第三届IMA管理会计案例大赛案例中文版

- 格式:pdf

- 大小:1.43 MB

- 文档页数:6

第三届MPAcc案例分析大赛初赛第一阶段案例案例背景:本案例是第三届MPAcc案例分析大赛初赛的第一阶段案例,旨在考察参赛者对于会计和财务管理领域的综合能力和解决问题的能力。

本案例涉及一家虚拟公司,名为XYZ有限公司,该公司是一家新兴的科技企业,主要从事软件开辟和云计算服务。

XYZ公司成立于2022年,目前正在面临一些挑战和机会,需要参赛者提供专业的分析和建议。

案例要求:参赛者需要结合XYZ公司的实际情况,分析以下几个方面的问题,并提出相应的解决方案和建议:1. XYZ公司的财务状况分析:a. 分析XYZ公司的财务报表,包括利润表、资产负债表和现金流量表,评估公司的盈利能力、偿债能力和现金流状况。

b. 分析XYZ公司的财务指标,比如利润率、资产回报率和流动比率等,评估公司的经营状况和财务健康度。

c. 根据财务分析的结果,提出改善公司财务状况的建议和措施。

2. XYZ公司的风险管理分析:a. 分析XYZ公司面临的风险,包括市场风险、经营风险和金融风险等,评估这些风险对公司的影响程度和可能的应对措施。

b. 提出改善公司风险管理的建议和措施,包括建立风险管理体系、完善内部控制和加强风险监测等方面。

3. XYZ公司的战略分析:a. 分析XYZ公司的竞争环境和市场定位,评估公司的竞争优势和竞争劣势。

b. 提出改善公司战略的建议和措施,包括调整产品组合、开辟新市场和提升品牌形象等方面。

4. XYZ公司的可持续发展分析:a. 分析XYZ公司的环境影响和社会责任,评估公司的可持续发展水平和潜在的改善方向。

b. 提出改善公司可持续发展的建议和措施,包括推行环境友好的生产方式、加强员工培训和社会公益活动等方面。

案例分析报告要求:参赛者需要根据以上要求,撰写一份完整的案例分析报告,报告内容应包括以下几个部份:1. 案例背景介绍:简要介绍XYZ公司的基本情况和面临的问题。

2. 财务状况分析:对XYZ公司的财务报表进行分析,提供相应的财务指标和评估结果,并给出改善建议。

管理会计案例大赛管理会计案例大赛是一项重点培养学生实际操作能力和解决问题能力的比赛。

在这次大赛中,我选择了一家面临困境的小型制造企业作为研究对象,通过分析企业的财务数据和经营情况,提出了一系列解决方案,并取得了较好的成绩。

首先,我对企业的财务数据进行了梳理和分析。

通过比较不同期间的财务数据,我发现企业的销售额在近期有所下降,而成本却不断增加,导致企业利润减少。

进一步分析后发现,企业的生产效率低下,导致生产成本增加,且销售渠道有限,无法达到更多的潜在客户。

基于这些问题,我提出了一系列解决方案。

首先,我建议企业优化生产流程,提高生产效率。

通过对生产环节进行分析和改进,减少不必要的时间和资源浪费,提高生产效率,从而降低生产成本。

其次,我建议企业开拓更多的销售渠道,通过加强与经销商的合作、拓展电子商务渠道等方式,扩大销售范围,增加销售额。

同时,我还建议企业进行财务管理上的改进。

因为企业没有及时了解和掌握财务状况,导致对企业财务情况没有清晰的认识。

因此,我建议企业通过引入财务管理软件,实时了解和监控财务数据,为企业决策和经营提供信息支持。

此外,我还建议企业建立绩效考核机制,对员工的绩效进行定期评估和奖惩,激励员工提高工作效率和质量。

最后,为了帮助企业更好地实施这些解决方案,我制定了一个详细的实施方案。

该方案包括了解决方案的具体步骤、时间计划、责任人等,并提出了预期效果和评估指标,以便企业能够及时评估改进举措的有效性,并进行调整和完善。

通过参加管理会计案例大赛,我不仅加深了对管理会计理论的理解,还锻炼了实际操作的能力。

通过分析实际案例,并提出解决方案,我不仅从理论上认识到了企业管理的重要性,还学习了如何将理论应用于实践当中。

同时,通过与其他选手的交流和竞争,我也深刻意识到自身的不足之处,并确定了今后的学习和提升方向。

综上所述,管理会计案例大赛是一次极具挑战性和收获的比赛。

通过参与这次比赛,我不仅为企业提供了解决问题的方案,还锻炼了自己的思维和实际操作能力。

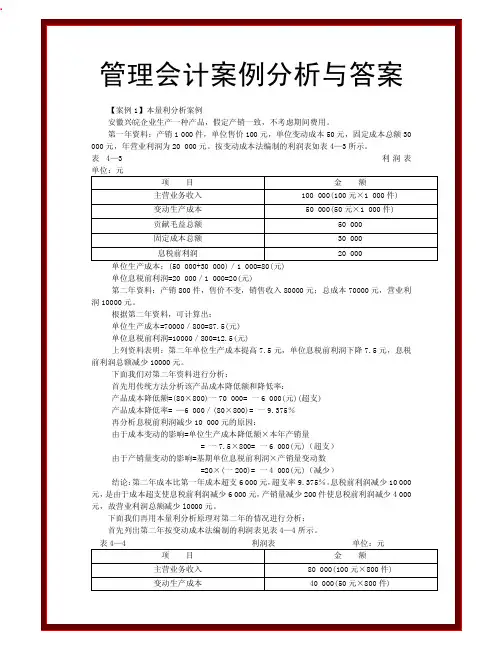

管理会计案例分析与答案【案例1】本量利分析案例安徽兴皖企业生产一种产品,假定产销一致,不考虑期间费用。

第一年资料:产销1 000件,单位售价100元,单位变动成本50元,固定成本总额30 000元,年营业利润为20 000元。

按变动成本法编制的利润表如表4—3所示。

表4—3 利润表单位:元项目金额主营业务收入100 000(100元×1 000件)变动生产成本50 000(50元×1 000件)贡献毛益总额50 000固定成本总额30 000息税前利润20 000 单位生产成本:(50 000+30 000)/1 000=80(元)单位息税前利润=20 000/1 000=20(元)第二年资料:产销800件,售价不变,销售收入80000元;总成本70000元,营业利润10000元。

根据第二年资料,可计算出:单位生产成本=70000/800=87.5(元)单位息税前利润=10000/800=12.5(元)上列资料表明:第二年单位生产成本提高7.5元,单位息税前利润下降7.5元,息税前利润总额减少10000元。

下面我们对第二年资料进行分析:首先用传统方法分析该产品成本降低额和降低率:产品成本降低额=(80×800)一70 000= 一6 000(元)(超支)产品成本降低率= —6 000/(80×800)= 一9.375%再分析息税前利润减少10 000元的原因:由于成本变动的影响=单位生产成本降低额×本年产销量= 一7.5×800= 一6 000(元)(超支)由于产销量变动的影响=基期单位息税前利润×产销量变动数=20×(一200)= 一4 000(元)(减少)结论:第二年成本比第一年成本超支6 000元,超支率9.375%。

息税前利润减少10 000元,是由于成本超支使息税前利润减少6 000元,产销量减少200件使息税前利润减少4 000元,故营业利润总额减少l0000元。

IMA案例大赛详解第三届IMA校园管理会计案例大赛是由美国管理会计师协会、海尔集团、华图教育集团共同组织,主要目的是通过对管理会计在实务中应用的案例分析,锻炼学生把所学的财务学、经济学、会计学、管理学、组织行为学以及管理会计应用于实践的能力,提升他们的分析能力、组织能力、协调能力、领导能力以及团队合作精神。

同时也是为高校学生搭建一个国际交流与学习以及在校学生与企业、在校学生与CMA在职会员、学员和成功人士的一个沟通和互动平台,最终增强学生的就业竞争力。

这次案例大赛除给学生提供展示自我、提升自我的平台外,还与学生的实习就业相结合,同时也为优胜团队提供了丰富的奖品。

1、海尔集团将借助案例大赛进行校园招聘,从优胜团队中录取应届毕业生进入海尔工作。

2、德勤、统一企业、华图教育、通用汽车等实习单位的实习机会3、冠军团队将免费前往美国参加全球学生的比赛,与来自不同国家的学生同台竞技,同时也获得与美国知名企业家的交流与互动机会。

这次案例大赛,IMA也会对参赛院校提供一些智力支持,主要是:免费提供CMA教材一套免费提供部分CMA管理会计教学案例图书免费提供CMA有关管理会计的研究成果如战略财务杂志等。

备选内容:IMA简介:美国管理会计师协会成立于1919年,协会所建立的认证则是目前全球针对管理会计及财务管理领域的权威认证。

2009年,国家外国专家局培训中心与协会签约正式引进了美国注册管理会计师认证。

同年,国资委也下发文件大力在名企、国企推广该认证考试。

CMA简介:美国注册管理会计师(英文简称CMA)是IMA于1972年推出的针对管理会计领域的全球专业财会认证,是国际财会领域公认的黄金认证。

目前全球CMA持证会员超过65,000名,遍布全球120多个国家。

CMA认证2007年由国家外国专家局引入中国,获得了政府及企业的高度认可。

2010年第二届案例大赛回顾2010年IMA管理会计案例大赛,吸引了全国28所重点高校的近1700名学生参加,比赛按地域分为华北,华南,华东,西南四个赛区;经过初赛,半决赛,决赛历时3个多月的选拔,来自全国高校的8个代表队入围决赛。

第三届IMA校园管理会计案例大赛华北区决赛圆满落幕2013年3月30日,第三届IMA(海尔杯)校园管理会计案例大赛华北区决赛在北京工商大学成功举行。

最终来自北京工商大学的Kirin麒麟队、来自东北财经大学的杜菲队和来自北京大学的4-ever 队突出重围,获得了华北区域决赛的一等奖,将代表华北赛区参加于4月14日在北京大学举办的全国总决赛。

本次决赛诚邀北京工商大学商学院党总支书记欧阳爱平教授、商学院副院长毛新述教授、商学院财务系主任王力军教授以及美国管理会计师协会(IMA)中国区首席代表白俊江先生、学术关系经理马丹女士等嘉宾出席了华北区决赛。

另外,本次决赛邀请了世界500强企业Kemsley Academy财务总监刘伟先、惠普中国区高级财务经理李丹女士、顺风速递高级财务顾问庄静思女士以及依文集团首席财务官陈仙云女士4位实务界专家担任评委。

第三届IMA校园管理会计案例大赛华北赛区部分参赛选手合影初赛阶段,华北赛区吸引了来北京大学、清华大学、中国人民大学、南开大学、北京工商大学等24所高校的108支队伍参赛。

通过初赛的选拨,华北赛区共有15支队伍晋级区域决赛,分别是:北京大学的4-ever,清华大学的A Team,北京师范大学的Bravo、Top End,东北财经大学的杜菲,大连理工大学的Shining,北京工商大学的Kirin麒麟、Dream Chaser、Unicorn、E.V,北京交通大学的SMG,中央财经大学的Golden Five Stars、Philicious,对外经济贸易大学的GENIUS 以及北京国家会计学院的BNAI。

决赛中,各支队伍准备充分,文思泉涌,有条不紊,慷慨陈词,给在场的老师和同学带来了一场管理会计案例分析和展示的大赛盛宴,现场惊喜不断、掌声连绵。

通过7个多小时的精彩角逐和现场评委的严密评判,最终来自北京工商大学的Kirin麒麟队、来自东北财经大学的杜菲队和来自北京大学的4-ever 队突出重围,获得了华北区域决赛的一等奖,将代表华北赛区参加于4月14日在北京大学举办的全国总决赛。

激情PK,第三届IMA(海尔杯)管理会计案例大赛华南赛区决赛圆满落幕2013年3月16日,第三届IMA(海尔杯)校园管理会计案例大赛华南赛区决赛在广东商学院顺利拉开帷幕,经过激烈角逐,中山大学Pi队、广东商学院Rapeseeds队拨得头筹,他们将代表华南赛区赴北京参加4月举行的全国总决赛。

通过初赛的选拔,华南赛区共有10支队伍晋级区域决赛。

这些队伍分别来自中山大学、暨南大学、广东商学院和北京理工大学。

主持人首先宣读了比赛规则。

紧接着,十支队伍用20分钟的演讲将他们各自对于IMA 管理会计案例的分析进行了展示,并对评委提出的问题进行了答辩。

从现场观众高涨的情绪和热烈的掌声中,不难感受到各支队伍给我们带来了非常精彩的表演。

经过他们的认真分析解释,IMA管理会计的案例变得简单明了,对于管理会计案例的分析方法也变得多种多样。

很多同学在赛后也反应“学到了很多东西”。

参赛队伍进行现场答辩在十支队伍中,第二个出场的中山大学PI队的精彩表现在众多优秀队伍中脱颖而出,让观众,甚至是评委们都赞不绝口。

他们熟练的英语、专业的分析、认真的态度不禁让人如同身临真实的企业高层会议。

广东商学院Rapeseeds队也是毫不逊色,技压群雄,他们凭借着对专业知识的积累、对于管理会计的多角度的思考以及灵活的应变能力,赢得了现场热烈的掌声和一致的好评。

这两支队伍在激烈的竞争中获得了本次IMA管理会计案例大赛华南赛区决赛的一等奖,将代表华南赛区前往北京参加IMA管理会计案例大赛的全国总决赛。

第三届IMA(海尔杯)校园管理会计案例大赛是由美国管理会计师协会(IMA)主办的校园传统活动。

IMA管理会计案例大赛为高校学生提供一次解读、分析、评估管理会计问题,整合资源、提供解决方案的展示综合能力的机会。

大赛面向华东、华南、华中、华北、西南五大赛区近百所高校的MBA、MPAcc、在校研究生及本科高年级学生,通过对案例的分析和讲演,选拔出具有卓越分析能力、沟通能力和团队合作精神的团队。

管理会计案例b13c案例一达利公司有一个新近从财务会计工作转入管理会计工作的会计人员张某,对于管理会计知识不甚了解。

以下是他对管理会计提出的个人观点:(1)管理会汁与财务会计的职能一样,主要是核算和监督。

(2)管理会计和财务会计是截然分开的,无任何联系。

(3)管理会计报告要在会计期末以报表的形式上报。

(4)管理会计吸收厂经济学、管理学和数学等方面的研究成果,在方法上灵活多样。

(5)贯穿管理会计的理论是本量利分析理论。

(6)管理会计服务于企业外部,受会计法规的约束。

(7)管理会计的职能主要是满足企业各项管理职能的需要。

(8)管理会计的信息质量特征与财务会计的信息质量特征完全不同。

(9)在提供管理会计信息时可以完全不用考虑成本效益原则。

(10)一个管理会计师可以将手中掌握的信息资料随意提供给他人。

(11)与财务会计相比,管理会计不能算是一个独立的职业,它的职业化发展受到限制。

要求:1.对以上观点加以分析说明,指出正确与否。

2.说明企业主要的管理目标和管理职能是什么。

案例一答案1.对于该会计人员观点正误详细分析如下:(1)错误。

管理会计的职能与财务会计不同,它不在于对数据的核算:和监督,而着重于管理方面。

具体可表述为:为决策提供客观可靠的信息;制定计划,编制预算;成本确定和成本计算;指导经营,实施控制等。

该会计人员混淆了财务会计和管理会计的职能,核算和监督是财务会计的主要职能。

(2)错误。

管理会计和财务会计是现代会计的两大分支,财务会计先于管理会计而存在,对管理会计的产生和发展都起到积极的铺垫和推进作用。

管理会计通常使用财务会计的资料来进行管理和经济效益方面的计算和分析。

该会计人员把财务会计和管理会计完全割裂开来,容易在企业内部造成财务会计和管理会计的对立,从而造成企业内部核计和管理方法之间的矛盾,对企业不利。

(3)错误。

财务会计报表必须在规定的日期进行上报,但管理会计信息的提供有其独特的时间特征,即不必拘泥时间的限制。

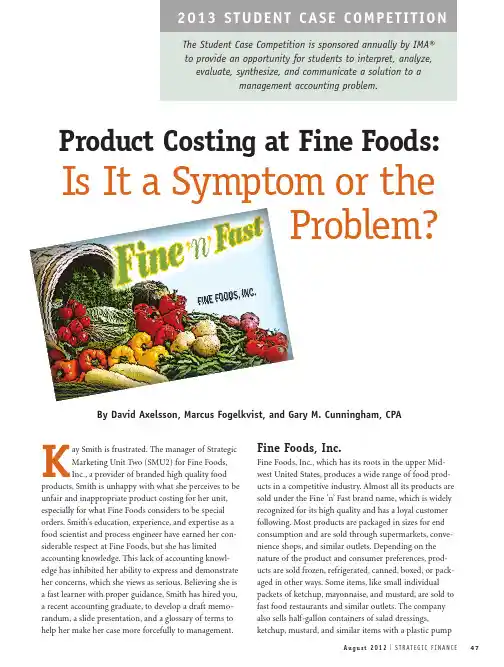

By David Axelsson, Marcus Fogelkvist, and Gary M. Cunningham, CPAK ay Smith is frustrated.The manager of Strategic Marketing Unit Two (SMU2) for Fine Foods,Inc.,a provider of branded high quality food products,Smith is unhappy with what she perceives to be unfair and inappropriate product costing for her unit, especially for what Fine Foods considers to be special orders.Smith’s education,experience,and expertise as a food scientist and process engineer have earned her con-siderable respect at Fine Foods,but she has limited accounting knowledge.This lack of accounting knowl-edge has inhibited her ability to express and demonstrate her concerns,which she views as serious.Believing she is a fast learner with proper guidance,Smith has hired you, a recent accounting graduate,to develop a draft memo-randum,a slide presentation,and a glossary of terms to help her make her case more forcefully to management.Fine Foods, Inc.Fine Foods,Inc.,which has its roots in the upper Mid-west United States,produces a wide range of food prod-ucts in a competitive industry.Almost all its products are sold under the Fine ’n’Fast brand name,which is widely recognized for its high quality and has a loyal customer following.Most products are packaged in sizes for end consumption and are sold through supermarkets,conve-nience shops,and similar outlets.Depending on the nature of the product and consumer preferences,prod-ucts are sold frozen,refrigerated,canned,boxed,or pack-aged in other ways.Some items,like small individual packets of ketchup,mayonnaise,and mustard,are sold to fast food restaurants and similar outlets.The company also sells half-gallon containers of salad dressings, ketchup,mustard,and similar items with a plastic pumpThe Student Case Competition is sponsored annually by IMA®to provide an opportunity for students to interpret, analyze,evaluate, synthesize, and communicate a solution to amanagement accounting problem. Product Costing at Fine Foods:Is It a Symptom or theProblem?A u g u s t2012I S T R AT E G I C F I N A N C E47and branded with the company logo so that restaurant customers can serve themselves at salad bars and similar places.Other products are sold,often in bulk,to institu-tional users such as large food service groups,caterers,and the like.These products may or may not be branded.A small portion of sales is made to other food producers,for example,salad dressing packets are sold to producers of packaged fresh salad greens.Fine Foods,Inc.doesn’t deal with fresh products.Fine Foods,Inc.is owned by Great Plains Capital,a private equity firm.Great Plains Capital gives Fine Foods almost complete freedom and control over management,product selection,performance evaluation,and so forth.Because it is privately owned,there is no external finan-cial reporting,nor is there any obligation to use any set of financial accounting standards for internal reporting.Any external financial reporting is on a group or consolidated basis and done by Great Plains Capital.Great Plains Capital also owns Fine Foods Canada,Ltd.,which sells products almost exclusively in Canada,with primary operations nearby in the prairie provinces.Fine Foods,Inc.and Fine Foods Canada,Ltd.don’t have any mutual ownership in each other,and there’s no man-agement connection between the two.Because the two companies produce many identical products using the Fine ’n’Fast brand,they do share recipes and process technology.Fine Foods,Inc.also produces some products for Fine Foods Canada,Ltd.that don’t have sufficient market size in Canada to justify separate production.Great Plains Capital also owns smaller companies with the Fine ’n’Fast name that are mostly importers of Fine ’n’Fast products in countries outside of the U.S.andCanada where high quality,branded North American food products have niche markets.These products are produced by Fine Foods,Inc.Fine Foods,Inc.(Fine Foods from this point forward) is organized into three strategic marketing units (SMUs)based on the markets they serve.SMU1 serves supermar-kets and similar outlets.SMU2 serves mostly institutional customers who order in large volumes and often in bulk quantities.SMU2 also sells special orders from time to time that involve unbranded bulk products that areexported.SMU3 serves affiliated Fine Foods companies in other countries,mostly for import into those countries;governmental organizations that sell food and have food service facilities,such as military organizations;and simi-lar customers that have special contracting requirements.Products sold by all three SMUs are manufactured by the same production facilities,including warehouses,food preparation and cooking facilities,and packaging facilities.The SMUs also share most headquarters activi-ties,such as IT,accounting and other administration,human resources,and similar activities.SMU1 and SMU2have their own marketing and sales departments,while there are no separate departments for these tasks in SMU3.Figure 1 shows an organizational chart for Fine Foods,Inc.Cost AllocationSmith tells you somewhat strongly and persistently that she believes her unit is being treated unfairly in the way costs are allocated to products.In particular,she has a problem with the product cost allocation for specialorders of product MP ,a basic product that is widely con-48S T R AT E G I C F I N A N C EIA u g u s t 2012Figure 1:Fine Foods,anization Chartsumed in North America.SMU2 is the only unit with special orders,and almost all the special orders are for product MP.While all three units sell product MP,it rep-resents a significantly larger percentage of total sales for SMU2 than it does for the other two units.SMU1 and SMU3 don’t perceive a product-costing problem because a substantial portion of their sales come from other prod-ucts,which means the product costs for product MP aren’t a major part of their cost of sales.After talking with Smith,you review what you learned in your accounting classes about product costing and special orders.With this knowledge,you set out to con-duct an in-depth look at product costing and accounting for special orders at Fine Foods,especially in SMU2.The Production ProcessIn order to learn about product costing at Fine Foods, you decide you first need to understand the physical flow of products through production lines.A simplified dia-gram of the product MP production process,which is typical of many of the company’s products,is shown in Figure 2.Basic raw food items begin production with prelimi-nary inspection,sorting,and so forth.The raw material then goes to the first stage of preparation,which can involve chopping,peeling,and other preparation.Some preliminary cooking can also take place at this step.After possible temporary storage,additional ingredients are added,such as seasonings,flavorings,etc.,and the final cooking and processing occur.The prepared product is then packaged,frozen,stored temporarily (if necessary), and then shipped to the customer.Product CostingThe management of Fine Foods believes that it must allo-cate all costs to its products in order to get a true and accurate measure of each product’s profitability.Here’s a look at the product-costing procedure that would applyto product MP as well as virtually all other products. (Product MP is one of several different products thatcome from the same initial raw material but are then processed and sold in different configurations and pack-age sizes.)Raw material,packaging material,and direct produc-tion salaries are added to determine what Fine Foods calls direct calculated costs.Electricity,steam,water,and ware-house costs are then allocated based on estimates and amark-up to cover spoilage and other incalculable costs.This calculation gives an amount the company calls vari-able manufacturing costs.Material costs are determinedbased on the cost required for one unit of product.Direct salaries are determined by the amount of time normally required for one unit multiplied by the hourly labor cost.Fine Foods allocates what it considers to be fixed pro-duction costs in a complicated process.A list of what Fine Foods considers to be fixed production costs is shown in Table 1.Costs for production management,steam boilers,and quality are shared by different factories.Estimates aremade about usage of these activities,and costs are allo-cated to factories based on these estimates.If only onefactory uses a service,the entire cost of the service is allo-cated to that factory.When these and other costs are assigned to factories,two approaches are used for further allocation to product groups (which represent groups of similar products,such as salad dressings,canned soupsand vegetables,and puddings) and products:x All costs for steam boilers,building maintenance, vehicles,and sanitation are allocated directly to productsusing net weight or gross weight.x Remaining factory costs are first allocated to prod-uct groups.One allocation is a fixed percentage based on estimates that don’t change for each product group.Oth-er costs are allocated based on the weight,labor time,andA u g u s t2012I S T R AT E G I C F I N A N C E49Figure 2:Production Process for Product MPproduction time of the product produced.If the alloca-tion of remaining factory costs is a fixed percentage,then allocation to products is based on production time.x For special orders (virtually all product MP),the total freight out is accumulated for a month and then allocated based on the weight of product shipped.The estimated freight cost is included in the sales price.Simi-lar procedures are followed for other products,for which Fine Foods pays the freight.Media and sales promotion costs for SMU1 and SMU2are allocated to product groups and to individual prod-ucts based on weight of product sold.Fine Foods allocates what it calls other fixed costs in two ways:x Sales and marketing costs,which are incurred only in SMU1 and SMU2,are allocated to products based on sales volume.x Costs for top management,business administration,information systems,human resources,supply manage-ment,and logistics are allocated in two steps.Costs are first allocated to cost centers based on number ofemployees,labor time,production time,or set percent-ages.Then costs are further allocated to products based on gross sales,amount of time spent on internal reviews,number of marketing campaigns,quantity sold,number of orders,net weight of product delivered,or equally to each product.Smith is concerned that the amount of costs allocated to special orders for product MP is excessive and there-fore causing her unit to be viewed less favorably than the other units.Among other things,she believes allocations based on weight are unfair because product MP is a rela-tively dense,bulky,and heavy product that,while prof-itable,has a relatively low profit per pound compared to other products.Special OrdersBecause of Smith’s concerns,you further explore what Fine Foods considers to be special orders .According to Smith,a special order is one in which the contract speci-fies that it can be rejected within one year before delivery;otherwise it isn’t special.Such special orders constitute 2% of total revenues for Fine Foods.Virtually all of the special orders are for product MP and for a food distributor in Mexico.Product MP isn’t a normal part of the diet of Mexican people,but there is a niche market for it.The market isn’t large enough to motivate a Mexican food production company to pro-duce the item,but Fine Foods is motivated to provide the items to Mexican food suppliers as so-called special orders because the company is already producing the product for a variety of customers in the U.S.and Cana-da.It’s packaged unbranded for sale in Mexico because it will be used primarily by institutional food preparers;it’s shipped frozen in 10-pound packages.The raw material used to make product MP can be kept in storage for a fairly long time under proper condi-tions,and there’s always a ready stock on hand because it’s used in many other products.Once product MP is produced,it can be kept frozen for up to one year.These factors provide a high degree of flexibility in scheduling production to meet such special orders.Production of product MP can be readily scheduled when there’s idle production capacity.Sometimes requests for these special orders come unexpectedly;other times,SMU2 approach-es the customer to indicate that idle capacity is planned.Typically,orders are in relatively large quantities.SMU2 accepts special orders when the contribution margin (CM1) is positive.As shown in Table 2,Fine Foods defines CM1 as net sales minus variable manufac-turing costs (defined above) and freight out.Smith is convinced that decisions to accept the special orders are good for the company and contribute to Fine Foods’50S T R AT E G I C F I N A N C EIA u g u s t 2012Table 1:Fixed Production CostsAllocated to Product MPoverall profitability,but she’s frustrated at the impact on the results of her unit’s operations.Performance Evaluation at Fine Foods At about the time you were halfway through your project, you found yourself discussing it with friends and col-leagues who are also recent accounting graduates.As you described Smith’s concerns with Fine Foods’product costing,as well as your frustration as you attempt to ana-lyze and develop recommendations,one friend interrupt-ed to say that the product-costing problem appeared to be only a symptom of a larger issue.Y our friend had recently covered the issue of symptoms vs.underlying problems in her management control class,and it seemed to her that the major issue is performance evaluation of the SMUs,not product costing.Somewhat skeptical,you looked at some of your text-books and other sources to brush up your knowledge of performance evaluation.Y ou then explored performance evaluation at Fine Foods.Y ou began by speaking to Peter Jones,the controller of Fine Foods,Inc.,who explainedhow the company computes CM1,CM2,CM3,CM4,and operating profit for each unit (see Table 2).Jones said the SMUs have the ability to control the costs of their divi-sions,and other costs are allocated easily and fairly.Targetsare established for CM1,CM2,CM3,CM4,and operating profit,and the numbers are reviewed monthly to see if cor-rective action is necessary.Evaluation of performanceagainst the targets is made at the end of the year.Smith,however,tells you that the primary evaluationfor the SMUs is operating profit.This is confirmed bySMU2’s controller and another unit controller.Smithfeels the method used by Fine Foods to calculate operat-ing profit doesn’t reflect the true performance of theSMUs because unit management can’t control several ofthe cost elements included in the calculation.Further,she believes using operating profit as the primary indicatorfor evaluating units has a negative motivational effect onthe employees of her unit.Your ReportWith your analysis complete,you are ready to presentyour findings.For better organization,you decide todivide everything into four sections:product costing,spe-cial orders,performance evaluation,and conclusions and recommendations.Part 1: Product Costing1. Develop a glossary of terms and definitions to be usedby Smith in her presentation and discussions to ensure consistency and mutual understanding of terms.In addi-tion to definitions,provide a brief description of the applicability of terms to Fine Foods.The glossary should include,but not be limited to:x Cost objectx Cost driverx Product vs.periodx Fixed vs.variablex Direct vs.indirectx Incremental and commonx Relevant vs.irrelevantx Controllable vs.Noncontrollablex Dual allocation (sometimes called departmental)x Volume allocationx Activity-based allocationA u g u s t2012I S T R AT E G I C F I N A N C E51Table 2:Contribution Margins and Operating Profit2. Write a draft of a memorandum that Smith can present to her colleagues and management to support her case.The memo should include,but not be limited to,an analysis of current product costing approaches used at Fine Foods, Inc.,changes she should recommend,and the extent to which the recommend changes would resolve her concerns.Part 2: Special OrdersWrite a draft of a memorandum that Smith can present to her colleagues and higher management that focuses on what Fine Foods calls special orders.The memo should include,but not be limited to:x A description of the accounting and other consider-ations that should be considered with respect to special orders.x A brief definition of the terms “by products”and “joint products”and the extent to which these items apply to special orders at Fine Foods,if at all.x Identification of all the benefits that Fine Foods receives from special orders.x An analysis of the way Fine Foods,Inc.handles its special orders and any recommended changesPart 3: Performance Evaluation1.Develop a glossary of terms and definitions to be used by Smith in her presentation and discussions to ensure consistency and mutual understanding of terms.In addi-tion to definitions,provide a brief description of the applicability of terms to Fine Foods.The glossary should include,but not be limited to:x Types of responsibility centers:• cost centers• revenue centers• profit centers• investment centersx Computation methods of monetary amounts to evaluate performance:• contribution margin• operating profit• return on investment• residual income and similar value-addedapproaches,such as EVA™x Agency costs2. Prepare a draft of a memorandum for Smith to pre-sent to her colleagues and management that includes,but isn’t limited to:x What roles do performance-evaluation and reward systems play in organizations? Discuss individual vs. team-based performance evaluation in this context.Are these roles relevant for all types of organizations and employees? To what extent,if any,do these roles apply to Fine Foods?x Discuss basic concepts of performance evaluation, particularly results control.Discuss issues of financial vs. nonfinancial performance in this context.x What types of responsibility centers are the SMUs in Fine Foods? Are these appropriate types of responsibility centers for Fine Foods? Why or why not?x Identify potential agency costs that might occur within Fine Foods.Discuss performance measurement (monitoring) and incentive systems as mechanisms to decrease agency costs at Fine Foods.Identify and discuss any recommendations to implement a reward system. Analyze the extent to which your recommendations would solve the issues that concern Smith and would decrease agency costs.x Analyze the performance evaluation approaches at Fine Foods.Identify and discuss any changes you might recommend.Analyze the extent to which these changes would resolve the issues raised by Smith.Part 4: Conclusion and Recommendations1.Prepare a draft memorandum for Smith to present to her colleagues and management that gives recommenda-tions for changes and discusses their benefits for the company as a whole.2. Prepare a draft of an executive summary of the entire memorandum (Parts 1-4).3.Prepare a slide presentation for Smith to use when presenting the memorandum to her colleagues and management.SFDavid Axelsson is the accountant and controller for an expanding wholesaler and a board director for a local savings bank and a family company that distributes consumer goods.You can contact David at davidaxelsson1987@.Marcus Fogelkvist is a research and development group con-troller in a large consumer goods manufacturing company. You can reach him at marcus.fogelkvist@.Gary M.Cunningham,CPA,Ph.D.,is Visiting Professor of Accounting at Åbo Akademi University in Turku,Finland. You can reach him at gcunning@abo.fi.The authors acknowledge the valuable assistance ofDr.Catherine Lions in preparation of the case.52S T R AT E G I C F I N A N C E I A u g u s t2012。

标题:2021年IMA中文案例精选集引言本文旨在对2021年IMA(管理会计师协会)中文案例精选集进行详细介绍和分析。

这些案例涵盖了不同行业、不同规模和不同业务场景,展示了管理会计师在企业价值创造和决策支持方面的重要作用。

通过对这些案例的学习和研究,有助于提升管理会计师的专业素养和实践能力,更好地服务于企业发展。

一、案例一:XYZ公司全面预算管理实践1. 案例背景XYZ公司是一家大型制造企业,面临着市场竞争加剧的背景。

为了提升企业竞争力,XYZ公司决定实施全面预算管理,以降低成本、提高效率。

2. 管理会计师的角色和作用管理会计师在XYZ公司全面预算管理中发挥了关键作用。

他们负责预算编制、预算执行监控、预算分析以及预算调整等工作,确保预算管理的有效实施。

3. 解决方案与实施过程管理会计师通过深入了解公司业务,与各部门沟通合作,共同制定了全面预算管理方案。

在实施过程中,他们运用专业知识和技能,对预算数据进行细致的分析和挖掘,发现潜在的成本节约途径,提出改进措施,并协助管理层做出决策。

经过一系列努力,XYZ公司的预算管理取得了显著成效,成本得到了有效控制,运营效率得到了提升。

4. 经验教训与启示本案例的经验教训包括:预算管理需要全员参与,各部门之间需要充分沟通与合作;预算数据需要真实可靠,避免主观臆断;预算管理需要与企业战略相结合,确保预算目标与企业发展方向一致。

通过本案例的学习,管理会计师可以更好地掌握全面预算管理的方法和实践技巧,提升专业素养和实践能力。

二、案例二:ABC公司基于大数据的决策分析1. 案例背景ABC公司是一家电商平台,拥有大量用户数据和交易数据。

为了更好地利用这些数据资源,ABC公司决定运用大数据技术进行决策分析,以优化运营策略、提升用户体验和增加企业价值。

2. 管理会计师的角色和作用管理会计师在ABC公司基于大数据的决策分析中扮演了重要角色。

他们负责数据采集、清洗和整合等工作,为决策提供可靠的数据支持。

2015“学生案例大赛”每年由美国管理会计师协会(IMA®)提供赞助,旨在为在校学生提供一个解读、分析、评估、综合以及沟通管理会计问题并提供解决方案的机会。

莫尔德公司:减少有毒物质使用的备选战略莫尔德公司由弗雷明汉船王之子——威廉•莫尔德三世创立于1922年。

为追求木制品制造业财富,威廉从弗兰明汉搬到了马萨诸塞州西部。

几十年来,莫尔德公司专注于生产高附加值木制产品,如细磨木材、门以及特定木制造型。

1950年代,威廉拓展了莫尔德公司的产品线,包括致力于体育场馆座椅生产的座椅部。

威廉•莫尔德经营公司直至他1970年代退休,他的女婿——威尔逊•雅各布接手公司,成为总裁。

威尔逊进一步扩大公司规模到四个部门,座椅部最终成为公司最大并且最盈利的部门。

无论是威廉•莫尔德还是他的继任者威尔逊•雅各布都认识到环境管理支出已成为企业负担,它降低了企业的盈利,也制约了新厂房和设备的生产性投入。

然而,新英格兰地区众多环保主义者异常活跃,致使产业环境发生了巨大变化。

最近一篇新闻报道给莫尔德公司敲响警钟,一个与当地报社和其他地区性环保组织有着密切联系的社区环保活激进组织开始调查莫尔德公司。

此后不久,当地报纸以头版文章刊出了莫尔德公司有毒物质排放清单(TRI)报告数据及它的环境影响。

1 后来,雅各布聘用了具多年环保工作经验的特里•威尔伯担任全职环保经理。

威尔伯接手了之前由几位工程师在业余时间履行的保持合理环保投入又符合强制性要求的环保职责,他意识到在有着明显环境风险情况下要实现目标比较困难。

监管者越来越自信,利益相关者的声音也越来越多。

此外,马萨诸塞州减少有毒物质使用法案(TURA)指南建议采取积极的污染预防方法,这要求那些有前瞻性的公司要不断推出战略可行性计划。

21 TRI是联邦法规定企业必须公告的有毒化学物质强制性清单/toxics-release-inventory-tri-program2 更多关于TURA的信息可以在马萨诸塞州环保部网站找到;网址为:/eea/agencies/massdep/toxics/tur/接受新任命后不久,威尔伯组建了环境、健康和安全小组(EH&S),该小组的核心成员主要来自座椅部和公司服务部(见图1组织结构图),包括威尔伯本人,负责财务和税务的公司财务总监宾翰姆以及业务和内部报告会计葛莱姆斯。

IMA管理会计案例答案管理会计是一种重要的会计学分支,旨在帮助管理者做出更好的商业决策。

通过分析财务信息和其他数据,管理会计帮助企业管理者了解业务绩效,并制定战略、计划和预算。

在本篇文档中,我们将讨论一些管理会计案例,并给出相应的答案。

案例一:成本-收益分析公司A正在考虑是否继续生产一种产品,该产品在市场上价格合适,但生产成本较高。

公司A的管理团队请你进行成本-收益分析,以确定是否应该继续生产该产品。

答案:成本-收益分析是一种重要的决策工具,通过比较产品的收益和成本来评估产品的盈利潜力。

对于公司A,我们首先计算该产品的单位销售价格和单位生产成本,然后计算每单位产品的毛利润。

接着,我们根据销量预测,计算总收益和总成本,最后得出该产品是否应该继续生产的结论。

案例二:预算编制公司B计划在新财年实施一项市场推广活动,管理团队向你寻求帮助,希望你协助编制活动的预算。

该市场推广活动需要考虑广告费用、人员成本、促销费用等各个方面的支出。

答案:预算编制是管理会计的核心内容之一,通过编制预算,企业可以设定明确的目标,并控制支出以实现这些目标。

对于公司B的市场推广活动,我们需要先列出各个方面的支出项,并估算每项支出的金额。

然后将这些支出项逐一总结,得出总预算数。

在编制预算时,我们还需要考虑风险因素,确保预算在实施过程中能够按照计划进行。

案例三:绩效评估公司C拥有多个生产车间,每个车间生产不同种类的产品。

管理团队希望你协助设计一个绩效评估体系,以评估各个车间的运营绩效,并为绩效优秀的车间提供奖励。

答案:绩效评估是管理会计中的重要环节,通过评估企业各方面的绩效,可以帮助企业管理者了解业务的运作情况,并对绩效较好的部门或个人进行奖励,激励他们创造更好的业绩。

对于公司C的生产车间,我们可以设计一个评估体系,包括各种指标如生产效率、产品质量、及时交货率等。

通过收集数据并分析评估结果,确定绩效最优秀的车间,并确定相应的奖励措施。

第三届IMA校园管理会计案例大赛西南区决赛圆满落幕

2013年3月22日,第三届IMA(海尔杯)校园管理会计案例大赛西南区决赛在重庆大学经管学院成功举行。

经过各个严密的比赛环节,来自西安交通大学的Just-in-time和Lotus 队突出重围,获得了代表西南赛区参加总决赛的资格。

通过初赛的选拔,西南赛区共有10支队伍晋级区域决赛,分别是:来自重庆大学的Mockingjay、Challengers、teammate、New Bee、2012队,来自西安交通大学的Just-in-time、X.A、Doves or Hawks、Lotus队,来自兰州商学院的Infinity队。

第三届IMA校园管理会计案例大赛西南赛区决赛现场

本次大赛有幸邀请到了5位实务界和学术界资深财会专家来担任西南赛区的评委:西南财经大学邹燕教授、重庆大学朱丹教授、西安交通大学董南雁教授、新蛋信息技术(上海)有

限公司中国区高级财务经理陈周、Honeywell China Co,Ltd Finance Controlling Manager Jihong Yang 。

比赛中各支队伍准备充分、文思泉涌、有条不紊、慷慨陈词,给在场的老师和同学带来了一场管理会计案例大赛盛宴,现场惊喜不断、掌声不断。

经过各个严密的比赛环节,Just-in-time、Lotus队突出重围,获得了代表西南赛区参加总决赛的资格。

案例四本量利分析案例北京市当代剧院是一家以服务社区、为提供群众高雅艺术的非营利组织。

日前已经宣告了其来年的经营安排。

根据剧院的管理导演麦根的意向,新季的第一部戏将是《莎士比亚著作集锦》。

“人们将会喜欢这部戏剧,”麦根说到,“他确实令人捧腹大笑。

它拥有所有最著名的饰演莎士比亚戏剧的一线演员。

演出尝试展示37部戏剧和154首十四行诗,而所有这一切仅仅在两小时内完成。

”虽然每月卖出大约8 000张戏票,卖根说他期望这会是剧院最好的一年。

“记住,”他指出,“对我们来说,好的年份并不意味着较高的利润,因为当代剧院是个非营利组织。

对我们来说,好的年份意味着许多人观看我们的戏剧,享受着我们所能提供的最好的当代剧院艺术。

”对麦根来说,当代剧院是个现实的梦想。

“我在大学里学习高雅艺术,”他说,“并且我想成为一名演员。

我花了10年时间在北京人艺充分展示自己的才干,并花了两年多的时间在伦敦获得了MFA。

但是,我一直清楚自己最终想成为一名导演。

当代剧院给了我想要的一切。

我在这个古老剧院中管理着美妙的戏剧公司。

我一年导演了6部戏剧,并且通常在一两部戏中参加演出。

”卖根解释说,当北京市政府同意其使用具有历史意义的市剧院做当代剧院时,戏剧公司从中获得了很大的发展。

“北京市可获得月租费,外加一份来自戏票销售收入的报酬。

我们尽力保持票价的合理性,因为我们的目标是将戏剧带入到尽可能多的人们生活中去。

当然,从财务上说,我们的目标是每年收支刚好持平。

我们不想获利,但是我们也不能亏损运作。

我们要支付剧本的版税、演员以及其他雇员的工资、保险费以及公用事业费等等。

陶醉在戏剧里是很容易的,但是注意到事情的商业方面也是我工作的一个重要部分。

有时,寻求我们的损益平衡点是很棘手的。

我们不得不测算我们的成本会是多少,票价应定在什么水平上,并且估算我们将会从我们的朋友和支持者那里获得多少慈善行捐赠。

即从财务上又从艺术上知道我们的行动是至关重要的。

我们想在未来的许多年中都要将伟大的戏剧带给朝阳区人民。