,047.08焦作市商业银行股份有限公司合并报表1,367,936.5152,447.3737,536.18长治市商业银行股份有限公司合并报表1,282,405.9147,520.8945,756.64许昌银行股份有限公司合并报表1,173,405.3351,063.2744,661.71信阳银行股份有限公司合并报表835,130.9948,706.4761,543.42三门峡市商业银行股份有限公司合并报表795,373.4528,045.2426,802.57枣庄市商业银行股份有限公司合并报表732,174.4337,179.9036,459.57合并报表524,010.6249,768.1346,626.08景德镇市商业银行股份有限公司营口沿海银行股份有限公司合并报表437,581.6814,248.6314,073.34达州市商业银行股份有限公司合并报表435,071.7719,376.4819,066.76数据来源:Wind资讯利息收入(万元)利息支出(万元)手续费及佣金净收入(万元)手续费及佣金收入(万元) 58,958,000.0022,681,600.0010,155,000.0010,907,700.00 48,224,700.0017,767,500.008,699,400.008,949,400.00 41,310,200.0018,503,800.006,466,200.007,001,800.00 47,292,100.0016,572,200.006,875,000.007,152,400.00 19,087,200.008,827,100.001,954,900.002,246,400.00 12,124,500.004,493,800.001,562,800.001,692,400.00 10,662,300.004,151,700.00883,700.00948,100.00 12,122,123.705,977,967.50671,572.60720,480.90 10,844,700.005,771,300.00884,500.00941,800.00 11,728,100.005,246,000.001,510,100.001,599,100.00 7,788,459.303,844,435.70697,311.90738,107.60 5,233,069.702,704,092.30366,466.90412,960.00 6,253,596.403,224,323.32297,550.02339,426.33 3,776,569.701,899,371.50161,273.00178,317.40 4,257,210.501,886,326.70416,453.90495,267.90 2,629,416.201,308,611.10108,445.50122,031.20 2,413,413.00925,411.40129,397.20133,945.80 2,513,456.071,815,102.85152,098.62156,675.46 1,342,813.60605,691.7750,714.8667,546.80 1,753,920.20703,418.3063,540.7067,107.40 1,206,078.70825,454.5089,412.9096,877.30 1,348,228.20539,305.2052,007.7062,183.70 1,533,814.00765,926.1060,654.1063,611.60 1,398,578.20704,843.80173,930.00194,391.10 1,300,240.40649,060.8073,044.3076,951.90 1,091,813.50407,564.2097,979.50107,411.10 1,455,460.20772,161.4071,913.1084,959.60 936,733.40416,389.3041,276.1046,117.20 1,224,256.60551,646.4060,651.8065,902.00 1,045,988.50582,337.6026,623.5028,482.00 1,155,285.20620,854.106,507.909,061.00 734,268.52361,755.7220,851.2124,114.00 776,178.18415,615.8641,185.3650,321.70 907,897.40439,650.5052,240.6054,898.50 921,277.49318,621.6631,112.1132,760.95 582,841.19377,183.7041,805.7744,317.38 717,371.40244,354.805,901.7013,779.90 508,135.70226,356.6073,011.8077,049.00 607,335.44200,477.8621,461.5125,078.87 374,181.13172,937.1430,451.3134,537.79 935,482.20607,025.0028,981.2032,833.90 436,601.10141,795.7021,901.4028,269.80 547,710.95252,381.0335,051.7835,644.25 463,425.77278,890.8123,651.0725,417.15 376,985.40134,155.2020,246.9020,834.60 506,905.39189,281.398,011.328,812.98 363,700.10220,677.428,029.959,154.31 358,851.96108,123.6113,719.1616,968.72 466,311.69169,227.344,265.486,655.52 417,349.24127,081.222,958.923,460.08 339,279.0198,429.0729,576.9630,196.22 471,748.45361,694.8817,086.7217,626.65 368,591.70150,382.709,975.1011,302.20302,104.60113,284.507,504.608,216.70 339,025.79144,888.0314,610.3114,936.04 365,231.20135,270.2014,133.4014,995.40 297,611.50152,269.0030,081.0035,473.80 302,619.47145,394.059,539.229,790.11 261,691.42102,851.414,403.705,582.27 224,190.4696,410.986,325.886,738.12 328,732.63109,987.848,699.399,818.03 277,910.68154,424.6716,568.4617,496.15 277,690.5087,674.409,109.509,493.90 341,871.14142,262.9017,267.9417,675.08 277,951.6689,282.667,469.238,418.28 374,258.1897,868.2813,751.0320,457.25 297,445.59113,409.674,119.864,861.20 229,679.19110,886.827,493.368,611.46 309,423.3077,320.707,269.109,876.80 245,675.3081,347.102,941.303,019.00 259,875.0173,785.519,700.619,809.35 159,622.1771,947.318,808.639,197.16 227,616.0877,235.608,166.398,456.21 203,822.9559,424.711,661.912,643.03 134,438.3462,049.0313,017.1713,584.38 312,437.4378,136.1317,859.8531,310.90 198,603.4653,643.453,476.283,755.05 220,941.8973,781.534,147.584,767.98 172,153.6948,818.551,799.221,959.31 265,430.16144,347.345,188.585,417.03 158,269.8869,216.113,999.195,620.26 162,081.6373,166.3910,775.6210,837.91 280,756.06109,088.818,332.0510,772.02 270,871.49117,316.8114,021.3015,843.90 194,312.4687,110.072,169.892,644.49 178,905.4571,344.461,994.802,746.46 202,527.3169,495.776,567.496,728.07 227,076.54107,033.139,203.8210,117.98 213,309.6729,873.1513,012.7313,264.06 139,274.2842,669.723,048.553,397.57 126,107.3346,354.016,004.976,466.85 157,241.0743,658.741,319.271,444.52 175,245.6567,751.563,342.284,890.76 89,712.2925,764.15681.521,390.49 82,642.0636,165.55-2,408.66500.25 89,803.1136,496.884,289.454,384.52 93,508.3125,302.48505.40645.87 93,242.0326,565.761,345.161,706.15 182,457.9487,000.693,913.595,107.99 72,068.0839,652.532,672.942,890.39 81,504.0719,456.99457.16568.33 92,417.3354,881.151,489.981,669.03 74,127.1528,370.511,215.531,297.76 58,790.8514,129.14311.17524.78 74,751.5513,208.13-13,870.48243.70 36,926.0310,123.46343.29671.96 48,685.4712,225.90558.09602.31211,070.10164,444.02765.45775.05 18,702.804,629.4728.2238.99 24,643.715,576.95206.32291.10手续费及佣金支出(万元)营业支出(万元)营业税费(万元)管理费用(万元)营业利润(万元) 752,700.0020,421,400.002,887,500.0013,959,800.0027,100,000.00250,000.0017,941,800.002,422,900.0011,829,400.0021,767,200.00535,600.0015,962,700.001,858,100.0010,851,100.0016,853,900.00277,400.0022,099,300.002,120,700.0013,556,100.0015,673,800.00291,500.006,206,000.00893,900.003,752,900.006,489,600.00129,600.004,954,400.00609,100.003,479,800.004,661,300.0064,400.003,552,300.00534,300.002,297,300.004,142,500.0048,908.303,216,094.50489,888.801,955,358.303,575,672.7057,300.002,633,800.00429,100.001,878,400.003,353,200.0089,000.004,508,300.00611,600.002,933,300.003,728,500.0040,795.702,192,537.90344,813.401,472,004.902,414,717.4046,493.101,651,036.00250,634.401,185,544.201,313,270.1041,876.312,102,028.45234,759.141,405,005.071,252,351.1017,044.40937,715.90147,927.60546,084.301,135,057.5078,814.001,592,618.20216,181.001,125,081.601,224,659.7013,585.70748,969.30115,008.60538,651.00667,249.904,548.60895,688.50105,115.20562,447.90756,728.904,576.84403,970.3464,222.85236,660.57538,911.8116,831.94737,277.4850,440.50446,911.16282,388.683,566.70559,813.3070,095.10404,913.50542,546.207,464.40398,100.1043,111.10286,573.00243,815.4010,176.00615,185.4055,031.10348,412.30287,521.302,957.50467,872.5062,932.90311,180.00377,391.7020,461.10546,905.3064,729.90412,595.40310,192.203,907.60355,255.3050,104.70231,079.30390,998.709,431.60425,712.5049,258.70256,363.20379,897.4013,046.50412,156.4055,173.50289,790.70384,456.904,841.10317,084.0050,697.20197,882.30452,531.705,250.20415,527.8054,697.40259,760.50335,740.701,858.50244,138.6041,843.40162,652.40254,849.602,553.10217,563.2042,889.20128,851.90324,705.403,262.79150,354.4825,381.7597,152.31245,917.829,136.34307,140.8925,304.13200,013.98230,727.292,657.90302,984.3036,207.30195,246.70222,819.701,648.84432,289.3741,022.06231,539.66207,909.612,511.61282,549.3135,863.33213,926.84264,133.197,878.20206,549.1030,569.00153,826.60289,956.204,037.20162,388.7022,126.70113,344.10190,913.403,617.37170,296.3316,469.43133,158.93258,859.454,086.4888,925.467,879.6253,350.43144,505.993,852.70162,350.9022,525.70121,381.80189,810.406,368.40154,324.8019,533.90110,481.10173,414.30592.46167,386.0219,651.88116,077.12167,944.301,766.0798,627.5114,705.5771,313.56105,037.56587.70150,361.3015,727.10105,225.80115,912.10801.65183,825.4418,636.53134,268.50141,421.051,124.36131,423.5611,818.18107,937.7581,115.933,249.56110,691.9214,417.0370,003.95150,627.462,390.04148,212.1911,954.2585,527.29160,743.46501.16190,258.6721,574.52106,512.24157,708.09619.27167,928.6114,980.1996,282.56163,090.64539.93116,172.4513,508.4686,130.9896,613.031,327.10135,314.8017,247.20100,847.9092,891.60712.10122,008.7018,376.2086,448.10148,100.70 325.73127,247.5512,411.7884,539.2783,551.41 862.00151,954.7013,384.1099,847.1096,544.80 5,392.8068,720.7011,399.5044,017.60132,185.00 250.88116,023.0616,097.9574,518.2288,584.09 1,178.5693,004.6312,292.6169,958.72127,377.35 412.2377,408.425,934.2852,714.1151,355.60 1,118.64140,123.2119,295.7893,768.7587,410.14 927.7095,073.0711,019.7555,193.43163,872.26 384.4080,328.9012,711.5042,436.60123,430.20 407.14125,988.0619,530.7574,724.65100,277.80 949.05103,135.2812,069.2375,191.9089,832.47 6,706.22134,238.3119,425.0383,031.90175,654.25 741.3482,742.048,594.8443,243.65109,152.75 1,118.1085,143.8710,364.1751,603.1967,412.15 2,607.70126,507.1014,584.7077,557.40113,979.7077.7073,463.706,699.6057,527.8097,581.40108.7477,154.5011,623.7657,896.52125,163.07 388.5354,623.945,945.1444,624.8352,896.36 289.82100,185.608,618.9362,608.6965,673.56 981.1294,350.3110,113.1047,623.6274,628.76 567.2148,002.506,632.3535,429.5581,250.89 13,451.06161,255.2617,765.67117,182.29103,056.16 278.77105,269.789,699.7574,002.0577,883.67 620.4090,835.8711,569.0360,872.7785,206.65 160.0957,833.228,725.3238,971.2080,770.36 228.4561,509.4610,376.3126,488.1272,871.86 1,621.0763,878.916,438.2543,988.3760,362.8762.2931,094.226,498.8612,294.2068,577.17 2,439.9889,142.5813,741.8649,840.8890,426.41 1,822.5962,908.5613,305.0735,742.92106,984.89 474.6044,711.788,630.3434,961.4066,739.10 751.6655,102.237,893.4524,482.3556,098.49 160.5870,671.558,679.3452,427.3390,754.11 914.1659,834.319,784.0443,137.9280,956.13 251.33129,999.218,643.9856,488.3080,557.34 349.0354,698.907,046.3133,952.1544,957.97 461.8955,933.436,802.4538,324.7139,616.50 125.2559,319.876,554.6245,724.9655,239.93 1,548.4954,424.356,443.4031,149.3356,897.58 708.9734,586.124,710.1719,781.3047,907.83 2,908.9138,776.412,129.7922,646.625,357.5095.0736,533.014,331.2525,752.2840,339.30140.4730,054.774,573.6752,035.79 360.9933,634.204,515.1524,590.2034,138.68 1,194.4062,975.559,484.3523,491.2037,687.73 217.4521,617.544,505.5015,352.3816,462.25 111.1736,132.744,695.1217,980.0732,737.84 179.0536,757.823,195.5713,832.6715,689.5682.2333,566.262,629.1712,609.8613,954.63213.6222,675.472,848.7318,111.5028,387.80 14,114.1834,005.433,944.2818,515.1514,701.04 328.6715,912.121,618.769,793.3612,133.1144.2121,589.502,402.819,791.5815,590.409.6123,555.0411,720.518,069.9326,213.0910.778,045.01574.176,524.256,203.62 84.7714,117.821,218.168,408.745,258.66营业外收入(万元)营业外支出(万元)净利润(万元)利润总额(万元)所得税(万元) 245,100.00114,000.0020,844,500.0027,231,100.006,386,600.00 243,600.00100,100.0016,943,900.0021,910,700.004,966,800.00 64,800.0054,300.0013,031,900.0016,864,400.003,832,500.00 202,500.0056,200.0012,195,600.0015,820,100.003,624,500.00 83,700.0028,200.005,081,700.006,545,100.001,463,400.00 58,600.007,700.003,612,700.004,712,200.001,099,500.00 23,000.006,500.003,084,400.004,159,000.001,074,600.00 15,735.707,479.702,735,511.203,583,928.70848,417.50 16,600.003,400.002,559,700.003,366,400.00806,700.00 21,400.0032,400.002,844,300.003,717,500.00873,200.00 12,615.006,194.001,808,512.202,421,138.40612,626.20 17,441.604,962.801,039,049.101,325,748.90286,699.803,765.053,376.23922,097.181,252,739.92330,642.746,368.301,677.60894,598.501,139,748.20245,149.70 20,148.006,652.90958,573.401,238,154.80279,581.405,899.301,490.90580,655.30671,658.3091,003.00 30,676.505,640.20583,388.10781,765.20198,377.103,338.66610.66414,832.22541,639.81126,807.584,999.031,537.13224,031.56285,850.5861,819.03 12,415.902,837.90427,234.80552,124.20124,889.406,767.704,105.10183,750.10246,478.0062,727.90 128,217.402,933.90320,219.90412,804.8092,584.90 1,862.801,413.80284,982.80377,840.7092,857.901,981.601,686.60240,873.60310,487.2069,613.604,862.00934.60323,535.20394,926.1071,390.906,830.601,977.40289,956.80384,750.6094,793.80 21,377.002,305.80325,351.00403,528.1078,177.109,290.901,457.90349,261.00460,364.70111,103.705,217.003,334.80269,143.70337,622.9068,479.201,932.00510.90212,144.80256,270.7044,125.902,854.30942.30260,535.20326,617.4066,082.208,195.29-609.81205,097.72254,722.9249,625.212,981.31464.22172,517.51233,244.3860,726.873,537.708,676.40172,288.30217,681.0045,392.705,311.153,536.34153,707.25209,684.4355,977.174,620.784,056.61209,359.59264,697.3755,337.78 23,548.703,179.70240,367.90310,325.2069,957.303,119.10196.40150,828.90193,836.1043,007.205,090.37331.60206,247.05263,618.2257,371.17 570.9347.51123,431.07145,029.4021,598.33 1,228.90708.50146,315.80190,330.8044,015.002,213.701,647.80142,024.30173,980.2031,955.90 798.672,778.78132,524.41165,964.1933,439.79669.11435.8778,614.57105,270.8026,656.23 1,081.00114.1099,870.40116,879.0017,008.60 809.94253.58107,426.82141,977.4134,550.59 10,935.37545.1772,709.1791,506.1218,796.951,299.57287.31110,728.70151,639.7240,911.022,864.242,686.63122,497.71160,921.0838,423.372,942.353,028.52111,204.47157,621.9146,417.44 860.33181.96123,229.25163,769.0140,539.76277.692,108.6168,226.5394,782.1126,555.59 3,745.10705.2073,983.3095,931.5021,948.204,745.901,196.40115,566.30151,650.2036,083.90 268.51120.7560,366.5383,699.1723,332.63 443.60279.1073,844.5096,709.3022,864.80 1,144.00274.00105,803.20133,055.0027,251.80 2,397.621,119.8466,275.2189,861.8723,586.66 713.555,731.4395,776.89122,359.4626,582.57 3,133.851,044.5137,849.8253,444.9415,595.12 596.841,373.1664,468.7286,633.8222,165.10 3,146.34284.88131,799.87166,733.7234,933.86 1,921.40721.0096,338.00124,630.6028,292.60 300.8379.2575,457.89100,499.3725,041.49 437.98159.9975,302.5390,110.4614,807.93 3,189.00604.68134,953.70178,238.5743,284.87 2,244.90273.6089,731.76111,124.0521,392.29 647.301,999.5450,040.7266,059.9116,019.19 2,291.40648.2088,025.70115,622.9027,597.20 2,001.10458.2076,790.5099,124.3022,333.80 6,796.96663.8897,189.62131,296.1534,106.53 723.9148.2240,454.7453,572.0513,117.31 441.3583.7551,144.4466,031.1714,886.73 592.561,284.0157,965.4073,937.3015,971.91 2,058.20214.9964,553.9483,094.1018,540.17 1,113.351,397.6177,215.17102,771.8925,556.72 2,411.52251.5359,781.4280,043.6620,262.23 1,231.321,927.4663,790.2384,510.5120,720.27 434.15147.7051,940.6981,056.8229,116.13 435.24276.7854,824.1773,030.3318,206.16 1,330.43146.5446,212.3361,546.7615,334.4480.67 3.4051,494.1468,654.4417,160.30797.65420.1368,281.7090,803.9322,522.23 552.43798.1581,162.38106,739.1725,576.79 425.41699.5753,067.8766,464.9413,397.07 235.6380.9257,169.5756,253.20-916.37 2,135.15216.8669,732.3592,672.4022,940.05 986.3516.2862,344.4881,926.2019,581.728.0218.9660,364.4180,546.4020,181.99216.47584.4734,503.2244,589.9710,086.75 404.11552.3630,088.5039,468.269,379.76 227.6893.3841,629.1555,374.2213,745.07 323.5666.2842,879.9657,154.8714,274.91 521.00581.5436,879.0947,847.2910,968.2018.9132.833,821.595,343.591,522.00 1,011.1065.3631,225.2541,285.0410,059.79 624.8730.4342,116.5352,630.2310,513.70 194.79235.0724,569.7034,098.409,528.70 1,070.10197.5129,654.3338,560.318,905.98 3,053.271,655.9013,795.1217,859.624,064.5018.61154.5321,357.2732,601.9211,244.64121.518.3910,520.7015,802.675,281.97 766.82134.0413,219.3014,587.421,368.12 238.7951.7421,372.2828,574.867,202.5739.9843.9910,949.5414,697.043,747.50 2,122.7387.6910,643.4414,168.153,524.71 140.8149.649,858.7215,681.585,822.8519.65593.4719,241.8625,639.266,397.41 47.9113.044,695.426,238.501,543.07 164.01133.323,899.515,289.351,389.84基本每股收益(万/股)稀释每股收益(元/股)少数股东损益(万元)属于母公司所有者的净利润(万元18,000.0020,826,500.000.000.0018,100.0016,925,800.000.000.00613,700.0012,418,200.000.000.00 2,900.0012,192,700.000.008,200.005,073,500.000.00-200.003,612,900.000.000.002,500.003,081,900.000.000.006,913.102,728,598.100.000.009,200.002,550,500.000.000.0052,300.002,792,000.000.000.001,723.401,806,788.800.000.0011,186.001,027,863.100.000.00 -96.18922,193.360.000.00-71.80894,670.300.000.00958,573.4040.50580,614.80583,388.100.001,314.71413,517.52291.07223,740.480.00153.80427,081.000.00183,750.100.000.00 1,519.80318,700.10284,982.80240,873.602,384.80321,150.400.000.00-162.40290,119.20325,351.000.000.00349,261.0033.80269,109.900.000.00243.30211,901.50260,535.200.000.00205,097.720.000.00 219.56172,297.950.000.00172,288.300.001,258.68152,448.57927.38208,432.21240,367.90-44.10150,873.000.000.00395.00205,852.060.000.005.29123,425.790.000.00146,315.800.000.00 1,319.40140,704.900.000.0033.45132,490.950.000.00243.0178,371.5677.8099,792.600.000.0035.89107,390.930.000.001,032.6871,676.4920.62110,708.080.000.00122,497.71-713.91111,918.380.000.00594.74122,634.500.000.0068,226.53402.2073,581.10-280.90115,847.200.000.0060,366.530.000.0073,844.501,519.40104,283.800.000.00 396.2265,878.9995,776.8937,849.8264,468.720.000.00 3,314.98128,484.890.000.00 1,460.2094,877.800.000.0075,457.890.000.0075,302.530.001,855.16133,098.541,540.2588,191.510.000.0050,040.7288,025.70639.8076,150.700.0097,189.6240,454.740.00311.7450,832.700.000.0057,965.400.000.00 415.5064,138.440.000.00 -3.0077,218.170.000.00 -471.5760,253.00551.1063,239.13942.2650,998.4454,824.170.000.00 474.1445,738.1951,494.1417.2468,264.4681,162.380.000.0016.9153,050.960.000.0057,169.57652.0269,080.330.0062,344.480.000.00 344.3360,020.0934,503.2230,088.5041,629.150.000.0042,879.960.0036,879.090.000.003,821.59449.0430,776.2242,116.5324,569.7029,654.3313,795.1221,357.270.000.0010,520.7013,219.3021,372.280.000.0010,949.5410,643.440.000.009,858.7219,241.86 4,695.42 3,899.51现金及存放中央银行款项(万元)拆出资金(万元)交易性金融资产(万元)存放同业和其它金融机构款项(万元276,215,600.0031,748,600.0016,051,600.0015,220,800.00237,980,900.0027,675,200.0010,904,000.002,309,600.00198,148,400.0052,913,100.0045,466,800.007,380,700.00248,708,200.0013,187,400.0021,268,300.006,805,200.0073,699,900.009,660,500.0014,872,600.004,283,700.0040,830,400.006,304,600.0013,138,100.001,553,000.0036,639,100.0038,653,500.0015,100,400.00819,000.0036,695,709.9026,787,648.2011,141,529.80586,684.1029,659,100.006,942,500.0022,889,900.00810,100.0033,280,500.0023,233,600.003,774,500.002,042,300.0022,866,575.3010,526,295.108,174,562.302,272,663.3016,063,523.603,988,434.20844,656.70260,790.2017,247,337.9410,166,212.622,993,562.90400,459.0912,598,446.5011,419,338.309,673,284.60536,062.8014,994,400.604,535,867.501,871,199.80229,336.4010,701,185.603,678,108.502,979,133.80630,691.509,786,312.406,696,953.20481,786.30518,796.004,277,853.544,520,537.62130,927.56473,645.327,375,363.425,147,963.92390,382.7486,279.055,066,276.801,144,495.801,146,071.601,343,452.803,727,601.20664,529.202,065,500.6041,470.605,210,721.301,365,994.20406,300.9043,850.004,793,663.002,345,430.201,298,718.20148,225.204,068,934.201,080,646.50242,947.701,485,694.203,284,060.802,086,171.60868,255.90699,506.104,434,781.20948,824.4052,617.404,158,244.503,893,278.00100,000.00198,019.405,582,864.40707,620.80358,117.20503,580.704,357,824.601,345,028.201,025,486.70348,239.104,182,326.501,243,417.90811,148.00544,577.704,814,511.501,623,540.8030,489.302,493,210.604,019,528.83250,508.363,093,573.151,540,704.2650,000.00478,081.403,437,948.101,174,504.50105,000.00699,494.803,259,486.23717,030.24444,109.982,450,795.871,322,441.74146,300.90170,387.512,773,146.304,038,224.001,809,558.502,281,440.1086,271.00235,798.502,167,102.71336,959.0520,000.00338,203.251,836,875.913,680,393.8757,227.111,933,986.00569,607.00397,450.20161,520.302,063,348.90940,587.00246.30150,608.601,947,319.69119,618.2099,568.52 964,180.20241,185.93231,149.79 1,941,298.801,001,656.803,780.50150,957.301,999,676.32410,596.5790,276.791,159,165.40153,536.3990,167.801,745,580.21941,412.3422,053.1585,605.431,284,013.61969,309.171,676,582.0079,070.0849,215.0021,199.882,276,275.511,329,699.3137,370.231,062,139.101,513,588.181,504,674.4047,087.5098,987.101,743,631.60845,547.30427,621.90 1,577,321.70199,876.86202,546.54 1,478,568.60171,048.00207,067.80911,811.602,824,442.905,000.0026,955.90 1,325,280.98569,986.78146,490.83 1,237,595.365,221.84414,988.18 963,072.911,572,208.02443,127.72 1,214,740.33362,590.32269,236.4015,256.16 1,313,299.15321,999.1880,182.49 1,032,869.0079,279.101,128,611.39653,207.2816,500.00914,027.31581,990.7397,682.2425,198.87 1,174,080.90500,629.42977,849.45143,048.7610,000.001,074,674.1450,370.5427,882.99 1,073,172.40441,981.60945,500.201,055,816.4081,791.90896,730.07666,090.16195,112.2110,130.00 822,942.42901,868.01187.26981.54 795,716.99943,222.1553,857.49 1,086,486.51408,021.96866,747.93558,276.95960,273.83441,712.87669,333.61605,349.85918,553.08170,573.2536,738.07 1,158,156.65113,033.061,075,035.59849,074.3830,980.00778,981.94715,524.8421,457.35464,878.27877,237.09886,402.11796,361.24117,544.983,150.45727,653.80242,290.1010,000.0044,371.92 757,973.61288,869.0632,627.87 531,211.74122,599.1235,523.89204,258.37 751,736.27339,794.18198,572.31 587,265.60367,603.5649,510.00694,211.59673,413.42494,816.1743,833.4921,500.00585,453.43217,874.74586,605.58430.34556,871.40202,756.82486,952.1372,617.16599,502.44319,348.273,370.00492,507.21121,186.76493,484.046,680.032,548.54385,966.15160,755.0310,000.00171,473.62 539,608.03125,213.35252,322.4481,868.885,853.87330,731.7911,712.08248,275.61145.59293,870.42199,682.40239,865.7761,064.5039,426.32 244,866.996,531.00174,863.6768,448.12192,044.68126,320.8294,270.2742,103.5560,453.10141,409.9530,000.00 96,968.7458,624.30衍生金融资产(万元)应收利息(万元)发放贷款及垫款(万元)中小企业贷款1,746,000.00759,401,900.001,412,700.005,677,600.00632,519,400.004,275,700.005,481,700.00620,313,800.00852,400.004,865,500.00539,886,300.00558,500.001,977,300.00250,538,500.00188,700.001,085,200.00160,437,100.00468,300.001,005,100.00141,077,900.0054,878.701,107,107.40130,232,395.00290,700.001,292,400.0096,894,000.0058,700.00721,000.00117,828,500.00226,179.30609,991.2086,878,223.2081,057.70727,418.9061,007,533.6020,184.10563,504.5259,420,410.022,222.50507,315.9039,607,691.8039,445.80287,924.1052,344,490.604,719.50267,995.2032,552,344.90134,923.9028,342,467.70139,149.0714,210,644.34103,872.9116,017,719.00225,538.0013,882,183.002,667.40166,953.7011,063,150.30109,710.3016,227,987.902,430.1063,733.1014,642,599.302,383.80171,021.6014,909,237.507,143.30196,064.8010,020,383.4099,644.9011,889,868.90168,763.00132,783.6012,074,193.30104,397.9013,392,288.3015,300.8097,729.6012,415,995.90115,055.709,293,872.10103,080.309,676,245.3042,726.257,180,711.93178,824.296,397,303.4868,054.408,365,065.1079,461.809,220,160.3192,157.984,774,111.1863,029.907,847,523.4049,521.604,681,142.9071,330.386,973,456.16134,312.312,059,303.0732,403.006,282,492.6048,909.304,007,640.6032,335.904,677,853.669,885.762,298,594.0943,164.503,810,355.7047,853.625,065,521.3640,742.982,909,608.0723,425.374,339,967.1331,570.104,830,515.6924,322.555,098,180.8818,240.743,284,042.252,438,185.7431,419.604,102,750.90。

2011年银保市场分析报告总公司银行保险部2012年3月主要内容●●●●一、2011年银保市场总体情况二、主要同业主体基本情况三、主要代理银行基本情况四、2012年主要同业主体发展计划一、银保新单规模同比减收822亿,部分大寿险主体的同比降速更为明显-17.9%4591.6 3769.3 合计 3.9%467.1485.5其他-37.4%171.8 107.5 太平人寿 4.6%122.9 128.5 阳光人寿-36.0%259.0 165.7 平安人寿36.1%122.0 166.0 生命人寿-25.9%411.5 305.1 太平洋人寿-29.9%443.3 310.5 新华人寿-27.5%559.0 405.4 泰康人寿-8.5%632.0 578.0 人保寿险-20.4%1403.0 1116.9 中国人寿同比2010年2011年新单规模保费公司单位:亿元◆2011年银保市场整体发展低迷,市场整体实现银保新单规模保费3769.3亿元,下降17.9%,同比减收822亿元。

◆前九大寿险主体累计同比减收841亿,同比下降20.4%,降速较市场整体降速更为明显。

◆2011年,仅有9家主体银保新单实现同比正增长:生命、阳光、合众人寿、光大永明、民生人寿、华夏人寿、长城人寿、金盛人寿、中邮人寿。

二、前九大寿险主体的市场位次发生变化,市场集中度有所下降2011年银保新单市场份额国寿29.6%人保寿险15.3%泰康10.8%新华8.2%太保8.1%阳光3.4%太平2.9%其他12.9%生命4.4%平安4.4%2010年银保新单市场份额国寿30.6%人保寿险13.8%泰康12.2%新华9.7%太保9.0%阳光2.7%生命2.7%其他10.2%平安5.6%太平3.7%◆2011年,银保新单市场排名发生变化,前九大主体依次变为:国寿、人保寿险、泰康、新华、太保、生命、平安、阳光、太平。

生命市场位次前进三位,跃居市场第六,平安后退一位,太平后退两位。

2011年银行理财产品市场展望<a rel='nofollow' onclick="doyoo.util.openChat();return false;"href="#">“这是最好的时代,这是最坏的时代。

”2010年,各国金融风险隐患尚未消除,全球经济经过年初较快复苏后增长趋缓。

由于实体经济低于产能要求,特别是发达国家与新兴市场复苏程度不均,导致各国宏观政策出现分化。

为刺激需求、对抗通缩风险和降低失业率,美国维持零利率,并推出第二轮量化宽松货币政策。

其他发达国家也采取竞争贬值的汇率政策,货币战和贸易战升级。

而新兴市场国家面临通胀与资产泡沫的压力,纷纷采取了加息、收紧信贷和控制资本流入等措施。

在实施大规模经济刺激政策后,中国的货币政策也回归稳健,并加大了对信贷和热钱的监管力度。

基于上述背景,2010年的金融市场中,黄金与大宗商品成为表现最佳的品种,美国国债指数表现亦不低,但股票市场整体机会难以把握。

银行理财产品的监管进一步加强,信贷资产类产品将逐渐步出市场。

展望2011年,世界经济有望继续恢复增长,但不确定因素仍然较多。

美国经济会逐步复苏,但失业率仍是主要问题;欧债危机悬而未决,主权债务危机仍将困扰国际市场;新兴市场通胀水平明显上升,宏观政策与国际资本管控压力增大。

由于面临的经济问题不同,各国的宏观政策分化,也将造成国际金融市场的动荡。

对于中国经济而言,2011年是"十二五"规划的开局之年,在积极的财政政策和稳健的货币政策调控下,我国经济将由较快增长转为稳定增长,经济发展的重点是"调结构"和"稳物价"。

在稳定物价方面,我国货币政策已明确转向"稳健"或"中性",货币投放和信贷增长将回归常态,预计央行还有调整存款准备金和加息的可能。

2011年中国银行年度报告中国银行股份有限公司(“中国银行”:香港联交所股份编号: 3988;上海证券交易所股份编号: 601988)于3月29日公布了2011年年度业绩。

根据国际财务报告准则,中国银行2011年实现税后利润1,303.19亿元,同比增长18.81%。

2011年,中国银行坚持以科学发展为主题,以转变发展方式为主线,继续实施发展战略规划,坚决执行“调结构、扩规模、防风险、上水平”的方针,大力推进创新发展、转型发展、跨境发展,取得了良好的经营业绩。

盈利能力稳步提升2011年,中国银行实现税后利润1,303.19亿元,实现本行股东应享税后利润1,241.82亿元,分别比上年增长18.81%和18.93%。

年末资产总额达到118,300.66亿元,比上年末增长13.10%。

集团净息差比上年提高0.05个百分点,达到2.12%。

平均总资产回报率(ROA)1.17%,净资产收益率(ROE)18.27%。

实现基本每股收益0.44元,同比增加0.05元,董事会建议派发2011年股息每股0.155元人民币。

中行盈利能力持续提升,主要得益于净息差持续改善,净利息收入稳步增长,同时充分发挥多元化平台优势,实施综合经营战略,非利息收入大幅增加。

2011年分别实现净利息收入和非利息收入2,280.64亿元和1,002.34亿元,比上年分别增长17.58%和21.41%。

非利息收入在营业收入中的占比达30.53%,同比提高0.67个百分点。

在传统优势和新兴业务的带动下,手续费及佣金收支净额达到646.62亿元,比上年增长18.68%。

信贷成本0.32%,继续保持较低水平。

成本收入比33.07%,比上年下降1.09个百分点。

实际税率进一步下降至22.73%。

业务转型不断深化2011年,中行加强网点和渠道建设,努力扩大客户基础,大力拓展存款来源,着力改善存款结构。

年末集团客户存款总额88,179.61亿元,增幅14.02%。

编者按:经中国社会科学院金融研究所金融中心独家授权,《银行家》杂志从2012年1月起每月定期发布《银行理财产品市场月度报告》,主要内容包括市场动态、指标数据、运行特点、创新评述、法律法规、潜在问题、机构排名和产品排名等。

主要目的在于:定期跟踪银行理财产品市场的发展动态,建立银行理财产品数据的统一征集和发布平台,推动银行理财产品市场第三方评级评价机制的完善,促进银行理财产品市场又好又快地健康发展。

2011年,伴随国内银行间资金面持续趋紧以及加息预期等因素,不断推高银行理财产品,尤其是短期银行理财产品的预期收益率。

商业银行利用银行理财产品进行“高息揽储”行为表现的淋漓尽致。

无论是银行为缓解资金压力,还是投资者为跑赢CPI,收益稳定、风险可控的银行理财产品都成为银根紧缩形势下银行与投资者的最佳选择。

2011年的银行理财产品的发行量更是实现历史性突破,截至2011年12月20日,发行数量逾1.7万款,同比增长102%。

央行发布的《中国货币政策执行报告——2011年3季度》显示:2011年9月末,商业银行表外理财产品余额为3.3万亿元,比年初增加9275亿元,同比增长45.7%。

为探析当前我国正处于转型关键时期的银行理财市场,本文将分析2011年度银行理财市场的发展情况、剖析银行理财市场年度热点并梳理银行理财业务监管动态,以期在借鉴和反思过往经验的基础之上,寻找2012年银行理财市场创新的突破口和着力点。

2011年银行理财产品市场概况据中国社科院陆家嘴研究基地金融产品中心(以下简称“中心”)统计,截至到2011年12月20日,银行理财产品市场共发售产品17463款,同比增长102%,其中普通类产品为7450款(包括48款开放式产品),同比增长122%;结构类产品为952款,同比下降19%。

发售产品的商业银行数量由2010年的81家上升为2011年的85家。

飙升的银行理财产品数量一方面展示出了银行理财产品市场的空前繁荣,另一方面也反映出商业银行由于吃紧的资金压力变相的通过发售银行理财产品来揽储的窘境。

编者按:经中国社会科学院金融研究所金融中心独家授权,《银行家》杂志从2012年1月起每月定期发布《银行理财产品市场月度报告》,主要内容包括市场动态、指标数据、运行特点、创新评述、法律法规、潜在问题、机构排名和产品排名等。

主要目的在于:定期跟踪银行理财产品市场的发展动态,建立银行理财产品数据的统一征集和发布平台,推动银行理财产品市场第三方评级评价机制的完善,促进银行理财产品市场又好又快地健康发展。

2011年,伴随国内银行间资金面持续趋紧以及加息预期等因素,不断推高银行理财产品,尤其是短期银行理财产品的预期收益率。

商业银行利用银行理财产品进行“高息揽储”行为表现的淋漓尽致。

无论是银行为缓解资金压力,还是投资者为跑赢CPI,收益稳定、风险可控的银行理财产品都成为银根紧缩形势下银行与投资者的最佳选择。

2011年的银行理财产品的发行量更是实现历史性突破,截至2011年12月20日,发行数量逾1.7万款,同比增长102%。

央行发布的《中国货币政策执行报告——2011年3季度》显示:2011年9月末,商业银行表外理财产品余额为3.3万亿元,比年初增加9275亿元,同比增长45.7%。

为探析当前我国正处于转型关键时期的银行理财市场,本文将分析2011年度银行理财市场的发展情况、剖析银行理财市场年度热点并梳理银行理财业务监管动态,以期在借鉴和反思过往经验的基础之上,寻找2012年银行理财市场创新的突破口和着力点。

2011年银行理财产品市场概况

据中国社科院陆家嘴研究基地金融产品中心(以下简称“中心”)统计,截至到2011年12月20日,银行理财产品市场共发售产品17463款,同比增长102%,其中普通类产品为7450款(包括48款开放式产品),同比增长122%;结构类产品为952款,同比下降19%。

发售产品的商业银行数量由2010年的81家上升为2011年的85家。

飙升的银行理财产品数量一方面展示出了银行理财产品市场的空前繁荣,另一方面也反映出商业银行由于吃紧的资金压力变相的通过发售银行理财产品来揽储的窘境。

相较翻番的普通类产品,结构类产品则是在数量激增的理财市场背景下显得相对冷清。

从理财产品的投资币种来看,2011年人民币银行理财产品共发行14902款,占到了全部产品数量的85%,占比较2010年上升了3个百分点。

而外币类产品仅占15%,数量为2561款。

与2010年不同的是,2011年新增发售了7款新西兰元产品,占比0.04%,数量虽微,但却丰富了银行理财产品外币的投资种类。

总体而言,2011年各币种占比较2010年变化不大,下降幅度最大的为美元产品,由2010年的占比7.8%下降到了2011年的5.2%,欧元产品升幅最大,但仅微幅上升0.7%。

从产品的资产主类来看,利率类产品依旧是占到了所有产品数量的半壁江山,共发售9244款,同比上升96.1%,占比达52.9%,但较2010年占比下降了1.7%。

混合类产品发售数量居次,共发售6837款,同比上升153.2%,占比为39.2%,较2010年上升8个百分点。

2011年,信用类产品共发售996款,占比5.7%,同比下降0.3%。

汇率类产品则发售183款,较2010年的65款,同比上升了181.5%,但仅占2011年产品总数量的1%。

股票类和商品类产品分别发售了164款和39款,占比为0.9%和0.2%。

总体而言,除汇率类产品和混合类产品之外,其余各类产品占比较2010年都有所下降。

详见图2。

从理财产品收益类型来看,2011年理财产品的收益类型分布较2010年有些许变化。

2011年非保本浮动收益型产品共发售11737款,同比上升33%,占2011年产品总量的67%,较2010年占比上升了17个百分点。

而保本浮动收益型产品和保息浮动收益型产品的占比分别下降了11个和6个百分点,占比分别为21%和12%。

图3展示了2011年各月度不同收益类型产品的数量和收益水平的变化趋势。

?

从理财产品的发行主体分布来看,2011年上市股份制银行、国有控股银行、城市商业银行和外资银行,分别发售7117款、6977款、2811款和558款产品。

相比2010年而言,三类中资银行的产品数量均大幅上涨,国有控股银行和上市股份制银行的增长动力更为强劲,而外资银行的发行量大幅下滑。

从占比来看,中资银行理财产品发行量占比上升9个百分点。

总结与未来展望

对2012年的银行理财产品市场,有三个基本判断:产品数量可能会略有下降,产品收益率日趋市场,监管力度日益加强。

展望2012年,除我们在2010年的总结报告提出的厘清理财产品的法律基础、统一理财产品的数据征集和发布等宏观建议外,如下我们给出进一步发展理财产品市场的四条微观建议:

加大对“资产池”类产品的监管力度。

2011年,“资产池”类理财产品被商业银行广泛采用,实际上这也是商业银行的一大创新,但由于其信息透明度很低,导致其出现了一些问题。

“资产池”一般包括债券、票据、拆借、股票、基金、委托贷款等各种投资标的。

银行通过发行各种形式的理财产品,将募集到的资金统一纳入一个或多个“资产池”。

此类产品信息透明度很低,这对银行来说是有利的,因为增加了其投资的灵活性。

但同时也带来很多问题,“资产池”里各类标的资产的风险系数不同,将不同风险系数的标的放在同一个池子里且各类标的占比含糊,这不但造成风险测算难度加大,容易给投资者带来误区,同时也给监管层出了一个难题。

2012年,监管层应该加大对此类产品监管,明确商业银行应在“资产池”类产品说明书中标明各类投资标的的比重。

适当放宽银行理财产品投资渠道。

理财产品市场若健康发展,可以很好地分流国内的资金,减轻因资本炒作而带来的短期物价上涨的压力。

只是目前我国商业银行理财产品市场同质化问题严重。

这主要是因为商业银行受限于狭窄的投资渠道,钱多而投资渠道窄,造成堵塞(大量不同类型产品投资标的近乎相同)。

适当放宽投资渠道后,商业银行可设计不同风险级别的产品供投资者选择,投资者可根据自身的风险承受能力选择适合自己的理财产品,从而盘活整个理财产品市场。

大力发展高端理财产品。

随着我国富裕人口的不断增加,高端理财业务成为各商业银行竞争的主要领地。

中资商业银行纷纷推出自己的私人银行业务,以吸纳这类富裕人群。

各商业银行所能提供的理财产品质量将成为吸引高端客户的关键。

不过,在理财产品设计领域,显然整个市场都面临一个产品同质化的尴尬局面。

私人银行产品投资标的与普通产品并无大

异,只是因其资金门槛高而录得略高的预期收益率。

长此以往,在与外资私人银行的较量中,中资私人银行必将会流失大量高端客户。

建立、健全第三方评级/评价机制。

这为市场提供揭示、分析、比较各种类型产品、各种理财机构信息的准公共品服务。

目前,我国已经出现第三方销售机构,各商业银行也逐步建立起自己的内部评级/评价体系。

但从国外的经验来看,光有第三方销售机构是远远不够的,而商业银行自己的评级/评价体系也存在公正性和客观性问题,只有独立第三方评级/评价机制的引入才能更好地促进整个市场的健康发展。